How to Calculate Customer Lifetime Value (CLV) & Why It Matters

Published: September 18, 2023

It's easier to sell to an existing customer than it is to acquire a new one.

The last thing you want is for customers to churn before you recoup the investment required to earn their business in the first place.

![lifetime value in business plan → Download Now: Customer Service Metrics Calculator [Free Tool]](https://no-cache.hubspot.com/cta/default/53/e24dc302-9dc2-466f-a5ca-ab4e08633c0f.png)

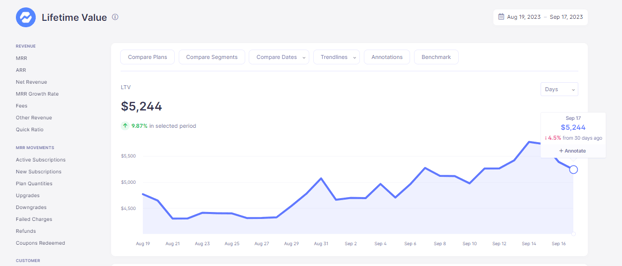

One of the best ways to fix retention issues is by measuring customer lifetime value (CLV or CLTV). Doing so will help your business acquire and retain highly valuable customers , which results in more revenue over time.

Continue reading or jump ahead:

What is customer lifetime value (CLV)?

Why is customer lifetime value important, customer lifetime value models, customer lifetime value formula, customer lifetime value metrics, customer lifetime value example, tips to increase customer ltv.

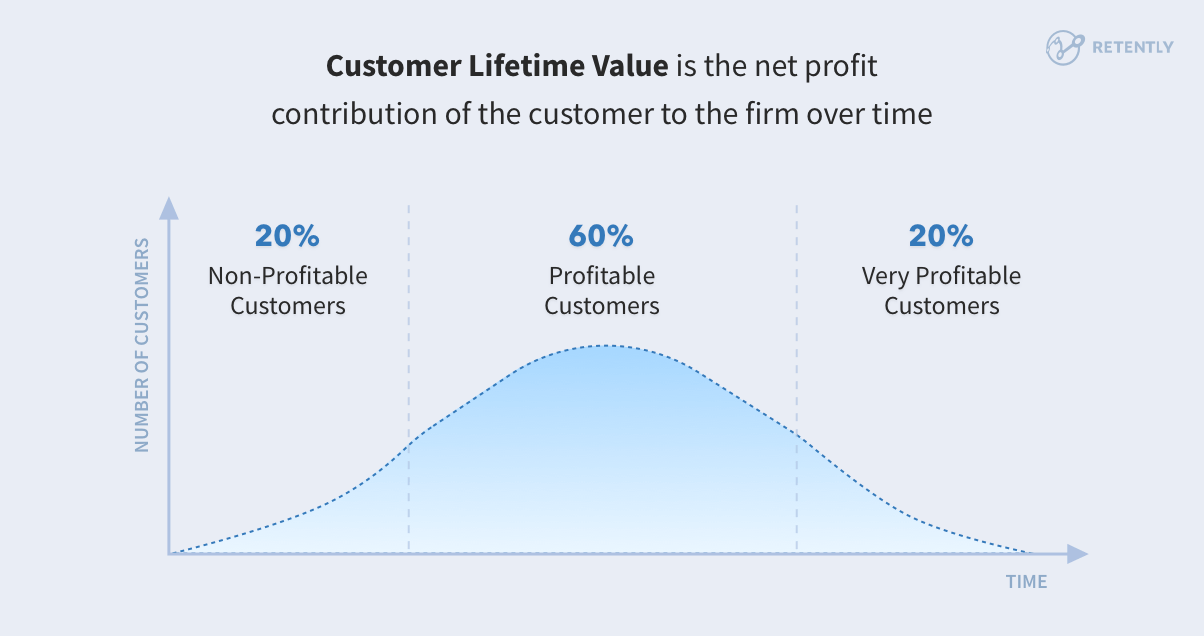

Customer lifetime value (CLV or CLTV) is a metric that indicates the total revenue a business can reasonably expect from a single customer account throughout the business relationship.

The metric considers a customer's revenue value and compares that number to the company's predicted customer lifespan.

Customer LTV is something that customer support and success teams can directly influence the customer's journey .

The longer your customer continues to purchase from your company, the greater their lifetime value becomes.

.png)

Free Customer Lifetime Value Calculator

Calculate CLV with this free template, alongside other metrics like:

Customer Acquisition Cost

- Customer Lifetime Value

- Customer Satisfaction Score

You're all set!

Click this link to access this resource at any time.

Tell us a little about yourself to access the template.

- Increasing CLV can increase revenue over time.

- It can help you find issues so you can boost customer loyalty and retention.

- It helps you target your ideal customers.

- Increasing CLV can help reduce customer acquisition costs.

- CLV can simplify financial planning.

- CLV trends can show you how to improve your products and services.

Customer lifetime value helps you understand the growth and revenue value of each customer over time. This metric is important to any business because it can help your business:

- Boost customer loyalty

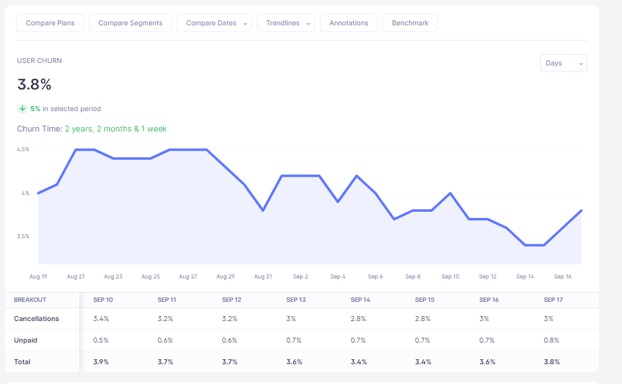

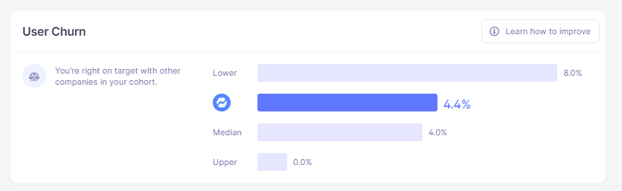

- Reduce churn

- Improve strategic decision-making

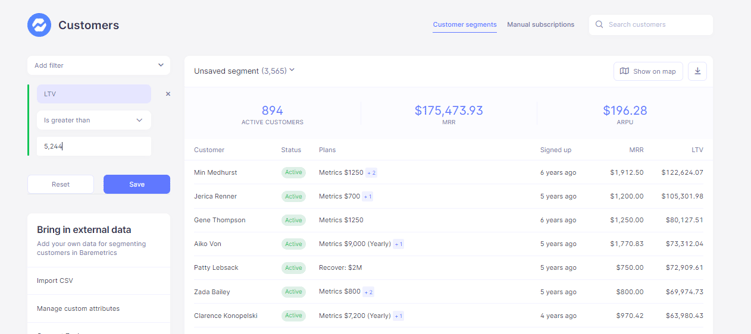

For example, you can use customer lifetime value to find the customer segments that are most valuable to your company.

Here are some other reasons why understanding your CLV is essential.

1. Increasing CLV can increase revenue over time.

The longer the lifecycle or the more value a customer brings during that lifecycle, the more revenue a business earns.

Therefore, tracking and improving CLV results in more revenue.

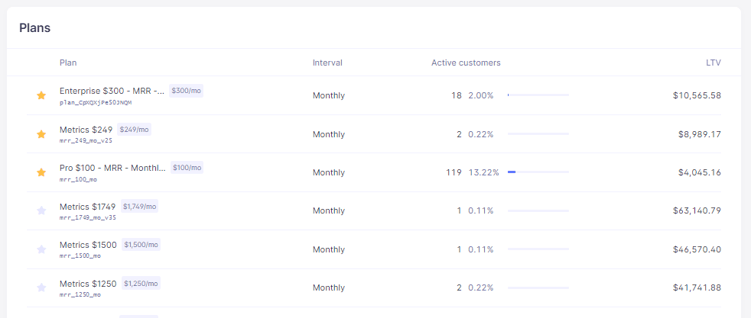

CLV helps you find the specific customers that contribute the most revenue to your business. You can use this information to segment your audience by the value those customers bring.

Once you find those customers, you can encourage repeat purchases and find specific cross-selling and upselling opportunities for different segments of your audience. Or you can tailor your products or marketing to your highest spenders to keep them coming back for more.

2. It can help you identify issues so you can boost customer loyalty and retention.

If CLV is a priority in your business, you can use it to identify impactful trends in your customer data. This insight can help you stay ahead of competition with action items to address those changes.

CLV helps you understand customer behavior, preferences, and spending patterns. With this analysis, you can improve your data-driven decision-making. This leads to more personalized marketing strategies for growth.

For example, say your CLV is low. You can work to optimize your customer support strategy or loyalty program to better meet the needs of your customers. Or you can optimize a new product to attract higher-value customers.

3. It helps you target your ideal customers.

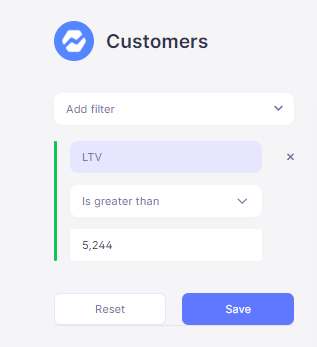

Customer lifetime value tracking makes it easier to segment your customers. You can segment based on profitability, customer needs, preferences, or behavior.

When you know the lifetime value of a customer, you also know how much money they spend with your business over some time — whether it's $50, $500, or $5000.

Armed with that knowledge, you can develop a customer acquisition strategy that targets customers who will spend the most at your business. You can personalize marketing to attract and retain them, and effectively allocate resources to get the most value from your efforts.

4. Increasing CLV can help reduce customer acquisition costs.

Acquiring new customers can be costly, and it's less expensive to retain a customer than it is to acquire a new one.

Customer lifetime value can help reduce costs with a focus on retaining existing customers. If you can keep a customer happy long-term, then you can improve their value to the business .

Using CLV metrics can improve customer loyalty and word-of-mouth referrals — it can also reduce marketing and sales expenses.

5. CLV can simplify financial planning.

The financial health of a business is often a big concern for CEOs and business owners.

Customer lifetime value helps you get a clear picture of your customers' relationship with your business and products. It can offer insights into future revenue streams and changes in customer behavior.

This knowledge can help you make more accurate predictions about future cash flows. So, CLV helps you reliably forecast revenue and plan the financial future of your business.

6. CLV trends can show you how to improve your products and services.

Understanding CLV can give you a better understanding of the value customers get from specific products or services.

With insights from your CLV you'll have a clear direction for further analysis. This may guide you to look at customer feedback and behavior, update pain points, or change your approach to product development.

Lifetime value data can help you find where to make key improvements that align with customer needs and boost satisfaction. This not only strengthens customer loyalty but also differentiates your company from competitors.

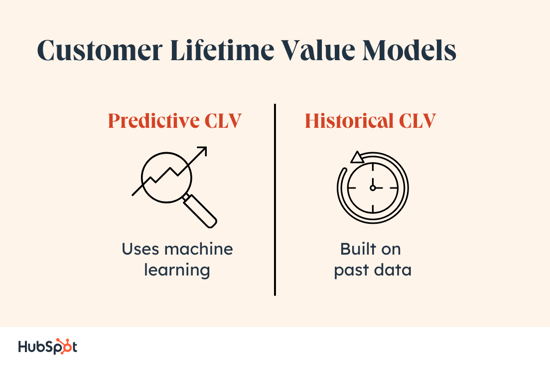

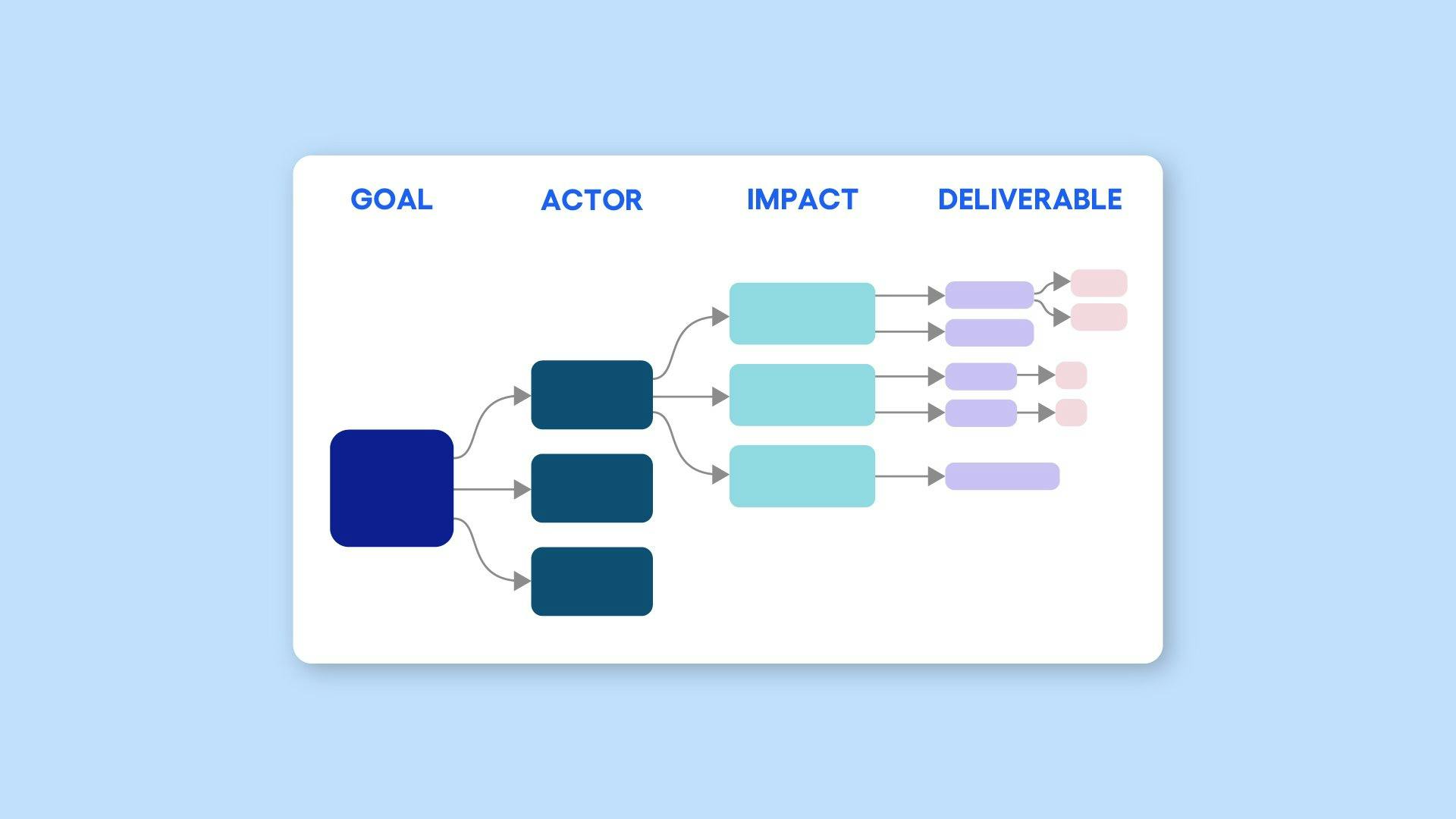

Now that we understand the importance of customer lifetime value, let's talk about the two main customer lifetime value models.

There are two models that companies will use to measure customer lifetime value.

Choosing between the two can result in different outcomes.

This depends on whether a business is looking at pre existing data, or trying to figure out the future behavior of customers based on current circumstances.

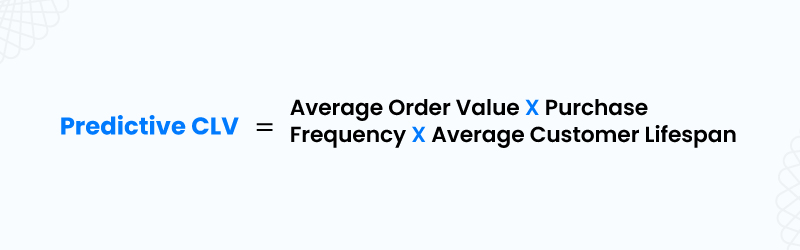

Predictive Customer Lifetime Value

The predictive CLV model forecasts the buying behavior of existing and new customers using regression or machine learning.

Using the predictive model for customer lifetime value helps you better identify your most valuable customers, the product or service that brings in the most sales, and how you can improve customer retention.

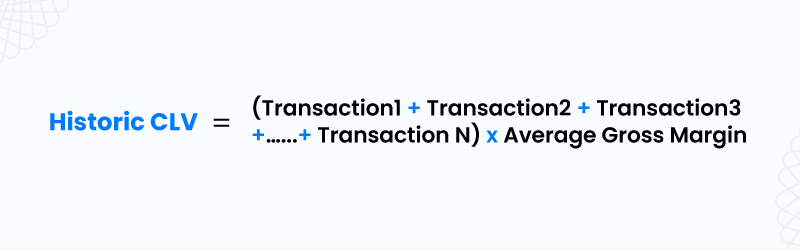

Historical Customer Lifetime Value

The historical model uses past data to predict the value of a customer without considering whether the existing customer will continue with the company or not.

With the historical model, the average order value is used to determine the value of your customers. You'll find this model to be especially useful if most of your customers only interact with your business over a certain period.

But because most customer journeys are not identical, this model has certain drawbacks.

Active customers (deemed valuable by the historical model) might become inactive and skew your data.

In contrast, inactive customers might begin to buy from you again, and you might overlook them because they've been labeled "inactive."

Read on to learn about the different metrics needed to calculate customer lifetime value and why they're important.

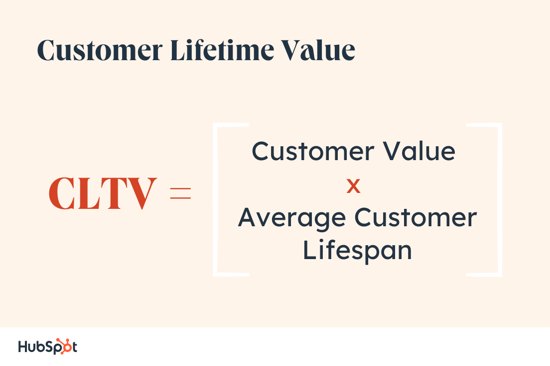

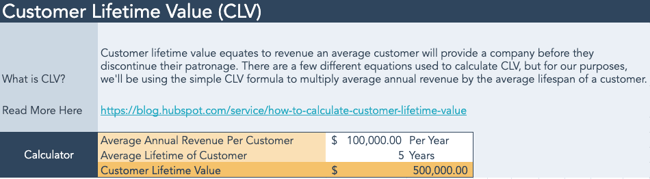

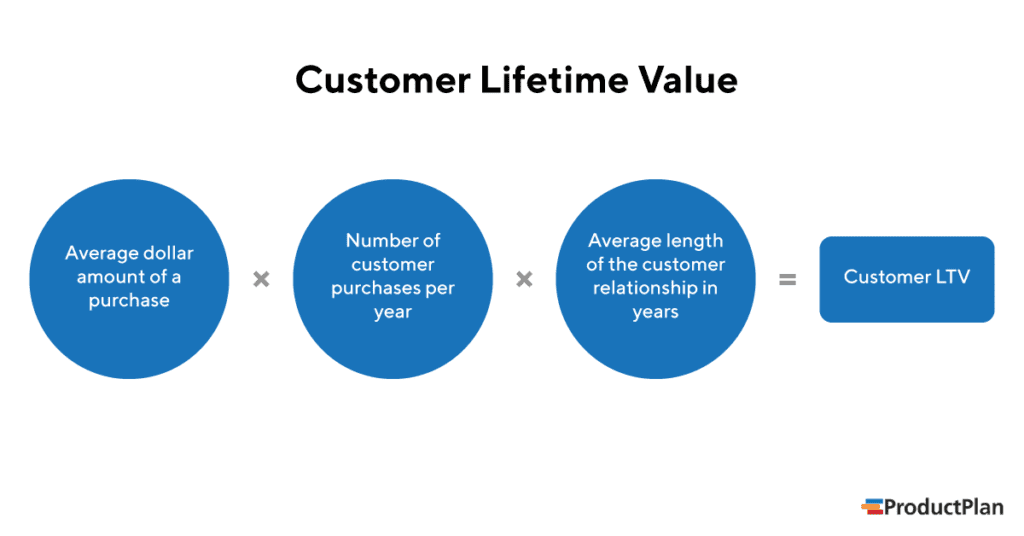

The customer lifetime value formula is Customer Lifetime Value = Customer Value x Average Customer Lifespan. The CLV result is the revenue you expect an average customer to generate during their relationship with your business.

Typically, lifetime value (LTV) calculates the overall value of all customers. But customer lifetime value (CLV) can also focus on the business value of specific customers or groups of customers.

The formula above is the standard formula to calculate CLV. But finding this important figure can be more complicated than it looks.

For example, the first time HubSpot marketing manager Jana Rumberger calculated customer lifetime value, it was a direct request from a company CEO. Jana had reached out to get approval for data analytics software, and before approval, they wanted a specific metric, CLV.

This was a small company where the majority of customers started on a freemium plan. The company tech stack made it tough to get accurate numbers for free to paid plan conversion, payment tiers, and plan retention.

Jana got approval for the software, but it wasn't able to give them the numbers they needed to calculate a reliable CLV for the business. It turns out calculating CLV wasn’t a priority when the business started and there were limited resources to update systems to collect this information. So, Jana’s team was unable to calculate customer lifetime value when they needed it to guide their strategy. In the end, figuring out an accurate CLV took months of manual data collection and analysis.

But using this free customer service metrics calculator , you have clear formulas to help find the data you need and calculate LTV for your business. Keep reading, or jump to the formula(s) you're looking for below:

How to Calculate Customer LTV

Average purchase value, average purchase frequency rate, customer value, average customer lifespan.

Customer Lifetime Value = (Customer Value * Average Customer Lifespan). To find CLTV, calculate the average purchase value x average number of purchases = customer value. Once you calculate the average customer lifespan, you can multiply that by customer value to determine customer lifetime value.

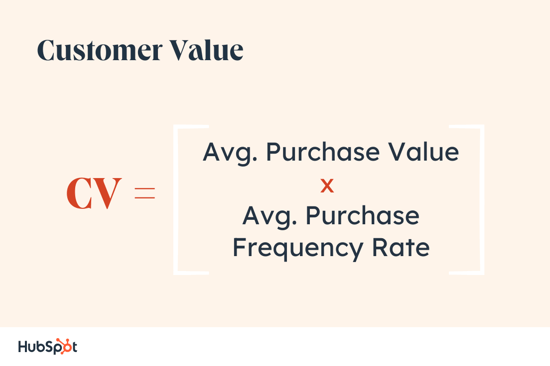

You can see both formulas below:

Customer Value = Average Purchase Value x Average Number of Purchases

Customer Lifetime Value = Customer Value x Average Customer Lifespan

There are many different ways to approach the lifetime value calculation. Keep reading to get an understanding of the most common CLV values. Then, analyze the variables that contribute to each to better serve your business needs.

Free Customer Service Metrics Calculator

Calculate your business's key metrics and KPIs for customer support, service, and success with this free template.

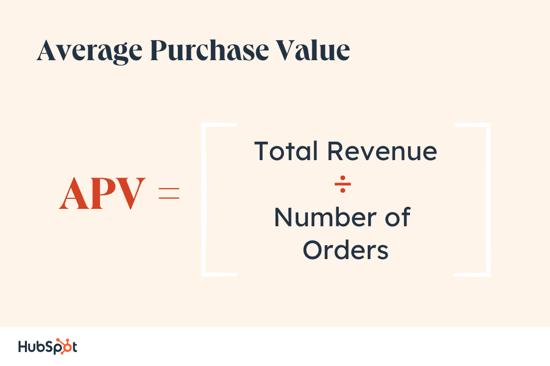

To calculate average purchase value:

Divide your company's total revenue in a period (usually one year) by the number of purchases throughout that same period.

Average purchase value helps you see the average amount of revenue each customer generates during a period. Analyzing this number also shows you:

- Opportunities to increase the value of each transaction

- New options for cross-selling and upselling

- Whether your pricing and packaging strategies are working

This data helps you find new and viable products or services and other strategies to increase value per transaction and revenue.

Average Purchase Value Challenges

Challenges that come up while calculating average purchase value include:

- Getting accurate and comprehensive data on individual customer transactions

- Inconsistent data across multiple channels or platforms

- Seasonal fluctuations in customer spending behavior

- Inconsistent purchasing patterns

- Variable customer segments or groups can skew data

Tips for Calculating Average Purchase Value

To solve for these common problems:

- Use a reliable CRM system that combines customer transaction data from different sources

- Set up automated data collection for consistent transaction data

- Regularly audit and clean up data to remove duplicates and errors

- Integrate channels and platforms for a centralized view of customer transactions

- Analyze customer spending behavior over different seasons and adjust accordingly

- Review segment criteria to make sure customer groups are accurate

- Assign priority to different customer segments

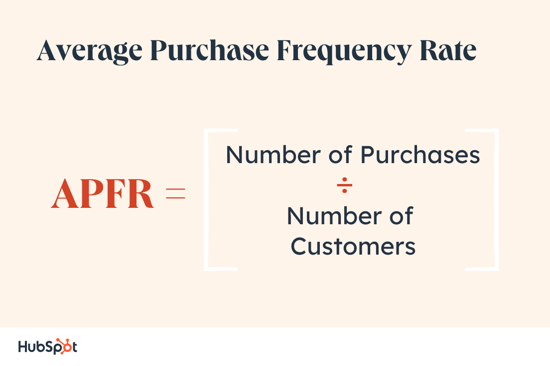

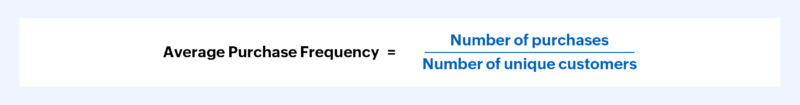

To calculate average purchase frequency rate:

Divide the number of purchases by the number of unique customers who made purchases during that period.

Recent research says that a 5% customer retention increase can create a 25%+ increase in profit.

Average Purchase Frequency Rate is essential for calculating CLV because it shows you how often customers make repeat purchases. This metric also offers insights into:

- Customer engagement and loyalty

- Trends in customer behavior over time

- Churn reduction

- Future revenue streams

Average Purchase Frequency Rate Challenges

Like average purchase value, inconsistent or incomplete data can also distort your purchase rate numbers.

Other challenges include:

- Purchase cycle timing, which can get skewed by industry trends or product releases

- Changing customer buying patterns

- Seasonality

Tips for Calculating Average Purchase Frequency Rate

- Track and analyze customer data to capture changing customer buying patterns

- Regularly review and update customer segmentation based on buying patterns

- Offer personalized promotions to inspire more consistent spending

- Conduct customer surveys or interviews for insights into reasons behind changing purchase patterns

To calculate customer value, figure out the average purchase value for your products. Then, calculate the average number of purchases per customer (also called purchase frequency rate). When you multiply these two figures, it will give you the customer value.

Customer value is important in calculating CLV because it makes it easier to find the customers who have the most impact on your revenue. This leads to better strategies, because you can make more effective decisions when you know what each customer is bringing to your business.

Customer value is also important because it gives you what you need to segment customers by their purchasing habits. Segment insights help you create more targeted, customized experiences for your top customers.

Customer Value Challenges

- Data sources must be reliable, properly integrated, and accurately reflect the monetary value of each customer

- Estimating customer lifespan can be difficult as many businesses have a wide range of customer retention rates.

- Factors such as brand loyalty and referrals can be difficult to calculate. So, you may need extra qualitative and quantitative data to calculate customer value.

Tips for Calculating Customer Value

- Implement a CRM to confirm data accuracy

- Create a consistent process for assigning monetary value to each customer based on their transaction history

- Combine financial systems with customer data to show the monetary value of each customer, like these finance integrations

- Watch customer feedback and sentiment through reviews and social listening to add it to customer value calculations

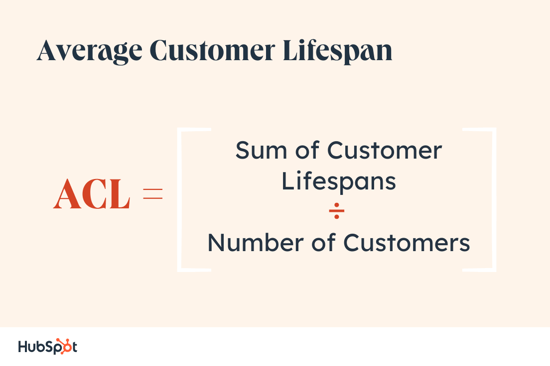

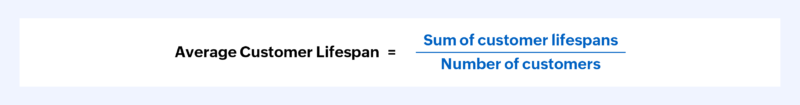

To calculate average customer lifespan:

First, figure out the average number of years a customer stays active with your company. Once you have your customer lifespan, you'll divide that by your total customer base to get the average.

You'll need excellent data management for this figure, and make sure you don't have duplicate accounts in your data.

Average customer lifespan is useful when calculating CLV. This is because it supports predictions on how long customer relationships will last with data. This helps you make more informed budgeting and resourcing decisions.

It can also help you:

- Launch proactive strategies to build customer relationships and reduce churn

- Figure out the ROI for customer acquisition

- Optimize marketing strategies

- Find acquisition channels with higher CLV potential

Average Customer Lifespan Challenges

Calculating average customer lifespan can be tough because:

- Accurate customer lifecycle tracking needs a robust data management system

- Different customer segments and subgroups can skew lifespan predictions

- Limited customer data or short relationships lead to projections that don't align with actual customer behavior

Tips for Calculating Average Customer Lifespan

- Use reliable customer service software to track the customer lifecycle

- Include data from different sources and platforms to create a full view of the customer journey

- Capture and analyze data at each stage of the buyer journey to track engagement and retention

- Analyze the average lifespan of each customer segment individually to limit skewed results

- Conduct regular trend analysis to predict shifts or changes that may impact lifespan

- Gather data on customer satisfaction and loyalty

- Constantly confirm and adjust lifespan average based on actual customer behavior and feedback

Customer acquisition cost is not a factor in most CLV formulas, but it can be useful to include in a customer lifetime value analysis.

Comparing how much it costs to acquire a customer with their lifetime value to the business, you can figure out how to:

- Decide how effective marketing and sales strategies are

- Distribute resources wisely

- Find fitting opportunities to improve customer retention and acquisition

Check out this guide to learn more about customer acquisition cost (CAC) and how to calculate. Then, review these tips for analyzing your CAC to LTV ratio .

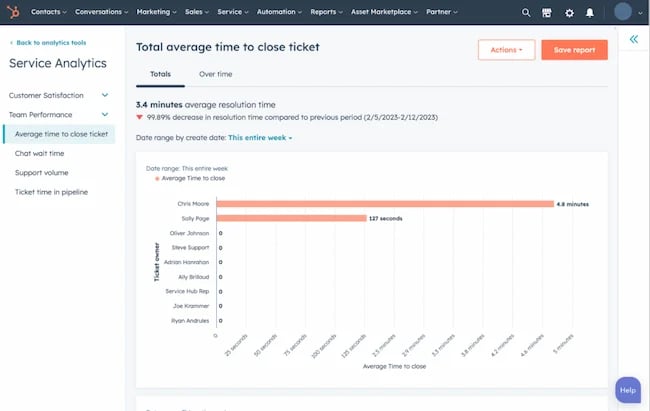

Using data from a Kissmetrics report, we can take Starbucks as an example for determining CLTV.

Its report measures the weekly purchasing habits of five customers, then averages their total values together.

Follow Along with HubSpot's CLV Calculator Template

As you scale it can become more difficult to personalize. But with tools like HubSpot Service Hub , you can create personalized onboarding workflows to guide customers through the necessary steps. This custom experience can help them quickly understand your product or service and get value from it quickly.

Streamline onboarding with useful tools.

Use a knowledge base or live chat to help simplify onboarding. These features help customers easily find information and get quick support whenever they need it.

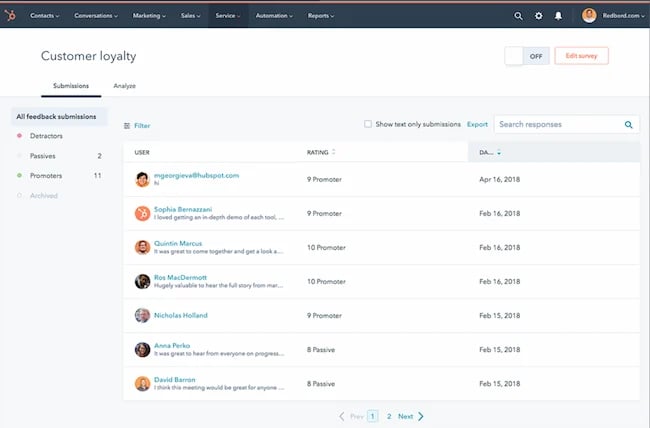

Collect customer feedback through surveys.

Connect after onboarding to get insights on their onboarding experience and find areas you can improve the customer experience with feedback .

Track key onboarding KPIs.

Collect and analyze service metrics such as customer activation rate, time to first interaction, customer retention rate, and repeat purchase rate. This data can help you enhance your onboarding process for increased CLV.

Why This Works

Optimized onboarding processes work because they establish a framework for long-term customer relationships that help increase CLV over time.

.png)

Free Customer Onboarding Templates

Eight templates to lead your new customers through their first several months with your product or service

- Customer Intake Form Template

- Customizable Welcome Packet

- Onboarding Timeline Template

2. Increase your average order value.

One of the smartest ways to improve your CLV is to increase your average order value.

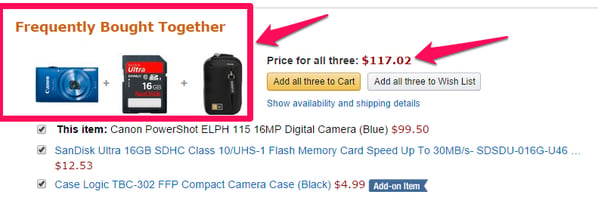

When a customer is about to check out, you can offer relevant complementary products to those they're about to buy.

Get inspired by these upsell and cross-sell examples.

Brands like Amazon and McDonald's are examples of companies that use upsell and cross-sell methods extremely well.

Amazon will offer you related products and bundle them into a group price as depicted below.

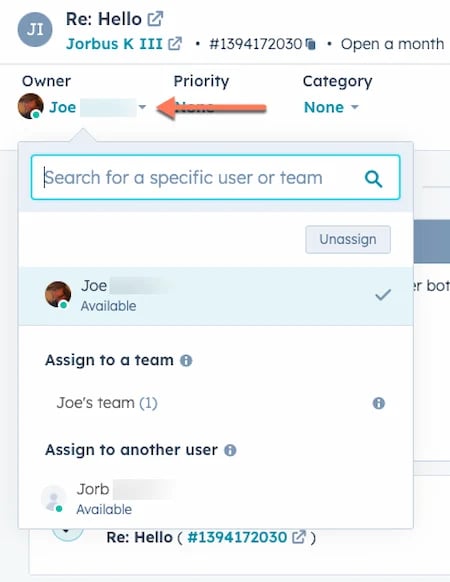

A ticketing system isn't just helpful for customer problem-solving. It can help you provide prompt and consistent support and engagement where your customers are. This is critical for building trust and mutual satisfaction.

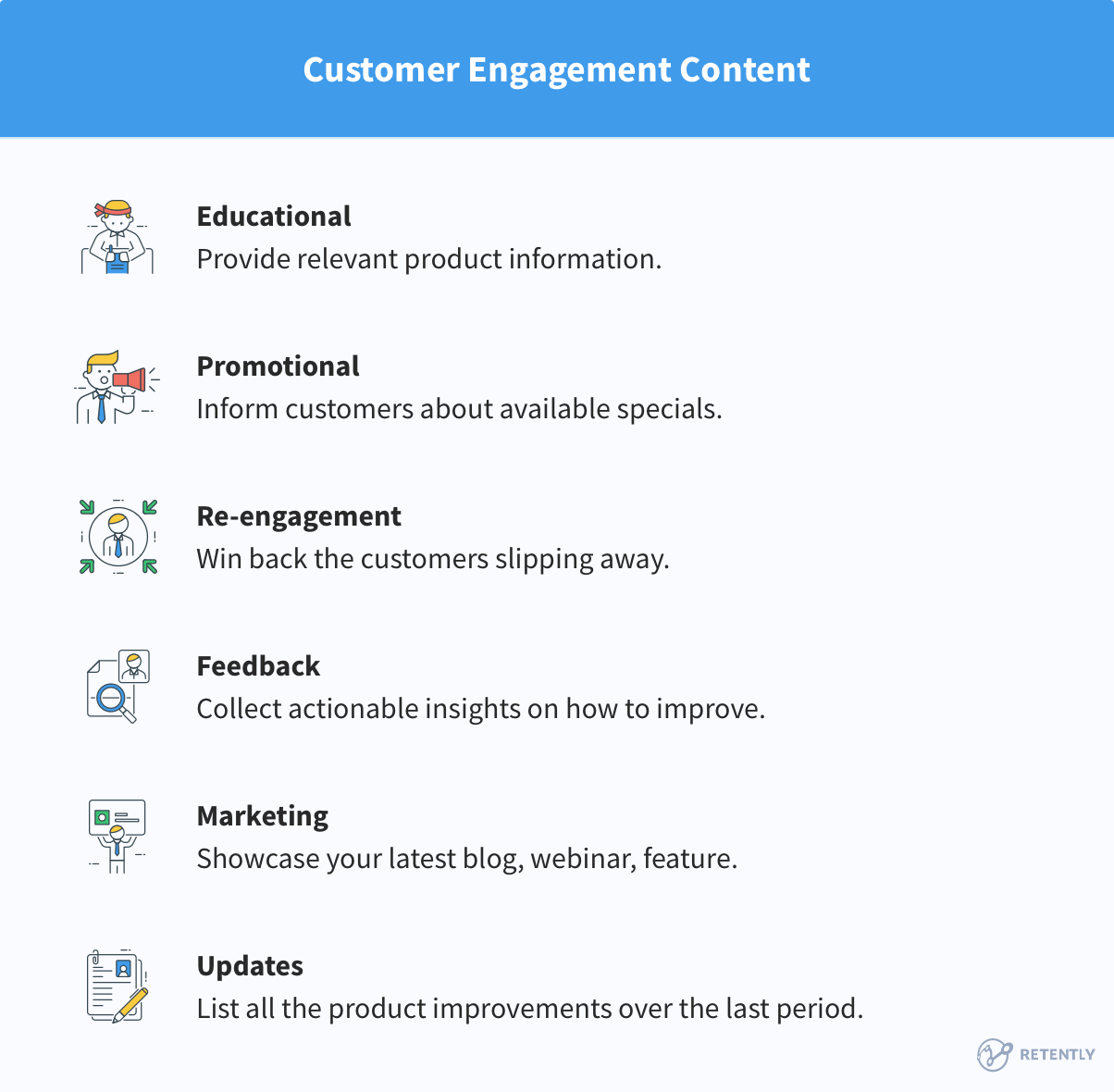

Share authentic and relatable content.

Get genuine and go beyond canned advertising posts. Tell stories, share behind-the-scenes moments, and encourage user-generated content to build community.

Host interactive events or challenges.

You may not be able to connect with every customer in person. But you can encourage active participation and build connections with online events. This guide to running virtual events can help you get started.

This works because you need to stand out from the crowd. Quick and easy eCommerce is now par for the course — if you can forge an actual connection with customers you'll keep them coming back and increase your total CLV.

4. Embrace good advice.

Sometimes it's better to listen than talk.

Customers often have good advice on how you could improve business practices to better serve their needs — and you can increase CLV by taking it.

To make the most of advice from your customers:

Analyze and rank customer suggestions.

For example, you could create a poll on new product or service ideas and see what your customer base thinks. Make sure you don't lock them into a specific set of choices. Instead, give them room to add their own ideas that could help make things better.

And don't stop at surveys. You can collect reviews, social media, and customer support interactions too. Then, review this feedback for common themes and to prioritize what you want to improve.

HubSpot's customer feedback tools make it easy to seek input and suggestions from your customers. While not every customer will engage, those who do will often have good advice and can end up being some of your most loyal customers.

Loop in relevant stakeholders for decision-making processes.

Bring in stakeholders from different departments to review, discuss, and evaluate customer feedback. Not every suggestion will be realistic for your business. But the more you can honor the needs of your customers, the more likely you are to boost CLV.

Service Hub's collaboration and team management features streamline knowledge sharing. This encourages internal collaboration.

Communicate changes you've made based on customer advice.

Give credit where credit is due. If a customer comes up with a good idea, credit them for the help. You may also want to consider sending them something as a token of appreciation.

This works because it shows you're willing to listen. Too many brands take the stance that they know what their customers want better than customers themselves, which in turn can lower total CLV.

5. Empower easy connections.

Customers won't wait around for your brand to connect with them or answer their questions. 2023 HubSpot data says that 66% of consumers want a response to emails from customer service in five minutes or less .

While this isn't always possible, businesses can put practices in place to shorten response times and empower easy connections.

Use technology such as chatbots or automated support systems.

When you can, offer instant responses to common customer queries. Tools like live chat , chatbots , and email integrations can help streamline the connection process. They can also offer immediate assistance to meet high customer expectations.

Create self-service resources and knowledge bases.

Make it simple for customers to find answers to their questions independently. You can accomplish this with a knowledge base , customer portal , and other self-serve resources . This empowers them to find information quickly. It also reduces the need for direct interactions while creating a connection.

Be proactive on customer feedback channels.

Equip your customer success team with tools and technology to monitor and respond to customer comments or concerns through different channels, such as social media and online reviews. This can help your brand jumpstart the connection process.

CLV is now driven by relationships and relationships require an ongoing connection.

While five-minute email response times may be out of reach, the easier you make it for customers to connect with your brand the more connected they'll feel overall.

And the more likely they'll come back to spend more money.

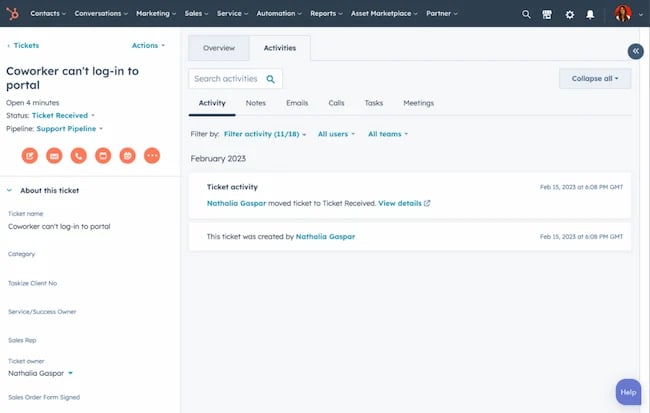

6. Improve your customer service.

According to 2023 HubSpot research, 93% of customers are likely to make repeat purchases with companies that offer excellent customer service.

So if you want to improve your customer lifetime value, you should pay attention to your customer service and look for ways to make it excellent.

Here are just a few ways you can improve your customer service:

Use omni-channel customer support.

Make sure your customer support experience is seamless and consistent. To do this, offer support across multiple channels, such as phone, email, live chat, and social media platforms. This makes it easy for customers to reach out through their preferred channel.

HubSpot's service automation features can help you automate support tasks. When you reduce manual outreach, like routine emails, it gives you more time to focus on resolving complex issues. This can help your team offer higher-quality service to your customers.

Add personalized services.

Use customer data insights to personalize the experience for each customer. This information can help your team make custom recommendations, offers, and product suggestions.

Offer a proper return and refund policy.

Create a clear and fair return or refund policy that shows your commitment to customer satisfaction. Keep in mind, any great refund or return process should be hassle-free.

Enhance customer service training.

Make sure your business has a training program in place. Great service training should educate employees on your products, best practices, and problem-solving. Training should also include active listening, empathy, and effective communication techniques.

Add customer service feedback systems.

Sending customer surveys is a great idea, but it won't help much if you don't have a process in place to analyze your data. Create processes to review customer feedback regularly. This can help you notice patterns or trends and address any recurring issues.

It's simple: The better your customer service the more customers feel valued by your brand for more than their purchases.

If you stand behind your products with substantive return and refund policies, it communicates to customers that your priority is quality and satisfaction, not overall sales volume.

The result? Increased CLV.

The Benefit of Customer Lifetime Value

Customer lifetime value is an incredibly useful metric. Once you know how to calculate lifetime value, you'll know which customers spend the most at your business and which ones will remain loyal to you for the longest amount of time.

Use the formulas and model provided above and start calculating CLTV for your business today.

Editor's note: This post was originally published in May 2021 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

32 Customer Service Email Templates to Support, Renew, & Refund Customers

4 Customer Acquisition Challenges You Might Face This Year

Are You Losing Customers? Find Out Why

Customer Loyalty vs. Brand Loyalty: Everything You Need to Know

![lifetime value in business plan Big Brands That Lost Customers' Satisfaction in 2023 [Where CX Went Wrong + Data]](https://blog.hubspot.com/hubfs/companies%20that%20lost%20customers_featured.png)

Big Brands That Lost Customers' Satisfaction in 2023 [Where CX Went Wrong + Data]

What DraftKings & Aaron Rodgers Taught Us About Customer Returns

Customer Win-Back Campaigns: How to Get Previous Buyers Back on Track

![lifetime value in business plan How to Calculate Churn Rate in 5 Easy Steps [Definition + Formula]](https://blog.hubspot.com/hubfs/ai%20customer%20service%20predictions%20%283%29.webp)

How to Calculate Churn Rate in 5 Easy Steps [Definition + Formula]

Customer Loyalty and Retention: 13 Ways to Improve Yours

How to Let Customers Know About a Price Increase (Without Making Them Mad)

Calculate your NPS, CSAT, CAC, and more for free with this calculator.

Service Hub provides everything you need to delight and retain customers while supporting the success of your whole front office

- Youth Program

- Wharton Online

Customer Lifetime Value: What It Is and Why It Matters

- Make more purchases consistently over time

- Refer other customers to a business

- Impact company sentiment through brand advocacy on channels such as social media

- Cost less to retain and build relationships with than new customers

According to Ali Cudby , a customer retention researcher and author, it costs six-to-seven-times more to acquire a new customer than it does to retain current customers. Cudby notes that a 5% increase in retention can lead to improved profitability of 25% or more, and potentially a 95% increase in profits.

Learn what customer lifetime value is, why it matters and how to use it to promote customer loyalty and potentially increase profits.

Identifying Target Customers

One way a business can identify target customers on which to focus is to estimate customer lifetime value. This business metric can drive everything from a company’s marketing strategy, to sales techniques, to product and service development.

What Is Customer Lifetime Value?

Put simply, customer lifetime value represents how much a customer is expected to spend with a company from their first to last purchase with the business.

For example, say the average customer with a skincare and beauty brand spends an average of $250 a year with the brand beginning when they’re around 25 years old. They’re expected to purchase regularly from the brand until they’re around 60 years old. That means, the average customer would spend $8,750 with that brand over their lifetime.

A customer who subscribes to the company’s email newsletter, for example, may spend $600 a year with the brand, which notably increases their customer lifetime value to $21,000.

A customer who has a bad experience with product shipment, for example, may abandon the brand a year into spending with them, which diminishes their customer lifetime value.

Factors that can impact customer lifetime value

Factors that can impact a customer’s lifetime value, include how:

- Engaged a customer is with the brand

- Much value of the products they regularly purchase from the brand

- Frequently they purchase

Companies that strategize how to increase the customer lifetime value of their most valuable customers and find ways to turn casual customers into more valuable customers, can increase their revenue.

Why Is Customer Lifetime Value Important?

Customer lifetime value matters because it helps businesses better understand their current customer base and who they should target to maximize profits.

According to research by the Wharton School’s Professor of Marketing David Reibstein , the probability of selling to an existing customer is up to 14 times higher than the likelihood of selling to a new customer.

Applying Best Practices

Because it’s more difficult and expensive to gain a new customer compared to keeping an existing customer, companies that focus on increasing the customer lifetime value of each one of their customers can boost their results while lowering costs.

When a business understands the customer lifetime value of various personas within their customer base, they can apply best practices from the most valuable group to other groups, as well as to new customers.

How to Estimate the Value of a Single Customer

A basic customer lifetime value formula is:

Customer lifetime value = Customer value x average customer lifespan

For the customer value and average customer lifespan components, you may want to calculate averages for each one. For example, out of a customer pool of 100 customers, you may find the average value is $100/year with an average customer lifespan of 10 years.

Looking at the average customer value

You could get more granular with your calculations, but looking at the average customer value for those who spend 10 years with a company, versus those who spend 15 years with a company.

To illustrate, referencing the skincare company example above, the business might segment their customer base into various personas that have various customer lifetime values.

For example, customers who start buying from the company:

- In their 20s may make more of their early purchases in the less expensive makeup category for their first decade with the company before adding products to their shopping cart.

- In their 40s may be more apt to purchase more expensive skincare items at the beginning of their customer journey.

Loyalty rewards programs

A business may also compare the customer lifetime value of people who are members of a brand’s loyalty rewards program versus those who are not. Using customer lifetime value figures, the company can strategize how to get more non-members into the club, and how to provide more value to club members to keep them engaged.

How you determine various customer lifetime values will depend on the variety within your customer base. That’s why it’s helpful to look at different buyer personas, so you can get a clearer view of the customer lifetime value of each one. Then, you can strategize how to increase that value across the business.

How to Increase Customer Lifetime Value

There are several ways to increase the customer lifetime value across a company’s customer base. These include:

- Increase the average purchase value . This can be done by promoting products that are relevant to a persona at checkout, sending offers for new or limited-edition items, suggestive selling in stores, and other sales and marketing methods. A company may also decide to invest in new service or product development for other products that provide value to engaged customers.

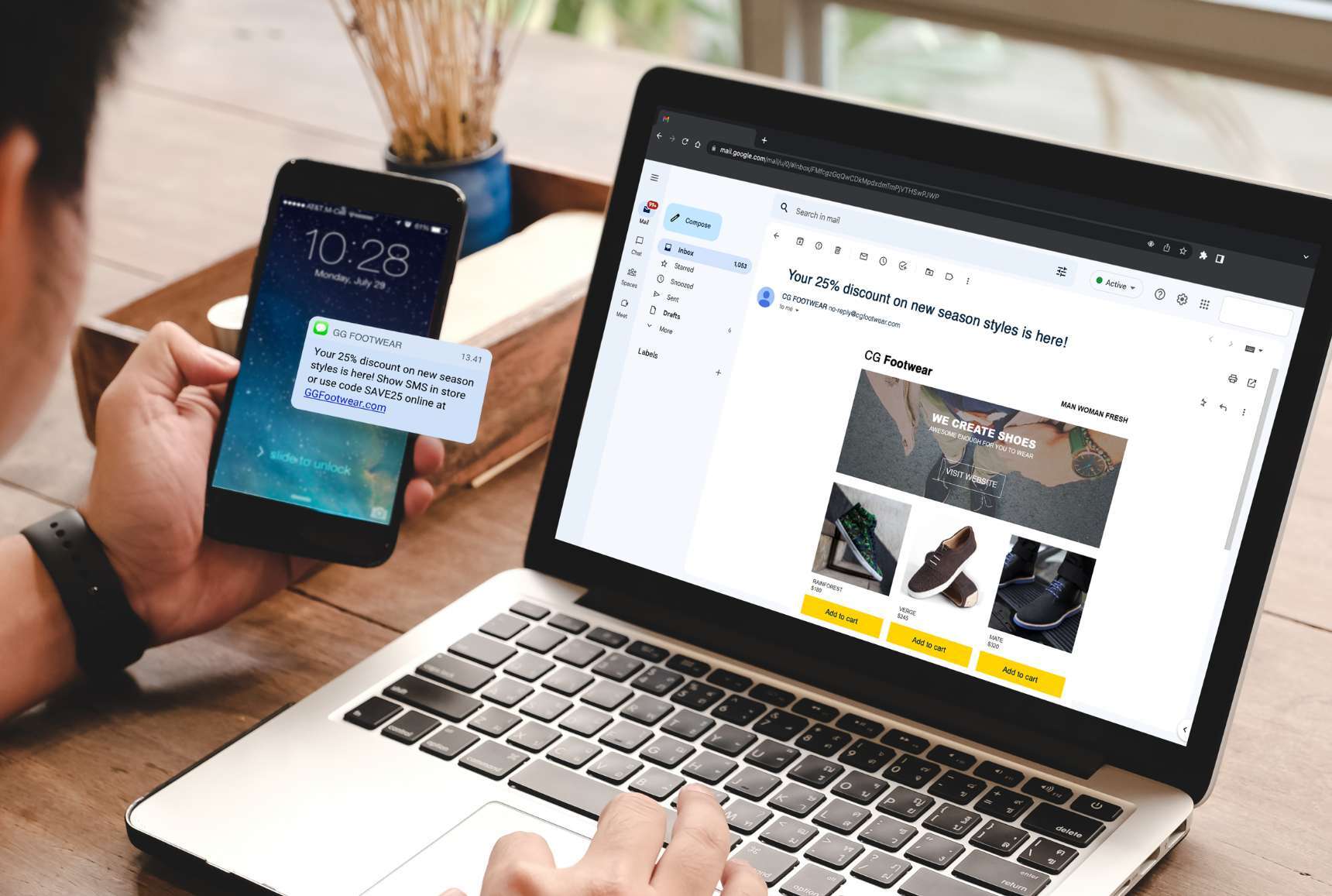

- Increase the average purchase frequency rate . Another way to boost customer lifetime value is to motivate existing customers to purchase more frequently. For a coffee shop, this might look like opening more locations in a high-sales area, or extending the open-close hours for each location. For an ecommerce brand, it might result from sending more frequent email communications or releasing more offer codes on social media.

- Increase the value of products and services sold . It’s easier to sell higher-value products and services to people who already trust in your brand. You can increase the average purchase value by creating products and services that are more valuable and, thus, come with a higher price tag.

- Increase the average customer lifespan . Another strategy to keep customers buying from you over a longer period of time is to understand when customers tend to stop purchasing and for what reason. For example, a clothing company that’s marketed to those in their 20s may see that customers quit buying from them in their 30s. The brand may explore creating a new fashion line or brand that’s geared toward customers in this age group.

Map the customer journey for each persona

These strategies will only work if you create strong brand-consumer relationships to begin with. That’s why it’s important to map out the customer journey for each persona, so you can identify pain points along the journey and offer proactive service every step of the way. This helps prevent customer drop-off, so customers stay loyal to the brand.

Learn More About Managing the Value of Customer Relationships

If digital marketing topics like customer lifetime value interest you, learn more in the Managing the Value of Customer Relationships course from Wharton School, part of the Digital Marketing Certificate Program . The course teaches how to make informed decisions for customer-centric strategies and how to choose the right metrics to guide them.

Discover other in-demand digital marketing skills that can help you grow your career. Contact us for information on our school programs and certificates, and we’ll get in touch with you.

The Wharton School is accredited by the International Association for Continuing Education and Training (IACET) and is authorized to issue the IACET CEU.

Content / Discovery

Product Discovery and CMS

Engagement platform

Please login through the link in your invite email

Explore by Category

Content Management System (CMS)

B2B Insights

Ecommerce Site Search and Merchandising

Real-Time Personalization

Executive Insights

Customer Data Platform (CDP)

Commerce Experience

Omnichannel Marketing Automation

Customer Success Stories

Life at Bloomreach

Explore by Tag

Subtopic tags

- Customer Journey Analytics and Segmentation

- Customer Experience

- Product Recommendations

- Email Marketing

- Headless Commerce

- B2B Manufacturers

- Conversion Rate Optimization

- Digital Transformation

- B2B Distributors

- Search Engine Optimization (SEO)

- Content Management

- Mobile & App

- A/B Testing

- Data Privacy, Security, and Consent Management

- SMS & Messaging

- AI Marketing and Commerce

Content Management System (CMS) (20)

B2B Insights (17)

Ecommerce Site Search and Merchandising (83)

Real-Time Personalization (60)

Executive Insights (11)

Customer Data Platform (CDP) (59)

Commerce Experience (79)

Omnichannel Marketing Automation (113)

Customer Success Stories (15)

Life at Bloomreach (47)

What Is Customer Lifetime Value (LTV) and How to Calculate It? The Ultimate Guide

By Samuel Kellett

Table of Contents

What Is Customer Lifetime Value (LTV)?

What is the difference between clv and ltv, why is customer lifetime value important, how to calculate customer lifetime value (with examples), how to increase your customer lifetime value, how to use customer lifetime value and increase profitability, what is the relationship between cac and customer lifetime value, how clv can drive business kpis (interview), why don’t more companies use customer lifetime value effectively, calculate and maximize your clv with bloomreach engagement.

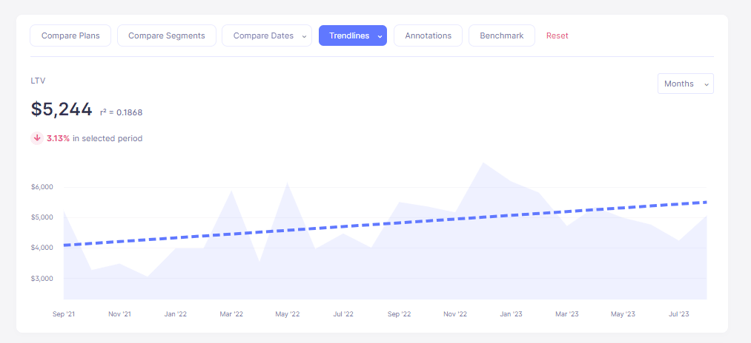

The importance of customer lifetime value (also called CLV, CLTV, LCV, or LTV marketing) has been understated for a long time. And more often than not, it's the most important metric that companies ignore.

Marketers have been writing about how important knowing CLV and LTV is for years, but it’s still being ignored or underutilized: only 42% of companies are actually able to accurately measure CLV. This is despite the fact that 89% agree that CLV and a great customer experience are crucial for driving brand loyalty.

- CLV is simply defined as the value a customer represents to a company over a period of time.

- CLV can be calculated by multiplying the average annual profit of a customer by the average duration of customer retention.

- Customer lifetime value is important because it informs how much your company can/should spend on customer acquisition.

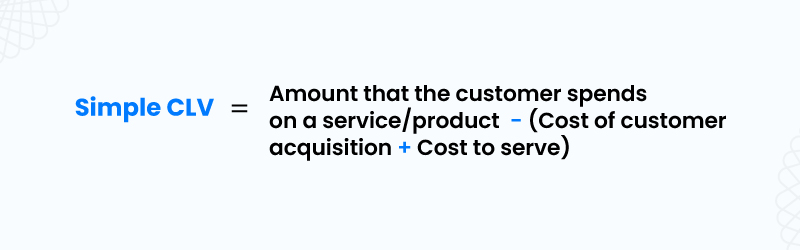

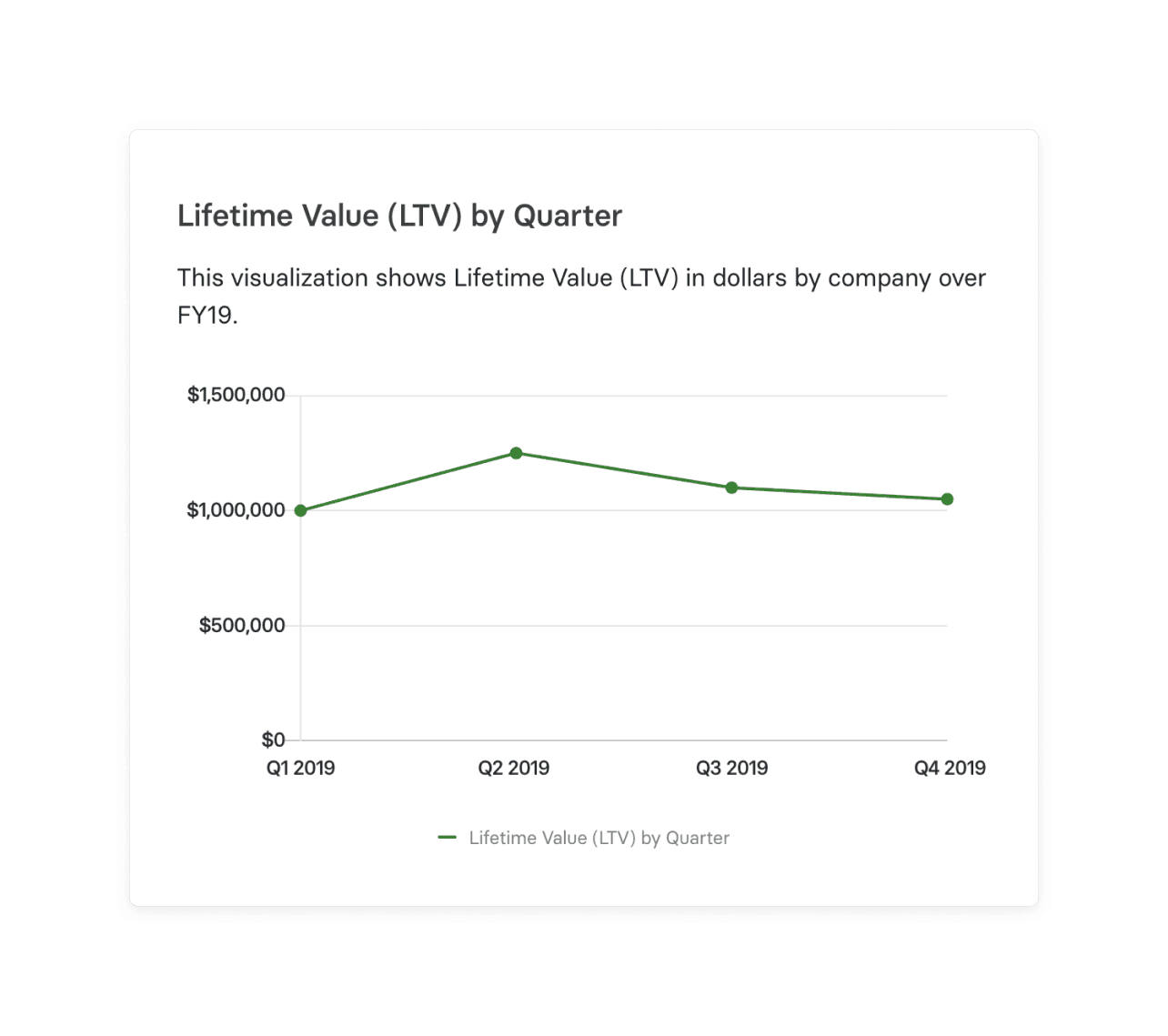

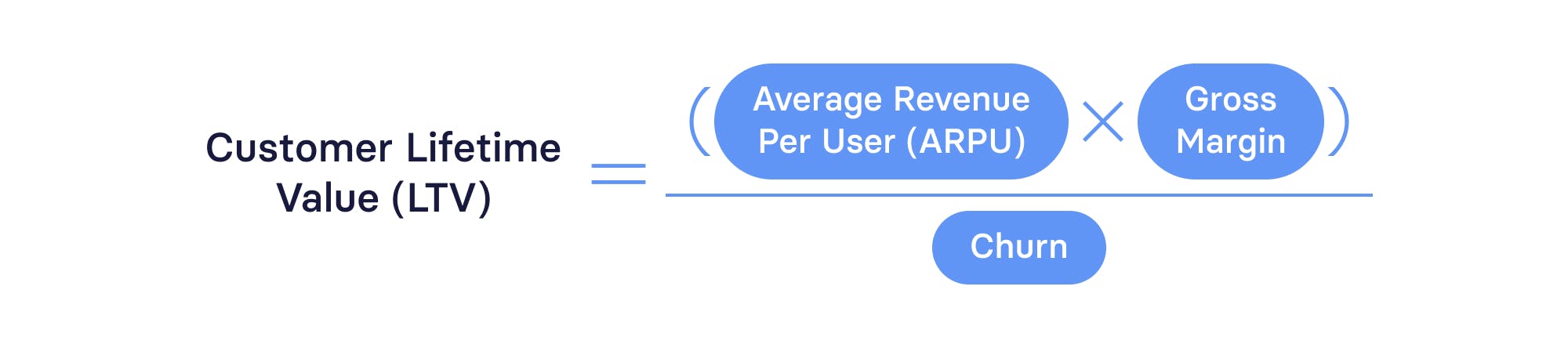

Customer Lifetime Value (CLV or CLTV) is a pivotal metric, offering insights into the anticipated total revenue a business can derive from a single customer account over the course of their entire relationship. This metric takes into account the revenue generated by a customer and aligns it with the anticipated duration of the business relationship.You can calculate a simple customer lifetime value model for your company with this formula:

There are other methods of calculating customer lifetime value that get much deeper and can focus on the average customer or an individual customer. To illustrate this, this article is going to cover the importance of CLV, a customer lifetime value formula you can use to find it, and the actionable ways you can use it to measure customer lifetime and improve your business.

CLV and LTV are both used as shorthand for customer lifetime value, and they essentially share the same meaning. There’s no industry-established difference between the terms and marketers often use them interchangeably.

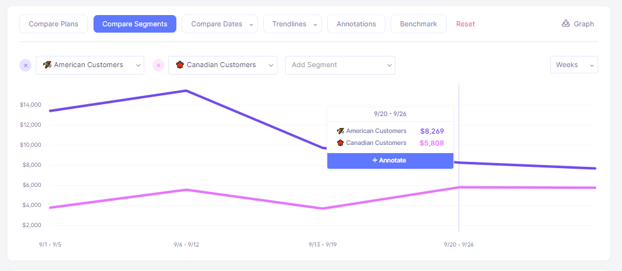

Some people differentiate between CLV and LTV in terms of specificity, with CLV identifying the value of an individual customer over their entire relationship with a brand and LTV referring to the average customer lifetime value of all existing customers .

But without company-specific factors for any one business’ calculations, this small degree of differentiation essentially produces the same metric, which is why the terms are understood to be identical.

Customer lifetime value calculations will get you one answer, but the knowledge you gain can be applied in a multitude of ways:

It Informs How Much You Should Spend on Customer Acquisition

Your customer acquisition costs (CAC) may very well equal more than you make from a customer's first purchase. But that doesn't take into account the average customer lifespan — are you still making money from that customer in the long run?

Figuring out the average lifetime value of a customer to your company will give you the answer.

It Allows You To Segment Your Customers Based on Value

"Using CLV, you can better understand the different personas among your customers — the first step to effective targeting or personalization."

Daniar Rusnak | Bloomreach Academy, Senior Trainer

Calculating your CLV allows you to narrow your marketing focus for more effective campaigns. When you know how valuable a customer is in the long term, you can create better interactions with your high-value customers and foster more meaningful engagement.

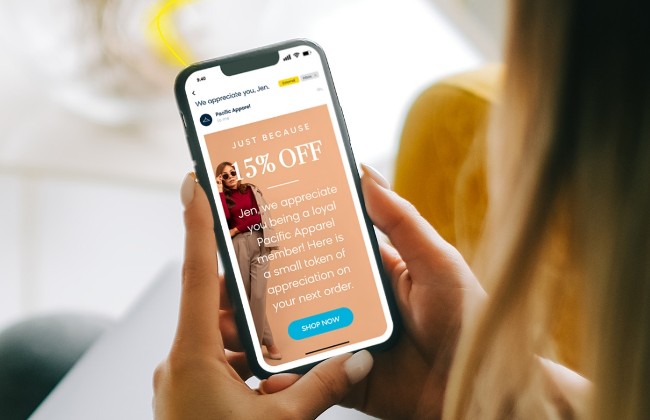

You can send a special offer or gift to your “VIP” customers, or focus on acquiring new customers with similar backgrounds. You can also nurture less valuable customers and start upselling to build a high customer lifetime value. Viewing your audience through customer segments allows for a personalized experience — which is key to keep your customer retention rates high.

Focusing on CLV Is Key for Long-Term Company-Wide Growth

It’s a competitive market for ecommerce companies, and price isn’t the only determining factor in a customer’s decisions.

CLV is a customer-centric metric, and one that depends on giving your audience a great customer experience . It's a powerful base metric to build upon to retain customers, increase revenue from less valuable customers, and improve the customer experience overall.

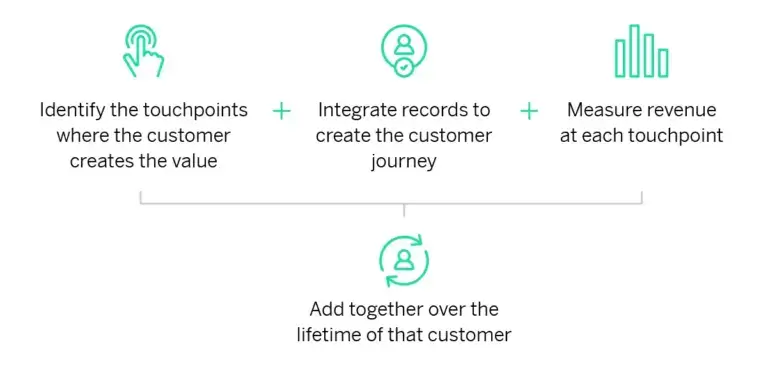

The Process of Finding Your CLV Is Valuable

"The advantage of determining customer lifetime value is not just the final number itself, but also the thinking and calculation behind the metric."

Lukas Sitar | Inbound Marketing Specialist

Determining your business' CLV or LTV provides more than one statistic. The process of finding your customer lifetime value will make you think — not just about the sale, but about the full customer journey: when, where, why, for how much, and how often do your customers make a purchase?

Answering these questions will bring valuable insights, lay out clear ways to strengthen your customer journeys, and help you spot issues in your customer engagement plan that you may not have noticed before.

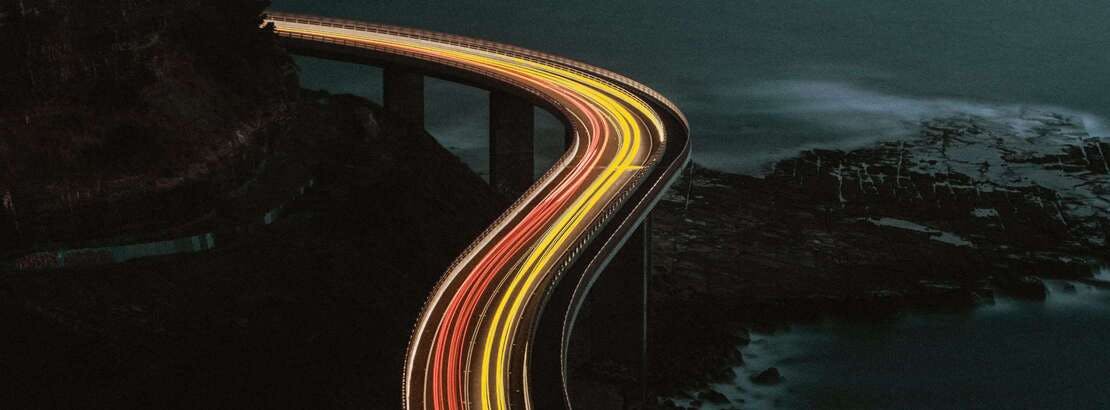

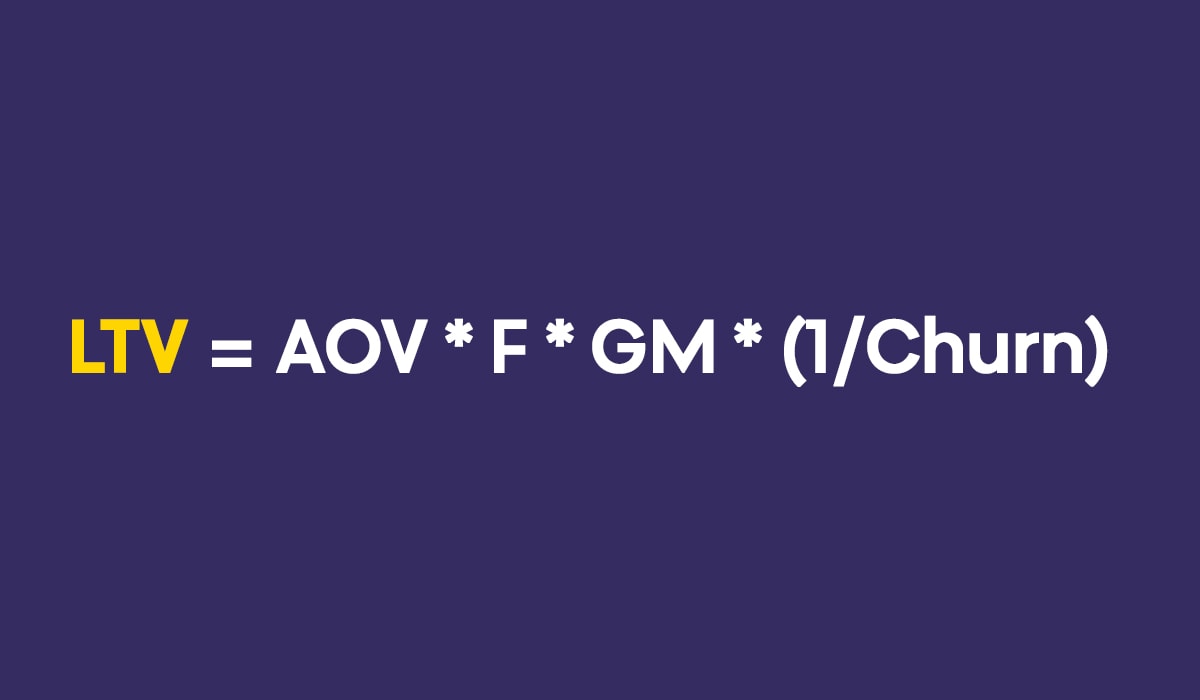

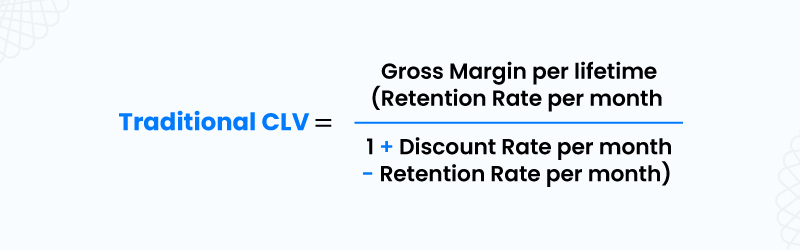

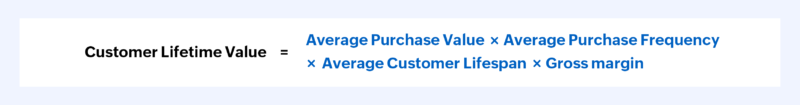

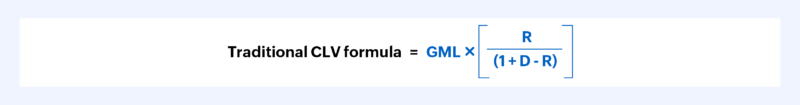

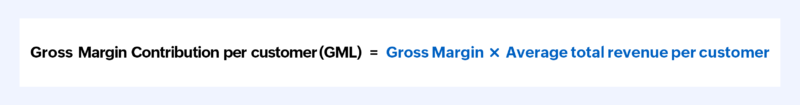

There are four KPIs that determine your LTV: average order value (AOV), purchase frequency (F), gross margin (GM) and churn rate (CR).

With all these metrics, you can use this formula to calculate customer lifetime value:

With this customer lifetime value model, all you need to do is break down the equation to identify each factor and plug them all in to the formula.

It’s important to look at each of these KPIs individually and determine their individual values before plugging them into the equation. This will help determine which one needs the most work in terms of profit maximization.

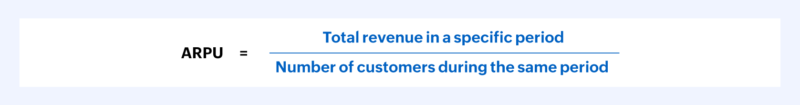

How to Calculate Your Average Order Value (AOV)

First, we need to calculate your AOV using this equation:

AOV = Total Sales Revenue / Total Number of Orders

Let's walk through an example computation of Company A's average order value:

AVERAGE ORDER VALUE ANALYSIS: COMPANY A

Total Sales Revenue (annual): $1,000,000 Total Number of Orders (annual): 40,000 1,000,000 / 40,000 = 25 Company A has an average order value of $25

How to Calculate Your Purchase Frequency (F)

Next, you need to calculate your purchase frequency, or the number of times a customer completes a purchase in a given period of time:

F = Total Number of Orders / Total Number of Unique Customers

Let's continue our example to find Company A's purchase frequency:

PURCHASE FREQUENCY ANALYSIS: COMPANY A

Total Number of Orders (annual): 40,000 Total Number of Unique Customers (annual): 15,000 40,000 / 15,000 = 2.67 Company A has a purchase frequency of 2.67

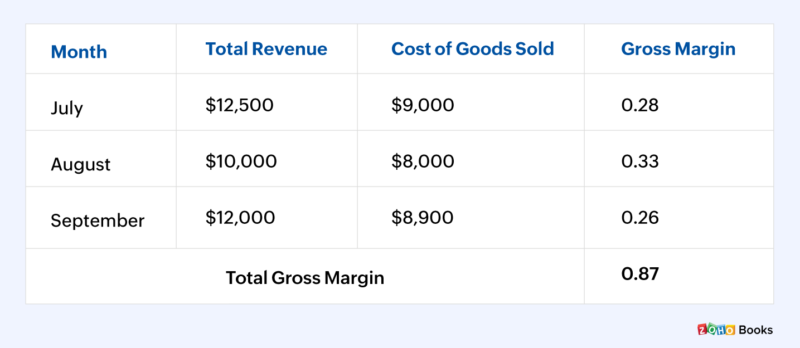

How to Calculate Your Gross Margin (GM)

Now you need your gross margin — a business’ profit percentage after subtracting all direct costs of producing or purchasing the goods or services it sells.

GM = Total Sales Revenue – Cost of Goods Sold (COGS) / Total Sales Revenue

To calculate your gross margin, you need to start by calculating the cost of goods sold (COGS) using this equation:

COGS = beginning inventory (inventory left from last year) + additional purchases during period cost – ending inventory (inventory left at the end of the year)

Here's a walkthrough of these calculations using our Company A example:

GROSS MARGIN ANALYSIS: COMPANY A

Beginning Inventory: $180,000 Additional Purchases During Period: $450,000 Ending Inventory: $160,000 180,000 + 450,000 – 160,000 = 470,000 Company A has a Cost of Goods Sold of $470,000

Total Sales Revenue: $800,000 COGS: $470,000 800,000 – 470,000 / 800,000 = 0.41 Company A has a gross margin of 41%

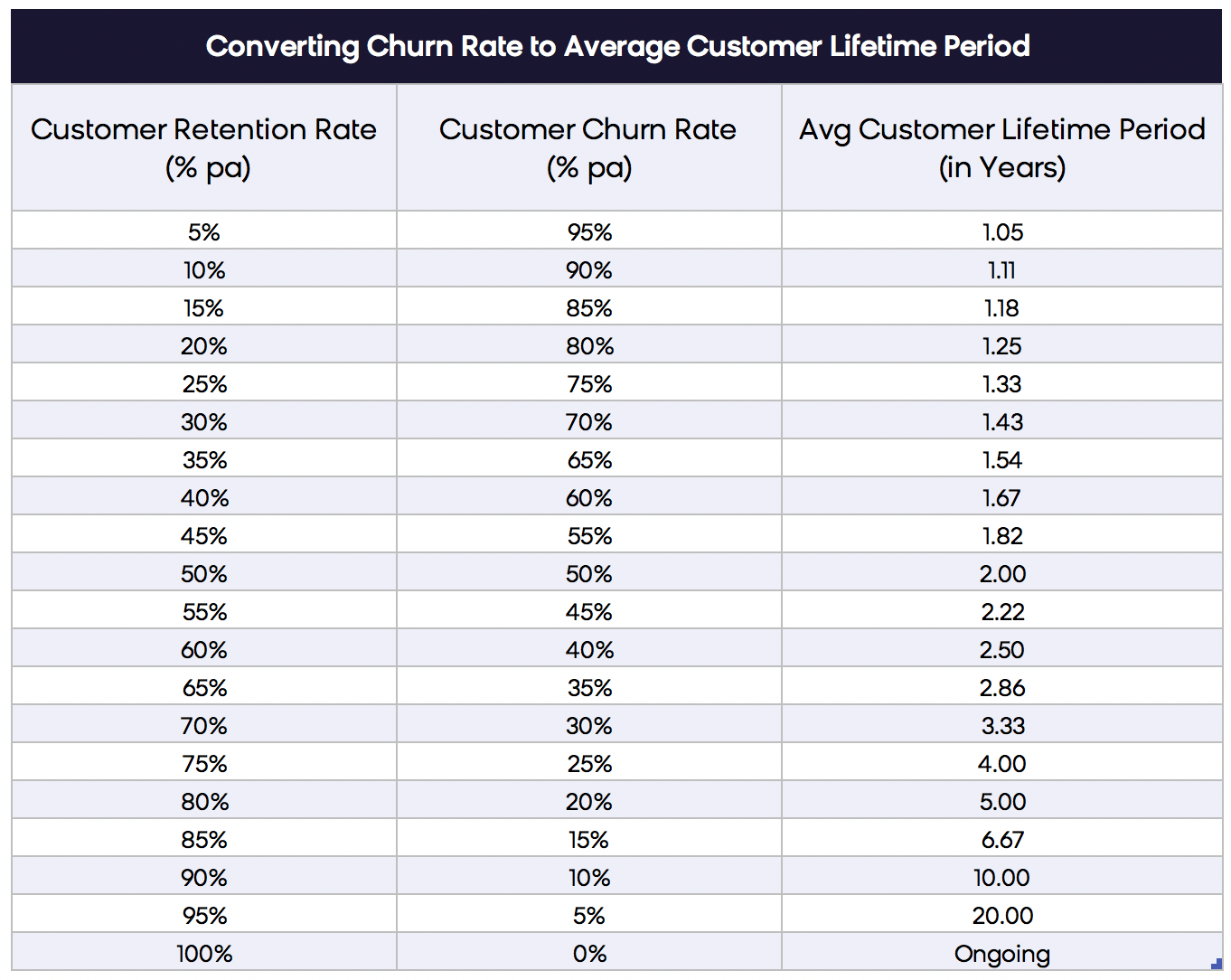

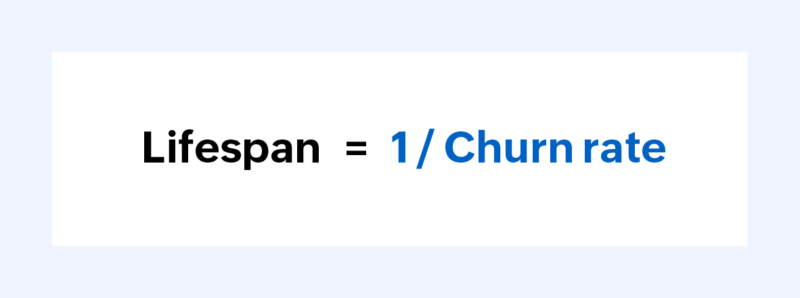

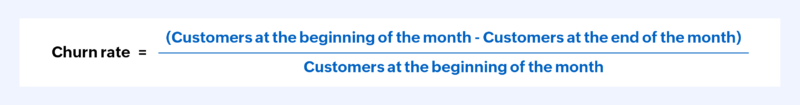

How to Calculate Customer Lifetime Period (1/Churn)

Now it's time to identify your customer lifetime period. To do so, you first need to find your churn rate, or the number of customers who stop doing business with a company during a given period.

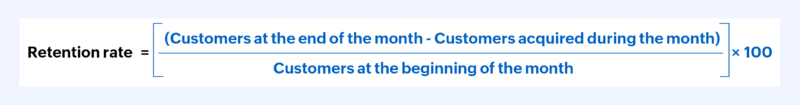

Churn Rate = (# of Customers at End of Time Period – # of Customers at Beginning of Time Period) / # of Customers at Beginning of Time Period

Once you calculate your churn rate percentage, you can determine your customer lifetime period.

You can plug your rate into the equation below or consult our corresponding chart to find your average customer lifetime period:

Customer Lifetime Period = 1/Churn Rate

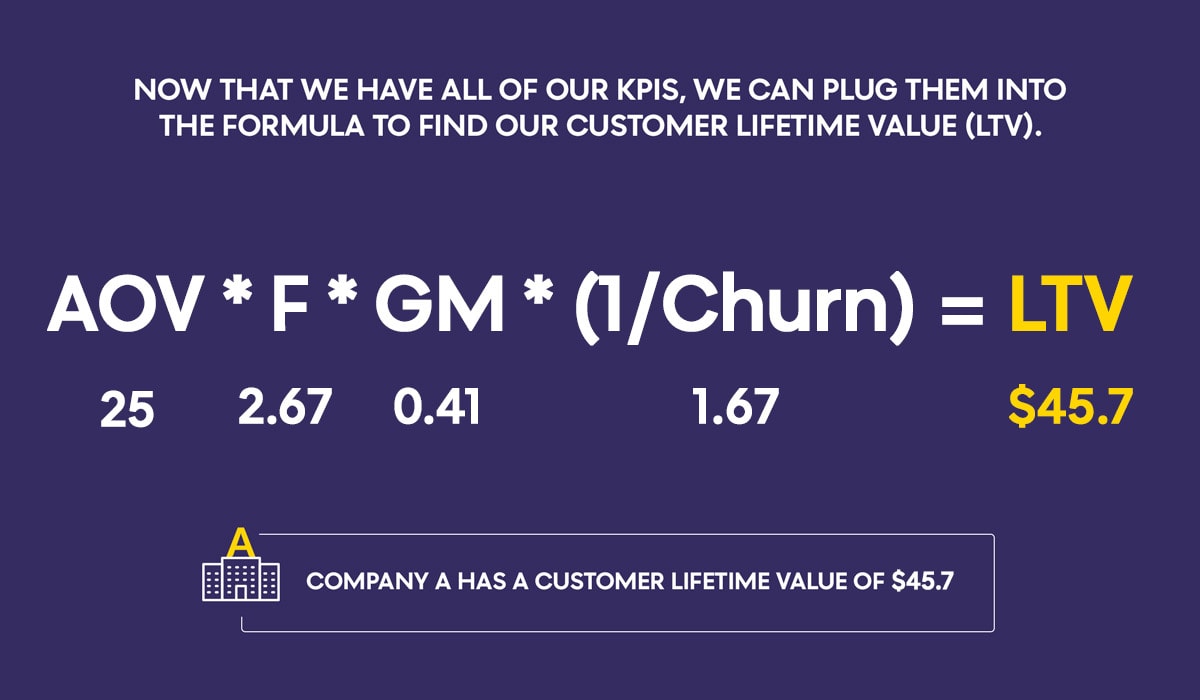

Plugging All Your KPIs Into the Customer Lifetime Value Model

Now that we have all the factors needed, we can plug them all into the customer lifetime value formula. Here's how the formula gets solved for our Company A example:

CUSTOMER LIFETIME VALUE ANALYSIS: COMPANY A

Average Order Value: $25 Average Purchase Frequency: 2.67 Gross Margin: 41% Churn Rate: 60% -> Customer Lifetime Period: 1,67

25 (AOV) * 2.67 (F) * 0.41 (GM) * (1/0.6) = $45.7 Customer Lifetime Value is $45.7 (per customer)

With our KPIs ready, it’s time to work on our customer value maximization. But which of your KPIs are strong, and which ones need improvement? What is a good profit margin? What is a good purchase frequency?

Compare your KPIs with industry benchmarks to determine which KPI needs the most improvement. It's important to take your industry into account because a good retail profit margin wouldn’t necessarily be a good food services profit margin.

Find current averages for your specific industry, then get to work on reaching — and surpassing — the standard metrics. Which one could improve customer value the most? Remember to focus on your weakest KPI first in order to maximize profit.

How To Improve Your Average Order Value (AOV)

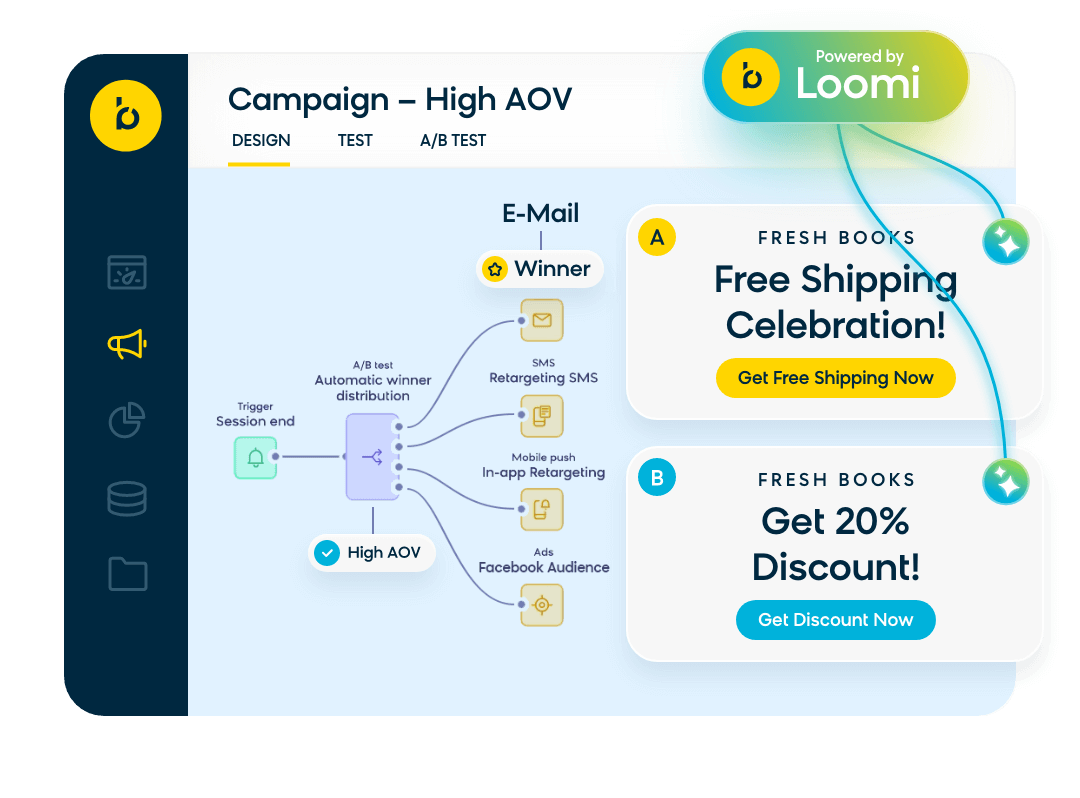

Having trouble getting your customers to increase their spending? Try these campaigns, which focus on providing incentives to increase AOV.

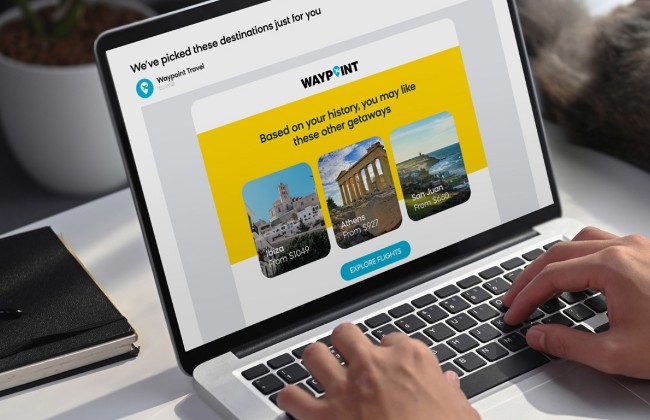

- Add personalized product recommendations to your site. The recommended products should be based on the ideal price point for each individual customer, thereby maximizing revenue.

- Send personalized newsletter campaigns to customers with dynamic product recommendations optimized for price.

- Set up triggered product recommendations for customers based on what they’ve added to their shopping cart, directly on your website.

- Send an abandoned cart email campaign with product recommendations based on what they’ve added to their shopping cart.

- Create product bundles that offer a discount for making a larger purchase. Bundle products that can be used together and recommend the bundle directly on the site, or through email, based off the user’s browsing and shopping cart history.

- Create a customer loyalty program incentivizing spending by adding loyalty points that customers can use for discounts and freebies.

How To Improve Your Purchase Frequency (F)

Maybe your customers spend a lot and you’re making a great margin, but they just don’t order very often. Try a few of these campaigns to maximize profit by nurturing long-term customer relationships.

- Communicate dynamically and send emails at the ideal time for each customer — which you can effortlessly achieve with a truly unified single customer view (SCV) .

- Test and analyze your communications to figure out if you’re communicating through the right channels. Does this particular customer respond better to email or SMS? Make sure target customers receive your message through their preferred channel.

- Segment your customers by their customer lifecycle stage , then reengage with existing customers who haven’t purchased recently and are in danger of churning.

- Use push notifications and banners to highlight time-sensitive deals based off a customer's browsing history.

- Use banners that trigger when a customer enters and exits the site to recommend personalized products or sales.

How To Improve Your Gross Margin (GM)

It doesn’t matter how valuable your orders are or how frequently they happen if your gross margin doesn’t allow for a profit from the sales. Here are some ideas for profit improvement through increasing the average revenue you make on the sale.

- Use an inventory manager to make better estimates for what you’ll need to resupply your stock for the next year.

- Sell higher margin products . This is an easy way to maximize profit margins, and you can adjust your recommendation models to exclude products that are hurting your margins.

- Use a price optimizer to automatically find the ideal selling price for each of your products based on where they are in the product lifecycle. This will keep you informed of any products with more room for profit maximization.

- Strive to sell leftover products from the previous year to reduce your cost of goods sold.

How To Improve Your Churn Rate (Customer Lifetime Period)

Churn is a very complex metric, and there are many factors that combine to cause a customer to churn from your business. To decrease churn, you need to mainly focus on customer loyalty. Create incredible shopping experiences and your customers will stay with you.

- Set up reengagement campaigns that offer incentives and value for repeat customers.

- Create personalized email campaigns that utilize historical data to speak directly to customers' wants and needs.

- Build a customer loyalty program encouraging spending with points and perks that loyal customers can use for discounts and freebies.

- Provide more ways for customers to engage with your brand by employing an omnichannel commerce strategy , offering seamless communication across channels and elevating customer experience.

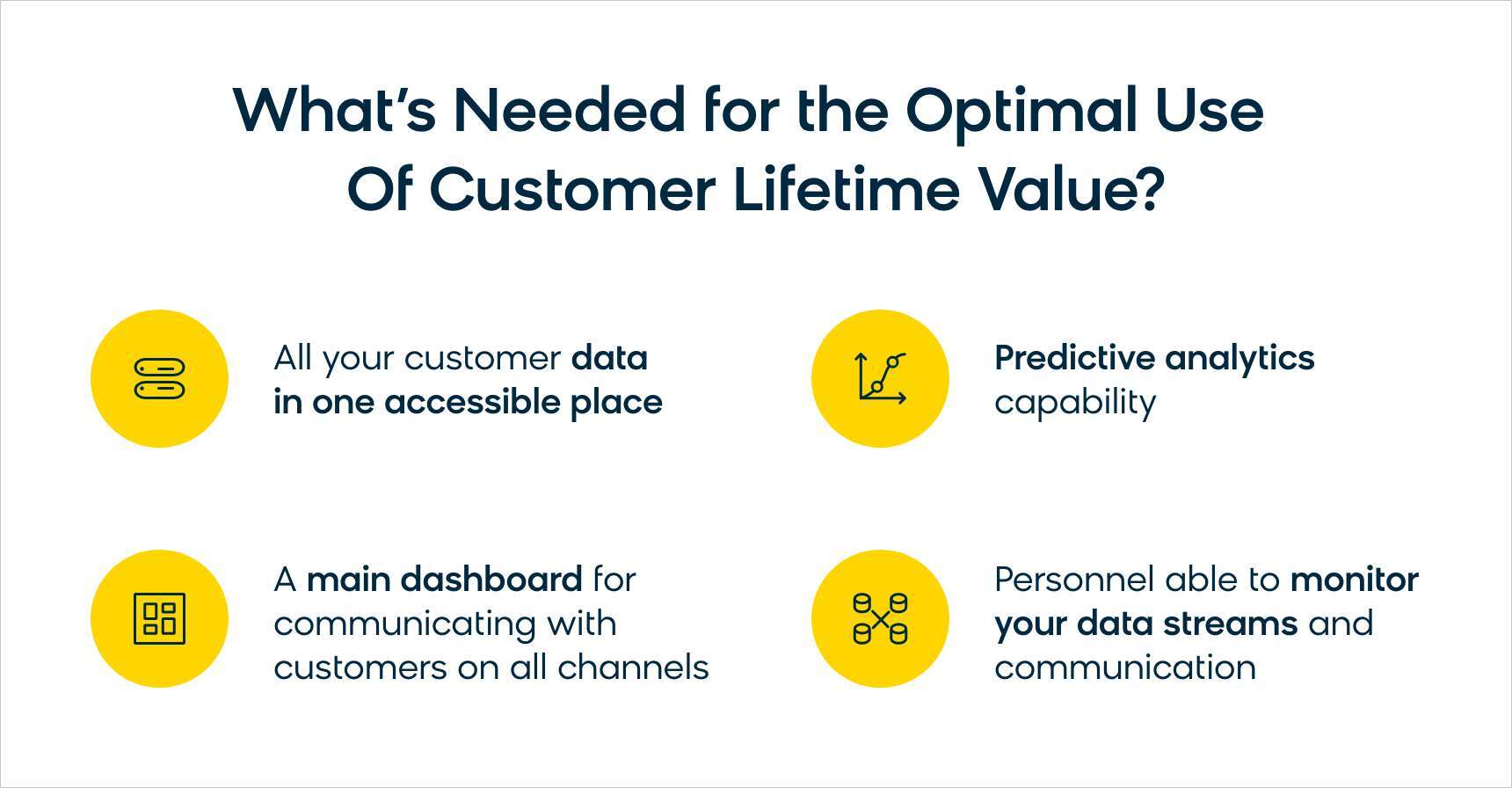

In order to get the most out of your CLV, there are some fundamental capabilities your business must have in your martech stack:

- Access to all your customer data in one place

- A unifying dashboard for communicating with customers on all channels

- Predictive analytics capabilities

- The ability to monitor your data streams and communication channels

Thankfully, marketing technology has evolved to meet all these needs and help businesses optimize their customer relationships. And with the rapid rise of artificial intelligence , your marketing team can easily organize, manage, and activate all your data.

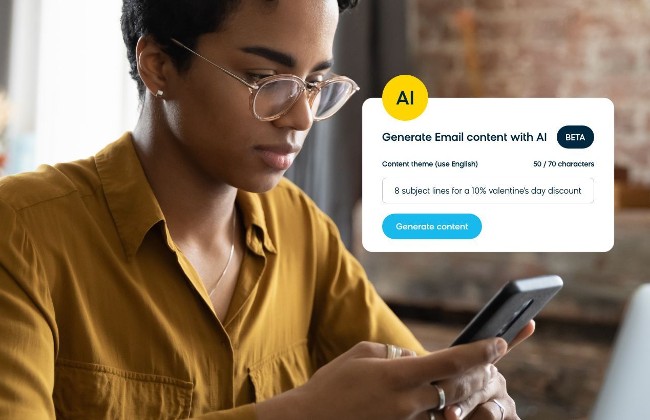

Harness AI To Streamline Your CLV Strategy

AI gives you the ability to handle complex data analysis, intelligent marketing automation, and generate content based on a customer’s past interactions with your brand — all without burdening your marketing team with a massive amount of data to comb through and rules to create for certain customer segments.

AI tools are quickly becoming an essential component of a successful ecommerce strategy, and adopting this revolutionary tech gives you all the capabilities necessary to calculate CLV and reach its full potential.

Read This Next: What Is Generative AI? Everything You Need To Know

Once all your fundamental features are in place, there are numerous actionable uses for your customer lifetime value formula. Using CLV effectively can improve customer acquisition and customer retention, prevent churn, help you plan your marketing budget, measure the performance of your ads in more detail, and much more.

Here are a few of our favorite ways to use CLV:

Acquire High-value Customers

Once you’ve performed a CLV analysis on all your current customers, you’ll know how much you should spend on acquisition . You’ll also know which acquisition channels produce the highest-value customers, and can repeat the strategies you used to find them.

Secure Future VIPs

With a solid data profile of what characteristics your VIPs have, you can use predictive analytics to get a strong idea of which new customers will likely be future VIPs , and focus on these customers with personalized messaging and offers. You can also make use of a look-alike model, as was mentioned in the first section, to target similar profiles.

Practice Value-tier Segmentation

As we touched on in the beginning of this blog, CLV makes it possible to identify which customers are VIPs and which are lower value. Once you separate your customers into different value tiers, you can see where your profits are really coming from. Look at your VIPs, specifically the 5% on top: How much of your total revenue is provided by just this 5% of your customer base?

With defined levels of customer value, you can then focus on converting loyal customers from their current tier to a higher one.

Prevent Churn

Now that you now know the average order value and purchase frequency of your customers, it's possible to craft personalized messaging and send the right offer to the right person at the right time.

Find Your Weak Point and Strengthen It

The insights gained from calculating your CLV will show you which of your company's KPIs need improvement — you’ll be able to see which area you most need to invest your time and money into.

Plan Your Yearly Advertising Budget

If you know your CLV, you can determine how much you can spend on customer acquisition while remaining profitable. This, in turn, allows you to accurately determine how much you’ll need to spend on advertising.

Measure Your Ad Performance

Without CLV, you’re inevitably defining a customer's value by the profit from their first purchase. But using that number to tell you which customer is more valuable is short-sighted.

Using that logic, if Jim spent $6 and Billy spent $15, Billy is the kind of customer you care about. But after measuring for CLV, you may find that Jim makes multiple purchases a month, while Billy is never seen again.

With your customer lifetime value model in mind, that scenario tells you everything you need to know about your ad spend. You know that the ads you invested in acquiring Jim can actually create more value than the ones that acquired Billy. Scale that with the data of all your customers, and you get the full picture of which ads are most effective for your business.

Understanding customer lifetime value is critical in its own right. But it is also one half of an important relationship for businesses to understand — the correlation between LTV and CAC.

Luckily, this correlation is easy to comprehend. Simply put, if you want to know if your ecommerce business is in good shape, your customer acquisition cost needs to be lower than your customer lifetime value .

What Is Customer Acquisition Cost and Why Does It Matter?

CAC measures how much a company spends to acquire new customers. It defines how much money is needed to convince a customer to buy a business' product or service.

It's easy to see why CAC is a crucial metric. You need to know how much your business can spend to acquire enough customers without spending more than the value those customers will bring to your company.

We've covered CAC before in our in-depth blog , but the metric boils down to a simple ratio:

CAC = All Costs Spent on Acquiring Customers in a Given Period / the # of Customers Acquired in That Same Period

Comparing this metric to your customer lifetime value is one of the most vital relationships a business needs to keep under control — it will tell you whether or not your business can succeed. If your CAC is higher than your customer lifetime value, then your business is in serious trouble.

The bottom line is you always want to reduce your CAC as much as possible, while also increasing your customer lifetime value.

Bloomreach clients like Desigual use customer lifetime value to drive critical KPIs for their business. We sat down with Ricardo Gómez, Global Head of 365 Consumer Marketing at Desigual, to understand how Desigual improves its CLV.

BLOOMREACH: What is more important for Desigual: lowering customer acquisition cost or increasing customer lifetime value?

RICARDO: For us, increasing CLV is what matters the most. Our CAC is quite low compared to the business our customers bring to the brand. The biggest acquisitions we do are done when our customers buy and we invite them to join our members program. This is why we have to ensure we’re driving traffic to the stores and increasing the CLV of our database.

BLOOMREACH : What have you found to be the most challenging part of increasing your customers’ lifetime value?

RICARDO: Our CLV is very closely linked to the overall experience we offer and to the quality of the products we sell. Therefore, we largely increase our CLV by making sure there are no pain points — or if there are, that we address them quickly. We also do not send campaigns for products that have had or could have any quality issues.

Omnichannel campaigns are important too; we run several campaigns to move clients who shop offline only to buy online as well. This has a great impact for us.

Finally, we found a correlation between lowered customer value and lower-quality purchased products, so we stopped communications around those items and began to remove the garments we believed to be below our standards.

With so many benefits and insights to be gained with customer lifetime value models, it's hard to believe that not every business utilizes the formula to its full potential. Here's some of the biggest roadblocks that companies face when trying to take advantage of CLV.

Many Established Companies Keep Their Data in Different Silos

As companies grow, it’s common for their data to become fractured. Different pieces are kept in separate places, and often accessed by different software, as each department pursues its own goals.

This makes collaboration between departments and proper business analysis difficult, commonly resulting in less trustworthy data. If the same information is stored in two places without an effective timestamp to show which is more current, data silos are likely hindering your company’s efforts.

These data silos are detrimental to calculating CLV. Without up-to-date data in one unified and organized place, you aren’t making use of the wealth of information you’re collecting, and your calculations are doomed to be inaccurate. Siloed data is the biggest issue facing modern businesses looking to scale their marketing, and it’s why only 24% of companies believe they are monitoring CLV effectively.

Read This Next: A Single Customer view: Everything you Need To Know

Customers Now Make Purchases From Multiple Devices

With the same customer making purchases from their computer, phone, and tablet, many companies have difficulty combining all their data streams into one measurable whole. Attempting to extract meaningful insight from these separate streams can be both expensive and inefficient. Companies without a main dashboard synthesizing all their customer data in one place will find themselves increasingly left behind.

Companies Lack In-House Skills and AI Technology

Many companies who have not yet begun tracking CLV are dealing with a lack of qualified personnel to follow the data and produce actionable plans based on it. This, coupled with the need for an in-house dashboard for that qualified personnel to use, creates a strong barrier to entry.

Luckily, the rapid evolution of marketing AI tools can help businesses organize and manage all their data without overwhelming marketing teams with tedious tasks.

Today’s marketers, data scientists, executives, and business professionals now have a powerful tool to help them determine and utilize customer lifetime value: a customer data platform. A CDP serves as a central hub for all your customer data, collecting it into individual profiles for each customer.

CDP capabilities are essential for calculating CLV, which is why Bloomreach Engagement offers all the key components you need to calculate customer lifetime value, apply it to your marketing efforts, and so much more.

Bloomreach Engagement is an all-in-one platform that helps marketers create personalized campaigns for every customer. Our solution combines the power of a customer data platform with the speed and scale of AI, helping you reach customers where and when it matters most.

It’s designed to impact every phase of your customer journey, providing a single marketing view of real-time customer data, campaign automation across 13 channels, and analytics that make it easy to grow your brand and your revenue — fast.

Learn more about the importance of understanding customer lifetime value by checking our CAC/LTV calculator . If you're looking to reduce your customer acquisition costs while simultaneously increasing your customer lifetime value, our calculator will give you a precise calculation to begin your pursuits.

Found this useful? Subscribe to our newsletter or share it.

Samuel Kellett

Head of Content

Sam leads the content team at Bloomreach, where he manages the production of ecommerce articles and case studies, as well as the content for webinars and events. With his background in screenwriting and theatre, Sam brings a unique perspective to his role as Bloomreach’s head of content. Sam’s passion is storytelling: he is constantly exploring new and creative ways to explain complex topics.

Discover more content like this

Building Unbreakable Customer Loyalty: How Bloomreach Engagement Empowers Businesses With AI

By Petr Václavek

Making the Most of AI in Omnichannel Marketing

By Donna-Marie Bohan

Top Use Cases That Prove AI Is Changing Ecommerce

By Kait Spong

Subscribe for Insights

Stay ahead in ecommerce and ai with the edge, a bi‑weekly newsletter featuring the latest insights on ecommerce topics, trends, and innovations. subscribe to get our hot takes delivered to straight your inbox..

By submitting this form you consent to Bloomreach processing your data and contacting you to fulfill your request. For more information on how we are committed to protecting and respecting your privacy, please review our Privacy policy.

I’d like updates on Bloomreach news, events, and services (see Privacy Policy ).

We'd like to give you some information on how we process your data

By submitting this form, you consent to Bloomreach processing your data and contacting you to fulfill your request. For more information on how we are committed to protecting and respecting your privacy, please review our Privacy Policy .

- Perspectives

- Best Practices

- Inside Amplitude

- Customer Stories

- Contributors

What is Customer Lifetime Value (CLV)? Definition & Formulas

Unlock the secrets of your most lucrative users through customer lifetime value calculations.

At the surface, it’s a simple idea: Customer lifetime value (CLV) is the monetary worth of a customer to your business for the length of their patronage. However, digging deeper into CLV reveals layers of complexity that speak to how essential the concept is to the continued success of your product.

A customer’s lifetime value is tied both to a customer’s satisfaction with a product and a company’s ability to retain frequent users. Calculating the lifetime value of a customer serves as an evaluation of your current sales and efforts. By establishing this baseline, you can plan for improvements in the customer journey that lead to cost savings and revenue increases down the line.

- Customer lifetime value (CLV) is the measurement of how a customer’s worth for as long as they do business with a company.

- Measuring CLV helps fuel marketing efforts, enhance audience targeting, and reduce churn.

- Personalization and friction reduction measures can improve CLV.

Why Customer Lifetime Value Matters to Your Business

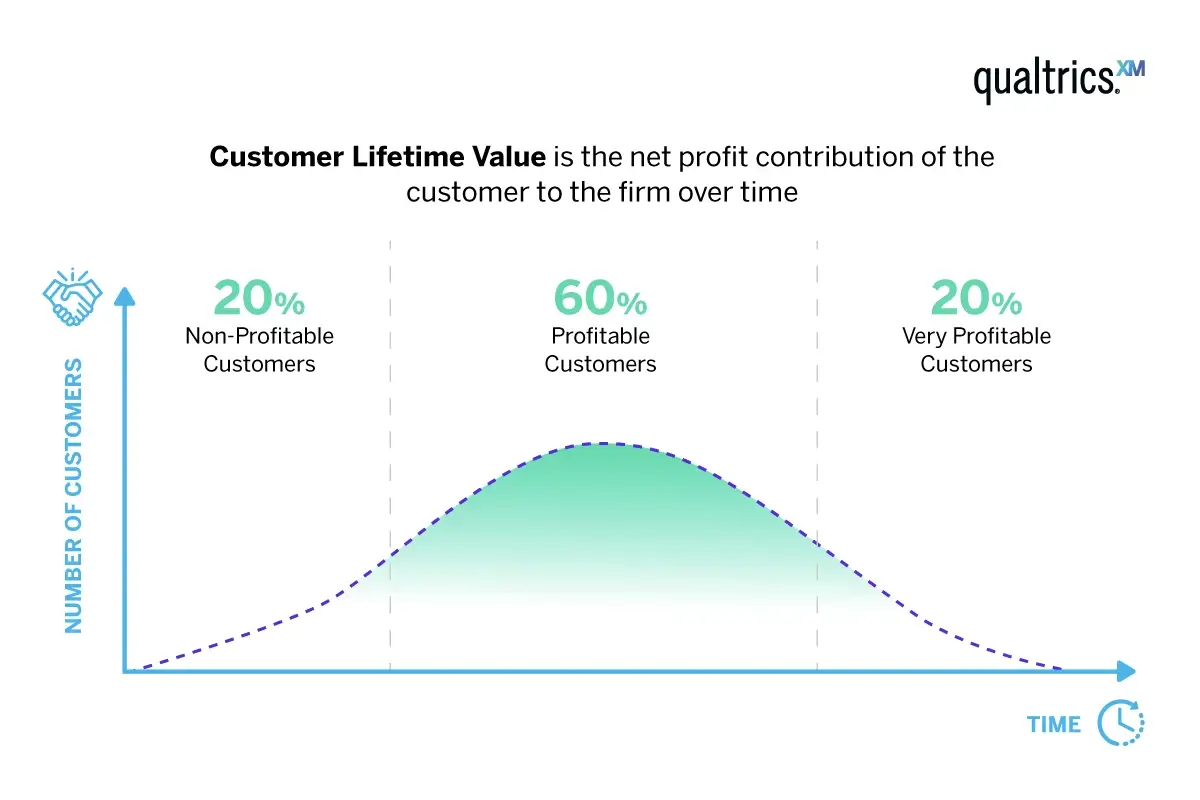

If every one of your customers behaved in the same manner and spent the same amount of money at all times, their value to your business would be the same. This, of course, is not the case, meaning a certain percentage of your customers are responsible for more of your revenue than others.

You can use CLV to calculate how much existing customers stand to spend on your product. By doing so, you can better project how much each new acquisition is likely to invest over the course of their life cycle. Additionally, the ability to identify high CLV customer behaviors is vital in understanding how to encourage said behaviors in lower CLV groups.

Real-World Applications of Customer Lifetime Value

Analyzing marketing campaign success.

Marketers can use this figure to measure marketing campaign successes. Imagine you discover that the average customer spends $400 on your product over the course of their life cycle. Sales-wise, this number may be acceptable or even exciting. However, if the marketing costs to convert each customer averages around $390, you’ll need to go back to the drawing board to determine how to reduce acquisition costs or boost sales.

A dream marketing campaign would bring prospects into the fold in droves at the cost of only pennies. This simply isn’t realistic. However, quantifying CLV will help you determine the upper limits of acceptable acquisition costs or identify which marketing strategies are wildly successful compared to an acquisition’s assumed revenue.

Improving Audience Targeting

Calculating the lifetime value of your customers helps identify how the most lucrative ones use your product. Studying customers with high CLV will likely reveal a segment of users spending money on your product over time. You may discover that your highest value customers are those who spend a great deal in a short time or ones who spend less money but have used your product steadily for years.

The money a customer spends on your product isn’t the only way to measure value. Your product analytics are likely to reveal that users who are more engaged with your product are more likely to leave good reviews, share experiences on social media, or refer your product directly to peers. This customer may not spend heavily on your product, but they are invaluable as vocal advocates.

Opportunities for upselling or long-term renewal give you a more complete picture of the value of your customers. Perhaps your video conferencing platform is only used by a single team at a large company on a trial basis. The team may not be spending an impressive sum currently, but the potential for widespread adoption and future investment in your product make them highly valuable customers.

Identifying high-CLV customers should reveal similarities in demographics and behaviors. You can build campaigns or messaging focused on targeting certain demos or encouraging specific behaviors to convert lower-value customers into bigger spenders.

For example, imagine your research reveals customers who use your wish list feature at least three times are 50% more likely to join the upper echelons of high-value customers. Your next marketing campaign should target existing low-engagement customers with messaging highlighting the benefits of your wish list feature.

Identifying Points of Frustration

Alternatively, studying your lower-CLV customers may reveal patterns into what obstacles hinder your user experience. Research has shown that customers are willing to spend as much as 16% more for products and services that offer a great customer experience .

Parsing through the analytics data for your lower-value customers might reveal friction at the critical sign-up event for your product’s premium feature. Removing the causes of churn or disengagement helps your users develop a better relationship with the product itself—and a willingness to spend more for that relationship.

Boosted Revenue Through Observation

Simply keeping an eye on your product’s CLV may prove to drive revenue in and of itself. A 2018 Criteo survey determined 81% of marketers believed that keeping tabs on their CLV resulted in increased sales.

It’s possible that the benefits are the result of the Hawthorne effect in action and that emphasis on tracking CLV resulted in greater effort from the marketers themselves. Either way, you’re not likely to quibble over the true cause of added revenue as you count your extra money.

How to Calculate Customer Lifetime Value

Customer lifetime value analysis has undeniable value, but how do you do it? Different variations of the CLV formula exist, but distilled down to its purest form, it looks like this:

CLV = Average Customer Lifespan x Customer Value

Firstly, you’ll need a sense of your average customer lifespan . This figure is usually expressed in years, though products with higher churn rates may prefer to measure it in months.

Determining customer value (CV) requires a bit more math. The calculation for customer value is:

CV = Average Purchase Frequency x Average Purchase Value

Both of the expressions contained within this equation are exactly what they sound like. Average purchase frequency is the mean number of times a customer spends money on or within your product over the course of a predetermined time period. Average purchase value is the mean monetary cost of these purchases over that same time period.

CV and CLV have one one key difference: CV calculates the value for a limited time frame, while CLV determines the value of a customer from “hello” to “goodbye.” Take customers who buy from your hypothetical ecommerce website. The average customer makes 100 purchases a year, with each purchase clocking in at $10 a transaction. This means your CV is $1,000.

Your most dedicated customers have been purchasing from your business since its inception 10 years ago. At $1,000 a year, their CLV is $10,000 and growing. On average, however, customers tend to churn after three years, making your average CLV $3,000.

How (and Why) to Calculate Customer Acquisition Cost (CAC)

Measuring CLV in a vacuum doesn’t factor in how much money it takes to acquire these customers in the first place. You may be excited to discover that your average customer brings in $3,000 on average, but you’re bound to be less enthused if it costs $3,300 to bring them into the fold.

Finding your customer acquisition cost (CAC) helps define how much it takes to bring a customer into the fold. It’s a simple calculation:

CAC = Total Acquisition Costs / Number of Acquisitions

Both acquisition costs and the number of acquisitions should be pulled from the same time span as that of your CV measurement for an apples-to-apples comparison of cost to value. Subtracting your CAC from your CLV will give you a more realistic figure with which to determine both the success of your marketing campaigns and revenue projections.

Data-Driven Best Practices for Improving Your CLV

Even after factoring in CAC, your average customer lifetime value may fall within acceptable parameters by your own standards. However, even great CLV figures can be improved by focusing on the two components that the metric is built on: customer value and customer retention.

Increase Your Customer Value Through Personalization

Eighty percent of customers are more likely to buy from brands that personalize user experience . One of the most powerful methods of personalization is custom recommendations. Not only do customers view products with personalization in higher regard, but recommendations also provide opportunities for upselling. Amazon’s tried-and-true recommendation efforts account for 35% of the company’s total product sales.

Luckily, Amplitude acts as a personalization engine. It lets you segment your customers by past behavior and build campaigns focused on their shared interests. If a group of customers buys new furnace filters every three months like clockwork, you might send a blast of emails to this group a few weeks early in anticipation of their needs.

Recommendations aren’t limited by past behaviors. Amplitude Recommend empowers you to build cohorts based on the likelihood of customers behaving a certain way in the future. Recommendations can be directed to customers likely to purchase new products based on a combination of historical and behavioral data, statistical modeling, and computer learning. A prediction may suggest that a customer who recently purchased a dog toy is likely to need dog food in the near future.

Increase Your Customer Retention by Minimizing Friction

Issues with the customer experience often stem from issues with the UI. Many of these issues can be identified through direct customer feedback or routine usability testing. In fact, it’s been suggested that as few as five users in a test setting can identify 85% of usability issues .

Amplitude provides data-backed ways of identifying and rectifying points of friction. For instance, a review of the analytics for your music streaming service may reveal that most customers on a free trial of your product churn within a day of signing up. You further identify that 50% of free trial users never even stream a single song.

Running predictions through Amplitude Recommend suggests that users who download a song within the first day of signing up for a trial are 60% more likely to convert at the end of it. You and your product development team work to build a new workflow that focuses on directly guiding users to their first download.

However, switching all of your customers to the new flow without testing it could create unforeseen disruptions to your customer journey. Instead, you use Amplitude to create a segment of users with a low likelihood of conversion and send them through the new workflow, comparing conversion rates to those in a similar segment who were kept in your existing process.

Improve Your Customer Lifetime Value

Users are attracted to quality products. Personalization and retention efforts will fall flat if customers aren’t engaged with a product that fulfills their needs in a way no other product can. Bake value into your product or new feature at the earliest stages of development so that later efforts to increase CLV are built on the strong foundation of a customer-pleasing product.

- Experience is everything: Here’s how to get it right , PwC.

- Hawthorne Effect , Investopedia.

- How retailers can keep up with consumers , McKinsey.

- New Epsilon research indicates 80% of consumers are more likely to make a purchase when brands offer personalized experiences , Epsilon.

- The state of Customer Lifetime Value report , Criteo.

- Why you only need to test with five users (explained) , MeasuringU.

Learn more about growing customer lifetime value with the Mastering Retention playbook .

About the Author

More best practices.

- Sales CRM Software

- Application Portals

- Call Center CRM

- Mobile CRM App

- Omnichannel Communication CONVERSE

- Reporting Dashboard SIERA

- Lead Management System

- Opportunity Management

- Sales Process Automation

- Sales Tracking

- Door-to-Door Sales

- Remote Team Management

- Field Sales CRM

- Merchant Onboarding App

- App UI/UX Customizer CASA

- Outside Sales CRM

- Field Force Automation

- Collections Management

- Field Force Tracking

- Event Campaign Management

- Bancassurance Management

- Marketing Automation

- Chatbot - Website

- Chatbot - WhatsApp

- Landing Pages

- Email Campaigns

- Lead Capture Automation

- Lead Engagement

- BTL Marketing Automation

- Advanced Marketing Analytics

- Hospitals and Clinics

- Hospice and Palliative Care

- Fertility Clinics

- Dental Care

- Diagnostics Labs

- ACQUISITION