Family Law Lawyers

909-307-2645

Free Consultations

Inland Empire - Financing Available

Wage Garnishments (Assignment Orders)

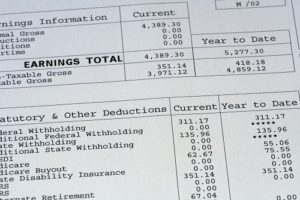

In family law, a wage garnishment is a court order that directs an employer to withhold a portion of an employee’s income, and thereafter deliver that withheld income directly to a third person (payee) to pay the employee’s (debtor’s) unpaid court ordered child support or spousal support.

Wage garnishments are legally enforceable against the employer and the employee; willful failure to comply with wage garnishment orders can lead to severe civil and criminal penalties.

For example, if a business owner receives a wage garnishment notice (court order), which informs the employer that he or she must keep a portion of his or her employee’s income from the employee, and the business owner thereafter willfully disobeys that court order, then the business owner could be found to be in contempt of court.

Also, if the owner of the business is the person whose wages are garnished, and he or she does not keep his or her own wages aside per the court’s order, then the business owner could be found to be in contempt of court.

Note: The term wage garnishment is sometimes referred to in family law court as either a wage assignment, earnings assignment, income earnings assignment, or withholding order . All of these terms share very similar, but not exact, definitions. The garnishment of wages, or the “withholding” of wages (income) is the act of keeping the wages from the employee. The assignment of wages (income) is the act of giving another person the right to receive the wages (income, earnings, salary, etc.).

Obtaining a Wage Garnishment

When a family law judge orders a person to pay child support or spousal support, then the person so ordered should be given an opportunity to comply with the court’s order (without further legal action such as a wage garnishment). If the person ordered to pay child support or spousal support willfully fails to pay pursuant to the court’s order, then the payee may seek an order for wage garnishment (earnings assignment, withhold order, etc.) against the debtor (payer).

For example, if a family law judge orders wife to pay her ex-husband spousal support, then wife will usually be given an opportunity to comply with the court’s order to pay spousal support without the issuance of a wage garnishment (opportunity to comply with court’s order). However, if wife refuses to pay spousal support as ordered, then her ex-husband may seek a court-ordered wage garnishment against husband.

Note: As stated, a person will usually be given an opportunity to pay child support or spousal support (alimony) without ordering a third person (employer) to garnish the non-paying party’s income. But, in some cases, a judge may allow a wage garnishment to issue even before the paying party is given an opportunity to comply with the court’s order (i.e. business is dissolving, employee cannot be found, etc.).;

Important: There are different legal remedies that might be available to a payee when a debtor fails to pay court ordered child support or spousal support. A payee should consider all legal options when a debtor fails to pay support, including, but not limited to, the following: civil penalties, contempt of court, modification of court orders, referral to Department of Child Support Services [DCSS]) , and more.

Every legal remedy accompanies certain benefits and detriments and wage garnishments might not necessarily be in the payee’s best interest in light of other available legal remedies. It's important to seek the advice of a family law attorney to learn the availability of all legal remedies and the legal benefits, as well as all legal detriments, which are associated with each legal remedy.

Where to Start: Before a family law litigant may have a wage garnishment ordered, the court will usually require the requesting party to show that a wage garnishment is necessary because the debtor has willfully failed to pay court ordered support. If the court grants the payee's request for a wage garnishment, the order must be timely and properly served on the debtor’s employer in order to become valid.

Note: The wage garnishment order informs the employer of the percentage of income that is to be deducted from the employee’s paycheck and where to send that deducted payment.

An employer must begin withholding child support monies within ten (10) days of the receipt of the wage garnishment. The withheld monies must be remitted within seven business days after the employee’s regular payday to the person or entity named in the Income Withholding Order (IWO).

Percentage of Income Withheld for Child Support: Child support wage garnishments cannot exceed fifty percent (50%) of the employee’s disposable income. Disposable income refer to the employee’s net pay (including bonus income), after taxes, unemployment insurance, and social security is deducted. Deductions do not include health and/or dental insurance, charitable or retirement contributions, and non-required union dues.

Note: Past due child support or spousal support (arrears) may also be withheld from an employee’s income; however, withholding for arrears may be “stayed” for good cause as determined by the family law judge. In this context, “stayed” for good cause means that the employee debtor does not have to pay, as a withholding, unless and until some subsequent condition arises (i.e. passage of time, future violations of the court’s order, etc.).

Self-Employed & Independent Contractors

For self-employed debtors, the rules regarding wage garnishment do not change. In other words, a self-employed person may be ordered to withhold his or her own income in order to pay a wage assignment. Of course, proof of compliance with the court’s wage garnishment order can be more difficult in self-employed debtor cases. This is especially true where self-employed persons subject to a wage garnishment have a fluctuating income. On the other hand, anyone caught falsifying income for purposes avoiding wage garnishments, could face severe criminal penalties, including penalties for felony perjury and felony tax evasion.

Note: The process of collecting legal documents from an opposing party in a legal dispute is known as “discovery.” Family law lawyers (and judges) have experience in obtaining the true income of self-employed persons suspected of concealing income and/or assets. When a self-employed person is determined to conceal his or her true income, the discovery process will usually uncover the debtor’s deception. Once true income and/or assets are discovered, the court will likely penalize the debtor more than the court would have if the self-employed person did not otherwise attempt to conceal his or her true income and/or assets.

Special Cases: Sometimes an employee has a fluctuating income and the fluctuation is unknown to the payee (i.e. service industry tip calculation fluctuation [food server, bartender, hair dresser, etc.], open salaried employee with fluctuating work schedule, 1099 contractors who do not report employment, service for service employees, etc.). Employers that employ these types of employees should do the best they can to completely comply with the withholding order. But if the employer does not know, or reasonably could know, the exact income of his or her employee, then there is not much else that employer can do to comply with the withholding order. In these types of cases, it is up to the lawyers, and the lawyers' investigators to discover the true income of the employee.

Wage Garnishment Agreement

Parties can agree that child support or spousal support payments can be paid in some way other than through a wage garnishment. If a wage garnishment has already been ordered before the parties reached an agreement to pay support other than through a wage garnishment, then the parties can ask the court for the wage garnishment to be stayed (put on hold).

Important: If the reason a debtor cannot pay child or spousal support is due to lost employment or loss of income, the debtor should seek a downward modification of support. The debtor is responsible for the full amount of child support or spousal support until the court orders a different amount.

Note: Child support is deducted before spousal support when both child support and spousal support are subject to a wage garnishment.

When DCSS is Involved

When either the local child support agency (LCSA), or the Department of Child Support Services (DCSS) is involved in a child support case, that respective government agency usually issues a wage garnishments without considering whether or not a wage garnishment is in the payee’s best interest (as opposed to other available legal remedies).

Note: DCSS is an over-burdened, underpaid, bureaucratic, government agency with overworked and underpaid lawyers that primarily represent the government’s interest in collecting reimbursement monies from parents who should have, but failed to, provide health insurance for their child or children. DCSS almost always chooses a wage garnishment over other available legal remedies. This is true even when other legal remedies might be better for the payee (as opposed to better for the government). If possible, seek the advice of a family law attorney independent of DCSS to learn the benefits and detriments of a wage garnishments in comparison to other legal remedies.

Quashing, Canceling, or Objecting to Wage Garnishment

An employee has up to ten (10) days from the day that his or her employer received the wage garnishment (Income Withholding Order [IWO]) in which to object to the payee’s wage garnishment request. The debtor may object to a wage garnishment request under one of the following situations:

There is a prior agreement to pay spousal support directly to the payee without the need for a wage garnishment,

or all of the following apply:

The debtor made timely and full payments for at least twelve (12) months without an earnings assignment (wage garnishment) in place;

No back support is owed (arrears);

The wage garnishment would cause undue hardship; and, when child support is included, it would be in the children’s best interest to cancel the wage garnishment.

Note: Failure to pay court ordered child support or spousal support can lead to any of the following: garnished wages (earning assignment), contempt of court, modification of court orders, civil penalties (with statutory interest on arrears ranging from six (6) percent a month to ten (10) percent a year, compounded!), negative credit rating, liens on property, liens on bank accounts, liens on tax refund(s), liens on lottery winnings, suspension or revocation of a professional license (doctor, dentist, lawyer, etc.), denial of U.S. passport, and more.

To learn more about garnishing wages (earnings assignments) in child support or spousal support cases, contact our divorce and family law attorneys today for a free consultation. Our lawyers are well versed in all family law issues, including child custody, child support, child visitation (parenting time), guardianship, conservatorship, fathers’ rights, juvenile dependency hearings, child protective service (CPS) defense, annulments, grandparents’ rights, and more. Call today!

Family Law Lawyers 909-307-2645 All Inland Empire Courts Free Consultations & Financing Available Se habla español

Divorce & Family Law Lawyers

Legal services , post-judgement orders, child custody mediation, guardianship law, emancipating a minor, rfo information, child support law, spanish speaking lawyers, conservators & the law, earnings assignment, child abduction defense, prenup lawyers, parental rights termination, legal & physical custody, modification of orders, contempt of court, trials & appeals, establishing parentage, juvenile dependency petitions, child protective service, domestic partnership, domestic violence, community property rights, common law marriage, child relocation request, changing child's name, grandparents' rights, community property businesses, parenting time, stepparent adoption, no fault divorce, pet custody, caci listing defense, legal separation, restraining orders, nullity of marriage, fathers' rights lawyers, inter-marital agreement, community debt division.

909-307-2645 Divorce & Family Law Lawyers Inland Empire Cities Served Jurupa Valley, Rancho Cucamonga , Highland , Grand Terrace, Yucaipa , Moreno Valley , Eastvale, Rialto , Hemet , Loma Linda , Chino, Ontario

Information contained in this website is provided for informational purposes only. While we strive to provide current and accurate information, we do not guarantee the information to be current and/or accurate. No attorney - client relationship is created by use of this information. If you are in need of a divorce or family law attorney, contact a lawyer without delay.

Abogados de derecho familiar 909-307-2645 Condados de San Bernardino y Riverside Consultas Gratis & Planes de pago Lunes a sábado de 7:00 a.m. a 7:00 p.m.

Selected Legal References for California

Wage Garnishment Law

CCP 706.011: As used in this chapter:

(a) “Disposable earnings” means the portion of an individual’s earnings that remains after deducting all amounts required to be withheld by law.

(b) “Earnings” means compensation payable by an employer to an employee for personal services performed by such employee, whether denominated as wages, salary, commission, bonus, or otherwise.

(c) “Earnings withholding order for elder or dependent adult financial abuse” means an earnings withholding order, made pursuant to Article 5 (commencing with Section 706.100) and based on a money judgment in an action for elder or adult dependent financial abuse under Section 15657.5 of the Welfare and Institutions Code.

(d) “Earnings assignment order for support” means an order, made pursuant to Chapter 8 (commencing with Section 5200) of Part 5 of Division 9 of the Family Code or Section 3088 of the Probate Code, which requires an employer to withhold earnings for support.

(e) “Employee” means a public officer and any individual who performs services subject to the right of the employer to control both what shall be done and how it shall be done.

(f) “Employer” means a person for whom an individual performs services as an employee.

(g) “Judgment creditor,” as applied to the state, means the specific state agency seeking to collect a judgment or tax liability.

(h) “Judgment debtor” includes a person from whom the state is seeking to collect a tax liability under Article 4 (commencing with Section 706.070), whether or not a judgment has been obtained on such tax liability.

(i) “Person” includes an individual, a corporation, a partnership or other unincorporated association, a limited liability company, and a public entity.

CCP 706.020: Except for an earning assignment order for support, the earnings of an employee shall not be required to be withheld by an employer for payment of a debt by means of any judicial procedure other than pursuant to this chapter.

CCP 706.021: Notwithstanding any other provision of this title, a levy of execution upon the earnings of an employee shall be made by service of an earnings withholding order upon the employer in accordance with this chapter.

CCP 706.022(a): As used in this section, “withholding period” means the period which commences on the 10th day after service of an earnings withholding order upon the employer and which continues until the earliest of the following dates:

(1) The date the employer has withheld the full amount required to satisfy the order.

(2) The date of termination specified in a court order served on the employer.

(3) The date of termination specified in a notice of termination served on the employer by the levying officer.

(4) The date of termination of a dormant or suspended earnings withholding order as determined pursuant to Section 706.032.

(b) Except as otherwise provided by statute, an employer shall withhold the amounts required by an earnings withholding order from all earnings of the employee payable for any pay period of the employee which ends during the withholding period.

(c) An employer is not liable for any amounts withheld and paid over to the levying officer pursuant to an earnings withholding order prior to service upon the employer pursuant to paragraph (2) or (3) of subdivision (a).

How to Enforce Spousal Support in California

- February 5, 2021February 1, 2021

- by Briana White

When your ex refuses to pay spousal support, is late on payments, or doesn’t give you the full amount, this can be understandably frustrating. Especially since the entire point of spousal support is to help a homemaker become economically independent after a divorce. Without this reliable, financial assistance, getting back on your feet becomes much more difficult.

If a judge included spousal support in your divorce order, it isn’t optional. Your ex might not like you, or agree with the verdict, but the hard truth is, that court orders are as iron clad as any other law—the only difference being, that it’s personalized to you. And California courts don’t look kindly on law breaking.

If you need to enforce spousal support in California, here’s how that might look in your situation.

Enforcing Spousal Support: Earnings Assignment

The easiest and fastest way to enforce spousal support in California, is to file an earnings assignment with your county clerk immediately after your divorce is finalized. An earnings assignment—also known as wage garnishment —is a legal document that requires your ex’s employer to pay you spousal support before giving them their take-home pay. This type of enforcement is automatically available to every California divorce.

Filing an Earnings Assignment in California

The only requirement to filing an earnings assignment, is that your divorce is finalized. Once you have your support order from the judge, activate your earnings assignment by completing:

- A Findings and Order After Hearing ( Form FL-340 );

- Any of the required attachments; and,

- An Earnings Assignment Order for Spousal or Partner Support ( Form FL-435 ).

Upon completion, take the finished forms (and attachments) to your local clerk for signatures. After everything has been processed, you can pick them up and have copies properly served to both your ex and his or her employer. This is done via mail, and must be initiated by someone who is not a party to the case (meaning: you can’t do it yourself). Make sure to have your server fill out two proof of service forms (one for your ex, and one for the employer), as these will also need to be filed with the clerk.

Earnings Assignments Are Not Required

Although convenient and efficient, wage garnishment isn’t actually required. If both parties agree, an earnings assignment can always be “stayed,” or rather: put on hold. Though, it’s important to note, that a stay of earnings can always be reversed, if proper payments are not made on time in the future.

How Long Before an Earnings Assignment Takes Effect?

Once everything has been filed and served, your ex’s employer will have ten days to begin deducting spousal support from the paycheck. If they do not, the employer could be held liable for payments in your ex’s stead.

Enforcing Spousal Support in California: Other Tactics

If your ex falls behind on payments, or you are having trouble with an employer not meeting the terms of a valid earnings assignment, you may need to involved the court again. In these situations, a judge might reinstate an earnings assignment, or possibly hold an employer liable for noncompliance, if applicable. During this process, you will likely need to make an accounting of all missed payments, so that the increased amount can be included in the amount owed.

While it’s possible for you and your attorney to do these things on your own, if you are still having problems, at this point you might also want to consider soliciting outside help.

Local Child Support Agency (LCSA)

One way to get help enforcing spousal support in California, is to open a case with your local child support agency (or LCSA). The LCSA is authorized to help enforce orders of both spousal support and child support , and they can do so at no charge to you .

The biggest benefit to using the LCSA, is the arsenal of enforcement tools they have at their disposal—tools that certainly aren’t available to the average citizen. To enforce spousal support in California, the LCSA can:

- Report all late and missed payments to major credit reporting agencies, detrimentally effecting credit scores;

- Notify the U.S. State Department, who can place a holds on the passport of any individual owing $2,500 or more in support payments;

- Put a lien on your ex’s land or house, so that if the property is sold, profits can’t be collected on the proceeds until support payments are made;

- Suspend any state-issued licenses, including any driver’s, business, or professional licensures your ex might have;

- Use the Franchise Tax Board to collect money from bank accounts, real property, deposit box cash, or even vehicles owned;

- Notify the IRS to take support payments out of tax refunds before they issue anything to your former spouse;

- Take the owed support out of unemployment benefits, or workers compensation; and even,

- Claim lottery winnings—if your ex happens to be so lucky. (And there’s definitely some satisfying karma in that, we think.)

As you can see, the tactics used by the LCSA are much more motivating than anything you can do on your own, and since they’re available at no cost to you, it might make a lot of sense to just skip the drama, and involve them in your case as soon as possible.

Contempt of Court

In extreme cases, it might be necessary to enforce spousal support by holding your ex in contempt of court. Unlike divorce cases, which are held in civil court, a charge of contempt is a very serious criminal charge, and could result in jail time.

When deciding on contempt, the judge will analyze whether or not the support was withheld on purpose—particularly if your ex was able to pay, but just decided not to. Because while you can’t (technically) get thrown in jail for being in debt, intentionally ignoring a court order can definitely get you there. This is usually a measure of last resort, though, and most judges will attempt to find a reasonable solution before putting anyone behind bars.

Spousal Support Modification

Because there are such serious consequences attached to not paying spousal support, if you are on the paying end and cannot fulfill the court’s order, it’s important you notify them as soon as possible. The court understands that life is unpredictable, and circumstances change. That’s why there are ways to modify a spousal support agreement—ones that don’t involve enraging the Powers at Be for not paying (which, really, is never a good idea).

Communication is the biggest key, here. As soon as you are aware of the change in circumstance, don’t wait. Notify the court, and fill out the necessary forms to initiate a hearing to modify. Amount changes cannot be applied retroactively, so acting fast is critical, as you’ll still be on the line for the original amounts, however long it takes you to get the wheels rolling.

Depending on the reasons for your request, the court may reduce the amount, though they’re unlikely to eliminate altogether.

Attorneys to Enforce Spousal Support in California

For many divorcees, spousal support is a critical means of income in the post-divorce era, and not receiving these funds in full and on time can be extremely stressful and financially crippling.

If you are entitled to receive regular spousal support, and are not getting it, we can help. Call us at (209) 989-4425, or get in touch online to schedule your consultation today. With our assistance, we can make sure you receive the funds you’re entitled to, without the stress and headache of going it alone.

Related articles

Your Name (required)

Your Email (required)

Your Message

This Site Uses Cookies. Read more.

IMAGES

COMMENTS

EARNINGS ASSIGNMENT ORDER FOR SPOUSAL OR PARTNER SUPPORT CASE NUMBER: Modification TO THE PAYOR: This is a court order. You must withhold a portion of the earnings of (specify obligor's name and birthdate): and pay as directed below. (An explanation of this order is printed on page 2 of this form.)

Earnings Assignment Order For Spousal or Partner Support (Family Law) FL-435. Instructions for form FL-435. Request for Hearing Regarding Earnings Assignment (Family Law-- Governmental -- UIFSA) FL-450. An information sheet is included with the form. It is given to the person whose earnings are being assigned (garnished) to allow them to object.

What is a wage garnishment or a wage assignment? Wage garnishments, aka earnings assignment, explained by child support and spousal support lawyers. All topics: legal separation, dissolution of marriage, nullity of marriage, community property, alimony mondification of court orders, objection to wage garnishing, ex parte hearing, guardianship, fathers rights, DVRO, domestic violence ...

The only requirement to filing an earnings assignment, is that your divorce is finalized. Once you have your support order from the judge, activate your earnings assignment by completing: A Findings and Order After Hearing (Form FL-340); Any of the required attachments; and, An Earnings Assignment Order for Spousal or Partner Support (Form FL-435).

An earnings assignment is a court order that tells your employer to take the support payments directly from each paycheck and where to send it. If you also pay child support, it's called an Income Withholding Order. Once your employer receives the order, they have 10 days to take the money from your next paycheck. If your spouse also has a ...

9. The existing earnings assignment order for spousal, domestic partner, or family support should be changed as follows (specify): The modified earnings assignment order is requested because (check all that apply): a. The support arrears in this case are paid in full, including interest. b.

EARNINGS ASSIGNMENT ORDER. Family Code Section 5230. (a) When the court orders a party to pay an amount for support or orders a modification of the amount of support to be paid, the court shall include in its order an earnings assignment order for support that orders the employer of the obligor to pay to the obligee that portion of the obligor ...

California Code, Family Code - FAM § 5246. (a) This section applies only to Title IV-D cases where support enforcement services are being provided by the local child support agency pursuant to Section 17400. (b) In lieu of an earnings assignment order signed by a judicial officer, the local child support agency may serve on the employer a ...

How to ask to stay an earnings assignment. Fill out a Stay of Service of Earnings Assignment Order (form FL-455) Make at least 2 copies of the form; File the form. The clerk will write a court date on your copies. Have someone 18 or over (a server) mail a copy of the filed form to the other parent.

(b) An earnings assignment order for support shall be issued, and shall be effective and enforceable pursuant to Section 5231, notwithstanding the absence of the name, address, or other identifying information regarding the obligor's employer. Ca. Fam. Code § 5230. Amended by Stats 2000 ch 808 (AB 1358), s 57.3, eff. 9/28/2000.

a Wage and Earnings Assignment Order and the employer is required to withhold $300 per month to pay on that order, when the employer receives this Earnings Withholding Order for Support, the employer should deduct the $300 for the Wage and Earnings Assignment Order from the $716 and pay the balance to the levying officer each month for this order.

EARNINGS ASSIGNMENT ORDER Family Code Section 5241 (a) An employer who willfully fails to withhold and forward support pursuant to a currently valid assignment order entered and served upon the employer pursuant to this chapter is liable to the obligee for the amount of support not withheld, forwarded, or otherwise paid to the obligee,including ...

Ex Parte Application to Issue, Modify, or Terminate an Earnings Assignment Order (FL-430) Ask the judge to change or stop an order for support to taken out of the paycheck of a parent, spouse, or partner. Get form FL-430. Effective: January 1, 2014.