Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Property Business Plan

Over the past 20+ years, we have helped over 10,000 entrepreneurs and business owners create business plans to start and grow their rental property business. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a rental property business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Rental Properties Business Plan?

A business plan provides a snapshot of your rental property business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Rental Properties Business

If you’re looking to purchase a rental property, multiple rental properties, or add to your existing rental properties business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your rental property business in order to improve your chances of success. Your rental property business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Rental Property Companies

With regards to funding, the main sources of funding for rental properties are personal savings, credit cards, mortgages, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a rental property is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan. Venture capitalists will not fund a rental property company. They might consider funding a rental property company with a national presence, but never an individual location. This is because most venture capitalists are looking for millions of dollars in return when they make an investment, and an individual location could never achieve such results.

Finish Your Business Plan Today!

How to write a business plan for a rental property company.

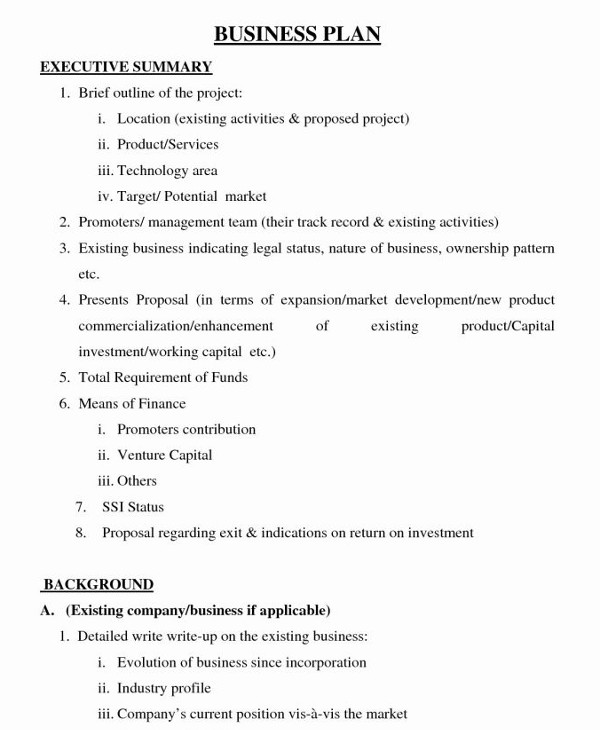

Your business plan should include 10 sections as follows:

Executive Summary

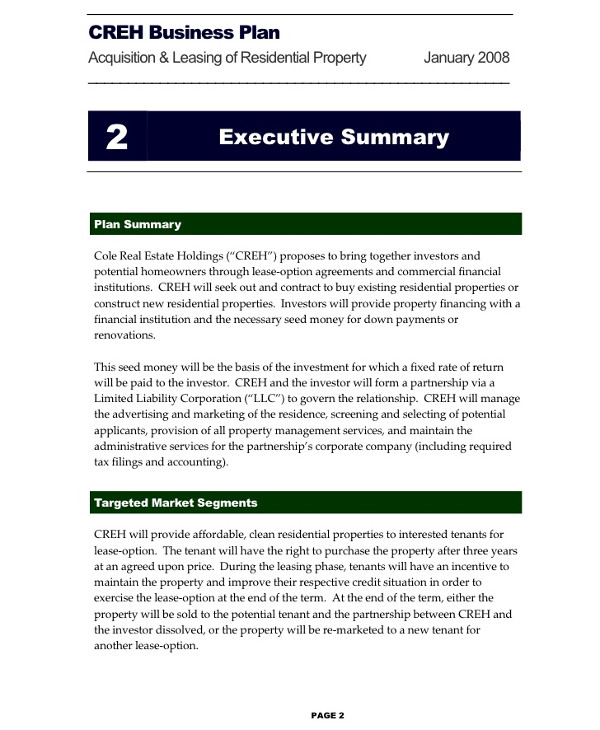

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property you are operating and the status; for example, are you a startup, or do you have a portfolio of existing rental properties that you would like to add to?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the rental properties industry. Discuss the type of rental property you are offering. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of rental properties you are offering.

For example, you might offer the following options:

- Single family homes – This type of rental property is often owned by a single individual, rather than a company, who acts as both landlord and property manager.

- Multi-family properties – These types of properties can be subcategorized by the number of units per site. Buildings with 2 – 4 units are the most common (17.5%), while multistory apartment complexes with more than 50 units represent the next-largest, at 12.6% of the industry.

- Short-Term Rental properties – These are fully furnished properties that are rented for a short period of time – usually on a weekly basis for vacation purposes.

In addition to explaining the type of rental property you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include occupancy goals you’ve reached, number of property acquisitions, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the rental properties industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the rental property industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your rental property business plan:

- How big is the rental properties industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your rental property. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population or tourist arrivals.

Customer Analysis

The customer analysis section of your rental property business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: households, tourists, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of rental property you offer. Clearly, vacationers would want different amenities and services, and would respond to different marketing promotions than long-term tenants.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Rental Properties Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

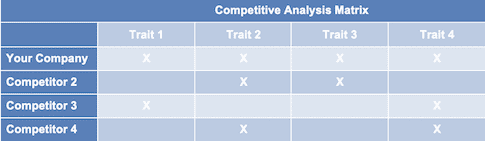

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other rental property companies.

Indirect competitors are other options customers may use that aren’t direct competitors. This includes the housing market, or hotels. You need to mention such competition to show you understand that not everyone who needs housing or accommodation will seek out a rental property.

With regards to direct competition, you want to detail the other rental properties with which you compete. Most likely, your direct competitors will be rental properties in the vicinity.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What lease lengths or amenities do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior properties?

- Will you provide services that your competitors don’t offer?

- Will you make it easier or faster for customers to book the property or submit a lease application?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a rental property business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of rental property business that you documented in your Company Analysis. Then, detail the specific options you will be offering. For example, in addition to long-term tenancy, are you offering month-to-month, or short-term rental?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the properties and term options you offer and their prices.

Place : Place refers to the location of your rental property. Document your location and mention how the location will impact your success. For example, is your rental property located in a tourist destination, or in an urban area, etc. Discuss how your location might draw customer interest.

Promotions : the final part of your rental property marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Reaching out to local websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your rental property business, such as customer service, maintenance, processing applications, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect 100% occupancy, or when you hope to reach $X in sales. It could also be when you expect to acquire a new property.

Management Team

To demonstrate your rental property business’ ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in rental property management. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in real estate, and/or successfully running small businesses.

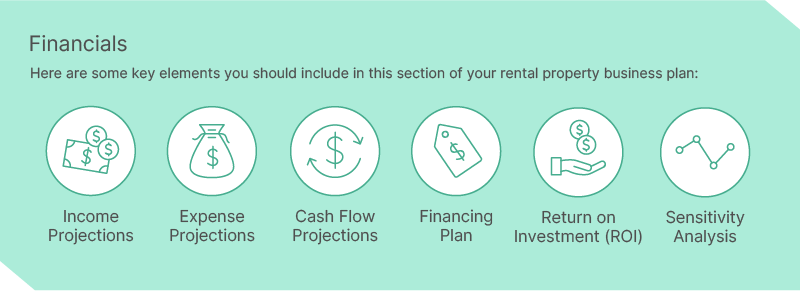

Financial Plan

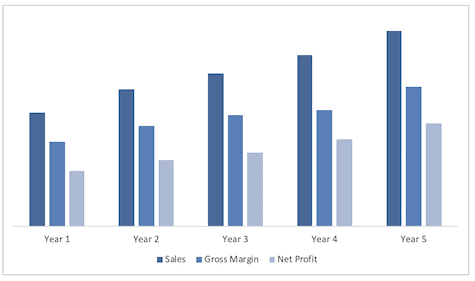

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you have 1 rental unit or 10? And will revenue grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $200,000 on purchasing and renovating your rental property, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $200,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

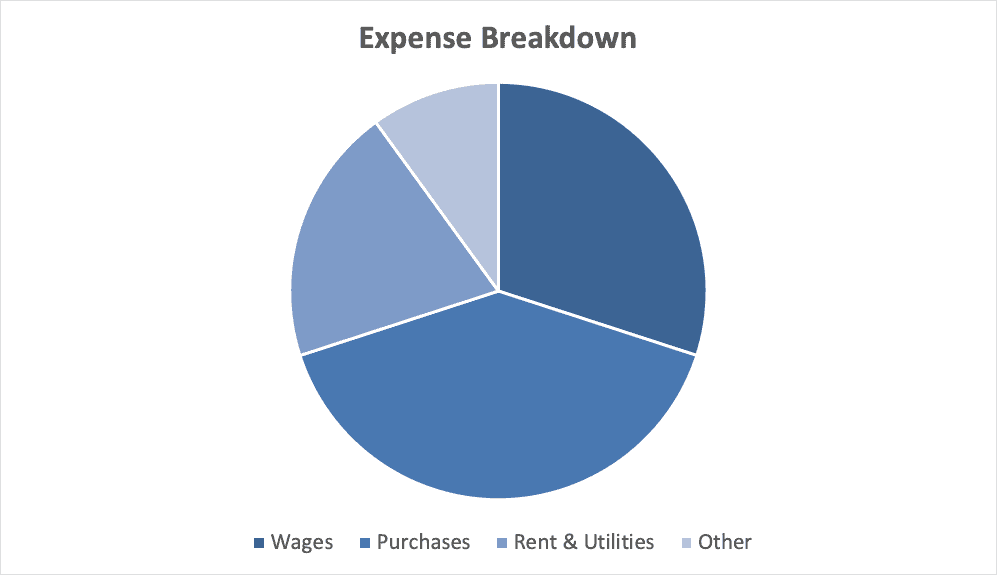

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a rental property business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers, software, etc.

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your property blueprint or map.

Putting together a business plan for your rental properties company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the rental property industry, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful rental properties business.

Rental Properties Business Plan FAQs

What is the easiest way to complete my rental properties business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Rental Properties Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of rental property business you are operating and the status; for example, are you a startup, do you have a rental properties business that you would like to grow, or are you operating multiple rental property businesses.

Don’t you wish there was a faster, easier way to finish your Rental Properties business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

How To Write a Winning Apartment Construction Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for apartment construction businesses who want to improve their strategy or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the critical elements that every apartment construction business owner should include in their business plan.

Download the Ultimate Construction Business Plan Template

What is an apartment construction business plan.

An apartment construction business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, and your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Apartment Construction Business Plan?

An apartment construction business plan is required for banks and investors. The document is a clear and concise guide to your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Apartment Construction Business Plan

The following are the key components of a successful apartment construction business plan:

Executive Summary

The executive summary of an apartment construction business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your apartment construction company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

If you are just starting your apartment construction business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your apartment construction firm, mention this.

Industry Analysis

The industry or market analysis is an important component of an apartment construction business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the apartment construction industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, an apartment construction business’ customers may include:

- First-time homebuyers

- People relocating for work

- Families with children

You will use this information to determine your marketing strategy and how you will reach your target audience.

You can include information about how your customers decide to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or apartment construction services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign.

Operations Plan

This part of your apartment construction business plan should include the following information:

- How will you deliver your service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters and then each year for the following four years. Examples of milestones for an apartment construction business include reaching $X in sales. Other examples include reaching a certain number of customers or constructing a certain number of units.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific apartment construction industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities, you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs and the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Apartment Construction Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Apartment Construction Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup apartment construction business.

Sample Cash Flow Statement for a Startup Apartment Construction Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your apartment construction company. It not only outlines your business vision but also provides a step-by-step process of how you will accomplish it.

A well-written business plan is an essential tool for any apartment construction. The tips we’ve provided in this article should help you write a winning business plan for your apartment construction company.

Finish Your Apartment Construction Business Plan in 1 Day!

Rental Properties Business Plan Template [Updated 2024]

Rental Properties Business Plan Template

If you want to start a Rental Property business or expand your current Rental Property business, you need a business plan.

The following Rental Property business plan template gives you the key elements to include in a winning Rental Properties business plan.

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

Rental Property Business Plan Example

Below are the key sections of a successful rental property business plan. Once you create your plan, download it to PDF to show banks and investors.

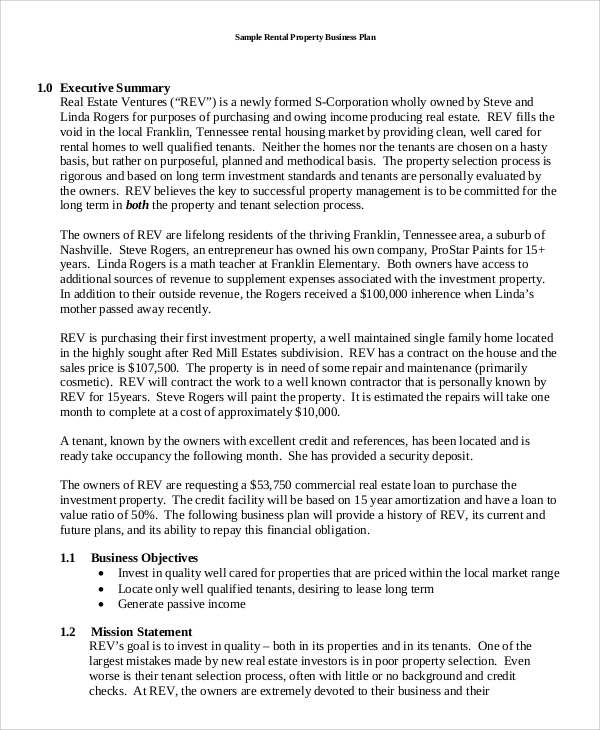

I. Executive Summary

Business overview.

[Company Name] is a rental property agency in [location name] that specializes in managing, renting and leasing properties. [Company Name] rents homes in dozens of markets across the country and has an online platform that allows customers to search by their specific criteria (number of bedrooms, region, amenities, etc.) to find a property that’s right for them in their preferred location.

Products Served/Service offering

The Company offers a variety of rental properties, listed below:

- 1-3 bedroom apartments

- Single family homes

- Multi-unit buildings

- Short-term rentals

- Rental of mobile homes or trailers

Customer Focus

[Company Name] will primarily provide its offerings to local renters, students and local professionals. The demographics of the customers are given as below:

- First time renters-29%

- Young adults-21%

- Perma – renters-16%

- Middle income boomers-11%

- Families-14%

Management Team

[Company Name] is led by [Founder’s name], who has been in the rental property industry for [x] years. During his extensive experience in the rental property industry, he [founder] acquired an in-depth knowledge of the local area, local regulations, facilities, and the characteristics of different neighborhoods. He also holds rich experience in handling business management activities (i.e., staffing, marketing, etc.).

Success Factors

[Company Name] is qualified to succeed due to the following reasons:

- There is currently a high demand for rental property services in the community. In addition, the company surveyed the local population and received highly positive feedback pointing towards an explicit demand for the products, supporting the business after launch.

- The Company’s online marketplace offers a high-volume traffic area and will thus be highly convenient to a significant number of residents living anywhere.

- The management team has a track record of success in the rental property business.

- The rental property business has proven to be a successful industry in the United States.

Financial Highlights

[Company Name] is currently seeking $370,000 to launch its rental property business. Specifically, these funds will be used as follows:

- Website design/build and startup business expenses: $120,000

- Working capital: $250,000 to pay for marketing, salaries, and lease costs until [Company Name] reaches break-even

II. Company Overview

Who is [company name].

[Company Name], located in [insert location here], is a rental property agency focusing on providing short-term and long-term rentals, as well as leased properties to the local community. [Company Name’s] rental properties have a clean and modern appearance that appeals to the current renter’s market. The [Company]’s properties will be fully furnished and include high-end technology and modern accessories.

[Company Name] is owned by [Founder’s Name]. While [Founder’s Name] has been in the rental property industry for some time, it was in [month, date] that he decided to launch [Company Name]. He evaluates that the growing number of students, working professionals, and overseas relocations create a need and expects growth in the country’s rental property market.

[Company Name]’s History

Upon surveying the local customer base and finding the potential retail location, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

[Founder’s Name] has selected an initial office location and is currently undergoing due diligence on each property and the local market to assess the most desirable location for additional offices.

[Company’s Name] operations are currently being run out of [Founder’s Name] home office.

Since incorporation, the company has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined rent/leasing and financing requirements

- Began recruiting key employees with experience in the rental homes/apartment industry

[Company Name]’s Products

Iii. industry analysis.

You can download our Rental Property Business Plan Template (including a full, customizable financial model) to your computer here. The market size of the rental property industry in the US increased immensely, and the market size, measured by revenue, of the rental property industry, is $174.2 billion. Rental income units are an increasingly important part of the US housing market. The return on expenditure in the property market is much better than in many economic sectors.

With tenant demand in the US increasing last year, this is thought to be related to tenants looking to downsize or move further out to save money. Most rental housing in the US is developed, financed, and owned by a diverse group of private, for-profit companies.

As the economy of the US began to grow and demand for rental apartments rose, industry revenue grew at a rapid pace, hence opening vast opportunities for rental property companies.

Another obvious trend that is common with rental property companies in the US is that most of them are improvising on more means of making money in the apartment rental industry; they are also acting as property developers and home staging agents, amongst other things.

IV. Customer Analysis

Demographic profile of target market.

[Company Name’s] target market include people of all demographics. The market [Company Name] serves is value-conscious and desires high comfort and basic amenities geared towards families, students, and the working population.

Customer Segmentation

The Company will primarily target the following three customer segments:

- High-Income Individuals: The Company will attract individuals with higher incomes who are looking for a rental property with modern furnishings and technology.

- Families: The Company will attract families looking for turn-key properties that are furnished and offer an array of amenities to suit their busy family life.

- Working Professionals: [Company name] is located along a well-traveled commute route, by offering a smart property to working professionals with walking distance (not more than 10 minutes) to a means of transport.

V. Competitive Analysis

Direct & indirect competitors.

Leasing Inc Leasing Inc is a marketplace to find rental homes in the country. It originally started more than a century ago as a networking tool for real estate agents, but today it is a fully searchable online database of homes for both sale and rent. Leasing Inc offers an ideal rental property with different amenities that can best suit the customer’s requirements. Leasing Inc’s properties are well furnished with all modern accessories.

Rental Barn Rental Barn is the most visited real estate website in the United States. Rental Barn and its affiliates offer customers an on-demand experience for selling, buying, renting, and financing with transparency and nearly seamless end-to-end service. The Company provides multiple rental apartments according to the customer’s needs and requirements.

Homewood Properties Homewood Properties is a leading digital marketing solutions company that empowers millions nationwide to find apartments and houses for rent. Customers can click on the items that are important to them, from hardwood floors to walk-in closets, and select the property which they are looking for according to their needs.

Competitive Advantage

[Company Name] enjoys several advantages over its competitors. These advantages include:

- Client-oriented service: [Company Name] will have a full-time sales manager to stay in contact with clients and answer their everyday questions. [Founder’s Name] realizes the importance of accessibility to his clients and will further keep in touch with his clients through newsletters.

- Robust clientele base: Another possible competitive strategy for winning the competitors in this particular industry is to build a robust clientele base and ensure that the company’s properties are top-notch and trendy. The Company is well-positioned, key members of its team are highly competent, and can favorably compete with some of the best players in the industry.

- Management: The Company’s management team has X years of business and marketing experience that allows them to market and serve customers in an improved and sophisticated manner than the competitors.

- Relationships: Having lived in the community for xx years, [Founder’s Name] knows all leaders, newspapers, and other influencers, including the local leaders who fought the [Competitor] opening xx years ago. It will be relatively easy for the company to build branding and awareness of the rental property industry.

VI. Marketing Plan

The [company name] brand.

The [Company Name] brand will focus on the company’s unique value proposition:

- Offering homes/apartments for rent suited for families, students, working professionals, landowners, foreign investors, and international migrants.

- Offering a diverse range of rental homes in a prime location.

- Providing excellent customer service.

Promotions Strategy

[Company Name] expects its target market to be students, international migrants, the working population, families mainly from surrounding locations in the [Location]. The Company’s promotions strategy to reach these individuals includes:

Phone Prospecting [Company Name] will assign salespeople to contact and work with clients to help them buy, sell or rent real estate properties. Salespeople will use their in-depth knowledge of the real estate market to help clients find rental properties and execute all the required formalities.

Advertisement Advertisements in print publications like newspapers, magazines, etc., are an excellent way for businesses to connect with their audience. The Company will advertise its offerings in popular magazines and news dailies. Obtaining relevant placements in industry magazines and journals will also help in increasing brand visibility.

Public Relations [Company Name] will hire an experienced PR agency/professional(s) to formulate a compelling PR campaign to boost its brand visibility among the target audience. It will look to garner stories about the company and its offerings in various media outlets like newspapers, podcasts, television stations, radio shows, etc.

Referrals [Company name] understands that the best promotion comes from satisfied customers. The Company will encourage its clients to refer other businesses by providing economic or financial incentives for every new client produced. This strategy will increase effectiveness after the business has already been established. Additionally, [company name] will aggressively network with useful sources such as home contractors, real estate development companies, and businesses. This network will generate qualified referral leads.

Social Media Marketing Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The Company will use social media to develop engaging content that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand the changing customer needs.

Pricing Strategy

Part of the [Company Name’s] business strategy is to ensure that it will work within the budget of its clients to deliver excellent properties. The real estate industry fluctuates and therefore, rental prices, for the most part, are usually out of a company’s control. However, the company will market their properties at a competitive rate to ensure they do no have vacant properties. They will also keep a tight control on costs in order to maximize profits.

VII. Operations Plan

Functional roles.

To execute on [Company Name]’s business model, the company needs to perform many functions, including the following:

Administrative Functions

- General & administrative functions including legal, marketing, bookkeeping, etc.

- Hiring and training staff

Service and Operations Functions

- Rental property maintenance

- Website maintenance, updates, and bug-fixing

- Ongoing search engine optimization

VIII. Management Team

Management team members.

[Company Name] is led by [Founder’s Name], who has been in the rental property business for xx years. He has worked in the industry most recently as a [Position Name] and has held various different positions in the management chain over the last xx years. As such, [Founder] has an in-depth knowledge of the rental property business, including operations and business management.

[Founder] has also worked as a real estate consultant on a part-time basis over the past xx years.

[Founder] graduated from the University of ABC and has done Master of Professional Studies in Real Estate.

Hiring Plan

[Founder] will serve as the [Position Name]. In order to introduce the rental property business, the company needs to hire the following personnel:

- Real estate agent (should have real estate sales experience in residential and commercial property)

- Property Manager

- Marketing and Sales Executive

- Part-Time Bookkeeper (will manage accounts payable, create statements, and execute other administrative functions)

- Customer Service Manager

IX. Financial Plan

Revenue and cost drivers.

[Company Name]’s revenue will come from the renting properties. The major costs for the company will be staff salaries and property maintenance. In the initial years, the company’s marketing spend will be high to establish itself in the market.

Capital Requirements and Use of Funds

[Company Name] is currently seeking $370,000 to launch its rental property business. The capital will be used for funding capital expenditures, workforce costs, marketing expenses, and working capital. Specifically, these funds will be used as follows:

Key Assumptions

5 Year Annual Income Statement

Comments are closed.

Rental Properties Business Plan Template

Written by Dave Lavinsky

Rental Properties Business Plan

You’ve come to the right place to create your Rental Property business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their rental property business.

Rental Property Business Plan Example

Below is a template to help you create each section of your rental property business plan.

Executive Summary

Business overview.

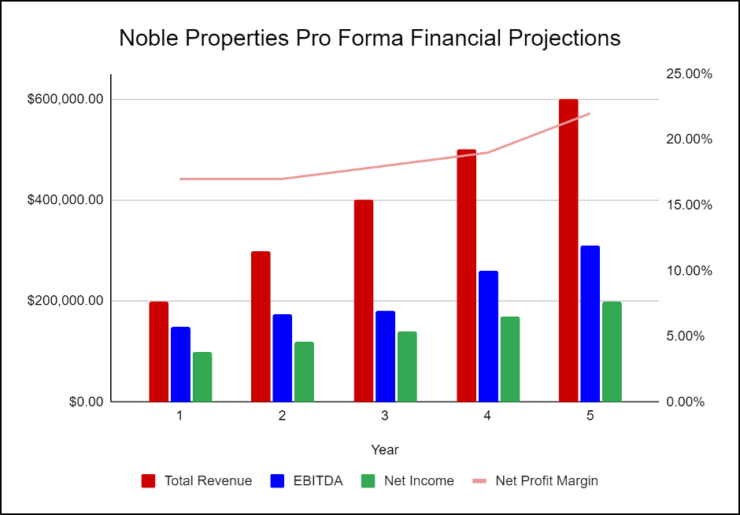

Noble Properties is a rental property agency in Seattle, Washington, that specializes in managing, renting, and leasing properties. Our mission is to provide luxury rentals that tenants can call home for years to come. Noble Properties rents out hundreds of homes across the Seattle area, including apartments, single-family homes, and trailers. To help prospective tenants find the perfect home, the company has created an online platform that allows them to search by their specific criteria (number of bedrooms, amenities, rent, etc.). We aim to be one of the most popular rental agencies in the area that customers can depend on again and again for their housing needs.

Noble Properties is founded and run by Joseph Pierce. He has worked in the industry for decades and has extensive knowledge of all aspects of the business. He will be in charge of most of the operations but will hire other staff to help with marketing, accounting, and managing the rentals.

Product Offering

Noble Properties offers a variety of properties for prospective tenants to choose from. Some of the options we provide include:

- 1-3 bedroom apartments

- Single-family homes

- Multi-unit buildings

- Short-term rentals

- Mobile homes or trailers

Customer Focus

Noble Properties will target renters located throughout the Seattle area. Most renters are under the age of 40 and earn about the median income. This means that we will primarily market to younger demographics and those who earn around the local median income or more.

Management Team

Noble Properties is led by Joseph Pierce, who has been in the rental property industry for 20 years. Throughout that time, he worked in various positions in local rental property agencies but is now eager to start a rental property business of his own. During his extensive experience in the rental property industry, he acquired an in-depth knowledge of the local area, local regulations, facilities, and the characteristics of different neighborhoods. He also has extensive experience in handling business management activities.

Karen Miller has been Joseph Pierce’s loyal administrative assistant for over ten years at his former rental agency. Joseph relies strongly on Karen’s diligence, attention to detail, and focus when organizing his clients, schedule, and files. Karen has worked in the rental agency industry for so long that she has a thorough knowledge of all aspects required to run a successful rental agency. She will help out with administrative tasks and some of the initial marketing efforts.

Success Factors

Noble Properties will be able to achieve success by offering the following competitive advantages:

- The founder, Joseph Pierce, has decades of extensive experience and knowledge of the industry that will prove invaluable for the company.

- The company will purchase rentals in popular areas around the city, putting our rentals in high demand.

- Noble Properties offers reasonable and affordable rates for all our rentals. Our pricing will be far more cost-effective than the competition.

Financial Highlights

Noble Properties is seeking $1,100,000 in debt financing to launch its rental property agency. The funding will be dedicated to securing initial rental spaces, securing an office space, and purchasing office equipment and supplies. Funding will also be dedicated toward six months of overhead costs, including payroll, rent, and marketing costs. The breakdown of the funding is below:

- Purchasing initial rentals: $600,000

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $20,000

- Six months of overhead expenses (payroll, rent, utilities): $350,000

- Marketing costs: $50,000

- Working capital: $60,000

Company Overview

Who is noble properties, noble properties’ history.

After decades of working for other rental agencies, Joseph Pierce decided to launch an agency of his own. He conducted extensive research on the rental market in the Seattle area. This helped him determine the best spots to find in-demand rentals and how much he should rent them out for. He also did extensive marketing research to determine the best customer segments to market to. After conducting this research and finding a potential office location, Joseph Pierce incorporated Noble Properties as an S-Corporation.

Noble Properties’ operations are currently being run out of Joseph Pierce’s home office but will move to the office location once the lease is finalized.

Since incorporation, Noble Properties has achieved the following milestones:

- Developed the company’s name, logo, and website

- Determined rent/leasing and financing requirements

- Found a potential office location and signed a Letter of Intent to lease it

- Began recruiting key employees with experience in the rental homes/apartment industry

Noble Properties’ Products

Industry analysis.

The rental market is expected to continue to grow over the next five years. According to RentCafe, the average rent for a Seattle apartment is around $2,300 per month. This value is only expected to increase as the demand for apartments and other rentals skyrockets. Furthermore, Seattle’s vacancy rate is incredibly low and expected to decrease further, meaning there aren’t enough rentals to keep up with demand.

The growth is primarily driven by increasing housing prices. Now that housing prices have increased substantially, fewer and fewer people can afford to buy a home. Therefore, many people seek out rentals to live in since they are far more affordable.

Another factor that will help the Seattle rental market is the increasing population. More people are moving to the city, meaning the demand for homes and rentals will continue to soar. This will only push rental prices even higher, which will increase the local rental market’s value substantially.

This is a great market to start a rental agency in. By capitalizing on these trends, Noble Properties is expected to have great success.

Customer Analysis

Demographic profile of target market.

Noble Properties’ target market includes people of all demographics. We are open to offering rentals to people of all ages and groups as long as they can afford to pay their rent. From our initial market research, we expect most of our marketing efforts will target young adults, medium and high-income individuals, and families.

The precise demographics for Seattle, Washington, are:

Customer Segmentation

Noble Properties will primarily target the following customer profiles:

- Young adults

- Individuals who earn the region’s median income or more

Competitive Analysis

Direct and indirect competitors.

Noble Properties will face competition from other companies with similar business profiles. A description of each competitor company is below.

Leasing Inc.

Leasing Inc. is a marketplace for finding rental homes and apartments in multiple metropolitan areas around the country. It originally started more than a decade ago as a networking tool for real estate agents, but today it is a fully searchable online database of homes for both sale and rent. Leasing Inc. offers ideal rental properties, all with different amenities that can best suit the tenant’s requirements. Leasing Inc.’s properties are well furnished with all modern accessories and priced competitively.

Rental Barn

Rental Barn is the most visited rental agency website in the United States. Rental Barn and its affiliates offer customers an on-demand experience for selling, buying, renting, and financing with transparency and nearly seamless end-to-end service. The company’s rental property portfolio provides multiple rental apartments according to the customer’s needs and requirements.

Seattle Properties

Seattle Properties is a local rental property business that has dominated the market since 1982. The company manages and rents out hundreds of properties all across the city, including apartments, single-family homes, and mobile homes. All prices are competitive, and some rentals qualify for government programs to help low-income individuals. The company also utilizes a well-designed website to help prospective tenants find their perfect home based on rent, location, and accessories.

Competitive Advantage

- The company will purchase rentals in popular areas around the city, making our rentals in high demand.

Marketing Plan

Brand & value proposition.

The Noble Properties brand will focus on the company’s unique value proposition:

- Offering homes/apartments for rent suited for families and working professionals.

- Offering a diverse range of rental homes in a prime location for a competitive rate.

- Providing excellent customer service.

Promotions Strategy

The promotions strategy for Noble Properties is as follows:

Print Advertising

Noble Properties will invest in professionally designed print ads to display in programs or flyers at industry networking events and relevant local establishments.

Website/SEO Marketing

Noble Properties has designed a website that is well-organized and informative, and lists all our available properties. The website also lists the company’s contact information and other services it provides. We will utilize SEO marketing tactics so that anytime someone types in the Google or Bing search engine “Seattle rental properties” or “rentals near me,” Noble Properties will be listed at the top of the search results.

Referrals

Noble Properties understands that the best promotion comes from satisfied tenants. The company will encourage its tenants to refer other individuals by providing economic or financial incentives for every new tenant produced. This strategy will increase effectiveness after the business has already been established.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand the changing customer needs.

The real estate industry fluctuates, and therefore, rental prices, for the most part, are usually out of a company’s control. However, Noble Properties will market its properties at a competitive rate to ensure we do not have vacant properties. We will also keep tight control of costs in order to maximize profits.

Operations Plan

The following will be the operations plan for Noble Properties.

Operation Functions:

- Joseph Pierce will be the Owner and President of the company. He will oversee all staff and manage tenant relations. Jay has spent the past year recruiting the following staff:

- Karen Miller will serve as the Office Manager. She will manage the office administration, client files, and accounts payable. She will also handle much of the marketing efforts until the agency becomes large enough to hire a marketing team.

- Tim Johnson will be the Maintenance Director, who will provide all maintenance at the properties.

- Joseph will outsource professionals to handle the accounting and human resources aspects of the business.

- Joseph will also hire Rental Managers for the various properties as the agency continues to grow.

Milestones:

Noble Properties will have the following milestones completed in the next six months.

5/1/202X – Finalize contract to lease office space.

5/15/202X – Finalize personnel and staff employment contracts for the Noble Properties team.

6/1/202X – Begin moving into Noble Properties office.

7/1/202X – Finalize purchases of initial properties that will be rented.

7/15/202X – Begin networking and marketing efforts.

8/1/202X – Noble Properties opens its office and rentals for business.

Financial Plan

Key revenue & costs.

Noble Properties’ revenue will come from rental income, property management fees and deposits received from tenants.

The major costs for the company will be staff salaries and property maintenance. In the initial years, the company’s marketing spending will be high to establish itself in the market.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Number of Managed Properties Per Month: 10

- Average Rent Per Month: $2,300

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, rental properties business plan faqs, what is a rental property business plan.

A rental property business plan is a plan to start and/or grow your rental properties business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your rental properties business plan using our rental properties Business Plan Template here .

What are the Main Types of Rental Property Businesses?

There are a number of different kinds of rental property companies , some focus on Single family homes, Multi-family properties and others on Short-Term Rental properties.

How Do You Get Funding for Your Rental Property Business Plan?

Rental Property Businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding. This is true for a real estate rental business plan or a rental property business plan.

A well-crafted rental property business plan is essential to securing funding from any type of potential investor.

What are the Steps To Start a Rental Properties Business?

Starting a rental property business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Rental Property Business Plan - The first step in starting a business is to create a detailed business plan for a rental property that outlines all aspects of the venture. This should include a market analysis, information on the services you will offer, marketing strategy, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your rental properties business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your rental properties business is in compliance with local laws.

3. Register Your Rental Properties Business - Once you have chosen a legal structure, the next step is to register your rental properties business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your rental properties business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Rental Properties Equipment & Supplies - In order to start your rental properties business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your rental properties business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful rental properties business:

- How to Start a Rental Properties Business

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

- Sample Business Plans

- Real Estate & Rentals

Rental Property Business Plan

A rental property business is a great way of earning a passive income. It can help you have great finances if you go about it in the right way.

The rental property market stood at a size of 174.2 bn dollars in the US in 2021. And with the subsiding pandemic isn’t about to shrink any time soon.

Now, if you are planning to become a landlord, you might need just one thing before you start your business. A business plan.

A business plan would become a guide in your business journey. It would also make your journey a less difficult and more successful one. So, if you are ready to start your rental property business , read on to find out all about a rental property business plan.

How can a rental property business plan help you?

A rental property business plan can help you have a clear goal, a well-defined business model, and strategies that work. It can also help you navigate smoothly through roadblocks in your journey and steer clear of costly business mistakes.

Also, putting your idea on paper makes it look more real and clear. Moreover, a business plan also comes in handy while you explain your ideas to your collaborators and investors.

All in all a business plan will help you figure out your way around obstacles through rigorous analysis and strategic planning. This brings us to our next section, how to write a business plan.

Rental Property Business Plan Outline

This is the standard rental property business plan outline which will cover all important sections that you should include in your business plan.

- Business Objectives

- Mission Statement

- Guiding Principles

- Keys to Success

- Start-Up Summary

- Location and Facilities

- Products/Services Descriptions

- Competitive Comparison

- Market Size

- Industry Participants

- Main Competitors

- Market Segments

- Market Tests

- Market Needs

- Market Trends

- Market Growth

- Positioning

- SWOT Analysis

- Strategy Pyramid

- Unique Selling Proposition (USP)

- Competitive Edge

- Positioning Statement

- Pricing Strategy

- Promotion and Advertising Strategy

- Marketing Programs

- Sales Forecast

- Sales Programs

- Exit Strategy

- Organizational Structure

- Steve Rogers

- Linda Rogers

- Management Team Gaps

- Personnel Plan

- Important Assumptions

- Start-Up Costs

- Source and Use of Funds

- Projected Profit and Loss

- Projected Cash Flow

- Projected Balance Sheet

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

After getting started with Upmetrics , you can copy this rental property business plan example into your business plan and modify the required information and download your rental property business plan pdf and doc file. It’s the fastest and easiest way to start writing your business plan.

How to write a rental property business plan?

Before writing a business plan, it is always good to ask yourself a few questions. It would surely make the process shorter and easier.

You should think about the following questions:

- What do you wish to achieve with your business?

- Who is your target audience?

- How would your business model work?

- What are your sources of funding?

- What would be your marketing strategy and so on?

All these questions would help you understand what you are getting yourself into. After that, you can start writing a business plan that focuses on all the different aspects of your business.

You can easily write such a plan either by using a premade template on the internet or through an online business plan software that’ll help you write a flexible and ever-changing plan.

What to include in a rental property business plan?

This section would give you a brief overview of the segments you can include in your business plan to make it a well-rounded one. They are as follows:

1. Executive Summary

The executive summary section contains a precise summary of all that your business stands for. If written well, it can help your business in getting funded. As it is mostly the only page an investor would read.

Professionals frequently suggest that this section should be written at the very end while writing your business plan, even if it is the first page. This helps you in summing up your business ideas properly.

2. Company Description

This section would consist of all the information about your business including its location, the services you offer, and your team.

It would also have information about your company’s history and its current position in the market. You can also include information about the projects you have worked on in the past.

3. Market Analysis

This is one of the chief sections of any business plan. It helps you understand what you are getting yourself into.

In this section, write down everything you can find out about the market. Include your target market, ways of reaching out to them, your market position, etc. Also, it is a good practice to include competitive analysis and take note of what your direct and indirect competitors are doing.

4. Marketing Strategy

While market analysis helps you in understanding the market, a marketing strategy helps you while getting into the market.

While formulating a marketing strategy, the most important thing is to have your target audience and market position in mind. Besides, keep in mind that your branding campaign should resonate with the client base you plan on serving.

5. Organization and management

This section includes information about the functioning aspects of your firm as well as about your team.

Include the roles and responsibilities of your team members as well as the progress they are making in their work.

If you write this section clearly and precisely, you’ll be able to identify the gaps you have in your team and your management system. This helps you in resolving those issues on time.

6. Financial Plan

This is one of the most crucial aspects of your business plan. More so in the rental property business. Planning your finances early on saves you from having financial troubles later on.

A financial plan section includes everything from your financial history, funding options, and requirements to projected cash flow and profits.

Download a sample rental property business plan

Need help writing your business plan from scratch? Here you go; download our free rental property business plan pdf to start.

It’s a modern business plan template specifically designed for your rental property business. Use the example business plan as a guide for writing your own.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Rental property business plan summary

In conclusion, a good business plan can help you have good finances, a proper marketing strategy, a well-managed company and team as well as clear business goals.

Especially, in the rental property business, planning the flow and structure of your business as well as your finances can take you a long way.

A rental property business depends highly upon well-managed finances and strategies. Planning your business is necessary to make it a good source of passive or primary income.

Moreover, it also makes the process of carrying out your business easier and smoother. So, if you are ready to start your rental property business, go ahead and start planning.

Related Posts

Party Rental Business Plan

Real Estate Investment Business Plan

400+ Business Plan Samples

How to Write Business Plan Step By Step

10 Main Components of a Business Plan

Important Location Strategy for a Business

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to Write a Business Plan as a Landlord

Editor's Note: This post was originally published in April 2020 and has been completely revamped and updated for accuracy and comprehensiveness.

Buying investment properties and renting them out to tenants is a great way to diversify your real estate portfolio and earn passive income. If you are considering becoming a landlord, writing a rental property business plan is vital to make your investment thoughtfully and deliberately. A well-crafted business plan can help you secure financing from lenders. A business plan demonstrates that you clearly understand your business and its potential, making you more attractive to potential lenders. Let's begin! This piece will walk you through what a rental property business plan is, why you should create one, and how to put one together.

What is a rental property business plan?

Most simply, a rental property business plan is a document that describes the following:

- You and your rental business.

- What your intentions and goals are with a property.

- Your plan for executing these goals.

Your rental property business plan will outline the strategies and goals for managing your properties.

Why should you develop a rental business plan?

Here are some reasons why you should create a rental property business plan:

- Provides a clear direction: A business plan outlines the goals and objectives of the rental property business, which helps you stay focused on achieving your vision. It also provides a roadmap for decision-making and ensures all activities align with the overall strategy.

- Helps secure financing: A business plan shows that you understand your business well, making your business more appealing to lenders.

- Identifies potential risks: A business plan identifies potential risks associated with the rental property business and provides strategies to mitigate them. This helps to avoid costly mistakes and ensures that you're well-prepared for any challenges that may arise.

- Enhances property management: A business plan includes a strategy outlining how you will manage your rental properties effectively.

- Enables monitoring and evaluation: A business plan provides performance metrics that will help you to monitor and evaluate your progress. This also allows you to identify areas for improvement and adjust your strategy accordingly.

First things first — set your business plan objectives.

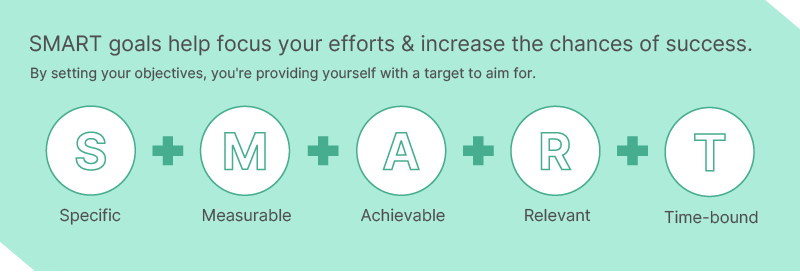

Before creating your business plan, consider your specific objectives for your rental business. By setting your objectives, you're providing yourself with a target to aim for. A SMART goal incorporates all of these criteria to help focus your efforts and increase the chances of achieving your goal. This is a specific, measurable, achievable, relevant, and time-bound goal commonly used in business and project management to set and achieve goals.

The acronym SMART stands for:

- S - Specific: The objective should be clear and well-defined so everyone involved understands what they need to accomplish.

- M - Measurable: The objective should be quantifiable to measure and track progress over time.

- A - Achievable: The objective should be realistic and achievable based on available resources and the timeframe.

- R - Relevant: The objective should be relevant to your business's or project's overall mission or goals.

- T - Time-bound: The objective should have a specific deadline or timeframe for completion so you can monitor progress and make adjustments as needed.

Here are some examples of SMART goals for a rental investment business:

- Own four properties by the end of the year

- Earn $5k in rental revenue per month

- Earn $150k in rental profit by the end of year 5

- Hire a team of 4 business partners and open an office in Nashville, TN, in the next five years

- Find 15 tenants by the end of next year

You may only have one key objective or multiple, but each goal should have strategies and tactics to help achieve it.

Strategies and tactics for your SMART objectives

Let's take the relatively straightforward objective — own four properties by the end of the year. Easier said than done, right? Your strategy will be your rough game plan to achieve this goal. Here are some examples of strategies you may employ:

- Study local housing markets to find undervalued neighborhoods.

- Use hard money lending groups and meetups to help secure capital.

- Specialize in and become a master of a specific housing type (single-family homes, duplexes, apartments, townhouses, etc.)

You can then drill down each strategy into specific tactics. Here's what that looks like:

Study local housing markets to find undervalued neighborhoods:

- Study Zillow and MLS listings to see locations and figures of sales.

- Physical drive-thrus of neighborhoods to see house styles, number of For Sale signs

- Attend foreclosure auctions in different Tennessee counties

- Leverage social media to identify potential properties

- Try creative methods to find undervalued properties beyond the MLS

Use hard money lending groups and meetups to secure affordable and scalable financing:

- Join online hard money communities and see which lenders offer low rates, good terms, etc.

- Go to real estate conferences and network with lenders, wholesalers, etc.

Specialize in and become a master of a specific housing type:

Focus on 3br/2b single-family homes between 1500-2500 sq feet

How to write a rental property business plan

Now that you've thought about precisely why and how you will structure your business and execute your investment, it's time to write it! A rental property business plan should have the following components: The business plan typically includes the following elements:

- Executive Summary

- Business Description

- Market Analysis

- Marketing and Advertising

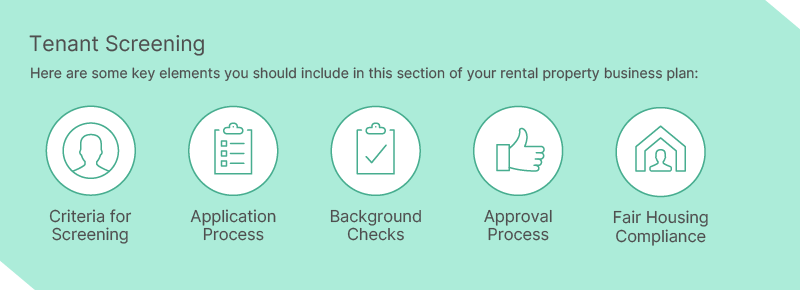

- Tenant Screening

Property Management

- Financial Projections

Risk Management

- Exit Strategy

Let's go through each of them separately.

Executive summary

The executive summary of a rental property business plan provides an overview of the key points of the plan, highlighting the most critical aspects. Here's an example of an executive summary:

[Your Business Name] is a real estate investment firm focused on acquiring and managing rental properties in [location]. The business aims to provide tenants high-quality rental properties while generating a steady income stream for investors. The rental property portfolio comprises [number] properties, including [type of properties]. These properties are located in [location], a growing market with a high demand for rental properties. The market analysis shows that rental rates in the area are stable, and the demand for rental properties is expected to increase in the coming years. The business's marketing and advertising strategies include online advertising, signage, and word-of-mouth referrals. The tenant screening process is thorough and includes income verification, credit checks, and rental history verification. The property management structure is designed to provide tenants with excellent service and to maintain the properties in excellent condition. The business works with a team of experienced property managers, maintenance staff, and contractors to ensure that the properties are well-maintained and repairs are made promptly. The financial projections for the rental property portfolio are promising, with projected revenue of [revenue] and net income of [net income] over the next [timeframe]. The risks associated with owning and managing rental properties are mitigated through careful screening of tenants, regular maintenance, and appropriate insurance coverage. Overall, [Your Business Name] is well-positioned to succeed in the rental property market in [location], thanks to its experienced team, careful management, and commitment to providing high-quality rental properties to tenants while generating a steady stream of income for investors.

Your executive summary is the Cliff Notes version of the complete business plan. Someone should be able to understand the full scope of the project just by reading this section. When writing your executive summary, assume it is the only part of your plan that someone reads. Aim for a half-page to full-page in length.

Business description

The business description section of a rental property business plan provides an overview of the company, including its mission, history, ownership structure, and management team. Here's an example of a company description section:

[Your Company Name] is a real estate investment company focused on acquiring and managing rental properties in [location]. The company was founded in [year] by [founder's name], who has [number] years of experience in the real estate industry.

Mission: Our mission is to provide high-quality rental properties to tenants while generating a steady income stream for our investors. We aim to be a trusted and reliable partner for tenants, investors, and stakeholders in our communities.

Ownership structure: [Your Company Name] is a privately held company with [number] of shareholders. The majority shareholder is [majority shareholder name], who holds [percentage] of the company's shares.

Management team: The management team of [Your Company Name] includes experienced professionals with a proven track record of success in the real estate industry. The team is led by [CEO/Managing Director's name], who has [number] years of experience in real estate investment and management. The other members of the management team include:

[Name and position]: [Brief description of their experience and role in the company] [Name and position]: [Brief description of their experience and role in the company]

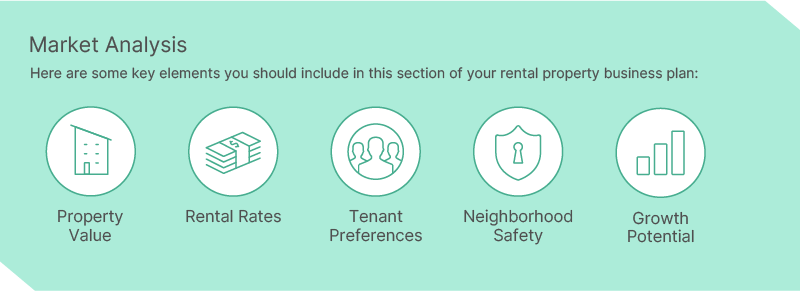

Market analysis

Researching neighborhood trends can help you identify areas poised for long-term growth. This can enable you to make strategic investments that will appreciate over time, providing a stable source of income for years to come. The Market Analysis section of a rental property business plan for landlords should provide a comprehensive overview of the local rental market. Below are some key elements you should include in the Market Analysis section of your rental property business plan.

- Property Value: The value of a rental property is highly dependent on its location. By researching neighborhood trends, landlords can stay updated on changes in property values, both positive and negative. They can make informed decisions about whether to purchase, hold or sell their properties based on changes in the area.

- Rental Rates: Knowing the rental rates in a neighborhood can help landlords determine how much to charge for rent. Understanding how much other landlords charge for similar properties in the area can help a landlord price their property competitively and attract quality tenants.