Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

Types of Risks in Business Planning

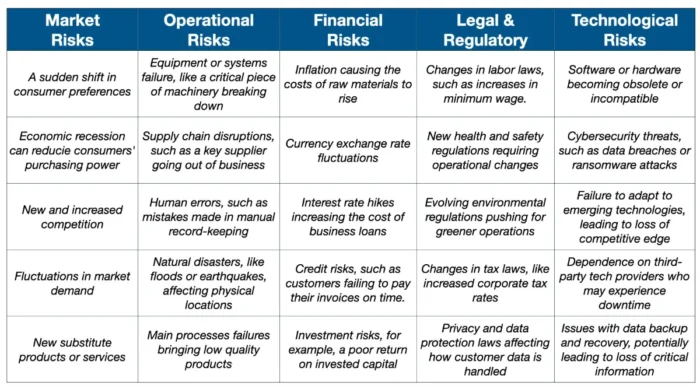

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

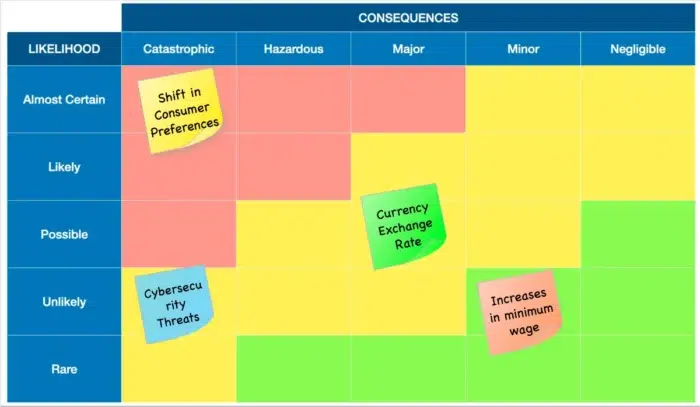

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

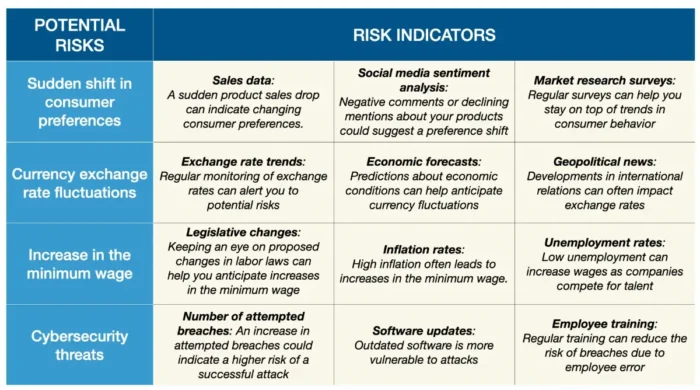

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

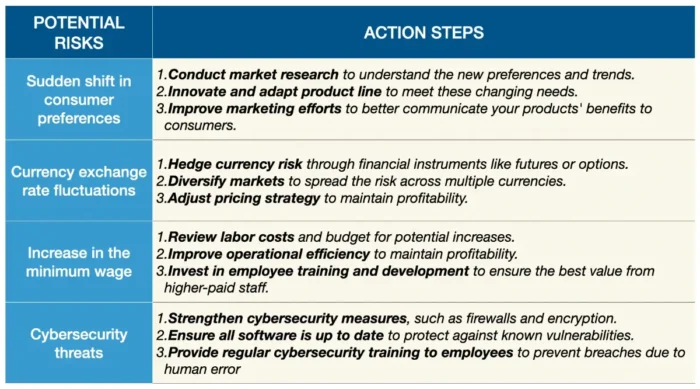

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

Risk Management Guide: Everything You Need to Know About Business Risk

Why Prioritizing Risk Management is Crucial for Healthcare Businesses

Start typing and press enter to search.

Business Plan Risk Analysis - What You Need to Know

The business plan risk analysis is a crucial and often overlooked part of a robust business plan. In the ever-changing world of business knowing potential pitfalls and how to mitigate them could be the difference between success and failure. A well-crafted business plan acts as a guiding star for every venture, be it a startup finding its footing or a multinational corporation planning an expansion. However, amidst financial forecasts, marketing strategies, and operational logistics, the element of risk analysis frequently gets relegated to the back burner. In this blog, we will dissect the anatomy of the risk analysis section, show you exactly why it is important and provide you with guidelines and tips. We will also delve into real-life case studies to bring to life your learning your learning.

Table of Contents

- Risk Analysis - What is it?

- Types of Risks

- Components of Risk Analysis

- Real-Life Case Studies

- Tips & Best Practices

- Final Thoughts

Business Plan Risk Analysis - What Exactly Is It?

Risk analysis is like the radar system of a ship, scanning the unseen waters ahead for potential obstacles. It can forecast possible challenges that may occur in the business landscape and plan for their eventuality. Ignoring this can be equivalent to sailing blind into a storm. The business plan risk analysis section is a strategic tool used in business planning to identify and assess potential threats that could negatively impact the organisation's operations or assets. Taking the time to properly think about the risks your business faces or may face in the future will enable you to identify strategies to mitigate these issues.

Types of Business Risks

There are various types of risks that a business may face, which can be categorised into some broader groups:

- Operational Risks: These risks involve loss due to inadequate or failed internal processes, people, or systems. Examples could include equipment failure, theft, or employee misconduct.

- Financial Risks: These risks are associated with the financial structure of the company, transactions the company makes, and the company's ability to meet its financial obligations. For instance, currency fluctuations, increase in costs, or a decline in cash flow.

- Market Risks: These risks are external to the company and involve changes in the market. For example, new competitors entering the market changes in customer preferences, or regulatory changes.

- Strategic Risks: These risks relate to the strategic decisions made by the management team. Examples include the entry into a new market, the launch of a new product, or mergers and acquisitions.

- Compliance Risks: These risks occur when a company must comply with laws and regulations to stay in operation. They could involve changes in laws and regulations or non-compliance with existing ones.

The business risk analysis section is not a crystal ball predicting the future with absolute certainty, but it provides a foresighted approach that enables businesses to navigate a world full of uncertainties with informed confidence. In the next section, we will dissect the integral components of risk analysis in a business plan.

Components of a Risk Analysis Section

Risk analysis, while a critical component of a business plan, is not a one-size-fits-all approach. Each business has unique risks tied to its operations, industry, market, and even geographical location. A thorough risk analysis process, however, typically involves four main steps:

- Identification of Potential Risks: The first step in risk analysis is to identify potential risks that your business may face. This process should be exhaustive, including risks from various categories mentioned in the section above. You might use brainstorming sessions, expert consultations, industry research, or tools like a SWOT analysis to help identify these risks.

- Risk Assessment: Once you've identified potential risks, the next step is to assess them. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on your business. Some risks might be unlikely but would have a significant impact if they did occur, while others might be likely but with a minor impact. Tools like a risk matrix can be helpful here to visualise and prioritise your risks.

- Risk Mitigation Strategies: After assessing the risks, you need to develop strategies to manage them. This could involve preventing the risk, reducing the impact or likelihood of the risk, transferring the risk, or accepting the risk and developing a contingency plan. Your strategies will be highly dependent on the nature of the risk and your business's ability to absorb or mitigate it.

- Monitoring and Review: Risk analysis is not a one-time task, but an ongoing process. The business landscape is dynamic, and new risks can emerge while old ones can change or even disappear. Regular monitoring and review of your risks and the effectiveness of your mitigation strategies is crucial. This should be an integral part of your business planning process.

Through these four steps, you can create a risk analysis section in your business plan that not only identifies and assesses potential threats but also outlines clear strategies to manage and mitigate these risks. This will demonstrate to stakeholders that your business is prepared and resilient, able to handle whatever challenges come its way.

Business Plan Risk Analysis - Real-Life Examples

To fully grasp the importance of risk analysis, it can be beneficial to examine some real-life scenarios. The following are two contrasting case studies - one demonstrating a successful risk analysis and another highlighting the repercussions when risk analysis fails.

Case Study 1: Google's Strategic Risk Mitigation

Consider Google's entry into the mobile operating system market with Android. Google identified a strategic risk : the growth of mobile internet use might outpace traditional desktop use, and if they didn't have a presence in the mobile market, they risked losing out on search traffic. They also recognised the risk of being too dependent on another company's (Apple's) platform for mobile traffic. Google mitigated this risk by developing and distributing its mobile operating system, Android. They offered it as an open-source platform, which encouraged adoption by various smartphone manufacturers and quickly expanded their mobile presence. This risk mitigation strategy helped Google maintain its dominance in the search market as internet usage shifted towards mobile.

Case Study 2: The Fallout of Lehman Brothers

On the flip side, Lehman Brothers, a global financial services firm, failed to adequately analyse and manage its risks, leading to its downfall during the 2008 financial crisis. The company had significant exposure to subprime mortgages and had failed to recognise the potential risk these risky loans posed. When the housing market collapsed, the value of these subprime mortgages plummeted, leading to significant financial losses. The company's failure to conduct a robust risk analysis and develop appropriate risk mitigation strategies eventually led to its bankruptcy. The takeaway from these case studies is clear - effective risk analysis can serve as an essential tool to navigate through uncertainty and secure a competitive advantage, while failure to analyse and mitigate potential risks can have dire consequences. As we move forward, we'll share some valuable tips and best practices to ensure your risk analysis is comprehensive and effective.

Business Plan Risk Analysis Tips and Best Practices

While the concept of risk analysis can seem overwhelming, following these tips and best practices can streamline the process and ensure that your risk management plan is both comprehensive and effective.

- Be Thorough: When identifying potential risks, aim to be as thorough as possible. It’s crucial not to ignore risk because it seems minor or unlikely; even small risks can have significant impacts if not managed properly.

- Involve the Right People: Diverse perspectives can help identify potential risks that might otherwise be overlooked. Include people from different departments or areas of expertise in your risk identification and assessment process. They will bring different perspectives and insights, leading to a more comprehensive risk analysis.

- Keep it Dynamic: The business environment is continually changing, and so are the risks. Hence, risk analysis should be an ongoing process, not a one-time event. Regularly review and update your risk analysis to account for new risks and changes in previously identified risks.

- Be Proactive, Not Reactive: Use your risk analysis to develop mitigation strategies in advance, rather than reacting to crises as they occur. Proactive risk management can help prevent crises, reduce their impact, and ensure that you're prepared when they do occur.

- Quantify When Possible: Wherever possible, use statistical analysis and financial projections to evaluate the potential impact of a risk. While not all risks can be quantified, putting numbers to the potential costs can provide a clearer picture of the risk and help prioritise your mitigation efforts.

Implementing these tips and best practices will strengthen your risk analysis, providing a more accurate picture of the potential risks and more effective strategies to manage them. Remember, the goal of risk analysis isn't to eliminate all risks—that's impossible—but to understand them better so you can manage them effectively and build a more resilient business.

In the ever-changing landscape of business, where uncertainty is a constant companion, the risk analysis section of a business plan serves as a guiding compass, illuminating potential threats and charting a course toward success. Throughout this blog, we have explored the critical role of risk analysis and the key components involved in its implementation. We learned that risk analysis is not just about identifying risks but also about assessing their potential impact and likelihood. It involves developing proactive strategies to manage and mitigate those risks, thereby safeguarding the business against potential pitfalls. In conclusion, a well-crafted business plan risk analysis section is not just a formality but a strategic asset that empowers your business to thrive in an unpredictable world. As you finalise your business plan, keep in mind that risk analysis is not a one-time task but an ongoing practice. Revisit and update your risk analysis regularly to stay ahead of changing business conditions. By embracing risk with a thoughtful and proactive approach, you will position your business for growth, resilience, and success in an increasingly dynamic and competitive landscape. Want more help with your business plan? Check out our Learning Zone for more in-depth guides on each specific section of your plan.

Unpacking Risk Assessment: Business Continuity Plan Risk Assessment

February 6, 2024

Business continuity planning is a critical aspect of modern business operations. With the increasing frequency and severity of natural disasters, cyberattacks, and other unexpected events, organizations need to develop and implement robust plans to ensure that they can continue to operate in the face of disruptions.

Risk assessment is a crucial component of business continuity planning , as it helps organizations identify potential risks , evaluate their likelihood and potential impact, and develop strategies to prevent or mitigate them.

This article aims to provide a comprehensive overview of the importance of risk assessment in business continuity planning. It will explore common mistakes to avoid, the risk assessment process, the significance of business impact analysis , and cybersecurity policies.

In providing insights into best practices for conducting risk assessments , this article aims to help organizations ensure business continuity in the face of any unforeseen circumstances.

Understanding the process of evaluating potential hazards and prioritizing risks is fundamental to creating a comprehensive plan for ensuring the continuity of business operations in the face of unexpected disruptions.

Risk assessment is an essential step in Business Continuity Planning (BCP) as it systematically identifies potential threats and vulnerabilities that could disrupt operations.

It involves assessing the likelihood of an event occurring and the impact it would have on the organization. Risk assessment should be carried out before undertaking a Business Impact Analysis (BIA) as it helps identify potential threats that could impact critical business functions.

The BIA then evaluates the impact of these threats on business operations, allowing organizations to prioritize their response strategies.

A comprehensive risk assessment should identify potential threats, evaluate the likelihood of those threats occurring, and determine the potential impact on the organization. The ongoing risk assessment process should be reviewed and updated regularly to ensure it remains relevant and reflects the organization’s current risk posture .

To be effective, a risk assessment should be conducted by trained professionals who can identify potential threats and vulnerabilities and evaluate their potential impact on the organization.

A thorough Business Continuity Plan Risk Assessment should also consider the potential impact of large-scale natural disasters , such as hurricanes, floods, or earthquakes. While these events may be rare, their potential to cause large-scale disruption and damage is significant.

Businesses should analyze the likelihood of these events occurring in their region, the potential severity of the impacts, and the potential costs associated with any damages. Further, businesses should consider the impact of any potential disruption to their supply chain and the potential costs associated with lost or damaged inventory.

Finally, businesses should review their insurance policies to ensure they are adequately covered in the event of a large-scale natural disaster .

In addition to natural disasters, businesses should assess the risks posed by cyber-attacks, terrorism, and other criminal activities. Companies should review the security measures they have in place and consider any additional measures that may be necessary to protect their assets and operations.

Businesses should also consider the potential impacts of a cyber attack, such as lost or compromised data, stolen funds, and disruption to their operations. Furthermore, businesses should consider the potential costs of any losses or damages resulting from a cyber attack .

Common Mistakes

These mistakes include not accounting for the loss of critical people, not planning for staff stress and trauma, and not having alternative recovery sites.

The mistakes can lead to a lack of preparedness during unexpected events, which can have severe consequences for the business. For example , not accounting for the loss of critical people can result in a lack of expertise and knowledge, which can be detrimental to the smooth functioning of the organization.

Another common mistake in business continuity planning is not making emergency plans accessible . Emergency plans should be accessible to all employees, including those who work remotely. This can help ensure that everyone is on the same page and knows what to do when an unexpected event occurs.

Not communicating plans and processes transparently is also a mistake. Communication is essential during a crisis, and transparent communication can help build employee trust and confidence.

Not having alternative recovery sites is another mistake that can have severe consequences. If the primary recovery site is unavailable, the organization should have an alternative site ready to ensure continuity of business operations . Failure to plan for alternative recovery sites can lead to prolonged downtime, which can be costly for the business.

Overall, it is essential to avoid these common mistakes to ensure that the business is prepared to navigate unexpected events and maintain continuity of operations.

Risk Assessment Process

The process involves identifying and describing risks , prioritizing risks associated with essential recovery processes, and evaluating risks to compare results with the organization’s risk tolerance.

It is important to venture outside the scope of risk assessment to find information that supports evaluation and have workshops with the enterprise risk team to test the articulation of risks.

The risk assessment process should focus on risks that have the potential to disrupt the business recovery process during a disaster . Risks associated with processes essential to the organization’s recovery process should be identified, and unforeseeable risks should not be anticipated.

The identified risks should be closely related to overall business continuity, and mitigation controls should justify the investment to mitigate.

The findings from the risk assessment process will be valuable input in designing a business recovery strategy , which will be the next step in the program.

Overall, the risk assessment process is integral to business continuity planning . It helps organizations prepare for and mitigate risks , prevent injuries or illnesses, meet legal requirements, create awareness about hazards and risks, create an accurate inventory of available assets

Justify the cost of managing risks, determine the budget to remediate risks , and understand the return on investment. A specialized compliance specialist can help with the risk assessment process, and risk assessment plans should be reviewed and updated regularly to stay on top of new hazards .

Business Impact Analysis

A thorough Business Impact Analysis is critical for organizations to gauge the impact of specific risks on their business operations and financial implications, ultimately leading to a more effective and resilient Business Continuity Plan .

The analysis involves identifying and assessing the potential consequences of disruptive events on critical business functions, assets, and stakeholders. It considers the time required for recovery, the cost of recovery, and the impact on revenue, reputation, and customer satisfaction.

The Business Impact Analysis enables organizations to prioritize recovery efforts and allocate resources effectively. It also helps them identify areas for improvement in their Business Continuity Plan.

Business Impact Analysis is an essential step in the risk assessment process for Business Continuity Planning. It helps organizations understand the potential impact of disruptive events on their operations, finances, and reputation.

Reporting and Review

Reporting and Review is a crucial step in the Business Impact Analysis process as it allows organizations to present their findings to stakeholders and obtain feedback. This feedback is important as it helps organizations to improve their Business Continuity Plan .

Reporting and Review also enable organizations to identify any gaps in their plan and make the necessary changes to better prepare for the risks identified during the risk assessment .

During the Reporting and Review process, it is important to use templates that are familiar to the enterprise risk team to report findings. These templates help to ensure consistency in reporting and make it easier for stakeholders to understand the findings.

It is also important to provide a high-level update to the steering committee and review the report with the GRC or enterprise risk management team. This review process helps to ensure that the findings are accurate and that the Business Continuity Plan is aligned with the enterprise risk management practices.

Reporting and Review is an essential step in the Business Impact Analysis process . The feedback obtained during this process is crucial in improving the Business Continuity Plan and ensuring that the organization is better prepared for the risks identified during the risk assessment process.

Risk assessment is a crucial component of business continuity planning that involves identifying and analyzing potential risks to an organization’s operations. It allows businesses to evaluate the likelihood and potential impact of various risks and develop strategies to prevent or mitigate them.

To ensure the success of a risk assessment process, organizations must avoid common mistakes, such as failing to involve key stakeholders or neglecting to update the assessment regularly.

Business impact analysis is also a critical aspect of risk assessment that helps organizations understand the potential consequences of a disruption and prioritize recovery efforts accordingly.

Additionally, cybersecurity policies must be integrated into the risk assessment process to address the increasing cyber-attack threat.

Implementing a comprehensive cybersecurity program that includes employee training and education, regular system and software updates, and up-to-date antivirus protection is important. Also, organizations should have a process in place to regularly review their policies and procedures to ensure they are up-to-date and in line with industry best practices.

Regular network activity monitoring should also be conducted to identify any suspicious activity and respond to potential threats quickly and effectively. Finally, organizations should develop a communication plan to ensure all staff and stakeholders are aware of the cybersecurity policies and related procedures.

Chris Ekai is a Risk Management expert with over 10 years of experience in the field. He has a Master’s(MSc) degree in Risk Management from University of Portsmouth and is a CPA and Finance professional. He currently works as a Content Manager at Risk Publishing, writing about Enterprise Risk Management, Business Continuity Management and Project Management.

Third-party Risk Management Lifecycle: An Essential Blueprint for Businesses

Understanding The Essential Role Of An Enterprise Risk Management System In Modern Business

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Reach out to understand more about Enterprise Risk Management, Project Management and Business Continuity.

© 2024 Risk Management

Value and resilience through better risk management

Today’s corporate leaders navigate a complex environment that is changing at an ever-accelerating pace. Digital technology underlies much of the change. Business models are being transformed by new waves of automation, based on robotics and artificial intelligence. Producers and consumers are making faster decisions, with preferences shifting under the influence of social media and trending news. New types of digital companies are exploiting the changes, disrupting traditional market leaders and business models. And as companies digitize more parts of their organization, the danger of cyberattacks and breaches of all kinds grows.

Stay current on your favorite topics

Beyond cyberspace, the risk environment is equally challenging. Regulation enjoys broad popular support in many sectors and regions; where it is tightening, it is putting stresses on profitability. Climate change is affecting operations and consumers and regulators are also making demands for better business conduct in relation to the natural environment. Geopolitical uncertainties alter business conditions and challenge the footprints of multinationals. Corporate reputations are vulnerable to single events, as risks once thought to have a limited probability of occurrence are actually materializing.

The role of the board and senior executives

Risk management at nonfinancial companies has not kept pace with this evolution. For many nonfinancial corporates, risk management remains an underdeveloped and siloed capability in the organization, receiving limited attention from the most senior leaders. From over 1,100 respondents to McKinsey’s Global Board Survey for 2017 , we discovered that risk management remains a relatively low-priority topic at board meetings (exhibit).

A long way to go

Boards spend only 9 percent of their time on risk—slightly less than they did in 2015. Other questions in the survey revealed that only 6 percent of respondents believe that they are effective in managing risk (again, less than in 2015). Some individual risk areas are relatively neglected, and even cybersecurity, a core risk area with increasing importance, is addressed by only 36 percent of boards. While many senior executives stay focused on strategy and performance management, they often fail to challenge capabilities or strategic decisions from a risk perspective (see sidebar, “A long way to go”). A reactive approach to risks remains too common, with action taken only after things go wrong. The result is that boards and senior executives needlessly put their companies at risk, while personally taking on higher legal and reputational liabilities.

Boards have a critical role to play in developing risk-management capabilities at the companies they oversee. First, boards need to ensure that a robust risk-management operating model is in place. Such a model allows companies to understand and prioritize risks, set their risk appetite, and measure their performance against these risks. The model should enable the board and senior executives to work with businesses to eliminate exposures outside the company’s appetite statement, reducing the risk profile where warranted, through such means as quality controls and other operational processes. On strategic opportunities and risk trade-offs, boards should foster explicit discussions and decision making among top management and the businesses. This will enable the efficient deployment of scarce risk resources and the active, coordinated management of risks across the organization. Companies will then be prepared to address and manage emerging crises when risks do materialize.

A sectoral view of risks

Most companies operate in a complex, industry-specific risk environment. They must navigate macroeconomic and geopolitical uncertainties and face risks arising in the areas of strategy, finance, products, operations, and compliance and conduct. In some sectors, companies have developed advanced approaches to managing risks that are specific to their business models. These approaches can sustain significant value. At the same time companies are challenged by emerging types of risks for which they need to develop effective mitigation plans; in their absence, the losses from serious risk events can be crippling.

- Automotive companies are controlling supply-chain risks with sophisticated monitoring models that allow OEMs to identify potential risks upfront across the supply chain. At the same time, auto companies must address the strategic challenge of shifting toward electric-powered and autonomous vehicles.

- Pharma companies seek to manage the downside risk of large investments in their product portfolio and pipeline, while addressing product quality and patient safety to comply with relevant regulatory requirements.

- Oil and gas, steel, and energy companies apply advanced approaches to manage the negative effects of financial markets and commodity-price volatility. As social and political demands for cleaner energy are increasing, these companies are actively pursuing growth opportunities to shift their portfolios in anticipation of an energy transition and a low-carbon future.

- Consumer-goods companies protect their reputation and brand value through sound practices to manage product quality as well as labor conditions in their production facilities. Yet they are constantly challenged to meet consumers’ ever-changing tastes and needs, as well as consumer-protection regulations.

Toward proactive risk management

An approach based on adherence to minimum regulatory standards and avoidance of financial loss creates risk in itself. In a passive stance, companies cannot shape an optimal risk profile according to their business models nor adequately manage a fast-moving crisis. Eschewing a risk approach comprised of short-term performance initiatives focused on revenue and costs, top performers deem risk management as a strategic asset, which can sustain significant value over the long term. Inherent in the proactive approach are several essential components.

Strategic decision making

More rigorous, debiased strategic decision making can enhance the longer-term resilience of a company’s business model, particularly in volatile markets or externally challenged industries. Research shows that the active, regular reevaluation of resource allocation, based on sound assessments of risk and return trade-offs (such as entering markets where the business model is superior to the competition), creates more value and better shareholder returns. 1 See, for example, Yuval Atsmon, “ How nimble resource allocation can double your company’s value ,” August 2016; William N. Thorndike, Jr., The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success , Boston, MA: Harvard Business Review Press, 2012; Rebecca Darr and Tim Koller, “ How to build an alliance against corporate short-termism ,” January 2017. Flexibility is empowering in a dynamic marketplace. Many companies use hedging strategies to insure against market uncertainties. Airlines, for example, have been known to hedge future exposures to fuel-price fluctuations, a move that can help maintain profitability when prices climb. Likewise, strategic investing, based on a longer-term perspective and a deep understanding of a company’s core proposition, generates more value than opportunistic moves aiming at a short-term bump in the share price.

Debiasing and stress-testing

Approaches that include debiasing and stress-testing help senior executives consider previously overlooked sources of uncertainty to judge whether the company’s risk-bearing capacity can absorb their potential impact. A utility in Germany, for example, improved decision making by taking action to mitigate behavioral biases. As a result, it separated its renewables business from its conventional power-generation operations. In the aftermath of the Fukushima disaster, which sharply raised interest in environmentally friendly power generation, the utility’s move led to a significant positive effect on its share price (15 percent above the industry index).

Higher-quality products and safety standards

Investments in product quality and safety standards can bring significant returns. One form this takes in the energy sector is reduced damage and maintenance costs. At one international energy company, improved safety standards led to a 30 percent reduction in the frequency of hazardous incidents. Auto companies with reputations built on safety can command higher prices for their vehicles, while the better reputation created by higher quality standards in pharma creates obvious advantages. As well as the boost in demand that comes from a reputation for quality, companies can significantly reduce their remediation costs—McKinsey research suggests that pharma companies suffering from quality issues lose annual revenue equal to 4 to 5 percent of cost of goods sold.

Comprehensive operative controls

These can lead to more efficient and effective processes that are less prone to disruption when risks materialize. In the auto sector, companies can ensure stable production and sales by mitigating the risk of supply-chain disruption. Following the 2011 earthquake and tsunami, a leading automaker probed potential supply bottlenecks and took appropriate action. After an earthquake in 2016, the company quickly redirected production of affected parts to other locations, avoiding costly disruptions. In high-tech, companies applying superior supply-chain risk management can achieve lasting cost savings and higher margins. One global computer company addressed these risks with a dedicated program that saved $500 million during its first six years. The program used risk-informed contracts, enabling suppliers to lower the costs and risks of doing business with the company. The measures achieved supply assurance for key components, particularly during market shortages, improved cost predictability for components that have volatile costs, and optimized inventory levels internally and at suppliers.

Stronger ethical and societal standards

To achieve standing among customers, employees, business partners, and the public, companies can apply ethical controls on corporate practices end to end. If appropriately publicized and linked to corporate social responsibility, a program of better ethical standards can achieve significant returns in the form of heightened reputation and brand recognition. Customers, for example, are increasingly willing to pay a premium for products of companies that adhere to tighter standards. Employees too appreciate being associated with more ethical companies, offering a better working environment and contributing to society.

The three dimensions of effective risk management

Ideally, risk management and compliance are addressed as strategic priorities by corporate leadership and day-to-day management. More often the reality is that these areas are delegated to a few people at the corporate center working in isolation from the rest of the business. By contrast, revenue growth or cost savings are deeply embedded in corporate culture, linked explicitly to profit-and-loss (P&L) performance at the company level. Somewhere in the middle are specific control capabilities regarding, for example, product safety, secure IT development and deployment, or financial auditing.

Would you like to learn more about our Risk Practice ?

To change this picture, leadership must commit to building robust, effective risk management. The project is three-dimensional: 1) the risk operating model, consisting of the main risk management processes; 2) a governance and accountability structure around these processes, leading from the business up to the board level; and 3) best-practice crisis preparedness, including a well-articulated response playbook if the worst case materializes.

1. Developing an effective risk operating model

The operating model consists of two layers, an enterprise risk management (ERM) framework and individual frameworks for each type of risk. The ERM framework is used to identify risks across the organization, define the overall risk appetite, and implement the appropriate controls to ensure that the risk appetite is respected. Finally, the overarching framework puts in place a system of timely reporting and corresponding actions on risk to the board and senior management. The risk-specific frameworks address all risks that are being managed. These can be grouped in categories, such as financial, nonfinancial, and strategic. Financial risks, such as liquidity, market, and credit risks, are managed by adhering to appropriate limit structures; nonfinancial risks, by implementing adequate process controls; strategic risks, by challenging key decisions with formalized approaches such as debiasing, scenario analyses, and stress testing. While financial and strategic risks are typically managed according to the risk-return trade-off, for nonfinancial risks, the potential downside is often the key consideration.

Finding the right level of risk appetite

Companies need to find the right level of risk appetite, which helps ensure long-term resilience and performance. Risk appetite that is too relaxed or too restrictive can have severe consequences on company financials, as the following two examples indicate:

Too relaxed. One nuclear energy company set its standards for steel equipment in the 1980s and did not review them even when the regulations changed. When the new higher standards were applied to the manufacture of equipment for nuclear power plants, the company fell short of compliance. An earlier adaptation of its risk appetite and tolerance levels would have been significantly less costly.

Too restrictive. A pharma company set quality tolerances to produce a drug to a significantly stricter level than what was required by regulation. At the beginning of production, tolerance intervals could be fulfilled, but over time, quality could no longer be assured at the initial level. The company was unable to lower standards, as these had been communicated to the regulators. Ultimately, production processes had to be upgraded at a significant cost to maintain the original tolerances.

As well as assessing risk based on likelihood and impact, companies must also assess their ability to respond to emerging risks. Capabilities and capacities needed to manage these risks should be evaluated and gaps filled accordingly. Of particular importance in crisis management is the timeliness of an effective response when things go awry. The highly likely, high-impact risk events on which risk management focuses most of its attention often emerge with disarming velocity, taking many companies unawares. To be effective, the enterprise risk management framework must ensure that the two layers are seamlessly integrated. It does this by providing clarity on risk definitions and appetite as well as controls and reporting.

- Taxonomy. A company-wide risk taxonomy should clearly and comprehensively define risks; the taxonomy should be strictly respected in the definition of risk appetite, in the development of risk policy and strategy, and in risk reporting. Taxonomies are usually industry-specific, covering strategic, regulatory, and product risks relevant to the industry. They are also determined by company characteristics, including the business model and geographical footprint (to incorporate specific country and legal risks). Proven risk-assessment tools need to be adopted and enhanced continuously with new techniques, so that newer risks (such as cyberrisk) are addressed as well as more familiar risks.

- Risk appetite. A clear definition of risk appetite will translate risk-return trade-offs into explicit thresholds and limits for financial and strategic risks, such as economic capital, cash-flow at risk, or stressed metrics. In the case of nonfinancial risks like operational and compliance risks, the risk appetite will be based on overall loss limits, categorized into inherent and residual risks (see sidebar, “Finding the right level of risk appetite”).

- Risk control processes. Effective risk control processes ensure that risk thresholds for the specified risk appetite are upheld at all levels of the organization. Leading companies are increasingly building their control processes around big data and advanced analytics. These powerful new capabilities can greatly increase the effectiveness and efficiency of risk monitoring processes. Machine-learning tools, for example, can be very effective in monitoring fraud and prioritizing investigations; automated natural language processing within complaints management can be used to monitor conduct risk.

- Risk reporting. Decision making should be informed with risk reporting. Companies can regularly provide boards and senior executives with insights on risk, identifying the most relevant strategic risks. The objective is to ensure that an independent risk view, encompassing all levels of the organization, is embedded into the planning process. In this way, the risk profile can be upheld in the management of business initiatives and decisions affecting the quality of processes and products. Techniques like debiasing and the use of scenarios can help overcome biases toward fulfilment of short-term goals. A North American oil producer developed a strategic hypothesis given uncertainties in global and regional oil markets. The company used risk modelling to test assumptions about cash flow under different scenarios and embedded these analyses into the reports reviewed by senior management and the board. Weak points in the strategy were thereby identified and mitigating actions taken.

2. Toward robust risk governance, organization, and culture

The risk operating model must be managed through an effective governance structure and organization with clear accountabilities. The governance model maintains a risk culture that strongly reinforces better risk and compliance management across the three lines of defense—business and operations, the compliance and risk functions, and audit. The approach recognizes the inherent contradiction in the first line between performance (revenue and costs) and risk (losses). The role of the second line is to review and challenge the first line on the effectiveness of its risk processes and controls, while the third line, audit, ensures that the lines one and two are functioning as intended.

- Three lines of defense. Effective implementation of the three lines involves the sharp definition of lines one and two at all levels, from the group level through the lines of business, to the regional and legal entity levels. Accountabilities regarding risk and control management must be clear. Risk governance may differ by risk type: financial risks are usually managed centrally, while operational risks are deeply embedded into company processes. The operational risk of any line of business is managed by the business owning the product-development, production, and sales processes. This usually translates into forms of quality control, but the business must also balance the broader impact of risk and P&L. In the development of new diesel engines, automakers lost sight of the balance between compliance risk and the additional cost to meet emission standards, with disastrous results. Risk or compliance functions can only complement these activities by independently reviewing the adequacy of operational risk management, such as through technical standards and controls.

- Reviewing the risk appetite and risk profile. Of central importance within the governance structure are the committees that define the risk appetite, including the parameters for doing business. These committees also make specific decisions on top risks and review the control environment for enhancements as the company’s risk profile changes. Good governance in this case means that risk decisions are considered within the existing divisional, regional, and senior-management governance structure of a company, supported by risk, compliance, and audit committees.

- Integrated risk and compliance governance setup. A robust and adequately staffed risk and compliance organization supports all risk processes. The integrated risk and compliance organization provides for single ownership of the group-wide ERM framework and standards, appropriate clustering of second-line functions, a clear matrix between divisions and control functions, and centralized or local control as needed. A clear trend is observable whereby the ERM layer responsible for group-wide standards, risk processes, and reporting becomes consolidated, whereas the expert teams setting and monitoring specific control standards for the business (including standards for commercial, technical compliance, IT or cyberrisks) become specialized teams covering both regulatory compliance as well as risk aspects.

- Resources. Appropriate resources are a critical factor in successful risk governance. The size of the compliance, risk, audit, and legal functions of nonfinancial companies (0.5 for every 100 employees, on average), are usually much smaller than those of banks (6.9 for every 100 employees). The disparity is partly a natural outcome of financial regulation, but some part of it reflects a capability gap in nonfinancial corporates. These companies usually devote most of their risk and control resources in sector-specific areas, such as health and safety for airlines and nuclear power companies or quality assurance for pharmaceutical companies. The same companies can, however, neglect to provide sufficient resources to monitor highly significant risks, such as cyberrisk or large investments.

- Risk culture. An enhanced risk culture covers mind-sets and behaviors across the organization. A shared understanding is fostered of key risks and risk management, with leaders acting as role models. Especially important are capability-building programs on risk as well as formal mechanisms to assess and reinforce sound risk management practices.

An enhanced risk culture covers mind-sets and behaviors across the organization. A shared understanding is fostered of key risks and risk management, with leaders acting as role models.

3. Crisis preparedness and response

A high-performing, effective risk operating model and governance structure, with a well-developed risk culture minimize the probability of corporate crises , without, of course, completely eliminating them. When unexpected crises strike at high velocity, multinational companies can lose billions in value in the first days and soon find themselves struggling to keep their market position. A best-in-class risk management environment provides the ideal conditions for preparation and response.

- Ensure board leadership. The most important action companies can take to prepare for crises is to ensure that the effort is led by the board and senior management. Top leadership must define the main expected threats, the worst-case scenarios, and the actions and communications that will be accordingly rolled out. For each threat, hypothetical scenarios should be developed for how a crisis will unfold, based on previous crises within and beyond the company’s industry and region.

- Strengthen resilience. By mapping patterns that arose in previous crises, companies can test their own resilience, challenging key areas across the organization for potential weaknesses. Targeted countermeasures can then be developed in advance to strengthen resilience. This crucial aspect of crisis preparedness can involve reviewing and revising the terms and conditions for key suppliers, shoring up financials to ensure short-term availability of cash, or investing in advanced cybersecurity measures to protect essential data and software in the event of failures and breaches.

- Develop action plans and communications. Once these assessments are complete and resilience-building countermeasures are in place, the company can then develop action plans for each threat. The plans must be well articulated, founded on past crises, and address operational and technical planning, financial planning, third-party management, and legal planning. Care should be taken to develop an optimally responsive communications strategy as well. The correct strategy will enable frontline responders to keep pace with or stay ahead of unfolding crises. Communications failures can turn manageable crises into irredeemable catastrophes. Companies need to have appropriate scripts and process logic in place detailing the response to crisis situations, communicated to all levels of the organization and well anchored there. Airlines provide an example of the well-articulated response, in their preparedness for an accident or crash. Not only are detailed scripts in place, but regular simulations are held to train employees at all levels of the company.

- Train managers at all levels. The company should train key managers at multiple levels on what to expect and enable them to feel the pressures and emotions in a simulated environment. Doing this repeatedly and in a richer way each time will significantly improve the company’s response capabilities in a real crisis situation, even though the crisis may not be precisely the one for which managers have been trained. They will also be valuable learning exercises in their own right.

- Put in place a detailed crisis-response playbook. While each crisis can unfold in unique and unpredictable ways, companies can follow a few fundamental principles of crisis response in all situations. First, establish control immediately after the crisis hits, by closely determining the level of exposure to the threat and identifying a crisis-response leader, not necessarily the CEO, who will direct appropriate actions accordingly. Second, involved parties—such as customers, employees, shareholders, suppliers, government agencies, the media, and the wider public—must be effectively engaged with a dynamic communications strategy. Third, an operational and technical “war room” should be set up, to stabilize primary threats and determine which activities to sustain and which to suspend (identifying and reaching out to critical suppliers). Finally, a deliberate effort must be made to address and neutralize the root cause of the crisis and so bring it to an end as soon as possible.

In a digitized, networked world, with globalized supply chains and complex financial interdependencies, the risk environment has grown more perilous and costly. A holistic approach to risk management, based on the lessons, good and bad, of leading companies and financial institutions, can derive value from that environment. The path to risk resilience that is emerging is an effort, led by the board and senior management, to establish the right risk profile and appetite. Success depends on the support of a thriving risk culture and state-of-the-art crisis preparedness and response. Far from minimal regulatory adherence and loss avoidance, the optimal approach to risk management consists of fundamentally strategic capabilities, deeply embedded across the organization.

Daniela Gius is a senior expert in McKinsey’s Hamburg office, Jean-Christophe Mieszala is a senior partner in the Paris office, Ernestos Panayiotou is a partner in the Athens office, and Thomas Poppensieker is a senior partner in the Munich office.

Explore a career with us

Related articles.

The business logic in debiasing

Are you prepared for a corporate crisis?

Nonfinancial risk today: Getting risk and the business aligned

Risk & Compliance Matters

4 steps to start a business continuity plan.

Most risk and compliance professionals already grasp the importance of business continuity planning. Pandemics, climate disasters, cybersecurity attacks, and supply chain instability tend to have that effect on this crowd.

But there’s a big difference between understanding the need for business continuity and developing an actual business continuity plan. Bridging this gap involves risk assessments, internal control remediation, and testing — with plenty of input from all parts of the enterprise along the way.

How can you start building a business continuity plan? Which steps are most important, and which ones hardest to get right? Read on to see the necessary steps in this process - after all, catastrophe is going to strike sooner or later.

1. Do a Risk Assessment Using a Business Continuity Framework

Like other risk-management efforts, business continuity planning begins with a risk assessment . The details of that assessment, however, might be more intricate than most risk and compliance professionals are used to; that’s why most organizations use a business continuity framework , such as ISO, or a NIST cybersecurity framework , to work through the risk assessment methodically.

The goal of a business continuity risk assessment is 1.) to map the organization’s business objectives to processes that support those objectives; then 2.) match those processes to the assets that support the processes. Once you understand how processes and assets support business objectives, the question becomes: “How could those assets be put at risk?”

For example, say a business objective is the timely delivery of goods and services to customers. The processes would include accepting customer orders, assuring sufficient inventory, and shipping goods from loading dock to customer. The assets would include IT systems to place orders, goods in the warehouse, and a reliable third-party shipping service.

We could identify 100 different ways those processes and assets could fail and disrupt the business. The above example is only one of many objectives and processes a business continuity plan should address. Without a framework to guide that analysis, the odds of overlooking a critical threat increase dramatically.

Download: Business Continuity Toolkit

2. Do a Business Impact Analysis

The results of the risk assessment will inform the business impact analysis (BIA). A business impact analysis takes the assets you identified that support your most critical business processes, and asks: “What would happen to those processes, and our ability to achieve our objectives, if the assets were suddenly unavailable?”

The BIA should tell you which goods, IT services, or employees are crucial to mission-critical business processes; and which risk events (power failures, hurricanes, IT system outages, pandemics, etc.) would cause the most disruption if those risks aren’t remediated.

Many companies prioritize risks to business continuity by using the risk assessments and BIA to generate a business impact score for each continuity risk; the higher the score, the more dangerous a risk is to business continuity. (Software is often used to assess risk and generate that score automatically .) Then you can develop a business continuity plan that addresses mission-critical risks first, the rest later.

3. Develop the Business Continuity Plan

The business continuity plan (BCP) can address risk in several ways. Here are a few examples:

- To avoid a shortage of critical components, for example, you might adopt a policy that specifies “When we’re down to our last 100 widgets, we order a fresh batch.”

- To avoid failures of critical IT systems, you might decide to establish backup data centers with all transactions archived to those sites every 12 hours.

- To avoid failures with critical third parties , you might maintain lists of alternative providers and have a policy to test the resiliency of those critical third parties every 60 days.

The business continuity plan should be documented and shared with senior executives and operations teams, so that everyone understands their responsibilities in the event of a disruption.

The plan also demonstrates responsible risk management to business partners, regulators, investors, and other stakeholders. The BC plan indicates that the organization has identified risks to business operations and put steps in place to keep those risks in check.

4. Communicate, Practice, and Monitor

Business continuity plans are living documents – you can’t leave it in a desk drawer to gather dust until disaster arrives. Risk managers need to put their business continuity plans to work in multiple ways.

Communicate: Circulate drafts of the plan among senior management and operations executives so all stakeholders know what it includes. Ask for feedback: What might the plan overlook, or which proposed mitigation steps aren’t practical? When the plan is finalized, share it with everyone in key roles to helping the organization endure a disaster.

Practice: Hold table-top exercises or drills of possible disasters at regular intervals. You might even hold table-top exercises for each draft of the plan, so risk managers can see what ideas will or won’t work in practice. The goal in stepping through the plan and response is to train key employees on their roles during a crisis, and to test the plan for weaknesses.

Monitor: Risks to business continuity will evolve. Resources may become more or less scarce, service providers may merge or go out of business, reorganizations send key employees into new roles, etc. Just like any other risk management, third-party and other risks should be assessed on an ongoing basis , and the BC plan should be updated as necessary.

Mike Tyson once said, “Everybody has a plan until they get punched in the mouth.” This doesn’t need to be the case in business. Business continuity plans take time, effort, and collaboration, but they can guide your organization through disaster — and they’re far better than the alternative of having no plan at all.

Put your BC plan into action with the Business Continuity Toolkit!

Chat with a solutions expert to learn how you can take your compliance program to the next level of maturity.

2021 Brings Risk and Compliance Together Under One Roof

2020 opened the pandora's box of risks: cybersecurity, supply chain, health and safety, financial fraud, and regulatory compliance as well. If the experiences of 2020 taught us anything, it’s that a federated approach to risk is not enough. Compliance and integrated risk management need to come together under one roof.

A Year of Uncertainty Spurs Integrated Risk Management Adoption

In the last five years, integrated risk management has gone from buzzword to practice. The primary driver of IRM across industries is uncertainty. After a year of uncertainty, organizations will direct GRC-related resources from compliance to a risk-oriented approach.