Principles of Macroeconomics

(3 reviews)

Copyright Year: 2016

ISBN 13: 9781946135179

Publisher: University of Minnesota Libraries Publishing

Language: English

Formats Available

Conditions of use.

Learn more about reviews.

Reviewed by Faunce Elizabeth, Adjunct Professor, Radford University on 1/10/23

This text appropriately addresses all required areas of macroeconomic topics and provides a clear table of contents/index; however, no glossary is provided. read more

Comprehensiveness rating: 5 see less

This text appropriately addresses all required areas of macroeconomic topics and provides a clear table of contents/index; however, no glossary is provided.

Content Accuracy rating: 5

The textbook is accurate and appears to be free of errors.

Relevance/Longevity rating: 3

This text was published in 2016, and while the content is accurate, it is not current. For example, Chapter 11, Monetary Policy & The Fed, discusses the challenges The Fed faced in 2008. Given the financial impact of Covid and the current inflationary period, the recent actions of The Fed's (2022) should be addressed. Supplemental material would be needed to accompany the use of this text.

Clarity rating: 5

The text appropriately utilizes jargon and terminology needed in a fundamental macroeconomics course. Additionally, the author presents the content as if he/she was speaking directly to a class, which I believe provides clarity to the reader.

Consistency rating: 5

The text is consistent with regards to the structure of the chapters, terminology, and resources (key takeaways, "try it!", etc).

Modularity rating: 5

The textbook is appropriately divided into chapters that can then be easily broken into smaller reading sections. The instructor could easily select the chapters most relevant for their class and then break the chapter up into several class lectures or reading assignments.

Organization/Structure/Flow rating: 4

The organization of the text is probably the one area that I would change. For example, I would present chapter 16 (inflation and employment) after chapter 8 (economic growth) and I would present chapter 12 (fiscal policy) before addressing chapter 9, 10 and 11 (money creation and monetary policy).

Interface rating: 5

This book is very easy to access, with multiple options provided. Additionally, the hyperlinks to the figures, located within each chapter, were very helpful.

Grammatical Errors rating: 5

The text is generally very well written and I found no significant grammatical errors.

Cultural Relevance rating: 5

The text is in no way culturally insensitive and I found most examples and visuals generic in nature.

Reviewed by Brad Humphreys, Professor of Economics, West Virginia University on 9/12/18

The textbook covers all the topics that would typically be covered in a one semester principles of macro course. Measurement of production, employment, prices, interest rates. Short run (cycles) and long run (growth). Theoretical perspectives... read more

The textbook covers all the topics that would typically be covered in a one semester principles of macro course. Measurement of production, employment, prices, interest rates. Short run (cycles) and long run (growth). Theoretical perspectives from the Keynesian and classical perspectives. International topics (trade, globalization). The index looks reasonable.

It appears accurate to me. I teach principles of macro every semester so I am familiar with the basic content. I have not used it in a class yet, so I have not been through this book in detail.

Relevance/Longevity rating: 4

The information is up to date as of 2015. The GDP estimates are from 2014/15 as are the inflation and unemployment estimates. I assume that this will be periodically updated. Not much has changed in principles of macro recently, so keeping this text current will not be much of an issue (until the next recession occurs).

Clarity rating: 4

This is based on Tim Taylors book (they bought the rights) so the original text was written by a respected economist. It is clearly written and undergrads should find this engaging and accessible. The jargon is minimal.

The terminology and framework are completely standard for a principles of macro text. Again, I have taught principles of macro every semester for the last 3-4 years, and the terminology and framework here are what would be expected.

Modularity rating: 4

No long blocks of text. Frequent and clear subheadings. If anything, the chapters appear to be quite short. Some of the chapters appear to be approximately one 75 minute lecture of material.

Very typical organization for a principles of macro text. I have used several (two in the last 3 years - John Taylor and Coppock and Mateer), and they all have the same basic organization.

The graphs, figures, photos and tables all looked good to me. Readable. Clear.

I did not see any grammatical errors. I did not read every chapter, but I'm sure Tim Taylor's book was thoroughly edited when it was being published by a for-profit publishing house.

Examples are drawn fro all over the world, and the photos are inclusive. I did not see any culturally insensitive passages.

Ancillary Material / / The test bank is relatively small. Each chapter has about 35-40 multiple choice questions. This probably not enough for use in a large enrollment section - most test banks from for-profit publishers contain at least 100 multiple choice questions per chapter. The multiple questions all look fine to me. There are some essay questions but I teach large (300+) sections that only use multiple choice questions. / / The provided PowerPoint slides are rudimentary. They basically contain some of the figures, photos, and tables from the text. It will take some time and effort for instructors to develop complete PowerPoint slides for this book.

Reviewed by Darcy Hartman, Senior Lecturer, The Ohio State University on 6/10/15

Having spent a bit of time working my way through other textbooks to arrive at one that seemed to fit my style of teaching, I am pleasantly surprised at the comprehensiveness of this text. It covers all the main principles that would typically be... read more

Having spent a bit of time working my way through other textbooks to arrive at one that seemed to fit my style of teaching, I am pleasantly surprised at the comprehensiveness of this text. It covers all the main principles that would typically be covered, but also includes some chapters on subjects that would be great to implement given enough time. At the very least, they are a resource for students that have taken a greater interest in the course work. I am speaking specifically on the chapters toward the end relating to poverty and income inquality. Additionally, the book contains a good review of graphing and some of the mathematics utilized within the book.

Content Accuracy rating: 4

I will not suggest that I am providing a thorough review in accuracy, but from what I have reviewed, nothing seemed remiss. Perhaps a typo here or there - not enough to interrupt the flow of the material. But everything seemed in order from a content perspective.

The ability to update material would be the part most concerning to me as I do not know the updating practices for the authors. There seems to be good coverage of more recent events, and certainly there is good coverage going further back. I do not take issue with it as it stands. Even with the more expensive textbooks, it is the obligation of the professor or lecturer to keep students current while applying the principles being taught.

I think that what I appreciate most with the textbook is that it seems to be written in a very straightforward manner. One common complaint that I hear from students is that textbook explanations can be tedious to get through. Given all the examples that are provided, and all the sample problems utilized, in addition to the actual writing, I think that students, including international students, would find this a generally approachable source.

Consistency rating: 4

Again, with the caveat that I have not read through every single part of the book, in my examination of the text, I did not enounter any inconsistencies within the book. Also, I felt that the presentation seemed consistent, yet more comprehensive, than most textbooks I have utilized.

The breakdown of the text makes it very approachable from a learner standpoint. It is clear what the objectives are within each small section, and the objectives never seem overwhelming. This is useful from a teaching standpoint to keep students from feeling overwhelmed.

Organization/Structure/Flow rating: 3

The organization of the book does not align with the current way that I teach. While I am open to making adjustments, I do think that the order of some chapters could be rearranged. For example, the topic of economic growth could easily be combined with development rather than treated as an afterthought. With an increasing focus on internationalization in higher education, separating the two suggests a sense of other from my perspective. I find it confusing to have GDP included in the chapter on inflation and unemployment, but then treated separately afterward.

Interface rating: 4

There were a few distractions for me in the layout that seemed to be issues with how it displayed on my computer. These were not so serious that they would prevent me from utilizing the materials. I have not had the chance to see how it presents on an ipad, tablet or phone.

Grammatical Errors rating: 4

I spotted one or two errors, but not enough to deter me from using the book.

Cultural Relevance rating: 4

I certainly did not encounter anything that seemed culturally insensitive or offensive. I would encourage greater use of international examples, particularly when looking at policy tools. The book is U.S. focused; although this is the case with virtually every textbook that is presented to me. Internationalization of the curriculum seems to be an increasingly popular theme. That said, the book certainly utilizes enough international examples for me to consider it.

I am pleasantly surprised by this book. As I prepare for the 2015-2016 academic year, I will certainly consider using this text. I would need to get a better idea of how easily one can access the specific materials needed on demand.

Table of Contents

- Chapter 1: Economics: The Study of Choice

- Chapter 2: Confronting Scarcity: Choices in Production

- Chapter 3: Demand and Supply

- Chapter 4: Applications of Demand and Supply

- Chapter 5: Macroeconomics: The Big Picture

- Chapter 6: Measuring Total Output and Income

- Chapter 7: Aggregate Demand and Aggregate Supply

- Chapter 8: Economic Growth

- Chapter 9: The Nature and Creation of Money

- Chapter 10: Financial Markets and the Economy

- Chapter 11: Monetary Policy and the Fed

- Chapter 12: Government and Fiscal Policy

- Chapter 13: Consumption and the Aggregate Expenditures Model

- Chapter 14: Investment and Economic Activity

- Chapter 15: Net Exports and International Finance

- Chapter 16: Inflation and Unemployment

- Chapter 17: A Brief History of Macroeconomic Thought and Policy

- Chapter 18: Inequality, Poverty, and Discrimination

- Chapter 19: Economic Development

- Chapter 20: Socialist Economies in Transition

Ancillary Material

About the book.

Recognizing that a course in economics may seem daunting to some students, we have tried to make the writing clear and engaging. Clarity comes in part from the intuitive presentation style, but we have also integrated a number of pedagogical features that we believe make learning economic concepts and principles easier and more fun. These features are very student-focused. The chapters themselves are written using a “modular” format. In particular, chapters generally consist of three main content sections that break down a particular topic into manageable parts. Each content section contains not only an exposition of the material at hand but also learning objectives, summaries, examples, and problems. Each chapter is introduced with a story to motivate the material and each chapter ends with a wrap-up and additional problems. Our goal is to encourage active learning by including many examples and many problems of different types.

A tour of the features available for each chapter may give a better sense of what we mean:

Start Up—Chapter introductions set the stage for each chapter with an example that we hope will motivate readers to study the material that follows. These essays, on topics such as the value of a college degree in the labor market or how policy makers reacted to a particular economic recession, lend themselves to the type of analysis explained in the chapter. We often refer to these examples later in the text to demonstrate the link between theory and reality.

Learning Objectives—These succinct statements are guides to the content of each section. Instructors can use them as a snapshot of the important points of the section. After completing the section, students can return to the learning objectives to check if they have mastered the material. Heads Up!—These notes throughout the text warn of common errors and explain how to avoid making them. After our combined teaching experience of more than fifty years, we have seen the same mistakes made by many students. This feature provides additional clarification and shows students how to navigate possibly treacherous waters.

Key Takeaways—These statements review the main points covered in each content section.

Key Terms—Defined within the text, students can review them in context, a process that enhances learning.

Try It! questions—These problems, which appear at the end of each content section and which are answered completely in the text, give students the opportunity to be active learners. They are designed to give students a clear signal as to whether they understand the material before they go on to the next topic.

Cases in Point—These essays included at the end of each content section illustrate the influence of economic forces on real issues and real people. Unlike other texts that use boxed features to present interesting new material or newspaper articles, we have written each case ourselves to integrate them more clearly with the rest of the text.

Summary—In a few paragraphs, the information presented in the chapter is pulled together in a way that allows for a quick review of the material. End-of-chapter concept and numerical problems—These are bountiful and are intended to check understanding, to promote discussion of the issues raised in the chapter, and to engage students in critical thinking about the material. Included are not only general review questions to test basic understanding but also examples drawn from the news and from results of economics research. Some have students working with real-world data.

Contribute to this Page

Macroeconomics

Macroeconomics focuses on the performance of economies – changes in economic output, inflation, interest and foreign exchange rates, and the balance of payments. Poverty reduction, social equity, and sustainable growth are only possible with sound monetary and fiscal policies.

The world has entered a new era of rapid global change driven by major shifts in demographics, wealth, technology, and climate.

But economic growth has been uneven, has come at the expense of the environment, and has already slowed due to climate damages. Global challenges — including fiscal strains on governments exacerbated by the COVID-19 pandemic, conflicts, environmental degradation, resource depletion, and record levels of displacement — are threatening recent gains. These challenges are compounded by intensifying systemic risks, including trade tensions, rising debt levels, and increasing inequality.

To accelerate sustainable economic growth and inclusion, developing countries must tackle a variety of challenges. These include low levels of productivity and international competitiveness, inefficient public spending, inadequate domestic resource mobilization, price distortions from fiscal systems that discourage sustainability, lack of economic resilience, increasing debt levels, and the rising danger of climate change.

Last Updated: Apr 01, 2024

Economic growth must benefit all and be sustainable. The World Bank Group is working with its clients and partners to develop smart economic policies that foster sustainable and inclusive economic growth, and address challenges to economic stability including climate change. Priority areas include:

- Fiscal policy: Fiscal policy is key to developing sustainable trajectories for revenues, expenditures, and deficits and the management of fiscal risks, with an emphasis on determining fiscal space and funding sources and improving public expenditure management.

- Domestic resource mobilization: Better tax systems are one of the largest untapped resources to promote poverty reduction and support climate, health, and other key government objectives.

- Debt: Debt is a critical form of financing for the sustainable development goals, but only when borrowing is done at sustainable levels and in a transparent fashion.

- Economics of climate change: Climate change is no longer seen simply as an environmental problem. It is recognized as a serious financial, economic, and social problem that, left unmitigated, could push an additional 130 million people into extreme poverty by 2030, underscoring the importance of zero-carbon growth strategies.

Promoting macroeconomic stability and sustainable and inclusive growth

- The World Bank supports countries in the design and implementation of economic reforms to strengthen macroeconomic stability. Examples include assistance in the design of fiscal, revenue and debt strategies, structural reforms, and the removal of distortions that result in unsustainable balance of payments and financial sector positions.

- World Bank economists create country-specific reports — such as Country Economic Memoranda (CEM) and Economic Updates — to address questions related to economic growth. The CEM is a comprehensive analysis of a country's economic developments, prospects, and policy agenda. It serves as a basis for dialogue between the World Bank and the government of the country, as well as other stakeholders. The CEM identifies policy reforms for key economic sectors and provides recommendations to promote growth, reduce poverty, and improve people's lives. It also serves as a source of information and analysis for aid groups and other donors. The CEM aims to guide policy decisions and support the country's economic development efforts.

Strengthening public expenditure policies and management

- The World Bank prepares Public Finance Reviews for many of its client countries, which provide feedback and advice on enhancing countries’ overall fiscal discipline and allocative and operational efficiency of their public revenue and expenditure programs.

- The BOOST Program operates in over 80 countries to make available previously unattainable micro-fiscal data in accessible, comparative, and usable formats in support of expenditure analyses (counting 100+ PERs and related analytics), lending operations ( Development Policy Financing and Program for Result), and fiscal transparency (almost 40 countries publicly disseminate data in the Open Budget Portal ).

Promoting debt management and transparency

- The World Bank provides technical advice for countries to strengthen their debt management capacity as part of lending operations and through advisory services.

- The Debt Management Facility (DMF) program offers advisory services and technical assistance, training, and peer-to-peer learning to 86 developing countries around the world. The goal of the Facility is to reduce debt-related vulnerabilities by strengthening debt management capacity, processes, and institutions, and improving debt transparency. By the end of FY23, 44 DMF countries published Debt Management Strategies, 11 countries published Annual Borrowing Plans, and 43 DMF countries published Debt Statistical Bulletins.

- We also run the Government Debt and Risk Management (GDRM) program, in partnership with Switzerland’s State Secretariat for Economic Affairs (SECO). Since 2011, the program has worked with middle-income countries to develop robust debt and risk management frameworks to reduce their vulnerability to financial shocks. Current participants include Albania, Azerbaijan, Colombia, Egypt, Ghana, Indonesia, North Macedonia, Morocco, South Africa, Serbia, Peru, Ukraine, and Vietnam.

- Working with the International Monetary Fund (IMF), the Bank implemented the Debt Sustainability Framework (DSF) for low-income countries , which allows multilateral institutions and other creditors to assess risks to debt sustainability in lower-income countries. The framework classifies countries based on their assessed debt-carrying capacity, estimates threshold levels for selected debt burden indicators, evaluates baseline projections and stress test scenarios relative to these thresholds, and then combines indicative rules and staff judgment to assign risk ratings of debt distress. The framework guides countries in supporting the SDGs, when their ability to service debt is limited.

people worldwide – nearly 1 in 6 – lack access to electricity

Global Economy Set for Weakest Half-Decade Performance in 30 Years | World Bank Expert Answers

Focus Areas

Debt & Fiscal Risks Toolkit

The World Bank Group helps countries manage debt and fiscal risks effectively. We offer a specific set of tools and reports to help countries balance the need for financing development while minimizing costs and risk.

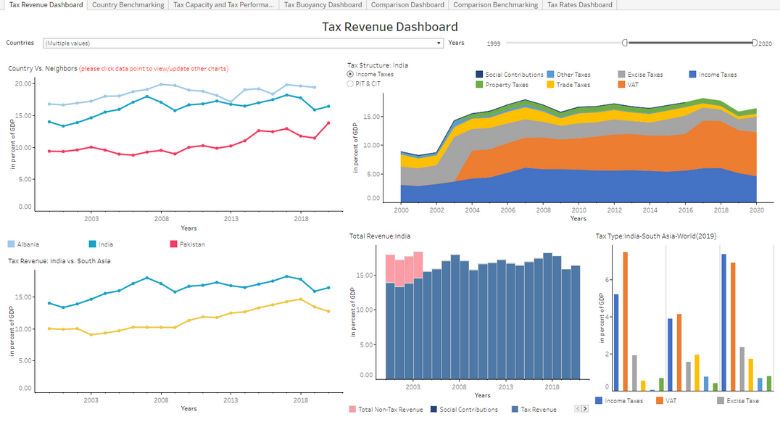

World Bank Revenue Dashboard

The Revenue Dashboard is a tool for benchmarking tax policy performance. The dashboard aims to provide policymakers and researchers with necessary data and information to conduct a high-level analysis of a country's tax ...

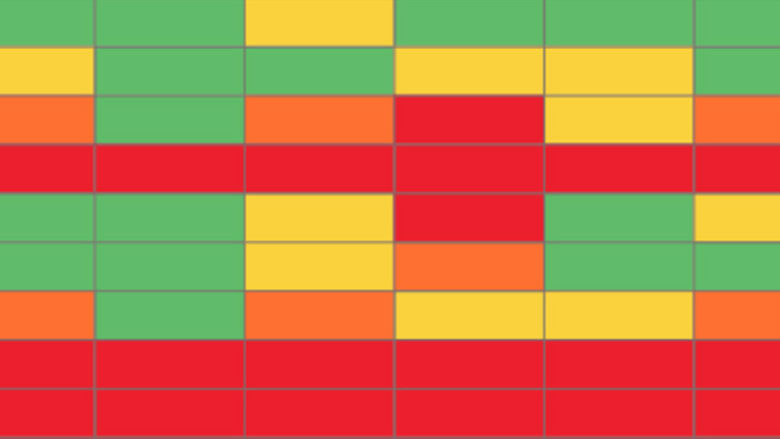

Debt Reporting Heat Map

How transparent are IDA countries in their debt reporting practices? This heat map presents an assessment based on the availability, completeness, and timeliness of public debt statistics and debt management documents ...

Innovations in Tax Compliance

A World Bank report demonstrates that building trust in governments is a fundamental step to make tax systems work better, benefiting all citizens.

Additional Resources

Areas of expertise.

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

On the site

- business & economics

Critical Essay on Modern Macroeconomic Theory

by Frank Hahn and Robert M. Solow

ISBN: 9780262581547

Pub date: August 21, 1997

- Publisher: The MIT Press

208 pp. , 6 x 9 in ,

ISBN: 9780262082419

Pub date: December 8, 1995

- 9780262581547

- Published: August 1997

- Rights: not for sale in Europe or the UK Commonwealth, except Canada

- 9780262082419

- Published: December 1995

- MIT Press Bookstore

- Penguin Random House

- Barnes and Noble

- Bookshop.org

- Books a Million

Other Retailers:

- Amazon.co.uk

- Waterstones

- Description

Macroeconomics began as the study of large-scale economic pathologies such as prolonged depression, mass unemployment, and persistent inflation. In the early 1980s, rational expectations and new classical economics dominated macroeconomic theory, with the result that such pathologies can hardly be discussed within the vocabulary of the theory. This essay evolved from the authors' profound disagreement with that trend. It demonstrates not only how the new classical view got macroeconomics wrong, but alsohow to go about doing macroeconomics the right way. Hahn and Solow argue that what was originally offered as a normative model based on perfect foresight and universal perfect competition—useful for predicting what an ideal, omniscient planner should do—has been almost casually transformed into a model for interpreting real macroeconomic behavior, leading to Panglossian economics that does not reflect actual experience. Following an explanation of microeconomic foundations, chapters introduce the basic elements for a better macro model. The model is simple, but combined with the appropriate model of the labor market it can say useful things about the fluctuation of employment, the correlation between wages and employment, and the role for corrective monetary policy.

Frank Hahn, one of Britain's most eminent economists, is Professor of Economics at Cambridge University and author of Equilibrium and Macroeconomics (MIT Press 1985).

Robert M. Solow is Institute Professor of Economics.

Like the great debate between Einstein and Bohr on quantum physics,the debate between Hahn-Solow and Lucas's rational expectationismis a must for all serious students of macro. This is how scientificprogress should be done—by sober analysis rather than cleverrhetoric or frenzied ideology. Paul A. Samuelson, Professor of Economics, M.I.T.

Professors Hahn and Solow pick up the simple general equilibrium models of new classical macroeconomics and run with them. Of course, they head off in directions that are theirs alone. Critics of these models, and enthusiasts, will want to read this book and see how far they get. Paul M. Romer, Professor of Economics, University of Californiaat Berkeley

Related Books

Introduction

Chapter objectives.

In this chapter, you will learn about:

- What Is Economics, and Why Is It Important?

- Microeconomics and Macroeconomics

- How Economists Use Theories and Models to Understand Economic Issues

- How Economies Can Be Organized: An Overview of Economic Systems

Bring It Home

Information overload in the information age.

To post or not to post? Every day we are faced with a myriad of decisions, from what to have for breakfast, to which show to stream, to the more complex—“Should I double major and add possibly another semester of study to my education?” Our response to these choices depends on the information we have available at any given moment. Economists call this “imperfect” because we rarely have all the data we need to make perfect decisions. Despite the lack of perfect information, we still make hundreds of decisions a day.

Streams, sponsors, and social media are altering the process by which we make choices, how we spend our time, which movies we see, which products we buy, and more. Whether they read the reviews or just check the ratings, it's unlikely for Americans to make many significant decisions without these information streams.

As you will see in this course, what happens in economics is affected by how well and how fast information disseminates through a society, such as how quickly information travels through Facebook. “Economists love nothing better than when deep and liquid markets operate under conditions of perfect information,” says Jessica Irvine, National Economics Editor for News Corp Australia.

This leads us to the topic of this chapter, an introduction to the world of making decisions, processing information, and understanding behavior in markets —the world of economics. Each chapter in this book will start with a discussion about current (or sometimes past) events and revisit it at chapter’s end—to “bring home” the concepts in play.

What is economics and why should you spend your time learning it? After all, there are other disciplines you could be studying, and other ways you could be spending your time. As the Bring it Home feature just mentioned, making choices is at the heart of what economists study, and your decision to take this course is as much as economic decision as anything else.

Economics is probably not what you think. It is not primarily about money or finance. It is not primarily about business. It is not mathematics. What is it then? It is both a subject area and a way of viewing the world.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-macroeconomics-3e/pages/1-introduction

- Authors: David Shapiro, Daniel MacDonald, Steven A. Greenlaw

- Publisher/website: OpenStax

- Book title: Principles of Macroeconomics 3e

- Publication date: Dec 14, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-macroeconomics-3e/pages/1-introduction

- Section URL: https://openstax.org/books/principles-macroeconomics-3e/pages/1-introduction

© Jan 23, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Tips for writing economics essays

Some tips for writing economics essays Includes how to answer the question, including right diagrams and evaluation – primarily designed for A Level students.

1. Understand the question

Make sure you understand the essential point of the question. If appropriate, you could try and rephrase the question into a simpler version.

For example:

Q. Examine the macroeconomic implications of a significant fall in UK House prices, combined with a simultaneous loosening of Monetary Policy.

In plain English.

- Discuss the effect of falling house prices on the economy

- Discuss the effect of falling interest rates (loose monetary policy) on economy

In effect, there are two distinct parts to this question. It is a valid response, to deal with each separately, before considering both together.

It helps to keep reminding yourself of the question as you answer. Sometimes candidates start off well, but towards the end forget what the question was. Bear in mind, failure to answer the question can lead to a very low mark.

2. Write in simple sentences

For clarity of thought, it is usually best for students to write short sentences. The main thing is to avoid combining too many ideas into one sentence. If you write in short sentences, it may sound a little stilted; but it is worth remembering that there are no extra marks for a Shakespearian grasp of English. (at least in Economics Exams)

Look at this response to a question:

Q. What is the impact of higher interest rates?

Higher interest rates increase the cost of borrowing. As a result, those with mortgages will have lower disposable income. Also, consumers have less incentive to borrow and spend on credit cards. Therefore consumption will be lower. This fall in consumption will cause a fall in Aggregate Demand and therefore lead to lower economic growth. A fall in AD will also reduce inflation.

I could have combined 1 or 2 sentences together, but here I wanted to show that short sentences can aid clarity of thought. Nothing is wasted in the above example.

Simple sentences help you to focus on one thing at once, which is another important tip.

3. Answer the question

Quite frequently, when marking economic essays, you see a candidate who has a reasonable knowledge of economics, but unfortunately does not answer the question. Therefore, as a result, they can get zero for a question. It may seem harsh, but if you don’t answer the question, the examiner can’t give any marks.

At the end of each paragraph you can ask yourself; how does this paragraph answer the question? If necessary, you can write a one-sentence summary, which directly answers the question. Don’t wait until the end of the essay to realise you have answered a different question.

Discuss the impact of Euro membership on UK fiscal and monetary policy?

Most students will have revised a question on: “The benefits and costs of the Euro. Therefore, as soon as they see the Euro in the title, they put down all their notes on the benefits and costs of the Euro. However, this question is quite specific; it only wishes to know the impact on fiscal and monetary policy.

The “joke” goes, put 10 economists in a room and you will get 11 different answers. Why? you may ask. The nature of economics is that quite often there is no “right” answer. It is important that we always consider other points of view, and discuss various different, potential outcomes. This is what we mean by evaluation.

Macro-evaluation

- Depends on the state of the economy – full capacity or recession?

- Time lags – it may take 18 months for interest rates to have an effect

- Depends on other variables in the economy . Higher investment could be offset by fall in consumer spending.

- The significance of factors . A fall in exports to the US is only a small proportion of UK AD. However, a recession in Europe is more significant because 50% of UK exports go to EU.

- Consider the impact on all macroeconomic objectives . For example, higher interest rates may reduce inflation, but what about economic growth, unemployment, current account and balance of payments?

- Consider both the supply and demand side . For example, expansionary fiscal policy can help to reduce demand-deficient unemployment, however, it will be ineffective in solving demand-side unemployment (e.g. structural unemployment)

Example question :

The effect of raising interest rates will reduce consumer spending.

- However , if confidence is high, higher interest rates may not actually discourage consumer spending.

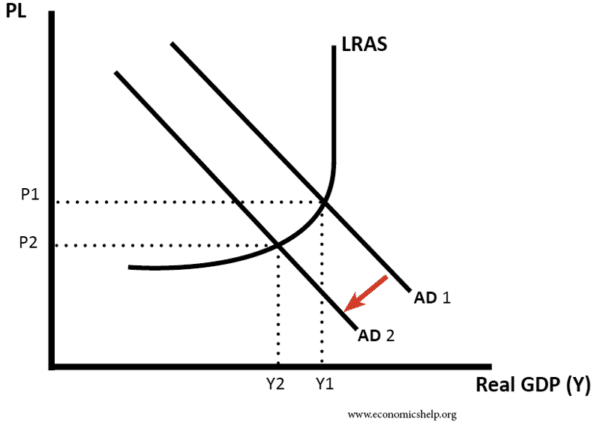

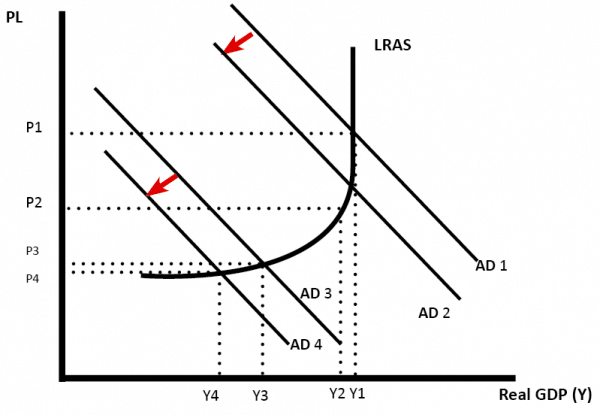

If the economy is close to full capacity a rise in interest rates may reduce inflation but not reduce growth. (AD falls from AD1 to AD2)

- However , if there is already a slowdown in the economy, rising interest rates may cause a recession. (AD3 to AD3)

Micro-evaluation

1. The impact depends on elasticity of demand

In both diagrams, we place the same tax on the good, causing supply to shift to the left.

- When demand is price inelastic, the tax causes only a small fall in demand.

- If demand is price elastic, the tax causes a bigger percentage fall in demand.

2. Time lag

In the short term, demand for petrol is likely to be price inelastic. However, over time, consumers may find alternatives, e.g. they buy electric cars. In the short-term, investment will not increase capacity, but over time, it may help to increase a firms profitability. Time lags.

3. Depends on market structure

If markets are competitive, then we can expect prices to remain low. However, if a firm has monopoly power, then we can expect higher prices.

4. Depends on business objectives

If a firm is seeking to maximise profits, we can expect prices to rise. However, if a firm is seeking to maximise market share, it may seek to cut prices – even if it means less profit.

5. Behavioural economics

In economics, we usually assume individuals are rational and seeking to maximise their utility. However, in the real world, people are subject to bias and may not meet expectations of classical economic theory. For example, the present-bias suggest consumers will give much higher weighting to present levels of happiness and ignore future costs. This may explain over-consumption of demerit goods and under-consumption of merit goods. See: behavioural economics

Exam tips for economics – Comprehensive e-book guide for just £5

8 thoughts on “Tips for writing economics essays”

I really want to know the difference between discussion questions and analysis questions and how to answer them in a correct way to get good credit in Economics

Analysis just involves one sided answers while Discussion questions involve using two points of view

This is a great lesson learnd by me

how can I actually manage my time

The evaluation points in this article are really useful! The thing I struggle with is analysis and application. I have all the knowledge and I have learnt the evaluation points like J-curve analysis and marshall learner condition, but my chains of reasoning are not good enough. I will try the shorter sentences recommended in this article.

What kind of method for costing analysis is most suitable for a craft brewery, in order to analyze the cost of production of different types of beer_

Really useful!Especially for the CIE exam papers

Does anyone know how to evaluate in those advantages/disadvantages essay questions where you would basically analyse the benefits of something and then evaluate? Struggling because wouldn’t the evaluation just be the disadvantages ?? Like how would you evaluate without just stating the disadvantage?

Leave a comment Cancel reply

- Search Search Please fill out this field.

Microeconomics

Macroeconomics.

- What Do Investors Focus on?

The Bottom Line

Microeconomics vs. macroeconomics: what’s the difference.

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Microeconomics vs. Macroeconomics: An Overview

Economics is divided into two categories: microeconomics and macroeconomics. Microeconomics is the study of individuals and business decisions, while macroeconomics looks at the decisions of countries and governments.

Though these two branches of economics appear to be different, they are interdependent and complement one another. Many overlapping issues exist between the two fields.

Key Takeaways

- Microeconomics studies individuals and business decisions, while macroeconomics analyzes the decisions made by countries and governments.

- Microeconomics focuses on supply and demand, and other forces that determine price levels, making it a bottom-up approach.

- Macroeconomics takes a top-down approach and looks at the economy as a whole, trying to determine its course and nature.

- Investors can use microeconomics in their investment decisions, while macroeconomics is an analytical tool mainly used to craft economic and fiscal policy.

Microeconomics is the study of decisions made by people and businesses regarding the allocation of resources, and prices at which they trade goods and services. It considers taxes, regulations, and government legislation.

Microeconomics focuses on supply and demand and other forces that determine price levels in the economy. It takes a bottom-up approach to analyzing the economy. In other words, microeconomics tries to understand human choices, decisions, and the allocation of resources.

Having said that, microeconomics does not try to answer or explain what forces should take place in a market. Rather, it tries to explain what happens when there are changes in certain conditions.

For example, microeconomics examines how a company could maximize its production and capacity so that it could lower prices and better compete. A lot of microeconomic information can be gleaned from company financial statements.

Microeconomics involves several key principles, including (but not limited to):

- Demand, Supply and Equilibrium : Prices are determined by the law of supply and demand . In a perfectly competitive market, suppliers offer the same price demanded by consumers. This creates economic equilibrium.

- Production Theory : This principle is the study of how goods and services are created or manufactured.

- Costs of Production : According to this theory, the price of goods or services is determined by the cost of the resources used during production.

- Labor Economics : This principle looks at workers and employers and tries to understand patterns of wages, employment, and income.

The rules in microeconomics flow from a set of compatible laws and theorems, rather than beginning with empirical study.

Macroeconomics , on the other hand, studies the behavior of a country and how its policies impact the economy as a whole. It analyzes entire industries and economies, rather than individuals or specific companies, which is why it’s a top-down approach. It tries to answer questions such as “What should the rate of inflation be?” or “What stimulates economic growth?”

Macroeconomics examines economy-wide phenomena such as gross domestic product (GDP) and how it is affected by changes in unemployment, national income, rates of growth, and price levels.

Macroeconomics analyzes how an increase or decrease in net exports impacts a nation’s capital account, or how gross domestic product (GDP) is impacted by the unemployment rate .

Macroeconomics focuses on aggregates and econometric correlations , which is why governments and their agencies rely on macroeconomics to formulate economic and fiscal policy. Investors who buy interest-rate-sensitive securities should keep a close eye on monetary and fiscal policy.

John Maynard Keynes is often credited as the founder of macroeconomics, as he initiated the use of monetary aggregates to study broad phenomena. Some economists dispute his theories , while many Keynesians disagree on how to interpret his work.

Investors and Microeconomics vs. Macroeconomics

Individual investors may be better off focusing on microeconomics, but macroeconomics cannot be ignored altogether. Fundamental and value investors may disagree with technical investors about the proper role of economic analysis. While it is more likely that microeconomics will impact individual investments, macroeconomic factors can affect entire portfolios.

Warren Buffett famously stated that macroeconomic forecasts didn’t influence his investing decisions. When asked how he and partner Charlie Munger choose investments, Buffett said, “Charlie and I don’t pay attention to macro forecasts. We have worked together now for 54 years, and I can’t think of a time we made a decision on a stock, or on a company...where we’ve talked about macro.” Buffett also has referred to macroeconomic literature as “the funny papers.”

John Templeton, another famously successful value investor, shared a similar sentiment. “I never ask if the market is going to go up or down because I don’t know, and besides, it doesn’t matter,” Templeton told Forbes in 1978 . “I search nation after nation for stocks, asking: ‘Where is the one that is lowest priced in relation to what I believe it’s worth?’”

Can Macroeconomic Factors Affect My Investment Portfolio?

Yes, macroeconomic factors can have a significant influence on your investment portfolio. For example, the Great Recession of 2008–09 and accompanying market crash were caused by the bursting of the U.S. housing bubble and subsequent near-collapse of financial institutions that were heavily invested in U.S. subprime mortgages.

For another example of the effect of macro factors on investment portfolios, consider the response of central banks and governments to the pandemic-induced crash of spring 2020. Governments and central banks unleashed torrents of liquidity through fiscal and monetary stimulus to prop up their economies and stave off recession, which had the effect of pushing most major equity markets to record highs in the second half of 2020 and throughout much of 2021.

What Is a Global Macro Strategy?

A global macro strategy is an investment and trading strategy that centers around large macroeconomic events at a national or global level. “Global Macro” involves research and analysis of numerous macroeconomic factors, including interest rates, currency levels, political developments, and country relations.

What Is the Basic Difference Between Microeconomics and Macroeconomics?

Microeconomics is the study of how individuals and companies make decisions to allocate scarce resources. Macroeconomics is the study of an economy as a whole.

How Do Core Concepts of Microeconomics Such as Supply and Demand Affect Stock Prices?

Microeconomic concepts such as supply and demand affect stocks prices in two ways: directly and indirectly.

- The direct effect can be gauged by the impact of demand and supply disequilibrium on stock prices. When demand for a stock exceeds supply at a given point in time because there are more buyers than sellers, the stock will rise; conversely, when supply exceeds demand because there are more sellers than buyers, the stock will fall.

- The indirect effect is based on supply and demand for the underlying company’s products and services. If the company’s products are flying off the shelves because of robust demand, it may be on a probable strong earnings trajectory that would likely translate into a higher price for its stock. But if demand is sluggish and there is excess inventory (or supply) of its products, the company’s earnings may disappoint and the stock may slump.

Does My Portfolio Performance Hinge on Both Microeconomic and Macroeconomic Factors?

Yes, the performance of your portfolio hinges on both microeconomic and macroeconomic factors. Microeconomic factors such as supply and demand, taxes and regulations, and macroeconomic factors such as gross domestic product (GDP) growth, inflation, and interest rates, have a significant influence on different sectors of the economy and hence on your investment portfolio.

Microeconomics and macroeconomics are related but separate approaches to studying the economy. Microeconomics is concerned with the actions of individuals and businesses, while macroeconomics is focused on the actions that governments and countries take to influence broader economies. While both will impact an investment portfolio, most investors focus primarily on microeconomic considerations when making their investment decisions.

CNBC, Warren Buffett Archive. “ Afternoon Session — 2013 Meeting .”

Google Books. “ The Oracle Speaks: Warren Buffett in His Own Words ,” Page 101.

- A Practical Guide to Microeconomics 1 of 39

- Economists' Assumptions in Their Economic Models 2 of 39

- 5 Nobel Prize-Winning Economic Theories You Should Know About 3 of 39

- Positive vs. Normative Economics: What's the Difference? 4 of 39

- 5 Factors That Influence Competition in Microeconomics 5 of 39

- How Does Government Policy Impact Microeconomics? 6 of 39

- Microeconomics vs. Macroeconomics: What’s the Difference? 7 of 39

- How Do I Differentiate Between Micro and Macro Economics? 8 of 39

- Microeconomics vs. Macroeconomics Investments 9 of 39

- Introduction to Supply and Demand 10 of 39

- Is Demand or Supply More Important to the Economy? 11 of 39

- Demand: How It Works Plus Economic Determinants and the Demand Curve 12 of 39

- What Is the Law of Demand in Economics, and How Does It Work? 13 of 39

- Demand Curves: What Are They, Types, and Example 14 of 39

- Supply 15 of 39

- Law of Supply Explained, With the Curve, Types, and Examples 16 of 39

- Supply Curve: Definition, How It Works, and Example 17 of 39

- Elasticity: What It Means in Economics, Formula, and Examples 18 of 39

- Price Elasticity of Demand: Meaning, Types, and Factors That Impact It 19 of 39

- Elasticity vs. Inelasticity of Demand: What's the Difference? 20 of 39

- What Is Inelastic? Definition, Calculation, and Examples of Goods 21 of 39

- What Affects Demand Elasticity for Goods and Services? 22 of 39

- What Factors Influence a Change in Demand Elasticity? 23 of 39

- Utility in Economics Explained: Types and Measurement 24 of 39

- Utility in Microeconomics: Origins, Types, and Uses 25 of 39

- Utility Function Definition, Example, and Calculation 26 of 39

- Definition of Total Utility in Economics, With Example 27 of 39

- Marginal Utilities: Definition, Types, Examples, and History 28 of 39

- The Law of Diminishing Marginal Utility: How It Works, With Examples 29 of 39

- What Does the Law of Diminishing Marginal Utility Explain? 30 of 39

- Economic Equilibrium 31 of 39

- What Is the Income Effect? Its Meaning and Example 32 of 39

- Indifference Curves in Economics: What Do They Explain? 33 of 39

- Consumer Surplus Definition, Measurement, and Example 34 of 39

- What Is Comparative Advantage? 35 of 39

- What Are Economies of Scale? 36 of 39

- Perfect Competition: Examples and How It Works 37 of 39

- What Is the Invisible Hand in Economics? 38 of 39

- Market Failure: What It Is in Economics, Common Types, and Causes 39 of 39

:max_bytes(150000):strip_icc():format(webp)/economics-source-67f961336a45429f890f74eb2d90cf0d.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Username or Email Address

Remember Me

Macroeconomics: Meaning, Scope, Importance and Limitations

Macroeconomics / macro economic analysis:.

The word “ MACRO “. is derived from the Greek word “ MAKROS “, which means large. Macroeconomics studies the economic actions and behaviours of an economy at aggregate or average levels and explains the problems at national and international levels. Macroeconomics is also called “The Theory of Income and Employment “, because it deals with the matters of unemployment, economic fluctuations, inflation, deflation, economic development, and international trade etc.

The concept of macroeconomics was introduced during 1930 when economies were facing economic crisis. Macroeconomics studies the economy as a whole. It is concerned with total income, total output, employment, total consumption, total saving, total investment and general price level. It, is aggregative economics that provides whole view of the economy.

Macroeconomics is called income and employment theory. It deals with the problems of unemployment, trade cycles, general price level and international trade and economic growth. It studies the causes of unemployment and different determinants of employment. It is concerned with trade cycles so it examines the effect of investment on total output, total income and total employment.

It deals with monetary matters in order to check effect of total quantity of money on general price level in the field of international trade it studies problems of balance of payments and foreign aid. In fact, macroeconomics examines problems relating to determination of total income of the country and causes of changes in total income. Moreover, it studies the factors relating to economic growth.

Definition :

According to Prof. K.B. Boulding

“Macroeconomics deals not with individual quantities as such but with aggregates of these quantities, not with individual income but with national income, not with individual price but with general price level, and not with individual output but / with national output.”

According to John B. Taylor

“Macroeconomics is the branch of theoretical economics that examines the workings and problems of the economy as a whole economic growth, inflation, unemployment and economic fluctuations.”

According to Gardner Ackley

“Macroeconomics concerns with such variables as the aggregate volume of the output of an economy, with the extent to which its resources are employed, with the size of the national income and with the general price level.”

According to Allen

“The term macroeconomics is applied to study which deals with the relationship of large economic aggregates.”

According to Culbertson

“Macroeconomics means the theory of income, employment, prices and money”.

Scope of Macroeconomics:

From the above discussion we find that macroeconomics has the following scope.

1.Theory of National Income:

In macroeconomics we study ‘NI’; its different concepts and its measurement.

2. Theory of NI Determination:

The major part of macroeconomics deals with the theory of NI determination. Accordingly, in macroeconomics, we study classical and Keynesian theories of national income and employment.

3. Theory of NI Fluctuations:

In capitalist economies, the economic activities are never alike. Sometimes there is a brisk in economic life, while on the other occasions, the business activities are sluggish. Such fluctuations in economic life of a country are known as trade cycles. Why there are such fluctuations? In this context we study a lot of theories, particularly, “Samuelson’s Multiplier-Accelerator” interaction is of great importance for the readers of macroeconomics.

4. Theory of Consumption and Savings:

In macroeconomics, AD plays an important role. The AD has an important component which is Consumption (C). The consumption has a counterpart which is Saving (S). How people behave regarding consumption expenditures and savings? In this connection, starting from Keynes consumption function, we have a lot of consumption theories like Dusenberry’s Relative Income Theory”, ” Friedman’s Permanent Income Theory” and “Modigliani’s Life Cycle Income Theory “.

5. Theory of Money:

In an economy ‘money’ plays an important role. What will be the effects of changes in supply of money on the economy? What are inflation and deflation? What causes the inflation. What is demand pull and cost push inflation? What a Phillips curve shows? In this respect we study a lot of theories in macroeconomics.

6. Theory of Economic Stabilization:

As told earlier that in capitalist economies, inflation, unemployment, unequal income distribution, misallocation of resources, deficit in BOP and budget deficits are the routine problems. Therefore, to remove them or for the sake of economic stabilization, government has to intervene with the help of ” Fiscal and Monetary Policies”. The role of such policies will be analyzed in macroeconomics.

7. Theory of Growth:

The Keynes model of income and employment just deals with static and comparative static situations. But in addition to this model, we have a lot of dynamic growth models in macroeconomics where we study the growth path of the economy; effect of change in population on the level of NI: the effect of change in technology on the level of NI, etc.

Importance of Macro Economics:

We can realize the importance of the study of macroeconomics from the following points.

1. Working of Economy:

Macroeconomics is helpful to understand working of economy. Economic system is complicated. Many interdependent-economic factors affect the economy. Microeconomics cannot provide clear picture of whole economy.

2. Making Economic Policies:

Macroeconomics is used to make economic policies. There is need facts and figures abut national income, total employment, total investment, total saving and general price level. Macroeconomics can provide statistics about such variables.

3. Solves Economic Problems:

An economy can face problems like overproduction, unemployment, and rising price level. The government can solve its problems with the help of macroeconomics.

4. Studies Trade Cycles:

The capitalistic economies can face problem of trade cycles or ups and downs, in business activities. Such problems upset the proper working of economy. Macroeconomics provides solution to overcome difficulties of trade cycles.

5. Widens Scope of Microeconomics:

The laws of microeconomics are framed with the help of macroeconomics. The law of diminishing marginal utility is derived from analysis of aggregate behaviour of people.

6. Changes in Price Level:

Macroeconomics deals with the problems of changes in price level. There may be inflation, deflation, or stagflation. The changes in price level create disturbance for proper working of economy.

7. Study of National Income:

The study of national income explains various problems of economy. National income of any Country can show its economic conditions. The population control program or defense program depend upon national income. Macroeconomics is used to calculate national income.

8. Behaviour of Individual Firms:

Microeconomics studies behaviour of individual firms. Demand for a product depends upon total of such product in the economy. The causes for decrease in total demand are analyzed to note decrease in demand of a product.

Limitations:

1. dependence on individual units:.

Macroeconomics deals with aggregates and such aggregates are taken from individuals. The results of aggregates may be different from individual. What is good for individual may not be good for the economy. The saving for a person is good but it is bad for whole economy. There is decrease in national income due to saving of society. Thus, decisions for economy on the basis of individual behaviour are wrong.

2. Statistical Difficulties:

The measurement of macroeconomic problems involves statistical difficulties. These problems relate to aggregation of microeconomic variables. When microeconomic variables relate to dissimilar individual units the aggregates of such variable provide wrong results.

3. Indiscriminate Use is Bad:

Indiscriminate use of macroeconomics for analysis of problems is bad. The measures suggested to control general price level may to be useful in controlling prices of individual products.

4. Aggregate Variables May Be Useless:

The aggregate variables relating to an economic system may not provide significant results. The national income of any country may be divided by population provides per head income. An Increase in national income does not means that income of every individual has gone up.

5. Aggregates Are Not Similar:

Macroeconomics considers that aggregates are similar without checking their internal structure. Average wages are calculated with the help of total wages of all workers. The wages of one sector may increase while that of other may decreases but average will remain the same and aggregates may differ.

References:

Munir Ahmed Bhutta. Economics, Azeem Academy Publishers, Lahore.

Abdul Haleem Khawja. Economics, Khawja and Khawja Publishing House, Islamabad.

Manzoor Tahir Ch. Principles of Economics , Azeem Academy Publishers, Lahore.

Muhammad Irshad. Economics , Naveed Publications, Lahore.

K K Dewett & M H Navalur . Modern Economic Theory (Theory and Policy), S. Chand Publishing.

You may also like

Law of diminishing marginal utility: concept, assumptions and limitations, economic system of islam important short questions, foreign trade of pakistan important short questions, add comment, cancel reply.

- Advanced Mathematical Economics 1

- Agricultural Economics 1

- Basic Math and Microeconomics 1

- Development Economics 31

- ECO401 Virtual University 2

- Econometrics 2

- Economics 38

- Economics of Pakistan 3

- Intermediate Part I 2

- Intermediate Part II 14

- International Trade Theory & Policy 3

- Islamic Economics 1

- M.A. Part-I 1

- M.A. Part-II 1

- Macro and Development of Pakistan 6

- Macroeconomics 1

- Major Issues in Pakistan Economy 1

- Mathematical Economics 1

- Microeconomics 4

- Monetary Theory and Policy 2

- Money Banking and Finance 4

- Public Finance 1

- Research Methodology 1

- Statistics For Economists 5

Follow Us on Facebook

Economics City

- March 2022 (1)

- January 2022 (11)

- August 2021 (5)

- July 2021 (1)

- January 2021 (1)

- December 2020 (2)

- November 2020 (5)

- October 2020 (5)

- September 2020 (12)

- August 2020 (24)

- July 2020 (6)

- June 2020 (11)

- May 2020 (8)

- April 2020 (31)

- March 2020 (4)

- February 2020 (27)

- July 2019 (1)

- November 2018 (3)

- October 2018 (2)

Advertisement

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

25.1: Major Theories in Macroeconomics

- Last updated

- Save as PDF

- Page ID 4507

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Keynesian Theory

Keynesian theory posits that aggregate demand will not always meet the supply produced.

Learning objectives

- Explain the main tenets of Keynesian economics

Historical Background

John Maynard Keynes published a book in 1936 called The General Theory of Employment, Interest, and Money , laying the groundwork for his legacy of the Keynesian Theory of Economics. It was an interesting time for economic speculation considering the dramatic adverse effect of the Great Depression. Keynes’s concepts played a role in public economic policy under Roosevelt as well as during World War II, becoming the dominant perspective in Europe following the war.

John Maynard Keynes : John Maynard Keynes came to fame after publishing his economic theories during the Great Depression.

At the time, the primary school of economic thought was that of the classical economists (which is still a popular school of thought today). The central tenet of the classical argument says that supply can always create demand, and that surpluses will result in price reductions to the point of consumption. Put simply, people have infinite needs and the market will self-correct to the aggregate demands and available resources. This implies a hands-of public policy where markets are capable of taking care of themselves.

Keynes positioned his argument in contrast to this idea, stating that markets are imperfect and will not always self correct. Keynes theorized that natural inefficiencies in the market will see goods that are not met with demand. This wasted capital can result in market losses, unemployment, and market inefficiency (this was called ‘general glut’ in the classical model, when aggregate demand does not meet supply). Keynes insisted that markets do need moderate governmental intervention through fiscal policy (government investment in infrastructure) and monetary policy ( interest rates ).

Main Tenets

With this overview in mind, Keynesian Theory generally observes the following concepts:

- Unemployment: Under the classical model, unemployment is often attributed to high and rigid real wages. Keynes argues there is more complexity than that, specifically that societies are highly resistant to wage cuts and furthermore that reducing wages would pose a great threat to an economy. Specifically, cutting wages reduces spending and may result in a downwards spiral.

- Excessive Saving: Keynes’s concept here is somewhat complicated, but in short Keynes notes excessive saving as a threat and prospective cause of economic decline. This is because excessive saving leads to reduced investment and reduced spending, which drives down demand and the potential for consumption. This can be another spiraling issue, as money not being exchanged is actively reducing prospective employment, revenues, and future investments.

- Fiscal Policy: The key concept in fiscal policy for Keynes is ‘counter-cyclical’ fiscal policy, which is the expectation that governments can reduce the negative effects of the natural business cycle. This is, generally, achieved through deficit spending in recessions and suppression of inflation during boom times. Simply put, the government should try to curb the extremes of economic fluctuation through informed fiscal policy.

- The Multiplier Effect: This idea has in many ways already been implied in the atom, but inversely. Consider the unemployment and excessive savings problems, and how they stand to lead to spiraling decline. The other side of that coin is that positive economic situations can spiral upwards. Take for example a government investment in transportation, putting money in the pockets of various individuals who build trains and tracks. These individuals will spend that extra capital, putting money in the hands of other business (and this will continue). This is called the multiplier effect.

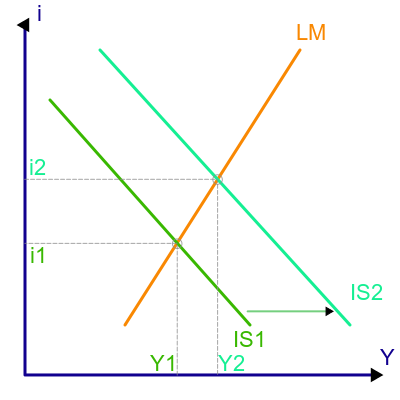

- IS-LM: While the IS-LM Model is a complicated byproduct of Keynesian economics, it can be summarized as the relationship between interest rates (y-axis) and the real economic output (x-axis). This is done through analyzing the invest-saving relationship (IS) in contrast to the liquidity preference and money supply relationship (LM), generating an equilibrium where certain interest rates and outputs will be generated.

While Keynesian Theory has been expounded upon significantly over the years, the important takeaway here is that aggregate demand (and thus the amount of supply consumed) is not a perfect system. Instead, demand is affected by various external forces that can create an inefficient market which will in turn affect employment, production, and inflation.

IS-LM Model : In this figure, the IS (Interest – Saving) curve is shifted outward in a way that raises both interest rates (i) and the ‘real’ economy (Y). The implication is that interest rates affect investment levels, and that these investment levels in turn affect the overall economy.

Monetarism focuses on the macroeconomic effects of the supply of money and the role of central banking on an economic system.

- Explain the main tenets of Monetarism

In the rise of monetarism as an ideology, two specific economists were critical contributors. Clark Warburton, in 1945, has been identified as the first thinker to draft an empirically sound argument in favor of monetarism. This was taken more mainstream by Milton Friedman in 1956 in a restatement of the quantity theory of money. The basic premise these two economists were putting forward is that the supply of money and the role of central banking play a critical role in macroeconomics.

The generation of this theory takes into account a combination of Keynesian monetary perspectives and Friedman’s pursuit of price stability. Keynes postulated a demand-driven model for currency; a perspective on printed money that was not beholden to the ‘ gold standard ‘ (or basing economic value off of rare metal). Instead, the amount of money in a given environment should be determined by monetary rules. Friedman originally put forward the idea of a ‘k-percent rule,’ which weighed a variety of economic indicators to determine the appropriate money supply.

Theoretically, the idea is actually quite straight-forward. When the money supply is expanded, individuals will be induced to higher spending. In turn, when the money supply retracted, individuals would limit their budgetary spending accordingly. This would theoretically provide some control over aggregate demand (which is one of the primary areas of disagreement between Keynesian and classical economists).

Monetarism began to deviate more from Keynesian economics however in the 70’s and 80’s, as active implementation and historical reflection began to generate more evidence for the monetarist view. In 1979 for example, Jimmy Carter appointed Paul Volcker as Chief of the Federal Reserve, who in turn utilized the monetarist perspective to control inflation. He eventually created a price stability, providing evidence that the theory was sound. In addition, Milton Friedman and Ann Schwartz analyzed the Great Depression in the context of monetarism as well, identifying a shortage of the money supply as a critical component of the recession.

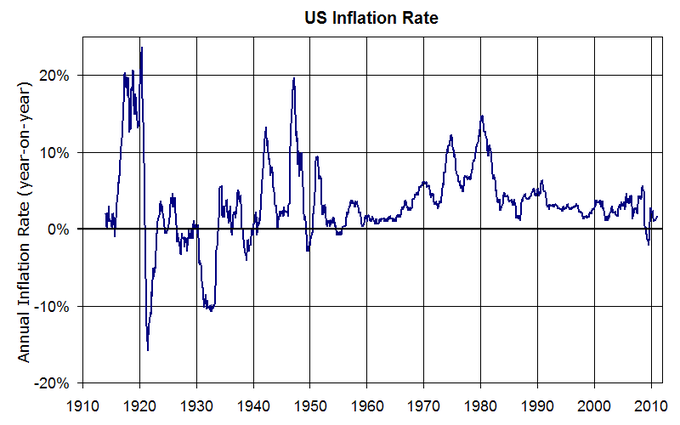

The 1980s were an interesting transitional period for this perspective, as early in the decade (1980-1983) monetary policies controlling capital were attributed to substantial reductions in inflation (14% to 3%)(see ). However, unemployment and the rise of the use of credit are quoted as two alternatives to money supply control being the primary influence of the boom that followed 1983.

U.S. Inflation Rates : The inflation rates over time in the U.S. represent some of the evidence put forward by monetarist economists, stating that governmental control of the money supply allows for some control over inflation.

Counter Arguments

As these counter arguments in the 1980s began to arise, critics of monetarism became more mainstream. Of the current monetarism critics, the Austrian school of thought is likely the most well-known. The Austrian school of economic thought perceives monetarism as somewhat narrow-minded, not effectively taking into account the subjectivity involved in valuing capital. That is to say that monetarism seems to assume an objective value of capital in an economy, and the subsequent implications on the supply and demand.

Other criticisms revolve around international investment, trade liberalization, and central bank policy. This can be summarized as the effects of globalization, and the interdependence of markets (and consequently currencies). To manipulate money supply there will inherently be effects on other currencies as a result of relativity. This is particularly important in regards to the U.S. currency, which is considered a standard in international markets. Controlling supply and altering value may have effects on a variety of internal economic variables, but it will also have unintended consequences on external variables.

Austrian economic thought is about methodological individualism, or the idea that people will act in meaningful ways which can be analyzed.

- Explain the main tenets of Austrian economics

The Austrian school of economics originated in the 19th century in Vienna, Austria. While there were a variety of famous economists attributed to the early foundations and later expansions of the Austrian economic perspective, Carl Menger, Friedrich von Weiser, and Eugen von Bohm-Bawerk are widely recognized as critical early pioneers. The general perspective of Austrian economic thought is methodological individualism, or the recognition that people will act in meaningful ways which can be analyzed for trends.

Central Tenets

The Austrian school of thought provided enormous value to the economic climate, both as a foundation for future economics and as a deliberate counterpoint to more quantitative analysis. Of the most important ideologies, the following central tenets are:

- Opportunity Cost: This is a concept you are likely already familiar with, and one of the most important ideas in all of business and economics. Essentially, the price of a good must also incorporate the value sacrificed of the next best alternative. Basically each choice a consumer or business makes intrinsically has the cost of not being able to make an alternative choice.

- Capital and Interest: Largely in response to Karl Marx’s labor theories, Austrian economist Bohm-Bawerk identified the building blocks of interest rates and profit are supply and demand alongside time preference. In short, present consumption is more valuable than future consumption (the time value of money).

- Inflation: The idea that prices and wages must rise as a result of increased money supply is inflation (note: this is different that price inflation). Simply put, more money in the system without a higher demand for that money will drive down the relative value of each dollar.

- Business Cycles: The Austrian business cycle theory (ABCT) is the simple observation that the issuance of credit (by banks) creates economic fluctuations that tend to be cyclical (see ). In simple terms, banks will lend out money at rates lower than the risk in which that money will be used. So when businesses fail more often than they succeed, thus losing interest as opposed to accruing it, will struggle to repay their debts. When the banks call in those debts the business cannot pay, creating negative business cycles.

- The Organizing Power of Markets: The idea of this concept is that no one person knows what the appropriate price of a good should be. Instead, markets naturally generate incentives to identify optimal price points. This negates the ideas of socialism common at the time, as communist systems will be unable to identify the appropriate exchange value of each good.

As you can see from the above points, this school of economics is largely about making qualitative observations of the markets. These observations are absolutely critical in understanding the theoretical landscape, but difficult to enact in practice.

Austrian economists are often criticized for ignoring arithmetic or statistical ways to measure and analyze economics. Indeed, Austrian economists do not often place much weight on concepts such as econometrics, experimental economics, and aggregate macroeconomic analysis. In this sense, the Austrian school of thought is something of an outsider relative to other perspectives (i.e. classical, Keynesian, etc.).

Paul Krugman criticized Austrian economics as lacking explicit models of analysis, or essentially a lack of clarity in their approach. This results in inadvertent blind spots. This is a sensible criticism in many ways, as the fundamental idea behind this economic theory is that it is driven by individuals and individuals are not always rational (indeed, they are quite often irrational). As a result of this, Austrian economics often rests on the integration of social sciences (psychology, sociology, etc.) to explain preferences and consumer behavior, which is often counter-intuitive. As a result, it is very difficult to accurately measure and provide tangible proof of the efficacy of Austrian models.

Alternative Views

Neoclassical and neo-Keynesian ideas can be coupled and referred to as the neoclassical synthesis, combining alternative views in economics.

- Summarize neoclassical and Neo-Keynesian economics

The history of different economic schools of thought have consistently generated evolving theories of economics as new data and new perspectives are taken into consideration. The two most well-known schools, classical economics and Keynesian economics, have been adapting to incorporate new information and ideas from one another as well as lesser known schools of economics (Chicago, Austrian, etc.). These different perspectives have motivated economists to generate the neoclassical and neo-Keynesian perspectives. The neoclassical perspective, in conjunction with Keynesian ideas, is referred to as the neoclassical synthesis, which is largely considered the ‘mainstream’ economic perspective.

Neoclassical

In approaching Neoclassical economics, it is most important to keep in mind the following three principles:

- People have rational preferences in the context of options or outcomes that can be identified and associated with a given value (usually monetary). In short, people make smart choices regarding how they spend their money.

- Individuals maximize utility and firms maximize profit. People will try to get the most from their money while corporations will try to invest their time and assets to capture the highest margin.

- People act independently based upon comprehensive and relevant information. People are influenced by rational forces (mostly information and logic), and will make the best personal purchasing decisions based upon this.

A brief timeline of classical to neoclassical perspectives would begin with thought processes put forward by Adam Smith and David Ricardo (alongside many others). The basic idea is that aggregate demand will adjust to supply, and that value theory and distribution will reflect this rational, cost of production model. The next phase was the observation that consumer goods demonstrated a relative value based on utility, which could deviate from consumer to consumer. The final phase, and most central to the advent of the neoclassical perspective, is the introduction of marginalism. Marginalism notes that economic participants make decisions based on marginal utility or margins. For example, a company hiring a new employee will not think of the fixed value of that employee, but instead the marginal value of adding that employee (usually in regards to profitability).

Neo-Keynesian