What Is An Assignment Fee — The Complete Investors Guide

Justin dossey.

- July 20, 2022

Whether you’re new to wholesaling , a real estate investor or agent looking to learn more about the “assignment business”, or even a homeowner asking…

… We want to give you a complete guide to understanding the assignment contract and fee from all angles.

Here’s a list of all the questions we’ll be covering:

- What is an assignment fee?

- Reasons to use an assignment?

- How to assign a contract?

- Is it legal?

- Is it ethical?

- How much should a fee be?

- Who pays for it?

- Does the seller or buyer see the fee?

- Alternatives to an assignment?

- Assignment fees and agents?

- Where to get a contract?

- How to increase your assignment fees?

- How to find discounted properties to wholesale ?

1. What’s an assignment fee?

First and foremost we have to define the term.

An assignment fee is a payment from the “ assignor ” (wholesaler) to the “ assignee ” (cash buyer) when the assignee transfers their rights or interest of a property to the assignor during the close of a real estate transaction.

Most often, this term is used in the real estate investing strategy of “wholesaling”.

The business of a “wholesaler”, is grounded in the assignment fee: They negotiate to buy a property, then while in the close of escrow they find a cash buyer. They will then sell the rights to that contract to the cash buyer for a fee.

In practical terms, the “fee” is the difference between what you negotiated in price with the seller, and what you negotiated with the end buyer.

Real-life example:

You find a seller who’s willing to sell her property for $250,000 dollars to you, cash. While in escrow you find a cash buyer who’ll be willing to buy that property for $260,000 cash. When it closes, you make $10,000.

The contracts Typically, most real estate contracts are “assignable”, meaning they can be transferred to another party; you mind find it expressed as an “assignment clause” or simply stated: “This contract is assignable”.

You’ll often hear this term amongst wholesalers, but there are other practicable uses for it as well…

2. Reasons to use an assignment

We covered why wholesalers do it: to make money.

But there are other reasons someone might need to use their assignment provision.

For example…

Changing ownership title If the contract is in your own name… but then, while in escrow, you want to change the “owner” to a trust rather than your personal name, you can then use the “assignment” clause.

Finding a partner While in the closing process of buying a property, you might come across a partner who’d like to have his equity/investment protected as well. So in that case you and your partner create a new entity and assign the rights of the contract to the new entity.

3. How to assign a contract?

Assigning a contract and taking a fee is as simple as giving instructions to your escrow or closing attorney, as long as the contract allows for that provision of assignment.

But the hard part is getting the price right…

It’s not as simple as finding a property on the MLS, saying you’re a cash buyer, then finding a real cash buyer to buy it from you at a mark-up.

There has to be “meat on the bone” for everyone AND a price that’s good enough for the seller to say, ”YES!”.

Most cash buyers will not buy a property at full retail value. There needs to be a way for them to make money either in a flip or having some equity in it if they decide to rent it.

That means, you as the wholesaler—who’s collecting assignment fees—need to find good deals for these cash buyers; that’s essentially what your job is: to find discounted properties.

What seller in their right mind will sell at a discount?

Many do, and for all sorts of reasons.

Here at Ballpoint Marketing, we specialize in creating marketing material for off-market investors looking for properties at a discount. Some of the marketing material that wholesalers might purchase from us to find these good deals is our real handwritten door hangers that you can pick up for .45¢ a piece.

4. Is it legal?

“Wholesaling” is a hot topic on the web and a source of a lot of controversies.

However, assigning a contract for an assignment is not technically illegal as long as the contract and both parties agree to it. If a State makes “assigning” illegal, then that hurts other people who are using assignments to change the name of the buying entity or assign to their family and/or partners.

However, there are many states that are against wholesalers and creating laws against them. That’s why you should meet with a real estate attorney to find out what you can do, and what you can say when you’re a wholesaler collecting assignment fees, however, at the time of this writing they have not exactly made wholesaling “illegal” but place restrictions like for example:

- Saying “ I have a property to sell ” when you actually don’t because it’s still in closing. Rather, You have a “contract” for sale.

- Representing the buyer when you’re not a licensed real estate agent under a broker.

There’s a very fine line between what a wholesaler does and what agents do. You have to make sure what you say and do doesn’t cross those lines.

Here’s a great video on why wholesalers have a bad rep and what you can do differently:

5. Is it ethical

Now that we got the “ legal ” question out of the way…

What about “How ethical is it to wholesale”.

Type that into the web and you’ll get thrown into a black hole of comments and forums chatter you won’t ever be able to get out of.

Here’s the bottom line of why it gets so much controversy and what it has to do with assignment fees…

Wholesalers are going around marketing “We buy houses CASH” when in reality, they aren’t buying it cash… they’re assigning the contract for a fee.

This is where everyone gets their tights all tied up in a bunch (did I just make up a word?! Yes! I did). Because if you say you’re going to close it with cash, but you have to walk away from the seller because you can’t find a buyer… how would you feel leaving a seller (who seriously needed to close yesterday), hanging)?

Some with a conscious would feel pretty bad… others don’t care.

So it’s up to you how you feel about the ethics side of things.

Can you close the deal yourself if you can’t find a cash buyer , via a hard money lender or partner? Or will you feel comfortable walking away from the deal? Or will you be confident enough to go up to the seller and tell her the truth, that you intended on selling the contract to a cash buyer but it seems that your priced it too high, can we renegotiate?

The underlying problem with “walking away” from a buyer is not pricing it right.

If you have a good deal, cash buyers will be all over it and be HAPPY to pay you an assignment fee.

Here’s a video on ethical wholesaling:

6. How much should a fee be?

New wholesalers typically aren’t sure what they should charge. But it’s going to vary from deal-to-deal, and market to market.

A decent wholesaling fee can range from $10,000 to $30,000.

There are occasions when you hear about $100,000 assignment fees. And they do happen. It’s just a matter of negotiating a good deal.

While there isn’t a “set fee” that wholesalers should charge, it all depends on how good of a deal you can negotiate, and how high you can mark up the contract for an end buyer.

So there are two components that determine how much you can get paid for an assignment fee:

- Seller’s price.

- End buyers price.

Later, in another section, I talk about how you can increase your assignment fee… for now, let’s just cover how much your can charge.

Earlier I mentioned that your market might have an influence on how much you can charge. And that has more to do with how low of a discount, sellers are willing to take AND how competitive it is in your market.

Here’s an example:

If a seller talks to three wholesalers, one offers $200,000 while the others offer $180,000, she most likely will go with the higher offer. Well, now those wholesalers might enter into bidding wars in the market, by creeping up their MAOP (Max allowable offer price).

When wholesalers start raising their Max offers (because the market is demanding it), AND if the end buying price (what cash buyers are willing to pay for that deal) does move up with it…

Then you start seeing wholesalers’ assignment fees start shrinking down. We’ll go over later some techniques for helping with this natural occurrence in the market.

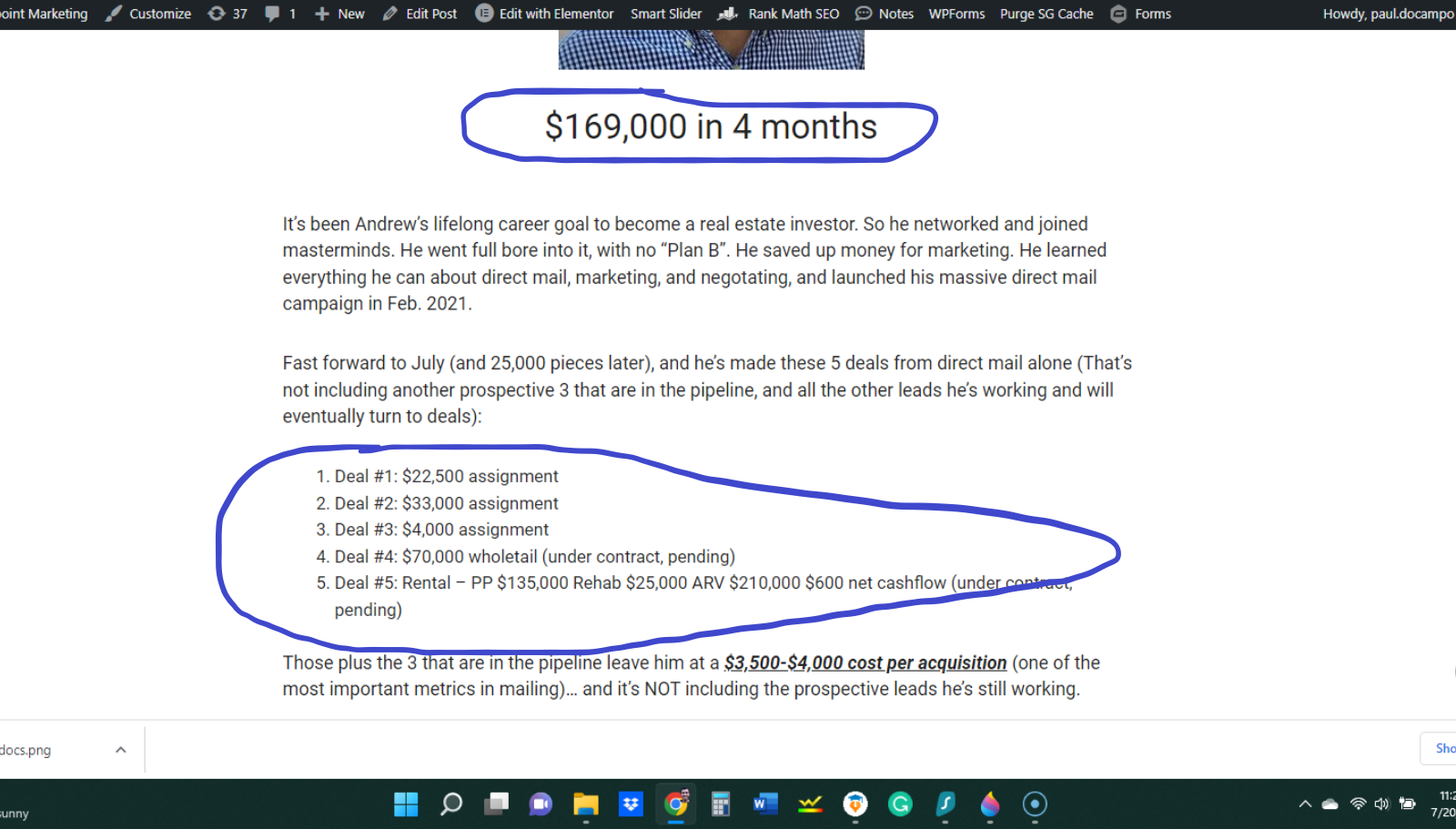

Here’s an example of a real wholesaler using our handwritten mailers, in a case study where he made anywhere from $4k fees to $22,500

7. Who pays for it?

Typically, in a traditional real estate wholesaling model, the end buyer (the cash buyer) is paying for your assignment fee.

For example: You negotiate with the seller to buy the property for $100,000. And the end buyer agrees to buy this deal for $120,000. He enters into escrow and pays the $120,000. You get the difference between the seller price and the end buyer price.

8. Does the seller or buyer see the fee?

In a typical assignment transfer, yes your assignment fee will be inside the closing statements.

After a property closes escrow, every party involved will get “closing statements” that look might look like this (depending on your state and the companies you use):

One of the line items may show up as “Assignment Fee” (or something similar), and show the amount.

Buyers will see these, as well as sellers.

However, a cash buyer (usually) understands that wholesaling is A LOT of work and that you should get paid for it. A good cash buyer understands that.

Sellers, most likely, won’t understand what an “assignment fee” is when they see this doc (they most likely won’t even read it).

On the rare occasion that they actually do ask what that line item is, you can tell the truth like this: “We work with partners and lenders all the time, and sometimes we end up selling the property during escrow to these partners, instead of keeping it ourselves. In this case we ended up selling to them”.

There’s a way to circumvent this potential problem of an assignment fee showing up on the closing documents…

And that’s by doing a double close instead of an assignment.

Let me explain in the next section…

9. Alternatives to an assignment?

As mentioned in the previous section, an assignment fee can have some cons to it. The primary being that sellers AND buyers can see how much you’re getting paid.

However, there is another “tool” you can use that hides this from both parties, and that’s called the “double close” (sometimes referred to as a “simultaneous closing” or “back to back” closing. As the name implies, there are 2 separate closings, not 1 (like our assignment fee transaction).

Here’s an explanation:

- The homeowner (party A) agrees to sell to a wholesaler (Party B) for $100,000

- They enter escrow

- While in escrow, Party B finds a cash buyer (Party C)

- Party C agrees to buy that property for $150,000

- They enter a second escrow agreement (different from the first)

- Party C funds the escrow account to buy the property at $150,000

- Party B uses those funds (minus his “assignment fee”) to pay the purchase from Party A

A little confusing?

Maybe this infographic helps:

We won’t go into too much detail about this as this is an article on the assignment fee… But just know that there is an alternative to hiding your fee but using a double close.

The con to this is that you pay a little more because you’re in fact doing 2 closes, not 1. So the times you might want to a double close vs an assignment fee is when you negotiated a very good deal and want to conceal the big check you’ll be getting.

10. Assignment fees and agents?

Anyone can get paid an assignment fee for this kind of “wholesaling” transaction. There’s no law that says agents can’t. However, that agent/broker needs to pay careful attention to their State RE commission laws as they’re put under serious scrutiny if they walk any fine lines.

For instance, if you’re buying the property and wholesaling it AND you’re licensed… in most states, you have to express to the seller that you are a licensed real estate agent but you are NOT representing them, and instead the principle of the transaction.

If you’re an agent wondering if you can (or should) do this, first contact your broker or RE Commission office to find out more.

Secondly, you might want to reconsider doing this as in some markets agent commission fees are higher than typical wholesaling fees. This is rare, but there are some hot markets where wholesalers have to keep raising their prices to win the deal, and therefore lower their assignment fee.

11. How to increase your assignment fees?

As mentioned in a previous section, your fee is greatly dependent on the kind of deal you negotiate.

So if you get a deal at $100,000 and another investor (cash buyer) is willing to pay $150,000 for it, you walk with a $50,000 assignment fee (assuming no closing costs are removed from this).

There are 4 factors to increasing your assignment fees…

- Become a better marketer If you improve your knowledge and skill set in marketing, you can essentially get to motivated sellers before anyone else.In the next section, we cover how to find these properties, which has everything to do with marketing, but one way (that we specialize in) is using handwritten mail to gain the best response rates from sellers.

- Become a better negotiator If you study and practice good salesmanship you can effectively win deals even if you’re offer is “low” . If you have no experience in sales, this will take time, but there are loads of resources available online (free and paid) that you can take advantage of. But, if you’re planning to stay in this entrepreneurship game for the long haul I HIGHLY suggest you study sales on a regular basis.

- Know you numbers Getting better and better at knowing what your market demands in terms of prices, rehab costs , etc… will help determine a more accurate price at a faster rate. Why does this matter to getting paid a higher assignment fee? It’s 2 reasons: First, if you know that cash buyers are willing to pay X, you can raise your asking price from end buyers, or on the flip side of that if, you know that a house needs some major repairs you can use that negotiated a lower price with the seller…Secondly, if you are really good with numbers, you can give an offer faster than your competition who has to take 1-2 days to send an offer in. In competitive markets “ Speed to lead ” wins and the person who can act fastest is usually the one who takes the trophy.

- Build a thriving buyers list The second component of the assignment fee and wholesaling business is selling the contract to a cash buyer.And, if you can build a list of buyers who will pay more for a good deal than most of the other “bottom of the barrel” buyers who demand very steep prices.Where do find buyers willing to pay more? It’s usually among high w-2 earners (doctors, lawyers, etc) who like to flip houses on the side. Or high-income business owners looking to park their cash somewhere to earn 15%+ annual ROI by doing so occasional flips.If you can find them, network with them, and add them to your list you can essentially raise your property raise to increase your assignment fee

12. How to find discounted properties to wholesale?

Finally our last section in this article which is probably at the top of some people’s minds:

“ Assignments sound great, but how do you FIND discounted properties!?!?”

Wholesaling is probably one of the toughest occupations in real estate.

You have to be well-rounded in almost every aspect of the industry. And you have to be top-notch in your selling and marketing capabilities.

But with that, there are foundational techniques to help you find these properties on your own. I’m going to give you 2 resources to start below.

First, is our article “ 8 ways to find 100 sellers for under $500”

Second is our eBook on Direct mail

You can get the Ebook for free by subscribing below to our newsletter, where we give lessons, stories, and value every week to real estate investors like you…

Spread the Word. Share this post!

Subscribe to our Newsletter

Sign up for news, updates, and more from BPM. It’s time to ZAG!

- Coaching Team

- Investor Tools

- Student Success

Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Navigate The Real Estate Assignment Contract

What is assignment of contract?

Assignment of contract vs double close

How to assign a contract

Assignment of contract pros and cons

Even the most left-brained, technical real estate practitioners may find themselves overwhelmed by the legal forms that have become synonymous with the investing industry. The assignment of contract strategy, in particular, has developed a confusing reputation for those unfamiliar with the concept of wholesaling. At the very least, there’s a good chance the “assignment of contract real estate” exit strategy sounds more like a foreign language to new investors than a viable means to an end.

A real estate assignment contract isn’t as complicated as many make it out to be, nor is it something to shy away from because of a lack of understanding. Instead, new investors need to learn how to assign a real estate contract as this particular exit strategy represents one of the best ways to break into the industry.

In this article, we will break down the elements of a real estate assignment contract, or a real estate wholesale contract, and provide strategies for how it can help investors further their careers. [ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

What Is A Real Estate Assignment Contract?

A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the home. That’s an important distinction to make, as the contract only gives the investor the right to buy the home; they don’t actually follow through on a purchase. Once under contract, however, the investor retains the sole right to buy the home. That means they may then sell their rights to buy the house to another buyer. Therefore, when a wholesaler executes a contact assignment, they aren’t selling a house but rather their rights to buy a house. The end buyer will pay the wholesale a small assignment fee and buy the house from the original buyer.

The real estate assignment contract strategy is only as strong as the contracts used in the agreement. The language used in the respective contract is of the utmost importance and should clearly define what the investors and sellers expect out of the deal.

There are a couple of caveats to keep in mind when considering using sales contracts for real estate:

Contract prohibitions: Make sure the contract you have with the property seller does not have prohibitions for future assignments. This can create serious issues down the road. Make sure the contract is drafted by a lawyer that specializes in real estate assignment contract law.

Property-specific prohibitions: HUD homes (property obtained by the Department of Housing and Urban Development), real estate owned or REOs (foreclosed-upon property), and listed properties are not open to assignment contracts. REO properties, for example, have a 90-day period before being allowed to be resold.

What Is An Assignment Fee In Real Estate?

An assignment fee in real estate is the money a wholesaler can expect to receive from an end buyer when they sell them their rights to buy the subject property. In other words, the assignment fee serves as the monetary compensation awarded to the wholesaler for connecting the original seller with the end buyer.

Again, any contract used to disclose a wholesale deal should be completely transparent, and including the assignment fee is no exception. The terms of how an investor will be paid upon assigning a contract should, nonetheless, be spelled out in the contract itself.

The standard assignment fee is $5,000. However, every deal is different. Buyers differ on their needs and criteria for spending their money (e.g., rehabbing vs. buy-and-hold buyers). As with any negotiations , proper information is vital. Take the time to find out how much the property would realistically cost before and after repairs. Then, add your preferred assignment fee on top of it.

Traditionally, investors will receive a deposit when they sign the Assignment of Real Estate Purchase and Sale Agreement . The rest of the assignment fee will be paid out upon the deal closing.

Assignment Contract Vs Double Close

The real estate assignment contract strategy is just one of the two methods investors may use to wholesale a deal. In addition to assigning contracts, investors may also choose to double close. While both strategies are essentially variations of a wholesale deal, several differences must be noted.

A double closing, otherwise known as a back-to-back closing, will have investors actually purchase the home. However, instead of holding onto it, they will immediately sell the asset without rehabbing it. Double closings aren’t as traditional as fast as contract assignment, but they can be in the right situation. Double closings can also take as long as a few weeks. In the end, double closings aren’t all that different from a traditional buy and sell; they transpire over a meeter of weeks instead of months.

Assignment real estate strategies are usually the first option investors will want to consider, as they are slightly easier and less involved. That said, real estate assignment contract methods aren’t necessarily better; they are just different. The wholesale strategy an investor chooses is entirely dependent on their situation. For example, if a buyer cannot line up funding fast enough, they may need to initiate a double closing because they don’t have the capital to pay the acquisition costs and assignment fee. Meanwhile, select institutional lenders incorporate language against lending money in an assignment of contract scenario. Therefore, any subsequent wholesale will need to be an assignment of contract.

Double closings and contract assignments are simply two means of obtaining the same end. Neither is better than the other; they are meant to be used in different scenarios.

Flipping Real Estate Contracts

Those unfamiliar with the real estate contract assignment concept may know it as something else: flipping real estate contracts; if for nothing else, the two are one-in-the-same. Flipping real estate contracts is simply another way to refer to assigning a contract.

Is An Assignment Of Contract Legal?

Yes, an assignment of contract is legal when executed correctly. Wholesalers must follow local laws regulating the language of contracts, as some jurisdictions have more regulations than others. It is also becoming increasingly common to assign contracts to a legal entity or LLC rather than an individual, to prevent objections from the bank. Note that you will need written consent from all parties listed on the contract, and there cannot be any clauses present that violate the law. If you have any questions about the specific language to include in a contract, it’s always a good idea to consult a qualified real estate attorney.

When Will Assignments Not Be Enforced?

In certain cases, an assignment of contract will not be enforced. Most notably, if the contract violates the law or any local regulations it cannot be enforced. This is why it is always encouraged to understand real estate laws and policy as soon as you enter the industry. Further, working with a qualified attorney when crafting contracts can be beneficial.

It may seem obvious, but assignment contracts will not be enforced if the language is used incorrectly. If the language in a contract contradicts itself, or if the contract is not legally binding it cannot be enforced. Essentially if there is any anti-assignment language, this can void the contract. Finally, if the assignment violates what is included under the contract, for example by devaluing the item, the contract will likely not be enforced.

How To Assign A Real Estate Contract

A wholesaling investment strategy that utilizes assignment contracts has many advantages, one of them being a low barrier-to-entry for investors. However, despite its inherent profitability, there are a lot of investors that underestimate the process. While probably the easiest exit strategy in all of real estate investing, there are a number of steps that must be taken to ensure a timely and profitable contract assignment, not the least of which include:

Find the right property

Acquire a real estate contract template

Submit the contract

Assign the contract

Collect the fee

1. Find The Right Property

You need to prune your leads, whether from newspaper ads, online marketing, or direct mail marketing. Remember, you aren’t just looking for any seller: you need a motivated seller who will sell their property at a price that works with your investing strategy.

The difference between a regular seller and a motivated seller is the latter’s sense of urgency. A motivated seller wants their property sold now. Pick a seller who wants to be rid of their property in the quickest time possible. It could be because they’re moving out of state, or they want to buy another house in a different area ASAP. Or, they don’t want to live in that house anymore for personal reasons. The key is to know their motivation for selling and determine if that intent is enough to sell immediately.

With a better idea of who to buy from, wholesalers will have an easier time exercising one of several marketing strategies:

Direct Mail

Real Estate Meetings

Local Marketing

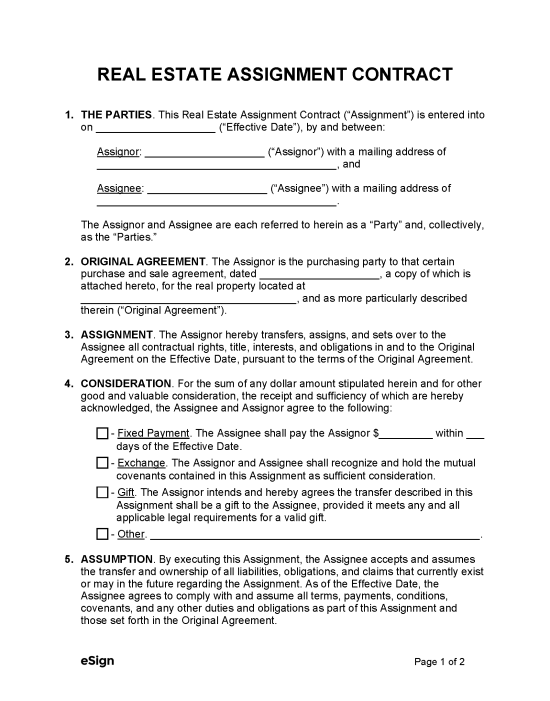

2. Acquire A Real Estate Contract Template

Real estate assignment contract templates are readily available online. Although it’s tempting to go the DIY route, it’s generally advisable to let a lawyer see it first. This way, you will have the comfort of knowing you are doing it right, and that you have counsel in case of any legal problems along the way.

One of the things proper wholesale real estate contracts add is the phrase “and/or assigns” next to your name. This clause will give you the authority to sell the property or assign the property to another buyer.

You do need to disclose this to the seller and explain the clause if needed. Assure them that they will still get the amount you both agreed upon, but it gives you deal flexibility down the road.

3. Submit The Contract

Depending on your state’s laws, you need to submit your real estate assignment contract to a title company, or a closing attorney, for a title search. These are independent parties that look into the history of a property, seeing that there are no liens attached to the title. They then sign off on the validity of the contract.

4. Assign The Contract

Finding your buyer, similar to finding a seller, requires proper segmentation. When searching for buyers, investors should exercise several avenues, including online marketing, listing websites, or networking groups. In the real estate industry, this process is called building a buyer’s list, and it is a crucial step to finding success in assigning contracts.

Once you have found a buyer (hopefully from your ever-growing buyer’s list), ensure your contract includes language that covers earnest money to be paid upfront. This grants you protection against a possible breach of contract. This also assures you that you will profit, whether the transaction closes or not, as earnest money is non-refundable. How much it is depends on you, as long as it is properly justified.

5. Collect The Fee

Your profit from a deal of this kind comes from both your assignment fee, as well as the difference between the agreed-upon value and how much you sell it to the buyer. If you and the seller decide you will buy the property for $75,000 and sell it for $80,000 to the buyer, you profit $5,000. The deal is closed once the buyer pays the full $80,000.

Assignment of Contract Pros

For many investors, the most attractive benefit of an assignment of contract is the ability to profit without ever purchasing a property. This is often what attracts people to start wholesaling, as it allows many to learn the ropes of real estate with relatively low stakes. An assignment fee can either be determined as a percentage of the purchase price or as a set amount determined by the wholesaler. A standard fee is around $5,000 per contract.

The profit potential is not the only positive associated with an assignment of contract. Investors also benefit from not being added to the title chain, which can greatly reduce the costs and timeline associated with a deal. This benefit can even transfer to the seller and end buyer, as they get to avoid paying a real estate agent fee by opting for an assignment of contract. Compared to a double close (another popular wholesaling strategy), investors can avoid two sets of closing costs. All of these pros can positively impact an investor’s bottom line, making this a highly desirable exit strategy.

Assignment of Contract Cons

Although there are numerous perks to an assignment of contract, there are a few downsides to be aware of before searching for your first wholesale deal. Namely, working with buyers and sellers who may not be familiar with wholesaling can be challenging. Investors need to be prepared to familiarize newcomers with the process and be ready to answer any questions. Occasionally, sellers will purposely not accept an assignment of contract situation. Investors should occasionally expect this, as to not get discouraged.

Another obstacle wholesalers may face when working with an assignment of contract is in cases where the end buyer wants to back out. This can happen if the buyer is not comfortable paying the assignment fee, or if they don’t have owner’s rights until the contract is fully assigned. The best way to protect yourself from situations like this is to form a reliable buyer’s list and be upfront with all of the information. It is always recommended to develop a solid contract as well.

Know that not all properties can be wholesaled, for example HUD houses. In these cases, there are often anti-assigned clauses preventing wholesalers from getting involved. Make sure you know how to identify these properties so you don’t waste your time. Keep in mind that while there are cons to this real estate exit strategy, the right preparation can help investors avoid any big challenges.

Assignment of Contract Template

If you decide to pursue a career wholesaling real estate, then you’ll want the tools that will make your life as easy as possible. The good news is that there are plenty of real estate tools and templates at your disposal so that you don’t have to reinvent the wheel! For instance, here is an assignment of contract template that you can use when you strike your first deal.

As with any part of the real estate investing trade, no single aspect will lead to success. However, understanding how a real estate assignment of contract works is vital for this business. When you comprehend the many layers of how contracts are assigned—and how wholesaling works from beginning to end—you’ll be a more informed, educated, and successful investor.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

What is an STR in Real Estate?

Wholetailing: a guide for real estate investors, what is chain of title in real estate investing, what is a real estate fund of funds (fof), reits vs real estate: which is the better investment, multi-family vs. single-family property investments: a comprehensive guide.

What is an Assignment Fee? The Ultimate Wholesaler’s Guide

In real estate investing, an assignment fee is the fee paid by the end buyer to the real estate wholesaler at the time of closing.

What is an assignment fee?

How do you assign a real estate contract?

How can you increase your assignment fee as a real estate wholesaler?

Those are just some of the questions we're going to answer in this ultimate assignment fee guide.

Let's dive in!

Part 1. Answering Common Questions About Assignment Fees

To start, we're going to answer some of the most commonly asked questions about assignment fees.

In real estate investing, an assignment fee is the fee paid by the end buyer to the real estate wholesaler at the time of closing.

This is the part of the process where the real estate wholesaler makes their money -- after finding a great deal and getting the property under contract, they then flip (i.e. assign) that contract to a cash buyer for a profit.

How are assignment fees calculated?

Assignment fees are calculated by taking the difference between what the seller was promised and what the buyer is paying.

For example, if a wholesaler has a contract to purchase a property for $100,000 and they assign that contract to a cash buyer for $120,000, then their assignment fee would be $20,000.

Who pays the assignment fee?

The assignment fee is paid by the cash buyer at closing.

And, critically, you -- the wholesaler -- are the person who gets to decide what that assignment fee is... it's only a matter of getting the cash buyer to agree (assuming you're not doing a double closing; more on that later).

What is the average wholesaler’s assignment fee?

The average assignment fee for a real estate wholesaler is between $2000 and $7000.

Of course, this number will depend on the market you're in as well as the level of experience that you have.

Many wholesalers charge upwards of $10,000 or even $20,000 for their assignment fee. Later in this guide, we'll show you how to systematically increase your assignment fee.

REISift users, on average, pull more money per deal than non-members. Here are some testimonials from our members and Sift Dojo attendees.

Are assignment fees taxable?

Yes, assignment fees are considered taxable income.

Be sure to speak with your accountant or tax advisor about the specific rules in your state.

What is a real estate assignment contract?

A real estate assignment contract is the contract between the wholesaler and the cash buyer that assigns (or transfers) the rights of the original purchase agreement to the cash buyer.

This contract will include all of the terms of the original purchase agreement, including:

- The price that was agreed to between the wholesaler and seller

- The property address

- The closing date

- Any contingencies that were in the original contract (i.e. financing, inspections, etc.)

Once the assignment contract is signed by both parties, the cash buyer will take over all responsibilities under the original purchase agreement and will be responsible for closing on the property.

What is a double close?

A double close is a type of real estate transaction where the wholesaler sells the property to the cash buyer and then immediately purchases the property from the seller.

In other words, there are two closings -- one for the sale of the property from wholesaler to cash buyer and another for the purchase of the property from seller to wholesaler.

In terms of assignment fees, double closings are often used when the wholesaler wants to keep their assignment fee confidential.

Download Assignment Fee Template

Part 2. how to assign a real estate contract .

Next, we're going to discuss the process for assigning a real estate contract -- from finding a great deal and building your buyers list to acquiring an assignment contract and collecting your assignment fee.

Step 1. Find a Great Deal

The first step in wholesaling real estate -- and thus assigning property contracts -- is finding a great real estate deal.

This is where your marketing efforts will come into play. You'll need to generate a steady stream of leads in order to find the best possible deals on properties that fit your criteria.

There are a number of ways to generate leads, but the most effective method is to use a combination of online and offline marketing.

This could include everything from direct mail campaigns and cold calling to driving for dollars and door knocking.

Check out our complete real estate investor marketing plan to learn more about this part of the process.

Step 2. Build Your Buyers List

A fundamental part of wholesaling real estate is flipping property contracts to cash buyers who have the funds to purchase your deals within just a couple of weeks.

A buyers list is a database of cash buyers (other real estate investors) who are interested in buying your deals.

You can find cash buyers by networking with other investors, attending real estate meetups and seminars, or searching online.

Here are 10 more ways to find cash buyers .

Step 3. Acquire an Assignment Contract

Once you've found a great real estate deal and got under contract with the seller, it's time to acquire an assignment contract.

You can do this by searching online for assignment contract templates or hiring a local lawyer to put the contract together for you. The assignment contract will pass the purchasing power and obligations from you to the new buyer.

Step 4. Collect Your Assignment Fee

After the new buyer has closed on the property, it's time for you to collect your assignment fee. This is typically done by wire transfer or check at the closing table via a title company.

And that's it! You've now successfully assigned a real estate contract and collected your assignment fee.

Part 3. The Pros & Cons of Assignment Contracts

Now let's take a moment to look at the pros and cons of assignment contracts.

- It's Cheaper Than Double Closing: Double closings can be more expensive (in terms of both time and money) than assignment contracts.

- It's Simple: Assignment contracts are relatively simple compared to other types of real estate transactions.

- It's Fast: Assignment contracts can be completed in as little as a week or two.

- It's Transparent: Unlike double closings, there is no need for two sets of escrow accounts, two sets of title insurance policies, or two sets of closing costs.

- Your Assignment Fee is Visible: Because your assignment fee is paid at closing, it will be visible to everyone involved in the transaction.

- It's Not Always Allowed: Some states have laws that prohibit or restrict the use of assignment contracts.

Part 4. 10 Ideas For Increasing Your Assignment Fee as a Wholesaler

To close out this guide, we're going to share 10 different ways that you -- the real estate wholesaler -- can increase your assignment fee.

1. Start With Great Deals

The better the deal, the higher your assignment fee will be.

This is why finding great deals -- and double-checking your math as well as your due diligence -- is absolutely critical to increasing your assignment fee.

So how do you find great real estate deals?

We have a detailed guide on finding great real estate deals over here .

2. Learn to Negotiate (With Sellers)

If you want to increase your assignment fee, you need to be able to negotiate with sellers.

The better you are at negotiating and sales — which in large part, just depends upon being an empathetic and helpful person — the better deals you’ll be able to get and the higher your assignment fee will be.

After all, if the seller agrees to a lower price, then that means you make a bigger profit.

The caveat here would be that you should always do right by your sellers. Don’t be afraid to negotiate (start lower than your max offer)... but also don’t try to screw anyone over.

3. Follow Up

It’s very rare that you’re going to turn someone from a lead into a deal with just a single phone call.

The nature of wholesaling real estate is that it requires a consistent and systematic follow-up process with seller leads to be successful.

Following up will help you close more deals… and closing more deals will give you the confidence, experience, and volume you need to increase your assignment fee.

4. Find Your Offer Min & Max

Good real estate deals are just a result of good due diligence and good math.

Determine how much money your cash buyer is going to want to pull, factor in your assignment fee, consider repair costs and holding costs… and calculate your max offer on the property.

Do this before you negotiate with the seller.

And make sure that when negotiations begin, you start well below your max offer so that you have room to adjust based on their response to your initial offer — this is your minimum offer.

You might find your max offer by using the popular 70% rule — which states that a real estate investor should pay no more than 70% of a property’s ARV (After Repair Value) — but you can find your starting offer by decreasing that to 50% or lower.

5. Qualify Your Cash Buyers

The amount of your assignment fee — as well as the efficiency with which your business operates — depends upon high-quality cash buyers.

Most wholesalers are a little over-eager to add email addresses to their cash buyer list.

But remember: quality over quantity.

You might have 500 cash buyers on your list… but only 20 or 30 of those are actually high-quality buyers.

Before adding buyers to your list, get proof of funds and make sure they’ve bought properties via assignment before.

Those buyers are going to move faster, pay the asking price for your properties, and return for more properties to buy.

6. Identify Cohorts of Cash Buyers

The instinct for most wholesalers is to send every deal to every cash buyer… but that actually wastes a lot of time.

It’s not in your interest to have to help every potential buyer determine whether or not they’re the right buyer for this deal.

It’s far more efficient to learn about your buyers upfront and determine what type of cash buyers they are — rehabbers, landlords, etc.

Using simple software, you can then create cohorts of cash buyers and send the right deal to the right people to get faster turn-around-times, less questions, and bigger assignment fees.

7. Text Your Buyers

Email is easy and popular… but it’s not necessarily the best channel when promoting deals to your list of cash buyers.

In fact, SMS or text messaging has some clear advantages.

Just consider these stats from ManyChat …

- 269 billion emails are sent every day with roughly 50% of them ending up in spam folders.

- SMS has a click-through rate of 19% and email has a click-through rate of 3.2%

The point is, if you want to get the attention of your high-quality buyers, then it’s probably worth sending both emails and text messages.

The faster you reach the right buyer, the easier it’ll be to get the assignment fee you want.

8. Don’t Negotiate (With Buyers)

As the wholesaler, realize that you determine your assignment fee.

No one else gets to decide what your assignment fee is going to be — now if you can’t get the buyer to agree to pay it, then that’s another problem… but you can always walk away and find another buyer.

If you’re going to raise your assignment fee, then it’s important to understand that all you have to do is… well, raise it. And see what happens.

High-quality buyers aren’t going to care about how much you’re making so long as they’re also making a good chunk of money.

9. Work With Real Estate Agents

Real estate agents control a huge part of every real estate market.

So if you exclude working with real estate agents to find cash buyers, then you’re ignoring a huge portion of the market’s revenue and potential.

Plain and simple.

Good real estate agents who work with cash buyers will understand your business model and be more than willing to coordinate the deal for you.

You will have to pay a bit of commission — or at least, the buyer will — but you’ll get to remove all the drama from the equation by working with agents. They understand how assignments work, and they negotiate on the behalf of the cash buyer.

It might not drastically increase your assignment fee, but it will help you dispose of deals far more efficiently.

10. Require a Nonrefundable Fee

When it comes to wholesaling, time really is money — the faster you can find a high-quality cash buyer, the more likely you are to get the assignment fee you want.

And one of the worst things that can happen is that your buyer will back out of the deal and you’ll have to restart the entire process.

That’s why you should make the buyer have skin in the game.

Require a nonrefundable fee from cash buyers who are ready to take action — this fee should be upwards of $3,000 and it can contribute to your total assignment fee.

If a buyer refuses to pay this to secure the deal as they’re own, then you probably want to find a different buyer anyway.

Final Thoughts on Real Estate Assignment Fees

We hope this guide has helped clear up any confusion you had about assignment fees and how they work in wholesaling real estate.

Remember: if you want to increase your assignment fee, focus on finding (and negotiating) great deals, following up with leads, qualifying cash buyers, and being systematic in your business.

Do those things, and you’ll be well on your way to making more money per deal.

Listen on other platforms

Join our ninja newsletter.

Subscription implies consent to our privacy policy

TRENDING POST

A2p / 10dlc: read this before you send real estate sms campaigns, wholesaling real estate contracts [template downloads], 7 mailing lists most real estate investors ignore, 5 top real estate wholesaling online courses in 2023, wholesaling real estate salary: how much can you make, visit our store to see all the courses available, popular tags, looking for more leads get it with reisift.

Related posts

Ready for more?

Subscription implies consent to our privacy policy.

- Deals Funded

- Deals in Process

Testimonials

An assignment clause (AC) is an important part of many contracts, especially for real estate. In this article we discuss:

- What is an Assignment Clause? (with Example)

- Anti-Assignment Clauses (with Example)

- Non-Assignment Clauses

- Important Considerations

- How Assets America ® Can Help

Frequently Asked Questions

What is an assignment clause.

An AC is part of a contract governing the sale of a property and other transactions. It deals with questions regarding the assignment of the property in the purchase agreement. The thrust of the assignment clause is that the buyer can rent, lease, repair, sell, or assign the property.

To “assign” simply means to hand off the benefits and obligations of a contract from one party to another. In short, it’s the transfer of contractual rights.

In-Depth Definition

Explicitly, an AC expresses the liabilities surrounding the assignment from the assignor to the assignee. The real estate contract assignment clause can take on two different forms, depending on the contract author:

- The AC states that the assignor makes no representations or warranties about the property or the agreement. This makes the assignment “AS IS.”

- The assignee won’t hold the assignor at fault. It protects the assignor from damages, liabilities, costs, claims, or other expenses stemming from the agreement.

The contract’s assignment clause states the “buyer and/or assigns.” In this clause, “assigns” is a noun that means assignees. It refers to anyone you choose to receive your property rights.

The assignment provision establishes the fact that the buyer (who is the assignor) can assign the property to an assignee. Upon assignment, the assignee becomes the new buyer.

The AC conveys to the assignee both the AC’s property rights and the AC’s contract obligations. After an assignment, the assignor is out of the picture.

What is a Lease Assignment?

Assignment Clause Example

This is an example of a real estate contract assignment clause :

“The Buyer reserves the right to assign this contract in whole or in part to any third party without further notice to the Seller; said assignment not to relieve the Buyer from his or her obligation to complete the terms and conditions of this contract should be assigning default.”

Apply For Financing

Assignment provision.

An assignment provision is a separate clause that states the assignee’s acceptance of the contract assignment.

Assignment Provision Example

Here is an example of an assignment provision :

“Investor, as Assignee, hereby accepts the above and foregoing Assignment of Contract dated XXXX, XX, 20XX by and between Assignor and ____________________ (seller) and agrees to assume all of the obligations and perform all of the duties of Assignor under the Contract.”

Anti-Assignment Clauses & Non-Assignment Clauses

An anti-assignment clause prevents either party from assigning a contract without the permission of the other party. It typically does so by prohibiting payment for the assignment. A non-assignment clause is another name for an anti-assignment clause.

Anti-Assignment Clause Example

This is an anti-assignment clause example from the AIA Standard Form of Agreement:

” The Party 1 and Party 2, respectively, bind themselves, their partners, successors, assigns, and legal representatives to the other party to this Agreement and to the partners, successors, assigns, and legal representatives of such other party with respect to all covenants of this Agreement. Neither Party 1 nor Party 2 shall assign this Agreement without the written consent of the other.”

Important Considerations for Assignment Contracts

The presence of an AC triggers several important considerations.

Assignment Fee

In essence, the assignor is a broker that brings together a buyer and seller. As such, the assignor collects a fee for this service. Naturally, the assignor doesn’t incur the normal expenses of a buyer.

Rather, the new buyer assumes those expenses. In reality, the assignment fee replaces the fee the realtor or broker would charge in a normal transaction. Frequently, the assignment fee is less than a regular brokerage fee.

For example, compare a 2% assignment fee compared to a 6% brokerage fee. That’s a savings of $200,000 on a $5 million purchase price. Wholesalers are professionals who earn a living through assignments.

Frequently, the assignor will require that the assignee deposit the fee into escrow. Typically, the fee is not refundable, even if the assignee backs out of the deal after signing the assignment provision. In some cases, the assignee will fork over the fee directly to the assignor.

Assignor Intent

Just because the contract contains an AC does not obligate the buyer to assign the contract. The buyer remains the buyer unless it chooses to exercise the AC, at which point it becomes the assignor. It is up to the buyer to decide whether to go through with the purchase or assign the contract.

Nonetheless, the AC signals the seller of your possible intent to assign the purchase contract to someone else. For one thing, the seller might object if you try to assign the property without an AC.

You can have serious problems at closing if you show up with a surprise assignee. In fact, you could jeopardize the entire deal.

Another thing to consider is whether the buyer’s desire for an AC in the contract will frighten the seller. Perhaps the seller is very picky about the type of buyer to whom it will sell.

Or perhaps the seller has heard horror stories, real or fake, about assignments. Whatever the reason, the real estate contract assignment clause might put a possible deal in jeopardy.

Chain of Title

If you assign a property before the closing, you will not be in the chain of title. Obviously, this differs from the case in which you sell the property five minutes after buying it.

In the latter case, your name will appear in the chain of title twice, once as the buyer and again as the seller. In addition, the latter case would involve two sets of closing costs, whereas there would only one be for the assignment case. This includes back-to-back (or double) closings.

Enforceability

Assignment might not be enforceable in all situations, such as when:

- State law or public policy prohibits it.

- The contract prohibits it.

- The assignment significantly changes the expectations of the seller. Those expectations can include decreasing the value of the property or increasing the risk of default.

Also note that REO (real estate owned) properties, HUD properties, and listed properties usually don’t permit assignment contracts. An REO property is real estate owned by a bank after foreclosure. Typically, these require a 90-day period before a property can be resold.

How Assets America Can Help

The AC is a portion of a purchase agreement. When a purchase involves a commercial property requiring a loan of $10 million or greater, Assets America ® can arrange your financing.

We can finance wholesalers who decide to go through with a purchase. Alternatively, we can finance assignees as well. In either case, we offer expedient, professional financing and many supporting services. Contact us today for a confidential consultation.

What rights can you assign despite a contract clause expressly prohibiting assignment?

Normally, a prohibition against assignment does not curb the right to receive payments due. However, circumstances may cause the opposite outcome. Additionally, prohibition doesn’t prevent the right to money that the contract specifies is due.

What is the purpose of an assignment of rents clause in a deed of trust and who benefits?

The assignment of rents clause is a provision in a mortgage or deed of trust. It gives the lender the right to collect rents from mortgaged properties if the borrower defaults. All incomes and rents from a secured property flow to the lender and offset the outstanding debt. Clearly, this benefits the lender.

What is in assignment clause in a health insurance contract?

Commonly, health insurance policies contain assignment of benefits (AOB) clauses. These clauses allow the insurer to pay benefits directly to health care providers instead of the patient. In some cases, the provider has the patient sign an assignment agreement that accomplishes the same outcome. The provider submits the AOB agreement along with the insurance claim.

What does “assignment clause” mean for liability insurance?

The clause would allow the assignment of proceeds from a liability award payable to a third party. However, the insured must consent to the clause or else it isn’t binding. This restriction applies only before a loss. After a first party loss, the insurer’s consent no longer matters.

Related Articles

- Intercreditor Agreements – Everything You Need to Know

- Alienation Clause – Everything You Need to Know

- Loan Defeasance – Everything You Need to Know

- Cross Default – Complete Guide

Other Resources

- Adjustable Rate Mortgage

- Aircraft Financing Terms & Loan – Complete Guide

- Alienation Clause – Everything You Need to Know

- ARM Components

- ARV – After Repair Value – Everything You Need to Know

- Assignment Clause – Everything You Need to Know

- Average Daily Rate (ADR) Formula – Complete Guide

- Balloon Mortgages

- Blanket Mortgage

- Cap Rate Simplified for Commercial Real Estate (+ Calculator)

- Cash Coverage Ratio | Complete Guide + Calculator

- Cash Out Refinance on Investment Property – Complete Guide

- Closing Costs

- CMBS Loans: Guide to Commercial Mortgage-Backed Securities

- Commercial Adjustable Rate Loan Indexes

- Commercial Real Estate Appraisals – Everything You Need to Know

- Commercial Real Estate Syndication – Ultimate Success Guide

- Contingency Reserve – Everything You Need to Know

- CRE Loans – What Nobody Tells You About Commercial Lending

- Cross Default – Everything You Need to Know

- Debt Service Coverage Ratio

- Debt vs Equity Financing

- DIP Financing

- EBITDA Margin – Ultimate Guide

- Effective Gross Income (+ Calculator)

- Equity Kicker – Everything You Need to Know

- Fixed Rate Loans

- Full Service Gross Lease – Everything You Need to Know

- Gap Funding Commercial Real Estate – Pros & Cons

- Ground Lease – Everything You Need to Know (+ Calculator)

- Guide to Floor Area Ratio, Floor Space Index & Plot Ratio

- Hard Costs vs Soft Costs – Commercial Real Estate Guide

- Hard Money vs Soft Money Loans in Real Estate

- How Much to Borrow

- Hypothecation Agreements – Everything You Need to Know

- Industrial Gross Lease

- Intercreditor Agreements – Everything You Need to Know

- Interest Only Mortgage

- Lines of Business

- Loan Defeasance

- Loan Proceeds – Everything You Need To Know

- Loan to Cost Ratio

- Loss to Lease – Everything You Need to Know

- Market Links

- Master Lease Agreements

- Master Planned Communities

- Mergers & Acquisitions Seller Intake Questionnaire

- Mergers & Acquisitions Buyer Intake Questionnaire

- Mini Perm Loan – Complete Guide

- MIRR Guide | Modified Internal Rate of Return (+ Calculator)

- Modified Gross Lease – Everything You Need to Know

- Mortgage Programs

- Net Effective Rent (+ Calculator)

- Net Income and NOI

- Net Leases (Single, Double, Triple)

- Operating Expense Ratio – Ultimate Guide (+ Calculator)

- Pari Passu – Everything You Need to Know

- Partially Amortized Loan – Complete Guide

- Potential Gross Income – Everything You Need to Know

- Preferred Equity in Real Estate – Complete Investor’s Guide

- Preferred Shares – Everything You Need to Know

- Property Interest – Everything You Need to Know

- Recourse Loans – Complete Guide

- Restrictive Covenants – Everything You Need to Know

- Reverse 1031 Exchange – Everything You Need to Know

Ronny was a pleasure to work with and is extremely knowledgeable. His hard work was never ending until the job was done. They handled a complex lease and guided us through entire process, including the paperwork. Not to mention a below market lease rate and more than all the features we needed in a site. We later used Assets America for a unique equipment financing deal where once again Ronny and team exceeded our expectations and our timeline. Thank you to Assets America for your highly professional service!

Great experience with Assets America. Fast turn around. Had a lender in place in 30 minutes looking to do the deal. Totally amazing. Highly recommend them to anyone looking for financing. Ronny is fantastic. Give them a call if the deal makes sense they can get it funded. Referring all our clients.

Assets America guided us every step of the way in finding and leasing our large industrial building with attached offices. They handled all of the complex lease negotiations and contractual paperwork. Ultimately, we received exactly the space we needed along with a lower than market per square foot pricing, lease length and end of term options we requested. In addition to the real estate lease, Assets America utilized their decades-long financial expertise to negotiate fantastic rates and terms on our large and very unique multimillion dollar equipment purchase/lease. We were thankful for how promptly and consistently they kept us informed and up to date on each step of our journey. They were always available to answer each and every one of our questions. Overall, they provided my team with a fantastic and highly professional service!

Assets America was responsible for arranging financing for two of my multi million dollar commercial projects. At the time of financing, it was extremely difficult to obtain bank financing for commercial real estate. Not only was Assets America successful, they were able to obtain an interest rate lower than going rates. The company is very capable, I would recommend Assets America to any company requiring commercial financing.

Assets America was incredibly helpful and professional in assisting us in purchasing our property. It was great to have such knowledgeable and super-experienced, licensed pros in our corner, pros upon which we could fully rely. They helped and successfully guided us to beat out 9 other competing offers! They were excellent at communicating with us at all times and they were extremely responsive. Having them on our team meant that we could always receive truthful, timely and accurate answers to our questions. We would most definitely utilize their services again and again for all of our real estate needs.

Assets America is a great company to work with. No hassles. Recommend them to everyone. Professional, fast response time and definitely gets the job done.

Ronny at Assets America has been invaluable to us and definitely is tops in his field. Great experience. Would refer them to all our business associates.

We were very pleased with Assets America’s expertise and prompt response to our inquiry. They were very straight forward with us and helped a great deal. We referred them to all our business associates.

I’ve worked with this company for decades. They are reputable, knowledgeable, and ethical with proven results. I highly recommend them to anyone needing commercial financing.

Ronny was incredibly adept and responsive – top-notch professional who arranged impressive term sheets.

Assets America helped us survive a very difficult time and we most definitely give them 5 stars!

Ronny was very friendly and though we were unable to make something happen at the moment he gave me some direction to go.

My business partner and I were looking to purchase a retail shopping center in southern California. We sought out the services of Ronny, CFO of Assets America. Ronny found us several commercial properties which met our desired needs. We chose the property we liked best, and Ronny went to work. He negotiated very aggressively on our behalf. We came to terms with the Seller, entered into a purchase agreement and opened escrow. Additionally, we needed 80 percent financing on our multimillion-dollar purchase. Assets America also handled the commercial loan for us. They were our One-Stop-Shop. They obtained fantastic, low, fixed rate insurance money for us. So, Assets America handled both the sale and the loan for us and successfully closed our escrow within the time frame stated in the purchase agreement. Ronny did and performed exactly as he said he would. Ronny and his company are true professionals. In this day and age, it’s especially rare and wonderful to work with a person who actually does what he says he will do. We recommend them to anyone needing any type of commercial real estate transaction and we further highly recommend them for any type of commercial financing. They were diligent and forthright on both accounts and brought our deal to a successful closing.

Questionnaire

Assignment Definition

Investing Strategy , Jargon, Legal, Terminology, Title

Table of Contents

- What Is an Assignment?

- What is an Assignment in Real Estate?

- What Does it Mean to Assign a Contract in Real Estate?

- How Does a Contract Assignment Work?

- Pros and Cons of Assigning Contracts

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

An assignment or assignment of contract is a way to profit from a real estate transaction without becoming the owner of the property.

The assignment method is a standard tool in a real estate wholesaler’s kit and lowers the barrier to entry for a real estate investor because it does not require the wholesaler to use much (or any) of their own money to profit from a deal.

Contract assignment is a common wholesaling strategy where the seller and the wholesaler (acting as a middleman in this case) sign an agreement giving the wholesaler the sole right to buy a property at a specified price, within a certain period of time.

The wholesaler then finds another buyer and assigns the contract to him or her. The wholesaler isn’t selling the property to the end buyer because the wholesaler never takes title to the property during the process. The wholesaler is simply selling the contract, which gives the end buyer the right to buy the property in accordance with the original purchase agreement.

In doing this, the wholesaler can earn an assignment fee for putting the deal together.

Some states require a real estate wholesaler to be a licensed real estate agent, and the assignment strategy can’t be used for HUD homes and REOs.

The process for assigning a contract follows some common steps. In summary, it looks like this:

- Find the right property.

- Get a purchase agreement signed.

- Find an end buyer.

- Assign the contract.

- Close the transaction and collect your assignment fee.

We describe each step in the process below.

1. Find the Right Property

This is where the heavy lifting happens—investors use many different marketing tactics to find leads and identify properties that work with their investing strategy. Typically, for wholesaling to work, a wholesaler needs a motivated seller who wants to unload the property as soon as possible. That sense of urgency works to the wholesaler’s advantage in negotiating a price that will attract buyers and cover their assignment fee.

RELATED: What is “Driving for Dollars” and How Does It Work?

2. Get a Purchase Agreement Signed

Once a motivated seller has agreed to sell their property at a discounted price, they will sign a purchase agreement with the wholesaler. The purchase agreement needs to contain specific, clear language that allows the wholesaler (for example, you) to assign their rights in the agreement to a third party.

Note that most standard purchase agreements do not include this language by default. If you plan to assign this contract, make sure this language is included. You can consult an attorney to cover the correct verbiage in a way that the seller understands it.

RELATED: Wholesaling Made Simple! A Comprehensive Guide to Assigning Contracts

This can’t be stressed enough: It’s extremely important for a wholesaler to communicate with their seller about their intent to assign the contract. Many sellers are not familiar with the assignment process, so if the role of the buyer is going to change along the way, the seller needs to be aware of this on or before they sign the original purchase agreement.

3. Find an End Buyer

This is the other half of a wholesaler’s job—marketing to find buyers. Once they find an end buyer, the wholesaler can assign the contract to the new party and work with the original seller and the end buyer to schedule a closing date.

4. Assign the Contract

Assigning the contract works through a simple assignment agreement. This agreement allows the end buyer to step into the wholesaler’s shoes as the buyer in the original contract.

In other words, this document “replaces” the wholesaler with the new end buyer.

Most assignment contracts include language for a nonrefundable deposit from the end buyer, which protects the wholesaler if the buyer backs out. While you can download assignment contract templates online, most experts recommend having an attorney review your contracts. The assignment wording has to be precise and comply with applicable local laws to protect you from issues down the road.

5. Close the Transaction and Collect the Assignment Fee

Finally, you will receive your assignment fee (or wholesale fee) when the end buyer closes the deal.

The assignment fee is often the difference between the original purchase price (the price that the seller agreed with the wholesaler) and the end buyer’s purchase price (the price the wholesaler agreed with the end buyer), but it can also be a percentage of it or even a flat amount.

According to UpCounsel, most contract assignments are done for about $5,000, although depending on the property and the market, it could be higher or lower.

IMPORTANT: the end buyer will see precisely how much the assignment fee is. This is because they must sign two documents that show the original price and the assignment fee: the closing statement and the assignment agreement, respectively, to close the transaction.

In many cases, if the assignment fee is a reasonable amount relative to the purchase price, most buyers won’t take any issue with the wholesaler taking their fee—after all, the wholesaler made the deal happen, and it’s compensation for their efforts. However, if the assignment fee is too big (such as the wholesaler taking $20,000 from an original purchase price of $10,000, while the end buyer buys it for $50,000), it may ruffle some feathers and lead to uncomfortable questions.

In these instances where the wholesaler has a substantially higher profit margin, a wholesaler can instead do a double closing . In a double closing, the wholesaler closes two separate deals (one with the seller and another with the buyer) on the same day, but the seller and buyer cannot see the numbers and overall profit margin the wholesaler makes between the two transactions. This makes a double closing a much safer way to conclude a transaction.

Assigning contracts is a way to lower the barrier to entry for many new real estate investors; because they don’t need to put up their own money to buy a property or assume any risk in financing a deal.

The wholesaler isn’t part of the title chain, which streamlines the process and avoids the hassle of closing two times. Compared to the double-close strategy, assignment contracts require less paperwork and are usually less costly (because there is only one closing occurring, rather than two separate transactions).

On the downside, the wholesaler has to sell the property as-is, because they don’t own it at any point and they cannot make repairs or renovations to make the property look more attractive to a potential buyer. Financing may be much more difficult for the end buyer because many mortgage lenders won’t work with assigned contracts. Purchase Agreements also have expiration dates, which means the wholesaler has a limited window of time to find an end buyer and get the deal done.

Being successful with assignment contracts usually comes down to excellent marketing, networking, and communication between all parties involved. It’s all about developing strategies to find the right properties and having a solid network of investors you can assign them to quickly.

It’s also critical to be aware of any applicable laws in the jurisdiction where the wholesaler is working and holding any licenses required for these kinds of real estate transactions.

Related terms

Double closing, wholesaling (real estate wholesaling), transactional funding.

Bonus: Get a FREE copy of the INVESTOR HACKS ebook when you subscribe!

Free Subscriber Toolbox

Want to learn about the tools I’ve used to make over $40,000 per deal ? Get immediate access to videos, guides, downloads, and more resources for real estate investing domination. Sign up below for free and get access forever.

Join our growing community

subscribers

Welcome to REtipster.com

We noticed you are using an ad blocker.

We get it, too much advertising can be annoying.

Our few advertisers help us continue bringing lots of great content to you for FREE.

Please add REtipster.com to your Ad Blocker white list, to receive full access to website functionality.

Thank you for supporting. We promise you will find ample value from our website.

Thanks for contacting us! We will get in touch with you shortly.

What’s an assignment fee — The wholesalers guide

Assignment fee:

The real estate wholesalers’ primary method of getting paid. It’s calculated by taking the difference between what the seller agreed on, and what the end buyer is paying for the house

For example:

Let’s call him Jim.

Jim is a wholesaler. Jim finds a seller who’ll sell her house to Jim for $100,000 CASH. Jim puts it under contract and takes it to closing. Jim then finds another cash buyer during the closing process. This new cash buyer will purchase the contract from Jim for $120,000. Jim then ASSIGNS the contract to the new end buyer. The new-end buyer closes on the property with his funds, and Jim pockets $20,000.

An assignment fee is a real estate wholesaler’s staple.

There are other ways to get paid as a wholesaler of course (which we’ll cover in this article).

But if you’re new into the whole world of assignment fees, wholesaling, and real estate, we’re going to give you a deep dive into this article.

Starting with …

Why use an assignment fee

Ever wonder why so many aspiring real estate gurus dive headfirst into wholesaling? Well, the allure of the assignment fee is undeniable. Imagine getting a slice of the real estate pie without having to fork out heaps of your own money to close a deal.

That’s the magic of assignment fees. Essentially, you’re not selling the house; you’re selling the contract to the house.

It’s like holding a golden ticket to a property and then offering that ticket to someone else for a higher price. And the best part? You don’t even need your own cash stack ready to go. You just need a savvy cash buyer with pockets ready to buy that golden ticket off you.

So, with an assignment fee, not only do you sidestep the heavy lifting of traditional real estate deals, but you also make a pretty penny without emptying your own. Clever, isn’t it?

NOTE: If you want to see how much flippers make check out his article.

Are assignments for wholesalers legal?

So, you’ve heard about this whole assignment fee thing, and it sounds pretty tempting, right? But you might be scratching your head wondering, “Is this even legal?” First off, if you’re thinking of jumping into the world of wholesaling, it’s a must to consult with a real estate attorney in your state. The landscape of real estate regulations can be as complex as a plot twist in a best-selling novel. Some states might give you the side-eye if you’re wholesaling without a real estate license. Why? Because in those states, you might be viewed as engaging in the business of real estate.

However, here’s the twist.

When you’re wholesaling or assigning contracts, you’re not truly the central character in this real estate story. You’re not the principle of the transaction. Rather, you’re like the supporting actor, selling the contract to the main star, the principal. But be wary of those gray clouds on the horizon. The industry has its share of posers—those who claim to be cash buyers but may lack the bankroll to close on a property if a real end buyer doesn’t emerge from the wings. It’s like holding a ticket to an exclusive show, only to find out it might be a no-show. So, while the allure of wholesaling is undeniable, ensure you’re on solid ground.

It’s always better to have a clear script before stepping onto the stage.

Do all states allow assignments?

Navigating the world of real estate assignments can sometimes feel like trying to complete a tricky jigsaw puzzle. So, you might be wondering, do all states even allow these nifty little things called assignments? While I’d love to give you a simple “yes” or “no”, the truth is, it’s a bit more intricate. Most states do permit assignments. In fact, if you peek into many real estate contracts, you’ll often spot a little line that reads: “this contract is assignable”. But, like any good mystery, there are twists.

Consider this scenario:

Jim, our wholesaler friend from earlier, isn’t looking to pocket a cool $20,000. Instead, he’s decided to buy a property under his name. But halfway through, he has an “Aha!” moment and realizes he’d rather have his trusty LLC purchase it. So, Jim goes ahead and assigns the contract to his LLC, changing the player in the game without altering the core deal. It’s not always about making a quick buck; sometimes it’s about strategy and structure.

But before you channel your inner Jim or dream up any other creative real estate ventures, it’s wise to sit down with a real estate attorney. Remember, while assignments are a powerful tool in the world of wholesaling, you want to ensure you’re building on solid ground and not about to stumble into any legal pitfalls. It’s all about playing the game smartly.

How to wholesale for assignment fees

(NOTE: we have a wholesaling guide here )

Wholesaling for assignment fees is like mastering a captivating dance, requiring both rhythm and skill. If you’re considering dipping your toes into this arena, understanding the core skills required is essential. Think of it as the choreography of a profitable dance. So, what steps does a successful wholesaler need to know? Let’s break it down.