Browse Course Material

Course info.

- Prof. Sugata Roychowdhury

Departments

- Sloan School of Management

As Taught In

Learning resource types, introduction to financial and managerial accounting, assignments.

The problem sets are to be done individually and are intended to help the student learn and practice the mechanics of the course material. Seven of the eight problem sets from the class are presented here.

You are leaving MIT OpenCourseWare

Managerial Accounting

(8 reviews)

Kurt Heisinger, Sierra College

Joe Hoyle, University of Richmond

Copyright Year: 2012

Last Update: 2023

ISBN 13: 9781453345290

Publisher: Saylor Foundation

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Salina Siddique, Assistant Professor, Metropolitan State University of Denver on 5/22/19

The textbook covers the all the major concepts of managerial accounting. Although they are followed in a slightly different way and order than are pursued in the textbook I am currently using. I found the book easy to follow; however, a number of... read more

Comprehensiveness rating: 5 see less

The textbook covers the all the major concepts of managerial accounting. Although they are followed in a slightly different way and order than are pursued in the textbook I am currently using. I found the book easy to follow; however, a number of concepts could have been stretched further, such as, First-in-first-out method for Process Costing in Chapter 4, Lease or sell decision and replacing an old equipment with a new one etc. in Chapter 7 and Budgeting for merchandising organizations in Chapter 9 are some examples to mention. Inclusion of Table of Contents in the PDF version would have assisted with the reviewing of the textbook. A comprehensive list of learning objective would be useful at the beginning of each chapter. In addition, inclusion of an index/glossary would have been really helpful for quick search.

Content Accuracy rating: 5

The definitions are comprehensive. I have randomly checked a number of problems for mathematical accuracy and found no errors. However, I was wondering if the answers for the end of the chapter exercises are also available to the reviewers for establishing the accuracy.

Relevance/Longevity rating: 5

In terms of contents, the textbook covered all the major concepts of managerial accounting and hence, remain relevant for a considerable period of time. However, there are scopes for adding more examples and recent business phenomena and reference to current information technology.

Clarity rating: 5

The book is easy reading. I really like the introduction of each chapter, which starts with a business scenario in the form of dialogues that raises a particular management issue and then points out the necessity of learning the managerial accounting concepts covered in that chapter to solve such issue.

Consistency rating: 5

The text is consistent in terms of terminology and organization format.

Modularity rating: 5

Splitting each concepts into smaller chunks/sections supplemented by relevant questions and answers and examples would make the reading easy to the students.

Organization/Structure/Flow rating: 5

The topics in the text are presented in a logical and workable manner.

Interface rating: 4

Throughout the book, spaces are omitted between the words in the "Key equation" boxes in the PDF version, which may confuse the reader. Some of the tables are hazy and interferes with the reading.

Grammatical Errors rating: 5

I have not noticed any grammatical errors.

Cultural Relevance rating: 5

I have not perceived any culturally insensitive content or example in any way.

I greatly appreciate the effort of the authors in completing this book and making it available to students at no charge.

Reviewed by David Milton, Community Faculty, MnSCU on 10/25/18

Comprehensive introduction to the key concepts and methodologies of costing, including budgeting, cash flow forecasting, decision analysis, performance evaluation, and non financial measures. read more

Comprehensive introduction to the key concepts and methodologies of costing, including budgeting, cash flow forecasting, decision analysis, performance evaluation, and non financial measures.

Lots of examples and no mathematical errors were noted.

Good examples of how concepts are actually used, and the impact on financial statements.

Clarity rating: 4

Good definitions and and thought-provoking questions to strengthen understanding of the concepts.

Concepts build upon each other and are sequentially introduced.

Well tagged and compartmentalized.

Organization/Structure/Flow rating: 4

Fair organization. It would help if the answers to problems or exercises were on a different page or indexed in the back of the book.

Interface rating: 1

The tables in the pdf version are completely illegible and blurred, even when you zoom in. The online version is better.

None were obvious.

People (professionals) referenced in the examples were gender neutral with a representative balance.

I am not appreciating the muted green and blue shadings on all the tables and exercise problems. It makes it difficult to read. The fonts on some of the tables and exercise problems are entirely too small.

The introduction and explanation of the concepts are fairly well done and they make good use of challenges faced by contemporary companies.

Reviewed by Phebe Davis, Clinical Assistant Professor, Clemson University on 2/1/18

There is no glossary or index included, which would assist greatly with quick referencing of the information. However, the table of contents presents a comprehensive detailed overview of the book's chapters and related sections. The material... read more

Comprehensiveness rating: 4 see less

There is no glossary or index included, which would assist greatly with quick referencing of the information. However, the table of contents presents a comprehensive detailed overview of the book's chapters and related sections. The material coverage is as complete as the book I currently use, though presented in a slightly different order. This does not reduce the effectiveness of the information. I enjoyed seeing the review problems after each chapter section rather than all at the end of the chapter. I think students might be more likely to work the review problems in this manner as the questions appear more relevant when presented right after the applicable information. The key takeaways are also nice as they seem to reinforce the learning objectives. Overall, I think the book is effective for the purpose of an Introduction to Managerial Accounting.

Content Accuracy rating: 4

The information appears accurate. No errors noted.

Relevance/Longevity rating: 4

The material in this book appears relevant and consistent with other managerial textbooks. This type of information does not change frequently. The book should be easy to update should changes become necessary.

The information is clear with easy to follow examples and problems. The simple writing of this textbook helps reduce cognitive overload.

Consistency rating: 4

The book follows a logical pattern in presenting the topical information, though slightly different from how I currently teach managerial accounting. Terminology and layout is consistent throughout the textbook.

Modularity rating: 4

I appreciate the subheadings with the key takeaways and review problem after each chapter sub-section. The flow allows a simple way to ensure the learning objectives have been met. Each chapter is comprehensive enough to stand-alone.

Text is organized logically and has good information flow. Easy to follow and understand.

Interface rating: 3

I reviewed the online book and noticed spacing issues that were a bit distracting. I think the example sections should have a brighter background color scheme. The gray is boring and looks dull. Some of the more compressed pictures were not completely clear. Overall, the images are decent.

No grammatical errors noted.

Cultural Relevance rating: 4

The textbook is culturally neutral.

Given that the book covers the same material as my current managerial text but without the steep cost, I will strongly consider switching to this text. I appreciate the open availability of this book.

Reviewed by Jill Gillett, Faculty, Lane Community College on 6/20/17

The contents of this book are very comprehensive and comparable to other Managerial Accounting texts I have used in the past from major publishers. All of the major subjects I expected to find in an introductory managerial text were listed. There... read more

The contents of this book are very comprehensive and comparable to other Managerial Accounting texts I have used in the past from major publishers. All of the major subjects I expected to find in an introductory managerial text were listed. There were some subject areas that I felt could have been expanded, particularly with more introductory/context-building information, but overall, everything is included. The table of contents was organized in a clear, logical progression. The table of contents is missing from the pdf version of the text, but included in the online version; this is not a big draw back since the content could be covered "out of order" in a course, or students could be directed to the specific pages to read. One thing I would like to see is some expansion of the learning objectives. Objectives are included in the text at the beginning of a section, but they are all numbered "1" and are not summarized anywhere. Other reviewers have mentioned the lack of index/glossary.

I recalculated several of the chapter example problems and found no errors. There are no solutions provided for end-of-chapter exercises, so those could not be checked.

The content included in an introductory managerial accounting course does not change substantially annually. I believe this text will remain relevant for a while. Another reviewer mentioned that there may be a need to update some of the example companies after a while.

Overall, most of the text is very concise. Sentences are not overly long, and the language used is a good blend of technical vocabulary that the student should become accustomed to, and layperson terms. I think this is an advantage of this text - most students dislike having to "wade through" a lot of dense writing to get to the point of the chapter or section.

The text uses vocabulary consistently throughout. The structure of chapters, practice problems, examples, all follow a consistent pattern. See numbering of learning objectives comment above.

This is another advantage of this text - the concise presentation of most of the topics make it easy to subdivide and reorder.

This is largely addressed in the "comprehensiveness" section. Very clear, logical progression through the content.

The online version was much easier to navigate than the pdf. There were a lot of formatting issues in the pdf that made it distracting to my eye at times (uneven highlighting, indenting, spacing, some graphics were blurry). A lot of these issues could be alleviated by recompiling parts of the text into an LMS learning tool (such as a Moodle Book), or webpage.

While there are many spacing issues throughout (which could be attributed to formatting), I did not find any significant grammatical errors.

I did not find any part of the text culturally insensitive or offensive. It could expand on some of the illustrative examples to include multi-cultural products and/or company names.

I think this text is a good starting point for OER content for an introductory managerial accounting course. I would not be comfortable relying solely on this text for content - there is not enough contextualization nor enough visual aids for some of the material.

Reviewed by Christine Stinson, Associate Professor, Ferrum College on 2/8/17

The text "Managerial Accounting" provides a comprehensive and broad review of the major topics usually covered in an introductory Managerial Accounting course. There is no index. New terms are explained well in the text when they are first... read more

The text "Managerial Accounting" provides a comprehensive and broad review of the major topics usually covered in an introductory Managerial Accounting course. There is no index. New terms are explained well in the text when they are first introduced. There is no Table of Contents in the downloadable PDF but a Table of Contents is available at the Open Textbook Library (OTL) webpage where one would download the text. I do use this text in my teaching and I refer students to the OTL Table of Contents.

I have not discovered any errors in the text. I have used this text for several semesters.

The content of the book is excellent for an introductory course. I suspect most professors will bring in supplemental, current examples to compliment the generalized examples in the text. Nevertheless, the text's examples are sufficient and illustrative.

My students find the text accessible and useful. For me, that is the single best measure of any text's clarity.

Examples used in the chapter text lend themselves to being used a guides when students work on assigned problems from the end every chapter. I am quite satisfied with the text's internal consistency.

This text is very easily divided (or reordered) into modules to suit different teaching objectives. I teach several of the chapters "out of order" so that I bring in some concepts early in the semester.

The text topics are presented in a logical fashion (but, as noted above, one can easily reorder several of the chapters to suit individual teaching needs).

Interface rating: 5

The PDF file is easy to scroll through and clearly organized.

I found no grammatical errors in the text.

I found no parts of the text to be culturally insensitive.

I think it is wonderful that this text is available to students at no charge. I appreciate the generosity of the authors in making this possible.

Reviewed by Elizabeth Ahrens, Assistant Professor, Minnesota State University, Mankato on 8/21/16

Differences between managerial and financial accounting seems to be abbreviated in chapter 1. Trends such as lean operations, social responsibility, sustainability or global marketplace not included. Overall very complete. read more

Differences between managerial and financial accounting seems to be abbreviated in chapter 1. Trends such as lean operations, social responsibility, sustainability or global marketplace not included. Overall very complete.

No biases detected.

Sections of book were clearly identified and coverage seemed to flow consistently.

Good use of real world examples.

Terminology was used consistently throughout the textbook.

Some sections/chapters seemed long. Could possibly be condensed but could be easily adapted to content coverage in the course.

Good job on organization of book.

No issues with the book's interface. Charts were clear and readable.

Grammatical Errors rating: 3

Pg. 12 - First paragraph needs space between words (This is the planning function). Pg 15 -Managerial Accountant paragraph needs space after term cost accountant. Pg. 28 - spacing in answer is incorrect, I noticed spacing issues throughout the textbook.

I didn't find any culturally insensitive or offensive material.

The textbook would be more than adequate for a lower level course in managerial accounting. Some content that could have been included is information about the global marketplace and lean accounting techniques.

Reviewed by Craig Moore, Assistant Professor, University of Wisconsin-Stout on 1/7/16

The text provides a comprehensive course in Managerial Accounting. All Managerial Accounting topics that would typically be covered in an Accounting II course are also covered. The text does not cover the Financial Accounting topics that would... read more

The text provides a comprehensive course in Managerial Accounting. All Managerial Accounting topics that would typically be covered in an Accounting II course are also covered. The text does not cover the Financial Accounting topics that would typically be covered in an Accounting II course---but that is not an objective of the book. The text could stand alone as the sole text for a course in pure Managerial Accounting. Alternatively, the book could serve to cover the Managerial Accounting topics in a typical Accounting II course. The text lacks an index or glossary. While these would be desirable, this is not a huge shortcoming for this particular subject matter. The lack of a Table of Contents or chapter listing within the PDF of the book itself is an issue.

Coverage of the content appeared to be accurate, unbiased, and consistent with current Managerial Accounting principles. While I did not review every example or problem, I noted no errors.

The material covered is completely relevant to current Managerial Accounting thinking. These concepts should not change dramatically, so in terms of concepts the text should remain relevant. Some of the case studies may not age as well and could eventually date the book, but this is a hazard in any business text. Some of the discussions of information technology solutions might not remain relevant either.

This is a strong point of the book. I really appreciated the less formal, less dense style. Managerial Accounting students can be discouraged by the tendency of their textbook to be overly laden with jargon and numeric calculations. While the book does provide the required terminology and numeric examples, it is much more readable than a typical textbook in the field.

The text was consistent in its approach both stylistically and conceptually.

The text’s divisibility was another strong point. Using some previously presented information is inevitable in a Managerial Accounting class; however, many of the individual chapters could be presented on a stand-alone basis with some instructor introduction. Using individual chapters in a modular fashion would also be particularly attractive if the text was being used as supplemental text for a typical Accounting II course. Specific chapters relating to Managerial topics could be used as supplementary material in an Accounting II course.

I noted no issues with organization or structure, and the ordering of topics appears reasonable. The author's sequence is not identical to what I am used to teaching, but it appears logical, workable and perhaps superior. This also speaks to the book’s modularity, as it is possible to present these topics in a different order if needed.

The lack of a Table of Contents hinders navigation. Some of the smaller graphics/charts were hard to read on my display. The larger graphics had a fuzziness to them compared to the standard text. I observed some unusual omitted spaces, but that was possibly a function of my specific PDF viewer. Generally the book can be navigated as easily any PDF.

Grammatical Errors rating: 4

I noted no egregious errors.

The text is as successful at being culturally relevant as a Managerial Accounting text could be. The subject matter does not lend itself to promoting diversity nor to generating content that is offensive or controversial.

A student could encounter this book as the sole text in a Managerial Accounting course, as a text that covers Managerial Accounting topics in an Accounting II class, or as a supplementary text using selected chapters to cover special topics. In all of these cases the student would have a quality educational resource.

Reviewed by Karen Bangs, Professor, California Polytechnic State University on 7/15/14

The book covers all I need and more. In fact I will probably use Ch 8 to supplement my Engineering Economics class. This text covers types of costs, contribution margin, product costing (ABC, process and job), absorption costing, standard costs,... read more

The book covers all I need and more. In fact I will probably use Ch 8 to supplement my Engineering Economics class. This text covers types of costs, contribution margin, product costing (ABC, process and job), absorption costing, standard costs, variance analysis, budgeting (capital and operating), Financial statement analysis (all 3) and ratio analysis, ethics and sensitivity anlaysis sprinkled throughout. There is no index/glossary or even a lead in listing of chapters.. that would be a helpful add. I had the chapter titles listed in the "about" doc so could tell where I was going.

Obviously I didn't look at every example or problem but the ones I did were correct. On page 478 the formula should be Fn*(1+r)^-n.... it currently reads Fn*(1+r)*n

Great... excellent organization in my opinion. The only "relevance" issue might be the companies used as examples are great for today, might not be in 10 years. But for the most part they are very well known (I think with college age students as well) so most likely helps peak interest.

Great.. I love the introduction with the Q&A from an actual business scenario and how answering those questions are what drives the chapter/section. The break down of topics is very readable/digestable in small doses.

Yes... reference comments in "clarity" section. I also appreciated the reference to earlier sections, that helps to intregrate the material for the reader (in my opinion).

Yes... great "chunks" of information and each chunk supplemented with problems and relevance to well known and interesting companies.

Yes... see "modularity". I am happy with the organization of chapters, I could see some re-arrangement. But I think that's a matter of personal preference not impacting the learning experience for the student.

Some of the images are blurry (alot of the tables/forms with the green background), most are readable but a few are not. The margin/indentations could use some organization. I didn't see any spelling errors but sometimes words are scrunched together (no space where there should be some).

None that I noticed.

It would be a little difficult for this topic to be culturally offensive (I think). The choice of companies for examples were very neutral (in my opinion) and easily and non-offensively cut across race/gender/ethnicity/etc... The choice of companies for examples seem very relevent in help increase interest in the subject matter.

I think it's great and will plan to incorporate it next time I teach my Industrial Cost & Controls (aka Managerial Finance) class. At this review I prefer this text to the one I've been using.

Table of Contents

- Chapter 1: What Is Managerial Accounting?

- Chapter 2: How Is Job Costing Used to Track Production Costs?

- Chapter 3: How Does an Organization Use Activity-Based Costing to Allocate Overhead Costs?

- Chapter 4: How Is Process Costing Used to Track Production Costs?

- Chapter 5: How Do Organizations Identify Cost Behavior Patterns?

- Chapter 6: How Is Cost-Volume-Profit Analysis Used for Decision Making?

- Chapter 7: How Are Relevant Revenues and Costs Used to Make Decisions?

- Chapter 8: How Is Capital Budgeting Used to Make Decisions?

- Chapter 9: How Are Operating Budgets Created?

- Chapter 10: How Do Managers Evaluate Performance Using Cost Variance Analysis?

- Chapter 11: How Do Managers Evaluate Performance in Decentralized Organizations?

- Chapter 12: How Is the Statement of Cash Flows Prepared and Used?

- Chapter 13: How Do Managers Use Financial and Nonfinancial Performance Measures?

Ancillary Material

About the book.

Kurt Heisinger and Joe Ben Hoyle believe that students want to learn accounting in the most efficient way possible, balancing coursework with personal schedules. They tend to focus on their studies in short intense segments between jobs, classes, and family commitments. Meanwhile, the accounting industry has endured dramatic shifts since the collapse of Enron and WorldCom, causing a renewed focus on ethical behavior in accounting. This dynamic author team designed Managerial Accounting to work within the confines of today's students' lives while delivering a modern look at managerial accounting.

Managerial Accounting was written around three major themes: Ready, Reinforcement and Relevance. This book is aimed squarely at the new learning styles evident with today's students and addresses accounting industry changes as well.

Ready . Your students want to be as efficient as possible in their learning. This book adopts a concise, jargon-free, and easy-to-understand approach that is ready with concise sections and concepts when the student is ready to study in a format the student wants. Key concepts are provided in short segments with bullet points and step-by-step instructions to simplify concepts. This thoughtful, step-wise approach will help your students avoid distractions and focuses attention on the big picture.

Reinforcement. Managerial Accounting boasts “Review Problems” at the end of each major section or learning objective which offer practical opportunities for students to apply what they have learned. These “Review Problems” allow students to immediately reinforce what they have learned and are provided within the body of the chapter along with the solutions.

Relevance. Why is managerial accounting important? Since all students perform better when they can answer the “why” question, meaningful references to companies throughout the chapters help students tie the concepts presented in each chapter to real organizations. In addition, realistic managerial scenarios present an issue that must be addressed by the management accountant. These will pique your students' interest and were designed to show how issues can be resolved using the concepts presented in the chapter. Finally, “Business in Action” features in Managerial Accounting link managerial decision-making to real business decisions to help your students complete the learning cycle from concept, to accounting decision, to real-world application.

Managerial Accounting by Heisinger and Hoyle also contains a handful of other pedagogical aids to compliment your lectures and help your students come to class prepared. From a focus on decision-making, to end of chapter materials that can only be characterized as very deep and very wide, to ethics coverage, group projects and spreadsheet applications—these features allow you to teach the course you want to teach and assign the materials you like to assign.

About the Contributors

Kurt Heisinger (CMA, CPA, MBA) teaches financial and managerial accounting full time and holds a tenured position at Sierra College. He recently received the 2011–12 Faculty of the Year award, which was voted on and presented by the Associated Students of Sierra College. Kurt has also taught accounting classes at the University of California—Davis and American River College.

Kurt began his career in public accounting with Ernst & Young and continued as a manager of a large local accounting firm in California. He received his MBA at the University of California—Davis and is currently a certified management accountant (CMA) and certified public accountant (CPA). The knowledge Kurt gained from his seven years in industry and more than 15 years in education has enabled him to write a clear and concise book filled with real world examples.

Joe Hoyle is an associate professor of accounting at the Robins School of Business at the University of Richmond. In 2006, he was named by BusinessWeek as one of 26 favorite undergraduate business professors in the United States. In 2007, he was selected as the Virginia Professor of the Year by the Carnegie Foundation for the Advancement of Teaching and the Council for the Advancement and Support of Education. In 2009, he was judged to be one of the 100 most influential members of the accounting profession by Accounting Today.

Joe has two market-leading textbooks published with McGraw-Hill—Advanced Accounting (eleventh edition, 2012) and Essentials of Advanced Accounting (fifth edition, 2012), both coauthored with Tom Schaefer of the University of Notre Dame and Tim Doupnik of the University of South Carolina.

At the Robins School of Business, Joe teaches fundamentals of financial accounting, intermediate financial accounting I, intermediate financial accounting II, and advanced financial accounting. He earned his BA degree in accounting from Duke University and his MA degree in business and economics, with a minor in education, from Appalachian State University. He has written numerous articles and continues to make many presentations around the country on teaching excellence.

Contribute to this Page

- Student Login

- 16-Week CMA Exam Accelerator

- CMA Textbooks

- CMA Test Bank

- CMA Video Lectures

- Private CMA Tutoring

- CMA Formula Guides

- CMA Audio Lectures

- CMA Discount Codes

- CPE Courses

- Testimonials

- CMA Show Podcast

Managerial Accounting: Everything You Need To Know

So you want to get into managerial accounting. It’s easy to see why: accountants in managerial roles tend to enjoy better salaries and higher rates of job satisfaction than junior and staff accountants.

Even a lower-level position in management can be a stepping stone to your dream role, from senior accountant all the way up to CFO .

Throughout my career, I’ve watched accountants work hard to land managerial accounting roles that have skyrocketed their careers to new heights.

If you’re interested in managerial accounting, you’re in the right place. Today, I’ll break down all the basics: core concepts, job opportunities, and frequently asked questions so you’re prepared to land the job you want.

Keep reading to learn more.

What Is Managerial Accounting?

The scope of managerial accounting, learning managerial accounting with the cma credential, managerial accounting methods, jobs in managerial accounting, managerial accounting faqs, become an industry leader with cma exam academy.

Let’s start with a definition: managerial accounting is a position in which skilled accountants use financial data to support a business with decision-making. The objective of these roles is to help direct a company toward its goals.

The professionals in these positions play a pivotal role in a business’s financial decision-making and strategic planning. They are critical members of a team who are highly valued by upper management.

This means landing a managerial accounting position will give you an excellent opportunity to impress your team while building valuable skills and relationships.

The definition sounds simple enough. But there’s a bit more to it than that.

Managerial accounting is different from financial accounting .

Unlike financial accounting, managerial accountants don’t always adhere strictly to financial accounting standards.

Because the goal of professionals in these roles is to support the management team, ad-hoc reports can be presented in a way customized to suit the unique needs of the business. They don’t need to adhere to GAAP since the ad-hoc reports are informal and for internal use only. However, all financial statements like the Profit & Loss, Balance Sheet, etc must follow GAAP.

Some key ways managerial accountants leverage data and financial information for their companies:

- Identifying trends, opportunities, and risks

- Measuring risk, reward, and ROI

- Analyzing current and historical information

- Interpreting data to draw conclusions about future possibilities

- Presenting findings, recommendations, and conclusions to upper management

And some of the direct applications for data and conclusions:

- Product costing

- Projecting and forecasting

- Strategic planning

- Financial analysis

The ultimate goal of managerial accounting is to support intelligent decision-making. This means a managerial accounting team needs to process a lot of information from multiple levels of a business and condense it into clear, actionable recommendations for the leadership team.

If you want to take the next step into the world of managerial accounting, there are a few ways you could start. My personal favorite is taking the path of a Certified Management Accountant .

The CMA is a highly-respected and revered certification for accounting professionals at any stage of their career. It prepares you for a career in accounting leadership by demonstrating your competencies in the key skills hiring managers look for in candidates.

The results speak for themselves: CMAs enjoy an average salary that is as much as 58% higher than their noncertified peers . They have high rates of job satisfaction, access to better job opportunities, and a competitive edge in an increasingly crowded job market.

Some management accountant methods and concepts you could learn include:

- Financial data analysis

- Cost management and budgeting

- Decision-making and decision analysis

- Investment decisions

- Risk management

- Forecasting and strategic planning

- Data analytics

- And much more

CMAs are also known for their upstanding commitment to professional ethics. Part 2 of the CMA exam covers professional ethics, and all CMAs must complete annual ethics training as a part of their continuing professional education, or CPE requirements.

Exam Secrets Cheat Sheet

Now let’s get into the nitty-gritty.

Here are some ways in which managerial accounting is used.

Margin Analysis

One of the most important ways businesses use management accounting is for margin analysis.

Weighing the benefits and costs associated with certain decisions is critical for ensuring a company remains profitable, so managerial accounting teams ensure the company’s leaders understand the risk during the decision-making process.

This way, the team avoids costly mistakes and improves the company’s ability to achieve its objectives.

Constraint Analysis

Managerial accounting teams also use data to present recommendations concerning constraint analysis.

A company’s control over bottlenecks has a direct correlation to profitability, so this is a big one. Understanding the cause and effects of past bottlenecks can help with policy design and strategic planning.

Managerial accountants can use constraint analysis to reduce operational inefficiencies by leveraging historical data to streamline processes.

Capital Budgeting

Managerial accounting also supports capital budgeting.

Since managerial accounting is different than financial accounting, this goes beyond just revenues and expenses. Using their analytical skills, managerial accounting teams will analyze cash inflows and outflows, including non-expense items, to get a bigger picture of a company’s financial pulse.

Inventory Valuation and Product Costing

During each reporting period, a company needs to calculate the value of and costs associated with its inventory. Management accounting teams present information to support this process.

Costs could include labor, overhead, fees, duties, and materials. Understanding the value of inventory is important for understanding the cost of goods sold. It’s also necessary for the loan application process, as inventory is sometimes used as collateral.

Trend Analysis and Forecasting

Managerial accountants are the closest a company can get to hiring a fortune teller.

These professionals are skilled in forecasting, which involves gathering and analyzing current and historical data to draw conclusions about potential future outcomes.

This process is valuable to employers because it can predict key outcomes for certain decisions including ROI and potential risks.

There are plenty of different roles to choose from when it comes to managerial accounting. Regardless of where you are in your career, you can find an option that is within your reach.

Here are some to choose from:

- Cost accountants and budget analysts: two great options for those early in their careers. Cost accountants assess budgets and look for opportunities to save their companies money. Budget analysts use data to create budgets that improve the profitability of their organizations.

- Financial analysts: another ideal early-career option. These professionals are skilled at forecasting. They use data to analyze the potential outcomes of certain decisions and then present recommendations to the C-Suite.

- Accounting manager: when you’re ready to take your technical skills to the next level, it’s time to seek a leadership position . A position like accounting manager is a great place to start. These professionals oversee operations at their company and manage reporting and compliance.

- Chief cost accountant and budget directors: as you grow in your career, you’ll want to seek opportunities with more responsibility. Chief cost accountants manage cost accountants and direct the team toward its goals. Similarly, budget directors oversee the process of planning and creating budgets.

- Corporate controller : This senior management position is a dream job for many. It involves a lot of responsibility, as corporate controllers manage all aspects of a company’s financial policies as well as managing the accounting team.

- VP of finance : Similar to controllers, VPs of finance are heavy hitters in their organizations. They are skilled strategists and leaders who guide entire accounting departments toward the company’s goals.

- Chief Financial Officer (CFO): Becoming a CFO means joining the C-Suite with the uppermost leaders in an organization. They are responsible for all aspects of financial decision-making and they work directly with the C-Suite on major decisions like investments, policy making, and acquisitions.

There are a few more things you should know about managerial accounting. Let’s explore.

What Types of Information Does Managerial Accounting Provide

Managerial accounting teams provide reports with recommendations that are critical in a business’s decision-making process.

This includes:

- Financial reports

- Financial metrics

- Revenue figures

- Sales reports

- Costs and expenses

- Cost controls

Using this information, accounting professionals create budgets, policies, strategies, plans, and recommendations that they then present to the executive leadership teams at their organizations.

What Are the Three Main Functions of Managerial Accounting?

The three main functions of managerial accounting are analysis, forecasting, and reporting. But truthfully, these teams serve many purposes for their companies.

The main function of any good managerial accounting team is to support its company with accurate, relevant, and timely information. This information is important for ensuring decision-makers know everything they need to know to direct the company toward its goals.

What Is the Main Focus of Managerial Accounting?

The primary focus of managerial accounting is ensuring that a company has all the information required to make sound decisions that limit risk and maximize profits.

Using budgets, forecasts, and strategic plans, these professionals paint a vivid picture of the past, present, and potential future of a company so executive leadership can guide the company toward sustainable growth and success.

Does GAAP Apply in Managerial Accounting?

GAAP — or Generally Accepted Accounting Principals — are a set of standards that govern corporate accounting.

Managerial accounting does not have to adhere to GAAP so long as the ad-hoc reports are for internal use only, and not official. However, all financial statements like the Profit & Loss, Balance Sheet, etc must follow GAAP.

This means managerial accounting reports can be used within a company to inform decisions and strategies, but they cannot be submitted as official government documents.

The path to becoming a managerial accountant isn’t easy, but it’s well worth the effort.

Throughout my career, I’ve worked with many professionals in managerial accounting — from cost accountants to CFOs.

I’ve met plenty of accounting students with big dreams. I know there are many different routes available to you, but trust me when I say the CMA is the best.

If you want to take the next step in your career, check out my 16-week accelerator exam prep course . It’s jam-packed with value: study materials, a detailed plan, and one-on-one coaching. Plus, it’s guaranteed to help you pass the exam so you can get one step closer to the career of your dreams.

Hi, I’m Nathan Liao (aka the CMA Coach)! For the last 10 years, over 82,000 accounting and finance pros came knocking at my door seeking guidance and help. If you’re also aiming to conquer the CMA exam on your very first try—without wasting away time or money—you’ve found your ultimate guide. Dive in deeper to discover more about me and the dedicated team that powers CMA Exam Academy. Click here and let’s embark on this journey together!

Found it helpful? Share it with others

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Email confirmation *

Notify me when new comments are added.

Get Your FREE Exam Secrets Cheat Sheet!

Plus a 3-part cma video course.

82,000+ accounting and finance pros got their free CMA cheat sheet. Get yours too, today!

Boise State Online

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share through Email

- Online Degree Information

What Is Managerial Accounting?

Contact a student success coach to learn more about the Boise State MBA program’s approach to managerial accounting and how it can benefit you in your career.

Executives in every industry must learn to speak the language of business. Marketing, economics, finance, organizational behavior and project management are all core components of any MBA curriculum for this very reason. Unless business leaders are familiar with the concepts and terminologies associated with these areas of operation, they cannot achieve the level of perspective necessary for continued growth.

Accounting plays a key role, both in day-to-day business operations and with respect to long-term business strategy. More than just a tabulation of debits and credits, or a set of mathematical formulae useful for generating budgets, accounting equips the executive with a set of quantitative analytical tools that can be applied to multiple tasks. Nowhere is this truer than in the realm of managerial accounting.

Definition of Managerial Accounting

Managerial accounting is the practice of using accounting information — from revenues to production inputs and outputs affecting the supply chain — internally, in support of organization-wide efficiency and for tracking the organization’s progress toward attaining its stated goals.

Managerial accounting differs from financial accounting. Financial accountants report profits and losses, issue earnings projections, and otherwise produce facts and figures that third parties (e.g., stockholders) are likely to encounter in an annual report. Financial accountants also create data for review by oversight agencies, such as the Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS).

What Is the Value Of Managerial Accounting?

While both managerial accountants and financial accountants may occasionally make use of the same data, the scope of managerial accounting is much wider. Managerial accounting supports a broad understanding of cost versus benefit. Managers faced with specific decisions may request information on any number of business operations to chart the best possible course of action.

Further, whatever their area of expertise, all managers are responsible for allocating and measuring the performance of their resources. These resources may be financial (e.g., investments), human (e.g., team members), or even technological (e.g., a customer database). To be fluent in accounting, all managers should be able to read a balance sheet, navigate line items in a budget, evaluate return on investment (ROI), and comprehend the host of underlying (and sometimes hidden) circumstances that affect how they manage the resources under their control. Managerial accounting information is, therefore, actionable data.

Managerial Accounting in Practice

Variance analysis remains one of most powerful and versatile of all managerial accounting tools. Because budgets constitute expressions of expectations, executives have a means of measuring just how reasonable those expectations are and how they relate to actual outcomes. Whether or not these outcomes are exceeded or unmet, variance analysis seeks to uncover the factors responsible for the difference between estimates and actual amounts (expenditures, earnings, etc.).

Further, variance analysis seeks to determine how particular factors interact in throwing off projections. Most importantly, it seeks to identify what steps may be taken to better predict future outcomes and to mitigate against unfavorable results. A variance analysis can also reveal mistaken assumptions that require dispelling, as well as create a context in which managers can begin asking even more important questions related to efficiency, cost savings and business growth.

Managerial accounting practices also play a vital role in corporate governance. Charles Tilley, former CEO of the Chartered Institute of Management Accountants (CIMA), observed in 2014 that “over the last few years, we’ve all seen how globalization and the breakneck pace of technological progress are making change harder to predict and organizations more vulnerable. Management accountants have the ability and judgment to make objective ethical decisions that consider the public interest.” Managerial accounting is thus instrumental to good customer relations and, by extension, strong reputation management. Even a handful of negative comments scattered across the internet can cost companies millions of dollars in annual sales.

Students who choose the online MBA program at Boise State University have the opportunity to learn and apply the principles of managerial accounting by enrolling in BUSMBA 525 . This 7-week course introduces students to an array of cost-based accounting concepts and practices. The readings and assignments designed for this course help MBA candidates meet the challenges involved in using best managerial accounting practices. Like all of Boise State’s online MBA courses, Managerial Accounting (BUSMBA 525) provides students with opportunities to enhance their interpersonal skills with collaboration with classmates to solve problems common to the profession.

- Follow us on Facebook

- Follow us on Instagram

- Follow us on Youtube

- Follow us on Linkedin

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

What is managerial accounting.

Managerial accounting is the process of identifying, analyzing, interpreting and communicating information to managers to help managers make decisions within a company and to help achieve business goals.

The data collected encompasses all fields of accounting that informs the management of business operations relating to the costs of products or services purchased by the company. Managerial accountants use budgets to quantify the business’ plan of operations.

Performance reports are used to note the deviation of actual results compared what was budgeted.

This article will also discuss:

How Managerial Accounting Helps in Decision Making?

5 types of managerial accounting that add value to your business, what are managerial accounting reports.

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Managerial accounting is very effective in highly competitive and fast-paced business environments where quick decisions need to be made. These decisions might have to do with a sales tactic, budgeting or cash flow management . Managerial accounting will use operational data to make sense of the situation quickly.

The goal is to use the budget to help make short-term operational decisions that will help increase the company’s operational efficiency.

Let’s say an internet company subscribes to cloud computing services. Monthly prices to rent out space in the cloud have been increased. The internet company’s managers can use budgets to see if the price increases are costing too much and decide to reduce cost and increase operational efficiencies.

The company budgets $100 a week for access to the cloud services and the actual expenditure for the week is $200. Managers know there is a 100 percent variance between budgets and actual costs. A managerial accountant would advise to increase their expectations on prices in their budget or move to another provider to meet their budget cost.

Management accounting presents your financial information in a way that will be useful for making operational decisions about your company. Keeping your financial records up to date will help you perform the following managerial accounting tasks that will add value to your company.

MARGIN ANALYSIS

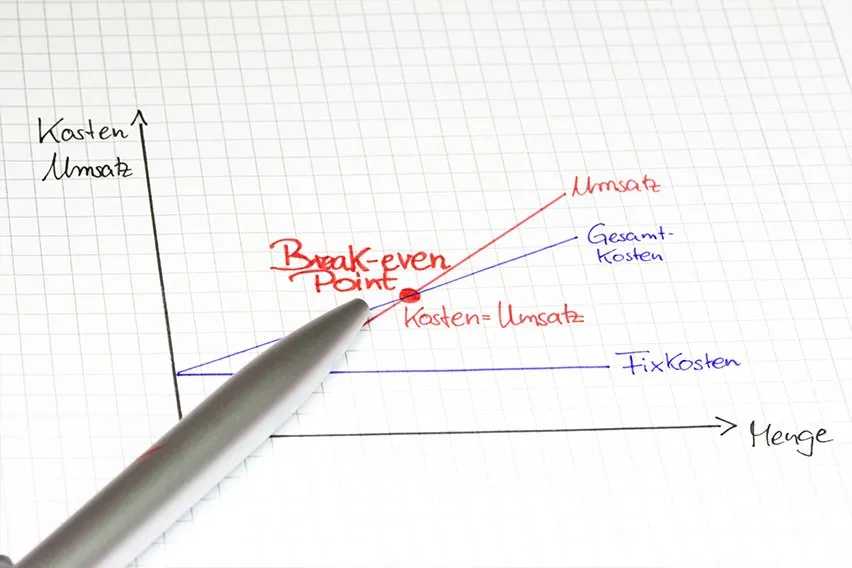

Managerial accounting analyzes the incremental benefit of increased production – this is called margin analysis. This flows into the breakeven analysis, which involves calculating the contribution margin on the sales mix to determine the unit volume at which the business’ gross sales equal total expenditures. A managerial accountant will use this information to determine the price point for products and services.

2) CONSTRAINT ANALYSIS

Constraint analysis indicates the limitations within a sales process or production line. Managerial accountants find out where the constraints occur and calculate the impact on cash flow, profit and revenue .

3) CAPITAL BUDGETING

Managerial accountants help a business decide when, where and how much money to spend based on financial data. Using standard capital budgeting metrics, such as net present value and internal rate of return, to help decision makers decide whether to embark on costly projects or purchases.

The process involves reviewing proposals, deciding if there is a demand for products or services, and finding the appropriate way to pay for the purchase. It also outlines payback periods, so management is able to anticipate future costs and benefits.

4) TREND ANALYSIS/FORECASTING

Reviewing the trendline for certain costs and investigating unusual variances or deviations is an important part of managerial accounting. Decisions are made by using previous information like historical pricing, sales volumes, geographical location, customer trends and financial data to calculate and project future financial situations.

5) PRODUCT COSTING/VALUATION

Determining the actual costs of products and services is another element of managerial accounting. Overhead charges are calculated and allocated to come up with the actual cost related to the production of a product. These overhead expenses may include the number of goods produced or other drivers related to the production, such as the square foot of the facility. Along with overhead costs , managerial accountants use direct costs to assess the cost of goods sold and inventory that may be in different stages of production.

Managerial accounting reports use budget reports to help guide managers to offer better employee incentives, cut costs and renegotiate terms with Managerial accounting reports use budget reports to help guide managers to offer better employee incentives, cut costs and renegotiate terms with vendors and suppliers.and suppliers.

Here are a few types of managerial reports.

ACCOUNT RECEIVABLE AGING REPORTS

Does your business rely heavily on extending credit ? Then an account receivable aging report is vital to your operations. This report breaks down the remaining balances of your clients into specific time periods allows managers to identify the debtors and identify issues in the company collection process.

If your company has many debtors, you may need to a complete rehaul to tighten up credit policies as cash flow is critical to the operations of any business. A company should always know who owes them what.

PERFORMANCE REPORTS

The performance of a whole company, each department and each employee are considered at the end of each term in performance reports. These reports are used to make important decisions about the company’s future. Under-performers are sometimes let go and individuals who achieve or over-achieve their goals are rewarded for their commitment to the business. Performance reports can show flaws in workflow setups if let’s say for example a whole department is somehow not performing to a certain capacity. A performance report is an important tool to stay on track a company’s mission.

Cost Managerial Accounting Reports

Managerial accounting determines the costs of articles that are manufactured. All raw material costs, overhead, labor and any added costs are considered, and those totals are divided by the amounts of products produced.

A cost report offers a summary of this information. This report offers showcases the cost prices of items versus their selling prices for managers. Using these reports, profit margins are estimated and monitored.

Better optimization of resources can be achieved by having this understanding of all expenses, including inventory waste, hourly labor costs, and overhead costs.

OTHER MANAGERIAL ACCOUNTING REPORTS

Other managerial reports that are vital to every business include order information reports, project reports, competitor analysis and many other similar reports.

These reports are either created internally or outsourced through professionals depending upon your company’s capability to handle reporting requirements. To make the most informed decision companies and managers must have access to authentic data and credible managerial accounting reports.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

Managerial Accounting

- Last updated

- Save as PDF

- Page ID 821

The accounting industry has endured dramatic shifts since the collapse of Enron and WorldCom, causing a renewed focus on ethical behavior in accounting. This dynamic author team designed Managerial Accounting to work within the confines of today's students' lives while delivering a modern look at managerial accounting. Managerial Accounting was written around three major themes: Ready, Reinforcement and Relevance. This book is aimed squarely at the new learning styles evident with today's students and addresses accounting industry changes as well.

- What is Accounting?

- What Is a General Ledger?

- What are Accounts Receivable?

- Balance Sheet vs Income Statement

- What are Real Accounts?

- What is Working Capital?

- Net Sales vs Gross Sales

- Overview of Financial Controls

- Financial Accounting

- Managerial Accounting

- Cost Accounting

- Cloud Accounting

- Project Accounting

- Best Accounting Software

- Free Accounting Software

- Nonprofit Accounting Software

- Cloud-Based Accounting Software

- Billing and Invoicing Software

- Payroll Software for Small Businesses

- QuickBooks Alternatives

- QuickBooks vs FreshBooks

- QuickBooks Time Pricing

- FreshBooks Pricing

- NetSuite Pricing

- Calculate Customer Acquisition Costs

- Calculate Accumulated Depreciation

- Accounts Receivable Turnover Ratio

- Calculate Cost of Goods Manufactured

- Calculate Cost of Goods Sold

- Calculate Job Order Costing

- Debt Service Coverage Ratio

- Calculate Unit Economics

What is Managerial Accounting? Definition, Functions, Examples

Accounting is an important function that every business, irrespective of its size, should pay maximum attention to. Accountants and bookkeepers are responsible for compiling, measuring, and analyzing accounting records in the form of financial reports or statements for companies.

However, it can be difficult for internal managers in a company to interpret these accounting records compiled by accountants and bookkeepers because they are mostly aimed at external parties.

Managerial accounting involves the compiling, analyzing, and interpretation of financial records for managers. It helps managers make informed internal decisions for the benefit of the company.

In this article, you will learn the meaning of managerial accounting, how managerial accounting works, who are the users of managerial accounting information, managerial accounting vs financial accounting, types of managerial accounting, techniques in managerial accounting, and managerial accounting reports to know.

Let’s get started.

What is Managerial Accounting?

Managerial accounting is a branch of accounting that deals with the compilation of financial records for internal decision-making. It is also known as cost accounting or management accounting, and managerial accounting.

Another definition of managerial accounting is that it is the process of compiling, measuring, analyzing, and interpreting accounting records for managers to make informed business decisions in the pursuit of business goals.

For managerial accountants, the analysis of various accounting operations and metrics is aimed at extracting useful information for the company's management.

By analyzing the cost of each product, activity, and facility, among others, detailed and useful information is provided to the management of a company. These analyses are based on the budget of the company and business decisions are aimed at productively exploiting this.

Managerial accounting is a very important accounting type for businesses in highly competitive business environments. It helps with operational data to quickly and easily make more accurate business decisions.

Overall, the goal of managerial accounting is to compare financial records with a company's budget and provide beneficial information for better internal decision-making and productivity.

How Managerial Accounting Works

Managerial accounting involves all areas of accounting aimed at providing useful information for better management of business operations. Accountants in this department make use of the cost of products and services, the sales revenue, as well as the budget of the company to generate useful information.

The area of managerial accounting that attracts the most focus is cost accounting. This includes financial records and accounts about the total cost of goods and services purchased by a company.

To give a good idea of how it works, here is an example.

If a company has a budget of $100 per week for purchasing a good and the weekly price of this good increases to $150, managerial accounting helps to provide quick information to go about this change.

The analysis would consider the cost of goods sold (COGS) and the revenue generated from sales and determine if the business can fund this price increase or if a cheaper alternative is better.

Without prior managerial accounting, the business may decide to go for a cheaper product which may affect the quality of products and, ultimately, the profitability of sales.

Managerial accounting only exists to help make these decisions much easier, accurate, and effective in relation to a company's budget and achieving business objectives.

Who are the Users of Managerial Accounting Information

Managerial accounting information is used by internal administrators of a business. These internal administrators include the general management of a company and the owner of a business to make better financial and operational decisions.

The management of a business makes use of the information to evaluate and analyze a company's performance and financial position. It also uses the information to make better financial decisions and prioritize business operations around fulfilling financial goals in terms of profitability and cash flow.

Owners of businesses invest capital in businesses and need accurate information to be able to access their level of profit or loss from their business operations. This allows them to know if business operations, as well as capital investments, need to be expanded or contracted.

Managerial accounting gives business owners appropriate information to make these important financial decisions.

For small or sole proprietary businesses, the owner of a business is usually part of the management. Nonetheless, information from managerial accounting is used by the internal administrators of a company that make the decisions.

Managerial accountants compile and analyze financial data and provide information for business administrators to use.

Managerial Accounting vs Financial Accounting

The main difference between managerial accounting and financial accounting is the users of the information generated.

Managerial accounting is intended for internal administrators of a business to make internal decisions.

Financial accounting, on the other hand, deals with financial records intended for external actors such as investors, creditors, or lenders. It aims to provide external parties with information about the financial health of a business

Apart from this, however, there are other grounds on which these two accounting types differ.

1. Presence of External Regulation

Financial accounting activities are regulated by external standards as opposed to the more flexible requirements placed on managerial accounting procedures.

External parties need to be protected from the incompetence of a firm as they are the main users of financial accounting information. Because of this, financial accounting procedures are required to fulfill certain standards set by regulatory bodies.

The Generally Accepted Accounting Principles (GAAP) set by the Securities Exchange Commission (SEC) and standards set by the Financial Accounting Standards Board( FASB) are the primary regulatory standards in the US.

Publicly held companies are required to complete all their financial accounts following GAAP standards to keep their public-traded status. Companies that also wish to get loans, entice investors, or fulfill debt covenants set by financial institutions also conform with the GAAP.

On the other hand, managerial accounting does not have to fulfill any form of general standards. Managerial accounting only has to fulfill internal standards and principles set to achieve business goals. Any set standard can be easily modified to meet the changing business environment and needs.

Standards relating to managerial accounting vary, not just from company to company but, even between departments within a company. Financial reports and data can be presented in any way, as long as the individuals intending to use them are satisfied and can use them to make decisions.

2. Futuristic Outlook

Managerial accounting compiles, analyses, and interprets data with the main aim of rendering decisions affecting the future of a company easier to make. The final interpretations presented to internal administrators offer clues to making accurate decisions that affect the future operations of a business.

Financial accounting, on the other hand, only aims to present information about the historical financial data of a company. It aims at presenting external stakeholders with information about the financial health of the company.

Financial accounting may seem to enable external stakeholders like investors and lenders to make more informed decisions but this is not the main aim for the company keeping accounts. A company may not need the help of external institutions and still engage in financial accounting activities.

Financial accounting is only aimed at keeping historical data about all the financial transactions a company has engaged in. It is responsible for producing financial statements for external use such as balance sheets and income statements .

3. Time for Generating Reports

The time when reports and statements are generated for use is different between managerial and financial accounting. While reports are only presented at the end of an accounting period with financial accounting, multiple operational reports are generated for managerial accounting.

An accounting period is usually set to be year-long and this could either be a regular calendar year or a fiscal year starting from a particular day. Financial accounting statements are usually run and presented at the end of this period.

Managerial accounting statements, on the other hand, are presented at any period of time that is convenient for the productive management of a business. They may be fixed over a period of time but this fixed period is entirely flexible and comes at different times and forms within a month.

With these, it is apparent that financial accounting statements are not useful for properly managing a business. Unlike managerial accounting statements that are compiled as at when needed, financial accounting statements are compiled too late for use.

Types of Managerial Accounting

Managerial accounting activities and operations come in different forms. Some of the most popular types of managerial accounting used by companies include product costing, marginal costing, cash flow analysis, inventory turnover analysis, constraint analysis, financial leverage analysis, and accounts receivable management.

1. Product Costing

Product costing is the process of determining the total cost involved in the production of goods and services. It is the process of tracking, recording, and studying every expense involved in the purchase and sale of goods and services including the cost of goods manufactured (COGM) .

These expenses span from the cost of raw materials to labor costs to factory overheads and the cost of delivering goods to buyers or consumers.

Costs are broken down into four categories; fixed cost, variable cost, direct cost, and indirect cost. Product costing aims at identifying and distinguishing expenses into these categories for better understanding and analysis.

Managerial accountants exercise product costing in several ways. Overhead charges are determined for each product by dividing the whole expense by the number of goods or other factors like storage space.

Proper product costing allows a company to accurately estimate the cost and value of products in different stages of production. Product costing helps managers to implement pricing strategies that are beneficial to the company.

2. Marginal Costing

Marginal Costing is another type of managerial accounting that deals with the cost of goods. It involves determining the impact of adding one additional unit of a product to the purchase or production order. This impact is then measured in relation to the overall cost of production.

Making use of marginal costing is good for short-term business decisions. It helps to measure the amount of contribution a product has to the overall cost and profit of a company.

For managerial accounting, marginal costing works closely with break-even analysis. Additional products are added to determine the unit volume that makes the total sales revenue equal to the total expenses. This gives companies enough information in determining the price points of products.

Marginal costing also helps businesses determine the best use of raw materials and the optimal sales mix for products.

3. Cash Flow Analysis

Cash flow refers to the different inflows of cash into a company and outflows of cash from a company. Cash flow analysis is the examination of these inflows and outflows of cash during a particular period under consideration.

Managerial accountants engage in cash flow analysis to identify the impact of business decisions on the cash flow of a company. This cash flow concerns activities surrounding outflowing operational costs, outflowing investments, and in-flowing financing of a business.

Financial information is usually recorded on an accrual basis. Accrual accounting provides the financial position of a company at the end of a particular period. However, each transaction within this period is not accounted for with accrual accounting alone.

Cash flow analysis measures the impact of a particular transaction on the final financial position of a company. The cash inflow and outflow resulting from a single transaction are recorded and considered.

Proper cash flow analysis gives managerial accountants and administrators a chance to optimize the flow of cash within a company.

Optimization of cash flow ensures that a company has enough liquid assets to cover immediate expenses. Companies optimize cash flow so that they do not worry about future events and insufficient finances to complete them.

4. Inventory Turnover Analysis

Inventory turnover is a financial ratio that shows the number of times a company has sold and replaced inventory over a given period. Inventory turnover analysis involves the process of studying this ratio and coming up with enough information for better business administration.

Calculating the inventory turnover ratio helps companies to better determine the price of products and make better decisions on the production, marketing, and purchase of new inventory.

When calculating inventory turnover, two factors are important: the cost of goods sold (COGS) and the average beginning and ending inventory.

With inventory turnover analysis, managerial accountants can determine the cost of storing each unsold inventory. Optimizations can then be made to reduce the possibility or impact of excessive inventory.

5. Constraint Analysis

Constraints are limitations or restrictions that prevent a business process from fully materializing. Constraint analysis involves the identification and examination of possible bottleneck situations in the whole production line or sales process.

Bottlenecks cause delays in the business process of a company and can prove very costly in the end. The possible bottlenecks that may occur and their impact on the overall cash flow, revenue, and profit are determined by managerial accountants. Managers then use the generated information to optimize the whole business workflow to maneuver these constraints.

Constraint analysis is a crude process and constraints or bottlenecks can be inaccurately identified or missed entirely. So it is important that it remains as carefully executed and accurate as possible.

6. Financial Leverage Analysis

Financial leverage is the use of borrowed capital to increase the value of assets, investments, and return on investments. Financial leverage analysis involves the in-depth study of all the implications borne by a company after acquiring financial leverage.

Information comparing a company's debt and equity is provided by managerial accountants. These pieces of information help business administrators put financial leverage to their most productive use.

Information such as return on equity, debt to equity ratio, and total return on invested capital helps a company to properly manage the exploitation and repayment of financial leverage.

7. Account Receivable Management

Account receivables are the invoices or credits which a company expects to be remunerated by its debtors. The proper management of account receivables is an important form of managerial accounting.

Managing account receivable involves the process of ensuring that debtors pay their dues on time. It helps to prevent a company from running out of working capital to keep the business running.

Account receivables management also helps a company avoid situations of harmfully overdue payments or total non-payment of pending receivables.

Some of the different stages of this process involve determining if credit to a client should be extended, ensuring agreements are well documented, sending out invoices, sending out reminders, and increasing payment collection efforts, among others.

Techniques in Managerial Accounting

To provide as much beneficial information as possible, managerial accounting relies on a number of techniques. These techniques include forecasting, financial planning, and trend analysis, standard costing, budgetary control, funds flow analysis, and revaluation accounting.

1. Forecasting, Financial Planning, and Trend Analysis

Forecasting is the act of predicting how financial situations will shape the future. Trend analysis involves the study of patterns and trends of product costs to recognize reasons for unusual variances.

Forecasting and trend analysis work together in making financial planning easier and more accurate. Financial planning, accordingly, acts as one of the primary techniques of managerial accounting.

Appropriate financial planning helps a company to easily determine all its future needs. A company's future operations are also easily streamlined for achieving business goals and objectives.

Financial planning is a culmination of other techniques involved in achieving the internal goals of an organization. It involves the analysis of comparative financial statements and accounting ratios and the use of generated data to plan for the future.

2. Standard Costing

Standard costing involves the establishment of a standard total cost that is characteristic of efficient business operating conditions. Current costs of operation and goods or services are then compared to these standard costs.

With this form of comparative analysis, the variance between the standard cost and actual cost is determined. Problem areas are then pinpointed and remedial actions are executed to get things up to standard.

3. Budgetary Control

Budgetary control is another technique used for controlling costs in running a business. It is a technique used to guide and regulate the financial activities of a business.

Under budgetary control, future financial needs are documented alongside their costs and arranged in an orderly manner for efficient business operations.

Information related to capital expenditure is generated and analyzed. The crucial key metrics taken into account are the net present value (NPV) and internal rate of return (IRR).

Business operations are then executed in accordance with the estimated budget. The budget is usually based on or limited by the amount of capital a company has to invest.

4. Funds Flow Analysis