Revenue models: 11 types and how to pick the right one

Finding the right revenue model for your company and products is an incredibly important part of starting and expanding your business. It's a key part of building a brand. Explore popular revenue models and how to choose the right one.

What is a revenue model?

- 11 different types of revenue models

Costs associated with revenue models

- How to choose your revenue model

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

In one of the most famous lines from the 1941 classic Citizen Kane , Mr. Bernstein proclaims: “ It's no trick to make an awful lot of money... if what you want is to do is make a lot of money .” If only that statement were as true as it seemed. It's probably more accurate to say, “There are a lot of ways to make a lot of money.”

That’s particularly true for software businesses, with the rise of the mobile internet stimulating an explosion in the number of viable revenue models. Choosing which revenue model works best for your SaaS business, though, is not easy (even if that's all you want to do is choose a revenue model for your SaaS business). Your choice will help determine your sales strategy , and from there the growth rates, the amount of money you’ll need to invest initially, and the kind of relationship you’re likely to build with your customers. More than that — the choice determines the future of your business. Let’s take a look at some of the most popular revenue models used today — why they’re popular, why they work, and why they will (or won’t) work for you.

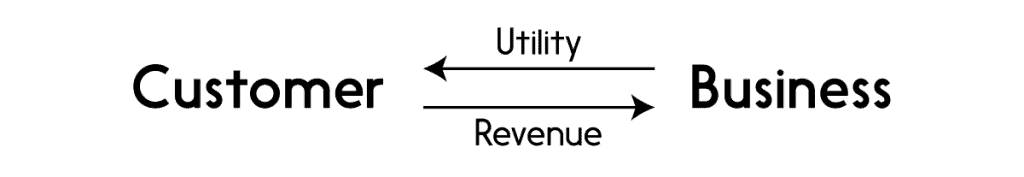

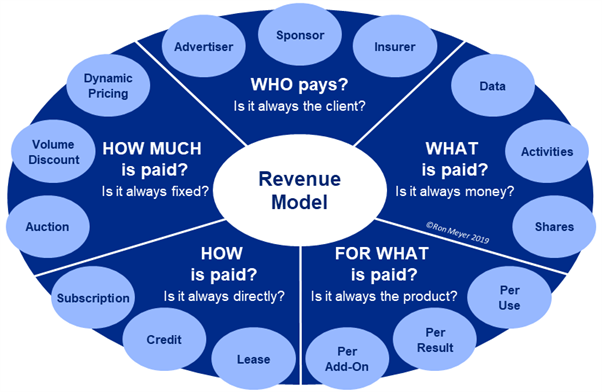

A revenue model is the income generating framework that is part of a company’s business model. Common revenue models include subscription, licensing and markup. The revenue model helps businesses determine their revenue generation strategies such as: which revenue source to prioritize, understanding target customers, and how to price their products.

Revenue models often get conflated with revenue streams, probably because each is a single revenue generation source. They are also confused with business models, of which revenue models are a part. Revenue models help business owners determine how to manage their revenue streams and are required to complete a business model.

Without a considered revenue model, your business will incur costs it cannot sustain. With a revenue model, you can set, track, and forecast business growth based on specific customer segments.

11 different types of revenue models

There is no such thing as a perfect revenue model, but the popularity of some of the methods below suggests that many of them are well-tailored for the current state of the market. Here we’ll walk through each type of revenue model and when they may be most beneficial and applicable.

1. Subscription

The subscription model is the “vanilla” SaaS revenue model, not that there’s anything boring about a well-worked subscription plan. Businesses charge a customer every month or year for use of a product or service. All revenue is deferred and then fulfilled in installments. The subscription model is perhaps the most popular among SaaS companies because of its versatility, promise of recurring revenue , and high value:customer lifetime balance. Done right it's a one-way-ticket to sustainable growth .

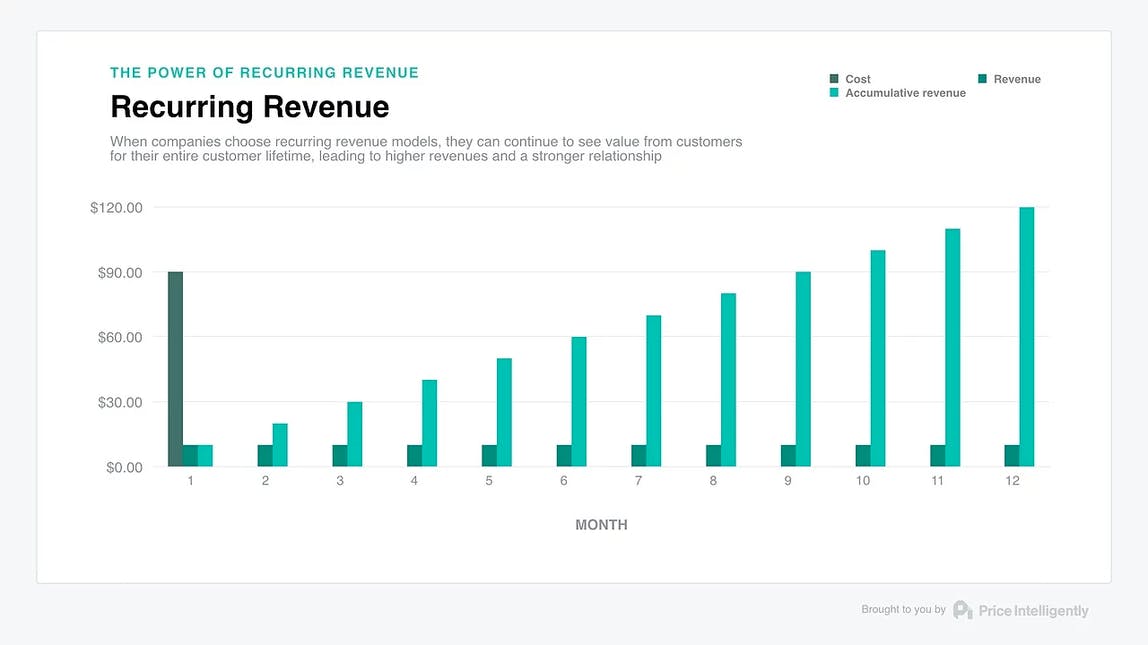

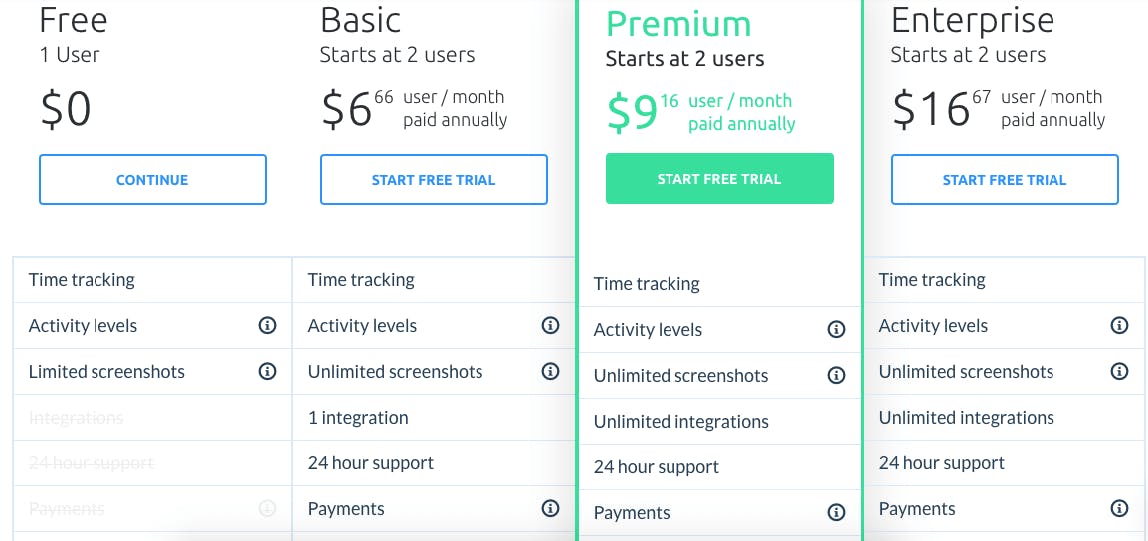

Companies working with recurring revenue models, such as subscription or licensing , see more value from a customer across a given customer lifetime. Being able to offer a variety of value options means your company can respond to more than one set of customer needs, expanding your appeal. Hubstaff’s subscription plan, seen below, is a classic of the genre:

Hubstaff’s various plans are distinct from one another in price and feature. This flexibility in the subscription model means that tentative or lower-budgeted customers can still get what they need, all the while maintaining visibility of what extra they could get for a few dollars more a month.

The freemium model is often described as a subscription revenue model, but in fact it’s an acquisition model, not a revenue model. Freemium involves giving users free access to an app and then selling subscriptions for a premium tier that includes more features.

Markup is a very common revenue model for buyer companies (i.e., companies that buy the products they sell). It’s as simple as can be: Take the cost of goods you just bought, mark it up X%, and make a profit margin on the original purchase. There are various subgenres of the markup model, including the following:

- Wholesale: Sale of goods or merchandise to retailers, business users, or other wholesalers

- Retail: Identification of demand, and satisfaction of it through a supply chain via a number of possible outlets, including physical and ecommercial ones

Markup is particularly used by mediators like ecommerce marketplaces — Amazon, for example. On average, Amazon charges a seller who uses their site 15% of the sale, plus FBA fees (including storage, pick & pack, shipping).

5. Pay-Per-User

One of the most enduring legacies of SaaS in the world of business is the introduction of pay-per-user (PPU). It involves giving a customer potentially unlimited to access to a range of features while charging them only for the services they use. At the dawn of SaaS, as the software required no physical delivery and deployed so quickly and cheaply, PPU appeared to be the most sensible revenue model. However, as natural as it seemed back in the day, pay-per-user is not popular anymore. Ascribing value to your product is one of the key considerations of your revenue model, and that includes demonstrating why it’s worth your target customers’ valuable dollars, not just making everything so cheap and easy that they can’t refuse. The issue with PPU, then, is that it’s rarely where value is ascribed to your product. Moreover, PPU kills your Monthly Active User metric. The per-user metric is not the most useful to customers in terms of deriving value — its take-it-or-leave-it approach actively works against your Daily Active Users number, and thus contributes to your churn rate.

6. Donation

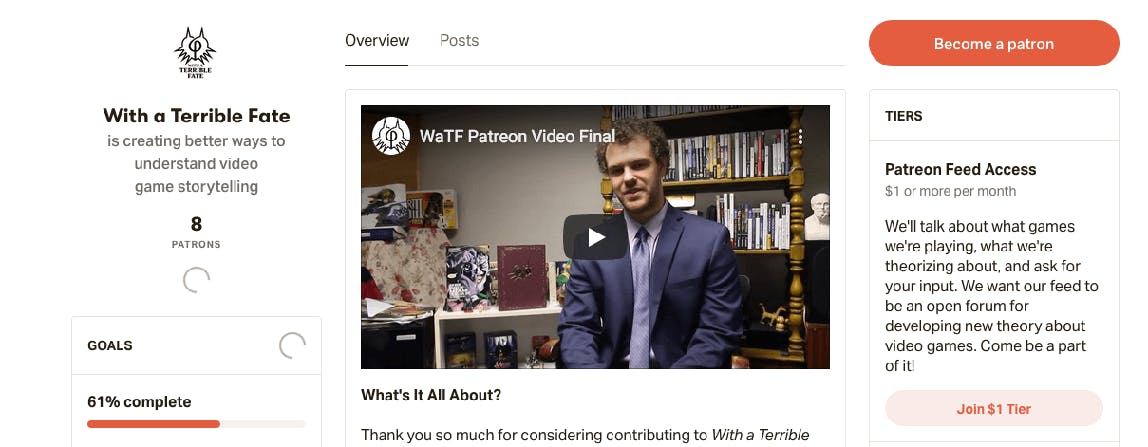

As evidenced by the rise and rise of Kickstarter - and Patreon -based ventures, altruism is, if unpredictable, a pretty effective revenue model by itself. Relying on the donations of regular users is a common revenue model for nonprofits, online media (i.e., YouTubers) and independent news outlets.

7. Affiliate

What is affiliate marketing ? This new, popular model works by promoting referral links to relevant products and collecting commission on any subsequent sales of those products. Leverage your product’s synergy with another product in an adjacent space and you both stand to gain. The affiliate model can be as simple as including in an article an outlink to a book or other product mentioned or offering your customers specialized recommendations relative to purchase history (again, Amazon is a master of this art). Some companies, such as Etsy, even have a specific program for their affiliates, where other companies can earn a commission on qualifying sales that result from featuring links to Etsy products and services. The affiliate revenue model is increasingly popular, owing to the way it dovetails effectively with other revenue models, particularly ad-based models.

8. Arbitrage

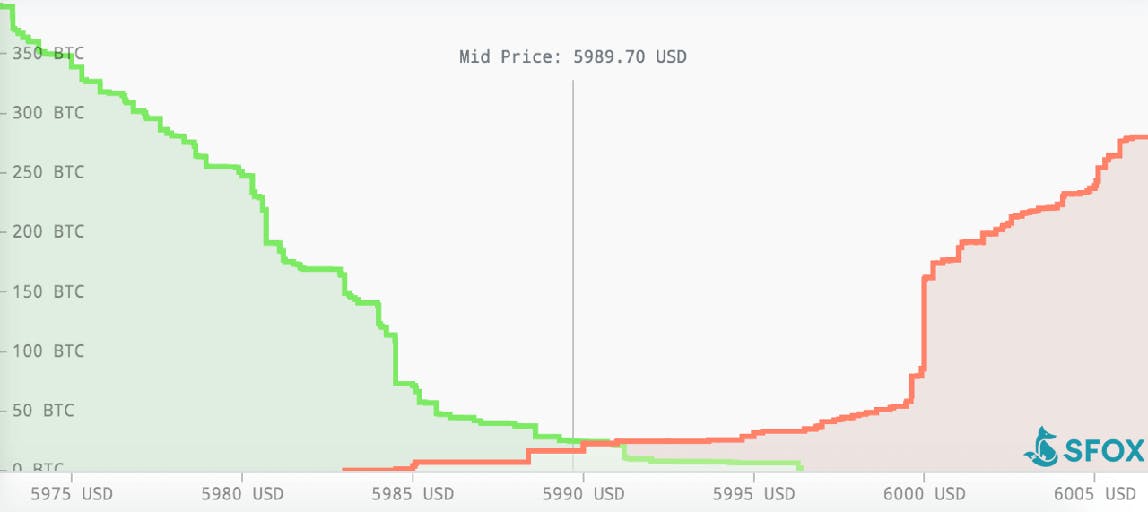

Applicable mainly to sellers or marketplace-oriented companies, the arbitrage revenue model uses the price difference in two different markets of the same good/service to make a profit. You buy in one market (a security/currency/commodity) and simultaneously sell in another market, at a higher price, what you just bought, pocketing the temporary price difference. Arbitrage is popular with affiliate marketers , as well as with many cryptocurrency firms, SFOX being a prime example.

9. Commission

This transactional revenue model involves a middleman charging commission for each transaction it handles between two parties or for any lead it provides to the other party. It’s particularly popular with online marketplaces and aggregators, as well as businesses like independent music distributors. It’s particularly easy to get up and running with a commission-based business model because you’re working off of existing products. However, unless your field is well-conditioned for a monopoly, and unless your company is (or can become) that monopoly, you’ll find the commission model very tough to scale .

10. Data Sales

Ever heard the phrase, “If you can’t see how the money’s made, you’re the product”? That’s data-selling in action. Many companies selling digital goods and services could not exist without core underlying data assets. In the data sale revenue model, this data is sold directly to a consumer or business customer. While certain companies will use data sale as their primary revenue model, the use of data sales to augment another revenue model is virtually ubiquitous. While some are using it as an entrepreneurial venture , it is also the subject of considerable justified public concern and should be handled with care in the event you decide to go with it as your revenue model.

11. Web/Direct Sales

The old-fashioned revenue model made new, web sales and direct sales involve payment for goods or services through a digital medium. Web sales involve a customer finding your product via outbound marketing (or a web search) and can used for software, hardware, and subscription-based offerings. Direct sales revolve around inbound marketing and is good for handling multiple buyers and influencers in big-ticket markets.

A good revenue model is not just about squeezing as much revenue possible out of a sales cycle; it’s also about balancing your ambitions in the market with your resourcing requirements. A startup revenue model may be significantly different than one for an established business because their resources are vastly different. When choosing your model, factoring in costs is paramount to ensure profitability.

Cost of revenue

The first cost you’ll be likely to factor in is your cost of goods — how much it costs to produce the goods or service that you then sell. For hardware, this can comprise testing and manufacture; for software, it’ll include the whole development cycle. Regardless of what you produce, administrative overheads will also apply. You will find cost of goods a considerably less comprehensive metric than cost of revenue, which is the total cost of manufacturing and delivering a product or service to consumers. That includes everything we’ve just covered, plus distribution and marketing costs. Cost of revenue is more often used in SaaS and other service-oriented industries because it makes the many costs incurred outside of production in SaaS easier to track.

Prototyping costs

Prototyping is a fundamental aspect of any production cycle and, unfortunately, is one of the most expensive. While testing prototypes or beta versions of your new product, even the smallest revisions can necessitate costly changes to your production/development process. This usually comprises a base-level cost, plus iteration costs on top of that. When forecasting prototyping costs, it’s wise to plan for several iterations; it’s highly unlikely you’ll get everything right the first time around, especially if your product is innovative or is composed of a number of features.

Equipment costs

One of the beautiful things about being a SaaS company is that there are no production lines to run. Nevertheless, equipment costs still factor into the bottom line. Firmware, app development tools , server rental, plus any other administrative services bought on subscription (e.g. Slack or Hubstaff) will play a part in your equipment costs, but, generally, equipment costs should be the easiest of all to forecast.

Labor costs

An underpaid workforce is an unhappy workforce (if it’s a workforce at all); wage costs come out of your bottom line. Based on the interaction of salary and commission in your compensation plan , as well as the type of commission you offer (entirely open-ended or capped? Will there be accelerators/decelerators involved?), you will have to plan for your expenditure on labor costs differently.

Advertising & marketing costs

Your advertising and marketing costs will be determined by the following:

- The size of your respective advertising and marketing teams

- The scale of exposure you’re shooting for

- Your method of approach to advertising and marketing: undefinedundefinedundefined

Take the headache out of growing your software business

We handle your payments, tax, subscription management and more, so you can focus on growing your software and subscription business.

Your revenue model is unique

So many revenue sources, so many revenue models, so little time. There are some fundamental differences between revenue models. For instance, if you’re a SaaS company producing your own software product, you’re unlikely to get all that far with an arbitrage model. Likewise, if your product is a medium or if you’re a seller, a subscription-based revenue model won’t do the trick. A product with a high ceiling for potential revenue is not best served by a donation model. Nevertheless, the choice of a main revenue model out of the batch that do work for your product, and how you then combine them with appropriate aspects of other models, is yours, and yours only. Your product and the market should be in mind at all times while you’re settling on, adding to, and refining your model. After that, bringing in the revenue itself should be as easy as Citizen Kane said.

Related reading

What Is a Revenue Model?

Published: October 06, 2021

Deciding how you’ll generate revenue is one of the most challenging decisions for a business to make, aside from coming up with what you’ll actually sell.

You want to ensure that you’re accounting for production costs, salaries for workers, what your consumers are willing to pay, and that you generate enough to continue business operations. You also want to make sure that your strategy fits with what you’re trying to sell.

Various revenue models will help you set your business on the right path. In this post, we’ll outline what they are and how to choose the right one for your company.

![revenue model of business plan Download Now: Annual State of RevOps [Free Report]](https://no-cache.hubspot.com/cta/default/53/78dd9e0f-e514-4c88-835a-a8bbff930a4c.png)

What is a revenue model?

A revenue model dictates how a business will charge customers for a product or service to generate revenue. Revenue models prioritize the most effective ways to make money based on what is offered and who pays for it.

Revenue models are not to be confused with pricing models , which is when a business considers the products’ value and target audience to establish the best possible price for what they are selling to maximize profits. Once the pricing strategy is set, the revenue model will dictate how customers pay that price when they purchase.

RevOps teams also use pricing models to predict and forecast revenue for future business planning. Knowing where your money is coming from and how you’ll get it makes it easier to predict how often it will come in.

There are various revenue models that businesses use, and we’ll cover some below.

Types of Revenue Models

Recurring revenue model.

Recurring revenue model , sometimes called the subscription revenue model, generates revenue by charging customers at specific intervals (monthly, quarterly, annually, etc.) for access to a product or service. Businesses using this model are guaranteed to receive payment at each interval so long as customers don’t cancel their plans.

Recurring Revenue Model Example

Businesses that benefit from recurring revenue models are service-based (like providing software), product-based (like subscription boxes), or content-based (like newspapers or streaming services). Businesses you may be familiar with that use this strategy are Spotify, Amazon, and Hello Fresh.

Affiliate Revenue Model

Businesses using affiliate revenue models generate revenue through commission, as they sell items from other retailers on their site or vice versa.

Sellers work with different businesses to advertise and sell their products, tracking transactions with an affiliate link . When someone makes a purchase, the unique link notes the responsible affiliate, and commission is paid.

Affiliate Revenue Model Example

Businesses you may be familiar with that use the affiliate revenue model include Amazon affiliate links and ticket promoting services. Influencers also use this model to advertise products from businesses and entice users to purchase them through custom links.

Advertising Revenue Model

The advertising revenue model involves selling advertising space to other businesses. This space is sought after because the advertiser (who is selling the space) has high traffic and large audiences that the buyer (who is purchasing the space) wants to benefit from to give their business, product, or service visibility.

Advertising Revenue Model Example

Various types of online businesses use this model, like YouTube and Google, and so do traditional outlets like newspapers and magazines.

Sales Revenue Model

The sales revenue model states that you make money by selling goods and services to consumers, online and in person. Therefore, any business that directly sells products and services uses this model.

Sales Revenue Model Example

Clothing stores that only sell their products in a storefront or business-specific retail website use the sales revenue model as they sell directly to consumers with no third-party involvement.

SaaS Revenue Model

The Software as a Service (SaaS) revenue model is similar to the recurring revenue model as users are charged on an interval basis to use software. Businesses using this model focus on customer retention, as revenue is only guaranteed if you keep your customers. The image below is the HubSpot Marketing Hub pricing page that uses the SaaS recurring subscription model pricing.

SaaS Revenue Model Example

Businesses using this revenue model include video conferencing tool Zoom, communication platform Slack, and Adobe Suite.

How to Choose a Revenue Model

Choosing a revenue model is entirely dependent on your specific business needs and your pricing strategy.

There is no one-size-fits-all solution, and some businesses have multiple revenue streams within their revenue model. For example, if you use a recurring revenue model, you still may sell advertising space on your website to other businesses because you have a high-traffic page.

There are some key factors to keep in mind, though:

1. Understand your audience.

When picking a revenue model, the most important thing to remember is the target market and audience your pricing strategy has identified. You want to understand their pain points and what model makes the most sense for charging them.

For example, if you’re a service that sells meal kits, your target audience is likely busy and wants the convenience of food that is set up and easy to make after a long day. Using the recurring revenue model makes sense, as you’ll automatically charge them on an interval basis, and they won’t have to remember to submit payment — speaking directly to their desire for convenience .

2. Understand your product or service.

It’s also essential to have an in-depth understanding of your product or service and how your audience will use it. For example, if you sell shoes, your audience likely won’t need a new pair every month, so it may make sense to go with the Sales Revenue Model. Instead, your customers can come to you directly every time they need a new pair.

Choose the Model That Best Fits Your Needs

Ultimately, choosing a revenue model is centered around understanding what makes the most sense for what you’re selling and what makes the most sense (and will be most convenient) for the audiences you’re targeting.

Take time to develop your pricing strategy, choose a revenue model aligned with it, and begin generating revenue.

Don't forget to share this post!

Related articles.

A Simple Guide to Lean Process Improvement

The Marketer's Guide to Process Mapping

Data Tracking: What Is It and What Are the Best Tools

What is a Data Warehouse? Everything You Need to Know

![revenue model of business plan Why Every Company Needs an Operating Model [+ Steps to Build One]](https://blog.hubspot.com/hubfs/Operating%20Model.webp)

Why Every Company Needs an Operating Model [+ Steps to Build One]

What is Data as a Service (DaaS)?

Data Ingestion: What It Is Plus How And Why Your Business Should Leverage It

Data Mapping: What Is It Plus The Best Techniques and Tools

Marketing vs. Operations: The Battle for a Small Business' Attention

![revenue model of business plan What Is an Enterprise Data Model? [+ Examples]](https://blog.hubspot.com/hubfs/woman%20working%20on%20enterprise%20data%20.jpg)

What Is an Enterprise Data Model? [+ Examples]

Free data that will get your RevOps strategy on the right track.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Revenue Models: 17 Types, Examples & Template [2023]

Revenue Models

How does (or will ) your business make money? It sounds almost too simple to ask, but having a clear understanding of your business' revenue model can be one of the most important ways to focus on key activities--and actually move the needles you care about most.

For indie businesses, settling on the right revenue model type rarely happens on first attempt. Instead, it's common to bounce around from subscriptions to digital products, membership communities and affiliate offerings until something finally *clicks* for you and your business.

This revenue models list component and template is intended to help you sort, consider and rank a list of common revenue models. In future, I'll be linking this table to related marketing channels, real data from other indie businesses and related templates--for now, let's take a quick look at the revenue models listed.

17 Common Revenue Model Examples

- Subscription

- Licensing (Digital Prod.)

- Advertising

- Affiliate Commission

- Project-Based Services

- Retainer-Based Services

- Tickets, Events, Workshops

- Manufacture (D2C)

- Library Access

- Community Access

- Marketplace

1. Subscription

The most common revenue model for SaaS and membership-based businesses. Customers pay a recurring fee, typically on a monthly or yearly basis, in exchange for access to your product or service.

Pros of subscription model

- Recurring revenue is more predictable and can be helpful in forecasting

- Can be a great way to build long-term relationships with customers

- Customers who are paying on a recurring basis are typically more engaged and have a higher lifetime value

Cons of subscription model:

- Can be difficult to acquire customers who are willing to pay a recurring fee

- Can be difficult to increase prices without losing customers

- There is always the risk of churn (customers cancelling their subscription)

The markup revenue model is most common in retail and ecommerce businesses, where goods are bought at wholesale prices and then sold to customers at a higher price.

Pros of markup model:

- Can be easier to get started since you don't need to develop a unique product or service

- There is less risk involved since you're not investing in developing or producing a good or service

- Can be easier to scale since you can simply buy more inventory as needed

Cons of markup model:

- Can be difficult to compete on price alone

- You may need to invest in marketing and branding to differentiate your business

- There can be slim margins if you're not careful with your pricing

3. Licensing (Digital Prod.)

The licensing revenue model is most common for digital products, where customers pay a one-time fee for access to your product.

Pros of licensing model:

- Can be a great way to generate one-time revenue from customers

- Customers who pays for a license typically have a higher perceived value of your product

- Can be easier to scale since you're not selling a physical good or service

Cons of licensing model:

- Can be difficult to acquire customers who are willing to pay a one-time fee

- There is always the risk of piracy (customers sharing your product without paying)

- Can be difficult to upsell customers or generate recurring revenue

4. Advertising

The advertising revenue model is most common for online businesses, where businesses sell advertising space on their website or in their email newsletter.

Pros of advertising model:

- Can be a great way to generate revenue from customers who are not ready to buy your product or service

- Advertising can be a complementary revenue stream to other revenue models

Cons of advertising model:

- Advertising can be disruptive to the user experience

- Advertising rates can fluctuate based on market conditions

- You may need to invest in marketing and branding to attract advertisers

5. Donation

The donation revenue model is most common for non-profit organizations, where customers donate money to support the cause or organization.

Pros of donation model:

- Can be a great way to generate revenue from customers who are passionate about your cause

- Donations are typically tax-deductible for the donor

- There is less pressure to generate revenue since donations are not expected to be recurring

Cons of donation model:

- Can be difficult to acquire customers who are willing to donate money

- May need to invest in marketing and branding to attract donors

- Donations can fluctuate based on economic conditions

6. Affiliate commission

The affiliate commission revenue model is another common for online businesses, where businesses pay a commission to affiliates for referring customers.

Pros of affiliate commission model:

- Can be a great way to generate revenue from customers who are already interested in your content

- Affiliates can provide valuable marketing and promotion for your business

- Can be easier to scale since you're not producing all the products you sell

Cons of affiliate commission model:

- Not always easy to find good affiliate programs

- You may need to invest in marketing and branding to attract affiliates, as well as readers

- Commissions can vary based on affiliate performance

7. Sponsors

The sponsorship revenue model is becoming increasingly common for online creators.

Pros of sponsorship model:

- Can be a great way to generate revenue from businesses or individuals who support your cause

- Sponsors typically have a high perceived value of your organization

Cons of sponsorship model:

- Can be difficult to acquire sponsors who are willing to pay

- May need to invest in marketing and branding to attract sponsors

- Sponsorship can fluctuate based on economic conditions

8. Data Sales

The data sales revenue model is most common for online businesses, where businesses sell data that they have collected.

Pros of data sales model:

- Scale advantages

- Data can be a valuable commodity for businesses

Cons of data sales model:

- Difficult to acquire unique data sets

- Longer sales cycle

- Data rates can fluctuate based on market conditions

9. Project-Based Services

The project-based services revenue model is most common for businesses that provide consulting or other services.

Pros of project-based services model:

- Can be a great way to generate revenue from customers who need your services

- Projects can be customized to the customer's needs

Cons of project-based services model:

- Very hands-on

- Need to keep your pipeline filled

- Projects can fluctuate based on economic conditions

10. Retainer-based services

The retainer-based services revenue model is most common recurring stream for businesses that provide consulting or other services.

Pros of retainer-based services model:

- Can be a good way to introduce recurring revenue to a services business

- Customers typically pay upfront for your services

Cons of retainer-based services model:

- Need to find a service that's profitable on retainer;

- Reducing churn;

- Pricing your retainer.

11. Tickets, Events, Workshops

The ticketing revenue model is most common for businesses that host events or workshops.

Pros of ticketing model:

- Can be a great way to generate revenue from customers who are interested in your event

- Tickets can be sold in advance of the event

- Virtual events and workshops can be easier to scale since you're not selling a physical good or service

Cons of ticketing model:

- Need to consistently market events

- Margins need to be high for it to be sustainable

- Often need to pay staff to help facilitate event

12. Royalties

The royalty revenue model is most common for businesses that sell digital content, such as books, music, or software.

Pros of royalty model:

- Royalties can be collected on a per-sale or per-use basis

- Highly asynchronous

Cons of royalty model:

- Can be difficult to track sales and commissions

- Typically low % commission

- Royalties can be volatile from year to year

13. Manufacture (D2C)

The manufacture model, going direct to customer, is probably the most familiar. You make a product and then sell it to the customer, whether that’s through your own store, a third-party retailer, or some other means.

Pros of Manufacture (D2C)

- You have complete control over your product

- You can build your own brand

- You can reach customers directly

Cons of Manufacture (D2C)

- It can be expensive to get started

- You have to invest in marketing and branding

- You have to manage inventory and shipping

14. Library Access

The library access model is common for businesses that offer digital content, such as books, music, or software. Customers can access your content through a subscription or pay-per-use basis.

Pros of Library Access

- Can reach a wide audience of potential customers

- Can generate revenue from customers who are interested in your content

Cons of Library Access

- Possibility of duplicating digital content without license

- Retaining users after they pay for first access

- Offering a unique library

15. Rent/Lease

The rent/lease revenue model is common for businesses that offer physical goods, such as equipment or vehicles. Customers can rent or lease your products on a short-term basis.

Pros of Rent/Lease

- Can generate revenue from customers who need your equipment

- Can be quite 'Passive' income

- Scalable if margins and demand are high enough

Cons of Rent/Lease

- High expenses upfront

- Potential damages costs

16. Community Access

The community access revenue model is common for businesses that offer physical goods or services. Customers can access your product or service through a subscription or pay-per-use basis.

Pros of Community Access

- Compounding as the community grows

- Plenty of online community software and tech popping up

Cons of Community Access

- Difficult to upgrade to a 'paid tier'

- Community moderation can be time-consuming

- Sustaining high community engagement

17. Marketplace

The marketplace revenue model is common for businesses that offer a platform for other businesses to sell their products or services. Customers can access the marketplace through a subscription or pay-per-use basis.

Pros of Marketplace

- Buyers will typically bring their own customers

- Can generate revenue from both sides of the market: buyers and sellers

- Don't need to produce your own products (beyond the marketplace itself)

Cons of Marketplace

- Quality control can be difficult

- Chicken-egg problem: getting your very first buyers and sellers

- Settling disputes and investing in customer support

Choosing A Revenue Model For Your Business

This Notion template database also includes some properties to help you understand more about the various revenue models listed, and how they compare with one another on a few important factors. These are:

- Volume needed;

- Typical Margins;

- Capital needed upfront;

- Relationship to customer (direct or indirect);

- Scalability;

- Revenue model examples; and

Volume Needed

The volume needed property gives an indication (on a scale from 'Very Low' to 'Very High') of how many customers are typically needed for this type of revenue model to work. For example, a subscription revenue model that charges $1.99/month will need a Very High volume of customers in order for the model to work; whereas a high-ticket services business may only need 1 or 2 big clients per year.

Typical Margins

The typical margins property is there to help you understand how profitable this revenue model can be, given the right circumstances, per sale or customer. For example, a business selling digital products will typically have very high margins (if they are priced correctly), whereas a business that relies on advertising as its primary revenue source may have lower margins.

Capital Needed Upfront

The capital needed upfront column describes (loosely) of how much money you will need to spend in order to get the business up-and-running. For example, a subscription business can be started with very little capital as there are no inventory or product development costs; whereas a manufacturing business may need a lot of money to get started as there are significant inventory and product development costs.

Relationship to Customer (Direct or Indirect)

The relationship to customer property gives an indication of whether the revenue model is direct, indirect or two-sided (e.g. marketplaces). A direct revenue model is one where you have a direct relationship with the customer; whereas an indirect revenue model is one where you do not have a direct relationship with the customer.

For example, a subscription business has a direct relationship with the customer as they are paying the business directly for a product/service; whereas an advertising-based revenue model has an indirect relationship with the customer as they are paying the advertiser, not the business.

Scalability

The scalability property gives an indication of how easy it is to scale this type of revenue model. A scalable revenue model is one that can grow without a significant increase in costs; whereas a non-scalable business is one that has fixed costs which limit its growth.

For example, a subscription business is usually more scalable than a manufacturing business as there are no inventory or product development costs; whereas a business that relies on a small number of high-value clients is usually less scalable as it is difficult for you to service more such clients with the same number of hours in a day.

Revenue Model Examples

This column provides an example of a real business that is deploying this revenue model. I've tried to select primarily indie businesses, however this isn't the case for all of the businesses listed (where I couldn't find an indie business, I chose something that may be relevant or a company that I just generally like).

It's also worth noting that many of the businesses listed under a certain revenue model type employ multiple revenue models, alongside the stream that they're listed under. This is quite common for indie businesses (to have multiple revenue streams) and can be a good hedge against any single revenue stream going dry.

As you look through the list of possible revenue models, you can give each a ranking and sort the list based on those that are best suited.

Getting Started

Duplicate this template into your own Notion workspace, and start ranking the various revenue models as they suit your own business, today.

.png)

Level up your Notion workspace, today⚡

"By far the most comprehensive Notion for business templates I've come across."

Components Library

Landmark All Access

All Access: Annual

Landmark Lifetime Access

%20(1).png)

Hey there! Free trials are available for Standard and Essentials plans. Start for free today.

Try Mailchimp risk-free with a 1-month trial. Start for free today .

Maximizing Profitability: Explore Effective Revenue Models for Your Business

Choosing the right revenue model can help you earn more and create an effective pricing strategy. Explore the different types of revenue models here.

Imagine you're walking down the street on a hot summer day and see the neighborhood kids setting up a lemonade stand. Nothing sounds better on a day like this than an ice-cold lemonade. You approach their stand and find the price is $2 for a cup. While you know it wouldn't cost $2 to make just a glass of lemonade at home, you are willing to pay this price because you are thirsty and also want to support the kids.

From a business perspective, these kids are making a good amount of profit from their lemonade stand. They're actually using a markup revenue model where they increase the price of a cup of lemonade to account for their operating costs. It seems like the perfect model for making money. However, this might not be the case in every business situation. Depending on the scale and complexity of your business model , you need to consider different methods of developing revenue streams.

There are various revenue models implemented by businesses across the board. Many business models are far more complex than a simple lemonade stand and thus require a different revenue model strategy. There are subscription-based, advertising, and commission-based models, to name a few—but what is a revenue model, and how do you choose one?

If you're considering which revenue model to incorporate into your business strategy, keep reading to learn more.

What is a revenue model?

A revenue model is a blueprint for how a company produces income from its services or products. Simply put, it outlines the methods through which a business makes money. There are several components within a revenue model, including how you price your products and which sales channels you choose. A revenue model is established to answer how a company plans to financially optimize its business model.

Revenue models can be seen as roadmaps for understanding how your business will operate financially. They define how a company generates revenue, covers costs, and eventually turns a profit. A revenue model should outline the various sources of income to help guide decision-making related to the overall business strategy.

Benefits of implementing revenue models

Developing a revenue model is an essential step for growing your business. Here are some of the main benefits of implementing revenue models:

Financial sustainability

An effective revenue model establishes consistent income streams, providing financial security and sustainability. Your revenue model should help you understand how much revenue to expect so you can properly plan expenses, growth, and investments.

Pricing strategy

Factors such as market demand, competition, and product costs are considered within a revenue model. Each of these factors can inform your pricing strategy. Based on the revenue model, you can determine which prices maximize revenue while remaining appealing to customers.

Profitability analysis

Revenue models show how your business generates revenue. Understanding the costs incurred by creating your products or services, along with the generated revenue, allows you to analyze the profit margin of your business. Subsequently, you can make informed decisions to improve your resource allocation and pricing strategy.

Scalability

Growth is key to your business revenue model thriving. Implementing a revenue model provides insight into the scalability potential of your business. You can easily assess potential revenue growth by attracting more customers and introducing new products or services. Knowledge is power—the more information you have about how your business operates, the better you can plan for the future and make smarter investments.

Decision-making

A sound revenue model produces meaningful insights to influence strategic decision-making. Your revenue model indicates which products or services generate the highest income, enabling you to better allocate resources and focus on areas with the highest profitability potential.

Investor confidence

A smart revenue model will inspire investor and stakeholder confidence. Potential investors will be impressed by a well-defined revenue model that demonstrates a clear plan for generating multiple revenue streams.

Types of revenue models

There are various revenue models that can be implemented based on your specific business operations and needs. Understanding when and how to choose different types of revenue models will help you better calculate revenue growth rates.

Here are just a few revenue model examples:

Advertisement-based

An advertising revenue model is a popular type of revenue model. The main source of income is generated by displaying advertisements. In this model, your company sells advertising space to other businesses or brands who want to advertise with your customer base and users. How your business earns revenue is by charging advertisers for ad placements.

Pros of advertising-based revenue models

- Successful advertisement-based revenue models typically generate significant income.

- An advertising model can greatly boost revenue streams if you have a large user base or a popular platform.

- There's a low barrier to entry, meaning it's relatively easy to set up and requires minimal investment upfront.

- This revenue model also offers flexibility and opportunities for diversification since you can provide many ad types and have a full roster of advertisers.

Cons of advertising-based revenue models

- Advertisers aren't guaranteed.

- You need to attract advertisers who are willing to pay for placements on your platform.

- The advertising market constantly fluctuates, meaning your revenue may fluctuate whenever advertisers reduce their budgets and don't buy ad space.

- You must also consider user experience and how incorporating display ads will impact your engagement.

YouTube is well-known for using an advertising model. Content creators on the platform can monetize their content by displaying ads on their videos. YouTube earns revenue by selling advertising space to companies that want to reach a vast audience. In this case, content creators can also receive a share of the ad revenue based on several metrics, including clicks, view time, and impressions.

The affiliate model is a more common type of revenue model. It's where a company or person makes a profit by promoting and selling products on behalf of another business. In the affiliate revenue model, an affiliate acts as the middleman between potential customers and the products or services.

Pros of affiliate revenue models

- Affiliate models are generally low-risk and cost-effective.

- As an affiliate, you don't need to create your own products, nor do you handle inventory or customer segments.

- It offers the potential for passive income by earning commissions without active involvement.

- You can also generate income from various affiliate partners, making this model great for diversification and scalability.

Cons of affiliate revenue models

- As an affiliate, you have little to no control over the products or services you promote. This means that negative customer experiences may harm your reputation.

- This type of model also creates revenue dependence on partners.

- Generating a profit with affiliate marketing may be easy, but intense competition and market saturation can make it difficult to generate significant income.

Affiliate marketing is a common revenue model. Amazon Associates is an example of an affiliate revenue model that allows individuals or businesses to make money through commissions on Amazon products they promote. Amazon provides unique affiliate links that lead to participants earning a percentage of the sales on products they advertise.

Commission-based

Similar to the affiliate model, commission-based revenue models allow companies to generate revenue by receiving a commission from each transaction it facilitates. Again, the company acts as a mediator between sellers and buyers.

Pros of commission-based revenue models

- The commission-based revenue model can be extremely scalable.

- The more users you gain, the more transactions will occur, leading to an increase in revenue growth.

- Another benefit of this model type is risk-sharing between the company and the sellers.

Cons of commission-based revenue models

- One of the major downsides to this model is dependency on transaction volume. If there are few transactions happening, the opportunities for generating revenue significantly decrease.

- You'll also experience limited control over pricing, which can lead to price competition among sellers and lower commission rates.

Airbnb uses a commission-based model. The platform makes money by connecting individuals with accommodation. Airbnb earns a commission on every booking made on the platform, making the company reliant on users securing lodging through their platform in order to generate revenue.

Another popular revenue model is donation-based. This strategy is implemented by soliciting and accepting voluntary donations instead of selling services or products.

Pros of donation revenue models

- One of the main benefits of a donation revenue model is the flexibility of revenue generation.

- Organizations can receive revenue streams from diverse donors.

- It's one of the most common revenue models implemented by charitable organizations and comes with tax benefits.

Cons of donation revenue models

- The downside of relying on donations is having an unsteady and uncertain revenue stream.

- Organizations are dependent on donors and are also required to spend money and time on fundraising.

- There are certain stipulations associated with receiving donations and how that money can be used

The Red Cross uses a donation revenue model. As a global humanitarian organization, the Red Cross relies on voluntary contributions to fund its services and programs. The Red Cross doesn't sell products, but they provide services for the community. The donation model is used to support the execution of these services.

The markup model entails a pricing strategy of marking up the cost or adding a margin on top to ensure financial viability. This strategy is used to cover expenses and generate profit despite external factors.

Pros of markup revenue models

- A markup revenue model is simple in practice.

- It doesn't require complex calculations and ensures the profit calculation is straightforward and transparent.

- The markup model also offers flexibility in pricing, meaning businesses can adjust the markup percentage depending on market conditions, supply, competition, and more.

Cons of markup revenue models

- The markup model can be difficult to implement in competitive markets.

- Competing while maintaining profit margins can be challenging when competitors implement aggressive pricing.

The retail industry generally relies on the markup model. There are specific production costs associated with making a pair of shoes. Retailers typically purchase the shoes from wholesalers at a fixed price. Then, they add a markup percentage to determine the selling price so it covers operating expenses and allows the retailer to earn money.

An interest revenue model refers to businesses generating income by earning interest. In this case, companies are making money by leveraging interest rates rather than making direct sales.

Pros of interest revenue models

- Interest models allow companies to earn passive income and diversify their revenue streams.

- This revenue model is also highly scalable and can benefit from changes in interest rates, leading to enhanced earning potential.

Cons of interest revenue models

- There's a level of risk associated with the interest revenue model. Risks include borrowers defaulting on loans, interest rate fluctuations, regulatory and compliance laws, and intense market competition.

Credit card companies use the interest operating model. They lend money to borrowers and earn interest back based on interest rates. These companies manage credit and loan portfolios while taking advantage of interest rates to increase profitability.

Subscription

A subscription revenue model relies on customers who subscribe and pay for your products or services. Customers pay fees to access the company's collection of products or services, allowing for steady revenue sources. The subscription-based revenue model allows a company to generate revenue by offering long-term subscriptions, resulting in consistent income such as monthly recurring revenue .

Pros of subscription revenue models

- The subscription model provides a reliable and predictable revenue stream.

- Customers pay in regular installments, allowing businesses to easily forecast finances.

- This revenue model also promotes customer retention and loyalty while lending itself to upselling and cross-selling opportunities.

Cons of subscription revenue models

- Acquiring customers with the subscription model can be challenging, meaning you may need to spend more time and money on marketing and sales.

- Customers can also cancel their subscriptions, leading to an increase in customer turnover.

Netflix is one of the most popular subscription revenue model examples. Users pay a monthly fee to access the streaming platform. Revenue generation results from monthly subscriptions. Not all subscription models are successful, but Netflix is the best example of how a subscription model can succeed in making money.

Which revenue model is right for you?

Choosing which revenue model is right for your business will depend on a variety of factors, such as your target audience, operating costs, and overall business model.

The first step for choosing a revenue model is to understand your market and the needs of your target audience. For example, media organizations will have different audiences than healthcare companies. Conduct market research to understand your customers and their needs, preferences, and pain points. These findings will inform your business strategy and how you decide to conduct business operations.

The next step is to specify your value proposition by clearly defining the unique value of your product or service. Identify key benefits and determine what sets your business apart from the competition. Consider how your business performs in terms of innovation, convenience, and quality. Communicating these benefits clearly and concisely enables your target customers to connect with your company.

Know your product or service inside-out. Understanding how your product functions, what it offers to target customers, and what your mission is will help you determine your company's business model. The ultimate goal is to generate revenue, so the more you understand your product or service, the better you can make sound business decisions.

There are several common revenue models to choose from. Online businesses, such as an e-commerce platform, might consider an advertising revenue model to diversify income streams. A local bakery may opt for other revenue models more suitable for their needs and production model. Select a revenue model after thorough research and consideration to ensure a steady and effective revenue stream.

Grow your profits with the right revenue model

Business models rely on generating income. The best way to grow your profits is to choose a revenue model that fits your company's unique needs. A company's revenue streams are dependent on more than just direct sales. Make sure to consider all different revenue model types when developing your strategy. A smart strategy is essential for a scalable business .

Whether you're just getting started or considering a switch in your revenue model, you can land more sales by leveraging market insights . Unlock your full earning potential by exploring the different tools and resources available for choosing a revenue model and growing your business. Rely on actionable data to make informed business decisions and hit your targets.

- What Is a Revenue Model and Why Does It Matter?

by William Lieberman | Feb 20, 2024 | Financial Strategy

Your company’s revenue model affects every aspect of your business, including growth, scalability, and value. Whether contemplating a change or selecting a model for the first time, thoughtful planning is critical. As a fractional CFO , I have helped many CEOs choose and refine their revenue models. I will explain what a revenue model is, how it impacts your business, and how to change it when needed.

What is a Revenue Model?

A revenue model is a framework that clarifies how your business will provide or sell its goods or services to generate income. For instance, many software providers use subscription-based revenue models with tiered pricing for individual and corporate subscribers.

The best types of revenue models often involve recurring revenue streams. Businesses with such models are more sustainable and less stressful than those relying on one-time sales. Yet, there is room for creativity, such as mixing and matching models to achieve your goals. For instance, software providers might combine subscription revenue models with one-time implementation services for corporate clients.

Why Does Your Revenue Model Matter?

Your revenue model is critical to your overall business model, the blueprint for running your organization and consistently delivering value to its stakeholders. Besides affecting your longevity, it impacts your cash flow, how others (like lenders or investors) perceive your company’s worth , your ability to plan, and how you market and sell. Therefore, performing market research before selecting a model and revisiting it occasionally is essential to ensure it is appropriate for your needs.

How Revenue Models Impact Planning

Once you choose a revenue model, you can develop other business model aspects, such as your cost structure, pricing strategy, objectives, target customers, and marketing and sales. Then, you can use that insight to build a financial model to analyze cash flow.

If the model shows you will earn a profit within a reasonable timeframe, great. But if you learn that you will likely experience cash-flow issues, your revenue model and cost structure may be incompatible, and you must rethink your plans.

How Models Affect Execution

Another thing to keep in mind is that your revenue model will influence foundational aspects of your business. It affects your marketing materials, the structure of your contracts, invoicing, collection practices, and even compensation packages. It will also help you establish key performance indicators (KPIs) for tracking and reporting results.

In other words, it touches everything. It provides vital information for coordinating efforts and impacts your ability to secure funding or explore opportunities like partnerships or acquisitions. Your revenue model of choice becomes core to how you present yourself as a business.

4 Common Types of Revenue Models

Below are some common revenue model examples grouped by similar characteristics. But please remember that this is just a sampling, and each approach has pros and cons, so the trick is to create the right mix for your environment.

1. Pay-Per-Use Models

Sometimes referred to as transaction revenue models or sales revenue models, pay-per-use involves direct sales to end customers with no guarantee of repeat business.

With some pay-per-use models, vendors determine price by taking the cost of the product or service and adding a margin. Then, they adjust in response to supply and demand trends. That can result in shallow profit margins and unreliable revenue, making this model less stable. Common examples include:

- Markup Revenue Models

- E-commerce Revenue Models

In contrast, sometimes vendors set prices based on the value (or perceived value) of their products and services. They may provide a luxury shopping experience, a superior product, or specialized knowledge or skills. When that is the case, profit margins are more generous. Examples include those above, plus:

- Project-Based Revenue Models

- Commission Revenue Models

Vendors using pay-per-use models typically generate more income in other ways to create stability. Common tactics include upselling, offering complimentary products or services, or encouraging loyalty by making buying easier (i.e., Amazon Prime’s free shipping).

2. Recurring Revenue Models

Any model that delivers a predictable source of income could fall in the recurring revenue category. Investors and lenders prefer these models, but they often involve high upfront costs, so you must be able to show that your cost structure is sound. Getting funding could help you float that investment until you generate revenue, but you need a clear path to a return on the investment. These models include:

- Subscription Revenue Models Customers pay a set fee every month or year. The subscription approach appeals to customers because fees are usually relatively low, and there is less commitment, while sellers like them because of the predictable income stream. Software as a Service (SaaS) revenue models typically fall under this category.

- Consulting Models Many consultants offer services on a retainer basis (a set number of hours or deliverables for a monthly fee). Such arrangements are mutually beneficial. Providers get a steady income, and customers get valuable skills while keeping their headcount low. Like the employer/employee relationship, finding the right fit isn’t easy, but once you do, these arrangements can work well for quite some time.

The trick with recurring revenue models is to make your product “sticky,” so customers stick around, even if their usage ebbs and flows. For instance, one way to make a product sticky is to make the customer’s life increasingly easier, so switching to a competitor is no longer appealing.

3. Advertising Revenue Models

The advertising revenue model often supports news and entertainment-related content and has done so since well before the age of digital media. Content providers sell space to advertisers who want access to their audience in whatever venue they control – streaming services, movie theaters, websites, YouTube, search engines, podcasts, billboards, etc. These models include:

- Pay-Per-Click, View, or Impression Revenue Models Display advertising, where you earn fees based on viewer behavior.

- Affiliate Revenue Models Content providers earn commissions for personally promoting products.

The advertising model is great because you can earn money purely from giving others access to your audience. But first, you must build that audience and earn (and maintain ) their trust. That typically means a significant investment in educational, informative, or entertaining content and a commitment to strict standards.

4. Passive Revenue Models

Another type of revenue model involves creating or acquiring something valuable and allowing others to use or buy it indefinitely. It’s a “passive” revenue model because once you invest, the result is mostly margin, but there will likely be ongoing costs for upkeep. Therefore, like every revenue model, ensure you understand precisely how the business operates before diving in. These models include:

- Royalty Revenue Models Income from the use of intellectual property (manuscripts, designs, or formulas for which you have a copyright, patent, or trademark).

- Digital Product Revenue Models Create courses, eBooks, apps, etc., once, then sell them for as long as you like.

- Membership Revenue Models Provide access to communities, resources, and exclusive opportunities for a fee.

- Rental Revenue Models Buy property, then charge others for using the space.

How to Change Your Revenue Model

Changing your revenue model isn’t easy because it is integral to many aspects of your business, but sometimes it is necessary. For example, perhaps you want to offer new products or services. Or maybe your current model has become less profitable due to technological advancements or customer sentiment changes. When that happens, explore options and develop plans by asking yourself the following questions.

1. Why do we want to make a change?

How will changing your revenue model affect your business? Will it make selling your products or services easier, help you manage costs better, create a new revenue stream, or something else? Consider the risks and opportunities, capture them in writing, and ensure team alignment.

2. How does the proposed approach compare to what our competitors are doing?

Would the change bring you up to speed with what your competitors are doing? If so, it may be unavoidable. If, however, you are considering something unique, you must weigh the costs and benefits. It might become a valuable differentiator, but it could also make it harder to compete in certain situations.

3. What will our customers think of the change?

Will it make your customers’ lives easier, or will they need to adjust their behavior or incur extra costs? Naturally, the latter scenarios are less appealing. If you are unsure how they will respond, consider running surveys so you can make an informed decision.

4. How would external stakeholders (like investors or lenders) view the model?

Sometimes, a change of this nature will result in customer attrition, but you might be ok with that if it will make your company more valuable in the long run. Resurface the financial model we discussed earlier and rerun the numbers to ensure you can defend any proposed changes when speaking with stakeholders.

5. What steps must we take to adopt a new revenue model?

Some changes are simple. For instance, adding a premium offering to your subscription-based service may be manageable, requiring little more than tweaks to your solution, new marketing materials, and small billing changes. However, shifting from a cloud-based to an on-premise solution is likely another ballgame. Still, it might be worthwhile if it will make your business stronger financially.

The Bottom Line

Choosing a revenue model for your business is a big decision with lasting effects, so you are right to be cautious. It impacts every aspect of your organization and its future opportunities. If you would like to discuss your unique situation, please reach out , and I would be happy to talk.

Related Posts

Mr. Lieberman is the founder and CEO of The CEO’s Right Hand, Inc., a New York-based consulting services firm that provides the full breadth of strategic, financial and operational advice to founders, CEOs and Executive Teams. As an experienced entrepreneur himself, he has served in various C-suite leadership and advisory roles across a wide spectrum of industries.

His first venture was CMR Technologies, a FinTech company based in San Francisco serving the investment management consulting space. From CMR, Mr. Lieberman formed Xtiva Financial Systems, a software company specializing in sales compensation solutions for the financial services industry. Mr. Lieberman served as Xtiva’s CEO, building the company to over $10 million in revenues and 100+ clients. He also served as the President and CFO for Interactive Donor, a New York-based Benefit Corporation which incentivizes charity through rewards.

Mr. Lieberman holds double Masters degrees, one in Business Administration and the other in Computer Science from the University of California at Los Angeles. He completed his Bachelors in Computer Engineering from the University of California at San Diego.

Contact William Lieberman [email protected] 646-277-8728

Recent Posts

- 3 Tips for Choosing and Implementing Professional Services Software

- What is Workplace Culture and Why Every CEO Should Care

- How to Read an Income Statement for a Service Company

- How to Minimize Inefficiencies in Your Real Estate Business

- How to Avoid Goal-Setting Mistakes as a Financial Services CEO

Financial Infrastructure 360°™

Learn the 5 key components of solid financial infrastructure with Financial Infrastructure 360°—our proprietary framework to assess and improve every aspect of your finance function.

Are you ready to get back to running your business?

The CEO’s Right Hand takes charge of your finance, accounting, human resources, and other foundational functions so you can focus on what you do best – running your company. We then arm you with reliable data so you can make confident and timely business decisions.

Fill out the form to get in touch. One of our team members will contact you within one business day.

- Company Profiles

How Companies Make Money

Learn to understand a company's profit-making plan

- Search Search Please fill out this field.

What Is a Business Model?

Understanding business models, evaluating successful business models, how to create a business model.

- Business Model FAQs

The Bottom Line

:max_bytes(150000):strip_icc():format(webp)/picture-53711-1421794744-5bfc2a9246e0fb005119864b.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

The term business model refers to a company's plan for making a profit . It identifies the products or services the business plans to sell, its identified target market , and any anticipated expenses . Business models are important for both new and established businesses. They help new, developing companies attract investment, recruit talent, and motivate management and staff.

Established businesses should regularly update their business model or they'll fail to anticipate trends and challenges ahead. Business models also help investors evaluate companies that interest them and employees understand the future of a company they may aspire to join.

Key Takeaways

- A business model is a company's core strategy for profitably doing business.

- Models generally include information like products or services the business plans to sell, target markets, and any anticipated expenses.

- There are dozens of types of business models including retailers, manufacturers, fee-for-service, or freemium providers.

- The two levers of a business model are pricing and costs.

- When evaluating a business model as an investor, consider whether the product being offered matches a true need in the market.

Investopedia / Laura Porter

A business model is a high-level plan for profitably operating a business in a specific marketplace. A primary component of the business model is the value proposition . This is a description of the goods or services that a company offers and why they are desirable to customers or clients, ideally stated in a way that differentiates the product or service from its competitors.

A new enterprise's business model should also cover projected startup costs and financing sources, the target customer base for the business, marketing strategy , a review of the competition, and projections of revenues and expenses. The plan may also define opportunities in which the business can partner with other established companies. For example, the business model for an advertising business may identify benefits from an arrangement for referrals to and from a printing company.

Successful businesses have business models that allow them to fulfill client needs at a competitive price and a sustainable cost. Over time, many businesses revise their business models from time to time to reflect changing business environments and market demands .

When evaluating a company as a possible investment, the investor should find out exactly how it makes its money. This means looking through the company's business model. Admittedly, the business model may not tell you everything about a company's prospects. But the investor who understands the business model can make better sense of the financial data.

A common mistake many companies make when they create their business models is to underestimate the costs of funding the business until it becomes profitable. Counting costs to the introduction of a product is not enough. A company has to keep the business running until its revenues exceed its expenses.

One way analysts and investors evaluate the success of a business model is by looking at the company's gross profit . Gross profit is a company's total revenue minus the cost of goods sold (COGS). Comparing a company's gross profit to that of its main competitor or its industry sheds light on the efficiency and effectiveness of its business model. Gross profit alone can be misleading, however. Analysts also want to see cash flow or net income . That is gross profit minus operating expenses and is an indication of just how much real profit the business is generating.

The two primary levers of a company's business model are pricing and costs. A company can raise prices, and it can find inventory at reduced costs. Both actions increase gross profit. Many analysts consider gross profit to be more important in evaluating a business plan. A good gross profit suggests a sound business plan. If expenses are out of control, the management team could be at fault, and the problems are correctable. As this suggests, many analysts believe that companies that run on the best business models can run themselves.

When evaluating a company as a possible investment, find out exactly how it makes its money (not just what it sells but how it sells it). That's the company's business model.

Types of Business Models

There are as many types of business models as there are types of business. For instance, direct sales, franchising , advertising-based, and brick-and-mortar stores are all examples of traditional business models. There are hybrid models as well, such as businesses that combine internet retail with brick-and-mortar stores or with sporting organizations like the NBA .

Below are some common types of business models; note that the examples given may fall into multiple categories.

One of the more common business models most people interact with regularly is the retailer model. A retailer is the last entity along a supply chain. They often buy finished goods from manufacturers or distributors and interface directly with customers.

Example: Costco Wholesale

Manufacturer

A manufacturer is responsible for sourcing raw materials and producing finished products by leveraging internal labor, machinery, and equipment. A manufacturer may make custom goods or highly replicated, mass produced products. A manufacturer can also sell goods to distributors, retailers, or directly to customers.

Example: Ford Motor Company

Fee-for-Service

Instead of selling products, fee-for-service business models are centered around labor and providing services. A fee-for-service business model may charge by an hourly rate or a fixed cost for a specific agreement. Fee-for-service companies are often specialized, offering insight that may not be common knowledge or may require specific training.

Example: DLA Piper LLP

Subscription

Subscription-based business models strive to attract clients in the hopes of luring them into long-time, loyal patrons. This is done by offering a product that requires ongoing payment, usually in return for a fixed duration of benefit. Though largely offered by digital companies for access to software, subscription business models are also popular for physical goods such as monthly reoccurring agriculture/produce subscription box deliveries.

Example: Spotify

Freemium business models attract customers by introducing them to basic, limited-scope products. Then, with the client using their service, the company attempts to convert them to a more premium, advance product that requires payment. Although a customer may theoretically stay on freemium forever, a company tries to show the benefit of what becoming an upgraded member can hold.

Example: LinkedIn/LinkedIn Premium

Some companies can reside within multiple business model types at the same time for the same product. For example, Spotify (a subscription-based model) also offers a free version and a premium version.

If a company is concerned about the cost of attracting a single customer, it may attempt to bundle products to sell multiple goods to a single client. Bundling capitalizes on existing customers by attempting to sell them different products. This can be incentivized by offering pricing discounts for buying multiple products.

Example: AT&T

Marketplace

Marketplaces are somewhat straight-forward: in exchange for hosting a platform for business to be conducted, the marketplace receives compensation. Although transactions could occur without a marketplace, this business model attempts to make transacting easier, safer, and faster.

Example: eBay

Affiliate business models are based on marketing and the broad reach of a specific entity or person's platform. Companies pay an entity to promote a good, and that entity often receives compensation in exchange for their promotion. That compensation may be a fixed payment, a percentage of sales derived from their promotion, or both.

Example: social media influencers such as Lele Pons, Zach King, or Chiara Ferragni.

Razor Blade

Aptly named after the product that invented the model, this business model aims to sell a durable product below cost to then generate high-margin sales of a disposable component of that product. Also referred to as the "razor and blade model", razor blade companies may give away expensive blade handles with the premise that consumers need to continually buy razor blades in the long run.

Example: HP (printers and ink)

"Tying" is an illegal razor blade model strategy that requires the purchase of an unrelated good prior to being able to buy a different (and often required) good. For example, imagine Gillette released a line of lotion and required all customers to buy three bottles before they were allowed to purchase disposable razor blades.

Reverse Razor Blade

Instead of relying on high-margin companion products, a reverse razor blade business model tries to sell a high-margin product upfront. Then, to use the product, low or free companion products are provided. This model aims to promote that upfront sale, as further use of the product is not highly profitable.

Example: Apple (iPhones + applications)

The franchise business model leverages existing business plans to expand and reproduce a company at a different location. Often food, hardware, or fitness companies, franchisers work with incoming franchisees to finance the business, promote the new location, and oversee operations. In return, the franchisor receives a percentage of earnings from the franchisee.

Example: Domino's Pizza

Pay-As-You-Go

Instead of charging a fixed fee, some companies may implement a pay-as-you-go business model where the amount charged depends on how much of the product or service was used. The company may charge a fixed fee for offering the service in addition to an amount that changes each month based on what was consumed.

Example: Utility companies

A brokerage business model connects buyers and sellers without directly selling a good themselves. Brokerage companies often receive a percentage of the amount paid when a deal is finalized. Most common in real estate, brokers are also prominent in construction/development or freight.

Example: ReMax

There is no "one size fits all" when making a business model. Different professionals may suggest taking different steps when creating a business and planning your business model. Here are some broad steps one can take to create their plan:

- Identify your audience. Most business model plans will start with either defining the problem or identifying your audience and target market . A strong business model will understand who you are trying to target so you can craft your product, messaging, and approach to connecting with that audience.

- Define the problem. In addition to understanding your audience, you must know what problem you are trying to solve. A hardware company sells products for home repairs. A restaurant feeds the community. Without a problem or a need, your business may struggle to find its footing if there isn't a demand for your services or products.