Stock Research Report for L&T Technology Services Ltd

Stock score of L&T Technology Services Ltd moved up by 1 in a month on a 10 point scale (Source: Refinitiv). Get detailed report on L&T Technology Services Ltd by subscribing to ETPrime .

Get 4000+ Stock Reports worth ₹ 1,499* with ETPrime at no extra cost for you

*As per competitive benchmarking of annual price. T&C apply

Make Investment decisions

with proprietary stock scores on earnings, fundamentals, relative valuation, risk and price momentum

Find new Trading ideas

with weekly updated scores and analysts forecasts on key data points

In-Depth analysis

of company and its peers through independent research, ratings, and market data

L&T Technology Services Limited is an India-based engineering research and development (ER&D) services provider. The Company offers consultancy, design, development and testing services across the product and process development life cycle. The Company operates in three segments: Mobility, Sustainability, and Hi-Tech. The Mobility segment encompasses automotive, commercial vehicles and aerospace verticals. The Sustainability segment covers industrial machinery and building technology, electric and power, fast-moving consumer goods (FMCG), and oil and gas. The Hi-Tech segment includes MedTech, semiconductors, consumer electronics, hyperscalers, and NexGen Comm verticals. It operates its technology areas into three horizontals: artificial intelligence (AI) and Software Defined Everything (SDx), embedded systems, and digital manufacturing solutions. It serves approximately 69 Fortune 500 companies and 57 ER&D companies.

EPC PROJECTS

Construction.

- Heavy Civil Infrastructure

- Water & Effluent Treatment

- Power Transmission & Distribution

- Buildings & Factories

- Transportation Infrastructure

- Minerals & Metals

- L&T GeoStructure

- Hydrocarbon

- Green Mfg & Development

- Power Plants & Equipment

HI-TECH MANUFACTURING

Heavy engineering, precision engineering & systems, l&t special steels & heavy forgings.

- Defence & Aerospace

- Defence Shipbuilding

IT Services

- LTIMindtree

Technology Services

- L&T Tech Services (LTTS)

Financial Services

- L&T Finance (LTF)

Digital Services & E-Commerce Platforms

- L&T EduTech

- Data Center & Cloud Services

- Semiconductor Systems

- Smart World & Communication

- Construction & Mining Machinery

- Rubber Processing Machinery

- SUSTAINABILITY

- EXECUTIVE COMMITTEE

- YEAR AT A GLANCE

- DOWNLOAD PDF

Wire Harness Centre

Providing insights into products and equipment health through Augmented Reality

Enabling smart manufacturing for real-time operational visibility and insights

L&T Technology Services Limited (LTTS) is a global leader in Engineering Research and Development (ER&D) services. The Company offers end-to-end consultancy, design, development, and testing across product and process lifecycles. With its deep expertise across software, digital engineering, embedded systems, engineering analytics, and plant engineering, LTTS delivers transformative value journeys for its customers clients worldwide, driving revitalised operational and business success paradigms.

Headquartered in India, LTTS has over 23,800 employees spread across 22 global design centres, 28 global sales offices and 104 innovation labs as of March 31, 2024. The Company caters to an impressive global clientele encompassing 69 Fortune 500 companies and 57 of the top ER&D firms across key sectors, including Transportation, Industrial Products, Telecom & Hi-tech, Plant Engineering, and Medical Devices.

LTTS continues to be at the forefront of cutting-edge innovation, partnering with leading technology majors and hyperscalers to enable next-gen solutions and offerings across emerging domains, including AI, Software Defined Everything (SDx), and Cybersecurity. These collaborations focus on streamlining new product development, enhancing remote asset management, enabling robust sustenance paradigms, and advancing virtual product design as well as prototyping.

SERVICE OFFERINGS

Digital Engineering and Consulting:

- Artificial Intelligence

- Cybersecure

- Immersive Experiences

- Industry 4.0

- Product Consulting

- Sustainability Engineering

- Sustainable Smart World

Product Engineering:

- Software Engineering

- Embedded Engineering

- Mechanical Design

- Testing & Validation

Manufacturing Engineering:

- Smart manufacturing

- Supply Chain Engineering

- Manufacturing & Planning

- Manufacturing Execution

Plant Engineering:

- Capex Project E/EPCM Services

- Operational Excellence

- Plant Sustenance & Management

- Material & Parts Management

- Regulatory Compliance Engineering

Engineering New Frontiers: Go Deeper to Scale

- We realise that technology is evolving at an unprecedented pace. As the rate of transformation picks up, it is vital that we continue to align our approach and offerings to align closer to the emerging market dynamics.

- With this in mind, LTTS has announced the streamlining and simplification of its organisational structure going into the new fiscal year. This would involve a reorganisation into 3 main segments to drive future growth, scalability, and technological innovation. The Company is consolidating its existing five segments into three: Mobility, Sustainability, and Hi-Tech, as part of our ‘ Go Deeper to Scale ’ strategy to meet the evolving customer demand patterns.

- The Mobility segment will encompass Automotive, Commercial Vehicles and Aerospace verticals. Sustainability will cover Industrial Machinery & Building Technology, Electric & Power, FMCG and Oil & Gas. The Hi-Tech segment will include MedTech, Semiconductors, Consumer Electronics, Hyperscalers and NexGen Comm verticals.

- Leveraging commonalities of engineering and technology skills, LTTS will consolidate and strengthen its technology areas into 3 overarching horizontals – AI & Software Defined Everything (SDx), Embedded Systems, and Digital Manufacturing Solutions.

Awards & Recognition

- LTTS’ leadership of the ER&D domain has been reaffirmed by leading analysts, including ISG, Zinnov, and Nelson Hall, who have consistently rated LTTS as the leader across Digital Manufacturing, Digital Engineering Services, Intelligent Operations, and new technologies.

- Our sustainability offerings were recognised by PTC, while Avasant rated LTTS as leaders in Manufacturing Smart Industry Services 2023 RadarView. Other prestigious accolades include the ‘BIG Innovation Award’ for IoT and the RoSPA Gold Health & Safety Awards for our smart city projects.

- 20 Multi-million-dollar Orders

- Large Digitization Deal Win from ExxonMobil

- USD 50 mn Aerospace Order

Track Record

- 235 Global clients

- 69 Fortune 500 customers

- 104 Global Innovation Centres

- 90 % Repeat business from customers over the last 4 years

- 26 % of Overall Revenue from Digital Engineering

- 328 Patents Filed

Subsidiary California-based Esencia provides design services from specification to final product in the semiconductor and hi-tech space.

Key Geographies

42 R&D Labs, 22 Countries

- Price / Volume

- Highs / Lows

- Index Analysis

- Sector Analysis

- Technical Strength

- Financial Strength

- EOD Beta Volatile

- Bullish Screener

- Bearish Screener

- Consolidation

- OHLC Screeners

- Overbought/Sold

- Trend Indicator

- Volume Based Indicator

- SMA Screener

- EMA Screener

- WMA Screener

- Pivot Point

- EOD Fibonacci

- Popular Chart Patterns

- Financial Highlight

- Guru Ratios

- Valuation Ratios

- Profitability Ratios

- Solvency Ratios

- Efficiency Ratios

- Income Statment Growth (Yr)

- Balance Sheet Growth (Yr)

- Cash Flow Stat Growth (Yr)

- Price Action Screeners

- Bullish Technical Screeners

- Bearish Technical Screeners

- Fundamental Screeners

- Moving Average Screeners

- Custom Screener

- Price Action Strategies

- Technical Indicator Strategies

- Moving Average Strategies

- Technical Charts

- Premium Plans

- Futures Screeners

- Call Option Screeners

- Put Option Screeners

- PCR Screeners

- MyTSR Links

- My Recent Activities

Fundamental Analysis of L&T Technology Services - Growth / Value Index

LTTS - Valuation Highlights

Valuation analysis, valuation key ratios, ltts - profitability highlights, profitability analysis, profitability key ratios, share holding, guru numbers, ltts - growth highlights, growth analysis, growth key fields, ltts - stability highlights, stability analysis, stability key ratios, historical valuation ratios of l&t technology services, historical valuation ratios, historical profitability ratios of l&t technology services, historical profitability ratios, historical efficiency ratios of l&t technology services, historical efficiency ratios, historical solvency ratios of l&t technology services, historical solvency ratios, quick overview of fundamental filters.

L&T Technology Services Ltd

LTTS is an engineering services provider incorporated in 2012, offers engineering,, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant Engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies.The business also provides digital engineering advisory services.The company went public on September 23, 2016. LTTS has 296 global clients in 25+ countries. [1] [2] [3] [4] [5]

Business Segments The Company has five Business Segments, namely Transportation, Plant Engineering, Industrial Products, Medical Devices, and Telecom & Hi-Tech. [1]

- Market Cap ₹ 54,770 Cr.

- Current Price ₹ 5,175

- High / Low ₹ 6,000 / 4,200

- Stock P/E 43.6

- Book Value ₹ 502

- Dividend Yield 0.97 %

- ROCE 33.4 %

- Face Value ₹ 2.00

- Sales & Margin

- EV / EBITDA

- Price to Book

- Market Cap / Sales

- Company has a good return on equity (ROE) track record: 3 Years ROE 25.9%

- Company has been maintaining a healthy dividend payout of 41.2%

- Stock is trading at 10.3 times its book value

* The pros and cons are machine generated. Pros / cons are based on a checklist to highlight important points. Please exercise caution and do your own analysis.

Peer comparison

Sector: IT - Software Industry: Computers - Software - Large

Part of BSE Information Technology BSE Quality Index BSE 400 MidSmallCap Index Nifty Total Market BSE 250 LargeMidCap Index Nifty MidSmallcap 400 Nifty LargeMidcap 250 Nifty200 Quality 30 Nifty Midcap150 Quality 50 Nifty 500 Multicap 50:25:25 BSE 200 Nifty 500 BSE Allcap BSE 150 MidCap Index BSE 500 BSE Dollex 200 Nifty India Digital Index Nifty IT BSE MidCap Nifty Midcap 150 show all

Quarterly Results

Standalone Figures in Rs. Crores / View Consolidated

Profit & Loss

Balance sheet, shareholding pattern.

Numbers in percentages

* The classifications might have changed from Sep'2022 onwards. The new XBRL format added more details from Sep'22 onwards. Classifications such as banks and foreign portfolio investors were not available earlier. The sudden changes in FII or DII can be because of these changes. Click on the line-items to see the names of individual entities.

Announcements

- Announcement under Regulation 30 (LODR)-Investor Presentation 2d

- Announcement under Regulation 30 (LODR)-Acquisition 2d - Acquisition of Intelliswift Software for USD 110 million.

- Announcement under Regulation 30 (LODR)-Press Release / Media Release 2d - L&T Technology Services acquires Intelliswift for $110M.

- Announcement under Regulation 30 (LODR)-Press Release / Media Release 29 Oct - L&T Technology Services wins Caterpillar Supplier Excellence Award.

- Announcement under Regulation 30 (LODR)-Press Release / Media Release 24 Oct - L&T Technology Services opens AI Experience Zone in Bengaluru.

Annual reports

- Financial Year 2024 from bse

- Financial Year 2023 from bse

- Financial Year 2022 from bse

- Financial Year 2021 from bse

- Financial Year 2020 from bse

- Financial Year 2019 from bse

- Financial Year 2018 from bse

- Financial Year 2017 from bse

- Financial Year 2010 from bse

Credit ratings

- Rating update 4 Jul from crisil

- Rating update 4 Jan from crisil

- Rating update 3 Jan from crisil

- Rating update 19 Jan 2023 from crisil

- Rating update 16 Jun 2022 from crisil

- Rating update 29 Apr 2021 from crisil

- Nov 2024 Transcript Notes PPT REC

- Oct 2024 Transcript Notes PPT

- Aug 2024 Transcript Notes PPT

- Jul 2024 Transcript Notes PPT

- May 2024 Transcript Notes PPT REC

- Jan 2024 Transcript Notes PPT

- Oct 2023 Transcript Notes PPT

- Jul 2023 Transcript Notes PPT

- May 2023 Transcript Notes PPT

- Jan 2023 Transcript Notes PPT

- Oct 2022 Transcript Notes PPT

- Jul 2022 Transcript Notes PPT

- Apr 2022 Transcript Notes PPT

- Jan 2022 Transcript Notes PPT

- Oct 2021 Transcript Notes PPT

- Sep 2021 Transcript Notes PPT

- Jul 2021 Transcript Notes PPT

- May 2021 Transcript Notes PPT

- Jan 2021 Transcript Notes PPT

- Oct 2020 Transcript Notes PPT

- Jul 2020 Transcript Notes PPT

- May 2020 Transcript Notes PPT

- Mar 2020 Transcript Notes PPT

- Jan 2020 Transcript Notes PPT

- Oct 2019 Transcript Notes PPT

- Jul 2019 Transcript Notes PPT

- May 2019 Transcript Notes PPT

- Jan 2019 Transcript Notes PPT

- Oct 2018 Transcript Notes PPT

- Aug 2018 Transcript Notes PPT

- May 2018 Transcript Notes PPT

- Jul 2017 Transcript Notes PPT

- Feb 2017 Transcript Notes PPT

- Nov 2016 Transcript Notes PPT

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- The Morning Brief

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Screeners Beta

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Editor's Picks

- Investing Insights

- Trending Stocks

- Morning Brief

- Opening Bid

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Yahoo Finance

L&T Technology Services (LTTS) Secures Landmark ∼$100 Million Program in Cybersecurity

In this article:.

LTTS to establish AI, ML-driven Cybersecurity & Digital Threat Analytics Centre for Maharashtra Cyber, enhancing citizen cyber safety and awareness.

BANGALORE, India, March 15, 2024 --( BUSINESS WIRE )--L&T Technology Services Limited (LTTS) (BSE: 540115, NSE: LTTS), a leading global pure-play engineering and technology services company, announced today that it has won a first-of-its-kind program in India worth around $100 million from Maharashtra State Cyber Department, under the Government of Maharashtra. This initiative extends LTTS’ commitment to developing secure, digitally interconnected smart and safe cities through premier Cyber Security and Digital Forensic solutions consolidated under one umbrella.

In this pioneering initiative by the Government of Maharashtra, LTTS in consortium with M/s KPMG Assurance and Consulting Services LLP as forensics partner will provide advanced Cyber Security Solutions for the State enhancing public safety against cyber threats.

The project entails designing a sophisticated cybersecurity system and establishing a state-of-the-art, fully equipped, Cyber security and Cybercrime prevention Centre to address Cybercrime Incidents and Investigations by leveraging AI and Digital Forensic tools. The program also encompasses the following:

A Digital Threat Analytics Centre (DTAC) paired with a Centre of Excellence (COE) that will equip the forensic team with cutting edge digital forensic tools including Deepfake detection, Mobile Malware forensics, IoT investigation, Network forensics, object detection supporting crypto & blockchain, Hardware & Embedded forensics, drone forensics, social media forensics, image enhancement, voice analysis labs, IMEI/CDR analysis, CCTV acquisition tools and computer forensics to streamline crime scene management, reduce timelines and improve the efficiency of cybercrime investigations.

A Central Emergency Response Team (CERT) to deal with incident response and investigation based on advanced cyber threat intelligence and analytics like APT detection and data breach, adversary intelligence from darknet, advanced malware analysis, proactive threat hunting and red teaming.

State-of-the-art Security Operations Centre (SOC) fortified by AI & ML technologies with a skilled cyber team to protect critical infrastructure. SOC handles Endpoint Detection & Response, SIEM, SOAR, UEBA, ZTNA, CASB, DLP, NAC, DNS Security, IDAM, and PAM solutions.

The integration of Smart World and Communication within LTTS has significantly amplified its capabilities, enabling the company to provide advanced engineering solutions for public cyber safety leveraging experience of setting up 25+ command centers. The successful execution of this project in India will pave the way for LTTS to extend these capabilities globally.

Commenting on the milestone win, Amit Chadha, CEO and Managing Director of L&T Technology Services, said , "This first-of-its-kind deal is more than just a business achievement for us. It’s an opportunity to leverage our experience in setting up over 25 command centers and recognizing the growing criticality of cybersecurity and the need to invest in advanced digital safeguard platforms and tools for the benefit of the larger society. This deal will set the stage for LTTS to scale its offerings for our global clientele."

M/s KPMG Assurance and Consulting Services LLP., as LTTS' consortium partner, has played a critical role in this engagement. Yezdi Nagporewalla, Chief Executive Officer, KPMG in India, said, "We are truly proud to be part of this groundbreaking initiative. Collaborating with Maharashtra State Cyber Department and LTTS as a forensic services partner is a matter of pride for KPMG and it showcases our shared commitment to public safety by providing advanced cyber security solutions to counter cyber threats."

ABOUT L&T TECHNOLOGY SERVICES

L&T Technology Services Limited (LTTS) is a listed subsidiary of Larsen & Toubro Limited focused on Engineering and R&D (ER&D) services. We offer consultancy, design, development and testing services across the product and process development life cycle. Our customer base includes 69 Fortune 500 companies and 57 of the world’s top ER&D companies, across industrial products, medical devices, transportation, telecom & hi-tech, and the process industries. Headquartered in India, we have over 23,200 employees spread across 22 global design centers, 28 global sales offices and 105 innovation labs as of December 31, 2023. For more information, please visit https://www.LTTS.com/

View source version on businesswire.com: https://www.businesswire.com/news/home/20240314467779/en/

Aniruddha Basu L&T Technology Services Limited E: [email protected]

Anindita Sarkar L&T Technology Services Limited E: [email protected]

Recommended Stories

Weʼre unable to load stories right now.

- Trending Stocks

- Waaree Energies INE377N01017, WAAREEENER, 544277

- Tata Motors INE155A01022, TATAMOTORS, 500570

- Asian Paints INE021A01026, ASIANPAINT, 500820

- Ola Electric INE0LXG01040, OLAELEC, 544225

- Reliance INE002A01018, RELIANCE, 500325

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- My Messages

- Price Alerts

- Loans up to ₹15 LAKHS

- Fixed Deposits

- Credit Cards Lifetime Free

- Credit Score

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Seasonality Analysis

- Stock Advisory by SEBI's RIA

- Auri ferous Aqua Farma , 519363

- Loans @ 12% Up to ₹ 15 Lakhs!

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Financial Times

- Opinion Learn

- GuruSpeak Webinar

- Interview Series Business In The Week Ahead

- Research Technical Picks

- Personal Finance My Subscription

- Loans

- Finance Tracker

- Home FII & DII Activity

- Earnings Technical Trends

- Webinar Bonds

- MC Learn Traders Conclave

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Economic Indicators

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Global AI Conclave Share.Market

- Financial Freedom Research Picks

- Policybazaar MF Summit

- Startup Conclave IFBA Season 3

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- Advanced Technical Charts

- International

- Go pro @₹99

- Assembly Elections

- Instant ₹15 Lakhs!

- Personal Finance

- Moneycontrol /

- Engineering /

- BALANCE SHEET

-324.40 (-1.36%)

-984.23 (-1.25%)

L&T Technology Services Ltd.

BSE: 540115 | NSE: LTTS | Represents Equity.Intra - day transactions are permissible and normal trading is done in this category Series: EQ | ISIN: INE010V01017 | SECTOR: Engineering Engineering

- Portfolio | Watchlist

- Set SMS Alert

- Today's L/H

- F&O Quote

- Historical Prices

- Pre Opening Session Prices

- Technical Chart

- Moving Average

- Pivot Table

- Moving Averages

- Board meetings

- Announcements

- Mgmt Interviews

- Research reports

- Balance sheet

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Financial Graphs

- Directors report

- Chairman's speech

- Auditors report

- Top Public SH

- Large deals

- Competition

- Latest price

- Stock Performance

- Total assets

- Fund Manager holdings

Prev. Close

5171.00 (2)

5221.00 (2)

5174.75 (47)

- Result in New Format

- Result in Old Format

- Consolidated

Results of L&T Technology

L&T Technology Consolidated September 2024 Net Sales at Rs 2,572.90 crore, up 7.81% Y-o-Y

L&T Technology Standalone September 2024 Net Sales at Rs 2,324.80 crore, up 8.83% Y-o-Y

L&T Technology Consolidated June 2024 Net Sales at Rs 2,461.90 crore, up 6.97% Y-o-Y

L&T Technology Standalone June 2024 Net Sales at Rs 2,246.40 crore, up 9.92% Y-o-Y

Midcap IT firms likely to maintain growth outperformance over Tier-1 in Q4FY22

L&T Technology Services Q3 PAT seen up 6% QoQ to Rs. 243.6 cr: Arihant Capital

L&T Technology Services Q2 PAT seen up 7.3% QoQ to Rs. 232.9 cr: Prabhudas Lilladher

L&T Technology Services Q2 PAT may dip 0.8% QoQ to Rs. 202.5 cr: Prabhudas Lilladher

Results of Engineering Sector

Stewarts and Lloyds of India's board meeting on May 03, 2017

Quess Corp's Group CFO Balasubramanian S resigns

Permanent Magnets: Outcome of board meeting

OM Metals Infraprojects sells stake in subsidiary companies

Shanthi Gears reports third quarter net at Rs 5 crore

Artson Engg standalone Dec '16 sales at Rs 23.91 crore

Shanthi Gears posts 9% rise in Q2 net

Remi Process standalone Jun '16 sales at Rs 2.20 crore

Thermax may report 12% fall in Q3 profit on slow orders

Thermax Q2 PAT seen down 17% to Rs 84 cr

Punj Lloyd likely to turn profitable in Q1 YoY

Adani Ports and SEZ Q1 PAT seen up 22% at Rs 309 cr

Quick links

- Stock Views

- Brokerage Reports

Corporate Action

- Board Meetings

Information

- Company History

- Listing Info

- Large Deals

- Shareholding

- Top Shareholders

- Promoter Holding

- Balance Sheet

- Nine Monthly Results

Annual Report

- Directors Report

- Chairman's Speech

- Auditors Report

- Notes to Accounts

- Finished Goods

- Raw Materials

- Board of Directors

Peer Comparison

- Price Performance

- Total Assets

- Price of SBI on previous budgets

Related Searches

You got 30 day’s trial of.

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- Kreyòl Ayisyen

Insights from the 2023-2024 Student Loan Borrower Survey

This report provides initial survey findings related to student loan borrowers’ difficulties with repayment and the make-up of borrowers applying for and receiving loan forgiveness and discharges. The survey was fielded between October 2023 and January 2024, as the payment pause on federal student loans ended and many borrowers were returning to repayment. Key findings include:

A majority of student loan borrowers report difficulty with their student loan payments and more than one in three have missed a payment.

- 63 percent of borrowers reported ever having difficulty making their student loan payments and 37 percent have missed at least one payment, with significantly higher rates for Black and Hispanic borrowers, Pell Grant recipients, and for those with less than a four-year degree.

- The COVID-19 payment pause provided meaningful relief, but many borrowers reported they had little confidence that they could afford their student loan payments when the federal student loan payment pause ended.

Borrowers who are struggling are especially likely to reach out for help, but many do not have enough information about or have difficulty accessing income-driven repayment (IDR) plan options that could benefit them.

- 42 percent of borrowers report only ever being on the standard repayment plan for their federal student loans, and an additional 21 percent do not know if they have ever chosen a repayment plan.

- Among the borrowers who have only been on the standard repayment plan, 31 percent report not knowing they could choose a different plan, and 14 percent report needing help or more information to choose a plan. These shares are largest for borrowers with lower incomes who would likely benefit the most from enrollment in IDR.

Nearly 1-in-10 surveyed federal student loan borrowers reported that they had a loan discharged, cancelled, or forgiven.

- The median household income for student loan borrowers who reported receiving debt relief was between $50,000 and $65,000 in 2022, relative to the national median of nearly $75,000 in 2022. But borrowers’ finances vary across debt relief programs.

- Though the amount of debt relief varies widely, 61 percent of borrowers reported that debt relief had allowed them to make a beneficial change in their life sooner than they otherwise would have.

Full report

Read the full report

- Personal Finance

- Today's Paper

- Partner Content

- Web Stories

- Entertainment

- Social Viral

L&T Technology Services acquires US-based Intelliswift for $110 million

The acquisition, according to the firm, will deepen its offerings across software product development, platform engineering, digital integration, data, and artificial intelligence (ai).

)

Listen to This Article

)

L&T to acquire 21% stake in E2E Networks in two-part Rs 1,406 crore deal

)

L&T Q2 results preview: Profit may rise up to 19% YoY; margins could shrink

L&t locks key contract for world's largest nuclear fusion project in france.

)

Ajit Mishra of Religare Broking suggests buying this stock on October 24

)

Expanding bond market to ease capital needs key to India's $5 trn goal

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 11 2024 | 7:15 PM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Reliance shares

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- Maharashtra Elections 2024 Business Standard at 50 IPO News Business Standard BFSI Summit 2024 Jharkhand Elections Results 2024 US Election 2024

Expand Search: the search bar will appear on the bottom of the header for you to search the content of the site.

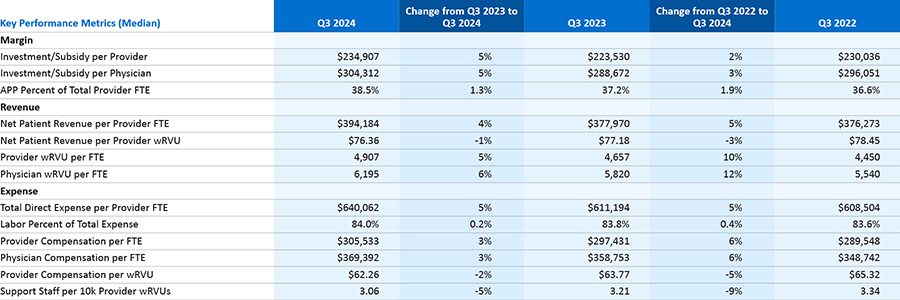

Physician Flash Report: Q3 2024 Metrics

In the third quarter of this year, the median investment/subsidy per physician was $304,312—rising above $300,000 for the first time. Other expense metrics such as the total direct expense per provider FTE and labor as a percentage of total expenses increased.

The Physician Flash Report features the most up-to-date industry trends drawn from the same data physician groups use to track their finances and operations. For more detailed benchmarks by specialty or custom peer groups, please email [email protected] .

Managing Director, Service Line Leader, Physician

Contact Expert

Senior Vice President

Physician Flash Report: Q2 2024 Data

Physician Flash Report: Q1 2024

Physician Flash Report: 2023 Year-in-Review

Do you have questions about our products, consulting services, or overall solutions?

- Leadership Team

- Our Experts

- Diversity, Equity & Inclusion

- Events & Speaking

- Office Locations

- Business Model Transformation

- Clinical Enterprise

- Enterprise Strategy

- Partnership Strategy

- Transactions

- Credit & Capital Management

- Debt and Derivative Advisory

- Invested Asset Strategy

- Investment Management

- Real Estate

- Strategic Resource Allocation

- Treasury Operations

- Clinical Variation

- Revenue Cycle Process

- Non-Labor Strategy

- Care Transitions

- Capital Planning Solutions for Healthcare

- Data & Analytics

- Clinical Solutions

- Ambulatory Surgery Centers

- Private Equity

- Post-Acute Care/Senior Living

- Strategic and Academic Program Planning

- Partnerships

- Featured Insights

- National Hospital Flash Report

- Physician Flash Report

- M&A Quarterly Activity Report

- Higher Education Insights

- Thoughts from Ken Kaufman

- Thoughts from Lisa Goldstein

- Gist Weekly

- Payer Perspectives

- Strategy Spotlight

- Sustaining Higher Education

- Trending in Healthcare Treasury & Capital Markets

- Research and Reports

- Webinars & Podcasts

- Healthcare Leadership Conference

- All Insights

- SECTOR : SOFTWARE & SERVICES

- INDUSTRY : IT CONSULTING & SOFTWARE

- L&T TECHNOLOGY SERVICES LTD.

L&T Technology Services Ltd.

NSE: LTTS | BSE: 540115

5174.75 -104.10 ( -1.97 %)

52W Low on Jun 04, 2024

107.7K NSE+BSE Volume

NSE 13 Nov, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Broker average target upside potential%

Broker 1Year buys

2 active buys

Broker 1Year sells

1 active sells

Broker 1Year neutral

0 active holds

Broker 1M Reco upgrade

0 Broker 1M Reco upgrade

L&T Technology Services Ltd. share price target

L&t technology services ltd. has an average target of 5966.67. the consensus estimate represents an upside of 15.30% from the last price of 5174.75. view 7 reports from 3 analysts offering long-term price targets for l&t technology services ltd...

- Recent Upgrades

- Recent Downgrades

- Sector Updates

- Most Recent

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

NIH Research Project Grant Program - R01

The Research Project Grant (R01) is the original and historically oldest grant mechanism used by NIH. The R01 provides support for health-related research and development based on the mission of the NIH. R01s can be investigator-initiated or can be in response to a program announcement or request for application.

Applicants planning to submit a R01 application to the NIBIB with direct costs of $500,000 or more within one year are reminded that they must submit a white paper (see templates below) and seek written agreement from the NIBIB staff at least 6 weeks prior to the application receipt date. Applicants are encouraged to contact the NIBIB staff well in advance of the 6 week deadline to discuss their planned application.

Download R01 White Paper Template (MS Word 42.3KB) New

Download R01 White Paper Budget Table Template (Excel Worksheet 12.7KB) New

Research: How Gen AI Is Already Impacting the Labor Market

by Ozge Demirci , Jonas Hannane and Xinrong Zhu

Summary .

In the early 2000s, when Amazon introduced its Kiva robots to automate warehouse operations, employees feared for their jobs as machines began taking over tasks previously performed by humans. Today, advances in gen AI and natural language processing, such as ChatGPT, are transforming many industries and raising similar concerns. However, unlike past automation technologies, gen AI has the unique potential to impact all job sectors, particularly given its fundamental ability to improve its capabilities over time — which promises to affect the workforce in ways that go beyond simple job replacement.

Partner Center

Next-Gen CT Solutions for Unmatched Precision and Performance

Revolutionizing Network Equipment Testing with LTTS

Unlocking the Future of Telecom with 5G O-RAN Automation Testing

Guaranteeing 100% compliance with operator and the 3GPP specifications

Futurize OT Cybersecurity of a Heavy Engineering Plant Quickly and Cost-Effectively

Redefining Testing Paradigm

Avasant: Digital Engineering Services 2024 RadarView

HFS Research: IoT Service Providers 2024

Revolutionizing Software-Defined Vehicles with Service-Oriented Architecture: An Innovative...

Biological Risk Evaluation for a Combination of ISO 10993 and ISO 18562 in Product Gas Pathways...

Ethylene Oxide Sterilization, Services and its Alternatives for Medical devices

Unlock the future of manufacturing with Factories of the Future

IMAGES

COMMENTS

L&T Technology Services Ltd. share price target. L&T Technology Services Ltd. has an average target of 5966.67. The consensus estimate represents an upside of 13.03% from the last price of 5278.85. View 7 reports from 3 analysts offering long-term price targets for L&T Technology Services Ltd.. Reco - This broker has downgraded this stock from ...

Log on to www.LTTS.com to read this report online. Corporate Overview 1. 02-38. Corporate Snapshot* FY23 Revenue $ 990 million ` 8,014 crore Global Clients 341 Global Presence 20+ countries ... we deliver industry-leading Engineering Research and Development (ER&D) services and cutting-edge solutions across the digital technologies landscape.

LTTS continues to leverage new and emerging technologies for ensuring a profitable, sustainable, and inclusive growth paradigm ... LTTS ANNUAL REPORT 2021-22 Read this report online or download at www.LTTS.com ... WE OFFER WORLD-CLASS ENGINEERING RESEARCH AND DEVELOPMENT (ER&D) SERVICES AND CUTTING-EDGE DIGITALIZATION SOLUTIONS.

Sharekhan. LTTS reported revenues stood at $295 million, down 3.1% q-o-q/ up 6.1% y-o-y in constant currency (CC) terms, missing our estimates of $301 million on account of SWC seasonality. Emkay downgraded L&T Technology Services Ltd. to Sell with a price target of 5000.0 on 16 Oct, 2024. L&T Technology Services Ltd.

The share price of L&T Technology Services Ltd is ₹5,100.95 (NSE) and ₹5,098.60 (BSE) as of 08-Nov-2024 IST. L&T Technology Services Ltd has given a return of 0.59% in the last 3 years.

PAGE 4 L&T TECHNOLOGY SERVICES | Q2 FY 22 - QUARTERLY RESULT KEY DEAL WINS LTTS closed several multi-million dollar projects from global customers across segments. The major wins are listed below: • A Hi-Tech client has selected LTTS as their strategic partner to establish their extended product development center for adoption of new-age technologies

L&T Technology Services Limited Share Price Today, Live NSE Stock Price: Get the latest L&T Technology Services Limited news, company updates, quotes, offers, annual financial reports, graph, volumes, 52 week high low, buy sell tips, balance sheet, historical charts, market performance, capitalisation, dividends, volume, profit and loss account, research, results and more details at NSE India.

About LTTS. L&T Technology Services Limited is an India-based engineering research and development (ER&D) services provider. The Company offers consultancy, design, development and testing services across the product and process development life cycle. The Company operates in three segments: Mobility, Sustainability, and Hi-Tech.

L&T Technology Services Limited (LTTS) is a global leader in Engineering Research and Development (ER&D) services. The Company offers end-to-end consultancy, design, development, and testing across product and process lifecycles. With its deep expertise across software, digital engineering, embedded systems, engineering analytics, and plant ...

Company Earning excess return. During the past twelve months, the company has given a strong Return On Equity of 25.19%. EBITDA is continuously increasing for last 3 Years. Good Return On Capital Employed of 24.52. Good Net Margin of 13.11% is achieved by the company. Very Low Dividend Yield of 0.980 %. Low Earning Yield of 2.43 %.

LTTS is an engineering services provider incorporated in 2012, offers engineering,, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant ... Annual reports. Financial Year 2024 from bse Financial Year 2023 from bse ...

BANGALORE, India & SAN FRANCISCO, November 11, 2024--(BUSINESS WIRE)--L&T Technology Services Limited (BSE: 540115, NSE: LTTS), a global leader in engineering and technology services, announced it ...

LTTS offers the complete gamut of engineering services and solutions for its global customers in the transportation industry, including OEMs and Tier 1 suppliers in Automotive, Trucks and Off-highway Vehicles, and Aerospace. LTTS caters to customer requirements through specialized state-of-the-art research and test labs for

BANGALORE, India, March 15, 2024--L&T Technology Services (LTTS) Secures landmark ∼$100 Million program in cybersecurity. ... Research Reports. Personal Finance. Credit Cards. Balance Transfer ...

L&T Technology Standalone June 2024 Net Sales at Rs 2,246.40 crore, up 9.92% Y-o-Y. Midcap IT firms likely to maintain growth outperformance over Tier-1 in Q4FY22. L&T Technology Services Q3 PAT ...

L&T Technology Services Ltd. (LTTS) live share price today on NSE/BSE at 3:31 p.m. on Nov 8, 2024 is Rs 5100.95. Explore financials, technicals, Deals, Corporate actions and more. ... All Research Reports Stock and sector reports. Recent broker upgrades Recent broker downgrades ...

This report describes a research study that analyzes the data collected from the matched-pair testing. Pairs of testers visited 25 bank branches located in Fairfax County, Virginia and 25 branches located in Nassau County, New York—consisting of 100 total visits across 23 financial institutions—over several months in 2023. Testers were ...

Zillow Research. Data. Housing Data. Zillow Transaction and Assessment Dataset (ZTRAX) Visuals. Buyers/Sellers. Renters. Policy/Politics. Fair Housing. Dashboards. Market Reports ... If you wish to report an issue or seek an accommodation, please let us know. Zillow, Inc. holds real estate brokerage licenses in multiple states.

This report provides initial survey findings related to student loan borrowers' difficulties with repayment and the make-up of borrowers applying for and receiving loan forgiveness and discharges. The survey was fielded between October 2023 and January 2024, as the payment pause on federal student loans ended and many borrowers were returning ...

LTTS AT A GLANCE L&T Technology Services Limited (LTTS) is a leading global pure-play Engineering Research & Development (ER&D) services company. It offers consultancy, design, development and testing services across the product and process development life cycle. Listed on BSE and NSE, LTTS is a subsidiary of Larsen & Toubro Limited (L&T).

Engineering and technology services firm L&T Technology Services (LTTS) announced that it has signed a definitive agreement to acquire Silicon Valley-based Intelliswift for $110 million. The acquisition, according to the firm, will deepen its offerings across software product development, platform engineering, digital integration, data, and ...

Research Report. Physician Flash Report: Q2 2024 Data. August 5, 2024. Research Report. Physician Flash Report: Q1 2024. May 2, 2024. Research Report. Physician Flash Report: 2023 Year-in-Review. January 30, 2024. More Physician Flash Reports. Questions? We'll Be Your Guide.

See 7 recent research reports for LTTS, BSE:540115 L&T Technology Services Ltd. from 3 source(s) with an average share price target of 5967.

The Research Project Grant (R01) is the original and historically oldest grant mechanism used by NIH. The R01 provides support for health-related research and development based on the mission of the NIH. R01s can be investigator-initiated or can be in response to a program announcement or request for application.

New research analyzed over a million job posts for online gig workers to see what affect the introduction of tools like ChatGPT and image-generating AI have already had on the quantity of posts ...

ABOUT LTTS REPORT ANNUAL 2020 - 2021 01 L&T Technology Services Ltd. | CSR Report 2020-2021 L&T Technology Services Ltd. | CSR Report 2020-2021 02 L&T Technology Services (LTTS), a listed subsidiary of Larsen & Toubro Limited, is a global leader in Engineering and R&D (ER&D) services. Founded in 2009, we specialize in

China has built a land-based prototype nuclear reactor for a large surface warship, in the clearest sign yet Beijing is advancing toward producing the country's first nuclear-powered aircraft ...

Unlock the future of manufacturing with LTTS's advanced OT cybersecurity solutions, as demonstrated by our transformation of a leading heavy engineering plant ... Analyst Report. HFS Research: IoT Service Providers 2024 The Internet of Things (IoT) encompasses a network of interconnected devices, from smart home gadgets to industrial machinery ...