Financial Tips, Guides & Know-Hows

Home > Finance > Assignment Of Trade (AOT) Definition

Assignment Of Trade (AOT) Definition

Published: October 9, 2023

Get a clear understanding of Assignment of Trade (AOT) in the world of finance. Learn the definition and how it affects various financial transactions.

- Definition starting with A

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

A Complete Guide to Assignment of Trade (AOT) Definition in Finance

Welcome to our finance blog, where we provide valuable insights into various aspects of the financial world. In this article, we are going to dive into the world of Assignment of Trade (AOT) and provide a comprehensive definition, along with key takeaways to help you better understand this concept. If you’ve ever wondered about the AOT and its implications in finance, you’ve come to the right place.

Key Takeaways:

- AOT refers to the transfer of rights and obligations associated with a trade from one party to another.

- It is commonly used by financial institutions and investors who want to transfer their positions without disturbing the underlying assets or contracts.

Now, let’s dive into the definition and intricacies of Assignment of Trade (AOT) in finance.

Understanding Assignment of Trade (AOT)

Assignment of Trade (AOT) is a concept widely used in finance, where one party assigns its rights and obligations associated with a trade to another party. It allows for the transfer of positions, such as futures contracts, options contracts, or other financial instruments, without the need to disturb the underlying assets or contracts.

In simpler terms, AOT allows financial institutions, investors, or traders to transfer their rights and responsibilities for a trade to another party, without needing to close the positions or terminate the contracts involved. This transfer can take place due to a variety of reasons, such as the need to manage risk or meet specific investment objectives.

The Process of Assignment of Trade (AOT)

When executing an Assignment of Trade (AOT), several steps are typically involved:

- The party seeking to assign its trade positions (assignor) identifies a willing party (assignee) who is interested in taking over the trade.

- Both parties negotiate and agree upon the terms and conditions of the assignment, including any potential fees or considerations.

- A formal contract or agreement is drafted and signed by both the assignor and assignee.

- The assignee assumes the rights and obligations associated with the trade, while the assignor’s involvement is effectively terminated.

- The assignee now takes over the trade and manages it according to their own strategies and objectives.

Benefits of Assignment of Trade (AOT)

The Assignment of Trade (AOT) offers several benefits for financial institutions, investors, and traders alike. Here are a few key advantages:

- Flexibility: AOT provides the flexibility to transfer positions without the need for liquidation or terminating contracts, allowing for efficient portfolio management.

- Risk Management: It enables investors to manage their risk exposure effectively by transferring positions to parties with a different risk appetite.

- Access to Market Opportunities: AOT allows market participants to seize investment opportunities by quickly transferring positions to capitalize on emerging trends.

- Cost Efficiency: Transferring positions through AOT can be cost-effective, as it eliminates the need for closing and reopening trades.

The Assignment of Trade (AOT) is an important concept in finance that enables the transfer of rights and obligations associated with a trade from one party to another. Whether you are a financial institution, investor, or trader, understanding AOT can be beneficial for managing your positions, optimizing risk exposure, and seizing market opportunities.

We hope this article has provided you with a clear definition and insights into Assignment of Trade (AOT). If you have any further questions or want to explore this topic in more depth, feel free to reach out to us. Stay tuned for more informative articles from our finance category!

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

Private Sector Adjustment Factor (PSAF) Definition

Biothermal Energy Definition

Latest articles.

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Written By:

Financial Literacy Matters: Here’s How to Boost Yours

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

Understanding XRP’s Role in the Future of Money Transfers

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Related post.

By: • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/assignment-of-trade-aot-definition/

If you still have questions or prefer to get help directly from an agent, please submit a request. We’ll get back to you as soon as possible.

Please fill out the contact form below and we will reply as soon as possible.

- Economics, Finance, & Analytics

- Investments, Trading, and Financial Markets

Assignment of Trade - Explained

What is an Assignment of Trade?

Written by Jason Gordon

Updated at April 23rd, 2024

- Marketing, Advertising, Sales & PR Principles of Marketing Sales Advertising Public Relations SEO, Social Media, Direct Marketing

- Accounting, Taxation, and Reporting Managerial & Financial Accounting & Reporting Business Taxation

- Professionalism & Career Development

- Law, Transactions, & Risk Management Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations Operations, Project, & Supply Chain Management Strategy, Entrepreneurship, & Innovation Business Ethics & Social Responsibility Global Business, International Law & Relations Business Communications & Negotiation Management, Leadership, & Organizational Behavior

- Economics, Finance, & Analytics Economic Analysis & Monetary Policy Research, Quantitative Analysis, & Decision Science Investments, Trading, and Financial Markets Banking, Lending, and Credit Industry Business Finance, Personal Finance, and Valuation Principles

What is Assignment of Trade?

An assignment of trade (AOT) is a tri-party agreement in the trade of mortgage-backed securities (MBS) in which a party in the initial agreement assigns his obligation to a third party. An assigned trade occurs when a counterparty in a forward contract or trade makes a separate deal with a third party to assign him his obligations. Assignment of Trade (AOT) can also occur in other trades where the seller who has an agreement with the buyer contacts a middleman or a broker-dealer to execute this transaction.

How Are Assignment of Trade Used?

In the United States, the Securities Industry and Financial Markets Association (SIFMA) has made AOT a formal process. Assignments of trade are used to avoid the need to deliver or receive deliveries from a To-Be-Announced (TBA) trade. Assignments can be used to facilitate the pricing and purchase of loans by a third party to whom the trade is assigned. Hence, the third party or assignee is responsible for making the delivery of a mortgage-backed security to the initial TBA trade. Through AOT, the originator of a mortgage can reverse its hedge position by assigning his obligations to a third party.

How does Assignment of Trade Work?

Essentially, AOT is a strategy that helps assignors eliminate risk by moving book mortgages. The assignor unwinds his hedge position in the MBS, the security must be delivered to the other party. Mr. A is an assignor who attempts to create a hedge against some risks related to a loan he issued. He enters a future contract with a broker in which he sells a mortgage-backed security to the broker for future delivery. Now, the broker is expecting to receive the security at a future date, and the assignor has the obligation to deliver the security. If the assignor then enters into a different agreement with an investor (assignee) who is interested in taking the loans and fulfilling the assignor's obligation to the broker, an assignment of trade has occurred. Once an agreement is made between the assignor and assignee, the assignee holds the loan, benefits from interest rates and profits of the loan but also faces the default risk of that loan. The assignee is also responsible for the delivery of the MBS to the broker at a future time.

Related Articles

- Greater Fool Theory - Explained

- Calamity Call - Explained

- AC-DC Option - Explained

- Roth IRA - Explained

Trade Finance: Streamlining Transactions through Assignment of Proceeds

1. introduction to trade finance and assignment of proceeds, 2. understanding the assignment of proceeds process, 3. benefits of using assignment of proceeds in trade finance, 4. types of transactions suitable for assignment of proceeds, 5. legal framework for assignment of proceeds, 6. how banks mitigate risk in assignment of proceeds transactions, 7. successful implementation of assignment of proceeds in trade finance, 8. challenges and disadvantages of using assignment of proceeds, 9. conclusion and future of assignment of proceeds in trade finance.

Trade finance includes various financial instruments that help facilitate international trade . One such financial instrument is the Assignment of Proceeds (AOP). AOP is a process in which a seller/exporter assigns the right to receive payment to a bank, which then releases the payment to the seller/exporter upon receipt of certain documents. AOP is often used in international trade transactions to mitigate payment risk for both the buyer/importer and seller/exporter.

Here are some key points to understand about AOP:

1. AOP is a payment mechanism that involves three parties: the seller/exporter, the buyer/importer, and the bank.

2. The seller/exporter assigns the right to receive payment to the bank, which acts as an intermediary in the transaction.

3. The buyer/importer agrees to pay the bank upon receipt of certain documents, such as a bill of lading or commercial invoice.

4. Once the bank receives the payment from the buyer/importer, it releases the payment to the seller/exporter.

5. AOP can help mitigate payment risk for both the buyer/importer and seller/exporter. The buyer/importer can be assured that the payment will only be released upon receipt of the required documents, while the seller/exporter can be assured of payment once the documents are submitted to the bank.

6. AOP can also help streamline the payment process, as the bank acts as an intermediary between the buyer/importer and seller/exporter.

7. AOP can be used in various types of trade transactions, such as letters of credit or open account transactions.

For example, let's say a company in the United States wants to purchase goods from a company in China. The Chinese company may require that the payment be made through AOP to mitigate payment risk. The U.S. Company would then agree to pay the bank upon receipt of certain documents, such as a bill of lading or commercial invoice. Once the bank receives the payment from the U.S. Company, it releases the payment to the Chinese company. This ensures that the Chinese company will receive payment once the required documents are submitted, and the U.S. Company can be assured that the payment will only be released once the documents are received.

Introduction to Trade Finance and Assignment of Proceeds - Trade Finance: Streamlining Transactions through Assignment of Proceeds

Trade finance is a complex and dynamic industry that requires a thorough understanding of its processes and procedures to ensure the smooth flow of transactions. One such process is the Assignment of Proceeds (AOP) process, which is a vital aspect of trade finance. The AOP process is a mechanism that enables the transfer of payment from the buyer's bank to the seller's bank through an intermediary bank. This process is used to mitigate the risk of non-payment by the buyer and to ensure that the seller receives payment for their goods or services. Understanding the AOP process is crucial for anyone involved in trade finance, from buyers and sellers to banks and intermediaries.

Here are some key points to consider when understanding the AOP process:

1. How it works: The AOP process involves an agreement between the buyer and the seller that stipulates the terms of payment. Once the agreement is in place, the buyer's bank issues a letter of credit (LC) to the seller's bank, which guarantees payment. The seller's bank then requests that an intermediary bank issue an AOP, which instructs the buyer's bank to pay the seller directly. The intermediary bank holds the payment in an escrow account until the conditions of the sale have been met.

2. The benefits of using the AOP process: The AOP process is beneficial for both the buyer and the seller. For the buyer, it provides a secure method of payment and reduces the risk of non-payment. For the seller, it ensures that they receive payment for their goods or services and provides protection against the risk of non-payment.

3. The role of intermediaries: Intermediary banks play a crucial role in the AOP process. They act as a neutral third party and ensure that the conditions of the sale have been met before releasing the payment to the seller. Intermediaries also provide a layer of protection for both the buyer and the seller by verifying the authenticity of the documents and ensuring compliance with international trade regulations.

4. Examples of AOP in practice: The AOP process is widely used in international trade, especially in high-value transactions. For example, a company that exports machinery to another country may use the AOP process to ensure that they receive payment for their products. Similarly, a company that imports raw materials may use the AOP process to ensure that they receive quality goods and that payment is only released once the goods have been verified.

The AOP process is a crucial aspect of international trade finance and requires a thorough understanding to ensure its smooth operation. By following the key points outlined above, buyers, sellers, and intermediaries can ensure that transactions are carried out efficiently and securely.

Understanding the Assignment of Proceeds Process - Trade Finance: Streamlining Transactions through Assignment of Proceeds

Assignment of proceeds is a vital tool in trade finance that streamlines transactions and mitigates risk for all parties involved. The benefits of using assignment of proceeds have been recognized by both buyers and sellers in international trade. From a seller's perspective, assignment of proceeds offers an assurance of payment from the buyer's bank, which reduces the risk of non-payment. In contrast, buyers can benefit from the use of assignment of proceeds by reducing the risk of fraud and ensuring that the goods they receive are of the expected quality.

To further understand the advantages of using assignment of proceeds in trade finance, here are some points to consider:

1. Mitigates Risk for All Parties Involved: One of the primary benefits of using assignment of proceeds is that it reduces the risk of non-payment for the seller. By using this tool, the seller can ensure that they will receive payment for their goods as long as they meet the agreed-upon terms of the contract. Similarly, buyers can be assured that they will only pay for goods that have been delivered and meet the expected quality standards.

2. Streamlines Transactions: Another advantage of using assignment of proceeds is that it streamlines transactions. By using this tool, the seller's bank is authorized to receive payment directly from the buyer's bank, which eliminates the need for the seller to wait for payment or for the buyer to manually issue payment. This simplifies the transaction process, making it faster and more efficient.

3. reduces the Risk of fraud : Since the bank acts as an intermediary between the buyer and seller, assignment of proceeds helps to reduce the risk of fraud. The bank ensures that all documentation and requirements are met before releasing payment, which reduces the risk of fraudulent activity. This benefit is particularly important in international trade, where the risk of fraud is higher due to differences in legal systems and business practices.

4. Provides Flexibility: Assignment of proceeds can be customized to meet the unique needs of each trade transaction. For example, it can be used to finance the purchase of goods, to secure payment for services rendered, or to facilitate the release of goods from a warehouse. This flexibility makes it an ideal tool for a wide range of trade finance transactions.

The benefits of using assignment of proceeds in trade finance are numerous. From mitigating risk to streamlining transactions, this tool provides a range of advantages to both buyers and sellers. By understanding the benefits of using assignment of proceeds, businesses can make informed decisions that reduce risk and improve efficiency in their trade transactions.

Benefits of Using Assignment of Proceeds in Trade Finance - Trade Finance: Streamlining Transactions through Assignment of Proceeds

When it comes to trade finance, the assignment of proceeds is a crucial aspect that streamlines transactions. It is a technique that involves the transfer of rights to receive payment from the buyer's bank to the seller's bank. This process reduces the risk of non-payment and provides assurance to both the buyer and the seller. However, not all transactions are suitable for the assignment of proceeds. Certain factors need to be considered before deciding to use this technique. In this section, we will delve into the types of transactions that are suitable for the assignment of proceeds.

1. International Trade Transactions: The most common type of transaction suitable for the assignment of proceeds is international trade transactions. These transactions involve buyers and sellers from different countries, and the involvement of multiple banks increases the risk of non-payment. The assignment of proceeds ensures that the payment is made to the seller's bank before the buyer receives the goods, which reduces the risk of non-payment.

2. High-Value Transactions: High-value transactions are also suitable for the assignment of proceeds. These transactions involve a significant amount of money, and the risk of non-payment is high. The assignment of proceeds provides security to both the buyer and the seller, ensuring that the payment is made to the seller's bank before the buyer receives the goods.

3. Complex Transactions: Complex transactions, such as those involving multiple parties, are also suitable for the assignment of proceeds. These transactions may involve different banks, intermediaries, and legal entities. The assignment of proceeds simplifies the payment process and reduces the risk of non-payment.

4. Commodity Transactions: Commodity transactions are also suitable for the assignment of proceeds. These transactions involve the sale and purchase of raw materials, such as oil, gas, and metals. The assignment of proceeds provides assurance to both the buyer and the seller that the payment will be made on time.

The assignment of proceeds is a valuable technique that streamlines transactions and reduces the risk of non-payment. However, it is essential to consider the type of transaction before deciding to use this technique. International trade transactions, high-value transactions, complex transactions, and commodity transactions are the types of transactions that are suitable for the assignment of proceeds.

Types of Transactions Suitable for Assignment of Proceeds - Trade Finance: Streamlining Transactions through Assignment of Proceeds

The legal framework for the assignment of proceeds is an essential component in trade finance. It provides the legal basis for the transaction, ensuring that the rights and obligations of all parties involved are clearly defined and understood. The framework typically involves an agreement between the buyer, the seller, the issuing bank, and the advising bank. The buyer agrees to pay the seller for the goods or services, and the seller assigns the right to receive payment to the bank. The bank then agrees to pay the seller once it has received payment from the buyer.

Here are some key points to understand about the legal framework for the assignment of proceeds:

1. The agreement between the buyer, seller, and banks must be clearly defined and in writing to ensure that all parties understand their roles and obligations.

2. The agreement must also specify the conditions under which the bank will release the funds to the seller. For example, the seller may need to provide certain documents before the bank can release the funds.

3. The legal framework for the assignment of proceeds can vary depending on the jurisdiction in which the transaction takes place. It's important to consult with legal experts to ensure that the agreement complies with all relevant laws and regulations .

4. One of the advantages of the assignment of proceeds is that it can help to mitigate risk for all parties involved. For example, the seller may be more willing to ship goods to a buyer in a foreign country if they know that they will receive payment from a bank.

5. In some cases, the assignment of proceeds can also be used to finance the transaction. For example, the seller may use the assignment of proceeds as collateral to obtain financing from a bank.

Overall, the legal framework for the assignment of proceeds is a critical component of trade finance. It provides a clear and transparent basis for the transaction, helping to mitigate risk and ensure that all parties understand their roles and obligations.

Legal Framework for Assignment of Proceeds - Trade Finance: Streamlining Transactions through Assignment of Proceeds

Mitigating risk is a crucial aspect of trade finance, especially when it comes to assignment of proceeds transactions. Banks have to be extra cautious when dealing with these types of transactions since the slightest mistake can lead to significant financial losses. The primary concern in these transactions is ensuring that the buyer pays the exporter, and the exporter delivers the goods to the buyer. Thus, banks have deployed various risk-mitigating measures, which include:

1. Documentary Credit: Banks use documentary credit, also known as letters of credit, to mitigate risk. In this case, the buyer's bank issues a letter of credit to the seller, promising to pay the seller once the goods have been shipped and the seller has provided the necessary documents. The bank acts as an intermediary, ensuring that both parties fulfill their obligations before releasing payment.

2. Due Diligence: Banks conduct extensive due diligence on both the buyer and the seller to ensure that they are reputable and trustworthy. They verify the buyer's creditworthiness and check if the seller has a history of delivering substandard goods or not fulfilling their obligations.

3. Insurance: Banks use insurance to mitigate the risk of loss or damage to goods during transit. Insurance covers the cost of the goods and ensures that the seller receives payment even if the goods are lost or damaged during transit.

4. Collateral: Banks may require the buyer to provide collateral to mitigate the risk of default . Collateral can be in the form of cash, securities, or assets that the bank can liquidate if the buyer defaults on their payment.

5. Legal Agreements: Banks may require both parties to sign legal agreements that outline each party's obligations and responsibilities. These agreements help to ensure that both parties fulfill their obligations, and in case of a dispute, the bank can refer to the agreement to resolve the issue.

Mitigating risk is a critical aspect of trade finance, and banks have deployed various measures to ensure that they mitigate the risks associated with assignment of proceeds transactions. These measures include using documentary credit, conducting due diligence , using insurance, requiring collateral, and signing legal agreements. By deploying these measures, banks can ensure that these transactions are streamlined, and both parties fulfill their obligations.

How Banks Mitigate Risk in Assignment of Proceeds Transactions - Trade Finance: Streamlining Transactions through Assignment of Proceeds

Trade finance is a complex process that involves numerous parties, transactions, and risks. One of the key concerns for exporters and importers is ensuring payment security throughout the trade process. The assignment of proceeds is a widely used mechanism to mitigate payment risks in trade finance. By assigning the right to receive payment to a bank, the exporter can ensure that it receives payment for the goods or services provided, while the importer can ensure that the payment is only released upon the receipt of the goods or services. In this section, we will delve into the successful implementation of the assignment of proceeds in trade finance. We will explore the benefits of using this mechanism, the challenges that can arise, and how to overcome them.

1. Benefits of the assignment of proceeds: The assignment of proceeds provides several benefits to both parties involved in the trade transaction. For the exporter, it ensures that it receives payment for the goods or services provided, which can be particularly important when trading with new or unfamiliar partners. For the importer, it provides assurance that the payment will only be released once the goods or services have been received, reducing the risk of fraud or non-delivery. Furthermore, the use of this mechanism can help improve the creditworthiness of the parties involved, making it easier for them to secure financing for future trade transactions.

2. Challenges and how to overcome them: Despite its benefits, the assignment of proceeds can also pose several challenges. One of the main challenges is ensuring that the parties involved understand the mechanism and their respective roles and responsibilities. This can be particularly challenging when dealing with new partners or when the trade transaction involves multiple parties. To overcome this challenge, it is important to provide clear and concise instructions and to ensure that all parties are aware of the terms and conditions of the assignment of proceeds. Another challenge is ensuring that the documentation is accurate and complete. This can be particularly important when dealing with letters of credit, which can be complex and require careful attention to detail. To overcome this challenge, it is important to work with experienced trade finance professionals who are familiar with the documentation requirements and can provide guidance and support throughout the process.

3. Case study: A successful implementation of the assignment of proceeds in trade finance can be seen in the example of Company X, which was exporting goods to a new partner in a different country. The company was concerned about the risk of non-payment or fraud, given the unfamiliarity of the partner and the distance involved. To mitigate this risk, the company worked with its bank to assign the right to receive payment to the bank, which would only release the payment once the goods had been received by the partner. The bank also provided support with the documentation and ensured that the terms and conditions of the assignment of proceeds were clearly communicated to all parties involved. As a result, the trade transaction was completed successfully, and both parties were satisfied with the outcome.

Successful Implementation of Assignment of Proceeds in Trade Finance - Trade Finance: Streamlining Transactions through Assignment of Proceeds

The Assignment of Proceeds (AOP) is a trade finance technique that helps streamline transactions, particularly in cross-border trading . It involves an agreement between the buyer's bank and the seller's bank, where the buyer's bank agrees to pay the seller's bank once it receives the payment from the buyer. The AOP technique helps reduce the risk of non-payment, as the seller's bank becomes the holder of the payment, and the buyer's bank releases the payment only upon the fulfillment of certain obligations. However, like any other trade finance technique, AOP has its drawbacks and challenges.

1. Lack of control over the payment: With AOP, the seller's bank holds the payment, and the buyer's bank releases it only upon the fulfillment of certain obligations. This can be challenging for the seller, as they have limited control over the payment. For instance, if the buyer disputes the payment, the seller's bank may withhold the payment until the dispute is resolved. This can cause delays and affect the seller's cash flow .

2. Increased cost: AOP involves the participation of multiple banks, which can increase the cost of the transaction. The seller may have to pay a fee to their bank for providing the AOP service, and the buyer may have to pay a fee to their bank for releasing the payment. This can add to the transaction cost and reduce the profit margin for both parties.

3. Complex documentation: AOP involves complex documentation, as it requires the participation of multiple parties. The seller's bank may require the buyer to provide certain documents, such as a letter of credit or a purchase order, to ensure that the payment is released only upon the fulfillment of certain obligations. This can be time-consuming and add to the administrative burden of both parties.

4. Limited applicability: AOP is not applicable in all trade transactions. For instance, if the buyer and the seller have a long-standing relationship and trust each other, AOP may not be necessary. In such cases, the parties may opt for other trade finance techniques, such as open account or documentary collection, which may be more cost-effective and less complex.

AOP is a useful trade finance technique that can help reduce the risk of non-payment and streamline transactions. However, it is not without its challenges and disadvantages, and parties should carefully consider their options before opting for AOP.

Challenges and Disadvantages of Using Assignment of Proceeds - Trade Finance: Streamlining Transactions through Assignment of Proceeds

The Assignment of Proceeds (AOP) is a mechanism that has been used for many years to protect the interests of parties involved in trade finance transactions. The AOP is used by buyers and sellers to mitigate the risks of non-payment and non-delivery, respectively. The AOP is also used by banks to secure their interests in the transaction. The future of AOP in the trade finance industry is promising as it streamlines and simplifies transactions for all parties involved.

Here are some insights into the Conclusion and Future of Assignment of Proceeds in Trade Finance:

1. AOP is a reliable and efficient mechanism for securing payment in trade finance transactions. The use of AOP has increased in recent years due to its effectiveness in reducing risks for all parties involved.

2. The use of AOP is not limited to any specific industry or sector. It is applicable to all types of transactions, including commodities, goods, and services.

3. The future of AOP in trade finance is promising due to the increasing demand for secure and reliable mechanisms for transactions. As the world becomes more connected, AOP will continue to be an essential tool for facilitating trade.

4. The use of AOP has been instrumental in reducing the number of disputes and legal issues that arise in trade finance transactions. By providing a secure and efficient mechanism for payment, AOP has helped to streamline transactions and reduce the risks of non-payment and fraud.

5. The rise of digital technologies has made it easier to implement and manage AOP transactions. The use of blockchain technology, for example, has made it possible to automate the entire process, from initiation to settlement.

6. The implementation of AOP requires a thorough understanding of the legal and regulatory frameworks governing trade finance transactions. Banks and financial institutions must ensure that their AOP agreements comply with the relevant laws and regulations in their respective jurisdictions.

The Assignment of Proceeds is an essential mechanism in trade finance transactions. Its use has increased in recent years due to its effectiveness in reducing risks for all parties involved. AOP has helped to streamline transactions and reduce the risks of non-payment and fraud. The future of AOP in trade finance is promising, and its use is expected to grow as the world becomes more connected.

Conclusion and Future of Assignment of Proceeds in Trade Finance - Trade Finance: Streamlining Transactions through Assignment of Proceeds

Read Other Blogs

In the world of digital marketing, Search Engine Marketing (SEM) plays a crucial role in helping...

Before launching a new product or service, startups need to validate their assumptions and test...

Dividend Reinvestment is a powerful tool that can help investors to reinvest their earnings and...

Cord blood is the blood that remains in the umbilical cord and placenta after a baby is born. It is...

In the dynamic world of fashion, the symbiotic relationship between brands and fashion events is...

1. What Is the Payback Period? The Payback Period is a...

In the bustling streets of urban business districts, parking meters stand as silent sentinels,...

In the realm of business, the concept of risk and return is a fundamental principle that guides...

In the evolving landscape of plastic surgery, the integration of blockchain technology through the...

What is Export Finance? A Comprehensive Guide (2020)

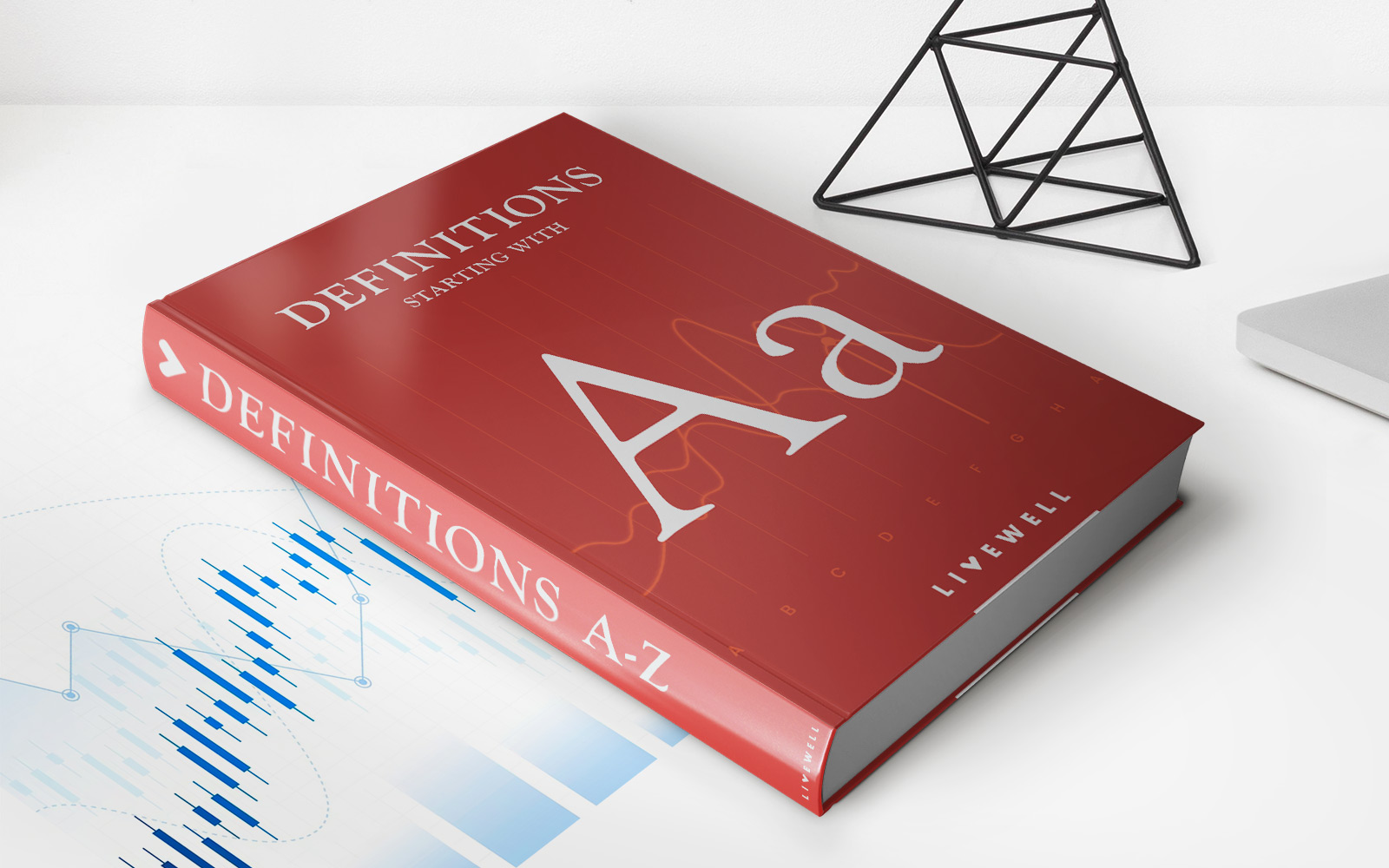

When an exporter’s operating cycle (length of time it takes to sell its inventory and collect on its sales) exceeds the credit terms extended by its trade creditors (suppliers), the exporter has a financing requirement. Export finance is needed to cover the gap between when an exporter is able to turn inventory and trade receivables to cash and when it has to pay on its trade payables.

For the purpose of this guide, export finance refers to the financing of working capital tied to exports, that exporters avail from banks, financial institutions and alternative finance providers (collectively “finance providers”).

The working capital components for trade are inventory (stocks), trade receivables (also known as accounts receivable and trade debtors) and trade payables (also known as accounts payable and trade creditors). The following formulae determine the exporter’s working capital financing requirements:

Inventory + Trade Receivables – Trade Payables Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Working capital financing requirement can be expressed as a number in currency or in days.

The financing required is the net working capital amount and the cash conversion cycle (the difference between its payables days and operating cycle).

This guide covers short term working capital financing, i.e. financing related to items classified under current assets and current liabilities on the exporter’s balance sheet, and excludes from its scope long term financing techniques that may relate to capital goods or projects.

The methods of financing shown are representative, noting that variations exist. This guide is written from a finance provider’s perspective.

How is export finance differentiated within trade finance?

Trade finance is a broad term given to all the financing techniques tied to both imports and exports. However, the methods of financing are different, and they serve different purposes.

Examples of import finance include issuances of documentary credits and payment guarantees, and loans to pay for imports. Import finance techniques are typically provided with recourse to the importer, meaning it will be responsible to repay the finance provider for any funds advanced.

Export finance caters to the working capital financing requirements of exporters, and serves a combination of liquidity and risk mitigation needs. Depending on the nature of financing, some types of export finance may be provided on ‘non-recourse’ basis to the exporter. The favourable effect of non-recourse financing may be a reduction of the exporter’s net working capital and shortening of its cash conversion cycle.

It is important when providing any form of trade finance to understand the purpose of the financing, its appropriateness to the nature of the underlying trade, and the source of repayment or settlement.

Who are the main parties involved in providing export finance?

Export finance may be provided by banks, non-bank financial institutions such as factoring companies, and ‘alternative’ finance providers such as invoice finance marketplaces, trade finance funds and fintechs. Trade credit insurers also have a role, by providing protection to exporters and finance providers for trade receivables.

What are the different export finance products and solutions?

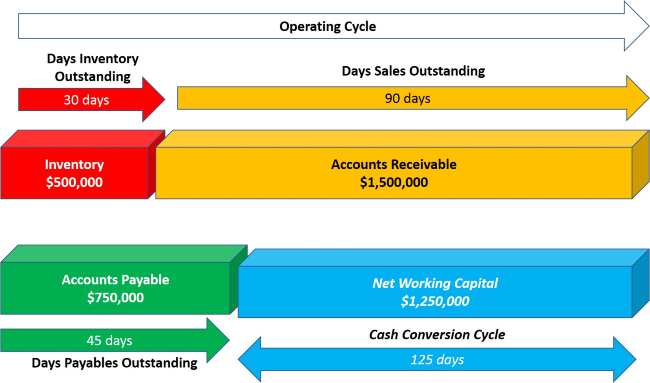

Export finance may be provided within the framework of either documentary trade finance or supply chain finance . The options for financing are linked to the method of payment that the exporter and the buyer have agreed to transact on.

Documentary Trade Finance

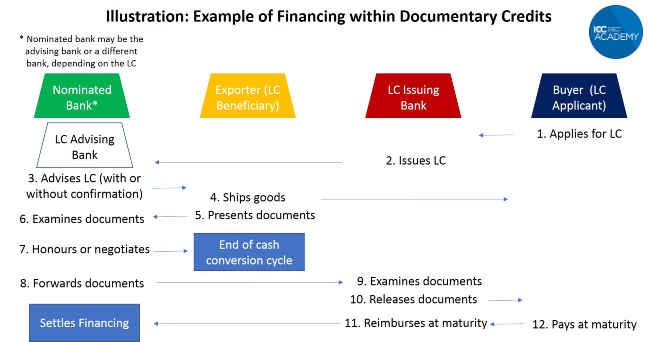

Documentary Credits A documentary credit (also commonly known as letter of credit or LC in short) is a bank undertaking to pay its beneficiary (the exporter) based on a complying presentation of required documents to the issuing bank or a nominated bank (which may be a bank in the location of the exporter). The buyer makes an application to its bank to issue an LC to the exporter, based on terms that the buyer and exporter have agreed beforehand.

The ICC rules applicable to LCs are the Uniform Customs and Practice for Documentary Credits ICC Publication No. 600 (“UCP 600”) , and they apply when the LC indicates that it is subject to the rules.

You can read more about how documentary credits work here and here .

When a nominated bank receives a complying presentation of documents from the exporter, it may prepay or advance funds on the drawn amount, acting on its nomination. Such financing can be on without-recourse basis, if the nominated bank is prepared to take the risk of the issuing bank. If the nominated bank is also a confirming bank, it would be obligated to provide such financing on a without-recourse basis.

There are many types of documentary credits and you can read our comprehensive guide to the different types here .

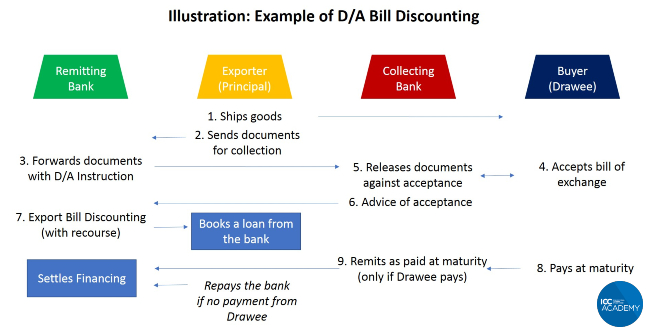

Documentary Collections Documentary collections are used by exporters who wish to utilise banks as intermediaries for the release of documents to the buyer. A collection instruction is sent by the exporter’s bank (called a remitting bank) to a collecting bank in the location of the buyer and stipulates either Documents against Payment (D/P) or Documents against Acceptance (D/A).

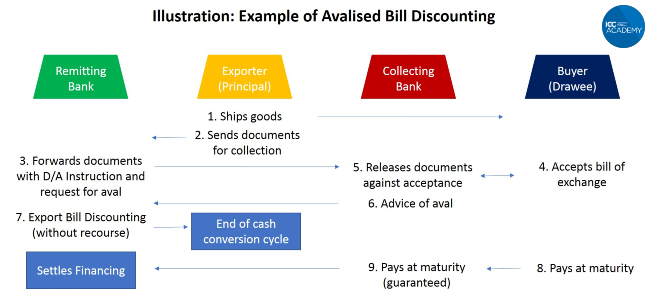

A D/P instruction requires that the buyer pays for the amount drawn on them before documents may be released to them. A D/A instruction requires that the buyer incurs an undertaking to pay, such as accepting a bill of exchange drawn on them, before documents are released to them.

The ICC rules applicable to documentary collections are the Uniform Rules for Collection ICC Publication No. 522 (“URC 522”) , and they apply when a Collection Instruction indicates that it is subject to the rules.

For D/A, the exporter is taking the payment risk of the buyer (drawee), as the collecting bank does not undertake to pay on the due date of the buyer’s payment undertaking. There is no provision in URC 522 for a bank to provide financing to the exporter. However, some banks may provide exporters with an advance against D/A acceptance (variously called Export Bill Discounting, Export Collections Discounting, Export Bill Financing, Export Bill Purchase etc.), which will be settled from proceeds of the D/A. Such financing is usually on with-recourse basis to the exporter.

The illustration below is an example of with-recourse financing of an export collection.

Although not provided for in URC 522, a documentary collection could also instruct that documents be released to the buyer against an ‘aval’ or guarantee by the collecting bank or buyer’s bank. Some banks may provide exporters with non-recourse financing based on the aval. The illustration below is an example of non-recourse financing linked to aval.

If the financing is provided on non-recourse basis to the exporter, the cash conversion cycle of the exporter will be shortened.

Advance Payment

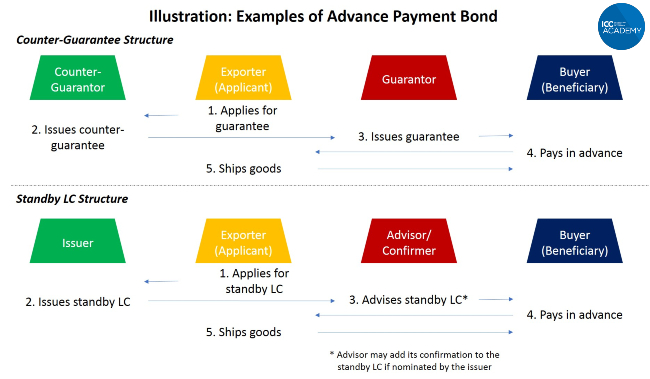

Advance Payment Bond or Guarantee In advance payment, the buyer pays the exporter prior to shipment. The advance payment may be for a partial amount or the full amount of the purchase. The exporter would have no financing requirement for the advance payment but may be required in some cases by the buyer to provide an advance payment bond or guarantee.

An advance payment bond may be issued by the exporter’s bank, in the form of a demand guarantee or a standby letter of credit . It is an undertaking of the guarantor or issuer to pay on a complying demand or presentation by the beneficiary.

For some transactions, the buyer might require that the advance payment bond be payable by a bank in its own geographic jurisdiction. In such cases, the exporter’s bank may issue a counter-guarantee to a bank in the location of the buyer to issue the guarantee, or issue a standby letter of credit that may be confirmed by a bank in the buyer’s location.

The ICC rules applicable to demand guarantees are the Uniform Rules for Demand Guarantees ICC Publication No. 758 (“URDG 758”) , and those that apply to standby letters of credit are the International Standby Practices ICC Publication No. 590 (“ISP98”) and the UCP 600. The choice of rules applies when the undertaking indicates that it is subject to the rules.

Further Learning: If export finance is an important part of your job, consider taking one of our internationally recognised courses and qualifications to bring your knowledge and skills up to ICC-endorsed, global standards. You can choose to focus specifically on export finance over a single course or earn a broader trade finance qualification like our Certified Trade Finance Professional (CTFP) that includes the course on export finance as part of a wider curriculum.

Supply Chain Finance

Supply chain finance (“SCF”) are a set of techniques and practices applied usually (but not exclusively) to the financing of open account trade . They can be classified under two categories:

- Loan or Advance-Based SCF

- Receivables Purchase

We’ll cover each of these categories in turn and the main techniques under each one.

Loan or Advance-Based SCF These include:

- Loan or advance against receivables

- Distributor Finance

- Loan or advance against inventory

- Pre-shipment finance

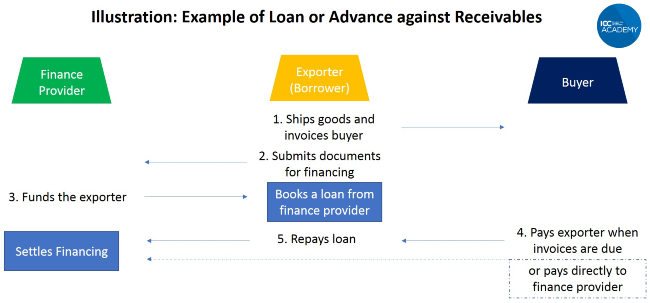

Loan or Advance against Receivables Loans or advances against trade receivables may be variously called Receivables Lending, Receivables Finance, Invoice Financing, Invoice Discounting, Trade Receivable Loans, Trade Loans etc.

A finance provider makes an advance to the exporter (borrower), based on the existence of trade receivables evidenced by invoices to buyers, and transport documents. The tenor of the financing corresponds to the tenor of the receivables, and the financing is to be repaid from the export proceeds. The advance ratio may be 100%, or a lower percentage, of the invoiced amounts. Financing is usually on a with-recourse basis, i.e. the borrower is required to repay the loan or advance when due, even if payment for the receivables is delayed or not made by the buyer.

The loan may be secured by the trade receivables, by way of charge, assignment or pledge – the precise nature of the security arrangement will take into account various factors such as nature of receivables (e.g. if there are restrictions on assignment), jurisdiction(s) involved and commercial arrangement between the parties.

Or the loan could be unsecured, with the receivables serving simply as comfort to the finance provider that the borrower has a source of repayment.

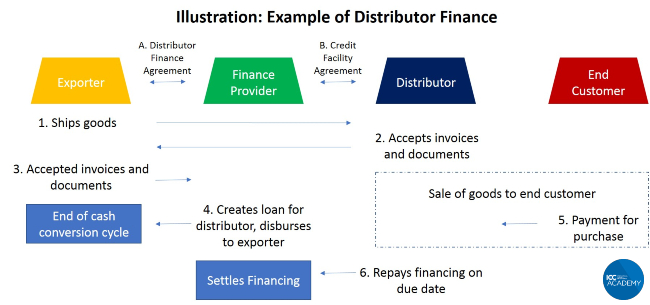

Distributor Finance This type of financing may be variously called Distributor Finance, Buyer Finance, Dealer Finance, Channel Finance etc.

A finance provider may enter an arrangement with the exporter to provide financing to distributors of the exporter’s products in its foreign markets. A distributor may require financing for its cash conversion cycle, when its inventory and receivables days exceed its payables days to the exporter.

The finance provider grants a credit facility to the distributor to pay for its purchases from the exporter on the exporter’s invoice due dates and is repaid by the distributor from the proceeds of the distributor’s sales of the exporter’s products.

The finance provider takes risk on the distributor and may create a security interest in the distributor’s inventory and trade receivables. To further mitigate its risk, the finance provider may have certain arrangements with the exporter for stop-supply, buy-back and risk-sharing.

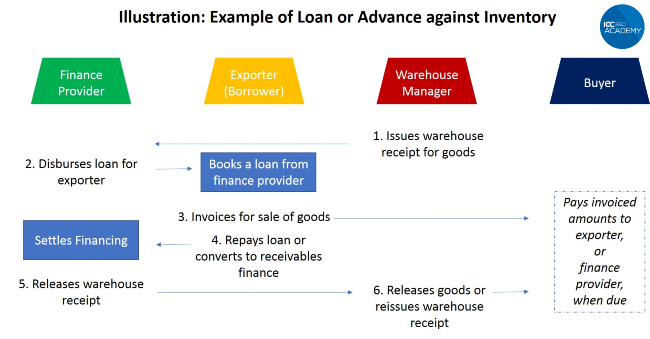

Loan or Advance against Inventory Loans or advances against inventory may be variously called Inventory Finance, Warehouse Finance, Financing against warehouse Receipts etc.

Many variations in structure are possible for inventory finance. The finance provider finances an exporter for a percentage of the value of its inventory which may be pre-sold (for example, under an offtake agreement) or un-sold, taking the goods as collateral.

If the goods are stored in a warehouse, the finance provider may exercise control over the goods by way of contractual agreements with the warehouse operator and may appoint a collateral manager. The finance provider may disburse against delivery to it of warehouse receipts issued by the warehouse manager or collateral manager evidencing the finance provider’s rights to the goods referenced therein.

In order to effect delivery to the buyer, the exporter repays the finance provider which would then release the warehouse receipts for surrender to the issuers.

The illustration below is an example of inventory finance against warehouse receipts.

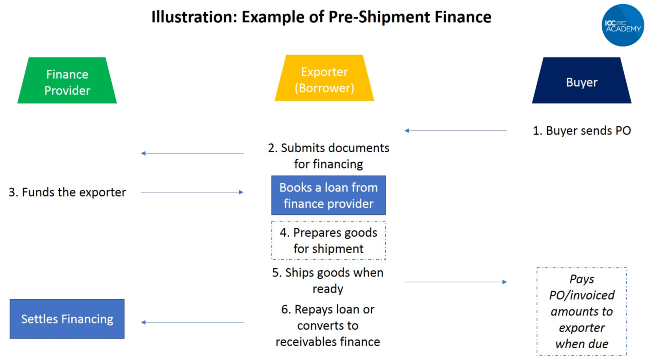

Pre-Shipment Finance Pre-shipment finance is commonly also known as packing credit and purchase order (“PO”) financing. The basis of financing can be a PO, a sales contract or demand forecast.

An exporter may have cashflow requirements for purchase of raw materials, labour, factory costs and other pre-shipment expenses, prior to delivering on its export order. The finance provider may provide financing for a percentage of the exporter’s expenses and may disburse progressively according to the exporter’s stages of order fulfilment.

Settlement of the financing may be from payment by the buyer, or by way of converting the pre-shipment finance to a form of post-shipment financing (e.g. Receivables Discounting).

Receivables Purchase Techniques for Receivables Purchase include:

- Receivables Discounting

- Payables Finance

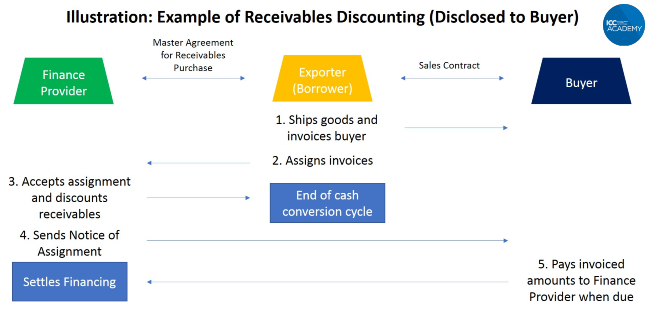

Receivables Discounting Also called Receivables Purchase, Receivables Finance, Invoice Discounting etc., Receivables Discounting is a method of financing in which the exporter sells its trade receivables to the finance provider at a discount.

The trade receivables are commercial debt that is owed the exporter by its customers (buyers) and is normally evidenced by invoices issued by the exporter to the buyers. A finance provider acquires the right to be paid from such commercial debt, typically by way of assignment or transfer of the receivables by the exporter to it.

The primary source of repayment for the financing would be the buyer. The exporter may retain responsibility for the collection of the sold receivables on behalf of the finance provider.

Depending on agreement between the finance provider and exporter, financing can be provided on non-recourse basis, or with limited recourse, to the exporter. Trade receivables may be subject to dilution, i.e. reduction in the amount collected due to credit notes, goods return, warranty claims etc., which the finance provider may consider when setting the advance ratio for its financing.

The sale of receivables to the finance provider can be either disclosed or undisclosed to the buyer.

In a disclosed structure, notice of the exporter’s assignment or transfer of the receivables is served on the buyer, and the buyer may be instructed to pay directly to the finance provider.

In an undisclosed structure, notice of the exporter’s assignment or transfer of the receivables is not served upfront on the buyer, and the finance provider may reserve the right to serve the notice at a later time on the buyer, if needed, to be able to enforce its rights on the receivables.

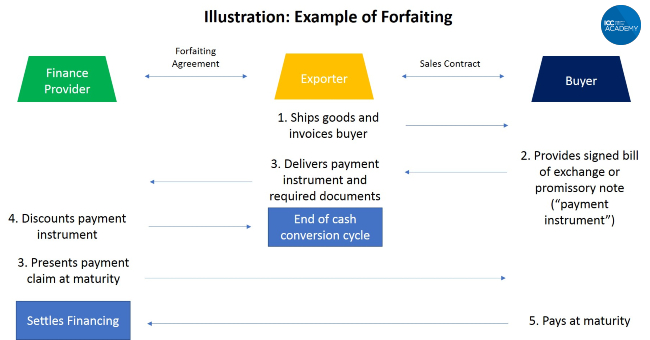

Forfaiting Forfaiting is without-recourse purchase of future payment obligations represented by financial instruments distinct from the commercial transaction that gave rise to it. Typical financial instruments are bills of exchange and promissory notes, which are unconditional payment undertakings, capable of transfer by way of endorsement or assignment.

The buyer delivers to the exporter signed bills of exchange or promissory notes, according to their contract of sale, for goods or services delivered by the exporter. The finance provider may examine the documents for the underlying trade for which the payment obligations are incurred. The amount of financing is usually for 100% of the value of the payment obligation.

The ICC rules applicable to forfaiting are the Uniform Rules for Forfaiting ICC Publication 800 (“URF 800”) , and they apply when the forfaiting agreement between finance provider and exporter indicates that it is subject to the rules.

In some cases, the payment obligation may carry an ‘aval’ by a third party such as a bank, in which case the financing may be provided taking the risk of the aval giver.

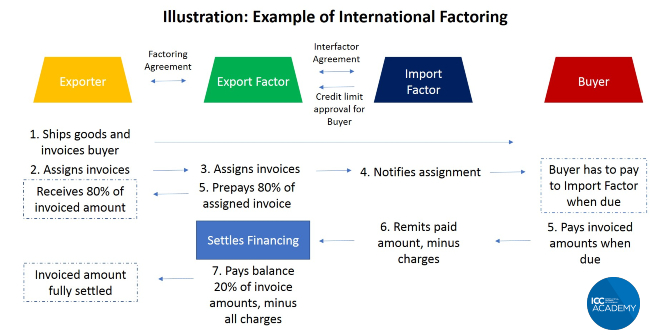

Factoring Factoring involves the sale of the exporter’s trade receivables, represented by outstanding invoices, to a finance provider (a factor) who typically takes over the management of the debtors and collection of the payment.

Financing may be with recourse or without recourse to the exporter. When it is without recourse, the factor provides the exporter with credit cover for the risk of the buyer. A factor finances by advancing up to a percentage of the assigned invoice value, and upon collection of the full debt from the buyer, pays the exporter the balance amount after deducting for all its charges.

In international factoring, an export factor (finance provider to the exporter) may rely on an import factor (a factor in the location of the buyer) to provide credit cover for the risk of the buyer – this is known as “two-factor international factoring”. The export factor will finance the exporter taking the risk of the import factor, rather taking the risk of the buyer.

The invoices assigned by the exporter to the export factor are assigned by the export factor to the import factor. The import factor is responsible to collect payment from the buyer, and in case of protracted buyer default, will pay the value of assigned invoices to the export factor.

Members of Factors Chain International (“FCI”) may conduct two-factor international factoring based on FCI rules, which include the General Rules for International Factoring “”GRIF”), edifactoring.com rules (for use of FCI’s communications system) and Rules for Arbitration.

Many variations of factoring that differ from the illustrated example exist. The variations include recourse factoring, confidential or non-notified factoring and maturity factoring.

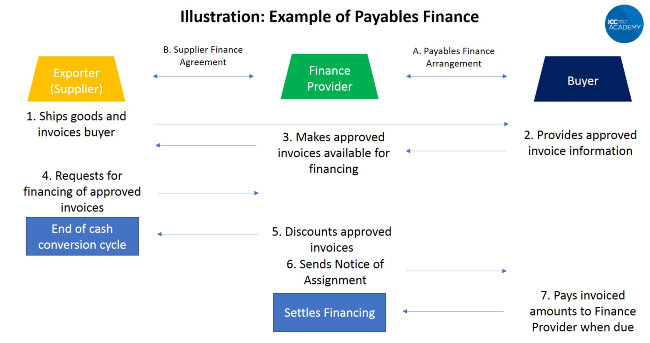

Payables Finance Payables Finance is a method of financing for the exporter arranged by the buyer. It is variously called Reverse Factoring, Approved Payables Finance, Supplier Finance, Supply Chain Finance etc.

The exporter participates in a Payables Finance program arranged by the buyer with a finance provider. In such a program, the exporter and the buyer agree on (possibly longer) payment terms, which can be financed within the Payables Finance program. Exporter invoices are approved by the buyer as early as possible, and made available for financing with the finance provider based on the buyer’s undertaking to pay at maturity.

The exporter may request for financing of some or all the approved invoices, and typically assigns the invoices to the finance provider, which then makes an early payment, less interest and charges, to the exporter.

The finance provider is financing the exporter taking the risk of the buyer, based on the undertaking of the buyer to effect payment on its approved invoices and the exporter’s assignment of the buyer’s payables (exporter’s receivables). Such programs are often provided on a technology platform, when a high volume of invoices and transactions are involved.

What are the benefits of export finance?

Export finance as described in this guide provides the exporter with liquidity for its working capital requirements, and risk mitigation in some cases. The financing could either fund the exporter’s cash conversion cycle (in cases of with-recourse financing), or shorten the cash conversion cycle (in cases of without-recourse financing).

The availability of export finance benefits the buyer as well, as it enables the exporter to perform under their sales contract, enlarges the capacity of the exporter to sell more to the buyer, provides capacity for the exporter to provide credit terms to the buyer, and helps maintain supply chain stability.

Export finance in the context of COVID-19

The COVID-19 pandemic has resulted in some disruptions to physical supply chains, document delivery and credit appetite.

Disruptions to physical supply chains have resulted in longer operating cycles for some exporters, due to various factors such as longer inventory holding periods caused by slowdown of sales or shipment, or longer work-in-progress due to disruption in supply of certain raw materials or components.

Some disruption in document delivery occurred due to public health measures that restricted the movement of people, and suspension of courier services, resulting in the inability to make timely presentations for documentary credits and delays in the forwarding of paper documents between banks.

Reduction in credit appetite due to increased sensitivity toward various risks – insolvency, fraud, geo-political tensions – has had some limiting effect on trade finance availability. For example, some banks have scaled down financing for certain commodity trades and have even announced closures of some commodities financing desks.

The ICC has issued a guidance paper on the impact of COVID-19 on trade finance transactions subject to ICC rules, which addresses various issues including force majeure, document delivery and provisions of ICC rules.

All of the ICC’s rules for trade finance are e-compatible. The ICC has published a Digital Trade Roadmap that sets out recommendations to achieve digitalisation of trade. Problems that have been encountered during the COVID-19 pandemic due to reliance on physical movement of paper for trade and trade finance transactions underscore the need for digital transformation, and it is hoped that all actors in global trade (including governments and industry) will support and adopt the use of digital technologies for such transactions.

About the author

Tat Yeen Yap is a consultant trainer for ICC Academy. He has held positions as head of trade finance at banks including Société Générale and ABN AMRO. He has also been a contributor to ICC rules and the Global Supply Chain Finance Forum.

Contact details: [email protected] https://www.linkedin.com/in/tat-yeen-yap/

Further Learning

If you would like to enhance your understanding of trade finance further, we recommend taking our one of our internationally recognised, professional trade finance certificate programmes.

Global Trade Certificate (GTC) : The GTC is our introductory trade finance certification programme which will give you a thorough and broad understanding of the various trade finance techniques and settlement methods available.

GTC Students get access to 14 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which you can use to improve your career prospects and work towards more advanced qualifications such as the CTFP.

Certified Trade Finance Professional (CTFP): The CTFP is our advanced trade finance programme intended for those with five or more years’ experience working in trade finance or those with an existing trade finance qualification from the ICC Academy or LIBF. It is designed to give you the tools to confidently sell, deliver and process global trade finance solutions and is fast becoming an industry standard for senior trade finance positions.

CTFP Students get access to 11 individual courses covering documentary credits, guarantees, standby letters of credit, supply chain finance, supply chain finance, fintechs, trade operations and much more. Once you have completed nine of the courses you will be eligible to take the final exam. If you pass you will receive an internationally recognized ICC Academy certificate, which will qualify you for more senior trade finance positions and help to fast-track your career.

Trade Finance

This article describe about Trade Finance, which has been reviewing the global trade market since 1983. It includes such activities as lending, issuing letters of credit, factoring, export credit and insurance. It depends on verifiable and secure tracking of physical risks and events in the chain between exporter and importer. It is used when financing is required by buyers and sellers to assist them with the trade cycle funding gap. The function of trade finance is to act as a third-party to remove the payment risk and the supply risk, whilst providing the exporter with accelerated receivables and the importer with extended credit.

Define Best Covered Call

Factors Considered for Sales Forecasting

Consumer Leverage Ratio

Government Debt

Concept of Social Accounting

The Woman and Her Bear

Payroll Management

Concept Testing

Use Iodine and silver sulphadiazine in thickness burn dressing

Define and Discuss on Ankle Brace

Latest post.

Negative Thermal Expansion (NTE)

Thermal Expansion

Angle Seat Piston Valve

Vitamin D modifies Mouse Gut Flora to enhance Cancer Immunity

Fossil Frogs’ Skincare Secrets

Piston Valve

- Events & Presentations

- Publications

- MOC Affiliate Network

- MOC Course at Harvard

- The New CEO Workshop

- Course Overview

- MOC Faculty

- Sample Student Projects

MOC Student Projects on Country & Cluster Competitiveness

The competitive assessments listed on this page have been prepared by teams of graduate students mostly from Harvard Business School and the Harvard Kennedy School of Government and other universities as part of the requirements for the Microeconomics of Competitiveness. Each study focuses on the competitiveness of a specific cluster in a country or region and includes specific action recommendations.

These studies represent a valuable resource for researchers, government officials, and other leaders. Students have given permission to publish their work here; the copyright for each report is retained by the student authors. References to the reports should include a full list of the authors.

Student Projects by Country

- Argentina Soy Cluster (2016)

- Armenia IT Services Cluster (2006)

- Australia Liquefied Natural Gas (LNG) Cluster (2016)

- South Australia Wine Cluster (2010)

- Australia Renewable Energy (2008)

- Belgium Chocolate Cluster (2016)

- Wallonia Aeronautic Cluster (2013)

- Belgium Pharmaceuticals (2011)

- The Botswana Textiles Cluster (2007)

- Brazilian Petrochemical Cluster (2017)

- Sao Paulo Plastics (2013)

- Leather Footwear in Brazil (2012)

- Brazil Aviation (2011)

- Bio-ethanol Cluster in Brazil (2009)

- Brazil Biotech Cluster: Minas Gerais (2009)

- The Poultry Cluster in Brazil (2006)

- Bulgaria's Apparel Cluster (2007)

- Alberta Energy Cluster (2010)

- Ontario Financial Services (2008)

- Transportation and Logistics Cluster in Northeast China (2017)

- Wind Turbine Cluster in Inner Mongolia (2009)

- The Chinese Apparel Cluster in Guangdong (2006)

- Bogota Software Cluster (2013)

- The Sugar Cane Cluster in Colombia (2007)

- Colombia Shrimp Aquaculture (2008)

- Costa Rica Data Centers (2016)

- Costa Rica Medical Tourism (2016)

- Ship & Boatbuilding in Croatia (2009)

- The Danish Wind Cluster (2017)

- The Danish Design Cluster (2007)

Dominican Republic

- The Dominican Republic Tourism Cluster (2012)

- Tourism in the Dominican Republic (2007)

- The Textile Cluster in Egypt (2012)

- The Offshoring Cluster in Egypt (2009)

- France's Competitiveness in AI (2017)

- Toulouse Aerospace Cluster (2013)

- France Wine Cluster (2013)

- Baden-Wuerttemberg Automobile Cluster (2015)

- Germany Wind Power Cluster (2010)

- Germany’s Photovoltaic Cluster (2009)

- Hamburg Aviation Cluster (2009)

- Biotechnology and Life Sciences in Munich (2007)

- Ghana Cocoa Sector (2017)

- Greece Shipping Cluster (2010)

- The Fresh Produce Cluster in Guatemala (2009)

- The Apparel Cluster in Honduras (2007)

- Hong Kong Financial Services (2008)

- Iceland Financial Services (2008)

- The Antiretroviral Drug Cluster in India (2017)

- Andhra Pradesh Pharmaceutical Cluster (2013)

- Tamil Nadu (India) Automotive Cluster (2012)

- Tirupur (India) Knitwear (2011)

- India (Maharashtra) Automotive Cluster (2010)

- Maharashtra Biopharmaceutical Cluster (2009)

- Bangalore Biotechnology (2008)

- Gujarat Diamonds (2008)

- Bollywood — Maharashtra and India’s Film Cluster (2008)

- Karnataka Offshore IT and Business Process Outsourcing Services Cluster (2006)

- Bali Tourism Cluster (2013)

- Ireland Financial Services Cluster (2017)

- Ireland Internet Cluster (2013)

- Ireland ICT Cluster (2010)

- The Dublin International Financial Services Cluster (2006)

- Israel Aerospace Cluster (2015)

- Jerusalem Tourism Cluster (2013)

- Israeli Biotechnology Cluster (2006)

- Italy Tourism (2011)

- The Italian Sports Car Cluster (2006)

- Japan Automobile Cluster (2016)

- Japan Skin Care Cluster (2013)

- The Japanese Gaming Cluster (2012)

- Japan Flat Panel Displays (2011)

- The Video Games Cluster in Japan (2009)

- Jordan Tourism Cluster (2009)

- Kazakhstan Oil and Gas Cluster (2010)

- Kazakhstan Energy Cluster (2007)

- Kenya ITC Services Cluster (2016)

- Kenya Tourism Cluster (2016)

- Kenya Business Process Offshoring (2011)

- Kenya Tea (2009)

- Kenya Coffee (2008)

- Kenya's Cut-Flower Cluster (2007)

- Korea Showbiz Cluster (2013)

- Korea Shipbuilding Cluster (2010)

- Korea Online Game Cluster (2006)

- Textile and Apparel Cluster in Kyrgyzstan (2012)

- The Macedonian Wine Cluster (2006)

- The Shrimp Cluster in Madagascar (2006)

- Malaysia Semiconductor Cluster (2015)

- Malaysia Palm Oil (2011)

- Malaysia Financial Services (2008)

- Queretaro Aerospace Cluster (2015)

- Mexico Central Region Automotive Cluster (2013)

- Mexico Chocolate Cluster (2010)

- Electronics Cluster in Guadalajara Mexico (2009)

- Baja California Sur Tourism (2008)

- Monaco Tourism (2011)

- Mongolia Mining Services Cluster (2010)

- Morocco Automotive Cluster (2015)

- Morocco Aeronautics Cluster (2013)

- Morocco Tourism (2008)

- Nepal Tourism Cluster (2015)

- Nepal Tourism (2011)

Netherlands

- Netherlands Medical Devices Cluster (2013)

- Netherlands Dairy (2011)

New Zealand

- New Zealand's Marine Cluster (2009)

- The Nicaraguan Coffee Cluster (2006)

- Lagos ICT Services Cluster (2017)

- Nollywood — The Nigerian Film Industry (2008)

- Nigeria Financial Services (2008)

- Norway’s Fish and Fish Products Cluster (2017)

- Textiles Cluster in Pakistan (2007)

- Lima Financial Services Cluster (2016)

- Asparagus Cluster in Peru (2012)

- Peru Tourism Cluster (2010)

Philippines

- The Philippines Electronics Components Manufacturing (2017)

- Medical Tourism in the Philippines (2008)

- The Philippines Contact Center Cluster (2007)

- The Tourism Cluster in Lisbon (2017)

- The Automotive Cluster in Portugal (2007)

- Romania Apparel Cluster (2010)

- The Moscow Financial Services Cluster (2012)

- Moscow Transportation (2006)

Saudi Arabia

- Saudi Arabia Chemicals Cluster (2016)

- Singapore Higher Education (2016)

- Slovakia Automobile Cluster (2016)

South Africa

- The Johannesburg Software Cluster (2017)

- South Africa Iron Ore Cluster (2013)

- South Africa Automotive Cluster (2012)

- The South African Wine Cluster (2009)

- Textiles & Apparel Cluster in South Africa (2009)

- The South African Wine Cluster (2006)

- Andalucia (Spain) Tourism (2011)

- Apparel Cluster in Galicia Spain (2009)

- The Spanish Wind Power Cluster (2007)

Switzerland

- Banking in Switzerland (2017)

- Switzerland Private Banking Cluster (2010)

- Switzerland Watchmaking (2010)

- Taiwan: Semiconductor Cluster (2007)

- Tanzania Horticulture Cluster (2010)

- Tanzania’s Tourism Cluster (2006)

- Thailand Automotive (2011)

- Thailand Automotive Cluster (2007)

- Thailand Medical Tourism Cluster (2006)

Trinidad & Tobago

- Tourism in Trinidad and Tobago (2006)

- Tourism Cluster in Tunisia (2012)

- Tunisian Tourism Cluster (2008)

- Turkey Textiles and Apparel Cluster (2012)

- Turkey Automotive (2011)

- Turkey & The Construction Services Cluster (2007)

- Uganda Fishing Cluster (2010)

United Arab Emirates

- Dubai Logistics Cluster (2015)

- Abu Dhabi (UAE) Petrochemical Cluster (2012)

- Dubai (UAE) Tourism (2011)

- The Transport and Logistics Cluster in UAE (2007)

- Dubai Financial Services Cluster (2006)

United Kingdom

- The Future of the UK Midlands Automotive Cluster (2017)

- London FinTech Cluster (2016)

- IT Hardware Cluster in Cambridge, UK (2012)

- UK Competitiveness and the International Financial Services Cluster in London (2007)

United States

- Massachusetts Clean Energy Cluster (2017)

- Ohio Automotive Cluster (2017)

- Chicago Biotech Cluster (2016)

- San Diego Craft Beer Cluster (2016)

- Kentucky Bourbon Cluster (2015)

- New York City Apparel Cluster (2015)

- Pennsylvania Natural Gas Cluster (2013)

- New York Motion Picture Cluster (2013)

- Massachusetts Robotics Cluster (2012)

- Miami, Florida Marine Transportation Cluster (2012)

- South Carolina Automotive Sector (2012)

- Tennessee Music Cluster (2012)

- California Solar Energy (2011)

- Silicon Valley (California) Internet-Based Services (2011)

- Minnesota Medical Devices (2011)

- Massachusetts Higher Education and Knowledge Cluster (2010)

- The North Carolina Furniture Cluster (2009)

- Automotive Cluster in Michigan USA (2009)

- Washington D.C. Information Technology and Services Cluster (2008)

- The Chicago Processed Food Cluster (2006)

- The Los Angeles Motion Picture Industry Cluster (2006)

Student Projects by Cluster

Aerospace vehicles & defense, agricultural products.

- Asparagus in Peru (2012)

- Textiles and Apparel Cluster in Turkey (2012)

- Bulgaria's Apparel Cluster (2007)

- South African Automotive Cluster (2012)

- South Carolina (USA) Automotive Cluster (2012)

Biopharmaceuticals

- Bangalore (India) Biotechnology (2008)

Business Services

- Karnataka (India) Offshore IT and Business Process Outsourcing Services Cluster (2006)

Construction Services

Education & knowledge creation.

- Massachusetts Higher Education and Knowledge Cluster (2010)

Entertainment

- Nollywood The Nigerian Film Industry (2008)

Financial Services

- The Moscow (Russia) Financial Services Cluster (2012)

- Ontario (Canada) Financial Services (2008)

- UK Competitiveness and the International Financial Services Cluster in London (2007)

Fishing & Fishing Products

Health services, hospitality & tourism.

- Baja California Sur (Mexico) Tourism (2008)

Information Technology

- The Johannesburg Software Cluster (2017)

Jewelry & Precious Metals

- Gujarat (India) Diamonds (2008)

Marine Equipment

Medical devices, metal manufacturing, metal mining, oil & gas products & services.

- Abu Dhabi (UAE) Petrochemical Cluster (2012)

- Norway Oil and Gas Cluster (2012)

Processed Food

Power generation & transmission, transportation & logistics.

- The Miami Florida Marine Transportation Cluster (2012)

- The Transport and Logistics Cluster in the United Arab Emirates (2007)

Virtual Tour

Experience University of Idaho with a virtual tour. Explore now

- Discover a Career

- Find a Major

- Experience U of I Life

More Resources

- Admitted Students

- International Students

Take Action

- Find Financial Aid

- View Deadlines

- Find Your Rep

Helping to ensure U of I is a safe and engaging place for students to learn and be successful. Read about Title IX.

Get Involved

- Clubs & Volunteer Opportunities

- Recreation and Wellbeing

- Student Government

- Student Sustainability Cooperative

- Academic Assistance

- Safety & Security

- Career Services

- Health & Wellness Services

- Register for Classes

- Dates & Deadlines

- Financial Aid

- Sustainable Solutions

- U of I Library

- Upcoming Events

Review the events calendar.

Stay Connected

- Vandal Family Newsletter

- Here We Have Idaho Magazine

- Living on Campus

- Campus Safety

- About Moscow

The largest Vandal Family reunion of the year. Check dates.

Benefits and Services

- Vandal Voyagers Program

- Vandal License Plate

- Submit Class Notes

- Make a Gift

- View Events

- Alumni Chapters

- University Magazine

- Alumni Newsletter

U of I's web-based retention and advising tool provides an efficient way to guide and support students on their road to graduation. Login to VandalStar.

Common Tools

- Administrative Procedures Manual (APM)

- Class Schedule

- OIT Tech Support

- Academic Dates & Deadlines

- U of I Retirees Association

- Faculty Senate

- Staff Council

College of Business and Economics

College of business & economics.

Physical Address: 875 Campus Drive J.A. Albertson Building

Mailing Address: College of Business & Economics University of Idaho 875 Perimeter Drive MS 3161 Moscow, ID 83844-3161

Phone: 208-885-6478

Fax: 208-885-5087

Email: [email protected]

Accounting Contact

Phone: 208-885-6453

Fax: 208-885-6296

Email: [email protected]

Business Contact

Phone: 208-885-6289

Fax: 208-885-5347

Email: [email protected]

Undergraduate Advising

ALB 304 - 305

Email: [email protected]

Barker Capital Management and Trading Program

Put risk management and trading theory to the test in the Barker Trading Program. Using real trading platforms and live markets, you will develop strategies and skills to manage financial assets (money) and instruments (contracts). You can also apply to trade funded accounts, manage financed portfolios with a team, and develop and use your own risk management strategies.

Why the Barker Trading Program?

Stand out among your peers entering the finance industry with real experience managing money and risk. You can also earn a Trading and Capital Management Certificate in the program, allowing employers to quickly identify your:

- comprehensive knowledge of markets

- detailed understanding of trading capital

- experience managing risk strategically

The Barker Trading Program also connects students to finance industry contacts and participates in hands-on learning competitions including Trading After Dark: College Edition.

The Barker Capital Management and Trading Program accepts applications every spring and fall, offers academic credit options and a trading certificate. To get involved, contact:

Brian “Duff” Bergquist, Program Director 118 J.A. Albertson Building [email protected]

Rejecting Groupthink

Barker Trading Program student Justin Chapman finds his niche

Read Justin's Story

The Barker Trading Program was one of five university teams invited to compete in the first Trading After Dark: Campus Edition Challenge. Each team submitted trades totaling $100,000, with positions evaluated after one week. U of I placed second with 8 of 10 trades being profitable.

Trading program experiences set me apart from the competition. Employers were impressed with my depth of knowledge in markets and financial instruments for having just graduated. Devyn DeLeon, B.S. Finance Academic Certificate, Trading and Capital Management

Assignment Russia

- Barnes & Noble

Ordering and Customer Service

- Amazon Kindle

- Apple iTunes

- Google eBookstore

- Table of Contents

- Chapter One

Subscribe to the Brookings Brief

Becoming a foreign correspondent in the crucible of the cold war.

A personal journey through some of the darkest moments of the cold war and the early days of television news

Marvin Kalb, the award-winning journalist who has written extensively about the world he reported on during his long career, now turns his eye on the young man who became that journalist. Chosen by legendary broadcaster Edward R. Murrow to become one of what came to be known as the Murrow Boys, Kalb in this newest volume of his memoirs takes readers back to his first days as a journalist, and what also were the first days of broadcast news.

Kalb captures the excitement of being present at the creation of a whole new way of bringing news immediately to the public. And what news. Cold War tensions were high between Eisenhower’s America and Khrushchev’s Soviet Union. Kalb is at the center, occupying a unique spot as a student of Russia tasked with explaining Moscow to Washington and the American public. He joins a cast of legendary figures along the way, from Murrow himself to Eric Severeid, Howard K. Smith, Richard Hottelet, Charles Kuralt, and Daniel Schorr among many others. He finds himself assigned as Moscow correspondent of CBS News just as the U2 incident—the downing of a US spy plane over Russian territory—is unfolding.

As readers of his first volume, The Year I Was Peter the Great , will recall, being the right person, in the right place, at the right time found Kalb face to face with Khrushchev. Assignment Russia sees Kalb once again an eyewitness to history—and a writer and analyst who has helped shape the first draft of that history.

Related Books

Marvin Kalb

October 10, 2017

September 21, 2015

September 25, 2018

Assignment Russia Book Events

- April 9: Politics & Prose LIVE! Marvin Kalb—Assignment Russia: Becoming a Foreign Corresponding in the Crucible of the Cold War – with Jake Tapper

- April 13: National Press Club Virtual Book Event —Marvin Kalb, Assignment Russia

- April 15: Brookings Event —Assignment Russia: A conversation on journalism and the Cold War

- April 29: Shorenstein Center on Media, Politics, and Public Policy Event —Assignment Russia: Becoming a Foreign Correspondent in the Crucible of the Cold War

- May 25: George Washington University —Assignment Russia: Becoming a Foreign Correspondent in the Crucible of the Cold War

Praise for Assignment Russia

“It is impossible to put this engrossing book down—it illuminates so many dark corners of the Cold War. With a master correspondent’s insight, skepticism, sensitivity, and great clarity, Kalb brings vividly to life all the hopes and fears of the most consequential foe this nation has had.” —Ken Burns, filmmaker