- Conference Schedule

- Register now

- Member Universities

- Future events

- Past events

- Degree awarding courses

- Modules, Options, or Electives within degree awarding courses

- Executive Education and other non-degree awarding courses

Doctor in Philosophy (DPhil/PhD) in Sustainable Finance topics

Course overview

Each year the Oxford Sustainable Finance Programme supervises or co-supervises Doctor of Philosophy (DPhil/PhD) students on sustainable finance topics.

Students apply to the DPhil in Geography and the Environment at the University of Oxford. The DPhil is the University of Oxford’s premier research degree, awarded to candidates who have successfully completed a major piece of original research. The course provides support and an intellectual environment to pursue your own independent research.

Course structure and content

The DPhil is offered as either a full-time three- to four-year degree, or a part-time six- to eight-year degree. Currently the expected contact time for the part-time arrangement is thirty days at Oxford per year; the majority of this will take place across the three eight-week terms and will include supervision meetings and core research training.

Teaching and assessment

The DPhil is an advanced research degree which is awarded on the basis of a thesis and oral examination (assessment of other work is not taken into consideration). The thesis should represent a significant and substantial piece of research which is conveyed in a lucid and scholarly manner which shows that you have a good general knowledge of the field of your thesis. You are required to work independently, to take the initiative in exploring a line of research and to acquire new skills in order to carry out your research. You will be allocated a supervisor who will meet with you at specifically agreed times and will agree with you a research plan and programme of work and to establish clear academic expectations and milestones.

Entry requirements, fees and application

Degree-level qualifications

As a minimum, applicants should hold or be predicted to achieve the equivalent of the following UK qualifications:

- a master’s degree with distinction (or a distinction grade on the dissertation, as a minimum) in geography or a related environmental field, and

- a first-class or strong upper second-class undergraduate degree with honours in any discipline.

For applicants with a degree from the USA, the minimum GPA sought is 3.7 out of 4.0.

You are encouraged to look at the department lists of potential supervisors and topics before writing your research proposal and to approach specific supervisors directly to discuss your research proposal before applying.

Career opportunities

Many graduates are commanding influential positions in multinational corporations, in national, state and international government, in non-governmental organisations, and by continuing with further research.

For course related inquiries please contact:

Course Features

- Host Institution University of Oxford

- Department / Institute School of Geography and the Environment

- Course Name Doctor in Philosophy (DPhil/PhD) in Sustainable Finance topics

- Course Type Degree program

- Course Mode Full time or part time

- Location Oxford

- Course Language English

- Course Level Doctoral

- Duration 3 years

- For information on course fees please see university website.

You May Like

Specialised Masters: Sustainable and Climate Finance

Sustainable Finance & Climate Change

https://www.exeter.ac.uk/study/postgraduate/courses/finance/sustainable-finance-climate/

Greening Energy Market and Finance

Climate Change Risk in Finance

This online course for financial professionals looks at how to navigate climate data, measure risks and gain reliable insights for financial decision making. Assessment...

Master of Advanced Studies in Sustainable Finance

Course overview Reducing systemic risks and addressing environmental and social aspects of sustainability are key issues for the financial services industry of tomorrow. Aimed...

Sign up to our mailing list

UK Companies House: Company number 12548538

Charity Commission for England and Wales Registration: 1202401

Cookies help us to give the best experience possible and help us understand how visitors use our website. Privacy policy is here .

Modal title

- About WordPress

- Get Involved

- WordPress.org

- Documentation

- Learn WordPress

Training current and future leaders is one of our theories of change. We offer a full range of programmes, including both open-enrolment executive and customised programmes delivered in-person, online, and blended, as well as undergraduate and graduate teaching and supervision for students enrolled at the University of Oxford.

Degree awarding

Doctor in philosophy (dphil/phd).

Each year the Oxford Sustainable Finance Group supervises or co-supervises Doctor of Philosophy (DPhil/PhD) students on sustainable finance topics. Students apply to the DPhil in Geography and the Environment at the University of Oxford. The DPhil is the University of Oxford’s premier research degree, awarded to candidates who have successfully completed a major piece of original research. The course provides support and an intellectual environment to pursue your own independent research.

Modules, Options, or Electives within degree awarding courses

The MSc Sustainability, Enterprise and the Environment addresses two pervasive and unmet challenges of our time: making the transition to a zero-carbon and environmentally sustainable economic model, whilst simultaneously enabling sustainable development for everyone, poor and rich alike. The course views these challenges through the lenses of finance, economics and enterprise – both public and private – whilst also leveraging the environmental, systems, and data sciences. Sustainable finance is a mandatory core module as part of the MSc.

Find Out More >

– Sustainable finance is available as an optional elective for all students enrolled in MSc/MPhil degrees in the School of Geography and the Environment.

The Oxford Geography degree provides a holistic view of the workings of physical and human environments, the ways in which humans are transforming the world and the implications for human societies. Students are introduced to the full range of geographical topics in the foundational courses, which they can then follow up in more detail in the optional papers, shaping their programme to match their developing interests. Sustainable finance is available as an optional second or third year Final Honour School option .

Oxford Sustainable Finance Student Society

Executive Education and other non-degree awarding courses

The Public and Third Sector Academy for Sustainable Finance (‘P3S Academy’)

P3S Academy is a global centre of learning and capacity building focused on how the public and third sectors can grasp the opportunities associated with sustainable finance.

Established in 2021, the P3S Academy supports central and local government, regulators, supervisory authorities, multilateral institutions, campaigning NGOs, charities, and philanthropy. We are building a full spectrum of capacity building activities in relation to sustainable finance and have a portfolio of in person, online and blended learning programmes, masterclasses, workshops, events, and more that will be open to individuals, teams and organisations. Many of these course are free or heavily subsidised for participants from the public and third sectors.

Oxford Sustainable Finance Executive Programme

Launched in 2016 and designed to be the premier executive programme on sustainable finance globally. A five-day residential workshop at the University of Oxford, the programme is an introduction to sustainable finance for professionals working across a range of sectors. It equips participants with essential knowledge the of principles and concepts, as well as an advanced understanding of the latest developments. The programme attracts the best and brightest current and future leaders from a diverse range of sectors and delivers a unique in-person experience that equips them with the knowledge and networks required to undertake significant future work on sustainable finance.

Oxford Climate-related Financial Risk Programme

Measuring and managing climate-related financial risks is critical for institutions across the financial system. This three-day programme is designed to equip individuals from financial institutions and regulators, government officials, and corporate strategists with the latest understanding of climate risks.

Oxford Programme on Net Zero Aligned Offsetting

On this programme, participants will explore principles of net zero aligned offsetting, the state and trends of offsetting projects, the role of investor coalitions, engagement campaigns, removals budgets, policy trends and developments for compliance and voluntary markets, examine case studies of net zero aligned offsetting in practice, as well as study societal impacts and perceptions of offsetting, and the increasing prevalence of greenwashing, greenhushing and greeenwishing.

Stewardship and Engagement Leadership Programme

The programme will provide participants with a range of tools for engagement escalation and for robust evaluation of outcomes and impacts. The programme is grounded in real-world examples of stewardship, and participants will engage in practical exercises to apply and develop their stewardship capabilities.

Sustainable Finance: ESG and the Future of Finance

Developed in partnership with Pearson, this sustainable finance online course is designed to equip you with the skills and knowledge needed to accelerate impactful and sustainable change.

Oxford Social Finance Programme

Helps participants build and negotiate multi-sector partnerships and combine capital sources. They will learn directly from world leaders in blended finance, and be shown how these leaders structure deals to achieve large scale positive impact.

Customised programmes

We have significant experience in designing and delivering customised executive education programme. These programmes are underpinned by cutting-edge research and delivered by world-leading faculty and expert practitioners from across Oxford’s networks. We have worked with clients from a multitude of geographies and sectors, and are able to tailor solutions for different layers within organisations (including, at board level.)

Our programmes can be designed to enable participants to engage critically with a number of systems and theories in sustainable finance and investment such as; active ownership, the carbon bubble, climate finance, conservation finance, disclosure, divestment, engagement, ESG, green banks, green bonds, green benchmarks and indices, impact investing, public private partnerships, reporting, responsible investment, stranded assets, green taxonomies, and more. Beyond these areas, we can speak to the wider sustainability and ESG agenda through resources and capabilities at Oxford.

Please contact Johney Fatimaharan for more information: [email protected]

Recent customised programmes we have developed include:

- A multi-cohort green finance programme for policy makers delivered in North America, Southeast Asia, Australasia and Latin America;

- A bespoke programme for senior leaders and the executive committee at a multi-national financial services company;

- A bespoke programme for a professional services firm that were seeker a deeper understanding of ESG.

GENEVA GRADUATE INSTITUTE

Chemin Eugène-Rigot 2A Case postale 1672 CH - 1211 Geneva 1, Switzerland +41 22 908 57 00

[email protected] + 41 22 908 58 98

MEDIA ENQUIRIES

[email protected] +41 22 908 57 54

[email protected] + 41 22 908 57 55

The Swiss Lab for Sustainable Finance: PhD Research on Sustainable Finance

The Swiss Lab for Sustainable Finance offers the opportunity to research Sustainable Finance under both PhD Programmes.

The Swiss Lab for Sustainable Finance is a multistakeholder and transdisciplinary research center that aims to advance sustainable finance research and practice focusing on financing the SDG goals, impact measurement and ESG regulation, and will produce research that can be applied to their fulfillment. The Lab will train the next generation of social scientists in sustainable finance. We encourage applications to research in this area under the two PhD programmes we offer:

International Economics: ESG is on the top of the agendas of central banks, regulators as well as financial firms globally. Climate risks and climate policies will increasingly affect economies and financial markets. Policy makers need to understand these effects on distribution, growth and inflation among others. The interaction between climate, monetary, financial and fiscal policies will be key research topics for the foreseeable future ;

Development Economics: Sustainable development is on top of the agenda of international organizations and governments as well as a growing area of investment in the financial sector. Finance is key to achieving these goals. Open research questions relate to measurement of impact, the development of markets for sustainable finance, the interaction between environment and society, and the effect of finance on well-being, inequality, and inclusion.

Link to the SWISS LAB FOR SUSTAINABLE FINANCE

Sustainable Finance and Investment

Ensure your investment strategies are driven by environmental, social, and governance factors..

With increasing pressure from regulators, investors, and consumers, sustainable finance has moved from a niche concept to a globally recognized strategic priority. 1 This form of financial services, which addresses environmental, social, and governance (ESG) factors in investment decisions, is key to addressing some of our global challenges and helping professionals and organizations achieve long-term profitability and success.

The Sustainable Finance and Investment online program explores this rising industry and gives you the skills to navigate the terminology, activity, drivers, and participants of the ESG ecosystem. Developed by the Yale School of Management Executive Education and guided by the school’s mission to educate leaders for business and society, this online program prepares you to harness ESG data to drive financial performance and investment strategies. You’ll explore the challenges of ESG factors within the context of investment decision-making, as well as its effect on asset pricing and portfolio management models. Using data, you’ll learn to assess the impact of an investment, and examine the role of ESG in debt, novel fixed-income products, and private equity investments.

How does this program differ from the Corporate Sustainability Management: Risk, Profit, and Purpose online program?

The Sustainable Finance and Investment online program focuses primarily on equipping you to make more informed analyses and decisions when investing in sustainable assets and products. The Corporate Sustainability Management: Risk, Profit, and Purpose online program, on the other hand, is designed to help you embed sustainability and sustainable practices into the core of your business strategies.

1 EY (Jan, 2021)

Program Dates

Registration closes: April 09, 2024

Start date: April 17, 2024

Program Details

Length: 6 weeks (excluding orientation), online

Commitment: 5–8 hours per week

Fee: $2,800

Outcome: Gain a long-term competitive advantage with sustainable investment strategies that meet investor expectations and drive financial performance.

Yale SOM developed this program to be administered by our program collaborator, GetSmarter. Please direct all program-related inquiries, including questions about fees and registration, to GetSmarter .

Through this program, I've learned about different sustainable investment strategies and the metrics to use when assessing an investment opportunity. I would recommend the program to anyone who needs to take into account sustainability factors in their investment decisions. Regina Zeng

About the Program

What to expect.

- Explore practical tools and models to make financial decisions that consider the environment, society, and institutions

- Gain a roadmap to navigate the ESG ecosystem, data, and metrics

- Understand how ESG factors can be used to derive investment strategies

- Learn how to integrate ESG factors into asset-pricing models and portfolio management, as well as fixed-income and non-public investment products

- Engage with empirical research, real-life data, and interactive experiential learning, as well as a global cohort of business professionals

Who Should Attend

- Business leaders and executives from the financial sector who are aiming to make sustainable investment decisions

- Executives and senior management professionals who need to budget for sustainable investments and report on returns

- Consultants and risk management professionals who need a broad understanding of the ESG landscape

- Public policy and regulation makers

- Orientation module

- Module 1: Sustainable investing strategies

- Module 2: Key organizations and tools in sustainable finance

- Module 3: ESG data, metrics, and analytics

- Module 4: Asset pricing and portfolio management

- Module 5: Impact metrics and investing

- Module 6: Diversity of ESG investment products

I now feel I have a good understanding of the universe of this industry. I know where to go for additional knowledge pursuits, where I need additional training and coursework to be relevant in this field, and the directions I could pursue to align with my passions and past experience. Nicole Rudnick

Program Convener

Senior Lecturer in Sustainability

Todd is a Senior Lecturer in Sustainability at the Yale School of Management with a courtesy appointment at the Yale School of the Environment. He serves as Faculty Co-Director for the Yale Center for Business and the Environment (CBEY) and the Yale Initiative on Sustainable Finance (YISF) as well as Faculty Director of the Executive MBA Program in Sustainability. He serves on a variety of advisory boards including the JUST Capital Scientific Advisory Board, PRIME Coalition Academic Advisory Committee, and Merck Sustainability Advisory Committee. His research and teaching focus on ESG metrics and data and how that information is integrated into corporate and investment strategies.

Registration Information

Registration closes: April 09, 2024 Program starts with orientation: April 17, 2024

There are no prerequisites for this program. Register to get started. Our online program partner, GetSmarter, will welcome you and guide you through the steps to secure your place in the program.

Program Fee Assistance

A program fee reduction of 15% is available for those working in the nonprofit or government sectors; Yale University alumni; small groups of 3-6; and those who have previously participated in a Yale Executive Education program with Yale SOM, ExecOnline, or 2U/GetSmarter.*

*Discounts cannot be combined

This program does not qualify for veteran financial aid or veterans benefits at this time.

Program Collaborator

This program is presented entirely online in collaboration with leader in digital education, GetSmarter , a 2U, Inc. brand. Technology meets academic rigor in GetSmarter’s people-mediated model, which enables lifelong learners across the globe to obtain industry-relevant skills that are certified by the world’s most reputable academic institutions. This interactive, supportive teaching model is designed for busy professionals and results in unprecedented certification rates for online programs.

View the Sustainable Finance and Investment online program on the GetSmarter website.

Modules are released on a weekly basis and can be completed in your own time and at your own pace.

UCL Institute for Sustainable Resources

Sustainable Finance

The sustainable finance work focuses upon the financing dimensions of low carbon investment and transition, and the architecture of the financial system to identify points of intervention that climate policy can leverage to spur green finance.

Exploring the dynamic interplay of the financial, technology and policy elements in the investment system is crucial to better inform policy design. These elements will likely influence key actors, leverage existing interconnections and deploy instruments of public finance and policy effectively to accelerate the deployment of low-carbon technologies. Current research on Sustainable Finance is supported by the LINKS project. This project will last for the next five years and will focus on the role of climate finance to meet the Paris climate goals (2019-2024). This research will promote essential guidance for a re-orientation of financial flows towards low-carbon and energy efficiency investments. Previous findings come from other two EU Horizon 2020 projects, namely GREEN-WIN and RIPPLES, both projects focus on the cross-cutting role of finance in overcoming barriers to climate action, with a particular emphasis on exploring avenues for integrating climate public policies with a mainstream finance framework and system. Below a short description of these projects and related websites.

The LINKS project looks at aligning the broader financial system with low-carbon pathways of development is key to delivering the Paris Agreement. However, the financial system is increasingly built on the interdependencies and interconnections of investors that, at the aggregate level, are hard to predict and control. The 2008 financial crisis demonstrated how policy makers and financial regulators had great difficulty managing interconnected systems - due to inadequate visibility on the structure and monitoring of the systems. When it comes to low-carbon assets, this interconnectedness between investors remains unexplored as climate policy analysis takes the existing structure of financial systems as given. Understanding the anatomy and the architecture of the financial system as well as its evolution, is crucial to identifying points of intervention that climate policy can leverage to spur green finance. ‘Shifting the trillions’ to close the climate investment gap will require to exploit investors’ interactions and dynamics as their collective dynamics shape the actual flows in low-carbon technologies and drive the direction of technical change. The evolution of inter-connected structures will determine how the system could pool long-term financial assets to boost the low-carbon transition; how policy can seek to take advantages of non-linearity and tipping points in the system by influencing key actors and connections; and will determine the main winners and losers within the financial system itself.

The recently established LINKS programme, focuses on the role of the financial system in boosting the low-carbon transition and explores the market structures for low-carbon finance. It looks at the capital flows directed towards renewables and energy efficiency interventions using advanced computational techniques and extensive financial and investment data. The goal is to show how micro investors’ behaviour and interactions give rise to large scale investment trends. Employing network analysis on long-term investment data will allows us to determine the structure and growth of the system based on the dynamism of its investors’ behaviour, their influence in the system and investment trends. Key features of this analysis are to determine:

- which network structures and investors lead to pathways of low-carbon deployment to reduce GHG emissions,

- how they evolve and self-organise over time in response to stimulus from external environment, and

- how their dynamics could boost more investment towards low-carbon projects, when supported by conducive policy.

GREEN-WIN focuses upon financing dimensions of low carbon investment and transition, and its interaction with technology and modelling. In particular, key analyses include:

- Map out key actors and financial instruments for climate finance in G20 countries with a focus on the US, China and selected European countries, including Germany, UK and Italy. In particular, this analysis explored i) key actors and their interests in providing climate finance ii) governance arrangements and financial instruments that affect finance flows; iii) possible misalignments between investors’ expectations and financial instruments available. This task included also analyses on the consistency between climate finance and mainstream finance versus climate goals;

- Analyse the reasons why institutional finance is not directing more substantial investment to low-carbon projects, and identify which policy packages can leverage more finance into low carbon assets. This analysis included interactions between government, private institutional finance and behavioural practices, and between pricing frameworks, market design and structural barriers;

- Explore several dimensions of economic analysis of transition to a low carbon economy, in particular concerning financial and technological considerations that need to be represented in the modelling work. This analysis focused on i) determinants and values of the weighted average cost of capital (WACC), and the micro-economic leverage effect of lower WACCs in lowering the cost of capital-intensive sources and thereby supporting investment; ii) technology spillover mechanisms used by the macroeconomic models; iii) multipliers in economic models and estimates of the associated macroeconomic leverage effects on employment intensities of investments in different technology/sector areas.

RIPPLES focuses on the financial implications of NDC and 2°C-1.5°C trajectories, in terms of investment required across all sectors, cross-border capital flows, public budgets, and the financial system more broadly. The analysis focuses on the role of the financial sector in facilitating the transition towards the Paris Agreement goals. It undertakes both quantitative and qualitative approaches in order to provide key recommendations to stakeholders and policymakers related to climate finance. The modelling analysis soft-links three different model types (TIAM-UCL, MEWA and ENGAGE) to consider investment requirement pathways and how the levels of investment are achieved through different financial instruments. The qualitative analysis explores how the financial sector must be transformed to meet the long-term public interest and common goods. Accordingly, it requires making finance sustainable as a whole rather than adding a layer of “sustainable finance”.

Nadia Ameli Principle Research Fellow View Nadia's profile Send Nadia an email

Jamie Rickman Research Fellow View Jamie's profile Send Jamie an email

Sumit Kothari PhD student

Michael Grubb Professor of Energy and Climate Change View Michael's profile Send Michael an email

Photo by Gordon Williams on Unsplash

View ISR's research projects

Related projects.

Funnelback feed: https://cms-feed.ucl.ac.uk/s/search.json?collection=drupal-bartlett-rese... Double click the feed URL above to edit

Tweets by UCL_ISR

- PhD Programmes

Sustainable Finance

Sustainable Finance Summer School

At the end of this course, students should be able to:

- Identify value creation (and destruction) across financial, social and ecological capital

- Establish risk and return profiles for all types of capital

- Identify the methods for long-term investing

- Know how fundamental equity valuation brings a deeper understanding of companies

- Make capital structure calculations for all types of capital

Information

Achieving the Sustainable Development Goals is the grand challenge of our time. This course gives insight in ‘how finance can contribute to sustainable development’ and aims to inspire PhD researchers to do research in this field.

The finance transition is about transforming finance from operating on financial value only to working with the concept of integrated value, which combines financial, social and ecological value. The concept of integrated value is approached from an academic angle: how to incorporate social and ecological factors in the cost of capital, the valuation and capital structure of companies?

Students apply the integrated value concept in a group assignment or research proposal.

Assessment is on a Pass/Fail basis. To pass the course, participants must meet the following requirements:

- Attend all sessions

- Actively participate in all sessions

- Prepare essential readings

- Complete at least one group assignment or present an outline of a research proposal

The course builds on a new text book (corporate finance) and recent articles (investment):

Schoenmaker, D. and W. Schramade (2023), Corporate Finance for Long-Term Value , Springer, Berlin, forthcoming . (Chapters will be made available in early June)

Schoenmaker, D. and W. Schramade (2019), ‘Investing for Long-Term Value Creation’, Journal of Sustainable Finance & Investment , 9(4), 356-377.

Zerbib, O. (2022), ‘A Sustainable Capital Asset Pricing Model (S-CAPM): Evidence from Environmental Integration and Sin Stock Exclusion’, Review of Finance , 26(6): 1345-1388.

Additional info

- 1, 2 & 4 July: 09:00-11:45 and 13:00-15:45

For the timetable of this course, please click here . The timetable is in the local time of Rotterdam, which is CEST (UTC+02:00).

This course is held fully online.

Registration

ERIM PhD candidates (full-time and part-time): register directly via Osiris . Participation free of charge.

Non-ERIM PhD candidates: register via online form . The course fee 500 euro.

RSM/ESE faculty members with ERIM membership and PhD candidates at SIKS: register via online form . Participation free of charge.

Please note that the number of places for this course is limited. In case the number of registrations exceeds the number of available seats, priority is given to ERIM PhD candidates.

Please contact us at [email protected] if you have questions.

- © 2024 Erasmus Universiteit Rotterdam

- Privacy statement

The Rise of Green Finance in Europe

Opportunities and Challenges for Issuers, Investors and Marketplaces

- © 2019

- Marco Migliorelli 0 ,

- Philippe Dessertine 1

IAE Université Paris 1 Panthéon-Sorbonne (Sorbonne Business School), Paris, France European Commission, Brussels, Belgium

You can also search for this editor in PubMed Google Scholar

IAE Université Paris 1 Panthéon-Sorbonne (Sorbonne Business School), Paris, France

- Adds to the scarce scientific literature on green finance, in particular as it concerns Europe

- Fosters the debate on the future of green finance in Europe and worldwide

- Includes a discussion on unexplored items such as the potential role of digitalisation and blockchain in fostering green finance, on the need of enhancing green finance in agriculture and on the relationship between sustainable finance and other forms of alternative finance

Part of the book series: Palgrave Studies in Impact Finance (SIF)

69k Accesses

122 Citations

5 Altmetric

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (11 chapters)

Front matter, state of the art, an overview of green finance.

- Romain Berrou, Philippe Dessertine, Marco Migliorelli

Defining Green Finance: Existing Standards and Main Challenges

- Romain Berrou, Nicola Ciampoli, Vladimiro Marini

The Development of Green Finance by Sector

- Olaf Weber, Amr ElAlfy

Sustainable Finance Management

- Giovanni Ferri, Francesca Lipari

Financial Performances of Green Securities

- Dirk Schiereck, Gunnar Friede, Alexander Bassen

Institutional Initiatives to Foster Green Finance at EU Level

- Vladimiro Marini

The (Long) Way Forward and New Opportunities

From transaction-based to mainstream green finance.

Marco Migliorelli, Philippe Dessertine

The Development of Green Finance in EU Agriculture: Main Obstacles and Possible Ways Forward

Marco Migliorelli

Fintech, Digitalization and Blockchain: Possible Applications for Green Finance

- Gregor Dorfleitner, Diana Braun

Sustainable Finance: A Common Ground for the Future in Europe?

- Silvio Goglio, Ivana Catturani

Green Finance Today: Summary and Concluding Remarks

Back matter.

- Sustainable Development Goals

- Green securities

- Sustainable banking

- Financing green practices in agriculture

- Green finance and stock exchanges in Europe

- Green washing

- digitalisation

- alternative finance

- sustainable finance

- impact finance

- agriculture

- investments and securities

- development finance

About this book

This book offers a comprehensive discussion of how green finance has been growing thus far and explores the opportunities and key developments ahead, with particular emphasis on Europe. The main features of the market, the key products, the issue of correctly defining green finance, the main policy actions undertaken, the risk of green washing and the necessary steps to mainstream green finance are discussed in depth. In addition, the book analyses some highly relevant aspects of the market that so far have not been sufficiently explored in the policy, industry and academic debate. This includes the potential role of digitalisation and blockchain in fostering green finance, the crucial role of the effective financing of the agriculture to reach climate and environmental targets and the possible relationship between sustainable finance and other forms of "alternative" finance. This book will be of interest to academics, practitioners, financial institutions and policy makers involved in green finance and to the finance industry in general.

Editors and Affiliations

European commission, brussels, belgium, about the editors.

Marco Migliorelli is a researcher in finance at the University Paris 1 Panthéon-Sorbonne, France and an economist at the European Commission. He earned a PhD from the University of Rome Tor Vergata, Italy. His research interests include green finance, cooperative banking and financial instruments innovation.

Philippe Dessertine is a full professor of finance at University Paris 1 Panthéon-Sorbonne, France, the director of Institut de Haute Finance , Paris, France and a former member of the Haut Conseil des finances publiques in France. He is author of several publications on the role of finance in the modern society.

Bibliographic Information

Book Title : The Rise of Green Finance in Europe

Book Subtitle : Opportunities and Challenges for Issuers, Investors and Marketplaces

Editors : Marco Migliorelli, Philippe Dessertine

Series Title : Palgrave Studies in Impact Finance

DOI : https://doi.org/10.1007/978-3-030-22510-0

Publisher : Palgrave Macmillan Cham

eBook Packages : Economics and Finance , Economics and Finance (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2019

Hardcover ISBN : 978-3-030-22509-4 Published: 02 December 2019

Softcover ISBN : 978-3-030-22512-4 Published: 24 December 2020

eBook ISBN : 978-3-030-22510-0 Published: 20 November 2019

Series ISSN : 2662-5105

Series E-ISSN : 2662-5113

Edition Number : 1

Number of Pages : XX, 275

Number of Illustrations : 17 b/w illustrations

Topics : Investments and Securities , Development Finance , Sustainable Development , Innovation/Technology Management

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Postgraduate research opportunities Corporate Sustainability and Sustainable Finance

- Opens: Wednesday 30 March 2022

- Deadline: Tuesday 31 May 2022

- Number of places: 2

- Duration: 3 years

- Funding: Home fee, Stipend

Eligibility

1st class honours/undergraduate degree and an excellent Masters-level qualification or equivalent (highly desirable), in a numerate subject such as finance, economics, operations research, mathematics, statistics and management science, from a recognised academic institution. If English is not your first language, you will also be required to provide evidence such as a recent UKVI recognised English language test (such as IELTS, minimum overall band score of 6.5 with no individual test score below 5.5) or a university degree completed in a recognized English speaking country.

Project Details

These two projects will focus on large international firms. The first project will develop and evaluate metrics to assess sustainability, reputation, and trust. The methodology will be case study and survey based. Measuring then linking corporate sustainability, sustainable finance, Government policy, and organizational trust provides a significant challenge to decision-makers. The second project will develop a cybernetic model capturing the systemic and circular causal relationships between corporate social media communications, shareholder opinion, market reaction, government, public opinion as well as private and public sector influences. As the research from the first project develops it is anticipated there will be synergies with the second in linking and identifying associated influences on key metrics of sustainability, reputation and trust. The second project will be primarily based on SDG (UN Sustainable Development Goals) related social media communications data, supplemented with interviews from relevant experts to structure the model.

Further information

These projects will form part of a collaboration between the School of Management at Politecnico di Milano and the School of Environment, Enterprise and Development at the University of Waterloo.

Strathclyde Business School is committed to supporting a diverse and inclusive postgraduate research population. We make decisions on entry by assessing the whole person and not relying solely on academic achievements. On that basis, please ensure that your application (via your CV and covering letter) can evidence your resourcefulness, commitment and resilience as demonstrated by broader professional and life experiences. This evidence should be centred on your ability to undertake and complete a PhD and contribute to a positive PhD community.

Funding details

Fully-funded scholarship for three years covers all university tuition fees (at UK level) and an annual tax-free stipend. International students are also eligible to apply, but they will need to find other funding sources to cover the difference between the home and international tuition fees. Exceptional international candidates may be provided funding for this difference.

Supervisors

Professor David Hillier

Associate Principal & Executive Dean Strathclyde Business School

Professor John Quigley

- Management Science

Dr Leilei Tang

Senior Lecturer Accounting and Finance

Number of places: 2

To read how we process personal data, applicants can review our 'Privacy Notice for Student Applicants and Potential Applicants' on our Privacy notices' web page .

Professor John Quigley [email protected] .

Our faculties & departments

Engineering.

- Faculty of Engineering

- Architecture

- Biomedical Engineering

- Chemical & Process Engineering

- Civil & Environmental Engineering

- Design, Manufacturing & Engineering Management

- Electronic & Electrical Engineering

- Mechanical & Aerospace Engineering

- Naval Architecture, Ocean & Marine Engineering

Humanities & Social Sciences

- Faculty of Humanities & Social Sciences

- Centre for Lifelong Learning

- Government & Public Policy

- Psychological Sciences & Health

- Social Work & Social Policy

- Faculty of Science

- Computer & Information Sciences

- Mathematics & Statistics

- Pure & Applied Chemistry

- Strathclyde Institute of Pharmacy & Biomedical Sciences

- Strathclyde Business School

- Accounting & Finance

- Hunter Centre for Entrepreneurship

- MBA & General Management

- Strathclyde Executive Education & Development

- Work, Employment & Organisation

- Schools & departments

Climate Change Finance and Investment MSc

Awards: MSc

Study modes: Full-time

Funding opportunities

Programme website: Climate Change Finance and Investment

Discovery Day

Join us online on 18th April to learn more about postgraduate study at Edinburgh

View sessions and register

Programme description

Our MSc in Climate Change Finance and Investment is dedicated to developing professionals in the field of low carbon finance and investment. Designed around an interdisciplinary foundation of carbon accounting, climate policy and financial economics, the programme will develop your skills and knowledge to help drive the trillions of dollars of new investment needed to face the climate emergency.

The MSc has an international focus, looking at the opportunities and challenges across different sectors, financial markets, and levels of national economic development.

Programme structure

Learning will primarily be through:

- set reading

- class discussions

- group-work assignments

- problem-solving in tutorials

- case studies

Assessment methods include examinations, assignments, presentations or continuous assessment.

- MSc Climate Change Finance and Investment programme structure

Find out more about compulsory and optional courses

We link to the latest information available. Please note that this may be for a previous academic year and should be considered indicative.

Learning outcomes

The programme is dedicated to professionals in the field of low carbon finance and investment, focusing on the financial flows driven by society's response to climate change, and is fundamentally interdisciplinary in nature.

By the end of the programme, you will be able to:

- explain and evaluate the current state of climate change science and key climate change policy initiatives

- understand how to incorporate environmental and climate issues in project finance in the energy sector

- describe and critically evaluate the structure and dynamics of the major global, regional and national-level carbon markets

- explain and apply practices and procedures of carbon accounting

- critically evaluate how governments provide and catalyse national and international climate finance

understand and apply methods for assessing climate risk and alignment with climate goals

MSc Climate Change Finance and Investment learning outcomes

Career opportunities

Industry opportunities.

The MSc in Climate Change Finance and Investment programme has a number of exciting partnerships with industry, consultants, government agencies and NGOs. Our strong connection to industry is embedded in the programme through guest lectures and the opportunity to engage with business figures.

- MSc Climate Change Finance and Investment industry opportunities

Career development

The explosion of climate change finance and investment has created a range of new types of business, professional careers and opportunities. Our dedicated Student Development Team within the Business School will be an integral part of your student experience from day one. We are here to help you become equipped to maximise your potential in the global market.

- MSc Climate Change Finance and Investment career development

Career outcomes

Graduates from the MSc in Climate Change Finance and Investment will typically pursue a career in climate change investment, carbon markets, consulting or carbon accounting.

Job titles of our recent graduates include:

- audit associate

- consultant analyst

- ESG research and models analyst

- head of green funding office

- international climate investment consultant

- private sector development manager

- research fellow

- responsible investment and engagement associate

- sustainability analyst

technical advisor (renewable energy)

MSc Climate Change Finance and Investment career outcomes

Choosing the Climate Change Finance and Investment Masters at the University of Edinburgh

Find out from Maurice, who studied Carbon Finance in 2018 (the precursor to CCFI), what it is like to live and study in Edinburgh.

Entry requirements

These entry requirements are for the 2024/25 academic year and requirements for future academic years may differ. Entry requirements for the 2025/26 academic year will be published on 11 July 2024.

Entrance to our MSc programmes is strongly competitive. You can increase your chances of a successful application by exceeding the minimum programme requirements.

- Important points to note when applying for this programme

Academic requirements

You will need a UK first-class or 2:1 honours degree in one of the subjects below, or its international equivalent.

- An undergraduate degree in business, economics, engineering or a social or physical science is normally required.

- Candidates with a very good Honours degree in other areas of study or relevant work experience will be considered on an individual basis

Supporting your application

- Relevant work experience is not required but may increase your chances of acceptance.

- Preference will be given to those with grades above the minimum requirements and/or relevant work experience due to strong competition for places on this programme.

If you do not meet the minimum academic requirement, you may still be considered if you have 2 or more years of relevant work experience. We may require you to complete the Graduate Management Admissions Test (GMAT) or Graduate Records Examination (GRE) which are internationally-recognised assessments of analytical, numerical and verbal reasoning.

If we require you to take GMAT, we would require a score of 600 as a minimum or 555 under the Focus edition. This equates to a performance in the 51st percentile under each format. For GRE we would require a score of 315 as a minimum to qualify for our Climate Change Finance and Investment MSc. The GMAT and GRE are not a compulsory part of the application process, but if you have a score that you wish to report to us then this would be welcomed.*

We will accept results from the GMAT Online exam.

- Official GMAT Exam website

*(Revised 24 October 2023 to provide equivalencies for the GMAT Focus edition.)

Students from China

This degree is Band A.

- Postgraduate entry requirements for students from China

International qualifications

Check whether your international qualifications meet our general entry requirements:

- Entry requirements by country

- English language requirements

Regardless of your nationality or country of residence, you must demonstrate a level of English language competency at a level that will enable you to succeed in your studies.

English language tests

We accept the following English language qualifications at the grades specified:

- IELTS Academic: total 7.0 with at least 6.0 in each component. We do not accept IELTS One Skill Retake to meet our English language requirements.

- TOEFL-iBT (including Home Edition): total 100 with at least 20 in each component. We do not accept TOEFL MyBest Score to meet our English language requirements.

- C1 Advanced ( CAE ) / C2 Proficiency ( CPE ): total 185 with at least 169 in each component.

- Trinity ISE : ISE III with passes in all four components.

- PTE Academic: total 70 with at least 59 in each component.

Your English language qualification must be no more than three and a half years old from the start date of the programme you are applying to study, unless you are using IELTS , TOEFL, Trinity ISE or PTE , in which case it must be no more than two years old.

Degrees taught and assessed in English

We also accept an undergraduate or postgraduate degree that has been taught and assessed in English in a majority English speaking country, as defined by UK Visas and Immigration:

- UKVI list of majority English speaking countries

We also accept a degree that has been taught and assessed in English from a university on our list of approved universities in non-majority English speaking countries (non-MESC).

- Approved universities in non-MESC

If you are not a national of a majority English speaking country, then your degree must be no more than five years old* at the beginning of your programme of study. (*Revised 05 March 2024 to extend degree validity to five years.)

Find out more about our language requirements:

Fees and costs

Application fee.

This programme requires a non-refundable application fee.

You will need to pay this deposit within 28 days of receiving your offer of admission (either unconditional or conditional).

- £1,500 (this contributes towards your tuition fees)

Additional programme costs

See the programme website for more information on additional costs, as well as application fees and deposit payment.

- MSc Climate Change Finance and Investment - fees and living expenses

Living costs

You will be responsible for covering living costs for the duration of your studies. Below you can find a breakdown of the cost of living in Edinburgh and other studying costs to help you calculate your finances.

- Other studying and living costs

Tuition fees

Scholarships and funding, featured funding.

Business School scholarships

External Scholarships

UK government postgraduate loans

If you live in the UK, you may be able to apply for a postgraduate loan from one of the UK’s governments.

The type and amount of financial support you are eligible for will depend on:

- your programme

- the duration of your studies

- your tuition fee status

Programmes studied on a part-time intermittent basis are not eligible.

- UK government and other external funding

Other funding opportunities

Search for scholarships and funding opportunities:

- Search for funding

Further information

- Enquiry Management Team

- Phone: +44 (0)131 650 9663

- Contact: [email protected]

- Programme Director, Ian Cochran

- Phone: +44 (0)131 651 5547

- Contact: [email protected]

- University of Edinburgh Business School

- 29 Buccleuch Place

- Central Campus

- Programme: Climate Change Finance and Investment

- School: Business School

- College: Arts, Humanities & Social Sciences

Select your programme and preferred start date to begin your application.

MSc Climate Change Finance & Investment - 1 Year (Full-time)

Application deadlines.

Due to high demand, the School operates a number of selection deadlines. We will make a small number of offers to the most outstanding candidates on an ongoing basis, but hold the majority of applications until the next published selection deadline when we will offer a proportion of the places available to applicants selected through the competitive process described on the School website.

Full details on the admissions process and the selection deadlines are available on the Business School website:

- Admissions Strategy

Deadlines for applicants applying to study in 2024/25:

- How to apply

You must submit one reference with your application.

Find out more about the general application process for postgraduate programmes:

- jump to main navigation

- jump to main content

- jump to zum Seitenende mit Direkt-Links springen

The faculty at a glance

- Accessibility

- Faculty of Economics and Management Science

work Institutsgebäude Grimmaische Straße 12 04109 Leipzig

Phone: work +49 341 97-33500 Fax: fax +49 341 97 311 33500

Vice-Dean Prof. Dr. Martin Friedrich Quaas

Dean Prof. Dr. Rainer Alt

Dean of Studies Prof. Dr. Roland Happ

Vice-Dean Prof. Dr. Utz Dornberger

Deanery Dr. Martina Diesener

Secretariat Cathérine Krobitzsch

Institutes & Facilities

- Centralised faculty body

- Information Systems Institute

- Institute for Infrastructure and Resource Management (IIRM)

- Institute for Theoretical Economics (ITVWL)

- Institute of Accounting, Finance and Taxation (IUFB)

- Institute of Business Education and Management Training (IFW)

- Institute of Economic Policy (IWP)

- Institute of Empirical Economic Research (IEW)

- Institute of Insurance Science (IVL)

- Institute of Public Finance and Public Management (PFPM)

- Institute of Service and Relationship Management (ISRM)

- Institute of Trade and Banking (IHB)

- Institute of Urban Development and Construction Management (ISB)

- Sustainable Banking and Finance

- Financial Economics

- Visual Help

- go to menu level 1

- go to menu level 2

- go to menu level 3

- go to menu level 4

- go to menu level 5

- Institut for Commerce and Banking

If you are planning to do a PhD at the Chair of Sustainable Banking and Finance, as the next academic step, you will find all the important information about the process and further procedure here.

General conditions

In principle, the Chair offers interested and qualified university graduates the opportunity to do a PhD in economics. On the one hand, there is the classic "internal" PhD programme , in which you work on your doctoral studies and at the same time participate in the Chair in a scientific manner. On the other hand, there is also the possibility of an external doctorate at the Chair , where you do your doctorate while working. In both cases, the aim is to create the right conditions for you to successfully complete your doctoral project within two to three years.

For both internal and external promotions, you create s everal individual publications on a specific topic ( cumulative procedure ). The common goal is that the papers you write have a realistic chance of being published in a renowned, peer-reviewed journal. As a rule, the papers will have a quantitative or empirical character and relate to the research areas of the Chair (exceptions confirm the rule!). Throughout the entire doctoral project, you will have the opportunity to discuss your ideas (and problems) at the professorship at any time.

Requirements

Admission to the doctoral procedure is subject to the Promotionsordnung of the Faculty of Economic Sciences. All formal requirements for admission are regulated there. In addition, they should ideally

- have an outstandingly business-oriented degree (Master's/ diploma/ state examination in the subjects of business studies/ economics, business mathematics, business informatics, business education, industrial engineering, mathematics or statistics)

- in addition, a very good knowledge of English is indispensable, as the dissertation will be written in English.

If you are interested in a PhD at the Chair, please send an E-Mail for further arrangements. In addition, you will find below cross-links to further information that may help with formal questions.

Complete PhD procedures

- Dr. Marcus Scheffer (2011-2016, internal, current employer: ERGO Group AG)

- Dr. Christopher Bierth (2013-2016, internal, current employer: B&W Deloitte GmbH)

- Dr. Felix Irresberger (2013-2015, internal, current employer: Leeds University Business School)

- Dr. Hendrik Supper (2012-2014, internal, current employerr: d-fine GmbH)

- Dr. Tobias Berens (2011-2014, external, current employer: Deutsche Apotheker- und Ärztebank eG)

This might also be of interest to you...

Phd at leipzig university, phd at the faculty, research academy leipzig.

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

- IMF at a Glance

- Surveillance

- Capacity Development

- IMF Factsheets List

- IMF Members

- IMF Timeline

- Senior Officials

- Job Opportunities

- Archives of the IMF

- Climate Change

- Fiscal Policies

- Income Inequality

Flagship Publications

Other publications.

- World Economic Outlook

- Global Financial Stability Report

- Fiscal Monitor

- External Sector Report

- Staff Discussion Notes

- Working Papers

- IMF Research Perspectives

- Economic Review

- Global Housing Watch

- Commodity Prices

- Commodities Data Portal

- IMF Researchers

- Annual Research Conference

- Other IMF Events

IMF reports and publications by country

Regional offices.

- IMF Resident Representative Offices

- IMF Regional Reports

- IMF and Europe

- IMF Members' Quotas and Voting Power, and Board of Governors

- IMF Regional Office for Asia and the Pacific

- IMF Capacity Development Office in Thailand (CDOT)

- IMF Regional Office in Central America, Panama, and the Dominican Republic

- Eastern Caribbean Currency Union (ECCU)

- IMF Europe Office in Paris and Brussels

- IMF Office in the Pacific Islands

- How We Work

- IMF Training

- Digital Training Catalog

- Online Learning

- Our Partners

- Country Stories

- Technical Assistance Reports

- High-Level Summary Technical Assistance Reports

- Strategy and Policies

For Journalists

- Country Focus

- Chart of the Week

- Communiqués

- Mission Concluding Statements

- Press Releases

- Statements at Donor Meetings

- Transcripts

- Views & Commentaries

- Article IV Consultations

- Financial Sector Assessment Program (FSAP)

- Seminars, Conferences, & Other Events

- E-mail Notification

Press Center

The IMF Press Center is a password-protected site for working journalists.

- Login or Register

- Information of interest

- About the IMF

- Conferences

- Press briefings

- Special Features

- Middle East and Central Asia

- Economic Outlook

- Annual and spring meetings

- Most Recent

- Most Popular

- IMF Finances

- Additional Data Sources

- World Economic Outlook Databases

- Climate Change Indicators Dashboard

- IMF eLibrary-Data

- International Financial Statistics

- G20 Data Gaps Initiative

- Public Sector Debt Statistics Online Centralized Database

- Currency Composition of Official Foreign Exchange Reserves

- Financial Access Survey

- Government Finance Statistics

- Publications Advanced Search

- IMF eLibrary

- IMF Bookstore

- Publications Newsletter

- Essential Reading Guides

- Regional Economic Reports

- Country Reports

- Departmental Papers

- Policy Papers

- Selected Issues Papers

- All Staff Notes Series

- Analytical Notes

- Fintech Notes

- How-To Notes

- Staff Climate Notes

Climate Change | Green Finance

Green Finance

The financial sector has an important role to play in the fight against climate change by supporting reductions in climate change risk and mitigating the impact of adverse climate events.

Long term institutional investors can help with rebalancing and redistributing of climate related risks and maintaining financial stability. Hedging instruments (e.g., catastrophe bonds, indexed insurance) help insure against increasing natural disaster risk, and other financial instruments (e.g., green stock indices, green bonds, voluntary de-carbonization initiatives) can help re-allocate investment to “green” sectors.

From the oversight perspective, central banks and other regulators are adapting frameworks and practices to address the multifaceted risks posed by climate change. This includes ways to improve climate risk disclosure and classification standards, which will help financial institutions and investors better assess their climate-related exposures—and help regulators better gauge system-wide risks.

The IMF is offering support by working with the Network of Central Banks and Supervisors for Greening the Financial System and other standard-setting bodies to promote green finance more broadly and developing climate-related stress tests.

Publications

Imf working paper, june 05 2020, this changes everything: climate shocks and sovereign bonds.

Download the publication

Global Financial Stability Report, April 2020

Markets in the time of covid-19 | chapter 5: climate change: physical risk and equity prices.

Global Financial Stability Report, October 2019

Lower for longer | chapter 6 sustainable finance.

FINANCE & DEVELOPMENT, DECEMBER 2019, VOL. 56, NO. 4 PDF VERSION

A greener future for finance.

Green bonds offer lessons for sustainable finance

Fifty Shades of Green

The world needs a new, sustainable financial system to stop runaway climate change.

Read more

Climate Change and Financial Risk

Central banks and financial regulators are starting to factor in climate change.

Back to Top

Equity Investors Must Pay More Attention to Climate Change Physical Risk

MAY 29, 2020

The damage from the 2011 floods in Thailand amounted to around 10 percent of Thailand’s GDP, not even considering all the indirect costs through a loss in economic activity in the country and abroad. By some estimates, the total costs of the 2018 wildfires in California were up to $350 billion, or 1.7 percent of U.S. GDP. Every year, climatic disasters cause human suffering as well as large economic and ecological damage. Over the past decade, direct damages of such disasters are estimated to add up to around US$ 1.3 trillion (or around 0.2% of world GDP on average, per year).

Connecting the Dots Between Sustainable Finance and Financial Stability

OCTOBER 10, 2019

Unsafe working conditions. Use of child or forced labor. Environmental impact on protected areas. More and more investors are looking at issues and factors beyond traditional financial analysis when directing their money. Sustainable finance aims to help society better meet today’s needs and ensure that future generations will be able to meet theirs too.

ORIGINAL RESEARCH article

Will green finance contribute to a green recovery evidence from green financial pilot zone in china.

- 1 School of Management, Hainan University, Haikou, China

- 2 Institute of Finance & Banking, Chinese Academy of Social Sciences, Beijing, China

- 3 The Graduate School of College of Arts and Sciences, Georgetown University, Washington, DC, United States

- 4 School of Literature, University of Chinese Academy of Social Sciences, Beijing, China

- 5 School of Finance, Central University of Finance and Economics, Beijing, China

In the post-epidemic era, green finance plays a more significant role in supporting the “green recovery” of the economy, so it is necessary to evaluate the implementation effect of previous green financial policies. In 2017, the green finance reform and innovation pilot zone set up in five provinces and autonomous regions made an exploration in the development of green finance. From the perspective of micro-enterprises, can this policy play a beneficial policy effect in the long run? Based on the quasi-natural experiment of green finance pilot, using the data of A-share listed companies, this paper empirically tests the impact of pilot policies on the long-term value of green enterprises in pilot areas. It is found that, compared with non-pilot zones, the green finance pilot enables a significant increase in the Tobin Q-measured value of green enterprises in the pilot zones. Heterogeneity analysis shows that green finance pilot has a more significant impact on non-state-owned enterprises, enterprises in traditional industries, large enterprises, and enterprises in the eastern region of China. Green finance pilot zone can achieve better policy effects in areas with stronger environmental impact regulation and higher financial development levels. The mechanism test shows that the green finance pilot affects the long-term value of green enterprises through the capital market effect improving the stock trading activity of enterprises and through the real effect improving the operational efficiency and profitability of enterprises. From the perspective of micro-enterprises, this paper enriches the research on the development effect of green finance and provides theoretical support for the effect evaluation of green finance pilot policies.

Introduction

The COVID-19 epidemic outbreak in early 2020 has made people more aware that the development of human society is always constrained by the natural environment, that economic development and growth should be well-coordinated with the protection of the natural ecological environment, and that any attempt to make the two in opposition shall be boomeranged. To prevent similar tragedies from happening again, we must promote the green and low-carbon transformation of the economy and society and enhance the sustainability of economic growth. After suffering from the impact of the COVID-19 epidemic, we must support and promote the “green recovery” of the economy, that is, in the post-epidemic era, the production and consumption return to the pre-epidemic level in terms of quantity and quality and achieve further growth while increasing the proportion of green consumption and green production, and thereby ultimately transforming the economic structure toward a green and sustainable direction.

From the perspective of economic theory, the economic recovery period after the COVID-19 epidemic impact is an excellent opportunity to promote structural transformation and “green recovery” of the economy: on the one hand, the COVID-19 epidemic impact leads to a cliff-like decline in pollution emissions in production, and a large number of backward production capacity has been naturally eliminated; on the other hand, government departments can use less green product subsidies to stimulate more green R&D investment in the context of declining production yield, thus creating more green production capacity at a lower policy cost.

As the blood of the entity economy, finance is the core of the modern economy. Therefore, finance should play an irreplaceable role in the process of economic “green recovery” in the post-epidemic era. Green finance bears the mission of providing investment and financing, project operation, risk management, and other services for economic activities supporting environmental improvement, coping with climate change, and resource conservation and efficient utilization. Because there is a limited amount of financial funds and the need for complex relief should be given priority during the epidemic crisis, green finance can help fill the financing gap faced by green investment in the process of “green recovery” in the post-epidemic era.

To give superior support to “green recovery,” green finance needs the sustenance of micro-enterprises. Only when the value of enterprises, especially those engaged in green and low-carbon related industries, improves the practice of green finance can micro-enterprises actively participate in green investment and transformation, and relevant practices can thereby be implemented stably and achieve the far-reaching effect. China's green finance started earlier. In 1995, the former State Environmental Protection Administration of China (SEPA) and the People's Bank of China respectively, issued the Notice on Using Green Credit to Promote Environmental Protection and the Notice on Implementing Credit Policy and Environmental Protection . In 2012, the former China Banking Regulatory Commission (CBRC) issued the Guidelines for Green Credit and gradually improved it into a statistical system for green credit. In 2015, the Integrated Reform Plan for Promoting Ecological Progress promulgated by the State Council proposed to build a green financial system. In August 2016, the People's Bank of China, the Ministry of Finance, the National Development and Reform Commission (NDRC), the former Ministry of Environmental Protection, the former China Banking Regulatory Commission (CBRC), the China Securities Regulatory Commission (CSRC) and the former China Insurance Regulatory Commission (CIRC) jointly issued the Guidelines for Establishing the Green Financial System, which constructed the top-level design of green financial development. The report of the 19th National Congress of the Communist Party of China put forward the requirement of vigorously developing green finance. Under the guidance of this spirit, the 5th Plenary Session of the 19th National Congress deliberated and adopted the Proposal of the Central Committee of the Communist Party of China on Formulating the 14th Five-Year Plan for National Economic and Social Development and the Long-term Goals for 2035 , which made further arrangements for ecological civilization construction and green development and further emphasized the critical role of green finance in promoting the green transformation and development of economy and society. Under such a top-level design, the pilot practice at the grassroots level also serves as a magic weapon for successful reform. On June 14, 2017, the State Council executive meeting decided to build green financial reform and innovation pilot zones with different emphasis and characteristics in provinces and autonomous regions, including Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, and put forward five major reform pilot tasks. At the practical level, China has carried out the construction of the green financial innovation pilot zone and continuously expanded the scope of the pilot and made a series of beneficial explorations in green financial policy and tool innovation, which laid a solid pilot foundation for promoting the further development of green finance.

With the promotion of policies and practices, green finance has gradually become a hot topic for scholars to study. Existing academic studies have achieved many research results in terms of the definition of green finance ( 1 – 5 ), impact effect ( 6 ), and relevant policy tools to support the development of green finance ( 7 – 11 ). However, the existing research focuses on the macro-impact of green finance on economic and social development and the meso-impact on industries, while there is relatively little research on the impact on micro-enterprises, which needs further exploration.

On June 14th, 2017, the State Council executive meeting decided to build green financial reform and innovation pilot zones with different emphasis and characteristics in provinces and autonomous regions, including Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang. Meanwhile, five major reform pilot tasks were proposed, including supporting financial institutions to set up green financial departments or green sub-branches, encouraging the development of green credit, exploring the establishment of environmental rights and interests trading markets, opening government service channels with priority for green projects and establishing green financial risk prevention mechanisms. As for the concrete situation of pilot zones, five provinces and autonomous regions actively introduced policies and measures, designed incentive mechanisms according to local conditions to promote green finance development, and achieved remarkable development efficacy. For example, Guizhou Province explores green finance supporting green agriculture and ecological environment governance; Huzhou City, Zhejiang Province, vigorously develops green credit, which accounts for 22% of the total credit balance, and improves the statistical system of green finance and starts the service of “Lvdaitong.” Jiangxi Ganjiang New District innovates various financial products and services such as credit, securities, and insurance to provide relevant financial services for investment and financing of green ecological industries. Regional Green Finance Development Index and Evaluation Report compiled by the International Institute of Green Finance, CUFE (Central University of Finance and Economics), shows that with the policy pilot promotion, the scores of the five pilot zones in green finance development and policy promotion measures are in the first echelon in China, and the relevant pilot zones have laid a solid pilot foundation for the further development of green finance.

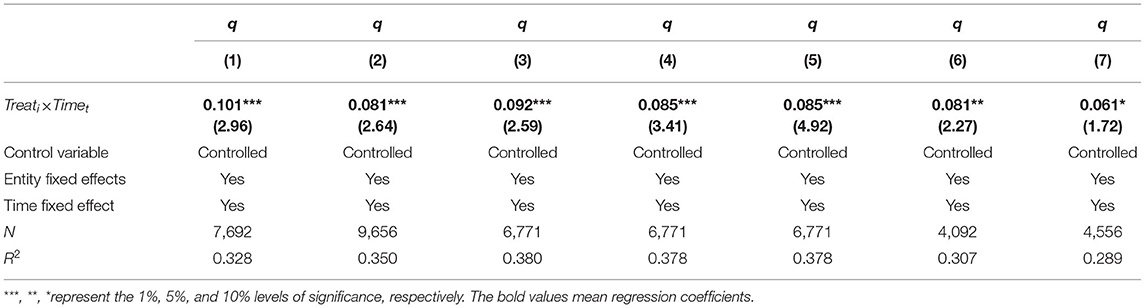

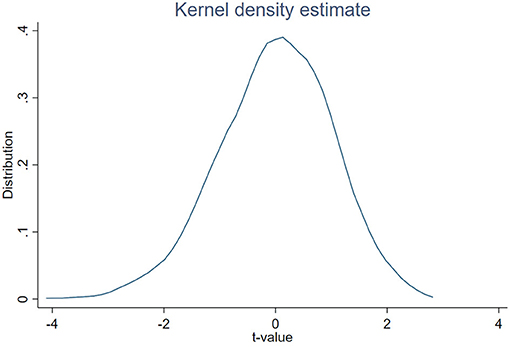

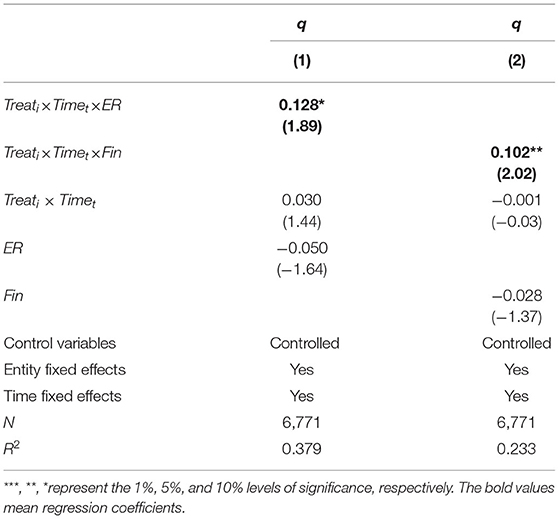

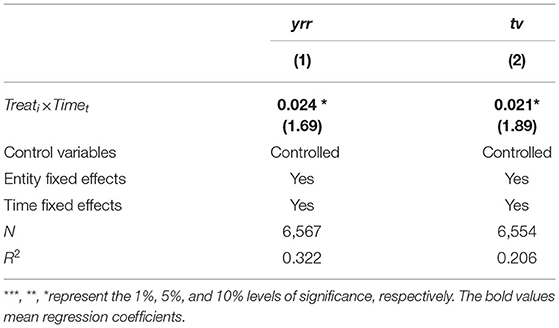

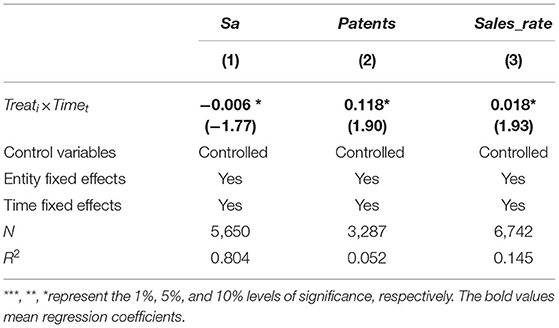

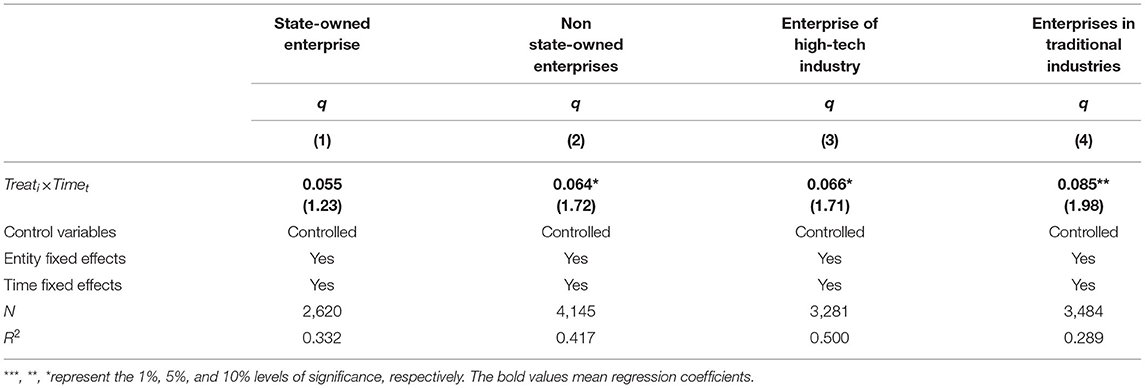

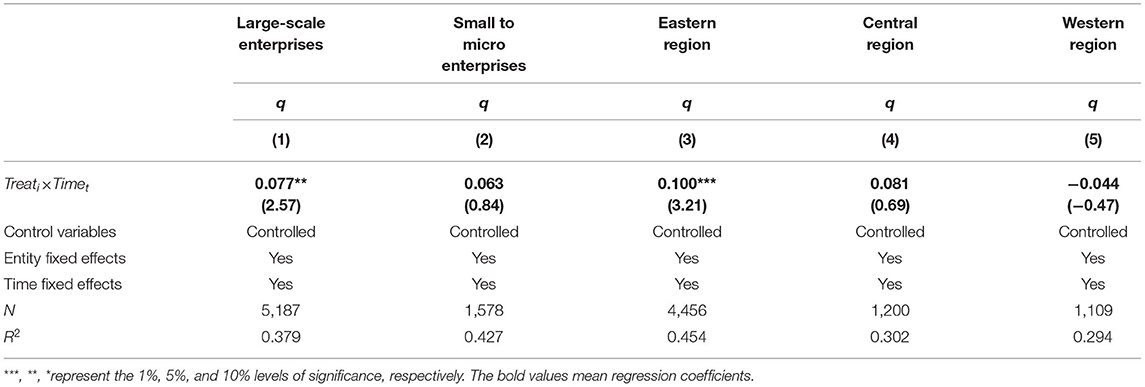

However, what impact does this pilot policy have on micro-green enterprises? Does it bring about a long-term value promotion to green enterprises? In order to answer this question, this paper resorts to the quasi-natural experimental scenario of green finance pilot in China and the data of green enterprises in listed companies to test the impact of green finance pilot on the value of green enterprises from long-term perspectives. Firstly, this paper uses the Differences-in-Differences (DID) method to test the impact of green finance pilots on the long-term value of green enterprises measured by Tobin Q. The results of benchmark regression and a series of robustness tests show that the pilot policy of green finance has significantly improved the long-term value of green enterprises in the pilot zones. At the same time, if a region has a more vigorous intensity of environmental regulation and a higher level of financial development, green finance pilots in the region will achieve a more obvious promotion effect for the value of local green enterprises. The above results show that China's green finance pilot policy has promoted the value of green enterprises in the pilot zones in the long run, and the pilot policy has achieved specific expected outcomes. Then, this paper tests the mechanism of green finance pilot enhancing the long-term value of green enterprises. It is found that the green finance pilot not only increases the enterprise value by improving the capital market effect of stock return and trading activity of green enterprises but also improves the value of green enterprises by relieving financing constraints, increasing the technological innovation level and improving profitability. Finally, heterogeneity analysis shows that for non-state-owned enterprises, enterprises in traditional industries, large-scale enterprises, and enterprises in the eastern region, the pilot policy of green finance has a more pronounced effect on the long-term value of green enterprises.

Such a particular institutional arrangement of green finance pilot zones in some areas in China provides a rare opportunity for quasi-natural experiments to test the microeconomic consequences of the development of green finance. Meanwhile, empirical evidence from China's pilot areas will further enrich the relevant literature on the impact effect of green finance. Compared with the available literature, this paper may have the possible marginal contributions as follows: first, from the perspective of micro-enterprises, it tests the impact of green finance development on the long-term value of green enterprises, and more comprehensively describes the micro effect of green finance development. Second, a quantitative evaluation is made for the effect of green finance regional pilot policies in China. The results of this study show that China's green finance pilot improves the value of green enterprises in the pilot areas in the long term, which manifests that from the perspective of micro-enterprises, China's green finance pilot has achieved sound policy effects. Thirdly, this paper analyzes the influence mechanism of green finance development on the value of green enterprises and finds that green finance adds value to green enterprises through capital market effect and real effect.

Literature Review and Theoretical Analysis

China's experience in the reform lies in the successful use of experimental (pilot) methods, which is also reflected in the development of green finance. On June 14th, 2017, the executive meeting of the State Council decided to build green financial reform and innovation pilot zones with different emphasis and characteristics in five provinces and autonomous regions, including Zhejiang, Jiangxi, Guangdong, Guizhou, and Xinjiang, and put forward five major reform pilot tasks, aiming at exploring replicable and scalable experiences and enriching green financial tools and policies through the green financial pilot zones. Whether the green finance development and policy promotion measures in the five pilot zones have facilitated the development of green enterprises and industries in the current period? How to objectively and comprehensively evaluate the pilot zones' experimental effect to develop green finance better is in urgent need of in-depth academic research.