- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

How to Write an Equity Research Report

By Brian Dzingai |

Reviewed By Rebecca Baldridge |

November 15, 2022

What is an Equity Research Report?

An equity research report may focus on a specific stock or industry sector, currency, commodity, or fixed-income instrument, or even on a geographic region or country, and generally make buy or sell recommendations. These reports are produced by a variety of sources, ranging from market research firms to in-house research departments at large financial institutions or boutique investment banks.

Key Learning Points

- An equity research report is a document prepared by an analyst that provides a recommendation to buy, hold, or sell shares of a public company.

- An equity research report is a document prepared by an analyst who is part of an investment research team in a brokerage firm or investment bank

- It provides an overview of the business, the industry it operates in, the management team, the company’s financial performance, and risks, and includes a target price and investment recommendation.

- It is intended to help an investor decide whether to invest in a stock.

Equity Research Report Structure

An equity research report can include varying levels of detail, and although there is no industry standard when it comes to formatting, there are common elements to all equity research reports. This guide includes some fundamental features and information that should be considered essential to any research report, as well as some tips for making your analysis and report as effective as possible.

Access the download to see a real-world example of an Equity Research Report, annotated to show each element discussed below.

Basic Information

The research report should begin with basic information about the firm, including the company’s ticker symbol, the primary exchange where its shares are traded, the primary sector and industry in which it operates, the current stock price and market capitalization, the target stock price, and the investment recommendation.

In addition, a security’s liquidity and float are important considerations for the equity analyst. The liquidity of a stock refers to the degree to which it can be purchased and sold without affecting the price. The analyst should understand that periods of financial stress can affect liquidity. A stock’s float refers to the number of shares that are publicly owned and available for trading and generally excludes restricted shares and insider holdings. The float of a stock can be significantly smaller than its market capitalization and thus is an important consideration for large institutional investors, especially when it comes to investing in companies with smaller market capitalizations. Consequently, a relatively small float deserves mention. Finally, it is good practice to identify the major shareholders of a firm.

Business Description

This section should include a detailed description of the company and its products and services. It should convey a clear understanding of the company’s economics, including a discussion of the key drivers of revenues and expenses. Much of this information can be sourced from the company itself and from its regulatory filings as well as from industry publications.

Industry Overview and Competitive Positioning

This section should include an overview of the industry dynamics, including a competitive analysis of the industry. Most firms’ annual reports include some discussion of the competitive environment. A group of peer companies should be developed for competitive analysis. The “Porter’s Five Forces” framework for industry analysis is an effective tool for examining the health and competitive intensity of an industry. Production capacity levels, pricing, distribution, and stability of market share are also important considerations.

It is important to note that there are different paths to success. Strength of brand, cost leadership, and access to protected technology or resources are just some of the ways in which companies set themselves apart from the competition. Famed investor Warren Buffett describes a firm’s competitive advantage as an economic “moat.” He says, “In business, I look for economic castles protected by unbreachable moats.”

Investment Summary

This section should include a brief description of the company, significant recent developments, an earnings forecast, a valuation summary, and the recommended investment action. If the purchase or sale of a security is being advised, there should be a clear and concise explanation as to why the security is deemed to be mispriced. That is, what is the market currently not properly discounting in the stock’s price, and what will prompt the market to re-price the security?

This section should include a thorough valuation of the company using conventional valuation metrics and formulas. Equity valuation models can derive either absolute or relative values. Absolute valuation models derive an asset’s intrinsic value and generally take the form of discounted cash flow models. Relative equity valuation models estimate a stock’s value relative to another stock and can be based on a number of different metrics, including price/sales, price/earnings, price/cash flow, and price/book value. Because model outputs can vary, more than one valuation model should be used.

Financial Analysis

This section should include a detailed analysis of the company’s historical financial performance and a forecast of future performance. Financial results are commonly manipulated to portray firms in the most favorable light. It is the responsibility of the analyst to understand the underlying financial reality. Accordingly, a careful reading of the footnotes of a company’s financial disclosures is an essential part of any examination of earnings quality. Non-recurring events, the use of off-balance-sheet financing, income and reserve recognition, and depreciation policies are all examples of items that can distort a firm’s financial results.

Financial modeling of future results helps to measure the effects of changes in certain inputs on the various financial statements. Analysts should be especially careful, however, about extrapolating past trends into the future. This is especially important in the case of cyclical firms. Projecting forward from the top or bottom of a business cycle is a common mistake.

Finally, it can be informative to use industry-specific financial ratios as part of the financial analysis. Examples include proven reserves/shares for oil companies, revenue/subscribers for cable or wireless companies, and revenue/available rooms for the hotel industry.

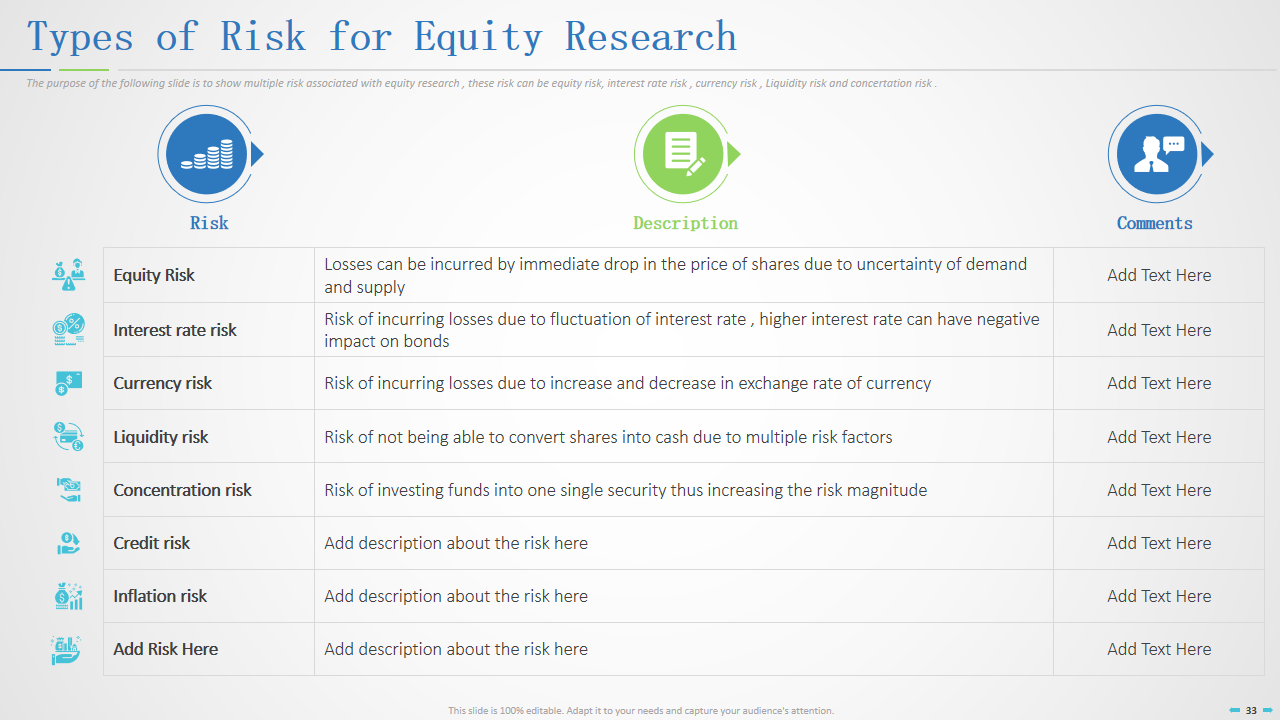

Investment Risks

This section should address potential negative industry and company developments that could pose a risk to the investment thesis. Risks can be operational or financial or related to regulatory issues or legal proceedings.

Although companies are generally obligated to discuss risks in their regulatory disclosures, risks are often subjective and hard to quantify (e.g., the threat of a competing technology). It is the job of the analyst to make these determinations. Of course, disclosures of “qualified opinions” from auditors and “material weakness in internal control over financial reporting” should be automatic red flags for analysts.

Environmental, Social & Governance (ESG)

This section should include information on how the company manages the relationships related to Environmental, Social, and Governance. Below are some examples within these three areas that can have a lasting impact on the company’s short- and long-term prospects:

- E nvironmental – how is the company working towards the conservation of the natural world? This can include climate change and carbon emissions, air and water pollution, energy efficiency, waste management, and more.

- S ocial – how does the company consider people and relationships? This can include community relations, human rights, gender and diversity, labor standards, customer satisfaction, and employee engagement.

- G overnance – what are the standards for running the company? This can include board composition, audit committee structure, executive compensation, succession planning, leadership experience, and bribery and corruption policies.

Enroll in our online ESG course and learn to identify the principles of ESG and how they are applied to investment strategies.

If you are interested in a career as an equity research analysts or in fixed income research, our online course covers all the key skills needed as either a sell side analyst in an investment bank or a buy side analyst working in an investment management firm.

Share this article

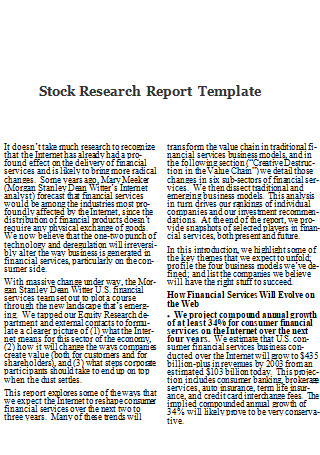

Example of an equity research report.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Recommended Course

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Stock Research Report Templates with Samples and Examples

DivyanshuKumar Rai

"Risk comes from not knowing what you're doing." - Warren Buffett

How often have you found yourself standing at the crossroads of investment, uncertain of which path to take? The world of stocks can be both thrilling and perplexing, a landscape where informed decisions make all the difference. As Warren Buffett, one of the most successful investors of our time, reminds us, risk stems from a lack of knowledge.

Now, let us pose a question: What if you had the tools to unravel the complexities of the stock market? What if, armed with knowledge and insight, you could confidently navigate the unpredictable terrain of investments?

In the journey of wealth creation, stock research is your compass. In this blog, we explore a set of Stock Research Templates designed to empower you with the wisdom needed to make calculated decisions in the market. Before we dive into the intricacies of these templates, let's reflect on the impact of thorough stock research, guided by the words of financial wisdom from the Oracle of Omaha himself.

Consider the cautionary tale of General Electric (GE). Once considered a stalwart of the stock market, GE faced a significant decline in its stock value in recent years. A closer look at its financial statements, debt levels, and business segments could have signaled potential challenges. Investors who incorporated detailed stock research might have been better equipped to anticipate and navigate the company's struggles.

General Electric's decline is a reminder of the importance of scrutinizing a company's fundamentals. By delving into the specifics of its financial health and business operations, investors could have gained valuable insights that extend beyond stock market trends. This example underscores the role that comprehensive stock research plays in protecting your investments and fostering long-term financial success. Now, armed with the right tools (in the form of our 100% editable PPT Templates) and insights, let's journey together into the world of strategic stock research.

Explore our Top Stock Volatility Chart Templates and Professional Report Templates to enhance your analytical capabilities and make well-informed investment decisions.

Company Stock Analysis and Equity Research Report

To complement the sharp eye of equity research analysts and investment bankers, this PPT Bundle analyzes a target company's financial performance, ratios, and financial models, aiding investors in their strategic buy or sell decisions. Commencing with an insightful overview, the presentation offers a glimpse into the equity research report, complemented by a thorough analyst overview. Within this context, the analyst's perspective is underscored, providing a concise summary of the report. Once acquainted with the report's essence, a detailed examination of the industry landscape unfolds, unraveling the competitive milieu and key industry trends. With the industry backdrop firmly established, the focus shifts to the target company's key highlights. This section encompasses a comprehensive overview, encompassing the company's profile, income statement, balance sheet, vertical and horizontal analyses, shareholding patterns, SWOT analysis, and historical share price performance. Transitioning from the organizational overview, the financial ratios take center stage, encompassing liquidity, asset management, leverage, profitability, and valuation metrics.

Download this Stock Research Report Template

Let’s explore the Slide-Specific breakdown of this template now!

Slide 1: Executive Summary

The Executive Summary offers a detailed overview of your equity research report. Explaining essential financial metrics such as net sales, dividend per year, and PE Ratio, this slide serves as a strategic compass for investors. It provides a comprehensive snapshot of the company's financial health, facilitating informed decision-making and setting the stage for a deeper exploration of the report's insights.

Download this template

Slide 2: Industry Analysis

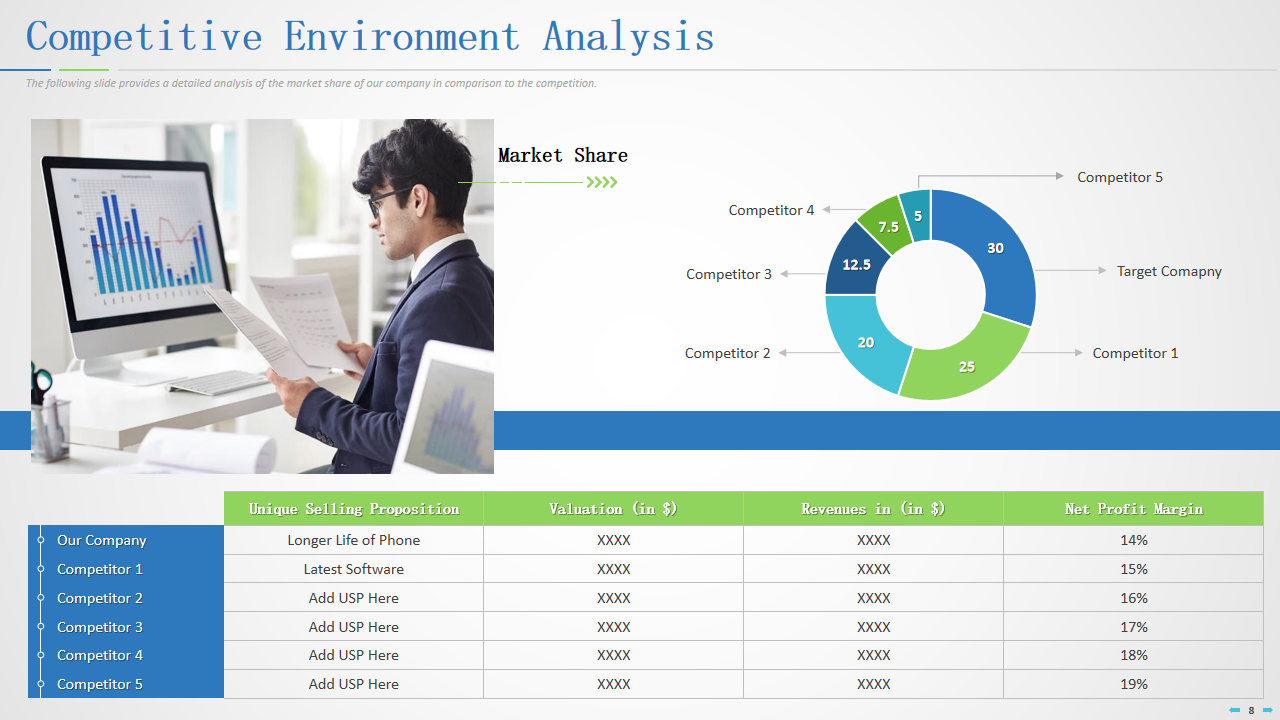

The Industry Analysis slide provides a dynamic framework for comparing your target company with competitors. It goes beyond the basics by covering USP, Valuation, Revenues, and Net Profit Margins. Key trends in Equity Research, such as BYOD Technology, Cryptocurrency, and AI, are highlighted, offering investors a strategic roadmap for navigating the competitive environment and staying abreast of industry dynamics.

Slide 3: Target Company Overview

Present the core of your target company with this comprehensive Target Company Overview. From founding details to market share, headquarters, and employee metrics, this slide provides investors with a holistic understanding. It goes beyond surface-level information, offering insights into market positioning and M&A (Mergers and Acquisitions). This in-depth overview serves as a foundational piece for investors to grasp the company's identity and potential.

Slide 4: Shareholding Pattern

Illustrate the equity landscape with the Shareholding Pattern slide. This isn't just a glance at ownership; it's a nuanced breakdown of the shareholding patterns of up to six influential stakeholders. Highlighting their total share count and percentage, this PPT Preset empowers investors to anticipate market dynamics and gauge the influence wielded by key players.

Slide 5: Financial Ratio Analysis

Translate the financial narrative with precision using the Financial Ratio Analysis slide. This isn't just about ratios; it's a detailed dissection of liquidity, asset management, leverage, profitability, and valuation ratios. Investors gain a clear understanding of the company's financial stability, enabling them to make informed investment decisions with a better grasp of its fiscal health.

Slide 6: Valuation Analysis

Peer into the future with the Valuation Analysis slide. This PPT Set isn't just about methodologies; it's a deep dive into the discounted cash flow method and the relative valuation approach. Armed with this slide, investors possess the tools to gauge a company's intrinsic worth, ensuring strategic positioning in an ever-evolving market.

Slide 7: Types of Risks

Navigate the financial landscape confidently with the Types of Risks slide. This slide explains equity, interest rate, currency, liquidity, credit, and inflation risks as a robust compass for risk management. It goes beyond a generic risk overview, providing investors with a detailed understanding of potential pitfalls. It's an essential tool for formulating a comprehensive risk management strategy tailored to the specific risks faced by the company.

Slide 8: About Us

The "About Us" slide establishes credibility and context. Going beyond a basic introduction, it showcases the identity of your team and the array of services offered, from Financial Research to Market Research. This slide builds trust, providing investors with a clear understanding of the expertise and capabilities of your team. It's a crucial piece for setting the stage and fostering confidence in the team's ability to deliver insightful research.

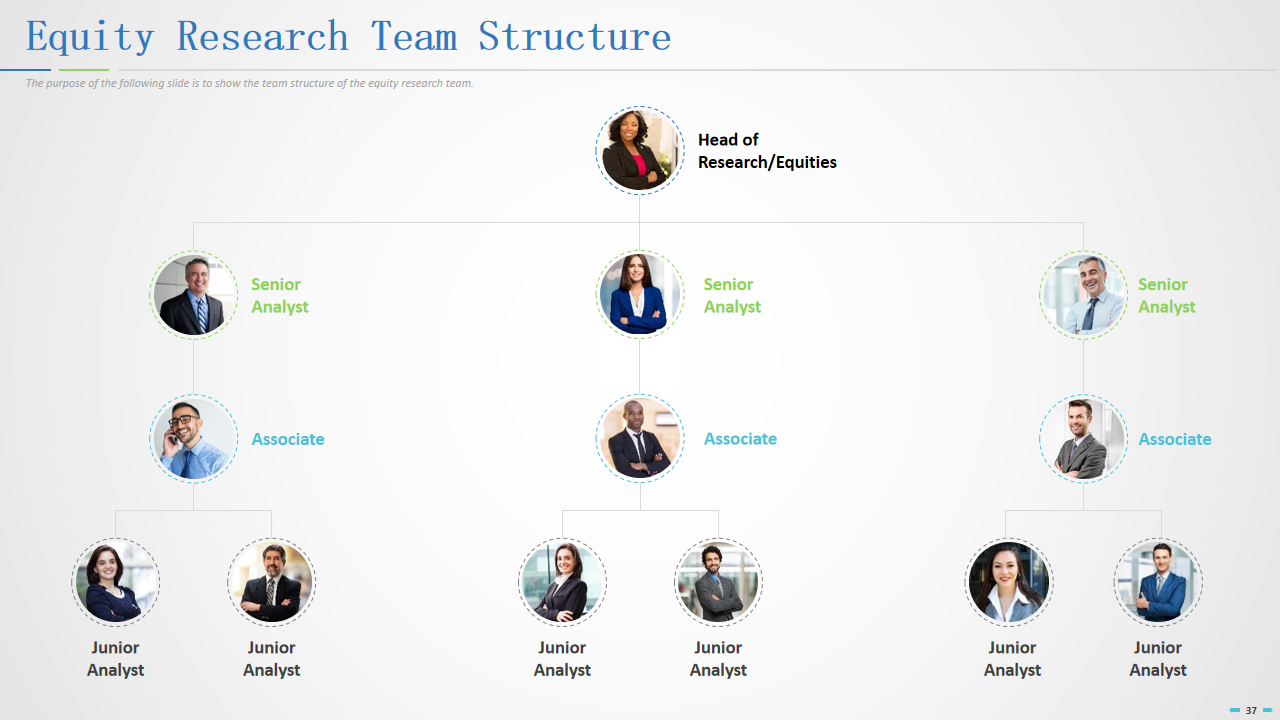

Slide 9: Team Structure

Humanize your research with the Team Structure slide. More than just a list of names, this PPT Layout is an in-depth exploration of the brains behind the analysis. Detailing names, designations, roles, expertise, and experience, this slide bridges the gap between data and the people driving insightful research. It's a testament to the team's capabilities, instilling investor confidence.

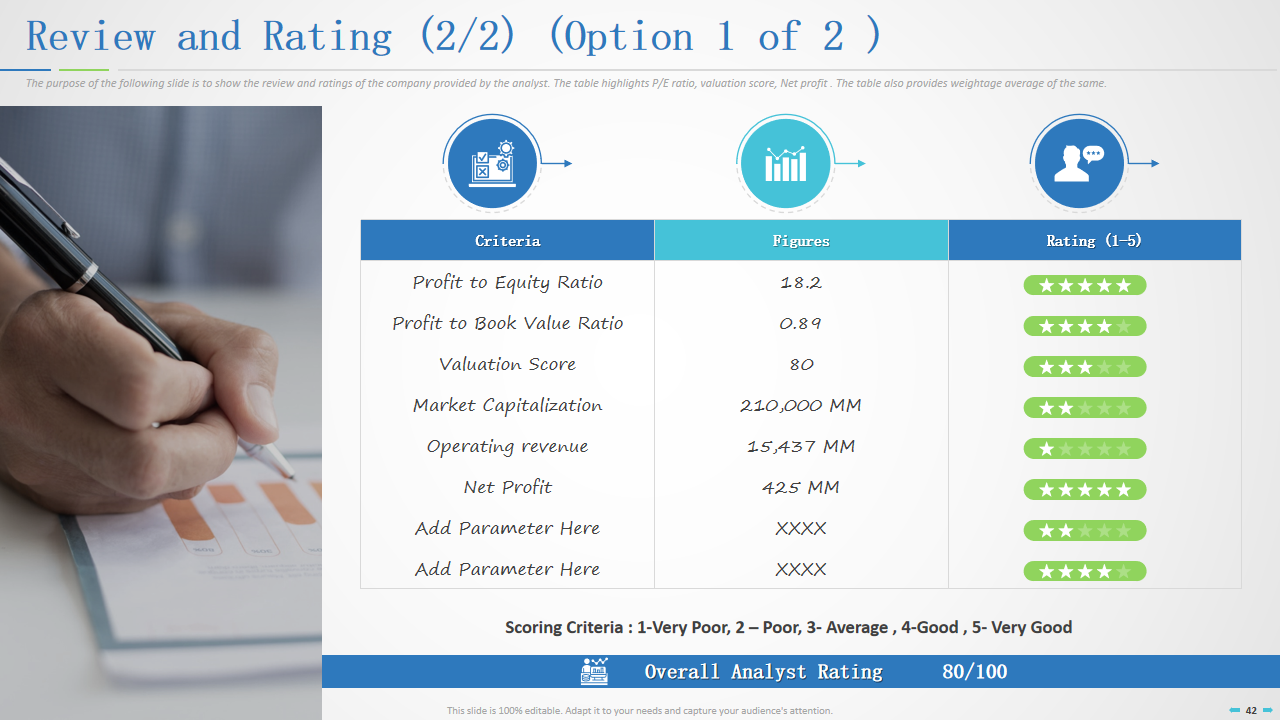

Slide 10: Review and Rating

Culminate your report with the conclusive Review and Rating slide. Beyond a summary, it provides a comprehensive evaluation of criteria, figures, and ratings. This slide offers a holistic verdict by encompassing profit and equity ratios, valuation scores, market capitalization, operating revenue, and net profit. It empowers investors to make well-informed and strategic investment decisions, serving as a capstone to the equity research report.

As we wrap up this insightful journey, let's acknowledge Warren Buffett's wisdom and reflect on the lessons, especially drawn from the cautionary tale of General Electric. Investing demands understanding, and our Stock Research Templates are designed to be your compass in this dynamic terrain. Construct your decisions with strategic insights and embark on a journey guided by wisdom. Explore the potential within your portfolio, as our templates pave the way for well-informed choices. Begin your path to financial clarity today with the subtle empowerment of our Stock Research Templates.

Related posts:

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

- 99% of the Pitches Fail! Find Out What Makes Any Startup a Success

Liked this blog? Please recommend us

Top 7 Business Report Templates with Samples and Examples

Top 10 Consulting Service Proposal Templates With Examples and Samples

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Valuation Resources

Equity Research Report

These reports serve as comprehensive summaries that investors or company leaders may utilize to make informed decisions.

Finance and Business Analytics & Information Technology with a minors in Spanish and Earth & Planetary Sciences

Graduation: B.Com (MIT Pune)

Post Graduation: MSc in Econ (MIT WPU)

Working as Admin, Senior Prelim Reviewer, Financial Chief Editor, & Editor Specialist at WSO.

Honors & awards: Student of The Year - Academics (PG) Vishwakarad Merit Scholarship (Attained twice in PG)

- What Is An Equity Research Report?

- Understanding The Equity Research Report

- Contents Of An Equity Research Report

- Uses Of Equity Research Report

Drawbacks Of Equity Research Report

What is an equity research report.

An equity research report is a thorough analysis of a company's stock or securities written by research teams or financial analysts. It offers insights and detailed information about the stock.

Investors, fund managers, and other financial professionals use these reports, which are usually generated by brokerage firms, investment banks, or independent research organizations, to help them make well-informed investment decisions.

The main goal of equities research reports is to provide investors and hedge fund managers with market information and investment suggestions. However, forward-thinking companies also understand how important this information is when making strategic choices for their own operations.

Equity research analysts are usually highly skilled individuals with knowledge of many industries. Their credentials as seasoned industry executives, professors, or previous CEOs typically enable them to offer authoritative viewpoints and in-depth analyses of firms, industries, and macroeconomic trends.

Sell-side firms produce equity research reports covering thousands of publicly traded businesses. Bigger firms, such as Morgan Stanley and Bank of America , have hundreds of analysts who cover different industries and offer in-depth analyses of various businesses.

Because they provide in-depth information about the company, its rivals, and its performance in relation to the market, equity research reports are beneficial for businesses.

By using this information, businesses may maintain their competitiveness and make well-informed decisions that support their strategic goals.

Key Takeaways

- Equity research reports provide detailed analysis and insights into stocks or securities, aiding investors, fund managers, and businesses in making informed decisions.

- Reports vary in format, covering company-specific, sector, thematic, geographic, event-driven, quantitative, technical analysis, and economic/market outlook perspectives.

- Typical sections of the report include recent results, upgrades/downgrades, management commentary, industry overview, financial history, valuation, recommendations, and more.

- Reports serve various purposes, including investment decisions, portfolio management, valuation, strategic decision-making, regulatory compliance, investor relations, and education.

Understanding the Equity Research report

A document made by an equity research analyst gives suggestions on how an investor should act upon a company that is being traded. This could include holding the share, selling it, or purchasing it.

An analyst outlines their recommendation, target price, investment thesis , value, and risks in an equities research report.

The format of equity research reports might vary based on the objective, target audience, and level of analysis. These are a few typical formats:

1. Company-specific Reports

These reports analyze stocks of specific firms. They usually include detailed financial analyses, valuation indicators , investment suggestions, and perceptions of company-specific elements, including management caliber, competitive positioning, and growth potential.

2. Sector Reports

Sector reports offer insights and analysis on certain economic sectors or entire industries. They look at possibilities, problems, and trends in a particular industry as well as the state of play and future prospects of major players in that field.

Sector reports may address more general market trends impacting the sector and frequently compare various companies within the industry.

3. Thematic Reports

These types of reports center on particular investment topics or trends that are anticipated to influence the market's performance. They examine how various industries and businesses are impacted by themes like developing technologies, demographic shifts, and regulatory changes.

Based on the themes found, thematic reports frequently offer investment advice.

4. Geographic Reports

These reports examine businesses or sectors operating in a particular market or geographic area. These papers offer insights into local economic situations, legal frameworks, and cultural aspects that can influence investment prospects, with an emphasis on global, regional, or national markets.

5. Event-driven Reports

These types of reports concentrate on particular occurrences or triggers, including earnings releases, mergers and acquisitions , court rulings, or new product introductions, that may affect a company's stock price.

After analyzing the event's possible effects on the company's financial performance , these reports offer investment recommendations based on the anticipated outcome.

6. Quantitative Reports

Quantitative reports employ quantitative research techniques, including statistical modeling and data analysis, to find investment possibilities or market trends. To bolster their analysis, these reports could contain quantitative measures, graphs, and charts.

Quantitative Reports are frequently appealing to investors who want to make decisions based on data.

7. Technical Analysis Reports

The primary goal of technical analysis reports is to find patterns and trends in stock prices by examining historical price and volume data. These reports forecast future market movements and trading opportunities using charting techniques and technical indicators.

Traders and investors who incorporate technical analysis into their investment plans could find technical analysis reports interesting.

8. Economic and Market Outlook Reports

These papers analyze and project macroeconomic variables, market patterns, and geopolitical developments that may affect the stock market as a whole. They might provide information on GDP growth, interest rates, inflation, and other economic variables that influence investment choices.

Contents of an Equity Research Report

An equity research report typically includes in-depth industry research, management analysis, financial history, trends, projections, valuations, and investor recommendations.

This kind of report, also known as broker research or investment research report, is intended to offer a thorough overview that investors or business executives may use to make informed judgments.

Here is a summary of what a typical report includes:

1. News & announcements of recent results

This section offers information on recent outcomes, including quarterly earnings, predictions, and general business updates, to help investors stay current on the company's performance.

2. Upgrades/Downgrades

Upgrades and downgrades are modifications to an analyst's forecast for the price of a specific stock. These revisions are often prompted by qualitative and quantitative studies that affect the security's financial valuation, either positively or negatively.

3. Revisions to the Estimate/Price Target

Estimates are detailed forecasts of how much a firm will make over the next few years. Price targets are derived from valuations of those earnings predictions.

The price target is based on fundamentals and future supply and demand forecasts for the asset.

4. A summary of Management & Commentary

Potential investors might read the Management Overview and Commentary to learn more about the caliber and makeup of a company's management team.

This section can also include a history of the company's leadership, including its track record with capital allocation, ESG , remuneration, incentives, and stock ownership, as well as a description of the firm's directors.

5. Industry Overview

This section discusses the firm's sector, rivals, and industry developments. In addition, industry research covers politics, economics , social trends, technical innovation, and more.

6. Financial Result History

Historical Financial Results often include a company's stock history and projections based on the present market and external factors.

Analysts must thoroughly comprehend the history of a certain sector and look for patterns or trends to support their recommendations. They must also judge whether a firm is performing at or above market expectations.

7. Valuation

A market analyst will perform stock valuation models using information such as previous financial data and market analysis. Analysts may use more than one valuation model to calculate the value of a company's shares or assets.

Absolute valuation models determine a business or asset's intrinsic worth. Relative equity valuation methods determine how much one firm or asset is worth in relation to another. Price/sales, Price/earnings, and Price/ cash flow are the foundations for relative values.

8. Recommendations

A buy, hold, or sell recommendation made by a stock research analyst. The analyst will also provide investors with a target price that indicates where they anticipate the stock to be in a year.

Uses of Equity Research Report

Equity research reports have several significant uses for different financial market participants:

1. Making Investment Decisions

Investors rely on equities research reports to make well-informed choices regarding purchasing, disposing of, or retaining stocks. These reports offer insightful analysis and useful information about the risks, growth potential, valuation, and financial performance of certain businesses, sectors, or market trends.

2. Portfolio Management

To create and oversee investment portfolios, portfolio managers consult equities research reports.

These reports help them diversify their portfolios across various sectors and industries, find appealing investment possibilities, and adjust their holdings in response to shifting market conditions and investing goals.

Equity research reports help investors assess the risks associated with potential investments. Analysts analyze various factors, including financial metrics, industry dynamics, competitive positioning, and macroeconomic trends, to identify potential risks and uncertainties that may impact a company's future performance and stock price.

3. Valuation

Equity research reports provide insights into the valuation of individual stocks or entire sectors.

Analysts use various valuation methodologies, such as discounted cash flow ( DCF ), comparable company analysis (CCA), and precedent transactions analysis (PTA), to estimate a company's intrinsic value and assess its potential upside or downside.

4. Strategic Decision Making

Corporate executives and management teams consult equity research reports to learn about their own businesses, industry competitors, and market trends.

They may make strategic decisions about business operations, capital allocation, and growth plans with the aid of these reports, which also help them comprehend investor perceptions and pinpoint areas for improvement.

5. Regulatory Compliance

Regulations, including those set down by stock exchanges and securities regulators, apply to equity research reports.

Analysts must follow disclosure standards, transparency rules, and conflict-of-interest policies when writing and disseminating research findings to ensure compliance with regulatory requirements and preserve market integrity.

6. Investor Relations

These reports are a common tool used by businesses in their investor relations campaigns to reach out to analysts, shareholders, and prospective investors.

They cover the company's business strategy, financial performance, growth prospects, and strategic goals in great detail, which contributes to investor confidence and capital attraction.

7. Educational Purposes

They are used for educational purposes by professionals, investors, and students who want to learn about investment analysis, financial markets , and market trends.

They assist people in improving their knowledge and abilities in the subject of finance by offering practical examples of market research procedures, valuation approaches, and financial analysis tools.

Even though equities research reports offer investors insightful information and analysis, it's crucial to take into account their limitations and potential downsides before utilizing them to guide your investing decisions.

To ensure a comprehensive grasp of potential investments, investors should complement stock research with their own due diligence and analysis.

Some disadvantages of the report are:

- Conflicts of Interest and Biases: Analysts may have conflicts of interest or biases, which could influence their recommendations.

- Restricted Coverage: Reports may only cover a few companies or industries, which leaves room for analysis gaps.

- Complexity: Some investors may find it difficult to comprehend complex financial concepts and technical language.

- Possible Inaccuracies: Reports can contain mistakes or erroneous assumptions that result in suggestions that are not correct.

- Problems with timeliness: Reports might not always accurately depict the state of the market or recent advancements.

- Focus on the Short Term: Prioritising performance measures over long-term principles could have unintended consequences.

- Regulatory Risks: The creation and distribution of research reports may be impacted by compliance standards and regulatory modifications.

Equity research reports are a mainstay in financial analysis, providing a plethora of data and analysis to inform investment and strategic decisions. With their thorough insights into organizations, industries, and market trends, these reports are a reliable resource for fund managers, investors, and enterprises alike.

Despite their indisputable importance, equity research reports must recognize their inherent limitations. Conflicts of interest, a lack of coverage, and the intrinsic complexity of financial analysis may introduce biases and errors.

Furthermore, due to the constantly changing regulatory environment and market conditions, reports might not always include the most recent data.

Equity research reports are still a valuable resource if used carefully and in concert with independent analysis. They promote a greater comprehension of financial markets, help strategic planning , and enable well-informed decision-making.

However, equity research reports—despite their flaws—remain indispensable for navigating the complexities of the investing landscape and enabling stakeholders to make wise and informed decisions.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Enterprise Value vs Equity Value

- Equity Valuation

- Equity Value

- Investment Value

- Levered Beta

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

- Search Search Please fill out this field.

What Is a Research Report?

Understanding research reports, financial analyst research reports, research report impact, conflicts of interest.

- Fundamental Analysis

What Is a Research Report? How They're Produced and Impact

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

A research report is a document prepared by an analyst or strategist who is a part of the investment research team in a stock brokerage or investment bank . A research report may focus on a specific stock or industry sector, a currency, commodity or fixed-income instrument, or on a geographic region or country. Research reports generally, but not always, have actionable recommendations such as investment ideas that investors can act upon.

Research reports are produced by a variety of sources, ranging from market research firms to in-house departments at large organizations. When applied to the investment industry, the term usually refers to sell-side research, or investment research produced by brokerage houses.

Such research is disseminated to the institutional and retail clients of the brokerage that produces it. Research produced by the buy-side, which includes pension funds, mutual funds, and portfolio managers , is usually for internal use only and is not distributed to external parties.

Financial analysts may produce research reports for the purpose of supporting a particular recommendation, such as whether to buy or sell a particular security or whether a client should consider a particular financial product. For example, an analyst may create a report in regards to a new offering being proposed by a company. The report could include relevant metrics regarding the company itself, such as the number of years they have been in operation as well as the names of key stakeholders , along with statistics regarding the current state of the market in which the company participates. Information regarding overall profitability and the intended use of the funds can also be included.

Enthusiasts of the Efficient Market Hypothesis (EMH) might insist that the value of professional analysts' research reports is suspect and that investors likely place too much confidence in the conclusions such analysts make. While a definitive conclusion about this topic is difficult to make because comparisons are not exact, some research papers do exist which claim empirical evidence supporting the value of such reports.

One such paper studied the market for India-based investments and analysts who cover them. The paper was published in the March 2014 edition of the International Research Journal of Business and Management. Its authors concluded that analyst recommendations do have an impact and are beneficial to investors at least in short-term decisions.

While some analysts are functionally unaffiliated, others may be directly or indirectly affiliated with the companies for which they produce reports. Unaffiliated analysts traditionally perform independent research to determine an appropriate recommendation and may have a limited concern regarding the outcome.

Affiliated analysts may feel best served by ensuring any research reports portray clients in a favorable light. Additionally, if an analyst is also an investor in the company on which the report is based, he may have a personal incentive to avoid topics that may result in a lowered valuation of the securities in which he has invested.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-167326832-5c3762a446e0fb000128fb6a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Fundamental Equity Research

- Sample Stock Report

Download a Sample Stock Report: Microsoft Corporation (MSFT)

CFRA provides independent and actionable research and analytics to our global subscribers to improve their investment and business decisions.

CFRA Stock Reports gives clients confidence and insight to make informed investment decisions. Each report combines the equity analyst’s evaluations and sub-industry outlook with the stock’s performance history, financials, key developments and relevant peers.

Download a sample stock report on Microsoft Corporation (MSFT) to learn more!

Download a Sample Stock Report

Begin your free, 2-week no obligation trial to access the latest insights:.

- Request Trial

- Key Financial Terms

- ETF Data & Analytics

- ETF & Mutual Fund Research

- Forensic Accounting Research

- Public Policy Research

- Technical Research

- Legal Research

- Wealth Management

- Institutional Investors

- Financial Advisors

- Individual Investors

- MARKETSCOPE Advisor

- LOWRY OnDemand

- FORENSIC Research

A Student’s Guide to Writing A Buy-Side Equity Research Report

- via Research , Resources

Marina Chang

A career in finance can take on many different forms — from investment banking to equity research. Equity researchers conduct detailed analyses in order to offer well-supported investment recommendations. Their analyses are then compiled into what is referred to as an equity research report. These reports differ on the sell-side and buy-side, but they do have some overlaps. This guide will break down the key components and formats to help you successfully craft your own equity research report.

What is an equity research report? What is the purpose of a research report?

An equity research report is a document prepared by an analyst that gives an overview of a business, including the industry it operates in, its management team, its financial performance, risks, and its target price. The purpose of a research report is to provide a recommendation on whether investors should buy, hold, or sell shares of a public company.

What’s the difference between a buy-side and sell-side equity research report?

Sell-side reports are the most common type of equity research report. They are typically produced by investment banks for their clients to help guide investment decisions. Sell-side analysts issue the often-heard recommendations of “buy,” “hold,” “neutral,” or “sell” to help clients with their investment decisions. This is favorable for the brokerage firm as each time a client decides to trade the brokerage firm gets a commission on the transaction.

Buy-side reports are internal reports, produced for the bank itself, and are guided by differing perspectives and motivations. Buy-side analysts determine how promising an investment seems and how well it fits with the fund’s investment strategy. These recommendations are made exclusively for the benefit of the fund that employs them and are not available to anyone outside the fund.

What information should be included within your equity research report?

- Recommendation – Typically to buy, sell, or hold shares in the company. This section also usually includes a target price (i.e., $47.00 in the next 12 months).

- Company Update – New releases, quarterly or annual results, major contracts, management changes, or any other recent or important information about the company.

- Investment Thesis – A summary of why the analyst believes the stock will over or underperform and what will cause it to reach the share price target included in the recommendation. This is probably the most interesting part of the report.

- Financial Information & Valuation – A forecast of the company’s income statement, balance sheet, cash flow, and valuation. This section is often an output from a financial model built in Excel.

- Risk & Disclaimers – An overview of the risks associated with investing in the stock. This is usually a laundry list of all conceivable risks, thus making it feel like a legal disclaimer. The reports also have extensive disclaimers in addition to the risk section.

What information is needed for the industry pages?

- Competitive Rivalry – This looks at the number and strength of competitors. How many rivals does the company have? Who are they, and how does the quality of their products and services compare?

- Supplier Power – This is determined by how easy it is for suppliers to increase their prices. How many potential suppliers does the company have? How unique is the product or service that it provides, and how expensive would it be to switch from one supplier to another?

- Buyer Power – Here, you ask how easy it is for buyers to drive prices down. How many buyers are there, and how big are their orders? How much would it cost them to switch from the company’s products and services to those of a rival? Are buyers strong enough to dictate terms?

- Threat of Substitution – This refers to the likelihood of customers finding a different way to do what the company offers.

- Threat of New Entry – The company’s position can be affected by how easy it is for a new company to enter the industry. How much would it cost, and how tightly is the industry regulated?

How to create and forecast a financial model.

- Gather the company’s most recent 10-K and 10-Q SEC filings.

- For all three financial statements, copy and paste the line items that can be forecasted.

- Make income statement projections based on margins as a percentage of revenue.

- Create a depreciation schedule to account for the reduction of PP&E and intangible assets over time.

- Calculate working capital assumptions.

- Forecast current assets and liabilities on the balance sheet.

- Adjust net change in cash and cash equivalents (CCE) with the cash flow statement.

- Reconcile the cash flow statement with the balance sheet.

- Compute the dividend payout ratio if the company offers a dividend.

- Create the shares repurchase schedule if the company has a share buyback program.

- Construct the debt schedule.

- Calculate interest income and interest expense from the debt schedule.

- Run multiple scenarios – Wall Street Case, Bear Case, Bull Case.

- Sanity check your assumptions.

How many pages should your equity research report contain?

An equity research report should not be more than 10 to 15 pages long. Aim to be both concise and cohesive.

What kind of disclaimer should be included?

It is important for the report to have certain disclaimers to show that the analyst writing the report isn’t biased. Some typical disclaimers are as follows:

- Every ER report entirely reflects the views and personal opinions of the analyst as on the date of publication.

- The equity research analyst does not have an interest in the shares of the company.

- Compensation of the analyst is not linked directly to any specific research recommendations contained in the report.

- Financial analysts or equity research analysts working in brokerage firms or sell-side analysts write equity research reports.

With all these points in mind, you are now ready to write your own equity research report. Select a public company, use this guide as a reference, and see what results from your analysis. Congratulations in advance on completing your research report!

Romero Mentoring’s Analyst Prep Program

In just 15-weeks, you can become a world-class finance professional. The Romero Mentoring Analyst Prep Program is an all-inclusive internship, mentorship, and training experience like no other. Learn the in-depth principles of finance and apply what you learn through an extensive internship led by a finance professional with over 12 years of experience. Learn more here.

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one.

About Romero Mentoring

Since 2016, Romero Mentoring investment banking training programs have been delivering career mentoring to job seekers, professionals, and college students pursuing careers in finance. We’ve helped over 400 students start their careers on Wall Street through our Analyst Prep and Associate Investment Banking Training Programs. Our graduates work at top-bulge bracket banks and consulting firms, including Goldman Sachs, JP Morgan, McKinsey, and many more.

References:

- https://www.financewalk.com/equity-research-report/

- https://corporatefinanceinstitute.com/resources/knowledge/valuation/equity-research-report/#:~:text=What%20is%20an%20Equity%20Research,distributes%20that%20research%20to%20clients.

- https://quickbooks.intuit.com/r/marketing/market-research-tips-how-to-conduct-an-industry-analysis/

About the Author

Marina Chang is a business student at New York University pursuing a double concentration in Finance and Data Science. She is currently an Investment Research Intern at Romero Capital. Marina is an Analyst at NYU's Smart Woman Securities, where she worked with a team of 5 to compete in a stock pitch. She is also a Staff Consultant at 180 Degrees Consulting. The organization provides affordable advising services for non-profits and social enterprises. Marina was a mentee of the Analyst Prep Program.

Recommendations For You

Securing A Financial Analyst Role & The Recruiting Process

The Cost of a College Education

Maximizing Your Networking Potential: Navigating the Finance and Investment Banking Industry

Free Career Consultation

Speak to a professional veteran with 15 years of experience, fill out the form below to request your appointment. learn how we can help you maximize your potential..

What is your highest level of education? High school student College/university student Master’s program student Working professional Other

What is your current annual income? $0-25,000 $26,000-50,000 $51,000-75,000 $76,000-100,000 $1000,000+

Upload Resume

By submitting this form, you agree to receive emails from or on behalf of Romero Mentoring. You understand that such emails may be sent using automated technology. You may opt out at any time. Please view our Privacy Policy or Contact Us for more details.

- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore Blockchain

Client Service

Process Payments

Manage Funds

Safeguard Information

Banking-as-a-service

Send Payments

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve

Explore a variety of insights.

- Global Research

- Newsletters

Insights by Topic

Explore a variety of insights organized by different topics.

Insights by Type

Explore a variety of insights organized by different types of content and media.

- All Insights

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Global Research Reports

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

9+ SAMPLE Stock Research Report in PDF | MS Word

Stock Research Report | MS Word

9+ sample stock research report, what is a stock research report, what’s in a stock research report, what are the types/categories of stocks, steps in researching stocks, what is the importance of a stock research report, what is the difference between common and preferred stock, what are cyclical stocks.

tock Research Report Template

Daily Stock Research Report

Sample Stock Research Report

Stock Research Report Format

Sample Stock Exchange Research Report

Basic Stock Research Report

Company Equity Research Report

Formal Stock Research Report

Equity Share Research Report

Standard Stock Research Report

1. review the company’s financials., 2. establish risk tolerance and budget, 3. perform a qualitative research, 4. analyze the research results, 5. pick the stocks, share this post on your network, file formats, word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates, you may also like these articles, 12+ sample construction daily report in ms word | pdf.

Introducing our comprehensive sample Construction Daily Report the cornerstone of effective project management in the construction industry. With this easy-to-use report, you'll gain valuable insights into daily activities report,…

25+ SAMPLE Food Safety Reports in PDF | MS Word

Proper food handling ensures that the food we intake is clean and safe. If not, then we expose ourselves to illnesses and food poisoning. Which is why a thorough…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

Investment Research Report

While it is true that there are many ways business people can invest their money, how sure are they that their wealth will grow through these investments? People can pour their money in a real estate business, retail business, stocks, bonds, mutual funds, etc. However, if they do not have enough knowledge on how to manage their investments, there will be chances that they will incur more losses than earning money. This scenario gives you, as a research firm leader, an opportunity to help out these people. Enlighten these wealth seekers by feeding them the essential information about the investment data before they can waste their money blindly on the investment schemes which they may not be familiar with.

What is Investment Research?

By conducting investment research, you can get a better understanding of the performance of different investments, such as stocks, mutual funds, and other assets . Through this study, you can give out the most recent information and provide data-driven recommendations to the investors.

What is Investment Research Report?

Strategists and equity analysts who are part of the investment research company of brokerage or investment banks prepare investment research reports to help investors decide which investment and company are best for them. These reports may include information about stocks, industry sectors, currency updates, and recommendations, which are the necessary information that will support your judgment.

Bank Recommendations

Speaking of recommendations, did you know that investment banks also earn money for publishing quarterly or annual equity analysis or other types of investment research reports? Yes, they do! Aside from creating collateralized products, propriety trading, dark pools, and swaps, banks also publish investment research reports such as equity research reports . Through this activity, banks can recommend the businesses they cover to the institutional investors, which encourages them to buy more shares. With that, they are getting commissions. JP Morgan is one of these banks.

8+ Investment Research Report Templates & Examples – Google Docs, MS Word, Pages

One of the most critical parts of an investment research paper development is creating a research report . It may also be the most time-consuming section of your research paper, especially if it is your first time to conduct this type of research. However, you don’t have to worry because we have collated a list of investment research report templates and examples below, which you can use for your investment research report creation. You can download these templates and samples in any file format mentioned right next to each of the contents for your convenience.

1. Market Research Report Template

- Google Docs

Size: A4 & US Letter

2. Business Research Report Template

3. Free Research Report Cover Page Template

4. Market Research Report

Size: 887 KB

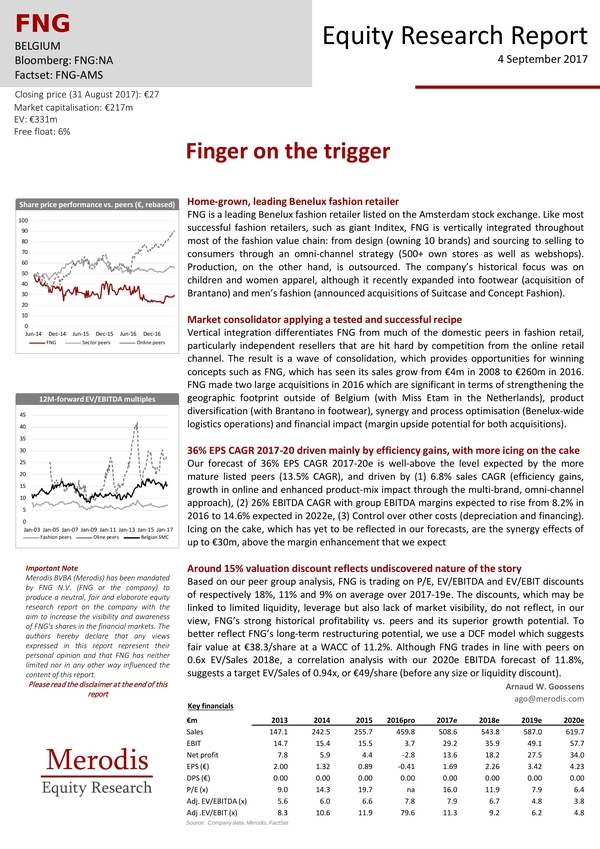

5. Fashion Retailer Equity Research Report

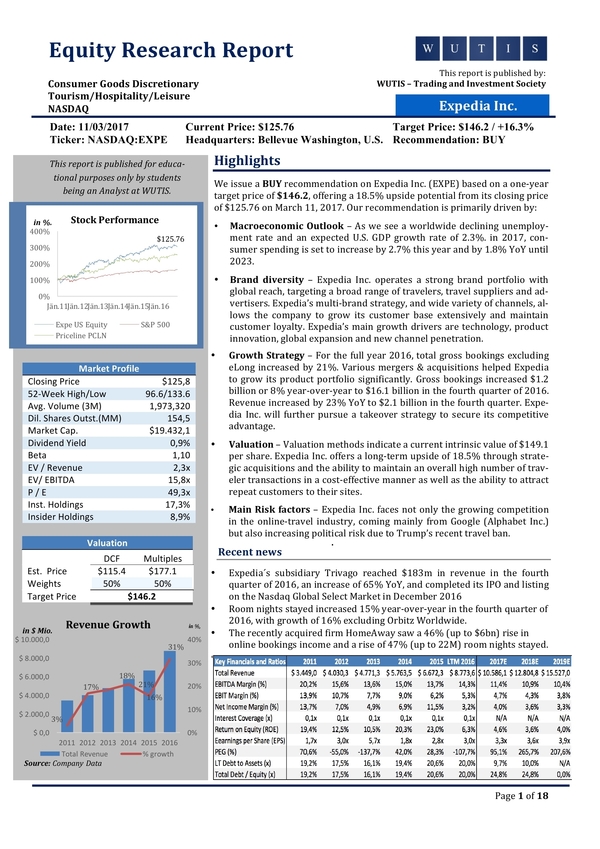

6. Equity Research Report

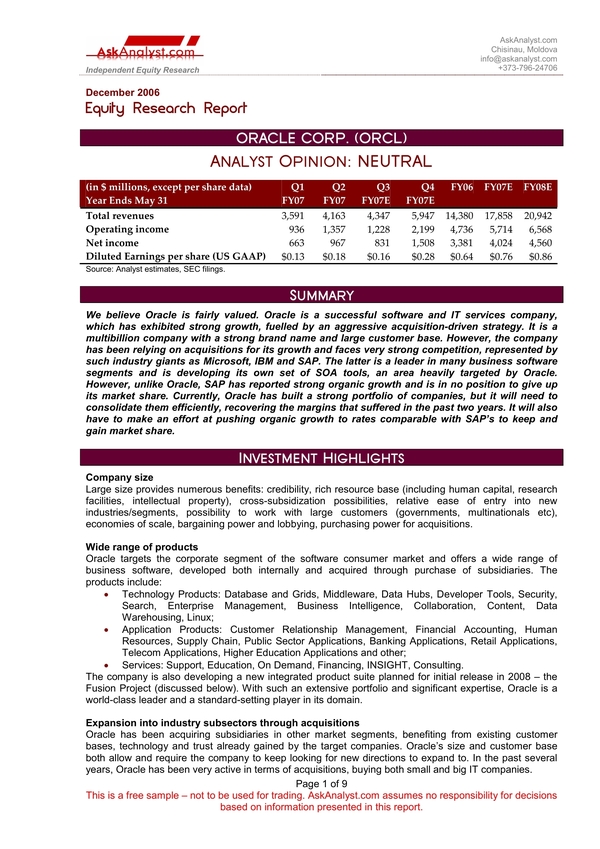

7. IT Firm Equity Research Report

Size: 290 KB

8. IT Company Equity Research Report

9. Equity Research Report

Size: 126 KB

Writing an Investment Research Report

There are several factors to consider when creating an investment research report. However, there are a few basic things that you should remember to ensure that the document you create will have an impact on your target market. Follow the instructions below to develop an efficient investment research report.

1. Do Your Research

Needless to say, before you can write anything, you have to be knowledgeable about your topic before you can start writing. For example, you are researching an individual company. You can begin by looking at the company’s form 10-k. Through this report, you can have a bigger picture of the business’ financial performance. Specificifically, you can get an overview or summary of the company’s primary operations, risk factors, financial data, etc.

2. Sort the Information That You Have

Once you have gathered all the necessary data, the next thing that you will do is to organize this information. In this step, you should be able to outline how your report will go following the research proposal . You should also know the proper flow of the information you are providing. Create graphs, charts, and other tools that will help you with the interpretation of the data that you hold. After that, you can analyze this data to create useful conclusions and come up with data-driven recommendations.

3. Start Writing

One of the hardest parts of creating an investment research report is getting started in writing. We recommend that you start with the basics. First, write down the necessary parts. Use the outline that you created earlier and start breaking down with the details. On the process, you will start noticing the unnecessary and missing information. Once you have written and placed all the information correctly, you can now proceed to the next step.

4. Proofread

This step is may not be the main essence of the document, but this will also play an essential role in convincing investors with your objectives. If you aim to convince new investors , you need to ensure that they will fully understand the contents of your stock research report. To do that, you need to observe correct grammar and spelling. You also need to consider the type of audience or target market of your research. You can also use the help of your team to read your report to spot any errors and ask update suggestions from them.

As an investment researcher, you should understand that the ultimate goal of an investor is to gain more profit. They hire people like you to materialize their goals. Therefore, you should ensure that the information that you will provide to them can actually help them attain their intention. In return, you will earn their trust and reach your organizational goals. This article is just a glimpse of the big world of investment. However, there are several materials that you can use to enhance your craft and learn more about your field. You can start by reading private equity investment .

Report Generator

Text prompt

- Instructive

- Professional

Generate a report on the impact of technology in the classroom on student learning outcomes

Prepare a report analyzing the trends in student participation in sports and arts programs over the last five years at your school.

- Get 7 Days Free

- Help Center

Finding a Stock Analyst Report

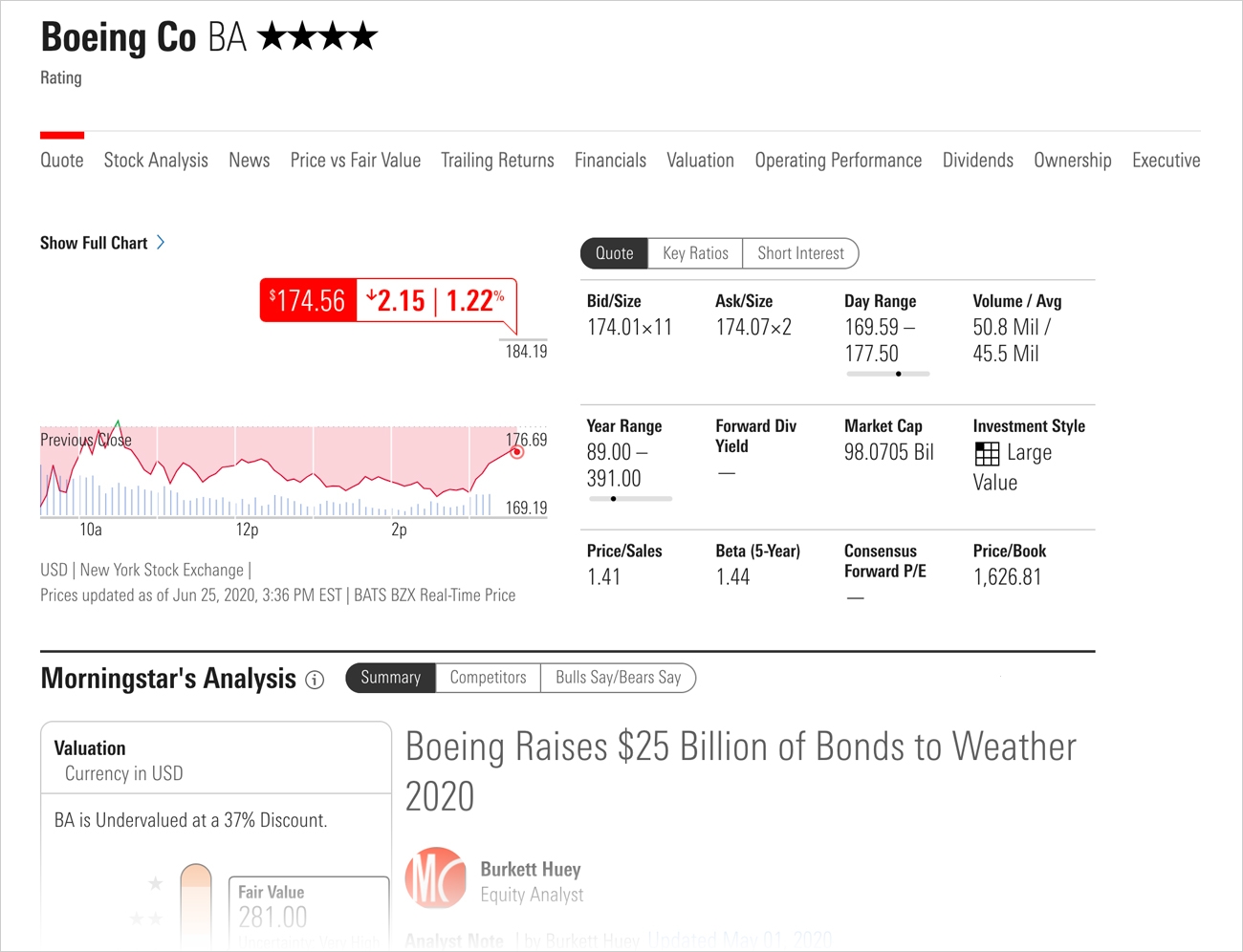

Example: To evaluate Boeing, begin typing the name or the ticker (BA) in the upper left search box, then select the stock.

Be selecting this stock you are direct to Stock Analyst Report with Quote tab selected by default. Each tab offers in depth information.

On the stock’s quote page , the following tabs are available.

- Quote: Contains bid/size, ask/size, day range, volume / avg, year range, forward div yield, market cap, investment style, price/sales, beta, (5-year), consensus forward P/E, price/book, a snapshot of Morningstar analysis, analyst note, view report archive, company profile.

- Stock Analysis: Access our analyst’s comprehensive review, including Morningstar’s exclusive Star Rating, Moat Rating and Fair Value Estimate.

- News: contains articles from Market Watch, PR Newswire, Global News Select.

- Price vs Fair Value: contains price vs fair value chart.

- Trailing Returns: contains trailing returns chart (daily, monthly, quarterly).

- Financials: contains valuation, growth (3-year annualized), financial health, profitability, income statement, balance sheet, cash flow.

- Valuation: contains valuation chart.

- Operating Performance: contains fiscal chart, financial leverage chart.

- Dividends: contains dividends & splits chart, ex-dividend date, payable date, divided type, amount, dividend yield (TTM), dividend reinvestment plan.

- Ownership: contains ownership data for funds and institutions.

- Executive: contains key executives, board of directors, committees, transaction history.

- Sample Research

FREE 10+ Stock Research Report Samples in MS Word | MS Excel | PDF

Obtaining information about the fundamental position of stocks is not sufficient in creating a research report for stock market profits. Technical stock analysts should also know the technical aspect of stocks. However, to study the technical aspects, analysts must incorporate a careful study of stock charts. Doing this may help them to gain better understanding of the phenomena happening in the stock market. In this article, we have some informative guide and downloadable stock short research report templates to guide you in your research work. Keep on reading!

Stock Research Report

Free 10+ stock research report samples, 1. stock research report template, 2. stock research report, 3. daily stock research report, 4. sample stock research report, 5. stock research report format, 6. sample stock exchange research report, 7. basic stock research report, 8. company equity research report, 9. formal stock research report, 10. equity share research report, 11. equity research report sample, what is a stock research report, how to write a stock research report, 1. define your primary investment goals and objectives , 2. use stock research data and analytical tools, 3. forecast future price movements, 4. create your conclusion, what is the format of the research report, how to research the best stock, how do you know a stock is good, what are the four types of stocks.

Size: 158 KB

Size: 494 KB

Size: 799 KB

Size: 370 KB

Size: 254 KB

Size: 467 KB

Size: 577 KB

Size: 670 KB

Size: 109 KB

Size: 176 KB

A stock research report is a useful document that is targeted on providing in-depth, comprehensive explanations and evaluations of a company’s stock, trade or investment issues. As an efficient stock analyst, you learn about the behavioral patterns of companies through their financial statements, balance sheets, and more, as well as the fundamental and technical aspects of the company’s stocks.

Below are some easy-to-follow tips that indicate how to design and initiate a research analysis report, as well as managing different kinds of phases in writing an effective stock research project :

When writing a stock research report , you need to define your primary investment goals and objectives. An article published by Investopedia explained that there are common objectives of investing which are safety, income, and capital gains. So, create your goals and objectives according to these essential factors.

The second step is to try to use several stock research data tools to seek out the value of a company’s stocks. You may use some well-known finance websites such as Google Finance, Morning Star, Bloomberg and Yahoo! Then to make an analysis , you need to study a stock’s price-to-earnings ratio by calculating the price-to-earnings ratio when you divide the stock’s market value per share by its earnings per share.

According to the book “ Technical Analysis and Stock Market Profits ,” you need to be able to read and see forecast analysis through an in-depth study of stock charts. Stock charts are most integral in forecasting price movements and are an absolute necessity for successful stock trading. But, you need to beware of early presumption as well.

The last important step of writing a stock research report is creating a conclusion. So, wrap up your report by explaining the fundamental aspects and evaluation of your stock research in a simple and concise summary.

The format of the research report provides a list of main sections and subsections which contain page numbers, tables, visual diagrams, reference list, and appendices. Also, it has an abstract which demonstrates a clear summary of goals, methods, results, and conclusions.

[/ns_row ]

Begin reviewing and analyzing the company’s financials while you compile your stock research materials. Narrow your concentration. Use some effective tools for qualitative research and put it into context.

Observe the stock price carefully. Consider the revenue growth, earnings per share, dividend and dividend yield, market capitalization, historical prices, analyst reports, and the overall condition of the industry.

The four types of stocks are growth stocks, dividend or yield stocks, defensive stocks, etc.

In conclusion, writing a stock research report is a beneficial step in discussing and evaluating a company’s stock. The book “ Stock Analysis in the Twenty-First Century and Beyond ” explained that performing a thorough study of the behavior of several corporations is a worthwhile and meaningful academic exercise for understanding the stock industry and the way we respond to information and create decisions. Here are some of our downloadable and printable research report samples available in different kinds of formats. Simply click the templates in this article and start downloading now!

Related Posts

Free 10+ content validity samples & templates in pdf, free 10+ construct validity samples & templates in ms word | pdf, free 10+ code of human research ethics samples & templates in ms word | pdf, free 10+ biography research report samples and templates in pdf, free 10+ system documentation samples & templates in ms word | pdf, free 10+ process document samples & templates in ms word | pdf, free 10+ action research samples & templates in pdf, free 10+ longitudinal research samples & templates in pdf | ms word, free 10+ causal research samples & templates in ms word | pdf, free 10+ client discovery samples & templates in ms word | pdf, free 10+ null hypothesis samples & templates in ms word | pdf, free 9+ product knowledge samples & templates in pdf, free 10+ software documentation samples & templates in ms word | pdf, free 10+ exploratory research samples & templates in pdf | ms word, free 10+ experimental research samples & templates in ms word | pdf, free 34 research papers in pdf, free 11+ laboratory audit report samples & templates in pdf ..., free 49+ sample reports in ms word pdf, free 6+ stock broker job description samples in ms word pdf.

- Free Sign Up

- Product Features

- Stock Research

- Investing Education

- Weekly Market Brief

Stock Rover Research Reports

Introduction, key features, ratings vs. peers, financial statement summary, valuation and profitability history.

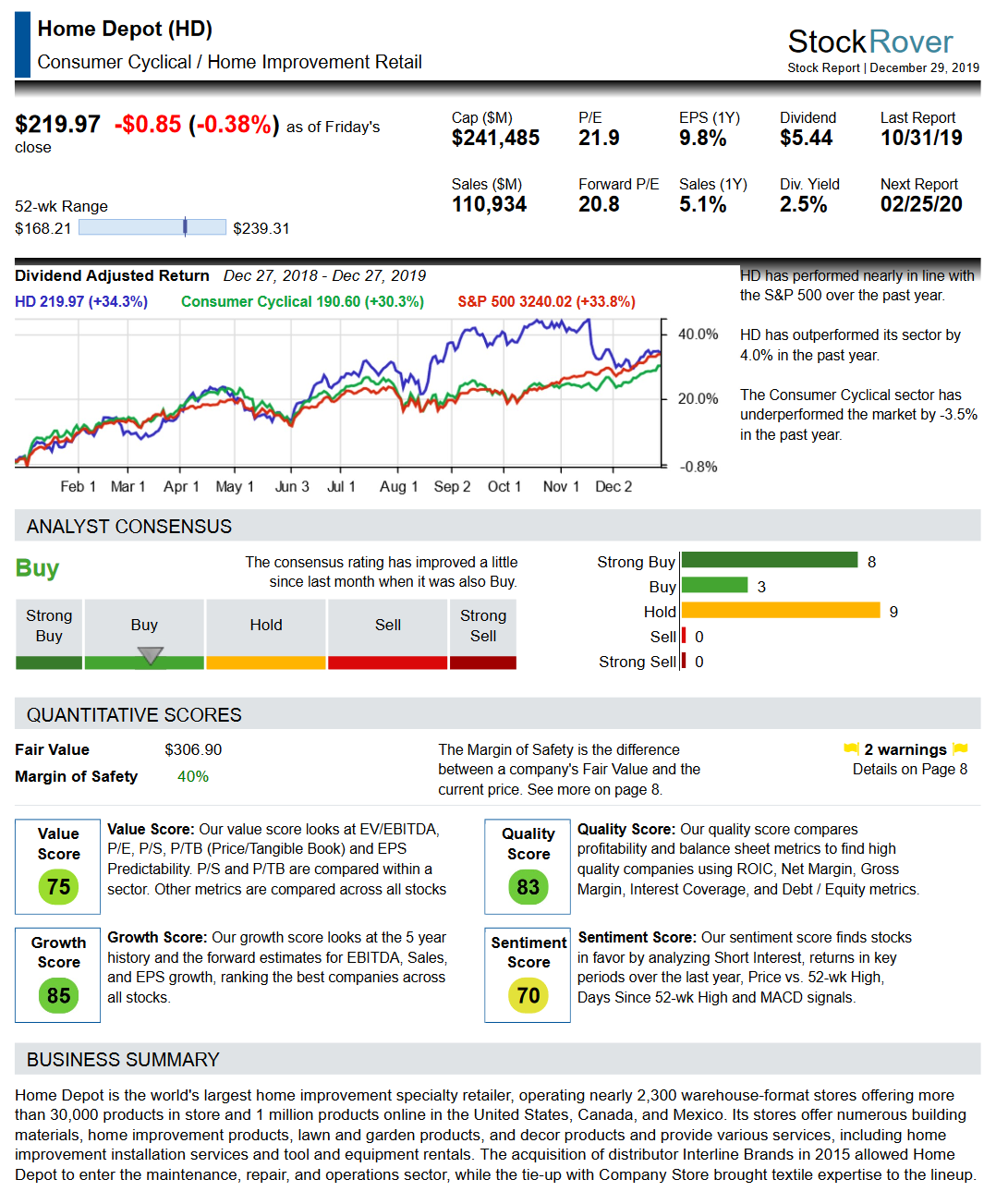

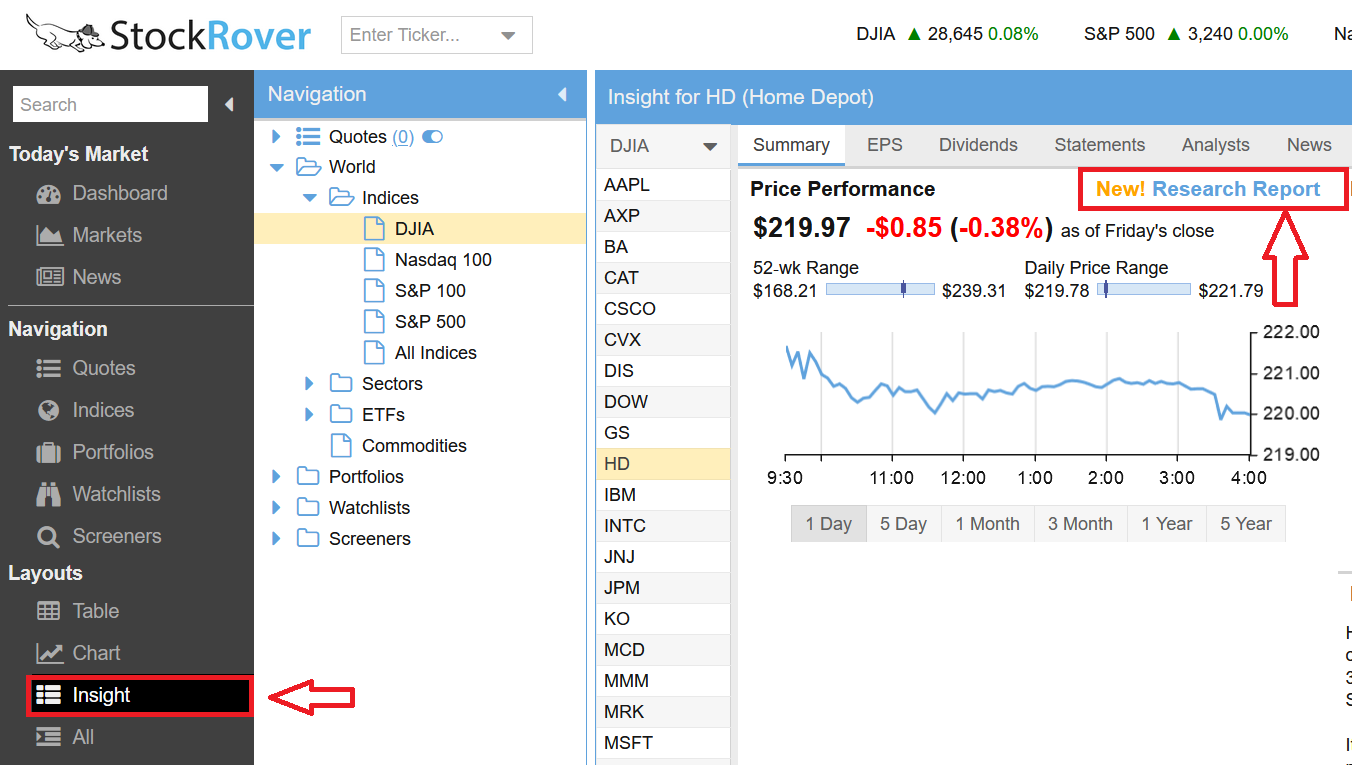

We are excited to announce a powerful new capability we have added to Stock Rover called Stock Rover Research Reports .

This new product provides a comprehensive summary on any of the 7000+ stocks we track in Stock Rover on the U.S. and Canadian exchanges. Research reports can be viewed in your browser and can be produced in PDF format for portability and sharing.

The first page of a sample Stock Rover Research Report for an example company (Home Depot) is shown below.

To see an example of the entire stock research report in PDF format, click here .

Currently Stock Rover Research Reports is in Beta. While in Beta, Premium Plus users will have unlimited use of the facility. Essentials and Premium users can see research reports for any of the Dow 30 stocks. Premium users can also enter three additional tickers per month to view. Essentials users can view one additional ticker per month. We expect the product to remain in Beta until the late February, early March time-frames, but that is subject to change.

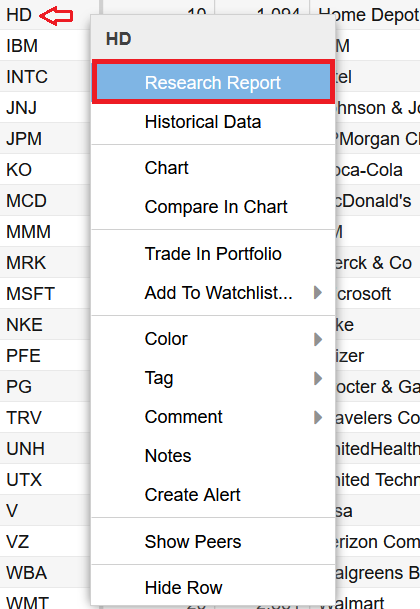

You can run the facility by right clicking on any stock ticker from the Table and selecting Research Report as shown below.

You can also run the report from the Insight Panel as shown below via the red arrows.

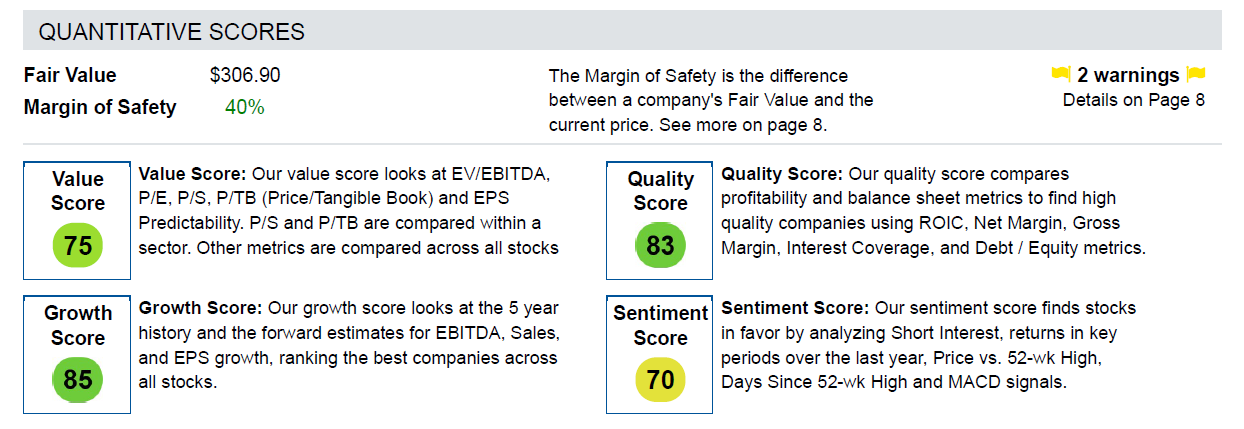

Some key features of the Stock Rover Research Report include our quantitative scores for stocks in the areas of value, quality, growth and sentiment. The research report also includes the computed fair value and margin of safety for the stock.

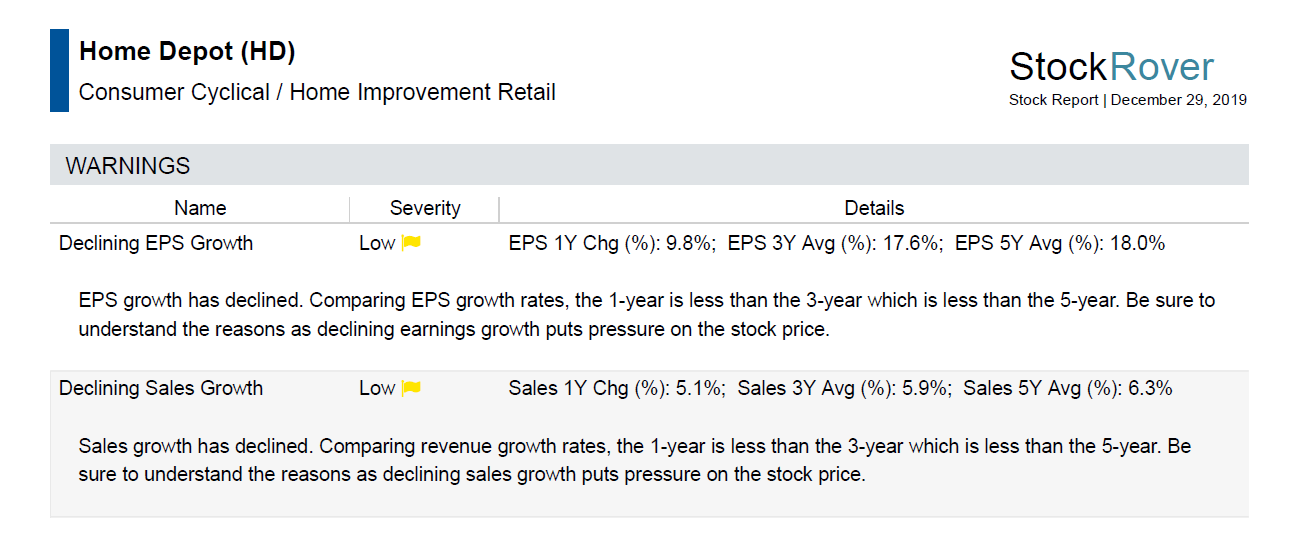

Research reports also highlight any warnings or issues of concern for the stock as well.

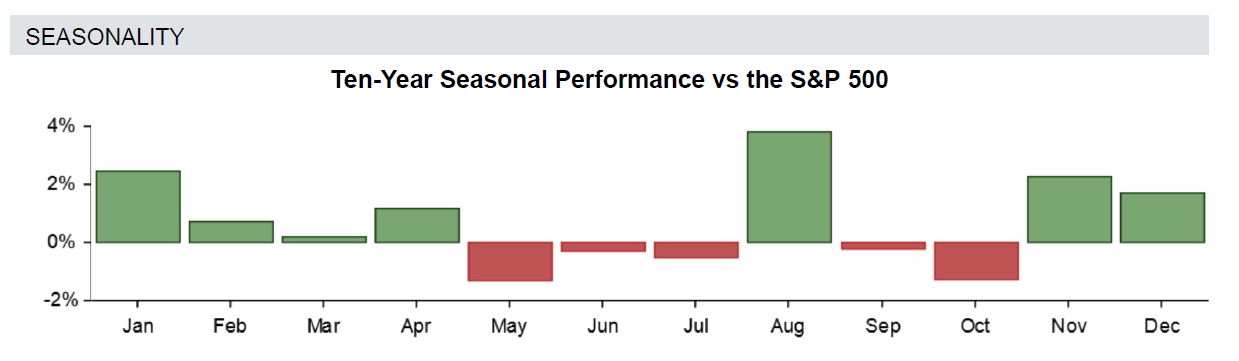

The research report encompasses much of the comprehensive information that is in the Stock Rover Insight Panel. It also includes new information not currently found in Stock Rover, such as seasonal performance as shown below.

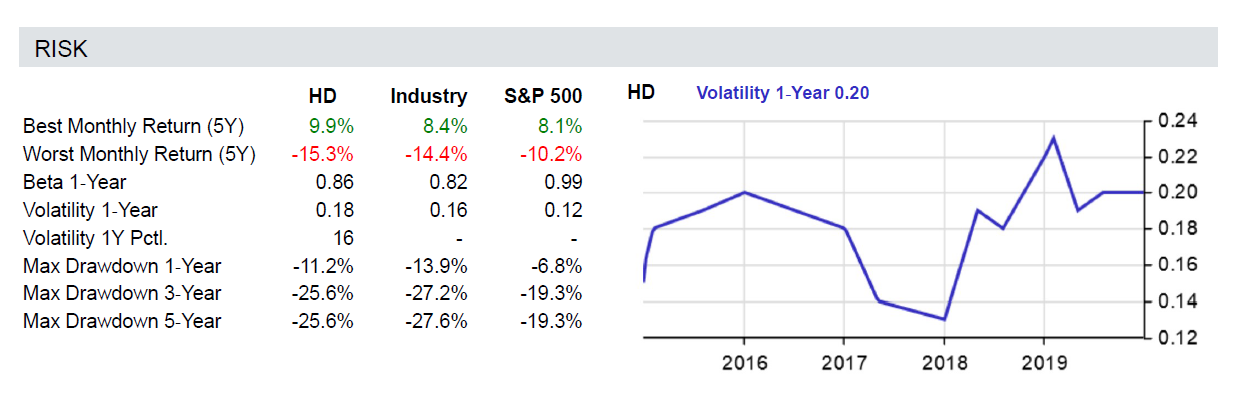

The report includes a new risk section incorporating information such as the best and worst monthly performance for a stock in the last 5 years. Other risk statistics such as the 1 and 3 year beta and volatility are included as well as a volatility graph over time and the maximum drawdown for a stock over the last 1, 3 and 5 year periods.

Research Report Structure

The Research Report is eight pages long and is structured as follows:

- Key Information (P/E, EPS and Sales Growth)

- Chart vs. Industry and S&P 500

- Analyst Summary Consensus

- Scores, Fair Value and Margin of Safety

- Business Summary

- Peers Analysis

- Profitability

- Earnings Surprises

- Risk Analysis

- Seasonality

- Relative Performance

- Financial Strength

- Dividend History

- Upcoming Dividend

- Dividend Rate

- Income Statement

- Balance Sheet

- 10 Year History of Key Valuation and Profitability Metrics

- Explanation of each Warning for the Stock

- Report Tips

The plan is to offer the Stock Rover Research Report facility as a separate product. This offering is designed for investors who just want the research reports and do not need or want everything else that Stock Rover provides.

For investors that want both Stock Rover and the Research Report facility, we plan to offer Research Reports as a low priced add-on to current subscription plans.

And for our current Stock Rover Essentials and Premium customers, there will be an introductory offer with special extra low cost pricing. Premium Plus users will receive the best deal of all, the extra cost will be zero. The introductory prices will be grandfathered for life, as long as the Stock Rover paid subscription is continuously maintained.