Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- Questionnaire Design | Methods, Question Types & Examples

Questionnaire Design | Methods, Question Types & Examples

Published on July 15, 2021 by Pritha Bhandari . Revised on June 22, 2023.

A questionnaire is a list of questions or items used to gather data from respondents about their attitudes, experiences, or opinions. Questionnaires can be used to collect quantitative and/or qualitative information.

Questionnaires are commonly used in market research as well as in the social and health sciences. For example, a company may ask for feedback about a recent customer service experience, or psychology researchers may investigate health risk perceptions using questionnaires.

Table of contents

Questionnaires vs. surveys, questionnaire methods, open-ended vs. closed-ended questions, question wording, question order, step-by-step guide to design, other interesting articles, frequently asked questions about questionnaire design.

A survey is a research method where you collect and analyze data from a group of people. A questionnaire is a specific tool or instrument for collecting the data.

Designing a questionnaire means creating valid and reliable questions that address your research objectives , placing them in a useful order, and selecting an appropriate method for administration.

But designing a questionnaire is only one component of survey research. Survey research also involves defining the population you’re interested in, choosing an appropriate sampling method , administering questionnaires, data cleansing and analysis, and interpretation.

Sampling is important in survey research because you’ll often aim to generalize your results to the population. Gather data from a sample that represents the range of views in the population for externally valid results. There will always be some differences between the population and the sample, but minimizing these will help you avoid several types of research bias , including sampling bias , ascertainment bias , and undercoverage bias .

Prevent plagiarism. Run a free check.

Questionnaires can be self-administered or researcher-administered . Self-administered questionnaires are more common because they are easy to implement and inexpensive, but researcher-administered questionnaires allow deeper insights.

Self-administered questionnaires

Self-administered questionnaires can be delivered online or in paper-and-pen formats, in person or through mail. All questions are standardized so that all respondents receive the same questions with identical wording.

Self-administered questionnaires can be:

- cost-effective

- easy to administer for small and large groups

- anonymous and suitable for sensitive topics

But they may also be:

- unsuitable for people with limited literacy or verbal skills

- susceptible to a nonresponse bias (most people invited may not complete the questionnaire)

- biased towards people who volunteer because impersonal survey requests often go ignored.

Researcher-administered questionnaires

Researcher-administered questionnaires are interviews that take place by phone, in-person, or online between researchers and respondents.

Researcher-administered questionnaires can:

- help you ensure the respondents are representative of your target audience

- allow clarifications of ambiguous or unclear questions and answers

- have high response rates because it’s harder to refuse an interview when personal attention is given to respondents

But researcher-administered questionnaires can be limiting in terms of resources. They are:

- costly and time-consuming to perform

- more difficult to analyze if you have qualitative responses

- likely to contain experimenter bias or demand characteristics

- likely to encourage social desirability bias in responses because of a lack of anonymity

Your questionnaire can include open-ended or closed-ended questions or a combination of both.

Using closed-ended questions limits your responses, while open-ended questions enable a broad range of answers. You’ll need to balance these considerations with your available time and resources.

Closed-ended questions

Closed-ended, or restricted-choice, questions offer respondents a fixed set of choices to select from. Closed-ended questions are best for collecting data on categorical or quantitative variables.

Categorical variables can be nominal or ordinal. Quantitative variables can be interval or ratio. Understanding the type of variable and level of measurement means you can perform appropriate statistical analyses for generalizable results.

Examples of closed-ended questions for different variables

Nominal variables include categories that can’t be ranked, such as race or ethnicity. This includes binary or dichotomous categories.

It’s best to include categories that cover all possible answers and are mutually exclusive. There should be no overlap between response items.

In binary or dichotomous questions, you’ll give respondents only two options to choose from.

White Black or African American American Indian or Alaska Native Asian Native Hawaiian or Other Pacific Islander

Ordinal variables include categories that can be ranked. Consider how wide or narrow a range you’ll include in your response items, and their relevance to your respondents.

Likert scale questions collect ordinal data using rating scales with 5 or 7 points.

When you have four or more Likert-type questions, you can treat the composite data as quantitative data on an interval scale . Intelligence tests, psychological scales, and personality inventories use multiple Likert-type questions to collect interval data.

With interval or ratio scales , you can apply strong statistical hypothesis tests to address your research aims.

Pros and cons of closed-ended questions

Well-designed closed-ended questions are easy to understand and can be answered quickly. However, you might still miss important answers that are relevant to respondents. An incomplete set of response items may force some respondents to pick the closest alternative to their true answer. These types of questions may also miss out on valuable detail.

To solve these problems, you can make questions partially closed-ended, and include an open-ended option where respondents can fill in their own answer.

Open-ended questions

Open-ended, or long-form, questions allow respondents to give answers in their own words. Because there are no restrictions on their choices, respondents can answer in ways that researchers may not have otherwise considered. For example, respondents may want to answer “multiracial” for the question on race rather than selecting from a restricted list.

- How do you feel about open science?

- How would you describe your personality?

- In your opinion, what is the biggest obstacle for productivity in remote work?

Open-ended questions have a few downsides.

They require more time and effort from respondents, which may deter them from completing the questionnaire.

For researchers, understanding and summarizing responses to these questions can take a lot of time and resources. You’ll need to develop a systematic coding scheme to categorize answers, and you may also need to involve other researchers in data analysis for high reliability .

Question wording can influence your respondents’ answers, especially if the language is unclear, ambiguous, or biased. Good questions need to be understood by all respondents in the same way ( reliable ) and measure exactly what you’re interested in ( valid ).

Use clear language

You should design questions with your target audience in mind. Consider their familiarity with your questionnaire topics and language and tailor your questions to them.

For readability and clarity, avoid jargon or overly complex language. Don’t use double negatives because they can be harder to understand.

Use balanced framing

Respondents often answer in different ways depending on the question framing. Positive frames are interpreted as more neutral than negative frames and may encourage more socially desirable answers.

Use a mix of both positive and negative frames to avoid research bias , and ensure that your question wording is balanced wherever possible.

Unbalanced questions focus on only one side of an argument. Respondents may be less likely to oppose the question if it is framed in a particular direction. It’s best practice to provide a counter argument within the question as well.

Avoid leading questions

Leading questions guide respondents towards answering in specific ways, even if that’s not how they truly feel, by explicitly or implicitly providing them with extra information.

It’s best to keep your questions short and specific to your topic of interest.

- The average daily work commute in the US takes 54.2 minutes and costs $29 per day. Since 2020, working from home has saved many employees time and money. Do you favor flexible work-from-home policies even after it’s safe to return to offices?

- Experts agree that a well-balanced diet provides sufficient vitamins and minerals, and multivitamins and supplements are not necessary or effective. Do you agree or disagree that multivitamins are helpful for balanced nutrition?

Keep your questions focused

Ask about only one idea at a time and avoid double-barreled questions. Double-barreled questions ask about more than one item at a time, which can confuse respondents.

This question could be difficult to answer for respondents who feel strongly about the right to clean drinking water but not high-speed internet. They might only answer about the topic they feel passionate about or provide a neutral answer instead – but neither of these options capture their true answers.

Instead, you should ask two separate questions to gauge respondents’ opinions.

Strongly Agree Agree Undecided Disagree Strongly Disagree

Do you agree or disagree that the government should be responsible for providing high-speed internet to everyone?

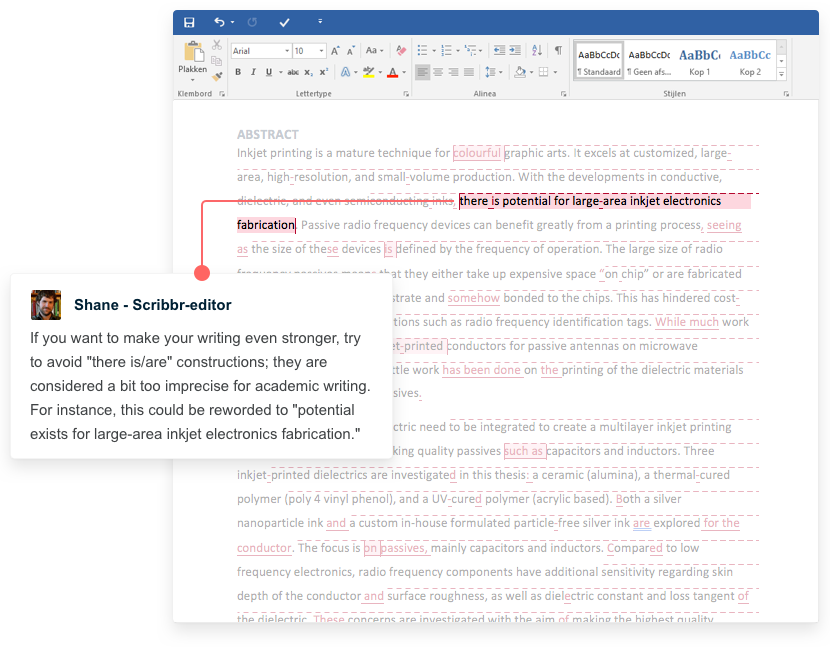

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

You can organize the questions logically, with a clear progression from simple to complex. Alternatively, you can randomize the question order between respondents.

Logical flow

Using a logical flow to your question order means starting with simple questions, such as behavioral or opinion questions, and ending with more complex, sensitive, or controversial questions.

The question order that you use can significantly affect the responses by priming them in specific directions. Question order effects, or context effects, occur when earlier questions influence the responses to later questions, reducing the validity of your questionnaire.

While demographic questions are usually unaffected by order effects, questions about opinions and attitudes are more susceptible to them.

- How knowledgeable are you about Joe Biden’s executive orders in his first 100 days?

- Are you satisfied or dissatisfied with the way Joe Biden is managing the economy?

- Do you approve or disapprove of the way Joe Biden is handling his job as president?

It’s important to minimize order effects because they can be a source of systematic error or bias in your study.

Randomization

Randomization involves presenting individual respondents with the same questionnaire but with different question orders.

When you use randomization, order effects will be minimized in your dataset. But a randomized order may also make it harder for respondents to process your questionnaire. Some questions may need more cognitive effort, while others are easier to answer, so a random order could require more time or mental capacity for respondents to switch between questions.

Step 1: Define your goals and objectives

The first step of designing a questionnaire is determining your aims.

- What topics or experiences are you studying?

- What specifically do you want to find out?

- Is a self-report questionnaire an appropriate tool for investigating this topic?

Once you’ve specified your research aims, you can operationalize your variables of interest into questionnaire items. Operationalizing concepts means turning them from abstract ideas into concrete measurements. Every question needs to address a defined need and have a clear purpose.

Step 2: Use questions that are suitable for your sample

Create appropriate questions by taking the perspective of your respondents. Consider their language proficiency and available time and energy when designing your questionnaire.

- Are the respondents familiar with the language and terms used in your questions?

- Would any of the questions insult, confuse, or embarrass them?

- Do the response items for any closed-ended questions capture all possible answers?

- Are the response items mutually exclusive?

- Do the respondents have time to respond to open-ended questions?

Consider all possible options for responses to closed-ended questions. From a respondent’s perspective, a lack of response options reflecting their point of view or true answer may make them feel alienated or excluded. In turn, they’ll become disengaged or inattentive to the rest of the questionnaire.

Step 3: Decide on your questionnaire length and question order

Once you have your questions, make sure that the length and order of your questions are appropriate for your sample.

If respondents are not being incentivized or compensated, keep your questionnaire short and easy to answer. Otherwise, your sample may be biased with only highly motivated respondents completing the questionnaire.

Decide on your question order based on your aims and resources. Use a logical flow if your respondents have limited time or if you cannot randomize questions. Randomizing questions helps you avoid bias, but it can take more complex statistical analysis to interpret your data.

Step 4: Pretest your questionnaire

When you have a complete list of questions, you’ll need to pretest it to make sure what you’re asking is always clear and unambiguous. Pretesting helps you catch any errors or points of confusion before performing your study.

Ask friends, classmates, or members of your target audience to complete your questionnaire using the same method you’ll use for your research. Find out if any questions were particularly difficult to answer or if the directions were unclear or inconsistent, and make changes as necessary.

If you have the resources, running a pilot study will help you test the validity and reliability of your questionnaire. A pilot study is a practice run of the full study, and it includes sampling, data collection , and analysis. You can find out whether your procedures are unfeasible or susceptible to bias and make changes in time, but you can’t test a hypothesis with this type of study because it’s usually statistically underpowered .

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analyzing data from people using questionnaires.

Closed-ended, or restricted-choice, questions offer respondents a fixed set of choices to select from. These questions are easier to answer quickly.

Open-ended or long-form questions allow respondents to answer in their own words. Because there are no restrictions on their choices, respondents can answer in ways that researchers may not have otherwise considered.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviors. It is made up of 4 or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with 5 or 7 possible responses, to capture their degree of agreement.

You can organize the questions logically, with a clear progression from simple to complex, or randomly between respondents. A logical flow helps respondents process the questionnaire easier and quicker, but it may lead to bias. Randomization can minimize the bias from order effects.

Questionnaires can be self-administered or researcher-administered.

Researcher-administered questionnaires are interviews that take place by phone, in-person, or online between researchers and respondents. You can gain deeper insights by clarifying questions for respondents or asking follow-up questions.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Bhandari, P. (2023, June 22). Questionnaire Design | Methods, Question Types & Examples. Scribbr. Retrieved April 10, 2024, from https://www.scribbr.com/methodology/questionnaire/

Is this article helpful?

Pritha Bhandari

Other students also liked, survey research | definition, examples & methods, what is a likert scale | guide & examples, reliability vs. validity in research | difference, types and examples, unlimited academic ai-proofreading.

✔ Document error-free in 5minutes ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

Questionnaires

Questionnaires can be classified as both, quantitative and qualitative method depending on the nature of questions. Specifically, answers obtained through closed-ended questions (also called restricted questions) with multiple choice answer options are analyzed using quantitative methods. Research findings in this case can be illustrated using tabulations, pie-charts, bar-charts and percentages.

Answers obtained to open-ended questionnaire questions (also known as unrestricted questions), on the other hand, are analyzed using qualitative methods. Primary data collected using open-ended questionnaires involve discussions and critical analyses without use of numbers and calculations.

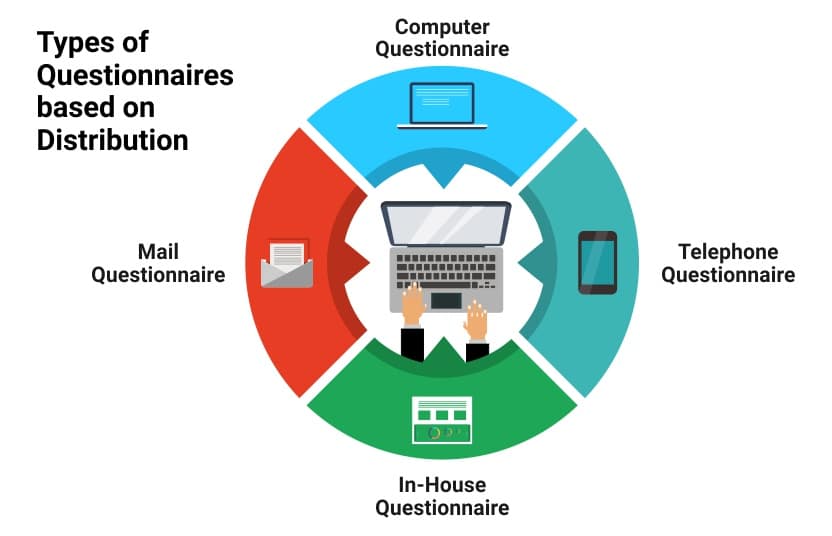

There are following types of questionnaires:

Computer questionnaire . Respondents are asked to answer the questionnaire which is sent by mail. The advantages of the computer questionnaires include their inexpensive price, time-efficiency, and respondents do not feel pressured, therefore can answer when they have time, giving more accurate answers. However, the main shortcoming of the mail questionnaires is that sometimes respondents do not bother answering them and they can just ignore the questionnaire.

Telephone questionnaire . Researcher may choose to call potential respondents with the aim of getting them to answer the questionnaire. The advantage of the telephone questionnaire is that, it can be completed during the short amount of time. The main disadvantage of the phone questionnaire is that it is expensive most of the time. Moreover, most people do not feel comfortable to answer many questions asked through the phone and it is difficult to get sample group to answer questionnaire over the phone.

In-house survey . This type of questionnaire involves the researcher visiting respondents in their houses or workplaces. The advantage of in-house survey is that more focus towards the questions can be gained from respondents. However, in-house surveys also have a range of disadvantages which include being time consuming, more expensive and respondents may not wish to have the researcher in their houses or workplaces for various reasons.

Mail Questionnaire . This sort of questionnaires involve the researcher to send the questionnaire list to respondents through post, often attaching pre-paid envelope. Mail questionnaires have an advantage of providing more accurate answer, because respondents can answer the questionnaire in their spare time. The disadvantages associated with mail questionnaires include them being expensive, time consuming and sometimes they end up in the bin put by respondents.

Questionnaires can include the following types of questions:

Open question questionnaires . Open questions differ from other types of questions used in questionnaires in a way that open questions may produce unexpected results, which can make the research more original and valuable. However, it is difficult to analyze the results of the findings when the data is obtained through the questionnaire with open questions.

Multiple choice question s. Respondents are offered a set of answers they have to choose from. The downsize of questionnaire with multiple choice questions is that, if there are too many answers to choose from, it makes the questionnaire, confusing and boring, and discourages the respondent to answer the questionnaire.

Dichotomous Questions . Thes type of questions gives two options to respondents – yes or no, to choose from. It is the easiest form of questionnaire for the respondent in terms of responding it.

Scaling Questions . Also referred to as ranking questions, they present an option for respondents to rank the available answers to questions on the scale of given range of values (for example from 1 to 10).

For a standard 15,000-20,000 word business dissertation including 25-40 questions in questionnaires will usually suffice. Questions need be formulated in an unambiguous and straightforward manner and they should be presented in a logical order.

Questionnaires as primary data collection method offer the following advantages:

- Uniformity: all respondents are asked exactly the same questions

- Cost-effectiveness

- Possibility to collect the primary data in shorter period of time

- Minimum or no bias from the researcher during the data collection process

- Usually enough time for respondents to think before answering questions, as opposed to interviews

- Possibility to reach respondents in distant areas through online questionnaire

At the same time, the use of questionnaires as primary data collection method is associated with the following shortcomings:

- Random answer choices by respondents without properly reading the question.

- In closed-ended questionnaires no possibility for respondents to express their additional thoughts about the matter due to the absence of a relevant question.

- Collecting incomplete or inaccurate information because respondents may not be able to understand questions correctly.

- High rate of non-response

Survey Monkey represents one of the most popular online platforms for facilitating data collection through questionnaires. Substantial benefits offered by Survey Monkey include its ease to use, presentation of questions in many different formats and advanced data analysis capabilities.

Survey Monkey as a popular platform for primary data collection

There are other alternatives to Survey Monkey you might want to consider to use as a platform for your survey. These include but not limited to Jotform, Google Forms, Lime Survey, Crowd Signal, Survey Gizmo, Zoho Survey and many others.

My e-book, The Ultimate Guide to Writing a Dissertation in Business Studies: a step by step approach contains a detailed, yet simple explanation of quantitative methods. The e-book explains all stages of the research process starting from the selection of the research area to writing personal reflection. Important elements of dissertations such as research philosophy, research approach, research design, methods of data collection and data analysis are explained in simple words.

John Dudovskiy

Questionnaire Method In Research

Saul Mcleod, PhD

Editor-in-Chief for Simply Psychology

BSc (Hons) Psychology, MRes, PhD, University of Manchester

Saul Mcleod, PhD., is a qualified psychology teacher with over 18 years of experience in further and higher education. He has been published in peer-reviewed journals, including the Journal of Clinical Psychology.

Learn about our Editorial Process

Olivia Guy-Evans, MSc

Associate Editor for Simply Psychology

BSc (Hons) Psychology, MSc Psychology of Education

Olivia Guy-Evans is a writer and associate editor for Simply Psychology. She has previously worked in healthcare and educational sectors.

On This Page:

A questionnaire is a research instrument consisting of a series of questions for the purpose of gathering information from respondents. Questionnaires can be thought of as a kind of written interview . They can be carried out face to face, by telephone, computer, or post.

Questionnaires provide a relatively cheap, quick, and efficient way of obtaining large amounts of information from a large sample of people.

Data can be collected relatively quickly because the researcher would not need to be present when completing the questionnaires. This is useful for large populations when interviews would be impractical.

However, a problem with questionnaires is that respondents may lie due to social desirability. Most people want to present a positive image of themselves, and may lie or bend the truth to look good, e.g., pupils exaggerate revision duration.

Questionnaires can effectively measure relatively large subjects’ behavior, attitudes, preferences, opinions, and intentions more cheaply and quickly than other methods.

Often, a questionnaire uses both open and closed questions to collect data. This is beneficial as it means both quantitative and qualitative data can be obtained.

Closed Questions

A closed-ended question requires a specific, limited response, often “yes” or “no” or a choice that fit into pre-decided categories.

Data that can be placed into a category is called nominal data. The category can be restricted to as few as two options, i.e., dichotomous (e.g., “yes” or “no,” “male” or “female”), or include quite complex lists of alternatives from which the respondent can choose (e.g., polytomous).

Closed questions can also provide ordinal data (which can be ranked). This often involves using a continuous rating scale to measure the strength of attitudes or emotions.

For example, strongly agree / agree / neutral / disagree / strongly disagree / unable to answer.

Closed questions have been used to research type A personality (e.g., Friedman & Rosenman, 1974) and also to assess life events that may cause stress (Holmes & Rahe, 1967) and attachment (Fraley, Waller, & Brennan, 2000).

- They can be economical. This means they can provide large amounts of research data for relatively low costs. Therefore, a large sample size can be obtained, which should represent the population from which a researcher can then generalize.

- The respondent provides information that can be easily converted into quantitative data (e.g., count the number of “yes” or “no” answers), allowing statistical analysis of the responses.

- The questions are standardized. All respondents are asked exactly the same questions in the same order. This means a questionnaire can be replicated easily to check for reliability . Therefore, a second researcher can use the questionnaire to confirm consistent results.

Limitations

- They lack detail. Because the responses are fixed, there is less scope for respondents to supply answers that reflect their true feelings on a topic.

Open Questions

Open questions allow for expansive, varied answers without preset options or limitations.

Open questions allow people to express what they think in their own words. Open-ended questions enable the respondent to answer in as much detail as they like in their own words. For example: “can you tell me how happy you feel right now?”

Open questions will work better if you want to gather more in-depth answers from your respondents. These give no pre-set answer options and instead, allow the respondents to put down exactly what they like in their own words.

Open questions are often used for complex questions that cannot be answered in a few simple categories but require more detail and discussion.

Lawrence Kohlberg presented his participants with moral dilemmas. One of the most famous concerns a character called Heinz, who is faced with the choice between watching his wife die of cancer or stealing the only drug that could help her.

Participants were asked whether Heinz should steal the drug or not and, more importantly, for their reasons why upholding or breaking the law is right.

- Rich qualitative data is obtained as open questions allow respondents to elaborate on their answers. This means the research can determine why a person holds a certain attitude .

- Time-consuming to collect the data. It takes longer for the respondent to complete open questions. This is a problem as a smaller sample size may be obtained.

- Time-consuming to analyze the data. It takes longer for the researcher to analyze qualitative data as they have to read the answers and try to put them into categories by coding, which is often subjective and difficult. However, Smith (1992) has devoted an entire book to the issues of thematic content analysis that includes 14 different scoring systems for open-ended questions.

- Not suitable for less educated respondents as open questions require superior writing skills and a better ability to express one’s feelings verbally.

Questionnaire Design

With some questionnaires suffering from a response rate as low as 5%, a questionnaire must be well designed.

There are several important factors in questionnaire design.

Pilot Study

Question order.

Questions should progress logically from the least sensitive to the most sensitive, from the factual and behavioral to the cognitive, and from the more general to the more specific.

The researcher should ensure that previous questions do not influence the answer to a question.

Question order effects

- Question order effects occur when responses to an earlier question affect responses to a later question in a survey. They can arise at different stages of the survey response process – interpretation, information retrieval, judgment/estimation, and reporting.

- Types of question order effects include: unconditional (subsequent answers affected by prior question topic), conditional (subsequent answers depend on the response to the prior question), and associational (correlation between two questions changes based on order).

- Question order effects have been found across different survey topics like social and political attitudes, health and safety studies, vignette research, etc. Effects may be moderated by respondent factors like age, education level, knowledge and attitudes about the topic.

- To minimize question order effects, recommendations include avoiding judgmental dependencies, separating potentially reactive questions, randomizing questions, following good survey design principles, considering respondent characteristics, and intentionally examining question context and order.

Terminology

- There should be a minimum of technical jargon. Questions should be simple, to the point, and easy to understand. The language of a questionnaire should be appropriate to the vocabulary of the group of people being studied.

- Use statements that are interpreted in the same way by members of different subpopulations of the population of interest.

- For example, the researcher must change the language of questions to match the social background of the respondent’s age / educational level / social class/ethnicity, etc.

Presentation

Ethical issues.

- The researcher must ensure that the information provided by the respondent is kept confidential, e.g., name, address, etc.

- This means questionnaires are good for researching sensitive topics as respondents will be more honest when they cannot be identified.

- Keeping the questionnaire confidential should also reduce the likelihood of psychological harm, such as embarrassment.

- Participants must provide informed consent before completing the questionnaire and must be aware that they have the right to withdraw their information at any time during the survey/ study.

Problems with Postal Questionnaires

At first sight, the postal questionnaire seems to offer the opportunity to get around the problem of interview bias by reducing the personal involvement of the researcher. Its other practical advantages are that it is cheaper than face-to-face interviews and can quickly contact many respondents scattered over a wide area.

However, these advantages must be weighed against the practical problems of conducting research by post. A lack of involvement by the researcher means there is little control over the information-gathering process.

The data might not be valid (i.e., truthful) as we can never be sure that the questionnaire was completed by the person to whom it was addressed.

That, of course, assumes there is a reply in the first place, and one of the most intractable problems of mailed questionnaires is a low response rate. This diminishes the reliability of the data

Also, postal questionnaires may not represent the population they are studying. This may be because:

- Some questionnaires may be lost in the post, reducing the sample size.

- The questionnaire may be completed by someone not a member of the research population.

- Those with strong views on the questionnaire’s subject are more likely to complete it than those without interest.

Benefits of a Pilot Study

A pilot study is a practice / small-scale study conducted before the main study.

It allows the researcher to try out the study with a few participants so that adjustments can be made before the main study, saving time and money.

It is important to conduct a questionnaire pilot study for the following reasons:

- Check that respondents understand the terminology used in the questionnaire.

- Check that emotive questions are not used, as they make people defensive and could invalidate their answers.

- Check that leading questions have not been used as they could bias the respondent’s answer.

- Ensure the questionnaire can be completed in an appropriate time frame (i.e., it’s not too long).

Frequently Asked Questions

How do psychological researchers analyze the data collected from questionnaires.

Psychological researchers analyze questionnaire data by looking for patterns and trends in people’s responses. They use numbers and charts to summarize the information.

They calculate things like averages and percentages to see what most people think or feel. They also compare different groups to see if there are any differences between them.

By doing these analyses, researchers can understand how people think, feel, and behave. This helps them make conclusions and learn more about how our minds work.

Are questionnaires effective in gathering accurate data?

Yes, questionnaires can be effective in gathering accurate data. When designed well, with clear and understandable questions, they allow individuals to express their thoughts, opinions, and experiences.

However, the accuracy of the data depends on factors such as the honesty and accuracy of respondents’ answers, their understanding of the questions, and their willingness to provide accurate information. Researchers strive to create reliable and valid questionnaires to minimize biases and errors.

It’s important to remember that while questionnaires can provide valuable insights, they are just one tool among many used in psychological research.

Can questionnaires be used with diverse populations and cultural contexts?

Yes, questionnaires can be used with diverse populations and cultural contexts. Researchers take special care to ensure that questionnaires are culturally sensitive and appropriate for different groups.

This means adapting the language, examples, and concepts to match the cultural context. By doing so, questionnaires can capture the unique perspectives and experiences of individuals from various backgrounds.

This helps researchers gain a more comprehensive understanding of human behavior and ensures that everyone’s voice is heard and represented in psychological research.

Are questionnaires the only method used in psychological research?

No, questionnaires are not the only method used in psychological research. Psychologists use a variety of research methods, including interviews, observations , experiments , and psychological tests.

Each method has its strengths and limitations, and researchers choose the most appropriate method based on their research question and goals.

Questionnaires are valuable for gathering self-report data, but other methods allow researchers to directly observe behavior, study interactions, or manipulate variables to test hypotheses.

By using multiple methods, psychologists can gain a more comprehensive understanding of human behavior and mental processes.

What is a semantic differential scale?

The semantic differential scale is a questionnaire format used to gather data on individuals’ attitudes or perceptions. It’s commonly incorporated into larger surveys or questionnaires to assess subjective qualities or feelings about a specific topic, product, or concept by quantifying them on a scale between two bipolar adjectives.

It presents respondents with a pair of opposite adjectives (e.g., “happy” vs. “sad”) and asks them to mark their position on a scale between them, capturing the intensity of their feelings about a particular subject.

It quantifies subjective qualities, turning them into data that can be statistically analyzed.

Ayidiya, S. A., & McClendon, M. J. (1990). Response effects in mail surveys. Public Opinion Quarterly, 54 (2), 229–247. https://doi.org/10.1086/269200

Fraley, R. C., Waller, N. G., & Brennan, K. A. (2000). An item-response theory analysis of self-report measures of adult attachment. Journal of Personality and Social Psychology, 78, 350-365.

Friedman, M., & Rosenman, R. H. (1974). Type A behavior and your heart . New York: Knopf.

Gold, R. S., & Barclay, A. (2006). Order of question presentation and correlation between judgments of comparative and own risk. Psychological Reports, 99 (3), 794–798. https://doi.org/10.2466/PR0.99.3.794-798

Holmes, T. H., & Rahe, R. H. (1967). The social readjustment rating scale. Journal of psychosomatic research, 11(2) , 213-218.

Schwarz, N., & Hippler, H.-J. (1995). Subsequent questions may influence answers to preceding questions in mail surveys. Public Opinion Quarterly, 59 (1), 93–97. https://doi.org/10.1086/269460

Smith, C. P. (Ed.). (1992). Motivation and personality: Handbook of thematic content analysis . Cambridge University Press.

Further Information

- Questionnaire design and scale development

- Questionnaire Appraisal Form

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Questionnaire: The ultimate guide, advantages & examples

What is a Questionnaire?

A questionnaire is a research instrument that consists of a set of questions or other types of prompts that aims to collect information from a respondent. A research questionnaire is typically a mix of close-ended questions and open-ended questions .

Open-ended, long-form questions offer the respondent the ability to elaborate on their thoughts. Research questionnaires were developed in 1838 by the Statistical Society of London.

LEARN ABOUT: Candidate Experience Survey

The data collected from a data collection questionnaire can be both qualitative as well as quantitative in nature. A questionnaire may or may not be delivered in the form of a survey , but a survey always consists of a questionnaire.

LEARN ABOUT: Testimonial Questions

Advantages of a good questionnaire design

- With a survey questionnaire, you can gather a lot of data in less time.

- There is less chance of any bias(like selection bias ) creeping if you have a standard set of questions to be used for your target audience. You can apply logic to questions based on the respondents’ answers, but the questionnaire will remain standard for a group of respondents that fall in the same segment.

- Surveying online survey software is quick and cost-effective. It offers you a rich set of features to design, distribute, and analyze the response data.

- It can be customized to reflect your brand voice. Thus, it can be used to reinforce your brand image.

- The responses can be compared with the historical data and understand the shift in respondents’ choices and experiences.

- Respondents can answer the questionnaire without revealing their identity. Also, many survey software complies with significant data security and privacy regulations.

LEARN ABOUT: Structured Questionnaire

Characteristics of a good questionnaire

Your survey design depends on the type of information you need to collect from respondents. Qualitative questionnaires are used when there is a need to collect exploratory information to help prove or disprove a hypothesis. Quantitative questionnaires are used to validate or test a previously generated hypothesis. However, most questionnaires follow some essential characteristics:

- Uniformity: Questionnaires are very useful to collect demographic information, personal opinions, facts, or attitudes from respondents. One of the most significant attributes of a research form is uniform design and standardization. Every respondent sees the same questions. This helps in data collection and statistical analysis of this data. For example, the retail store evaluation questionnaire template contains questions for evaluating retail store experiences. Questions relate to purchase value, range of options for product selections, and quality of merchandise. These questions are uniform for all customers.

LEARN ABOUT: Research Process Steps

- Exploratory: It should be exploratory to collect qualitative data. There is no restriction on questions that can be in your questionnaire. For example, you use a data collection questionnaire and send it to the female of the household to understand her spending and saving habits relative to the household income. Open-ended questions give you more insight and allow the respondents to explain their practices. A very structured question list could limit the data collection.

LEARN ABOUT: Best Data Collection Tools

- Question Sequence: It typically follows a structured flow of questions to increase the number of responses. This sequence of questions is screening questions , warm-up questions, transition questions, skip questions, challenging questions, and classification questions. For example, our motivation and buying experience questionnaire template covers initial demographic questions and then asks for time spent in sections of the store and the rationale behind purchases.

Types & Definitions

As we explored before, questionnaires can be either structured or free-flowing. Let’s take a closer look at what that entails for your surveys.

- Structured Questionnaires: Structured questionnaires collect quantitative data . The questionnaire is planned and designed to gather precise information. It also initiates a formal inquiry, supplements data, checks previously accumulated data, and helps validate any prior hypothesis.

- Unstructured Questionnaires: Unstructured questionnaires collect qualitative data . They use a basic structure and some branching questions but nothing that limits the responses of a respondent. The questions are more open-ended to collect specific data from participants.

Types of questions in a questionnaire

You can use multiple question types in a questionnaire. Using various question types can help increase responses to your research questionnaire as they tend to keep participants more engaged. The best customer satisfaction survey templates are the most commonly used for better insights and decision-making.

Some of the widely used types of questions are:

- Open-Ended Questions: Open-ended questions help collect qualitative data in a questionnaire where the respondent can answer in a free form with little to no restrictions.

- Dichotomous Questions: The dichotomous question is generally a “yes/no” close-ended question . This question is usually used in case of the need for necessary validation. It is the most natural form of a questionnaire.

- Multiple-Choice Questions: Multiple-choice questions are a close-ended question type in which a respondent has to select one (single-select multiple-choice question) or many (multi-select multiple choice question) responses from a given list of options. The multiple-choice question consists of an incomplete stem (question), right answer or answers, incorrect answers, close alternatives, and distractors. Of course, not all multiple-choice questions have all of the answer types. For example, you probably won’t have the wrong or right answers if you’re looking for customer opinion.

- Scaling Questions: These questions are based on the principles of the four measurement scales – nominal, ordinal, interval, and ratio . A few of the question types that utilize these scales’ fundamental properties are rank order questions , Likert scale questions , semantic differential scale questions , and Stapel scale questions .

LEARN ABOUT: System Usability Scale

- Pictorial Questions: This question type is easy to use and encourages respondents to answer. It works similarly to a multiple-choice question. Respondents are asked a question, and the answer choices are images. This helps respondents choose an answer quickly without over-thinking their answers, giving you more accurate data.

Types of Questionnaires

Questionnaires can be administered or distributed in the following forms:

- Online Questionnaire : In this type, respondents are sent the questionnaire via email or other online mediums. This method is generally cost-effective and time-efficient. Respondents can also answer at leisure. Without the pressure to respond immediately, responses may be more accurate. The disadvantage, however, is that respondents can easily ignore these questionnaires. Read more about online surveys .

- Telephone Questionnaire: A researcher makes a phone call to a respondent to collect responses directly. Responses are quick once you have a respondent on the phone. However, a lot of times, the respondents hesitate to give out much information over the phone. It is also an expensive way of conducting research. You’re usually not able to collect as many responses as other types of questionnaires, so your sample may not represent the broader population.

- In-House Questionnaire: This type is used by a researcher who visits the respondent’s home or workplace. The advantage of this method is that the respondent is in a comfortable and natural environment, and in-depth data can be collected. The disadvantage, though, is that it is expensive and slow to conduct.

LEARN ABOUT: Survey Sample Sizes

- Mail Questionnaire: These are starting to be obsolete but are still being used in some market research studies. This method involves a researcher sending a physical data collection questionnaire request to a respondent that can be filled in and sent back. The advantage of this method is that respondents can complete this on their own time to answer truthfully and entirely. The disadvantage is that this method is expensive and time-consuming. There is also a high risk of not collecting enough responses to make actionable insights from the data.

How to design a Questionnaire

Questionnaire design is a multistep process that requires attention to detail at every step.

Researchers are always hoping that the responses received for a survey questionnaire yield useable data. If the questionnaire is too complicated, there is a fair chance that the respondent might get confused and will drop out or answer inaccurately.

LEARN ABOUT: Easy Test Maker

As a survey creator , you may want to pre-test the survey by administering it to a focus group during development. You can try out a few different questionnaire designs to determine which resonates best with your target audience. Pre-testing is a good practice as the survey creator can comprehend the initial stages if there are any changes required in the survey .

Steps Involved in Questionnaire Design

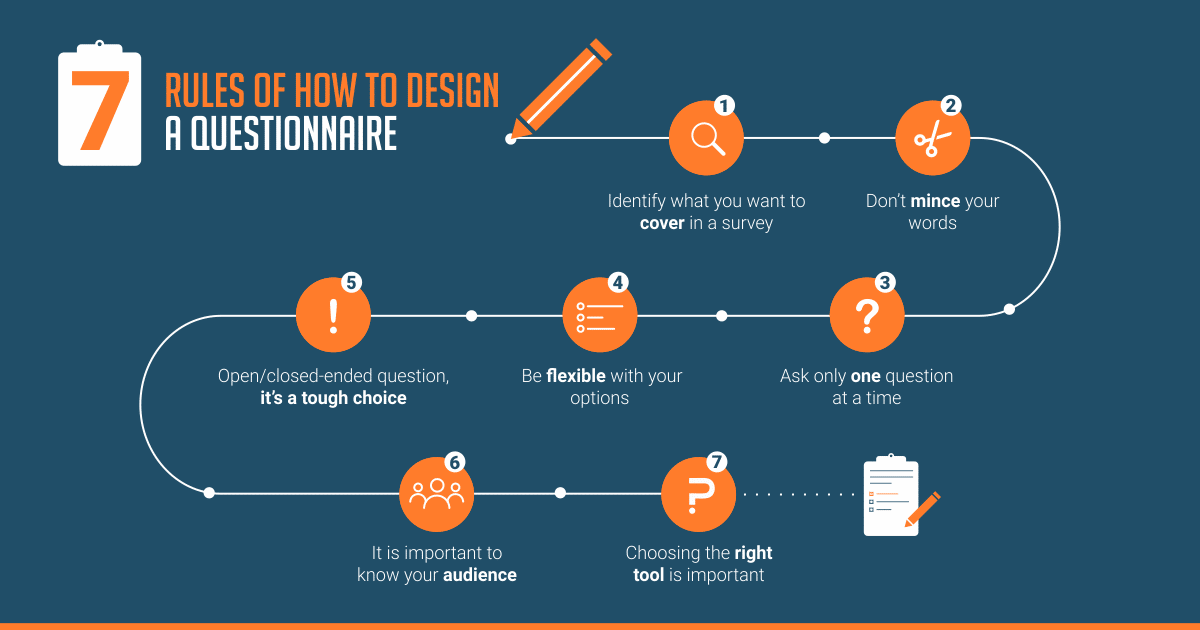

1. identify the scope of your research:.

Think about what your questionnaire is going to include before you start designing the look of it. The clarity of the topic is of utmost importance as this is the primary step in creating the questionnaire. Once you are clear on the purpose of the questionnaire, you can begin the design process.

LEARN ABOUT: Social Communication Questionnaire

2. Keep it simple:

The words or phrases you use while writing the questionnaire must be easy to understand. If the questions are unclear, the respondents may simply choose any answer and skew the data you collect.

3. Ask only one question at a time:

At times, a researcher may be tempted to add two similar questions. This might seem like an excellent way to consolidate answers to related issues, but it can confuse your respondents or lead to inaccurate data. If any of your questions contain the word “and,” take another look. This question likely has two parts, which can affect the quality of your data.

4. Be flexible with your options:

While designing, the survey creator needs to be flexible in terms of “option choice” for the respondents. Sometimes the respondents may not necessarily want to choose from the answer options provided by the survey creator. An “other” option often helps keep respondents engaged in the survey.

5. The open-ended or closed-ended question is a tough choice:

The survey creator might end up in a situation where they need to make distinct choices between open or close-ended questions. The question type should be carefully chosen as it defines the tone and importance of asking the question in the first place.

If the questionnaire requires the respondents to elaborate on their thoughts, an open-ended q u estion is the best choice. If the surveyor wants a specific response, then close-ended questions should be their primary choice. The key to asking closed-ended questions is to generate data that is easy to analyze and spot trends.

6. It is essential to know your audience:

A researcher should know their target audience. For example, if the target audience speaks mostly Spanish, sending the questionnaire in any other language would lower the response rate and accuracy of data. Something that may seem clear to you may be confusing to your respondents. Use simple language and terminology that your respondents will understand, and avoid technical jargon and industry-specific language that might confuse your respondents.

For efficient market research, researchers need a representative sample collected using one of the many sampling techniques , such as a sample questionnaire. It is imperative to plan and define these target respondents based on the demographics required.

7. Choosing the right tool is essential:

QuestionPro is a simple yet advanced survey software platform that the surveyors can use to create a questionnaire or choose from the already existing 300+ questionnaire templates.

Always save personal questions for last. Sensitive questions may cause respondents to drop off before completing. If these questions are at the end, the respondent has had time to become more comfortable with the interview and are more likely to answer personal or demographic questions.

Differences between a Questionnaire and a Survey

Read more: Difference between a survey and a questionnaire

Questionnaire Examples

The best way to understand how questionnaires work is to see the types of questionnaires available. Some examples of a questionnaire are:

USE THIS FREE TEMPLATE

The above survey questions are typically easy to use, understand, and execute. Additionally, the standardized answers of a survey questionnaire instead of a person-to-person conversation make it easier to compile useable data.

The most significant limitation of a data collection questionnaire is that respondents need to read all of the questions and respond to them. For example, you send an invitation through email asking respondents to complete the questions on social media. If a target respondent doesn’t have the right social media profiles, they can’t answer your questions.

Learn More: 350+ Free Survey Examples and Templates

MORE LIKE THIS

Top 13 A/B Testing Software for Optimizing Your Website

Apr 12, 2024

21 Best Contact Center Experience Software in 2024

Government Customer Experience: Impact on Government Service

Apr 11, 2024

Employee Engagement App: Top 11 For Workforce Improvement

Apr 10, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

Your ultimate guide to questionnaires and how to design a good one

The written questionnaire is the heart and soul of any survey research project. Whether you conduct your survey using an online questionnaire, in person, by email or over the phone, the way you design your questionnaire plays a critical role in shaping the quality of the data and insights that you’ll get from your target audience. Keep reading to get actionable tips.

What is a questionnaire?

A questionnaire is a research tool consisting of a set of questions or other ‘prompts’ to collect data from a set of respondents.

When used in most research, a questionnaire will consist of a number of types of questions (primarily open-ended and closed) in order to gain both quantitative data that can be analyzed to draw conclusions, and qualitative data to provide longer, more specific explanations.

A research questionnaire is often mistaken for a survey - and many people use the term questionnaire and survey, interchangeably.

But that’s incorrect.

Which is what we talk about next.

Get started with our free survey maker with 50+ templates

Survey vs. questionnaire – what’s the difference?

Before we go too much further, let’s consider the differences between surveys and questionnaires.

These two terms are often used interchangeably, but there is an important difference between them.

Survey definition

A survey is the process of collecting data from a set of respondents and using it to gather insights.

Survey research can be conducted using a questionnaire, but won’t always involve one.

Questionnaire definition

A questionnaire is the list of questions you circulate to your target audience.

In other words, the survey is the task you’re carrying out, and the questionnaire is the instrument you’re using to do it.

By itself, a questionnaire doesn’t achieve much.

It’s when you put it into action as part of a survey that you start to get results.

Advantages vs disadvantages of using a questionnaire

While a questionnaire is a popular method to gather data for market research or other studies, there are a few disadvantages to using this method (although there are plenty of advantages to using a questionnaire too).

Let’s have a look at some of the advantages and disadvantages of using a questionnaire for collecting data.

Advantages of using a questionnaire

1. questionnaires are relatively cheap.

Depending on the complexity of your study, using a questionnaire can be cost effective compared to other methods.

You simply need to write your survey questionnaire, and send it out and then process the responses.

You can set up an online questionnaire relatively easily, or simply carry out market research on the street if that’s the best method.

2. You can get and analyze results quickly

Again depending on the size of your survey you can get results back from a questionnaire quickly, often within 24 hours of putting the questionnaire live.

It also means you can start to analyze responses quickly too.

3. They’re easily scalable

You can easily send an online questionnaire to anyone in the world and with the right software you can quickly identify your target audience and your questionnaire to them.

4. Questionnaires are easy to analyze

If your questionnaire design has been done properly, it’s quick and easy to analyze results from questionnaires once responses start to come back.

This is particularly useful with large scale market research projects.

Because all respondents are answering the same questions, it’s simple to identify trends.

5. You can use the results to make accurate decisions

As a research instrument, a questionnaire is ideal for commercial research because the data you get back is from your target audience (or ideal customers) and the information you get back on their thoughts, preferences or behaviors allows you to make business decisions.

6. A questionnaire can cover any topic

One of the biggest advantages of using questionnaires when conducting research is (because you can adapt them using different types and styles of open ended questions and closed ended questions) they can be used to gather data on almost any topic.

There are many types of questionnaires you can design to gather both quantitative data and qualitative data - so they’re a useful tool for all kinds of data analysis.

Disadvantages of using a questionnaire

1. respondents could lie.

This is by far the biggest risk with a questionnaire, especially when dealing with sensitive topics.

Rather than give their actual opinion, a respondent might feel pressured to give the answer they deem more socially acceptable, which doesn’t give you accurate results.

2. Respondents might not answer every question

There are all kinds of reasons respondents might not answer every question, from questionnaire length, they might not understand what’s being asked, or they simply might not want to answer it.

If you get questionnaires back without complete responses it could negatively affect your research data and provide an inaccurate picture.

3. They might interpret what’s being asked incorrectly

This is a particular problem when running a survey across geographical boundaries and often comes down to the design of the survey questionnaire.

If your questions aren’t written in a very clear way, the respondent might misunderstand what’s being asked and provide an answer that doesn’t reflect what they actually think.

Again this can negatively affect your research data.

4. You could introduce bias

The whole point of producing a questionnaire is to gather accurate data from which decisions can be made or conclusions drawn.

But the data collected can be heavily impacted if the researchers accidentally introduce bias into the questions.

This can be easily done if the researcher is trying to prove a certain hypothesis with their questionnaire, and unwittingly write questions that push people towards giving a certain answer.

In these cases respondents’ answers won’t accurately reflect what is really happening and stop you gathering more accurate data.

5. Respondents could get survey fatigue

One issue you can run into when sending out a questionnaire, particularly if you send them out regularly to the same survey sample, is that your respondents could start to suffer from survey fatigue.

In these circumstances, rather than thinking about the response options in the questionnaire and providing accurate answers, respondents could start to just tick boxes to get through the questionnaire quickly.

Again, this won’t give you an accurate data set.

Questionnaire design: How to do it

It’s essential to carefully craft a questionnaire to reduce survey error and optimize your data . The best way to think about the questionnaire is with the end result in mind.

How do you do that?

Start with questions, like:

- What is my research purpose ?

- What data do I need?

- How am I going to analyze that data?

- What questions are needed to best suit these variables?

Once you have a clear idea of the purpose of your survey, you’ll be in a better position to create an effective questionnaire.

Here are a few steps to help you get into the right mindset.

1. Keep the respondent front and center

A survey is the process of collecting information from people, so it needs to be designed around human beings first and foremost.

In his post about survey design theory, David Vannette, PhD, from the Qualtrics Methodology Lab explains the correlation between the way a survey is designed and the quality of data that is extracted.

“To begin designing an effective survey, take a step back and try to understand what goes on in your respondents’ heads when they are taking your survey.

This step is critical to making sure that your questionnaire makes it as likely as possible that the response process follows that expected path.”

From writing the questions to designing the survey flow, the respondent’s point of view should always be front and center in your mind during a questionnaire design.

2. How to write survey questions

Your questionnaire should only be as long as it needs to be, and every question needs to deliver value.

That means your questions must each have an individual purpose and produce the best possible data for that purpose, all while supporting the overall goal of the survey.

A question must also must be phrased in a way that is easy for all your respondents to understand, and does not produce false results.

To do this, remember the following principles:

Get into the respondent's head

The process for a respondent answering a survey question looks like this:

- The respondent reads the question and determines what information they need to answer it.

- They search their memory for that information.

- They make judgments about that information.

- They translate that judgment into one of the answer options you’ve provided. This is the process of taking the data they have and matching that information with the question that’s asked.

When wording questions, make sure the question means the same thing to all respondents. Words should have one meaning, few syllables, and the sentences should have few words.

Only use the words needed to ask your question and not a word more .

Note that it’s important that the respondent understands the intent behind your question.

If they don’t, they may answer a different question and the data can be skewed.

Some contextual help text, either in the introduction to the questionnaire or before the question itself, can help make sure the respondent understands your goals and the scope of your research.

Use mutually exclusive responses

Be sure to make your response categories mutually exclusive.

Consider the question:

What is your age?

Respondents that are 31 years old have two options, as do respondents that are 40 and 55. As a result, it is impossible to predict which category they will choose.

This can distort results and frustrate respondents. It can be easily avoided by making responses mutually exclusive.

The following question is much better:

This question is clear and will give us better results.

Ask specific questions

Nonspecific questions can confuse respondents and influence results.

Do you like orange juice?

- Like very much

- Neither like nor dislike

- Dislike very much

This question is very unclear. Is it asking about taste, texture, price, or the nutritional content? Different respondents will read this question differently.

A specific question will get more specific answers that are actionable.

How much do you like the current price of orange juice?

This question is more specific and will get better results.

If you need to collect responses about more than one aspect of a subject, you can include multiple questions on it. (Do you like the taste of orange juice? Do you like the nutritional content of orange juice? etc.)

Use a variety of question types

If all of your questionnaire, survey or poll questions are structured the same way (e.g. yes/no or multiple choice) the respondents are likely to become bored and tune out. That could mean they pay less attention to how they’re answering or even give up altogether.

Instead, mix up the question types to keep the experience interesting and varied. It’s a good idea to include questions that yield both qualitative and quantitative data.

For example, an open-ended questionnaire item such as “describe your attitude to life” will provide qualitative data – a form of information that’s rich, unstructured and unpredictable. The respondent will tell you in their own words what they think and feel.

A quantitative / close-ended questionnaire item, such as “Which word describes your attitude to life? a) practical b) philosophical” gives you a much more structured answer, but the answers will be less rich and detailed.

Open-ended questions take more thought and effort to answer, so use them sparingly. They also require a different kind of treatment once your survey is in the analysis stage.

3. Pre-test your questionnaire

Always pre-test a questionnaire before sending it out to respondents. This will help catch any errors you might have missed. You could ask a colleague, friend, or an expert to take the survey and give feedback. If possible, ask a few cognitive questions like, “how did you get to that response?” and “what were you thinking about when you answered that question?” Figure out what was easy for the responder and where there is potential for confusion. You can then re-word where necessary to make the experience as frictionless as possible.

If your resources allow, you could also consider using a focus group to test out your survey. Having multiple respondents road-test the questionnaire will give you a better understanding of its strengths and weaknesses. Match the focus group to your target respondents as closely as possible, for example in terms of age, background, gender, and level of education.

Note: Don't forget to make your survey as accessible as possible for increased response rates.

Questionnaire examples and templates

There are free questionnaire templates and example questions available for all kinds of surveys and market research, many of them online. But they’re not all created equal and you should use critical judgement when selecting one. After all, the questionnaire examples may be free but the time and energy you’ll spend carrying out a survey are not.

If you’re using online questionnaire templates as the basis for your own, make sure it has been developed by professionals and is specific to the type of research you’re doing to ensure higher completion rates. As we’ve explored here, using the wrong kinds of questions can result in skewed or messy data, and could even prompt respondents to abandon the questionnaire without finishing or give thoughtless answers.

You’ll find a full library of downloadable survey templates in the Qualtrics Marketplace , covering many different types of research from employee engagement to post-event feedback . All are fully customizable and have been developed by Qualtrics experts.

Qualtrics // Experience Management

Qualtrics, the leader and creator of the experience management category, is a cloud-native software platform that empowers organizations to deliver exceptional experiences and build deep relationships with their customers and employees.

With insights from Qualtrics, organizations can identify and resolve the greatest friction points in their business, retain and engage top talent, and bring the right products and services to market. Nearly 20,000 organizations around the world use Qualtrics’ advanced AI to listen, understand, and take action. Qualtrics uses its vast universe of experience data to form the largest database of human sentiment in the world. Qualtrics is co-headquartered in Provo, Utah and Seattle.

Related Articles

December 20, 2023

Top market research analyst skills for 2024

November 7, 2023

Brand Experience

The 4 market research trends redefining insights in 2024

September 14, 2023

How BMG and Loop use data to make critical decisions

August 21, 2023

Designing for safety: Making user consent and trust an organizational asset

June 27, 2023

The fresh insights people: Scaling research at Woolworths Group

June 20, 2023

Bank less, delight more: How Bankwest built an engine room for customer obsession

June 16, 2023

How Qualtrics Helps Three Local Governments Drive Better Outcomes Through Data Insights

April 1, 2023

Academic Experience

How to write great survey questions (with examples)

Stay up to date with the latest xm thought leadership, tips and news., request demo.

Ready to learn more about Qualtrics?

How to Design Effective Research Questionnaires for Robust Findings

As a staple in data collection, questionnaires help uncover robust and reliable findings that can transform industries, shape policies, and revolutionize understanding. Whether you are exploring societal trends or delving into scientific phenomena, the effectiveness of your research questionnaire can make or break your findings.

In this article, we aim to understand the core purpose of questionnaires, exploring how they serve as essential tools for gathering systematic data, both qualitative and quantitative, from diverse respondents. Read on as we explore the key elements that make up a winning questionnaire, the art of framing questions which are both compelling and rigorous, and the careful balance between simplicity and depth.

Table of Contents

The Role of Questionnaires in Research

So, what is a questionnaire? A questionnaire is a structured set of questions designed to collect information, opinions, attitudes, or behaviors from respondents. It is one of the most commonly used data collection methods in research. Moreover, questionnaires can be used in various research fields, including social sciences, market research, healthcare, education, and psychology. Their adaptability makes them suitable for investigating diverse research questions.

Questionnaire and survey are two terms often used interchangeably, but they have distinct meanings in the context of research. A survey refers to the broader process of data collection that may involve various methods. A survey can encompass different data collection techniques, such as interviews , focus groups, observations, and yes, questionnaires.

Pros and Cons of Using Questionnaires in Research:

While questionnaires offer numerous advantages in research, they also come with some disadvantages that researchers must be aware of and address appropriately. Careful questionnaire design, validation, and consideration of potential biases can help mitigate these disadvantages and enhance the effectiveness of using questionnaires as a data collection method.

Structured vs Unstructured Questionnaires

Structured questionnaire:.

A structured questionnaire consists of questions with predefined response options. Respondents are presented with a fixed set of choices and are required to select from those options. The questions in a structured questionnaire are designed to elicit specific and quantifiable responses. Structured questionnaires are particularly useful for collecting quantitative data and are often employed in surveys and studies where standardized and comparable data are necessary.

Advantages of Structured Questionnaires:

- Easy to analyze and interpret: The fixed response options facilitate straightforward data analysis and comparison across respondents.

- Efficient for large-scale data collection: Structured questionnaires are time-efficient, allowing researchers to collect data from a large number of respondents.

- Reduces response bias: The predefined response options minimize potential response bias and maintain consistency in data collection.

Limitations of Structured Questionnaires:

- Lack of depth: Structured questionnaires may not capture in-depth insights or nuances as respondents are limited to pre-defined response choices. Hence, they may not reveal the reasons behind respondents’ choices, limiting the understanding of their perspectives.

- Limited flexibility: The fixed response options may not cover all potential responses, therefore, potentially restricting respondents’ answers.

Unstructured Questionnaire:

An unstructured questionnaire consists of questions that allow respondents to provide detailed and unrestricted responses. Unlike structured questionnaires, there are no predefined response options, giving respondents the freedom to express their thoughts in their own words. Furthermore, unstructured questionnaires are valuable for collecting qualitative data and obtaining in-depth insights into respondents’ experiences, opinions, or feelings.

Advantages of Unstructured Questionnaires:

- Rich qualitative data: Unstructured questionnaires yield detailed and comprehensive qualitative data, providing valuable and novel insights into respondents’ perspectives.

- Flexibility in responses: Respondents have the freedom to express themselves in their own words. Hence, allowing for a wide range of responses.

Limitations of Unstructured Questionnaires:

- Time-consuming analysis: Analyzing open-ended responses can be time-consuming, since, each response requires careful reading and interpretation.

- Subjectivity in interpretation: The analysis of open-ended responses may be subjective, as researchers interpret and categorize responses based on their judgment.