- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Plan Your Business Plan Before you put pen to paper, find out how to assess your business's goals and objectives.

You've decided to write a business plan, and you're ready to get started. Congratulations. You've just greatly increased the chances that your business venture will succeed. But before you start drafting your plan, you need to--you guessed it--plan your draft.

One of the most important reasons to plan your plan is that you may be held accountable for the projections and proposals it contains. That's especially true if you use your plan to raise money to finance your company. Let's say you forecast opening four new locations in the second year of your retail operation. An investor may have a beef if, due to circumstances you could have foreseen, you only open two. A business plan can take on a life of its own, so thinking a little about what you want to include in your plan is no more than common prudence.

Second, as you'll soon learn if you haven't already, business plans can be complicated documents. As you draft your plan, you'll be making lots of decisions on serious matters, such as what strategy you'll pursue, as well as less important ones, like what color paper to print it on. Thinking about these decisions in advance is an important way to minimize the time you spend planning your business and maximize the time you spend generating income.

To sum up, planning your plan will help control your degree of accountability and reduce time-wasting indecision. To plan your plan, you'll first need to decide what your goals and objectives in business are. As part of that, you'll assess the business you've chosen to start, or are already running, to see what the chances are that it will actually achieve those ends. Finally, you'll take a look at common elements of most plans to get an idea of which ones you want to include and how each will be treated.

Determine Your Objectives Close your eyes. Imagine that the date is five years from now. Where do you want to be? Will you be running a business that hasn't increased significantly in size? Will you command a rapidly growing empire? Will you have already cashed out and be relaxing on a beach somewhere, enjoying your hard-won gains?

Answering these questions is an important part of building a successful business plan. In fact, without knowing where you're going, it's not really possible to plan at all.

Now is a good time to free-associate a little bit--to let your mind roam, exploring every avenue that you'd like your business to go down. Try writing a personal essay on your business goals. It could take the form of a letter to yourself, written from five years in the future, describing all you have accomplished and how it came about.

As you read such a document, you may make a surprising discovery, such as that you don't really want to own a large, fast-growing enterprise but would be content with a stable small business. Even if you don't learn anything new, though, getting a firm handle on your goals and objectives is a big help in deciding how you'll plan your business.

Goals and Objectives Checklist If you're having trouble deciding what your goals and objectives are, here are some questions to ask yourself:

- How determined am I to see this succeed?

- Am I willing to invest my own money and work long hours for no pay, sacrificing personal time and lifestyle, maybe for years?

- What's going to happen to me if this venture doesn't work out?

- If it does succeed, how many employees will this company eventually have?

- What will be its annual revenues in a year? Five years?

- What will be its market share in that time frame?

- Will it be a niche marketer, or will it sell a broad spectrum of good and services?

- What are my plans for geographic expansion? Local? National? Global?

- Am I going to be a hands-on manager, or will I delegate a large proportion of tasks to others?

- If I delegate, what sorts of tasks will I share? Sales? Technical? Others?

- How comfortable am I taking direction from others? Could I work with partners or investors who demand input into the company's management?

- Is it going to remain independent and privately owned, or will it eventually be acquired or go public?

Your Financing Goals

It doesn't necessarily take a lot of money to make a lot of money, but it does take some. That's especially true if, as part of examining your goals and objectives, you envision very rapid growth.

Energetic, optimistic entrepreneurs often tend to believe that sales growth will take care of everything, that they'll be able to fund their own growth by generating profits. However, this is rarely the case, for one simple reason: You usually have to pay your own suppliers before your customers pay you. This cash flow conundrum is the reason so many fast-growing companies have to seek bank financing or equity sales to finance their growth. They are literally growing faster than they can afford.

Start by asking yourself what kinds of financing you're likely to need--and what you'd be willing to accept. It's easy when you're short of cash, or expect to be short of cash, to take the attitude that almost any source of funding is just fine. But each kind of financing has different characteristics that you should take into consideration when planning your plan. These characteristics take three primary forms:

- First, there's the amount of control you'll have to surrender. An equal partner may, quite naturally, demand approximately equal control. Venture capitalists often demand significant input into management decisions by, for instance, placing one or more people on your board of directors. Angel investors may be very involved or not involved at all, depending on their personal style. Bankers, at the other end of the scale, are likely to offer no advice whatsoever as long as you make payments of principal and interest on time and are not in violation of any other terms of your loan.

- You should also consider the amount of money you're likely to need. Any amount less than several million dollars is too small to be considered for a standard initial public offering of stock, for example. Venture capital investors are most likely to invest amounts of $250,000 to $3 million. On the other hand, only the richest angel investor will be able to provide more than a few hundred thousand dollars, if that.

Almost any source of funds, from a bank to a factor, has some guidelines about the size of financing it prefers. Anticipating the size of your needs now will guide you in preparing your plan.

- The third consideration is cost. This can be measured in terms of interest rates and shares of ownership as well as in time, paperwork and plain old hassle.

How Will You Use Your Plan

Believe it or not, part of planning your plan is planning what you'll do with it. No, we haven't gone crazy--at least not yet. A business plan can be used for several things, from monitoring your company's progress toward goals to enticing key employees to join your firm. Deciding how you intend to use yours is an important part of preparing to write it.

Do you intend to use your plan to help you raise money? In that case, you'll have to focus very carefully on the executive summary, the management, and marketing and financial aspects. You'll need to have a clearly focused vision of how your company is going to make money. If you're looking for a bank loan, you'll need to stress your ability to generate sufficient cash flow to service loans. Equity investors, especially venture capitalists, must be shown how they can cash out of your company and generate a rate of return they'll find acceptable.

Do you intend to use your plan to attract talented employees? Then you'll want to emphasize such things as stock options and other aspects of compensation as well as location, work environment, corporate culture and opportunities for growth and advancement.

Do you anticipate showing your plan to suppliers to demonstrate that you're a worthy customer? A solid business plan may convince a supplier of some precious commodity to favor you over your rivals. It may also help you arrange supplier credit. You may want to stress your blue-ribbon customer list and spotless record of repaying trade debts in this plan.

Assessing Your Company's Potential

For most of us, unfortunately, our desires about where we would like to go aren't as important as our businesses' ability to take us there. Put another way, if you choose the wrong business, you're going nowhere.

Luckily, one of the most valuable uses of a business plan is to help you decide whether the venture you have your heart set on is really likely to fulfill your dreams. Many, many business ideas never make it past the planning stage because their would-be founders, as part of a logical and coherent planning process, test their assumptions and find them wanting.

Test your idea against at least two variables. First, financial, to make sure this business makes economic sense. Second, lifestyle, because who wants a successful business that they hate?

Answer the following questions to help you outline your company's potential. There are no wrong answers. The objective is simply to help you decide how well your proposed venture is likely to match up with your goals and objectives.

- What initial investment will the business require?

- How much control are you willing to relinquish to investors?

- When will the business turn a profit?

- When can investors, including you, expect a return on their money?

- What are the projected profits of the business over time?

- Will you be able to devote yourself full time to the business, financially?

- What kind of salary or profit distribution can you expect to take home?

- What are the chances the business will fail?

- What will happen if it does?

- Where are you going to live?

- What kind of work are you going to be doing?

- How many hours will you be working?

- Will you be able to take vacations?

- What happens if you get sick?

- Will you earn enough to maintain your lifestyle?

- Does your family understand and agree with the sacrifices you envision?

Sources: The Small Business Encyclopedia , Business Plans Made Easy, Start Your Own Business and Entrepreneur magazine.

Continue on to the next section of our Business Plan How-To >> Elements of a Business Plan

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- James Clear Explains Why the 'Two Minute Rule' Is the Key to Long-Term Habit Building

- They Designed One Simple Product With a 'Focus on Human Health' — and Made $40 Million Last Year

- Lock Younger Americans Don't Necessarily Want to Retire in Florida — and the 2 Affordable States at the Top of Their List Might Surprise You

- I Tried Airchat , the Hottest New Social Media App in Silicon Valley — Here's How It Works

- Lock This Side Hustle Is Helping Farmers Earn Up to $60,000 a Year While Connecting Outdoor Lovers With Untouched Wilderness

- Are Franchises in the Clear After the Expanded Joint Employer Rule Was Struck Down? Industry Experts Answer 2 Critical Questions About What's Next.

Most Popular Red Arrow

Passengers are now entitled to a full cash refund for canceled flights, 'significant' delays.

The U.S. Department of Transportation announced new rules for commercial passengers on Wednesday.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Franchising Is Not For Everyone. Explore These Lucrative Alternatives to Expand Your Business.

Not every business can be franchised, nor should it. While franchising can be the right growth vehicle for someone with an established brand and proven concept that's ripe for growth, there are other options available for business owners.

The TikTok Ban Bill Has Been Signed — Here's How Long ByteDance Has to Sell, and Why TikTok Is Preparing for a Legal Battle

TikTok has nine months to cut ties with its China-based parent company ByteDance.

Why Companies Should Prioritize Emotional Intelligence Training Alongside AI Implementation

Emotional intelligence is just as important as artificial intelligence, and we need it now more than ever.

Elon Musk Tells Investors Cheaper Tesla Electric Cars Should Arrive Ahead of Schedule

On an earnings call, Musk told shareholders that Tesla could start producing new, affordable electric cars earlier than expected.

Successfully copied link

Entrepreneurs! Want to earn

$75 by going outside? — Learn more

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated April 17, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

.png?format=auto)

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

6 Min. Read

11 Common Business Plan Mistakes You Should Avoid

8 Min. Read

What Type of Business Plan Do You Need?

How to Write a Law Firm Business Plan + Free Sample Plan PDF

4 Min. Read

How to Create an Expense Budget

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Business Description

This section describes the industry, your product, and the business and success factors. It should provide a current outlook as well as future trends and developments. You also should address your company’s mission, vision, goals, and objectives. Summarize your overall strategic direction, your reasons for starting the business, a description of your products and services, your business model, and your company’s value proposition. Consider including the Standard Industrial Classification/North American Industry Classification System (SIC/NAICS) code to specify the industry and insure correct identification. The industry extends beyond where the business is located and operates, and should include national and global dynamics. Table 11.4 shows a sample business description for La Vida Lola.

Industry Analysis and Market Strategies

Here you should define your market in terms of size, structure, growth prospects, trends, and sales potential. You’ll want to include your TAM and forecast the SAM . (Both these terms are discussed in Conducting a Feasibility Analysis .) This is a place to address market segmentation strategies by geography, customer attributes, or product orientation. Describe your positioning relative to your competitors’ in terms of pricing, distribution, promotion plan, and sales potential. Table 11.5 shows an example industry analysis and market strategy for La Vida Lola.

Competitive Analysis

The competitive analysis is a statement of the business strategy as it relates to the competition. You want to be able to identify who are your major competitors and assess what are their market shares, markets served, strategies employed, and expected response to entry? You likely want to conduct a classic SWOT analysis (Strengths Weaknesses Opportunities Threats) and complete a competitive-strength grid or competitive matrix. Outline your company’s competitive strengths relative to those of the competition in regard to product, distribution, pricing, promotion, and advertising. What are your company’s competitive advantages and their likely impacts on its success? The key is to construct it properly for the relevant features/benefits (by weight, according to customers) and how the startup compares to incumbents. The competitive matrix should show clearly how and why the startup has a clear (if not currently measurable) competitive advantage. Some common features in the example include price, benefits, quality, type of features, locations, and distribution/sales. Sample templates are shown in Figure 11.17 and Figure 11.18 . A competitive analysis helps you create a marketing strategy that will identify assets or skills that your competitors are lacking so you can plan to fill those gaps, giving you a distinct competitive advantage. When creating a competitor analysis, it is important to focus on the key features and elements that matter to customers, rather than focusing too heavily on the entrepreneur’s idea and desires.

Operations and Management Plan

In this section, outline how you will manage your company. Describe its organizational structure. Here you can address the form of ownership and, if warranted, include an organizational chart/structure. Highlight the backgrounds, experiences, qualifications, areas of expertise, and roles of members of the management team. This is also the place to mention any other stakeholders, such as a board of directors or advisory board(s), and their relevant relationship to the founder, experience and value to help make the venture successful, and professional service firms providing management support, such as accounting services and legal counsel.

Table 11.6 shows a sample operations and management plan for La Vida Lola.

Marketing Plan

Here you should outline and describe an effective overall marketing strategy for your venture, providing details regarding pricing, promotion, advertising, distribution, media usage, public relations, and a digital presence. Fully describe your sales management plan and the composition of your sales force, along with a comprehensive and detailed budget for the marketing plan. Table 11.7 shows a sample marketing plan for La Vida Lola.

Financial Plan

A financial plan seeks to forecast revenue and expenses; project a financial narrative; and estimate project costs, valuations, and cash flow projections. This section should present an accurate, realistic, and achievable financial plan for your venture (see Entrepreneurial Finance and Accounting for detailed discussions about conducting these projections). Include sales forecasts and income projections, pro forma financial statements ( Building the Entrepreneurial Dream Team , a breakeven analysis, and a capital budget. Identify your possible sources of financing (discussed in Conducting a Feasibility Analysis ). Figure 11.19 shows a template of cash-flow needs for La Vida Lola.

Entrepreneur In Action

Laughing man coffee.

Hugh Jackman ( Figure 11.20 ) may best be known for portraying a comic-book superhero who used his mutant abilities to protect the world from villains. But the Wolverine actor is also working to make the planet a better place for real, not through adamantium claws but through social entrepreneurship.

A love of java jolted Jackman into action in 2009, when he traveled to Ethiopia with a Christian humanitarian group to shoot a documentary about the impact of fair-trade certification on coffee growers there. He decided to launch a business and follow in the footsteps of the late Paul Newman, another famous actor turned philanthropist via food ventures.

Jackman launched Laughing Man Coffee two years later; he sold the line to Keurig in 2015. One Laughing Man Coffee café in New York continues to operate independently, investing its proceeds into charitable programs that support better housing, health, and educational initiatives within fair-trade farming communities. 55 Although the New York location is the only café, the coffee brand is still distributed, with Keurig donating an undisclosed portion of Laughing Man proceeds to those causes (whereas Jackman donates all his profits). The company initially donated its profits to World Vision, the Christian humanitarian group Jackman accompanied in 2009. In 2017, it created the Laughing Man Foundation to be more active with its money management and distribution.

- You be the entrepreneur. If you were Jackman, would you have sold the company to Keurig? Why or why not?

- Would you have started the Laughing Man Foundation?

- What else can Jackman do to aid fair-trade practices for coffee growers?

What Can You Do?

Textbooks for change.

Founded in 2014, Textbooks for Change uses a cross-compensation model, in which one customer segment pays for a product or service, and the profit from that revenue is used to provide the same product or service to another, underserved segment. Textbooks for Change partners with student organizations to collect used college textbooks, some of which are re-sold while others are donated to students in need at underserved universities across the globe. The organization has reused or recycled 250,000 textbooks, providing 220,000 students with access through seven campus partners in East Africa. This B-corp social enterprise tackles a problem and offers a solution that is directly relevant to college students like yourself. Have you observed a problem on your college campus or other campuses that is not being served properly? Could it result in a social enterprise?

Work It Out

Franchisee set out.

A franchisee of East Coast Wings, a chain with dozens of restaurants in the United States, has decided to part ways with the chain. The new store will feature the same basic sports-bar-and-restaurant concept and serve the same basic foods: chicken wings, burgers, sandwiches, and the like. The new restaurant can’t rely on the same distributors and suppliers. A new business plan is needed.

- What steps should the new restaurant take to create a new business plan?

- Should it attempt to serve the same customers? Why or why not?

This New York Times video, “An Unlikely Business Plan,” describes entrepreneurial resurgence in Detroit, Michigan.

- 48 Chris Guillebeau. The $100 Startup: Reinvent the Way You Make a Living, Do What You Love, and Create a New Future . New York: Crown Business/Random House, 2012.

- 49 Jonathan Chan. “What These 4 Startup Case Studies Can Teach You about Failure.” Foundr.com . July 12, 2015. https://foundr.com/4-startup-case-studies-failure/

- 50 Amy Feldman. “Inventor of the Cut Buddy Paid YouTubers to Spark Sales. He Wasn’t Ready for a Video to Go Viral.” Forbes. February 15, 2017. https://www.forbes.com/sites/forbestreptalks/2017/02/15/inventor-of-the-cut-buddy-paid-youtubers-to-spark-sales-he-wasnt-ready-for-a-video-to-go-viral/#3eb540ce798a

- 51 Jennifer Post. “National Business Plan Competitions for Entrepreneurs.” Business News Daily . August 30, 2018. https://www.businessnewsdaily.com/6902-business-plan-competitions-entrepreneurs.html

- 52 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition . March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf

- 53 “Rice Business Plan Competition, Eligibility Criteria and How to Apply.” Rice Business Plan Competition. March 2020. https://rbpc.rice.edu/sites/g/files/bxs806/f/2020%20RBPC%20Eligibility%20Criteria%20and%20How%20to%20Apply_23Oct19.pdf; Based on 2019 RBPC Competition Rules and Format April 4–6, 2019. https://rbpc.rice.edu/sites/g/files/bxs806/f/2019-RBPC-Competition-Rules%20-Format.pdf

- 54 Foodstart. http://foodstart.com

- 55 “Hugh Jackman Journey to Starting a Social Enterprise Coffee Company.” Giving Compass. April 8, 2018. https://givingcompass.org/article/hugh-jackman-journey-to-starting-a-social-enterprise-coffee-company/

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-4-the-business-plan

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

Setting Business Goals & Objectives: 4 Considerations

- 31 Oct 2023

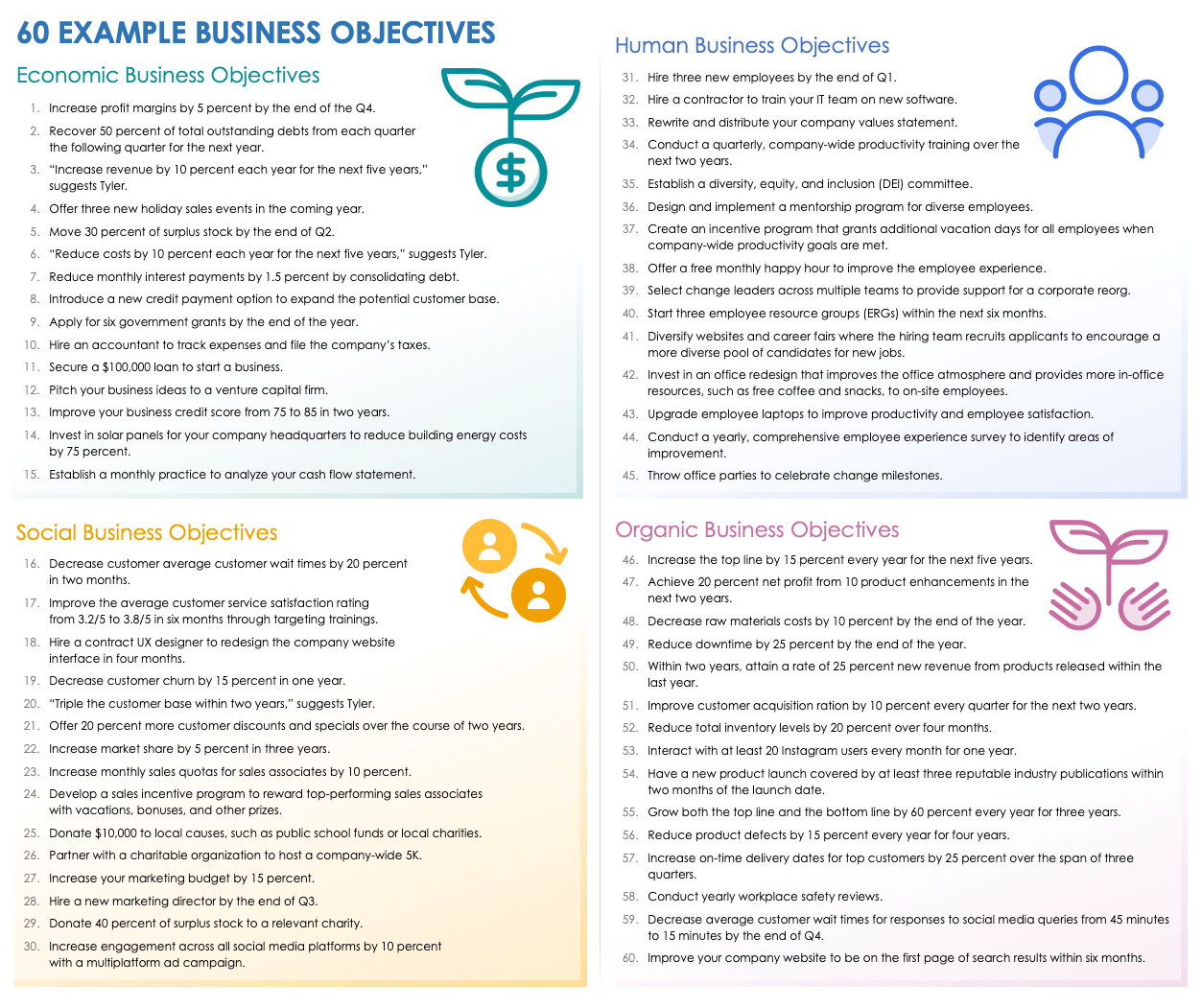

Setting business goals and objectives is important to your company’s success. They create a roadmap to help you identify and manage risk , gain employee buy-in, boost team performance , and execute strategy . They’re also an excellent marker to measure your business’s performance.

Yet, meeting those goals can be difficult. According to an Economist study , 90 percent of senior executives from companies with annual revenues of one billion dollars or more admitted they failed to reach all their strategic goals because of poor implementation. In order to execute strategy, it’s important to first understand what’s attainable when developing organizational goals and objectives.

If you’re struggling to establish realistic benchmarks for your business, here’s an overview of what business goals and objectives are, how to set them, and what you should consider during the process.

Access your free e-book today.

What Are Business Goals and Objectives?

Business objectives dictate how your company plans to achieve its goals and address the business’s strengths, weaknesses, and opportunities. While your business goals may shift, your objectives won’t until there’s an organizational change .

Business goals describe where your company wants to end up and define your business strategy’s expected achievements.

According to the Harvard Business School Online course Strategy Execution , there are different types of strategic goals . Some may even push you and your team out of your comfort zone, yet are important to implement.

For example, David Rodriguez, global chief human resources officer at Marriott, describes in Strategy Execution the importance of stretch goals and “pushing people to not accept today's level of success as a final destination but as a starting point for what might be possible in the future.”

It’s important to strike a balance between bold and unrealistic, however. To do this, you must understand how to responsibly set your business goals and objectives.

Related: A Manager’s Guide To Successful Strategy Implementation

How to Set Business Goals and Objectives

While setting your company’s business goals and objectives might seem like a simple task, it’s important to remember that these goals shouldn’t be based solely on what you hope to achieve. There should be a correlation between your company’s key performance indicators (KPIs)—quantifiable success measures—and your business strategy to justify why the goal should, and needs to, be achieved.

This is often illustrated through a strategy map —an illustration of the cause-and-effect relationships that underpin your strategy. This valuable tool can help you identify and align your business goals and objectives.

“A strategy map gives everyone in your business a road map to understand the relationship between goals and measures and how they build on each other to create value,” says HBS Professor Robert Simons in Strategy Execution .

While this roadmap can be incredibly helpful in creating the right business goals and objectives, a balanced scorecard —a tool to help you track and assess non-financial measures—ensures they’re achievable through your current business strategy.

“Ask yourself, if I picked up a scorecard and examined the measures on that scorecard, could I infer what the business's strategy was,” Simon says. “If you've designed measures well, the answer should be yes.”

According to Strategy Execution , these measures are necessary to ensure your performance goals are achieved. When used in tandem, a balanced scorecard and strategy map can also tell you whether your goals and objectives will create value for you and your customers.

“The balanced scorecard combines the traditional financial perspective with additional perspectives that focus on customers, internal business processes, and learning and development,” Simons says.

These four perspectives are key considerations when setting your business goals and objectives. Here’s an overview of what those perspectives are and how they can help you set the right goals for your business.

4 Things to Consider When Setting Business Goals and Objectives

1. financial measures.

It’s important to ensure your plans and processes lead to desired levels of economic value. Therefore, some of your business goals and objectives should be financial.

Some examples of financial performance goals include:

- Cutting costs

- Increasing revenue

- Improving cash flow management

“Businesses set financial goals by building profit plans—one of the primary diagnostic control systems managers use to execute strategy,” Simons says in Strategy Execution . “They’re budgets drawn up for business units that have both revenues and expenses, and summarize the anticipated revenue inflows and expense outflows for a specified accounting period.”

Profit plans are essential when setting your business goals and objectives because they provide a critical link between your business strategy and economic value creation.

According to Simons, it’s important to ask three questions when profit planning:

- Does my business strategy generate enough profit to cover costs and reinvest in the business?

- Does my business generate enough cash to remain solvent through the year?

- Does my business create sufficient financial returns for investors?

By mapping out monetary value, you can weigh the cost of different strategies and how likely it is you’ll meet your company and investors’ financial expectations.

2. Customer Satisfaction

To ensure your business goals and objectives aid in your company’s long-term success, you need to think critically about your customers’ satisfaction. This is especially important in a world where customer reviews and testimonials are crucial to your organization’s success.

“Everything that's important to the business, we have a KPI and we measure it,” says Tom Siebel, founder, chairman, and CEO of C3.ai, in Strategy Execution . “And what could be more important than customer satisfaction?”

Unlike your company’s reputation, measuring customer satisfaction has a far more personal touch in identifying what customers love and how to capitalize on it through future strategic initiatives .

“We do anonymous customer satisfaction surveys every quarter to see how we're measuring up to our customer expectations,” Siebel says.

While this is one example, your customer satisfaction measures should reflect your desired market position and focus on creating additional value for your audience.

Related: 3 Effective Methods for Assessing Customer Needs

3. Internal Business Processes

Internal business processes is another perspective that should factor into your goal setting. It refers to several aspects of your business that aren’t directly affected by outside forces. Since many goals and objectives are driven by factors such as business competition and market shifts, considering internal processes can create a balanced business strategy.

“Our goals are balanced to make sure we’re holistically managing the business from a financial performance, quality assurance, innovation, and human talent perspective,” says Tom Polen, CEO and president of Becton Dickinson, in Strategy Execution .

According to Strategy Execution , internal business operations are broken down into the following processes:

- Operations management

- Customer management

While improvements to internal processes aren’t driven by economic value, these types of goals can still reap a positive return on investment.

“We end up spending much more time on internal business process goals versus financial goals,” Polen says. “Because if we take care of them, the financial goals will follow at the end of the day.”

4. Learning and Growth Opportunities

Another consideration while setting business goals and objectives is learning and growth opportunities for your team. These are designed to increase employee satisfaction and productivity.

According to Strategy Execution , learning and growth opportunities touch on three types of capital: