Applications , Request Letters

Loan Request Letter (Format & Sample Applications)

A Loan Request Letter is a letter written by a loan applicant and addressed to a lending institution, generally sent as a part of the loan application process. A loan request letter introduces you to the bank or other lending institution, clearly describes your planned use for the loan funds, and describes how you will pay back the loan. It is the part cover letter and part resume because you demonstrate the qualities that make you a good candidate for a loan by outlining your qualifications.

Anyone who applies for personal or business loan should write a loan request letter and enclose it with their loan application. This letter is often the lending institution’s first impression of you as a borrower. Therefore, it should be professional, clear, and concise, easily fitting into one page.

Important: Write using a professional format and in a professional tone. Banks and other lending organizations are concerned about your ability to repay the loan. Pointing out your financial problems works against you – instead, point out your qualifications as a borrower. Remember, this letter is your first contact with the lender and uses it to showcase your company as a reliable borrower.

What a Lender Needs to Know

In order to consider your loan request, a lender needs some information about you or your company. Although this information is included in detail in your loan application, your letter should formally introduce your request. Here is what you should include in your loan request letter:

- Your name and/or your company name, including any DBA

- Your contact information

- Your business entity structure

- Brief description of your business

- Your number of employees

- How long you have been in operation

- Annual revenue and profits if your company is profitable

- Amount of loan requested

- How the funds will be spent

- Your financial security

- A list of enclosures

The bank or lending institution is primarily concerned with how the money they are lending will be spent and repaid. Be sure to include information on these two critical points in your letter.

In addition to the loan application, you should enclose applicable financial documents, such as tax returns. Send your business plan, cash flow statement, and profit and loss (P&L) statement.

Loan Request Letter (Format)

{your name}

{your company’s name}

{your address}

{lender name}

{lender title}

{lender institution name}

{lender address}

RE: {(Small business) or (Personal)} loan request for {amount}

Dear {lender name}:

The purpose of this letter is to request a {(small business) or (personal)} loan in the amount of {amount} for the purpose of {purpose}. {Use this space to discuss your small business. Include name, business structure, and industry.}

{Business name} began operation on {date}, with {number} employees. As a {business structure type}, {business name} has consistently grown and now employs {number} individuals. {Use this space to discuss your marketing presence.}

{Use this area to briefly discuss your most recent year’s revenue and profit, if profitable. Discuss revenue and profit consistently over time when possible.}

{Use this area to describe the reason for the loan request.} {Use this area to explain that the opportunity is immediately available, but you lack sufficient immediate funds.}

Attached, please find our business plan, our annual profit and loss statement, and our most recent cash flow statement for your review. These financial documents and our strong credit score of {number} combine to make us a safe credit risk for {lending institution name}.

I would greatly appreciate the opportunity to speak with you about a {(small business) or (personal)} loan. I can be reached at {phone number} or by email at {email address}.

Thank you for your time and your consideration of my request.

{your signature}

Sample Loan Application Letter

Matthew Dobney

Entirely Electronics

3048 West First Street

Spavinah, OK 89776

EntirelyElectronics.com

June 22, 2048

Mr. James Burrows

SBA Loan Administrator

Bank of American Businesses

New York, NY 65782

RE: Small business loan request for $20,000

Dear Mr. Burrows:

The purpose of this letter is to request a small business loan in the amount of $20,000 for the purpose of enlarging our warehouse.

Entirely Electronics began operation on June 1, 2020, with two employees. As a partnership, Entirely, Electronics has consistently grown and now has 20 full-time employees. Entirely Electronics has been quite successful in obtaining a proportionate share of the online electronic retail community. Our online presence has grown from our website alone to Facebook, Instagram, and Yelp. Our marketing techniques consistently drive new customers to Entirely Electronics, and we boast a high customer retention rate.

Last year, Entirely, Electronics saw a growth of 25% in revenue over the previous year. Our profit margin remained stable at 18% throughout the year.

Our growth has created a significant shortage of available warehouse space, and market research shows we will continue to grow. As we look to the future, we understand we must create more warehouse space to continue growing. Although our revenue is consistent, we do not have the immediate large amount needed to complete the necessary expansions to our warehouse.

Attached, please find our business plan, our annual profit and loss statement, and our most recent cash flow statement for your review. These financial documents and our strong credit score of 790 combine to make us a safe credit risk for Bank of American Businesses.

I would greatly appreciate the opportunity to speak with you about a small business loan. I can be reached at 983-744-6597 or by email at [email protected] .

Loan Request Letter Template

Writing a loan request letter takes a bit of time and research, but does not have to be difficult. Using the above format, you can easily request a loan for your small business or a personal need. The sample letter demonstrates how to make a great first impression on a lending institution.

How did our templates helped you today?

Opps what went wrong, related posts.

Boyfriend Application Forms

Rental Application Forms & Templates

Rental Application Denial Letter: Template and Example

Leave Application Cancellation Letter

Cancellation Letter for House Purchase – Sample & Template

Sample Application Cancellation Letter (Tips & Template)

How to Write a Maternity Leave Letter

Leave of Absence Letter for Personal Reasons

Thank you for your feedback.

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

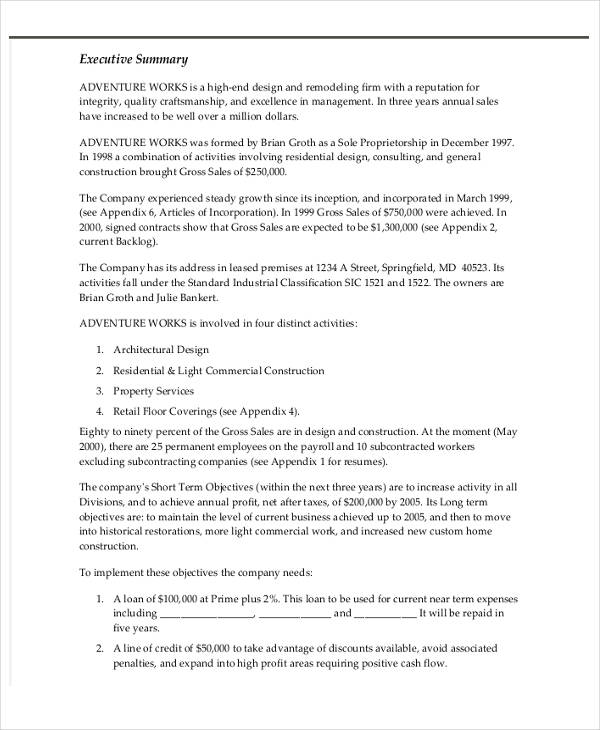

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

Word & Excel Templates

Printable word and excel templates.

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- One Day Absent Note to Boss

- Request Letter to Staff for Voluntary Deduction from Salary

- Holiday Closing Messages

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication

Sample Letters

Writing a Loan Application Letter That Works

In this guide, I’ll share my personal tips, real-life examples, and three unique templates to help you write a loan application letter that works.

Key Takeaways

- Purpose of a Loan Application Letter : Explain why you need the loan and how you plan to use the funds.

- Essential Elements : Include your contact information, a formal greeting, a clear purpose, a detailed financial plan, and a professional closing.

- Tone and Language : Maintain a polite, respectful, and professional tone.

- Personal Experience Tips : Highlight your financial stability, previous successful loans, and your commitment to repayment.

- Templates : Three unique and customizable templates to suit different needs.

Understanding the Purpose

The primary purpose of a loan application letter is to provide the lender with a clear understanding of why you need the loan and how you plan to use it. It should also demonstrate your ability to repay the loan. From my experience, being transparent about your financial situation and future plans significantly increases your chances of approval.

Elements of a Successful Loan Application Letter

Tips from personal experience.

- Be Specific : Clearly outline the purpose of the loan. For instance, if you need a loan for home renovation, specify the projects you plan to undertake.

- Provide Evidence : Include any relevant documents that support your application, such as business plans, invoices, or contracts.

- Show Stability : Highlight your financial stability by mentioning your employment status, income, and any assets you have.

- Repayment Plan : Detail your plan for repaying the loan, including timelines and amounts.

Real-Life Example

When I applied for a loan to expand my small business, I included a detailed business plan showing projected revenue and expenses. I also attached contracts from new clients that demonstrated the demand for my services. This thorough approach impressed the lender and led to a successful loan approval.

Template 1: Personal Loan Application

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

Trending Now 🔥 {"title":"Trending Now \ud83d\udd25","limit":"3","offset":0,"range":"all","time_quantity":24,"time_unit":"hour","freshness":false,"order_by":"views","post_type":"post, page","pid":"","cat":"42","taxonomy":"category","term_id":"","author":"","shorten_title":{"active":false,"length":0,"words":false},"post-excerpt":{"active":true,"length":"15","keep_format":false,"words":true},"thumbnail":{"active":false,"build":"manual","width":0,"height":0},"rating":false,"stats_tag":{"comment_count":false,"views":"1","author":false,"date":{"active":false,"format":"F j, Y"},"category":false,"taxonomy":{"active":false,"name":"category"}},"markup":{"custom_html":true,"wpp-start":" ","wpp-end":" ","title-start":" ","title-end":" ","post-html":" {title} "},"theme":{"name":""}}

[Loan Officer’s Name] [Bank’s Name] [Bank’s Address] [City, State, ZIP Code]

Dear [Loan Officer’s Name],

I am writing to formally request a personal loan of $[amount] to [state purpose, e.g., consolidate my debt]. I have been a loyal customer of [Bank’s Name] for [number] years, and I am confident in my ability to repay this loan in a timely manner.

My current financial situation is stable, as I am employed at [Your Employer] with a monthly income of $[amount]. Attached are my recent pay stubs and a detailed budget outlining my expenses and repayment plan.

I appreciate your consideration and look forward to your positive response.

Sincerely, [Your Name]

Template 2: Business Loan Application

[Your Name] [Your Business Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

I am writing to request a business loan of $[amount] to [state purpose, e.g., expand my business operations]. My business, [Your Business Name], has been operating successfully for [number] years, and this loan will enable us to [specific plans, e.g., open a new branch, purchase new equipment].

Enclosed are our financial statements, business plan, and contracts from new clients, which demonstrate our growth potential and ability to repay the loan.

Thank you for your time and consideration.

Template 3: Home Renovation Loan Application

I am seeking a home renovation loan of $[amount] to improve my residence at [your address]. The planned renovations include [specific projects, e.g., kitchen remodeling, roof replacement], which will enhance the value and functionality of my home.

Attached are estimates from contractors, my recent bank statements, and a detailed plan of the renovations. I am committed to repaying the loan over [repayment period], as outlined in the attached budget.

I look forward to your favorable response.

Final Thoughts

Writing a compelling loan application letter requires attention to detail and a clear presentation of your financial situation and plans. By following this guide and using the provided templates, you can increase your chances of securing the loan you need. Remember, honesty and clarity are your best allies in this process.

Request letter for approval of a loan

Ai generator.

James Thompson Finance Manager XYZ Enterprises 456 Corporate Way Houston, TX 77002 [email protected] (555) 123-4567

October 21, 2024

Loan Department First National Bank 789 Financial Avenue Houston, TX 77003

Subject: Request for Approval of Business Loan

Dear Loan Officer,

I hope this letter finds you well. I am writing to formally request approval for a business loan of $250,000 to support the upcoming expansion of XYZ Enterprises. This loan will be used to finance the opening of a new branch in Dallas, TX, as part of our strategic growth plan for 2025.

We have completed a comprehensive financial analysis and project that the new branch will significantly increase our revenue by 30% within the first year of operations. The funds from this loan will be used for:

- Lease and facility renovations : $100,000

- Equipment and technology upgrades : $80,000

- Initial marketing and staffing : $70,000

Our financial statements demonstrate a solid credit history, and the company has maintained consistent profitability over the past five years. We are confident that the additional revenue generated from the expansion will allow us to repay the loan within the agreed-upon terms.

Please find attached the required documentation, including our financial statements, business plan, and projected cash flow for the new branch. I kindly request your prompt review and approval of this loan application.

If you need any additional information or wish to discuss the application further, please feel free to contact me at (555) 123-4567 or [email protected] .

Thank you for your time and consideration.

Sincerely, James Thompson Finance Manager XYZ Enterprises

Text prompt

- Instructive

- Professional

10 Examples of Public speaking

20 Examples of Gas lighting

Letters.org

The Number 1 Letter Writing Website in the world

Sample Loan Application Letter

Last Updated On December 25, 2019 By Letter Writing Leave a Comment

Loan application is written when the applicant wants to seek monetary assistance in the form of loan mostly on a mortgage of property. Since it is a request, the letter should be written in a polite tone.

Use the following tips and samples to write an effective loan application letter to a bank manager or a company.

Sample Loan Application Letter Writing Tips:

- As loan application letter is formal, the phrases and words should be chosen carefully.

- The language used should be simple and easy to understand

- The content of the letter should be short and straightforward.

Sample Loan Application Letter Template

__________ (Branch Manager’s name) __________ (Branch address) __________ __________

______________ (Your name) ______________ (Your address) __________________

Date __________ (date of writing letter)

Dear Mr. /Ms_____________ (name of the concerned person),

I have a savings account in your bank with account no._________ for the past …………… years. I want to apply for a ……………..(type of loan) loan for ………………….(state purpose) .

If you can inform me about the details and formalities required for seeking the loan, I shall make all the arrangements and meet you at the earliest.

Looking forward to meeting you,

Thanking you,

Yours Sincerely,

___________ (Your name)

Sample Loan Application Letter Sample, Email and Example/Format

Pavan Kumar 3214 Breeze apts Worli Hyderabad

The Branch Manager, Axis Bank, Station Road Branch, Hyderabad

30th September 2013

Subject: Loan application letter

Dear Sir/Madam,

I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank.

I am a salaried employee, and I work for a central government organisation as a research scientist. You can verify my salary certificate and other details.

As the home loan interest rates have down, I would like to utilise this opportunity to buy a house. I have already booked a flat in Banjara Hills Hyderabad, and I need about Rs 35 lakhs as the loan amount. With my pay scale, I think I am eligible to seek a loan for this amount.

If you can send your representative to my place, we can discuss and finalise the loan. I shall keep all the documents ready so that there will not be a delay in processing the loan.

Looking forward to hearing from you,

_____________

Pavan Kumar

Email Format

A loan application letter is written to ask for financial credit service on some secured mortgage basis. As it is our requirement, the words should be so humble and sincere that the banker or the lender acquires total trust on the applicant. Loan application letter helps the loan applier to appeal for the various types of loans whichever he wishes to depend upon certain conditions.

I have sent this letter to you to explain my reasons behind requesting a loan modification on my mortgage. I wish to purchase a Mercedes Benz 300 Limousine costing Rs 56 lakhs. I am seeking an interest reduction down to 6.25% from my current 8.80%. I feel it is a fair percentage for you, and it is just within my means.

Without a reduction on the interest, I will not be able to afford the monthly payments. I have to choose between a loan modification and a foreclosure. I would far prefer the former, and you probably would as well. 6.25% is the most I will be able to manage, even if I cut all of my expenses out of the picture. Please consider my application seriously, and I hope to hear more from you on the matter.

Yours Faithfully,

____________

Jimmie Verna Melendez.

Related Letters:

- Sample Application Letter

- Sample Job Application Cover Letter

- Sample College Application Letter

- Sample Application Cover Letter

- Sample Scholarship Application Letter

- Job Application Letter

- Transfer Application

- Application Letter by Fresher

- Application Letter for Referral

- Business Application Letter

- College Application Letter

- Credit Application Letter

- General Application Letter

- Good Application Letter

- Grant Application Letter

- Letter Of Intend Application

- Job Application E-Mail Template

- Job Application Letter Format

- Job Application Letter Template

- Receptionist Application Letter

- Solicited Application Letter

- Summer Job Application Letter

- Work Application Letter

- Unsolicited Application Letter

- Corporation Application Letter

Leave a Reply Cancel reply

You must be logged in to post a comment.

- Documents Templates

- Letter Templates

- Application Letter Templates

- Loan Application Letter Templates

Free Loan Application Letter Word Templates

What are Loan Application Letter Templates?

Loan application letter templates are pre-designed formats that individuals can use when applying for a loan. These templates provide a structure for the letter and guide users on the necessary information to include.

What are the types of Loan Application Letter Templates?

There are several types of loan application letter templates available to users. Some common types include: 1. Personal Loan Application Letter 2. Business Loan Application Letter 3. Mortgage Loan Application Letter 4. Student Loan Application Letter

How to complete Loan Application Letter Templates

Completing a loan application letter template is a simple process that involves filling in the required information. Here are some steps to help you complete the template:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Loan Application Letter Templates

Thousands of positive reviews can’t be wrong, questions & answers.

Let’s get in touch

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Business Loan Application Letter Generator

Your generated business loan application letter:.

Disclaimer: The content of this letter is for informational purposes only and should not be considered as professional legal or financial advice. Consult with your legal advisor or financial professional for personalized guidance.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Trending Now: Find Out Why!

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

MORE FOR YOU

Ultimate personal loan request letter template.

When it comes to requesting a personal loan, the process can be both daunting and delicate. Over the years, I’ve written numerous personal loan request…

Read More »

Personal Loan Paid in Full Letter Sample: Free & Effective

In this article, I’ll guide you through the step-by-step process of writing an effective personal loan paid in full letter, provide a customizable template, and…

Ultimate Loan EMI Extension Request Letter (Template Included)

As someone who has written many extension letters, I understand the importance of communicating effectively, especially when dealing with sensitive financial matters like a loan…

Ask Someone for Money in a Letter Sample: Free & Effective

As someone who has written numerous apology letters and requests for financial assistance, I’ve learned that crafting a letter to ask for money is a…

Business Loan Request Letter Sample: Free & Customizable

In this article, I’ll share a step-by-step guide on how to write a compelling business loan request letter, complete with a template and personal tips…

Crucial Funding Request Letter for Small Business Template

If you’re a small business owner, you’ll know how crucial securing funding can be to growing or sustaining your business. From expanding operations to purchasing…

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

- Home

- Consumer Letters

- Bank Loan Request

How to Write a Bank Loan Application Letter: Example and Writing Tips

Last updated on January 02, 2023 - © Free-Sample-Letter.com

What is Bank Loan Application?

A bank loan application is a request made to a financial institution , such as a bank, to borrow a specific amount of money. The purpose of the loan can vary, such as to fund a business venture, pay for education expenses, or make a large purchase.

In order to apply for a loan, an individual or business must complete an application that includes personal and financial information, as well as details about the purpose of the loan and the requested amount . The lender will use this information to evaluate the borrower's creditworthiness and determine whether to approve the loan and at what terms.

Step-by-Step Guide: Crafting a Successful Loan Request Letter

Here are some tips on how to write a bank loan application letter:

- Identify the purpose of the loan and the amount you’re requesting . Be specific and clearly state your financial needs. For example: "I am writing to request a loan of $10,000 to cover the costs of my daughter's tuition at XYZ University." or "I am writing to request a loan of $50,000 to fund the expansion of my small business, XYZ Company."

- Explain your current financial situation and provide evidence of your ability to repay the loan. This may include income statements, tax returns, and other financial documents. For example: "I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of $30,000 per year / I have been employed as a software engineer at ABC Company for the past 8 years and have a stable income of $75,000 per year. Attached, you will find my tax returns and financial statements as evidence of my ability to repay the loan."

- Describe the specific use of the loan proceeds and how they will benefit you or your business. Be sure to include a detailed plan for how you will use the funds and how you will generate the income to repay the loan. For example: "The loan funds will be used solely for my daughter's tuition and other education-related expenses. I have a budget in place and am confident that I can make the monthly loan payments while still being able to cover my other financial obligations." or "The loan funds will be used to purchase additional inventory and hire two additional employees, which will allow us to increase our sales and profitability. I have a solid business plan in place and am confident that these investments will enable us to repay the loan within 3 years."

- Include any supporting documents that may help your case , such as financial statements or a business plan. For example: "In addition to the documents mentioned above, I have also included a copy of my budget plan, which shows my projected income and expenses for the next 3 years." or "In addition to the documents mentioned above, I have also included a copy of my detailed business plan, which outlines my marketing strategy and projected financial performance."

- Request a specific repayment plan and timeline. Be realistic and considerate of the lender's needs when proposing a repayment schedule . For example: "I am requesting a loan repayment period of 3 years, with monthly payments of $1,500. I understand that this may be negotiable and am open to discussing alternative repayment terms that work for both parties."

- Express your appreciation for the lender's consideration and provide contact information for follow-up. Thank the lender for their time and make it easy for them to get in touch with you if they have any questions. For example: "Thank you for considering my loan request. I am confident that this investment will help my business grow and thrive / I am confident that this investment in my daughter's education will pay off in the long run. If you have any questions or would like to discuss further, please don't hesitate to contact me at 555-555-5555 or by email at [email protected]."

➤ You May Also be Interested in Our Sample Letter to Request an Alternative Payment Plan from a Creditor

Need to Write a Bank Loan Request Letter? Use Our Free Templates for Success

For applying loan in a bank or financial institution.

Dear (mr/miss etc. + Loan manager name),

Following my visit to the bank yesterday where all necessary papers were filed regarding my loan request, here are a few more details pertaining to the loan.

I have been a long-standing customer with (name of bank) for over (number) years now and I recently applied for a (personal/company) loan of ($/€ amount). This loan will allow me to pay for (reason needed) which I have been planning for some time now.

My preferred loan structure, after much thought, is a (secured/unsecured) loan. I believe this is the best option for me and I also hope to be able to pay it off within (X years).

I prefer to take out a shorter loan period rather than the popular long term packages, and therefore hope that you will be able to see this as a positive factor in granting me this loan.

I am currently employed at (company name) and have been the (name of position) for (No. of years). Should you require any references or further information, please do not hesitate to contact (my boss/the HR Dept. etc.) at any time. They can be reached on (tel. no.) or via email on: ([email protected]).

As requested by (Mr./Miss X), please find (enclosed/attached) copies of my most recent bank statements for the last (3/6) months.

I am available to come in and speak with you at any time, I do hope that you will look favorably on my request and I very much look forward to hearing from you.

(name/signature)

Bank Loan Request Letter for Small Business (SBA)

Dear [Loan Manager's Name],

I am writing to request a loan of $50,000 from the Small Business Administration (SBA) to fund the expansion of my small business, XYZ Company.

I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of $30,000 per year. Attached, you will find my tax returns and financial statements as evidence of my ability to repay the loan.

The loan funds will be used to purchase additional inventory and hire two additional employees, which will allow us to increase our sales and profitability. I have a solid business plan in place and am confident that these investments will enable us to repay the loan within 3 years. In addition to the documents mentioned above, I have also included a copy of my detailed business plan, which outlines my marketing strategy and projected financial performance.

I am requesting a loan repayment period of 3 years, with monthly payments of $1,500. I understand that this may be negotiable and am open to discussing alternative repayment terms that work for both parties.

Thank you for considering my loan request. I am confident that this investment will help my business grow and thrive. If you have any questions or would like to discuss further, please don't hesitate to contact me at 555-555-5555 or by email at [email protected].

[Your Name]

You may also find these examples useful:

- Expert Advice: How to Write a Successful Administrative Letter

- Sample Bad Check Notice Letter: How to Request Payment for a Bounced Check

- Get Your Security Deposit Back: Use This Sample Letter for Claiming It

- Winning Grants: A Step-by-Step Guide to Crafting a Successful Request Letter

- Write a Winning Refund Request Letter with These Tips

- How to Write an IOU Letter (Writing Tips and Samples)

- How to Write a Successful Sponsorship Proposal Letter

- Email Template to Advise Customer of a Returned Check

We also recommend:

- IOU Template and Promissory Note - Sample & Free Download

- Payment Plan Request Letter - Sample & Free Download

- Bank Customer Service Representative Sample Cover Letter

- Banking Internship Sample Cover Letter

- Bank Teller Sample Cover Letter - Tips & Free Download

- Annual Leave Request Letter - Sample & Free Download

- Funeral Leave Request Letter - Sample & Free Download

- Refund Request Letter - Sample & Free Download

- Claiming Back a Security Deposit Letter (Tips & Samples)

All Formats

9+ Loan Letter Templates

A loan letter or a loan application form is a structured, formatted legal document that is usually handed out by a loan agency or bank to the borrower. It usually states a request of a certain loan plan. These 7+ loan letter sample letter templates provides the best layout template, complete with great functional content that can be used on your next loan transaction. These loan samples are only applicable for those people who open a loan company, but this can also be open to bank companies. You may also see more different types of loan letters in word from our official website.

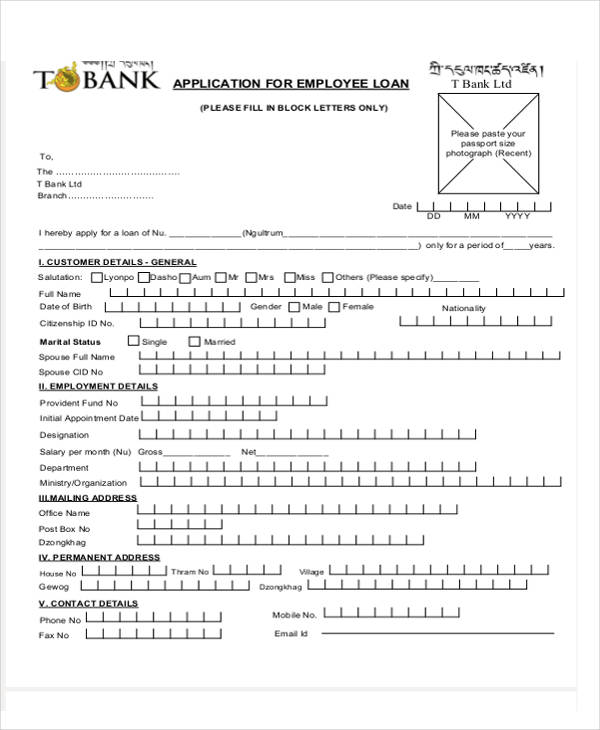

Employee Loan Application Template

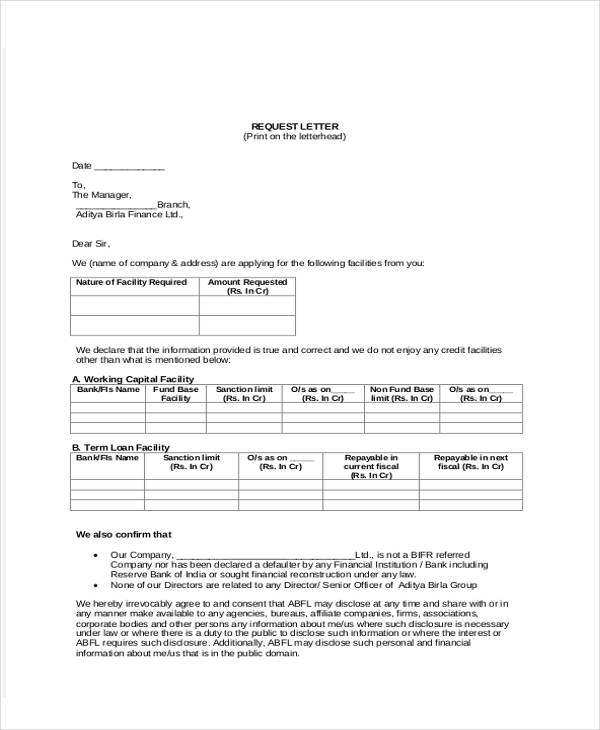

Company Loan Letter Template

Bank Loan Letter Template

Student Loan Letter Template

A Few Tips on How to Format a Loan Letter

- Write down direct and straightforward information in regard with the terms and conditions of the loan transaction. For a wider selection of formal letter templates, check out more options here.

- Be formal and concise with your content. Make it short and simple.

- The words being used within the content should be easy to understand.

What Are the Benefits of a Loan Letter?

Types of loan letters.

- Loan Application or the Loan Request is a starting process wherein the borrower fills up an application form or sends out a request letter to the loan agency or bank for a loan plan.

- Loan Repayment is a process wherein the borrower decided to pay the loan, it can either be a half or full payment.

- Loan Approval is an indicator that the loan agency or the bank accepted your loan request. It will usually notify the borrower through email or traditional mail. You can also find a wider variety of letters in Pdf format on our official website at template.net.

- Student Loan is a type of loan that is applicable for any students who wish to enter a university or college. The loan will be used in paying for the college tuition fee, which will more likely take years to pay, depending on the plan being applied.

Loan Approval Letter Template

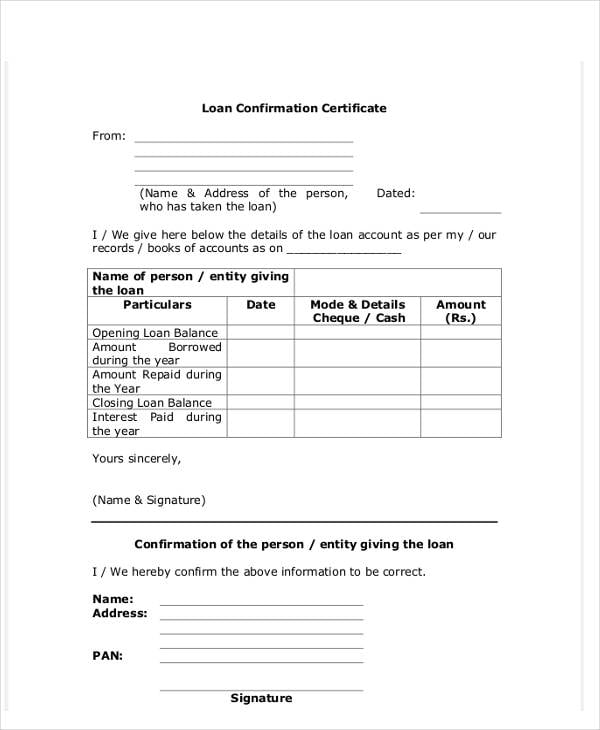

Loan Confirmation Letter Template

Loan Repayment Letter Template

Loan Request Letter Template

More Templates on Offer

- Graphic Elements that includes web and print posters, vector illustrations, sketch samples, icons, buttons, print banners, invitation cards, greeting cards, business calling cards, print logos, etc.

- Web Graphic Elements such as web design templates, icons, buttons, web banners and illustrations for web animations, header designs, and logos for websites.

- Print Documents that is tailored for both legal or personal purposes such as business application forms, job application forms, cover letters, resumes, contract forms, etc.

More in Letters

Blank loan letter template, business loan proposal letter template, commercial real estate loan letter template, loan appeal letter template, lender loan agreement letter template, work-related loan request letter template, loan explanation letter template, notarized loan agreement letter template, loan disbursement letter template, loan transfer letter template.

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

- 22+ Internal Transfer Letters

- 16+ Sample Professional Reference Letter Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

IMAGES

VIDEO

COMMENTS

Name of Loan Officer. Name of Financial Institution or Bank. Address of Financial Institution or Bank. City, State, Zip Code. RE: Loan Application for $100,000. Dear [Loan Officer's Name], I am writing to formally request a loan of $100,000. As a loyal customer for the past 20 years, I have always trusted this institution with my financial ...

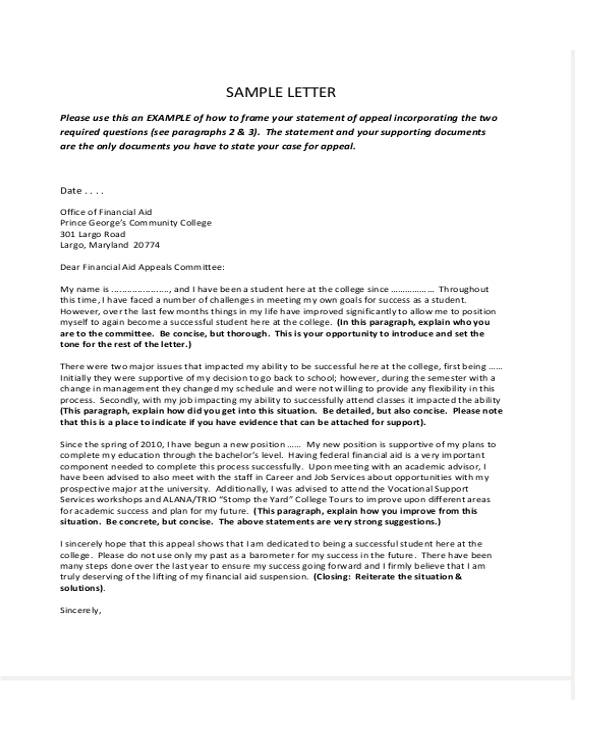

20 Best Loan Application Letter Samples (Guide and Format) An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time. The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the ...

Details. File Format. Google Docs. Word. Apple Pages. PDF. Download Now. If you are planning to craft an effective loan application letter in pdf, it would be easier for you to make one if you refer to the loan application letters available on this page. These sample loan are available in PDF and loan word formats, thus making it easier for you ...

August 22, 2022. Mr. Jacob Harrison. Personal Loan Administrator. Bank of Texas. 4886 West 93 Street. Bowen, TX 89558. RE: Personal loan request for $6,000. Dear Mr. Harrison: The purpose of this letter is to request a personal loan in the amount of $6,000.

New York, NY 65782. RE: Small business loan request for $20,000. Dear Mr. Burrows: The purpose of this letter is to request a small business loan in the amount of $20,000 for the purpose of enlarging our warehouse. Entirely Electronics began operation on June 1, 2020, with two employees.

Your name. Company name. Company phone number. Company address. Loan agent or lender's name and title. Loan agent or lender's contact details. A subject line stating the desired loan amount. Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone. 2.

Embark on your financial journey with confidence using Template.net's Loan Application Letter Templates. Our offerings, seamlessly editable and fully customizable, empower you to articulate your borrowing needs effortlessly. Harness the potential of our Ai Editor Tool, ensuring each application reflects your unique narrative. Streamline your loan process with precision - because financial ...

File: Word (.doc) 2003 + and iPad Size: 31 KB. Download. I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father.

Template 1: Personal Loan Request for Medical Expenses. [Your Name][Your Address][City, State, ZIP Code][Email Address][Phone Number][Date] [Lender's Name][Lender's Address][City, State, ZIP Code] Dear [Lender's Name], I hope this letter finds you well. I am writing to request a personal loan of $ [Amount] to cover unexpected medical ...

In this guide, I'll share my personal tips, real-life examples, and three unique templates to help you write a loan application letter that works.. Key Takeaways. Purpose of a Loan Application Letter: Explain why you need the loan and how you plan to use the funds.; Essential Elements: Include your contact information, a formal greeting, a clear purpose, a detailed financial plan, and a ...

Dear [Recipients Name], I am applying for a loan since I want to be able to acquire a car for myself and my family. I ask that you kindly send me the list of any and all requirements which I have to send to you so that I can be able to proceed with my application as soon as possible. Loan application letter.

Subject: Request for Approval of Business Loan. Dear Loan Officer, I hope this letter finds you well. I am writing to formally request approval for a business loan of $250,000 to support the upcoming expansion of XYZ Enterprises. This loan will be used to finance the opening of a new branch in Dallas, TX, as part of our strategic growth plan ...

Subject: Loan application letter. Dear Sir/Madam, I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank. I am a salaried employee, and I work for a central government organisation as a research scientist.

Step 3: Structure Your Letter. A well-structured letter is key. Generally, it should include: Introduction: Briefly introduce yourself and state the purpose of the letter. Body: Detail your financial situation, loan purpose, and repayment plan. Conclusion: Summarize your request and express gratitude.

Sample. Business owners request loans for a variety of reasons. In this loan application letter sample, the owner of a decorating business is requesting a loan in the amount of $25,000.00 to expand her warehouse space. She includes information regarding her business success to inspire interest in her loan application. I am requesting a business ...

Loan applications form are a standard piece of document that is significant when asking for a sample loan, and in this website, we provide you with ample of application letter templates for loan to choose from and use. Our simple templates are free of charge, reusable, easily accessible for your own convenience, and simple to use.

Here are some steps to help you complete the template: 01. Gather all necessary financial documents such as pay stubs, bank statements, and tax returns. 02. Fill in personal information including name, address, contact details, and social security number. 03. Specify the loan amount and purpose of the loan. 04.

Step 3: Craft a Compelling Introduction. In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter - to apply for a business loan - and the amount you are requesting. This sets the stage for the details that follow.

Bank Loan Request Letter for Small Business (SBA) Dear [Loan Manager's Name], I am writing to request a loan of $50,000 from the Small Business Administration (SBA) to fund the expansion of my small business, XYZ Company. I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of ...

Download this Loan Application Letter Design in Word, Google Docs, PDF, Apple Pages, Outlook Format. Easily Editable, Printable, Downloadable. A neat and well layered application template that you can get for free. The design is perfect for those who are applying for any kind of loan. High-quality and printable, this template is easy to edit.

9+ Loan Letter Templates. A loan letter or a loan application form is a structured, formatted legal document that is usually handed out by a loan agency or bank to the borrower. It usually states a request of a certain loan plan. These 7+ loan letter sample letter templates provides the best layout template, complete with great functional content that can be used on your next loan transaction.