Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Multiple Linear Regression | A Quick Guide (Examples)

Published on February 20, 2020 by Rebecca Bevans . Revised on June 22, 2023.

Regression models are used to describe relationships between variables by fitting a line to the observed data. Regression allows you to estimate how a dependent variable changes as the independent variable(s) change.

Multiple linear regression is used to estimate the relationship between two or more independent variables and one dependent variable . You can use multiple linear regression when you want to know:

- How strong the relationship is between two or more independent variables and one dependent variable (e.g. how rainfall, temperature, and amount of fertilizer added affect crop growth).

- The value of the dependent variable at a certain value of the independent variables (e.g. the expected yield of a crop at certain levels of rainfall, temperature, and fertilizer addition).

Table of contents

Assumptions of multiple linear regression, how to perform a multiple linear regression, interpreting the results, presenting the results, other interesting articles, frequently asked questions about multiple linear regression.

Multiple linear regression makes all of the same assumptions as simple linear regression :

Homogeneity of variance (homoscedasticity) : the size of the error in our prediction doesn’t change significantly across the values of the independent variable.

Independence of observations : the observations in the dataset were collected using statistically valid sampling methods , and there are no hidden relationships among variables.

In multiple linear regression, it is possible that some of the independent variables are actually correlated with one another, so it is important to check these before developing the regression model. If two independent variables are too highly correlated (r2 > ~0.6), then only one of them should be used in the regression model.

Normality : The data follows a normal distribution .

Linearity : the line of best fit through the data points is a straight line, rather than a curve or some sort of grouping factor.

Here's why students love Scribbr's proofreading services

Discover proofreading & editing

Multiple linear regression formula

The formula for a multiple linear regression is:

- … = do the same for however many independent variables you are testing

To find the best-fit line for each independent variable, multiple linear regression calculates three things:

- The regression coefficients that lead to the smallest overall model error.

- The t statistic of the overall model.

- The associated p value (how likely it is that the t statistic would have occurred by chance if the null hypothesis of no relationship between the independent and dependent variables was true).

It then calculates the t statistic and p value for each regression coefficient in the model.

Multiple linear regression in R

While it is possible to do multiple linear regression by hand, it is much more commonly done via statistical software. We are going to use R for our examples because it is free, powerful, and widely available. Download the sample dataset to try it yourself.

Dataset for multiple linear regression (.csv)

Load the heart.data dataset into your R environment and run the following code:

This code takes the data set heart.data and calculates the effect that the independent variables biking and smoking have on the dependent variable heart disease using the equation for the linear model: lm() .

Learn more by following the full step-by-step guide to linear regression in R .

To view the results of the model, you can use the summary() function:

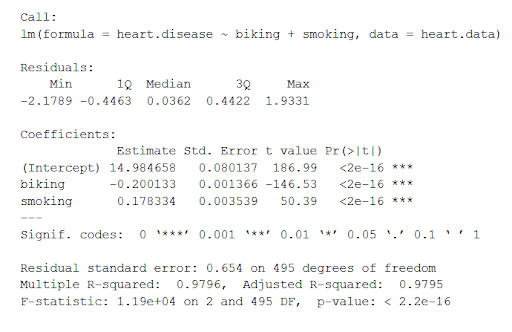

This function takes the most important parameters from the linear model and puts them into a table that looks like this:

The summary first prints out the formula (‘Call’), then the model residuals (‘Residuals’). If the residuals are roughly centered around zero and with similar spread on either side, as these do ( median 0.03, and min and max around -2 and 2) then the model probably fits the assumption of heteroscedasticity.

Next are the regression coefficients of the model (‘Coefficients’). Row 1 of the coefficients table is labeled (Intercept) – this is the y-intercept of the regression equation. It’s helpful to know the estimated intercept in order to plug it into the regression equation and predict values of the dependent variable:

The most important things to note in this output table are the next two tables – the estimates for the independent variables.

The Estimate column is the estimated effect , also called the regression coefficient or r 2 value. The estimates in the table tell us that for every one percent increase in biking to work there is an associated 0.2 percent decrease in heart disease, and that for every one percent increase in smoking there is an associated .17 percent increase in heart disease.

The Std.error column displays the standard error of the estimate. This number shows how much variation there is around the estimates of the regression coefficient.

The t value column displays the test statistic . Unless otherwise specified, the test statistic used in linear regression is the t value from a two-sided t test . The larger the test statistic, the less likely it is that the results occurred by chance.

The Pr( > | t | ) column shows the p value . This shows how likely the calculated t value would have occurred by chance if the null hypothesis of no effect of the parameter were true.

Because these values are so low ( p < 0.001 in both cases), we can reject the null hypothesis and conclude that both biking to work and smoking both likely influence rates of heart disease.

When reporting your results, include the estimated effect (i.e. the regression coefficient), the standard error of the estimate, and the p value. You should also interpret your numbers to make it clear to your readers what the regression coefficient means.

Visualizing the results in a graph

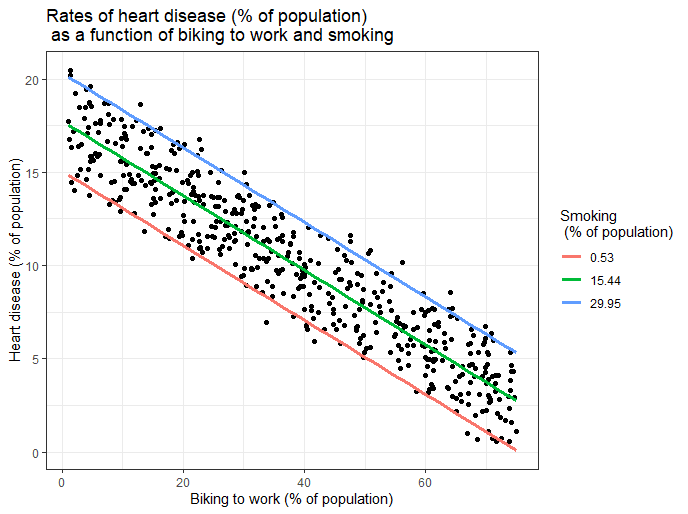

It can also be helpful to include a graph with your results. Multiple linear regression is somewhat more complicated than simple linear regression, because there are more parameters than will fit on a two-dimensional plot.

However, there are ways to display your results that include the effects of multiple independent variables on the dependent variable, even though only one independent variable can actually be plotted on the x-axis.

Here, we have calculated the predicted values of the dependent variable (heart disease) across the full range of observed values for the percentage of people biking to work.

To include the effect of smoking on the independent variable, we calculated these predicted values while holding smoking constant at the minimum, mean , and maximum observed rates of smoking.

Prevent plagiarism. Run a free check.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Chi square test of independence

- Statistical power

- Descriptive statistics

- Degrees of freedom

- Pearson correlation

- Null hypothesis

Methodology

- Double-blind study

- Case-control study

- Research ethics

- Data collection

- Hypothesis testing

- Structured interviews

Research bias

- Hawthorne effect

- Unconscious bias

- Recall bias

- Halo effect

- Self-serving bias

- Information bias

A regression model is a statistical model that estimates the relationship between one dependent variable and one or more independent variables using a line (or a plane in the case of two or more independent variables).

A regression model can be used when the dependent variable is quantitative, except in the case of logistic regression, where the dependent variable is binary.

Multiple linear regression is a regression model that estimates the relationship between a quantitative dependent variable and two or more independent variables using a straight line.

Linear regression most often uses mean-square error (MSE) to calculate the error of the model. MSE is calculated by:

- measuring the distance of the observed y-values from the predicted y-values at each value of x;

- squaring each of these distances;

- calculating the mean of each of the squared distances.

Linear regression fits a line to the data by finding the regression coefficient that results in the smallest MSE.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

Bevans, R. (2023, June 22). Multiple Linear Regression | A Quick Guide (Examples). Scribbr. Retrieved April 2, 2024, from https://www.scribbr.com/statistics/multiple-linear-regression/

Is this article helpful?

Rebecca Bevans

Other students also liked, simple linear regression | an easy introduction & examples, an introduction to t tests | definitions, formula and examples, types of variables in research & statistics | examples, what is your plagiarism score.

Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10 .

- Payment Plans

- Product List

- Partnerships

- Try Free Trial

- Study Packages

- Levels I, II & III Lifetime Package

- Video Lessons

- Study Notes

- Practice Questions

- Levels II & III Lifetime Package

- About the Exam

- About your Instructor

- Part I Study Packages

- Parts I & II Packages

- Part I & Part II Lifetime Package

- Part II Study Packages

- Exams P & FM Lifetime Package

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

- About your Instructors

- EA Practice Questions

- Data Sufficiency Questions

- Integrated Reasoning Questions

Hypothesis Tests and Confidence Intervals in Multiple Regression

After completing this reading you should be able to:

- Construct, apply, and interpret hypothesis tests and confidence intervals for a single coefficient in a multiple regression.

- Construct, apply, and interpret joint hypothesis tests and confidence intervals for multiple coefficients in a multiple regression.

- Interpret the \(F\)-statistic.

- Interpret tests of a single restriction involving multiple coefficients.

- Interpret confidence sets for multiple coefficients.

- Identify examples of omitted variable bias in multiple regressions.

- Interpret the \({ R }^{ 2 }\) and adjusted \({ R }^{ 2 }\) in a multiple regression.

Hypothesis Tests and Confidence Intervals for a Single Coefficient

This section is about the calculation of the standard error, hypotheses testing, and confidence interval construction for a single regression in a multiple regression equation.

Introduction

In a previous chapter, we looked at simple linear regression where we deal with just one regressor (independent variable). The response (dependent variable) is assumed to be affected by just one independent variable. M ultiple regression, on the other hand , simultaneously considers the influence of multiple explanatory variables on a response variable Y. We may want to establish the confidence interval of one of the independent variables. We may want to evaluate whether any particular independent variable has a significant effect on the dependent variable. Finally, We may also want to establish whether the independent variables as a group have a significant effect on the dependent variable. In this chapter, we delve into ways all this can be achieved.

Hypothesis Tests for a single coefficient

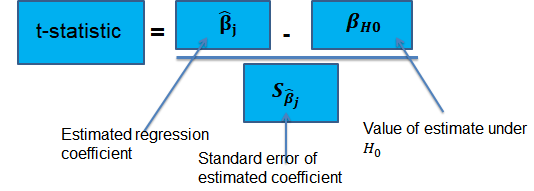

Suppose that we are testing the hypothesis that the true coefficient \({ \beta }_{ j }\) on the \(j\)th regressor takes on some specific value \({ \beta }_{ j,0 }\). Let the alternative hypothesis be two-sided. Therefore, the following is the mathematical expression of the two hypotheses:

$$ { H }_{ 0 }:{ \beta }_{ j }={ \beta }_{ j,0 }\quad vs.\quad { H }_{ 1 }:{ \beta }_{ j }\neq { \beta }_{ j,0 } $$

This expression represents the two-sided alternative. The following are the steps to follow while testing the null hypothesis:

- Computing the coefficient’s standard error.

$$ p-value=2\Phi \left( -|{ t }^{ act }| \right) $$

- Also, the \(t\)-statistic can be compared to the critical value corresponding to the significance level that is desired for the test.

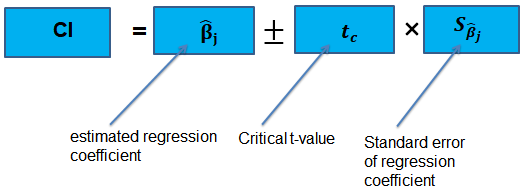

Confidence Intervals for a Single Coefficient

The confidence interval for a regression coefficient in multiple regression is calculated and interpreted the same way as it is in simple linear regression.

The t-statistic has n – k – 1 degrees of freedom where k = number of independents

Supposing that an interval contains the true value of \({ \beta }_{ j }\) with a probability of 95%. This is simply the 95% two-sided confidence interval for \({ \beta }_{ j }\). The implication here is that the true value of \({ \beta }_{ j }\) is contained in 95% of all possible randomly drawn variables.

Alternatively, the 95% two-sided confidence interval for \({ \beta }_{ j }\) is the set of values that are impossible to reject when a two-sided hypothesis test of 5% is applied. Therefore, with a large sample size:

$$ 95\%\quad confidence\quad interval\quad for\quad { \beta }_{ j }=\left[ { \hat { \beta } }_{ j }-1.96SE\left( { \hat { \beta } }_{ j } \right) ,{ \hat { \beta } }_{ j }+1.96SE\left( { \hat { \beta } }_{ j } \right) \right] $$

Tests of Joint Hypotheses

In this section, we consider the formulation of the joint hypotheses on multiple regression coefficients. We will further study the application of an \(F\)-statistic in their testing.

Hypotheses Testing on Two or More Coefficients

Joint null hypothesis.

In multiple regression, we canno t test the null hypothesis that all slope coefficients are equal 0 based on t -tests that each individual slope coefficient equals 0. Why? individual t-tests do not account for the effects of interactions among the independent variables.

For this reason, we conduct the F-test which uses the F-statistic . The F-test tests the null hypothesis that all of the slope coefficients in the multiple regression model are jointly equal to 0, .i.e.,

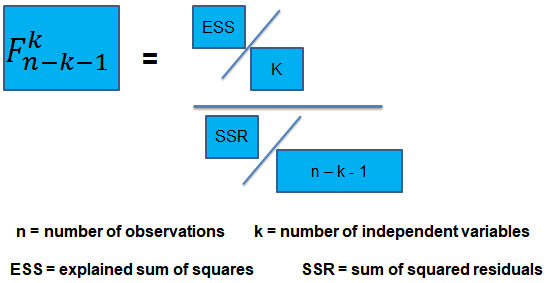

\(F\)-Statistic

The F-statistic, which is always a one-tailed test , is calculated as:

To determine whether at least one of the coefficients is statistically significant, the calculated F-statistic is compared with the one-tailed critical F-value, at the appropriate level of significance.

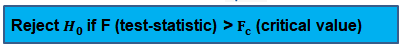

Decision rule:

Rejection of the null hypothesis at a stated level of significance indicates that at least one of the coefficients is significantly different than zero, i.e, at least one of the independent variables in the regression model makes a significant contribution to the dependent variable.

An analyst runs a regression of monthly value-stock returns on four independent variables over 48 months.

The total sum of squares for the regression is 360, and the sum of squared errors is 120.

Test the null hypothesis at the 5% significance level (95% confidence) that all the four independent variables are equal to zero.

\({ H }_{ 0 }:{ \beta }_{ 1 }=0,{ \beta }_{ 2 }=0,\dots ,{ \beta }_{ 4 }=0 \)

\({ H }_{ 1 }:{ \beta }_{ j }\neq 0\) (at least one j is not equal to zero, j=1,2… k )

ESS = TSS – SSR = 360 – 120 = 240

The calculated test statistic = (ESS/k)/(SSR/(n-k-1))

=(240/4)/(120/43) = 21.5

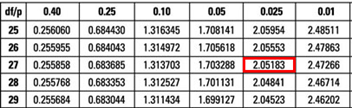

\({ F }_{ 43 }^{ 4 }\) is approximately 2.44 at 5% significance level.

Decision: Reject H 0 .

Conclusion: at least one of the 4 independents is significantly different than zero.

Omitted Variable Bias in Multiple Regression

This is the bias in the OLS estimator arising when at least one included regressor gets collaborated with an omitted variable. The following conditions must be satisfied for an omitted variable bias to occur:

- There must be a correlation between at least one of the included regressors and the omitted variable.

- The dependent variable \(Y\) must be determined by the omitted variable.

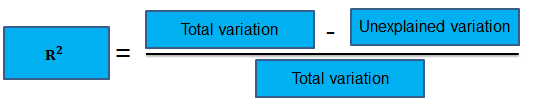

Practical Interpretation of the \({ R }^{ 2 }\) and the adjusted \({ R }^{ 2 }\), \({ \bar { R } }^{ 2 }\)

To determine the accuracy within which the OLS regression line fits the data, we apply the coefficient of determination and the regression’s standard error .

The coefficient of determination, represented by \({ R }^{ 2 }\), is a measure of the “goodness of fit” of the regression. It is interpreted as the percentage of variation in the dependent variable explained by the independent variables

\({ R }^{ 2 }\) is not a reliable indicator of the explanatory power of a multiple regression model.Why? \({ R }^{ 2 }\) almost always increases as new independent variables are added to the model, even if the marginal contribution of the new variable is not statistically significant. Thus, a high \({ R }^{ 2 }\) may reflect the impact of a large set of independents rather than how well the set explains the dependent.This problem is solved by the use of the adjusted \({ R }^{ 2 }\) (extensively covered in chapter 8)

The following are the factors to watch out when guarding against applying the \({ R }^{ 2 }\) or the \({ \bar { R } }^{ 2 }\):

- An added variable doesn’t have to be statistically significant just because the \({ R }^{ 2 }\) or the \({ \bar { R } }^{ 2 }\) has increased.

- It is not always true that the regressors are a true cause of the dependent variable, just because there is a high \({ R }^{ 2 }\) or \({ \bar { R } }^{ 2 }\).

- It is not necessary that there is no omitted variable bias just because we have a high \({ R }^{ 2 }\) or \({ \bar { R } }^{ 2 }\).

- It is not necessarily true that we have the most appropriate set of regressors just because we have a high \({ R }^{ 2 }\) or \({ \bar { R } }^{ 2 }\).

- It is not necessarily true that we have an inappropriate set of regressors just because we have a low \({ R }^{ 2 }\) or \({ \bar { R } }^{ 2 }\).

An economist tests the hypothesis that GDP growth in a certain country can be explained by interest rates and inflation.

Using some 30 observations, the analyst formulates the following regression equation:

$$ GDP growth = { \hat { \beta } }_{ 0 } + { \hat { \beta } }_{ 1 } Interest+ { \hat { \beta } }_{ 2 } Inflation $$

Regression estimates are as follows:

Is the coefficient for interest rates significant at 5%?

- Since the test statistic < t-critical, we accept H 0 ; the interest rate coefficient is not significant at the 5% level.

- Since the test statistic > t-critical, we reject H 0 ; the interest rate coefficient is not significant at the 5% level.

- Since the test statistic > t-critical, we reject H 0 ; the interest rate coefficient is significant at the 5% level.

- Since the test statistic < t-critical, we accept H 1 ; the interest rate coefficient is significant at the 5% level.

The correct answer is C .

We have GDP growth = 0.10 + 0.20(Int) + 0.15(Inf)

Hypothesis:

$$ { H }_{ 0 }:{ \hat { \beta } }_{ 1 } = 0 \quad vs \quad { H }_{ 1 }:{ \hat { \beta } }_{ 1 }≠0 $$

The test statistic is:

$$ t = \left( \frac { 0.20 – 0 }{ 0.05 } \right) = 4 $$

The critical value is t (α/2, n-k-1) = t 0.025,27 = 2.052 (which can be found on the t-table).

Conclusion : The interest rate coefficient is significant at the 5% level.

Offered by AnalystPrep

Modeling Cycles: MA, AR, and ARMA Models

Empirical approaches to risk metrics and hedging, multifactor models of risk-adjusted as ....

After completing this reading, you should be able to: Explain the arbitrage pricing... Read More

The Black-Scholes-Merton Model

After completing this reading you should be able to: Explain the lognormal property... Read More

Exchanges and OTC Markets

After completing this reading, you should be able to: Describe how exchanges can... Read More

Properties of Options

After completing this reading, you should be able to: Identify the six factors... Read More

Leave a Comment Cancel reply

You must be logged in to post a comment.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Section 5.3: Multiple Regression Explanation, Assumptions, Interpretation, and Write Up

Learning Objectives

At the end of this section you should be able to answer the following questions:

- Explain the difference between Multiple Regression and Simple Regression.

- Explain the assumptions underlying Multiple Regression.

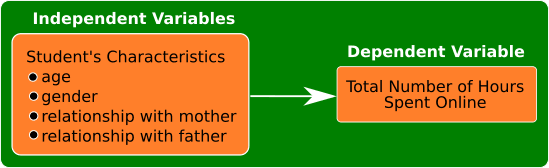

Multiple Regression is a step beyond simple regression. The main difference between simple and multiple regression is that multiple regression includes two or more independent variables – sometimes called predictor variables – in the model, rather than just one.

As such, the purpose of multiple regression is to determine the utility of a set of predictor variables for predicting an outcome, which is generally some important event or behaviour. This outcome can be designated as the outcome variable, the dependent variable, or the criterion variable. For example, you might hypothesise that the need to belong will predict motivations for Facebook use and that self-esteem and meaningful existence will uniquely predict motivations for Facebook use.

Before beginning your analysis, you should consider the following points:

- Regression analyses reveal relationships among variables (relationship between the criterion variable and the linear combination of a set of predictor variables) but do not imply a causal relationship.

- A regression solution – or set of predictor variables – is sensitive to combinations of variables. Whether a predictor is important in a solution depends on the other predictors in the set. If the predictor of interest is the only one that assesses some important facet of the outcome, it will appear important. If a predictor is only one of several predictors that assess the same important facet of the outcome, it will appear less important. For a good set of predictor variables – the smallest set of uncorrelated variables is best.

PowerPoint: Venn Diagrams

Please click on the link labeled “Venn Diagrams” to work through an example.

- Chapter Five – Venn Diagrams

In these Venn Diagrams, you can see why it is best for the predictors to be strongly correlated with the dependent variable but uncorrelated with the other Independent Variables. This reduces the amount of shared variance between the independent variables. The illustration in Slide 2 shows logical relationships between predictors, for two different possible regression models in separate Venn diagrams. On the left, you can see three partially correlated independent variables on a single dependent variable. The three partially correlated independent variables are physical health, mental health, and spiritual health and the dependent variable is life satisfaction. On the right, you have three highly correlated independent variables (e.g., BMI, blood pressure, heart rate) on the dependent variable of life satisfaction. The model on the left would have some use in discovering the associations between those variables, however, the model on the right would not be useful, as all three of the independent variables are basically measuring the same thing and are mostly accounting for the same variability in the dependent variable.

There are two main types of regression with multiple independent variables:

- Standard or Single Step: Where all predictors enter the regression together.

- Sequential or Hierarchical: Where all predictors are entered in blocks. Each block represents one step.

We will now be exploring the single step multiple regression:

All predictors enter the regression equation at once. Each predictor is treated as if it had been analysed in the regression model after all other predictors had been analysed. These predictors are evaluated by the shared variance (i.e., level of prediction) shared between the dependant variable and the individual predictor variable.

Multiple Regression Assumptions

There are a number of assumptions that should be assessed before performing a multiple regression analysis:

- The dependant variable (the variable of interest) needs to be using a continuous scale.

- There are two or more independent variables. These can be measured using either continuous or categorical means.

- The three or more variables of interest should have a linear relationship, which you can check by using a scatterplot.

- The data should have homoscedasticity. In other words, the line of best fit is not dissimilar as the data points move across the line in a positive or negative direction. Homoscedasticity can be checked by producing standardised residual plots against the unstandardized predicted values.

- The data should not have two or more independent variables that are highly correlated. This is called multicollinearity which can be checked using Variance-inflation-factor or VIF values. High VIF indicates that the associated independent variable is highly collinear with the other variables in the model.

- There should be no spurious outliers.

- The residuals (errors) should be approximately normally distributed. This can be checked by a histogram (with a superimposed normal curve) and by plotting the of the standardised residuals using either a P-P Plot, or a Normal Q-Q Plot .

Multiple Regression Interpretation

For our example research question, we will be looking at the combined effect of three predictor variables – perceived life stress, location, and age – on the outcome variable of physical health?

PowerPoint: Standard Regression

Please open the output at the link labeled “Chapter Five – Standard Regression” to view the output.

- Chapter Five – Standard Regression

Slide 1 contains the standard regression analysis output.

On Slide 2 you can see in the red circle, the test statistics are significant. The F-statistic examines the overall significance of the model, and shows if your predictors as a group provide a better fit to the data than no predictor variables, which they do in this example.

The R 2 values are shown in the green circle. The R 2 value shows the total amount of variance accounted for in the criterion by the predictors, and the adjusted R 2 is the estimated value of R 2 in the population.

Moving on to the individual variable effects on Slide 3, you can see the significance of the contribution of individual predictors in light blue. The unstandardized slope or the B value is shown in red, which represents the change caused by the variable (e.g., increasing 1 unit of perceived stress will raise physical illness by .40). Finally, you can see the standardised slope value in green, which are also known as beta values. These values are standardised ranging from +/-0 to 1, similar to an r value.

We should also briefly discuss dummy variables:

A dummy variable is a variable that is used to represent categorical information relating to the participants in a study. This could include gender, location, race, age groups, and you get the idea. Dummy variables are most often represented as dichotomous variables (they only have two values). When performing a regression, it is easier for interpretation if the values for the dummy variable is set to 0 or 1. 1 usually resents when a characteristic is present. For example, a question asking the participants “Do you have a drivers license” with a forced choice response of yes or no.

In this example on Slide 3 and circled in red, the variable is gender with male = 0, and female = 1. A positive Beta (B) means an association with 1, whereas a negative beta means an association with 0. In this case, being female was associated with greater levels of physical illness.

Multiple Regression Write Up

Here is an example of how to write up the results of a standard multiple regression analysis:

In order to test the research question, a multiple regression was conducted, with age, gender (0 = male, 1 = female), and perceived life stress as the predictors, with levels of physical illness as the dependent variable. Overall, the results showed the utility of the predictive model was significant, F (3,363) = 39.61, R 2 = .25, p < .001. All of the predictors explain a large amount of the variance between the variables (25%). The results showed that perceived stress and gender of participants were significant positive predictors of physical illness ( β =.47, t = 9.96, p < .001, and β =.15, t = 3.23, p = .001, respectively). The results showed that age ( β =-.02, t = -0.49 p = .63) was not a significant predictor of perceived stress.

Statistics for Research Students Copyright © 2022 by University of Southern Queensland is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

Multiple linear regression

Multiple linear regression #.

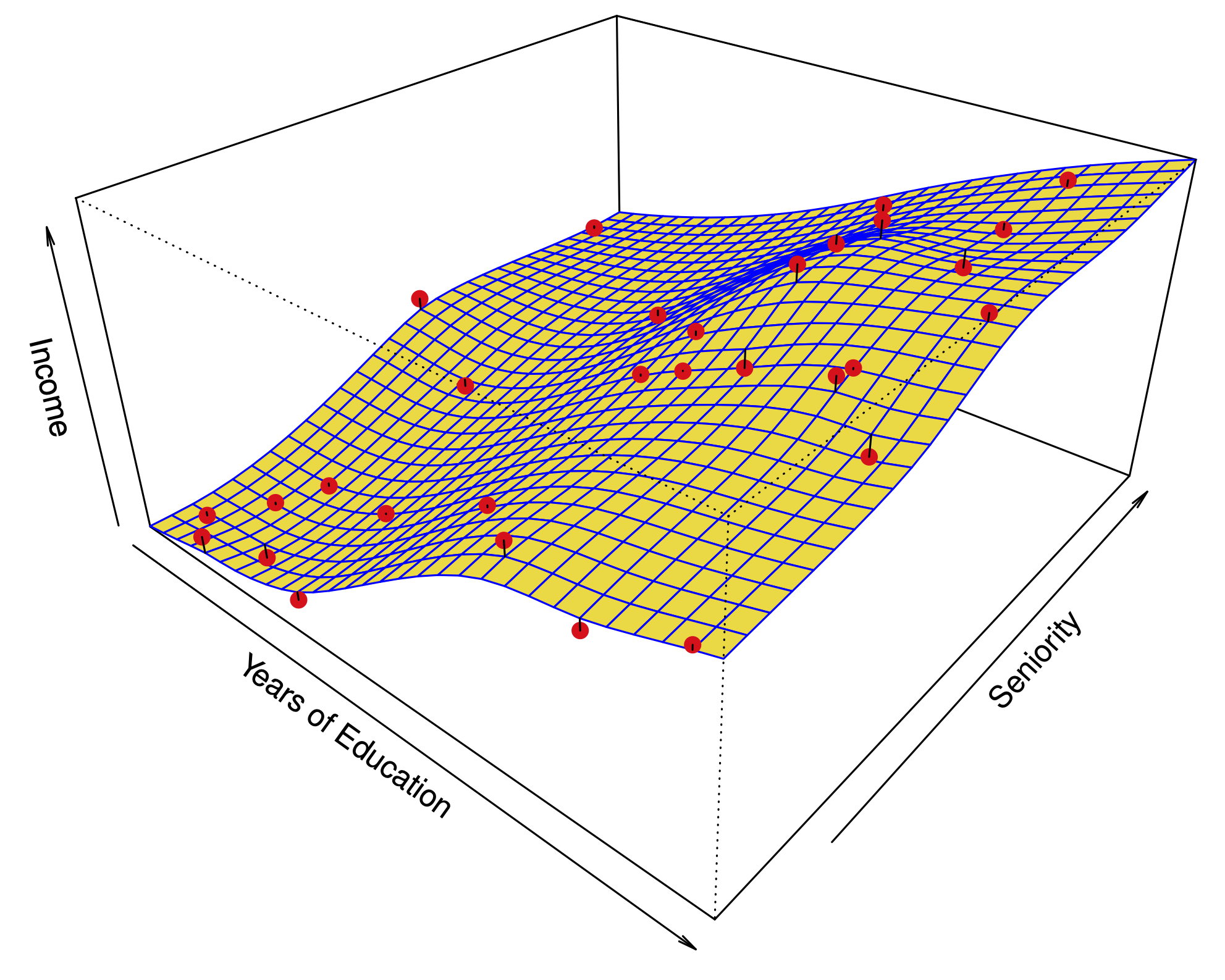

Fig. 11 Multiple linear regression #

Errors: \(\varepsilon_i \sim N(0,\sigma^2)\quad \text{i.i.d.}\)

Fit: the estimates \(\hat\beta_0\) and \(\hat\beta_1\) are chosen to minimize the residual sum of squares (RSS):

Matrix notation: with \(\beta=(\beta_0,\dots,\beta_p)\) and \({X}\) our usual data matrix with an extra column of ones on the left to account for the intercept, we can write

Multiple linear regression answers several questions #

Is at least one of the variables \(X_i\) useful for predicting the outcome \(Y\) ?

Which subset of the predictors is most important?

How good is a linear model for these data?

Given a set of predictor values, what is a likely value for \(Y\) , and how accurate is this prediction?

The estimates \(\hat\beta\) #

Our goal again is to minimize the RSS: $ \( \begin{aligned} \text{RSS}(\beta) &= \sum_{i=1}^n (y_i -\hat y_i(\beta))^2 \\ & = \sum_{i=1}^n (y_i - \beta_0- \beta_1 x_{i,1}-\dots-\beta_p x_{i,p})^2 \\ &= \|Y-X\beta\|^2_2 \end{aligned} \) $

One can show that this is minimized by the vector \(\hat\beta\) : $ \(\hat\beta = ({X}^T{X})^{-1}{X}^T{y}.\) $

We usually write \(RSS=RSS(\hat{\beta})\) for the minimized RSS.

Which variables are important? #

Consider the hypothesis: \(H_0:\) the last \(q\) predictors have no relation with \(Y\) .

Based on our model: \(H_0:\beta_{p-q+1}=\beta_{p-q+2}=\dots=\beta_p=0.\)

Let \(\text{RSS}_0\) be the minimized residual sum of squares for the model which excludes these variables.

The \(F\) -statistic is defined by: $ \(F = \frac{(\text{RSS}_0-\text{RSS})/q}{\text{RSS}/(n-p-1)}.\) $

Under the null hypothesis (of our model), this has an \(F\) -distribution.

Example: If \(q=p\) , we test whether any of the variables is important. $ \(\text{RSS}_0 = \sum_{i=1}^n(y_i-\overline y)^2 \) $

The \(t\) -statistic associated to the \(i\) th predictor is the square root of the \(F\) -statistic for the null hypothesis which sets only \(\beta_i=0\) .

A low \(p\) -value indicates that the predictor is important.

Warning: If there are many predictors, even under the null hypothesis, some of the \(t\) -tests will have low p-values even when the model has no explanatory power.

How many variables are important? #

When we select a subset of the predictors, we have \(2^p\) choices.

A way to simplify the choice is to define a range of models with an increasing number of variables, then select the best.

Forward selection: Starting from a null model, include variables one at a time, minimizing the RSS at each step.

Backward selection: Starting from the full model, eliminate variables one at a time, choosing the one with the largest p-value at each step.

Mixed selection: Starting from some model, include variables one at a time, minimizing the RSS at each step. If the p-value for some variable goes beyond a threshold, eliminate that variable.

Choosing one model in the range produced is a form of tuning . This tuning can invalidate some of our methods like hypothesis tests and confidence intervals…

How good are the predictions? #

The function predict in R outputs predictions and confidence intervals from a linear model:

Prediction intervals reflect uncertainty on \(\hat\beta\) and the irreducible error \(\varepsilon\) as well.

These functions rely on our linear regression model $ \( Y = X\beta + \epsilon. \) $

Dealing with categorical or qualitative predictors #

For each qualitative predictor, e.g. Region :

Choose a baseline category, e.g. East

For every other category, define a new predictor:

\(X_\text{South}\) is 1 if the person is from the South region and 0 otherwise

\(X_\text{West}\) is 1 if the person is from the West region and 0 otherwise.

The model will be: $ \(Y = \beta_0 + \beta_1 X_1 +\dots +\beta_7 X_7 + \color{Red}{\beta_\text{South}} X_\text{South} + \beta_\text{West} X_\text{West} +\varepsilon.\) $

The parameter \(\color{Red}{\beta_\text{South}}\) is the relative effect on Balance (our \(Y\) ) for being from the South compared to the baseline category (East).

The model fit and predictions are independent of the choice of the baseline category.

However, hypothesis tests derived from these variables are affected by the choice.

Solution: To check whether region is important, use an \(F\) -test for the hypothesis \(\beta_\text{South}=\beta_\text{West}=0\) by dropping Region from the model. This does not depend on the coding.

Note that there are other ways to encode qualitative predictors produce the same fit \(\hat f\) , but the coefficients have different interpretations.

So far, we have:

Defined Multiple Linear Regression

Discussed how to test the importance of variables.

Described one approach to choose a subset of variables.

Explained how to code qualitative variables.

Now, how do we evaluate model fit? Is the linear model any good? What can go wrong?

How good is the fit? #

To assess the fit, we focus on the residuals $ \( e = Y - \hat{Y} \) $

The RSS always decreases as we add more variables.

The residual standard error (RSE) corrects this: $ \(\text{RSE} = \sqrt{\frac{1}{n-p-1}\text{RSS}}.\) $

Fig. 12 Residuals #

Visualizing the residuals can reveal phenomena that are not accounted for by the model; eg. synergies or interactions:

Potential issues in linear regression #

Interactions between predictors

Non-linear relationships

Correlation of error terms

Non-constant variance of error (heteroskedasticity)

High leverage points

Collinearity

Interactions between predictors #

Linear regression has an additive assumption: $ \(\mathtt{sales} = \beta_0 + \beta_1\times\mathtt{tv}+ \beta_2\times\mathtt{radio}+\varepsilon\) $

i.e. An increase of 100 USD dollars in TV ads causes a fixed increase of \(100 \beta_2\) USD in sales on average, regardless of how much you spend on radio ads.

We saw that in Fig 3.5 above. If we visualize the fit and the observed points, we see they are not evenly scattered around the plane. This could be caused by an interaction.

One way to deal with this is to include multiplicative variables in the model:

The interaction variable tv \(\cdot\) radio is high when both tv and radio are high.

R makes it easy to include interaction variables in the model:

Non-linearities #

Fig. 13 A nonlinear fit might be better here. #

Example: Auto dataset.

A scatterplot between a predictor and the response may reveal a non-linear relationship.

Solution: include polynomial terms in the model.

Could use other functions besides polynomials…

Fig. 14 Residuals for Auto data #

In 2 or 3 dimensions, this is easy to visualize. What do we do when we have too many predictors?

Correlation of error terms #

We assumed that the errors for each sample are independent:

What if this breaks down?

The main effect is that this invalidates any assertions about Standard Errors, confidence intervals, and hypothesis tests…

Example : Suppose that by accident, we duplicate the data (we use each sample twice). Then, the standard errors would be artificially smaller by a factor of \(\sqrt{2}\) .

When could this happen in real life:

Time series: Each sample corresponds to a different point in time. The errors for samples that are close in time are correlated.

Spatial data: Each sample corresponds to a different location in space.

Grouped data: Imagine a study on predicting height from weight at birth. If some of the subjects in the study are in the same family, their shared environment could make them deviate from \(f(x)\) in similar ways.

Correlated errors #

Simulations of time series with increasing correlations between \(\varepsilon_i\)

Non-constant variance of error (heteroskedasticity) #

The variance of the error depends on some characteristics of the input features.

To diagnose this, we can plot residuals vs. fitted values:

If the trend in variance is relatively simple, we can transform the response using a logarithm, for example.

Outliers from a model are points with very high errors.

While they may not affect the fit, they might affect our assessment of model quality.

Possible solutions: #

If we believe an outlier is due to an error in data collection, we can remove it.

An outlier might be evidence of a missing predictor, or the need to specify a more complex model.

High leverage points #

Some samples with extreme inputs have an outsized effect on \(\hat \beta\) .

This can be measured with the leverage statistic or self influence :

Studentized residuals #

The residual \(e_i = y_i - \hat y_i\) is an estimate for the noise \(\epsilon_i\) .

The standard error of \(\hat \epsilon_i\) is \(\sigma \sqrt{1-h_{ii}}\) .

A studentized residual is \(\hat \epsilon_i\) divided by its standard error (with appropriate estimate of \(\sigma\) )

When model is correct, it follows a Student-t distribution with \(n-p-2\) degrees of freedom.

Collinearity #

Two predictors are collinear if one explains the other well:

Problem: The coefficients become unidentifiable .

Consider the extreme case of using two identical predictors limit : $ \( \begin{aligned} \mathtt{balance} &= \beta_0 + \beta_1\times\mathtt{limit} + \beta_2\times\mathtt{limit} + \epsilon \\ & = \beta_0 + (\beta_1+100)\times\mathtt{limit} + (\beta_2-100)\times\mathtt{limit} + \epsilon \end{aligned} \) $

For every \((\beta_0,\beta_1,\beta_2)\) the fit at \((\beta_0,\beta_1,\beta_2)\) is just as good as at \((\beta_0,\beta_1+100,\beta_2-100)\) .

If 2 variables are collinear, we can easily diagnose this using their correlation.

A group of \(q\) variables is multilinear if these variables “contain less information” than \(q\) independent variables.

Pairwise correlations may not reveal multilinear variables.

The Variance Inflation Factor (VIF) measures how predictable it is given the other variables, a proxy for how necessary a variable is:

Above, \(R^2_{X_j|X_{-j}}\) is the \(R^2\) statistic for Multiple Linear regression of the predictor \(X_j\) onto the remaining predictors.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

14.8: Introduction to Multiple Regression

- Last updated

- Save as PDF

- Page ID 2648

- Rice University

Learning Objectives

- State the regression equation

- Define "regression coefficient"

- Define "beta weight"

- Explain what \(R\) is and how it is related to \(r\)

- Explain why a regression weight is called a "partial slope"

- Explain why the sum of squares explained in a multiple regression model is usually less than the sum of the sums of squares in simple regression

- Define \(R^2\) in terms of proportion explained

- Test \(R^2\) for significance

- Test the difference between a complete and reduced model for significance

- State the assumptions of multiple regression and specify which aspects of the analysis require assumptions

In simple linear regression, a criterion variable is predicted from one predictor variable. In multiple regression, the criterion is predicted by two or more variables. For example, in the SAT case study, you might want to predict a student's university grade point average on the basis of their High-School GPA (\(HSGPA\)) and their total SAT score (verbal + math). The basic idea is to find a linear combination of \(HSGPA\) and \(SAT\) that best predicts University GPA (\(UGPA\)). That is, the problem is to find the values of \(b_1\) and \(b_2\) in the equation shown below that give the best predictions of \(UGPA\). As in the case of simple linear regression, we define the best predictions as the predictions that minimize the squared errors of prediction.

\[UGPA' = b_1HSGPA + b_2SAT + A\]

where \(UGPA'\) is the predicted value of University GPA and \(A\) is a constant. For these data, the best prediction equation is shown below:

\[UGPA' = 0.541 \times HSGPA + 0.008 \times SAT + 0.540\]

In other words, to compute the prediction of a student's University GPA, you add up their High-School GPA multiplied by \(0.541\), their \(SAT\) multiplied by \(0.008\), and \(0.540\). Table \(\PageIndex{1}\) shows the data and predictions for the first five students in the dataset.

The values of \(b\) (\(b_1\) and \(b_2\)) are sometimes called "regression coefficients" and sometimes called "regression weights." These two terms are synonymous.

The multiple correlation (\(R\)) is equal to the correlation between the predicted scores and the actual scores. In this example, it is the correlation between \(UGPA'\) and \(UGPA\), which turns out to be \(0.79\). That is, \(R = 0.79\). Note that \(R\) will never be negative since if there are negative correlations between the predictor variables and the criterion, the regression weights will be negative so that the correlation between the predicted and actual scores will be positive.

Interpretation of Regression Coefficients

A regression coefficient in multiple regression is the slope of the linear relationship between the criterion variable and the part of a predictor variable that is independent of all other predictor variables. In this example, the regression coefficient for \(HSGPA\) can be computed by first predicting \(HSGPA\) from \(SAT\) and saving the errors of prediction (the differences between \(HSGPA\) and \(HSGPA'\)). These errors of prediction are called "residuals" since they are what is left over in \(HSGPA\) after the predictions from \(SAT\) are subtracted, and represent the part of \(HSGPA\) that is independent of \(SAT\). These residuals are referred to as \(HSGPA.SAT\), which means they are the residuals in \(HSGPA\) after having been predicted by \(SAT\). The correlation between \(HSGPA.SAT\) and \(SAT\) is necessarily \(0\).

The final step in computing the regression coefficient is to find the slope of the relationship between these residuals and \(UGPA\). This slope is the regression coefficient for \(HSGPA\). The following equation is used to predict \(HSGPA\) from \(SAT\):

\[HSGPA' = -1.314 + 0.0036 \times SAT\]

The residuals are then computed as:

\[HSGPA - HSGPA'\]

The linear regression equation for the prediction of \(UGPA\) by the residuals is

\[UGPA' = 0.541 \times HSGPA.SAT + 3.173\]

Notice that the slope (\(0.541\)) is the same value given previously for \(b_1\) in the multiple regression equation.

This means that the regression coefficient for \(HSGPA\) is the slope of the relationship between the criterion variable and the part of \(HSGPA\) that is independent of (uncorrelated with) the other predictor variables. It represents the change in the criterion variable associated with a change of one in the predictor variable when all other predictor variables are held constant. Since the regression coefficient for \(HSGPA\) is \(0.54\), this means that, holding \(SAT\) constant, a change of one in \(HSGPA\) is associated with a change of \(0.54\) in \(UGPA'\). If two students had the same \(SAT\) and differed in \(HSGPA\) by \(2\), then you would predict they would differ in \(UGPA\) by \((2)(0.54) = 1.08\). Similarly, if they differed by \(0.5\), then you would predict they would differ by \((0.50)(0.54) = 0.27\).

The slope of the relationship between the part of a predictor variable independent of other predictor variables and the criterion is its partial slope. Thus the regression coefficient of \(0.541\) for \(HSGPA\) and the regression coefficient of \(0.008\) for \(SAT\) are partial slopes. Each partial slope represents the relationship between the predictor variable and the criterion holding constant all of the other predictor variables.

It is difficult to compare the coefficients for different variables directly because they are measured on different scales. A difference of \(1\) in \(HSGPA\) is a fairly large difference, whereas a difference of \(1\) on the \(SAT\) is negligible. Therefore, it can be advantageous to transform the variables so that they are on the same scale. The most straightforward approach is to standardize the variables so that they each have a standard deviation of \(1\). A regression weight for standardized variables is called a "beta weight" and is designated by the Greek letter \(β\). For these data, the beta weights are \(0.625\) and \(0.198\). These values represent the change in the criterion (in standard deviations) associated with a change of one standard deviation on a predictor [holding constant the value(s) on the other predictor(s)]. Clearly, a change of one standard deviation on \(HSGPA\) is associated with a larger difference than a change of one standard deviation of \(SAT\). In practical terms, this means that if you know a student's \(HSGPA\), knowing the student's \(SAT\) does not aid the prediction of \(UGPA\) much. However, if you do not know the student's \(HSGPA\), his or her \(SAT\) can aid in the prediction since the \(β\) weight in the simple regression predicting \(UGPA\) from \(SAT\) is \(0.68\). For comparison purposes, the \(β\) weight in the simple regression predicting \(UGPA\) from \(HSGPA\) is \(0.78\). As is typically the case, the partial slopes are smaller than the slopes in simple regression.

Partitioning the Sums of Squares

Just as in the case of simple linear regression, the sum of squares for the criterion (\(UGPA\) in this example) can be partitioned into the sum of squares predicted and the sum of squares error. That is,

\[SSY = SSY' + SSE\]

which for these data:

\[20.798 = 12.961 + 7.837\]

The sum of squares predicted is also referred to as the "sum of squares explained." Again, as in the case of simple regression,

\[\text{Proportion Explained} = SSY'/SSY\]

In simple regression, the proportion of variance explained is equal to \(r^2\); in multiple regression, the proportion of variance explained is equal to \(R^2\).

In multiple regression, it is often informative to partition the sum of squares explained among the predictor variables. For example, the sum of squares explained for these data is \(12.96\). How is this value divided between \(HSGPA\) and \(SAT\)? One approach that, as will be seen, does not work is to predict \(UGPA\) in separate simple regressions for \(HSGPA\) and \(SAT\). As can be seen in Table \(\PageIndex{2}\), the sum of squares in these separate simple regressions is \(12.64\) for \(HSGPA\) and \(9.75\) for \(SAT\). If we add these two sums of squares we get \(22.39\), a value much larger than the sum of squares explained of \(12.96\) in the multiple regression analysis. The explanation is that \(HSGPA\) and \(SAT\) are highly correlated (\(r = 0.78\)) and therefore much of the variance in \(UGPA\) is confounded between \(HSGPA\) and \(SAT\). That is, it could be explained by either \(HSGPA\) or \(SAT\) and is counted twice if the sums of squares for \(HSGPA\) and \(SAT\) are simply added.

Table \(\PageIndex{3}\) shows the partitioning of the sum of squares into the sum of squares uniquely explained by each predictor variable, the sum of squares confounded between the two predictor variables, and the sum of squares error. It is clear from this table that most of the sum of squares explained is confounded between \(HSGPA\) and \(SAT\). Note that the sum of squares uniquely explained by a predictor variable is analogous to the partial slope of the variable in that both involve the relationship between the variable and the criterion with the other variable(s) controlled.

The sum of squares uniquely attributable to a variable is computed by comparing two regression models: the complete model and a reduced model. The complete model is the multiple regression with all the predictor variables included (\(HSGPA\) and \(SAT\) in this example). A reduced model is a model that leaves out one of the predictor variables. The sum of squares uniquely attributable to a variable is the sum of squares for the complete model minus the sum of squares for the reduced model in which the variable of interest is omitted. As shown in Table \(\PageIndex{2}\), the sum of squares for the complete model (\(HSGPA\) and \(SAT\)) is \(12.96\). The sum of squares for the reduced model in which \(HSGPA\) is omitted is simply the sum of squares explained using \(SAT\) as the predictor variable and is \(9.75\). Therefore, the sum of squares uniquely attributable to \(HSGPA\) is \(12.96 - 9.75 = 3.21\). Similarly, the sum of squares uniquely attributable to \(SAT\) is \(12.96 - 12.64 = 0.32\). The confounded sum of squares in this example is computed by subtracting the sum of squares uniquely attributable to the predictor variables from the sum of squares for the complete model: \(12.96 - 3.21 - 0.32 = 9.43\). The computation of the confounded sums of squares in analysis with more than two predictors is more complex and beyond the scope of this text.

Since the variance is simply the sum of squares divided by the degrees of freedom, it is possible to refer to the proportion of variance explained in the same way as the proportion of the sum of squares explained. It is slightly more common to refer to the proportion of variance explained than the proportion of the sum of squares explained and, therefore, that terminology will be adopted frequently here.

When variables are highly correlated, the variance explained uniquely by the individual variables can be small even though the variance explained by the variables taken together is large. For example, although the proportions of variance explained uniquely by \(HSGPA\) and \(SAT\) are only \(0.15\) and \(0.02\) respectively, together these two variables explain \(0.62\) of the variance. Therefore, you could easily underestimate the importance of variables if only the variance explained uniquely by each variable is considered. Consequently, it is often useful to consider a set of related variables. For example, assume you were interested in predicting job performance from a large number of variables some of which reflect cognitive ability. It is likely that these measures of cognitive ability would be highly correlated among themselves and therefore no one of them would explain much of the variance independently of the other variables. However, you could avoid this problem by determining the proportion of variance explained by all of the cognitive ability variables considered together as a set. The variance explained by the set would include all the variance explained uniquely by the variables in the set as well as all the variance confounded among variables in the set. It would not include variance confounded with variables outside the set. In short, you would be computing the variance explained by the set of variables that is independent of the variables not in the set.

Inferential Statistics

We begin by presenting the formula for testing the significance of the contribution of a set of variables. We will then show how special cases of this formula can be used to test the significance of \(R^2\) as well as to test the significance of the unique contribution of individual variables.

The first step is to compute two regression analyses:

- an analysis in which all the predictor variables are included and

- an analysis in which the variables in the set of variables being tested are excluded.

The former regression model is called the "complete model" and the latter is called the "reduced model." The basic idea is that if the reduced model explains much less than the complete model, then the set of variables excluded from the reduced model is important.

The formula for testing the contribution of a group of variables is:

\[F=\cfrac{\cfrac{SSQ_C-SSQ_R}{p_C-p_R}}{\cfrac{SSQ_T-SSQ_C}{N-p_C-1}}=\cfrac{MS_{explained}}{MS_{error}}\]

\(SSQ_C\) is the sum of squares for the complete model,

\(SSQ_R\) is the sum of squares for the reduced model,

\(p_C\) is the number of predictors in the complete model,

\(p_R\) is the number of predictors in the reduced model,

\(SSQ_T\) is the sum of squares total (the sum of squared deviations of the criterion variable from its mean), and

\(N\) is the total number of observations

The degrees of freedom for the numerator is \(p_C - p_R\) and the degrees of freedom for the denominator is \(N - p_C -1\). If the \(F\) is significant, then it can be concluded that the variables excluded in the reduced set contribute to the prediction of the criterion variable independently of the other variables.

This formula can be used to test the significance of \(R^2\) by defining the reduced model as having no predictor variables. In this application, \(SSQ_R\) and \(p_R = 0\). The formula is then simplified as follows:

\[F=\cfrac{\cfrac{SSQ_C}{p_C}}{\cfrac{SSQ_T-SSQ_C}{N-p_C-1}}=\cfrac{MS_{explained}}{MS_{error}}\]

which for this example becomes:

\[F=\cfrac{\cfrac{12.96}{2}}{\cfrac{20.80-12.96}{105-2-1}}=\cfrac{6.48}{0.08}=84.35\]

The degrees of freedom are \(2\) and \(102\). The \(F\) distribution calculator shows that \(p < 0.001\).

F Calculator

The reduced model used to test the variance explained uniquely by a single predictor consists of all the variables except the predictor variable in question. For example, the reduced model for a test of the unique contribution of \(HSGPA\) contains only the variable \(SAT\). Therefore, the sum of squares for the reduced model is the sum of squares when \(UGPA\) is predicted by \(SAT\). This sum of squares is \(9.75\). The calculations for \(F\) are shown below:

\[F=\cfrac{\cfrac{12.96-9.75}{2-1}}{\cfrac{20.80-12.96}{105-2-1}}=\cfrac{3.212}{0.077}=41.80\]

The degrees of freedom are \(1\) and \(102\). The \(F\) distribution calculator shows that \(p < 0.001\).

Similarly, the reduced model in the test for the unique contribution of \(SAT\) consists of \(HSGPA\).

\[F=\cfrac{\cfrac{12.96-12.64}{2-1}}{\cfrac{20.80-12.96}{105-2-1}}=\cfrac{0.322}{0.077}=4.19\]

The degrees of freedom are \(1\) and \(102\). The \(F\) distribution calculator shows that \(p = 0.0432\).

The significance test of the variance explained uniquely by a variable is identical to a significance test of the regression coefficient for that variable. A regression coefficient and the variance explained uniquely by a variable both reflect the relationship between a variable and the criterion independent of the other variables. If the variance explained uniquely by a variable is not zero, then the regression coefficient cannot be zero. Clearly, a variable with a regression coefficient of zero would explain no variance.

Other inferential statistics associated with multiple regression are beyond the scope of this text. Two of particular importance are:

- confidence intervals on regression slopes and

- confidence intervals on predictions for specific observations.

These inferential statistics can be computed by standard statistical analysis packages such as \(R\), \(SPSS\), \(STATA\), \(SAS\), and \(JMP\).

SPSS Output JMP Output

Assumptions

No assumptions are necessary for computing the regression coefficients or for partitioning the sum of squares. However, there are several assumptions made when interpreting inferential statistics. Moderate violations of Assumptions \(1-3\) do not pose a serious problem for testing the significance of predictor variables. However, even small violations of these assumptions pose problems for confidence intervals on predictions for specific observations.

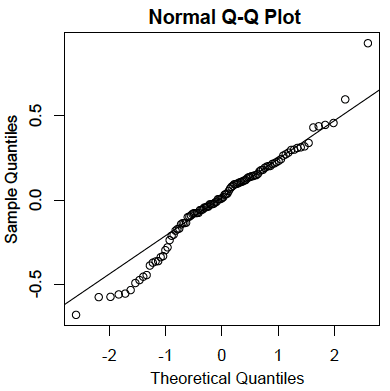

- Residuals are normally distributed:

As in the case of simple linear regression, the residuals are the errors of prediction. Specifically, they are the differences between the actual scores on the criterion and the predicted scores. A \(Q-Q\) plot for the residuals for the example data is shown below. This plot reveals that the actual data values at the lower end of the distribution do not increase as much as would be expected for a normal distribution. It also reveals that the highest value in the data is higher than would be expected for the highest value in a sample of this size from a normal distribution. Nonetheless, the distribution does not deviate greatly from normality.

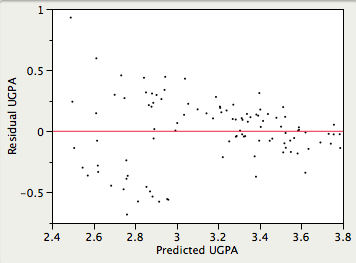

- Homoscedasticity:

It is assumed that the variances of the errors of prediction are the same for all predicted values. As can be seen below, this assumption is violated in the example data because the errors of prediction are much larger for observations with low-to-medium predicted scores than for observations with high predicted scores. Clearly, a confidence interval on a low predicted \(UGPA\) would underestimate the uncertainty.

It is assumed that the relationship between each predictor variable and the criterion variable is linear. If this assumption is not met, then the predictions may systematically overestimate the actual values for one range of values on a predictor variable and underestimate them for another.

Lesson 5: Multiple Linear Regression (MLR) Model & Evaluation

Overview of this lesson.

In this lesson, we make our first (and last?!) major jump in the course. We move from the simple linear regression model with one predictor to the multiple linear regression model with two or more predictors. That is, we use the adjective "simple" to denote that our model has only predictor, and we use the adjective "multiple" to indicate that our model has at least two predictors.

In the multiple regression setting, because of the potentially large number of predictors, it is more efficient to use matrices to define the regression model and the subsequent analyses. This lesson considers some of the more important multiple regression formulas in matrix form. If you're unsure about any of this, it may be a good time to take a look at this Matrix Algebra Review .

The good news is that everything you learned about the simple linear regression model extends — with at most minor modification — to the multiple linear regression model. Think about it — you don't have to forget all of that good stuff you learned! In particular:

- The models have similar "LINE" assumptions. The only real difference is that whereas in simple linear regression we think of the distribution of errors at a fixed value of the single predictor, with multiple linear regression we have to think of the distribution of errors at a fixed set of values for all the predictors. All of the model checking procedures we learned earlier are useful in the multiple linear regression framework, although the process becomes more involved since we now have multiple predictors. We'll explore this issue further in Lesson 6.

- The use and interpretation of r 2 (which we'll denote R 2 in the context of multiple linear regression) remains the same. However, with multiple linear regression we can also make use of an "adjusted" R 2 value, which is useful for model building purposes. We'll explore this measure further in Lesson 11.

- With a minor generalization of the degrees of freedom, we use t -tests and t -intervals for the regression slope coefficients to assess whether a predictor is significantly linearly related to the response, after controlling for the effects of all the opther predictors in the model.

- With a minor generalization of the degrees of freedom, we use confidence intervals for estimating the mean response and prediction intervals for predicting an individual response. We'll explore these further in Lesson 6.

For the simple linear regression model, there is only one slope parameter about which one can perform hypothesis tests. For the multiple linear regression model, there are three different hypothesis tests for slopes that one could conduct. They are:

- a hypothesis test for testing that one slope parameter is 0

- a hypothesis test for testing that all of the slope parameters are 0

- a hypothesis test for testing that a subset — more than one, but not all — of the slope parameters are 0

In this lesson, we also learn how to perform each of the above three hypothesis tests.

- 5.1 - Example on IQ and Physical Characteristics

- 5.2 - Example on Underground Air Quality

- 5.3 - The Multiple Linear Regression Model

- 5.4 - A Matrix Formulation of the Multiple Regression Model

- 5.5 - Three Types of MLR Parameter Tests

- 5.6 - The General Linear F-Test

- 5.7 - MLR Parameter Tests

- 5.8 - Partial R-squared

- 5.9 - Further MLR Examples

Start Here!

- Welcome to STAT 462!

- Search Course Materials

- Lesson 1: Statistical Inference Foundations

- Lesson 2: Simple Linear Regression (SLR) Model

- Lesson 3: SLR Evaluation

- Lesson 4: SLR Assumptions, Estimation & Prediction

- 5.9- Further MLR Examples

- Lesson 6: MLR Assumptions, Estimation & Prediction

- Lesson 7: Transformations & Interactions

- Lesson 8: Categorical Predictors

- Lesson 9: Influential Points

- Lesson 10: Regression Pitfalls

- Lesson 11: Model Building

- Lesson 12: Logistic, Poisson & Nonlinear Regression

- Website for Applied Regression Modeling, 2nd edition

- Notation Used in this Course

- R Software Help

- Minitab Software Help

Copyright © 2018 The Pennsylvania State University Privacy and Legal Statements Contact the Department of Statistics Online Programs

Statistics Made Easy

Understanding the Null Hypothesis for Linear Regression

Linear regression is a technique we can use to understand the relationship between one or more predictor variables and a response variable .

If we only have one predictor variable and one response variable, we can use simple linear regression , which uses the following formula to estimate the relationship between the variables:

ŷ = β 0 + β 1 x

- ŷ: The estimated response value.

- β 0 : The average value of y when x is zero.

- β 1 : The average change in y associated with a one unit increase in x.

- x: The value of the predictor variable.

Simple linear regression uses the following null and alternative hypotheses:

- H 0 : β 1 = 0

- H A : β 1 ≠ 0

The null hypothesis states that the coefficient β 1 is equal to zero. In other words, there is no statistically significant relationship between the predictor variable, x, and the response variable, y.

The alternative hypothesis states that β 1 is not equal to zero. In other words, there is a statistically significant relationship between x and y.

If we have multiple predictor variables and one response variable, we can use multiple linear regression , which uses the following formula to estimate the relationship between the variables:

ŷ = β 0 + β 1 x 1 + β 2 x 2 + … + β k x k

- β 0 : The average value of y when all predictor variables are equal to zero.

- β i : The average change in y associated with a one unit increase in x i .

- x i : The value of the predictor variable x i .

Multiple linear regression uses the following null and alternative hypotheses:

- H 0 : β 1 = β 2 = … = β k = 0

- H A : β 1 = β 2 = … = β k ≠ 0

The null hypothesis states that all coefficients in the model are equal to zero. In other words, none of the predictor variables have a statistically significant relationship with the response variable, y.

The alternative hypothesis states that not every coefficient is simultaneously equal to zero.

The following examples show how to decide to reject or fail to reject the null hypothesis in both simple linear regression and multiple linear regression models.

Example 1: Simple Linear Regression

Suppose a professor would like to use the number of hours studied to predict the exam score that students will receive in his class. He collects data for 20 students and fits a simple linear regression model.

The following screenshot shows the output of the regression model:

The fitted simple linear regression model is:

Exam Score = 67.1617 + 5.2503*(hours studied)

To determine if there is a statistically significant relationship between hours studied and exam score, we need to analyze the overall F value of the model and the corresponding p-value:

- Overall F-Value: 47.9952

- P-value: 0.000

Since this p-value is less than .05, we can reject the null hypothesis. In other words, there is a statistically significant relationship between hours studied and exam score received.

Example 2: Multiple Linear Regression

Suppose a professor would like to use the number of hours studied and the number of prep exams taken to predict the exam score that students will receive in his class. He collects data for 20 students and fits a multiple linear regression model.

The fitted multiple linear regression model is:

Exam Score = 67.67 + 5.56*(hours studied) – 0.60*(prep exams taken)

To determine if there is a jointly statistically significant relationship between the two predictor variables and the response variable, we need to analyze the overall F value of the model and the corresponding p-value:

- Overall F-Value: 23.46

- P-value: 0.00

Since this p-value is less than .05, we can reject the null hypothesis. In other words, hours studied and prep exams taken have a jointly statistically significant relationship with exam score.

Note: Although the p-value for prep exams taken (p = 0.52) is not significant, prep exams combined with hours studied has a significant relationship with exam score.

Additional Resources

Understanding the F-Test of Overall Significance in Regression How to Read and Interpret a Regression Table How to Report Regression Results How to Perform Simple Linear Regression in Excel How to Perform Multiple Linear Regression in Excel

Published by Zach

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Multiple Regression Analysis using SPSS Statistics

Introduction.

Multiple regression is an extension of simple linear regression. It is used when we want to predict the value of a variable based on the value of two or more other variables. The variable we want to predict is called the dependent variable (or sometimes, the outcome, target or criterion variable). The variables we are using to predict the value of the dependent variable are called the independent variables (or sometimes, the predictor, explanatory or regressor variables).

For example, you could use multiple regression to understand whether exam performance can be predicted based on revision time, test anxiety, lecture attendance and gender. Alternately, you could use multiple regression to understand whether daily cigarette consumption can be predicted based on smoking duration, age when started smoking, smoker type, income and gender.

Multiple regression also allows you to determine the overall fit (variance explained) of the model and the relative contribution of each of the predictors to the total variance explained. For example, you might want to know how much of the variation in exam performance can be explained by revision time, test anxiety, lecture attendance and gender "as a whole", but also the "relative contribution" of each independent variable in explaining the variance.

This "quick start" guide shows you how to carry out multiple regression using SPSS Statistics, as well as interpret and report the results from this test. However, before we introduce you to this procedure, you need to understand the different assumptions that your data must meet in order for multiple regression to give you a valid result. We discuss these assumptions next.

SPSS Statistics

Assumptions.

When you choose to analyse your data using multiple regression, part of the process involves checking to make sure that the data you want to analyse can actually be analysed using multiple regression. You need to do this because it is only appropriate to use multiple regression if your data "passes" eight assumptions that are required for multiple regression to give you a valid result. In practice, checking for these eight assumptions just adds a little bit more time to your analysis, requiring you to click a few more buttons in SPSS Statistics when performing your analysis, as well as think a little bit more about your data, but it is not a difficult task.

Before we introduce you to these eight assumptions, do not be surprised if, when analysing your own data using SPSS Statistics, one or more of these assumptions is violated (i.e., not met). This is not uncommon when working with real-world data rather than textbook examples, which often only show you how to carry out multiple regression when everything goes well! However, don’t worry. Even when your data fails certain assumptions, there is often a solution to overcome this. First, let's take a look at these eight assumptions:

- Assumption #1: Your dependent variable should be measured on a continuous scale (i.e., it is either an interval or ratio variable). Examples of variables that meet this criterion include revision time (measured in hours), intelligence (measured using IQ score), exam performance (measured from 0 to 100), weight (measured in kg), and so forth. You can learn more about interval and ratio variables in our article: Types of Variable . If your dependent variable was measured on an ordinal scale, you will need to carry out ordinal regression rather than multiple regression. Examples of ordinal variables include Likert items (e.g., a 7-point scale from "strongly agree" through to "strongly disagree"), amongst other ways of ranking categories (e.g., a 3-point scale explaining how much a customer liked a product, ranging from "Not very much" to "Yes, a lot").

- Assumption #2: You have two or more independent variables , which can be either continuous (i.e., an interval or ratio variable) or categorical (i.e., an ordinal or nominal variable). For examples of continuous and ordinal variables , see the bullet above. Examples of nominal variables include gender (e.g., 2 groups: male and female), ethnicity (e.g., 3 groups: Caucasian, African American and Hispanic), physical activity level (e.g., 4 groups: sedentary, low, moderate and high), profession (e.g., 5 groups: surgeon, doctor, nurse, dentist, therapist), and so forth. Again, you can learn more about variables in our article: Types of Variable . If one of your independent variables is dichotomous and considered a moderating variable, you might need to run a Dichotomous moderator analysis .

- Assumption #3: You should have independence of observations (i.e., independence of residuals ), which you can easily check using the Durbin-Watson statistic, which is a simple test to run using SPSS Statistics. We explain how to interpret the result of the Durbin-Watson statistic, as well as showing you the SPSS Statistics procedure required, in our enhanced multiple regression guide.

- Assumption #4: There needs to be a linear relationship between (a) the dependent variable and each of your independent variables, and (b) the dependent variable and the independent variables collectively . Whilst there are a number of ways to check for these linear relationships, we suggest creating scatterplots and partial regression plots using SPSS Statistics, and then visually inspecting these scatterplots and partial regression plots to check for linearity. If the relationship displayed in your scatterplots and partial regression plots are not linear, you will have to either run a non-linear regression analysis or "transform" your data, which you can do using SPSS Statistics. In our enhanced multiple regression guide, we show you how to: (a) create scatterplots and partial regression plots to check for linearity when carrying out multiple regression using SPSS Statistics; (b) interpret different scatterplot and partial regression plot results; and (c) transform your data using SPSS Statistics if you do not have linear relationships between your variables.

- Assumption #5: Your data needs to show homoscedasticity , which is where the variances along the line of best fit remain similar as you move along the line. We explain more about what this means and how to assess the homoscedasticity of your data in our enhanced multiple regression guide. When you analyse your own data, you will need to plot the studentized residuals against the unstandardized predicted values. In our enhanced multiple regression guide, we explain: (a) how to test for homoscedasticity using SPSS Statistics; (b) some of the things you will need to consider when interpreting your data; and (c) possible ways to continue with your analysis if your data fails to meet this assumption.

- Assumption #6: Your data must not show multicollinearity , which occurs when you have two or more independent variables that are highly correlated with each other. This leads to problems with understanding which independent variable contributes to the variance explained in the dependent variable, as well as technical issues in calculating a multiple regression model. Therefore, in our enhanced multiple regression guide, we show you: (a) how to use SPSS Statistics to detect for multicollinearity through an inspection of correlation coefficients and Tolerance/VIF values; and (b) how to interpret these correlation coefficients and Tolerance/VIF values so that you can determine whether your data meets or violates this assumption.

- Assumption #7: There should be no significant outliers , high leverage points or highly influential points . Outliers, leverage and influential points are different terms used to represent observations in your data set that are in some way unusual when you wish to perform a multiple regression analysis. These different classifications of unusual points reflect the different impact they have on the regression line. An observation can be classified as more than one type of unusual point. However, all these points can have a very negative effect on the regression equation that is used to predict the value of the dependent variable based on the independent variables. This can change the output that SPSS Statistics produces and reduce the predictive accuracy of your results as well as the statistical significance. Fortunately, when using SPSS Statistics to run multiple regression on your data, you can detect possible outliers, high leverage points and highly influential points. In our enhanced multiple regression guide, we: (a) show you how to detect outliers using "casewise diagnostics" and "studentized deleted residuals", which you can do using SPSS Statistics, and discuss some of the options you have in order to deal with outliers; (b) check for leverage points using SPSS Statistics and discuss what you should do if you have any; and (c) check for influential points in SPSS Statistics using a measure of influence known as Cook's Distance, before presenting some practical approaches in SPSS Statistics to deal with any influential points you might have.

- Assumption #8: Finally, you need to check that the residuals (errors) are approximately normally distributed (we explain these terms in our enhanced multiple regression guide). Two common methods to check this assumption include using: (a) a histogram (with a superimposed normal curve) and a Normal P-P Plot; or (b) a Normal Q-Q Plot of the studentized residuals. Again, in our enhanced multiple regression guide, we: (a) show you how to check this assumption using SPSS Statistics, whether you use a histogram (with superimposed normal curve) and Normal P-P Plot, or Normal Q-Q Plot; (b) explain how to interpret these diagrams; and (c) provide a possible solution if your data fails to meet this assumption.

You can check assumptions #3, #4, #5, #6, #7 and #8 using SPSS Statistics. Assumptions #1 and #2 should be checked first, before moving onto assumptions #3, #4, #5, #6, #7 and #8. Just remember that if you do not run the statistical tests on these assumptions correctly, the results you get when running multiple regression might not be valid. This is why we dedicate a number of sections of our enhanced multiple regression guide to help you get this right. You can find out about our enhanced content as a whole on our Features: Overview page, or more specifically, learn how we help with testing assumptions on our Features: Assumptions page.