Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

What Is Capital in Business, and How Does it Work?

Whether you’re a new startup or you’ve been in business for decades, your company needs capital to grow and thrive. And, having a solid understanding of capital and how it can benefit your company can help you regardless of what stage your business is in. So, what is capital?

Capital definition:

So, what does capital mean? Capital is anything that increases your ability to generate value. You can use capital to increase value in your business’s financial assets. Generally, business capital includes financial assets held by your company that you can use to leverage growth and build financial stability.

Capital and cash are not one and the same. Capital can be stronger than cash because you can use it to produce something and generate revenue and income (e.g., investments). But because you can use capital to make money, it is considered an asset in your books (i.e., something that adds value to your business).

So, how does capital work? Companies can use capital to invest in anything to create value for their business. The more value it creates, the better the return for the business.

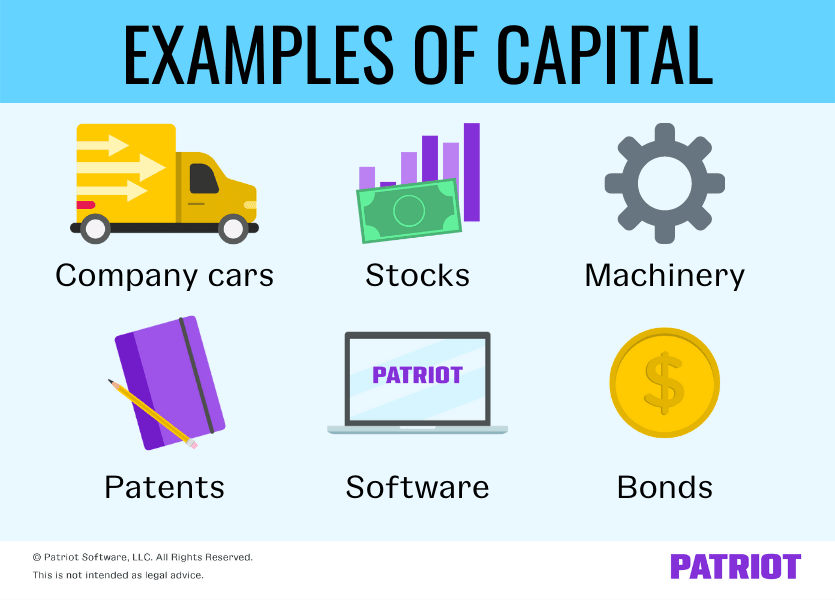

Capital examples

So, what does capital include? Capital can expand to a variety of things in business, both tangible and intangible. Here are a few examples of capital:

- Company cars

- Brand names

- Bank accounts

There are also different types of capital in business, including:

- Use this capital to pay for day-to-day business operations

- Converts into cash more quickly than other investments (e.g., a new oven at a bakery)

- Capital a business earns from taking out loans and debt

- Comes in several forms, including public equity and private equity (e.g., shares of stock in the company)

- Amount of money available to a company for purchasing and selling assets

Capital gains and losses

When you make an investment, the goal is to generate wealth for your business to help it grow and expand. And as your investments grow your business , the capital itself can increase in value, which can result in capital gains.

Capital gains

When your capital’s worth increases, you see a capital gain. A capital gain occurs when your investment is worth more than its purchase price.

For example, say you buy a machine for $1,500. The machine needs work, but you fix it without needing any new parts. You then turn around and sell it for $2,000 because you gave it a higher value by fixing it.

To calculate the gain in your business accounting records, take the final sale price of the machine ($2,000) and subtract the initial purchase price ($1,500). Your accounting records should reflect a gain of $500.

Capital losses

Not every investment is going to be worth it in the end. This is where capital losses come into play. With a capital loss, your investment is worth less than its initial purchase price.

Let’s take a look at the machine example again. You purchase the machine for $1,500, but you spend $600 on new parts to fix the machine before you sell it for $2,000. Between the cost of the machine and its new parts, you spend $2,100. This is considered a capital loss of $100 because you spent more money on the total investment ($2,100) than you received for the sale ($2,000). In your books, record a capital loss of $100.

How to grow capital

So, how do you go about growing capital? There are a number of ways you can increase your capital, including:

- Apply for a small business loan

- Find an angel investor

- Ask friends and family for a loan

- Use crowdfunding

- Look into SBA loans and programs

Growing your capital can take time and a whole lot of dedication. To ensure you have a good shot at growing your capital, develop and refine your business plan . And, practice pitching why investors and lenders should invest in your business.

Once you establish your company and get it off the ground, you can typically gain funding from other sources. You should gain capital primarily from your profits. And as you gain equipment, property, and other assets, your capital grows. When it grows, the financial worth of your business grows.

Capital in accounting

Business owners can use their capital records to make savvy investments and help make smart financial decisions. But in order to do that, your accounting records need to be as accurate as possible.

To easily track capital, make smart financial moves, and avoid major mistakes, record your investments in your books regularly. And, be sure to examine them to see what’s working and what isn’t.

To easily track capital in your books, you can opt to use accounting software. That way, you can record your capital quickly and avoid making accounting mistakes yourself. Plus, you can access numerous reports and financial statements to help make investments and decisions.

To determine if an investment was worth it, examine your books and ask yourself the following questions:

- Did the capital I invested in help grow my company?

- Am I in a good place financially that I can invest more in my company?

- Which investments were not worth it?

When your capital is growing, so is your business. So to keep your business prospering, build a solid strategy for tracking, using, and gaining investments.

Want to spare yourself the time and frustration involved in keeping track of your business capital and other transactions? Give Patriot’s online accounting a whirl to keep your books in order. Try it free for 30 days today!

This article has been updated from its original publication date of January 15, 2016.

This is not intended as legal advice; for more information, please click here.

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Understanding Capital in Business: A Comprehensive Guide

Table of Contents

To understand what capital is in business, delve into the introduction that defines capital, and explores its significance for the growth and sustainability of businesses. Learn the essential concepts and benefits associated with capital, and how it plays a vital role in driving business success.

Definition of capital in business

Capital in business stands for the funds of a company that are used to make money and meet its goals. It consists of both equity and debt investments. Capital is vital for businesses as it gives them the ability to purchase assets, pay for expenses, and fund potential growth.

Capital comes in multiple forms, such as money , equipment, buildings, stock, investments, and intellectual property. These assets contribute to a business’s total value and show its financial potential. Equity capital is ownership held by shareholders, and debt capital is borrowed funds that need to be paid back with interest.

Managing capital correctly is important for keeping business operations going and making a profit. By using resources properly, companies can improve their efficiency and increase shareholder value. Allocating capital the right way allows firms to invest in R&D, grow their market presence, or strengthen production.

Also, businesses often do capital restructuring to get an optimal balance of risk and return with their financial structure. This involves issuing fresh stocks or bonds, buying back existing securities, or switching debt into equity. By making wise financial choices about capital structure, firms strive to achieve success in the long term.

Understanding what capital in business means is necessary for entrepreneurs and managers. It’s the basis for effective financial planning and decision making at organizations. Therefore, recognizing different kinds of capital and utilizing them effectively can have a significant influence on a company’s success.

Pro Tip: Looking at capital needs regularly and allocating it smartly lets businesses adjust to changing markets while maximizing returns.

Importance of capital for business growth and sustainability

Capital is a must for any business’s growth and sustainability. Without enough, businesses battle to extend their functions and meet their daily activities. Its significance for business growth and sustainability can be seen through these key points:

- Capital lets businesses buy essential resources and equipment , which are necessary for their enlargement. This includes buying new tech, improving current structure, and getting raw materials.

- Having enough capital allows businesses to take chances in the market , such as broadening into new areas or launching new products and services. This can help them gain an advantage and up their share of the market.

- Capital is vital for attracting investors and lenders . When businesses have a strong financial position, they are more probable to get funds from exterior sources, which can further fuel their development.

- With sufficient capital, businesses can hire skilled workers and put money into training programs to enhance their staff. An educated and motivated team is crucial for driving creativity, increasing productivity, and giving great customer service.

- Capital provides a safeguard during times of economic instability or unexpected issues . It allows businesses to go through tough times by footing expenses like rent, wages, and utilities without dropping quality or customer satisfaction.

- Having abundant capital also increases a company’s capacity to negotiate decent terms with suppliers and partners . It gives them a leverage in price discussions and strengthens their overall position in the value chain.

Besides these points, it is worth noting that capital has a big part in gaining the trust of stakeholders such as customers, suppliers, and employees. When a business has access to plentiful financial resources, it indicates stability and dependability, making it attractive for collaborations and partnerships.

Pro Tip: While getting enough capital is essential for business growth and sustainability, it’s also important for entrepreneurs to handle it correctly. Regular financial reviews, budgeting, and effective cash flow management are key practices to make sure capital is used as best as possible.

Types of Capital

To understand Types of Capital in Business, delve into Financial Capital, Human Capital, and Physical Capital. Each sub-section offers unique solutions in the realm of business . Financial capital helps with funding and investment decisions, human capital concentrates on skills and knowledge of employees, while physical capital involves tangible assets like buildings and machinery.

Financial capital

Five types of financial capital exist, each with its own unique characteristics.

- Equity capital represents ownership in a company. It can be obtained through issuing shares or investments from shareholders; it also provides voting rights and a share in profits.

- Debt capital involves borrowing funds from external sources which must be repaid with interest.

- Working capital covers day-to-day operational expenses.

- Fixed capital consists of long-term assets like land and machinery.

- Intellectual capital is composed of intangible assets like patents and customer loyalty.

Apart from these types of financial capital, there could be others depending on the industry or context. Understanding these forms helps businesses make sound funding decisions. Investopedia suggests diversifying assets across different classes to mitigate risks in an investment portfolio.

Let’s continue exploring other types of capital to gain further insight into the realm of finance.

Definition and examples

Capital is the resources a person or company owns to create wealth or income. There are numerous sorts of capital, each with its own characteristics and examples. Let’s discover some of these!

Financial Capital: Money or financial assets that can be invested. Examples: cash, stocks, bonds, savings accounts, and real estate.

Human Capital: Skills, knowledge, and experiences of people. Examples: education, training, work experience, and expertise in a certain area.

Social Capital: Networks and relationships people have. Examples: professional associations, social connections, and influential contacts.

Natural Capital: Natural resources and ecosystems. Examples: land, forests, water bodies, and minerals.

Moreover, there’s cultural capital (such as art and culture) and intellectual capital (like patents and copyrights). These elements increase someone’s or company’s overall value.

Pro Tip: Knowing the different forms of capital helps businesses and individuals make smart decisions when allocating resources and looking for growth opportunities. By using diverse forms of capital, one can increase their competitive edge and achieve success.

Sources of financial capital

Financial capital is essential for any business. It is the money used to fund operations, investments, and other financial activities. Knowing where to get financial capital is key for businesses to make smart decisions about financing. Let’s look at some sources:

- Equity financing: Selling shares or ownership in a business. Investors get a stake in the company’s profits and assets.

- Debt financing: Borrowing from banks or financial institutions. This provides access to capital but adds debt.

- Retained earnings : Reinvesting profits instead of giving them to shareholders. This funds operations, expansion, and new projects.

- Leasing: Renting equipment or property instead of buying outright. This conserves cash flow.

- Grants and subsidies: Funds from government agencies or non-profits for research, energy, or disadvantaged communities.

- Trade credit: Negotiating with suppliers to get goods or services on credit. This manages cash flow.

Each source has its own advantages and considerations. The best option depends on the company’s goals, risk tolerance, and growth plans. Regularly monitoring capital structure and repayment schedules can maximize returns and manage risk. By making informed decisions about sources of financial capital, businesses can fuel growth and optimize their resources.

Human capital

Let us explore the multiple dimensions of human capital visually. Check out the table below:

These are only a few elements of human capital. Don’t forget the importance of diversity! It brings unique perspectives, encourages creativity, and helps with decision-making.

If you trace the roots of human capital, you’ll find that it began with education. Ancient philosophers and Islamic scholars all valued knowledge, which empowered individuals and benefited civilizations. Human capital has been important for centuries!

Capital is money or assets used by businesses to fund their operations and investments. There are four types: financial, human, physical, and social. Let’s take a look at the definitions and examples in the table below:

Financial capital is important for businesses to grow and can be raised through equity investments or debt financing. Human capital means the skills and knowledge of those in an organization. Training programs and educational opportunities can enhance this. Physical capital is tangible assets used in production and must be assessed and maintained. Social capital means networks and relationships with others. This enables access to resources like information or support.

To optimize these types of capital, businesses should:

- Diversify sources of financial capital.

- Invest in employee development.

- Assess and maintain physical capital.

- Nurture social capital.

By doing this, businesses can leverage their resources and stay competitive.

Importance of human capital for business success

The success of businesses depends on human capital . This means employees’ skills, knowledge, and experience. It’s essential for innovation, problem-solving, and decision-making .

Strong human capital brings diverse perspectives and knowledge. It helps companies evolve and stay ahead in competition. It also boosts customer satisfaction through excellent communication and interpersonal skills. This results in loyal customers, good reputation, and higher profits.

Investing in human capital development, like training and mentorship, leads to long-term benefits. Employees are more motivated, stay longer, and attract top talent.

Take Alex , a software developer at a multinational corporation. He had limited experience, but was trained and exposed to challenging projects. He rapidly improved his programming skills and innovated cost-saving solutions. He communicated complex concepts and secured partnerships, and was promoted multiple times.

Physical capital

Physical capital is essential for businesses to operate. It helps increase productivity, reduce costs, and improve overall performance. It has been used for thousands of years in human civilization. Examples include the invention of the wheel, the Great Wall of China, and the Pyramids of Egypt.

In modern times, physical capital still plays a vital role. It drives innovation and economic growth. Check out this table of physical capital:

Capital stands for the assets or funds of a person or company. Essential for the success and expansion of businesses, it is a huge part of the economy. There are many types of capital, each with its own characteristics and use. Let’s take a look!

It’s important for businesses and individuals to be aware of the various types of capital available and how to use them. By diversifying their capital, businesses can reduce risk and improve resilience. People should also work on growing their human capital by gaining new skills and knowledge to stay competitive in the job market.

Don’t miss out on the opportunities capital provides. Tap into the power of financial, physical, human, and social capital to reach your goals and succeed in today’s fast-changing world. Get started now and maximize your potential!

Role of physical capital in business operations

Physical capital is significant in business operations. It’s the tangible assets a company uses to make goods or services. Examples are buildings, machinery, equipment, and vehicles .

Let’s look at what physical capital is:

- Buildings: Give workspace and production facilities.

- Machinery: Used for manufacturing.

- Equipment: Tools and instruments.

- Vehicles: For transporting goods and employees.

Investing in physical capital helps businesses expand and stay competitive. Upgrading machinery or getting new technology can improve efficiency, cut costs, and enhance product quality. It’s essential for long-term success.

Henry Ford is an example of how physical capital works. By introducing efficient machinery, tools, and infrastructure, he revolutionized mass production in the early 20th century. Productivity increased and cars became more affordable.

Sources of Capital

To understand the sources of capital in business, dive into the section on “Sources of Capital.” Discover how equity financing, debt financing, and other sources of capital can provide solutions for acquiring funding for your business ventures. With these sub-sections, you’ll gain insight into the different avenues available for securing the necessary financial resources in your entrepreneurial journey.

Equity financing

Equity financing gives businesses the ability to get big amounts of money without owing debt. It provides investors a chance to be part of a company’s success and profit from any potential rise in share prices. This technique also divides the risk amongst various shareholders, lessening the burden on single investors.

In 1792, the NYSE was created. This is a remarkable event in equity financing history. This central market let firms list their shares for public trading, granting more liquidity and access to capital. With advancements in technology and regulations, equity financing has transformed and is now an important part of the current financial scene.

Definition and explanation

Sources of capital are the avenues through which a company can get money for operations and expansion. These include both internal and external sources.

Internal financing uses the company’s earnings or profits. Selling assets or inventory can also create cash.

External financing involves getting money from banks or credit unions.

Equity financing gives investors a share in business profits and decision-making, but reduces ownership percentages.

Venture capitalists and angel investors offer capital plus expertise and guidance to startups and small businesses.

Governments or non-profits give business grants for certain industries or projects that benefit society.

When looking for sources of capital, analyze benefits, drawbacks, and implications based on your business’s needs. By considering different sources, you can optimize your financial structure for growth.

Pros and cons of equity financing

Equity financing offers a range of advantages! Flexibility, growth prospects, and shared risks. But, be aware of the potential loss of control. Let’s explore the pros and cons with creativity and flair!

Flexible: Access capital without needing to repay loans – more financial freedom!

Growth: Raise lots of capital to expand and pursue new opportunities.

Shared Risk: Investors who own shares also share the risk, reducing the burden on the business.

Expertise & Connections: Equity investors often bring valuable knowledge and connections, helping to navigate challenges.

Loss of Control: Owners may have to surrender control over decisions.

Don’t miss out! Equity financing could open up expert investors, growth potential, shared risks and more. Make the most of it and watch your business soar!

Debt financing

Debt financing offers businesses a chance to obtain funds they wouldn’t usually be able to. It can be used for various purposes, like growth, buying equipment or inventory, or funding day-to-day operations.

A benefit of debt financing is that the business will keep total management and control. Unlike equity financing, debt financing won’t reduce ownership. This is good for entrepreneurs who want to hold full control and power of decisions.

Here’s an example of debt financing: a small bakery wanted funds for enlargement. Instead of getting investors who’d take a share, they got a loan from a bank. This loan enabled them to buy new baking tools and employ more staff. As sales rose because of the increased production ability, the bakery paid off the loan in regular payments while still having full control over their business.

The phrase ‘ Sources of Capital ‘ refers to the various ways businesses acquire money to fund their operations and investments. Equity financing , debt financing , and retained earnings are all examples of internal and external sources.

Here’s a table of the different sources:

These sources are important for businesses to have the funds they need to progress and operate.

Crowdfunding, venture capital, and government grants are also alternative methods for businesses to acquire capital.

For example, an entrepreneur secured venture capital for her tech startup. This capital allowed her to quickly scale her business and launch her product sooner than expected.

Overall, understanding the different sources of capital helps businesses make smart financial decisions and create more opportunities to grow and succeed.

Pros and cons of debt financing

Debt financing is borrowing money to finance business operations. It has advantages and disadvantages.

Pros of debt financing:

- Easy access to capital : Businesses can get large sums of money quickly, allowing them to pursue opportunities or even out cash flow.

- Tax benefits : The interest paid on debt is usually tax-deductible, reducing the overall tax burden.

- Retaining control : Unlike equity financing, debt does not reduce ownership in the business. Owners still have control.

- Predictable repayment : Debt comes with repayment terms, making it easier to plan and budget.

Cons of debt financing:

- Interest costs : Borrowing money has interest costs that add to business expenses. High interest rates can decrease profitability.

- Default risk : If a business can’t make timely repayments, it might default on debt. This can harm credit ratings and limit borrowing options.

- Less flexibility : Debt creates fixed financial obligations that must be met regardless of performance or market conditions. It limits flexibility in making decisions.

- Loss of assets : Some lenders may require collateral. Failing to repay the debt could result in seizure of assets.

Businesses should evaluate the pros and cons of debt financing based on their situation and financial goals.

Henry Ford is a famous example of debt financing. In the early 1900s, he used it to fund his venture. Despite skepticism, he secured capital to develop the Model T. This highlights the power of debt financing in driving innovation and industry transformation.

Other sources of capital

Businesses can consider alternative funding options aside from traditional methods. These provide a new way to get capital to expand and grow. Here are some examples:

- Angel investors: People who use their own funds to invest in startups or small companies. Most times, they provide more than just money, but mentorship and industry connections too.

- Venture capital: Funds invested in high-growth potential companies. Usually, large amounts given in exchange for equity or ownership, as well as advice and expertise.

- Crowdfunding: Businesses can raise money through online platforms. People donate small amounts of money to support a project or business idea.

- Government grants: Agencies offer grants to businesses that meet certain criteria. These don’t need to be paid back – but require rigorous reporting and accountability.

These alternatives have unique advantages. Angel investors , for instance, contribute experience and knowledge as well as money. Crowdfunding campaigns can create a customer base before a product or service is launched.

Pro Tip: Research each option before making any decisions. Understand the terms, risks, and benefits.

Grants and subsidies

Grants and subsidies are valuable sources of capital. Let’s explore them! Here’s a quick overview:

These sources of support are tailored to specific purposes and have been around since ancient times. Governments and organizations have spent funds to foster development and stimulate growth. Grants and subsidies provide individuals and businesses with the funding to turn their ideas into reality, or to expand operations. They are vital for progress across all sectors.

Alternative financing options (crowdfunding, angel investors, etc.)

Alternative financing options, such as crowdfunding and angel investors , are important for businesses seeking to raise capital. These options offer entrepreneurs a way to secure funds without relying on banks. Let’s explore the different alternative financing options.

Table: Alternative Financing Options

Each option has its own set of advantages and disadvantages. Crowdfunding provides easy access to capital, but you may not have control over the investor base. Angel investors bring expertise and guidance, but you may have to give up autonomy in decision-making. Venture capital firms offer extensive financial and strategic support, but there is a high equity stake and strict vetting process. Lastly, peer-to-peer lending offers flexible repayment terms, but the interest rates may be higher.

There are countless stories of successful alternative financing. A tech startup used crowdfunding to get vital investment. They had an engaging pitch that resonated with backers and they surpassed their goal within weeks. This shows that alternative financing can help businesses get the capital they need for growth.

Managing Capital

To effectively manage capital in business, you need to understand its importance and implement appropriate strategies for allocation, utilization, and evaluation. This involves recognizing the significance of effective capital management, devising strategies for capital allocation and utilization, and consistently monitoring and evaluating capital efficiency. Each sub-section will provide valuable insights into these aspects of managing capital.

Importance of effective capital management

The significance of capital management cannot be over-emphasized. It’s the secret to achieving financial prosperity and sustainability for any organization. When capital is managed expertly, it guarantees the right amount of funds are allocated to different aspects of the business – operations, expansion, research and development, and marketing . This helps companies make informed decisions, seize opportunities, and overcome challenges successfully.

Effective capital management consists of various strategies and techniques. One such approach is optimizing cash flow by precisely monitoring incoming and outgoing payments. This helps companies recognize potential cash deficits or surpluses beforehand and take appropriate action. Another important element is managing debt cleverly to minimize interest expenses and keep a healthy balance sheet.

Moreover, successful capital management involves evaluating risks associated with investments and making rational decisions about allocating resources. This requires a deep understanding of the business’s financial standing, market trends, and industry trends. By examining all these factors cautiously, companies can guarantee their capital investments give maximum returns.

Along with these strategies, here’s an inspiring true story about effective capital management in action. A few years ago, a small manufacturing company was facing financial issues due to inadequate capital utilization. But, under new leadership, the company implemented sound measures to optimize its capital allocation.

The first step was conducting a thorough assessment of its assets and liabilities. They identified superfluous or underutilized assets that were taking up valuable capital. These assets were sold or repurposed to generate extra income.

Next, they restructured their debt by negotiating better deals with lenders. This helped reduce interest expenses and better their cash flow situation.

Also, they concentrated on improving working capital management by carrying out strict inventory control procedures. This cut carrying costs and freed up funds for other critical areas of the business.

Eventually, these efforts paid off as the company experienced remarkable improvements in profitability and growth. With efficient capital management practices in place, they were able to invest in new technologies, expand their market reach, and diversify their product offerings.

Strategies for capital allocation and utilization

Check out the table below to see what strategies successful companies use:

- Cost-cutting: reduce costs without compromising quality.

- Diversification: invest in various industries or sectors.

- Research and Development: allocate funds for innovation and new products.

- Debt Financing: get funds with loans or bonds.

- Asset Acquisition: buy valuable assets to help the business.

Plus, companies can also focus on strategic partnerships, mergers, acquisitions, and reinvesting profits to grow.

For long-term success, it’s important to allocate capital for research and development. This will help with innovation, staying competitive, and meeting customer needs.

To show the importance of good capital allocation, take XYZ Corporation. Market competition was tough, so they put capital into upgrading their production facilities. This brought cost savings and high product quality. As a result, XYZ Corporation saw huge market share and profit growth.

By using different strategies for capital allocation and utilization, companies can stay ahead in the business world while growing and staying financially secure.

Monitoring and evaluating capital efficiency

Measuring and assessing capital efficiency is key for success. Here’s how:

Metrics: Return on Investment, Net Working Capital, Debt-to-Equity Ratio.

Calculation:

- (Net Profit / Cost) * 100

- Current Assets – Liabilities

- Total Debt / Shareholders’ Equity * 100

Target Value: >10%; Positive; <50%.

Monitoring capital efficiency means regularly checking these metrics against set targets. This helps businesses to understand their financial performance and spot potential problems. If the return on investment is lower than expected or the debt-to-equity ratio is too high, action needs to be taken.

Also, monitoring and evaluating capital efficiency enables companies to spot growth opportunities and reduce risks. It helps to identify underperforming assets or projects which might be wasting resources. By investing in profitable areas or divesting from low-performing investments, businesses can optimize their portfolio and improve overall profitability.

In summary, closely monitoring capital efficiency is essential for long-term financial success. It helps businesses to allocate resources wisely, increase productivity, and cut down on unnecessary costs. Analyzing financial performance constantly assists in making informed decisions and achieving organizational goals.

Ernst & Young have reported that companies who consistently assess their capital efficiency are more profitable and create more value for their shareholders than their competitors.

To solidify your understanding of capital in business, let’s dive into the conclusion. Recap of key points discussed and final thoughts on the role of capital in business success are the solutions you’ll find in this section.

Recap of key points discussed

I. Recap of key points discussed:

- We discussed numerous important topics.

- Let’s review the most crucial ones to ensure clarity.

- Knowing these key points will give a comprehensive view.

- This point focused on the importance of effective communication.

- Talking is vital for expressing ideas and creating understanding.

- Using clear and brief language enables us to engage and connect with our audience.

- We dove into the value of time management.

- Making good use of our time helps to maximize productivity and reach goals.

- Setting priorities properly can result in better organization and lower stress levels.

- The last point discussed the advantages of teamwork and collaboration.

- Working together boosts creativity and problem-solving skills.

- Adopting different perspectives improves results and sets up a pleasant work environment.

II. Unique details:

- We also brought up the significance of adaptability in today’s changing world.

- Adapting to alterations allows individuals and organizations to prosper in varying conditions.

III. Pro Tip:

Remember, consistency is essential to effectively apply the discussed key points throughout your professional journey.

Final thoughts on the role of capital in business success

Capital is a key element to success for any business. It’s like the fuel that helps them seize all the opportunities. Without enough capital, a business can struggle with expansion, equipment and research. While capital is very important, it doesn’t guarantee success. Factors like leadership, planning and a strong market position also contribute.

Capital can give a business credibility and make them reliable. It can open new doors, get top talent and collaborate with other companies. Plus, capital helps businesses through tough times like economic downturns and unexpected expenses. Having enough reserves keeps operations going and protects them from external shocks.

An example of capital’s power is XYZ Corporation . They began with a small seed investment, but got more money from venture capitalists for their product and team. This gave them the finances to scale up, hire great people and invest in technology. In a few years, they became a market leader and had a lot of revenue and customers.

Overall, capital is important but it’s only one part of the equation. Companies must also focus on management, decision-making and growth strategies. A balance between capital and other factors is what will help businesses truly excel.

Frequently Asked Questions

1. What is capital in business?

Capital in business refers to the financial resources or assets that a company uses to operate, invest, and grow. It can include cash, equipment, buildings, inventory, and even intellectual property.

2. Why is capital important in business?

Capital is essential because it enables businesses to fund their operations, purchase necessary assets, hire employees, and expand their operations. It provides companies with the resources needed to generate revenue and achieve their goals.

3. How do businesses obtain capital?

Businesses can obtain capital through various means, such as investments from owners or shareholders, bank loans, venture capital funding, crowdfunding campaigns, or by issuing bonds or stocks in the financial markets.

4. What is the difference between debt and equity capital?

Debt capital is borrowed money that a business must repay with interest over a specific period. Equity capital, on the other hand, represents ownership in the company and is obtained by selling shares or stocks to investors, who become partial owners and share in the company’s profits or losses.

5. How is capital different from revenue?

Capital represents the assets and resources a business owns, while revenue refers to the income a company generates from its operations. Capital is a long-term investment, whereas revenue is the short-term result of business activities.

6. Can a business operate without capital?

It is extremely difficult for a business to operate without any capital. While some businesses may start with minimal capital or rely on initial revenues, having access to sufficient capital is crucial to support ongoing operations, investments, and growth.

- Latest Posts

- Vintage Typewriters: The Art and Nostalgia of Manual Typing - October 18, 2023

- Welcome to the Insider! - October 18, 2023

- Explore Lucrative State Farm Careers and Job Opportunities for your Future Success - October 18, 2023

Share this post:

Similar posts.

Important Dates: When Are Business Taxes Due in 2024?

Business taxes are a major part of running a company. In 2024, owners need to keep track of certain dates. A key due date for filing federal taxes is March 15th for corporations and partnerships. Apri…

A Guide on How to Start a Successful Lawn Care Business

To successfully embark on your journey into the world of lawn care business, equip yourself with the necessary knowledge through the introduction. Discover why starting a lawn care business is a viable option and explore the various benefits it offers. Unveil the potential this industry holds and prepare yourself for the exciting sub-sections that lie…

Post-Business Plan: Essential Steps for Entrepreneurs

Beginning a business is an exciting venture that needs thoughtful planning and implementation. After crafting a business plan, the real work starts! It’s essential to have a clear understanding of what to do next to properly launch and develop the business. Assessing feasibility is the initial step for entrepreneurs. This includes studying market circumstances, competition,…

How to Secure a Startup Business Loan with No Money: Proven Strategies and Tips

Aspiring entrepreneurs face a challenge when starting a business – securing capital. This article looks into how to get a startup loan without any money. Beginning a new venture requires funds for equipment, inventory and marketing. Without capital, many are at a disadvantage. There are options available, though. Investors and venture capitalists may be willing…

Mastering the Art of Spelling ‘Business’: Key Tips for Success

What is the spelling of ‘business’? It starts with ‘b’ – a symbol of ambition. Followed by ‘u’ for unity and collaboration. ‘S’ stands for strategy and decision-making. Double ‘i’ reflects intuition a…

Understanding Business Trusts: Exploring the Concept and Benefits

Business trust is a complex concept. It’s an entity formed to hold and manage assets for the benefit of its beneficiaries, who are called unit holders. This trust structure lets investors pool their f…

- Search Search Please fill out this field.

- Building Your Business

- Business Taxes

What Is Capital in Business?

Capital Structure of a Business Explaineed

- What is Capital in a Business?

- Capital Structure of a Business

Other Terms for Business Capital

Business capital and taxes.

- Asset Information for Taxes

Frequently Asked Questions (FAQs)

Jetta Productions Inc / Getty Images

The term capital has several meanings, and it is used in several areas in business. In general, capital is accumulated assets or ownership. The roots of the term "capital" go back to Latin, where the term was capitālis, "head," and Latin capitale "wealth.

Capital is important to businesses because the cost of buying and owning these investments can affect the business's value and tax situation.

Key Takeaways

- Business capital is all of the long-term assets of the business that have value while the business is operating and in the sale of a business.

- Capital in accounting terms is the accumulated wealth or net worth of a business and the owners, expressed as the value of its assets minus its liabilities.

- Capital in taxes is assets that a business uses to make a profit.

- A business can lower its business taxes by spreading out its tax deductions for capital expenses over several years.

Capital in Business

Business capital is in the form of assets (things of value). Capital is a necessary part of business ownership because businesses use assets to create products and services to sell to customers. Capital can have one of three specific meanings:

- The amount of cash and other assets (owned by a business, including accounts receivable, equipment, inventory, and buildings of the business)

- The accumulated wealth or net worth of a business, represented on a balance sheet by its owner's equity (ownership) minus liabilities

- Stock or ownership in a company, the capital account of a stockholder

Capital for Tax Purposes

The Internal Revenue Service (IRS) uses the term capital assets to describe assets that are used to generate a profit. These assets aren't easily turned into cash and they are expected to last more than one year. A building, equipment, and vehicles are examples of capital assets for tax purposes.

Capital Structure of a Business

The capital structure of a business is the mix of types of debt (borrowing) and equity (ownership). Business capital is shown on the business's balance sheet . The format for this report shows all the asses of the business in one column and the liabilities and owner equity in the other. Total assets must equal total liabilities plus total owner equity.

Another way to express capital in business is through its debt to equity ratio. This ratio divides the company's total liabilities by its shareholder equity, measuring how much of the company is financed by debt. An acceptable ratio is 2:1, meaning that debt can be two times equity.

Other associated terms which relate to capital in business situations are:

- Capital gains : Capital gains and losses are increases or decreases in the value of stock and other investment assets when they are sold.

- Capital improvements : Improvements made to capital assets, to increase their useful life, or add to the value of these assets. Capital improvements may be structural improvements or other renovations to a building to enhance usefulness or productivity.

- Venture capital : Private funding (capital investment) provided by individuals or other businesses to new business ventures.

- Capital lease : A lease of business equipment that represents ownership and is shown in the company's balance sheet as an asset.

- Capital contribution : A contribution to the business by an owner, partner, or shareholder in the form of money or property. The contribution increases the owner's equity (investment) in the company.

Businesses with capital assets must deal with two types of tax reporting. The business must report depreciation, amortization, and deductions for income taxes during the time the business owns the asset. It must also report and pay capital gains taxes when the asset is sold.

Income Taxes

The expense of buying or improving an asset must be capitalized for income tax purposes. That means the assets must be spread out over a number of years, rather than being deducted in one year. Each year, the business can take a tax deduction for the yearly deduction for all capital assets.

The two processes for capitalizing assets are:

- Depreciation : For tangible assets like vehicles, equipment, furniture, and buildings

- Amortization : For intangible assets like patents, trademarks, and trade secrets

Capital improvements on an asset, which add to an asset's value and must be capitalized, are distinguished from repairs, which are deductible.

Some deductible repairs are painting, repairing a roof, or fixing an elevator. Some capital improvements that must be depreciated including replacing a roof or improving a storefront.

Business startup costs are considered capital assets and they must be amortized. But you may be able to up to $5,000 of business startup costs and $5,000 of organization costs (for forming and registering your new business) in the first year you are in business.

Capital Gains Tax

Businesses that have capital assets must pay capital gains tax on those assets when they are sold. Capital gains taxes are payable at a different rate from ordinary business gains. Short-term capital gains are taxed as ordinary income to the individual, and corporations pay short-term capital gains tax at the regular corporate tax rate of 21%. Long-term capital gains (held more than a year) are taxed at different rates, depending on the individual's income.

Gathering Asset Information for Taxes

Capitalizing business assets is probably the most difficult and complicated part of business taxes; it's not something you should attempt yourself. Before you turn over your yearly records to your tax preparer, gather all the information you can on the original costs of each asset, called " asset basis ."

Information for asset basis for physical assets includes:

- Sales price

- Installation and training

- Recording fees

- Permits and inspection fees

The asset basis for intangible assets like patents, copyrights, trademarks, trade names, and franchises is usually the cost to buy or create it. For a patent, for example, the basis is the cost of development, including costs of research and experiment, drawings, working models, attorney fees, and application fees. You can't include your time as the inventor, but you can include the time for workers you paid to help you.

What is capital in business?

Capital is the assets (things of value) in a business that the business uses as collateral for loans and to pay expenses. For tax purposes, business capital assets are the long-term assets (like equipment, vehicles, and furniture) used to make a profit.

You can see the types of business capital by looking at the "Assets" column on a business balance sheet. A balance sheet shows assets on one side and liabilities (what's owed to others) plus owner's equity (ownership) on the other side, with total assets equal to total liability + owner's equity.

What is an example of capital in a business?

Here's a list of all the types of business capital as they are shown on a business balance sheet. They are in order by how quickly they can be turned into cash, and categorized by short-term and long-term assets.

Short-term assets are used up or paid within a year.

- Accounts receivable (money owed by others)

- Prepaids (like insurance)

Long-term assets (capital assets) are used over a number of years:

- Furniture and Fixtures

- Equipment and Machinery

- Land and Buildings

How do businesses use capital?

Capital is important to a business in both short-term and long-term situations. In the short term, it's used to fund operations. For example, cash is an important asset to a business because it is used to pay expenses.

In the long term, capital assets like buildings and can be used as collateral for a business loan. For example, the equity in a business building can be used to get a second mortgage. To finance short-term cash flow shortages, a business can sell accounts receivable to a factoring service for quick cash.

Why do businesses need capital?

Businesses need capital to attract investors. Investors can use capital to analyze the strength of a business, using a debt-to-equity ratio. This ratio compares long-term capital to owner's equity; an acceptable ratio of 2:1, meaning that debt is twice equity.

Capital is also important in selling a business because buyers also look at the strength of business assets and their usefulness to fund the business purchase or make changes. For example, a buyer could sell off several buildings to get cash to expand into other markets.

Legal Information Institute. " Capital Assets ." Accessed Aug. 12, 2021.

International Journal of Management Sciences, " Financial Ratio Analysis of Firms: A Tool for Decision Making ," Page 136-37. Accessed Aug. 19, 2021.

Tax Policy Center. " How Does Corporate Income Tax Work ?" Accessed Aug. 19, 2021.

IRS. " Capital Gains and Losses - 10 Helpful Facts to Know ." Accessed Aug. 19, 2021.

IRS. " Publication 551 Basis of Assets ." Accessed Aug. 19, 2021.

What Is Capital Planning?

The act of a formal planning process requires you and your company to zoom out, way out. So often individuals within an organization get caught up with the day-to-day that they hardly have an opportunity to think about next quarter’s strategies, much less one to five years down the road.

Capital Planning is here to help.

Even those companies that do have a “5 Year Plan” often fail to align those goals with a formal capital planning process. Without doing so, many of these plans turn out to be not much more than “pie in the sky dreams” or even more simply put, tag lines, and “company vision statements.”

Of course, tying in a Capital Plan with strategic plans is more work, but without it, you could run into problems.

Below we are going to explain the basic components of the Capital Planning process and steps you can follow to implement a Capital Planning team within your role and/or organization.

Capital Planning Basics

- Capital Planning – The process of budgeting resources for the future of the organization’s long-term plans. Not limited to plans already in place, but also on the projection of future projects and their gains and losses.

- Capital Request Form – This form is created and used to standardize the process of information gathering for each capital planning project detail. This form allows the planning team member or members to quickly scan and vet the information concerning its specific project.

- Capital Project Drivers – Every organization has different definitions of drivers, but typical common drivers are growth, obsolescence, regulatory, strategic, alignment to the project goals, and cost reduction and/or avoidance.

- Capital Planning Group – This is the team or team member responsible for the management of the Capital Planning project. They are generally in charge of vetting the capital request forms for sub-projects, prioritizing and reprioritizing the available capital, condensing, and reformatting project information for presentation to management and executive approval.

- Capital Management Committee – These are the managerial or executive persons or groups responsible for approving or denying the Capital Planning project’s funding and spending plans.

- Capital Project Approval Processes – This process is typically unique to your own company, but these usually require different formatting, version control, and approval processes. Many companies have different Capital Planning approval processes for differing amounts of capital. For example, one company might have any project expected to have a spend of over $500,000 be required to go through their major approval process, while another company might consider this figure to be far below their risk level, and only require amounts of 10 million dollars or more to be fully vetted.

- Minor Versus Major Capital – As mentioned above, each company will have its own risk tolerances. Minor Capital categories require little to no formal approval while Major Capital categories might require months of intensive research and several rounds of vetting before it moves to a board of directors vote for approval. Each company will have its own delineation on Minor and Major capital categories for its Capital Planning processes.

- Operating Capital Versus New Capital – An example of minor capital. Generally, routine or Operating Capital consumes the bulk of business operations and is standard and expected. These projects can have bulk or automated approval as long as they fall within company parameters.

- Finance – This portion of your Capital Planning team has a hand in both the Capital Planning Group side, as well as the Capital Management side. For instance, you might have a financial analyst on the planning side, and the CFO on the Management side that has the final say and can officially approve capital funds to be spent.

- Management Programs – Inpensa provides a unique and custom-built Capital Planning management software program that can provide the platform you and your team need to effectively manage version control; be team enabled to allow for edits without sending files via email; and format reports ready for your Capital Management Committee’s approval.

- Business Unit Leaders – These are the leaders of the multiple operating groups who sit on the Capital Management Committee for the approval process. We already talked about the Finance portion above (CFO) but this could be anyone from a manager of a department to the president, CEO, or even board of directors, if the project is large enough.

- Monthly Variance Report – These reports are sent out monthly (sometimes quarterly) to inform the decision-makers of incremental progress. They also serve as an early warning detection for everyone on the capital planning team. Detecting overspends, delays, early wins, and budget surpluses about every 30 days. These are increasingly important as the modern world causes pricing and logistics to change by the minute, versus changes by the month, quarter, or year in the past.

Now that we have a basic rundown of the who and what is working with the Capital Planning Process, let’s continue to why Capital Planning and using software you can trust is important.

Planning Helps You Avoid Problems

Capital Planning is a tight rope. There are, on one hand, executives, and heads of departments who over-promise, and expect you and the Capital Planning team to “make the numbers work” on near-impossible projects, and on the other hand there is a team of financial professionals who often times get into a habit of saying “it doesn’t make financial sense for the company to pursue this project/idea/dream at this time.”

This may be done without doing the true due diligence every capital investment requires. Inpensa offers a custom-built Management Software that allows every company to complete the due diligence needed and demanded for both sides of this tight rope.

On the first hand, a program like Inpensa’s allows you to fiscally prove to a senior member of the organization that a Capital Expenditure/Investment doesn’t align with the current goals of the organization with clear facts and numbers.

The opposite side of this tight rope is also solved by Inpensa’s offering of a strong and streamlined solution that allows the Capital Planning team to cut through the busy work of structuring, finding Excel formulas they have long forgotten, and formatting version after version to fit individual aesthetic preferences with a pre-formatted reporting dashboard.

With all of this, a Capital Planning team can quickly get to work on the actual numbers and planning of every project, not just the Major Capital categories. This leads to increased performance on the Capital Planning team and increased profits, lower risk, and more effective long-term success for the overall organization.

Steps For Effective Capital Planning

- Ground Your Plan In Reality – Many organizations that are starting the capital planning process from scratch make the mistake of not making plans based on past performance and present numbers. Organizations often make the mistake of desiring 300% growth in the next five years, when the past five years have produced 85% growth. It is much better to be realistic and grow 105% in the next five years with a Capital Plan based on reality, than to wish for 300% growth and get 80% again. A thorough assessment of the prior five-year financials and operating performance is key to understanding liquidity needs and drivers in the future for performance, along with the macro view of your organization’s business and commodity cycles. Dream big, but have a plan in place to produce your organization’s vision.

- Define Your Companies Five-Year Strategic Plan – Plans and priorities are a requirement, and tools like Inpensa’s Capital Planning software can help you with expected capital requirements and how they can align with the organization’s long-term goals.

- Financial Modeling – This is where Inpensa thrives. Financial modeling is what Inpensa makes easy. Without a program like Inpensa’s case management software , you can quickly lose yourself within increasingly cumbersome and non-uniform financial models. Financial models quantify the impact of capital, ground your numbers with historical performance, and give decision makers easy to read financial reports and understand overviews on the expected capital needs and gains as projects move forward.

- Modeling Alternatives – Use software like Inpensa’s to design alternatives to capital expenditures and deployment. Some of the most successful ideas for organizational success come from the Capital Planning team asking “What if?” What if we tweaked this plan? What if we explored this opportunity instead? Big wins come from using modeling software that allows you to confidently and easily explore all the options for your organization.

- Implement the Plan – Meet with the decision-makers within your organization. Ask them what the Capital Planning structure and approval process is for your company. Now it’s time to get organized. Play by the rules and policies provided to you, document, research, model, and present your plan. Get approval, provide monthly reports, and meet your goals.

Inpensa knows Capital Planning comes with many frustrations, but our project management software is not one of them.

Follow the above instructions, get to know your team, and meet your goals with Inpensa’s custom software and Capital Planning advice and modeling. Do not let your companies Capital Plan become just another company “vision.”

PMO versus EPMO versus TMO

Common Challenges of The Transformation Office

Five Trends for Enterprise SaaS Platforms

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Business Capital: Definition and Where to Get It

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Business capital, or small-business capital, commonly refers to lump sums of money that come from external sources and are used to fund business purchases, operations or growth. These sources can include small-business loans , as well as free funding like small-business grants .

The right type of business capital for you depends on how established your business is, as well as other factors like your funding purpose and how fast you need it.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

What is business capital?

Technically speaking, business capital is anything that generates value for your business. That can include financial capital like cash, human capital like employees and personnel or physical capital like real estate and intellectual property.

Business capital, or small-business capital, can also simply refer to external financing, or lump sums your business attains to fund operations or large purchases.

Types of business capital

There are several types of business capital that you can use to fund your business at various stages.

Debt funding

With debt funding — taking out a small-business loan — you borrow money from a third party and repay it, with interest, over a specific period of time. Debt funding can be a good option for a variety of small businesses, especially established companies looking to grow their operations.

Business term loans

With a business term loan , you receive a lump sum of capital upfront from a lender. You then repay the loan, with interest, over a set period of time — usually with fixed, equal payments.

Business term loans are well-suited for specific funding purposes, such as purchasing real estate or renovating your storefront. Some loans, like equipment financing , are designed to accommodate specific business purchases.

You can get business term loans from banks, credit unions and online lenders . Banks and credit unions will offer term loans with the most competitive rates and terms, but you’ll need to meet strict criteria to qualify. Online lenders are typically more flexible and may work with startups or businesses with bad credit. These companies will often charge higher interest rates.

» MORE: Compare the best banks for business loans

SBA loans are partially guaranteed by the U.S. Small Business Administration and issued by participating lenders, typically banks and credit unions. There are several types of SBA loans , but generally, these products are structured as term loans.

These loans usually have low interest rates and long repayment terms and can be used for a range of purposes, such as working capital, equipment purchases and business expansions.

This type of government funding can be a good option if you’re an established business with good credit but you can’t qualify for a bank loan.

>> MORE: Top SBA lenders

Business lines of credit

A business line of credit is one of the most flexible types of business capital — making it well-suited to meet the working capital needs of new and established companies alike.

With a business line of credit, you can draw from a set limit of funds and pay interest on only the money you borrow. After you repay, you can draw from the line as needed. Lines of credit are often used to manage cash flow, buy inventory, cover payroll or serve as an emergency fund.

Like term loans, business lines of credit are available from traditional and online lenders. Traditional lenders typically offer credit lines with the lowest rates but require an excellent credit history and several years in business to qualify.

Online lenders, on the other hand, may charge higher interest rates but generally work with a wider range of businesses. Some online lenders offer startup business lines of credit and/or options for borrowers with fair credit.

Business credit cards

Business credit cards work similarly to personal credit cards, although business cards typically offer rewards for spending on operational expenses, such as gas, internet, software purchases and more.

Business credit cards can be a good option for startups because they offer quick access to capital and most entrepreneurs with good personal credit can qualify. You may not want to completely fund your business with a credit card , however, because overspending can lead to expensive debt that’s difficult to repay.

In general, business credit cards can be useful for all types of entrepreneurs because they allow you to earn rewards (e.g., cash back, miles, points) for everyday spending on your business purchases. Responsible spending on a credit card can also help you establish business credit, which will allow you to qualify for more competitive loan products.

»MORE: Debt vs. equity financing

Equity funding

With equity funding , you receive money from an investor in exchange for partial ownership of your company. If you’re a startup that can’t qualify for a business loan or you want to avoid debt, equity funding may be a suitable option for your needs.

Angel investors and venture capital firms

Angel investors and venture capital firms are common forms of equity financing that involve receiving money in exchange for equity in your company.

With angel investors , you work with individuals who invest their money into your business. These individuals often invest in startups with high growth potential. In addition to the equity they receive, your angel investor may offer business expertise to help your company progress.

A venture capital firm, on the other hand, will be an individual or group that invests from a pool of money. VCs may require a higher amount of equity in your company as well as some operational control, such as a seat on the board of directors. Compared to angel investors, VCs tend to offer larger amounts of money and invest in businesses that are a little more established.

You can find angel investors and venture capitalists through organizations like the Angel Capital Association or the National Venture Capital Association . You can also search online for investors in your area as well as attend industry events and talk to other business owners.

Either of these startup funding options may be a good option for your business if you’re looking to avoid debt. Finding and receiving capital may take time, however, and some businesses may not be able to meet the requirements set out by an angel investor or venture capital firm.

Crowdfunding

With crowdfunding your business , you raise money online through public donations in exchange for equity or rewards, such as an exclusive product or early access to an event.

You can set up a campaign using a crowdfunding platform, which allows you to manage the process through the platform’s website.

With equity crowdfunding , you can use platforms like Fundable, StartEngine and Netcapital to receive capital in exchange for ownership of your business. For rewards-based crowdfunding , you can turn to well-known websites like Kickstarter or Indiegogo .

Crowdfunding can be well-suited for a range of businesses as long as they’re dedicated to managing and promoting a campaign. Rewards-based crowdfunding is usually a better option for small amounts of capital, especially for businesses with a unique product or service.

Equity crowdfunding, on the other hand, may give you access to larger funding amounts, but you may have to meet stricter eligibility requirements to use one of these crowdfunding platforms.

» MORE: How to fund your business idea

Free business capital

On top of these main sources of external financing, entrepreneurs can access free small-business capital through grants. Grants do not have to be repaid and are available from government agencies, corporations and nonprofits.

Small-business grants are available for new and existing businesses. You can get a business grant from a few sources:

Federal and state governments. Government agencies offer a range of small-business grants, including those designed for companies that focus on scientific research and technology innovation. Grants.gov provides a comprehensive list of business grants available from the federal government.

Private corporations. Many corporations offer annual small-business grant programs or competitions, such as the FedEx Small Business Grant Contest . In many cases, you have to meet specific criteria to qualify for one of these grants.

Nonprofits. Certain nonprofits offer grants designed for small-business owners. Among these organizations, some focus on providing business grants for women or business grants for minority groups .

Business grants are a good option for startups as well as companies that can’t qualify for other types of small-business capital. Because grants give you access to free capital, however, applications are competitive — and often time-consuming.

Bootstrapping

In addition to the previous external financing sources, many small-business owners also bootstrap, or self-fund, their business venture. Options for bootstrapping your business include using personal savings or tapping into their retirement account through a Rollover as Business Startup , or ROBS.

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

How to get business capital

The right funding option is different for every small-business owner. And the best type of funding for you now might not be the best choice to meet your needs later.

Consider why you need business capital. Your funding purpose is a key component of which type of business capital is best for you, and how much money you need. Plus, any potential lender or funder will likely ask for this information.

Decide which type of funding is best for your business. Before you start researching, think about which type of business capital is best for you. Consider if you would rather take on debt or give up business equity, how fast you need access to funding and your current resources and qualifications.

Research lenders or funders. Once you’ve decided which type of capital your business needs, you can begin researching providers — either lenders, investors or funding platforms — to determine the best options.

Gather documents. It may vary based on your capital provider, but generally you’ll need documents like your business plan, filing information and financial information like profit and loss statements, tax returns or bank statements.

How you get small-business capital depends on why you need capital and how long you’ve been in business. Startups may consider self-funding, working with angel investors or applying for grants. Businesses with at least a year in operation and solid finances, likely have more options, such as SBA funding and other types of business loans.

Capital in business generally refers to anything the business uses to generate value, including finances, physical assets, human resources and more. It can also refer to external sources of financing, like loans or grants.

If you need money to get your business off the ground, you’ll likely have difficulty qualifying for traditional funding, like a term loan or line of credit. Instead, you might turn to alternative sources, such as friends and family, crowdfunding, small-business grants or angel investors for the startup capital you need.

On a similar note...

Capitalization in Business Finance

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 30, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

What is the meaning of capitalization.

Capitalization refers to the amount of capital required by a business enterprise. Capital can be obtained in the following ways:

- Issuing equity and preference shares

- Issuing debentures

- Obtaining loans

- Retained earnings

Therefore, capitalization is the sum total of the funds received through shares , bonds , loans, and retained earnings . In other words, the sum total of fixed capital and working capital forms capitalization.

Definitions of Capitalization

Some notable definitions of the term capitalization are stated and discussed below.

1. A. S. Dewing: "The term capitalization or the valuation of capital includes the capital stock and debt."

2. Gestenbergh: "For all practical purposes, capitalization means the total accounting value of all the capital regularly employed in the business ."

When determining the capital of a company, the promoter must consider the cost of fixed assets , as well as the cost of establishing, organizing, and running the business, working capital, and sufficient funds to meet contingency demand .

The term capitalization is closely associated with the earning capacity of an enterprise. Both overcapitalization and undercapitalization are dangerous for organizations.

A stage of optimum capitalization is the desired goal of every enterprise.

This is the stage where the company earns a fairly good return.

In a nutshell, these definitions indicate that capitalization refers to all the long-term funds raised through issuing shares, debentures, and loans from specialized financial institutions .

Suppose that a company has the following information on the liabilities side of its balance sheet :

Capitalization, in this case, amounts to the sum total of long-term funds. These are:

- Equity share capital

- Preference share capital

- Loans from IBRD and IFC

Now, it's clearly seen that capitalization—in a broader sense—refers to the process of determining the plan or patterns of financing.

In a narrower sense, capitalization is the sum total of all long-term securities issued by a company and the surpluses not meant for distribution.

It should also be noted that the term capitalization is used only for companies and not for sole proprietorships . Capitalization is capital plus long-term loans and retained earnings.

Capitalization in Business Finance FAQs

What is a capitalization table.

A capitalisation table shows the amount of money that has been borrowed by a business and what each creditor requires in terms of interest. It also shows the day-to-day trading activities such as sales, purchases and other financial transactions. A capitalisation table can be used to compare sales with debtors, creditors, purchases with suppliers or financial transactions.

Why is a capitalization table needed?

A capitalisation table is needed because it shows the amount of money that has been borrowed by a business and what each creditor requires in terms of interest. It also shows the day-to-day trading activities such as sales, purchases and other financial transactions and enables the company to compare sales with debtors and creditors, purchases with suppliers and financial transactions.

What is the capitalization in business finance?

Capitalisation refers to the amount of capital required by a business enterprise. Capital can be obtained through issuing equity and preference shares, Debentures, loans as well as Retained Earnings. The total amount of capital is divided into share capital, preference capital and Debentures.

What is the difference between "shareholders' equity" and "capitalization"?

Shareholders’ equity (or stockholder's equity), also referred to as book value or net worth, represents the total assets minus total liabilities of a company. Capitalization, on the other hand, refers to the amount of money required by a business enterprise. Capital can be obtained through issuing equity and preference shares, Debentures as well as Retained Earnings. The total amount of capital is divided into stockholder's equity, preference capital and Debentures.

What are some examples of financial ratios?