- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : November 30, 2023 at 8:16 AM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

What is an Assignment of Membership Interest?

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Necessary Approvals and Consent

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

Impact on Ownership, Voting, and Profit Rights

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

Complete Assignment

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Partial Assignment

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Step 1: Gather Relevant Information

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Step 2: Review the LLC's Operating Agreement

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Step 3: Obtain Necessary Approvals and Consents

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Step 4: Outline the Membership Interest Being Transferred

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Step 5: Determine the Effective Date of the Assignment

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

Step 6: Specify Conditions and Representations

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Step 7: Address Tax and Liability Issues

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

Step 8: Draft the Entire Agreement and Governing Law Clauses

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

Step 9: Review and Sign the Assignment Agreement

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

Do you need a lawyer for this?

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

We hope this guide provides valuable insight into the process of assigning membership interest in your LLC. By understanding the legal requirements, implications, and steps involved, you can navigate this essential task with confidence. Ready to secure your business with a professionally-drafted contract template? Visit our website to purchase the reliable and user-friendly Assignment of Membership Interest Agreement template that enables your business success.

Partnership

Sole proprietorship, limited partnership, compare businesses, employee rights, osha regulations, labor hours, personal & family, child custody & support, guardianship, incarceration, civil and misdemeanors, legal separation, real estate law, tax, licenses & permits, business licenses, wills & trusts, power of attorney, last will & testament, living trust, living will.

- Share Tweet Email Print

Assignment of Limited Liability Company Interest

By Joe Stone, J.D.

- Do All Members of an LLC Have to Sign the Purchase Contract?

As a limited liability company member, you usually have the right to assign your membership interest in the LLC to a nonmember, subject to the requirements of state LLC law. Typically, the assignment provides the nonmember with the right to receive your share of any LLC profits but does not give the nonmember any of your management rights. The remaining LLC members usually decide whether the nonmember is admitted as a member with management rights.

Assignments

An assignment involving your LLC membership occurs whenever there is a transfer of your property rights in the membership. The transfer of rights can occur voluntarily such as in a sale of your membership to cash out of the LLC. Another type of voluntary transfer involves using your membership to satisfy your personal debts in lieu of bankruptcy, generally referred to as an assignment for the benefit of creditors. A transfer of your membership to your legal heirs or designated beneficiaries occurs by operation of law upon your death. In each situation, the assignment results in a complete transfer of your property rights in your LLC membership.

LLC Membership Interest

An LLC is commonly considered a cross between a corporation and partnership. LLC members enjoy personal liability protection, as do a corporation's shareholders, and the ability to structure the LLC management to suit their own needs, as in a partnership. An LLC is also like a partnership in that the profits and losses of the LLC are passed through to each member just as in a partnership. As a result, your LLC membership consists of two parts: an economic interest -- the right to share in the profits and losses of the LLC; and a control interest -- the right to vote on and manage the affairs of the LLC.

Membership Transfer Rules

If a member assigns his LLC membership to a nonmember without the consent of the other members, state law typically limits the assignment to only economic rights, not control rights. For example, Arizona Revised Statute 29-732 states that “the assignment of an interest in a limited liability company does not…entitle the assignee to participate in the management of the business and affairs of the limited liability company or to become or to exercise the rights of a member.” The Revised Uniform Limited Liability Act, which has been adopted in nine states as of June 2013, contains a similar provision that states, "the transferor retains the rights of a member other than the interest in distributions transferred and retains all duties and obligations of a member." To acquire control rights, the LLC members must consent to extend full membership to the nonmember.

Other Considerations

LLC members usually create an operating agreement to govern their rights and duties to the LLC and each other. Unless specifically prohibited by state law, the members can agree to provisions in the operating agreement that alter the default rules that apply under state law. In anticipation of future assignments, the members can include in an operating agreement the rules for whether control rights can be assigned with economic rights and under what conditions.

- FindLaw: Legal Dictionary -- Assignment

- Texas Secretary of State: Selecting A Business Structure

- The Free Dictionary: Limited Liability Company

- Arizona Legislature: Arizona Revised Statute 29-732

- National Conference of Commissioners on Uniform State Laws: Revised Uniform Limited Liability Act

- National Conference of Commissioners on Uniform State Laws: Enactment Status Map -- RULLCA

- SBA.gov: Operating Agreements; The Basics

Joe Stone is a freelance writer in California who has been writing professionally since 2005. His articles have been published on LIVESTRONG.COM, SFgate.com and Chron.com. He also has experience in background investigations and spent almost two decades in legal practice. Stone received his law degree from Southwestern University School of Law and a Bachelor of Arts in philosophy from California State University, Los Angeles.

Related Articles

- How to Change Ownership of a California LLC

- How Does Equity Work in a Multimember LLC?

- Can an LLC Offer Both Preferred & Common Shares?

General Principles of Assignments in Real Estate Transactions

Assume a seller, ABC Company, enters into a contract to sell a parcel of land (referred to here as “Blackacre”) to Ms. Green. Ms. Green subsequently assigns her interest in the contract to Mr. Smith. Such assignments of contracts of purchase and sale raise a number of practical issues—e.g. notice to the seller, payment for the assignment, and transfer of the deposit—that affect not only the seller but also the original purchaser and the eventual purchaser. A party wishing to assign its interest in a contract of purchase and sale to a new party should not assume that the matter is as simple as entering into an assignment with the new party and then walking away and forgetting about the contract.

A real estate contract will often contain provisions that limit or prohibit an assignment of a party’s interest in the contract. If the contract is silent as to the rights to the parties to assign their interests in the contract, then the rights of the parties, with few exceptions, can be assigned. Normally, assignments of contracts relating to the purchase and sale of real estate involve the purchaser assigning its interest in the contract; however, it is not unheard of to have the seller assign its interest in the contract.

In our scenario, to be binding on it as the seller, ABC Company must be given notice of the assignment, although it does not have to receive a copy of the assignment or the business terms relating to the assignment. If ABC Company has been given notice that Ms. Green’s interest in the contract has been assigned, it may be concerned that she is ‘flipping’ her interest in the contract for a profit. Consequently, ABC Company may wish to seek advice as to whether the contract is enforceable.

Assuming that Mr. Smith is paying Ms. Green a specified amount of money for the assignment, the question arises as to when this money will be paid. Ms. Green will want the money to be paid when they enter into the assignment but Mr. Smith will want to pay at the time that they complete the purchase and sale of Blackacre. In most cases, the latter time period is the norm but, in any case, money paid for an assignment is subject to the Goods and Services Tax.

Ms. Green will likely have paid a deposit to ABC Company pursuant to the contract and will want the deposit to be repaid to her at the time of the assignment rather than having to wait until the purchase and sale of Blackacre is completed. It would not be unusual for Mr. Smith to reimburse the deposit to Ms. Green at the time that they enter into the assignment.

Mr. Smith should look to obtain assurances by way of representations and warranties from Ms. Green that the contract to purchase Blackacre is in full force and effect and that her interest can be assigned to him. In turn, Ms. Green should look to obtain representations and warranties from Mr. Smith that he will fulfill her obligations to complete the purchase of Blackacre since an assignment will not release Ms. Green of her obligations under the contract unless such release is specifically provided for—and has been agreed to by ABC Company.

Frequently, and contrary to the scenario presented here, a contract for a real estate transaction will often limit the right of the purchaser to assign its interest in the contract. A common limitation is that “. . . the purchaser may only assign its interest in the contract with the consent of the seller, such consent not to be unreasonably withheld.” In most cases, it would not be unreasonable for the seller to insist that the assignee contract directly with the seller to fulfill the obligations of the assignor under the contract so that, if there is a default, the seller has the right to seek remedies against both the assignor and the assignee.

So long as all parties to a contract of purchase and sale are aware of their rights and obligations, the completion of a purchase and sale where a contract has been assigned can and should proceed in a straightforward manner.

Learn More About Commercial Real Estate

Our Commercial Real Estate Group has experience in all aspects of the law and practice related to commercial property acquisitions, management, structuring, development and sales.

Related Articles

Articles | Dec 23, 2021

Critical March 1, 2022 Deadline for Preserving Non-Domestic Water Rights Nears

Case Studies | Jan 8, 2021

Lease found to be "clear and unambiguous"

Articles | Apr 20, 2020

Real Estate Transactions and COVID: Challenges to Closing

Or call toll-free at 1-877-682-4404

This field is required

Subscribe to our mailing list

- Employment Law Seminar

- Construction Law Seminar

- Women's Event

- Golf Tournament

- Hockey Night

- Client Reception

- Employment Alert

Sale and Assignment of LLC Membership Interests

Transfers from Member to Member or to Non-Member Third Parties by David J. Willis J.D., LL.M.

Introduction

This article addresses legal points to consider when conveying a membership interest in a limited liability company from one individual to another. It does not address the initial issuance of such interests when the LLC is formed, nor sales of membership interests by an existing LLC to incoming members.

Additionally, this article addresses absolute assignments (full and final transfers) rather than collateral assignments (made only as security for a loan) which are a different topic entirely.

Assignments of this type may follow the execution of a letter of intent which provides for a due-diligence period. This article does not cover the contents of such an LOI but does address issues that should be considered by a prospective assignee in conducting due diligence. An LOI will often make reference to specific due diligence steps that a buyer will be permitted to take.

After covering definitions and applicable law, we will turn to principal points that should be considered in negotiating and drafting an assignment of LLC membership interest.

APPLICABLE LAW

Relevant statutory definitions.

Applicable law is found in the Business Organizations Code (BOC):

Bus. Orgs. Code Section 1.002. DEFINITIONS

(7) “Certificated ownership interest” means an ownership interest of a domestic entity represented by a certificate issued in bearer or registered form.

(32) “Fundamental business transaction” means a merger, interest exchange, conversion, or sale of all or substantially all of an entity’s assets.

(35)(A) “Governing authority” means a person or group of persons who are entitled to manage and direct the affairs of an entity under this code and the governing documents of the entity, except that if the governing documents of the entity or this code divide the authority to manage and direct the affairs of the entity among different persons or groups of persons according to different matters, “governing authority” means the person or group of persons entitled to manage and direct the affairs of the entity with respect to a matter under the governing documents of the entity or this code.

(41) “Interest exchange” means the acquisition of an ownership or membership interest in a domestic entity as provided by Subchapter B, Chapter 10. The term does not include a merger or conversion.

(46) “Limited liability company” means an entity governed as a limited liability company under Title 3 or 7. The term includes a professional limited liability company.

(53) “Member” means: (A) in the case of a limited liability company, a person who has become, and has not ceased to be, a member in the limited liability company as provided by its governing documents or this code. . . .

(54) “Membership interest” means a member’s interest in an entity. With respect to a limited liability company, the term includes a member’s share of profits and losses or similar items and the right to receive distributions, but does not include a member’s right to participate in management.

(64) “Ownership interest” means an owner’s interest in an entity. The term includes the owner’s share of profits and losses or similar items and the right to receive distributions. The term does not include an owner’s right to participate in management.

(69-b) “Person” means an individual or a corporation, partnership, limited liability company, business trust, trust, association, or other organization, estate, government or governmental subdivision or agency, or other legal entity, or a protected series or registered series of a domestic limited liability company or foreign entity.

(87) “Uncertificated ownership interest” means an ownership interest in a domestic entity that is not represented by an instrument and is transferred by: (A) amendment of the governing documents of the entity; or (B) registration on books maintained by or on behalf of the entity for the purpose of registering transfers of ownership interests.

A well-drafted assignment of LLC membership interest will be mindful of and consistent with these statutory terms.

Statute Authorizing LLC Membership Assignments

Foundational to the idea of a sale and assignment of LLC membership interest is the legal authority to enter into such a transaction in the first place:

Bus. Orgs. Code Sec. 101.108. ASSIGNMENT OF MEMBERSHIP INTEREST

(a) A membership interest in a limited liability company may be wholly or partly assigned.

(b) An assignment of a membership interest in a limited liability company: (1) is not an event requiring the winding up of the company; and (2) does not entitle the assignee to: (A) participate in the management and affairs of the company; (B) become a member of the company; or (C) exercise any rights of a member of the company.

Consent by other members is required. BOC Section 101.103(s) states that a “person who, after the formation of a limited liability company, acquires directly or is assigned a membership interest in the company or is admitted as a member of the company without acquiring a membership interest becomes a member of the company on approval or consent of all of the company’s members.” BOC Section 101.105 states that a “limited liability company, after the formation of the company, may: (1) issue membership interests in the company to any person with the approval of all of the members of the company. . . .”

An additional consent requirement is found in BOC Section 101.356(c) which provides that, for the most part, “a fundamental business transaction of a limited liability company, or an action that would make it impossible for a limited liability company to carry out the ordinary business of the company, must be approved by the affirmative vote of the majority of all of the company’s members.”

Accordingly, it is advisable to accompany an assignment of membership interest with a special meeting of members that approves and ratifies the change. One or more LLC resolutions may be produced as well. All affected parties (and their spouses, even if non-members) should sign off.

What category of property is an LLC membership interest?

Regardless of the type of property owner by a limited liability company, a membership interest in the LLC is personal property:

Bus. Orgs. Code Sec. 101.106. NATURE OF MEMBERSHIP INTEREST

(a) A membership interest in a limited liability company is personal property.

(a-1) A membership interest may be community property under applicable law.

(a-2) A member’s right to participate in the management and conduct of the business of the limited liability company is not community property.

(b) A member of a limited liability company or an assignee of a membership interest in a limited liability company does not have an interest in any specific property of the company.

The characterization of an LLC membership interest as personal property is important because it also signifies what it is not . For instance, it is not a real property interest even though the LLC may own real estate. It is not a negotiable instrument subject to the Uniform Commercial Code (found in Texas Business & Commerce Code Section 3.201 et seq.). Nor is a small-business LLC membership interest usually considered to be a security subject to state and federal securities laws: “An interest in a partnership or limited liability company is not a security unless it is dealt in or traded on securities exchanges or in securities markets, [and the company agreement] expressly provide[s] that it is a security . . . or it is an investment company security.” Tex. Bus. & Com. Code Sec. 8.103(c).

The foregoing applies regardless of whether the membership interest is considered certificated or uncertificated.

Statutory Qualifications for LLC Membership

Qualifications and requirements for membership in an LLC are found in the BOC:

Bus. Orgs. Code Sec. 101.102. QUALIFICATION FOR MEMBERSHIP

(a) A person may be a member of or acquire a membership interest in a limited liability company unless the person lacks capacity apart from this code.

(b) A person is not required, as a condition to becoming a member of or acquiring a membership interest in a limited liability company, to:

(1) make a contribution to the company; (2) otherwise pay cash or transfer property to the company; or (3) assume an obligation to make a contribution or otherwise pay cash or transfer property to the company.

(c) If one or more persons own a membership interest in a limited liability company, the company agreement may provide for a person to be admitted to the company as a member without acquiring a membership interest in the company.

Rights and Duties of an Assignee

BOC Sec. 101.109. RIGHTS AND DUTIES OF ASSIGNEE OF MEMBERSHIP INTEREST BEFORE MEMBERSHIP

(a) A person who is assigned a membership interest in a limited liability company is entitled to:

(1) receive any allocation of income, gain, loss, deduction, credit, or a similar item that the assignor is entitled to receive to the extent the allocation of the item is assigned; (2) receive any distribution the assignor is entitled to receive to the extent the distribution is assigned; (3) require, for any proper purpose, reasonable information or a reasonable account of the transactions of the company; and (4) make, for any proper purpose, reasonable inspections of the books and records of the company.

(b) An assignee of a membership interest in a limited liability company is entitled to become a member of the company on the approval of all of the company’s members.

(c) An assignee of a membership interest in a limited liability company is not liable as a member of the company until the assignee becomes a member of the company.

BOC Sec. 101.110. RIGHTS AND LIABILITIES OF ASSIGNEE OF MEMBERSHIP INTEREST AFTER BECOMING MEMBER

(a) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is:

(1) entitled, to the extent assigned, to the same rights and powers granted or provided to a member of the company by the company agreement or this code; (2) subject to the same restrictions and liabilities placed or imposed on a member of the company by the company agreement or this code; and (3) except as provided by Subsection (b), liable for the assignor’s obligation to make contributions to the company.

(b) An assignee of a membership interest in a limited liability company, after becoming a member of the company, is not obligated for a liability of the assignor that:

(1) the assignee did not have knowledge of on the date the assignee became a member of the company; and (2) could not be ascertained from the company agreement.

It is important to note that these statutory rights and duties are subject to “restrictions and liabilities” that may be imposed by the company agreement.

PRELIMINARY CONSIDERATIONS

The company agreement.

When considering a transfer of LLC membership, it is important to first check the company agreement (operating agreement) to determine if there are buy-sell provisions or a right-of-first-refusal clause that must be worked through before the membership interest can be assigned. company agreements often require that before a sale and assignment of a membership interest can occur, the interest must first be offered pro rata to the other members, and/or to the company itself, before a transfer may be made to a person who is not currently a member. Unless waived, such provisions may be accompanied by an offer period of (for example) 10, 30, or 60 days.

Buy-sell and right-of-first-refusal provisions exist so that existing LLC members do not unwillingly find themselves in business with someone they do not know.

Non-Member Spouses

Are non-member spouses involved? Like real estate, personal property in Texas is presumed to be community property. A frequent error in transfers of LLC membership interest is failure to secure the signature of an assignor-seller’s non-member spouse. The result is that the entire interest may not have been conveyed, at least not in Texas. This is no different than if a grantee in a deed accepts the conveyance without requiring execution by the grantor’s spouse; since community property is presumed, the transfer may be incomplete if the spouse does not sign off, at least in a pro forma capacity.

To say that omitting the signature of a non-member spouse can drive subsequent disputes would be an understatement. Even though BOC Section 101.108 provides that a non-member spouse of an assignee may not assert control over the company, the potential for awkward and potentially disastrous disruption remains. Consider the case of a withdrawing member who is contemplating divorce but has not yet revealed this to other members who may want to buy his LLC membership interest. Will the assignment get tangled up in the parties’ divorce?

As is the case in transfers of real estate, it is common for sellers of an LLC membership interest to argue that the spouse should not be required to sign the assignment because the property transferred is a business asset rather than a part of the homestead. Real estate lawyers hear such excuses all the time. Other reasons may be given (“My wife is in China”). None of these excuses should be allowed to carry any weight unless the membership interest has been lawfully converted into separate property by a written partition agreement according to Section 4.102 et seq. of the Family Code.

What will be the accounting consequences? Is timing an issue?

There will likely be accounting consequences as a result of transferring an LLC membership interest. BOC Section 101.201 partially addresses this issue, stating “The profits and losses of a limited liability company shall be allocated to each member of the company on the basis of the agreed value of the contributions made by each member, as stated in the company’s records. . . .” This rule will apply unless the members collectively agree otherwise.

Attention should be given to the effective date of the assignment, since the transfer date may have more than one level of significance. It is advisable to select an effective date or record date for the assignment that facilitates easier calculation of profits and losses, or at least does not unduly complicate that calculation.

Will the membership interest pass a due-diligence inspection?

The issues referred to above are part of a larger group of due-diligence considerations that may concern a prospective buyer, which brings us to the due-diligence checklist in the next section.

DUE DILIGENCE BY THE ASSIGNEE-BUYER

Due diligence checklist.

The following is a partial list of items that should be of concern to a prospective assignee-buyer of an LLC Membership Interest:

(1) Valuation . Most small-business assignments of LLC membership interest occur among insiders who are already acquainted with the company’s assets, liabilities, management, and operations. For potential assignees who do not fall in this category, the question of valuation arises—not just valuation of the membership interest itself but valuation of the LLC as a whole, since the two are effectively inseparable.

Several articles could be written on how to evaluate and appraise a business; suffice it to say that there should be some rational basis for the asking price that can be independently confirmed by looking at the company’s finances and assets. Certain numbers will be hard (real property and bank accounts) and others will be soft (marketing strategy, proprietary information, and value of the brand).

If assets include real properties, an evaluation of value may include appraisals by licensed appraisers or the less-formal alternative of a broker price opinion (BPO). It is impressive if a real estate investment firm has an inventory of 30 rental properties; it is less so if half the properties are drowning in deferred maintenance. Numbers guys may be satisfied with financials and a spreadsheet; traditionalists will want to physically inspect the properties as part of the due-diligence process.

(2) Good Standing . It is important to verify that the LLC and the assignor (if a registered entity) are in good standing with the secretary of state and the comptroller. If not, they do not have the legal capacity to do business, which could potentially make execution of an LLC membership assignment invalid.

(3) Core LLC Documents . A prospective assignee-buyer will want to see core LLC documents including the certificate of formation; the certificate of filing (the secretary of state’s approval); the minutes of the first organizational meeting of members along with subsequent minutes of special meetings (if any) and annual meetings; company resolutions or grants of authority; the company agreement, as currently amended or restated; and any membership certificates that may have been issued (or at least a record of same).

Also: where are the official LLC records kept? Who is responsible for keeping them, and is access readily available? Is there a company book, i.e., a binder containing these? Failure of an LLC to keep organized and complete records is a warning sign for a potential assignee. This is true regardless of and aside from any statutory requirements for LLC record keeping.

A vital object of an assignee’s investigation should be the company agreement. The company agreement is essentially a partnership agreement among LLC members, so it will directly bind a prospective assignee . Is it valid? Is it a legal document of substance or is it a three-page printout from the internet that is not even relevant to Texas? Are provisions of the company agreement compatible with the intentions and goals of the assignee? What limitations does the company agreement impose (for example, restrictions on transfer of membership interests)? Can one easily re-sell the membership interest or are there hoops to jump through?

(4) Managers . It is operationally important to determine if the LLC is member-managed or manager-managed and, if the latter, to identity of the managers. Can the assignee work with these persons? Are they professional and competent? What is their track record?

(5) Member List . LLCs are required to keep current lists of members, their respective interests in the company, and a list of all contributions to the company. BOC Sections 101.501(a)(1)-(7). Fellow members of a smaller LLC are effectively your partners in the enterprise. It is good to know to know something about them.

(6) Contracts and Agreements with Third Parties . Any agreements with third parties that affect control, management, or operation of the LLC should be examined. Examples would be contracts with vendors or a property management agreement with a third-party management company. Is the LLC currently part of a joint venture with a different group of investors?

(7) Voting Agreements . These may or may not exist. Any one or more of the members may enter into voting agreements (including but not limited to proxies and pledges) that can affect control of the entity.

(8) Federal Tax Returns. Tax returns are important to verify how the LLC is taxed and how ownership is reported to the IRS. Tax returns and LLC records should be consistent in this respect. It is a good idea for a prospective assignee to have a CPA review the company’s tax returns.

(9) Texas Annual Filings . A prospective assignee should review the franchise tax returns and public information reports (PIRs) that must be annually filed with the comptroller’s office. Do these accurately reflect the LLC’s affairs? Are they diligently prepared and timely filed?

(10) Transactional Records . What property does the LLC own? Are warranty deeds in the name of the LLC duly recorded in the real property records? How are properties managed and who is responsible for doing so? What do the files and records look like—are they orderly or are they a mess? And what about completeness? Do files for rental properties contain all essential documents like warranty deeds, notes and loan agreements, deeds of trust, leases, appraisals, maintenance records, and so on? A specific person should be responsible for keeping such records at a designated location.

(11) Salaries, Draws, and Distributions. These should be examined to discover if there is a pattern of excessive or erratic compensation to managers or distributions to members. Is there a coherent schedule or plan? Are measures in place to insure that the LLC maintains sufficient working capital to fund existing and planned operations?

(12) Bank and Depository Accounts . Current and recent copies of account statements should be examined. Look for any unusual withdrawals or capital flows. Is the LLC adequately capitalized? Does it have an adequate capital reserve? Inadequate capitalization is the number one cause of small business failure.

(13) Records of Pending, Prospective, and Resolved Legal Actions . Is the LLC being sued? Has it been sued in the past? Do the managers have a history of shoddy or deceptive dealings? Is the LLC continually receiving DTPA notice letters from attorneys? Default letters from HOAs or appraisal districts? Does the company charter get periodically revoked (and then have to be reinstated) because the LLC fails to timely file its franchise tax return or PIR? Consider meeting with the LLC’s attorney and CPA. Require that confidentiality be waived in order to get a frank assessment of the situation.

(14) Best Practices Generally . It is important to ascertain whether or not the LLC is run with diligence, integrity, and in compliance with applicable law. What is the company culture with regard to best practices? Does the LLC have a regular business attorney and CPA to advise the managers? Or do the managers wing it on a DIY basis most of the time, counting on a surging market to cover their mistakes?

(15) Reputational Evidence . A prospective assignee may want to do some digging in order to evaluate the business and personal reputations of the managers and members. What is their professional history? The personal lives of the existing members may also be relevant: are any of them getting a divorce from a spouse who might turn into a hostile party? Was one of them just expelled from the country club for non-payment of dues? An internet search is, of course, the bare minimum but it may also be prudent to consider a private investigator (These are not just for the movies).

(16) Company Performance . How have the LLC’s investments fared, particularly over the last three years? What do the company accounts show and are these numbers verifiable? Does the spreadsheet match up with the checkbook?

Trends are an important part of value analysis. Try to reduce the LLC’s quarterly and annual results to line graphs for income and costs. Which way are these factors trending?

(17) Business Plan . Do the managers and members have specific goals or is their strategy more built around finding targets of investment opportunity? Is their plan realistic or pie-in-the-sky? What will the company likely look like in three years? Five years? Is a change in direction required?

The importance of thorough due diligence conducted during an adequate inspection period cannot be understated. Knowledge, as they say, is power. If one must sign a confidentiality or non-disclosure agreement in order to get relevant information on the LLC and its members, then that is what should be done.

CLAUSES AND PROVISIONS OF THE ASSIGNMENT

Assignments of interest generally.

All assignments of interest (regardless of the interest assigned) include—or should include—certain common clauses and provisions. After identifying the parties and the exact interest to be assigned, the document should state the consideration being paid; whether the consideration is nominal, cash, or a financed amount (secured or unsecured); recite both transfer and acceptance language; state whether the assignment is made entirely “as is” or instead with representations and warranties; state whether the assignee will have any recourse in the event certain post-assignment conditions are not met and identify the recourse mechanism; recite covenants and agreements of both parties that will result in the implementation of the transfer along with remedies for default if these measures are not carried out; a mutual indemnity clause; any special provisions agreed to by the parties; an alternative dispute resolution (mandatory mediation) clause; and conclude with various miscellaneous provisions that identify applicable law and venue, advise all parties to consult an attorney, set an effective date, and so forth.

A “Consent of Non-Member Spouses” should be appended if applicable. Exhibits to the assignment (pertaining to company assets and liabilities, for instance) may also be needed.

Representations and Warranties

An assignment may include a full set of representations and warranties (“reps and warranties”), limited reps and warranties, or no reps and warranties at all—in which case the assignment is made entirely as is and (in such cases) is almost always without recourse, meaning there is no defined remedy against the assignor-seller if the LLC membership goes sour for some reason. Representations and warranties may be made by assignor, assignee, both, or neither.

Core reps and warranties are basic assurances to which no reasonable party should object. Reps and warranties can get much more detailed and extensive from there. If attorneys are involved, the reps and warranties section of a contract may be heavily negotiated.

The assignor-seller’s goal is to minimize post-closing liability by transferring the membership interest “as is” to the maximum extent by including only a minimum number of reps and warranties. It should be noted that inclusion of the above-mentioned core items does not impair the ability of an assignor to assign an interest “as is.” For this reason, it is always somewhat suspicious when an assignor refuses to give any reps or warranties at all.

The assignee-buyer instead prefers a longer and more specific list of reps and warranties on the part of the assignor-seller. One of the goals of the assignee in the due diligence process is to ascertain, to the greatest extent practicable, the accuracy of reps and warranties that have been or will be made by the seller.

Examples of Reps and Warranties

Examples of basic reps and warranties would include assurances that each party, if a registered entity, is in good standing; the party has power and authority to enter into the transaction without joinder of others; and there exists no condition or circumstance that would render the transaction illegal or invalid or place the party in breach of an existing contract. Additional near-core items would include assurances that each party has performed adequate due diligence and has consulted an attorney before signing.

Both assignor and assignee should also want to include a statement that neither party is making or relying upon any reps or warranties that are not expressly set forth in the assignment. The goal is to prevent anyone from assuming anything or alleging that certain assurances were oral or implied.

Reps and Warranties: Duration and Default

Once reps and warranties are negotiated, it must be determined how long they will survive closing—if at all. 30 days? 90 days? Indefinitely?

A final issue in this area has to do with remedies for default in the event of breach. Attorneys frequently include a clause requiring that such default be a material (rather than a trivial) breach in order to be legally actionable. The issue is then raised, how does one define material ? One method is to impose a monetary floor, e.g., by confining assignor liability to issues that result in a loss or cost of (say) $10,000 or more.

Assignments Made “As Is”

As noted, an assignor-seller can include basic (limited) representations and warranties and still convey an LLC membership interest “as is.” Many business persons, including lawyers, do not adequately understand this. For example, stating that one has sufficient power and authority to enter into a transaction does not suggest any representation or warranty as to the item being conveyed. It is a core representation that should probably be included in every assignment.

The key to protecting the assignor is a thorough “as is” clause. Just as is true with real estate conveyances, the more thorough and extensive the “as is” clause, the better. One-liners will generally not do. This is particularly true if there have been oral or email negotiations over a period of weeks or months. The goal should be not only to convey the interest “as is” but also to entirely exclude any statement that cannot be expressly found in writing within the four corners of the assignment instrument.

Covenants and Agreements of the Parties

Covenants and agreements address the legal obligations of the parties going forward—specifically what actions they are required to take in order to implement the assignment. Covenants and agreements of the assignor-seller would include, for example, an obligation to promptly endorse and deliver to the assignee-buyer any certificates evidencing the membership interest in question.

The assignee-buyer should also covenant and agree to abide by the company agreement and other governing documents. Since Texas is a community property state, the spouse of a new assignee should also be asked to sign off on this commitment. The best practice is to secure the signatures of both the new assignee and any non-member spouse not only on the assignment but on the company agreement itself.

Additional covenants and agreements of the parties may be (and usually are) included. This is another area that is subject to extensive negotiation and customization to the circumstances.

Recourse by Assignee upon Occurrence of Specified Conditions

The option for some form of limited or conditional recourse may be included in any assignment of interest. In the case of an LLC membership interest, the assignment could provide that, upon occurrence of certain conditions, the assignee would have the right to re-convey the membership interest and receive return of all or part of the consideration. Examples of such conditions would be any adverse event—a negative outcome in a pending lawsuit or zoning proceeding; condemnation of certain LLC property; failure of a pending joint venture; or the discovery that any representations or warranties of assignor were materially false or deceptive when made. The availability of a recourse mechanism is generally time-limited, say for 90 days after closing. Some assignments might also refer to this recourse mechanism as a right to rescind.

In any assignment instrument, the alternative to full or limited recourse is no recourse at all by the assignee-buyer. For example, real estate notes are often sold without (either full or limited) recourse against the assignor-seller in the event that the borrower on the note defaults. In such a case, absent any provision for recourse, the assignee-buyer of the note would then be in possession of a non-performing asset. The remedy is not against the assignor, but to pursue the debtor directly.

Mutual Indemnity

Ideally, and unless there are special circumstances, the assignor and assignee should release and indemnify one another for LLC-related actions, claims, liabilities, and obligations occurring before and after (respectively) the effective date of the assignment. Indemnity provisions are useful and worthwhile, but one needs to clearly understand their limitations. They are not a covenant not to sue.

Non-Compete and Non-Disclosure Provisions

Sale by a departing LLC member to another member may raise concerns that the departing member will utilize proprietary and confidential information in order to compete with the company in the same line of business within the same geographical area. Agreements regarding intellectual property and non-competition are typically stand-alone full-length contracts; nevertheless, it is possible to include compact and enforceable IP and non-compete provisions that fit smoothly and purposefully into a sale and assignment of LLC membership interest. Failing to do this can be an error with serious consequences.

Corporate Transparency Act and FinCEN Reporting

The Financial Crimes Enforcement Network (FinCEN), an arm of the Treasury Department, is charged with rulemaking to enforce the Corporate Transparency Act which was passed in 2021. The CTA contains sweeping requirements regarding the reporting of beneficial interests in LLCs and corporations.

To the extent that a sale and assignment of LLC membership interest constitutes a change in beneficial ownership, then a report to FinCEN will likely be required. The assignment instrument should expressly address the applicability of the CTA and designate which party (usually the assignee) will be responsible for filing a supplemental FinCEN report.

If the burden of FinCEN reporting falls on the assignee, then the assignor may want to include an indemnity clause for added protection. The assignor may also want to limit liability for past FinCEN reporting.

Alternative Dispute Resolution: Mandatory Mediation

Since we live in a litigation nation, it is highly advisable to include a provision that requires mediation prior to commencing legal action. Approximately 80% of mediations result in a settlement. In other words, mediation works, at least most of the time.

A mediation clause should require the conflicting parties to first confer in good faith and attempt to resolve the dispute in a way that accommodates the legitimate interests of both sides. If agreement is reached, it should be reduced to a signed writing and implemented. If not, the parties should then agree to formally mediate the dispute before a certified mediator prior to resorting to litigation or filing any complaint with a governmental or administrative agency.

A mandatory mediation provision should also state where the mediation will be held (which city or county) and for how long (mediations are usually either a half-day or a full day). Each party should commit to bearing its own fees and costs until the mediation is concluded.

Special Provisions and Stipulations

It is useful to include a catch-all special provisions section that allows room for terms that may be specific to the subject transaction and its unique circumstances. These special agreements and provisions frequently arise and this is the place to insert them.

Stipulations are a slightly different concept. For example, an assignment of LLC membership interest may involve a new list of members. It may also require a re-allocation of percentage interests among the remaining members. So it may be beneficial to include a stipulation that after conclusion of the assignment, the new membership list (with accompanying revised percentage interests) will be as described in Exhibit A. This usefully erases any doubt as to the overall final outcome of the transaction.

As previously noted, a special meeting of members is an important companion document to the assignment of LLC membership interest. The meeting, signed by all affected parties, can not only approve the assignment but mention issues such as record date, a general ratification of the assignment and the new member list, and also authorize issuance of new membership certificates.

No Reliance and No Representation Clauses

The assignor-seller (in particular) may want to make it clear that the assignment is made and accepted by the assignee-buyer only after a proper due-diligence investigation and without reliance on any statements or assurances (especially oral ones) made by the assignor-seller or its agents.

Wrap-Up Provision Relating to Execution and Delivery of Documents and Records

It would be an oversight if an assignment of LLC membership interest failed to mention possession and delivery of company books and records, an omission that has resulted in more than a few lawsuits. An agreement to execute and deliver such additional and further documents as may be reasonably necessary to effectuate the purposes of the assignment should cover and include any affected LLC records, including the company book and accounting records. These may need to be transferred to a new assignee-owner or returned to the assignor-seller after due-diligence inspection.

Clients often do not understand why a sale and assignment of LLC membership interest cannot be a simple, one-page document. It is hoped that this article will clarify the answer to that question.

Information in this article is provided for general informational and educational purposes only and is not offered as legal advice upon which anyone may rely. The law changes. No attorney-client relationship is created by the offering of this article. This firm does not represent you unless and until it is expressly retained in writing to do so. Legal counsel relating to your individual needs and circumstances is advisable before taking any action that has legal consequences. Consult your tax advisor as well.

Copyright © 2024 by David J. Willis. All rights reserved. Mr. Willis is board certified in both residential and commercial real estate law by the Texas Board of Legal Specialization. More information is available at his website, www.LoneStarLandLaw.com .

Share this entry

- Share on Facebook

- Share on LinkedIn

- Share on Reddit

- Share by Mail

Consumer Notices:

State Bar of Texas Notice to Clients TREC Consumer Protection Notice TREC Information about Brokerage Services (IABS) Policies Applicable to All Cases and Clients Policies Regarding Copying of Website Content

Office Meeting Address:

Lucid Suites at the Galleria 5718 Westheimer, Suite 1000 (Westheimer at Bering Drive) Houston, TX 77057

Hours: 8 am – 6pm M-F Phone: 713-621-3100 Fax: 832-201-5321 Contact Us Vacation Schedule

© 2024 David J. Willis – LoneStarLandLaw.com

Design and Marketing – Advanced Web Site Publishing

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

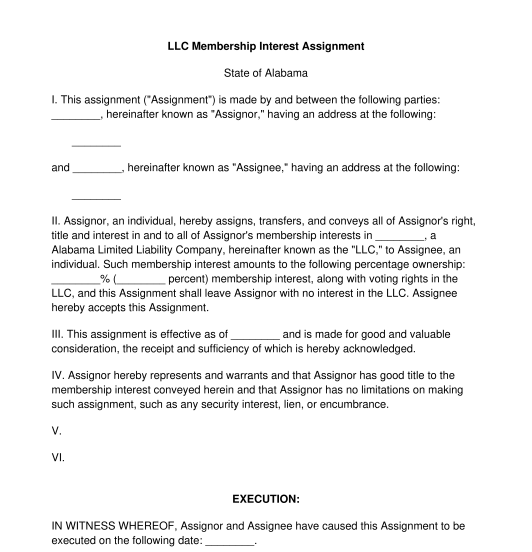

LLC Membership Interest Assignment

Rating: 4.8 - 951 votes

An LLC Membership Interest Assignment is a document used when one member of an LLC, also known as a limited liability company, wishes to transfer their interest to another party entirely. LLC Membership Interest Assignments are often used where a member in an LLC is leaving or otherwise wants to relinquish the entirety of their interest in the company.

An LLC Membership Interest Assignment normally happens well after the LLC has already been operating . To form a limited liability company in most states, any party must begin with Articles of Organization (sometimes called Certificates of Formation or other varying names). These documents will get the LLC formed and in compliance with state laws.

A limited liability company can operate and be formed for any reason (except illegal ones). For example, even if it is a small business, like dog-walking, the owners might want to have an LLC to protect themselves. If so, and if any owner decided to one day relinquish their interest in the LLC , that owner could use this LLC Membership Interest Assignment to assign it to another person.

LLC Membership Interest Assignments are short, relatively easy documents which contain all the information needed to transfer an interest in an LLC.They contain a place for both the person transferring the interest (called the Assignor) and the person receiving the interest (called the Assignee) to execute the document.

How to use this document

This document can be used when any party would like to transfer the ownership of an interest in an LLC or when any party would like a membership interest in an LLC transferred to them, as long as the current owner of the membership interest agrees. It should be used it when both parties understand that the membership interest will be completely assigned and wish to create a record of their agreement, as well as a document that the LLC will likely keep on file.

This document will allow the form-filler to input details of the identities of both parties, as well as the details of the membership interest, such as percentage and whether or not it comes with voting rights . It also has an optional addendum at the end, in case full consent is needed from all the rest of the members of the LLC .

Please keep in mind that this form requires both signatures , from the party assigning the interest and the party receiving it.

Applicable law

LLC Membership Interest Assignments are subject to the laws of individual states . There is no one federal law covering these documents, because each individual state governs the businesses formed within that state.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Percentage in an LLC

- How to Sell your Business

- How to Transfer Business Ownership

Other names for the document:

Assignment of Interest for LLC Member, Interest Assignment for LLC Membership, LLC Interest Assignment Agreement, Member Interest Transfer for LLC, Membership Assignment for LLC

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- Partnership Agreement

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

- Other downloadable templates of legal documents

- Real Estate Lawyer

- Wills & Estate Planning

- Business Law

- Marty’s Musings

- Testimonials

- Assigning an Agreement of Purchase and Sale (Prior to Closing)

- Marty's Musings

By Martin Rumack

September 3, 2016

What is an Assignment of an Agreement of Purchase and sale?

At its essence, an Assignment of an Agreement of Purchase and Sale – informally known as “flipping a home” – is a simple concept: A buyer of a new home allows someone else to take over the purchase contract, which allows that person to buy that same home him or herself.

More specifically, the original buyer enters into a formal Agreement of Purchase and Sale with a Builder, and then allows another person – who we will call the “new buyer” – to step into his or her shoes through what is legally known as an “Assignment” of that original Agreement or Offer to buy. The new buyer pays the original buyer a higher price than what was set out in that original Agreement, with the difference begin the original buyer’s profit. All of this takes place after the original buyer has agreed to buy from the Builder, but before the deal closes ; the original buyer never takes title to the property.

This arises primarily with homes: For newly-built homes with typically long closing dates (e.g. often 18 months or more), an Assignment is particularly attractive in situations where the Builder has already sold all of the units in the development early on, but where there is still demand for soon-to-be-completed homes and new condominium units in the development. The assignment of a new condominium unit is also interesting for similar reasons, although the time frame may be significantly longer depending on when the assignment occurs. This puts the original buyer in position to make a profit by inflating the new price well above what he or she agreed to pay the Builder in the first place.

And what is the benefit to the new buyer? There can be several:

- The new buyer may be able to buy into a desirable neighbourhood at a time when there are no more units available to be purchased directly from the Builder;

- Even taking the original buyer’s profit into account, the assignment may give the new buyer a price advantage over other properties that are currently on the market; and

- Depending on the timing of the assignment, the new buyer may be position to choose finishes and make minor changes to the yet-to-be-built home.

Whatever the respective motivations of the original and new buyer, the assignment of an Agreement of Purchase and Sale has many specific features – and just as many potential pitfalls. What follows is a discussion of some of the key points.

When Can An Agreement of Purchase and Sale Be Assigned?

Unlike the standard Toronto Real Estate Board (TREB) or Ontario Real Estate Association (OREA) agreements, many Builders’ own ( i.e. customized) Agreements of Purchase and Sale contain a clause that generally prohibits the assignment of the contract outright – or else allows it only certain very strict conditions and in exchange for a significant fee payable to the Builder.

In fact, the vast majority of new home or condominium-purchase agreements do not allow the original buyer to assign the contract to someone else and stipulate that any attempt by the buyer to do so, or to list the home for sale on the Multiple Listing Service (MLS) or otherwise, or else list the property for rent, will put the original buyer in breach of the Agreement. This triggers the Builder’s right, with notice, to terminate the original Agreement, keep the original buyer’s deposit, and seek additional damages from him or her. (And in most cases, the original buyer’s Agreement is “dead”; i.e. he or she cannot go back and try to complete the transaction as if no assignment had taken place).

All of this means that anyone who has agreed to purchase a home from a Builder should give careful consideration to, and should seek legal advice prior to signing the Agreement, or in the case of condominium units during the 10-day cooling-off period in order to determine whether it’s possible to assign the Agreement in the first place.

This in turn involves a careful review of the clauses in that Agreement.

Typical (and Not-So-Typical) Provisions:

As a practical matter, there are as many variations in these types of provisions as there are Builders.

Many Agreements of Purchase and Sale will include a largely-standard “No Assignment” clause, which disentitles the original buyer from “directly or indirectly” taking any steps to “lease, list for sale, advertise for sale, assign, convey, sell, transfer or otherwise dispose of” the property or any interest in it.

A potential exception – and this is important – arises if the Builder gives prior written consent , although in the more draconian version of these kinds of contract, that consent may be “unreasonably and arbitrarily withheld” by the Builder, essentially on its whim. In other words, the buyer is not allowed to deal with the property, unless the Builder pre-approves it in writing, but in many cases the Builder has no obligation to give that approval and may withhold it for any reason whatsoever, including unreasonable and arbitrary ones.

(With that said, the “No Assignment” clause in some Agreements will allow for express exceptions or situations where the Builder will not withhold consent, for example: a) Assignments made to a member of the original buyer’s immediate family; or b) where the Builder has determined that a sufficient and satisfactory percentage of the available units have already been sold).

The bottom line is that the basic clause in an Agreement of Purchase and Sale may or may not allow for the assignment of the Agreement to a new buyer, and if it is allowed, it will be subject to specified conditions such as obtaining the Builder’s written consent. Most Agreements will embellish this basic clause by adding further written stipulations such as:

- Having both the original buyer and the new buyer sign an Assignment Agreement that has been drafted by the Builder;

- Mandating the original buyer will not assign the Agreement until the Builder has managed to sell a certain percentage of the units in the overall development (e.g. 85 or 90%), and even then it must be with the Builder’s written consent as usual;

- Requiring the original buyer to pay a fee to the Builder of (for example) $5,000 plus taxes as part of obtaining the Builder’s consent to the assignment;

- Requiring the original buyer to pay another fee plus taxes to the Builder’s lawyer (ostensibly as a sort of “legal processing fee”);

- Getting the pre-approval of any lending institution or mortgagee that is providing funding to the Builder for construction or otherwise;

- Assuming the Builder agrees to the assignment in the first place, prohibiting any further assignments of the offer by the new buyer to any subsequent party;

- Confirming that the breach of any of the original buyer’s promises in relation to how and when an assignment can occur will be considered a breach of the whole agreement (and one that cannot be remedied); and

- Requiring the original buyer to confirm in writing that the property is not being purchased for short-term speculative purposes.

- Note that even if the Agreement of Purchase and Sale does not expressly allow or provide for it in writing, some Builders will permit an original buyer to make an assignment nonetheless. This is because it is always in the Builder’s discretion to give up (usually for a fee) its right to technically insist on the purchase going ahead with the original buyer.

Getting the Builder’s Consent

It’s important to remember that, initially, the original buyer and the Builder had a valid legal contract in place that obliged the buyer to purchase a home or condominium unit from the Builder. That original buyer, for whatever reason – whether it’s a change of circumstances (such as a change in a marital situation, job transfer to another city, province or country; birth of children resulting in a home/condominium unit being too small for the buyer), cold feet, or simply the desire to make a profit – has subsequently decided to “sell” that right to buy to the new buyer.

To protect the Builder, the Assignment will contain clauses that are designed to safeguard the Builder’s rights. The most important one is that, as discussed, the Builder must give its written consent to the Assignment. This will often involve specific Builder-imposed requirements, fees and forms which must be completed.

Once consent has been obtained, there may be additional restrictions on the manner in which the original owner can market the property. For example, some Builders will insist that the property is not to be listed on MLS (where it may be competing with the Builder’s own listings for still-unsold home and units in the same development); if the original owner does so nonetheless, it will be tantamount to a breach of the Agreement of Purchase and Sale which could entitle the Builder to damages, or rescission of the Agreement of the Purchase and Sale while retaining the deposits paid, as well as the monies paid for extras.

However, aside from any marketing / advertising restrictions that may be imposed, the original buyer must clearly indicate in any listing that it is an assignment of an Agreement of Purchase and Sale, not merely an ostensible sale from the original buyer.

Continuing Liability After Assignment

One key provisions in the Agreement of Purchase and Sale – and one that is easy to overlook – may significantly impact whether an original buyer will want to assign his or her agreement at all.

Even though the original buyer has essentially transferred his or her right to buy the property to the new buyer, the original buyer is not fully off-the-hook. Rather, under the terms of the Assignment document, the original buyer can remain liable to go through with the contract if the new buyer does not complete the transaction with the Builder.

This written obligation appears in the original buyer’s Agreement of Purchase and Sale, and is couched in phrases that give the buyer continuing liability for the “covenants, agreements, and obligations” contained the original agreement. But the net effect is that the original buyer remains fully liable should the agreement between the Builder and the new buyer collapse. The Agreement may also stipulate that the assignee, meaning the person receiving the benefit of the assignment (i.e. the new buyer) must sign an “assumption covenant” which creates a binding contract between the new buyer and the Builder.

(Incidentally, in contrast some Builder’s agreements quite conveniently allow the Builder itself to freely assign the agreement to any other Builder registered with Tarion, which assignment completely releases the Builder from its obligations.)

The original buyer’s continuing liability under the Assignment Agreement is a major drawback in these types of arrangements. The original buyer always has to balance the risks and rewards inherent in this scenario.

Documenting the Transaction

Assuming that the assignment of an offer is even permitted by the Builder, then (as with all contracts) it must be documented to reflect and protect the legal right of the parties.

The technical aspects of an assignment require more than simply taking the original buyer’s Agreement of Purchase and Sale with the Builder, scratching out his or her name, and replacing it with the new buyer. (Although, in some cases people do try to “squeeze in” assignment-of-offer terminology into a new Agreement of Purchase and Sale made out in the new buyer’s name – but this is definitely NOT recommended).

Rather, a properly-documented transaction makes reference to the Agreement of Purchase and Sale between the original buyer and the Builder, but adds a separate document called an “Assignment of Agreement of Purchase and Sale.” The Ontario Real Estate Association (OREA) provides a standard form that can be used, although in many cases those Builders who permit Assignments will insist that the original buyer and the new buyer use the Builder’s customized assignment forms, rather than the OREA standardized version.