- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Financial analysis

- Finance and investing

- Corporate finance

Putting the Balanced Scorecard to Work

- Robert S. Kaplan

- David P. Norton

- September 01, 1993

Strategic Analysis for More Profitable Acquisitions

- Alfred Rappaport

- From the July 1979 Issue

Lessons from the Past for Financial Services

- Matthew Sebag-Montefiore

- Nuno Monteiro

- From the December 2008 Issue

Don't Let Metrics Undermine Your Business

- Michael Harris

- Bill Taylor

- From the September–October 2019 Issue

Real-World Way to Manage Real Options

- Tom Copeland

- Peter Tufano

- From the March 2004 Issue

Pitfalls in Evaluating Risky Projects

- James E. Hodder

- Henry E. Riggs

- From the January 1985 Issue

The Benefits of Bargaining with Your Customers

- Andrew Shipilov

- July 16, 2014

When AI Becomes an Everyday Technology

- Andrew Moore

- June 07, 2019

How to Navigate a Digital Transformation

- Barry Libert

- Yoram (Jerry) Wind

- June 22, 2016

Get More Funding for Your R&D Initiatives

- Christoph Loch

- October 30, 2023

Today’s Options for Tomorrow’s Growth

- W. Carl Kester

- From the March 1984 Issue

What’s It Worth?: A General Manager’s Guide to Valuation

- Timothy A. Luehrman

- From the May–June 1997 Issue

How Much Should a Corporation Earn?

- John J. Scanlon

- From the January 1967 Issue

CEOs Don’t Care Enough About Capital Allocation

- José Antonio Marco-Izquierdo

- April 16, 2015

The Balanced Scorecard: Measures That Drive Performance

- From the July–August 2005 Issue

The Best-Performing CEOs in the World 2017

- Harvard Business Review

- From the November–December 2017 Issue

Finding Your Next Core Business

- From the April 2007 Issue

Are You Paying Too Much for That Acquisition?

- Robert G. Eccles

- Kersten L. Lanes

- Thomas C. Wilson

- From the July–August 1999 Issue

When Unequal Pay Is Actually Fair

- March 31, 2016

Putting the Service-Profit Chain to Work

- James L. Heskett

- Thomas O. Jones

- Gary W. Loveman

- W. Earl Sasser, Jr.

- Leonard A. Schlesinger

- From the March–April 1994 Issue

Juliette's Lemonade Stands

- Mark Potter

- February 01, 2018

Ratios Tell A Story--2007

- Mark E. Haskins

- June 04, 2008

Kaitlyn Otashi: Budgeting and Spending Analysis

- Richard Bliss

- October 01, 2021

Finansbank 2006

- C. Fritz Foley

- Linnea Meyer

- May 14, 2008

Chestnut Foods (B)

- Michael J. Schill

- Frank Briceno

- Donald Stevenson

- May 02, 2021

Identify the Nonprofit

- Regina E. Herzlinger

- Ramona K. Hilgenkamp

- April 20, 1995

Sustainable Investing in Ambienta (A)

- Atalay Atasu

- Benjamin Kessler

- November 13, 2022

AltaGas Ltd.: Acquisition of Decker Energy International

- Craig Dunbar

- Cherise Nielsen

- October 25, 2017

The South Sea Bubble and the Rise of the Bank of England (A)

- Robert F. Bruner

- Scott Miller

- July 30, 2018

Cookie Man: Exploring New Frontiers

- Neena Sondhi

- Afsha Dokadia

- September 08, 2015

Vyaderm Pharmaceuticals: The EVA Decision

- Robert Simons

- Indra A. Reinbergs

- October 04, 2000

Schneider Electric: Linking Pay to ESG

- Gaizka Ormazabal

- September 01, 2022

Classic Fixtures & Hardware Company

- Craig Stephenson

- February 05, 2015

Butler Lumber Co.

- Thomas R. Piper

- October 30, 1991

Transaero: Turbulent Times

- Elena Senatorova

- Grigori Erenburg

- Ruth Ann Strickland

- July 20, 2018

Harbor Garage

- John D. Macomber

- Jared Katseff

- January 31, 2014

DIY CAMBRIDGE ANALYTICA: RUNNING PERSONALITY ANALYTICS

- Karl Schmedders

- Marc Chauvet

- Jung Eung Park

- March 15, 2021

Traverse Bank

- Marc Lipson

- December 04, 2019

Danica Purg: Entrepreneurial Leadership In Shaping Leadership Development (C)

- Derek Abell

- June 02, 2014

First Investments, Inc.: Analysis of Financial Statements

- David F. Hawkins

- August 22, 1996

Saint Honore: Benchmarking Store-Level Performance, Teaching Note

- June 07, 2022

Granite Apparel: Funding an Expansion, Teaching Note

- James E. Hatch

- Larry Wynant

- November 06, 2010

Ratios Tell A Story-2007, Teaching Note

Popular topics, partner center.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Financial Statements Examples – Amazon Case Study

Financial Statements are informational records detailing a company’s business activities over a period.

Austin has been working with Ernst & Young for over four years, starting as a senior consultant before being promoted to a manager. At EY, he focuses on strategy, process and operations improvement, and business transformation consulting services focused on health provider, payer, and public health organizations. Austin specializes in the health industry but supports clients across multiple industries.

Austin has a Bachelor of Science in Engineering and a Masters of Business Administration in Strategy, Management and Organization, both from the University of Michigan.

- What Are Financial Statements?

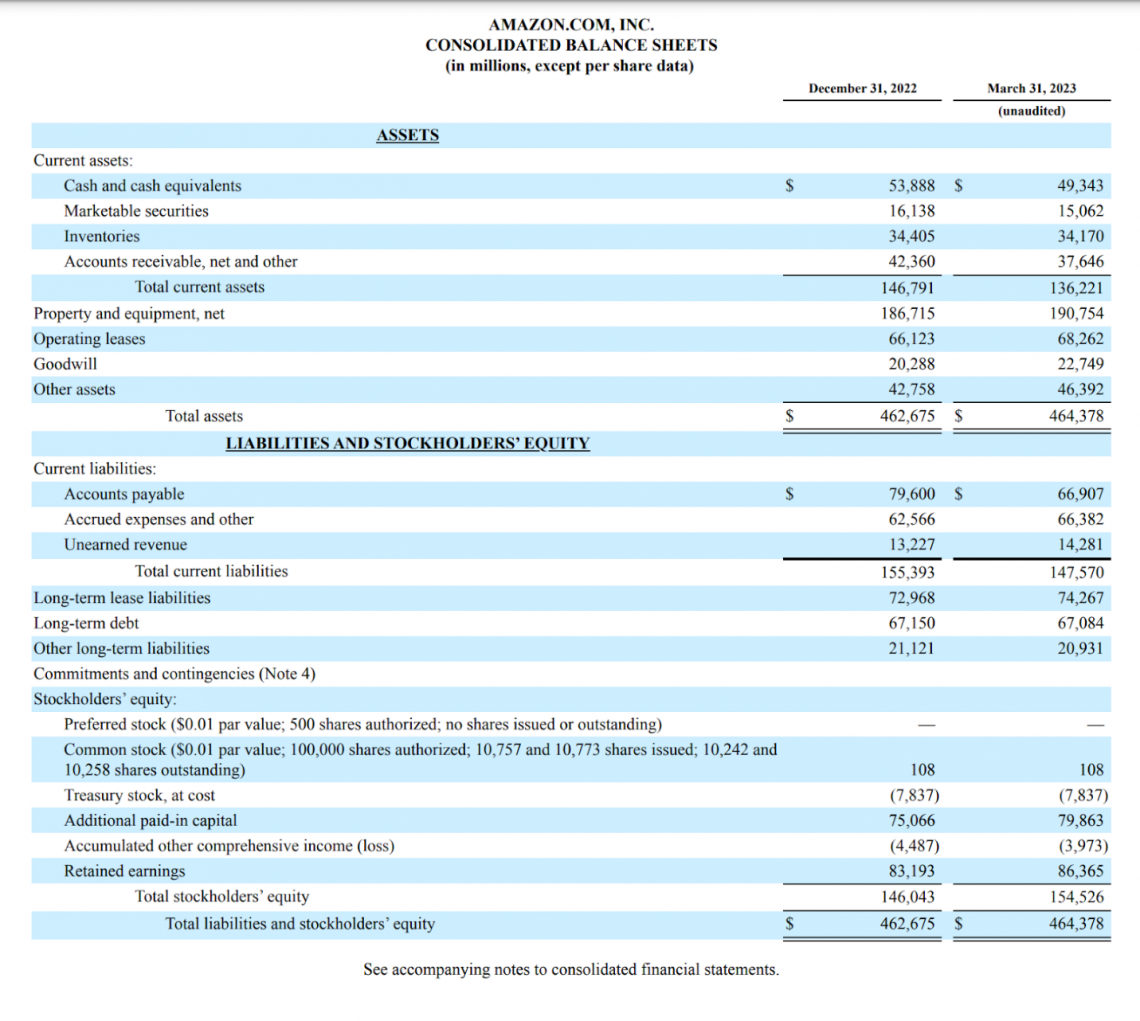

Amazon’s Balance Sheet

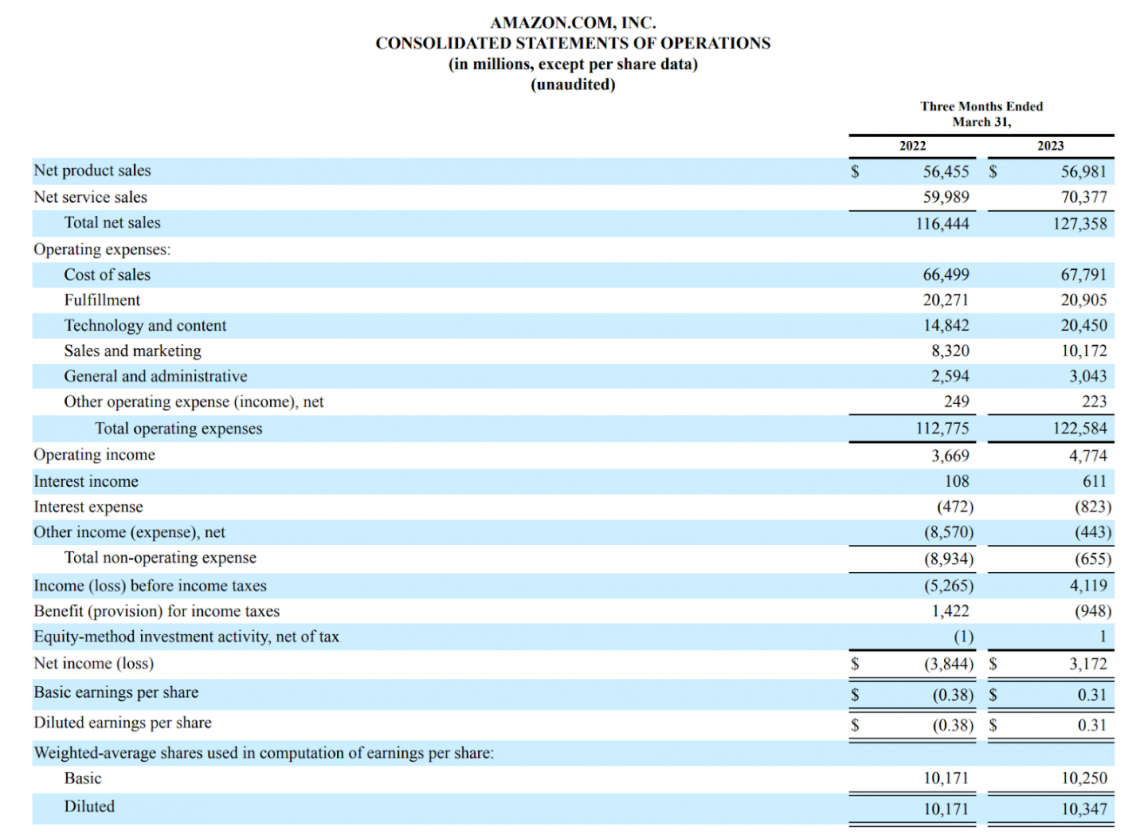

Amazon’s income statement, amazon’s cash flow statement, usage of financial statements, amazon case study faqs, what are financial statements.

Investors need financial statements to gain a full understanding of how a company operates in relation to competitors. In the case of Amazon , profitability metrics used to analyze most businesses cannot be used to compare the company to businesses in the same sector.

Amazon remains low in profitability continuously to reinvest in growing operations and new business opportunities. Instead, investors can point to the metrics signified in Amazon’s cash flow statement to demonstrate growth in revenue generation over the long term.

There are three main types of financial statements, all of which provide a current or potential investor with a different viewpoint of a company’s financials. These include the following below.

Balance Sheet

The balance sheet represents a company’s total assets, liabilities, and shareholder ’s equity at a certain time.

Assets are all items owned by a company with tangible or intangible value, while liabilities are all debts a company must repay in the future.

Shareholders' equity is simply calculated by subtracting total assets from total liabilities. This represents the book value of a business.

Income Statement

The income statement represents a company’s total generated income minus expenses over a specified range of time. This can be 3 months in a quarterly report or a year in an annual report .

Revenue includes the total money a company makes over a set time.

This includes operating revenue from business activities and non-operating revenue, such as interest from a company bank account.

Expenses include the total amount of money spent by a company over time. These can be grouped into two separate categories, Primary expenses occur from generating revenue, and secondary expenses appear from debt financing and selling off held assets.

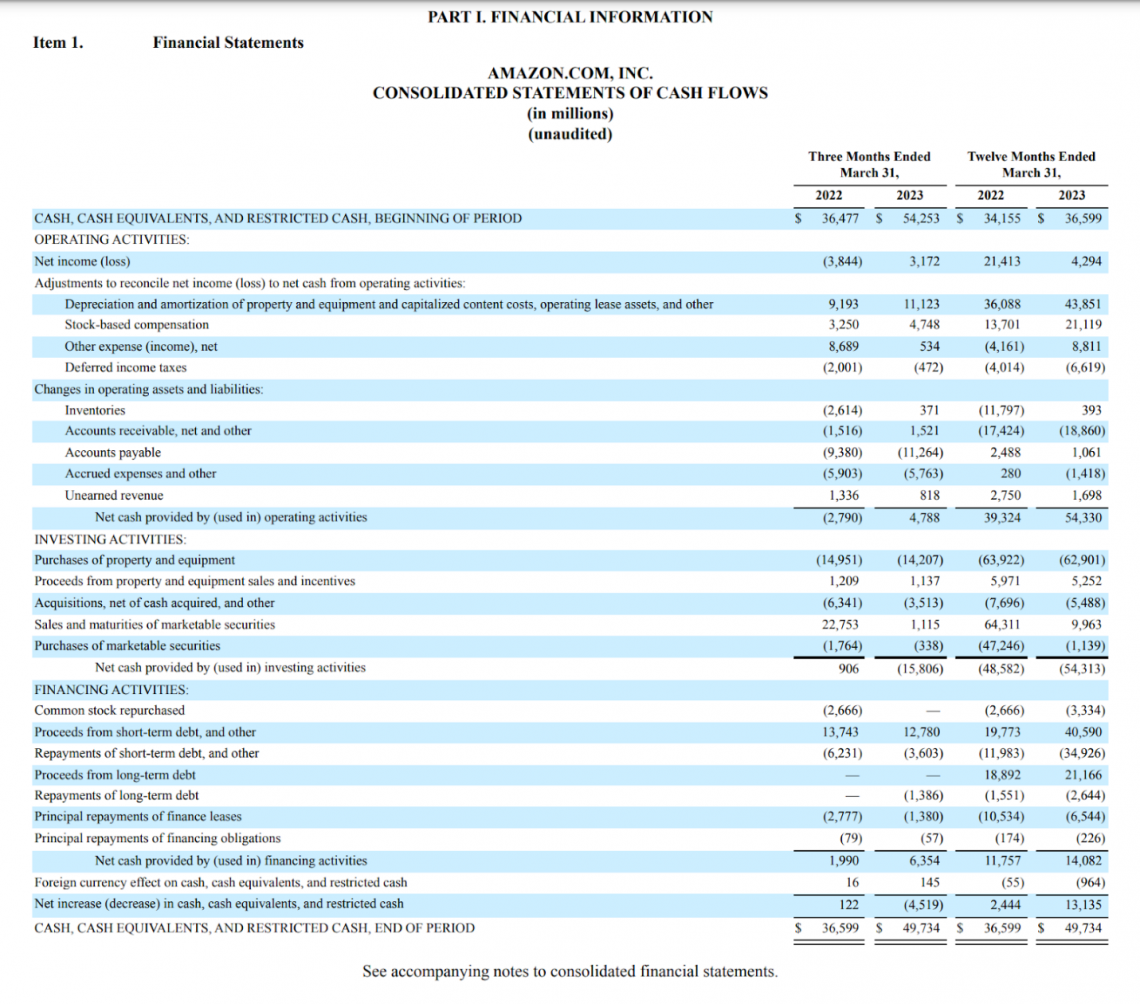

Cash Flow Statement

The cash flow statement represents a company’s total cash inflows and outflows over a specified time range, similar to the income statement. Cash in a business can come from operating, investing, or financing activities.

Operating activities are events in which the business produces or spends money to sell its products or services. This would be income from the sales of goods or services or interest payments and expenses such as wages and rent payments for company facilities.

Investing activities include selling or purchasing assets, which can include investing in business equipment or purchasing short-term securities. Financing activities include the payment of loans and the issuance of dividends or stock repurchases.

Key Takeaways

- Financial statements have information relevant for investors to understand the operations and profitability of a business over a specified time.

- Fundamental analysis typically focuses on the main three financial statements: the balance sheet, income statement, and cash flow statement.

- Although analyzing business financials can provide an unaltered outlook into the operations of a business, the numbers don’t always demonstrate the full story, and investors should always conduct thorough due diligence beyond pure statistics.

- Investors must ensure all of a company's financial statements are analyzed before forming a thesis, as inconsistencies in one sheet may be caused by an unusual one-time expense or dictated by a global measure out of the company’s control (ex., COVID-19).

Now that we have a general understanding of the financial statements, we can begin to take a look at Amazon’s most recent quarterly filing.

Company filings can be found by using EDGAR (database of regulatory filings for investors by the SEC) or from Amazon’s investor relations website.

Before we begin analyzing this sheet, it is important to take note of the statement just below the title, indicating that the data is being displayed in millions.

This can throw off newcomers, who may be very confused upon seeing Amazon’s revenue is $53,888. Amazon’s quarterly revenue is indeed $53.8 billion as calculated in millions.

When looking at Amazon’s assets, it is important to note the difference between current and total assets. Current assets are categorized separately due to the expectation that they can be converted to cash within the fiscal year.

Current assets can be used in the current ratio to analyze Amazon’s ability to pay off its short-term obligations. The current ratio formula is:

Current Ratio = Current Assets / Current Liabilities

Amazon’s current ratio sits at 0.92, which is below the e-commerce industry average of 2.09 as of March 2023 (Source: Macrotrends ).

This could mean that Amazon is potentially overvalued compared to competitors, but this is only one metric and should ultimately be all of an investment decision, especially considering the capital-intensive nature of Amazon’s business model.

It is also important to understand all of the vocabulary used to detail items in Amazon’s balance sheet. Some of the major items’ definitions can be found below:

Assets are classified as follows.

- Cash and cash equivalents: Assets of high liquidity, such as certificates of deposit or treasury bonds.

- Marketable securities: Liquid securities can be sold in the public market, such as stock in another company or corporate bonds.

- Accounts receivable (A/R): Money owed to the company that has not been received yet, such as from items previously bought on credit.

- Inventories: Unsold finished or unfinished products from a company that has yet to be sold.

- Property and equipment (PP&E): Assets owned by a company that is used for business activities. It may include factory assets or other types of real estate.

- Operating leases: Assets rented by a business for operational purposes. Calculated as the net present value on the balance sheet.

- Goodwill: Calculates intangible assets that cannot be sold or directly measured, such as customer reputation and loyalty.

Liabilities are of the following types.

- Accounts payable (A/P): Obligations accrued through business activities that must be paid off shortly.

- Accrued expenses: Current liabilities for a business that must be paid in the next 12 months.

- Unearned revenue: This represents revenue earned by a business that has not yet received. Prevents profits from being overstated for a specific period.

- Long-term debt: Debts in which payments are required over 12 months.

- Lease liabilities: Payment obligations of a lease taken out by a company.

- Stockholders’ equity: Net worth of a business/asset value to shareholders.

- Retained earnings: Net profit remaining for a company after all liabilities are paid.

Amazon’s next statement in its quarterly filing is the income statement. The income statement is useful for comparing a company’s growth over time and matching it up against competitors in the same or different sectors.

An essential factor to note when looking at a company’s income statement is whether its revenue and net income are consistently growing year over year. Investors should also be aware of Wall Street expectations, as they can heavily influence the business’s share price.

Many important ratios are used when analyzing a company’s income statement. Some of the most notable ones include:

- EV/EBITDA = (Market Capitalization + Debt - Cash) / (Revenue - Cost of Goods Sold - Operating Expenses)

- Gross Margin = (Revenue - Cost of Goods Sold) / Revenue

- Operating Margin = Operating Income / Revenue

- Net Margin = Net Income / Revenue

- Return on Equity (ROE) = Net Income / Average Shareholder Equity (End Value + Beginning Value / 2)

- Earnings Per Share = Net Income / Shares Outstanding

Let’s use these ratios to conduct a comparables analysis between Amazon and eBay, a company at a much lower valuation relative to the e-commerce giant. Here are their ratios side-by-side, as of Amazon’s Q1 2023 and eBay’s Q1 2023 filings:

* = EV/EBITDA ratios sourced from finbox.com , March 2023 trailing twelve months (TTM)

Looking at these statistics on paper, it is clear to see that Amazon seems overvalued compared to eBay due to lower margins, negative earnings per share, and an EV/EBITDA multiple over three times as high as the business.

However, pure stats on an income statement cannot fully justify purchasing one company or another. The statement merely shows what a company is doing without a corporate spin.

One thing to note that is unique about Amazon’s business model is how the company invests huge amounts of capital into R&D and technology to expand its operations continuously.

Their numbers don’t account for the massive cash flows and growth opportunities that the business takes advantage of.

When conducting fundamental analysis, an investor must consider all aspects of a business beyond the financial statements, including comparing business models to competitors and setting benchmarks encompassing the overall sector.

Amazon’s cash flow statement is where the company begins to shine compared to its competitors in the online commerce sector. The company has consistently increased cash flow from operating activities and constantly returns value to shareholders in the form of capital appreciation.

It is notable for focusing on what the company is doing inside of its cash flow statements to get a better picture of why its income or stock price is trending a certain way.

For example, an explosive drop in net income in an otherwise stable company could be due to mismanagement or hampered growth but is most likely due to M&A activity charged in a quarter that may be skewing the numbers. The cash flow statement clears this up.

Compared to 2022, Amazon has increased its annual cash from operating activities by over 38% from the previous year based on a 12-month rolling basis.

This increase has also resulted in an 11.7% increase in investment expenditures, which should allow Amazon to continue growing faster than similar companies.

In comparison, according to eBay’s most recent 10-K filing , the company generated an 82% growth in operating cash flow (OCF), however, this stat can be very misleading due to the company’s lack of investment in processes such as R&D and SG&A.

In 2022, the company reported $92M in investing activities, representing only 26% of operating cash flows. Amazon reported over $37.6B in investing activities representing approximately 88% of its OCF.

The income statement can misrepresent how well a company is doing, as while eBay has a higher net income, Amazon strategically reinvests its cash flows into R&D and other expenses to produce more over time continuously.

What makes the cash flow statement so essential to fundamental analysis is the fact that it is tough to manipulate its numbers through financial engineering or clever accounting.

The statement purely shows precisely where all of the money a company makes is being used. Many investors use the cash flow statement to tell the true financial health of a business, as profits can often not be indicative of a growth company's value.

The stock price of a company can easily be swayed by sentiment or the market cycle , and the income statement can be skewed through large one-time transactions or large amounts of financed revenue. The amount of money in the possession of a company is very hard to adjust.

Amazon currently has much better growth prospects than eBay and thus sells at a higher premium in the open market , but you wouldn’t understand why unless you took in the full picture of the company.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Financial statements are excellent tools to learn more about a business in terms of an overall market or sector of operation. Using financial statements to determine the current value of a business is essential for understanding a company’s stock price.

Along with the ratios mentioned, analysts often form their methodologies over time to focus on companies that are strong in specific financial circumstances.

Tools such as stock screeners can sort millions of companies by certain factors. For instance, some investors may seek defensive companies with consistent dividend growth over long periods, while others may seek growth companies with the most innovative new technology.

Investors should keep all of this information in mind, as well as pay attention to the reports of analysts with varied performance outlooks. It is essential to seek out the opinions of multiple sources before establishing an opinion on a business.

Looking at reports from analysts specializing in the industry can also ensure that your expectations are reasonable compared to industry experts.

If your thesis results in Amazon growing its revenues by 20% a year while analysts across the country are only expecting growth in the range of 5-7%, it could be a sign that you may have overlooked a key factor in your due diligence .

The overall goal of using financial statements is to fully understand the company you are investing in to justify a position. Although your views may slightly differ from experts, quality due diligence can result in somewhat varied outcomes based on an investor’s outlook for the future.

Using EBITDA instead of net income strips away the capital structure and taxation of a business to analyze the pure earnings potential of a business. This is more practical for investors to see the general trajectory of a company’s income over time.

For example, companies may decide on completing a merger or acquiring another company. This will require a company to report its current and acquired assets on its balance sheet .

Over time, these assets must be recorded as expenses through the use of depreciation, which is the process of deducting from gross revenue to account for the decreasing value of company plant assets.

If these assets increase in value over time, this could decrease revenues over time not due to company performance but because of increased prices for equipment outside of the company’s control.

Without looking at EBITDA, company financials may paint a completely different picture with the use of net income that may or may not be justified at all.

ROE is an important metric to distinguish how good a company is at generating profits with investor capital compared to its share price and competitors. It is yet another indicator used to analyze the trajectory of a business over time.

Using ROE can also demonstrate how much financing a company requires to generate its revenue and if investors are really getting a great return for the amount of money shareholders contribute.

A startup that has recently gone public on the stock exchange may have a very low to negative ROE compared to an established company. Still, the startup may have the margins and growth to justify its valuation .

Much like every financial ratio, ROE doesn’t demonstrate the entire story of a business, and the full picture of a business must be considered to decide on an equity investment.

To proliferate and take market share from competitors , Amazon undercuts prices on many products to decrease competition and remain the top player in the industry.

Amazon, like many other companies recently since the pandemic, has also faced significant increases in operating expenses , thus lowering operating and net margins in the short term. Once Amazon begins to slow expansion, these margins are expected to rise.

Amazon’s net income is very low for many of the same reasons. The company is profitable yet is constantly reinvesting into new businesses and products to further grow cash flows for future expenditures.

Amazon investors are not focused on income but rather on its ability to continuously grow in the long term. Growth companies like Amazon do not issue dividends because they believe that the money is better reinvested in business operations.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Tanner Hertz | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Conservatism

- Accounting Equation

- Accounting Ratios

- Three Financial Statements in FP&A

- Working Capital Cycle

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Get Involved

- Reading Materials

- Teaching & Curriculum

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

Costco Wholesale Corporation Financial Statement Analysis (A)

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

Financial Statement Analysis by Wallace Davidson III

Get full access to Financial Statement Analysis and 60K+ other titles, with a free 10-day trial of O'Reilly.

There are also live events, courses curated by job role, and more.

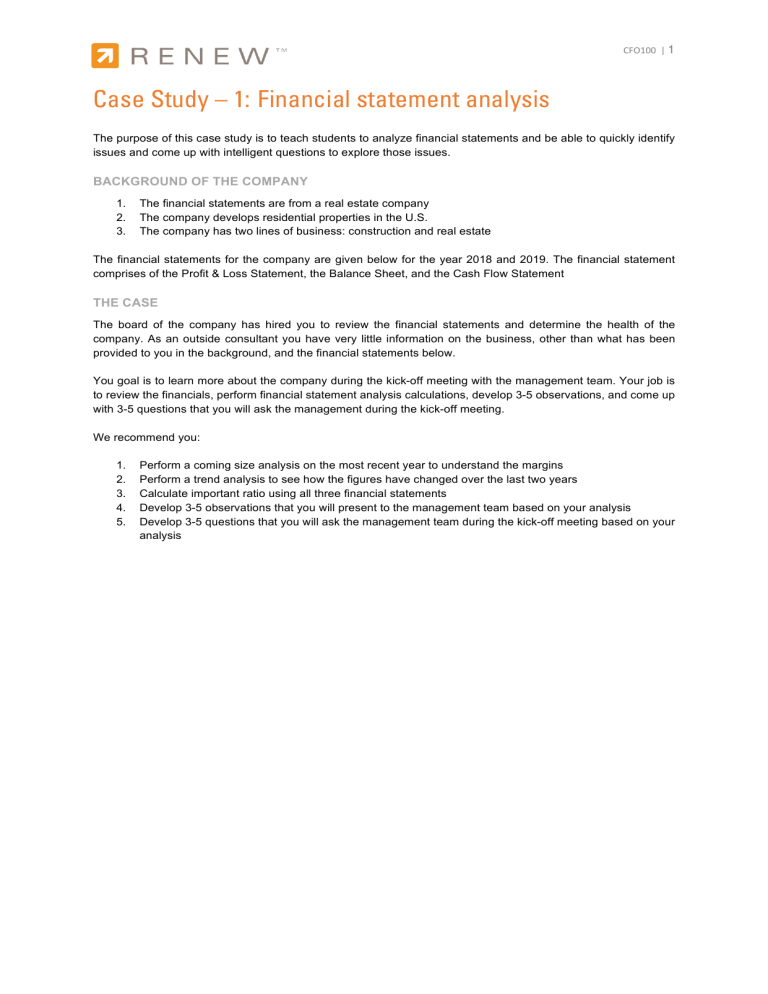

Chapter 6 Case Studies

Learning objective.

- Recall measures that are useful in the analysis of financial statements and data.

The following four case studies provide examples of financial information upon which liquidity, leverage, profitability, and casual calculations may be performed. The first two case studies also contain example ratio summary and analysis. Considering this information, what problem areas regarding each company’s financial health exist?

Two discussion cases are also provided, followed by questions related to the financial condition of the subject company.

Case study 1: Paper products company

Get Financial Statement Analysis now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Don’t leave empty-handed

Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

It’s yours, free.

Check it out now on O’Reilly

Dive in for free with a 10-day trial of the O’Reilly learning platform—then explore all the other resources our members count on to build skills and solve problems every day.

- Search Search Please fill out this field.

What Is Financial Analysis?

Understanding financial analysis, corporate financial analysis, investment financial analysis, types of financial analysis, horizontal vs. vertical analysis.

- Example of Financial Analysis

- Financial Analysis FAQs

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Financial Analysis: Definition, Importance, Types, and Examples

:max_bytes(150000):strip_icc():format(webp)/david-kindness-cpa-headshot1-beab5f883dec4a11af658fd86cb9009c.jpg)

Financial analysis is the process of evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. Typically, financial analysis is used to analyze whether an entity is stable, solvent , liquid , or profitable enough to warrant a monetary investment.

Key Takeaways

- If conducted internally, financial analysis can help fund managers make future business decisions or review historical trends for past successes.

- If conducted externally, financial analysis can help investors choose the best possible investment opportunities.

- Fundamental analysis and technical analysis are the two main types of financial analysis.

- Fundamental analysis uses ratios and financial statement data to determine the intrinsic value of a security.

- Technical analysis assumes a security's value is already determined by its price, and it focuses instead on trends in value over time.

Investopedia / Nez Riaz

Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. This is done through the synthesis of financial numbers and data. A financial analyst will thoroughly examine a company's financial statements —the income statement , balance sheet , and cash flow statement . Financial analysis can be conducted in both corporate finance and investment finance settings.

One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own historical performance.

For example, return on assets (ROA) is a common ratio used to determine how efficient a company is at using its assets and as a measure of profitability. This ratio could be calculated for several companies in the same industry and compared to one another as part of a larger analysis.

There is no single best financial analytic ratio or calculation. Most often, analysts use a combination of data to arrive at their conclusion.

In corporate finance, the analysis is conducted internally by the accounting department and shared with management in order to improve business decision making. This type of internal analysis may include ratios such as net present value (NPV) and internal rate of return (IRR) to find projects worth executing.

Many companies extend credit to their customers. As a result, the cash receipt from sales may be delayed for a period of time. For companies with large receivable balances, it is useful to track days sales outstanding (DSO), which helps the company identify the length of time it takes to turn a credit sale into cash. The average collection period is an important aspect of a company's overall cash conversion cycle .

A key area of corporate financial analysis involves extrapolating a company's past performance, such as net earnings or profit margin , into an estimate of the company's future performance. This type of historical trend analysis is beneficial to identify seasonal trends.

For example, retailers may see a drastic upswing in sales in the few months leading up to Christmas. This allows the business to forecast budgets and make decisions, such as necessary minimum inventory levels, based on past trends.

In investment finance, an analyst external to the company conducts an analysis for investment purposes. Analysts can either conduct a top-down or bottom-up investment approach. A top-down approach first looks for macroeconomic opportunities, such as high-performing sectors, and then drills down to find the best companies within that sector. From this point, they further analyze the stocks of specific companies to choose potentially successful ones as investments by looking last at a particular company's fundamentals .

A bottom-up approach, on the other hand, looks at a specific company and conducts a similar ratio analysis to the ones used in corporate financial analysis, looking at past performance and expected future performance as investment indicators. Bottom-up investing forces investors to consider microeconomic factors first and foremost. These factors include a company's overall financial health, analysis of financial statements, the products and services offered, supply and demand, and other individual indicators of corporate performance over time.

Financial analysis is only useful as a comparative tool. Calculating a single instance of data is usually worthless; comparing that data against prior periods, other general ledger accounts, or competitor financial information yields useful information.

There are two types of financial analysis: fundamental analysis and technical analysis .

Fundamental Analysis

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

Technical Analysis

Technical analysis uses statistical trends gathered from trading activity, such as moving averages (MA). Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements . Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

When reviewing a company's financial statements, two common types of financial analysis are horizontal analysis and vertical analysis . Both use the same set of data, though each analytical approach is different.

Horizontal analysis entails selecting several years of comparable financial data. One year is selected as the baseline, often the oldest. Then, each account for each subsequent year is compared to this baseline, creating a percentage that easily identifies which accounts are growing (hopefully revenue) and which accounts are shrinking (hopefully expenses).

Vertical analysis entails choosing a specific line item benchmark, then seeing how every other component on a financial statement compares to that benchmark. Most often, net sales is used as the benchmark. A company would then compare cost of goods sold, gross profit, operating profit, or net income as a percentage to this benchmark. Companies can then track how the percent changes over time.

Examples of Financial Analysis

In the nine-month period ending Sept. 30, 2022, Amazon.com reported a net loss of $3 billion. This was a substantial decline from one year ago where the company reported net income of over $19 billion.

Financial analysis shows some interesting facets of the company's earnings per share (shown above. On one hand, the company's EPS through the first three quarters was -$0.29; compared to the prior year, Amazon earned $1.88 per share. This dramatic difference was not present looking only at the third quarter of 2022 compared to 2021. Though EPS did decline from one year to the next, the company's EPS for each third quarter was comparable ($0.31 per share vs. $0.28 per share).

Analysts can also use the information above to perform corporate financial analysis. For example, consider Amazon's operating profit margins below.

- 2022: $9,511 / $364,779 = 2.6%

- 2021: $21,419 / $332,410 = 6.4%

From Q3 2021 to Q3 2022, the company experienced a decline in operating margin, allowing for financial analysis to reveal that the company simply earns less operating income for every dollar of sales.

Why Is Financial Analysis Useful?

The financial analysis aims to analyze whether an entity is stable , liquid, solvent, or profitable enough to warrant a monetary investment. It is used to evaluate economic trends, set financial policies, build long-term plans for business activity, and identify projects or companies for investment.

How Is Financial Analysis Done?

Financial analysis can be conducted in both corporate finance and investment finance settings. A financial analyst will thoroughly examine a company's financial statements—the income statement, balance sheet, and cash flow statement.

One of the most common ways to analyze financial data is to calculate ratios from the data in the financial statements to compare against those of other companies or against the company's own historical performance. A key area of corporate financial analysis involves extrapolating a company's past performance, such as net earnings or profit margin, into an estimate of the company's future performance.

What Techniques Are Used in Conducting Financial Analysis?

Analysts can use vertical analysis to compare each component of a financial statement as a percentage of a baseline (such as each component as a percentage of total sales). Alternatively, analysts can perform horizontal analysis by comparing one baseline year's financial results to other years.

Many financial analysis techniques involve analyzing growth rates including regression analysis, year-over-year growth, top-down analysis such as market share percentage, or bottom-up analysis such as revenue driver analysis .

Last, financial analysis often entails the use of financial metrics and ratios. These techniques include quotients relating to the liquidity, solvency, profitability, or efficiency (turnover of resources) of a company.

What Is Fundamental Analysis?

Fundamental analysis uses ratios gathered from data within the financial statements, such as a company's earnings per share (EPS), in order to determine the business's value. Using ratio analysis in addition to a thorough review of economic and financial situations surrounding the company, the analyst is able to arrive at an intrinsic value for the security. The end goal is to arrive at a number that an investor can compare with a security's current price in order to see whether the security is undervalued or overvalued.

What Is Technical Analysis?

Technical analysis uses statistical trends gathered from market activity, such as moving averages (MA). Essentially, technical analysis assumes that a security’s price already reflects all publicly available information and instead focuses on the statistical analysis of price movements. Technical analysis attempts to understand the market sentiment behind price trends by looking for patterns and trends rather than analyzing a security’s fundamental attributes.

Financial analysis is a cornerstone of making smarter, more strategic decisions based on the underlying financial data of a company. Whether corporate, investment, or technical analysis, analysts use data to explore trends, understand growth, seek areas of risk, and support decision-making. Financial analysis may include investigating financial statement changes, calculating financial ratios, or exploring operating variances.

Amazon. " Amazon.com Announces Third Quarter Results ."

:max_bytes(150000):strip_icc():format(webp)/investing20-5bfc2b8f46e0fb00517be081.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Financial statement analysis: Principal component analysis (PCA) approach case study on China telecoms industry

Asian Journal of Accounting Research

ISSN : 2459-9700

Article publication date: 3 September 2019

Issue publication date: 11 December 2019

The Chinese Telecoms Industry has been rapidly growing over the years since 2001. An analysis of financial performance of the three giants in this industry is very important. However, it is difficult to know how many ratios can be used best with little information loss. The paper aims to discuss this issue.

Design/methodology/approach

A total of 18 financial ratios were calculated based on the financial statements for three companies, namely, China Mobile, China Unicom and China Telecom for a period of 17 years. A principal component analysis was run to come up with variables with significance value above 0.5 from each component.

At the end, the authors conclude how financial performance can be analysed using 12 ratios instead of the costly analysis of too many ratios that may be complex to interpret. The results also showed that ratios are all related as they come from the same statements, hence, the authors can use a few to represent the rest with limited loss of information.

Originality/value

This study will help different stakeholders who are interested in the financial performance of each company by giving them a shorter way to analyse performance. It will also assist those who do financial reporting on picking the ratios which matter in reflecting the performance of their companies. The use of PCA gives unbiased ratios that are most significant in assessing performance.

- Performance analysis

- Financial ratios

- Principal component analysis

- China telecoms industry

Mbona, R.M. and Yusheng, K. (2019), "Financial statement analysis: Principal component analysis (PCA) approach case study on China telecoms industry", Asian Journal of Accounting Research , Vol. 4 No. 2, pp. 233-245. https://doi.org/10.1108/AJAR-05-2019-0037

Emerald Publishing Limited

Copyright © 2019, Reginald Masimba Mbona and Kong Yusheng

Published in Asian Journal of Accounting Research . Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence may be seen at http://creativecommons.org/licences/by/4.0/legalcode

Introduction

The financial performance of a company is a primary concern for every stakeholder especially for investors, both aspiring and current ones. The measurement of the financial health of a company through the reported financial statements gives a qualitative analysis of the company’s position as well as an account of how the company has utilised its capital in production. According to Bhunia et al. (2011) , financial performance analysis involves using reported results in a company’s financial statements to obtain the quantitative performance characteristics of a company with the aim of determining how efficient the company has been in terms of the use of their resources according to the decisions made by the management.

Financial statement analysis using ratios has been one of the most commonly used primary models of assessing business performance. It is one of the primary models of assessment of a firm’s performance over years and as well as comparing it to the rest of the players in the industry. Due to limited time for those who do the analysis of financial statements and also given the fact that these ratios are mostly correlated, the number of ratios that are being evaluated has to be reduced so that focus is given to a few with minimum loss of data ( Taylor, 1986 ). Using principal component analysis (PCA), the study reduced the number of variables for any further regression analysis from 17 variables to 3 variables. Likewise, the number of ratios that are important have also been reduced with only significant ratios for each principal component now being used to analyse the performance of these companies as well as their industry. This study proves that the performance of a company can be analysed using just a few factors or by focusing on fewer ratios, which is cost effective with lesser time as well as obtaining more precise results that have least duplication of calculations.

Since 2002, China has been the largest telecom market by subscriber base and the industry has been attracting a lot of investment within and outside China ( Uria-Recio and O’Connor, 2004 ). The telecom industry in China has been the backbone of the economy that is highly dependent on the internet and online services ( Grubman, 2010 ). Their research, innovation and building of different technologies including the current 5G that they are jointly working on have given China high growth to make it compete with countries like the USA that are considered as earlier entrants into this market. Their internet and data services have facilitated access to online shopping, IPTV, online messaging and calling platforms, data cloud and many other services that are available at very fast speed and cheap rates. The rapid build-up of the industry’s infrastructure has been the main sign of the aggressive growth and development over the past two decades ( Lu, 2000 ).

The Chinese Telecom industry was heavily controlled by the government through the ownership and formation of policies on investment, areas of operations and tariffs charged. In late 2001, China successfully joined the World Trade Organization and this meant that it had to adjust some of its policies including regulations on players in its telecoms industry. Even though they opened the doors for foreigners, this industry remained monopolised by the three state-owned companies who have been competing for the highest market share, best financial performance and top innovation into new technologies including 5G network. Over the past years, they have cemented their dominance by taking over the other small players in the industry that were state owned as well. This study, thus, seeks to assess the financial performance of this industry since the doors for open competition were opened in this sector.

China Telecom Limited

China Telecom is an incorporated company in the People’s Republic of China as China Telecom Corporation Limited with the aim of providing information services. These are, but not limited to wireline and telecommunication services, broadband and wireless internet access services, information services and other services that relate to information and telecommunications. According to the company’s report, there were at least 250m mobile subscribers, 134m broadband subscribers and 122m active access lines. The company is currently listed on the Hong Kong Stock Exchange and the New York Stock Exchange where they trade American Depositary Shares ( Telecom, 2019 ).

China Mobile Limited

This is a company which is incorporated on Hong Kong and New York Stock Exchanges since 1997 with a constituent stock of Hang Seng Index in Hong Kong. Since its formation, China Mobile has grown to have the highest market share in the telecommunications globally with the highest number of subscribers, of which 887m are mobile subscribers while 113m of them are broadband subscribers. Mobile services in the form of mobile voice and data services are the main businesses of the company and other services include wireline broadband and other services in the telecommunications industry ( Mobile, 2019 ).

China Unicom (Hong Kong) Limited

China Unicom, which was formed in 1994, is one of the oldest Telecoms Company in China and in the 2000s was listed on the Hong Kong and New York Stock Exchange. The company is the second largest mobile services provider in China with a subscriber base of 248m mobile subscribers, and 60m fixed line subscribers. Their service coverage includes all the telecommunications services and it has been doing exceptionally well in the mobile and fixed networks provision ( Unicom, 2019 ).

The rest of this paper is structured as follows: literature review, research objectives, methodology, discussion and analysis of results and finally the conclusion.

Literature review

Financial analysis involves the use of quantitative information from financial statements, that is, income statement, balance sheet and statement of cash flows in order to come up with relationships of the items that are reported by the company according to the accounting standards for reporting. In doing this, the company is able to evaluate its decisions during a financial year or a given period and see its strengths, weaknesses and areas that need attention in the organisation ( Abraham, 2004 ; Bhargava, 2017 ; Schönbohm, 2013 ). Additionally, “they also provide clues on where the management might find more resources to boost its revenue” ( Mahajan and Yaday, 2016 ). In a case study on India’s telecommunications industry, Bhargava (2017) concludes that due to the increased contribution of the telecoms industry to different economies the financial health of the industry is important to the whole economy. Therefore, there is need for measurement of this constantly to monitor the economic performance of the whole industry. The telecoms industry is highly capital intensive and investors will be interested in knowing the “the financial condition and worthiness” of the industry which is achieved through financial analysis. However, even though it is beneficial it has to be noted that the ratios isolate the assessed factors from the rest of the report; hence, precaution has to be taken when interpreting them ( Abraham, 2004 ).

Even though ratios were seen as less significant due to the introduction of more sophisticated statistical analysis tools, authors still believe that they are still a useful tool in measuring performance. For example, a study which was done by Altman (1968) proved how ratios are still useful in prediction of bankruptcy using the case of manufacturing firms. Other studies on proving the importance and usefulness of ratios by Lewellen (2004) and Floros et al. (2009) found that investment ratios are useful in predicting market values of shares.

With this in mind, this study looks at internal determinants of performance as in the study by Allen et al. (2011) and another by Burja (2011) . These are factors within the control of management and can be able to influence them through their decisions. Through this, “the management can anticipate changes in the external environment and try to position the company to take advantage of anticipated developments” ( Burja, 2011 ). The external environment includes factors like demographic changes, GDP, inflation and other external environmental factors. However, besides the quantitative factors, management also have to analyse qualitative factors internally and externally even though these have no standard set to assess them as their measurement can be highly subjective.

A lot of other case studies have been done on financial performance analysis using ratios ( Eversull and Rotan, 1997 ; Collier et al. , 2010 ; Hossan and Habib, 2010 ; Grubman, 2010 ; Bhargava, 2017 ). For example Al-Jafari and Al Samman (2015) investigated the determinants of profitability for industrial firms in Oman. By utilising ordinary least squares (OLS) model on seven ratios, they drew up conclusions on the relationship between profitability ratios and other calculated non-profitability ratios. They found that there is a positive significant relationship between profitability, firm size, growth, fixed assets and working capital. Additionally, they also conclude that management efficiency on these large firms gives them better profit returns.

While Burja (2011) only focussed on the micro or internal environment in his regression analysis of financial performance, Allen et al. (2011) carried out an investigation on both internal and external environment to see how it impacts the profitability of the firm. This was a distinguished study as it included both internal and external factors in the regression analysis.

In a case study on the furniture industry, Traian-Ovidiu and Daniel-Teodor (2013 ) and Tsuji (2014) made a detailed analysis of a company’s statements to aid those who use them for investment decisions. Their studies focussed on bringing together financial ratios from financial statements and market data from stock markets to see how the indices on the market are influenced by the performance of different rations on the reported statements.

A study on the Indian public sector looked at how strategic industries with the government as major player performs financially ( Bhunia et al. , 2011 ). The case study looked at the ratios for India’s pharmaceutical industry financial reports. Using a number of statistical methods including standard deviation, mean and also regression analysis, they established the relationship between profit measure and other performance measures.

According to Buse et al. (2010 ) economic rate of return (ERR) is an important ratio in financial statement analysis because they considered it as an indicator of the economic performance of a company. In their study, they took ERR as a comprehensive ratio that looks at the organisation return and contribution with consideration of both internal and external factors affecting the business.

Kofi-Akrofi (2013 ) carried out a similar study but he, however, used multiple regression to look at the profitability of Telecommunications in Ghana for a period of four years. In his research, the main objective was to establish the relationship between the two main statements, hence, he treated them as independent from each other. A study by Oloko et al. (2014) looked at the telecoms industry but they focussed on how management style, cost of labour and competition impacts performance and profitability of Kenya’s Telkom.

While the literature reviewed covers a number of case studies on financial statements using ratios, some gaps exist. First, we have found that none has so far focussed on the Chinese telecoms especially the period after the Chinese Government opened its doors to the world to invest in their industries. Second, few research studies have used PCA to find out which ratios give best performance analysis with least loss of data from amongst the pool of all ratios. From the review of the past studies, we realized that different ratios were used and some are correlated because they are all from the same statements. A similar study was done by Taylor (1986) which focussed on the Australian firms. The study did not point to a specific industry; hence, with differences in industries the model might not be a one-size-fits-all especially given also the differences in the operational environment between China and Australia. Third, using PCA allows the use of at least 18 ratios reducing subjectivity effects on which ratios should be used for further analysis which include regression analysis on performance. Finally, as shown in our correlation matric we can see that all ratios are related which means that there is no independency to carry out the regression. This relationship comes from the fact that these ratios use data from the same statement. By applying PCA we create new independent variables that allow for effective further analysis with even lesser variables.

To carry out a PCA on 18 financial ratios for the Chinese Telecoms Industry to reduce the number of variables.

To analyse how the components are related to each other.

To recommend a combination or mix of ratios that best assess and analyse performance in the industry.

To examine the ratios with highest variation and assess their impact on the industry.

Methodology

In previous studies on relationship analysis for financial statements and financial ratios, two models have mainly been used. The first one is the panel OLS regression model which has been applied by a number of accounting articles on financial performance and in most literature less than ten variables are used ( Al-Jafari and Al Samman, 2015 ; Jakob, 2017 ; Burja, 2011 ). The second model has been the multiple regression which was adopted by other researchers ( Bhunia et al. , 2011 ; Kofi-Akrofi, 2013 ; Buse et al. , 2010 ).

In this research, we use PCA which is a statistical tool that is used to reduce the variables that are used in data analysis with minimum loss of the original data ( Karamizadeh et al. , 2013 ). It has been used in a number of industries with one of the most common being in biometrics or “bioimaging” where physical features are used to identify a person with application on mobile phones, security systems. PCA has also been used for dimension reduction of large volumes of data and also in image compressing ( Arab et al. , 2018 ; Karamizadeh et al. , 2013 ; Polyak and Mikhail, 2017 ). The application of PCA in reducing variables as already noted in the literature review makes it a useful tool in modern days where large volumes of data are compiled and compared for its usefulness. In accounting field, PCA was used in a study by Taylor (1986) to reduce the number of ratios used in analysis of Australian companies since a lot of ratios are available, this makes the model very useful in helping investors and those who study ratios on knowing the most important ratios as it offers a way to reduce the numbers of ratios by statistically taking those that are most important with limited bias. The fact that PCA creates a new set of artificial variables which are independent makes it less complex to do regressions and come up with conclusions on related variables. In itself the PCA only reduces the variables that can be further used for regression analysis.

The first principal component combines the X -variables that have the maximum variance amongst all the combinations. Much of the variation in the data is taken by this first component. The second one likewise also takes the maximum remaining variation in the data with the condition that the correlation between the first and the second component is 0. This continues until the “ i th” component, which will account to the last variation that has not been accounted for by the other components with the condition still remaining that its correlation with the other components is 0. This condition is what creates the independence of the variable being used.

The principal component estimation uses eigenvectors as the coefficient to come up with the following basic equations: (1) Y 1 = e ˆ 11 Z X 1 + e ˆ 12 Z X 2 + e ˆ 13 Z X 3 + ⋯ + e ˆ 1 i Z X i , (2) Y 2 = e ˆ 21 Z X 1 + e ˆ 22 Z X 2 + e ˆ 23 Z X 3 + ⋯ + e ˆ 2 i Z X i , (3) Y i = e ˆ i 1 Z X 1 + e ˆ i 2 Z X 2 + e ˆ i 3 Z X 3 + ⋯ + e ˆ i i Z X i , where Y is the principal component; e ˆ the eigenvector; ZX the standardized value of the ratios used.

A total of 18 accounting ratios that are used in most literature in accounting and are deemed to be the most important measures of profitability, liquidity, management efficiency, leverage, valuation and growth, cash flow indicator and effective tax rate. This list, however, is not exhaustive; it has the ability to cover more ratios. Some of the ratios differ from the ones by Taylor (1986) because they are more relevant to the telecoms industry as used in previous studies. Second, in his study, Taylor used “debt coverage” due to missing data for interest cover but for this study we used interest cover as all relevant data were available ( Table I ).

The data used are from 2001 to 2017. This is the period that has financial statements available on the websites of the companies. Statistical Package for Social Sciences 20 was then used for the analysis of the financial statement with Microsoft Excel 13 used in the calculation of the final coefficients for each principal component. Standardized data were used instead of the original data as the ratios have different units of measurement. If the raw data are used, then a PCA will tend to give more emphasis to those variables that have higher variances than those variables that have lower variances meaning results will depend on the unit of measurement for each variable and since these data do not have that we used the standardized values.

All the financial data are secondary data taken from the company’s annual financial reports as presented on their websites and also from trusted journals and websites ( Table II ).

The matrix in Table III shows the relations within the ratios, which means we cannot have any ratio that is independent from the other, hence, we cannot use these ratios in regression as independent variables. This means we need to create new variables using PCA that will be independent from each other.

Results and discussion

The financial statements of the three telecoms companies in China were used to assess the firms’ performance. Thus, PCA was adopted to suggest the most suitable ratios that can best explain the firms’ performance while ensuring minimum data loss among the pool of ratios. Using the data from the industry, which is described in Table II , we use standardized values of the ratios in the extraction of the principal component.

In this section, we first examined the components that have been extracted and the new independent variables according to our first objectives. Then second, we looked at the ratio mix that can be used for analysis of the telecoms industry performance.

Based on the extraction in Table IV , we only need four components to use as variables in the telecoms industry instead of the initial 18. These new variables are not only independent but are more easily comparable than the initial variables we had. The first principal component covers the highest variation in the data with an initial eigenvalue of 7.982, which represent 44.344 per cent of the variance. Three other components needed to, at least, get to 85 per cent of the variance, which is significant with least data being lost in the analysis. This contradicts with the initial conclusion that was made on Australian firms, who used similar ratios but got four components at 64.8 per cent Taylor (1986) . This variation is huge and is likely to be because of these data being focussed on one industry, hence, reducing the differences in valuation and reports of numerous firms. The increased percentage means there is lesser data loss from the four components and this allows for better analysis of the financial statements. From the PCA for the telecoms industry, we remain with four variables, Y1–Y4 whose calculation based on Equations (1) –( 3) ( Table V ).

Table VI shows us the mix of ratios that PCA extract to give significant analysis on the performance of the telecoms industry. The 12 ratios represent the mix that has important ratios from the classes that we have in general. The performance of the telecoms industry is measured mainly with four classes of ratios.

First, profitability of the company is very important as also concluded in research studies by Altman (1968) , Collier et al. (2010) and Mahajan and Yaday (2016) . In component 1, we see profitability measures having a very significant value of above 0.8. This is supported through most literatures that use the profitability of a firm as one of the primary indicators of its performance or as the dependent variable in most of the regression analysis, for example, return on assets ROA which was used by Kofi-Akrofi (2013 ) and Al-Jafari and Al Samman (2015) . Profit maximisation should be the main goal of management so as to give the high return expected by their shareholders and measured by ROSE. This is achieved by maintaining a high and constant profit margin throughout operations of the industry with a balance being kept between the profits and the expenditure of the firm especially in the salaries.

Second, liquidity in the industry is very important as proved by component 1. From the analysis, we established the importance of working capital assets as well as the importance of the operating cash to the firms which are also included in literature as significant measures as in the studies published by Bhunia et al. (2011) , Neves (2011) , Baños-Caballero et al. (2012) , Knauer and Wöhrmann (2013) . Operating cash has the highest value in component 1 which may signify its importance in the industry. The combination of the cash and the other current assets shows how performance in this industry is dependent on the liquid assets at the disposal of the firms. These resources are important for use in growth and expansion of operations. In analysing the individual companies it is interesting to see how failure to maintain high liquidity has led to the struggle of China Telecom and China Unicom to perform well and this supports what Singhania et al. (2014) noted the necessity of maintaining a balance between liquidity and profitability. In an analysis done on individual companies as the study built on the industry average, it was observed that China Telecom and China Unicom have been struggling to maintain favourable liquidity balances which has always left them as market followers behind China Mobile in terms of ability to generate profits, launch new services and upgrad to newer technologies including 4G network coverage.