School of Graduate Studies

Mathematical finance, program overview.

In the 12-month Master of Mathematical Finance (MMF) program , students’ superior math skills are focused on the tools of financial mathematics for an initial four-month period. Students then move immediately into an internship with a firm. Afterwards, students will continue their coursework for the remainder of the school year.

Quick Facts

Master of mathematical finance, program description.

In the MMF program, students reshape their existing analytical abilities with the help of senior academics in mathematics, computer science, statistics, and engineering who have experience with the tools of mathematical finance. This cross-disciplinary approach develops graduates with a richer, more innovative approach to applied mathematics in real-world situations. Some of the faculty are seasoned practitioners from the financial industry while others are from leading firms in the financial software industry, developing applications around requirements like risk management, portfolio analysis, and the pricing of advanced derivatives.

The heart of the program is the four-month internship or campus project. Working on real financial projects, students learn to integrate and apply theoretical knowledge gained earlier in the program. In the internship, students team up with employees of the sponsoring firm to experience how financial mathematics impacts the decision-making processes of a financial services organization.

Minimum Admission Requirements

Applicants are admitted under the General Regulations of the School of Graduate Studies. Applicants must also satisfy the graduate unit's additional admission requirements stated below.

Applicants must have an appropriate bachelor's degree in a quantitative, technical discipline with a minimum of a mid-B standing in the final two years.

Applicants whose primary language is not English and who graduated from a university where the language of instruction was not English must demonstrate proficiency in the English language through the successful completion of the Test of English as a Foreign Language (TOEFL) with minimum scores as follows:

paper-based TOEFL exam: 580 and 5 on the Test of Written English (TWE)

Internet-based TOEFL exam: 93/120 and 22/30 on the writing and speaking sections

Applicants must also show evidence of strong mathematical ability. Appropriate workplace experience will be considered in lieu of formal education.

Admission to the program is competitive. Those accepted into the program will normally have achieved a standing considerably higher than the minimum mid-B standing or have demonstrated exceptional ability through appropriate workplace experience.

Applicants must satisfy the Admissions Committee of their ability to do rigorous quantitative analysis at an advanced level. The broad background required for this program makes it likely that many strong applicants will not possess all the background requirements. It is expected that applicants will have extra depth in certain areas and need to do additional work in others. Admission may be conditional upon the applicant's satisfactory completion of the required background material.

Applicants should submit a written statement of approximately 300 words outlining their objectives for entering the program. Applicants should also explain how their background is appropriate. An interview may be required.

Inquiries about part-time options for the program should be addressed to the Program Director.

Program Requirements

The program of study begins in mid-August and includes a four-month internship during the second session. Students will be responsible for obtaining their own internship. In cases where the student is taking a leave of absence from an appropriate job, it is expected that the student will return to this job for the internship. In all cases, the Director must approve the placement.

Students will proceed through the program as a group, following a common course of study. The course of study will be fully integrated and computer-laboratory intensive. Course projects and assignments will be designed to integrate the material learned from a variety of the courses and to utilize it in a practical context. Excellent communication and presentation skills will be emphasized in both the oral and written components of the projects.

Students must complete all required courses listed below.

Program Length

3 sessions full-time (typical registration sequence: F/W/S)

3 years full-time

Study and Work in Mathematical Finance in Canada

Graduate Mathematical Finance Admission Requirements The prequisites required to become accepted in an graduate and/or post-graduate PhD program in Mathematical Finance.

What Mathematical Finance Students Learn Topics and concepts that are covered and the overall approach or focus taken in studying Mathematical Finance.

Research in Mathematical Finance Research areas, topics, interests projects in Mathematical Finance.

Career and Employment Opportunities in Mathematical Finance Professions or occupations available to graduates in Mathematical Finance and links to employment resources.

Copyright 2021 - Hecterra Publishing Inc. - Privacy Statement - Terms of Service

Main navigation

- Undergraduate Programs

- Bachelor of Commerce

- MBA Programs

- MM in Analytics

- MM in Finance

- MM in Retailing

- Global Manufacturing and Supply Chain Management

- Graduate Certificate in Healthcare Management

- Graduate Certificate in Professional Accounting

- McGill-HEC Montréal Executive MBA

- McGill Executive Institute

- International Masters for Health Leadership

- International Masters Program for Managers

- PhD in Management

- McGill Personal Finance Essentials

- McGill Dobson Centre for Entrepreneurship

- Career Management

- Marcel Desautels Institute for Integrated Management (MDIIM)

- Equity, Diversity and Inclusion (EDI)

- Laidley Centre for Business Ethics and Equity (LCBEE)

- Sustainability

- Sustainable Growth Initiative (SGI)

- Entrepreneurship & Innovation Initiative (E&I)

- Managing Disruption: Analytics, Advanced Digital Technologies and AI (AAAI)

- Information Systems

- Operations Management

- Organizational Behaviour

- Retail Management

- Strategy & Organization

- Our Students

Addressing current issues confronting organizations and investors operating in today’s rapidly changing financial environment.

The PhD specialization in Finance at McGill prepares students for research-oriented academic careers. While students from all backgrounds are encouraged to apply, the typical student holds an undergraduate or a master's degree in economics, finance, mathematics, statistics, computer science, engineering or physics.

The program is normally completed in five years. The first two years in the program are devoted primarily to taking courses in finance, as well as supporting disciplines (economics, mathematics and econometrics/statistics). After the first two years, students enter the dissertation phase of the program. For details on the Finance Area, research domains, publications and working papers, visit the Desmarais Global Finance Research Centre website.

Numerous required and elective doctoral courses are offered by the McGill Finance Faculty, including:

- Financial Economics

- Corporate Finance

- Empirical Methods in Finance

- Continuous-Time Finance

- International Finance

- Fixed Income Securities Theory

- Corporate Governance

Faculty and Research

The McGill Finance area includes fourteen faculty members who regularly publish in the top finance journals. The moderate size of the program (currently we have 13 Ph.D. students in residence) make it possible for the students to closely interact with the faculty and to benefit from personalized attention and support. Because the faculty's interests span a wide spectrum of specialized fields in finance, students enjoy a lot of freedom in the choice of their dissertation topic.

Related Content

Insightful research for visionary management.

See the PhD Program Finance Postcard

Finance members

Department and university information, desautels faculty of management mcgill university.

- Bachelor of Commerce (BCom)

- Master of Management in Analytics (MMA)

- Master of Management in Finance (MMF)

- Master of Management in Retailing (MMR)

- Global Manufacturing and Supply Chain Management Program (GMSCM)

- Graduate Certificate in Healthcare Management (GCHM)

- Graduate Certificate in Professional Accounting (GCPA Program)

- Executive MBA

- McGill Executive Institute (MEI)

- International Masters for Health Leadership (IMHL)

- International Masters Program for Managers (IMPM)

- Desautels at a Glance

- Marcel Desautels

- Administration & Governance

- Desautels Strategic Plan 2025

- Equity, Diversity and Inclusion

- Academic Integrity

- International Advisory Board

- Desautels Global Experts

- Delve Thought Leadership

- Search the Desautels directory

- Areas of specialization

- Desautels 22: Top-tier Publications

- Research publications

- Research centres

- McGill Centre for the Convergence of Health and Economics (MCCHE)

- Desautels alumni

- Get involved

- Support Desautels

- News and social

- Desautels Stories

- DesautelsConnect on 10KC

- Working at Desautels

- Student Hub

- Casual payroll

Universal Navigation

Universal navigation2.

- U of T's Statistical Sciences Rankings

- Collaborate With Us

Search form

- Program Requirements

PhD Program Requirements

Students in the PhD program can conduct research in the fields of 1) Statistical Theory and Applications or 2) Probability or 3) Actuarial Science and Mathematical Finance .

The research conducted in the department is vast and covers a diverse set of areas in theoretical and applied aspects of Statistical Sciences. Students can work in multidisciplinary areas and team up with researchers in, for example, Astronomy and Astrophysics, Computer Science, Economics, Engineering, School of the Environment, Faculty of Information, Mathematics, Public Health Sciences, Sociology, Philosophy, and Psychology, and the Rotman School of Management.

The main purpose of the program is to prepare students for pursuing advanced research both in academia and in research institutes.

Program Length

This full-time program normally takes 12 academic sessions (four years) to complete and requires continuous registration. There is a maximum time limit of six years to complete the program.

PhD Direct Entry

This full-time program normally takes 15 academic sessions (five years) to complete and requires continuous registration. There is a maximum time limit of seven years to complete the program .

Course Requirements

During Year 1, students are required to complete the following 3.0 full-course equivalents (FCEs):

Students must complete an additional 2.0 full-course equivalents (FCEs) at the graduate level . The additional courses must be approved by the student's supervisor and the Associate Chair of Graduate Studies . It is strongly recommended that these courses are completed at the end of Year 2, but no later than the end of Year 4.

Field: Actuarial Science and Mathematical Finance

During Year 1, students must complete the following 3.0 full-course equivalents (FCEs):

Comprehensive Examination Requirements

Within Years 1 and 2, students must complete a two-part comprehensive examination: 1) an in-class written comprehensive exam and 2) a research comprehensive exam. Students must pass both the in-class written exam and the research exam to continue in the program.

In-Class Written Exam

Students must attempt the in-class written comprehensive exam by the end of Year 1. If a student fails this portion of the comprehensive exam, one further attempt will be allowed by the end of Year 2. Students who achieve A or A+ grades in all required coursework are exempt from the in-class written exam.

Research Comprehensive Exam

Students must attempt the research comprehensive exam by the beginning of Year 2, which includes a technical report and an oral presentation. If a student fails this portion of the comprehensive exam, one further attempt will be allowed at the end of Year 2.

Thesis Requirements

Conducting original research is the most important part of doctoral work. Your thesis must constitute significant and original contribution to the field.

Annual Doctoral Progress

You will have yearly meetings with a committee of no less than three faculty members to assess your progress.

Departmental Oral Examination and Final Oral Examination

The completed thesis must be presented and defended within the Department of Statistical Sciences in addition to being presented and defended at the School of Graduate Studies (SGS).

Residency Requirements

All students must satisfy a two-year residency requirement as outlined in the Calendar of the School of Graduate Studies, General Regulations .

Direct-Entry PhD students must satisfy a three-year residency requirement.

Questions about your program?

Please reach out to our graduate team at [email protected] .

- Future Students

- PhD Program

- MSc Program

- Masters of Financial Insurance (MFI)

- MScAC Data Science Concentration

- Graduate Timetable

- Request new password

- Doctor of Philosophy in Mathematics (PhD)

- Graduate School

- Prospective Students

- Graduate Degree Programs

Canadian Immigration Updates

Applicants to Master’s and Doctoral degrees are not affected by the recently announced cap on study permits. Review more details

Go to programs search

Mathematicians use theoretical and computational methods to solve a wide range of problems from the most abstract to the very applied. UBC's mathematics graduate students work in many branches of pure and applied mathematics. The PhD program trains students to operate as research mathematicians. The focus of the program is on substantial mathematical research leading to the PhD dissertation. Students also develop their skills in presenting and teaching mathematics and its applications.

For specific program requirements, please refer to the departmental program website

What makes the program unique?

UBC has one of the largest and most vigorous departments of mathematics in Canada. Our faculty routinely win national and international awards for their research and teaching achievements. We have an engaged and sociable cohort of graduate students who are essential members of a broad selection of active research groups. Each group holds a variety of seminars and events that allow graduate students, postdoctoral fellows, visitors and faculty to enjoy regular interaction.

UBC is the headquarters for the Pacific Institute of Mathematical Sciences (PIMS). PIMS hosts a plethora of mathematical events such as conferences and summer schools, greatly enriching the scientific environment in the quantitative sciences at UBC. Our mathematics students are also regular participants at the nearby Banff International Research Station for Mathematical Innovation and Discovery. Finally, our Institute for Applied Mathematics provides options for interdisciplinary studies for PhD students who wish to work in applied and computational mathematics.

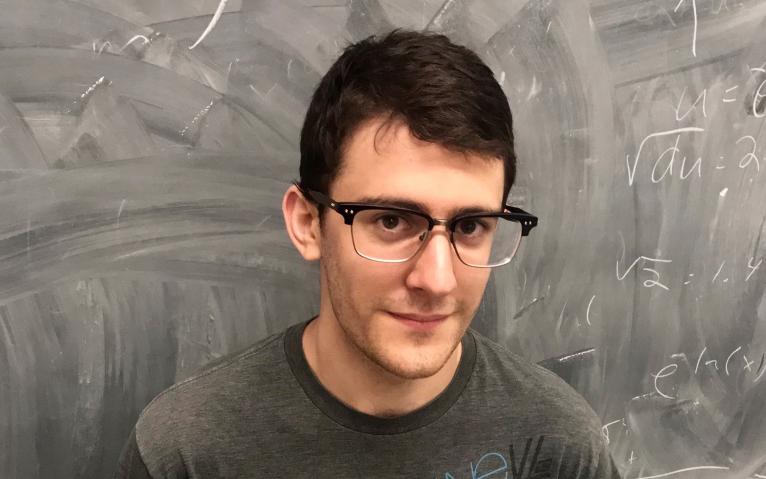

I chose UBC because of the reputation of the university and mathematics department, the alignment of my research interests with my advisor’s expertise, and my love for Canada!

Ethan White

Quick Facts

Program enquiries, admission information & requirements, 1) check eligibility, minimum academic requirements.

The Faculty of Graduate and Postdoctoral Studies establishes the minimum admission requirements common to all applicants, usually a minimum overall average in the B+ range (76% at UBC). The graduate program that you are applying to may have additional requirements. Please review the specific requirements for applicants with credentials from institutions in:

- Canada or the United States

- International countries other than the United States

Each program may set higher academic minimum requirements. Please review the program website carefully to understand the program requirements. Meeting the minimum requirements does not guarantee admission as it is a competitive process.

English Language Test

Applicants from a university outside Canada in which English is not the primary language of instruction must provide results of an English language proficiency examination as part of their application. Tests must have been taken within the last 24 months at the time of submission of your application.

Minimum requirements for the two most common English language proficiency tests to apply to this program are listed below:

TOEFL: Test of English as a Foreign Language - internet-based

Overall score requirement : 100

IELTS: International English Language Testing System

Overall score requirement : 7.0

Other Test Scores

Some programs require additional test scores such as the Graduate Record Examination (GRE) or the Graduate Management Test (GMAT). The requirements for this program are:

The GRE is not required.

2) Meet Deadlines

3) prepare application, transcripts.

All applicants have to submit transcripts from all past post-secondary study. Document submission requirements depend on whether your institution of study is within Canada or outside of Canada.

Letters of Reference

A minimum of three references are required for application to graduate programs at UBC. References should be requested from individuals who are prepared to provide a report on your academic ability and qualifications.

Statement of Interest

Many programs require a statement of interest , sometimes called a "statement of intent", "description of research interests" or something similar.

Supervision

Students in research-based programs usually require a faculty member to function as their thesis supervisor. Please follow the instructions provided by each program whether applicants should contact faculty members.

Instructions regarding thesis supervisor contact for Doctor of Philosophy in Mathematics (PhD)

Citizenship verification.

Permanent Residents of Canada must provide a clear photocopy of both sides of the Permanent Resident card.

4) Apply Online

All applicants must complete an online application form and pay the application fee to be considered for admission to UBC.

Tuition & Financial Support

Financial support.

Applicants to UBC have access to a variety of funding options, including merit-based (i.e. based on your academic performance) and need-based (i.e. based on your financial situation) opportunities.

Program Funding Packages

All full-time students who begin a UBC-Vancouver PhD Mathematics program in September 2018 or later will be provided with a funding package of at least $24,256 for each of the first four years of their PhD. The funding package may consist of any combination of internal or external awards, teaching-related work, research assistantships, and graduate academic assistantships.

Average Funding

- 52 students received Teaching Assistantships. Average TA funding based on 52 students was $13,784.

- 48 students received Research Assistantships. Average RA funding based on 48 students was $11,580.

- 3 students received Academic Assistantships. Average AA funding based on 3 students was $1,814.

- 54 students received internal awards. Average internal award funding based on 54 students was $13,279.

- 4 students received external awards. Average external award funding based on 4 students was $27,083.

Scholarships & awards (merit-based funding)

All applicants are encouraged to review the awards listing to identify potential opportunities to fund their graduate education. The database lists merit-based scholarships and awards and allows for filtering by various criteria, such as domestic vs. international or degree level.

Graduate Research Assistantships (GRA)

Many professors are able to provide Research Assistantships (GRA) from their research grants to support full-time graduate students studying under their supervision. The duties constitute part of the student's graduate degree requirements. A Graduate Research Assistantship is considered a form of fellowship for a period of graduate study and is therefore not covered by a collective agreement. Stipends vary widely, and are dependent on the field of study and the type of research grant from which the assistantship is being funded.

Graduate Teaching Assistantships (GTA)

Graduate programs may have Teaching Assistantships available for registered full-time graduate students. Full teaching assistantships involve 12 hours work per week in preparation, lecturing, or laboratory instruction although many graduate programs offer partial TA appointments at less than 12 hours per week. Teaching assistantship rates are set by collective bargaining between the University and the Teaching Assistants' Union .

Graduate Academic Assistantships (GAA)

Academic Assistantships are employment opportunities to perform work that is relevant to the university or to an individual faculty member, but not to support the student’s graduate research and thesis. Wages are considered regular earnings and when paid monthly, include vacation pay.

Financial aid (need-based funding)

Canadian and US applicants may qualify for governmental loans to finance their studies. Please review eligibility and types of loans .

All students may be able to access private sector or bank loans.

Foreign government scholarships

Many foreign governments provide support to their citizens in pursuing education abroad. International applicants should check the various governmental resources in their home country, such as the Department of Education, for available scholarships.

Working while studying

The possibility to pursue work to supplement income may depend on the demands the program has on students. It should be carefully weighed if work leads to prolonged program durations or whether work placements can be meaningfully embedded into a program.

International students enrolled as full-time students with a valid study permit can work on campus for unlimited hours and work off-campus for no more than 20 hours a week.

A good starting point to explore student jobs is the UBC Work Learn program or a Co-Op placement .

Tax credits and RRSP withdrawals

Students with taxable income in Canada may be able to claim federal or provincial tax credits.

Canadian residents with RRSP accounts may be able to use the Lifelong Learning Plan (LLP) which allows students to withdraw amounts from their registered retirement savings plan (RRSPs) to finance full-time training or education for themselves or their partner.

Please review Filing taxes in Canada on the student services website for more information.

Cost Estimator

Applicants have access to the cost estimator to develop a financial plan that takes into account various income sources and expenses.

Career Outcomes

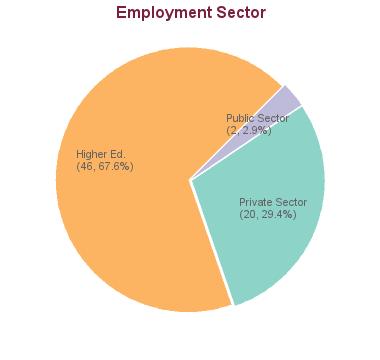

88 students graduated between 2005 and 2013: 1 is in a non-salaried situation; for 19 we have no data (based on research conducted between Feb-May 2016). For the remaining 68 graduates:

Sample Employers in Higher Education

Sample employers outside higher education, sample job titles outside higher education, phd career outcome survey, career options.

A great majority of our PhD graduates move on to postdoctoral fellowships and faculty positions at universities and research institutes in North America and around the world. However, a significant fraction of students move into careers in industry. Students considering non-academic careers are encouraged to complete an industrial internship (for instance through the Mitacs Accelerate program - headquartered at UBC) during their studies.

Enrolment, Duration & Other Stats

These statistics show data for the Doctor of Philosophy in Mathematics (PhD). Data are separated for each degree program combination. You may view data for other degree options in the respective program profile.

ENROLMENT DATA

Completion rates & times, upcoming doctoral exams, monday, 27 may 2024 - 12:30pm - room 203.

- Research Supervisors

Advice and insights from UBC Faculty on reaching out to supervisors

These videos contain some general advice from faculty across UBC on finding and reaching out to a supervisor. They are not program specific.

This list shows faculty members with full supervisory privileges who are affiliated with this program. It is not a comprehensive list of all potential supervisors as faculty from other programs or faculty members without full supervisory privileges can request approvals to supervise graduate students in this program.

- Adem, Alejandro (Cohomology of finite groups, orbifolds, stringy topology, algebra, sporadic simple group, group actions, arithmetic groups, K-theory, homotopy theory, spaces of homomorphisms)

- Angel, Omer (Probability theory, percolation, random graphs, random walks, particle processes, scaling limits)

- Bachmann, Sven (Mathematics and statistics; Mathematical Analysis; quantum phenomena; Mathematical physics; Quantum statistical physics; Topological states of matter)

- Balmforth, Neil (Fluid mechanics, nonlinear dynamics and applied partial differential equations)

- Behrend, Kai (Moduli spaces, Gromov-Witten invariants, string theory, Donaldson-Thomas invariants, Euler characteristics, categorification)

- Bennett, Michael (Number Theory, Diophantine Approximation and Classical Analysis)

- Bryan, Jim (Algebraic and differential geometry; Algebraic geometry, moduli spaces, enumerative invariants related to theoretical physics.)

- Cautis, Sabin (Mathematics and statistics; Geometry)

- Chau, Albert (Differential Geometry and Partial Differential Equations)

- Chen, Jingyi (Algebraic and differential geometry; Differential Geometry, Partial Differential Equations)

- Colliander, James (hamiltonian dynamical systems; partial differential equations; harmonic analysis)

- Coombs, Daniel (Mathematical biology; Cellular immunology; Complex physical systems; Epidemiology (except nutritional and veterinary epidemiology); Cell Signaling and Infectious and Immune Diseases; Cell biophysics; Disease models; Epidemiology; Immune cell signalling; Mathematics)

- Cytrynbaum, Eric (Bacterial cell division, Microtubule and cellular organization, Wave propagation in excitable media)

- Dao Duc, Khanh (Genomics; Mathematical biology; Neurocognitive patterns and neural networks; Agricultural spatial analysis and modelling; combine mathematical,computational and statistical tools to study fundamental biological processes; regulation and determinants of gene expression and translation; Machine Learning for Biological Imaging and Microscopy; Database development and management; Biological and Artificial Neural Networks for geometric representation)

- Doebeli, Michael Walter (Mathematical ecology and evolution, evolution of diversity, adaptive speciation, evolution of cooperation, game theory, experimental evolution in microorganisms)

- Feng, James (Chemical engineering; Mathematics and statistics; Biophysics; Complex fluids; Fluid mechanics; Mathematical biology)

- Fraser, Ailana (Differential Geometry, Geometric Analysis)

- Friedlander, Michael (numerical optimization, numerical linear algebra, scientific computing, Scientific computing)

- Frigaard, Ian (Fluid mechanics (visco-plastic fluids))

- Ghioca, Dragos (Drinfeld modules, isotrivial semiabelian varieties, Lehmer inequality)

- Gordon, Julia Yulia (Representation theory of p-adic groups and motivic integration; Trace Formula and its applications)

- Gustafson, Stephen James (Mathematics and statistics; Mathematical Analysis; Differential Equation; Global and Non-Linear Analysis; Mathematical physics; Nonlinear partial differential equations; Nonlinear waves; Topological solitons)

- Hauert, Christoph (Mathematics and statistics; Modelization and Simulation; Evolution and Phylogenesis; Biological Behavior; dynamical systems; evolution; game theory; social dilemmas; stochastic processes)

- Hermon, Jonathan (probability theory; Markov chains and the cutoff phenomenon; particle systems; percolation)

- Holmes-Cerfon, Miranda (Mathematical modelling and simulation; Computational methods in statistics; Numerical analysis; Thermodynamics and statistical physics)

Doctoral Citations

Sample thesis submissions.

- On a completion of cohomological functors generalizing Tate cohomology

- Distribution of integral points on varieties

- Effective and explicit S-unit equations with many terms

- Classifying space for commutativity and unordered flag manifolds

- Finite-size scaling of a few statistical physics models in high dimensions

- Residual supersingular Iwasawa theory and μ-invariants for Zₚ²-extensions

- Numerical methods for biological flows laden with deformable capsules and solid particles

- The construction of blow-up solutions for some evolution equations

- Topics in discrete analysis

- Inviscid damping phenomena in some fluid models

- Gibbs measures and factor codes in symbolic dynamics

- Deep reinforcement learning agents for industrial control system design

- Structure-preserving numerical schemes for phase field models

- Enumerative geometry problems for Calabi-Yau manifolds with an action

- Tamagawa numbers of symplectic algebraic tori, orbital integrals, and mass formulae for isogeny class of abelian varieties over finite fields

Related Programs

Same specialization.

- Master of Science in Mathematics (MSc)

At the UBC Okanagan Campus

Further information, specialization.

Mathematicians use theoretical and computational methods to solve a wide range of problems from the most abstract to the very applied. UBC's mathematics graduate students work in many branches of pure and applied mathematics.

UBC Calendar

Program website, faculty overview, academic unit, program identifier, classification, social media channels, supervisor search.

Departments/Programs may update graduate degree program details through the Faculty & Staff portal. To update contact details for application inquiries, please use this form .

Nicholas Richardson

Having grown up outside of Toronto and completed my undergrad and master's degree at the University of Waterloo, I was ready to change the scenery and go study somewhere else. I joke that is it the farthest I could move without leaving Canada, but more truthfully it was the campus that felt "right...

Gabriel Currier

I quite like the kind of math that people do here, and enjoy working with my supervisors. The campus is also a beautiful place and the graduate student community is pretty laid back and friendly.

Nathan Lawrence

Many factors contributed to my choice of UBC for graduate school. I was attracted to Vancouver’s geographical similarities to Portland in the pacific northwest. Also, I have family in the area. However, most importantly, I was intrigued and inspired by my professors and advisors to take on the...

Considering UBC for your graduate studies?

Here, you can choose from more than 300 graduate degree program options and 2000+ research supervisors. You can even design your own program.

- Why Grad School at UBC?

- Application & Admission

- Info Sessions

- Research Projects

- Indigenous Students

- International Students

- Tuition, Fees & Cost of Living

- Newly Admitted

- Student Status & Classification

- Student Responsibilities

- Supervision & Advising

- Managing your Program

- Health, Wellbeing and Safety

- Professional Development

- Dissertation & Thesis Preparation

- Final Doctoral Exam

- Final Dissertation & Thesis Submission

- Life in Vancouver

- Vancouver Campus

- Graduate Student Spaces

- Graduate Life Centre

- Life as a Grad Student

- Graduate Student Ambassadors

- Meet our Students

- Award Opportunities

- Award Guidelines

- Minimum Funding Policy for PhD Students

- Killam Awards & Fellowships

- Policies & Procedures

- Information for Supervisors

- Dean's Message

- Leadership Team

- Strategic Plan & Priorities

- Vision & Mission

- Equity, Diversity & Inclusion

- Initiatives, Plans & Reports

- Graduate Education Analysis & Research

- Media Enquiries

- Newsletters

- Giving to Graduate Studies

Strategic Priorities

- Strategic Plan 2019-2024

- Improving Student Funding

- Promoting Excellence in Graduate Programs

- Enhancing Graduate Supervision

- Advancing Indigenous Inclusion

- Supporting Student Development and Success

- Reimagining Graduate Education

- Enriching the Student Experience

Initiatives

- Public Scholars Initiative

- 3 Minute Thesis (3MT)

- PhD Career Outcomes

- Great Supervisor Week

Main Content

Rotman Finance offers top-tier training from some of the world’s leading experts in fields such as risk management, corporate governance, delegated asset management, and behavioural finance. The PhD Program in Finance at the Rotman School trains prospective scholars to become highly skilled and innovative researchers and teachers, and to prepare them for careers as faculty members at premier academic institutions throughout the world.

Strengths of the Program

Rotman Finance offers top-tier training from some of the world's leading experts in fields such as risk management, corporate governance, delegated asset management, and behavioural finance. Students are assigned faculty mentors upon admission and work closely with faculty throughout the program. We train prospective scholars to become highly skilled and innovative researchers and teachers.

Admission to the Program

The PhD Program in Finance is looking for accomplished graduate and undergraduate students, with strong backgrounds in economics, finance, quantitative methods or related fields. Our admission is highly competitive. We encourage you to explore our website to discover what makes a successful candidate.

PhD Courses

Rotman PhD courses in finance stream provide a strong base in finance theory, economics and empirical methods. Preview course offerings here.

Program Structure and Requirements

The PhD program in Finance is an intense academic exercise providing effective training for an academic career. Our program includes required courses, comprehensive examinations, research paper presentations as well as the final dissertation.

Current PhD Students

The doctoral students in the Finance stream are a key strength of the Rotman School. After graduation, these students will go on to work at some of the world's top universities, helping to extend the reputation of Rotman and of the University of Toronto.

Meet the Rotman Finance faculty.

Faculty by Research Focus

As a PhD student you will work closely with faculty that share your research interests, are working on similar areas, or can provide a new perspective. Find out what our faculty members are currently working on here.

Risk Management Research Team

Exciting research opportunities at Rotman abound. Learn about a new research team in Risk Management.

ICPM Grant on Corporate Governance

Exciting research opportunities at Rotman abound. Learn about a new research project on Governance.

PhD in administration - Financial Engineering

Phd in administration – financial engineering.

- Tuition fees and Funding

- Students wanted

Be part of a community of multidisciplinary researchers, with solid internationally recognized expertise.

Do your PhD in a rigorous milieu, renowned for its resources and the quality of support available for junior researchers.

Your PhD in short

- Offered by HEC Montréal jointly with Concordia and McGill universities and the Université du Québec à Montréal (UQAM). This partnership gives you access to resources (faculty and courses) rarely available elsewhere in the world.

- This specialization offers a variety of high-level courses in finance and mathematics. The mathematics courses are recognized by the Institut des sciences mathématiques (ISM) and may be taken by PhD in mathematics students at the main universities in the region.

- Full-time program allowing you to complete your studies in 4 years.

- Tuition fees waived and competitive funding for the first four years of your studies.

For a career in academia or business

Around 40% of graduates from this specialization between 2006 to 2022 hold positions as professors at universities in Canada or the United States.

The others are working as executives or consultants for leading firms or investment funds, e.g. Deloitte, KPMG, PSP Investment and the Abu Dhabi Investment Authority.

Among the best

The work of PhD students in the Financial Engineering specialization has been recognized for its outstanding quality and has earned them many awards and scholarships:

- awards for the best PhD dissertation in 2008 and 2014

- two Alexander Graham Bell Canada Graduate Scholarships from the Natural Sciences and Engineering Research Council of Canada (NSERC) , in 2010 and 2012

- four Bourse de Montréal awards, in 2014, 2015, 2017 and 2018

- a scholarship from the Society of Actuaries

- a “Women in Finance” scholarship from the National Bank

Papers based on dissertations by PhD students in the Financial Engineering specialization are published in top-tier journals in the field, including:

- European Journal of Operational Research

- Journal of Banking and Finance

- Journal of Economic Dynamics and Control

- Journal of Risk and Insurance

- The Energy Journal

- The Review of Financial Studies

- Quantitative Finance

Varied research interests

- Credit risk

- Derivatives pricing

- Dynamic optimization

- Energy market

- High-frequency data

- Machine learning

- Mean field games

- Monte Carlo simulation

- Numerical methods

- Operational research

- Optimal hedging

- Optimization

- Risk management

- Probability and statistics

- Statistical methods

- Stochastic control

- Stochastic processes

- Text mining

Our PhD students and candidates

See the list of students in this specialization on Google Scholar.

Top-flight research infrastructure

PhD students in this specialization benefit from the best possible infrastructure, allowing them to carry out advanced research in financial engineering.

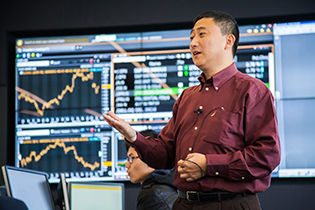

- National Bank Financial trading room

- Computing and Data Mining Laboratory (LACED) and its computing grid

- Access to major databases, including CRSP, Compustat, TAQ, Thomson Financial, FISD, TRACE, WRDS, OptionMetrics and Moody’s Credit Risk

World-class research in financial engineering

HEC Montréal offers doctoral students in financial engineering an exceptional scientific milieu, with a research chair and two professorships.

- Canada Research Chair in Decision Making Under Uncertainty , held by Professor Érick Delage

- Canada Research Chair in Risk Management , directed by Professor Georges Dionne

- Research Professorship in derivatives analysis: Professor Jean-Guy Simonato

- Research Professorship in Financial Engineering: Professor Geneviève Gauthier

- Research Professorship in financial risk factors and derivatives: Professor Christian Dorion

- Research Professorship in Sentometrics: Professor David Ardia

- Research Professorship in statistics: Professor Debbie J. Dupuis

The professors are members of various internationally renowned research centres or institutes:

- Canadian Derivatives Institute

- Centre for Interuniversity Research and Analysis on Organizations (CIRANO)

- Centre de recherches mathématiques (CRM)

- Group for Research in Decision Analysis (GERAD)

All the members of the Decision Sciences group have individual grants from the Natural Sciences and Engineering Research Council of Canada (NSERC) .

An internationally renowned multidisciplinary team

Members of the Department of Decision Sciences associated with the Financial Engineering specialization

- David Ardia

- Hatem Ben Ameur

- Michèle Breton

- Michel Denault

- Debbie Dupuis

- Dena Firoozi

- Geneviève Gauthier

- Chantal Labbé

Members of the Department of Finance associated with the Financial Engineering specialization

- Tolga Cenesizoglu

- Philippe d’Astous

- Georges Dionne

- Christian Dorion

- Pascal François

- Pascale Valery

- Simon van Norden

- Jean-Guy Simonato

- 100% distance

- Côte-des-Neiges

- Questions about our PHD Program?

- Download our brochure

Future students, follow us

Share this page

- APPLY TO MMF

- HIRE A QUANT

- CURRENT STUDENTS

- MMF E-LEARNING

MMF 2024-2025 Applications Are Now Closed

The application window for Fall 2024 entry into the MMF Program for the 2024-2025 school year is now closed. Applications for Fall 2025 entry will open in October 2024.

If you are interested in joining the MMF Program in the future, click here for more information on MMF’s application criteria, and be sure to follow MMF on LinkedIn , YouTube , Instagram , Twitter , Facebook , and Spotify for more updates throughout the year.

MMF Blog: 2023-24 Squarepoint Scholars

Last fall, the Squarepoint Foundation awarded scholarships to six Master of Mathematical Finance (MMF) grads from the class of 2024. They share what it means to be recognized.

MMF Ranked A Top-25 Quant Program By Risk.net

This year’s Risk.net annual ranking of the top Quant Finance Master’s programs has been released. MMF has moved up five places to 13th, and it’s still the only Canadian university to be in the top 25 programs listed.

Established in 1998 MMF remains at the forefront of training in quantitative finance. MMF is a boutique Program admitting a select number of students each year who will move through the Program as one cohort. The boutique nature of our Program means that students will learn in smaller class sizes, have the opportunity to build lasting bonds with their classmates and work in industry-like teams to complete projects and presentations.

If you have advanced math, statistics and programming skills you may be a great fit for Quantitative Finance. After 12 months of training your Master of Mathematical Finance degree prepares you to join a dynamic and growing industry

Financial Mathematics is one of the fastest growing areas of applied mathematics. Institutions that employ financial mathematicians are among the wealthiest and most sophisticated corporations in the world. A career in financial mathematics provides you with an invigorating combination of intellectual challenge and accelerated professional growth.

A fast-track Program

During your 12 months of training in MMF your superior quantitative skills are focused on the tools of financial mathematics for the initial 4 months of course work. You then move into a full-time 4 month internship with one of our industry partners. Finally, you will complete course work during the last 4 months of the Program.

Applied mathematics in business is as demanding and interesting as it is in the sciences, engineering or technology

You may join an institution (hedge fund, bank, government or pension plan) with multibillion-dollar investment portfolios. You may manage sophisticated hedge funds, complex derivatives, assess the risk in a bank’s commercial loans portfolio or develop original software applications for financial markets. There have been Nobel Prizes awarded for work in financial mathematics.

U of T Home | Graduate Faculty Members A-Z | A-Z Index

SGS Home

School of Graduate Studies (SGS) Calendar

Mathematical finance, mathematical finance: introduction, faculty affiliation.

Arts and Science

Degree Programs

Financial engineering is one of the fastest-growing areas of applied mathematics.

Contact and Address

Web: www.mmf.utoronto.ca Email: [email protected] Telephone: (416) 946-5206

Mathematical Finance Program University of Toronto Suite 17030, 700 University Avenue Toronto, Ontario M5G 1Z5 Canada

Mathematical Finance: Graduate Faculty

Full members, associate members, mathematical finance: mathematical finance mmf, master of mathematical finance, program description.

In the MMF program, students reshape their existing analytical abilities with the help of senior academics in mathematics, computer science, statistics, and engineering who have experience with the tools of mathematical finance. This cross-disciplinary approach develops graduates with a richer, more innovative approach to applied mathematics in real-world situations. Some of the faculty are seasoned practitioners from the financial industry while others are from leading firms in the financial software industry, developing applications around requirements like risk management, portfolio analysis, and the pricing of advanced derivatives.

The heart of the program is the four-month internship or campus project. Working on real financial projects, students learn to integrate and apply theoretical knowledge gained earlier in the program. In the internship, students team up with employees of the sponsoring firm to experience how financial mathematics impacts the decision-making processes of a financial services organization.

Minimum Admission Requirements

Applicants are admitted under the General Regulations of the School of Graduate Studies. Applicants must also satisfy the graduate unit's additional admission requirements stated below.

Applicants must have an appropriate bachelor's degree in a quantitative, technical discipline with a minimum of a mid-B standing in the final two years.

Applicants whose primary language is not English and who graduated from a university where the language of instruction was not English must demonstrate proficiency in the English language through the successful completion of the Test of English as a Foreign Language (TOEFL) with minimum scores as follows:

paper-based TOEFL exam: 580 and 5 on the Test of Written English (TWE)

Internet-based TOEFL exam: 93/120 and 22/30 on the writing and speaking sections

Applicants must also show evidence of strong mathematical ability. Appropriate workplace experience will be considered in lieu of formal education.

Admission to the program is competitive. Those accepted into the program will normally have achieved a standing considerably higher than the minimum mid-B standing or have demonstrated exceptional ability through appropriate workplace experience.

Applicants must satisfy the Admissions Committee of their ability to do rigorous quantitative analysis at an advanced level. The broad background required for this program makes it likely that many strong applicants will not possess all the background requirements. It is expected that applicants will have extra depth in certain areas and need to do additional work in others. Admission may be conditional upon the applicant's satisfactory completion of the required background material.

Applicants should submit a written statement of approximately 300 words outlining their objectives for entering the program. Applicants should also explain how their background is appropriate. An interview may be required.

Inquiries about part-time options for the program should be addressed to the Program Director.

Program Requirements

The program of study begins in mid-August and includes a four-month internship during the second session. Students will be responsible for obtaining their own internship. In cases where the student is taking a leave of absence from an appropriate job, it is expected that the student will return to this job for the internship. In all cases, the Director must approve the placement.

Students will proceed through the program as a group, following a common course of study. The course of study will be fully integrated and computer-laboratory intensive. Course projects and assignments will be designed to integrate the material learned from a variety of the courses and to utilize it in a practical context. Excellent communication and presentation skills will be emphasized in both the oral and written components of the projects.

Students must complete all required courses listed below.

Program Length

3 sessions full-time (typical registration sequence: F/W/S)

3 years full-time

Mathematical Finance: Mathematical Finance MMF Courses

Courses are offered in modules. A module will consist of a four-week unit with a minimum of three contact hours per week, or its equivalent. A large portion of the learning for the module will take place outside of class through carefully designed computer projects and group study. The courses have been packaged in units of one, two, three, four, or five modules, and the course weight will be equal to the number of modules; for example, a course with three modules will have a weight of three credit hours. Six modules will be considered the equivalent of one full-course equivalent in a standard format. The third digit of the four-digit course number determines the course weight.

Third Digit Notation

1 = one-third of a half course 2 = two-thirds of a half course 3 = one half course 4 = two-thirds of a full course 5 = one full course

Required Courses

Additional courses.

0 Course that may continue over a program. The course is graded when completed.

- Programs at a Glance

- Programs by Graduate Unit

- Programs by SGS Division

- Search Collaborative Specializations

- Search Combined Degree Programs

- Search Graduate Faculty Members

- Glossary of Degrees and Honorifics

- Sessional Dates

- Important Notices

- General Regulations

- Degree Regulations

- Fee Regulations

- Financial Support

- Dean's Welcome

- Mission Statement

- Graduate Studies at the University of Toronto

- PDF Calendar and Archives

PhD program

Phd degree requirements, requirements:.

- Four graduate courses , including a breadth requirement . Candidates for the PhD degree must achieve an average grade of at least 70% in their courses. Note: students who transfer directly into the PhD program (without completing the Master's degree), must take a total of eight courses .

- Comprehensive examination

- Lecturing requirement

Course restriction: Students may not count more than one graduate course that is cross-listed with an undergraduate course for credit towards their PhD degree. This restriction applies to all 600-level AMATH courses and any cross-listed courses offered by other departments. Note: students who transfer directly into the PhD program (without completing the Master's degree) may take up to two cross-listed courses.

Selection of courses: Courses are selected in consultation with the student's supervisor. Beyond the breadth requirement, there are no other constraints on course selection. We encourage students to select courses that will help them develop a broad knowledge of Mathematics and its applications: appropriate courses are often offered by other departments in the Faculties of Mathematics, Science and Engineering.

Advisory committee: The program of studies of a PhD student is directed by a PhD advisory committee consisting of the supervisor(s) and two other faculty members. This committee should be approved (by the graduate officer) within three terms of enrolment . At least one of the two other members should be from (or cross-appointed to) the Department, and it is recommended that one of the members be from outside the research group of the supervisor(s).

Pre-comprehensive seminar: During the third term of enrollment, the candidate will give a 30-minute pre-comprehensive seminar on the proposed research area, emphasizing background material. Shortly thereafter the advisory committee shall decide on the background topics that will comprise the candidate's comprehensive exam. These topics are normally chosen to extend beyond the specific research project. This material should be at the level of a 400-700 course, but need not correspond to a specific course. The list of topics (and corresponding examiners) should be submitted to the graduate coordinator not more than two weeks after the pre-comprehensive seminar. Once approved by the graduate officer, the list will be provided to the student. Comprehensive examination: The comprehensive examination is to be completed by the end of the student’s fifth term. The candidate will prepare a written research proposal (approximately 25 pages) that will be submitted to the members of the advisory committee and the examination chair (normally the graduate officer) at least two weeks prior to the comprehensive examination. The proposal should describe the research problem, together with motivation, literature review, an indication of methodology, any progress made to date, and a research plan with timeline. Shortly before the comprehensive examination, the examination chair (through the graduate coordinator) will consult with the advisory committee to determine whether the committee wishes the exam to proceed and, if so, whether the committee wishes to meet to discuss the questions to be asked on background material. Each committee member will provide a typeset list of questions to the graduate coordinator four business days before the exam (about 3-5 questions, which can all be answered at a whiteboard in about 15 minutes). This list of questions will be provided to the candidate one hour prior to the start of the exam. The candidate will use this time to prepare answers, with no access to outside materials. The examination will consist of a 20 minute presentation of the proposed research followed by two rounds of questions: the first on the prepared background questions, the second on the research proposal and the relevant literature. Each examiner shall question the candidate for approximately 15 minutes in each round. If there is more than one supervisor, they will share the allotted 15 minute time-slot. The comprehensive examination should normally be completed in two hours, after which the committee will consider the student’s progress to date, the proposal, and the student’s performance in the exam. They will then make one of the following assessments: pass (possibly contingent on some further action, such as completing a specific course); re-examination on background and/or proposal; or fail. Students who have not satisfactorily completed the comprehensive examination by the end of the fifth term will have their progress reviewed by the departmental graduate committee. PhD Thesis: A PhD thesis contains original results that warrant publication in the research literature. Indeed, candidates are encouraged to publish papers based on their research before submitting their theses. Moreover, the Department expects a PhD thesis to be a scholarly work that is broad in scope. As such, it should contain a discussion of the history of the research problem and an analysis of the relevant literature. For University guidelines on co-authored material in PhD theses please visit the Graduate Studies and Postdoctoral Affairs (GSPA) website; additional departmental guidelines apply.

The candidate shall defend the thesis in an oral examination before an examining committee , which shall consist of at least 5 voting members (External Examiner, Supervisor(s), Internal Member (from home department), Internal-external member (external to home department) and one other member). In the case that there is more than one supervisor, the co-supervisors shall count as one voting member. The external examiner should be familiar with the student's research field.

For submission deadlines please consult the Math Graduate Office website. PhD thesis defence requirements and external examiner criteria can be found on the Graduate Studies website .

Lecturing: This requirement is normally met by teaching a one-term undergraduate course, usually at the first or second year level, under the supervision of a faculty member. Students will satisfy this requirement after completing the comprehensive examination and after obtaining experience as a teaching assistant. If the department is unable to provide the student with a suitable undergraduate course to teach, the requirement may be met by giving a series of lectures of an introductory nature concerning the student's field of research. The University's Centre for Teaching Excellence provides support for all aspects of university teaching.

For more resources for graduate students, please visit the Math Graduate Office website.

Detailed descriptions of the following programs can be found in the Graduate Studies Academic Calendar :

- MMath Applied Mathematics

- MMath Applied Mathematics (Quantum Information)

- MMath Applied Mathematics (Water)

- PhD Applied Mathematics

- PhD Applied Mathematics (Quantum Information)

- PhD Applied Mathematics (Water)

Contact Info

Department of Applied Mathematics University of Waterloo Waterloo, Ontario Canada N2L 3G1 Phone: 519-888-4567, ext. 32700 Fax: 519-746-4319

Provide website feedback

PDF files require Adobe Acrobat Reader

- Contact Waterloo

- Maps & Directions

- Accessibility

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations .

Why Study for a Mathematical Finance PhD?

I was emailed by a reader recently asking about mathematical finance PhD programs and the benefits of such a course. If you are considering gaining a PhD in mathematical finance, this article will be of interest to you.

If you are currently near the end of your undergraduate studies or are returning to study after some time in industry, you might consider starting a PhD in mathematical finance. This is an alternative to undertaking a Masters in Financial Engineering (MFE), which is another route into a quantitative role. This article will discuss exactly what you will be studying and what you are likely to get out of a PhD program. Clearly there will be differences between studying in the US, UK or elsewhere. I personally went to grad school in the UK, but I will discuss both UK and US programs.

Mathematical finance PhD programs exist because the techniques within the derivatives pricing industry are becoming more mathematical and rigourous with each passing year. In order to develop new exotic derivatives instruments, as well as price and hedge them, the financial industry has turned to academia. This has lead to the formation of mathematical finance research groups - academics who specialise in derivatives pricing models, risk analysis and quantitative trading.

Graduate school, for those unfamiliar with it, is a very different experience to undergraduate. The idea of grad school is to teach you how to effectively research a concept without any guidance and use that research as a basis for developing your own models. Grad school really consists of a transition from the "spoon fed" undergraduate lecture system to independent study and presentation of material. The taught component of grad school is smaller and the thesis component is far larger. In the US, it is not uncommon to have two years of taught courses before embarking on a thesis (and thus finding a supervisor). In the UK, a PhD program is generally 3-4 years long with either a year of taught courses, or none, and then 3 years of research.

A good mathematical finance PhD program will make extensive use of your undergraduate knowledge and put you through graduate level courses on stochastic analysis, statistical theory and financial engineering. It will also allow you to take courses on general finance, particularly on corporate finance and derivative securities. When you finish the program you will have gained a broad knowledge in most areas of mathematical finance, while specialising in one particular area for your thesis. This "broad and deep" level of knowledge is the hallmark of a good PhD program.

Mathematical Finance research groups study a wide variety of topics. Some of the more common areas include:

- Derivative Securities Pricing/Hedging: The technical term for this is "financial engineering", as "quantitative analysis" now encompasses a wide variety of financial areas. Some of the latest research topics include sophisticated models of options including stochastic volatility models, jump-diffusion models, asymptotic methods as well as investment strategies.

- Stochastic Calculus/Analysis: This is more of a theoretical area, where the basic motivation stems from the need to solve stochastic differential equations. Research groups may look at path-dependent PDEs, functional Ito calculus, measure theory and probability theory.

- Fixed Income Modeling: Research in this area centres on effectively modelling interest rates - such as multi-factor models, multi-curve term structure models as well as interest rate derivatives such as swaptions.

- Numerical Methods: Although not always strictly related to mathematical finance, there is a vast amount of university research carried out to try and develop more effective means of solving equations numerically (i.e. on the computer!). Recent developments include GPU-based Monte Carlo solvers, more efficient matrix solvers as well as Finite Differences on GPUs. These groups will almost certainly possess substantial programming expertise.

- Market Microstructure/High-Frequency Modeling: This type of research is extremely applied and highly valued by funds engaged in this activity. You will find many academics consulting, if not contracting, for specialised hedge funds. Research areas include creating limit order market models, high frequency data statistical modelling, market stability analysis and volatility analysis.

- Credit Risk: Credit risk was a huge concern in the 2007-2008 financial crisis and many research groups are engaged in determining such "counterparty risks". Credit derivatives are still a huge business and so a lot of research goes into collateralisation of securities as well as pricing of exotic credit derivatives.

These are only a fraction of the total areas that are studied within mathematical finance. The best place to find out more about research topics is to visit the websites of all the universities which have a mathematical finance research group, which is typically found within the mathematics, statistics or economics faculty.

The benefits of undertaking a PhD program are numerous:

- Employment Prospects: A PhD program sets you apart from candidates who only possess an undergraduate or Masters level ability. By successfully defending a thesis, you have shown independence in your research ability, a skill highly valued by numerate employers. Many funds (and to a lesser extent, banks) will only hire PhD level candidates for their mathematical finance positions, so in a pragmatic sense it is often a necessary "rubber stamp". In investment banks, this is not the case so much anymore, as programming ability is generally prized more. However, in funds, it is still often a requirement. Upon being hired you will likely be at "associate" level rather than "analyst" level, which is common of undergraduates. Your starting salary will reflect this too.

- Knowledge: You will spend a large amount of time becoming familiar with many aspects of mathematical finance and derivatives theory. This will give you a holistic view into the industry and a more transferable skill set than an undergraduate degree as you progress up the career ladder. In addition, you will have a great deal of time to learn how to program models effectively (without the day-to-day pressure to get something implemented any way possible!), so by the time you're employed, you will be "ahead of the game" and will know best practices. This aspect is down to you, however!

- Intellectual Prospects: You are far more likely to gain a position at a fund after completing a PhD than without one. Funds are often better environments to work in. There is usually less stress and a more relaxed "collegiate" environment. Compare this to working on a noisy trading floor, where research might be harder to carry out and be perceived as less important.

I would highly recommend a mathematical finance PhD, so long as you are extremely sure that a career in quantitative finance is for you. If you are still unsure of your potential career options, then a more general mathematics, physics or engineering PhD might be a better choice.

Join the QSAlpha research platform that helps fill your strategy research pipeline, diversifies your portfolio and improves your risk-adjusted returns for increased profitability.

The Quantcademy

Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability.

Successful Algorithmic Trading

How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine.

Advanced Algorithmic Trading

How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- 17 April 2024

Canadian science gets biggest boost to PhD and postdoc pay in 20 years

- Brian Owens

You can also search for this author in PubMed Google Scholar

Researchers in Canada got most of what they were hoping for in the country’s 2024 federal budget, with a big boost in postgraduate pay and more funding for research and scientific infrastructure.

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

24,99 € / 30 days

cancel any time

Subscribe to this journal

Receive 51 print issues and online access

185,98 € per year

only 3,65 € per issue

Rent or buy this article

Prices vary by article type

Prices may be subject to local taxes which are calculated during checkout

doi: https://doi.org/10.1038/d41586-024-01124-2

Reprints and permissions

Related Articles

- Scientific community

Want to make a difference? Try working at an environmental non-profit organization

Career Feature 26 APR 24

Future of Humanity Institute shuts: what’s next for ‘deep future’ research?

News 26 APR 24

Algorithm ranks peer reviewers by reputation — but critics warn of bias

Nature Index 25 APR 24

How India can become a science powerhouse

Editorial 16 APR 24

US COVID-origins hearing puts scientific journals in the hot seat

News 16 APR 24

What the India election means for science

News 10 APR 24

NIH pay rise for postdocs and PhD students could have US ripple effect

News 25 APR 24

India’s 50-year-old Chipko movement is a model for environmental activism

Correspondence 23 APR 24

Berlin (DE)

Springer Nature Group

ECUST Seeking Global Talents

Join Us and Create a Bright Future Together!

Shanghai, China

East China University of Science and Technology (ECUST)

Position Recruitment of Guangzhou Medical University

Seeking talents around the world.

Guangzhou, Guangdong, China

Guangzhou Medical University

Junior Group Leader

The Imagine Institute is a leading European research centre dedicated to genetic diseases, with the primary objective to better understand and trea...

Paris, Ile-de-France (FR)

Imagine Institute

Director of the Czech Advanced Technology and Research Institute of Palacký University Olomouc

The Rector of Palacký University Olomouc announces a Call for the Position of Director of the Czech Advanced Technology and Research Institute of P...

Czech Republic (CZ)

Palacký University Olomouc

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

- Learning Mall

- Undergraduate

- Short, Summer Courses

- Executive Education & Professional Development

- International Mobility

- Why study at XJTLU

- Chinese Mainland

- Entry Requirements

- How to Apply

- Fees & Scholarship

- China's Hong Kong, Macao, & Taiwan

- International

- Programme Fees

- Postgraduate Research Scholarships

- Visa Information for International Students

- Pre-Arrival Information for International Students

- Key Research Areas

- Research Strategies

- Research Innovation Ecosystem

- Research Publications

- Research Projects

- Centres, Labs, Institutes and Schools

- Academy of Film and Creative Technology

- Academy of Future Education

- XJTLU-JITRI Academy of Industrial Technology

- XJTLU Wisdom Lake Academy of Pharmacy

- School of Advanced Technology

- Design School

- School of Film and TV Arts

- School of Humanities and Social Sciences

- International Business School Suzhou

- School of Languages

- School of Mathematics and Physics

- School of Science

- Chinese Cultural Teaching Centre

- Physical Education Centre

- School of AI and Advanced Computing

- School of CHIPS

- School of Cultural Technology

- Entrepreneurship and Enterprise Hub

- School of Intelligent Finance and Business

- School of Intelligent Manufacturing Ecosystem

- School of Internet of Things

- School of Robotics

- HeXie Academy

- Digital Transformation Research Centre

- Industrial Software Ecosystem Research Centre

- Strategic Issues of Industrial Innovation & Development Research Centre

- Test Centres

- Health & Wellbeing

- Sports and Club Activities

- Accommodation

- Life in Suzhou

- Vision and Mission

- Partnership

- Higher Education in China

- Associate Vice Presidents & Deans

- Previous Senior Staff

- Jobs & Careers

- Policies & Regulations

- Professional Services

- Meta Education

- Brand Resources

- Publications

International Cultural Bazaar celebrates diversity

April 11, 2024

Quick Links

- Undergraduate Programmes

Backtesting expected shortfall: a duration-severity approach

10:00 AM - 11:00 AM

- Time: 10:00-11:00 am (Beijing Time)

- Date: Monday, April 29, 2024

- Venue: MB441

- Speaker:Dr. Yang Lu, Concordia University

- Host:Dr. Jiajun Liu

We propose an original two-part, duration-severity approach to backtesting expected shortfall. From the daily probability integral transform of the return, we construct a sequence of durations counting the time elapsed between successive VaR violations, as well as a sequence of severities corresponding to the realized quantiles in case of a violation. Then the serial and mutual independence of the duration and severity sequences are tested using the theory of (bivariate) orthogonal polynomials. Our test includes as special cases unconditional coverage (UC) and conditional coverage (CC) backtests of both VaR and ES, allowing the risk manager to easily identify the mis-specified component(s) of the internal model in case of a rejection of the test. Our test can also be applied to other systemic risk measures, such as the marginal expected shortfall. Simulation experiments suggest that our test has good finite sample properties for realistic sample sizes. A case study illustrates the usefulness of the proposed test. This is a joint work with Christophe Hurlin (University of Orleans, France) and Sullivan Hue (Aix-Marseille University, France).

Yang Lu is assistant professor (and associate professor as of June 2024) at Concordia University in Montreal, Canada. He previously worked as assistant professor at University of Paris 13 from 2017 to 2020, as a postdoc total fellow from 2015 to 2017 at Aix-Marseille University. He studied maths at École Normale Supérieure, Paris and actuarial science at Ecole Nationale de la Statistique et de l’administration économique (now IP Paris). He completed his PhD in applied mathematics at University of Paris Dauphine, under the supervision of Christian Gourieroux. His research interest is statistical and econometric methodology for insurance and finance applications. He has published 25 papers to date, in journals such as IME, JRI, Astin, SAJ, Management Science, Mathematical Finance, Journal of Banking and Finance, Electronic Journal of Statistics, Scandinavian Journal of Statistics, Journal of Multivariate Analysis, JRSSA, Journal of Time Series Analysis, and Journal of Applied Econometrics.

You may be interested.

A Gen Xer who got $250,000 in student loans forgiven said he can now finally start saving for retirement — and consider his dream of studying in India

- Joel Lambdin, 49, received $250,000 in student-loan forgiveness in January.

- It's a result of the Education Department's one-time account adjustments.

- Lambdin said the relief would allow him to save for retirement and consider long-term dreams.

Joel Lambdin finished graduate school in 1998 — but as a professional musician, he was hardly making enough money to pay off his student loans and other bills.

So Lambdin, now 49, said his only option to make ends meet was to put his student loans in forbearance — in which he was not making payments but interest was still accumulating .

"It was just so that I could subsist, so that I could survive," Lambdin told Business Insider. "With the hope that at some point, I would be making enough money that I would be able to take them out of forbearance and start paying them down."

But he grew to realize that the only way he could make a significant dent in his student loans was by switching careers. He didn't want to do that because he loved working in music, so he decided to keep his larger student loan in forbearance and begin paying off his smaller loan with a lower monthly payment.

He continued making those payments until the pandemic pause on student-loan payments , at which point he and his wife started making a plan of action to tackle the larger debt once the pause ended. That led them to discover the Education Department's initiative allowing some borrowers a one-time account adjustment . It lets the department evaluate borrowers' accounts and update payment progress toward forgiveness on income-driven repayment plans and Public Service Loan Forgiveness, including any payments made during a forbearance period.

That account adjustment led to a letter Lambdin received on January 31, reviewed by BI, from his student-loan servicer Aidvantage. It said: "Congratulations! The Biden-Harris Administration has forgiven your federal student loan(s) listed below with Aidvantage in full."

For Lambdin, that letter meant his $249,255 outstanding student-loan balance was effectively wiped out.

"It had started to feel like my fate was being decided for me by the cold hand of finance," Lambdin said, "and that was a weight that I didn't realize was there until it wasn't there."

He added: "The feeling was much more like putting down a backpack that was really full of books that you got used to. And then you put it down, and you're like, 'Oh, man, that feels so much better.' It's more like that, rather than sort of a jump-for-joy kind of situation."

While Lambdin is still working to determine what exactly the relief will mean for him and his wife, he said, discussing retirement is "a much more present conversation now" because contributing to savings is viable after the relief. He can also begin to look into buying a home.

Related stories

The Education Department continues to cancel student debt through its one-time account adjustments, a process it plans to complete this summer. Most recently, the department wiped out $7.4 billion in student debt for 277,000 borrowers , some of whom benefited from the adjustments.

Beyond financial goals, Lambdin said the relief was also allowing him the freedom to pursue some of his long-term dreams, including taking a sabbatical to study with his meditation teacher in India.