Essays About Money: Top 5 Examples and 6 Prompts

With money comes great power; however, power must always come with responsibility. Discover thought-provoking essays about money in our guide.

Money is everywhere. We use it to eat, drink, clothe ourselves, and get shelter, among many other uses. Nowadays, it is an undisputed fact that “money makes the world go round.” The earliest known form of money dates back to around 5,000 years ago ; trade was previously carried out using a barter system. However, over the centuries, more and more nations began implementing a currency system, and money has become more critical.

In the contemporary world, it seems to be “all about money.” However, it is important not to lose sight of what is important; we must maintain good physical and mental health and healthy relationships with the people around us. Money is necessary; it is just not the only thing necessary. To start your essay, read these examples to write insightful essays about money.

5 Top Examples On Essay About Money

1. essay on money by prasanna, 2. how money changed human history by jacob wilkins, 3. capitalism: money that make money by ernestine montgomery, 4. is money the most important thing by seth higgins.

- 5. An Introduction to Saving Money by Jeremy Vohwinkle

Writing Prompts For Essays About Money

1. good uses for money, 2. the “dark side” of money, 3. money’s role in history, 4. morality vs. money, 5. can money buy happiness, 6. how to save money.

“Imagine the world without money. We will eventually come to a point where we will be asking questions like “what’s the point of life”. Hope and goals are some of the important things that will keep a man going in life. Without any sense of achievement or motivation, there wouldn’t be any inventions or progress in the world. People work to get money and then people work harder to get more money. This cycle of life that keeps a man motivated and hopeful is one of the biggest advantages of the system of money”

This essay gives readers a general outlook on money and its advantages and disadvantages. It gives people equal opportunity to work for their dreams and motivates them to be productive members of society, while it also raises the question of greed. Money, without a doubt, has its positive and negative aspects, but it exists and is only becoming more critical.

“But the barter economy was flawed. There was no universal measure for determining the value of an item. It was all based on the subjective opinion of the individuals involved. And to make matters worse, the barter economy relied on both sides wanting something the other had to offer. Trade, therefore, could be sluggish and frustrating. Human beings needed something different, and money was the answer.”

Wilkins writes about how money revolutionized the way trade was conducted. The barter system involved trading any objects if both parties agreed to a deal, such as trading animal skins for fish or medicine for timber. However, the only measure of an item’s value was how much one party wanted it- both sides needed to have something the other wanted. The introduction of money allowed people to put a solid value on commodities, making trade easier.

“So, if you were to closely observe the dirty, disordered canvas of economic progress during the 20th and 21 st century, you should conclude that, for all its warts, capitalism has been the winner. It has sometimes caused pain; suffered from serious cycles; and often needed the clout of the state- such as we have seen from September 2008. It has also been quite resistant to sensible regulation. Even so, the basic institutions of capitalism have worked, not just in the US and the OECD (Organization for Economic Co-operation and development) nations, but also many developing countries, of which India is one.”

Albeit lengthy, Montgomery’s essay discusses the debate between socialism and capitalism, a topic of which money is at the core. Montgomery describes Karl Marx’s criticism of capitalism: all the money goes to a few people, not the workers. She believes these are valid to an extent and criticizes certain forms of capitalism and socialism. Neither capitalism nor socialism is perfect, but according to Montgomery, capitalism creates a better economy.

“Being the richest man in the world does not mean you are the happiest man in the world, although money can buy you happiness sometimes, but not always. If we could all appreciate the way life is, the fun, and the beauty I think the world would be better. If people weren’t power hungry maybe we’d have a lesser demand for money. Those people who is money hungry and power hungry need to relax. Money can’t buy you happiness. These individuals need to understand that.”

Higgins implores readers to remember that money is not the only thing people need in the world. He stresses the necessity of money, as it is used to pay for various necessary goods and services; however, he believes it is not a prerequisite for happiness. Material things are temporary, and there are other things we should focus on, like family and friends.

5. An Introduction to Saving Money by Jeremy Vohwinkle

“A financial emergency may take the form of a job loss, significant medical or dental expense, unexpected home or auto repairs, a hurricane or major storm, or something unthinkable, such as a global pandemic. The last thing you want to do is to rely on credit cards with their hefty interest fees or to be forced to take out a loan. That’s where your emergency fund can come in handy. Historically, the formula for an emergency account is to have enough readily available cash to cover three to six months of living expenses.“

Vohwinkle’s essay gives readers some suggestions on how to save more money. Most importantly, he suggests setting up an emergency fund, as all other saving techniques stem from there. He also suggests creating an automatic savings plan and cutting down on “spending leaks,” like buying coffee. You might also be interested in these essays about celebration .

In this essay, write about why money is necessary and the ways to use it for the greater good, and include ways in which it can be used (investing, donating, etc.). For each point, you make, be sure to explain why. Of course, this is entirely subjective; feel free to write about what you consider “good uses” for money.

On the other hand, money also has a negative side —research on money-related issues, such as taxpayer-funded corruption and trading of illegal goods. In your essay, explore this side of money and perhaps give solutions on how to stop these problems.

Money has played a progressively more important role throughout human history. Discuss the development of currency and the economy, from the barter system to the digital world we live in today. You need not go too in-depth, as there is a lot of ground to cover and many eras to research. Be sure to cite reputable sources when discussing history.

Many people warn of “selling your soul” for financial gain. In your essay, you can write about the importance of having solid values in this day and age, where money reigns supreme. What principles do you need to keep in mind? Explain how you can still value money while staying grounded; mention the balance between material needs and others.

As stated in Higgins’ essay, more people have begun to prioritize money over all else. Do you believe that money is truly the most important thing? Can it alone make you happy? Discuss both sides of this question and choose your position accordingly. Be sure to provide precise supporting details for a stronger argument.

Enumerate tips on how you can save money. Anything works, from saving certain things for special occasions to buying more food in the grocery rather than eating out. This is your opinion; however, feel free to consult online sources and the people around you for extra advice.

For help with your essays, check out our round-up of the best essay checkers .If you’re still stuck, check out our general resource of essay writing topics .

Martin is an avid writer specializing in editing and proofreading. He also enjoys literary analysis and writing about food and travel.

View all posts

25,000+ students realised their study abroad dream with us. Take the first step today

Meet top uk universities from the comfort of your home, here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- School Education /

Essay On Money: 100, 250 Words Samples

- Updated on

- Nov 9, 2023

Why do you think money is important? Can we live without money? Does money have its own value? What’s the difference between hard money and digital money? When we plan on buying something, we have to pay a certain amount. Let’s say you want to buy a wristwatch worth $50. How do you compare that commodity with money? Do they have equal value? Is there any authority that states the value of money ? These and several other questions about money can make one wonder why money is given so much importance. Let’s go in-depth with an essay on money and find answers to all these questions.

Table of Contents

- 1 What is Money?

- 2 Why is Money So Important?

- 3 Essay on Money in 100 Words

- 4 Essay on Money in 250 Words

Also Read: Essay on Chandrayaan – 3

What is Money?

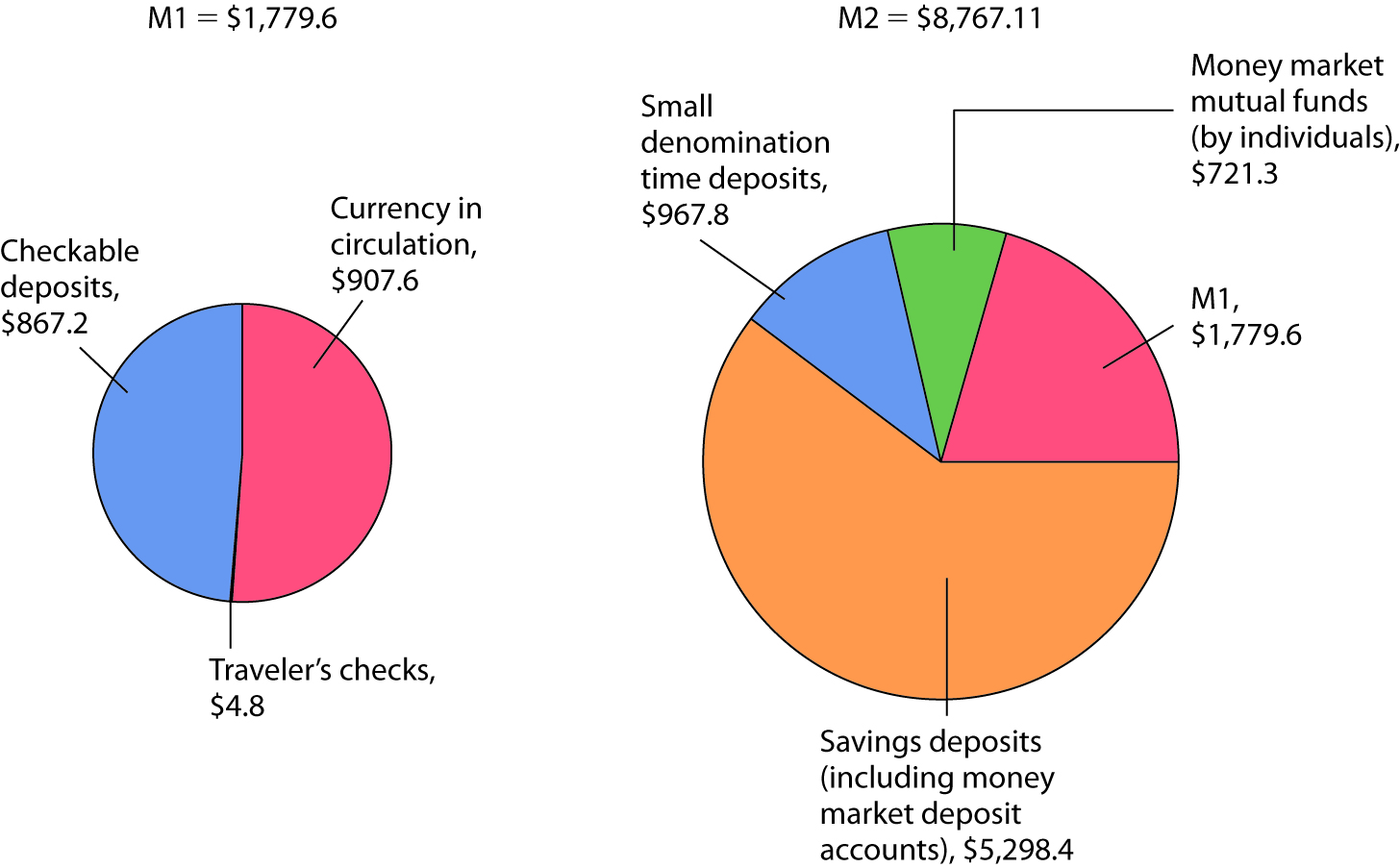

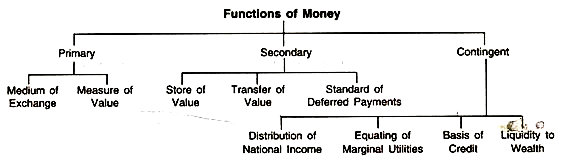

According to Wikipedia and Oxford Dictionary, Money is simply a medium of exchange. Some even consider money as one of the most important resources , which is used to make transactions of goods, services, or repayment of debts within a specific country or socio-economic context.

Money can have various forms, coins and banknotes in physical form, and electronic balances in bank accounts in digital forms. Money serves as a unit of account, facilitating the measurement of value in terms of prices, and as a store of value, allowing individuals to save purchasing power for future use.

Learn Why Financial Literacy is Important for Students.

Why is Money So Important?

What makes money such an important resource is its acceptance across the globe in multiple transactions and services. From serving as a medium of exchange to facilitating financial activities, the importance of money goes beyond our everyday needs. Here are several reasons stating the importance of money.

- Money serves as a convenient medium of exchange that facilitates the buying and selling of goods and services, making transactions more efficient than barter systems.

- It provides a standardized unit for measuring the value of goods, services, and assets, allowing for easier comparison and assessment of value across different items.

- Money enables individuals and businesses to store wealth and purchasing power over time, facilitating savings and investment for future needs and goals.

- A stable and reliable monetary system encourages investment, trade, and economic growth, fostering overall prosperity within an economy.

- By using money, individuals and businesses can avoid the high transaction costs associated with bartering and the inefficiencies of non-monetary exchange systems.

- The use of money encourages specialization in the production of goods and services, leading to increased productivity and efficiency within an economy.

- Money is essential for the functioning of financial markets, banking systems, and investment activities, which are crucial for the allocation of resources and capital within an economy.

Also Read: Essay on National Unity Day

Essay on Money in 100 Words

El dinero or money is used as a medium of exchange, unit of account, and store of value. It facilitates trade, allowing for the smooth exchange of goods and services, while also enabling efficient allocation of resources and encouraging economic growth. As a unit of account, it provides a standardized measure of value, simplifying the comparison of different goods and assets.

Moreover, money acts as a store of value, allowing individuals to save and plan for the future. Its role in reducing transaction costs, enabling specialization, and supporting complex financial activities highlights its significance in the functioning of contemporary economies.

Essay on Money in 250 Words

Modern economics is heavily dependent on money or we can say that money is the pillar of modern economies. As a medium of exchange, it simplifies trade by providing a universally accepted method of payment for goods and services, eliminating the inefficiencies and limitations of barter systems. Its characteristic fosters the development of complex market systems, encouraging specialization and the efficient allocation of resources.

Apart from being a medium of exchange, money functions as a unit of account, providing a standardized measure of value that enables individuals to compare prices and evaluate the worth of different goods and services. This uniformity in valuation streamlines commercial activities and allows for effective planning and decision-making in both personal and business contexts.

Money serves as a store of value, allowing individuals to save and accumulate wealth over time. This feature empowers people to prepare for future expenses, emergencies, or long-term goals, providing a sense of security and stability in an uncertain world.

In addition to its role in daily transactions , money fuels economic growth by facilitating investment, entrepreneurship, and innovation. Financial institutions utilize money as a tool to allocate capital efficiently, enabling the development of new businesses, industries, and technologies that contribute to overall economic prosperity.

Money plays multiple roles in our lives; it is a physical or digital representation of currency; it is a fundamental pillar of modern economies, underpinning the intricate web of commercial activities, financial systems, and societal well-being. Its importance lies not only in its tangible properties but also in the complex functions and structures it supports within the global economic framework.

Money is globally accepted as a medium of exchange in multiple transactions and services. From serving as a medium of exchange to facilitating financial activities, the importance of money goes beyond our everyday needs. To buy goods or services, you are required to pay a certain amount, which is fulfilled by paying money.

To write an essay on money, you need to highlight the key aspects of this essential resource. The multiple transactions in which money is used in our day-to-day lives make money an important part of our lives. Give examples of how money can change our lives and what would happen if we were out of money. Highlight the latest trends in the financial sector and what governments are doing to save our money from inflation.

Here are the 5 strongest currencies in the world: Kuwait Dinar (KWD), Bahraini Dinar (BHD), Omani Rial (OMR), Jordanian Dinar (JOD), and Gibraltar Pound (GIP).

Related Articles

For more information on such interesting topics, visit our essay writing page and follow Leverage Edu .

Shiva Tyagi

With an experience of over a year, I've developed a passion for writing blogs on wide range of topics. I am mostly inspired from topics related to social and environmental fields, where you come up with a positive outcome.

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Contact no. *

Connect With Us

25,000+ students realised their study abroad dream with us. Take the first step today.

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

January 2024

September 2024

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

Have something on your mind?

Make your study abroad dream a reality in January 2022 with

India's Biggest Virtual University Fair

Essex Direct Admission Day

Why attend .

Don't Miss Out

Essay on Money for Students and Children

500+ words essay on money.

Money is an essential need to survive in the world. In today’s world, almost everything is possible with money. Moreover, you can fulfill any of your dreams by spending money. As a result, people work hard to earn it. Our parents work hard to fulfill our dreams .

Furthermore various businessmen , entrepreneurs have startup businesses to earn profits. They have made use of their skills and intelligence in getting an upper hand in earning. Also, the employee sector works day and night to complete their tasks given to them. But still, there are many people who take shortcuts to success and get involved in corruption.

Black Money

Black money is the money that people earn with corruption . For your information corruption involves the misuse of the power of high posts. For instance, it involves taking bribes, extra money for free services, etc. Corruption is the main cause of the lack of proper growth of the country .

Moreover, money that people having authority earns misusing their powers is black money. Furthermore, these earnings do not have proper documentation. As a result, the people who earn this do not pay income tax . Which is a great offense and the person who does this can be behind bars.

Money Laundering

In simple terms, money laundering is converting black money into white money. Also, this is another illegal offense. Furthermore, money laundering also encourages various crimes. Because it is the only way criminal can use their money from illegal sources. Money laundering is a crime, and the people who practice it are liable to go to jail.

Therefore the Government is taking various preventive measures to abolish money laundering. The government is linking bank accounts to AADHAR Card. To get all the transaction detail of each bank account. As a result, the government comes to know if any transaction is from an illegal source .

Also, every bank account has its own KYC (Know your Customer) this separates different categories of income of people. Businessmen are in the high-risk category. Then comes the people who are on a high post they are in the medium-risk category. Further, the last category is of the Employee sector they are at the lowest risk.

Get the huge list of more than 500 Essay Topics and Ideas

White Money

White money is the money that people earn through legal sources. Moreover, it is the money on which the people have already paid the tax. The employee sector of any company always has white money income.

Because the tax is already levied on their income. Therefore the safest way to earn money is in the employment sector. But your income will be limited here. As a result, many people take a different path and choose entrepreneurship. This helps them in starting their own company and make profitable incomes .

Every person in this world works hard to earn money. People try different methods and set of skills to increase their incomes. But it is always not about earning money, it’s about saving and spending it. People should spend money wisely. Moreover, things should always be bought by judging their worth. Because money is not precious but the efforts you make for it are.

Q1. What is Black Money?

A1. Black money is the money that people earn through illegal ways. It is strictly prohibited in our country. And the people who have it can go to jail.

Q2. What is the difference between Black money and White money?

A2. The difference between black money and white money is, Black money comes from illegal earnings. But white money comes from legal sources with taxation levied on it.

Customize your course in 30 seconds

Which class are you in.

- Travelling Essay

- Picnic Essay

- Our Country Essay

- My Parents Essay

- Essay on Favourite Personality

- Essay on Memorable Day of My Life

- Essay on Knowledge is Power

- Essay on Gurpurab

- Essay on My Favourite Season

- Essay on Types of Sports

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Essay on Importance of Money

Students are often asked to write an essay on Importance of Money in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Importance of Money

Introduction.

Money is a crucial part of our lives. It is the medium used for exchange of goods and services, and it helps us meet our basic needs.

Significance in Daily Life

Money allows us to acquire food, shelter, and clothing. Without money, survival would be difficult.

Role in Society

Money also plays a societal role. It helps us contribute to community development through taxes.

While money is important, it’s not everything. It’s a tool for survival and contribution, but happiness and fulfillment also require love, health, and peace.

Also check:

- Speech on Importance of Money

250 Words Essay on Importance of Money

The significance of money.

Money, a medium of exchange, is a fundamental component of modern society. It is a tool that allows us to acquire goods, services, and experiences, thus playing a vital role in our lives.

Money as a Means of Exchange

Money simplifies trade, replacing the need for a direct barter system. It provides a standardized measure of value, enabling us to understand the worth of various commodities. This standardization facilitates smooth economic transactions and promotes economic efficiency.

Money and Freedom

Money also provides a certain level of freedom. It allows individuals to make choices about their lifestyle, from basic necessities to luxury items. It grants us the liberty to explore different opportunities, be it travel, education, or investment.

Money and Social Status

In many societies, money is often equated with power and status. While this perspective can lead to materialism and inequality, it also motivates individuals to strive for financial stability, fostering innovation and economic growth.

Money as a Tool, Not a Goal

However, it is crucial to remember that money is a means to an end, not an end in itself. The pursuit of money should not overshadow the importance of relationships, health, and personal fulfillment.

In conclusion, money holds significant importance in our lives. It is the cornerstone of economic activity, a catalyst for personal freedom, and a symbol of status. However, its value lies in its ability to enable us to achieve our goals, not in its mere accumulation.

500 Words Essay on Importance of Money

Money, often seen as a simple medium of exchange, plays a pivotal role in modern society. Its importance transcends mere transactions, permeating every aspect of our lives – from the economy to social structures, personal relationships, and even our sense of self-worth.

The Economic Imperative

At its most basic level, money is the lifeblood of any economy. It facilitates trade, allowing for the efficient exchange of goods and services. Without money, barter would be the only alternative – a system fraught with inefficiencies and limitations. Money, therefore, enables economic growth by allowing for specialization and the division of labor.

Money as a Social Construct

Beyond its economic function, money also plays a crucial role in society. It is a social construct that shapes and is shaped by our societal norms and values. Money can affect social dynamics, influencing relationships and power structures. It can serve as a tool for social mobility or conversely, a means of maintaining social stratification.

The Psychological Dimension

Money also has a profound psychological impact. It can influence our behavior, our motivations, and even our sense of self. Money can provide a sense of security and freedom, but it can also lead to stress and anxiety. The desire for money can motivate us to work harder and strive for success, but it can also lead to greed and materialism.

Money and Happiness

The relationship between money and happiness is a complex one. While money can provide for our basic needs and desires, research suggests that beyond a certain point, additional wealth does not lead to additional happiness. This suggests that while money is important, it is not the be-all and end-all of life.

In conclusion, the importance of money cannot be understated. It is a crucial component of our economy, a significant social construct, and a powerful psychological influence. However, it is also important to remember that money is a means to an end, not an end in itself. The pursuit of money should not overshadow the pursuit of happiness, fulfillment, and meaningful relationships. As society continues to evolve, so too will our understanding and use of money, necessitating an ongoing exploration of its role and importance in our lives.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Happiness Is More Important Than Money

- Essay on Expensive Weddings Are a Waste of Money

- Essay on Pocket Money Advantages and Disadvantages

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

Is Money Really the Best Measure of Value?

If we want a more equitable world, then we need to consider the different ways people value money.

April 03, 2024

While some economic theories might assert that one dollar is in fact worth one dollar, Mohammad Akbarpour says this overlooks an important fact: Different people value money differently.

“How to allocate scarce resources and who should get what and why is the fundamental question of economic sciences,” says Akbarpour , who is an associate professor of economics at Stanford Graduate School of Business. In a free market, money plays a central role in answering that question, but as Akbarpour discusses in this episode of If/Then: Business, Leadership, Society , if we want a more equitable world, then we need to consider the different ways people value money.

Much of Akbarpour’s research has explored economic scenarios where wealth inequality presents an impediment to market maximization. One example is ride-sharing in Chicago, where Akbarpour identified systematic income disparities at play between an app’s riders and drivers, as well as among the riders themselves. Because riders in the city’s south side tend to be less affluent than those in the north, market-based pricing incentivizes drivers to concentrate in wealthy areas where riders can afford surge prices, leaving less affluent riders with less access to transportation.

Instead of allowing market forces to determine the cost of fares at a one-size-fits-all rate, Akbarpour argues for tailoring pricing based on income levels and people’s marginal value for money. “Once we believe in this one assumption and add it to the classic models, then we can ask the question of how to allocate scarce resources,” Akbarpour says. “If you care about the utility of these people too, then a policy that increases prices here and decreases prices there can start making sense.”

As Akbarpour explores in this episode of If/Then , creating a more equitable world requires that we challenge our prevailing assumptions about money and the value that people place on it.

Senior Editor, Stanford GSB

Listen & Subscribe

If/Then is a podcast from Stanford Graduate School of Business that examines research findings that can help us navigate the complex issues we face in business, leadership, and society. Each episode features an interview with a Stanford GSB faculty member.

Full Transcript

Note: Transcripts are generated by machine and lightly edited by humans. They may contain errors.

Kevin Cool: If we want a more equitable world then we need to consider the different ways people value money.

Aziz: I like it because I can work whenever I like. I’m not a morning person. I used to be a cab driver for five years, and the car was sitting in the garage so I decided just to do Uber with my car. It’s just sitting there.

Kevin Cool: Meet Aziz. He’s an Uber driver in Chicago. Driving his red Toyota Yaris around the city most afternoons and evenings, and he’s been doing it a long time.

Aziz: I start 2013 so it’s almost 10 years.

Kevin Cool: Aziz has driven more than 20,000 Uber trips in those 10 years.

Aziz : So with Uber you just drive and more relaxing of driving. Not like that stress. Yeah, a lot of cab drivers, they were killed just for 50 bucks, but now, with Uber I don’t carry cash with me. It’s good. Yeah, it’s more safe, and you can drive whenever you are. If it’s busy in the summer I can stay in the summer. With Uber it’s more safe for me.

Kevin Cool: For Aziz, one of the biggest benefits of working for Uber is the control and choice he has. When he works, where he drives and which rides he accepts.

Aziz: So sometimes, I drive to Indiana or Michigan. I have no problems driving around. I drive south, north, west, northeast … the lake.

Kevin Cool: Aziz, like a number of the Uber drivers we met in Chicago, just wants to stay busy keeping the back seat of his car full of passengers for as much time as possible. The more rides with less down time affects what he takes home at the end of the day. Yet all the drivers we spoke to are very aware of the incentive prices for both drivers and passengers like surge pricing for different parts of the city.

Aziz: Now, I said it depends — what do you call it? When it’s busy, full charge, and if it’s not busy, they will get a price. You can make like between 20 bucks per hour until if it’s busy you can reach 30 or 35 per hour. So holidays like Thanksgiving we can do when it’s — only when the weather is bad like snowing it’s like people gave us work so you can make some extra money. It shows here like you are in the summer, and if it’s busy I stay there. Why I have to come to downtown because it’s busy in downtown or the surcharges? Sometimes, it’s like surcharge is very high in the south.

Kevin Cool: Price incentives determine where drivers like Aziz pick up rides, but if the only people who can afford those surge prices are in the wealthier parts of Chicago, is that fair for the people who need cars just as much in poorer neighborhoods on the South Side?

Higher prices are easier to stomach for people with lots of money, but what if these incentives could also help people who value money differently? It may sound simple, but it’s not something that conventional economics usually takes into account.

I’m Kevin Cool, Senior Editor at the GSB. Today, we explore the differences in how people value money and how those differences affect market dynamics with Mohammad Akbarpour, associate professor of Economics.

Mohammad Akbarpour: Really, one of the most fundamental questions of economics I try to answer in the project of economics is how to allocate scarce resources. If you read the classics like, “The Wealth of Nations,” the Karl Marx books from left and right this question of how to allocate the scarce resources, and who should get what, and why is a fundamental question of economic sciences.

And the most accepted, widely-recognized answer to this question is the market mechanism. It’s the free market. So if someone is willing to pay more than me for the good they have to get it. So let’s find the market-clearing price, the price at which the supply of something is equal to the demand and let the market work.

What we did in this paper was really to ask the very same question with one extra assumption. And the extra assumption was: different people have different marginal value for money. The whole idea of Econ 101 when you have supply curve, and demand curve, and the intersection of supply and demand curve will give you the market equilibrium, and that’s the point that the total value is maximized. That’s a picture that pretty much everyone who has taken one class in Economics has seen.

That idea that market equilibrium maximizes the total value, total surplus, or even total welfare comes from the belief that getting one dollar from me, and giving it to Elon Musk, is welfare-neutral. That one dollar has the same value for Elon Musk or Mohammad.

If we do not believe in this, which I do find an uncontroversial assumption, although we can talk about that like there is a fundamental philosophical critique to this assumption, if we believe that different people have different marginal values for cash then we should immediately believe that if you’re willing to pay more for something, that does not mean that the social welfare is maximized for giving a good to you. Because it could be that you are rich.

Once we believe in this one assumption and add it to the classic models, then we can ask the question of how to allocate the scarce resources in this way. And it turns out that with that one assumption, we can identify conditions under which free market remains efficient, and optimal, and fair, but that’s not always the case.

There would be many, many cases in which you want to start using non-market allocation mechanisms. And by non-market allocation mechanisms I mean things such as rationing, running a lottery, people waiting in the queue, and allocating the good for free like the allocation of vaccines.

Kevin Cool: So I want to ask you about a few examples in which this plays out, but the one I want to start with is Taylor Swift. I understand you just recently went to a Taylor Swift concert. Is that right?

Mohammad Akbarpour: Yeah, that’s right. I did not plan to, but I had a free ticket.

Kevin Cool: So you didn’t have to make the decision about how much it was, quote, unquote, worth, right? Yeah, but this does seem like a place where the free market failed or at least was flawed. There were some people who paid 70 times the face value. Seven-zero times the face value for a ticket. And, of course, legions of fans who were priced out and were angry about that. I know it’s just concert tickets, but what can we learn from these exorbitant prices and the calls for change that resulted?

Mohammad Akbarpour: Well, I should start by saying that this is really difficult problem. As we are sitting here multiple economists are thinking about the problem of ticket allocation because it’s a really difficult problem. So everything starts by this observation that if Taylor Swift concert tickets are allocated completely by some competitive equilibrium or free markets, then people who are going to be able to go to this concert are not necessarily people who love Taylor Swift the most.

This is again, should be uncontroversial. In fact, that’s the reason that Taylor Swift has started Very Fine Fans. And saying that if you are a Very Fine Fan now you can get the ticket before other people at lower prices. This is also the case for say, WorkUP. Whoever is happy to wake up at 5:00 a.m. and be the first person who signs in, in that website can get it.

FIFA for the World Cup decided that, “We are going to allocate tickets by lottery.” So everyone puts their name down for a hundred-dollar ticket, and then, “We are going to allocate it with lottery and 10 percent of people are going to get it.” These are all allocation mechanisms that Econ 101, the supply and demand curve, would tell you they are wrong. There is someone who was willing to pay more for this ticket, and you did not give the ticket to them.

And yet, policymakers do that, and in this paper, if you like, in this sequence of papers and research agenda that I started with my fantastic co-authors, Piotr Dworczak and Scott Kominers basically, our idea was people are doing it out there in the world. Some economists think that that is wrong. Could we actually make sense of this policy decision based on economic principles? Based on first principles.

And we could do that by just adding one feature to the model which is different people have different marginal value for money. So if someone is willing to pay $1,000 for a Taylor Swift concert they do not necessarily get more value from going to Taylor Swift concert than someone who is willing to pay $500.

Kevin Cool: Another example. A lot of the people who went to these concerts probably arrived in a Lyft or an Uber. And you’ve done some work looking at ride-sharing companies and how those mechanisms or how the market works in that. First of all, what is wrong with that market that needs to be fixed, and what would you propose as a remedy?

Mohammad Akbarpour: One thing that we discovered in the mathematics of the model was that there are two different types of inequality that can change the way you regulate a market. One type of inequality is the inequality across two sides of the market. In the Uber example that you just said or Lyft example, drivers are systematically poorer than riders.

That’s a fact that you can look at their tax returns. It’s clear that the typical Uber passenger is, on average, more well-off than a typical Uber driver. So that’s what we call the cross-saving equality. The other type of inequality is with inside inequality. Within riders. Some riders are rich, some riders are poor.

And these two different types of inequality give rise to two different policies or different types of policy outcomes. Within the framework of your question, drivers are systematically poorer than riders. And then, if you go to Chicago, riders of South Side Chicago are actually much poorer than riders of Lincoln Park, which is a much more well-off neighborhood.

And then when we take that observation that’s like basically, distribution of marginal values for cash which comes from the distribution of inequality into the model we will see that policies such as increased prices under Lincoln Park, because passengers are much less price-sensitive, and decreased prices on the South Side because passengers are very price-sensitive. And, in fact, you might even start getting negative revenue on the South Side. It doesn’t make sense for you to have business there. But if you have some redistributive goal, if you care about the utility of these people, too, then a policy that increases prices here and decreases prices here can start making sense.

Another policy that can start making sense is to detach the price of drivers and passengers. Instead of saying that the price is $100, and I’m going to get 40 percent of it as Uber as the platform you can set a higher price for riders, a lower price for drivers you will generate some revenue that is more than what you could do otherwise because now, you can charge riders much more. And then, you can use that revenue to give drivers benefits like such as health insurance and stuff like that as part of their compensation.

And I should emphasize, these are policies that are optimal if you are a social planner thinking about welfare, or a regulator who wants to actually maximize welfare. From an Uber perspective, if their only objective is revenue then it’s unclear that this is a good policy.

But I believe and working with different companies, I believe that even companies, even if it’s only about their own long term stock value, they do care about consumer welfare. They do care about actually creating a great PR, making sure that they are a company known as a good company. And in that case, if they want to help drivers this is the way they can do that.

Kevin Cool: You’re listening to “ If/Then ,” a podcast from Stanford Graduate School of Business. We’ll continue our conversation after the break.

[Music plays]

Kevin Cool: So you’re making an economic argument here, but it seems to me that it’s possible that someone would interpret this as a political argument. It’s redistributing money in a way from the rich to the poor. Have you had any pushback on that in that regard?

Mohammad Akbarpour: A lot of pushback. The very first few economists whom I really appreciate we talked about this idea, they were like very much against it because of several reasons. And let me actually get into some of the detail.

The first reason is what we are doing here is what a classic economist would call an interpersonal utility comparison, which means I’m saying that if I give one dollar to you versus one dollar to me this will generate more utility in your brain. This is going to give you more happiness than if I give it to Elon Musk.

I’m basically making a comparison of what happens in your brain. There is no reason to believe that actually, maybe Elon Musk is still as happier with getting one dollar than you. How do I know that? This is a really subtle philosophical critique. That’s why economists historically were really against interpersonal utility comparison. They were like, “The only thing we can observe is willingness to pay. How much you’re willing to pay for this tea. And if you are willing to pay more you probably enjoy it more.”

Kevin Cool: So the market is determining what happens?

Mohammad Akbarpour: Exactly.

Kevin Cool: Yeah, right.

Mohammad Akbarpour: So we are here in this paper, we are making these sequence of papers. We are making interpersonal utility comparisons. We are saying, “No, one dollar for an average American is more valuable than one dollar for Elon Musk,” and we are happy to take that stand.

The second critique, which is much more fundamental, is economists are actually not against redistribution. They believe — or at least some economists, I would call them market fundamentalists — they believe that the right way to do a distribution is through the tax system. It’s not through redistribution through markets that we do. It’s not distorting markets or that we suggest that it is sometimes optimal.

They say, “Let the markets work. If you want to actually have the poor tax the rich, and then redistribute using all kinds of redistributive policies from lump sum transfer, to free insurance, to free school.” All the social and welfare systems that we have in the United States and everywhere in the world.

What we’re doing in the very first part of our very first paper in this agenda is to actually debunk this by showing that if people have private information about how much they value something, if I know that the value of this concert ticket or value of this cancer treatment for me is a million dollars, but you don’t know that as the market-maker or as the regulator, then we show that actually, this result that the optimal path is to let the market work and redistribute. And we argue that this is a private information in pretty much any market. You really don’t know how much someone values a piece of vaccine, a dose of vaccine, or a cancer treatment, or a Taylor Swift concert.

Second argument is yes, it’s amazing if we could have an optimal tax system, but that’s really a political outcome. Can we really control the whole tax system? Like Democrats have an ideal tax point. Republicans have a different ideal tax point, and we can never be at the optimal tax system which makes distorting markets irrelevant.

So what we do here is to say, “Hey, we cannot change the tax system in short term or medium term, so let’s take that as given. And then given the tax system, how should we design a market? How should we allocate public housing? How should we allocate healthcare? How should we allocate even concert tickets?” And then, we can identify conditions under which market distortion makes sense.

Kevin Cool: Is one of the goals of your research to help solve inequality? And do you think more economists should be pursuing research with that goal in mind?

Mohammad Akbarpour: They say academia is the opposite of the military. Military people do what you tell them and academia people do not listen to anyone. So I cannot really tell what economists should work on. I think what we are doing is alleviating the problem of inequality. Solving the problem of inequality really comes at a macro level. That’s my view that you have to have the government and society who believes, “I don’t want to live in a society that’s extremely unequal.”

And then, the tax system, the welfare system is going to take care of that. So the reason that Scandinavia is a much more equal country than United States is not because of market distortions. It’s because the society as a whole and the government has decided, “We want to have a really, really progressive tax system.”

That doesn’t mean that Scandinavia is in a better situation than United States. That’s really a choice. A social choice of a society. Maybe in America we love to have a country that accepts some high-level of inequality in the name of innovation and growth. That’s a separate question.

So I think solving inequality comes at that level so what we’re doing in this paper is to take inequality as given, and then think about the question of, “How can you alleviate this problem that inequality exists through tools that you have in the market?” And it turns out that what we find is that for most of the day-to-day goods, for yogurt, for oat milk, for a car you actually don’t want to have market distortions.

The paper and this agenda mathematically we prove, and then we can look at data as well, that you want to start having market distortions for goods in which people do not have a huge valuation in their taste. So the social planner kind of knows, the regulator knows that the value of one dose of vaccine for different people with the same observables cannot be that massively different.

A better example is cancer treatment. If you and I both have some kind of cancer, probably both of us would like to get the best treatment equally. There is no reason for me to love my life significantly more than you. So if someone is willing to pay a million dollars for a cancer treatment and someone is willing to pay $10,000 for the cancer treatment I would argue most of the difference comes from the fact that the first one is much richer. It’s a budget constraint more than an actual value.

And the paper says for these types of goods, goods in which variation and willingness to pay can be mostly explained by variation in wealth. You want to have non-market mechanisms. So we are not solving the problem of inequality, but we are alleviating this problem for these types of goods that we refer to as essential goods.

Kevin Cool: Are you optimistic that policymakers, regulators could be persuaded that we have tools to make markets more fair or that that should happen?

Mohammad Akbarpour: I think it’s to some extent already happening in a lot of places. So one in every 10 almost houses in New York City are public houses. This is a redistributive program. Fifty percent of Amsterdam housing is public so we are already seeing this happening in practice.

What I’m optimistic we are going to do more and more with more data and more analysis is that policymakers and regulators start thinking about this problem more rigorously and identify the best policies instead of just some policy that we think might work.

Kevin Cool: What drew you to first of all, become an economist and to this research in particular?

Mohammad Akbarpour: The economics really came from the fact that I always loved mathematics, and I also loved looking at humans. Reading novels. Thinking about psychology. “Brothers Karamazov” was my favorite novel, and I realized that economics is somehow a great mix of thinking about humans and mathematics.

I came to Stanford University as a PhD student in the School of Engineering. And then, I got a few economics classes, and I fell in love with economics, and then I switched to economics. So that’s how it really all started for me thinking about economics.

This particular research I was uncomfortable by this assumption. From day one I saw it. This fact that the whole economics builds on the fact that moving one dollar from A to B or at least the whole Econ 101 is welfare-neutral. And coming from Iran I was kind of in the middle class myself, but I had a lot of family members in a really small city five hours away from the capital who are really, really poor.

And it was so clear that one dollar to them is significantly different than one dollar to people that I was surrounded with in Tehran in my university. So all of those really existed in my brain and I was uncomfortable with this question. And then, with my two fantastic co-authors they had different personal experiences and we were talking about these topics.

And we were like, “Do we want to commit the crime and do interpersonal utility comparison?” And we wrote the papers. I do remember that when I told this to one of my friends who is also an economist he was like, “I think with probability five percent this paper is going to start a whole new way of thinking. And with probability 95 percent people are going to laugh at you.” And I was like, “I will take that bet.”

Kevin Cool: You’ll take the five percent?

Mohammad Akbarpour: Yeah.

Kevin Cool: Yeah.

Mohammad Akbarpour: I will take the five percent. Life is too short to get the risk-less papers.

Kevin Cool: “ If/Then ” is produced by Jesse Baker and Eric Nuzum of Magnificent Noise for Stanford Graduate School of Business. Our show is produced by Jim Colgan and Julia Natt. Mixing and sound design by Kristin Mueller. From Stanford GSB, Jenny Luna, Sorel Husbands Denholtz, and Elizabeth Wyleczuk-Stern.

If you enjoyed this conversation we’d appreciate you sharing this with others who might be interested and hope you’ll try some of the other episodes in this series. For more on our professors and their research or to discover more podcasts coming out of Stanford GSB visit our website at gsb.stanford.edu. Find more on our YouTube channel. You can follow us on social media at StanfordGSB. I’m Kevin Cool.

For media inquiries, visit the Newsroom .

Explore More

Studying social networks in developing worlds: five key insights, editor’s picks.

Redistribution Through Markets Piotr Dworczak Scott Duke Kominers Mohammad Akbarpour

November 22, 2021 What If Markets Maximized Both Efficiency and Fairness? A Stanford GSB economist argues that well-designed markets can address inequality while remaining competitive.

August 21, 2018 Rigged Auctions? Why Top Bidders Don’t Always Feel Like Winners New research casts suspicion about auctions in the online advertising market.

October 15, 2021 A Beautiful Application: Using Economics to Make Kidney Exchanges More Efficient and Fair Even modest improvements to organ exchange markets can save many lives. That’s where economists and operations experts come in.

March 13, 2017 Is It Ever OK to Sell (or Buy) a Kidney? Research seeks ways to reduce wait times and increase matches for kidney transplants.

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- CBSE Class 10th

- CBSE Class 12th

- UP Board 10th

- UP Board 12th

- Bihar Board 10th

- Bihar Board 12th

- Top Schools in India

- Top Schools in Delhi

- Top Schools in Mumbai

- Top Schools in Chennai

- Top Schools in Hyderabad

- Top Schools in Kolkata

- Top Schools in Pune

- Top Schools in Bangalore

Products & Resources

- JEE Main Knockout April

- Free Sample Papers

- Free Ebooks

- NCERT Notes

- NCERT Syllabus

- NCERT Books

- RD Sharma Solutions

- Navodaya Vidyalaya Admission 2024-25

- NCERT Solutions

- NCERT Solutions for Class 12

- NCERT Solutions for Class 11

- NCERT solutions for Class 10

- NCERT solutions for Class 9

- NCERT solutions for Class 8

- NCERT Solutions for Class 7

- JEE Main 2024

- JEE Advanced 2024

- BITSAT 2024

- View All Engineering Exams

- Colleges Accepting B.Tech Applications

- Top Engineering Colleges in India

- Engineering Colleges in India

- Engineering Colleges in Tamil Nadu

- Engineering Colleges Accepting JEE Main

- Top IITs in India

- Top NITs in India

- Top IIITs in India

- JEE Main College Predictor

- JEE Main Rank Predictor

- MHT CET College Predictor

- AP EAMCET College Predictor

- GATE College Predictor

- KCET College Predictor

- JEE Advanced College Predictor

- View All College Predictors

- JEE Main Question Paper

- JEE Main Mock Test

- JEE Main Registration

- JEE Main Syllabus

- Download E-Books and Sample Papers

- Compare Colleges

- B.Tech College Applications

- GATE 2024 Result

- MAH MBA CET Exam

- View All Management Exams

Colleges & Courses

- MBA College Admissions

- MBA Colleges in India

- Top IIMs Colleges in India

- Top Online MBA Colleges in India

- MBA Colleges Accepting XAT Score

- BBA Colleges in India

- XAT College Predictor 2024

- SNAP College Predictor

- NMAT College Predictor

- MAT College Predictor 2024

- CMAT College Predictor 2024

- CAT Percentile Predictor 2023

- CAT 2023 College Predictor

- CMAT 2024 Registration

- TS ICET 2024 Registration

- CMAT Exam Date 2024

- MAH MBA CET Cutoff 2024

- Download Helpful Ebooks

- List of Popular Branches

- QnA - Get answers to your doubts

- IIM Fees Structure

- AIIMS Nursing

- Top Medical Colleges in India

- Top Medical Colleges in India accepting NEET Score

- Medical Colleges accepting NEET

- List of Medical Colleges in India

- List of AIIMS Colleges In India

- Medical Colleges in Maharashtra

- Medical Colleges in India Accepting NEET PG

- NEET College Predictor

- NEET PG College Predictor

- NEET MDS College Predictor

- DNB CET College Predictor

- DNB PDCET College Predictor

- NEET Application Form 2024

- NEET PG Application Form 2024

- NEET Cut off

- NEET Online Preparation

- Download Helpful E-books

- LSAT India 2024

- Colleges Accepting Admissions

- Top Law Colleges in India

- Law College Accepting CLAT Score

- List of Law Colleges in India

- Top Law Colleges in Delhi

- Top Law Collages in Indore

- Top Law Colleges in Chandigarh

- Top Law Collages in Lucknow

Predictors & E-Books

- CLAT College Predictor

- MHCET Law ( 5 Year L.L.B) College Predictor

- AILET College Predictor

- Sample Papers

- Compare Law Collages

- Careers360 Youtube Channel

- CLAT Syllabus 2025

- CLAT Previous Year Question Paper

- AIBE 18 Result 2023

- NID DAT Exam

- Pearl Academy Exam

Animation Courses

- Animation Courses in India

- Animation Courses in Bangalore

- Animation Courses in Mumbai

- Animation Courses in Pune

- Animation Courses in Chennai

- Animation Courses in Hyderabad

- Design Colleges in India

- Fashion Design Colleges in Bangalore

- Fashion Design Colleges in Mumbai

- Fashion Design Colleges in Pune

- Fashion Design Colleges in Delhi

- Fashion Design Colleges in Hyderabad

- Fashion Design Colleges in India

- Top Design Colleges in India

- Free Design E-books

- List of Branches

- Careers360 Youtube channel

- NIFT College Predictor

- UCEED College Predictor

- NID DAT College Predictor

- IPU CET BJMC

- JMI Mass Communication Entrance Exam

- IIMC Entrance Exam

- Media & Journalism colleges in Delhi

- Media & Journalism colleges in Bangalore

- Media & Journalism colleges in Mumbai

- List of Media & Journalism Colleges in India

- CA Intermediate

- CA Foundation

- CS Executive

- CS Professional

- Difference between CA and CS

- Difference between CA and CMA

- CA Full form

- CMA Full form

- CS Full form

- CA Salary In India

Top Courses & Careers

- Bachelor of Commerce (B.Com)

- Master of Commerce (M.Com)

- Company Secretary

- Cost Accountant

- Charted Accountant

- Credit Manager

- Financial Advisor

- Top Commerce Colleges in India

- Top Government Commerce Colleges in India

- Top Private Commerce Colleges in India

- Top M.Com Colleges in Mumbai

- Top B.Com Colleges in India

- IT Colleges in Tamil Nadu

- IT Colleges in Uttar Pradesh

- MCA Colleges in India

- BCA Colleges in India

Quick Links

- Information Technology Courses

- Programming Courses

- Web Development Courses

- Data Analytics Courses

- Big Data Analytics Courses

- RUHS Pharmacy Admission Test

- Top Pharmacy Colleges in India

- Pharmacy Colleges in Pune

- Pharmacy Colleges in Mumbai

- Colleges Accepting GPAT Score

- Pharmacy Colleges in Lucknow

- List of Pharmacy Colleges in Nagpur

- GPAT Result

- GPAT 2024 Admit Card

- GPAT Question Papers

- NCHMCT JEE 2024

- Mah BHMCT CET

- Top Hotel Management Colleges in Delhi

- Top Hotel Management Colleges in Hyderabad

- Top Hotel Management Colleges in Mumbai

- Top Hotel Management Colleges in Tamil Nadu

- Top Hotel Management Colleges in Maharashtra

- B.Sc Hotel Management

- Hotel Management

- Diploma in Hotel Management and Catering Technology

Diploma Colleges

- Top Diploma Colleges in Maharashtra

- UPSC IAS 2024

- SSC CGL 2024

- IBPS RRB 2024

- Previous Year Sample Papers

- Free Competition E-books

- Sarkari Result

- QnA- Get your doubts answered

- UPSC Previous Year Sample Papers

- CTET Previous Year Sample Papers

- SBI Clerk Previous Year Sample Papers

- NDA Previous Year Sample Papers

Upcoming Events

- NDA Application Form 2024

- UPSC IAS Application Form 2024

- CDS Application Form 2024

- CTET Admit card 2024

- HP TET Result 2023

- SSC GD Constable Admit Card 2024

- UPTET Notification 2024

- SBI Clerk Result 2024

Other Exams

- SSC CHSL 2024

- UP PCS 2024

- UGC NET 2024

- RRB NTPC 2024

- IBPS PO 2024

- IBPS Clerk 2024

- IBPS SO 2024

- Top University in USA

- Top University in Canada

- Top University in Ireland

- Top Universities in UK

- Top Universities in Australia

- Best MBA Colleges in Abroad

- Business Management Studies Colleges

Top Countries

- Study in USA

- Study in UK

- Study in Canada

- Study in Australia

- Study in Ireland

- Study in Germany

- Study in China

- Study in Europe

Student Visas

- Student Visa Canada

- Student Visa UK

- Student Visa USA

- Student Visa Australia

- Student Visa Germany

- Student Visa New Zealand

- Student Visa Ireland

- CUET PG 2024

- IGNOU B.Ed Admission 2024

- DU Admission

- UP B.Ed JEE 2024

- DDU Entrance Exam

- IIT JAM 2024

- IGNOU Online Admission 2024

- Universities in India

- Top Universities in India 2024

- Top Colleges in India

- Top Universities in Uttar Pradesh 2024

- Top Universities in Bihar

- Top Universities in Madhya Pradesh 2024

- Top Universities in Tamil Nadu 2024

- Central Universities in India

- CUET PG Admit Card 2024

- IGNOU Date Sheet

- CUET Mock Test 2024

- CUET Application Form 2024

- CUET PG Syllabus 2024

- CUET Participating Universities 2024

- CUET Previous Year Question Paper

- CUET Syllabus 2024 for Science Students

- E-Books and Sample Papers

- CUET Exam Pattern 2024

- CUET Exam Date 2024

- CUET Syllabus 2024

- IGNOU Exam Form 2024

- IGNOU Result

- CUET PG Courses 2024

Engineering Preparation

- Knockout JEE Main 2024

- Test Series JEE Main 2024

- JEE Main 2024 Rank Booster

Medical Preparation

- Knockout NEET 2024

- Test Series NEET 2024

- Rank Booster NEET 2024

Online Courses

- JEE Main One Month Course

- NEET One Month Course

- IBSAT Free Mock Tests

- IIT JEE Foundation Course

- Knockout BITSAT 2024

- Career Guidance Tool

Top Streams

- IT & Software Certification Courses

- Engineering and Architecture Certification Courses

- Programming And Development Certification Courses

- Business and Management Certification Courses

- Marketing Certification Courses

- Health and Fitness Certification Courses

- Design Certification Courses

Specializations

- Digital Marketing Certification Courses

- Cyber Security Certification Courses

- Artificial Intelligence Certification Courses

- Business Analytics Certification Courses

- Data Science Certification Courses

- Cloud Computing Certification Courses

- Machine Learning Certification Courses