- Grades 6-12

- School Leaders

Free end-of-year letter templates to your students 📝!

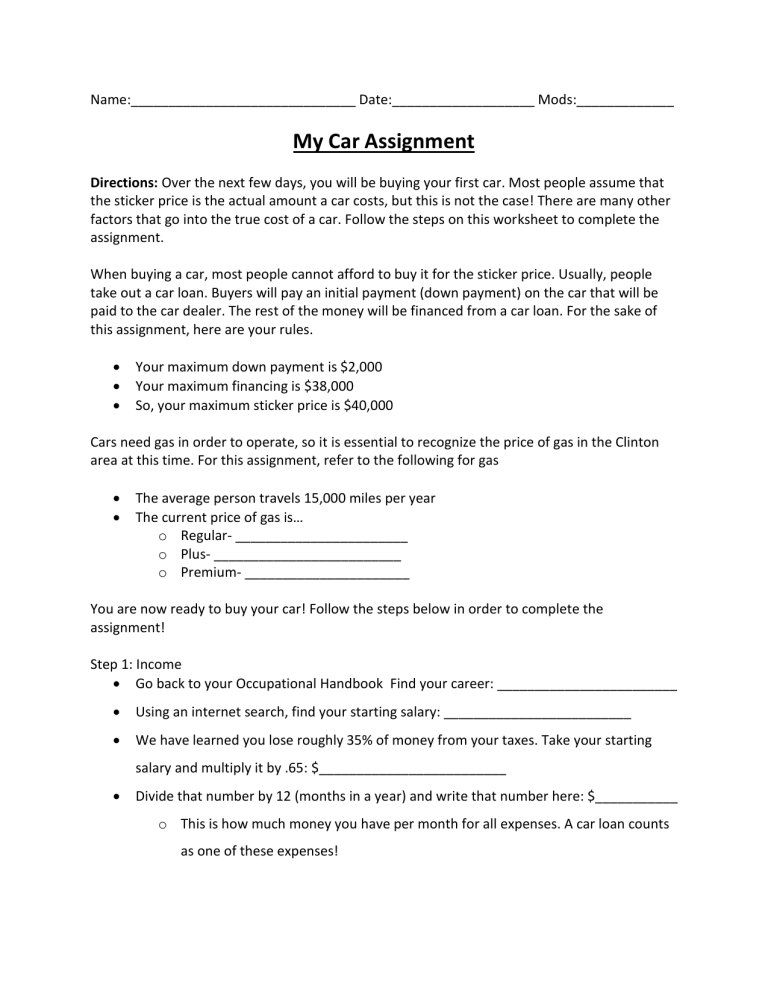

How To Buy Your First Car: Free Financial Literacy Lessons

Such a fun way to teach students in grades 6-12 the steps to buying their first car! 🚗

Ramsey Education exists to equip educators across the country with the tools and resources they need to teach their students how to successfully manage their money and their lives. Together with educators, Ramsey Education wants to see every student in America enter adulthood with the confidence needed to set and achieve their goals — and ultimately live up to their fullest potential.

Many of our students daydream about cars they’d like to buy one day. So, how can we take students from daydreaming to making an informed financial decision and reaching their goal? Check out the Ticket to Drive: Your Path to Car Ownership lesson bundle.

Four different activities take your students from brainstorming their dream car to researching what cars truly cost, to creating a realistic budget to purchase their first car in cash. A reflection activity ties up the experience and provides a perfect opportunity for students to share their learning with each other. Your students will love being able to look at real cars currently available for purchase and seeing what it would take for them to actually buy one on their own.

Lessons included:

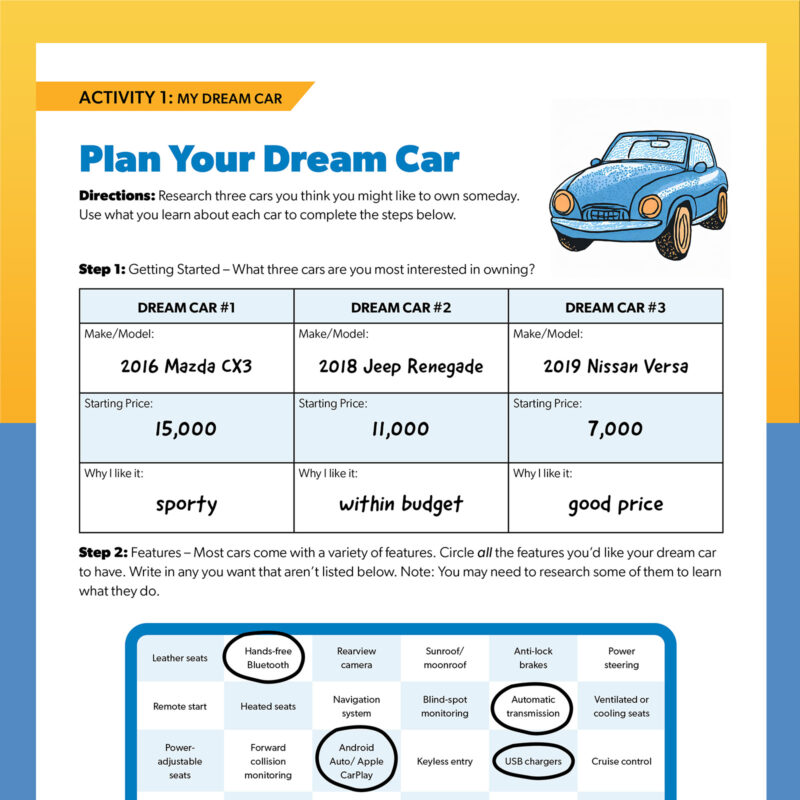

Activity 1: my dream car.

Many students already have a “dream car” in mind when they think about buying their first automobile. This activity asks students to research the cars they’re most interested in, while also encouraging them to consider the features they actually need in a car and which features are unnecessary “wants.”

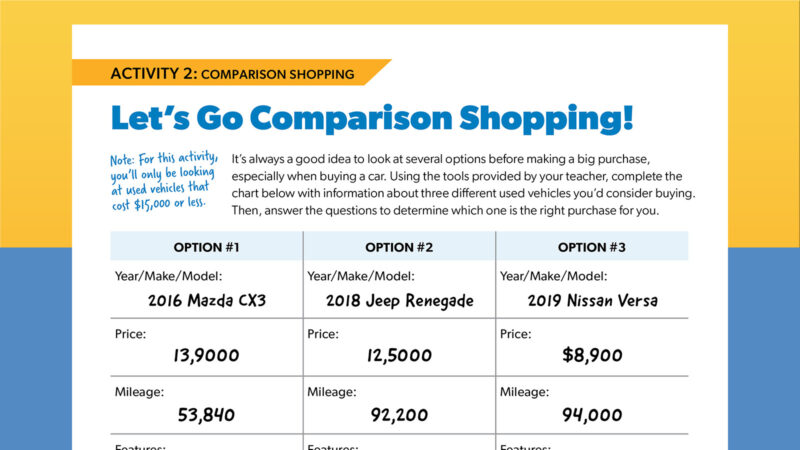

Activities 2 and 3: Comparison Shopping and Building a Budget

In “Comparison Shopping,” students will dive into the world of car shopping by selecting three vehicles that fit their needs. They’ll choose which features are truly essential in their first car, and which ones they can live without. Then comes the fun part: deciding which one is the perfect match and why. Once that’s settled, it’s time to crunch some numbers. In “Building a Budget,” students will figure out how much they need to save to buy their car. Additionally, they’ll determine how long it’ll take to reach their goal.

Activity 4: Student Reflection

After completing Activities 1 through 3, students will have the chance to reflect on their newfound knowledge. The questions are perfect as a take-home assignment or as a tool to assist with a post-activity group discussion. This activity provides a great opportunity for students to realize that they can approach this huge financial milestone with confidence.

Keep the financial literacy learning going with great resources

Our students want to learn about practical ways they can improve their lives after leaving high school. A strong financial literacy program that focuses on real-life applications can leave our students feeling empowered instead of anxious about their financial future. Check out Ramsey Education’s Foundations in Personal Finance curriculum to learn more about their life-application approach to financial literacy.

Copyright © 2024. All rights reserved. 5335 Gate Parkway, Jacksonville, FL 32256

Chapter 8: Consumer Strategies

8.2 a major purchase: buying a car, learning objectives.

- Show how the purchasing process (e.g., identifying the product, the market, and the financing) may be applied to a car purchase.

- Explain the advantages (and disadvantages) of leasing versus borrowing as a form of financing.

- Analyze all the costs associated with car ownership.

- Define “lemon laws.”

Many adults will buy a car several times during their lifetimes. A car is a major purchase. Its price can be as much as or more than one year’s disposable income. Its annual operating costs can be substantial, including the cost of fuel, legally mandated insurance premiums, and registration fees, as well as maintenance and perhaps repairs and storage (parking). A car is not only a significant purchase, but also an ongoing commitment.

In the United States, people spend a considerable amount of time in their cars, commuting to work, driving their children to school and various activities, driving to entertainment and recreational activities, and so on. Most people want their car to provide not only transportation, but also comforts and conveniences. You can apply the purchasing model, described in this chapter, to the car purchase.

First, you identify the need: What is your goal in owning a car? What needs will it fulfill? Here are some further questions to consider:

- What kind of driving will you use the car for? Will you depend on it to get you to work, or will you use it primarily for weekend getaways?

- Do you need carrying capacity (for passengers or “stuff”) or hauling capacity?

- Do you live in a metropolitan area where you will be driving shorter distances at lower speeds and often idling in traffic?

- Do you live in a more rural area where you will be driving longer distances at faster speeds?

- Do you live in a climate where winter or a rainy season would make traction and storage an issue?

- How much time will you spend in the car every day?

- How many miles will you drive each year?

- How long do you expect to keep the car?

- Do you expect to resell or trade in the car?

Your answers to these questions will help you identify the product you want.

Identify the Product

Answering these questions can help identify the attributes you value in a car, based on how you will use it. Cars have many features to compare. The most critical (in no particular order) are shown in Figure 8.9 “Automobile Attributes and Relevance” .

Figure 8.9 Automobile Attributes and Relevance

All these attributes affect price, and you may think of others. Product attribution scoring can help you identify the models that most closely fit your goals.

Mary lives on a dirt road in a rural area; she drives about 18,000 miles per year, commuting to her job as an accountant at the corporate headquarters of an auto parts chain and taking her kids to school. She is also a pretty good car mechanic and does basic maintenance herself.

John lives in the city; he walks or takes a bus to his job as a market researcher for an ad agency, but keeps a car to visit his parents in the suburbs. He drives about 5,000 miles per year, often crawling in traffic. All John knows about a car is that the key goes in the ignition and the fuel goes in the tank.

John and Mary would rate these attributes very differently, and their scoring of the same models would have very different results.

Mary may value fuel efficiency more, as she drives more (and so purchases more fuel). Driving often and with her children, she may rank size, safety, and entertainment features higher than John would, who is in his car less frequently and alone. Mary relies on the car to get to work, so reliability would be more important for her than for John, who drives only for recreational visits. But Mary also knows that she can maintain and repair some things herself, which makes that less of a factor.

Car attributes are widely publicized by car dealers and manufacturers, who are among the top advertisers globally year after year. Advertising Age, “Global Marketers: Top 100,” December 8, 2007, http://adage.com/images/random/datacenter/2008/globalmarketing2008.pdf (accessed April 1, 2009). You can visit dealerships in your area or manufacturers’ Web sites. Using the Internet is a more efficient way of narrowing your search. Specialized print and online magazines, such as Car and Driver , Road and Track , and Edmunds.com , offer detailed discussions of model attributes and their actual performance. Consumer Reports also offers ratings and reviews and also provides data on frequency of repairs and annual maintenance costs.

You want to be sure to consider not only the price of buying the car, but also the costs of operating it. Fuel, maintenance, repair, insurance, property taxes, and registration may all be affected by the car’s attributes, so you should consider operating costs when choosing the product. For example, routine repairs and maintenance are more expensive for some cars. A more fuel-efficient car can significantly lower your fuel costs. A more valuable car will cost more to insure and will mean higher property (or excise) taxes. Moreover, the costs of fuel, maintenance, insurance, registration, and perhaps property tax on the car will be ongoing expenses—you want to buy a car you can afford and afford to drive.

If you are buying a new car, you know its condition, and so you can predict annual maintenance and repair costs and the car’s longevity by the history for that model. Depending on how long you expect to own the car, you may also be concerned with its predicted resale value.

Used cars are generally less expensive than new. A used car has fewer miles left in it. Its condition is less certain: you may not know how it has been driven or its repair and maintenance history. This makes it harder to predict annual maintenance and repair costs. Typically, since it is already used when you buy it, you expect little or no resale value. You can gain a significant price savings in the used car market, and there are good used cars for sale. You may just have to look a bit harder to find one.

The National Automobile Dealers Association (NADA) offers a checklist for used vehicle inspection when buying a used car. The NADA also publishes guidebooks on used car book values (see http://www.nadaguides.com ). Items to inspect in your exterior, interior, and engine checks are outlined in Figure 8.10 “Used Car Buyer’s Checklist” .

Figure 8.10 Used Car Buyer’s ChecklistNational Automobile Dealers Association, http://www.nadaguides.com (accessed November 23, 2009).

The condition of exterior and interior features can indicate past accidents, repairs, or lack of maintenance that may increase future operating expenses, or just driving habits that have left a less attractive or less comfortable vehicle.

Services like Carfax ( http://www.carfax.com ) provide research on a vehicle’s history based on its VIN (vehicle identification number), including any incidence of accidents, flooding, frame damage, or airbag deployment, the number and type of owners (was it a rental or commercial vehicle?), and the mileage. All these events affect your expectations of the vehicle’s longevity, maintenance and repair costs, resale value, and operating costs, which can help you calculate its value and usefulness.

Unless you are an expert yourself, you should always have a trained mechanic inspect a used vehicle before you buy it. With cars, as with any item, the better informed you are, the better you can do as a consumer. Given the cost of a car and its annual expense, there is enough at stake with this purchase to make you cautious.

Identify the Market

New cars are sold through car dealerships. The dealer has a contract with the manufacturer to sell its cars in the retail market. Dealers may also offer repair and maintenance services as well as parts and accessories made especially for the models it sells.

New car dealers may also resell cars that they get as trade-ins, especially of the same models they sell new. Used car dealers typically buy cars through auctions of corporate, rental, or government cars.

Individuals selling a used car can also do so through networking—in an online auction such as eBay, a virtual bulletin board such as Craig’s List, or the bulletin board in the local college snack bar. Dealers will have more information about the market, especially about the supply of cars and price levels for them.

Some people prefer a new car, with its more advanced features and more certain quality, but a used car may be a viable substitute for many purchasers. Many people buy used cars while their incomes are lower, especially in the earlier stages of their adult (working) life. As income rises and concern for convenience, reliability, and safety increases with age and family size, consumers may move into the new car market.

While they are two very different markets, the markets for new and used cars are related. Supply of and demand for new cars affect price levels in the new car market, but also in the used car market. For example, when new car prices are high, more buyers seek out used cars and when low, used car buyers may turn to the new car market.

Demand for cars is affected by macroeconomic factors such as business cycles and inflation. If there is a recession and a rise in unemployment, incomes drop. Demand for new cars will fall. Many people will decide to keep driving their current vehicle until things pick up, unwilling to purchase a long-term asset when they are uncertain about their job and paycheck. That slowing of demand may lower car prices, but will also lower the resale or trade-in value of the current vehicle. For first-time car buyers, that may be a good time to buy.

If there is inflation, it will push up interest rates because the price of borrowing money rises with other prices. Since many people borrow when purchasing a car, that will make the borrowing, and so the purchase, more costly, which will discourage demand.

When the economy is expanding, on the other hand, and inflation and interest rates are low, demand for new cars rises, pushing up prices. In turn, prices are kept in check by competition. As demand for new cars rises, demand for used cars may fall, causing the supply of used cars to rise as more people trade in their cars to buy a new one. They trade them in earlier in the car’s life, so the quality of the used cars on the market rises. This may be a good time to buy a used car.

Identify the Financing: Loans and Leases

The cost of a car is significant. Car purchases usually require financing through a loan or a lease. Each may require a down payment, which you would take out of your savings. That creates an opportunity cost of losing the return you could have earned on your savings. You also lose liquidity: you are taking cash, a liquid asset, and trading it for a car, a not-so-liquid asset.

Your opportunity cost and the cost of decreasing your liquidity are costs of buying the car. You can reduce those costs by borrowing more (and putting less money down), but the more you borrow, the higher your costs of borrowing. If you trade in a vehicle, dealers will often use the trade-in value as the down payment and will sell the car to you with “no money down.”

Car loans are available from banks, credit unions, consumer finance companies, and the manufacturers themselves. Be sure to shop around for the best deal, as rates, maturity, and terms can vary. If you shop for the loan before shopping for the car, then the loan negotiation is separate from the car purchase negotiation. Both may be complex deals, and there are many trade-offs to be made. The more separate—and simplified—each negotiation is, the more likely you will be happy with the outcome.

Loans differ by interest rate or annual percentage rate (APR) and by the time to maturity. Both will affect your monthly payments. A loan with a higher APR is costing you more and, all things being equal, will have a higher monthly payment. A loan with a longer maturity will reduce your monthly payment, but if the APR is higher, it is actually costing you more. Loan maturities may range from one to five years; the longer the loan, the more you risk ending up with a loan that’s worth more than your car.

Rebecca buys a used Saturn for $6,000, with $1,000 cash down from savings and a GMAC-financed loan at 7.2 APR, on which she pays $115 a month for forty-eight months. She could have gotten a twenty-four-month loan, but wanted to have smaller monthly payments. After only twenty-five months, she totals her car in a chain collision but luckily escapes injury. Now she needs another car. The Saturn has no trade-in value, her insurance benefit won’t be enough to cover the cost of another car, and she still has to pay off her loan regardless. Rebecca is out of luck, because her debt outlived her asset. If your debt outlives your asset, your ability to get financing when you go to replace that vehicle will be limited, because you still have the old debt to pay off and now are looking to add a new debt—and its payments—to your budget. Rebecca will have to use more savings and may have to pay more for a second loan, if she can get one, increasing her monthly payments or extending her debt over a longer period of time.

An alternative to getting a car loan is leasing a car. Leases are a common way of financing a car purchase. A lease [1] is a long-term rental agreement with a buyout option [2] at maturity. Typically, at the end of the lease, usually three or four years, you can buy the car outright for a certain amount, or you can give it back (and buy or lease another car), which removes the risk of having an asset that outlives its financing. Leases specify an annual mileage limit, that is, the number of miles that you can drive the car in a year before incurring additional costs. Leases also specify the monthly payment and requirements for routine maintenance that will preserve the car’s value.

So, lease or borrow? The price of the car should be the same regardless of how it is financed—the car should be worth what it’s worth, no matter how it is paid for. The cost of borrowing, in percentage terms, is the interest rate or APR of the loan. The costs of leasing, in dollars, are the down payment, the lease payments, and the buyout. Since the price of the car itself is the same in either case, the present value of all the lease costs should be the same as the price of the car. You can use what you know about the time value of money to calculate the discount rate that produces that price; that is the equivalent annual cost of the lease, in percentage terms.

For example, you want to buy a car with a price of $19,000. You can get a car loan with an APR of 6.5 percent from your bank. You are offered a lease requiring a down payment of $2,999, monthly payments of $359 for three years, and a final buyout of $5,000. The APR of the lease is actually 5.93 percent, which would make it the cheaper financing alternative.

In general, the longer you intend to keep the car, the less sense it makes to lease. If you typically drive a car “into the ground,” until it costs more to repair than replace it, then you are better off borrowing and spreading the costs of financing over a longer period. On the other hand, if you intend to keep the car only for the term of the lease and not to exercise the buyout option, then it is usually more cost effective to lease. You also need to consider whether or not you are likely to stay within the mileage limits of the lease, as the mileage penalties can add significantly to your costs.

Some people will say that they like to borrow and then “own” in order to have an asset that can store value or “build equity.” Given the unpredictable nature of the used car market, however, a car is really not an asset that can be counted on to store value. Thinking of a car as something that you will use up (although over several years) rather than as an asset you can preserve or save will help you make better financial decisions.

When you are buying a car, you want to minimize the cost of both the car and the financing. If you are purchasing both the car and the financing from the same dealer, you should be careful to discuss them separately. Car dealers, who offer loans and leases as well as cars, often combine the three discussions, offering a break on the financing to make the car more affordable, or offering a break on the car to make the financing more affordable. To complicate matters further, they may also offer a rebate on a certain model or with a certain lease. The more clearly you can separate which costs belongs to which—the car or the financing—the more clearly you can understand and minimize your costs.

Purchase and Postpurchase

A car purchase requires significant prepurchase activities. Once you have identified and compared appropriate car attributes, a seller, and financing options, all you have to do is drive away, right? Not quite.

Car purchases are one instance where the buyer is expected to haggle over price. The sticker price is the manufacturer’s suggested retail price (MSRP) [3] for that vehicle model with those features. Dealers negotiate many of the factors that ultimately determine the value of the purchase: the optional features of the car, the warranty terms, service discounts on routine maintenance, financing terms, rebates, trade-in value for you old car, and so on.

As more of these factors are discussed at once, the negotiation becomes more and more complex. You can help yourself by keeping the negotiations as simple as possible: negotiate one thing at a time, settle on that, and then negotiate the next factor. Keep track of what has been agreed to as you go along. When each factor has been negotiated, you will have the package deal.

Your ability to get a satisfying deal rests on your abilities as a negotiator. For this reason, many people who find that process distasteful or suspect that their skills are lacking find the car purchasing process distasteful. Dealers know this, and some will try to attract customers by being more transparent about their own costs and about prices. Some even promise the “no-dicker sticker” sale with no haggling over price at all.

As with any product in any market, the more information you have, the better you can negotiate. The more thorough your prepurchase activities, the more satisfying your purchase will be.

While you own the car, you will maximize the benefits enjoyed by operating the vehicle safely and by keeping it in good condition. Routine maintenance (e.g., replacing fluids, rotating tires) can ensure the quality and longevity of your vehicle. New cars come with owner’s manuals that detail a schedule of service requirements and good driving practices for your vehicle. You will be required to keep the car legally insured and registered with the state where you reside, and you must maintain a valid license to drive.

New cars, and some used cars, are sold with a warranty [4] , which is a promise about the quality of the product, made for a certain period of time. The terms and covered repair costs may vary. You should understand the terms of the warranty, especially if something covered should need servicing, so that you know what repairs you may be charged for. The manufacturer, and sometimes the seller, issues the warranty. If you have questions about the warranty after purchasing, it may be best to contact the manufacturer directly.

If you are dissatisfied with your purchase (and the fault seems to be with the car), your first step should be a conversation with your dealer. If the problem is not addressed, you can contact the automobile company directly; its Web site will provide you with a customer service contact. If the dealer and the manufacturer refuse to make good, you should contact your state’s consumer affairs division in the attorney general’s office. In some states, there are entire state agencies or departments devoted to auto purchases.

For his first car Ray bought a ten-year-old coupe with only 60,000 miles on it for a price that seemed too good to be true. The seller said the good price was in exchange for getting payment in full in cash. The car broke down right away, however, and within two weeks died of a cracked block. When Ray complained, the seller claimed he didn’t know about the cracked block and pointed out that there was no warranty on the car, so Ray was out of luck. Fortunately, Ray had read that a defective car, referred to as a “lemon,” is covered under laws that protect consumers who unknowingly purchase a car that proves to be defective. Lemon laws [5] regulate sales terms, purchase cancellation conditions, and warranty requirements. These laws are enforced on both the federal and state level in the United States. Other consumer protection laws apply specifically to motor vehicles and vary by state. Ray learned that laws in his state include used cars as well as new ones, and when he told the seller, he was able to get most of his cash back.

Key Takeaways

- The purchase process may be applied to a car purchase.

- Attribute scoring may be helpful to identify the product.

- Common car financing is through a loan or a lease.

- A warranty guarantees minimal satisfaction with performance attributes.

- Laws protect consumers who are dissatisfied with their car purchases or unknowingly buy defective cars.

- Perform an attribute analysis for your next new or used car. Go online to research cars with the attributes you have prioritized, and find where you could buy what you want locally. Then research the dealership, including a quick check at the Better Business Bureau Web site or your local chamber of commerce to learn if there have been many consumer complaints. After researching the product, the market, and the price, visit a dealership, preferably with a classmate or partner, for the experience of getting information and practicing your negotiation skills (but without making any commitments, unless you really are in the market for a car at this time).

- How will you finance a car? Play with the Car Loan Calculator at http://www.edmunds.com/apps/calc/CalculatorController . First identify a sample of new or used cars you would like to own, and for each choice calculate what your down payment, monthly loan payments, and term of payment would be. How much would you need to buy a car and where would that money come from? How much could you afford to pay each month and for how long? How could you modify your budget to accommodate car payments?

- For a car you would like to drive, calculate and compare what it would cost you to buy it and to lease it. Use the Lease versus Buy Calculator at http://www.leaseguide.com/leasevsbuy.htm . What would be the advantages of owning the car? What would be the advantages of leasing it? For your lifestyle, needs, and uses of a vehicle, should you buy or lease?

- View a 2009 Money Talks video on “Buying Cars in a Credit Crunch” at http://articles.moneycentral.msn.com/video/default-ap.aspx?cp-documentid=f5dda393-7ab1-4e25-b446- 30e313aa3796%26tab=Money %20Talks%20News . What sources of financing does the video identify for times when national banks and finance companies are not forthcoming with car loans because of downturns in the economy?

- Check the lemon laws in your state at Lemon Law America’s Web site: http://www.lemonlawamerica.com/ . Click on your state on the map. What conditions do your state lemon laws cover? Some states do not cover used or leased cars under lemon laws. Under federal laws, if you buy a used car “as is,” do you still retain rights under the lemon laws? Under federal lemon laws, in what situations, when the seller does not divulge the information, may you be able to get your money back on a car?

- A rental agreement used as a form of financing for automobile purchases. ↵

- A feature of a lease that offers the option to buy the asset financed by the lease at the end of the lease term. ↵

- The “sticker price” for an item. ↵

- A manufacturer’s guarantee of product performance for a period of time. ↵

- Federal and state laws protecting consumers against products that repeatedly fail to meet standards of performance. The federal Magnuson-Moss Warranty Act was enacted in 1975. ↵

- Personal Finance. Provided by : Saylor Academy. Located at : https://saylordotorg.github.io/text_personal-finance . License : CC BY-NC-SA: Attribution-NonCommercial-ShareAlike

Privacy Policy

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

6.1: Buying a Car

- Last updated

- Save as PDF

- Page ID 66049

- Lumen Learning

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Buy a New Car

Whether you are buying or leasing a new car, consider these tips to get the best deal and avoid problems:

- Compare car makes and models. Visit the websites of car manufacturers to review the models that interest you.

- Research the dealer’s price (or wholesale price) for the car and options. This information can help you negotiating the final price.

- Find out if the manufacturer is offering rebates that will lower the cost.

- Read car advertisements closely. Ads may over promise on the deals, or only apply to a small group of buyers.

- Get price quotes from several dealers. Find out if the amounts quoted are the prices before or after rebates are deducted.

- Research financing options. Be mindful of “loan packing.”, where a lender presses you to add features and services to your car to increase the amount of your loan.

- Avoid low-value extras such as credit insurance, auto club memberships, extended warranties , rust proofing, and upholstery finishes.

- Get estimates for how much your auto insurance would cost for each model you are considering.

Buy a Used Car

Consider these factor If you are buying a used car from a dealership.

- Contact your state or local consumer protection office to learn your rights when buying a used car.

- Find out from your state motor vehicle department what paperwork you will need to register a vehicle.

- Check prices of similar models with used car guides that you can find online or at your local library.

- Research the vehicle’s history . Ask the seller for details concerning past owners, use, and maintenance. You can also find out whether the car has been damaged in a flood, involved in a crash, had its odometer rolled back, or been labeled a “lemon.” Get the car’s unique vehicle information number (VIN), usually found on the car’s lower left dashboard.

- Research the car’s title history with your state motor vehicle department.

- Find out if the car has any recalls , investigations or complaints searchable online database.

- Verify that mileage disclosures match the car’s odometer reading.

- Check with the manufacturer to verify if the manufacturer’s warranty is still in effect.

- Get and read the seller’s return policy in writing.

- Have the car inspected by your mechanic. Talk to the seller and agree in advance that you’ll pay for the examination if the car passes inspection, but the seller will pay if the mechanic discovers significant problems. A qualified mechanic should check the vehicle’s frame, tires, air bags, and undercarriage, as well as the engine.

- Examine dealer documents carefully. Make sure you are buying—not leasing—the vehicle. Leases use terms such as “balloon payment” and “base mileage” disclosures.

Buying a Car from a Private Owner

You may choose to buy a car directly from an individual, instead of a dealer. The purchase price is often lower and easier to negotiate if you buy a car from a private owner. You should still take the same steps as if you bought the car from a dealership. There are more factors to consider if you buy from a private owner.

A private owner sells the car “as is.” If the car has defects when you buy it, the seller isn’t required to repair them before you purchase it. Also, federal protections and rules, such as FTC’s Buyer’s Guide don’t apply. If the seller is fraudulent, it can be more difficult to resolve the problem. You can’t complain to your local consumer protection office about the seller.

If you choose to purchase a car from a private seller:

- Ask to get service records from the owner.

- Verify that the seller actually owns the car and that the title and registration are in their name.

- Verify that there are no liens against the car, or if it is still under a finance agreement.

- Contact the manufacturer to determine if the manufacturer warranty, or other warranty protection, transfer to you.

- Meet the seller in a public place or busy area, especially if the seller is a someone you don’t know.

Vehicle Financing

Learn about the options available for paying for a vehicle.

Lease a Car

When you lease, you pay to drive a vehicle owned by a automobile dealership or leasing company. Monthly lease payments may be lower than loan payments, but at the end of the lease you have no ownership or equity in the car. To get the best deal, follow the advice below.

- Compare leasing versus owning. The Consumer Leasing Act requires leasing companies to give you information so that you can compare monthly payments and other charges.

- Compare lease offers from multiple dealers. Consider buying from an independent agent rather than a car dealership

- Find out what the down payment, or capitalized cost reduction, is for the lease.

- Calculate the total cost over the life of the lease, and include the down payment. A lease with a higher down payment and low monthly payments may be a better deal for you.

- Ask for details on wear and tear limits. Damages that you regard as normal wear and tear could be billed as significant damage at the end of your lease.

- Find out how many miles you can drive in a year. Most leases allow 12,000 to 15,000 miles a year. Expect a charge of 10 to 25 cents for each additional mile driven.

- Check the manufacturer’s warranty. It should cover the entire lease term and the number of miles you are likely to drive.

- Ask the dealer what happens if you give up the car before the end of your lease. You could be responsible for termination fees if you end the lease early.

- Ask what happens if the car is involved in an accident.

- Get all the terms in writing. Everything included with the car should be listed on the lease to avoid being charged for “missing” equipment later.

Get more tips to help you understand the differences between a buying or leasing a car .

Car Safety Information

Car safety tests.

These organizations conduct automobile safety crash tests:

- Conducts new vehicle crash tests to determine the protection level for drivers and passengers during front and side-impact crashes.

- Evaluates vehicle restraints such as air bags and safety belts.

- Determines the likelihood of a vehicle rolling over if involved in a single-vehicle crash.

- The Insurance Institute for Highway Safety performs a different test that uses offset-frontal car crashes to assess the protection provided by a vehicle’s structure.

Safety Performance Reporting

These organizations report on or provide automobile safety information:

- Provides information on how to file a complaint about child safety seats, tires, equipment, and vehicles

- Lists vehicle and equipment defects and recalls – If a vehicle has been recalled, ask your car dealer for proof that the defect has been repaired. Used vehicles should also have a current safety inspection sticker if your state requires one.

- Lists vehicles equipped with Electronic Stability Control (ESC)

- The National Motor Vehicle Title Information System provides information about a vehicle’s history and condition, including information about its title, odometer reading, and, in some cases, theft.

- Consumer Reports’ car issue rates vehicles in terms of overall safety. Its safety score combines crash test results with a vehicle’s accident avoidance factors, such as emergency handling, braking, acceleration, and driver comfort.

Car Rental and Car Sharing Services

Even if you don’t own a car, there are times when you may need one. When you rent a car, you’re using a company’s vehicle for a short period of time. Use these tips before signing the rental agreement to help you avoid unexpected problems and charges:

- Fees: What is the total cost, after all fees are included? Will there be an airport surcharge or fees for car drop-off, insurance, fuel, mileage, taxes, additional drivers, an underage driver, or equipment rental (for items such as ski racks and car seats)?

- Driving record: Ask whether the rental company checks customers’ driving records when they arrive at the service counter. If there are problems with your driving record, the rental company could turn you away, even if you have a confirmed reservation.

- Insurance: Be sure that you aren’t duplicating coverage. You might have coverage through your personal auto insurance policy, a motor club membership, the credit card you used to reserve the rental, or your employer, if you’re traveling on business.

- Damages: Before driving off, inspect the vehicle for dents, scratches, and marks and check the tires. Report any pre-existing problems and ask the company to note them on your rental agreement. Try to return the car during regular business hours so you and the rental staff can look at the car together to verify that you didn’t damage it.

- Fuel: Some rental companies, particularly at airports, may require you to refuel within a 10 mile radius of the airport or show a fuel receipt when you return the car.

- Payment method: Pay with a credit card rather than a debit card to avoid holds on other funds in your checking account.

- Rental deposit: Does the rental company require a deposit? If so, ask for a clear explanation of the deposit refund procedures.

Some state laws cover short-term car and truck rentals. Contact your state or local consumer protection office for information or to file a complaint.

Car Sharing

If you’d rather rent a car on an hourly basis and have greater flexibility in where and when you can pick up a vehicle, you can join a car sharing service. You get the convenience of a car when you need one, without the costs of ownership.

- Fees: What fees does the company charge (annual fees, application fee)? Are they refundable, even if you cancel or are denied membership?

- Availability of cars: Are there cars available at times that you need one? How far in advance do you need to reserve a vehicle?

- Attendants: Are there on-site staff present when you check out your car and return it? This can be very helpful when you need to verify that the car is returned in the same condition as when you borrowed it.

- Fuel: Do you have to pay for gas out of your own pocket or does the company pay for it?

- Extension of time: How easy is it to extend the length of your rental? Is it done through an app or is there a dedicated customer service hotline?

- Cancellation: How far in advance must you give notice to cancel a reservation or your membership? And can the company cancel your membership without notification?

- Damages: Are you responsible for damages, even if they were not your fault or they happened after you returned the car? This is especially important if you return the car to a lot that does not have on-site staff.

- Insurance: Is insurance included? You may be insured by a personal policy or the credit card that you use to pay for this service.

Contributors and Attributions

- Authored by : USA.gov. Located at : www.usa.gov/buy-a-car. License : Public Domain: No Known Copyright

Buying a Car Unit

New to ngpf.

Save time, increase student engagement, and help your students build life-changing financial skills with NGPF's free curriculum and PD.

Start with a FREE Teacher Account to unlock NGPF's teachers-only materials!

Become an ngpf pro in 4 easy steps:.

1. Sign up for your Teacher Account

2. Explore a unit page

3. Join NGPF Academy

4. Become an NGPF Pro!

Want to see some of our best stuff?

Spin the wheel and discover an engaging activity for your class, your result:.

MOVE: Build Your Budget

Unit 9: Unit Plan & Assessments

Unit assessment.

There is no assessment for this unit.

Mini-Unit Lessons

Unit plan & assessments, choosing a car.

Students will be able to:

- Identify factors to consider when looking for a car

- Compare different types of cars

- Understand the differences between popular car research websites and apps

- Conduct research to find a few cars that meet their needs

Costs of Owning a Car

- Summarize the different costs associated with owning a car

- Explain the different factors that can affect car insurance rates

- Understand how depreciation affects car’s value over time

- Calculate the total costs of car ownership for a specific vehicle

Buying New and Used Cars

- Understand the pros and cons of buying a new vs. a used car

- Explain the various warranty options available to them when purchasing a car

- Identify the differences between a pre-owned vehicle and a certified pre-owned vehicle

- Explore the various options they have to get an auto loan and understand the pros and cons of each

- Read a vehicle history report in detail

Leasing vs. Buying

- Explain the pros and cons of leasing a car instead of buying one

- Read a car lease agreement to understand costs, restrictions on use, and what happens at the end of an auto lease

- Understand the costs of monthly payments and why they differ between buying and leasing

Sealing the Deal

- List items they need to bring to a dealership when buying a car

- Explain how buying a car from a private seller differs from buying from a dealership

- Identify best practices when negotiating a car price

- FINE PRINT: Auto Lease Agreement

- FINE PRINT: Vehicle History Report

- RESEARCH: Find Your Next Car

FINCAP FRIDAYS

- Selling Like Hot Brakes

- Is MSRP the Price for Me?

QUESTIONS OF THE DAY

- Can you name two of the top websites used car buyers visit to research and shop?

- In what 3 states is it most expensive to own a car?

- What is the average price of a new car?

- When is the best time to buy a used car?

DATA CRUNCH + MATH

- MATH: Depreciation of Car Value

Assessments and Answer Keys

Sending form..., one more thing.

Before your subscription to our newsletter is active, you need to confirm your email address by clicking the link in the email we just sent you. It may take a couple minutes to arrive, and we suggest checking your spam folders just in case!

Great! Success message here

Teacher Account Log In

Not a member? Sign Up

Forgot Password?

Thank you for registering for an NGPF Teacher Account!

Your new account will provide you with access to NGPF Assessments and Answer Keys. It may take up to 1 business day for your Teacher Account to be activated; we will notify you once the process is complete.

Thanks for joining our community!

The NGPF Team

Want a daily question of the day?

Subscribe to our blog and have one delivered to your inbox each morning, create a free teacher account.

Complete the form below to access exclusive resources for teachers. Our team will review your account and send you a follow up email within 24 hours.

Your Information

School lookup, add your school information.

To speed up your verification process, please submit proof of status to gain access to answer keys & assessments.

Acceptable information includes:

- a picture of you (think selfie!) holding your teacher/employee badge

- screenshots of your online learning portal or grade book

- screenshots to a staff directory page that lists your e-mail address

- any other means that can prove you are not a student attempting to gain access to the answer keys and assessments.

Acceptable file types: .png, .jpg, .pdf.

Create a Username & Password

Once you submit this form, our team will review your account and send you a follow up email within 24 hours. We may need additional information to verify your teacher status before you have full access to NGPF.

Already a member? Log In

Welcome to NGPF!

Take the quiz to quickly find the best resources for you!

ANSWER KEY ACCESS

- No category

Buying a Car assignment

Related documents

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

From Frugal to Free

24 Reasons Why Buying a New Car Is a Financial Trap

Posted: January 6, 2024 | Last updated: January 6, 2024

Buying a new car is an exhilarating experience. It’s easy to get caught up in the excitement of buying a new vehicle, but it’s not necessarily the smart choice. Some people consider buying a new car a financial trap based on the long-term financial implications. Based on these 24 reasons, do you agree? Or do you think we should throw caution to the wind and buy that shiny new car?

1. Immediate Depreciation

The moment you drive a new car off the lot, it loses a significant portion of its value – as much as 20% to 30%. This instant depreciation is a substantial financial hit that you’ll never recover, even if you decide to sell the car soon after. It’s like watching a chunk of your investment evaporate before your eyes.

And it’s the main reason I’ll never buy a brand new vehicle. I just can’t stand the thought of immediately losing that much money on what is essentially, in my humble opinion, a vanity purchase.

Unlike real estate, which often appreciates over time, cars are depreciating assets. The steep decline in value continues as the car ages, making the purchase of a new vehicle a less-than-ideal investment for your hard-earned money.

2. Higher Insurance Costs

New cars typically come with higher insurance premiums. Insurance companies set rates based on the value of the car. So it follows that a more expensive, newer model costs more to insure than an older, less valuable vehicle.

The logic is simple: the more valuable the car, the more it costs the insurance company to repair or replace it if you have an accident or your lovely new vehicles gets stolen. So you have to pay higher premiums. Additionally, if you finance your car, the lender may require more comprehensive insurance coverage, further increasing your insurance costs.

3. Expensive Financing Options

Many new car buyers, understandably, finance their purchases. But the interest on car loans adds a hefty sum to the total cost, making the car much more expensive over time than its sticker price suggests.

The longer the loan term, the more interest you’ll end up paying. Even with low-interest rates, these costs can accumulate, making your affordable car not so affordable. Remember to consider the total cost of ownership, including these financing charges, when deciding whether to buy a new car.

4. Longer Loan Terms

Longer loans mean you’re in debt longer, and you’ll pay more interest over the life of the loan, increasing the overall cost. While monthly payments may be lower, the extended payment period leads to paying much more than the car’s actual value.

Extended financial commitments like a car loan also limit your flexibility with future financial decisions, as a significant portion of your income is tied up for many years.

5. Overbuying Due to Financing

Longer loan terms can be deceptive, making it seem like you’re paying less for the car. This often leads to overbuying – choosing a more expensive car than you can realistically afford. The allure of low monthly payments can tempt you into purchasing a luxury car that stretches your budget.

Just be aware that this could lead to financial stress and difficulty in managing other expenses. Consider the monthly payment as well as the total price of the car and how it fits into your long-term financial plan.

6. Rapid Technology Obsolescence

Thanks to rapidly evolving technology, just like new computers and phones, new cars quickly become outdated. The cutting-edge features you pay a premium for today might be standard in just a few years, diminishing your car’s value and appeal.

Fast-paced technological advancement means that the high-tech car you buy today might lose its wow factor very quickly, resulting in a lower resale value. Keeping up with the latest tech trends in vehicles can result in you finding yourself wanting to upgrade sooner than necessary.

7. The Temptation of Unnecessary Features

New cars come with fancy features, many of which you don’t need. Extras significantly increase the cost of the car without providing substantial value. Luxuries like heated seats, high-end sound systems, and advanced navigation are enticing, but they’re often overpriced and add little to the car’s functionality. When these features become obsolete or are no longer in vogue, they do little to retain the car’s value.

8. The Impact on Your Budget

A new car payment is a substantial monthly expense. Can you really afford is or will it strain your budget? How about if unexpected financial needs arise? Really consider whether you can manage this significant portion of your budget alongside other expenses like housing, utilities, and savings.

Additionally, the psychological burden of a large, recurring payment can lead to financial stress. Think about how a car payment fits into your overall financial picture, including emergency funds and long-term savings goals.

9. Opportunity Cost

The money you spend on a new car could be invested elsewhere. This opportunity cost – what you give up in potential investment returns – is a significant financial consideration. Instead of allocating thousands to a depreciating asset, that money could be growing in an investment fund, retirement account, or even a high-interest savings account. Over time, the compounding effect of these investments can far outweigh the benefits of owning a new car.

In 10 years, I’d much rather have a tidy sum from investment returns than an old beaten up care that I’ll sell at a huge loss.

10. Higher Registration Fees

Many states base registration fees on the car’s value and age. New cars often come with higher registration fees, adding to the overall cost of ownership. This ongoing expense, often overlooked in the excitement of buying a new car, makes the new car an even more expensive proposition over its lifespan.

11. The Burden of Sales Tax

When you buy a new car, you’ll pay sales tax on the purchase price, which adds a considerable amount to the total cost, especially in states with high sales tax rates.

For a high-value item like a new car, the sales tax amounts to a substantial sum, further inflating the actual price you pay.

12. Dependent on Financing Approval

If you need to finance your new car, you’re dependent on getting loan approval. This can be an issue if you have less-than-perfect credit, leading to higher interest rates or even denial of financing.

13. Negative Equity Risk

If your car depreciates faster than you’re paying off the loan, you could end up in negative equity – owing more on the car than it’s worth. This is a precarious financial position to be in. It can complicate selling the car or trading it in for a new one, as you’ll need to cover the gap between the car’s value and the remaining loan balance. This scenario is particularly common with long-term loans and can trap you in a cycle of debt.

14. The Seduction of Leasing

Leasing a new car might seem like a good deal, but it can be a financial trap. You’re essentially renting the car for a set period and will have nothing to show for it at the end of the lease term.

While monthly lease payments can be lower than loan payments, you’re bound by mileage limits, potential damage fees, and no equity in the vehicle. At the end of the lease, you either return the car or buy it at a residual value, often leading to more expenses.

15. Maintenance and Warranty Misconceptions

While new cars come with warranties, many also require specific maintenance schedules to keep the warranty valid. This maintenance is costly and is often more frequent than with older vehicles.

Dealerships may also charge more for services that can be done at a lower cost elsewhere, but stepping outside dealership services can void the warranty. This catch-22 can lead to higher maintenance costs throughout the warranty period.

16. The Pressure of Keeping Up Appearances

There’s often social pressure to have a new car, but this desire to keep up with others can lead to poor financial decisions. The status associated with a new car is fleeting and not worth the financial strain. In the pursuit of impressing others, you may find yourself overspending and under-saving, affecting your financial stability and future goals. Make car-buying decisions based on practicality and affordability, rather than societal expectations.

17. Increased Property Taxes

In some areas, property taxes on vehicles are based on their value. A new, more expensive car will leads higher property taxes compared to an older, less valuable model. This recurring annual expense adds up over the years, making the new car more expensive than anticipated. This is especially significant for luxury or high-value vehicles, where the tax rate can make a noticeable difference in annual expenses.

18. The Cost of Customization

New cars offer customization options – color, trim, accessories – but these come at a premium. Customizing your car can significantly increase its cost without necessarily adding to its resale value. These personalizations, while satisfying, are often specific to your taste and may not appeal to future buyers, making them a poor investment. Additionally, dealerships typically charge much more for these add-ons compared to aftermarket options.

19. The Illusion of Zero Maintenance

While new cars generally require less maintenance initially, they are not maintenance-free. Regular upkeep is still necessary, and once the warranty expires, repair costs can be surprisingly high.

Even with a warranty, not all maintenance and repairs are covered, and you may still incur expenses for routine services. As the car ages, the cost of maintaining it can increase, especially for models known for their complexity and expensive parts.

20. The Environmental Impact

Producing a new car has a significant environmental impact. The manufacturing process consumes resources and emits pollutants, contributing to environmental degradation. If you’re environmentally conscious, buying a new car contributes to this impact, whereas buying used does not. Opting for a pre-owned vehicle can be a more sustainable choice, as it extends the life of an existing car and reduces the demand for new car production, thereby having a lesser impact on the environment.

21. The Temptation of Easy Trade-Ins

Dealerships make trading in your current vehicle for a new one seem easy and appealing. However, you’re likely to get less value for your trade-in than if you sold it privately. Dealerships aim to make a profit on trade-ins, offering you less than the market value. This lower trade-in value can then be rolled into the cost of your new car purchase, effectively increasing the amount you pay. Selling your old car privately may require more effort but can result in a better financial return.

22. The Risk of Recalls

New cars are not immune to recalls. Buying a brand-new model means you might be more likely to face recalls as manufacturers work out new vehicle kinks. These recalls are inconvenient and time-consuming. In some cases, they may also point to larger issues with the car’s reliability and safety.

23. The Draw of Extended Warranties

Dealers often push extended warranties on new cars, but these are costly and often unnecessary. While they offer peace of mind, many extended warranties come with fine print and exclusions that limit their usefulness. The likelihood of requiring repairs that justify the cost of the warranty is often low, especially in the first few years when the car is less likely to encounter major issues.

24. The False Economy of Fuel Efficiency

While new cars might offer better fuel efficiency, the savings at the pump are often offset by the higher overall cost of the car. The premium paid for a new, fuel-efficient vehicle can often outweigh the savings made from reduced fuel consumption.

Calculate whether the fuel savings truly justify the higher price tag. Consider the total cost of ownership, including depreciation, insurance, and financing, alongside fuel efficiency, to get a true picture of cost and savings.

More for You

Caitlin Clark breaks unbelievable WNBA record in her debut with the Indiana Fever

NATO makes strong statement on Ukraine

9 tricks for getting the best deals at Costco, from a former employee

I Asked 5 Chefs to Name Their Favorite Mayo, and They All Chose the Same Brand

12 Strange Facts About Redheads You Never Knew

The Most Powerful Mustang From Each Generation, Ranked

Blood pressure is best lowered by 2 exercises, study finds

Rock Goddesses: 25 Women Who Defined Music History

The Most Reliable Hybrid SUV You Can Buy In 2024

Controversial Netflix show watched almost 14 million times despite backlash

I ordered the same burger meal at McDonald's and Chili's, and the latter served up better value

This Map Shows the Most Popular Pies by State

14 Best New Aldi Products That Are Worth Every Penny

Martha Stewart’s Trick for the Best Baked Potatoes Every Single Time

Cheese Recall Map Shows Multiple States Impacted: 'Discard it Immediately'

11 Brilliant Uses for Your Leaf Blower

Columbia students boo as graduation speaker’s mic cuts off when she starts to scolds college on Gaza

16 Popular Pizza Chains, Ranked Worst to Best

I've studied positive psychology for 10 years: This is the secret to happiness—and you can start today

2024 NFL schedule release: Predictions, takeaways for 32 teams

Ukraine war latest: Russia and China issue nuclear war warning - as Putin holds crucial talks with Xi amid fierce fighting in Ukraine'

Vladimir Putin is in China, where he is meeting with president Xi Jinping less that a week after launching a fresh incursion into the Kharkiv region of Ukraine. The major state visit has already seen Mr Putin greeted with full military honours, as Mr Xi talked up their "friendship".

Thursday 16 May 2024 15:40, UK

Please use Chrome browser for a more accessible video player

- Anti-Putin Russian paramilitaries fight for Ukraine on new front

- Putin in China: Leaders warn against nuclear war - and agree to expand military drills

- Were Putin and Xi really pictured with their 'nuclear footballs'?

- China will play role in European peace, says Xi

- Analysis: Great power politics on display in China visit

- The latest from the battlefield - as Russia launches fresh attacks on border area

- Russia claims to arrest Ukrainian agents carrying out Crimean bridge reconnaissance

- Live reporting by Lauren Russell and (earlier) Brad Young

Ask a question or make a comment

A Russian activist living in exile in Georgia has sounded alarm over a bill dubbed "the Russian law".

Over the past month, thousands of Georgian protesters have taken to the streets to voice their opposition to a draft law on "foreign agents".

Critics call it a copycat of Russian legislation that has been wielded for more than a decade to target critics of Vladimir Putin's Kremlin.

If it passes, charities receiving at least 20% of their funding from abroad will have to register with the government as "foreign agents" and submit onerous financial reports.

Grigory Sverdlin, 43, was himself branded a "foreign agent" by the Russian government last September in connection with a non-profit he runs from Georgia advising Russian men on how to avoid military conscription.

"Georgia has just adopted the same 'foreign agents act' using the very same arguments. It is quite obvious that this act will be used to oppress dissidents," he told Reuters.

"I think a lot of people in Georgia want to move along a different path - they want to move towards European integration."

The Georgian government says the law - which cleared parliament on Tuesday and now heads to Georgia's president for review - is needed to ensure transparency in the foreign financing of non-profit organisations.

The Kremlin has denied any association with the bill.

Back in China, and Vladimir Putin is continuing his state visit, hosted by Chinese leader Xi Jinping.

He laid a wreath at the Monument to the People's Heroes at Tiananmen Square in Beijing.

Then he attended a gala event celebrating the 75th anniversary of diplomatic relations forged between the former Soviet Union and the Peoples Republic of China, which was established following a civil war in 1949.

By Ivor Bennett, Moscow correspondent

There's obviously a great deal of symbolism to this visit.

The banquet, the tea ceremony, the walk in the park - Xi and Putin are closer than ever, and they want the world to see it.

Their message is that it's time for a new global order, that isn't dominated by the West.

The Kremlin also wants to tell those watching back home that Russia isn't alone. That it no longer needs Europe.

But the primary aim for Putin here is more pragmatic. It's about the economy.

The war in Ukraine has left Russia isolated from Western markets, and it needs China to keep it afloat.

So far, Beijing's been more than happy to buy discounted Russian energy, which has proved a lifeline for Moscow.

A tidal wave of Chinese goods has come the other way, which has kept the shelves stocked for consumers and softened the impact of sanctions.

For now, Russia's economy is growing. It's forecast to expand more than 3% this year. But for how much longer?

There are labour shortages in key sectors, like oil and gas. The losses on the frontline have exacerbated a demographic crisis, and the brain-drain that followed the invasion has affected the quality of the workforce.

What's more, the war is fast turning into a money pit for Moscow. Defence spending is projected to reach nearly 9% of GDP this year.

That explains the recent reshuffle of Putin's top team, in which he replaced his defence minister with an economist.

He wants to ensure Russia can continue to afford the war for as long as it takes.

And that's where China comes in.

The delegation accompanying Putin speaks volumes: both new and old defence ministers, his finance minister, central bank governor, oil bosses and oligarchs, and more.

Putin will be pushing for more support for Russia's war economy. The West will be scrutinising what form that support takes.

Vladimir Putin and Xi Jinping announced their new "new era" strategic partnership agreement in a statement topping 7,000 words.

Earlier, we took you through the key points regarding the Ukraine war (see our 10.52am post), but there were other important sections regarding international relations.

Following are the key points:

Ukraine war: "The Russian side positively assesses China's objective and unbiased position on the Ukrainian issue."

China "supports the efforts of the Russian side to ensure security and stability, national development and prosperity, sovereignty and territorial integrity, and opposes outside interference in Russia's internal affairs."

United States: Russia and China have serious concerns at "US attempts to violate the strategic balance", including the development of high-precision non-nuclear weapons for potential "decapitation" strikes, and plans to deploy ground-based missiles in the Asia-Pacific and European regions.

North Korea: "The parties oppose the actions of intimidation in the military sphere carried out by the United States and its allies, which provoke further confrontation with the DPRK."

Industry: Develop civil aircraft construction, shipbuilding, carmakers, machine tool industry, electronics industry, metallurgy, iron ore mining, chemical industry and forestry.

Agriculture: Expand mutual access of agricultural products, increase the volume of trade in soybeans, pig breeding, water production, grain, fat and oil, fruits and vegetables, nuts and other products.

Technology: Develop cooperation in information and communication technologies, including artificial intelligence, software, and network and data security.

Nuclear: Deepen partnership in peaceful nuclear energy, including thermonuclear fusion, fast neutron reactors and the closed nuclear fuel cycle.

Anti-Putin Russian paramilitary soldiers have joined Ukrainian troops on the new frontier in northeastern Ukraine.

The Freedom of Russia Legion are attempting to shore up Kyiv's defence against the unrelenting Russian incursion, launched across the border on Friday.

Its deputy commander, Maksimilian Andronikov, who is also known by his call sign, Caesar, said Russia's fighters had become more innovative.

"They've learned the lessons of the war, they're using rather intelligent tactics," he said.

In particular, Russia has been expending relatively cheap Soviet-era bombs by packing several hundred kilograms into planes and hammering frontline towns and infantry positions.

"The situation is difficult, the intensity is very high, there is fighting almost every 10 minutes," said a Legion mortarman from under a hat and face covering, identifying himself only by his call sign, Winnie.

"It's an unbelievable meat grinder that they're still [sending] their people into," Winnie said, describing Russian losses as Moscow's infantry tries to storm deeper into Ukraine.

Mr Andronikov said the Russian forces have fewer vehicles than before, but have the manpower and artillery advantage.

He blasted the limits placed by some Ukrainian allies on the use of their weapons to strike Russia, saying they limited Kyiv's ability to fight back where front lines are only few miles from Russian territory.

Context: The Freedom of Russia legion gained name-recognition in the war after they claimed responsibility for raids into the Belgorod and Kursk regions of Russia.

Russia launched its newest border incursion with the goal of capturing two specific settlements, a Russian-installed official said, quoted by RIA state news agency.

The village of Lyptsi, located 19 miles north of Kharkiv city, where Volodymyr Zelenskyy is currently visiting, and the town of Vovchansk, 30 miles further east, where combat has reportedly been fiercest.

"The most important city, which is now on the verge of complete liberation, is undoubtedly Vovchansk," said Vitaly Ganchev, a Russian-installed official in Ukraine.

"Next is the settlement of Lyptsi - our guys are already on the outskirts. Work is beginning to liberate it, aviation and artillery are working constantly, they do not stop," he said.

Ahead of talks between Vladimir Putin and Xi Jinping, the two leaders were seen being tailed by two officials carrying bags.

Pictures and videos of the pair prompted social media speculation that the leaders were showing off their nations' so-called "nuclear footballs" - potentially as part of some form of signalling to the West.

These are the briefcases which travel with the leaders of nuclear powers at all times, and contain the codes and communication devices needed to authorise the use of nuclear weapons

However, Sky News military analyst Professor Michael Clarke said it was "unlikely" the bags being carried by officials walking behind the Chinese and Russian presidents contained the tools necessary for ordering a nuclear strike.

"The people carrying the nuclear briefcases, or nuclear footballs, as they are often known, will generally seek to remain as unobtrusive as possible," he said.

"We certainly can't rule out the idea that it could be part of some kind of clumsy gesture, but there are other more likely explanations.

"For example, the two leaders obviously do not share the same language, so they will always have translators close by - and it could well just be officials carrying documents that will be needed for their meetings.

"The other thing to note is that while Putin has certainly been known to engage in thinly veiled nuclear threats, the Chinese are far less keen on that kind of rhetoric, so it would seem quite unlikely that they would want to get involved in that kind of crude signalling."

Russia's nuclear briefcase is traditionally carried by a naval officer. Known as the "Cheget" (named after Mount Cheget in the Caucasus Mountains), the briefcase is rarely filmed.

Last year, footage was shown of Mr Putin in Beijing accompanied by uniformed officers carrying the device.

Former Russian president Dmitry Medvedev has praised Slovakian prime minister Robert Fico, who was wounded in an attempted assassination yesterday.

He said there were few politicians like Mr Fico in Europe and that he had "reasonable" positions regarding Russia.

Mr Fico is fighting for his life after in hospital after being shot multiple times, Slovak officials said.

The divisive leader returned to power last year on a pro-Russian, anti-American message.

His government has already halted arms deliveries to Ukraine, and has plans to amend the penal code to eliminate a special anti-corruption prosecutor and to take control of public media.

His critics worry that he will lead Slovakia — a nation of 5.4 million that belongs to NATO — down a more autocratic path.

Vladimir Putin sent a message to Slovak president Zuzana Caputova, expressing his support and wishing the prime minister a fast and full recovery.

"This atrocious crime cannot be justified. I know Robert Fico as a courageous and strong-willed person. I truly hope these personal qualities will help him overcome this harsh situation."

Volodymyr Zelenskyy also denounced the attack: "Every effort should be made to ensure that violence does not become the norm in any country, form or sphere."

Volodymyr Zelenskyy has travelled to the city of Kharkiv, following a fresh Russian incursion across Ukraine's northeastern border into the region on Friday.

He described the situation as extremely difficult though "controlled in general", adding he held a meeting with the military.

Ukraine said its forces were fighting Russian troops in northern districts of Vovchansk, 40 miles from Kharkiv.

The capture of Vovchansk, three miles from the border, would be Russia's most significant gain on this second front.

"The enemy's plans to penetrate deeper into the town of Vovchansk and gain a foothold there were thwarted," the Ukrainian general staff said in a statement.

Military spokesperson Nazar Voloshyn said Ukrainian troops were focused on trying to prevent Russian forces establishing footholds in the region's north. "Our units... detect separate enemy units, the location of artillery deployments, and inflict damage to prevent the enemy from accumulating forces and equipment in the northern part of the town of Vovchansk."

Russia and China have released a joint statement expressing concern for the increased risks resulting from aggravation of relations between nuclear powers.

There can be no winners in a nuclear war, Russian state media cited the statement as saying.

The two nations noted concern about the participation of Australia in US plans for extended nuclear deterrence, it read.

Russia and China are against a drawn out conflict in Ukraine and it is possible it could transition to an uncontrollable phase, the statement warned.

Moscow and Beijing will further deepen trust and cooperation in the military field, the statement said, adding they will expand the scale of joint military drills.

China said it supports the efforts of the Russian side to ensure sovereignty and territorial integrity.

Both nations opposed attempts by certain countries to use space for military confrontation, the statement read.

Russia and China condemn initiatives to seize the assets and property of foreign states, Russia state media.

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

VIDEO

COMMENTS

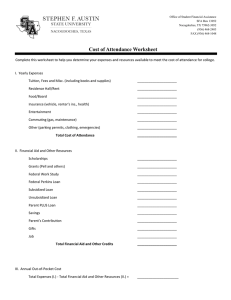

Through this assignment you will gain a better understanding of the car-buying process and the components that affect your monthly payments. We will compare the purchase of a new car, used car, and a lease. ASSIGNMENT INSTRUCTIONS Is there a new car or truck you have dreamed about owning? Now is your chance to see how much it would cost. For ...

Assignment 6: Buying A Car . Now that Jennifer is working full time, she would really like to buy a car. She is unsure if she would like a new or used car. She does not want to spend more than $20 000 on a car. Ideally, she would really like to buy a SUV or a pickup truck but she knows that if she buys new those types of cars are out of her ...

THE SKILLS THAT MATTER in Adult Education. Financial Literacy: Introduction to Purchasing a Car Lesson Plan 9. Guided Practice (continued) Sample: $30,000 car price x .2 (20%) = $6,000 down payment. $6,000 - $2,000 trade-in = $4,000, which is the amount of cash needed to complete the sale. Ask if any students have experiences to share about ...

Buying a Car Presentation. Written by Kevin Smith. This presentation accompanies our lesson on buying a car, which is available as a class Assignment with a built-in assessment. Click Here to view the main lesson! Copy this presentation to Google Slides. Download this presentation as a PowerPoint. Comments are closed.

Activity 1: My Dream Car. Many students already have a "dream car" in mind when they think about buying their first automobile. This activity asks students to research the cars they're most interested in, while also encouraging them to consider the features they actually need in a car and which features are unnecessary "wants.".

• What are some costs that come with buying a car? • What is a pro/con of buying a new/old car? • What would be the first step if you were thinking about buying a car? Resource Links: Lesson Content (Included in the Assignment on PersonalFinanceLab.com) Buying a Car (personalfinancelab.com) Accompanying Presentation: Buying a Car ...

Lumen Learning. A new car is second only to a home as the most expensive purchase many consumers make. According to the National Automobile Dealers Association, the average price of a new car sold in the United States is about $30,000. That's why it's important to know how to make a smart deal. A link to an interactive elements can be found ...

For example, you want to buy a car with a price of $19,000. You can get a car loan with an APR of 6.5 percent from your bank. You are offered a lease requiring a down payment of $2,999, monthly payments of $359 for three years, and a final buyout of $5,000. The APR of the lease is actually 5.93 percent, which would make it the cheaper financing ...

Whether you are buying or leasing a new car, consider these tips to get the best deal and avoid problems: Compare car makes and models. Visit the websites of car manufacturers to review the models that interest you. Research the dealer's price (or wholesale price) for the car and options. This information can help you negotiating the final price.

Teachers' top choice for financial literacy curriculum, games, activities, and industry-leading teacher professional development. Always free.

GRADE LEVELS. 7+. Secondary - Adult Education. Suggested Car Financing Money Lesson Plan to use with this Worksheet. Use this worksheet to help students identify and understand the main variables for purchasing and financing a car. Purchasing a car may seem out of reach because cars are expensive items. One way to help individuals afford a car ...

48 Car-Buying Strategies TOC PFM Standardized Curriculum 2016 Handouts Trainer's note: Refer learners to The Three Deals of Car Buying and Car-Buying Sources of Help handouts. Most Americans will purchase a vehicle at some point in their lives. Although it can be exciting to dream and plan for buying a car, there are many opportunities