The benefits of a cashless society

We're shifting toward a cashless society, with potential for enormous socio-economic benefits for both developed and developing countries. Image: Jonas Leupe/Unsplash

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Mehul Desai

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Fourth Industrial Revolution is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, davos agenda.

The first recognisable coins were produced in China more than 3,000 years ago.

If you visit China today, however, there’s a strong chance you’ll see people paying for things using facial recognition on their phones.

This is a radical shift, but it’s just the beginning of the cash revolution.

Have you read?

Africa should follow in india's footsteps towards a cashless economy. this is why, these are the countries that would benefit most from a cashless world.

The new global payments ecosystem, including both physical cash as well as mobile wallets, is the result of the convergence of three large and powerful industries: telecommunications, banking and retail.

And if the private and public sector can work together to harness the latest technology and realise the full potential of a cashless society, there will be enormous benefits.

It’s important to first reflect upon where we are on the journey toward a cashless society.

Thus far, the shift is basically a move from physical cash to cash-replacements. With private companies involved in processing those transactions, there is inevitably a cost. And that means there is a loss of value when the transfer occurs.

This is my vision of a true cashless society. There is an exchange of value in its entirety – just like cash. And it requires a national government – rather than banks or the like – to act as the payment provider, effectively becoming a state-backed utility.

The savings from avoiding the processing costs could then be used to benefit those in need, such as by being transferred to a fund to rejuvenate economically depressed areas, as one example.

This might sound counterintuitive, but I would argue just about everyone has access to capital. However, for the poorer members of society, there’s often a prohibitively high cost to accessing it. If you have a great business idea but can’t afford start-up capital, then your venture is unlikely to get off the ground.

A cashless society – along with the transformation of the last mile of money transfers, payments and banking services – will help to close the financial inclusion gap.

Cashless technologies could be some of our greatest assets in the fight against corruption and organised crime, too.

And, once again, the people who stand to benefit most are those who are most in need.

There are 1.4 billion people in the world who have to make do with less than $1.25 a day. At the same time, around $1.26 trillion is effectively stolen from developing countries , due to corruption, bribery, theft and tax evasion. If we could reclaim that money for those countries, we could lift those 1.4 billion people above the poverty threshold and keep them there for at least six years.

If everyone were connected to an end-to-end e-payment infrastructure – a cashless environment – there would be transparency in money flows. Whether it’s international aid or private investment, if everyone in the chain were connected digitally, you could see where the money went and how it was spent.

Any sums appearing outside of that framework could immediately be flagged and investigated. This would narrow the focus for law enforcement and forensic accountants, making it easier to target and recoup hidden money.

There are, of course, many challenges to overcome as we embrace this level of disruption. And governments will need to take preemptive and proactive action in areas such as identity management and the protection of security and privacy.

However, the underlying support structures to make it all possible – the building blocks, or e-plumbing – are already in place. We already have secure, enabled ecosystems and the next generation of infrastructure.

At Finablr, we have four decades of experience in regulatory alignment and cross-border compliance, with a network spanning 170 countries. We also have proprietary technology, which enabled 150 million transactions at a total value of $115 billion in 2018 alone.

There’s no going back – which means we need to face the risks and deal with some of the difficulties of going cashless in order to unlock the benefits.

In developed countries, a cashless society will deliver transactions that are seamless, frictionless and low-cost. And in developing nations, it could deliver life-changing socio-economic benefits.

This easily accessible exchange of value will create a more equal world, and strengthen the bond between people, regardless of where they live.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Davos Agenda .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

From 'Quit-Tok' to proximity bias, here are 11 buzzwords from the world of hybrid work

Kate Whiting

April 17, 2024

Davos 2024 Opening Film

Building trust amid uncertainty – 3 risk experts on the state of the world in 2024

Andrea Willige

March 27, 2024

Why obesity is rising and how we can live healthy lives

Shyam Bishen

March 20, 2024

Global cooperation is stalling – but new trade pacts show collaboration is still possible. Here are 6 to know about

Simon Torkington

March 15, 2024

How messages of hope, diversity and representation are being used to inspire changemakers to act

Miranda Barker

March 7, 2024

Related Expertise: Payments and Transaction Banking , Financial Institutions , Economic Development

How Cashless Payments Help Economies Grow

May 28, 2019 By Markus Massi , Godfrey Sullivan , Michael Strauß , and Mohammad Khan

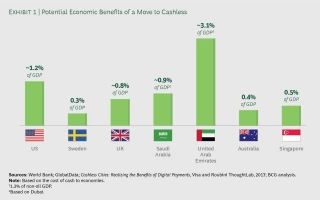

Cash is no longer king. In fact, economies that are more cash intensive tend to grow slowly and miss out on significant financial benefits. Conversely, economies that switch to digital are more successful; the switch can boost annual GDP by as much as 3 percentage points, BCG research shows.

Numerous examples around the world illustrate how cashless payments are economic propellers. Bangladesh’s bKash, which enables transfers via mobile phones, has spurred growth and boosted financial inclusion in that country. The upside comes not from more money but from digital’s role in simplifying the process of sending and receiving payments. Among advanced economies, Sweden and South Korea have moved steadily away from cash. (Cash transactions in Sweden made up less than 2% of the value of payments in 2018, for example.) The result has been a shrinking gray economy, booming online commerce, and a sharp reduction in fraud.

And yet, despite the evidence, there is little sign the world will go cashless anytime soon. Cash remains the world’s most widely used payment instrument. Perhaps surprisingly, the global ratio of cash to GDP rose to 9.6% in 2018, compared with 8.1% in 2011 . In Europe, 80% of point-of-sale transactions are still conducted in cash. People have a strong emotional connection to notes, coins, and currency—and a lingering distrust of digital alternatives.

Slow progress toward cashless economies may be a source of frustration to policymakers, merchants, and financial institutions, all of which stand to accrue benefits from digital. However, there are steps they can take. The right strategies, incentives, infrastructure, and regulation can encourage innovation and boost public confidence in noncash systems. Partnerships, both public and private, can also be critical in marshaling expertise and creating momentum. The tools are in place. All that is required to move forward is the will to act.

The right strategies, incentives, infrastructure, and regulation can boost public confidence in noncash systems.

Copy Shareable Link

Cash Versus Digital

Despite huge growth in smartphone adoption and increasing demand for digital banking, the majority of countries remain heavily dependent on cash. Some 2 billion people globally do not have a bank account, showing that cash remains essential to financial inclusion. And cash is entrenched in the economies of many developed markets. In the UK, the broad measure of money supply, encompassing coins, notes, and cash-like instruments, reached £82 billion in late 2018, compared with about £68 billion four years previously.

Cash is popular because it is user-friendly. It is inclusive, trusted (it does not require intermediation by third parties), accessible, and reliable. It doesn’t require point-of-sale (POS) technology and can’t be hacked or undermined by a loss of power, a cyber attack, or a system failure. Spending cash does not create a data point that might be exploited for cross-selling.

Still, cash is inherently problematic. Undeclared payments in cash lead to tax gaps, and there are costs associated with handling, printing, transporting, and safeguarding cash. One major North American bank spends approximately $5 billion per year processing cash and check transactions and servicing ATMs. In the UK, the cost of free-to-the-customer ATM withdrawals is estimated at about £1 billion a year. Where ATM fees are charged, they are regressive, impacting lower-income demographics more than others.

Cash is inherently problematic.

Payments using a card, app, or computer, conversely, are transparent, clean, and usually quite simple. No trips to the ATM are required, and there’s no need to worry about carrying large amounts of cash in public. There is no cost of handling (although those savings are more than offset by card fees paid by merchants and indirectly by customers).

Further, because cards, apps, and other digital solutions make it easier to send and receive money, they increase economic activity and generate a wide array of financial and nonfinancial benefits.

BCG estimates that a move to a cashless model would add about 1 percentage point to the annual GDPs of mature economies and more than 3 percentage points to those of emerging economies. (See Exhibit 1.) One reason is that mobile money can increase the velocity of value transfers. In addition, digital transactions provide more transparency, making it easier to offer and obtain financing.

In an increasingly urbanized world, many cities (among them Bucharest, Seoul, Dubai, Madrid, and New York City) have introduced smart-city initiatives, leveraging digital to improve lives across a variety of parameters. Digital-payments technology is part of that equation, and one study estimates that increasing digital payments in 100 leading cities could generate direct net benefits of $470 billion per year. Small businesses in particular may benefit, with mobile payments enabling them to rent, buy, and get paid more easily.

Cashless payments can help supervisors, central banks, and commercial banks do better jobs. Electronic payments enable more comprehensive oversight and monitoring and can inform central banks’ monetary and economic policies. More visibility aids credit process management, allowing banks to make more-informed lending decisions. Cashless societies may also bring less obvious benefits: During the European sovereign debt crisis in 2012, some economists argued that moves by central banks to cut interest rates to below zero would be ineffective without a concurrent ban on cash. If people must pay to make bank deposits, it makes sense to keep money under the mattress.

Challenges in Making the Switch to Digital

Digital is an attractive alternative where the cost of cash is high (transport, ATM servicing, security, labor), where technology uptake is accelerating, or where the government struggles to collect sales tax. Numerous countries meet one or more of these criteria, according to an analysis in Harvard Business Review. They include developed markets such as France, Belgium, Spain, and Germany. Still, barriers to uptake remain. We have identified five principal areas of resistance. (See Exhibit 2.)

The High Cost of Electronic Payments. Electronic payments incur significant fees and charges. The British Retail Consortium said in 2018 that, despite regulation of interchange fees, the all-in cost of digital payments had risen in 2017. UK retailers spent an additional £170 million to process card payments, for a total cost of almost £1 billion. Increasing card costs were driven entirely by scheme fee increases, which rose 39%, measured as a percentage of turnover; the problem was exacerbated by limited market competition, the BRC said. Most payments systems are monopolies or duopolies.

A Lack of Customer-Centric Solutions. Payments solutions are often designed without customers’ needs in mind and with a focus on technology rather than user-friendliness. Many countries offer a fragmented patchwork of solutions that lack interoperability. In many cases, you cannot make a payment from one brand of e-wallet to another. Consumers habitually need to carry multiple cards to meet their daily needs. As a result, the penetration rates of person-to-person (P2P) solutions have remained relatively low (below 15%) outside the frontier markets of Norway, Sweden, and Denmark.

Minimal Coordination Between Government Entities. Lacking a central authority to drive transformation and coordination, projects are likely to fail. In addition, a lack of proper governance, planning, and education on the implementation frontline is likely to result in fragmentation, bureaucracy, and parallel processes.

Insufficient Trust in Electronic Payments. Banks and companies are under rising pressure to protect their customers against cyber attacks. More than a few large companies with global operations have been hacked in recent years, resulting in massive losses of customer data. The UK’s national crime agency said in April 2018 that seven of the country’s biggest banks reduced operations or shut down systems following an attack the previous year. One reason is that, in many cases, attempts to increase cyber resilience do not keep pace with the rapid uptake of digital payments.

In some countries, consumers are concerned about the impact of digital payments on the cost of living and their control over their own budget. Japanese consumers remain wedded to cash, for instance, and visitors to the country are often struck by how many transactions are still conducted using notes and coins compared with neighboring China. Uptake in Germany is also relatively slow.

The data created by digital transactions is a valuable commodity. It may bring significant benefits to companies, even though consumers in many countries experience a “trust gap” and are less certain of those benefits. Even in Sweden, the most cashless society globally (about three-quarters of all purchases are made by card), there are residual doubts, particularly over security. In early 2018, Sweden’s central bank governor, Stefan Ingves, urged his government to consider the vulnerability of the payment network in case of extreme circumstances.

The Absence of Supporting Infrastructure. Infrastructure is a key element of a thriving payments ecosystem. Equally, its absence can be a hindrance. Rural areas in particular may not have infrastructure in place. In some places, there is a gender divide, with women excluded from internet access. In many countries delays of two to three days in real-time interbank transfers are common. The necessary standards to support infrastructure are also often absent.

For a digital-payments system to take root, support in the form of legal frameworks, electrical networks, and security is also necessary.

How Policymakers Have Driven Uptake

In September 2016, the G20 heads of state and government endorsed the High-Level Principles of Digital Financial Inclusion (HLPs), recognizing the capacity of digital to help people get access to financial services. Certainly, countries with dedicated digital policies and infrastructure have seen faster progress. Examples abound:

- In Singapore, cashless payments took a major step forward in 2017 with the introduction of PayNow, a national real-time payment platform.

- South Korea saw accelerating adoption after introducing end-of-year tax credits for up to 30% of spending on debit cards.

- Sweden has rolled out an array of policies encouraging cashless payments, from eliminating infrastructure such as ATMs while putting in place enabling measures such as electronic know-your-customer (e-KYC) capabilities and real-time payments and by granting stores the right to refuse cash. A tangential impact has been a surge in tax receipts, with value-added tax rising nearly 30% over five years.

- The Reserve Bank of Australia has taken action to address the high cost of digital payments, capping interchange fees and putting a ceiling on card surcharges for small businesses. The moves led to a US$11 billion decline in merchant payment costs and an acceleration in the growth of card transactions. A similar cap in the US in 2011 led to an 8% rise in credit card usage.

An emerging group of “payments tigers” have also made especially rapid progress. Poland, for example, saw card transactions increase from fewer than 30 per capita in 2010 to approximately 125 in 2017, driven by initiatives such as Cashless Poland, a public-private partnership to support cashless payments for small businesses.

Numerous initiatives are underway in Africa. Ghana is digitizing with the aim of improving access to financial services, and Malawi has seen a sharp rise in cashless transactions. Rwanda aims to become a cashless economy by 2024. In late 2018, the nation’s central bank launched a regulatory sandbox for testing digital payment solutions.

Clearly, given the diversity of economic systems around the world, there’s no single solution that will guarantee a seamless transition. Still, several foundational elements raise the chances of a successful digital journey.

Laying the Foundations

Laying the foundations for a cashless economy should typically begin with a holistic and overarching national payments agenda, driven by a consortium of key stakeholders including the government, the central bank, financial institutions, consumer protection agencies, and merchants. The government should determine a timeline and a target end state, based on a thorough assessment of the technological, competitive, and regulatory landscape and benchmarking of functional requirements and enablers. (See “Enablers of a Cashless Economy” for two ways in which stakeholders can support an environment conducive to a cashless economy.)

Begin with a holistic and overarching national payments agenda.

Enablers of a cashless economy.

In addition to taking direct action to effect cashless transactions, stakeholders will benefit from helping to create an environment that is conducive to a cashless economy. Two areas of focus stand out as being particularly valuable.

Safeguarding of Consumer Interests. Consumer protection is vital. One regulatory initiative that addresses this issue is Europe’s General Data Protection Regulation, which came into force in May 2018. The GDPR has increased consumer confidence by requiring companies to safeguard consumer data and seek explicit permission for its commercial use. Government-mandated means of streamlining dispute resolution mechanisms would further bolster consumer protection and confidence, building comfort with the notion of a cashless economy.

An Ecosystem of Innovation. One in four fintechs globally is focused on payments. They bring with them, of course, a new focus on digital technologies. Several central banks are now evaluating the potential of these technologies, including blockchain and digital currencies, which may promote financial inclusion and increase efficiency through disintermediation and faster settlement cycles. Open-banking initiatives in many countries are encouraging collaboration between financial institutions and startups, leading to more data sharing, increased cross-selling, and the emergence of payments ecosystems.

Appropriate governance and operational structures must be put in place. These would include establishing an overarching body to manage strategy and facilitate alignment and an operational committee to provide feedback and identify issues as projects move forward.

Industry stakeholders should be closely involved, providing both technical and market expertise.

Finally, teams driving change need to be multidisciplinary, bringing together skills and know-how spanning economics, technologies, and payments.

It makes sense to start small, targeting low-value, high-frequency transactions. However, it pays to think big in terms of collaboration and long-term implementation. BCG has identified five levers that can drive the transformation process. (See Exhibit 3.)

Establish the right incentives. Targeted incentives will encourage consumers and merchants to consider moving away from cash. This might be achieved through reducing the cost of digital payments, introducing cash-handling charges, or restricting the use of cash above certain thresholds (the EU is currently considering this final measure). In Sweden, a consortium of banks launched a free mobile payments app, which was adopted by 50% of the population within four years of launch.

PromptPay , the electronic payment service under the Thai government’s e-payment plan, encouraged uptake by removing charges for online banking. Chinese mobile payment leaders Alipay and WeChat Pay are engaged in an ongoing battle to attract users to their e-wallets, offering incentives that include cash rebates, free bus rides, and even the chance to win gold.

Governments and companies might also consider consumer-friendly schemes such as weekly prize drawings based on transaction IDs or systems with specific demographics in mind.

Encourage competition and ensure a level playing field. Competition naturally exerts downward pressure on prices and encourages innovation, helping to offset the high cost of electronic payments. Measures to enable point-of-sale solutions are likely to help, as are rules for transparency regarding fees. And governments can seek to actively support innovation. The UK, for example, offers research and development tax relief and has introduced a number of tax-related initiatives as part of the National Innovation and Science Agenda, including for investors in startups. The country’s Faster Payments Central Infrastructure is open to established banks and challengers and creates a mechanism for fintechs to access payment systems.

Some countries encourage competition by encouraging or enabling the creation of privately owned payment rails. This has long been the case in the US, where The Clearing House operates several privately owned payment rails that integrate with the federally owned rails.

Provide world-class supporting infrastructure . Infrastructure is the key enabler of a cashless payments model and should encompass the internet, mobile and payments technologies, regulation, security, and electricity networks. Governments should in parallel encourage innovations that promote real-time interbank payments for retail transactions and strengthen operations through new business and operating models.

Already, some countries have transferred responsibility for payments infrastructures from central banks to private companies or consortiums of banks. The UK Faster Payments Service, an initiative to reduce payment times between bank accounts, is run by privately owned Vocalink, for instance. In 2018, a group of Australian financial institutions and the Reserve Bank of Australia launched the New Payments Platform, which is based on ISO 20022 messaging formats and enables consumers, businesses, and government agencies to make real-time, data-rich payments between accounts. And Hong Kong and Singapore, among others, have built multicurrency payment systems for interbank transfers, strengthening their positions as global trading hubs.

Streamline and enforce regulations. Targeted and proportional regulation can strengthen confidence in electronic payments and enforce financial inclusion. Initiatives such as rapid dispute resolution mechanisms, licensing schemes, and fee caps have been highly effective in boosting the uptake of cashless solutions.

A strong and proactive regulator is essential. For example, the US regulator made a big push after 9/11 to enforce an electronic check exchange standard. If the regulator does not make this kind of effort (for example, in real-time payments), everything takes longer.

Partner with the private sector. Policymakers should seek to collaborate with stakeholders to foster innovation; already around the world many are doing so. Thai state authorities, for example, have joined with the private sector to launch the National e-Payment Master Plan. The plan’s PromptPay initiative enables interbank fund transfers using mobile phones and has signed up more than 2 million merchants to QR-code payment. In Europe, the Cashless Poland Foundation provides small and medium-sized retail businesses with point-of-sale terminals and subsidizes them to take low-value card payments, which otherwise might not be cost-effective. Noncash payments in Russia grew from approximately 25 per capita in 2010 to roughly 150 in 2017, amid collaboration between banks and government. Russia’s Sberbank, with its 55% market share, employed 10,000 meet-and-greeters in bank branches to provide information and encourage adoption.

As digital lifestyles expand and more people around the world get connected, it makes sense that payment systems will adapt. Consumers, companies, and governments stand to benefit, and the rise of e-commerce requires an efficient electronic payments infrastructure. However, after thousands of years of fiat currencies, policymakers and corporate leaders should not underestimate the challenges. The solution should be a holistic approach, comprising the right infrastructure, legal frameworks, technologies, and a willingness to partner and collaborate. The task is complex, but the prize is faster growth and an economy enabled for the future.

Managing Director & Senior Partner

Managing Director & Partner

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

Subscribe to our Financial Institutions E-Alert.

- Preferences

cashless economy - PowerPoint PPT Presentation

cashless economy

A cashless economy is secure, it is clean. you have a leadership role to play in taking india towards an increasingly digital economy.” cash is set to lose currency in india, as an explosion in smartphone usage drives a digital payments boom. – powerpoint ppt presentation.

- Cashless society

- India has the highest use of cash in the world, according to MasterCard report

- Such high use of cash would only strengthen the countrys informal economy, which is not in the larger interest of the nation

- Reduced use of cash would choke the grey economy, curb money laundering and result in increased tax collections to the governments coffers.

- Various options towards a cashless or less-cash economy include Unified Payments Interface, Bank Card, prepaid cards, using various cards at any point of sale/ ATM, e-wallet or digital wallet, etc.

- Current cash flow deficit force people to make digital payments.

- Security of online transacting companies PayTM, is certified under the Payment Card Industry Data Security Standard (PCI DSS) 2.0 certification

- There are many more platfors which provides you to go cashless with their e-wallets services.

- Cash facilitates drug trafficking, human trafficking, extortion, money laundering and illegal immigration

- In a cashless society, people would be forced to remove savings from under their mattresses and keep them in the bank

- It is an intuitive method of exchange and acts as a store of value.

- It doesnt come with the transaction fees of electronic payment methods.

- Hackers continuously test security systems, therefore, entrusting savings to financial institutions is not an easy decision.

- Creating fake mobile applications and spyware that steal information, or social engineering tactics that make you reveal your login credentials.

- Forums on Internet are flush with step-by-step instructions on how to create fake websites that imitate digital payment platforms.

- Context Growing popularity of e-payments and mobile wallets among the youth in the country

- Background Recently, govt. cleared the implementation of a few measures to promote digital and card-based payments to curb cash use in the system

- Measures It includes withdrawal of surcharge, service charge or convenience fee on card and other digital transactions

- Impact This makes RBIs work easy to bring in accountability and transparency in each financial transaction

- Future Country is heading for a cashless economy with a change in the way netizens make their day-to-day transactions

- Because it is also much more risky to conduct criminal transactions or avoid the proper payment of due taxes in a cashless society, such violations are likely to be greatly reduced.

- It eliminates the need to carry cash or plastic. Digital payments can be made with a tap or wave of a smart phone, depending on the technology used. It would make it easier to loan or borrow money as with digital payments, lending and borrowing can be reduced to a tap or wave of a smart phone.

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

- IAS Preparation

- UPSC Preparation Strategy

- Cashless Economy

Cashless Economy in India - UPSC GS-III Notes

When the transactions in an economy are not heavily based on the money notes, coins or any other physical form of money but are aided by the use of credit cards, debit cards and prepaid payment instruments, such an economy is called cashless economy.

The cashless Economy in India has been amplified with the Indian Government’s initiative of Digital India . This is a flagship programme with a vision to transform India into a digitally empowered society and knowledge economy.

The topic, ‘Cashless Economy’ is important for GS-III Indian Economy of the IAS Exam . This article will talk about it, the types of cash transfer modes, UPI and more.

Table of Contents:

Cashless Economy in India – UPSC Notes:- Download PDF Here

What is a Cashless Economy?

Cashless Economy can be defined as a situation in which the flow of cash within an economy is non-existent and all transactions must be through electronic channels such as direct debit, credit cards, debit cards, electronic clearing, and payment systems such as Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) in India.

To know the Difference Between RTGS and NEFT , visit the linked article

Highlights of Cashless Economy in India

- Post Demonetization , the Centre is making a big push for online and card-based transactions in the country to achieve its target of becoming a largely cashless economy.

- The rapid growth of e-payment startups in the country.

- Launch of Unified Payments Interface (UPI) to facilitate cashless transactions.

- The Covid-19 pandemic fueled a massive shift towards digital transactions in India aligning with the prime minister’s vision of a Digital India. In fact, according to the National Payments Corporation of India (NPCI) data, payments on UPI in June 2020 hit an all-time high of 1.34 billion in terms of volume with transactions worth nearly Rs 2.62 lakh crore.

Cashless Economy – Types of Cashless Modes and Payments

There are various cashless payment modes and these are mentioned below:

Mobile wallet: It is basically a virtual wallet available on your mobile phone. You can store cash in your mobile to make online or offline payments. Various service providers offer these wallets via mobile apps, which is to be downloaded on the phone. You can transfer the money into these wallets online using credit/debit card or Net banking. This means that every time you pay a bill or make a purchase online via the wallet, you won’t have to furnish your card details. You can use these to pay bills and make online purchases.

Plastic money: It includes credit, debit and prepaid cards. The latter can be issued by banks or non-banks and it can be physical or virtual. These can be bought and recharged online via Net banking and can be used to make online or point-of-sale (PoS) purchases, even given as gift cards. Cards are used for three primary purposes – for withdrawing money from ATMs, making online payments and swiping for purchases or payments at PoS terminals at merchant outlets like shops, restaurants, fuel pumps etc.

Net banking : It does not involve any wallet and is simply a method of online transfer of funds from one bank account to another bank account, credit card, or a third party. You can do it through a computer or mobile phone. Log in to your bank account on the internet and transfer money via national electronic funds transfer (NEFT), real-time gross settlement (RTGS) or immediate payment service (IMPS), all of which come at a nominal transaction cost.

The cashless economy in India is being promoted through various platforms and applications which provide easy methods of funds transfer and payments:

Cashless Economy – Prepaid Payment Instrument

The RBI classifies every mode of cashless fund transfer using cards or mobile phones as ‘prepaid payment instrument’ . They can be issued as smart cards, magnetic stripe cards, Net accounts, Net wallets, mobile accounts, mobile wallets or paper vouchers. They are classified into four types:

- Open Wallets : These allow you to buy goods and services, withdraw cash at ATMs or banks and transfer funds. These services can only be jointly launched in association with a bank. Apart from the usual merchant payments, it also allows you to send money to any mobile number linked with a bank account. M-Pesa by Vodafone is an example.

- Semi-Open Wallets : You cannot withdraw cash or get it back from these wallets. In this case, a customer has to spend what he loads. For example, Airtel Money/Ola Money is a semi-open wallet, which allows you to transact with merchants having a contract with Airtel/Ola.

- Closed Wallets : This is quite popular with e-commerce companies; wherein a certain amount of money is locked with the merchant in case of a cancellation or return of the product or gift cards. Flipkart and Book My Show wallets are an example.

- Semi-Closed Wallets : These wallets do not permit cash withdrawals or redemption, but it allows you to buy goods and services from listed vendors and perform financial services at listed locations. Paytm is an example.

Read in detail about the Fiscal Policy in India at the linked article.

Advantages of a Cashless Economy in India

- The main advantage of a cashless society in India is that a record of all economic transactions through electronic means makes it almost impossible to sustain black economies or underground markets that often prove damaging to national economies. This reduces the chances of black money entering the system. It is also much riskier to conduct criminal transactions. An economy that is largely cash-based facilitates a rampant underground market which abets criminal activities such as drug trafficking, human trafficking, terrorism, extortion etc. Cashless transactions make it difficult to launder money for such nefarious activities.

- Circulation of Fake Currency notes can be curbed.

- Increase Tax base: It is difficult to avoid the proper payment of due taxes in a cashless society, such violations are likely to be greatly reduced. The increased tax base would result in greater revenue for the state and greater amount available to fund the welfare programmes.

- Digital transactions bring in better transparency, scalability and accountability.

- Digital transactions are convenient and improve market efficiency

- It will eliminate the risks associated with carrying and transporting huge amounts of cash

- The cashless economy will reduce the production of paper currency and coins. This will save a lot of production cost in turn.

- A lot of data transfer happens due to the cashless transaction. This data will help the government plan for future expenses such as housing, energy management, etc from the pattern of the data transmission.

Challenges in transitioning to a Cashless society

- Acceptance infrastructure and digital inclusion: Lack of adequate infrastructure is a major hurdle in setting up a cashless economy. Inefficient banking systems, poor digital infrastructure, poor internet connectivity, lack of robust digital payment interface and poor penetration of PoS terminals are some of the issues that need to be overcome. Increasing smartphone penetration, boosting internet connectivity and building a secure, seamless payments infrastructure is a prerequisite to transition into a cashless economy.

- Financial Inclusion – For a cashless economy to take off the primary precondition that should exist is that there should be universal financial inclusion. Every individual must have access to banking facilities and should hold a bank account with debit/credit card and online banking facilities. Read more about Financial Inclusion in the linked article.

- Digital and Financial Literacy – Ensuring financial and digital inclusion alone are not sufficient to transition to a cashless economy. The citizens should also be made aware of the financial and digital instruments available and how to transact using them.

- Cyber Security – Digital infrastructure is highly vulnerable to cyber-attacks, cyber frauds, phishing and identity theft. Off late cyber-attacks have become more sophisticated and organised and poses a clear and present danger. Hence establishing secure and resilient payment interfaces is a prerequisite for going cashless. This includes enhanced defences against attacks, data protection, addressing privacy concerns, robust surveillance to pre-empt attacks and institutionalised cybersecurity architecture.

- Changing habits and attitude – Indian economy functions primarily on cash due to lack of penetration of e-payment modes, digital illiteracy of e-payment and cashless transaction methods and thirdly habit of handling cash as a convenience. In this scenario, the ideal thing to do is to make people adopt e-payments in an incremental fashion and spread awareness to initiate behavioural change in habits and attitude.

- Urban-Rural Divide – While urban centres mostly enjoy high-speed internet connectivity, semi-urban and rural areas are deprived of a stable net connection. Therefore, even though India has more than 200 million smartphones, it is still some time away for rural India to seamlessly transact through mobile phones. Even with regard to the presence of ATM’s, PoS terminals and bank branches there exists a significant urban-rural divide and bridging this gap is a must to enable a cashless economy.

To understand the Digital Divide in India , candidates can visit the linked article. This will also give them a brief idea of the areas of improvement to make India a cashless economy.

Is India Ready for a cashless economy?

The difficulty in going digital is exemplified by the data on debit card usage — over 85% (in volume) and 94% (in value) of all debit card usage is at ATMs for the purpose of withdrawing cash. The principal purpose for cards in an Indian context is thus a means to withdraw cash. The exponential growth in debit cards (over 600 million) is a direct consequence of the financial inclusion drive that led to the opening of over 170 million bank accounts. Though the move put plastic money into the hands of millions, effectively it has only shifted cash withdrawals from banks to ATMs, which was not quite the intent.

India’s Cash to GDP ratio:

As calls for going cashless grows louder in India, a key challenge being faced at the global level is to check the continuing rise in the total value of the currency in circulation and its share in the overall GDP , a trend particularly seen in the US, Switzerland and Euro area.

Such a continuing rise in the circulation of currencies for economic activities could well be a major impediment in the transformation to a cashless and digital economy.

India’s cash to GDP ratio — an indicator of the amount of cash being used in the economy — is around 12 to 13%, which is much higher than major economies including the US, the UK and Euro area but below that of Japan (about 18%).

Cashless Economy in India & The Challenges ahead

Typically in India, a cashless economy may take a bit longer to be adaptable. The challenges with regard to the same have been discussed below:

- A large part of the population does not have access to debit cards and smartphones, which is why they prefer to make transactions in cash

- The maximum population uses debit cards to withdraw money rather than paying directly through it

- People are not entirely aware and educated about the cashless methods of payment

- As per the survey and data collected, only 26% has access to the internet and choose online payments as an option for transactions

- Making the people aware of the privacy and security under cashless transactions is another challenge for the government. As the cashless economy in India is also taking time to recover as people do not trust the privacy terms of the online portals, platforms and applications

Penetration of Mobile Accounts

Cashless Economy and Government Initiatives

- Paytm had witnessed 5 million daily usage post demonetisation as opposed to their average transaction of three million. It also saw a 700% increase in the overall traffic and a 1000% increase in the amount of money added to its account in the first two days of post-demonetization. Ola Money too saw a 1500% increase in its e-wallet.

- Payment service providers (PSPs) to provide the interface between the payer and the payee. Unlike wallets, here the payer and the payee can use two different PSPs.

- Banks will provide the underlying accounts. In some cases, the bank and the PSP may be the same.

- NPCI will act as the central switch by ensuring Virtual Payment Address (VPA) resolution, affecting credit and debit transactions through IMPS.

- Direct Benefit Transfer (DBT): It is a scheme that was launched by the Government of India to transfer the benefits and subsidies of various social welfare schemes like LPG subsidy, Old Age Pension, Scholarship, MGNREGA , etc. directly to the bank account of the beneficiaries. This allowed for the penetration of digital banking into rural India.

- The Centre has set up a committee headed by NITI Aayog CEO Amitabh Kant, to formulate a strategy to expedite the process of transforming India into a cashless economy.

- The panel is tasked with identifying various bottlenecks that are affecting access to digital payments.

- The panel will engage regularly with all stakeholders – Central ministries, regulators, state governments, district administration, local bodies, trade and industry associations to promote adoption of digital payment systems.

- The idea is to establish and monitor an implementation framework with strict timelines to ensure that nearly 80% of the transactions in India moves to the digital-only platform

- The committee will also try to estimate the costs involved in various digital payments options and oversee the implementation of these measures to make such transactions between the government and citizens cheaper than cash-based transactions.

- Pradhan Mantri Jan Dhan Yojana , one of the biggest financial inclusion initiatives in the world, was launched in 2014. It is a national mission on financial inclusion which has an integrated approach to bring about comprehensive financial inclusion and provide banking services to all households within the country. This scheme ensures access to a range of financial services like availability of basic savings, bank accounts, access to need-based credit, insurance and pension. It has played a significant role in the opening of bank accounts for the poor.

- The terms of reference of the committee include identifying global best practices for implementing an economy primarily based on digital payments and examine the possibility of adopting these global standards in the Indian context.

- The panel will also outline measures for rapid expansion and adoption of the system of digital payments like cards (Debit, Credit and pre-paid), Digital-wallets/ e-wallets, internet banking, Unified Payments Interface (UPI), banking apps, etc. and shall broadly come up with the roadmap to be implemented in one year.

- Ratan Watal panel on digital payments

The panel, headed by former finance secretary Ratan Watal, was constituted in August to suggest ways to encourage India’s movement towards a cashless economy.

Way Forward

India must learn from other countries in the developing world, which have managed to reduce their dependence on cash even while bringing in more people in the folds of the formal banking system. Kenya has been a well-documented success story, where mobile money has spread much faster and deeper than in India. Kenyan households with access to mobile money were able to manage negative economic shocks (like job loss, death of livestock or problems with harvests) better than those without access to mobile money.

The path forward is clear:

- Invest in building the required financial and digital infrastructure

- A nationwide financial and digital literacy campaign accompanied by a medium-term strategy to improve access to, and awareness of, electronic payments. Targeted financial education programs can improve financial skills and credit management, and increase account ownership.

- the government must undertake the herculean task of changing attitudes towards digital payments among customers and merchants

- Put in place all necessary cybersecurity measures

Cashless Economy – What is United Interface Payments (UPI)?

How to Approach the topic ‘Cashless Economy in India’ for UPSC

- Economics – Learn about UPI, Payments Modes etc.

- Current Affairs – Check on important editorials related to the Indian economy.

General Studies III:

- Indian Economy

- Cashless Economy – a probable essay topic

Practice Questions:

- Which of the following committees dealt with digital payments?

- Urjit Patel committee

- Bimal Jalan committee

- Ratan Watal committee

- Nachiket Mor committee

- Critically Discuss the benefits of India transitioning into a cashless economy. Does India possess the required prerequisites?

Frequently Asked Questions on Cashless Economy in India

Q 1. what is cashless economy and is india ready for cashless economy, q 2. how is cashless economy beneficial.

Related Links:

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

IAS 2024 - Your dream can come true!

Download the ultimate guide to upsc cse preparation.

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

- Ultimate Combo

- Sign Out Sign Out Sign In

35 Best Cashless-Themed Templates for PowerPoint & Google Slides

With over 6 million presentation templates available for you to choose from, crystalgraphics is the award-winning provider of the world’s largest collection of templates for powerpoint and google slides. so, take your time and look around. you’ll like what you see whether you want 1 great template or an ongoing subscription, we've got affordable purchasing options and 24/7 download access to fit your needs. thanks to our unbeatable combination of quality, selection and unique customization options, crystalgraphics is the company you can count on for your presentation enhancement needs. just ask any of our thousands of satisfied customers from virtually every leading company around the world. they love our products. we think you will, too" id="category_description">crystalgraphics creates templates designed to make even average presentations look incredible. below you’ll see thumbnail sized previews of the title slides of a few of our 35 best cashless templates for powerpoint and google slides. the text you’ll see in in those slides is just example text. the cashless-related image or video you’ll see in the background of each title slide is designed to help you set the stage for your cashless-related topics and it is included with that template. in addition to the title slides, each of our templates comes with 17 additional slide layouts that you can use to create an unlimited number of presentation slides with your own added text and images. and every template is available in both widescreen and standard formats. with over 6 million presentation templates available for you to choose from, crystalgraphics is the award-winning provider of the world’s largest collection of templates for powerpoint and google slides. so, take your time and look around. you’ll like what you see whether you want 1 great template or an ongoing subscription, we've got affordable purchasing options and 24/7 download access to fit your needs. thanks to our unbeatable combination of quality, selection and unique customization options, crystalgraphics is the company you can count on for your presentation enhancement needs. just ask any of our thousands of satisfied customers from virtually every leading company around the world. they love our products. we think you will, too.

Widescreen (16:9) Presentation Templates. Change size...

Slides featuring qr code payment online shopping cashless technology concept

PPT theme enhanced with cashless society background

Presentation theme consisting of qr code payment online shopping cashless technology concept

PPT theme consisting of customer scanning tag in coffee shop to pay online close up of hand scanning qr code for cashless payment at cafeteria girl framing qr code to make a purchase small business accepts digital payment

PPT theme featuring qr code payment online shopping cashless technology concept

Presentation design consisting of close-up a credit card for cashless pay and keyboard symbolic photo for shopping on the internet

Slides featuring woman barista wearing medical face mask holding cashless terminal to pay for order at the counter

PPT theme featuring woman barista wearing medical face mask holding cashless terminal to pay for order at the counter customer paying with mobile phone backdrop

Slides having customer pays cashless and makes mobile payment with cash card at checkout

Slides enhanced with qr code payment online shopping cashless technology concept

Theme enhanced with asian barista woman holding creadit card reader machine cashless payment for coffee purchase at cafe cashless preventing from coronavirus covid-19 spreading and infection panoramic web banner crop

Theme having close up of woman hands holding mobile phone with application to receive money people holding smart phone and making cashless payment transaction smartphone screen displaying money received message

PPT theme consisting of hand puts credit card in the reader at the checkout for cashless payment in retail

Theme featuring cashless payment at the card terminal with a credit card or giro card in retail background

Theme with cashless and contactless payment with a smartphone app on the nfc reader in retail

Slide set with senior's hand holds a credit card for cashless payment and for e-commerce in online retail

Slide deck consisting of woman barista wearing medical face mask holding cashless terminal to pay for order at the counter

Slide deck featuring woman barista wearing medical face mask holding cashless terminal to pay for order at the counter

Theme featuring woman barista wearing medical face mask holding cashless terminal to pay for order at the counter backdrop

PPT layouts featuring customer making cashless payment with credit card at the reader in the flower shop

PPT theme enhanced with close-up of man putting credit card to payment terminal while using cashless payment in cafe backdrop

PPT theme featuring cashless payment with a credit card using the reader at the checkout as a retail service background

PPT theme having young man barista wearing medical face mask holding cashless terminal to pay for order at the counter

Presentation theme with young man barista wearing medical face mask holding cashless terminal to pay for order at the counter cutomer paying with mobile phone

Theme enhanced with customer pays cashless with credit card at the reader at the checkout in the flower shop background

PPT theme having young woman with colorful shopping bags while shopping using credit cards for cashless payment

Theme enhanced with asian barista woman holding creadit card reader machine cashless payment using emv chip technology for coffee purchase at cafe cashless preventing from coronavirus covid-19 spreading and infection

Slides enhanced with leisure cashless payment and lifestyle concept - happy women with credit card paying bill at restaurant or wine bar

Presentation theme featuring gold credit card and euro banknotes symbolic photo for cashless transactions and status symbols

Slides featuring golden credit card bank statement and calculator symbolic photo for cashless purchases and status symbols

Slides enhanced with cashless payments in a flower shop

Presentation design enhanced with golden credit card and bank statement symbolic photo for cashless purchases and status symbols

Slide deck with asian barista woman make payment with customer credit card using emv chip technology for coffee purchase at a cafe bar cashless preventing from coronavirus covid-19 spreading and infection background

Slides with golden credit card and bank statement symbolic photo for cashless purchases and status symbols

Slides having leisure cashless payment and lifestyle concept - happy women with credit card paying bill at restaurant or wine bar background

More cashless presentation templates.

Company Info

IMAGES

COMMENTS

It's important to first reflect upon where we are on the journey toward a cashless society. Thus far, the shift is basically a move from physical cash to cash-replacements. With private companies involved in processing those transactions, there is inevitably a cost. And that means there is a loss of value when the transfer occurs.

1 of 9. Download Now. Download to read offline. Cashless economy - Download as a PDF or view online for free.

3. Introduction and Background There is a worldwide tremendous interest among policy makers, academicians, and commercial enterprises to explore the possibilities of moving towards a cashless economy. It is widely believed that the movement from cash to cashless economy has significant benefits Economy has always moved through period of transformation from time immemorial.

Our PPT comes with a range of features that make it an ideal choice for business owners, financial advisors, educators, and government officials to depict a cashless economy's payment modes and opportunities. Leverage the fully editable slides to showcase the security-related challenges, pros, and cons of the cashless economy.

A cashless economy is secure, it is clean. We have a leadership role to play in taking India towards an increasingly "digital economy". Thus, as citizens and youths of India it is in our hands to promote this magnificent India encouraged by our PM Mr. Narendra Modi who has a bright vision towards the upcoming of future India.

3. Background • India - 4th largest user of cash in the world • Government of India has taken measures to promote a cashless economy through digital payments • In the past, progress had been made, such as: Electronic banking in the 1990s In the following decade: 'Core banking' plus use of credit cards Popularization of digital payments in this decade - electronic wallets, swipe cards ...

Conversely, economies that switch to digital are more successful; the switch can boost annual GDP by as much as 3 percentage points, BCG research shows. Numerous examples around the world illustrate how cashless payments are economic propellers. Bangladesh's bKash, which enables transfers via mobile phones, has spurred growth and boosted ...

A cashless society is one in which cash, in the form of physical banknotes and coins, is not accepted in any financial transaction. Instead, people and businesses transfer money to one another digitally—via credit or debit cards, electronic money transfers, cryptocurrency, or online and mobile payment services, such as PayPal and Apple Pay.

A cashless economy has important positive implications for a society, such as the reduction in the shadow economy due to greater transparency or the decrease in transaction costs. Rogoff and Rogoff ( Citation 2017 ) concludes that there are benefits from less use of cash since it discourages tax evasion, illegal immigration and crime and ...

A collective effort is needed to ensure preparedness for the new cashless economy. We believe that the areas below will have to be re-examined to ensure adaptive and real-time cyber defence. While data will be at the core, the network perimeter will extend to end devices. Faster development will demand agile security.

Download our Cashless Society PPT template to describe the ways to pave the way for a cashless society, highlighting the merits and demerits of a cash-free s...

A cashless economy is secure, it is clean. You have a leadership role to play in taking India towards an increasingly digital economy." Cash is set to lose currency in India, as an explosion in smartphone usage drives a digital payments boom. - A free PowerPoint PPT presentation (displayed as an HTML5 slide show) on PowerShow.com - id: 85243e-ODFkM

With our editable Cashless Economy PPT template, you can demonstrate all ins and outs and merits and demerits of a cashless economy. - https://www.sketchbubb...

Cashless Economy presentation.pptx - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. Scribd is the world's largest social reading and publishing site.

Green Economy. (6 Editable Slides) Details. Reviews. Download our Cashless Economy PPT template to discuss the initiatives to encourage monetary transactions through digital mediums and limit or remove the flow of hard cash in the economy. Economists and IT professionals can leverage this deck to showcase the role of technological advancements ...

The cashless Economy in India has been amplified with the Indian Government's initiative of Digital India. This is a flagship programme with a vision to transform India into a digitally empowered society and knowledge economy. The topic, 'Cashless Economy' is important for GS-III Indian Economy of the IAS Exam. This article will talk ...

Cashless Economy - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. This presentation was prepared by MBA students BRISTI SONOWAL BINAYAK BARMAN DAVID THANGEW

A. Aishwarya Joshi. The village of Dhasai initially embraced a cashless economy after demonetization, with villagers using ATM cards and mobile payments like BHIM. However, presently only 15-20% of daily transactions remain cashless. This is due to several factors, including a lack of access to banking services and digital literacy - only 4,000 ...

A cashless economy is an economy in which all types of transactions are carried out through digital means. It includes e-banking (mobile banking or computers), debit and credit cards, card-swipe or point of sales (POS) machines and digital wallets. The RBI and the government are making several efforts to reduce the

35 Best Cashless-Themed Templates. CrystalGraphics creates templates designed to make even average presentations look incredible. Below you'll see thumbnail sized previews of the title slides of a few of our 35 best cashless templates for PowerPoint and Google Slides. The text you'll see in in those slides is just example text.

Cashless economy - Presentation of Cashless economy methods to follow Abhinav Reddy Lattu ...

We completed the presentation "Cashless economy" using the teachers' prior knowledge, expertise, and assistance. We also want to express our gratitude to the TRS601 P1 class team, who have supported us and assisted us greatly over the last two months. We appreciate your support and working through in this times with us.

4. • Before demonetization, 86% cash in India was in the form of 1000 and 500 rupee notes. • It cost the central bank Rs.3917 crore to print Rs. 500 notes and Rs. 2000 crore to print Rs.1000 notes. • Manufacturing of coins cost a lot to government of India as the value of metal of one rupee coin is 70 paisa when melted, so more care is to be taken.