- Exploring the Bid Rent Theory: Unraveling Urban Land Use Dynamics

In the intricate tapestry of urban development, the Bid Rent Theory emerges as a powerful lens through which to understand the intricate dynamics of land use. This theory delves into the fascinating interplay between location, accessibility, and economic forces that shape the urban landscape. By dissecting the concept of bid rent curves and examining the factors that influence them, we can unlock a deeper understanding of how cities evolve and thrive. Join us on this captivating journey as we unravel the mysteries behind urban land use dynamics, and discover the fascinating realm where economics meets urban planning.

How does the bid rent theory apply to urban land use? Exploring its implications

What is a real world example of the bid rent theory a case study illustrating bid rent theory., frequently asked questions (faq).

The Bid Rent Theory and Urban Land Use

The bid rent theory is an economic concept that helps explain how urban land use is determined. It explores the relationship between the price of land and its location within a city. Understanding this theory can provide valuable insights into the implications it has on urban development and planning.

The Basic Idea

At its core, the bid rent theory suggests that the value or rent of land decreases as one moves farther away from the central business district (CBD) of a city. This decline in land value occurs due to various factors, including transportation costs, accessibility to amenities, and convenience.

Implications for Urban Land Use

This theory has significant implications for urban land use. It helps explain why different types of land use tend to cluster in specific areas within a city.

1. The CBD:

As per the bid rent theory, the central business district experiences the highest land values due to its prime location and excellent accessibility. This area typically consists of commercial, retail, and financial activities.

2. Transitional Zones:

As one moves away from the CBD, the bid rent theory suggests the presence of transitional zones. These zones often exhibit mixed land use, combining elements of commercial, residential, and light industrial activities. The rent here gradually decreases as the distance from the CBD increases.

3. Residential Areas:

Further away from the CBD, the bid rent theory indicates the presence of residential areas. These areas typically offer lower land values, making them more affordable for housing purposes. Factors such as proximity to schools, parks, and transportation infrastructure influence the desirability and rent of residential land.

Planning Implications

Understanding how the bid rent theory applies to urban land use can help inform urban planning decisions. Planners can use this theory to strategically allocate land for different uses, considering factors such as transportation networks, amenities, and community needs.

The Bid Rent Theory:

The bid rent theory is a concept in urban economics that explains how the price or rent for land decreases as one moves away from the central business district (CBD) of a city. The theory suggests that businesses and residents are willing to pay higher rents for land closer to the CBD due to its accessibility and proximity to economic opportunities.

Real World Example:

A case study that illustrates the bid rent theory can be seen in the city of New York. Manhattan, which houses the CBD and is known for its high property values, is a prime example of this theory in action.

Case Study: New York City

In New York City, Manhattan is the central business district and the most sought-after location for both businesses and residents. Due to its prime location, the demand for land in Manhattan is incredibly high, which drives up property prices and rental rates.

As one moves away from the CBD, such as to the boroughs of Brooklyn, Queens, or the Bronx, the cost of land significantly decreases. This is because these areas are further from the economic hub and may not offer the same level of convenience and accessibility.

For example, in Manhattan, you will find prestigious neighborhoods like the Upper East Side and Tribeca, which are known for their high-end properties and sky-high rents. These areas are highly desirable due to their proximity to businesses, cultural attractions, and amenities.

How does the bid rent theory work modern agriculture: Explained

The bid rent theory is a concept that helps us understand how land use and agricultural practices are influenced by the location and availability of land.

In the context of modern agriculture, the bid rent theory provides valuable insights into how agricultural activities are organized and optimized for maximum efficiency and profitability.

At its core, the bid rent theory suggests that the value of land is directly linked to its proximity to markets or consumers. In other words, the closer agricultural land is to urban centers or areas with high demand for agricultural products, the higher its value becomes. This principle is a crucial factor in the decision-making process of farmers and agricultural businesses.

According to the bid rent theory, farmers will allocate their land based on a cost-benefit analysis. They will compare the potential returns from cultivating a specific crop or raising livestock with the costs associated with transportation, labor, and other factors. This analysis is essential in determining the bid rent, which represents the maximum amount a farmer is willing to pay for a specific piece of land.

In modern agriculture, the bid rent theory helps explain the spatial distribution of different types of agricultural activities. The theory suggests that high-value, perishable crops or livestock products that are in high demand will be cultivated or raised closer to urban centers. This proximity minimizes transportation costs and ensures fresher products reach market shelves, meeting consumer expectations.

On the other hand, lower-value crops or products that are less perishable can be cultivated further away from urban centers, where land prices are lower. This allows farmers to optimize their production costs and cater to markets that prioritize affordability over freshness.

Moreover, the bid rent theory also influences the decision-making process when it comes to land use. For example, if the value of agricultural land close to urban centers increases due to urbanization or increased demand, farmers may decide to convert their land into more profitable uses, such as commercial or residential purposes.

What is bid rent theory in APHG? Understanding the concept and its relevance.

Bid Rent Theory in APHG: Understanding the Concept and Its Relevance

The Bid Rent Theory is a concept often explored in the field of Advanced Placement Human Geography (APHG). It provides valuable insights into the spatial distribution of different land uses in urban areas. This theory helps us understand how the price and demand for land vary as we move away from the central business district (CBD) in a city.

What is Bid Rent Theory?

Bid Rent Theory proposes that the maximum amount someone is willing to pay for a piece of land decreases as the distance from the CBD increases. In other words, the demand for land diminishes the further you move away from the city center. This is due to a combination of factors such as transportation costs, accessibility, and the nature of different land uses.

Understanding the Concept

According to the Bid Rent Theory, different types of land uses, such as residential, commercial, or industrial, will be located at particular distances from the CBD based on their perceived value and accessibility. The theory suggests that high-value land uses, like prime retail areas or corporate offices, will be located closer to the CBD where the land prices are typically higher.

As one moves further away from the CBD, the land prices decrease, making it more feasible for lower-value land uses, such as manufacturing or low-income housing, to establish themselves. This pattern creates concentric rings of land use zones around the city center, known as the concentric zone model.

Relevance of Bid Rent Theory

Bid Rent Theory is relevant in understanding urban land use patterns, urban growth, and the dynamics of real estate markets. By studying this theory, urban planners, geographers, and policymakers can gain insights into the factors that influence the location and pricing of different land uses within a city.

This theory helps explain why certain areas within a city are more expensive and sought after than others. It also sheds light on the transportation networks and infrastructure development needed to support urban growth. Additionally, the Bid Rent Theory contributes to our understanding of gentrification, urban renewal, and the social impacts of urban development.

What is the Bid Rent Theory?

The Bid Rent Theory is a concept in urban economics that explains how the price and demand for land vary as you move away from the city center. According to this theory, land rent increases as you get closer to the central business district (CBD) due to higher demand and limited supply.

How does the Bid Rent Theory impact urban land use?

The Bid Rent Theory influences the spatial distribution and use of land in urban areas. As land rent decreases with distance from the CBD, different types of land uses emerge. High-rent land near the CBD is typically occupied by commercial and retail activities, while lower-rent land on the outskirts may be used for residential or industrial purposes.

Can the Bid Rent Theory be applied to all cities?

While the Bid Rent Theory provides a useful framework for understanding urban land use dynamics, its applicability may vary across different cities and regions. Factors such as local geography, transportation infrastructure, and government policies can influence the extent to which the theory accurately describes land use patterns in a particular area.

What are the implications of the Bid Rent Theory for urban planning?

The Bid Rent Theory offers valuable insights for urban planners and policymakers. Understanding how land rents change with distance from the CBD helps in determining optimal locations for different land uses, designing transportation networks, and promoting sustainable urban development. By considering the principles of the Bid Rent Theory, planners can create more efficient and livable cities.

If you want to know other articles similar to Exploring the Bid Rent Theory: Unraveling Urban Land Use Dynamics you can visit the category Economy .

Related posts

Unveiling the Power: Maximum Shear Stress Theory Explained

Exploring Ethical Theories: Understanding the Foundations

Revitalizing Your Fitness Journey: The Orange Theory Fitness Logo Unveiled

Unveiling Critical Race Theory in Utah: Debunking Myths & Exploring Realities

Unraveling Game Secrets: MatPat from Game Theory Sheds Light

Unraveling Relational Frame Theory: Understanding ABA's Transformative Power

Find Study Materials for

- Business Studies

- Combined Science

- Computer Science

- Engineering

- English Literature

- Environmental Science

- Human Geography

- Macroeconomics

- Microeconomics

- Social Studies

- Browse all subjects

- Read our Magazine

Create Study Materials

Imagine a moment in the near future: with a little help from StudySmarter, you passed your AP Human Geography exam with flying colours, then got accepted to a great university. Your new school does not require first-years to stay in a campus dorm, so you've been shopping around for an apartment: somewhere cool, somewhere fun, with lots of little shops and restaurants. But, taken aback by the prices, you start looking for something a little more affordable, even if means you will have less access to the interesting retail experiences your university's city has to offer.

Explore our app and discover over 50 million learning materials for free.

- Bid Rent Theory

- Explanations

- StudySmarter AI

- Textbook Solutions

- Agricultural Geography

- Cultural Geography

- Economic Geography

- Introduction to Human Geography

- Political Geography

- Population Geography

- African City Model

- Air Quality

- Brownfield Redevelopment

- Central Place Theory

- Challenges Of Urban Changes

- Challenges to Urban Sustainability

- Concentric Zone Model

- Disamenity Zones

- Environmental Injustice

- Galactic City Model

- Gentrification

- Hoyt Sector Model

- Internal Structure of Cities

- Mixed Land Use

- Multiple Nuclei Model

- New Urbanism

- Primate City

- Rank Size Rule

- Redlining and Blockbusting

- Squatter Settlements

- Suburban Sprawl

- Sustainable Design

- Transit Oriented Development

- Urban Renewal

- Urban Sustainability

- Water Quality

- World Cities

Lerne mit deinen Freunden und bleibe auf dem richtigen Kurs mit deinen persönlichen Lernstatistiken

Nie wieder prokastinieren mit unseren Lernerinnerungen.

Imagine a moment in the near future: with a little help from StudySmarter, you passed your AP Human Geography exam with flying colours, then got accepted to a great university. Your new school does not require first-years to stay in a campus dorm, so you've been shopping around for an apartment: somewhere cool, somewhere fun, with lots of little shops and restaurants. But, taken aback by the prices, you start looking for something a little more affordable, even if means you will have less access to the interesting retail experiences your university's city has to offer.

Why were those apartments so expensive? It may have been part of a pattern known as bid rent theory. Using Seattle as a case study, we will explore the bid rent theory definition, some bid rent theory assumptions, and major bid rent theory strengths and weaknesses – and try and figure out if it stands up to scrutiny.

Bid Rent Theory Definition

Bid rent theory is one way to explain the internal structure of cities .

Bid rent theory : Land/property/rental unit costs increase the closer one gets to a city's central business district.

Bid rent theory (which you may alternatively see written out as "bid-rent theory") builds upon very general urban patterns identified by urban geographers:

A city will include a central business district (CBD), where most commerce takes place

A city will include an industrial district, where most manufacturing takes place

A city will include one or more outlying residential districts

The CBD is the "heart" of the city; in everyday language, we might call the CBD "downtown" or "the city centre," though some cities may classify their CBD as a part of downtown, as we will see later. CBDs are often built upon an original, historic "town centre."

Most cities' CBDs have a positive feedback loop in place: most commerce, retail activity, social opportunities, and urban conveniences are located in the CBD because that's where the population density is higher—and most people want to live in the CBD because that's where most commerce, retail activity, social opportunities, and urban conveniences are located or are taking place. Population density and commerce continue to increase in proportion to each other.

The "rent" in bid rent refers to revenue after production and transportation costs have been subtracted. If production costs are fixed, the goal then becomes to reduce transportation costs as much as possible, which is why the densely populated CBD is the most desirable area for commerce.

"Rent" in "bid rent" does not refer to how much you're paying per month to live in an apartment—though the two concepts are inextricably linked, as higher apartment rental costs can be an indicator of an area's desirability and density.

People who live in the CBD may have more readily available social and economic opportunities than those living outside of it. Businesses located in the CBD can generate greater profits thanks to the dense population. The high desirability of both residential apartments and retail spaces in the CBD drives prices up; this is the crux of the bid rent theory.

The farther you get from the CBD, the less competition you face for land use . This is because:

commerce will not be as common because businesses will want to maximize profits by being located in as dense an area as possible

social opportunities decrease in less densely populated areas, making them less attractive to residents.

Additionally, the cost of transportation (both in terms of time and money) outweighs the benefit of cheaper rent outside the CBD. These factors drive bid rent down relative to bid rent in the CBD.

The bid rent theory implies that cities will organically create zones based on building function, that is to say, industry and commerce will not naturally be in the same areas of the city.

William Alonso Bid Rent Theory

William Alonso (1933-1999) was an urban planner and economist. He is credited with creating the bid rent theory.

Alonso was born in Argentina but moved with his family to the US in 1946 when he was around 14. After several positions in academia, Alonso wrote Location and Land Use : Toward a General Theory of Land Rent, which was first published in 1964. 2 This book was significant in that it was one of the first modern attempts to explain rent costs in cities.

Alonso's ideas about land use and bid rent theory were later adapted for use in agricultural geography to explain the spatial distribution of intensive farming and extensive farming .

Bid Rent Theory Assumptions

Alonso made several assumptions about the internal structure of cities in formulating the bid rent theory:

Cities will generally have distinct and recognizable districts, notably a centralized business district.

The CBD will inherently be the most desirable area for a majority of people.

Transportation costs will be constant throughout the city; i.e., transportation costs are lower when travelling within the CBD than when travelling from the residential district to the CBD because the geographic distance is shorter.

Profit/affordability proportional to population density is the single greatest determining factor for the desirability of a location for commerce.

Bid rent theory presents an urban layout that is in many ways very similar to the Concentric Zone Model or the Hoyt Sector Model. Many of these assumptions do hold true in many cases , but we will discuss the strengths and weaknesses of the bid rent theory a bit later.

Bid-Rent Theory Example

Let's take a look at a few general patterns in Seattle, Washington, to determine the applicability of the bid rent theory. All prices shown are in US dollars.

First, take a look at the map produced by the Office of the Seattle City Clerk, defining the general downtown area and the CBD within it:

Using the parameters as defined in this map as of November 2022:

Single-bedroom apartments in the heart of the CBD ranged from $3200 to $3700 per month

Retail space in and around the CBD (including the Pike Market retail area) ranged from around $32 to $70 per square foot per year

Office space in and around the CBD ranged from $25 to $55 per square foot per year

Let's go a little further south to Seattle's formal industrial district. This area serves as the headquarters for several corporations (like Starbucks and Uwajimaya) as well as a major location for industrial buildings. For the purpose of this exercise, we will also include Southern Downtown ("SODO") as part of the industrial district.

Again, as of November 2022:

Single bedroom/studio apartments in SODO ranged from $1700 to $2200 per month; residences are virtually non-existent closer to the industrial centre

Retail space in and around the industrial centre ranged from $20 to $25 per square foot per year, but was very limited relative to the CBD

Office/warehouse space in and around the industrial district was around $20 per square foot per year

So far, so good: the bid rent theory holds up. Next, let's compare prices in one of Seattle's residential areas.

West Seattle is mostly a mishmash of different residential neighbourhoods with some limited retail/commerce services. As of November 2022:

Single-bedroom apartments in West Seattle ranged from $1400 to $3500 per month; many apartments available

Retail space in and around West Seattle was around $27 to $31 per square foot per year

Office space in and around the industrial district was around $15 to $35 per square foot per year

What general patterns can we glean from this case study? Well, in Seattle, residential space, office space, and retail space are generally more expensive around the CBD than they are around the industrial district or the West Seattle residential district. This suggests that, in the most general sense, Seattle conforms to the bid rent theory: prices are higher around the CBD, presumably because that area of the city is perceived as more desirable for commerce and residence.

Bid Rent Strengths and Weaknesses

The bid rent theory is simple, almost intuitive—as we mentioned in the introduction, you may have even encountered bid rent at play while browsing for apartments or while shopping downtown, perhaps without even fully understanding the patterns you were seeing. Or maybe, you thought to yourself, "Oh, we're in the heart of the city—these prices make sense."

In either case, the bid rent theory does have a number of weaknesses. For example, in 1964, Alonso could not have possibly predicted the rise of online shopping and its role in retail activity. Online shopping undercuts the relationship between physical location and profit margins; population density is not necessarily a determining factor in a retail business's success. If online commerce continues to increase (which seems likely), it is not entirely impossible that competition for physical retail space within CBDs will decrease. For now, rural-to-urban migration patterns are still generally steady, but what long-term effect the Internet will have on residential population distributions remains to be seen.

Another weakness of the bid rent theory is its assumption about how any given city will be organized. Unlike Seattle, not every city conforms to the general pattern of "CBD-Industrial District-Residential Districts." For example, Tokyo, Japan, has multiple CBDs (see our explanation on the Multiple Nuclei Model ). Meanwhile, Chesapeake, Virginia, has no real discernable CBD—which is not all that unusual for cities and towns that have developed out of suburbs. In those cases, the bid rent theory is not particularly applicable.

Bid Rent Theory - Key takeaways

- Bid rent theory states that land/real estate/rental costs are higher in and around a city's central business district due to demand.

- Bid rent theory was first postulated by William Alonso (1933-1999), an urban planner, academic, and economist, who described bid rent in his 1964 book Location and Land Use: Toward a General Theory of Land Rent.

- Many cities, like Seattle, generally conform pretty well to the bid rent theory.

- The bid rent theory does not fit all cities, and it remains to be seen how internet commerce will affect its applicability moving forward.

- Fig. 1: Bid rent1 (https://en.wikipedia.org/wiki/File:Bid_rent1.svg), by SyntaxError55 (https://en.wikipedia.org/wiki/User:SyntaxError55), Licensed by CC-BY-SA-3.0 (https://creativecommons.org/licenses/by-sa/3.0/deed.en)

- Alonso, W. (1968). Location and land use: Toward a general theory of land rent. Harvard University Press.

Frequently Asked Questions about Bid Rent Theory

--> what is the bid rent theory .

Bid rent theory states that land/real estate/rental costs are higher in and around a city's central business district due to demand.

--> Who created bid rent theory?

Urban planner William Alonso (1933-1999) is credited with creating bid rent theory.

--> When was the bid rent theory created?

Bid rent theory was first described in Alonso's 1964 book Location and Land Use.

--> How is the bid rent theory used?

Bid rent theory is used to explain patterns in rent prices across an urban environment.

--> What is the purpose of the bid rent theory?

The purpose of bid rent theory is to explain how population density and commerce affect rent prices in a city.

Test your knowledge with multiple choice flashcards

Which of the following books is credited with first describing bid rent theory?

Bid rent theory assumes a city has a _____, a _____, and a _____.

Bid rent theory states that generally, the closer you are to the _____, the _____ rent costs will be.

Your score:

Join the StudySmarter App and learn efficiently with millions of flashcards and more!

Learn with 10 bid rent theory flashcards in the free studysmarter app.

Already have an account? Log in

Who created bid rent theory?

William Alonso.

Location and Land Use (1964)

Central business district; manufacturing/industrial district; residential district(s).

CBD; higher.

What is one reason a retail-oriented business might want to locate one of its stores in a CBD?

Higher population density is likely to lead to a higher volume of customers, and with it, profits.

The competition for space in the CBD generally _______.

Drives prices up.

- Urban Geography

of the users don't pass the Bid Rent Theory quiz! Will you pass the quiz?

How would you like to learn this content?

Free human-geography cheat sheet!

Everything you need to know on . A perfect summary so you can easily remember everything.

Join over 22 million students in learning with our StudySmarter App

The first learning app that truly has everything you need to ace your exams in one place

- Flashcards & Quizzes

- AI Study Assistant

- Study Planner

- Smart Note-Taking

Sign up to highlight and take notes. It’s 100% free.

This is still free to read, it's not a paywall.

You need to register to keep reading, create a free account to save this explanation..

Save explanations to your personalised space and access them anytime, anywhere!

By signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Entdecke Lernmaterial in der StudySmarter-App

Advertisement

Do COVID-19 pandemic-related policy shocks flatten the bid-rent curve? Evidence from real estate markets in Shanghai

- Published: 28 April 2023

Cite this article

- Yifu Ou 1 ,

- Zhikang Bao 2 ,

- S. Thomas Ng 2 &

- Jun Xu 2 , 3

1863 Accesses

2 Citations

Explore all metrics

The COVID-19 pandemic has drastically affected the socioeconomic activities and peoples’ daily life, resulting in a change in locational preferences in the real estate markets. Although enormous efforts have been devoted to examining the housing price impacts of the COVID-19 pandemic, little is known about the responses of the real estate markets to the evolving pandemic control measures. This study investigates the price gradient effects of various pandemic-related policy shocks using a hedonic price model on the district-level property transaction data in Shanghai, China over a 48-month period from 2018 to 2021. We found that these shocks have significantly altered the bid-rent curves. The price gradient for residential property units decreased in absolute value to − 0.433 after Wuhan’s lockdown, demonstrating peoples’ preferences to avoid the high infection risks in districts closer to the city center. However, in the post-reopening and post-vaccine periods, the price gradient increased to − 0.463 and − 0.486, respectively, implying rational expectations of a recovering real estate market for the low infection and mortality rates. In addition, we discovered that Wuhan’s lockdown has steepened the price gradient for commercial property units, suggesting a decline in business volumes and an increase in operating costs in the low-density districts imposed by the strict pandemic control measures. This study contributes to the empirical literature on the price gradient effects of the COVID-19 pandemic by extending the study period to the post-vaccine era.

Similar content being viewed by others

Assessing the impacts of pandemic and the increase in minimum down payment rate on Shanghai housing prices

Impact of the COVID-19 pandemic on the housing market at the epicenter of the outbreak in China

Trends in housing markets during the economic crisis and Covid-19 pandemic: Turkish case

Avoid common mistakes on your manuscript.

1 Introduction

Coronavirus disease 2019 (COVID-19) is a newly emerged respiratory disease caused by a novel coronavirus. The COVID-19 outbreaks have severely challenged global public health since the disease was initially reported in December 2019 (Fauci et al., 2020 ). By October 2022, there have been approximately 0.6 billion cumulative confirmed cases, causing over 6.5 million deaths worldwide (World Health Organization, 2022 ). In this context, the pandemic and its control measures have led to substantial economic losses in the world’s major economies, such as the United States (Cutler & Summers, 2020 ), China (World Bank, 2022 ), European Union (European Commission, 2022 ), etc.

Against this background, the economic impacts of COVID-19 have been widely investigated from various aspects with a goal of devising mitigating measures. In the labor market, for example, the COVID-19 pandemic has contributed to massive employment losses, especially among the disadvantaged groups (Albanesi & Kim, 2021 ; Cortes & Forsythe, 2020 ). COVID-19 and its control measures have also been regarded as a major culprit of the recessions of various industries, including the retail sales (Lee et al., 2021 ), manufacturing (Deb et al., 2020 ), transportation (Nundy et al., 2021 ), energy (Fu & Shen, 2020 ), exporting and importing (Mou, 2020 ), and financial industries (Baker et al., 2020 ; Mazur et al., 2021 ).

Given a strong connection between the macroeconomic conditions and the real estate market, an increasing body of literature has explored the impacts of COVID-19 on the property market. For example, a group of studies focusing on the impacts of spread of COVID-19 on the housing and land markets has observed declines in housing and residential land prices associated with an increasing number of confirmed COVID-19 cases in China (Qian et al., 2021 ; Tian et al., 2021 ), the United States (Kuk et al., 2021 ) and Australia (Hu et al., 2021 ).

Another group of studies has explored the price gradient effects of COVID-19 in connection with peoples’ location choices. Among these, a flattening housing price gradient associated with households’ preferences is indicated due to an avoidance of high infection risks and a preference for work-from-home (WFH) arrangement during the pandemic in the United States (Brueckner et al., 2021 ; Gupta et al., 2022 ; Liu & Su, 2021 ; Ramani & Bloom, 2021 ) and China (Cheung et al., 2021 ; Huang et al., 2022 ). However, these studies mainly focused on the pre-2021 period when infection risks and mortality rates were high, with the potential impacts of pandemic-related policy shocks (e.g. lockdowns, reopenings and vaccination promotion) on the real estate market having been largely neglected. Thus, our study is motivated to fill this gap.

This study adopts a bid-rent theory to examine the price gradient effects of pandemic-related policy shocks. The bid-rent theory posits a negative association between property price and the distance to the city center, which hypothesizes that increased commuting costs in the urban peripheries are compensated by lower land prices (Alonso, 1964 ; Mills, 1967 ; Muth, 1969 ; Wheaton, 1977 ). Based on this theory, any changes in commuting/traveling behaviors in response to the policy shocks would consequently affect the property price gradient. For the analysis, we apply a hedonic price model to a 48-month (January 2018–December 2021) panel dataset of 16 districts in Shanghai, China. We select Shanghai for two reasons. First, as an international financial center, Shanghai has a large population with flourishing economic growth, ensuring sufficient transactions in the real estate market even during the pandemic period. Second, Shanghai has experienced different stages of pandemic severity, allowing us to test the responses of the real estate market at different COVID-19 pandemic stages.

The remainder of this study is structured as follows. Section 2 comprises three literature review sections on the pandemic control measures, the property market responses to public health crises, and the impacts of COVID-19 on the bid-rent curve. The methodology and data are articulated in Sect. 3 . Section 4 explains the model results and Sect. 5 discusses the policy implications and limitations of our study. Finally, conclusions are drawn in Sect. 6 . The goal of this study is twofold. The first is to introduce the bid-rent theory to the literature on the real estate market effects of the COVID-19 pandemic. The second goal is to empirically examine the changes in the property price gradient associated with various pandemic-related policy shocks.

2 Literature review

2.1 covid-19 pandemic control measures.

After the first case of COVID-19 infection was reported in late 2019 in Wuhan, China, the COVID-19 pandemic rapidly spread throughout China and the rest of the world, which significantly threatened global public health. Since then, various pandemic control measures have been implemented in different countries. In the earlier stages of the pandemic, control measures were mainly designed to contain the transmission of disease and mitigate the corresponding infections. For example, in China, aggressive containment strategies combined with tremendous efforts of medical workers and Chinese citizens significantly contributed to containing COVID-19 within the first two months after Wuhan’s initial lockdown (Cheng et al., 2021 ). In particular, two pandemic control measures, viz. the suspension of intra-city public transport and closures of entertainment venues, helped significantly reducing the number of confirmed cases in China within 50 days, reflecting the effectiveness of China’s national emergency responses in curbing the spread of COVID-19 (Tian et al., 2020 ).

Similar measures were also adopted in other countries. In European countries such as Germany, Spain, France, Italy and the UK, pandemic control measures like isolating suspected and confirmed cases, closing schools and universities, encouraging social distancing, banning mass gatherings, as well as complete lockdowns, were implemented at varying degrees since March 2020 (Aquino et al., 2020 ). In February 2020, the United States, as one of the first countries to impose a border control measure, suspended the entry of foreigners who had visited China within the previous 14 days (Lai & Cheong, 2020 ). However, other transmission control measures and government responses were relatively delayed in the United States, leading to an exponential growth in infections (Dandekar & Barbastathis, 2020 ).

Since the availability of the COVID-19 vaccine in early 2021, various governments had shifted their strategy to promoting vaccination and subsequently changed their pandemic-related policies. Although vaccines cannot prevent transmission of the virus that causes COVID-19, their effectiveness in protecting the infected population from severe health impacts is well-proven (Duckett et al., 2021 ). By September 2022, approximately 110 million US citizens had been fully vaccinated (Centers for Disease Control & Prevention, 2022 ), and the US president, Joe Biden, declared the end of the COVID-19 pandemic in the United States (Williams, 2022 ). In Australia, the national cabinet approved a national reopening plan after implementing successful vaccination policies (Angeles et al., 2022 ). In China, over 88% of the population were fully vaccinated as of October 2022, and the dynamic zero COVID-19 policy, which requires mass testing and strict quarantine measures, is still China’s central COVID-19 control strategy at the time this paper was published (Burki, 2022 ).

With a decreasing mortality rate due to the extensive vaccinationprogram, discussions about a balance between public health and economic growth have received growing attention from the public and policymakers. Despite the importance of this topic in the context of policymaking, relevant studies on the socioeconomic impacts of pandemic-related policies are relatively sparse, with their findings being inconclusive. Guan et al. ( 2020 ) asserted that stricter initial lockdowns could minimize economic losses and bring substantial positive externality to the whole world. Contrastingly, a study focusing on 46 countries suggested that strict containment measures would result in smaller economic gains, while the vaccination rate is positively associated with the economic activities (Deb et al., 2022 ). In China, the real estate market has been heavily affected during the COVID-19 pandemic (Cheung et al., 2021 ; Tian et al., 2021 ). However, to the best of our knowledge, there is a lack of relevant studies to explore the impacts of vaccination and other pandemic control measures on the real estate market. Therefore, this study is motivated to fill this gap.

2.2 Public health crises and real estate market

Few studies in the literature explored the impact of public health crises prior to the COVID-19 pandemic on the real estate market. This is partially due to the speedy containment of these incidents and the incomplete historical transaction records. We only identify three studies on this topic, and all documented a negative association between the public health incidents and housing prices. Of the three studies, two focused on the severe acute respiratory syndrome (SARS), suggesting a housing price decline of 1.0–7.1% associated with the SARS outbreak in the Hong Kong Special Administrative Region, China (Lu et al., 2022 ; Wong, 2008 ). Another study conducted in European countries explored the impacts of plague and cholera on housing prices in Amsterdam and Paris, respectively (Francke & Korevaar, 2021 ). The SARS outbreak in Hong Kong was rapidly contained without causing a long-term economic impact, while the studied infectious diseases in Europe remained local due to relatively less international mobility in the seventeenth and nineteenth centuries. In contrast, the COVID-19 pandemic has lasted for nearly three years, resulting in long-lasting impacts on the real estate markets worldwide. This reveals an urgent need for an enhanced understanding of the real estate market impacts brought by COVID-19.

Numerous recent studies have examined the impacts of COVID-19 outbreaks on property prices worldwide. For example, a decline in housing rental prices in 49 metropolitan areas in the United States is observed after a local spread of COVID-19 (Kuk et al., 2021 ). In Australia, when newly confirmed COVID-19 cases in a state were doubled, the housing returns were found to have decreased by 1.26% (Hu et al., 2021 ). In China, Qian et al. ( 2021 ) found a 2.47% nationwide decrease in housing prices associated with the confirmed COVID-19 cases, using a difference-in-differences model. Similarly, Tian et al. ( 2021 ) indicated a 13.7% decline in urban residential land prices with a unit percent increase in epidemic severity in the Yangtze River Delta of China. However, these estimates only investigated the short-term responses of the real estate market to the COVID-19 pandemic. There is a lack of studies focusing on the middle- or long-term impacts of the pandemic in connection to location choices.

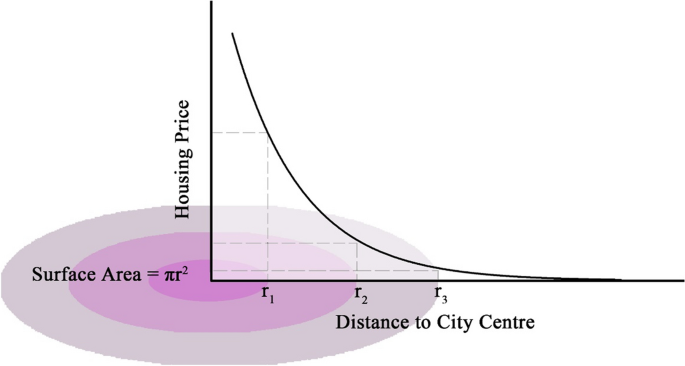

2.3 COVID-19 and the bid-rent curve

The bid-rent curve has long been used to examine households’ locational preferences in the land and real estate markets. Theoretical works on the bid-rent theory by Alonso ( 1960 , 1964 ), Mills ( 1967 ), and Muth ( 1969 ) propose a downward-sloping price gradient from the city center, as illustrated in Fig. 1 , assuming that households make a trade-off between the transport costs and housing costs when there is scarcer land supply near the city center. Since then, the Alonso–Muth–Mills model of the bid-rent theory has been extensively applied in empirical studies to examine the changes in housing price gradients associated with urban developments (Huai et al., 2021 ), urban industrial transition (Ahlfeldt & Wendland, 2013 ), and transportation infrastructure supply (Chang & Murakami, 2019 ; Yiu & Wong, 2005 ; Zheng & Kahn, 2008 ). In this sense, estimating the bid-rent curves can help understand the formation of the urban spatial structure and housing price differentials. This is of great use to policymakers when formulating various urban policies or public infrastructure development strategies and to homebuyers or private property developers when making investment decisions.

Source: Created by the authors

Illustration of the bid-rent curve.

Given its impacts on peoples’ daily routines, the COVID-19 pandemic has significantly affected consumer preferences for location choices and may potentially change the bid-rent curve for the following reasons. First, a higher infection risk near the city center due to higher population density and more socioeconomic activities may lower households’ preference for living closer to the city center (Cheung et al., 2021 ). Second, a rising trend of remote working during the pandemic may also contribute to a decreased housing demand and prices in city centers, as explained by the reduced price premiums for shorter commuting distances (Brueckner et al., 2021 ).

Several empirical studies have examined the price gradient effects of the COVID-19 pandemic (Table 1 ). Five US-based studies discovered the flattening of bid-rent curves affected by the COVID-19 pandemic. Brueckner et al. ( 2021 ) identified a flattened intra-city housing price gradient associated with a rising trend of WFH. Ramani and Bloom ( 2021 ) asserted a “donut effect” in 12 metropolitans in the United States, suggesting the decreased rents and housing values in high-density areas after the pandemic. Similarly, Gupta et al. ( 2022 ) and Liu and Su ( 2021 ) concluded a declining trend in housing prices associated with an increasing distance to city centers and population density in the US metropolitan areas during the pandemic. According to a more recent study focusing on commercial units, the rent price premium associated with employment density substantially drops during the pandemic in 89 urban areas in the United States (Rosenthal et al., 2022 ).

In China, studies on this topic are relatively sparse; however, empirical evidence in support of the flattening of the bid-rent curve still exists. Using housing transaction data from January 2019 to July 2020 in Wuhan, Cheung et al. ( 2021 ) reported a 4.8–7.0% drop in housing prices due to the COVID-19 pandemic, with corresponding districts closer to the epicenter experiencing a greater decline in housing prices than suburban districts. Another study by Huang et al. ( 2022 ) also observed a 2% decrease in housing prices 35 days after the 2020 Chinese Lunar Festival among the 60 Chinese cities, where a flattened housing price gradient is also explicitly exhibited. However, these studies’ which primarily focused on the pre-2021 period may not reflect the long-term impacts of COVID-19 control measures on housing prices, and this calls for the urgent need to extend the study period.

China’s strict pandemic-related policies have led to consistently low infection rates and a slow economic recovery of the country, particularly after Wuhan’s reopening and vaccination program (Tian, 2021 ). Given the rational expectation of a recovering housing market associated with the low infection risk and vaccine availability, we hypothesize a steepened bid-rent curve for the post-reopening and post-vaccine periods.

3 Methodology

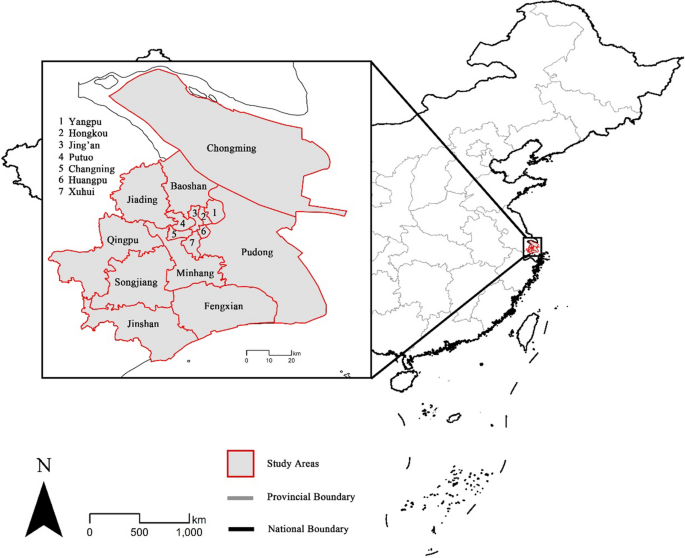

3.1 study area and data sources.

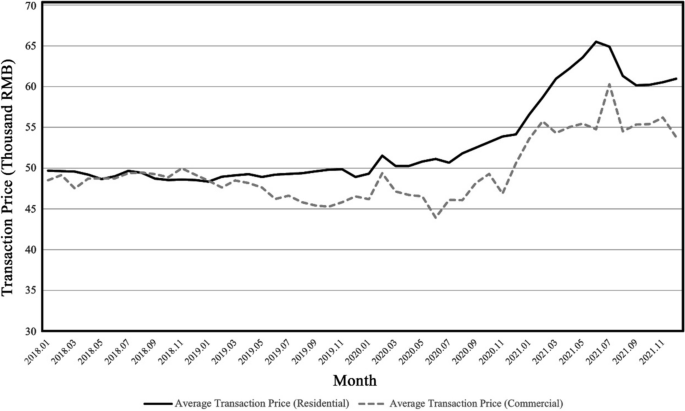

Shanghai, an international financial center in eastern China, has a metropolitan area of over 6,340 km 2 . As of the end of 2020, the population of Shanghai was approximately 25 million, with a GDP per capita of 22,600 USD (Shanghai Bureau of Statistics, 2022 ). The large population and strong economic performance have ensured Shanghai’s booming real estate markets. During the study period, the property prices for residential and commercial units share a similar trend, with them being relatively stable during the pre-2021 period, followed by a gradual increase in early 2021 after vaccine became available (Fig. 2 ). This offers a favorable environment to test the price gradient effects of the pandemic-related shocks for the residential and commercial real estate markets, where drastic fluctuations in the supply and price with a potential to incur biased estimates are not observed during the study period.

Source: Created by the author from Xitai data ( 2022 )

Monthly average transaction prices for residential and commercial units during the study period.

Our 48-month panel dataset for the 16 districts in Shanghai was constructed from three primary sources (See Fig. 3 for spatial distribution of districts in Shanghai). The transaction data for residential and commercial property units, aggregated at the district level, including the supply volume and average selling prices, were obtained from the Xitai database—one of the largest online Chinese real estate transaction databases (Xitai Data, 2022 ). The population density data were extracted from the Shanghai Statistical Yearbook (Shanghai Bureau of Statistics, 2022 ). Other density measures, such as the hospital, retail and school density, were computed based on the point of interest data collected from the OpenStreetMap dataset (OpenStreetMap, 2022 ). The descriptive statistics for all tested variables are summarized in Table 2 .

Source: Created by authors

Spatial distribution of 16 districts in Shanghai.

3.2 Empirical model

The hedonic price model, which assumes that a commodity’s explicit price is the composite of the implicit prices of its attributes (Rosen, 1974 ), has been widely adopted to examine the prices of various housing attributes, both inherently and extrinsically, such as the number of rooms (Fletcher et al., 2000 ; Li & Brown, 1980 ), transit accessibility (Yang et al., 2020 , 2022 , 2023 ) and environmental (dis)amenities (Nam et al., 2022 ; Ou et al., 2022 ). This model has also been applied to examine the price gradient effects, given its ability to estimate the marginal willingness to pay for the locational attributes regarding the distance to the city center and population density (Brander & Koetse, 2011 ; Chen & Hao, 2008 ).

In this study, we first estimate a baseline hedonic price model to capture the average price gradient in Shanghai during the study period. The full-log fixed-effects model is given in Eq. ( 1 ), where \(y_{it}\) is the average selling or rental price in district i at month t ; \(d_{i}\) is a locational attribute; \(x_{it}\) is a control variable of the housing unit supply; \(\beta_{0}\) , \(\beta_{1}\) , and \(\beta_{2}\) are parameters to be estimated; \(\alpha_{i}\) and \(\gamma_{t}\) are the district and time fixed effects, respectively; and \(\varepsilon_{it}\) is the error term.

We tested two locational attributes for \(d_{i}\) in this model. One is the distance to the city centre (DTC), where the city centre is defined as the location of the Shanghai Municipal Government Office. The other is the district-level population density in 2019 (POP_D). These two locational attributes are used to capture the distance price gradient and density price gradient, respectively.

To examine the impacts of several pandemic-related shocks on the housing price gradient, we additionally introduced a vector, \({\mathbf{T}}_{it}\) , to Eq. ( 2 ), which includes the interaction terms between time dummies and \({\text{ln}}\left( {d_{i} } \right)\) with the model. All other notations remain identical to those as defined in Eq. ( 1 ).

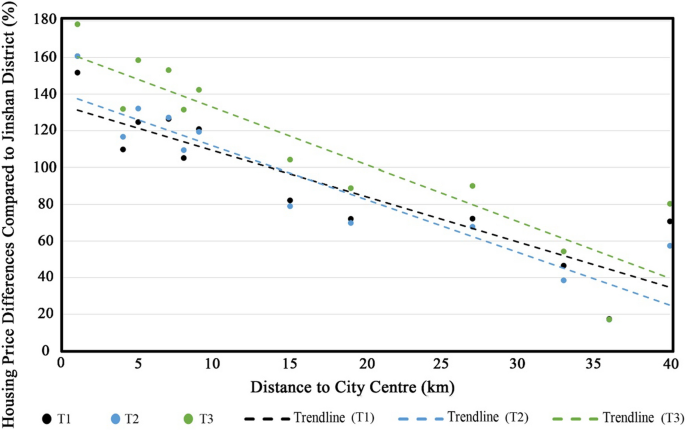

Three time dummies were included, namely post-COVID (T1), post-reopening (T2), and post-vaccine (T3). The T1 period, starting from January 23, 2020, is used to test the real estate market impacts associated with the lockdown of Wuhan, given that semi-lockdown measures, such as social distancing and quarantine interventions, were also imposed in Shanghai since February 2020 to contain the spread of COVID-19 (Leung et al., 2020 ; Qiu et al., 2020 ). In comparison, the T2 (April 8, 2020) and T3 (February 5, 2021) periods were applied to test the respective real estate market responses to the reopening of Wuhan and vaccine availability associated with the rational expectations of low infection risk and the return to pre-pandemic daily life.

4.1 Price gradient models

Our baseline hedonic price model results suggest positive housing price impacts of the proximity to the city center and population density during the study period (Table 3 ). As shown in Model [1], the coefficient of − 0.457 for our key explanatory variable is significant at the 1% level, suggesting that housing prices decrease by 0.457% with a 1% increase in the distance to the city center. Accordingly, the results presented in Model [2] reveal that housing prices rise by 0.513% for every 1% increase in population density. These findings confirm an overall downward bid-rent curve in Shanghai during the study period.

The results of the price gradient models with interaction terms show that COVID-19 pandemic-related shocks have significantly affected housing price gradients; however, their impacts, in terms of sign, tend to be divergent (Table 4 ). As shown in Model [1], all three interaction terms are significant at 10% or higher levels, with the first interaction term (T1) having a positive sign and the remaining two (T2 and T3) having negative signs. The base elasticity of − 0.445 for months before the pandemic first declined in absolute values to − 0.433 during the lockdown of Wuhan. It then increased to − 0.463 and − 0.486 after the reopening of Wuhan and after the vaccine availability, respectively. This trend is also confirmed by the bid-rent curves drawn from the three different periods (Fig. 4 ), with the steepness of the curves increasing over time.

Source: Created by the authors from Xitai data ( 2022 )

Bid-rent curves for T1, T2, and T3 periods.

Similar results are also reported in Model [2]. The density gradient declined from 0.505 to 0.490 after Wuhan’s lockdown, bounced back to 0.519 during the post-reopening period and further increased to 0.544 during the post-vaccine period. On the one hand, the flattened bid-rent curve observed during Wuhan’s lockdown is consistent with the findings of existing empirical studies (Cheung et al., 2021 ; Huang et al., 2022 ), reflecting homebuyers’ housing preferences in avoiding higher infection risk in the city center with a higher population density. On the other hand, an increase in price premium for proximity to the city center for the post-reopening and post-vaccine periods may be understood in two ways. First, a high infection risk and a rising trend of remote working, which flatten the price gradient, no longer exist under China’s stringent pandemic control and vaccination policies. Second, public service and medical resources with greater price premiums are concentrated in more developed high-density areas during the pandemic (Yang & Zhou, 2022 ). Additionally, a higher elasticity measured in absolute value for the post-vaccine period compared to the post-reopening period reflects that the expectations for long-term recovery associated with vaccine availability bring homebuyers greater confidence in the housing market than the short-term recovery associated with the dynamic zero COVID-19 strategies.

4.2 Robustness tests

We designed robustness tests to examine the sensitivity of the price gradient regarding the measure of density. For this purpose, we replaced the population density with school, mall, and hospital densities which often explain the patterns of population distribution associated with education, shopping, and healthcare purposes (Bao et al., 2022 ). As demonstrated in Table 5 , the key findings still hold, with the coefficients for density measures and their interaction terms in all three models showing identical signs and being significant at the 5% or higher levels.

The base estimates for the three models presented in Table 5 range within [0.468, 0.526], presenting acceptable differences in the absolute value between 4.2 and 7.3% from the referenced base estimate of 0.505. The most significant difference of 7.3% is found in Model [3] when the population density is replaced by the hospital density, showing the lowest base elasticity of 0.468 among all the three models. This is probably due to the dual effects of hospital accessibility on housing prices. Healthcare services with high accessibility could positively affect the housing prices, while higher infection risks in the vicinity of hospitals during the pandemic would negatively affect the housing prices (Cheung et al., 2021 ).

4.3 Commercial real estate market

Another interesting question on this topic is whether the price gradient for commercial units has a different response to the pandemic-related policy shocks compared to residential ones. Theoretically, the steepness of the bid-rent curves for residential and commercial property markets is determined by different factors, which may be affected by various impacts of the pandemic-related shocks. According to Alonso ( 1960 ), three factors affecting the residential location choices are the budget constraints, commuting distances and living spaces, while location decisions made by firms are based on their business volumes and operating costs. In this study, we limited our discussion to the commercial units, given a lack of observations for the office units in Shanghai’s Chongming, Jinshan and Fengxian districts.

The results of the price gradient models for commercial units are summarized in Table 6 . The baseline results for commercial units presented in Models [1] and [3] are consistent with residential units in terms of the sign and statistical significance for DTC and POP_D. In Model [1], the coefficient of − 0.274 for DTC is significant at the 1% level, suggesting that the selling price for commercial units will drop by 0.27% with every 1% increase in the distance to the city center. Similarly, the coefficient of 0.281 presented in Model [3] demonstrates a 0.28% increase in selling price associated with a 1% increase in population density. However, the estimates of base elasticity for commercial units are lower in absolute value than those for residential units. One possible explanation for the lower price gradient for commercial units is that some district-specific advantages (e.g. better access to education and healthcare services) provided in the urban core districts may attract local residents more than commercial entities. As shown in Table 7 , both the school and hospital densities strongly correlate with population density and distance to the city center, suggesting that education and healthcare resources favored by local residents are concentrated in urban core districts with a high population density. Also, the strong negative correlations between DTC and other density measures reflect the monocentric structure of Shanghai, validating our use of the bid-rent model. Footnote 1

Interestingly, Table 6 shows that Wuhan’s lockdown seems to have opposite impacts on the price gradients for commercial and residential units in Shanghai. As presented in Models [2] and [4], the coefficients of − 0.003 and 0.027 for the first interaction term (T1) are significant at the 1% level, suggesting a steeper bid-rent curve for commercial units after Wuhan’s lockdown. This result indicates that disruptions in the public transit systems and in the daily lives of residents during the semi-lockdown in Shanghai posed stronger negative impacts on business volumes in the low-density districts than in high-density ones. Similar findings are also reported in the United States, with more job opportunities being concentrated in the urban cores shortly after the pandemic (Delventhal et al., 2022 ). For the post-vaccine period, the distance and density price gradients for commercial units increase in absolute values to − 0.284 and 0.318, respectively. A similar trend is also found for residential units, reflecting the common expectations of a pre-pandemic lifestyle associated with low infection and mortality risks.

5 Discussion

Overall, our results on the flattening bid-rent curve during the lockdown period from February to April 2020 in Shanghai are consistent with the findings drawn from other cities in China (Cheung et al., 2021 ; Huang et al., 2022 ) and in the US (Brueckner et al., 2021 ; Gupta et al., 2022 ; Liu & Su, 2021 ; Ramani & Bloom, 2021 ; Rosenthal et al., 2022 ), confirming people’s infection-avoidance behaviors and a shift towards remote working during the COVID-19 pandemic. However, by extending the study period to the post-vaccine era, we find that the reopening of Wuhan and the promotion of vaccination tend to steepen the bid-rent curve, reflecting people’s growing confidence in the recovery of the real estate markets associated with dynamic zero COVID-19 strategies and vaccine availability in China. These findings enhance the current understanding of the price gradient impacts of COVID-19 and carry rich policy implications. The following subsections discuss policy implications drawn from the findings and potential limitations underlying our data and methods.

5.1 Policy implications

This study conveys several policy implications. First, it gives insight into land and housing policymaking in the post-2020 period. Our results show a steeper bid-rent curve since the reopening of Wuhan, reflecting an oversupply of housing units associated with a shrinking housing demand in urban peripheries after the pandemic. Second, the steep price gradients shown in our results also reflect an uneven distribution of public service resources and job opportunities in the post-2020 period in Shanghai. This suggests that policymakers should increase public service provisions in districts farther away from the city center, as uneven access to public services and job opportunities could threaten sustainable economic growth (World Economic Forum, 2014 ). Finally, our results of evolving bid-rent curve in response to multiple policy shocks shed light on the potential real estate market impacts of public health policies. Although China dropped its dynamic zero COVID-19 strategies on December 7, 2022 (Dyer, 2023 ), the promotion of vaccination is expected to have long-lasting effects on the real estate market since COVID-19 still exists. In addition, the steeper bid-rent curve found during the reopening period provides some new insights into the potential real estate market responses to the recent abandonment of dynamic zero COVID-19 strategies, given the common features these two policies shared with each other.

5.2 Limitations and future research

There are a few limitations of this study, which demand further improvements in future studies. First, the property price data used in this study was aggregated at the district level due to constrained data availability, limiting our study to focus only on a few district-level locational attributes, such as distance to the city center and population density. However, some community-level attributes, such as urban green space and public service accessibilities, which may also be affected by pandemic control measures (Nanda et al., 2021 ), are largely neglected. Therefore, we recommend future studies use unit-level transaction data combined with community-level locational attributes when data becomes available. Second, our findings were derived from Shanghai; however, it is unclear whether similar findings can also be drawn from other Chinese cities since China’s uneven regional economic development may contribute to heterogeneous property market responses to pandemic-related policy shocks, which is also considered as an inevitable weakness for case study research (Bao, 2023 ; Bao et al., 2023 ; Bao & Lu, 2023 ). For this reason, we suggest that future studies conduct cross-regional analyses to explore inter-regional variations. Finally, although our revealed preference model with direct market data successfully captures the changes in price gradient associated with pandemic-related policy shocks, the underlying mechanisms may not be explicitly demonstrated. Given the evolving COVID-19 pandemic and the variety of pandemic control measures, it is important to understand the rationales behind the changes in consumer preferences. We recommend future studies attempt using the stated preference methods to explore the causes of changing market behaviors during the pandemic.

6 Conclusion

The COVID-19 pandemic flattened the bid-rent curve in real estate markets during its earlier stages due to its strong influence on people’s preferences for locational attributes. However, there is a lack of empirical evidence on how consumer preferences respond to the evolving pandemic-related policies at different stages of the pandemic. To fill this gap, we examined the impacts of various pandemic control measures and vaccine availability on property price gradients in Shanghai, using a fixed-effects hedonic price model on a 48-month panel dataset.

Our results show that pandemic-related shocks have significant impacts on both distance and density price gradients, and the price gradient effects of different shocks tend to be divergent. Before the lockdown of Wuhan, a unit percent increase in the distance to the city center was associated with a 0.45% decrease in housing prices in Shanghai. The elasticity drops in absolute value to − 0.433 during Wuhan’s lockdown, bounced back to − 0.463 after Wuhan’s reopening and further increases to − 0.486 after vaccine availability. A similar pattern is also observed for the density price gradient. The elasticity first decreased to 0.490, then increased to 0.519 and 0.544 during the three study periods, exhibiting households’ preference for low-density areas to avoid high infection risk at the beginning of the pandemic and a transition associated with the expectations for a recovery in the housing market under stringent COVID-19 control measures after Wuhan’s reopening and vaccine availability.

We also found inconsistency in the price gradient effects of the pandemic-related shocks between residential and commercial units in Shanghai. The density price gradient increased by approximately 10% for commercial units after Wuhan’s lockdown, in contrast to a 3% decrease for residential units during the same period. This phenomenon could be attributed to a sharper decline in business volumes and a more significant increase in operating costs in low-density areas associated with semi-lockdown measures.

There are two main contributions of this study. From an academic perspective, our study enriches the existing empirical literature on the price gradient impacts of pandemic-related shocks by exploring consumer preferences for vaccine availability. Existing studies focused primarily on the short-term property market responses to the outbreaks of COVID-19. By extending this study to cover the post-vaccine period, our study reflects the market effects in the post-pandemic stage. From a policy perspective, our results, which show a steeper bid-rent curve in Shanghai associated with the reopening of Wuhan and vaccination promotion, reveal a need for policy interventions to address the oversupply of residential and commercial units in the urban peripheries and an undersupply in the urban core areas in Shanghai in the post-reopening and post-vaccine periods. Our results also provide a new angle to understand the socioeconomic impacts of various COVID-19 pandemic control measures.

The bid-rent model is based on the assumption of a monocentric city (Alonso 1960 ; Alonso 1964 ).

Ahlfeldt, G. M., & Wendland, N. (2013). How polycentric is a monocentric city? Centers, spillovers and hysteresis. Journal of Economic Geography, 13 (1), 53–83.

Article Google Scholar

Albanesi, S., & Kim, J. (2021). Effects of the COVID-19 recession on the US labor market: Occupation, family, and gender. Journal of Economic Perspectives, 35 (3), 3–24.

Alonso, W. (1960). A theory of the urban land market. Papers in Regional Science, 6 , 149–157.

Alonso, W. (1964). Location and land use; toward a general theory of land rent.

Angeles, M. R., Wanni Arachchige Dona, S., Nguyen, H. D., Le, L. K. D., & Hensher, M. (2022). Modelling the potential acute and post-acute burden of COVID-19 under the Australian border reopening plan. BMC Public Health , 22 (1), 1–13.

Aquino, E. M., Silveira, I. H., Pescarini, J. M., Aquino, R., Souza-Filho, J. A. D., Rocha, A. D. S., & Lima, R. T. D. R. S. (2020). Social distancing measures to control the COVID-19 pandemic: Potential impacts and challenges in Brazil. Ciencia & Saude Coletiva, 25 , 2423–2446.

Baker, S. R., Bloom, N., Davis, S. J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies, 10 (4), 742–758.

Bao, Z., Ou, Y., Chen, S., & Wang, T. (2022). Land use impacts on traffic congestion patterns: A tale of a Northwestern Chinese City. Land, 11 (12), 2295.

Bao, Z., & Lu, W. (2023). Applicability of the environmental Kuznets curve to construction waste management: A panel analysis of 27 European economies. Resources, Conservation and Recycling, 188 , 106667.

Bao, Z. (2023). Developing circularity of construction waste for a sustainable built environment in emerging economies: New insights from China. Developments in the Built Environment, 13 , 100107.

Bao, Z., Lu, W., Peng, Z., & Ng, S. T. (2023). Balancing economic development and construction waste management in emerging economies: A longitudinal case study of Shenzhen, China guided by the environmental Kuznets curve. Journal of Cleaner Production, 396 , 136547.

Brander, L. M., & Koetse, M. J. (2011). The value of urban open space: Meta-analyses of contingent valuation and hedonic pricing results. Journal of Environmental Management, 92 (10), 2763–2773.

Brueckner, J., Kahn, M. E., & Lin, G. C. (2021). A new spatial hedonic equilibrium in the emerging work-from-home economy? (No. w28526). National Bureau of Economic Research.

Burki, T. (2022). Dynamic zero COVID policy in the fight against COVID. The Lancet. Respiratory Medicine.

Centers for Disease Control and Prevention. (2022). COVID Data Tracker. https://covid.cdc.gov/covid-data-tracker/#vaccinations_vacc-people-additional-dose-totalpop

Chen, J., & Hao, Q. (2008). The impacts of distance to CBD on housing prices in Shanghai: A hedonic analysis. Journal of Chinese Economic and Business Studies, 6 (3), 291–302.

Chang, Z., & Murakami, J. (2019). Transferring land-use rights with transportation infrastructure extensions. Journal of Transport and Land Use, 12 (1), 1–19.

Cheng, Z. J., Zhan, Z., Xue, M., Zheng, P., Lyu, J., Ma, J., & Sun, B. (2021). Public health measures and the control of COVID-19 in China. Clinical Reviews in Allergy & Immunology , 1–16.

Cheung, K. S., Yiu, C. Y., & Xiong, C. (2021). Housing market in the time of pandemic: A price gradient analysis from the COVID-19 epicentre in China. Journal of Risk and Financial Management, 14 (3), 108.

Cortes, G. M., & Forsythe, E. (2020). Heterogeneous labor market impacts of the COVID-19 pandemic. ILR Review , 00197939221076856.

Cutler, D. M., & Summers, L. H. (2020). The COVID-19 pandemic and the $16 trillion virus. JAMA, 324 (15), 1495–1496.

Dandekar, R., & Barbastathis, G. (2020). Neural Network aided quarantine control model estimation of global Covid-19 spread. arXiv preprint arXiv:2004.02752 .

Deb, P., Furceri, D., Ostry, J. D., & Tawk, N. (2020). The economic effects of COVID-19 containment measures.

Deb, P., Furceri, D., Jimenez, D., Kothari, S., Ostry, J. D., & Tawk, N. (2022). The effects of COVID-19 vaccines on economic activity. Swiss Journal of Economics and Statistics, 158 (1), 1–25.

Delventhal, M. J., Kwon, E., & Parkhomenko, A. (2022). JUE Insight: How do cities change when we work from home? Journal of Urban Economics, 127 , 103331.

Duckett, S., Wood, D., Coates, B., Mackey, W., Crowley, T., & Stobart, A. (2021). Race to 80: our best shot at living with COVID (No. Grattan Institute Report No. 2021-09). Grattan Institute.

Dyer, O. (2023). Covid-19: China stops counting cases as models predict a million or more deaths.

European Commission. (2022). Jobs and economy during the coronavirus pandemic. https://ec.europa.eu/info/live-work-travel-eu/coronavirus-response/jobs-and-economy-during-coronavirus-pandemic_en

Fauci, A. S., Lane, H. C., & Redfield, R. R. (2020). Covid-19—navigating the uncharted. New England Journal of Medicine, 382 (13), 1268–1269.

Fletcher, M., Gallimore, P., & Mangan, J. (2000). Heteroscedasticity in hedonic house price models. Journal of Property Research, 17 (2), 93–108.

Francke, M., & Korevaar, M. (2021). Housing markets in a pandemic: Evidence from historical outbreaks. Journal of Urban Economics , 123 , 103333.

Fu, M., & Shen, H. (2020). COVID-19 and corporate performance in the energy industry. Energy Research Letters, 1 (1), 12967.

Guan, D., Wang, D., Hallegatte, S., Davis, S. J., Huo, J., Li, S., & Gong, P. (2020). Global supply-chain effects of COVID-19 control measures. Nature Human Behaviour, 4 (6), 577–587.

Gupta, A., Mittal, V., Peeters, J., & Van Nieuwerburgh, S. (2022). Flattening the curve: Pandemic-induced revaluation of urban real estate. Journal of Financial Economics, 146 (2), 594–636.

Hu, M. R., Lee, A. D., & Zou, D. (2021). COVID-19 and housing prices: Australian evidence with daily hedonic returns. Finance Research Letters, 43 , 101960.

Huai, Y., Lo, H. K., & Ng, K. F. (2021). Monocentric versus polycentric urban structure: Case study in Hong Kong. Transportation Research Part a: Policy and Practice, 151 , 99–118.

Google Scholar

Huang, N., Pang, J., & Yang, Y. (2022). JUE insight: COVID-19 and household preference for urban density in China. Journal of Urban Economics , 103487.

Kuk, J., Schachter, A., Faber, J. W., & Besbris, M. (2021). The COVID-19 pandemic and the rental market: Evidence from Craigslist. American Behavioral Scientist, 65 (12), 1623–1648.

Lai, J. W., & Cheong, K. H. (2020). Superposition of COVID-19 waves, anticipating a sustained wave, and lessons for the future. BioEssays, 42 (12), 2000178.

Lee, B. P., Dodge, J. L., Leventhal, A., & Terrault, N. A. (2021). Retail alcohol and tobacco sales during COVID-19. Annals of Internal Medicine, 174 (7), 1027–1029.

Leung, K., Wu, J. T., Liu, D., & Leung, G. M. (2020). First-wave COVID-19 transmissibility and severity in China outside Hubei after control measures, and second-wave scenario planning: A modelling impact assessment. The Lancet, 395 (10233), 1382–1393.

Li, M. M., & Brown, H. J. (1980). Micro-neighborhood externalities and hedonic housing prices. Land Economics, 56 (2), 125–141.

Liu, S., & Su, Y. (2021). The impact of the COVID-19 pandemic on the demand for density: Evidence from the US housing market. Economics Letters, 207 , 110010.

Lu, S., Wang, C., Wong, S. K., & Shi, S. (2022). Is this time the same? Housing Market Performance during SARS and COVID-19. Housing Market Performance during SARS and COVID-19 (August 31, 2022).

Mazur, M., Dang, M., & Vega, M. (2021). COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Research Letters , 38 , 101690.

Mills, E. S. (1967). An aggregative model of resource allocation in a metropolitan area. The American Economic Review, 57 (2), 197–210.

Mou, J. (2020, July). Research on the Impact of COVID19 on Global Economy. In IOP Conference Series: Earth and Environmental Science (Vol. 546, No. 3, p. 032043). IOP Publishing.

Muth, R. F. (1969). Cities and housing: the spatial pattern of urban residential land use.

Nam, K. M., Ou, Y., Kim, E., & Zheng, S. (2022). Air Pollution and housing values in Korea: A hedonic analysis with long-range transboundary pollution as an instrument. Environmental and Resource Economics, 82 (2), 383–407.

Nanda, A., Thanos, S., Valtonen, E., Xu, Y., & Zandieh, R. (2021). Forced homeward: The COVID-19 implications for housing. Town Plan. Rev, 92 , 25–31.

Nundy, S., Ghosh, A., Mesloub, A., Albaqawy, G. A., & Alnaim, M. M. (2021). Impact of COVID-19 andemic on socioeconomic, energy-environment and transport sector globally and sustainable development goal (SDG). Journal of Cleaner Production, 312 , 127705.

OpenStreetMap. (2022). OpenStreetMap data for Chinat. https://download.geofabrik.de/asia/china.html . Accessed 15 Sept 2022.

Ou, Y., Zheng, S., & Nam, K. M. (2022). Impacts of air pollution on urban housing prices in China. Journal of Housing and the Built Environment, 37 (1), 423–441.

Qian, X., Qiu, S., & Zhang, G. (2021). The impact of COVID-19 on housing price: Evidence from China. Finance Research Letters, 43 , 101944.

Qiu, Y., Chen, X., & Shi, W. (2020). Impacts of social and economic factors on the transmission of coronavirus disease 2019 (COVID-19) in China. Journal of Population Economics, 33 , 1127–1172.

Ramani, A., & Bloom, N. (2021). The Donut effect of COVID-19 on cities (No. w28876). National Bureau of Economic Research.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82 (1), 34–55.

Rosenthal, S. S., Strange, W. C., & Urrego, J. A. (2022). JUE insight: Are city centers losing their appeal? Commercial real estate, urban spatial structure, and COVID-19. Journal of Urban Economics, 127 , 103381.

Shanghai Bureau of Statistics. (2022). 2021 Shanghai statistical yearbook. https://tjj.sh.gov.cn/tjnj/20220309/0e01088a76754b448de6d608c42dad0f.html . Accessed 15 Sept 2022.

Tian, H., Liu, Y., Li, Y., Wu, C. H., Chen, B., Kraemer, M. U., & Dye, C. (2020). An investigation of transmission control measures during the first 50 days of the COVID-19 epidemic in China. Science , 368 (6491), 638–642.

Tian, C., Peng, X., & Zhang, X. (2021). COVID-19 pandemic, urban resilience and real estate prices: The experience of cities in the Yangtze River Delta in China. Land, 10 (9), 960.

Tian, W. (2021). How China managed the COVID-19 pandemic. Asian Economic Papers, 20 (1), 75–101.

Wheaton, W. C. (1977). Income and urban residence: An analysis of consumer demand for location. The American Economic Review , 620–631.

Williams, M. (2022). Why Biden's premature COVID ending could help it surge. The Hill . https://thehill.com/opinion/healthcare/3658032-why-bidens-premature-covid-ending-could-help-it-surge/

Wong, G. (2008). Has SARS infected the property market? Evidence from Hong Kong. Journal of Urban Economics, 63 (1), 74–95.

World Bank. (2022). COVID-19 Outbreaks and Headwinds Have Disrupted China's Growth Normalization. https://www.worldbank.org/en/news/press-release/2022/06/08/covid-19-outbreaks-and-headwinds-have-disrupted-china-s-growth-normalization-world-bank-report

World Economic Forum. (2014). Global Risks 2014.

World Health Organization. (2022). WHO Coronavirus (COVID-19) Dashboard. https://covid19.who.int/

Xitai Data. (2022). Shanghai housing price dataset. https://www.creprice.cn/urban/sh.html . Accessed 15 Sept 2022.

Yang, M., & Zhou, J. (2022). The impact of COVID-19 on the housing market: Evidence from the Yangtze river delta region in China. Applied Economics Letters, 29 (5), 409–412.

Yang, L., Chau, K. W., Szeto, W. Y., Cui, X., & Wang, X. (2020). Accessibility to transit, by transit, and property prices: Spatially varying relationships. Transportation Research Part d: Transport and Environment, 85 , 102387.

Yang, L., Liang, Y., He, B., Lu, Y., & Gou, Z. (2022). COVID-19 effects on property markets: The pandemic decreases the implicit price of metro accessibility. Tunnelling and Underground Space Technology, 125 , 104528.

Yang, L., Liang, Y., He, B., Yang, H., & Lin, D. (2023). COVID-19 moderates the association between to-metro and by-metro accessibility and house prices. Transportation Research Part d: Transport and Environment, 114 , 103571.

Yiu, C. Y., & Wong, S. K. (2005). The effects of expected transport improvements on housing prices. Urban Studies, 42 (1), 113–125.

Zheng, S., & Kahn, M. E. (2008). Land and residential property markets in a booming economy: New evidence from Beijing. Journal of Urban Economics, 63 (2), 743–757.

Download references

Acknowledgements

The study was supported by the Collaborative Research Fund (CRF) (Project Number: C7080-21GF) from the Research Grants Council of Hong Kong Government, SAR.

Author information

Authors and affiliations.

Department of Urban Planning and Design, Faculty of Architecture, The University of Hong Kong, Pokfulam, Hong Kong

Department of Architecture and Civil Engineering, City University of Hong Kong, Kowloon Tong, Hong Kong

Zhikang Bao, S. Thomas Ng & Jun Xu

School of Mathematics, Hunan University, Changsha, China

You can also search for this author in PubMed Google Scholar

Contributions

Y.O. Conceptualization; Data curation; Formal analysis; Investigation; Methodology; Project administration; Writing—original draft preparation. Z.B.: Funding acquisition; Resources; Supervision; Validation; Visualization; Writing—review & editing. S.T.N.: Data curation; Investigation; Validation; Visualization. J.X.: Funding acquisition; Resources; Writing—review & editing.

Corresponding author

Correspondence to Zhikang Bao .

Ethics declarations

Conflict of interest.

The authors have no relevant financial or non-financial interests to disclose.