Policygenius does not allow the submission of personal information by users located within the EU or the UK. If you believe this action is in error, or have any questions, please contact us at [email protected]

- Search Search Please fill out this field.

- Life Insurance

- Definitions

What Is a Collateral Assignment of Life Insurance?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

The advantage to using a collateral assignee over naming the lender as a beneficiary is that you can specify that the lender is only entitled to a certain amount, namely the amount of the outstanding loan. That would allow your beneficiaries still be entitled to any remaining death benefit.

Lenders commonly require that life insurance serve as collateral for a business loan to guarantee repayment if the borrower dies or defaults. They may even require you to get a life insurance policy to be approved for a business loan.

Key Takeaways

- The borrower of a business loan using life insurance as collateral must be the policy owner, who may or may not be the insured.

- The collateral assignment helps you avoid naming a lender as a beneficiary.

- The collateral assignment may be against all or part of the policy's value.

- If any amount of the death benefit remains after the lender is paid, it is distributed to beneficiaries.

- Once the loan is fully repaid, the life insurance policy is no longer used as collateral.

How a Collateral Assignment of Life Insurance Works

Collateral assignments make sure the lender gets paid only what they are due. The borrower must be the owner of the policy, but they do not have to be the insured person. And the policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums . You can use either term or whole life insurance policy as collateral, but the death benefit must meet the lender's terms.

A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults. Many lenders don't accept term life insurance policies as collateral because they do not accumulate cash value.

Alternately, the policy owner's access to the cash value is restricted to protect the collateral. If the loan is repaid before the borrower's death, the assignment is removed, and the lender is no longer the beneficiary of the death benefit.

Insurance companies must be notified of the collateral assignment of a policy. However, other than their obligation to meet the terms of the contract, they are not involved in the agreement.

Example of Collateral Assignment of Life Insurance

For example, say you have a business plan for a floral shop and need a $50,000 loan to get started. When you apply for the loan, the bank says you must have collateral in the form of a life insurance policy to back it up. You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral.

So, you then designate the bank as the policy's assignee until you repay the $50,000 loan. That way, the bank can ensure it will be repaid the funds it lent you, even if you died. In this case, because the cash value and death benefit is more than what you owe the lender, your beneficiaries would still inherit money.

Alternatives to Collateral Assignment of Life Insurance

Using a collateral assignment to secure a business loan can help you access the funds you need to start or grow your business. However, you would be at risk of losing your life insurance policy if you defaulted on the loan, meaning your beneficiaries may not receive the money you'd planned for them to inherit.

Consult with a financial advisor to discuss whether a collateral assignment or one of these alternatives may be most appropriate for your financial situation.

Life insurance loan (policy loan) : If you already have a life insurance policy with a cash value, you can likely borrow against it. Policy loans are not taxed and have less stringent requirements such as no credit or income checks. However, this option would not work if you do not already have a permanent life insurance policy because the cash value component takes time to build.

Surrendering your policy : You can also surrender your policy to access any cash value you've built up. However, your beneficiaries would no longer receive a death benefit.

Other loan types : Finally, you can apply for other loans, such as a personal loan, that do not require life insurance as collateral. You could use loans that rely on other types of collateral, such as a home equity loan that uses your home equity.

What Are the Benefits of Collateral Assignment of Life Insurance?

A collateral assignment of a life insurance policy may be required if you need a business loan. Lenders typically require life insurance as collateral for business loans because they guarantee repayment if the borrower dies. A policy with cash value can guarantee repayment if the borrower defaults.

What Kind of Life Insurance Can Be Used for Collateral?

You can typically use any type of life insurance policy as collateral for a business loan, depending on the lender's requirements. A permanent life insurance policy with a cash value allows the lender a source of funds to use if the borrower defaults. Some lenders may not accept term life insurance policies, which have no cash value. The lender will typically require the death benefit be a certain amount, depending on your loan size.

Is Collateral Assignment of Life Insurance Irrevocable?

A collateral assignment of life insurance is irrevocable. So, the policyholder may not use the cash value of a life insurance policy dedicated toward collateral for a loan until that loan has been repaid.

What is the Difference Between an Assignment and a Collateral Assignment?

With an absolute assignment , the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

The Bottom Line

If you are applying for life insurance to secure your own business loan, remember you do not need to make the lender the beneficiary. Instead you can use a collateral assignment. Consult a financial advisor or insurance broker who can walk you through the process and explain its pros and cons as they apply to your situation.

Progressive. " Collateral Assignment of Life Insurance ."

Fidelity Life. " What Is a Collateral Assignment of a Life Insurance Policy? "

Kansas Legislative Research Department. " Collateral Assignment of Life Insurance Proceeds ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1465621717-5f131bf876c043898c13e6c471acf50f.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Shop for Car Insurance

Other Insurance Products

Types of mortgages

Calculators

Find & Compare Credit Cards

Cards with Rewards

Cards for a Purpose

Cards for Building Credit

Credit Card Reviews

Understanding Credit & Score

Student Loans

Paying for College

Personal Finance for College Students

Life Events

What Is Collateral Assignment of Life Insurance?

Quality Verified

Updated: December 14, 2023

On This Page:

- How It Works

- Overview of Application Process

- Pros and Cons

- Impact on Beneficiaries

- Alternatives

Related Content

Advertising & Editorial Disclosure

Collateral assignment of life insurance is an arrangement where a policyholder uses the face value of their life insurance policy, which can be a term or permanent life insurance policy, as collateral to secure a loan. If the policyholder dies before the loan is paid off, the lender is prioritized to receive a portion of the death benefit equivalent to the outstanding loan balance. The remaining benefit then goes to the policy's beneficiaries.

- Collateral assignment involves using a life insurance policy as security for a loan , where the lender has a claim on the death benefit if the borrower defaults or passes away before repaying the loan.

- The lender receives priority over the death benefit , which means they are paid first from the policy's payout before any beneficiaries if the loan remains unpaid.

- Various life insurance policies, including term, whole and universal, can be used for collateral assignment , depending on the insurance company's policies and the policy's value.

- If a life insurance policy lapses or is canceled during a collateral assignment, it can breach the loan agreement , potentially resulting in immediate loan repayment demands.

- After the loan is fully repaid, the policyholder must formally release the collateral assignment to restore the policy to its original status and ensure beneficiaries receive the full death benefit.

How Collateral Assignment of Life Insurance Works

The collateral assignment allows you to use your life insurance policy as security for a loan. The process involves legally designating your policy as collateral, which means if you pass away before fully repaying the loan, the lender can claim the death benefit to cover the remaining balance. You start by choosing either a term policy or whole life insurance and then complete a collateral assignment agreement. This agreement is legally binding and sets the terms for the lender to access the death benefit .

For your beneficiaries, this arrangement means the death benefit they receive could be reduced. If you die with an outstanding loan balance, the lender is paid first from the policy's proceeds. Any remaining amount goes to your beneficiaries only after the loan is settled.

For example, a policyholder with a $500,000 policy was assigned as collateral for a $200,000 loan. If the policyholder dies before settling the loan, the lender will receive $200,000 from the policy's death benefit. Meanwhile, the remaining $300,000 gets disbursed to the policy's beneficiaries.

Applying for Collateral Assignment

Applying for collateral assignment is a process moderated by your life insurance company designed to secure loans using your life insurance policy as collateral. It involves a series of steps:

Obtain a Collateral Assignment Form

Request a collateral assignment form from your life insurance provider. This form is crucial for designating the lender as a beneficiary for the loan amount. Ensure you obtain the correct form, as forms vary based on policy type and insurer.

Fill Out the Form Correctly

Complete the form with accurate details, including policy number, loan amount and lender information. Pay close attention to all sections to avoid errors that could delay or invalidate the assignment. Incomplete or incorrect information can lead to processing delays or rejection.

Signed by Both Policyholder and Lender

Ensure both the policyholder and lender sign the form, confirming the agreement. This dual signature legally binds both parties to the terms of the collateral assignment. Any discrepancy in signatures may question the form's validity.

Submit Completed Form

Submit the signed form back to the insurance company for processing. Consider using a traceable delivery method for submission to confirm receipt. Delays in submission can impact the timeline of the loan approval process.

Await Approval or Rejection From Insurance Company

Wait for the insurer to review and approve or reject the collateral assignment. The insurer may request additional information or clarification, which can extend the approval timeline.

Receive a Letter of Acknowledgment

You and your lender will receive a letter of acknowledgment from the insurer if your collateral assignment application is approved.

Obtaining Required Documentation

The required documentation for collateral assignment of life insurance is straightforward. Typically, you'll need to provide two main types of documents:

- Collateral Assignment Form: This form is critical because it officially transfers a portion of your life insurance policy benefits to the lender as collateral. It demonstrates to the lender that you have taken the requisite steps to secure your loan against your life insurance policy.

- Original Life Insurance Policy and Proof of Loan: Lenders may require your original life insurance policy to ensure it is valid and enforceable. Proof of the loan agreement or obligation, such as a mortgage note or other loan document, is also commonly required. This establishes the legitimacy of your loan and substantiates the collateral assignment.

Pros and Cons of Collateral Assignment

Utilizing a life insurance policy for collateral assignment can offer a range of benefits and potential drawbacks. This method allows you to secure loans and is often safer than using physical assets as collateral. However, you should also note the inherent risks, primarily that the lender retains the first right to your policy’s death benefit upon your death.

Impact of Collateral Assignment on Beneficiaries

While the collateral assignment of life insurance has its benefits, it’s important to remember that it can impact the amount your beneficiaries receive. If you pass away with an outstanding balance on your loan:

Your Lender Will Be Paid First

In the collateral assignment arrangement, the lender is designated as the primary beneficiary for the outstanding loan amount. This means if you pass away before fully repaying the loan, the lender is entitled to receive payment from the death benefit first. The amount collected by the lender is limited to the remaining loan balance.

Any Remaining Death Benefit Will Be Disbursed to Your Beneficiaries

After the lender's claim is satisfied, the remaining death benefit is disbursed to your policy’s designated beneficiaries. The amount they receive depends on the loan balance at the time of your death. If the loan balance is substantial, your beneficiaries will receive significantly less than the policy's full death benefit.

Alternatives to Collateral Assignment

Alternatives to collateral assignment include personal loans , home equity loans , or surrendering the life insurance policy for its cash value. None of these options require using life insurance as collateral. Each option offers different benefits and risks compared to using life insurance as collateral.

These questions covers various topics related to collateral assignments, including the requirements, implications for beneficiaries and what happens under various scenarios.

How does collateral assignment differ from naming a beneficiary?

Collateral assignment allows a lender to claim the life insurance death benefit for an outstanding loan amount while naming a beneficiary designated who receives the death benefit. The lender's claim is prioritized over the beneficiaries' in collateral assignment.

Can any type of life insurance policy be used for collateral assignment?

Most types of life insurance policies, including term, whole and universal life, can be used for collateral assignment, provided the insurance company allows it and the policy has sufficient value.

Can the policyholder still change beneficiaries after a collateral assignment?

Yes, the policyholder can change beneficiaries after a collateral assignment, but the lender's right to the death benefit amount remains until the loan is repaid.

What happens if I cancel my life insurance before paying off the debt collateralized with my policy?

Canceling your life insurance policy before repaying the debt can lead to a breach of the loan agreement. This action may prompt the lender to increase your interest rate or demand immediate repayment of the outstanding loan balance.

These related sections offer additional insights into concepts and alternatives connected to collateral assignments and life insurance:

Using Collateral for a Personal Loan — This link explains how to use various types of collateral for securing a personal loan, providing a broader context to the specific use of life insurance as collateral.

Term vs. Permanent Life Insurance — This resource compares term and permanent life insurance, helping to understand which types of policies can be used for collateral assignments.

Permanent Life Insurance — This page details permanent life insurance, a type commonly used in collateral assignments due to its cash value component.

Life Insurance Calculator — This page lets you calculate the appropriate amount of life insurance coverage needed, which is crucial when considering using a policy for collateral.

About Nathan Paulus

Nathan Paulus is the Head of Content Marketing at MoneyGeek, with nearly 10 years of experience researching and creating content related to personal finance and financial literacy.

Paulus has a bachelor's degree in English from the University of St. Thomas, Houston. He enjoys helping people from all walks of life build stronger financial foundations.

Collateral assignment of life insurance

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our content is backed by Coverage.com, LLC, a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed . Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Auto insurance

- • Life insurance

- Connect with Mary Van Keuren on LinkedIn Linkedin

- Get in contact with Mary Van Keuren via Email Email

- Connect with Natasha Cornelius, CLU on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . This content is powered by HomeInsurance.com (NPN: 8781838). For more information, please see our Insurance Disclosure .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Insurance Disclosure

This content is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate.com. HomeInsurance.com LLC services are only available in states where it is licensed and insurance coverage through HomeInsurance.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

Secured loans are often used by individuals needing financial resources for any reason, whether it’s to fund a business, remodel a home or pay medical bills. One asset that may be used for a secured loan is life insurance. Although there are pros and cons to this type of financial transaction, it can be an excellent way to access needed funding. Bankrate’s insurance editorial team discusses what a collateral assignment of life insurance is and when it might—or might not—be the best loan option for you.

What is collateral assignment of life insurance?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral . If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy . Any remaining funds from the death benefit would then be disbursed to the policy’s designated beneficiary(ies).

Why use life insurance as collateral?

Collateral assignment of life insurance may be a useful option if you want to access funds without placing any of your assets, such as a car or house, at risk. If you already have a life insurance policy, it can be a simple process to assign it as collateral. You may even be able to use your policy as collateral for more than one loan, which is called cross-collateralization, if there is enough value in the policy.

Collateral assignment may also be a credible choice if your credit rating is not high, which can make it difficult to find attractive loan terms. Since your lender can rely on your policy’s death benefit to pay off the loan if necessary, they are more likely to give you favorable terms despite a low credit score.

Pros and cons of using life insurance as collateral

If you are considering collateral assignment, here are some pros and cons of this type of financial arrangement.

- It may be an affordable option, especially if your life insurance premiums are less than your payments would be for an unsecured loan with a higher interest rate.

- You will not need to place personal property, such as your home, as collateral, which you would need to do if you take out a secured loan. Instead, if you pass away before the loan is repaid, lenders will be paid from the policy’s death benefit. Any remaining payout goes to your named beneficiaries.

- You may find lenders who are eager to work with you since life insurance is generally considered a good choice for collateral.

- The amount that your beneficiaries would have received will be reduced if you pass away before the loan is paid off since the lender has first rights to death benefits.

- You may not be able to successfully purchase life insurance if you are older or in poor health.

- If you are using a permanent form of life insurance as collateral, there may be an impact on your ability to use the policy's cash value during the life of the loan. If the loan balance and interest payments exceed the cash value, it can erode the policy's value over time.

What types of life insurance can I use as collateral for a loan?

You may use either of the main types of life insurance— term and permanent —for collateral assignment. If you are using term life insurance, you will need a policy with a term length that is at least as long as the term of the loan. In other words, if you have 20 years to pay off the loan, the term insurance you need must have a term of at least 20 years.

Subcategories of permanent life insurance, such as whole life , universal life and variable life, may also be used. Depending on lender requirements, you may be able to use an existing policy or could purchase a new one for the loan. A permanent policy with cash value may be especially appealing to a lender, considering the added benefit of the cash reserves they could access if necessary.

How do I take out a loan using a collateral assignment of life insurance?

If you already have enough life insurance to use for collateral assignment, your next step is to find a lender who is willing to work with you. If you don’t yet have life insurance, or you don’t have enough, consider the amount of coverage you need and apply for a policy . You may need to undergo a medical exam and fill out an application .

Once your policy has been approved, ask your insurance company or agent for a collateral assignment form, which you will complete and submit with your loan application papers. The form names your lender as an assignee of the policy—meaning that they have a stake in its benefits for as long as the loan exists. You will also name beneficiaries or a single beneficiary, who will receive whatever is left over from the death benefits after the loan is repaid.

Note that you will need to stay current on your life insurance premium payments while the collateral assignment is active. This will be stated in the loan agreement, and failure to do so could have serious repercussions.

Alternatives to life insurance as collateral

If you are considering a collateral assignment of life insurance, there are a few alternative funding options that might be worth exploring. Since many factors determine each option, working with a financial advisor may be the best way to find the ideal solution for your situation.

Unsecured loan

Depending on your situation, an unsecured loan may be more affordable than a secured loan with life insurance as collateral. This is more likely to be the case if you have good enough credit to qualify for a low-interest rate without having to offer any type of collateral. There are many different types of unsecured loans, including credit cards and personal loans.

Secured loan

In addition to life insurance, there are other items you can use as collateral for a secured loan . Your home, a car or a boat, for example, could be used if you have enough equity in them. Typically, secured loans are easier to qualify for than unsecured, since they are not as risky for the lender, and you are likely to find a lower interest rate than you would with an unsecured loan. The flip side, of course, is that if you default on the loan, the lender can take the asset that you used to secure it and sell it to recoup their losses.

Life insurance loan

Some permanent life insurance policies accumulate cash value over time that you can use in different ways. If you have such a policy, you may be able to partially withdraw the cash value or take a loan against your cash value. However, there are implications to using the cash value in your life insurance policy, so be sure to discuss this solution with a life insurance agent or your financial advisor before making a decision.

Home equity line of credit (HELOC)

A home equity line of credit (HELOC) is a more flexible way to access funds than a standard secured loan. While HELOCs carry the downside of risking your home as collateral, you retain more control over the amount you borrow. Instead of receiving one lump sum, you will have access to a line of credit that you can withdraw from as needed. You will only have to pay interest on the actual amount borrowed.

Frequently asked questions

What is the best life insurance company, what type of loans are collateral assignments usually associated with, what are other common forms of collateral, what are the two types of life insurance assignments, related articles.

What is collateral insurance and how does it work?

What does life insurance cover?

What is an irrevocable beneficiary?

Life insurance death benefits

Collateral assignment of life insurance

S ecured loans are often used by individuals needing financial resources for any reason, whether it’s to fund a business, remodel a home or pay medical bills. One asset that may be used for a secured loan is life insurance. Although there are pros and cons to this type of financial transaction, it can be an excellent way to access needed funding. Bankrate’s insurance editorial team discusses what a collateral assignment of life insurance is and when it might—or might not—be the best loan option for you.

What is collateral assignment of life insurance?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral . If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy . Any remaining funds from the death benefit would then be disbursed to the policy’s designated beneficiary(ies).

Why use life insurance as collateral?

Collateral assignment of life insurance may be a useful option if you want to access funds without placing any of your assets, such as a car or house, at risk. If you already have a life insurance policy, it can be a simple process to assign it as collateral. You may even be able to use your policy as collateral for more than one loan, which is called cross-collateralization, if there is enough value in the policy.

Collateral assignment may also be a credible choice if your credit rating is not high, which can make it difficult to find attractive loan terms. Since your lender can rely on your policy’s death benefit to pay off the loan if necessary, they are more likely to give you favorable terms despite a low credit score.

Pros and cons of using life insurance as collateral

If you are considering collateral assignment, here are some pros and cons of this type of financial arrangement.

- It may be an affordable option, especially if your life insurance premiums are less than your payments would be for an unsecured loan with a higher interest rate.

- You will not need to place personal property, such as your home, as collateral, which you would need to do if you take out a secured loan. Instead, if you pass away before the loan is repaid, lenders will be paid from the policy’s death benefit. Any remaining payout goes to your named beneficiaries.

- You may find lenders who are eager to work with you since life insurance is generally considered a good choice for collateral.

- The amount that your beneficiaries would have received will be reduced if you pass away before the loan is paid off since the lender has first rights to death benefits.

- You may not be able to successfully purchase life insurance if you are older or in poor health.

- If you are using a permanent form of life insurance as collateral, there may be an impact on your ability to use the policy's cash value during the life of the loan. If the loan balance and interest payments exceed the cash value, it can erode the policy's value over time.

What types of life insurance can I use as collateral for a loan?

You may use either of the main types of life insurance— term and permanent —for collateral assignment. If you are using term life insurance, you will need a policy with a term length that is at least as long as the term of the loan. In other words, if you have 20 years to pay off the loan, the term insurance you need must have a term of at least 20 years.

Subcategories of permanent life insurance, such as whole life , universal life and variable life, may also be used. Depending on lender requirements, you may be able to use an existing policy or could purchase a new one for the loan. A permanent policy with cash value may be especially appealing to a lender, considering the added benefit of the cash reserves they could access if necessary.

How do I take out a loan using a collateral assignment of life insurance?

If you already have enough life insurance to use for collateral assignment, your next step is to find a lender who is willing to work with you. If you don’t yet have life insurance, or you don’t have enough, consider the amount of coverage you need and apply for a policy . You may need to undergo a medical exam and fill out an application .

Once your policy has been approved, ask your insurance company or agent for a collateral assignment form, which you will complete and submit with your loan application papers. The form names your lender as an assignee of the policy—meaning that they have a stake in its benefits for as long as the loan exists. You will also name beneficiaries or a single beneficiary, who will receive whatever is left over from the death benefits after the loan is repaid.

Note that you will need to stay current on your life insurance premium payments while the collateral assignment is active. This will be stated in the loan agreement, and failure to do so could have serious repercussions.

Alternatives to life insurance as collateral

If you are considering a collateral assignment of life insurance, there are a few alternative funding options that might be worth exploring. Since many factors determine each option, working with a financial advisor may be the best way to find the ideal solution for your situation.

Unsecured loan

Depending on your situation, an unsecured loan may be more affordable than a secured loan with life insurance as collateral. This is more likely to be the case if you have good enough credit to qualify for a low-interest rate without having to offer any type of collateral. There are many different types of unsecured loans, including credit cards and personal loans.

Secured loan

In addition to life insurance, there are other items you can use as collateral for a secured loan . Your home, a car or a boat, for example, could be used if you have enough equity in them. Typically, secured loans are easier to qualify for than unsecured, since they are not as risky for the lender, and you are likely to find a lower interest rate than you would with an unsecured loan. The flip side, of course, is that if you default on the loan, the lender can take the asset that you used to secure it and sell it to recoup their losses.

Life insurance loan

Some permanent life insurance policies accumulate cash value over time that you can use in different ways. If you have such a policy, you may be able to partially withdraw the cash value or take a loan against your cash value. However, there are implications to using the cash value in your life insurance policy, so be sure to discuss this solution with a life insurance agent or your financial advisor before making a decision.

Home equity line of credit (HELOC)

A home equity line of credit (HELOC) is a more flexible way to access funds than a standard secured loan. While HELOCs carry the downside of risking your home as collateral, you retain more control over the amount you borrow. Instead of receiving one lump sum, you will have access to a line of credit that you can withdraw from as needed. You will only have to pay interest on the actual amount borrowed.

Frequently asked questions

Finding the best life insurance company is important for you and your family. What works well for others might not fit your needs or current budget. First, find out how much life insurance you need by speaking with a financial advisor and using this life insurance calculator as a starting point. Similar to shopping for car insurance, you might want to look at customer service and claim reviews and the company’s financial stability ratings, then get quotes from several providers and ask for recommendations from people you trust.

Life insurance can be used as collateral for auto or home loans, but it is also commonly used for small business loans . Often small business owners have to use most of their private money to fund their businesses. When it is time to expand, upgrade technology or maybe hire more staff, they may need a loan to invest in their business that won’t put their remaining personal finances at risk.

It is typical for borrowers to put up their real estate or vehicles as collateral since they are usually our most valuable assets. Some loan companies may accept cash in the form of money market accounts or certificates of deposit (CD) , investments or valuable items such as jewelry, art and collectibles. Valuables are usually subject to an appraisal before they are accepted.

Although we have talked above about collateral assignment of your life insurance policy to secure a loan, there is another type of assignment called absolute assignment. With collateral assignment, you still exercise control over the policy, and the assignment only exists as long as the loan is active. Absolute assignment, however, transfers all policy rights to the lender, who becomes the new owner of the policy. The original policyholder gives up their right to name beneficiaries or access the policy’s cash value. This arrangement is more like a sale of the policy , with the new owner assuming all rights and responsibilities over it.

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow-City: 7 surprising facts about the Russian capital’s business center

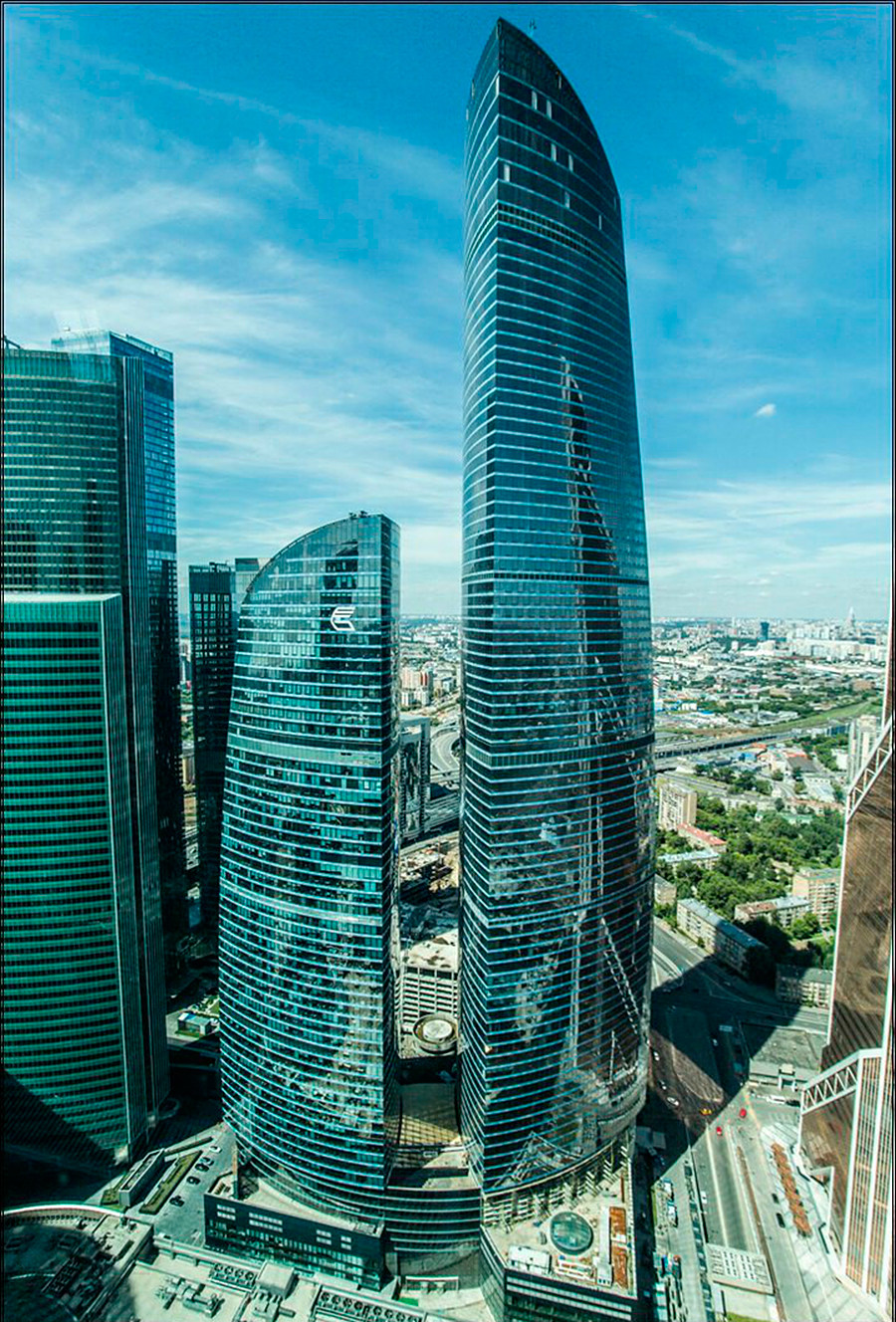

1. Guinness World Record in highlining

The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the ‘Moscow-City Day’ is celebrated. The cord was stretched at the height of 350 m between the ‘OKO’ (“Eye”) and ‘Neva Towers’ skyscrapers. The distance between them is 245 m. The first of the athletes to cross was Friede Kuhne from Germany. The athletes didn't just walk, but also performed some daredevil tricks. Their record is 103 meters higher than the previous one set in Mexico City in December 2016.

2. Domination of Europe's top-10 highest skyscrapers

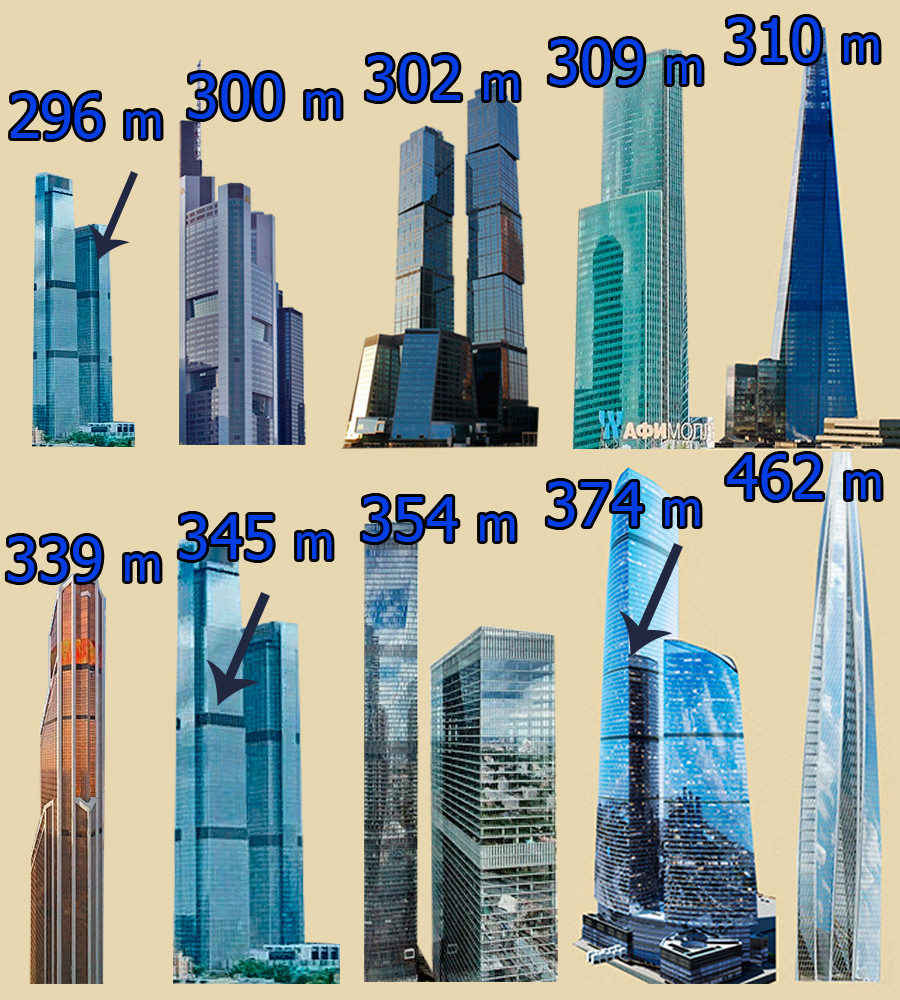

7 out of 10 Europe’s highest skyscrapers are located in Moscow-City. Earlier, the ‘Federation Tower’ complex’s ‘Vostok’ (“East”) skyscraper was the considered the tallest in Europe.

Left to right: the lower of the ‘Neva Towers’ (296 m), Commerzbank Tower in Frankfurt (300 m), Gorod Stolits (“City of Capitals”) Moscow tower (302 m), Eurasia tower (309 m), The Shard’ skyscraper in London (310 m), Mercury City Tower (339 m), Neva Towers (345 m).

However, in 2018, the construction of the 462 meter tall ‘Lakhta Center’ in Saint-Petersburg was completed, pushing ‘Vostok’ (374 m) into 2nd place. The 3rd place is taken by OKO’s southern tower (354 m).

3. The unrealized ‘Rossiya’ tower

If all the building plans of Moscow-City were realized, the ‘Lakhta Center’ in St. Petersburg wouldn't have a chance to be Europe's highest skyscraper. Boris Tkhor, the architect who designed the concept of Moscow-City, had planned for the ‘Rossiya’ tower to be the tallest. In his project, it was a 600 meter tall golden cylindrical skyscraper ending with a spire that was inspired by traditional Russian bell towers. Then, the project was reinvented by famous British architect Sir Norman Foster. He had designed ‘Rossiya’ as a pyramid ending with a spire. The skyscraper itself would have been 612 meters tall, and the height including the spire would have reached 744,5 meters (for comparison, the ‘Burj Khalifa’ in Dubai, UAE, would have been just 83,5 meters taller). Unfortunately, the investors faced a lot of economic problems, due to the 2008 financial crisis, so the ‘Rossiya’ skyscraper was never built. A shopping mall and the ‘Neva Towers’ complex was constructed at its place in 2019.

4. Changed appearance of ‘Federation Tower’

In its first project, the ‘Federation Tower’ was designed to resemble a ship with a mast and two sails. The mast was to be represented by a tall glass spire with passages between the towers. It was planned to make a high-speed lift in it. The top of the spire was going to be turned into an observation deck. But the ship lost its mast in the middle of its construction. Experts at the Moscow-city Museum based in the ‘Imperia’ (“Empire”) tower say, that the construction of the spire was stopped, firstly, due to fire safety reasons and secondly, because it posed a threat to helicopter flights – the flickering glass of the spire could potentially blind the pilots. So, the half-built construction was disassembled. However, an observation deck was opened in the ‘Vostok’ tower.

5. Open windows of ‘Federation Tower’

We all know that the windows of the upper floors in different buildings don’t usually open. Experts say that it’s not actually for people’s safety. Falling from a big height is likely to be fatal in any building. The actual reason is the ventilation system. In a skyscraper, it’s managed with a mechanical system, and the building has its own climate. But in the ‘Zapad’ (“West”) tower of the ‘Federation Tower’ complex, the windows can open. The 62nd and last floor of the tower are taken up by a restaurant called ‘Sixty’. There, the windows are equipped with a special hydraulic system. They open for a short period of time accompanied by classical music, so the guests can take breathtaking photos of Moscow.

6. Broken glass units of ‘Federation Tower’

The guests of the ‘Sixty’ restaurant at the top of the ‘Zapad’ tower can be surprised to see cracked glass window panes. It is particularly strange, if we take into consideration the special type of this glass. It is extremely solid and can’t be broken once installed. For example, during experiments people threw all sorts of heavy items at the windows, but the glass wouldn’t break. The broken glass units of ‘Zapad’ were already damaged during shipment . As each of them is curved in its own way to make the tower’s curvature smooth, making a new set of window panes and bringing them to Russia was deemed too expensive . Moreover, the investors had financial problems (again, due to the 2008 financial crisis), so the ‘Vostok’ tower even stood unfinished for several years. Eventually, the cracked window panes were installed in their place.

7. The highest restaurant in Europe

‘Birds’, another restaurant in Moscow-City, is remarkable for its location. It was opened at the end of 2019 on the 84th floor of the ‘OKO’ complex’s southern tower. Guests at the restaurant can enjoy an amazing panoramic view at a height of 336 meters. On January 28, the experts of ‘Kniga Recordov Rossii’ (“Russian Records Book”) declared ‘Birds’ the highest restaurant in Europe, a step toward an application for a Guinness World Record.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- The evolution of Russia's No. 1 news program - from the USSR to now

- The Khodynka tragedy: A coronation ruined by a stampede

- ‘Moskvitch’: the triumph and sad end of a famous Moscow car plant (PHOTOS)

This website uses cookies. Click here to find out more.

IMAGES

COMMENTS

Traditional and Roth Individual Retirement Account (IRA) forms. Traditional and Roth IRA Account Application. Designation or Change of Beneficiary Request - IRA. IRA Distribution Request. IRA Rollover/Transfer Form. Minor Traditional or Roth Individual Retirement Account Application.

1000707Part (B) Policy Values (Annuities and Tax Qualified Policies)To: Re:Change Mail Address to:ForName of InsuredPolicy NumbersPolicyowner's Telephone NumberPage 3 of 8State Farm Life Insurance CompanyState Farm Life and Accident Assurance Company 2007 135986 207 03-06-2015 Do not use this for non-TQ Life Policies. (State) (ZIP Code) (City)(Street)

Collateral assignment of life insurance is an arrangement where you agree to give a lender the first claim to the payout from your life insurance policy. This allows your life insurance to serve as the collateral that many loans — especially small business loans or Small Business Administration (SBA) loans — require before they can lend you money you need.

Katharine Beer. A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the ...

Advertising & Editorial Disclosure. Collateral assignment of life insurance is an arrangement where a policyholder uses the face value of their life insurance policy, which can be a term or permanent life insurance policy, as collateral to secure a loan. If the policyholder dies before the loan is paid off, the lender is prioritized to receive ...

Make payment for your subscription with a card or via PayPal to proceed. Pick the file format for your State Farm Collateral Assignment Of Life Insurance Form and download it to your device. Print out your form to fill it out in writing or upload the sample if you prefer to do it in an online editor. Preparing legal paperwork under federal and ...

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. If you pass away before the loan is repaid, the lender can collect the ...

Assignment of Life Insurance Policy or Annuity Contract as Collateral Security. Life and Annuity Operations: PO Box 21008, Greensboro, NC 27420-1008 Phone: 800-487-1485 Fax: 800-819-1987 Email: [email protected]. Annuity Service Ofice: PO Box 2348, Fort Wayne, IN 46801-2348 LincolnFinancial.com. Policy / Contract No.:

3. Fill out a collateral assignment form. Once you sign your life insurance contract and pay your first premiums, complete a collateral assignment form with your insurer. You'll fill out your lender's contact details so your insurer can designate them as a collateral assignee while your loan is outstanding. 4.

What is collateral assignment of life insurance? A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral.If you pass away before the ...

Collateral Assignment Form. Use this form to collaterally assign the policy(ies) referenced below. This form must be completed and signed by the Owner. MI Last Sufix. "Company" as referred to herein, is Massachusetts Mutual Life Insurance Company, and/or MML Bay State Life Insurance Com-pany and/or C.M. Life Insurance Company.

Updated June 22, 2023. An insurance assignment allows a beneficiary (assignor) to transfer all or a portion of the proceeds to someone else (assignee). This is especially common with life insurance when a family does not have the money to pay for the funeral expenses and chooses to assign a portion of the decedent's life insurance proceeds to cover the funeral costs.

This form is used to collaterally assign the policy as collateral security for an obligation owed to the assignee. Who must sign this form: POLICYOWNER(S) - Required signature(s). NEW ASSIGNEE(S) - Required signature(s). CURRENT ASSIGNEE(S) - If the policy is currently assigned, any current assignee's signature(s) or consent is required ...

Once your first life insurance premium is paid, you can proceed with completing a collateral assignment form via your insurer. On the form, you'll need to provide your lender's contact information so they can be added as the death benefit collateral assignee until your loan is repaid.

to this assignment and to the rights of the Assignee. D. This assignment is made and the Policy is to be held as collateral security for any and all liabilities of one or more of the undersigned to the Assignee, either now existing or that may later arise in the ordinary course of business between any of the

To send your quote to an agent, complete these steps: Locate Get a quote for term life insurance at the top of this page. In the State field, select your state from the drop-down list and click Go.; Complete all of the information for the Life Insurance Quote page and click Get Quote.; Complete the information on the Customize Policy page or review the Your Quote Summary screen.

Eastside Marketplace Moscow Candy Company State Farm Insurance Fairfield Inn and Suites Moscow Chamber Stepping Stones Gail Byers Realty Moscow Elks Club Subway Gambino's Moscow Fire Department The Breakfast Club GameStop Moscow Moose Lodge The Corner Club Gritman Medical Center Moscow Mountain Therapy Tri-State

Russia's 5 Best-Known Ballets. Anna Galayda, special to RBTH. Performed across the centuries, these timeless productions are known and loved throughout the world. RBTH looks back at the history of ...

How do I file a life insurance claim? We offer the following ways to notify State Farm of a death: Contact your State Farm agent. Call Life Claims at 877-292-0398. 877-292-0398. Select Option 1 to report a new claim. Select Option 2 to discuss an existing claim.

Moscow-City is a vivid skyscraper cluster with a lot of amazing secrets. 1. Guinness World Record in highlining. mos.ru. The record was set in 2019 by a team of seven athletes from Russia, Germany ...

In August, the Idaho State Board of Education unanimously approved a ground lease between Home Depot and the University of Idaho to build a 138,000-square-foot store and garden center on UI land ...