AssignmentsBag.com

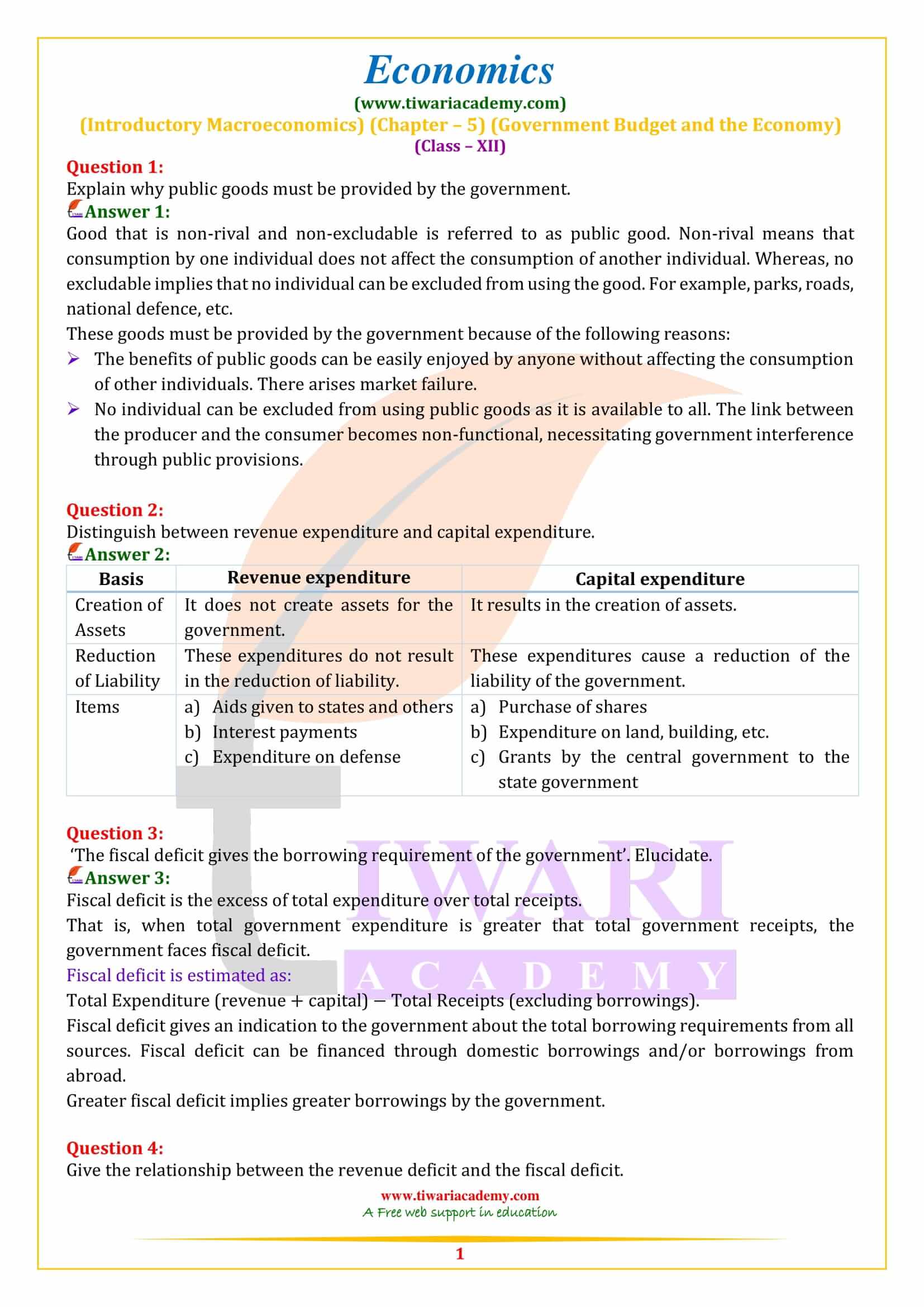

Case Study Chapter 5 Government Budget and Economy

Please refer to Case Study Chapter 5 Government Budget and Economy with answers provided below. These case study based questions are expected to come in the upcoming Class 12 Economics examinations. We have provided economics case studies with answers class 12 for all chapters on our website as per the latest examination pattern issued by CBSE, NCERT, and KVS.

Chapter 5 Government Budget and Economy Economics Case study with Answers Class 12

Case Based Questions :

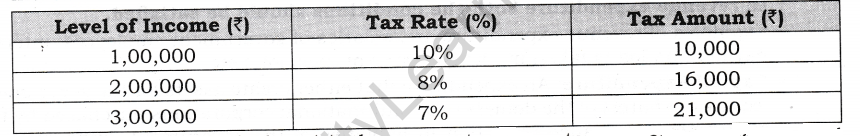

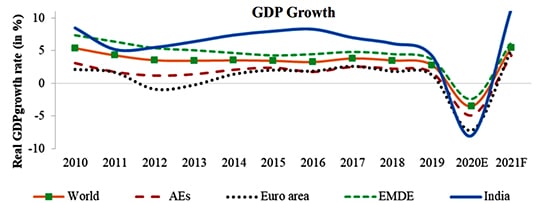

Finance Minister Nirmala Sitharaman has pegged fiscal deficit for the coming year 2021-22 at 6.8% of GDP and aims to bring it back below the 4.5% mark by 2025-26. The original fiscal deficit target for 2020-21 was 3.5%. However, in reality, the deficit shot up to a high of 9.5% of GDP due to the double impact of the COVID-19 pandemic- low revenue flows due to the lockdown and negative economic growth clubbed with the high government spending to provide essential relief to the vulnerable sections of the society, as well as a stimulus package aimed at reviving domestic demand.

Question. Fiscal deficit is financed through: (a) Borrowings (b) Tax revenue receipts (c) Disinvestment (d) All of the above

Question. If fiscal deficit is ₹4000 crore and interest payments is ₹500 crore, then primary deficit is: (a) ₹4,500 crore (b) ₹ 3,500 crore (c) ₹ 5,000 crore (d) ₹ 4,200 crore

Question. Deficit budget refers to a situation when: (a) government’s budget expenditure is less than its budget receipts (b) government’s budget expenditure is more than its budget receipts (c) government’s budget expenditure is equal to its budget receipts (d) government’s budget receipts are more than its budget expenditure

Question. Fiscal deficit is equal to: (a) Total expenditure -Total receipts other than borrowings (b) Capital expenditure – Capital receipts (c) Revenue expenditure – Revenue receipts (d) Revenue expenditure + Capital expenditure – Revenue receipts

Presenting the Union Budget for 2021-22, Finance Minister Nirmala Sitharaman said that the budget proposals for this financial year rest on six pillars – health and well-being, physical and financial capital and infrastructure, inclusive development for aspirational India, reinvigorating human capital, innovation and R &D, and ‘Minimum Government, Maximum Governance’. Significant announcements included a slew of hikes in customs duty to benefit Make in India, proposal to disinvest two more public sector banks (PSBs) and a general insurance company, and numerous infrastructure pledges to poll- bound states.

Question. Which of the following is not an objective of government budget? (a) Reallocation of resources (b) Increasing regional disparities (c) Economic Stability (d) Economic Growth

Question. In which of the following taxes, the impact and incidence of the tax lies on different person? (a) Goods and service tax (b) Custom duty (c) Income tax (d) both (a) and (b)

Question. Disinvestment of a general insurance company is an example of: (a) revenue receipt (b) revenue expenditure (c) capital receipt (d) capital expenditure

Question. Expenditure on infrastructure is a capital expenditure because: (a) It creates liability of the government (b) It reduces assets of the government (c) It increases assets of the government (d) It neither creates any liability nor reduces any asset of the government

Related Posts

Moving Charges and Magnetism Class 12 Physics Important Questions

Evolution Class 12 Biology Important Questions

Class 12 Business Studies Important Questions

myCBSEguide

- Class 12 Economics Case...

Class 12 Economics Case Study Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

In this article, we will discuss how to download CBSE class 12 Economics Case Study Questions from the myCBSEguide App and our Student Dashboard for free. For the students appearing for class 12 board exams from the commerce/ humanities stream, Economics is a very lucrative and important subject. It is a very high-scoring subject that aids the students to increase their percentile and excel in academics.

The exam is divided into 2 parts:

- Macro Economics

- Indian Economics Development

12 Economics Case Study Questions

CBSE introduced case-based questions for class 12 in the year 2021-22 to enhance critical thinking in students. CBSE introduced a few changes in the question paper pattern to enhance and develop analytical and reasoning skills among students. Sanyam Bharadwaj, controller of examinations, CBSE quoted that the case-based questions would be based on real-life situations encountered by students.

The purpose was to drift from rote learning to competency and situation-based learning. He emphasized the fact that it was the need of the hour to move away from the old system and formulate new policies to enhance the critical reasoning skills of students. Introducing case study questions was a step toward achieving the goals of the National Education Policy (NEP) 2020.

What is a Case Study Question?

As part of these questions, the students would be provided with a comprehensive passage, based on which analytical questions will have to be solved by them. The students will have to read the given passage thoroughly before attempting the questions. In The current examination cycle (2021-22), case-based questions have a weightage of around 20%.

Types of Case Study Questions in Economics

CBSE plans to increase the weightage of such questions in the following years, so as to enhance the intellectual and analytical abilities of the students. Case-based questions are predominantly of 3 types namely:

- Inferential

Local questions

Local questions can be easily solved as the answers are there in the given passage itself.

Global Questions

For Global questions, the students will have to read the passage in depth, analyze it and then solve it.

Inferential questions

Inferential questions are the ones that would require the student to have complete knowledge of the topic and could be answered by application of the concepts. The answers to such questions are tricky and not visible in the given passage, though the passage would highlight the concept on which the questions would be asked by CBSE.

HOTS Questions in Class 12 Economics

Personally, the concept of case-based questions is not new since CBSE has always included questions based on Higher Order Thinking Skills (HOTs). Though now we will have an increased percentage of such questions in the question paper.

Advantages of Case-based Questions

Class 12 Economics has two books and CBSE can ask Case study questions from any of them. Students must prepare themselves for both the books. They must practice class 12 Economics case-based questions as much as possible.

Case study questions:

- Enhance the intellectual and analytical abilities of the students.

- Provide a complete and deeper understanding of the subject.

- Inculcate intellectual reasoning and scientific temperamental in students.

- Help students retain knowledge for a longer time.

- Would definitely help to discard the concept of memorizing insanely and cramming without a factual understanding of the content.

- The questions would help to terminate the existing system of education in India that promotes rote learning.

Sample case study questions (Economics) class 12

Here are some case study questions for CBSE class 12 Economics. If you wish to get more case study questions and other related study material, download the myCBSEguide App now. You can also access it through our Student Dashboard.

Case Study 1

Keeping in view the continuing hardships faced by banks in terms of social distancing of staff and consequent strains on reporting requirements, the Reserve Bank of India has extended the relaxation of the minimum daily maintenance of the CRR of 80% for up to September 25, 2020. Currently, CRR is 3% and SLR is 18.50%.

“As announced in the Statement of Development and Regulatory Policies of March 27, 2020, the minimum daily maintenance of CRR was reduced from 90% of the prescribed CRR to 80% effective the fortnight beginning March 28, 2020 till June 26, 2020, that has now been extended up to September 25, 2020,” said the RBI.

Q.1 The full forms of CRR and SLR are:

- Current Reserve Ratio and Statutory Legal Reserves

- Cash Reserve Ratio and Statutory Legal Reserves

- Current Required Ratio and Statutory Legal Reserves

- Cash Reserve Ratio and Statutory Liquidity Ratio (ans)

Q.2 What will be the value of the money multiplier?

- None of these

Q.3 SLR implies:

- a) Certain percentage of the total banks’ deposits has to be kept in the current account with RBI

- b) Certain percentage of net total demand and time deposits have to be kept by the bank themselves (ans)

- c) Certain percentage of net demand deposits has to be kept by the banks with RBI

- d) None of the above

Q.4 Decrease in CRR will lead to __.

- a) fall in aggregate demand in the economy

- b) rise in aggregate demand in the economy (ans)

- c) no change in aggregate demand in the economy

- d) fall in the general price level in the economy

Case Study 2

An important lesson that the COVID-19 pandemic has taught the policymakers in India is to provide greater impetus to sectors that make better allocation of resources and reduce income inequalities. COVID-19 has also taught a lesson that in crisis the population returns to rely on the farm sector. India has a large arable land, but the farm sector has its own structural problems. However, directly or indirectly, 50 percent of the households still depend on the farm sector. Greater support to MSMEs, higher public expenditure on health and education and making the labour force a formal employee in the economy are some of the milestones that the nation has to achieve.

One of the imminent reforms to be done in the country is labour reforms. Labour laws are outmoded in India, and some of these date back to the last century.

India’s complex labour laws have been blamed for keeping manufacturing businesses small and hindering job creation. Industry hires labour informally because of complex laws and that is responsible for low wages.

- Which types of structural problems are faced by the agricultural sector?

- “It is necessary to create employment in the formal sector rather than in the informal sector.’’ Defend or refute the given statement with valid argument.

- Hired labour comes in …………………. (Informal organisation / formal organisation)

- What do you mean by MSMEs?

Case Study 3

People spend to acquire information relating to the labour market and other markets like education and health. This information is necessary to make decisions w.r.t investment in human capital and its efficient utilization. Thus, expenditure incurred for acquiring information relating to the labour market and other markets is also a source of human capital formation.

Q1. Which of the following is the source of human capital formation in India?

- Acquiring information

- All of these (ans)

Q2. Education provides

- Private benefit

- Social benefit

- Both 1) and 2) (ans)

Q3. __ persons contribute more to the growth of an economy.

Q4. Training given by a company to its employees is generally__________

- Investment (ans)

- Social wastage

- Both 1) and 2)

Tips to Solve Case Study Questions in Economics

Let’s understand how you can solve case study questions in class 12 Economics. The two books are Macroeconomics and Indian Economic Development.

- Read the passage thoroughly

- Can follow a reversal pattern, especially macroeconomics questions, i.e. read questions first and then look for the answers in the passage.

- In case the question asked is about Indian Economic Development, read the passage very carefully as most of the answers would be hidden in the passage itself.

- Macro Economics questions will be more application-based and would test your conceptual clarity.

- Answer briefly and precisely.

Important Chapters – Economics Case Study Questions

Following are some of the very important topics that need to be prepared very thoroughly under CBSE class 12 Economics. We expect that CBSE will certainly ask case-based questions from these chapters.

- National income and its aggregates

- Government budget

- Current challenges faced by the Indian economy

“Stop waiting for tomorrow, Start now”

Test Generator

Create question paper PDF and online tests with your own name & logo in minutes.

Question Bank, Mock Tests, Exam Papers, NCERT Solutions, Sample Papers, Notes

Related Posts

- Competency Based Learning in CBSE Schools

- Class 11 Physical Education Case Study Questions

- Class 11 Sociology Case Study Questions

- Class 12 Applied Mathematics Case Study Questions

- Class 11 Applied Mathematics Case Study Questions

- Class 11 Mathematics Case Study Questions

- Class 11 Biology Case Study Questions

- Class 12 Physical Education Case Study Questions

3 thoughts on “Class 12 Economics Case Study Questions”

thanks for your information, dont forget to visit airlangga university website https://www.unair.ac.id/mahasiswa-unair-dan-y20-indonesia-diskusikan-isu-resesi-ekonomi/

thank you for Economics MCQs

https://mcqquestions.net/economics

Leave a Comment

Save my name, email, and website in this browser for the next time I comment.

25,000+ students realised their study abroad dream with us. Take the first step today

Here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- Economics /

Government Budget And The Economy Class 12

- Updated on

- Mar 19, 2021

Every new year, the whole country eagerly waits for the new fiscal or the nation’s budget that the government presents in the parliament. Almost every news channel covers and telecasts this important day before the country. Class 12 Macroeconomics covers many such new topics that we have never discussed before in earlier classes. The chapter of Government Budget and the Economic is one such chapter that will make you understand the importance and need of government budget. It is an important part of class 12 economics . This blog will cover the study notes on the chapter Government Budget and the economy class 12.

This Blog Includes:

What is the government budget , objectives of the government budget, components of government budget , budget receipts , revenue receipts vs capital receipts , tax revenues vs non-tax revenues , budget expenditure , plan expenditure vs non-plan expenditure, types of budget, implications of revenue deficits and fiscal deficits, measures to reduce or correct different deficits.

According to the chapter government budget and the economy class 12, the government budget is basically an annual final statement which shows item wise expenditures of the government or a ruling entity during a fiscal year. It also presents the anticipated tax revenues and proposed spending or expenditures in areas like Healthcare, Defence, Education, Infrastructure, Banks, State Benefits, etc. The fiscal year is taken into account from 1st April to 31st March.

As per the chapter on Government Budget and the Economy class 12, the main purpose or the main objectives of the government budget is as follows:

- Reallocation of resources

- Redistribution of activities

- Stabilizing economic activities

- Management of public enterprises

- Economic growth

- Generation of employment

According to Government Budget and the Economy class 12, there are 2 components of the budget. These are:

- Revenue Receipts

- Revenue Expenditure

- Capital Receipts

- Capital Expenditure

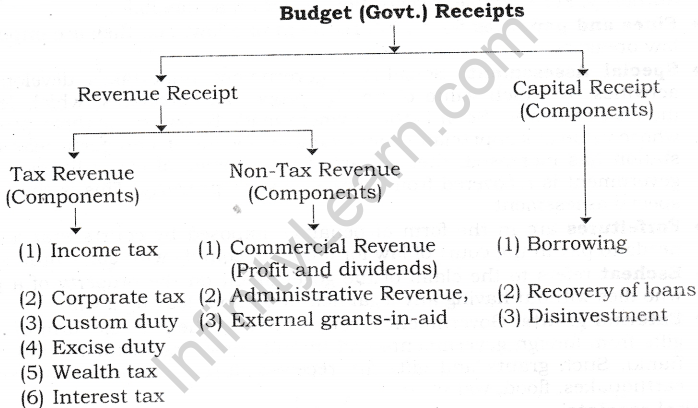

According to the chapter government budget and the economy class 12, the budget receipts refer to the estimated receipts/revenue or money receipts that the government may earn from all the sources during a fiscal year. Receipts can be of 2 types, i.e. revenue receipts and capital receipts.

Government budget and the economy class 12 chapter gives the various differences between revenue receipts and capital receipts. They are tabulated below:

As we have discussed above in this blog of Government Budget and the Economy class 12 study notes, the revenue receipts are divided into 2 categories which are tax revenue receipts and non-tax revenue receipts. The tax revenue receipts can further be divided into 2 categories:

- Direct taxes

- Indirect taxes

On the other hand, the non-tax revenues, which is the second type of revenue receipts which government may receive from all other sources other than taxes are:

- Commercial Revenue

- Dividends and Profits

- External Grants

- Administrative Revenues

- License Fee

- Fines and/or Penalties

- Cash grants-in-aid from foreign countries and international organisations or the World Bank

The second component of the government budget is, of course, the government budget expenditure. As we have discussed above, these are of two types, the revenue expenditure and the capital expenditure. Let us understand the difference between these two according to Government Budget and the Economy class 12.

According to the chapter on Government Budget and the Economy class 12, expenditures can be of 2 types:

- Plan expenditures : all those expenditures of the government that are to be incurred during the fiscal or the financial year on things like development and investment programs are termed as plan expenditures.

- Non-plan expenditures : all those expenditures of the government that are not included in the current five year plan are termed as non-plan expenditures.

According to the chapter on Government Budget and the Economy class 12, we can bifurcate the government budget into 3 major types:

- Balanced Budget: when estimated receipts are equal to the government estimated expenditures.

- Surplus Budget: when government estimated receipts are shown more than the government estimated expenditures.

- Deficit Budget: when government estimated receipts are shown less than the government estimated expenditures. This implies an increase in the government liabilities and fall in the reserves.

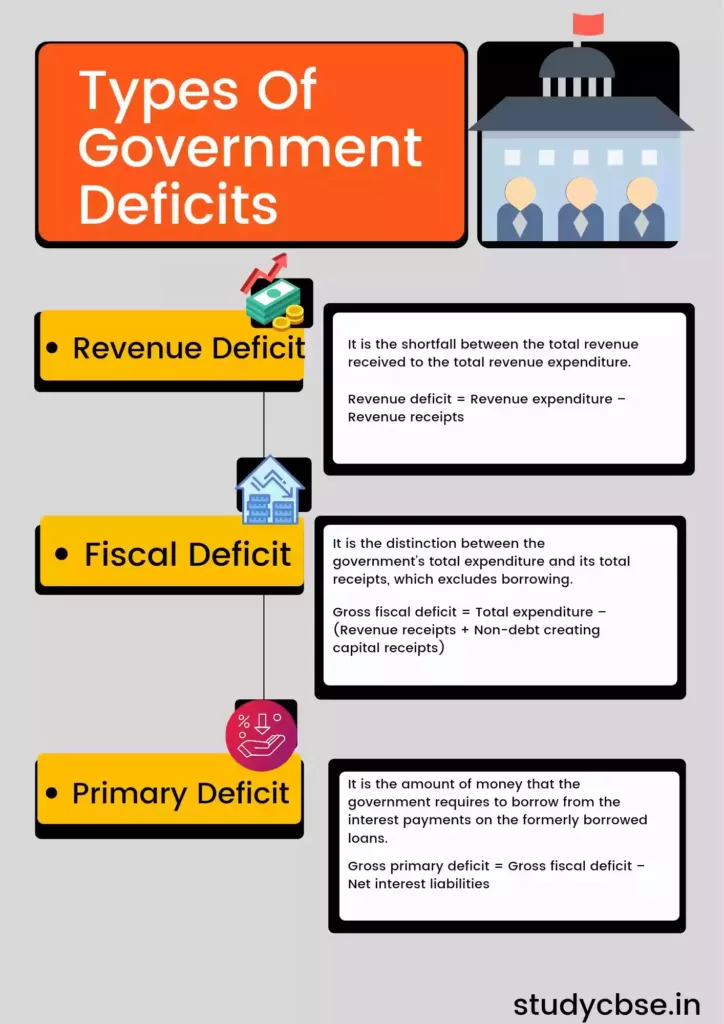

Deficit can be of 3 types:

- Revenue Deficit: Total Revenue Expenditure – Total Revenue Receipts

- Fiscal Deficit: Total Budget Expenditure – Total Budget Receipts excluding borrowings

Fiscal Deficit = Borrowings

- Primary Deficit: Fiscal Deficit Interest Payment

Moving further in the government budget and the economy class 12, it mentions the implications of revenue deficits and fiscal deficit. They are tabulated below.

As per the chapter on Government Budget and the Economy class 12, the measures that can be adopted to reduce or correct different deficits in the economy are:

- Borrowing from international monetary institution and other countries

- Lowering government expenditure

- Increasing government revenue

- Monetary expansion

- deficit financing

- Borrowing from public

- Disinvestment

So we end this blog on Government Budget and the Economy class 12 chapter of macroeconomics hoping that this may prove to be helpful for that last moment revision for your exams. If you want to study abroad after 12th commerce or want to know more about the courses after 12th commerce , reach out to our experts at Leverage Edu . Sign up for a free session today!

Team Leverage Edu

Leaving already?

8 Universities with higher ROI than IITs and IIMs

Grab this one-time opportunity to download this ebook

Connect With Us

25,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

September 2024

January 2025

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

NCERT Solutions for Class 12 Macro Economics Chapter 5 Government Budget and the Economy

NCERT Solutions for Class 12 Economics Chapter 5 Government Budget and the Economy – Macroeconomics designed and developed for session 2024-25023. Along with the solutions, student can get here class 12 Macroeconomics chapter 5 MCQ, Case Studies and extra question answers.

Class 12 Macroeconomics Chapter 5 Macroeconomics Government Budget and the Economy Question answers

- Class 12 Macroeconomics Chapter 5 Solutions

- Class 12 Macroeconomics Chapter 5 MCQ

- Class 12 Macroeconomics Chapter 5 Case Studies

- Class 12 Macroeconomics NCERT Books PDF

- Class 12 Economics all Chapters Solutions

- Class 12 all Subjects NCERT Solutions

There is a constitutional demand in Republic of India to present before the Parliament, an announcement of calculable receipts and expenditure of the govt in respect of each financial year which runs from 1st April to 31st March. This ‘Annual Financial Statement’ represent the primary budget document of the govt. The govt plays an awfully vital role in increasing the welfare of the people. Government provides certain goods and services that can’t be provided by the market mechanism, i.e.; by exchange between individual shoppers and producers.

Example of such merchandise are national defence, roads, government administration, etc., that are noted as public goods. To grasp why public merchandise, got to be provided by the govt, we must understand the difference between non-public merchandises such as garments, cars, food items, etc. and public merchandise. The benefit of public goods is available to all and not restricted to one particular user. Think about a public park or measures to scale back pollution, the advantages are obtainable to all or any. Just in case of personal merchandise, anyone who does not pay to obtain the product, can be excluded from enjoying its advantages. Like, if you don’t buy a ticket of the movie, you may not be allowed to enter the cinema hall.

However, in case of public merchandise, there is no possible approach of excluding anyone from enjoying the advantages of the product. That is why public merchandise is known as non-excludable. Even if some users do not pay, it’s tough and typically not possible to gather fees for the general public merchandise. These non-paying users are known as ‘free-riders’. There is, however, a distinction between public provision and public production. Public provision implies that they’re finances through the budget and may be used with none direct payment. Public merchandise could also be created by the govt or the non-public sector. When goods are created directly by the govt, it is known as public production.

Revenue receipts : These receipts are those receipts that don’t lead result in a claim on the govt. They’re thus termed non-redeemable. They’re divided into tax and non-tax revenues. Taxation, a vital element of revenue receipts, have for long been divided into direct taxes and companies, and indirect taxes like excise taxes, custom duties and service taxes. Alternative direct taxes like wealth tax, gift tax and state duty haven’t brought in a great deal of revenue and therefore are remarked as paper taxes. The distribution objective is wanted to be achieved through progressive financial gain taxation, within which higher the financial gain, higher is that the rate. Companies are taxed on a proportional basis, wherever the rate could be an explicit proportion of the profits.

With respect to excise taxes, requirements of life are exempted or taxed at low rates, comforts and semi-luxuries are moderately taxed and luxuries, tobacco and fossil fuel merchandise are taxed heavily. Non-tax revenue of the central government primarily consists of interest receipts on account of loans by the central government, dividends and profits on investments created by the govt, fees and alternative receipts for services rendered by the govt. Money grant-in-aid from foreign countries and international organisations are enclosed. The estimate of revenue receipts takes into accounts the consequences of tax proposal created within the finance bill.

Capital receipts The govt additionally receives cash by means of loans or from the sale of its assets. Loans can need to be returned to the agencies from that they have been borrowed. Thus, they produce liability. Sale of presidency assets, like sale of shares in Public Sector Undertakings, that is remarked as PSU withdrawal, cut back the whole quantity of monetary assets of the govt. All those receipts of the govt that produce liability or cut back monetary assets are termed as capital receipts.

Revenue expenditure : It is an expenditure incurred for purposes other than the creation of physical or financial assets of the central govt. It relates to those expenses incurred for the normal functioning of the govt departments and various services, interest payment on debt incurred by the govt, and grants given to state govt and other parties. Budget documents classify total expenditure into planned and non-planned expenditure. By this classification, planned revenue expenditure relates to the central plans and central assistance for state and union territory plans.

Non-plan expenditure, covers a vast range of general, economic and social services of the govt. The main items of non-plan expenditure are interest payments, defence services, subsidies, salaries and pensions. Interest payments on market loan, external loans and from various reserve funds constitute the single largest component of non-plan revenue expenditure. Defence expenditure, is committed expenditure in the sense that given the national security concerns, there exists little scope for drastic reduction. Subsidies are an important policy instrument which aims at increasing welfare. Apart from providing implicit subsidies through under-pricing of public goods and services like education and health, the government also extends subsidy explicitly on items such as exports, interest on loans, food and fertilisers.

Capital expenditure There are expenditure of the govt which result in creation of physical or financial assets or reduction in financial liabilities. This includes expenditure on the acquisition of land, building, machinery, equipment, investment in shares, and loan and advances by the central govt to state and union territory govts, PSUs and other parties. Capital expenditures are also categorised as plan and non-plan in the budget documents. Plan capital expenditure, like its revenue counterpart, relates to central plan and central assistance for states and union territory plans. Non-plan capital expenditure covers various general, social and economic services provided by the govt.

What are the important topics of class 12 Macroeconomics chapter 5?

Class 12 Macroeconomics chapter 5 carries 6 marks according to CBSE board- split into two sub topics namely Foreign exchange and balance of payment. There are three systems of Foreign exchange determination. India follows the managed floating system. We study the merits and demerits of the fixed exchange system and the flexible exchange system. We try to understand what determines the demand and supply of foreign exchange in a flexible exchange rate system, We can also understand and appreciate the benefits/consequences of devaluation/ depreciation of currency. In the topic Balance of Payment (which is the concluding chapter of macroeconomics), we study the components of BOP namely the current account and the capital account. The current account deficit (CAD) can and does have adverse consequences on the overall BOP possession and foreign exchange rate (particularly the US Dollar). Numerical on calculation on BOT, current account deficit, devaluation of currency can also be asked in the Board examination- though the marks allotted would be 1 or 2. Students should note that these two sub-topics namely Balance of Payment and Foreign exchange are interrelated. Any deficit in BOP affects the foreign exchange rate adversely. Hence, these two have been combined into one unit.

What are the main concepts to prepare 12th Macroeconomics chapter 5?

The important concepts in the topic determination of foreign exchange are- Foreign exchange rate, Foreign exchange market, Devaluation, Depreciation, Revaluation and Appreciation of currency, Speculation, demand for foreign currency and supply of foreign currency. The important concepts in BOP are current account, Capital account, BOT, Autonomous items, accommodating items, disequilibrium in BOP, surplus or deficiting BOP, visible and invisible items in current account, Unilateral transfers.

Which questions, in chapter 5 of 12th Economics, are considered as most important for examination perspective?

- Discuss the concepts of: (2 marks each) (a) Fixed exchange rate system (b) Flexible exchange rate system (c) Managed floating rate system.

- Discuss the major reasons for demand (outflow) and supply (inflow) of foreign exchange. (4 marks)

- Distinguish between: (2- 3 marks each) (a) Devaluation and depreciation of domestic currency (b) Revaluation and Appreciation of Domestic Currency.

- What is the meaning of balance of payments? State its main components (3 marks)

- Distinguish between Autonomous items and Accommodating items. (3 marks)

- What is meant by deficit in balance of payments? How is it corrected? (3 marks)

What are the main Abbreviations in class 12 Macroeconomics chapter 5 to learn?

- BOP = Balance of payment

- BOT = Balance of trade

- CAD = Current account deficit

- NRI = Non – resident Indian

- CAS = Current account Surplus

- TCS = Tata consultancy services

- MNC = Multi-national corporations

Copyright 2024 by Tiwari Academy | A step towards Free Education

- CBSE Class 12 Macro Economics Chapter 5 – Government Budget and the Economy Class 12 Notes

Government Budget and the Economy Class 12 Revision Notes

In the government budget and the economy class 12 notes, we will study the concept of public and private goods. Also, we will learn the concept of allocation and distribution function. Then, we will learn the differences between public and private goods. Moving ahead, we will present the components of the government budget to bring out the sources of government revenue and the avenues of government spending. Furthermore, we will discuss the issue of government deficit It is a situation when expenditures exceed revenue collection. Moreover, we will deal with fiscal policy and the multiplier process within the income-expenditure approach. We will study the use of fiscal policy in stabilizing the level of output and employment.

Then, we will study the perspectives on the appropriate amount of Government Debt. Moreover, we will study other perspectives on Deficit and debts. We will understand that Government borrowing to cover deficits leads to debt accumulation – what the government owes.

Download Toppr app for Android and iOS or signup for free.

Sub-topics under Government Budget and the Economy:

- Revenue Account and Capital Account : In this Sub-topic, we will, at first, study Revenue receipts and Expenditure under Revenue Account. Then we will study Capital Receipts and expenditure Under Capital Account.

- Measures of Government Deficit : In this Sub-topic, we will study the various measures that capture government deficit. Moreover, we will study their implications for the economy.

- Fiscal Policy : In this Sub-topic, we will study the fiscal policy of the Government. We will study its use in stabilizing the level of output and employment.

- Debt : In this Sub-topic, we will study the perspectives on the appropriate amount of Government Debt. Moreover, we will study other perspectives on Deficit and debts and the concept of debt reduction.

Customize your course in 30 seconds

Which class are you in.

CBSE Class 12 Macro Economics Revision Notes

- CBSE Class 12 Macro Economics Chapter 4 – Income Determination Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 3 – Money and Banking Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 6 – Open Economy Macroeconomics Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 2 – National Income Accounting Class 12 Notes

- CBSE Class 12 Macro Economics Chapter 1 – Introduction to Macro Economics Class 12 Notes

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Talk to our experts

1800-120-456-456

- Government Budget and the Economy Class 12 Notes CBSE Macro Economics Chapter 5 (Free PDF Download)

- Revision Notes

Revision Notes for CBSE Class 12 Macro Economics Chapter 5 - Free PDF Download

Class 12 Economics Chapter 5 Notes have been prepared by the experts at Vedantu to help the students revise the concepts of the chapter thoroughly before the exams. The experts have used their experience and specialized knowledge to summarise the important concepts of the chapter in a methodical manner. It is very important for students in Class 12 to be clear with the fundamentals of economics as these are used as the base for specialized topics in economics in higher classes. Economics Class 12 Chapter 5 The Government - Functions and Scope is an important chapter and helps the students in learning about the budget.

Download CBSE Class 12 Macro Economics Revision Notes 2023-24 PDF

Also, check CBSE Class 12 Macro Economics revision notes for all chapters:

Related Chapters

Access Class 12 Macroeconomics Chapter 5 - Government Budget and the Economy

Budget: A budget is a year-long financial report that explains how future revenue and expenditure will be calculated item-wise. The budget details a country's revenue and expenditures.

The Main Objectives of the Budget are:

Resource reallocation.

Income and wealth redistribution

Public-sector management

Economic Stability

Economic Development

Employment Creation

Two Components of Budget:

1. Revenue budget: The revenue budget is made up of the government of India's revenue receipts and the expenditures that are met with that revenue.

2. Capital budget: Capital receipts and payments are included in the capital budget. It also includes transactions from the Public Account.

Budget Receipts

1. Revenue Receipts: Revenue receipts are those that do not result in a liability or a decrease in assets. The revenue is then split into two categories.

Receipt from tax

a. Direct tax: A taxpayer pays direct taxes in full to the government. It is also characterised as a tax in which the individual bears both the duty and the burden of payment. According to the type of tax charged, both the central government and state governments collect direct taxes.

b. Indirect tax: The end-consumer of products and services is ultimately responsible for indirect taxes. It is impossible to avoid because taxes are levied on both products and services. It entails lower administrative costs as a result of convenient and regular collections.

Receipt from non-tax: These include interest, commercial revenue, external grants, fines, penalties, and so on.

2. Capital Receipts: Capital receipts are government receipts that create liability or deplete financial assets. The main sources of capital receipts are loans from the public, also known as market borrowings, as well as borrowings from the Reserve Bank, commercial banks, and some other financial institutions through the sale of treasury bills, borrowings from foreign governments and international organizations, and loan recoveries. Small savings, provident funds, and net receipts from the sale of shares in Public Sector Undertakings are among the other items (PSUs).

Budget Expenditure

1. Revenue expenditure: The nature of revenue expenditure is generally current or short-term. They are costs that the government must incur to carry out its daily operations. These costs are fully charged in the year they are incurred and are not depreciated over time. They might either be recurring or non-recurring.

2. Capital Expenditure: Capital expenditures are one-time investments of money or capital made by a government for the aim of expanding in various sectors and businesses in order to create profits. These funds are typically used to acquire fixed assets or assets with a longer lifespan. These include machinery, manufacturing equipment, and infrastructure-improvement equipment. These assets provide value to the government during their entire lifespan and may or may not have a salvage value.

Budget Deficit: The amount by which a budget's expenditures exceed its revenue is referred to as a budget deficit. This deficit is a good indicator of the economy's financial health.

Revenue deficit: Revenue deficit is defined as the difference between total revenue collected and total revenue expenditure. Only current income and current expenses are included in this deficit. A large deficit figure implies that the government should reduce its spending. The government may be able to boost revenue by raising tax revenue.

Revenue deficit = Total revenue expenditure – Total revenue receipts

Implications of Revenue Deficit are:

A significant revenue shortfall indicates budgetary indiscipline.

It indicates that the government is dissaving, i.e., the government is utilizing savings from other sectors of the economy to pay its consumer expenditure.

It demonstrates the government's excessive expenditures on administration.

It lowers the government's assets owing to disinvestment.

A significant revenue deficit sends a warning signal to the government to either cut spending or boost revenue.

Fiscal Deficit: A fiscal deficit occurs when the government's total expenditures exceed its entire revenue produced. The government's borrowings, however, are not included.

Fiscal deficit = Total expenditure – Total receipts excluding borrowings

Implications of Fiscal Deficits are:

A significant drawback or consequence of fiscal deficit is that it may result in a debt trap.

It causes inflationary pressures.

It stifles future advancement.

It increases reliance on foreign resources.

It raises the government's obligation.

Primary Deficit: It is derived by subtracting interest payments from the fiscal deficit.

Primary deficit = Fiscal deficit – Interest payments on previous loans

Implications of Primary Deficit:

It reflects how much of the government's borrowings will be used to cover costs other than interest payments.

Measures to Correct Different Deficits:

Government subsidy cuts will aid in reducing the deficit.

Where assets are not being used efficiently, disinvestment should be carried out.

Increased emphasis on tax-based revenues, as well as necessary steps to prevent tax evasion.

Borrowing from both domestic and international sources.

A broader tax base could also aid in the reduction of the government's deficit.

Fiscal Policy: Keynesian economics, a theory developed by economist John Maynard Keynes, serves as the foundation for fiscal policy. It is the system by which a government makes changes to its planned expenditure and tax rates in order to monitor and influence the performance of a country's economy. It is implemented in tandem with monetary policy, by which the central bank of the country impacts the country's money supply. This policy influence aids in containing inflation, increasing employment, and, most significantly, maintaining a healthy currency value.

Debt: A quantity of the money borrowed by one entity, the borrower, from another entity, the lenders, is referred to as debt. Governments borrow money to cover their deficits, which allows them to fund regular operations as well as large capital expenditures. This debt might be in the form of a loan or bond issuance.

Class 12 Macroeconomics Chapter 5 Notes PDF

Class 12 Macroeconomics Chapter 5 Notes will also help the students in framing their answers in the question paper. Most of the time, a concept is explained in detail in the chapter but the same matter cannot be reproduced in the exam as it is difficult to learn and can make the answer unnecessary lengthy. With the help of these revision notes, students can write to the point answers, covering the appropriate matter. Chapter 5 Economy Class 12 Notes PDF by Vedantu can also be accessed by the students online from anywhere, anytime.

Chapter 5 Macroeconomics Class 12 Notes cover all the aspects of the budget, starting from the objectives of the budget and its components. The budget can be classified into revenue budget and capital budget. While the revenue budget consists of the revenue receipts and expenditure met from this revenue, the capital budget includes capital receipts and expenditure.

Budget receipts can be sub-classified into revenue and capital receipts and revenue receipts can be further subdivided into tax and non-tax receipts. These notes will provide ample examples of each category so that the students can understand the concept well. Concepts of receipts and expenditure have been covered well in these notes, complete with examples and the importance of each.

Expenditure and Deficit

Just like receipts, expenditure can also be divided into revenue and capital expenditure. When students are learning about the budget, another important concept that warrants time and attention is the topic of the budget deficit. Economics Chapter 5 Class 12 Notes elaborates on this topic by giving the meaning of deficit and ways to calculate it. In simple words, when the expenditure exceeds the revenues, it leads to a deficit. When revenue expenditure exceeds the revenue receipts, it leads to a revenue deficit. When the total expenditure exceeds the total revenues, it leads to a fiscal deficit.

There are implications of a deficit on the economy and by going through these revision notes students can learn them easily as they have been stated in an easy-to-learn format. There are several measures to correct a budgetary deficit which include steps like borrowing from the public, disinvestment among others that have been included in the notes. The easy pointers can be retained by the students and can be elaborated upon in the exam.

By going through the revision notes students can understand the concept of the budget and its components. They will learn about the effects of receipts exceeding expenditure and vice versa. Students often find it difficult to gauge the importance of every concept given in the chapter and the weightage it might carry in the exam. CBSE Class 12 Macroeconomics Chapter wise Notes by Vedantu highlight all the key concepts that students must revise before the exam. This way students can utilize their time wisely.

Conclusion

The availability of free PDF download notes for CBSE Class 12 Macroeconomics Chapter 5 - "Government Budget and the Economy" is an invaluable resource for students. These notes provide a structured and comprehensive overview of the intricate relationship between government budgets and economic stability. Understanding this topic is not only crucial for academic excellence but also for comprehending the broader economic landscape. These notes simplify complex concepts like fiscal policy, government revenue, and expenditure, making it easier for students to grasp and apply these principles. Ultimately, these downloadable notes empower students to understand the vital role of government budgets in shaping an economy, promoting fiscal responsibility and informed citizenship.

FAQs on Government Budget and the Economy Class 12 Notes CBSE Macro Economics Chapter 5 (Free PDF Download)

1. What is the Difference Between Direct Taxes and Indirect Taxes?

Macroeconomics Class 12 Chapter 5 Notes explain the difference between direct and indirect taxes with the help of examples. Taxes form an important part of the revenue for the government. Direct taxes are the taxes of which the burden cannot be shifted to others. The Impact and incidence of these taxes are on the same person, eg wealth tax. Indirect taxes are the taxes for which the burden can be shifted to others. The impact and incidence of these taxes fall on different people, eg, service tax. Students can refer to the government budget and the economy class 12 notes to understand this difference clearly.

2. How do These Revision Notes Help the Students in Preparing for the Exams?

Budget is an important concept in economics and understanding all its components is vital for students to grasp further knowledge on this topic. The revision notes have been curated by the experts after a careful and thorough study of the chapters. The notes have been prepared, keeping in mind the concepts on which questions are based. The explanations for every concept have been given in a format that can be formulated into answers by the students. Each topic is followed by examples, and equations to help the students revise easily.

3. What is a government budget Class 12?

A government budget is a country's document or yearly financial statement that shows estimated revenue and expenditure of one by one every item during the course of that year. This government budget is presented on the budget day in Lok Sabha. In India, the financial year begins on April 1st and ends on March 31st of the following year. The government develops a budget based on its goals, and then begins to collect the resources and finances needed to complete the investment.

4. What are the objectives of the government budget 12th?

Savings and investments are essential to a nation's overall economic prosperity. As a result, budgetary measures are implemented in order to ensure that different governmental sectors have enough resources. Economic savings and investments are boosted by the government. A number of government-sponsored budgetary programmes are being implemented to close the income gap between the wealthiest and the poor in the country. Financial measures such as subventions or taxes can help attain this goal. It's a top priority for the Budget to reduce the market's pricing fluctuations.

5. How do you measure the government deficit?

There are majorly three ways to measure the government deficit, which are as follows:

Revenue Deficit- The difference between government revenue expenditures and total revenue receipts is known as the revenue deficit.

Fiscal Deficit- It is the difference between government expenses and the total receipts, excluding borrowing, that determines the fiscal deficit.

Primary Deficit- The primary deficit's purpose is to focus on the current fiscal imbalances, which is why it is measured. Basically, it's the budget deficit minus interest payments.

6. What are the important topics covered in Class 12 Macroeconomics Chapter 5 revision notes?

Vedantu makes sure not to leave a single important topic unnoticed. All the topics are briefly explained in the revision notes provided by Vedantu. Following are the important questions that are covered in Class 12 Macroeconomics Chapter 5 revision notes:

Components of government budget

The revenue account- revenue expenditure and receipts

The capital account- capital expenditure and receipts

Measures of government deficit- revenue, fiscal and primary deficit

Fiscal policy

Changes in government expenditure

Changes in taxes

7. Where can I get the NCERT solutions for Class 12 Macroeconomics Chapter 5 in PDF format?

Vedantu app and Vedantu website both offer the NCERT Solutions for Class 12 Macroeconomics Chapter 5 in PDF format which can be downloaded for free of cost. Every chapter ends with a set of questions which Vedantu answers in-detail in its NCERT Solutions. You can use these solutions to prepare for your exams by going through them and practicing them regularly. It's simple, just visit the page CBSE Class 12 Macro Economics Revision Notes Chapter 5 and you'll be taken to a page with the NCERT Solutions.

REVISION NOTES FOR CLASS 12 MICRO ECONOMICS

Cbse study materials.

Government Budget And The Economy Chapter 4 Notes, QnA 2023

Government budget and the economy, government budget – meaning, objectives and components..

A government budget is an annual financial statement showing item wise estimates of expected revenue and anticipated expenditure during a fiscal year.

Just like your household budget, the government also has a budget of its income and expenditure. In the beginning of every year, the government presents before the Lok Sabha an estimate of its receipts and expenditure for the coming financial year.

The government plans a budget according to its expenditure and then tries to raise funds to meet the proposed expenditure.

Government earns money broadly from taxes, fees and fines, interest on loans given to states and dividends by public sector enterprises.

Government spends mainly on: Securing and providing goods and services to citizens, On law and order and Internal security, defence, staff salaries, etc.

In India there is a constitutional requirement to present a budget before Parliament for the ensuing financial year. The financial (fiscal) year starts on April 1 and ends on March 31 of next year.

General objectives of a government budget are as under:

- To promote rapid and balanced economic growth to improve the living standard of the people.

- To eradicate poverty and unemployment by creating employment opportunities and providing maximum social benefits to the poor

- To reduce inequalities of income and wealth, the government can influence distribution of income through levying taxes and granting subsidies.

- To reallocate resources so as to achieve social and economic objectives. e.g., public sanitation, rural electrification, education, health, etc.

- To bring economic and price stability, by controlling fluctuations in general price level through taxes, subsidies and expenditure.

- To finance and manage public enterprises like railways, power generation and water lines etc.

Components And Classification

There are two main components of the Government Budget.

Revenue Receipts

Incomes which are received by the government from all sources in its ordinary course of governance are revenue receipts.

Revenue receipts are further classified as tax revenue and non-tax revenue.

- Tax Revenue

Tax revenue is the income received from different taxes and other duties levied by the government. It is a major source of public revenue.

Taxes are of two types of tax], viz., Direct Taxes and indirect taxes

Direct taxes are taxes that an individual pays directly to the government, such as income tax, land tax, and personal property tax. Such direct taxes are based on the ability of the taxpayer to pay, higher their capability of paying is, the higher their taxes are.

Indirect taxes are those taxes which are levied on goods and services and affect the income of a person through their consumption expenditure. E.g. Custom duties, sales tax, services tax, excise duties, etc.

- Non-Tax Revenue

Apart from taxes, governments also receive revenue from other non-tax sources.

Fees : Fees paid for registration of property, births, deaths, etc.

Fines and penalties : Fines and penalties for not following (violating) the rules and regulations.

Profits from public sector enterprises : Many enterprises are owned and managed by the government. It is an important source of non-tax revenue. For example in India, the Indian Railways, Oil and Natural Gas Commission, Air India, etc.

Gifts and grants : Gifts and grants are received by the government. Citizens of the country, foreign governments and international organisations like the UNICEF, UNESCO, etc. donate during times of natural calamities.

Special assessment duty : It is a type of levy imposed on the people for getting some special benefit. For example, in a particular locality, if roads are improved, property prices will rise.

Capital Receipts

Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

Some more examples:

- Loans raised by the government from the public through the sale of bonds and securities. They are called market loans.

- Borrowings by government from RBI and other financial institutions through the sale of Treasury bills.

- Loans and aids received from foreign countries and other international Organisations like International Monetary Fund (IMF), World Bank, etc.

- Receipts from small saving schemes like the National saving scheme, Provident fund, etc.

- Recoveries of loans granted to state and union territory governments and other parties.

Click Below To Learn Other Chapter Notes

- Unit 1: National Income and Related Aggregates

- Unit 2: Money and Banking

- Unit 3: Determination of Income and Employment

- Unit 5: Balance of Payments

- Unit 6: Development Experience (1947-90) and Economic Reforms since 1991

- Unit 7: Current challenges facing Indian Economy

- Unit 8: Development Experience of India

Click Below For Class 12 All Subject Sample Papers 2024

1. 15+ Political Science Sample Paper 2024 2. 15+ Economics Sample Paper 2024 3. 15+ Business Studies Sample Paper 2024 4. 12+ Physical Education Sample Paper 2024 With Solution 5. 15+ Physics Sample Paper 2024 With Solution 6. 15+ Chemistry Sample Paper 2024 With Solution 7. 15+ Biology Sample Paper 2024 With Solution 8. 15+ English Sample Paper 2024 9. 15+ History Sample Paper 2024 10. 15+ Geography Sample Paper 2024 11. 15+ Maths Sample Paper 2024

Classification Of Capital Expenditure And Revenue Expenditure

Capital Expenditure

Any projected expenditure which is incurred for creating asset for a long life is capital expenditure.

Therefore, expenditure on land, machines, equipment, irrigation projects, oil exploration and expenditure by way of investment in long term physical or financial assets are capital expenditure.

The following are the examples of capital expenditure :

Expenditure incurred for :

- Acquisition of fixed tangible assets such as land, building, machinery, furniture, motor vehicle etc. Improvement or extension of fixed assets such as increasing the seating capacity of a theatre.

- Bring the fixed assets to the place of their use and expenditure incurred on their installation or erection such as freight on fixed assets, wages paid for purchase of intangible assets such as goodwill, patent rights, and trademarks, copyright, etc.

- Reconditioning of old fixed assets such as expenditure incurred on repairing or overhealing of secondhand machinery.

- Major repairs and replacement of plants which increase the efficiency of the plant.

Rules for Determining Capital Expenditure.

An expenditure is capital expenditure:

- When it is incurred for acquiring a long term asset (having a useful life of more than one year) for use in the business to earn revenue and not meant for sale.

- When it is incurred to put an asset into working condition. For example, the transportation and installation charges are added to the cost of machine, the legal charges like registration and stamp duty is added to the cost of land and building, etc.

- When it incurred for putting an old asset into working condition is treated as capital expenditure and added to the cost of the asset.

- When it is incurred to increase the earning capacity of a business is treated as capital expenditure. For example, expenditure incurred for shifting the factory to convenient site is a capital expenditure.

Revenue Expenditure

When an expenditure is made for running the business with a view to produce the profits is revenue expenditure. Such expenditure benefits the current period only.

It is incurred to maintain the existing earning capacity of the business. Administrative expenses and selling and distribution expenses are examples of revenue expenditure.

Rules for Determining Revenue Expenditure.

An expenditure incurred:

- For the purpose of acquiring goods purchased for resale, consumable items, etc. Other direct expenses like production and purchase of goods such as wages, power, freight etc. are revenue expenditure.

- For maintaining fixed assets in working order e.g. amount spent on repairs and renewals

- Depreciation on fixed assets

- On office and administrative and selling and distribution departments in the normal course of business. These include salaries, rent, telephone expenses, electricity, postage, advertisement, travelling expenses, commission to salesmen.

- On non-operating expenses and losses are revenue expenditures. For example, interest on loan taken after commencement of commercial production, loss on sale of a long term asset, loss by theft, loss by fire are revenue expenditures.

- By an enterprise to discharge itself from recurring liability is of revenue nature. For example, a lump sum amount paid to a pensioner by the employer is revenue expenditure.

- For protecting the business is a revenue expenditure. For example, the amount spent on propaganda campaign to oppose the threatened nationalisation of industry is of revenue nature.

- To maintain the existing efficiency or the earning capacity is of revenue type.

Distinction Between Capital Expenditure and Revenue Expenditure:

Measures Of Government Deficit

A Deficit is the budgetary situation where expenditure is higher than the revenue. When in a set budget government expenditure exceeds the income amount it is government deficit.

This deficit indicates the financial health of the economy. To reduce this deficit between expenditures and income, the government cut back certain expenditures and also increased revenue-generating activities.

This expenditure revenue gap may be financed by either printing of currency or through borrowing.

Nowadays most governments in the world are having deficit budgets and these deficits are often financed through borrowing.

Types Of Government Deficits

- Revenue Deficit

- Fiscal Deficit

- Primary Deficit

Revenue Deficit

It is the surplus of the government’s revenue expenditure over the revenue receipts.

It is the shortfall between the total revenue received to the total revenue expenditure.

Revenue deficit = Revenue expenditure – Revenue receipts

Revenue deficit only incorporates current income and current expenses. A high degree of deficit symbolises that the government should reduce its expenses.

The government may raise its revenue receipts by raising income tax. Disinvestment and selling off assets is another corrective measure to minimise a revenue deficit.

Fiscal deficit

It is the distinction between the government’s total expenditure and its total receipts, which excludes borrowing.

Gross fiscal deficit = Total expenditure – (Revenue receipts + Non-debt creating capital receipts)

A fiscal deficit has to be financed by borrowing. Thus, it includes the total borrowing necessities of the government from all the possible sources. From the financing part.

A greater deficit implies more borrowing by the government and the extent of the deficit indicates the amount of expense for which the money is borrowed.

Gross fiscal deficit = Net borrowing at home + Borrowing from RBI + Borrowing from abroad

Fiscal deficit indicates the amount of money that the government will need to borrow during the financial year.

A disadvantage or implication of fiscal deficit is it may lead to a debt trap or it may lead to unnecessary and wasteful expenditure by the government which may lead to uncontrolled inflation.

Primary deficit

It is the amount of money that the government requires to borrow from the interest payments on the formerly borrowed loans.

The aim of quantifying the primary deficit is to concentrate on current fiscal imbalances.

Gross primary deficit = Gross fiscal deficit – Net interest liabilities

Net interest liabilities comprise interest payments – interest receipts by the government on the net domestic lending.

Difference between Fiscal Deficit and Revenue Deficit

Measures to Reduce Government Deficit

- Increased emphasis on tax-based revenues and appropriate measures to reduce tax evasion.

- Disinvestment should be done where assets are not being used effectively

- Reduction in subsidies by the government will also help reduce the deficit.

- Try to avoid unplanned expenditures.

- Borrowing from domestic sources.

- Borrowing from external sources.

- A broadened tax base

An uncontrolled government deficit may lead to decline in the financial health of the economy. The agenda of the government should be to plan the revenues and expenditures in such a way that the economy moves towards a balanced budget situation.

Frequently Asked Questions

Q1. What is Government Budget?

Answer : A government budget is an annual financial statement showing item wise estimates of expected revenue and anticipated expenditure during a fiscal year.

Q2. What is revenue receipts?

Answer : Incomes which are received by the government from all sources in its ordinary course of governance are revenue receipts.

Q3. What is Capital receipts?

Answer : Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets.

Q4. What is revenue deficit?

Answer : It is the surplus of the government’s revenue expenditure over the revenue receipts. It is the shortfall between the total revenue received to the total revenue expenditure.

Q5. What is Fiscal deficit?

Answer : It is the distinction between the government’s total expenditure and its total receipts, which excludes borrowing.

Q6. What is primary deficit?

Answer : It is the amount of money that the government requires to borrow from the interest payments on the formerly borrowed loans.

Government Budget and the Economy Unit 4 CBSE, class 12 Economics notes. This cbse Economics class 12 notes has a brief explanation of every topic that NCERT syllabus has.

You will also get ncert solutions, cbse class 12 Economics sample paper, cbse Economics class 12 previous year paper.

Final Words

From the above article you must have learnt about ncert cbse class 12 Economics notes of unit 4 Government Budget and the Economy. We hope that this crisp and latest Economics class 12 notes will definitely help you in your exam.

Gurukul of Excellence

Classes for Physics, Chemistry and Mathematics by IITians

Join our Telegram Channel for Free PDF Download

Government Budget and the Economy Case Study Questions for Class 12 Economics Chapter 4

- Last modified on: 2 months ago

- Reading Time: 11 Minutes

Table of Contents

Here you will find Case Study Questions for CBSE Class 12 Economics Chapter 4 Government Budget and the Economy.

Government Budget and the Economy Case Study Based Questions

Case Study Question 1:

Units and Chapter List:

PART A: INTRODUCTORY MACROECONOMICS

- National Income and Related Aggregates

- Money and Banking

- Determination of Income and Employment

- Government Budget and the Economy

- Balance of Payment

PART B: INDIAN ECONOMIC DEVELOPMENT

- Development Experience (1947-90) and Economic Reforms Since 1991

- Current Challenges Facing Indian Economy

- Development Experience of India

How to be a Well-prepared Examinee?

Getting prepared for the CBSE Examinations can be a challenging task, but with the right approach, you can be well-prepared. Every student wants to score well in the exams and be among the toppers. They all work hard to achieve this goal. The difference, between those who achieve the goal and those who do not, is not much. Here are a few points that will surely help in covering that difference and achieving the desired goal.

BE UPDATED First, get a clear understanding of the syllabus and the exam pattern of the CBSE Examinations. This will help you know which topics you need to focus on and what to expect in the exam.

DEVISE A STUDY PLAN Create a realistic study plan that covers all the subjects and topics that you need to study. Set realistic study goals for each day.

PRIORITISE THE TOPICS Identify the important topics and prioritise them in your study plan. This will help you focus on the most important concepts and reduce stress.

MAKE NOTES AND SUMMARIES Make concise notes and summaries of all the important topics. This will help you revise the concepts efficiently and effectively.

MNEMONICS Try to remember various concepts using the mnemonics

PRACTISE REGULARLY AND DILIGENTLY Solving previous years’ question papers and sample papers will help you assess your preparation level and identify your weak areas. It will also help you manage your time effectively during the exam.

STAY COMPOSED Try to keep calm and be in control of your feelings. Take a balanced diet, sleep well and do some physical exercise regularly. Spend some time doing the things which you like. Stay fit, calm and focused. It will help you immensely in your preparations and will lead you to success.

PREPARE FOR THE BIG DAY The examination day holds a great significance for the learners. Most of the learners try to assimilate as much as they can, just before the examination. This stressful, last minute preparation should be avoided, as much as possible. The preparation should end a night before the examination. A sound sleep is important for a fresh start in the morning. Avoid over-stressing just before the examination.

MINDSET DURING THE EXAM

In the examination hall, ensure that you have filled your particulars in the answer sheet correctly. Answer the questions according to the given directions. First attempt the questions that you can answer easily. It will create a positive mindset.

EFFECTIVE USE OF TIME

If you have solved the paper before time, don’t leave the examination hall. Revise your answers and look for any correction or improvement. There is always room for improvement. Do utilise your time effectively.

How to Tackle Business Studies Case Studies in Exams

Here’s a tip on how to approach and answer case study questions for Class 12 BST (Business Studies) exams:

1. Understand the Format:

- Case study questions are designed to test your ability to analyze and apply your knowledge to real-world situations.

- These questions are usually longer in length, but your answers should be concise and to the point.

2. Careful Reading:

- Begin by carefully reading the entire case study. Don’t rush; understand the context and details provided.

- Pay attention to any data, statistics, or specific information presented in the case.

3. Examine the Question:

- Before diving into the case study, read the question(s) associated with it. This will help you focus on what to look for while reading the case.

- Identify the key concepts or issues the question is addressing.

4. Highlight Key Information:

- While reading the case, underline or highlight important facts, figures, or statements that seem relevant to the question.

- Make notes if necessary to organize your thoughts.

5. Analyze the Situation:

- Once you have a good grasp of the case and its details, analyze the situation. Consider the cause-and-effect relationships, potential solutions, and any ethical or business principles involved.

6. Structure Your Answer:

- Start your answer with a brief introduction, summarizing the main problem or situation presented in the case.

- Organize your response logically. You can use bullet points or numbered lists for clarity.

- Present your analysis, providing relevant business theories or concepts as appropriate.

- Offer solutions or recommendations based on your analysis. Be clear and concise in your suggestions.

7. Use Simple Language:

- Write your answers in clear and simple language. Avoid unnecessary jargon or complex vocabulary.

- Ensure your answers are easy to understand for the examiner.

8. Practice with Sample Papers:

- Practice case study questions from sample papers and previous year papers to get a feel for the format and types of questions that may be asked.

- Writing practice answers will help you refine your approach.

Remember to practice, and you’ll become more proficient at tackling case study questions effectively.

Download CBSE Books

Exam Special Series:

- Sample Question Paper for CBSE Class 10 Science (for 2024)

- Sample Question Paper for CBSE Class 10 Maths (for 2024)

- CBSE Most Repeated Questions for Class 10 Science Board Exams

- CBSE Important Diagram Based Questions Class 10 Physics Board Exams

- CBSE Important Numericals Class 10 Physics Board Exams

- CBSE Practical Based Questions for Class 10 Science Board Exams

- CBSE Important “Differentiate Between” Based Questions Class 10 Social Science

- Sample Question Papers for CBSE Class 12 Physics (for 2024)

- Sample Question Papers for CBSE Class 12 Chemistry (for 2024)

- Sample Question Papers for CBSE Class 12 Maths (for 2024)

- Sample Question Papers for CBSE Class 12 Biology (for 2024)

- CBSE Important Diagrams & Graphs Asked in Board Exams Class 12 Physics

- Master Organic Conversions CBSE Class 12 Chemistry Board Exams

- CBSE Important Numericals Class 12 Physics Board Exams

- CBSE Important Definitions Class 12 Physics Board Exams

- CBSE Important Laws & Principles Class 12 Physics Board Exams

- 10 Years CBSE Class 12 Chemistry Previous Year-Wise Solved Papers (2023-2024)

- 10 Years CBSE Class 12 Physics Previous Year-Wise Solved Papers (2023-2024)

- 10 Years CBSE Class 12 Maths Previous Year-Wise Solved Papers (2023-2024)

- 10 Years CBSE Class 12 Biology Previous Year-Wise Solved Papers (2023-2024)

- ICSE Important Numericals Class 10 Physics BOARD Exams (215 Numericals)

- ICSE Important Figure Based Questions Class 10 Physics BOARD Exams (230 Questions)

- ICSE Mole Concept and Stoichiometry Numericals Class 10 Chemistry (65 Numericals)

- ICSE Reasoning Based Questions Class 10 Chemistry BOARD Exams (150 Qs)

- ICSE Important Functions and Locations Based Questions Class 10 Biology

- ICSE Reasoning Based Questions Class 10 Biology BOARD Exams (100 Qs)

✨ Join our Online JEE Test Series for 499/- Only (Web + App) for 1 Year

✨ Join our Online NEET Test Series for 499/- Only for 1 Year

Leave a Reply Cancel reply

Join our Online Test Series for CBSE, ICSE, JEE, NEET and Other Exams

Editable Study Materials for Your Institute - CBSE, ICSE, State Boards (Maharashtra & Karnataka), JEE, NEET, FOUNDATION, OLYMPIADS, PPTs

Discover more from Gurukul of Excellence

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

CBSE NCERT Solutions

NCERT and CBSE Solutions for free

Government Budget and Economy Class 12 Economics Important Questions

Students can read the important questions given below for Government Budget and Economy Class 12 Economics. All Government Budget and Economy Class 12 Notes and questions with solutions have been prepared based on the latest syllabus and examination guidelines issued by CBSE, NCERT and KVS. You should read all notes provided by us and Class 12 Economics Important Questions provided for all chapters to get better marks in examinations. Economics Question Bank Class 12 is available on our website for free download in PDF.

Important Questions of Government Budget and Economy Class 12

Question. What is Govt. Budget? Ans : The term budget has been derived from the French word ‘Bougett’ which refers to ‘a small bag’. A govt. budget is an annual statement of estimated receipts & expenditure of the govt. during a financial year. Question. Explain the objectives of Govt. Budget. Ans : The govt. prepares budget with the following objectives: 1. Proper Allocation/Reallocation of resources is one of the important objectives of govt. budget. The govt. makes a proper allocation of resources through its budgetary policy so as to make a balance between the goals of profit maximization & social welfare. In other words, there is a justifiable allocation of resources which can promote the welfare of the common mass. 2. Economic Stability is another objective of budgetary policy of the govt. During the period of depression & inflation, govt. adopts the policy of deficit & surplus budgeting respectively. The govt. adopts certain policies through budget to save the economy from the clutches of business cycles. The economic stability is indispensable for the stimulation of savings & investment which further raises the level of economic growth & development. 3. Economic Growth is one of the important objectives of the govt. budget. Government prepares such a favorable budget which can create conducive onditions to raise the level of savings & investment on which the economic growth of a country depends. 4. Economic Equality is another important objective of govt. budget as economic disparity is inherent in any economic system which is politically &bsocially undesirable for a healthy nation. In order to curb the economic inequality to a socially acceptable level, fiscal policy play as an effective instrument through which the govt. exercise, with the help of taxation & expenditure, in redistribution of income & wealth in the economy. This helps to bring social & economic justice which is an important element of any welfare state.

Question. Define the term Deficit Financing & state its sources. Ans : It refers to the financing of the budgetary deficits. The sources are expansion in money supply, i.e. the Central Bank may print money equal to the deficit against of treasury bills of the govt., & secondly by borrowing from the public through market loans. It is a very common instrument to finance the deficit if the govt. budget. Usually it is used by the govt. in India, as every year the budgetary deficit is on rise. The deficit financing can be also done by borrowing from the abroad, which may be burdensome in the future. It is used as the best alternative in the less developed countries because in these countries the people cannot be highly taxed.

Question. There has been constant rise in price of sugar overtime. What measure would you support to bring down the prices? Ans. Using measures of budgetary policy, government can try to fix prices at a lower level by incurring expenditure through subsides which would reduce cost of production and hence the prices. If the government does not want to add to its expenditure on subsidies, then it should ensure availability of sugar at reasonable prices through its fair price shops. In the situations of emergency, buffer stocks may also be used.

Question. How can government budget be a useful instrument in reducing inequalities in the distribution of income and wealth? Ans. Government uses budgetary policies to reduce inequalities in the distribution of income and wealth by: i). Imposing new taxes and increasing the rates of existence taxes; ii) Spending more on education, health care and housing for the poor; iii) Strengthening public distribution system(through fair price shops)

Question. What is the relationship between the revenue deficit and the fiscal deficit? Ans. Fiscal deficit is a wider concept than revenue deficit. Revenue deficit is defined as the excess of government’s revenue expenditure over revenue receipt. Thus, Revenue deficit=Revenue expenditure (RE)-Revenue receipt(RR). Where as fiscal deficit is defined as the excess of total expenditure over total receipts excluding borrowings. It does not take into account borrowings. Fiscal deficit= (total budgetary expenditure)-(total budgetary receiptborrowings)