Home » Application » Loan Foreclosure Application – Sample Application for Foreclosure of Loan

Loan Foreclosure Application – Sample Application for Foreclosure of Loan

To, The Manager, __________ (Bank Name), __________ (Branch Address)

Date: __/__/____ (Date),

Subject: Foreclosure of loan

Respected Sir/Madam,

Most respectfully, I would like to inform you that I do hold a loan account in your branch bearing account number ___________ (Account number).

I am currently holding a loan of _______ (Amount) for _______ (Purpose) and I am writing this letter to inform you that I am looking forward to the foreclosure of the loan. My loan ID is ________ (Loan ID/Account Number) and I opted for ________ (Number of EMI’s) EMIs. I have already paid ______ (Amount) in _______ (Number of EMIs) EMIs and I am willing for foreclosure of the loan. I am ready to pay all pending amount i.e. ________ (Pending loan amount) in a single installment.

I request you to kindly guide me through the procedure to avail the above-mentioned service. I shall be highly obliged for your kind response. In case of any queries, you may contact me at __________ (Contact number).

Thanking you, _________ (Signature) _________ (Your name), _________ (Contact number)

Incoming Search Terms:

- sample letter to bank manager for forepayment of loan

- request letter regarding foreclosure of loan

By letterskadmin

Related post, internship request letter – how to write an application for internship | sample letter.

Salary Increment Request Letter – Sample Request Letter for Salary Increment

Request letter for outdoor fitness equipment installation in parks – sample letter requesting for outdoor fitness equipment installation in parks, leave a reply cancel reply.

You must be logged in to post a comment.

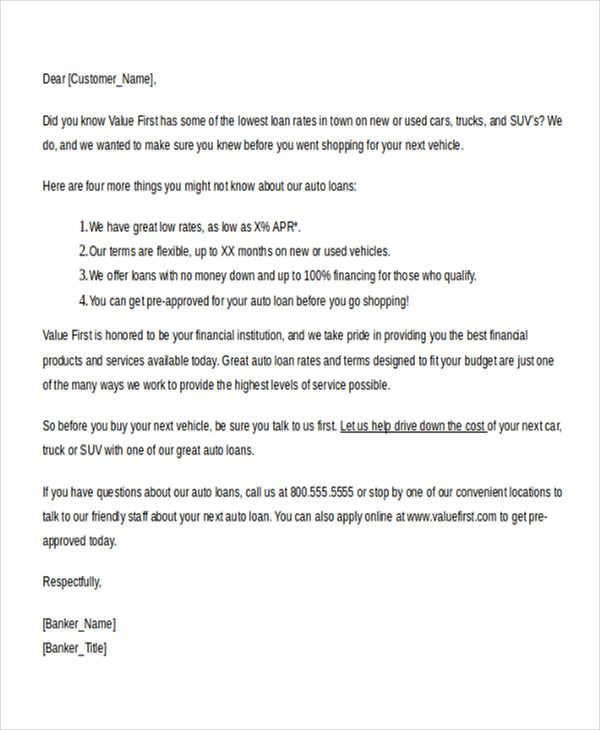

Sales letter

Business order letter, request email for sick leave – how to write an sick leave email, follow-up email for pending leave approval – how to write an email for leave submitted and pending approval | sample email, privacy overview.

- Letter Writing

- Formal Letter Writing In English

- Foreclosure Letter

Foreclosure Letter | Know How to Write & Check the Samples

By making an early payment of the complete outstanding amount, any loan account holder can appeal for the premature loan to be closed. In order to apply for the closure of the premature loan account, the loan holder will have to go through a procedure, and the first step is to write a foreclosure letter to the bank. To know the loan foreclosure request letter format, read the article till the end.

Table of Contents

How to write a loan foreclosure letter to the bank, foreclosure letter format and samples, home loan foreclosure letter, home loan foreclosure letter for joint account, frequently asked questions on foreclosure letter.

Writing a letter to the bank for any purpose follows a specific format. Even if you are applying for a bank statement or writing a loan foreclosure letter, you need to follow the format for the same. For the purpose of closing your loan account permanently, you will have to write a loan foreclosure letter to the branch manager stating the reason behind the closure. Do not forget to mention your account details, name, loan account number, etc.

Because of the procedures, some people find it difficult to write a bank application. We have included some samples of foreclosure letters, as well as some examples of house loan foreclosure letter formats, to make things easier. To learn more, continue reading.

The loan foreclosure request letter format is pretty simple if you have all the details with you. The person applying for the closure of the loan account will have to state the reason behind the closure and follow the format for writing the letter.

If a person is willing to close the premature home loan account, then they will have to follow the home loan foreclosure letter format and write a letter to the bank. We have provided a few samples of loan foreclosure letters for a better understanding of the format. In order to write a foreclosure letter for a home loan, refer to the below samples.

In case a person wants to write a home loan foreclosure letter to the bank, they can refer to the below-provided sample.

#57 Saheed Nagar

Bhubaneswar, 751007

The Branch Manager

State Bank of India

#44, Bandra Branch

Bhubaneswar – 751007

Sub: Request for home loan foreclosure

Dear Madam,

I am Nisha Mittal, and I currently have a home loan against my account number (mention your account number). I want to foreclose my home loan this month by paying the outstanding amount in a single payment.

I have paid 8 EMIs as of now, and there are 5 EMIs pending until this year.

I request you to please inform me about the home loan foreclosure procedure at your bank as well as the remaining loan balance that I must pay in order to foreclose my home loan.

Sharing my contact information in case you require any more information.

Mobile number: 123456

E-mail address: [email protected]

Waiting for your response.

Yours sincerely,

Nisha Mittal

If there is a joint account for a home loan and they want to write an application to close the loan account, they can follow the below-mentioned home loan foreclosure letter format.

From Address

Name of the Bank

Sub: Home loan foreclosure request letter

Dear Sir/Madam,

With utmost respect we, _____ and ____ husband/father/mother and wife/daughter (any relationship) respectively run a combined home loan account in your bank under the loan account number _____________.

We now want to foreclose on our home loan, and we paid the outstanding loan amount of Rs.___ via check with number ____ dated ___.

We are aware of the charges applicable on the foreclosure of loan accounts as a part of your policy.

We request you to kindly do the needful to close the above-said home loan account and provide us with the relevant documents.

Thanking you.

Borrower name & signature

Co-borrower name & signature

What is meant by a foreclosure letter?

When a borrower repays the entire outstanding loan amount in one payment rather than in EMIs, they need to write a letter for the foreclosure of the loan, which is known as the foreclosure letter.

Are there any foreclosure charges deductions?

Yes, there will be foreclosure charges which will be deducted as a part of the bank’s policy.

What are the advantages of a loan foreclosure?

Prepaying your current personal loan in full or foreclosing it is deemed favourable and can help you raise your CIBIL score. An enhanced credit score can help you conclude your next loan application faster and negotiate better terms with the lender.

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

- Share Share

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

16+ Foreclosure Letter Format – How to Write & Check Samples

- Letter Format

- January 23, 2024

- Contract Letters , Agreement Letters , Legal Letters , Marketing Letters

Foreclosure Letter Format: Foreclosure is the legal process through which a lender can seize a property when a borrower fails to meet their loan obligations . marketing letters are the first step in this process, and they notify the borrower that they are in default and that the foreclosure process is about to begin.

Also Visit:

- Services Proposal Letter Format

- Company Introduction Letter to Client Format

- Partnership Proposal Letter Format

Format of Foreclosure Letter

Content in this article

The Legal letter format may vary depending on the jurisdiction, but typically it includes the following information:

- The borrower’s name and address

- The lender’s name and address

- The loan number and amount

- The date of default

- A description of the property to be foreclosed

- A statement indicating that the borrower is in default and the reasons why

- A statement indicating the lender’s intention to foreclose on the property

- A statement indicating the borrower’s right to cure the default and the timeframe in which they must do so

- Contact information for the lender and instructions on how to respond

The Foreclosure Letter Format is usually sent via certified mail or delivered in person to the borrower’s last known address. It is important that the Foreclosure Letter Format is written clearly and concisely, and that it follows the guidelines set out by the jurisdiction.

In addition to the standard format, the foreclosure letter may also include additional information or attachments, such as:

- A copy of the loan agreement or promissory note

- A statement of the borrower’s account history and payment records

- A notice of the borrower’s right to request a meeting with the lender or their representative.

- A notice of the borrower’s right to seek legal counsel and representation.

- A statement of the lender’s intention to auction the property or sell it to a third party.

Foreclosure Letter Format can be emotionally charged and stressful for both the borrower and the lender. Foreclosure Letter Format is important to approach the situation with empathy and professionalism, and to provide the borrower with all the information they need to understand their options and rights .

Foreclosure Letter Format – Sample Format

Here’s a sample format for a Foreclosure Letter:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

[Recipient’s Name] [Recipient’s Address] [City, State, ZIP Code]

Subject: Notice of Foreclosure

Dear [Recipient’s Name],

I hope this letter finds you well. This letter serves as formal notice of the foreclosure of the property located at [Property Address], which is secured by the mortgage dated [Mortgage Date], recorded in the office of [County Recorder’s Office] in Book [Book Number], Page [Page Number].

Due to non-payment of the outstanding mortgage amount, we regret to inform you that the lender has initiated foreclosure proceedings on the aforementioned property. The total outstanding balance as of [Current Date] is [Outstanding Amount].

Please be advised that you have [number of days] from the date of this notice to settle the outstanding balance to avoid the completion of the foreclosure process. If payment is not received by [Deadline Date], the lender will proceed with the legal actions necessary to complete the foreclosure.

For payment instructions or to discuss potential alternatives, please contact our office at [Lender’s Contact Information]. It is our sincere hope to find a resolution to this matter and avoid any further legal proceedings.

We understand the challenges that may lead to financial difficulties, and we are willing to work with you to explore potential solutions. However, prompt action is required to prevent the completion of the foreclosure process.

Thank you for your attention to this matter. We encourage you to seek legal advice to understand your rights and responsibilities in this situation.

[Your Full Name] [Your Title, if applicable] [Lender’s Company Name] [Lender’s Contact Information]

Foreclosure Letter Format – Example

Here’s an example of a Foreclosure Letter:

Subject: NOTICE OF FORECLOSURE

I trust this letter finds you. I am writing to inform you about the initiation of foreclosure proceedings on the property located at [Property Address]. This action is being taken due to non-payment of the mortgage secured by the property.

As of [Current Date], the outstanding balance on your mortgage is [Outstanding Amount]. Despite multiple attempts to contact you regarding the overdue payments, we have not received any response or payment.

Please be aware that you are now in default under the terms of your mortgage, and as a result, foreclosure proceedings have begun. You have [number of days] from the date of this notice to settle the outstanding balance and bring the mortgage current.

To avoid further legal actions and the completion of the foreclosure process, it is imperative that you contact us at [Lender’s Contact Information] immediately to discuss your options for resolving this matter. This may include payment arrangements, loan modification, or other alternatives.

If we do not receive payment or a viable plan for resolution by [Deadline Date], we will proceed with the necessary legal actions to complete the foreclosure. We understand that financial difficulties may arise, and we are willing to work with you to find a solution.

Please treat this matter with urgency, and do not hesitate to reach out to us to discuss your situation. Seeking legal advice is also recommended to fully understand your rights and responsibilities in this matter.

Thank you for your immediate attention to this serious matter.

Formal Foreclosure Letter Format

This is a Formal Foreclosure Letter Format

[Your Name] [Your Address] [City, State ZIP Code] [Date]

[Recipient’s Name] [Recipient’s Address] [City, State ZIP Code]

Dear [Recipient’s Name],

This letter serves as a formal notice of foreclosure on the property located at [Property Address]. As the lender on this property, we regret to inform you that the borrower has defaulted on the loan and is in breach of the loan agreement.

We have made numerous attempts to work out a repayment plan with the borrower, but unfortunately, all efforts have been unsuccessful. Therefore, we have no other option but to initiate foreclosure proceedings.

We understand that this may be a difficult time for you, and we are committed to working with you to resolve this matter as efficiently and amicably as possible. We urge you to contact us immediately to discuss the options available to you.

We would appreciate your cooperation in this matter, and we look forward to hearing from you soon.

[Your Name]

Informal Foreclosure Letter Format

Here’s an Informal Foreclosure Letter Format

I regret to inform you that foreclosure proceedings have been initiated on the property located at [Property Address]. The borrower has defaulted on the loan, and despite numerous attempts to work out a repayment plan, all efforts have been unsuccessful.

As a result, we have no other option but to proceed with foreclosure. We understand that this may be a difficult time for you, and we are committed to working with you to resolve this matter as efficiently and amicably as possible.

Please contact us as soon as possible to discuss the options available to you. We would appreciate your cooperation in this matter, and we look forward to hearing from you soon.

Foreclosure Letter Format – Template

Here’s a template for a Foreclosure Letter format:

I hope this letter finds you. I am writing to inform you that foreclosure proceedings have been initiated on the property located at [Property Address]. This action is a result of non-payment of the mortgage secured by the property.

As of [Current Date], the outstanding balance on your mortgage is [Outstanding Amount]. Despite our previous attempts to contact you regarding the overdue payments, we have not received any response or payment.

You are now in default under the terms of your mortgage, and foreclosure proceedings have commenced. You have [number of days] from the date of this notice to settle the outstanding balance and bring the mortgage current.

To prevent further legal actions and the completion of the foreclosure process, it is crucial that you contact us at [Lender’s Contact Information] immediately. We are open to discussing options for resolution, which may include payment arrangements, loan modification, or other alternatives.

Foreclosure letter format for real estate

Here’s a foreclosure letter for real estate:

[Your Name] [Your Title, if applicable] [Your Company Name, if applicable] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

I trust this letter finds you well. I am writing to formally notify you that foreclosure proceedings have been initiated on the real estate property located at [Property Address]. This action is a result of non-payment of the mortgage secured by the property.

As of [Current Date], the outstanding balance on your mortgage is [Outstanding Amount]. Despite our previous attempts to communicate with you regarding the overdue payments, we have not received any response or payment.

You are currently in default under the terms of your mortgage, and as a consequence, foreclosure proceedings have commenced. You have [number of days] from the date of this notice to settle the outstanding balance and bring the mortgage current.

To avoid further legal actions and the completion of the foreclosure process, it is imperative that you contact us at [Lender’s Contact Information] immediately. We are open to discussing options for resolution, which may include payment arrangements, loan modification, or other alternatives.

[Your Full Name] [Your Title, if applicable] [Lender’s Company Name, if applicable] [Lender’s Contact Information]

Foreclosure Letter Format for Real Estate

Foreclosure Letter Format to delinquent borrower

Here’s a Foreclosure Letter Format addressed to a delinquent borrower:

I hope this letter finds you. Unfortunately, I am writing to inform you that due to non-payment of the mortgage secured by your property, foreclosure proceedings have been initiated on the real estate located at [Property Address].

As of [Current Date], the outstanding balance on your mortgage is [Outstanding Amount]. Despite our multiple attempts to contact you regarding the overdue payments, there has been no response or payment received.

You are now in default under the terms of your mortgage, leading to the commencement of foreclosure proceedings. You have [number of days] from the date of this notice to settle the outstanding balance and bring the mortgage current.

To prevent further legal actions and the completion of the foreclosure process, it is crucial that you contact us at [Lender’s Contact Information] immediately. We are open to discussing options for resolution, such as payment arrangements, loan modification, or other alternatives.

If payment or a viable plan for resolution is not received by [Deadline Date], we will proceed with the necessary legal actions to complete the foreclosure. We understand that financial difficulties may arise, and we are willing to work with you to find a solution.

Foreclosure Letter Format to Delinquent Borrower

Foreclosure letter to property owner

Here’s a foreclosure letter addressed to a property owner:

[Property Owner’s Name] [Property Owner’s Address] [City, State, ZIP Code]

Dear [Property Owner’s Name],

I hope this letter reaches you in good health. Unfortunately, I am writing to inform you that foreclosure proceedings have been initiated on the real estate property located at [Property Address] due to non-payment of the mortgage secured by the property.

As of [Current Date], the outstanding balance on your mortgage is [Outstanding Amount]. Despite our numerous attempts to reach you regarding the overdue payments, there has been no response or payment received.

You are currently in default under the terms of your mortgage, resulting in the commencement of foreclosure proceedings. You have [number of days] from the date of this notice to settle the outstanding balance and bring the mortgage current.

To avoid further legal actions and the completion of the foreclosure process, it is crucial that you contact us at [Lender’s Contact Information] immediately. We are open to discussing options for resolution, including payment arrangements, loan modification, or other alternatives.

Foreclosure Letter to Property Owner

Email Format about Foreclosure Letter Format

Here’s an Email format of Foreclosure Letter Format:

Subject: Notice of Foreclosure on [Property Address]

I am writing to inform you that we have initiated foreclosure proceedings on the property located at [Property Address]. As the lender on this property, we regret to inform you that the borrower has defaulted on the loan and is in breach of the loan agreement.

Please note that failure to respond to this notice may result in legal action being taken against you. Therefore, we urge you to take this matter seriously and contact us as soon as possible.

[Your Title]

[Your Contact Information]

foreclosure letter to mortgage company

Here’s a foreclosure letter addressed to a mortgage company:

[Mortgage Company’s Name] [Mortgage Company’s Address] [City, State, ZIP Code]

Dear [Mortgage Company’s Name],

I trust this letter finds you well. Unfortunately, I am writing to formally notify you that foreclosure proceedings have been initiated on the real estate property located at [Property Address]. This action is a result of non-payment of the mortgage secured by the property.

As of [Current Date], the outstanding balance on the mortgage is [Outstanding Amount]. Despite our previous communications regarding the overdue payments, there has been no response or payment received.

The borrower, [Borrower’s Name], is currently in default under the terms of the mortgage, leading to the commencement of foreclosure proceedings. They have [number of days] from the date of this notice to settle the outstanding balance and bring the mortgage current.

To prevent further legal actions and the completion of the foreclosure process, it is imperative that you contact us at [Lender’s Contact Information] immediately. We are open to discussing options for resolution, including payment arrangements, loan modification, or other alternatives.

Please treat this matter with urgency, and do not hesitate to reach out to us to discuss the situation. Seeking legal advice is also recommended to fully understand your rights and responsibilities in this matter.

Foreclosure Letter to Mortgage Company

Foreclosure letter draft

Here’s a draft of a foreclosure letter:

I hope this letter finds you. It is with regret that I write to inform you that foreclosure proceedings have been initiated on the real estate property located at [Property Address]. This action is a consequence of non-payment of the mortgage secured by the property.

As of [Current Date], the outstanding balance on your mortgage is [Outstanding Amount]. Despite our numerous attempts to communicate with you regarding the overdue payments, there has been no response or payment received.

Foreclosure Letter Draft

FAQS About Foreclosure Letter Format – How to Write & Check Samples

What should be included in a foreclosure letter format.

A Foreclosure Letter Format should include details such as the borrower’s name, property address, outstanding balance, the reason for foreclosure, a deadline for resolution, and contact information for the lender.

How do I write a Foreclosure Letter Format to a homeowner?

This Foreclosure Letter Format Start with a clear subject line, mention the outstanding balance, specify the reason for foreclosure, provide a deadline for resolution, and include contact information for further discussion.

Are there specific legal requirements for a Foreclosure Letter Format?

Legal requirements for Foreclosure Letter Format may vary by jurisdiction. It’s advisable to consult legal experts or follow local regulations to ensure compliance.

Can a Foreclosure Letter Format be used as a negotiation tool?

Yes, a Foreclosure Letter Format can serve as a starting point for negotiations. Lenders may be open to discussing alternatives such as payment plans or loan modifications.

What is the importance of a Foreclosure Letter Format in the foreclosure process?

A Foreclosure Letter Format is a formal notice that informs the borrower about the initiation of foreclosure proceedings. It outlines the steps they can take to avoid foreclosure and serves as a legal requirement in many jurisdictions.

Can a Foreclosure Letter Format be customized based on the borrower’s situation?

Yes, a Foreclosure Letter Format can be customized to address specific details of the borrower’s situation, outstanding balance, and potential resolutions.

Is it necessary to include a deadline in a Foreclosure Letter Format?

Including a deadline in a Foreclosure Letter Format is crucial. It provides the borrower with a specific timeframe to address the outstanding balance and prevent further legal actions.

The foreclosure letter format is an important part of the foreclosure process. It should be clear, concise, and include all the necessary information for the borrower to understand the situation and take action. By following the guidelines of Foreclosure Letter Format set out by the jurisdiction and approaching the situation with empathy and professionalism, lenders can ensure that the foreclosure process is carried out in a fair and transparent manner .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

28+ Assurance Letter Format – How to Start, Examples, Email Template

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Loan Closure Letter

People worldwide opt for loans for various needs. There are so many kinds of loans that banks provide, such as Home Loan, Personal Loan, Car Loan, Gold Loan, Loan against Property, etc. Before learning about a loan closure letter, one should know what a loan closure is.

When a person opts for any loan from any lender, they need to repay the loan within a fixed tenure via Equated Monthly Installments (EMIs). Other than this, they can also prepay or foreclose the loan amount before the pre-decided time period. So, when a person pays off all the outstanding balance of their loan, the loan gets closed. This is called a loan closure.

A loan closure letter is a formal letter written to the lender whenever you want to close your loan. It applies to all kinds of loans like personal loans, vehicle loans and home loans, etc. After closing the loan you are required to get a no-due certificate, which acts as proof that you have paid all the balance loan amount. This letter will be retained by the person as an official note that he/she owes nothing more to the lender/bank as far as the loan transaction is concerned.

Loan Closure Letter: Guidelines and Tips

- The loan closure letter should be written following the format of a formal letter. As an official letter, the matter should be brief and to the point.

- It is important to mention the correct date for the bank to note down your date. It also acts as proof that you have written to the lender on a particular date.

- The subject should be precise and a single line telling the purpose of your letter.

- Add a formal and respectful salutation for the receiver.

- The main body should contain an introduction, the purpose of writing, and the bank details needed for the procedure.

- Mention in the letter, if you have attached some verification documents in the end.

- Senders should provide the contact details if needed for the process or in case of any query.

- Proofread the letter before sending it.

Format of a Loan Closure Letter

Sender’s address

Date: (dd/mm/yyyy)

Receiver’s address

Body of the letter

Yours sincerely/faithfully/truly

Sender’s name

Contact details

Attachments: (if any)

Sample Letter 1 – Letter for Closure of Personal Loan

21 Nehru Layout

Ganapati Road

The Branch Manager

State Bank of India

Main Branch

Subject: Request Letter for Loan Closure

Dear Sir/Ma’am,

I am Sudarshan Dubey, and I have a personal loan in my account in your bank. I am writing this letter to request you to close my personal loan account with the number 19948383782885.

I have cleared all of my EMIs, and the loan tenure is complete. I am attaching all the mentioned documents, including the No Objection Certificate, Payment Receipts, Loan Sanction Documents, and a copy of my Aadhaar Card and PAN Card as per the requirements of the bank with this letter.

Kindly do the needful and let me know the further procedure for the closure of the loan. Please contact me on the number or email provided below in case of any queries. I would be grateful if you could do the process at the earliest.

Yours sincerely,

Sudarshan Dubey

Contact number: 929588394783

Email: Sudarshan@dubey

Attachments:

- Loan A/c number

- Loan payment receipts

- No objection certificate (NOC)

- Aadhar Card copy

- PAN Card copy

Explore More Sample Letters

- Leave Letter

- Letter to Uncle Thanking him for Birthday Gift

- Joining Letter After Leave

- Invitation Letter for Chief Guest

- Letter to Editor Format

- Consent Letter

- Complaint Letter Format

- Authorization Letter

- Application for Bank Statement

- Apology Letter Format

- Paternity Leave Application

- Salary Increment Letter

- Permission Letter Format

- Enquiry Letter

- Cheque Book Request Letter

- Application For Character Certificate

- Name Change Request Letter Sample

- Internship Request Letter

- Application For Migration Certificate

- NOC Application Format

- Application For ATM Card

Sample Letter 2 – Letter for Closure of Home Loan

Apartment No. 134,

Krishna Apartments

Lakshmi Nagar

Central Bank of India

West Branch

Subject: Request for Home Loan Closure

I am Sudha Verma, a home loan account holder in your bank. I would like to bring to your notice that I have completed all the EMI payments for the loan, and thus would like to request for closure of my home loan account.

The actual tenure of my home loan with account number 174836839383 ends in August. As per the terms and conditions, I would have a minimum of a 3.5% prepayment penalty as I am closing the loan prior to the completion of the loan tenure. I am attaching all the mentioned documents, including the No Objection Certificate, Payment Receipts, Loan Sanction Documents, and a copy of my Aadhaar Card and PAN Card as per the requirements of the bank with this letter.

Yours faithfully,

Sudha Verma

Contact number: 748384637283

Email: sudha@verma

FAQs about Loan Closure Letter

Question 1. What do you understand by loan closure?

Answer. When a person opts for any loan from any lender, they need to repay the loan within a fixed tenure via Equated Monthly Installments (EMIs). Other than this, they can also prepay or foreclose the loan amount before the pre-decided time period. So, when a person pays off all the outstanding balance of their loan, the loan gets closed. This is called a loan closure.

Question 2. What is a loan closure letter?

Answer. A loan closure letter is a formal letter written to the lender whenever you want to close your loan. It applies to all kinds of loans like personal loans, vehicle loans and home loans, etc.

Question 3. Is a no-due letter/certificate important after loan closure?

Answer. After closing the loan you are required to get a no-due certificate, which acts as proof that you have paid all the balance loan amount. This letter will be retained by the person as an official note that he/she owes nothing more to the lender/bank as far as the loan transaction is concerned.

Customize your course in 30 seconds

Which class are you in.

Letter Writing

- Letter to School Principal from Parent

- ATM Card Missing Letter Format

- Application for Quarter Allotment

- Change of Address Letter to Bank

- Name Change Letter to Bank

- Application for School Teacher Job

- Parents Teacher Meeting Format

- Application to Branch Manager

- Request Letter for School Admission

- No Due Certificate From Bank

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Loan Closure Letter Format Sample in Word

Whenever you want to close your loan some times you need to write a request letter to the bank or finance company to close your loan. It applies to all kinds of loans like personal clowns, vehicle loans and home loans, etc.

After closing your loan you need to get a no due certificate, which acts as proof that you have paid all the balance loan amount.

- Required documents to close loan

- Perosonal loan closure letter format

- Bike/car loan closure letter format

- Home loan closure letter format

Required Documents to Close Loan

- Loan A/c number.

- Loan approval letter

- Customer KYC like Aadhar & PAN.

Here you can find sample loan closure letter formats which you can also download in Word format.

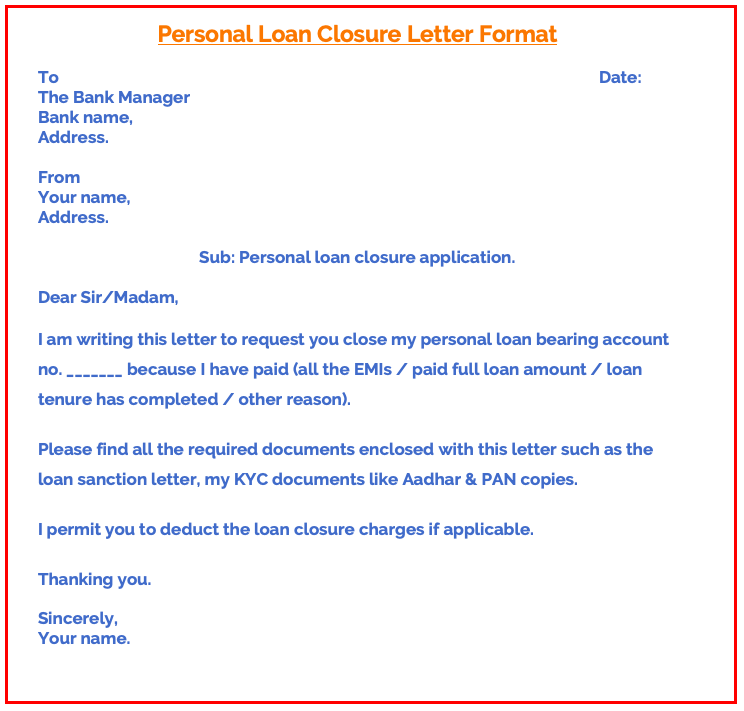

Sample personal Loan Closure Letter Format

To The Bank Manager Bank name, Address.

From Your name, Address.

Sub: Personal loan closure application.

Dear Sir/Madam,

I am writing this letter to request you close my personal loan bearing account no. _______ because I have paid (all the EMIs / paid full loan amount / loan tenure has completed / other reason) .

Please find all the required documents enclosed with this letter such as the loan sanction letter, my KYC documents like Aadhar & PAN copies.

I permit you to deduct the loan closure charges if applicable.

Thanking you.

Sincerely, Your name.

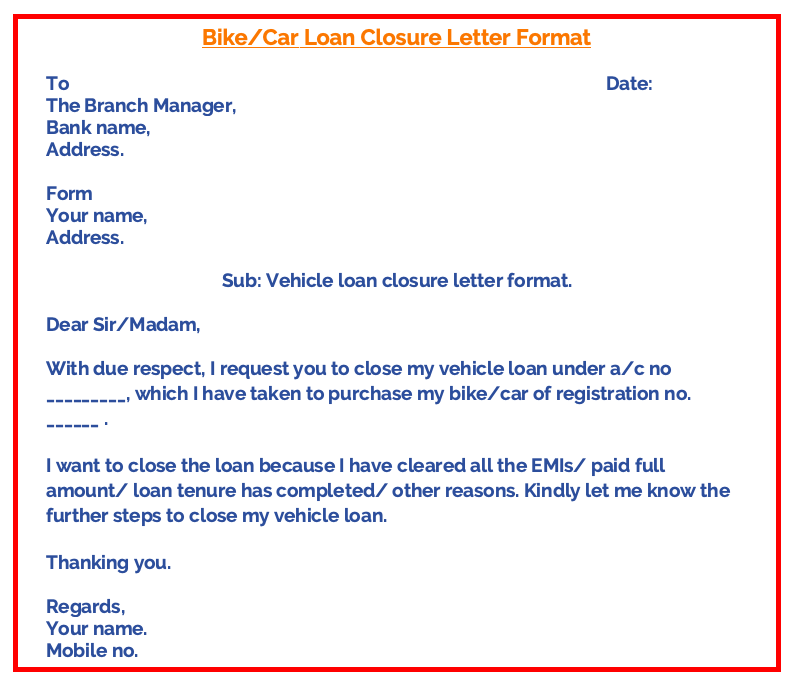

Bike/Car Loan Closure Letter Format

To The Branch Manager, Bank name, Address.

Form Your name, Address.

Sub: Vehicle loan closure letter format.

With due respect, I request you to close my vehicle loan under a/c no _________, which I have taken to purchase my bike/car of registration no. ______ .

I want to close the loan because I have cleared all the EMIs/ paid full amount/ loan tenure has completed/ other reasons. Kindly let me know the further steps to close my vehicle loan.

Regards, Your name. Mobile no.

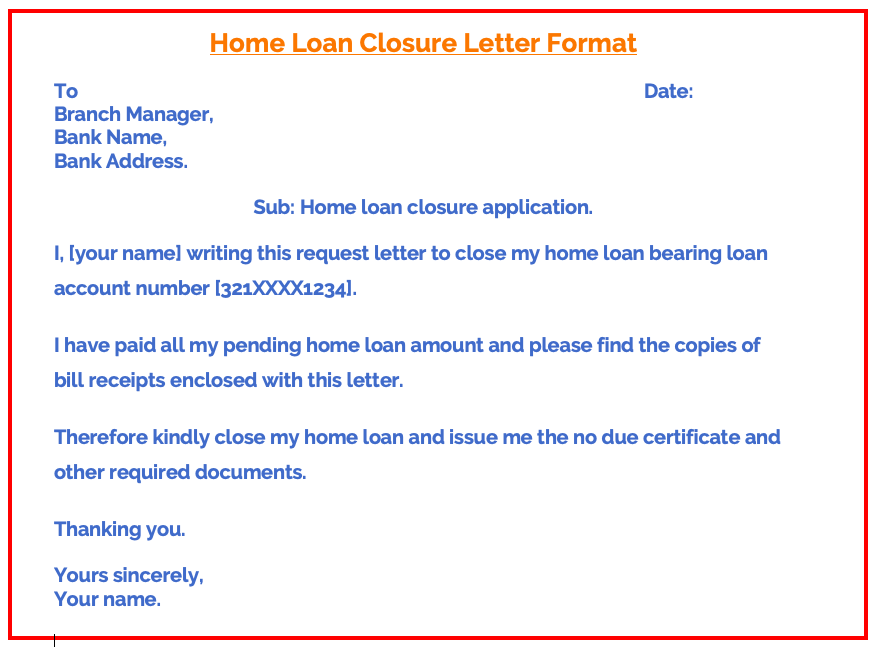

Home Loan Closure Letter Format

To Branch Manager, Bank Name, Bank Address.

Sub: Home loan closure application.

I, [your name] writing this request letter to close my home loan bearing loan account number [321XXXX1234].

I have paid all my pending home loan amount and please find the copies of bill receipts enclosed with this letter.

Therefore kindly close my home loan and issue me the no due certificate and other required documents.

Yours sincerely, Your name.

How to close my personal loan

- Visit your bank’s branch.

- Fill the loan closure application

- Pay any pending loan amount/charges.

- Submit your KYC & loan closure letter.

- Sign the required documents.

- Collect the acknowledgment.

How do I know my loan was closed?

You will receive a loan closure SMS on your mobile and the bank send the loan closing documents to your address.

Should I need to pay any loan closure charges?

There is no need to pay any charges in normal cases, except If you have any pending EMIs (or) if you wish to foreclose the loan. These charges vary from one bank to another bank.

Recommended:

SBI home loan closure letter format.

Leave a Comment Cancel reply

Application Letter

- Leave Application

- School & College Letter

- Office Application

- Bank Application

- Other Application

Loan Closure Letter Format & Sample In Word, Pdf

Loan Closure Letter Format: Are you searching for some of the Best Loan Closure Letter Format Sample In Word & Pdf? If Yes, then here you will get these types of application letter sample.

Let me tell you first, To close an account with the bank from which you took your loan, follow & read their terms and conditions very carefully.

Then write the account closure request letter using the application samples given below. Submit with it some documents (e.g. Personal Loan account number, approval letter, other documents issued by the bank) and Identity proof (e.g. Passport, PAN card, Aadhar).

If the bank has any pre-closure amount, then they have to pay it. Then in a few days, the bank will send you the loan completion document. After that all the process of closing your loan account will be completed.

The letter samples given below can be used for any bank without any problem. For example, you can use them in the case of HDFC personal loan closure letter format or SBI home loan closure letter format.

Personal Loan Closure Letter Format

To, The Branch Manager (Bank Name), (Bank Address), (Date).

Subject: Request Letter For Loan Closure.

Dear Sir/Madam,

I, ___________(Write Your Name) have a personal loan in my account on your _______ (Mention Your Bank Name) bank. I am writing this application letter to request you to close my personal loan account bearing account number ____________ (Mention Your Loan Account Number). The reason for closure is ___________ (Mention the reason for the closure correctly here).

I would like to inform you that I have paid all the EMI, loans. You can check your records. As per the requirements of the bank, I am attaching the applicable documents with this application.

Kindly consider this request letter and do the needful as soon as possible.

Thanking you,

Yours Faithfully, (Your Legal Name), (Your Address), (Your Email), (Your Mobile).

Car Loan Closure Letter Format

To, The Bank Manager (Name of the Bank ), (Branch Address), (Date).

Subject: Closure of the car loan account.

Respected Sir/Madam,

I am writing this letter to state that, I am holding an auto/vehicle/car loan bank account in your ________ (Mention Your Bank Branch Name) branch.

All details of my account are listed below: Loan Account Holder Name:- Loan Account Number:- Loan Approved Amount:- My PAN Number:-

Currently, I am willing to pay all my remaining amount and at the same time, I want to close my loan account.

So I request you, please let me know the detailed process and necessary documents for it. So that I can pay the remaining amount quickly and close the account.

Thank you in advance.

Yours Truly, (Your Name), (Full Address), (Your Contact Details).

Home Loan Closure Letter Sample

To, The Branch Manager, (Bank Name), (Branch Name), (Branch Address), (Date).

Subject: Application for home loan.

With due respect, I Beg to say that I hold a loan account & account no is ___________ [Mention Your Bank Account No] with your __________ [Mention Your Branch Name] branch. For some personal reason, I want to close my home loan account. (You can specify the reason for this closure)

Therefore, you are requested to kindly close my account. I will always be grateful to you. If any other information or documents is required for it, kindly contact me on my mobile number. my mobile number is ____________ (Mention Your mobile Number).

Thanking You.

Yours Sincerely, (Your Name), (Address), (Your Account Details), (Contact Details).

Loan Closure Letter HDFC, SBI & ICICI

To The Bank/Branch Manager, [Bank Name], [Bank Address], [Date:__/__/__].

Subject: Personal/Home/Car loan closure application letter.

With due respect, I ______ [Your name], I am writing this letter to request that I want to close my personal/home/car loan associated with loan account no _______ [Mention your loan account no].

Now, that I am already paid my total due & I request you to please go through the process of pre-closing my loan.

If you need any additional information or documents to complete this process, you can let me know at the phone number below.

Yours Sincerely, [Your Name], [Phone Number], [E-mail Address].

Read Also: Application For Closing Bank Account Letter

Application For Closing Loan Account

To The Branch Manager, [Name of the Bank], [Branch Address],

Date: Day/Month/Year.

Subject: Loan account close application.

Most respectfully I beg to state that, I ______ [Your name], I am a saving account holder in your branch. Also, I have a loan account & my loan account number is ________ [Mention your account no]. I want to close my loan account for some personal reasons.

Therefore, I request you to close my loan account and provide me with all the original documents that I submitted when applying for the loan account.

We hope you’ll consider my request properly and begin the process of closing the account as soon as possible.

Yours Sincerely, [Signature], [Contact Details], [Address].

Loan Closure Letter Format Sample In Word & PDF

👉 [Download In Word / PNG / PDF ] 👈

FAQ’s On Loan Closure Letter Format Sample

How do you close a loan account? You can easily close your loan account by following the steps given below –

- Visit the bank with all required documents.

- Write a loan closure letter to the bank manager OR, You may be required to fill a form.

- If there is a pre-closing amount, then pay it.

- Return your credit card. (If issue)

- Take acknowledgment paper from your bank.

- Then your loan account will be closed automatically in a few days.

Which bank is best for personal loan? Below we have mentioned the names of some of the best banks in India for taking loans –

- State Bank of India (SBI): Interest Rate- 9.60% onwards , Loan Amount- Up to Rs. 20 lakh .

- ICICI Bank: Interest Rate- 11.25% onwards , Loan Amount- Up to Rs. 20 lakh .

- HDFC Bank: Interest Rate- 10.75% onwards , Loan Amount- Up to Rs. 40 lakh .

- Bajaj Finserv: Interest Rate- 12.99% onwards , Loan Amount- Up to Rs. 25 lakh .

- Axis Bank: Interest Rate- 12% onwards , Loan Amount- Up to Rs. 15 lakh .

Can we close HDFC loan online? Unfortunately, you cannot close our HDFC Bank loan online, for this, you need to visit your nearest HDFC Bank and close the loan account. Also, you need to pay a certain amount to pre-close your loan.

Is there any pre-closure charges for home loan in SBI? No, you don’t have to pay any penalty for pre-closing your SBI home loan on fixed and floating rate interest. However, you may have to go to any branch of SBI and fill up some forms for it.

Online receipt makers can help you create professional receipts for loan closings. These tools let you customize the template, add your logo, and track receipts. Using a Zintego online receipt maker can help you create a clear and concise receipt that meets all of the necessary requirements.

Read Also:-

- Banking Related Cyber Crime Complaint Letter

- Application For Degree Certificate

- Kannada Letter Writing Format & Samples

One comment on “ Loan Closure Letter Format & Sample In Word, Pdf ”

- Pingback: Application To Bank Manager For Atm Card First Time

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Sample Letter Hub

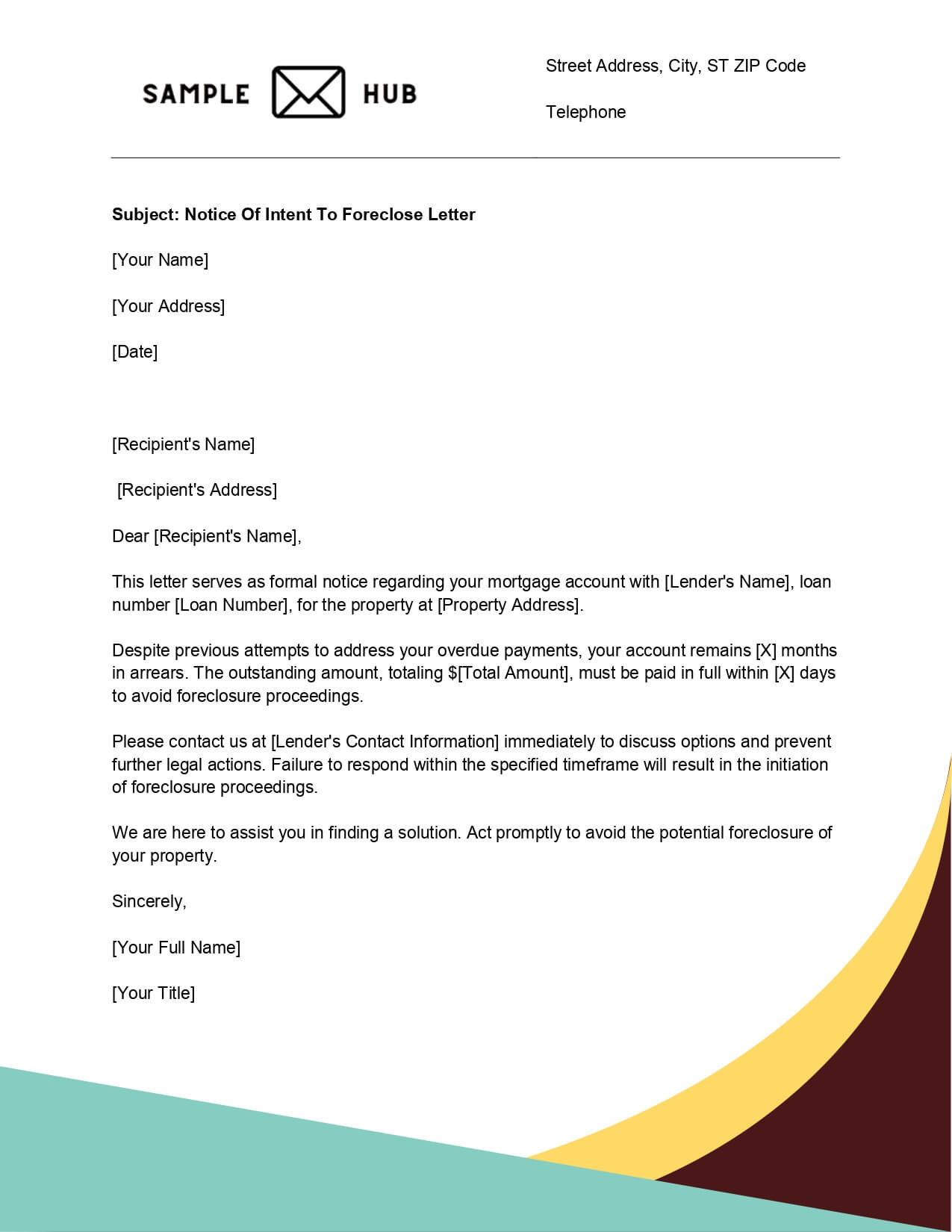

Notice Of Intent To Foreclose Letter

By Sikandar Ali

February 14, 2024

Are you facing the possibility of foreclosure on your property? If so, you may receive a Notice of Intent to Foreclose Letter from your lender. This letter is a formal notification that your lender intends to foreclose on your property if you do not take action to resolve your delinquent mortgage payments.

The purpose of this letter is to give you a warning and an opportunity to take corrective action before the foreclosure process begins.

In this blog article, we will provide you with templates, examples, and samples of Notice of Intent to Foreclose Letters. Our goal is to make it easy for you to write a letter that effectively communicates your situation to your lender.

We understand that writing a letter can be a daunting task, especially when you are facing the stress of foreclosure. That’s why we want to provide you with the tools you need to write a clear and concise letter that will help you avoid foreclosure.

Our templates and examples are designed to be user-friendly and easy to understand. We want to help you communicate your situation to your lender in a way that is professional and effective.

Whether you are seeking a loan modification, a repayment plan, or another form of assistance, our samples will help you get started. So, let’s get started and take the first step towards resolving your delinquent mortgage payments.

Dear [Recipient’s Name],

We hope this letter finds you in good health. We are writing to inform you of our intent to initiate foreclosure proceedings on the property located at [Property Address].

This action is prompted by the failure to meet the obligations outlined in the mortgage agreement dated [Date of Mortgage Agreement]. Despite our previous notices and attempts to work out a resolution, the outstanding amount of [Total Amount Due] remains unpaid.

As per the terms of the mortgage agreement, you are hereby provided with [Number of Days] days from the date of this letter to settle the outstanding amount in full. Failure to do so will result in the commencement of foreclosure proceedings, and legal actions may be pursued to recover the debt.

We understand that unforeseen circumstances may lead to financial difficulties. If you are facing challenges in meeting the payment requirements, we encourage you to contact our office at [Contact Information] to discuss possible alternatives and find a mutually agreeable solution.

We value open communication and aim to explore all available options before proceeding with legal actions. We believe that finding a resolution is in the best interest of all parties involved.

Thank you for your immediate attention to this matter.

[Your Full Name]

Intent To Foreclose Letter

We trust this letter finds you well. It is with regret that we write to inform you of our intent to initiate foreclosure proceedings on the property located at [Property Address].

This decision is a result of the failure to meet the financial obligations set forth in the mortgage agreement dated [Date of Mortgage Agreement]. Despite our previous attempts to reach a resolution, the outstanding amount of [Total Amount Due] remains unsettled.

In accordance with the terms of the mortgage agreement, you are hereby given [Number of Days] days from the date of this letter to settle the outstanding amount in full. Failure to do so will compel us to commence foreclosure proceedings, and legal actions may be pursued to recover the debt.

We understand that unforeseen circumstances may contribute to financial difficulties. Should you encounter challenges in meeting the payment requirements, we urge you to contact our office at [Contact Information] promptly. Exploring potential alternatives and finding an amicable resolution is our priority.

We emphasize the importance of open communication and are willing to consider all viable options before resorting to legal actions. Our aim is to work collaboratively towards a resolution that benefits all parties involved.

Your immediate attention to this matter is appreciated.

Mortgage Reinstatement Letter

We hope this letter finds you well. We are writing to discuss the possibility of reinstating your mortgage for the property located at [Property Address].

We understand that unforeseen circumstances may have led to the challenges in maintaining regular mortgage payments. However, we are committed to helping you get back on track and avoid any further complications.

After a thorough review of your account, we propose a reinstatement plan that includes the repayment of the overdue amount of [Total Amount Due]. This amount should be paid in full by [Repayment Deadline].

If you are unable to make the full payment by the specified date, we are open to discussing alternative arrangements to ease the financial burden. Please contact our office at [Contact Information] at your earliest convenience to explore suitable options.

Reinstating your mortgage will not only prevent the escalation of the situation but also provide you with an opportunity to maintain homeownership and improve your financial standing.

We value your commitment to resolving this matter promptly and appreciate your cooperation in reaching a mutually beneficial solution.

Notice Of Foreclosure Letter Sample

We regret to inform you that, due to the continued non-payment of your mortgage, we are compelled to issue this notice of foreclosure for the property located at [Property Address].

Despite our previous attempts to work out a resolution, it appears that the outstanding balance on your mortgage remains unpaid. As a result, we have no choice but to initiate the foreclosure process.

The total amount due, including arrears, late fees, and other associated costs, is [Total Amount Due]. Please be advised that this amount must be settled in full within [Notice Period] days from the date of this notice to prevent further legal actions.

If you are facing financial difficulties, we strongly urge you to contact our office at [Contact Information] immediately. We are willing to explore options to avoid foreclosure and find a mutually agreeable solution.

It is our hope that we can reach an arrangement that allows you to keep your home. However, time is of the essence, and prompt action is required to prevent the foreclosure process from moving forward.

Please treat this matter with the utmost urgency, and feel free to reach out with any questions or concerns you may have.

Loan Default Letter

Dear [Borrower’s Name],

We hope this letter finds you well. We regret to inform you that your loan account with [Lender’s Name] is currently in default.

Despite our previous communications regarding the outstanding payments, it appears that your account remains unpaid. As a result, we are left with no alternative but to formally notify you of the default status.

The total outstanding amount, including principal, interest, and any applicable fees, is [Total Amount Due]. This amount needs to be settled within [Notice Period] days from the date of this notice to avoid further consequences.

We understand that unforeseen circumstances can lead to financial difficulties. If you are experiencing challenges in meeting your payment obligations, we encourage you to contact our office at [Contact Information]. We are committed to working with you to explore possible solutions and establish a plan to bring your account back to good standing.

However, it is imperative that prompt action is taken to address the default and prevent any adverse actions, such as legal proceedings or negative impacts on your credit history.

Please consider this notice seriously, and do not hesitate to reach out if you have any questions or require further clarification. We are here to assist you in resolving this matter amicably.

Thank you for your prompt attention to this important issue.

How to Write a Notice of Intent to Foreclose Letter

If you are a homeowner who has fallen behind on mortgage payments, you may receive a notice of intent to foreclose letter from your lender. This letter is a legal document that informs you of the lender’s intention to foreclose on your property if you do not take action to resolve the delinquency.

Writing a notice of intent to foreclose letter can be a daunting task, but with the right approach, you can create a compelling letter that may help you avoid foreclosure. Here are seven steps to help you write an effective notice of intent to foreclose letter.

1. Understand the Purpose of the Letter

The first step in writing a notice of intent to foreclose letter is to understand its purpose. This letter is a legal document that serves as a warning to the homeowner that the lender intends to foreclose on the property if the delinquency is not resolved.

The letter should be written in a professional tone and should clearly state the consequences of not taking action to resolve the delinquency.

2. Gather the Necessary Information

Before you start writing the letter, you should gather all the necessary information. This includes your loan number, the amount of the delinquency, and the date of the last payment. You should also review your loan documents to ensure that you understand the terms of your mortgage and the consequences of default.

3. State the Purpose of the Letter

The first paragraph of the letter should clearly state the purpose of the letter. You should explain that you have fallen behind on your mortgage payments and that you have received a notice of intent to foreclose from your lender.

You should also state that you are writing the letter to request a loan modification or other form of assistance to help you avoid foreclosure.

4. Explain Your Financial Situation

In the next paragraph, you should explain your financial situation. You should provide details about your income, expenses, and any other financial obligations that you have. You should also explain any extenuating circumstances that have contributed to your delinquency, such as a job loss or medical emergency.

5. Request Assistance

In the next paragraph, you should request assistance from your lender. You should explain that you are willing to work with the lender to find a solution that will allow you to keep your home. You should also provide details about the type of assistance that you are requesting, such as a loan modification or forbearance.

What is a Notice of Intent to Foreclose Letter?

A Notice of Intent to Foreclose Letter is a formal communication sent by a lender or mortgage company to a borrower, informing them of their intention to initiate foreclosure proceedings on their property.

What should be included in a Notice of Intent to Foreclose Letter?

A Notice of Intent to Foreclose Letter should include important details such as the borrower’s name, address, and loan account number. It should clearly state the lender’s intention to foreclose on the property due to the borrower’s failure to meet their mortgage obligations.

The letter should also provide a deadline for the borrower to take necessary actions to prevent foreclosure.

Can a borrower dispute a Notice of Intent to Foreclose Letter?

Yes, a borrower has the right to dispute a Notice of Intent to Foreclose Letter. They can challenge the lender’s claims by providing evidence of their compliance with the mortgage terms or by presenting any relevant legal defenses. It is advisable for borrowers to seek legal advice and respond promptly to the notice to protect their rights and interests.

FAQs About Notice of Intent to Foreclose Letter

1. what should i do if i receive a notice of intent to foreclose letter.

If you receive a Notice of Intent to Foreclose Letter, it is important to take action immediately. Contact your lender to discuss your options, which may include loan modification, forbearance, or repayment plans. You may also want to consult with a housing counselor or attorney for guidance.

2. How long do I have to respond to a Notice of Intent to Foreclose Letter?

The amount of time you have to respond to a Notice of Intent to Foreclose Letter varies depending on the state you live in and the terms of your mortgage. In some cases, you may have as little as 30 days to respond. It is important to act quickly to avoid foreclosure.

3. Can I stop foreclosure once it has started?

Yes, it is possible to stop foreclosure once it has started. You may be able to negotiate a loan modification or repayment plan with your lender, or you may be able to sell the property before the foreclosure sale. It is important to act quickly and seek professional guidance.

4. What are my options if I cannot afford to keep my home?

If you cannot afford to keep your home, you may be able to sell it through a short sale or deed in lieu of foreclosure. These options allow you to avoid foreclosure and may have less of an impact on your credit score. You may also want to consider bankruptcy as a last resort.

5. What happens if my home is foreclosed on?

If your home is foreclosed on, you will lose ownership of the property and may be evicted. The foreclosure will also have a negative impact on your credit score, making it difficult to obtain credit in the future.

- Letters To The President ( 5 Samples )

- Letter To The Bride Book ( 5 Samples )

- Authorization Letter To Bank ( 5 Samples )

- Day care Welcome Letter To Parents ( 5 Samples )

- Letter Of Appeal To Insurance ( 5 Samples )

Reach out to us for a consultation.

SLH is your favorite destination for all types of letter samples and templates.

+923498230044

© 2024, SampleLetterHub

All Formats

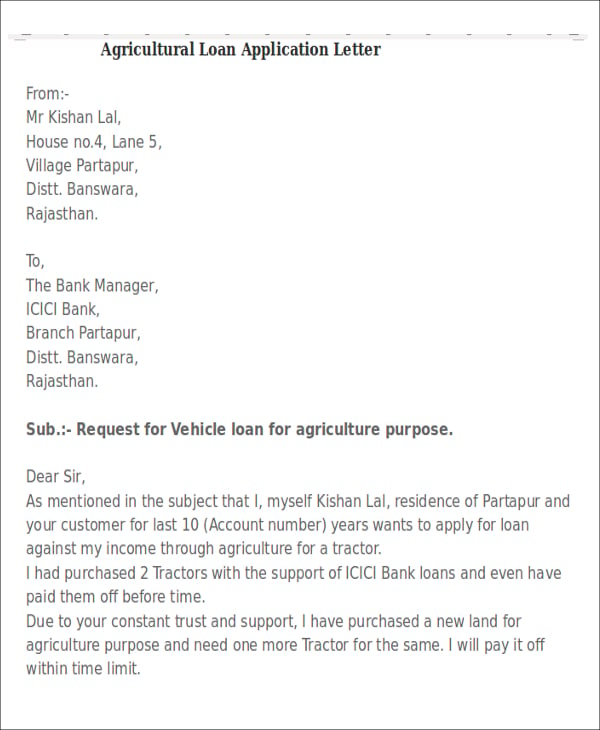

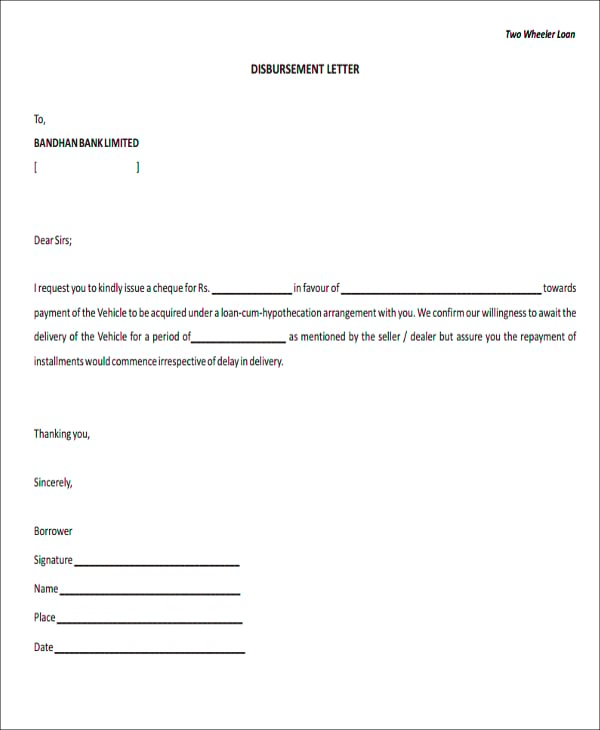

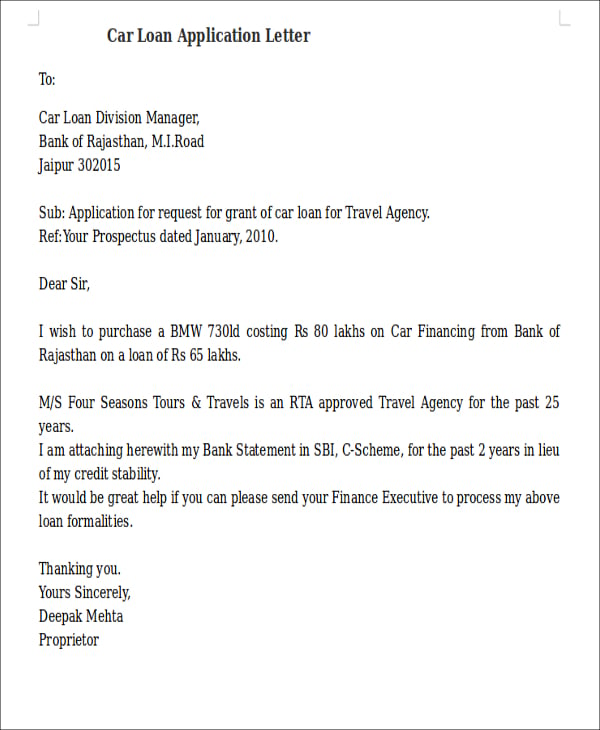

22+ Sample Loan Application Letters – PDF, DOC

There are times when we need financial aid to push through with our education, business ideas, or other personal projects or goals which require a huge amount of money for its realization. It is for this reason that lending companies have been existing ever since the days of old. Today, the primary step to being taken by someone who wants to borrow money from another individual or institution is to write a loan application letter .

Loan Application Letter

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

Formal Loan Purpose Application Letter to Senior Manager

Formal Event Management Small Business Letter

Sample Vehicle Application Letter Example

Agricultural Office Vehicle Application Letter Template

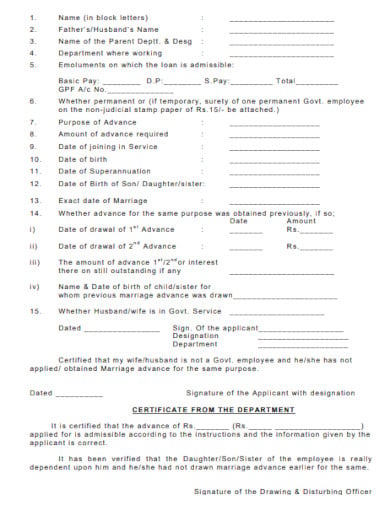

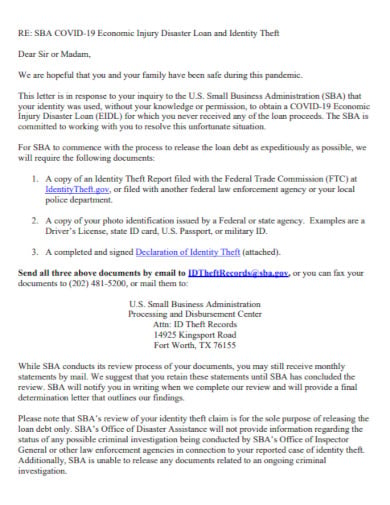

Sample Foreclosure Disbursement Application Form Letter

Example Work Travel Agency Letter

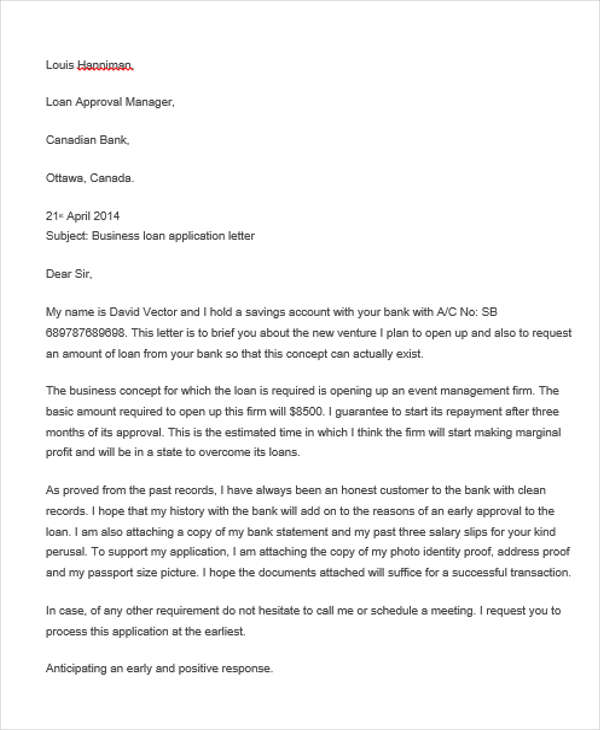

Application Letter to Canadian Bank for Loan

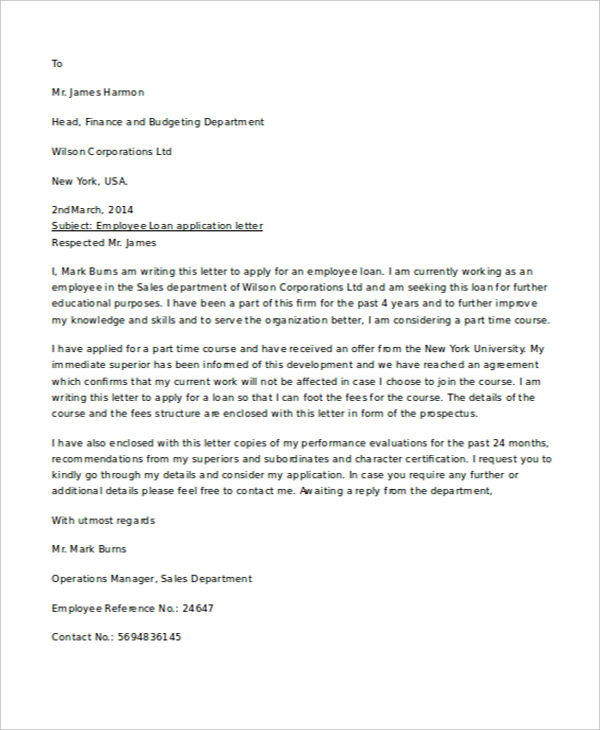

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract , the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

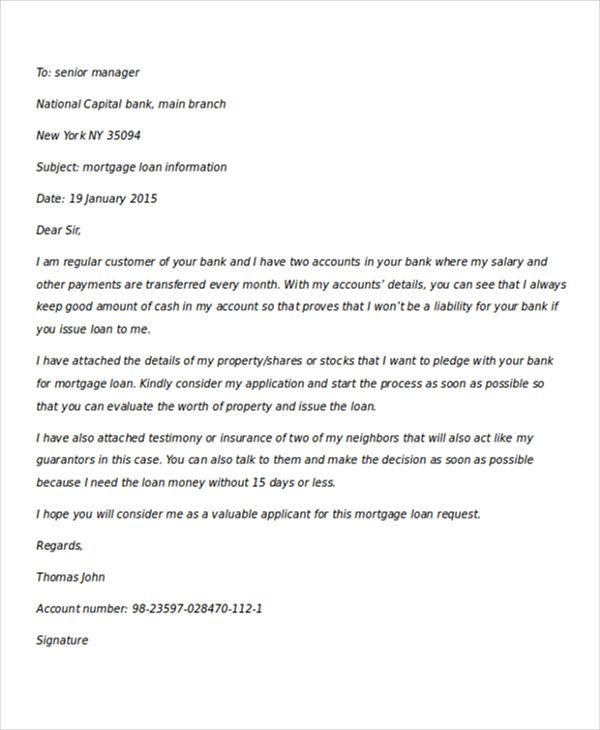

Basic Senior Typist Home Loan Application Letter Template

Mortgage Loan Application Letter with Boss Recommendation

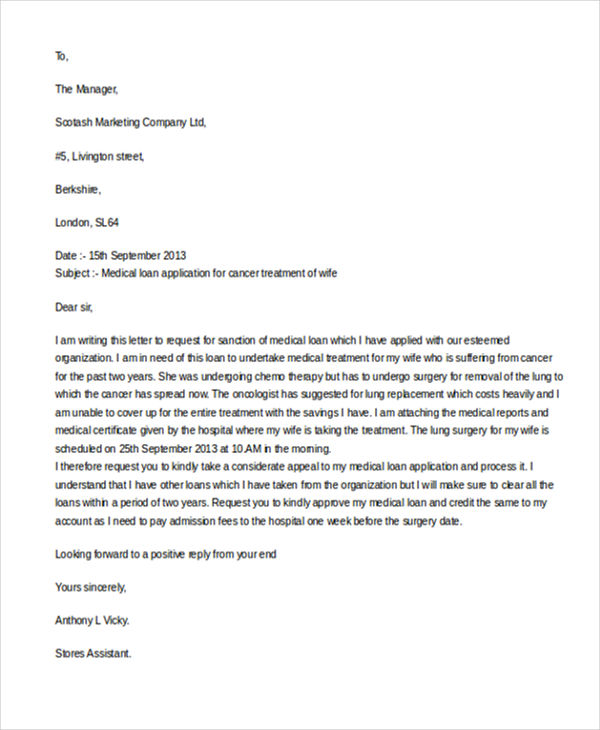

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

Request Urgent / Emergency Loan Letter for Borrowing Money

Free Commercial Vehicle Application Letter Template

Loan Application Letter for Wedding/Marriage Template

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters .

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

More in Letters

Loan requisition letter, loan application letter template, sample loan application letter template, simple loan application letter template, loan application letter to employer template, personal loan application letter template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

IMAGES

VIDEO

COMMENTS

Subject: Foreclosure of loan. Respected Sir/Madam, Most respectfully, I would like to inform you that I do hold a loan account in your branch bearing account number ___________ (Account number). I am currently holding a loan of _______ (Amount) for _______ (Purpose) and I am writing this letter to inform you that I am looking forward to the ...

A loan foreclosure letter format is a formal notification from a lender that you have failed to meet the terms of your loan agreement and that the lender intends to take legal action to recover the outstanding balance on the loan.This letter is an important document, as it outlines the specific terms of the foreclosure and provides you with an opportunity to respond to the lender's claims.

Yours sincerely, [Your Full Name] [Your Address] [City, State, ZIP Code] Other types of Sample Letters for Foreclosure of Personal Loans: 1. Sample Letter Requesting Foreclosure Options: This type of letter is written when a borrower is experiencing financial difficulties but wishes to explore alternative solutions to foreclosure, such as loan ...

Joint Personal Loan Foreclosure Application Letter: In cases where a personal loan is jointly availed by multiple borrowers, a joint foreclosure application letter is used. This letter is signed by all co-borrowers, stating their unanimous consent to close the loan and requesting instructions on how to settle the joint liability.

The loan foreclosure request letter format will follow the format of a formal letter. You will have to write the address at the beginning of your loan foreclosure letter. The letter will have the recipient's address. The date will be mentioned next in the loan foreclosure letter. It is important to mention the date for the authorities to note ...

I am writing to formally request the foreclosure of my personal loan under the terms and conditions stated in the loan agreement. Loan Details: Loan Account Number: [Account Number] Loan Amount: [Loan Amount] Date of Loan Agreement: [Date of Agreement] Term of Loan: [Loan Term] Monthly Payment Amount: [Monthly Payment] Reason for Foreclosure: I ...

Pune - 118821. Sub: Request for Education Loan Foreclosure. Dear Sir/Madam, I Anand Talmale, having a savings account in your branch with account number 8311xxxxxx9119. To sum up, I have written this letter to forclose my remaining loan amount. I am currently having an educational loan of INR 1,00,000 in your branch.

For the purpose of closing your loan account permanently, you will have to write a loan foreclosure letter to the branch manager stating the reason behind the closure. Do not forget to mention your account details, name, loan account number, etc. Because of the procedures, some people find it difficult to write a bank application.

The Branch Manager, Bank Name, Address. Sub: Home Loan foreclosure request. Dear Sir/Madam, I [your name] currently have a home loan in your bank, bearing loan account number [loan a/c number]. Now I want to foreclose that loan. I have cleared all the outstanding loan amount of Rs. ______________ through net banking on [date], please find the ...

Dear [Mortgage Company's Name], I trust this letter finds you well. Unfortunately, I am writing to formally notify you that foreclosure proceedings have been initiated on the real estate property located at [Property Address]. This action is a result of non-payment of the mortgage secured by the property.

Chennai. Subject: Request Letter for Loan Closure. Dear Sir/Ma'am, I am Sudarshan Dubey, and I have a personal loan in my account in your bank. I am writing this letter to request you to close my personal loan account with the number 19948383782885. I have cleared all of my EMIs, and the loan tenure is complete.

Home Loan Closure Letter Format. To. Branch Manager, Bank Name, Bank Address. Sub: Home loan closure application. I, [your name] writing this request letter to close my home loan bearing loan account number [321XXXX1234]. I have paid all my pending home loan amount and please find the copies of bill receipts enclosed with this letter.

A package of letters and forms to use in the process of foreclosure on real property. Foreclosure Letter for Personal Loan: A Comprehensive Guide Foreclosure letter for personal loan is a formal document initiated by a lender to notify a borrower about the impending foreclosure or seizure of collateralized assets due to non-payment or default on a personal loan.

Car Loan Closure Letter Format. To, The Bank Manager. (Name of the Bank ), (Branch Address), (Date). Subject: Closure of the car loan account. Respected Sir/Madam, I am writing this letter to state that, I am holding an auto/vehicle/car loan bank account in your ________ (Mention Your Bank Branch Name) branch.

City, State, Zip Code. RE: Loan Application for $100,000. Dear [Loan Officer's Name], I am writing to formally request a loan of $100,000. As a loyal customer for the past 20 years, I have always trusted this institution with my financial needs, both in my personal savings and checking accounts.

August 22, 2022. Mr. Jacob Harrison. Personal Loan Administrator. Bank of Texas. 4886 West 93 Street. Bowen, TX 89558. RE: Personal loan request for $6,000. Dear Mr. Harrison: The purpose of this letter is to request a personal loan in the amount of $6,000.

If you apply for a loan modification, short sale, or deed in lieu of foreclosure to prevent a foreclosure, you might have to write a hardship letter.Or you might just need to fill out a hardship affidavit rather than write a letter. What Is a "Hardship"? A "hardship" is a circumstance beyond your control that has resulted in a situation where you can no longer afford to make your current ...

This form is a sample letter in Word format covering the subject matter of the title of the form. Sample letter for foreclosure of personal loan is a formal document that serves as a written notice from the borrower to the lender, expressing their intention to pay off the loan amount in full before the specified loan tenure.

Sample Personal Loan Foreclosure Request Letter - Request Letter Format for Foreclosure of Personal LoanIn this video, you will find a sample Personal Loan F...

Here are seven steps to help you write an effective notice of intent to foreclose letter. 1. Understand the Purpose of the Letter. The first step in writing a notice of intent to foreclose letter is to understand its purpose. This letter is a legal document that serves as a warning to the homeowner that the lender intends to foreclose on the ...

A sample Notice of Foreclosure Letter typically includes the following key elements: 1. Header: The letter begins with the lender's name, address, and contact information, followed by the borrower's name and address. 2. Date: The date the letter is issued is included to establish the timeline of events.

The following examples of printable letters apply to loan purposes for COVID-19, small business template capital, personal loans, home loans, mortgage payment, education, car loans, wedding/marriage, medical emergency, foreclosure, and bank loans. Loan Application Letter