Home » Blog » Working Capital Management – Estimation and Calculation

Working Capital Management – Estimation and Calculation

- Blog | Account & Audit |

- 29 Min Read

- Last Updated on 27 April, 2023

Recent Posts

News, Blog, Insolvency and Bankruptcy Code

Appeal Against NCLAT’s Order Remanding Approved RP to NCLT Rejected as AA Passed Order Violating Sec. 419(3) of Co(s) Act | SC

Blog, News, FEMA & Banking

Secured Creditor’s Action Under SARFAESI Act Abates References to AAIFR, Including Appellant Co.’s SICA Reference | HC

Latest from taxmann.

🟢 Union Budget 2022-23 Live Update!

“The fact that cash inflows are not matched in both timing and amount by cash outflows, provides us with an operating cycle and rationale for investing in working capital. In any analysis of working capital, a distinction is made between temporary and permanent working capital requirements. The latter are a function of secular and cyclical trends in sales and operating expenses. The former depend on seasonal factors. In a proforma projection of working capital requirements, management must forecast the maximum level of current assets required to support an expected volume of sales and maximum level of short term credit it can anticipate to finance these assets.” 1

1. Estimation Procedure 2. Working Capital as a Percentage of Net Sales 3. Working Capital as a Percentage of Total Assets 4. Working Capital Based on Operating Cycle

- Need for Cash and Bank Balance

- Need for Inventories

- Need for Receivables

- Provided by Creditors

- Provided by Outstanding Wages and Expenses

5. Estimation of Working Capital Requirement 6. Graded Illustrations in Working Capital Estimation

The efficiency of the planning and management is subject to the correct estimate of the working capital requirement. Irrespective of the planning exercise made and control mechanism adopted, the correct estimation of working capital requirement is the fundamental necessity of a good and efficient working capital management. The present article looks into the steps and calculations required to estimate the working capital requirement for a firm.

1. Estimation Process

A firm must estimate in advance as to how much net working capital will be required for the smooth operations of the business. Only then, it can bifurcate this requirement into permanent working capital and temporary working capital. This bifurcation will help in deciding the financing pattern i.e. , how much working capital should be financed from long term sources and how much be financed from short term sources. There are different approaches available to estimate the working capital requirements of a firm as follows :

2. Working Capital as a Percentage of Net Sales

This approach to estimate the working capital requirement is based on the fact that the working capital for any firm is directly related to the sales volume of that firm. So, the working capital requirement is expressed as a percentage of expected sales for a particular period. The working capital estimation is thus, solely dependent on the sales forecast. This approach is Based on the assumption that higher the sales level, the greater would be the need for working capital. There are three steps involved in the estimation of working capital.

( a ) To estimate total current assets as a % of estimated net sales.

( b ) To estimate current liabilities as a % of estimated net sales, and

( c ) The difference between the two above, is the net working capital as a % of net sales.

So, the firm has to find out on the basis of past experience, or on the basis of other firm’s experience in the same competitive environment, as to how much total current assets and total current liabilities should be maintained for a given level of expected sales. The step ( a ) above i.e. , total current assets as a % of net sales will give the gross working capital requirement and step ( b ) above i.e. , current liabilities as a % of net sales will give the funds provided by current liabilities. The difference between the two is the net working capital which the firm has to arrange for. For example, the following information is available for ABC Ltd. for past three years, on the basis of which the working capital requirement for the next year is to be estimated, given that the sales are expected to increase by 10% over sales level of current year.

In this case, the average of current assets as a % of sales is 21% i.e. , (20%+21%+22%)/3; and the average of current liabilities as a % of sales is 5%. So, the net working capital as a % of sales is 16% i.e. , 21%-5%. Now, if the firm expects an increase of 10% in sales next year, then its working capital requirement can be estimated as follows :

Expected Sales = Rs. 14,00,000 + 10% thereof

= Rs. 15,40,000.

Net working capital as a % of sales = 16%.

= Rs. 15,40,000 × 16% = Rs. 2,46,400.

The firm is expected to have gross working capital of Rs. 3,23,400 ( i.e. , 21% of Rs. 15,40,000) out of which financing by current liabilities is expected to be Rs. 77,000 ( i.e. , 5% of Rs. 15,40,000). It may be noted that in the above situation the simple arithmetic average of current assets and current liabilities as a % of sales have been taken. If there is a consistent trend (increase or decrease) in current assets or current liabilities or both, then the weighted average may be preferred.

3. Working Capital as a Percentage of Total Assets or Fixed Assets

This approach of estimation of working capital requirement is based on the fact that the total assets of the firm are consisting of fixed assets and current assets. On the basis of past experience, a relationship between ( i ) total current assets i.e. , gross working capital; or net working capital i.e. , Current assets – Current liabilities, and ( ii ) total fixed assets or total assets of the firm is established. For example, a firm is maintaining 20% of its total assets in the form of current assets and expects to have total assets of Rs. 50,00,000 next year. Thus, the current assets of the firm would be Rs. 10,00,000 ( i.e. , 20% of Rs. 50,00,000).

In this approach, the working capital may also be estimated as a % of fixed assets. The firm basically plans the future level of fixed assets in terms of capital budgeting decisions. In order to use these fixed assets in an efficient and optimal way, the firm must have sufficient working capital. So, the working capital requirement depend upon the planned level of fixed assets. The estimation of working capital therefore, depends upon the estimation of fixed capital which depends upon the capital budgeting decisions. It has already been noted in Chapter 8 that the investment decisions of a firm are consisting of capital budgeting decisions (relating to fixed assets) and working capital management (relating to current assets and current liabilities). So, the working capital estimation, being a part of the investment decisions, should be made together with the capital budgeting decisions.

Both the above approaches to the estimation of working capital requirement are relatively simple in approach but difficult in calculation. The main shortcoming of these approaches is that these require to establish the relationship of current assets with the net sales or fixed assets, which is quite difficult. The past experience either may not be available, or even if available, may not help much in correct estimation. There is yet another approach to estimate the working capital requirement based on the concept of operating cycle.

Working capital requirement of a firm depends upon two variables :

(a) Time Factor

(b) Value Factor

The relevance and use of these two factors is summarised in the Table below:

Elements of Working Capital and Relation with Time & Value Factors

Both these factors have been considered by operating cycle approach to working capital, and has been discussed below.

Dive Deeper: What is Capital Budgeting? | Financial Management

4. Working Capital based on Operating Cycle

The concept of operating cycle, as discussed in the preceding chapter, helps determining the time scale over which the current assets are maintained. The operating cycle for different components of working capital gives the time for which an assets is maintained, once it is acquired. However, the concept of operating cycle does not talk of the funds invested in maintaining these current assets. The concept of operating cycle can definitely be used to estimate the working capital requirements for any firm.

In this approach, the working capital estimate depends upon the operating cycle of the firm. A detailed analysis is made for each component of working capital and estimation is made for each of these components. The different components of working capital may be enumerated as follows :

Different components of current assets require funds depending upon the respective operating cycle and the cost involved. The current liabilities, on the other hand, provide financing depending upon the respective operating cycle or the lag period in payment. The estimation of working capital requirement can now be made as follows :

( a ) Need for Cash and Bank Balance : Every firm must maintain some minimum cash and bank balance ( i.e. , immediate liquidity) to meet day to day requirement for petty expenses, general expenses and even for cash purchases. The minimum cash requirement for these transactions can be estimated on the basis of past experience. The need or motives for holding cash and bank balance have been discussed in detail in the next chapter. However, it must be noted, at this stage that the cash and bank balance must be estimated correctly for two reasons : ( i ) That the cash and bank balance is the least productive of all the current assets, hence a minimum balance be maintained, and ( ii ) The cash and bank balance provide liquidity to the firm, which is of utmost importance to any firm. The minimum cash and bank balance is also considered while preparing the cash budget for the firm (Chapter 14).

( b ) Need for Raw Materials : Every manufacturing firm has to maintain some stock of raw material in stores in order to meet the requirements of the production process. The number of units to be kept in stores for different types of raw materials depend upon various factors such as raw material consumption rate, time lag in procuring fresh stock, contingencies and other factors. For example, if it takes 5 days to procure fresh stock of raw materials, and 50 units are used daily, then there should be a minimum of 250 units in stock. The firm may also like to have a safety stock of 20 units. Thus, the total units to be maintained in stores would be 270 units. If the cost per unit of this item of raw material is Rs. 10 per unit, then the working capital requirement is Rs. 2,700 ( i.e. , 270 × Rs. 10).

( c ) Need for Work-in-progress : In any manufacturing firm, the production process is continuous and is generally consisting of several stages. At any particular point of time, there will be different number of units in different stages of production. Some of these units may be 10% complete, some may be 60% complete and some may be even 99% complete. These units, which can neither be defined as raw material nor as finished goods, are known as work-in-progress or semi-finished goods. The value of raw material, wages and other expenses locked up in these semi-finished units is the working capital requirement for work-in-progress.

It may be noted that all the units are not equally completed and hence valuation of all these units is a difficult job. For this purpose, certain assumptions may be made as follows :

( i ) The production process starts with the intake of full raw material. So, the value of raw material locked up in work-in-progress will be equal to full cost of number of units of raw material being represented in work-in-progress.

( ii ) The units in work-in-progress may be unfinished with respect to labour expenses and overhead expenses only. Some of these units may be 10% complete, some may be 75% complete and some may be even 80% complete and so on. It is assumed for simplification, that all work-in-progress units are on an average 50% complete with respect to labour and overhead expenses. However, if some other information is given, then the valuation of work-in-progress may be made accordingly.

( d ) Need for Finished Goods : In most of the cases, be it a trading concern or a manufacturing concern, the goods are not immediately sold after purchase/procurement/completion of production process. The goods in fact, remain in stores for some times before they are sold. The cost which is already incurred in purchasing, procuring or production of these units is locked up and hence working capital is required for them. It may be noted that these finished goods are valued on the basis of cost of these units. The carriage inward ofcourse, is included.

( e ) Need for Receivables : The term receivables include the debtors and the bills. When the goods are sold by a firm on cash basis, the sales revenue is realized immediately and no working capital is required for after sale period. However, in case of credit sales, there is a time lag between sales and collection of sales revenue. For example, a firm makes a credit sale of Rs. 1,50,000 per month and a credit of 15 days given to customers. The working capital locked up in receivables is Rs. 75,000 (Rs. 1,50,000 × 1/2 month).

However, an important point is worth noting here. The calculation of Rs. 75,000 is based upon the selling price, whereas the actual funds locked up in receivables are restricted to the cost of goods sold only. There is no investment in profit element as such. Therefore, it is better to calculate the working capital locked up in receivables on the cost basis. Thus, if the firm is selling goods at a gross profit of 20% then the working capital requirement in the above case, for receivables would be Rs. 60,000 only ( i.e. , Rs. 75,000 × 80%).

The total of working capital requirement for all the above elements is also known as the gross working capital of the firm. At any particular point of time every firm requires this gross working capital as there will be some units of raw materials in stores, some units in work-in-progress, some units as finished goods and there will be some debtors yet to be collected.

( f ) Creditors for the Purchases : Likewise a firm sells goods and services on credit it may procure/purchases raw materials and finished goods on credit basis. The payment for these purchases may be postponed for the period of credit allowed by suppliers. So, the suppliers of the firm in fact provide working capital to the firm for the credit period. For example, a firm makes credit purchases of Rs. 60,000 per month and the credit allowed by the suppliers is two month, then the working capital supplied by the creditors is Rs. 1,20,000 ( i.e. , Rs. 60,000×2 months). It means that the firm would be getting the supplies without however, making the payment for two months. The postponement of the payment to the creditors makes the firm to utilize this money elsewhere or help the firm to sell on credit without blocking its own funds.

( g ) Creditors for Expenses and Wages : Usually, the expenses and wages are paid at the end of a month. However, these wages and expenses accumulate in the work-in-progress and finished goods on a regular basis. The time lag in payment of wages and other expenses also provide some working capital to the firm. It may be noted that these wages and expenses are considered for the valuation of work-in-progress and finished goods, but are paid usually at the end of the month, providing a working capital to the firm for that period.

The working capital estimation as per the method of operating cycle, is the most systematic and logical approach. In this case, the working capital estimation is made on the basis of analysis of each and every component of the working capital individually. As already discussed, the working capital, required to sustain the level of planned operations, is determined by calculating all the individual components of current assets and current liabilities. There are different steps required for estimation of working capital based on operating cycle. These steps are :

( i ) Identify the current assets and current liabilities to be maintained. Estimation of each element of current assets and current liability is required.

( ii ) Determine the average operating cycle (or holding period) for each of these elements. Calculation of different holding periods has been explained in the previous chapter.

( iii ) Find out the rate per unit for each of these elements. For example, the rates of raw materials, work in progress, finished goods are to be ascertained.

( iv ) Find out the amount (funds) expected to be blocked in each of these elements. For example, in raw materials, the funds blocked are :

Av. holding period × No. of units required Per Period × Rate per unit.

( v ) Prepare the working capital estimation sheet and find out the working capital requirement.

The calculation of net working capital may also be shown as follows :

The work-sheet for estimation of working capital requirements under the operating cycle method may be presented as follows :

5. Estimation of Working Capital Requirements

The following points are also worth noting while estimating the working capital requirement :

- Depreciation : An important point worth noting while estimating the working capital requirement is the depreciation on fixed assets. The depreciation on the fixed assets, which are used in the production process or other activities, is not considered in working capital estimation. The depreciation is a non-cash expense and there is no funds locked up in depreciation as such and therefore, it is ignored. Depreciation is neither included in valuation of work-in-progress nor in finished goods. The working capital calculated by ignoring depreciation is known as cash basis working capital. In case, depreciation is included in working capital calculations, such estimate is known as total basis working capital.

- Safety Margin : Sometimes, a firm may also like to have a safety margin of working capital in order to meet any contingency. The safety margin may be expressed as a % of total current assets or total current liabilities or net working capital. The safety margin, if required, is incorporated in the working capital estimates to find out the net working capital required for the firm. There is no hard and fast rule about the quantum of safety margin and depends upon the nature and characteristics of the firm as well as of its current assets and current liabilities.

6. Points to Remember

- Every firm must estimate in advance as to how much net working capital will be required for the smooth operations of the business.

- Working capital estimates may be made on the basis of ( i ) As a % of net sales, ( ii ) As a % of total assets or fixed assets and ( iii ) operating cycle of the firm.

- In the operating cycle method, the working capital requirement is ascertained by finding out the need for cash, for raw materials, for work in progress, for finished goods and for debtors. However, if the credit is allowed by creditors or others then it is deducated to find out the net working capital requirement.

- At the work in progress stage, the three elements is RM, wages and expenses are estimated separately.

- Unless given otherwise, 100% RM is assumed to introduced in the production process in the beginning, but wages and expenses are assumed to accrue evenly throughout the production process.

- The requirement for finished goods and work in progress is taken at cash cost only and the amount of depreciation is ignored.

- The debtors (receivables) may be taken at cash cost or selling price. But it is better to take the debtors at cash cost because that shows the funds required for financing of working capital.

- While finding out the working capital requirement, the firm should also include a safety margin to take care of the contingencies.

7. Graded Illustrations

Illustration A

ABC Ltd. expects its cost of goods sold for 2000-2001 to be Rs. 600 lacs. The expected operating cycle is 90 days. It wants to keep a minimum cash balance of Rs. one lac. What is the expected working capital requirement? Assume a year consists of 360 days.

Working Capital Requirement:

Illustration B

Estimation of working capital requirement

Illustration C

Prepare an estimate of networking capital requirement of Zero company from the data given below:

The following is the additional information:

Cash at Bank is expected to be Rs. 25,000. Assume that production is sustained during 52 weeks of the year.

Statement of working capital requirement

Working Notes:

( i ) Annual production is 1,04,000 units and year is consisting of 52 weeks. So, the weekly production is 2000 units.

( ii ) Debtors have been taken at cost of production.

Illustration D

The cost sheet of PQR Ltd. provides the following data :

Average raw material in stock is for one month. Average material in work-in-progress is for half month. Credit allowed by suppliers: one month; credit allowed to debtors : one month. Average time lag in payment of wages: 10 days; average time lag in payment of overheads 30 days. 25% of the sales are on cash basis. Cash balance expected to be Rs. 1,00,000. Finished goods lie in the warehouse for one month.

You are required to prepare a statement of the working capital needed to finance a level of the activity of 54,000 units of output. Production is carried on evenly throughout the year and wages and overheads accrue similarly. State your assumptions, if any, clearly.

As the annual level of activity is given at 54,000 units, it means that the monthly turnover would be 54,000/12 = 4,500 units. The working capital requirement for this monthly turnover can now be estimated as follows :

Estimation of Working Capital Requirement

Working Notes :

- The Overheads of Rs. 40 per unit include a depreciation of Rs. 10 per unit, which is a non-cash item. This depreciation cost has been ignored for valuation of work-in-progress, finished goods and debtors. The overhead cost, therefore, has been taken only at Rs. 30 per unit.

- In the valuation of work-in-progress, the raw materials have been taken at full requirements for 15 days; but the wages and overheads have been taken only at 50% on the assumption that on an average all units in work-in-progress are 50% complete.

- Since, the wages are paid with a time lag of 10 days, the working capital provided by wages has been taken by dividing the monthly wages by 3 (assuming a month to consist of 30 days).

Illustration E

The following information has been extracted from the records of a Company : Product cost sheet

– Raw materials are in stock on an average for two months.

– The materials are in process on an average for one month. The degree of completion is 50% in respect of all elements of cost.

– Finished goods stock on an average is for one month.

– Time lag in payment of wages and overheads is 1½ weeks.

– Time lag in receipt of proceeds from debtors is 2 months.

– Credit allowed by suppliers is one month.

– 20% of the output is sold against cash.

– The company expects to keep a Cash balance of Rs. 1,00,000.

The Company is poised for a manufacture of 1,44,000 units in the next year.

You are required to prepare a statement showing the Working Capital requirements of the Company

Statement showing the Working Capital requirement of the Company

- Finished goods and Debtors have been taken at cost.

- Production per month has been taken at 12,000 units. For payment of wages and overheads, month is taken as consisting of 4 weeks.

Illustration F

XYZ Ltd. supplied the following information:

20% Sales are on cash basis and credit sales allowed to customers for one month. Overheads include Rs. 5 as depreciation. There is regular production and Sale cycle and wages and overheads accrue evenly. Wages are paid in the next month of accrual and overheads are paid 15 days in arrears. Material is introduced in the beginning of Production cycle. You are required to find out its working capital requirement on cash cost basis.

[B.Com.(H.), D.U., 2014]

Statement of Working Capital Requirement

Illustration G

Following Information is provided by ABC Ltd. :

Find out : (i) Operating Cycle Period, (ii) No. of Operating Cycles in a year, and (iii) Working Capital Requirement on cash cost basis.

Operating Cycle Period :

OC = RMCP + WPCP + FGCP + RCP – DP

= 50 + 18 + 22 + 45 – 55

No. of Operating Cycle in a year :

No. of Cycles = 360 ÷ Length of OC

= 360 ÷ 80 = 4.5 Cycles

Working Capital Requirement :

Working Capital Requirement = OC × Requirement per day

= Rs. 5,250 × 80

= Rs. 4,20,000

Illustration H

Prepare an estimate of net working capital requirement for the WCM Ltd. adding 10% for contingencies from the information given below :

Estimated cost per unit of production Rs. 170 includes raw materials Rs. 80, direct labour Rs. 30 and overheads (exclusive of depreciation) Rs. 60. Selling price is Rs. 200 per unit. Level of activity per annum 1,04,000 units. Raw material in stock : average 4 weeks; work-in-progress (assume 50% completion stage): average 2 weeks; finished goods in stock : average 4 weeks; credit allowed by suppliers : average 4 weeks; credit allowed to debtors: average 8 weeks; lag in payment of wages : average 1.5 weeks, and cash at bank is expected to be Rs. 25,000. You may assume that production is carried on evenly throughout the year (52 weeks) and wages and overheads accrue similarly. All sales are on credit basis only. You may state your assumptions, if any.

Statement of Net Working Capital Requirement

Assumptions : Net working capital requirement has been estimated on cash cost basis. Hence, investment in debtor has been computed on cash cost.

Illustration I

The management of Royal Industries has called for a statement showing the working capital to finance a level of activity of 1,80,000 units of output for the year. The cost structure for the company’s product for the above mentioned activity level is detailed below :

Additional information :

(a) Minimum desired cash balance is Rs. 20,000.

(b) Raw materials are held in stock, on an average, for two months.

(c) Work-in-progress (assume 50% completion stage in respect of all elements) will approximate to half-a-month’s production.

(d) Finished goods remain in warehouse, on an average, for a month.

(e) Suppliers of materials extend a month’s credit and debtors are provided two month’s credit; cash sales are 25% of total sales.

(f) There is a time-lag in payment of wages of a month; and half-a-month in the case of overheads.

From the above facts, you are required to prepare a statement showing working capital requirements.

Statement of Total Cost

Note : Depreciation is a non-cash item, therefore, it has been excluded from total cost as well as working capital provided by overheads. Work-in-progress has been assumed to be 50% complete in respect of materials as well as labour and overheads expenses.

Illustration J

Hi-tech Ltd. plans to sell 30,000 units next year. The expected cost of goods sold is as follows :

The duration at various stages of the operating cycle is expected to be as follows :

Assuming the monthly sales level of 2,500 units, estimate the gross working capital requirement if the desired cash balance is 5% of the gross working capital requirement, and work-in-progress is 25% complete with respect to manufacturing expenses. [B.Com. (H.), D.U., 2013 Adapted]

Note: Selling, administration and financial expenses have not been included in valuation of closing stock. However, Debtors have been valued at full cost. Alternatively, Debtors can also be valued at Rs. 30.

Illustration K

Calculate the amount of working capital requirement for SRCC Ltd. from the following information:

Raw materials are held in stock on an average for one month. Materials are in process on an average for half-a-month. Finished goods are in stock on an average for one month.

Credit allowed by suppliers is one month and credit allowed to debtors is two months. Time lag in payment of wages is 1½ weeks. Time lag in payment of overhead expenses is one month. One fourth of the sales are made on cash basis.

Cash in hand and at the bank is expected to be Rs. 50,000 : and expected level of production amounts to 1,04,000 units for a year of 52 weeks.

You may assume that production is carried on evenly throughout the year and a time period of four weeks is equivalent to a month.

Illustration L

The data of ABC Ltd. is as under:

There is a regular production on sales cycle, wages and overheads accrue evenly. Wages are paid in the next month of accrual. Material is introduced in the beginning of production cycle. Work-in-process involves use of full unit of raw materials in the beginning of manufacturing process and other conversion costs equivalent to 50%.

You are required to find out working capital requirement of ABC Ltd.

[B.Com. (H.), D.U., 2010]

Monthly Production (69000 ÷ 12) = 5750

Illustration M

Prepare a working capital forecast from the following information :

Production during the previous year was 10,00,000 units. The same level of activity is intended to be maintained during the current year. The expected ratios of cost to selling price are :

The raw materials ordinarily remain in stores for 3 months before production. Every unit of production remains in the process for 2 months and is assumed to be consisting of 100% raw material, wages and overheads. Finished goods remain in the warehouse for 3 months. Credit allowed by creditors is 4 months from the date of the delivery of raw material and credit given to debtors is 3 months from the date of dispatch.

The estimated balance of cash to be held Rs. 2,00,000

Lag in payment of wages ½ month

Lag in payment of expenses ½ month

Selling price is Rs. 8 per unit. You are required to make a provision of 10% for contingency (except cash). Relevant assumptions may be made.

Total Sales = 10,00,000 × 8 = Rs. 80,00,000

Illustration N

AB Ltd. provides the following particulars relating to its working:

For an expected annual sale of 1,00,000 units, work out the working capital requirement assuming that production is carried on evenly throughout the year and wages and overheads accrue similarly.

- Current Assets:

Illustration O

Grow More Ltd. is presently operating at 60% level, producing 36,000 units per annum. In view of favourable market conditions, it has been decided that from 1st January 2014, the Company would operate at 90% capacity The following informations are available :

(i) Existing cost-price structure per unit is given below :

(ii) It is expected that the cost of raw material, wages rate, expenses and sales per unit will remain unchanged in 2000.

(iii) Raw materials remain in stores for 2 months before these are issued to production. These units remain in production process for 1 month.

(iv) Finished goods remain in godown for 2 months.

(v) Credit allowed to debtors is 2 months. Credit allowed by creditors is 3 months.

(vi) Lag in wages and overhead payments is 1 month. It may be assumed that wages and overhead accrue evenly throughout the production cycle.

You are required to :

(a) Prepare profit statement at 90% capacity level; and

(b) Calculate the working requirements on an estimated basis to sustain the increased production level.

Assumptions made if any, should be clearly indicated.

Statement of Profitability at 90% Capacity

Working Note :

Overheads and Wages : The work in progress period is one month. So, the wages and overheads included in work-in-progress, are on an average, for half month or 1/24 of a year.

The valuation of finished goods can also be arrived at as follows :

As the decision to increase the operating capacity from 60% to 90% is already taken, it has been assumed that the opening balance of raw materials, work in progress and finished goods have already been brought to the desired level. Consequently, goods purchased during the period will be only for the production requirement and not for increasing the level of stock.

8. Problems

1. You are required to prepare a statement showing the working capital needed to finance a level of annual activity of 52,000 units of output. The following information are available :

Raw materials are in stock, on an average for 4 weeks. Materials are in process, on an average, for 2 weeks. Finished goods are in stock, on an average, for 6 weeks. Credit allowed to customers is for 8 weeks. Credit allowed by suppliers of raw materials is for 4 weeks. Lag in payment of wages is 1½ weeks. It is necessary to hold cash in hand and at bank amounting to Rs. 75,000. It may be noted that production is carried on evenly during the year and wages and overheads accrue similarly.

[ Answer : Working Capital requirement for 52,000 units ( i.e. , 1,000 unit per week) is Rs. 3,20,000.]

2. From the following information, prepare a statement showing estimated working capital requirement :

( i ) Projected Annual sales 26,000 units.

( ii ) Selling price per unit Rs. 60.

( iii ) Analysis of selling price :

Material 40%; Labour 30%; Overheads 20%; Profit 10%.

( iv ) Time lag (on average)

Raw materials in stock 3 weeks.

Production process 4 weeks.

Credit to debtors 5 weeks.

Credit by suppliers 3 weeks.

Lag in payment of wages and overheads 2 weeks.

Finished goods are in stock 2 weeks,

( v ) Cash in hand is expected to be Rs. 32,000.

[ Answer : Working Capital requirement is Rs. 2,69,000.]

3. From the following information presented by a manufacturing company, prepare a working capital requirement forecast for the coming year : Expected monthly sales of 32,000 units @ Rs. 10 per unit. The anticipated ratios of cost to selling prices are :

4. M/s. PQR and Co. have approached their bankers for their working capital requirement, who has agreed to sanction the same by retaining the margins as under :

From the following projections for next year you are required to work out :

( i ) the working capital required by the company; and

( ii ) the working capital limits likely to be approved by bankers.

The firm enjoys a credit of 15 days on its purchases and allows one month credit on its supplier. On sales orders the company has received an advance of Rs. 15,000. State your assumptions, if any.

[ Answer : Working capital Rs. 3,50,625, Loan to be approved at Rs. 3,32,750.]

______________

- Curran, W.S., Principles of Financial Management. McGraw-Hill Book Company, New York, First Edition, p. 161.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

One thought on “Working Capital Management – Estimation and Calculation”

Before it components a selected invoice, the company reveals you the exact charge you pays for that invoice, so you won’t be caught off guard whenever you repay the advance.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

How to Plan Your Business’s Working Capital Requirements

Managing working capital is the biggest challenge faced by businesses while running their operations. Many business owners feel that acquiring clients or increasing revenue can only help their business flourish. While it is partly true, what is equally important for a business to grow is how well it manages and strikes a balance between cash inflows and outflows.

The level of existing working capital available to a business is measured by comparing its current assets against current liabilities. It tells the business the short-term liquid assets remaining after paying short-term liabilities.

Working capital requirements might differ from business to business, but it is an important metric to assess the long-term financial health of a business. Effective working capital management also ensures that a business always maintains sufficient cash to meet its short-term commitments.

When working capital requirements are not managed efficiently, the business can suffer from cash flow problems, in turn, affecting its ability to expand, improve processes or even operate its operations. Therefore, a business owner needs to know how to plan his or her business’s working capital requirements effectively.

In this article, we will show you 6 steps that a business should follow to build a solid working capital plan. Meanwhile, if you’re interested in acquiring working capital for your businesses, click below:

Assess future fund requirements

An effective working capital plan should begin by evaluating the short-term funding needs of a business. These short-term funding needs include meeting payroll expenses, paying vendors, paying rent and taxes to the government.

The due date of cash outflows may not correspond to cash inflows, so a business owner must assess future fund requirements in order to meet various financial obligations.

An organisation might have long-term fund requirements too like acquiring new land or building or upgrading manufacturing machines. A business should aim to secure requisite long-term funding before executing a large capital investment plan.

Compute the working capital you will need

Every business should determine whether its current working capital is adequate under various growth scenarios.

To establish a reasonable expectation of growth opportunities available, the business has to consider the economy, its industry and competitions. For instance, how will the balance sheet get affected if current liabilities grew by 10%? Will the business still be able to pay salaries or rent on time?

Also, the business can perform a shock analysis by running the growth numbers above or below the expected rates. This will help the stakeholders to make a sound contingency plan for their business.

Suggested Read: 6 Tips to Rebuild Your Small Business after COVID-19

Evaluate your access to working capital and the alternatives

Businesses should review their current access to various funding sources, such as a line of credit , WC loan, account receivables, inventory, investment accounts and cash-in-hand. A business needs to ensure that these sources are sufficient to meet its strategic goals.

Many medium and large business enterprises consider holding cash and investments with at least two separate institutions. This diversification helps businesses protect themselves from losing access to credit during uncertain times.

Review your accounts receivables and payable processes

A business can employ several strategies and processes to maximise its working capital.

On the receivables side, a business can offer direct debit to customers, so the payments arrive on the scheduled date. This approach is used by the companies providing services that call for periodic scheduled payments like a utility service provider. Also, accepting credit card payments can help businesses improve their cash inflow.

While on the payable side, businesses can use controlled disbursement accounts to know every morning which issued cheques will hit its bank account that day. This will help the business maintain sufficient cash balance and maximise its working capital at the same time.

Don’t eat up cash, use borrowings or credit facilities

It is advisable for businesses to not use up the cash as they grow since a positive cash flow position improves the business’s access to capital and reduces its cost of capital as well. So, when the economy improves, and investments generate positive returns, the business will likely have access to credit at lower interest rates.

Test and update the plan regularly

Ideally, a business should update its working capital plan annually, supplemented with a quarterly or monthly financial position review to see if adjustments are needed.

For instance, if a business has downsized or has been merged with or taken over by another entity, its working capital requirements change drastically. This happens due to the changes in the level of current assets and current liabilities.

Therefore, a business should regularly access the state of the economy to test their access to credit facilities and improvise its plan accordingly.

Given the pandemic situation, many small and medium businesses are facing a lack of cash flow and are unable to manage their working capital requirements effectively. They are willing to take a working capital loan or open up a line of credit with banks or other sources. But, challenges in raising funds from formal sources have increased in this new-normal situation.

To disrupt the lending segment in India and provide capital to small businesses, Razorpay has built a product called Working Capital Loans .

Now businesses can get collateral-free working capital loans within 24 hours. The loans can be rapid in daily, weekly or monthly instalments as per the borrower’s convenience.

Just click on the ‘Loans’ tab to apply through our Razorpay dashboard, upload a few documents and receive a loan offer within 3 working days followed by a quick disbursal within a day. It’s that simple!

To summarise, while it is tough to predict the future, businesses must prepare their working capital plans and ensure access to capital when the economy bounces back to growth.

Also read: Razorpay Disrupts Working Capital Loan Processes for MSMEs

Liked this article? Subscribe to our weekly newsletter for more.

Writer-by-chance and overthinker-by-choice, raging a war against the Pineapple-on-pizza brigade

Related Posts

Monthly Average Balance (MAB)

Recruitment Process

What is Procurement? A Guide to Procurement Process

Vendor Payment

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

- Financial management

Everything you need to know about working capital requirement (WCR): method, calculation, analysis

Working capital requirement is a concept that anyone starting a company has to know and understand. To ensure the success of their company, it is vital for leaders and financial executives to have a handle on any discrepancies between incomings and outgoings. In this article, we will help you learn about working capital requirements (frequently known as WCR), a term that is unique to the world of finance. What exactly is it? How do you calculate it? How do you interpret it and what actions do you take?

Defining working capital requirement

Working capital requirement (WCR) is the amount of money required to cover your operating costs. It represents your company’s short-term financing requirements. These requirements are caused by gaps in your cash flows (money coming in and out) corresponding to cash inflow and cash outflow linked to your business operations , in other words your company’s primary activity.

There are three main reasons why these gaps can appear:

Lead times for selling inventory.

When a company produces a certain quantity of goods , it often takes time to liquidate this inventory . The result is a time lag between the points when money is spent on production and the cash flows in after the goods or services are sold. This is one of the leading causes of insolvencies that can affect your working capital on an ongoing basis.

Client payment periods

Although payment may be earned and specified at a given moment in time, you often have to wait a while before it is settled. This means that a company can spend money to produce goods or provide services but may not receive the amount owed to it for another few days, weeks or months.

Payment periods for suppliers

Companies rarely produce their goods from scratch – they often rely on suppliers to source raw materials. If this is the case, once the production cycle has started, the company is indebted to these external parties for the period that it takes to receive the money from selling its products or services. In certain circumstances, however, suppliers may claim repayment before the company has received sufficient funds to cover its costs. A premature cash outflow such as this will increase the company’s WCR .

Related article: Days Inventory Outstanding

Calculating working capital requirement

Now that we know what WCR is, let’s look at why calculating it is so crucial and how you can calculate it accurately.

Why should you calculate your working capital requirement?

There are two main reasons for calculating and monitoring WCR .

1. Ensuring your business launches successfully

Calculating WCR is an indispensable step when starting a business. In fact, one of the main reasons that new companies fail is that they have inaccurate WCR estimates. Too large a gap between cash inflow and cash outflow must be anticipated to avoid any complications that could, in extreme cases, lead to bankruptcy.

This is why a well-calculated WCR is an essential piece of data for your business plan. To include WCR in your business plan , simply add a dedicated row containing a WCR estimate that is as accurate as possible.

2. Being able to make the right decisions throughout the life cycle of your company

Estimating your WCR before launching your business does not mean that you can save yourself from doing this at a later point in time. That’s right: WCR has to be calculated throughout the life cycle of your company. This is because it’s a key indicator of your company’s financial health, so it has to be calculated as you go, and its performance has to be anticipated if you are to make the most appropriate decisions for your situation.

Download our free guide to manage your cash flows more effectively.

👉 What are formulas for Working Capital Requirement?

Key calculations for working capital requirement.

Finally, let’s look at the specifics for calculating WCR. WCR is part of the information calculated in your company’s balance sheet. It shows the difference between your current assets and current liabilities.

Be careful : here we are looking both at non-cash current assets and non-cash current liabilities. More specifically, current assets include inventory and client receivables, while current liabilities are made up of accounts payable and tax and social security liabilities. You should also note that some amounts will be posted with taxes included and some will not. This is due to the fact that there can be delays between paying tax and receiving tax rebates. Remember that when calculating your WCR the aim is to be able to visualise this potential gap, for example when you receive your VAT and when you pay this to the relevant authorities.

In a nutshell,

Current assets include:

- Cash, including money in bank accounts and cheques not deposited by customers.

- Marketable securities, such as US Treasury bills and money market funds.

- Short-term investments that the company intends to sell within one year.

- Accounts receivable, less allowances for accounts where payment is unlikely.

- Notes receivable - such as short-term loans to customers or suppliers - that are due within one year.

- Other receivables, such as income tax refunds, cash advances to employees and insurance claims.

- Inventories, including raw materials, work in progress and finished goods.

- Prepaid expenses, such as insurance premiums.

- Prepayments on future purchases.

Current liabilities include:

- Accounts payable.

- Notes payable within one year.

- Wages and salaries payable.

- Taxes payable.

- Interest payable on loans.

- Any loan principal that must be paid within the year.

- Other accrued expenses.

- Deferred income, such as advance payments from customers for goods or services not yet delivered.

Change in working capital

Changes in working capital may therefore occur when either current assets, or current liabilities have been increased or decreased in their value. any big changes should be anticipated in order to

Another interesting step may be to calculate your company’s days working capital (DWC).

Days working capital formula:

This calculation can seem a bit abstract at first glance , so let’s look at an example to understand how it is used:

If your DWC number is 50 days, this indicates that your company should, on average, use the revenue it will generate in a period of 50 days to cover its operating cycle costs.

Analysing working capital requirement

How do you interpret your working capital requirement.

There can be three different scenarios, depending on the difference between your current assets and your current liabilities.

If your WCR is positive , your company has to find a way to finance its short-term requirements. Therefore, you have to be vigilant and anticipate that you may need to go in search of funding. We will look at the different ways of financing a company’s WCR later in this article. You might also like to read: Elevated WCR: how to anticipate and better manage your cash flow

If your WCR is zero , your company has enough operational resources available to cover all requirements. Your company does not need any additional financing, nor does it have a surplus. Although we mention it in this article, having a WCR of exactly zero is rare in reality.

If your WCR is negative , your company has no short-term financial requirements, so can free up resources to fund its net cash flow.

How do you get a handle on your working capital requirement?

To truly have an overview of your WCR, there are three different parameters that you can adjust: supplier payment periods, client payment periods and inventory turnover.

Adjust supplier payment periods

If you choose to take control of your WCR by focussing on supplier payment periods , you are essentially extending these by negotiating with your supplier. Doing this will allow you more time to receive the cash you need to repay your debts. It’s best to try your luck with your longer-time partners first, though, because they will be more likely to give you the extra time that you need.

When explaining the reasons for the extension request, you can, for example, emphasise your reputation as a reliable customer or the fact that you order large volumes from the supplier (if this is in fact the case). If your supplier agrees to extend your payment period, it can be a good idea to pay your bill just a few days before it is due – the aim is to preserve your cash for as long as possible.

Adjust client payment periods

If you decide to focus on client payment periods to manage your WCR, you will be looking at shortening the payment period by negotiating payment terms . The aim here is to receive payments more quickly. For example, if you usually stipulate a 60-day payment period , you could choose to shorten this to 30 days to receive payments sooner. However, you should be careful that changing a payment period does not damage your relationship with your client. Therefore, it may be wise to start negotiating with clients with whom you have had a good customer relationship for a long time, as they are likely to understand your situation and be more willing to help you.

Another solution may be to propose a discount – this can help you get around significant gaps in your cash flow. Alternatively, if an invoice deadline has passed, you can forward the invoice to an online collection platform. This is a way of simplifying and speeding up the recovery of your client’s debts while keeping the situation amicable.

You may also like: How unpaid invoices can impact your cash flow

Adjust inventory turnover

The third option for managing your WCR is to reduce inventory turnover. However, while this does not involve negotiating with external parties, it isn’t actually as simple as it seems: by reducing your inventory turnover , you risk being faced with inventory shortages. The just-in-time inventory management approach requires an extremely precise analysis of your anticipated sales in order to minimise potential complications.

How do you finance your working capital requirement?

Since managing your WCR is a rather complex task, you will often be asked to look for ways to finance your WCR, depending on how high or low your WCR is. There are four options available to suit your situation.

Financing WCR through cash

If you are fortunate enough to have cash reserves in your company, you may be able to use these to finance your WCR (as long as this isn’t too high). This is one of the reasons that keeping your cash flow table up to date is so vital.

Financing WCR through a bank overdraft

If you don’t have enough cash to finance your WCR but it is still relatively low, you may be able to afford to have a short-term bank overdraft . This should only be a one-off solution that you use for a short period of time, otherwise it is risky for your business – especially since unexpected things can happen at any time.

Financing WCR through current account contributions

Another solution is to make use of a current account contribution . This is a short-term contribution that is paid back at a later point in time with a fixed rate of additional compensation.

Financing WCR through working capital

Finally, you can also finance your WCR via surpluses of long-term resources , mainly consisting of capital contributions and bank loans. These resources are often referred to as working capital.

You can calculate the amount using the following calculation:

Here are more details to help you better understand the calculation above:

Permanent capital = equity + long-term borrowings (with a term of longer than one year) Fixed assets = intangible assets + tangible assets + financial assets There you have it – you’re now ready to calculate, interpret and take control of your own working capital requirement.

Learn more about the relationship between cash flow and working capital in this article.

Limitations of working capital requirement

Despite all the positive aspects, it is not a good idea to assess the financial situation of a company by looking only at its working capital requirement. For example, to assess the long-term financial performance of a company, it is a good decision to use other indicators.

There are several limitations on the working capital requirement:

WCR does not reflect the quality or profitability of the current assets and liabilities. For example, a business may have a high WCR because it has a large inventory of unsold goods or a high amount of receivables that are overdue or doubtful. These assets may not generate any cash flow or income for the business and may even incur additional costs such as storage, maintenance, or bad debts . Similarly, a business may have a low WCR because it has negotiated favourable terms with its suppliers or creditors, such as discounts, extended payment periods, or low interest rates. These liabilities may not pose any financial burden or risk for the business and may even enhance its cash flow or profitability.

WCR does not account for the seasonality or cyclicality of the business. For example, a retail business may have a high WCR during the peak sales season when it has to stock up on inventory and increase its sales staff. However, this does not necessarily mean that the business is performing well or growing. Conversely, a retail business may have a low WCR during the off-season when it has to reduce its inventory and sales staff. However, this does not necessarily mean that the business is struggling or shrinking.

WCR does not capture the long-term financial position or strategy of the business. For example, a business may have a low WCR because it has invested heavily in fixed assets such as machinery, equipment, or property. These assets may not contribute to the current cash flow or income of the business, but they may generate future returns or competitive advantages for the business. Similarly, a business may have a high WCR because it has retained a large amount of cash or marketable securities. These assets may not be used for the current operations or growth of the business, but they may provide liquidity, flexibility, or diversification for the business.

Working Capital example

Let's take a look at the balance sheet of Tesla Inc. (TSLA), which shows the company's financial position as of a certain date. It includes the company's assets and liabilities, as well as shareholders' equity.

In 2022, the company reported $40.9 billion in total current assets and $26.7 billion in current liabilities . This means that Tesla's working capital at the end of 2022 was $14.2 billion ($40.9 billion - $26.7 billion = $14.2 billion). Thus, Tesla had enough liquidity to cover its short-term obligations and invest in its growth.

Tesla's balance sheet reflects its financial position as of a certain date, but it does not show its performance over a period of time. To evaluate Tesla's performance, it is also important to look at its income statement and cash flow statement, which show its revenues, expenses, profits, and cash flows for a given period.

Tesla's balance sheet also does not capture some of the intangible aspects of its business, such as its brand value, customer loyalty, innovation, and social impact. These factors may not be reflected in the numbers, but they may have a significant influence on Tesla's future growth and competitiveness.

Key takeaways on working capital management

All in all, the calculation of working capital is a crucial step for every company. It shows whether the company has sufficient resources to finance future operational expenses and reduces the risk of cash shortages . Knowing in advance that your business may need additional financing (for example, for new product development) can give you the opportunity to negotiate loans with attractive lending and reduce future liquidity problems.

If you want to learn more, discover free of charge and obligation how Agicap’s cash flow management software can help you efficiently track your company’s financial situation in real time.

Subscribe to our newsletter

You may also like.

201 Borough High Street London SE1 1JA

- Manage your cash flow

- Cash flow monitoring

- Cash flow forecast

- Consolidation

- Custom dashboards

- Debt management

- Late payment reminders

- Supplier Invoice Management

- Terms of Use

- General Terms of Service

- Privacy Policy

- Legal Notice

- We're hiring

Working Capital: Calculation and Interpretation

)

Working capital is a financial ratio that plays a crucial role in the day-to-day operations and financial health of businesses. It serves as an indicator of a company's ability to meet its short-term obligations and sustain its operations. In this article, we will explore the meaning of working capital, how to calculate it, and whether it is advantageous to have a high or low working capital.

Key Insights:

Working capital provides insights into a company's operational efficiency, short-term financial health, and negotiation power.

Working capital is calculated by subtracting current liabilities (short-term debts and obligations due within a year) from current assets (cash, accounts receivable, inventory, and other assets convertible to cash within a year).

High working capital usually signals an ability to cover short-term liabilities, invest in operations, and weather short-term financial downturns. However, excessively high working capital could indicate inefficiency in utilizing assets.

Some companies can operate effectively with negative working capital, especially in industries like retail or technology. This often reflects efficiency, with quick cash collection from customers and longer payment terms negotiated with suppliers.

What is Working Capital?

Working capital, in simple terms, refers to the financial resources a company has available to cover its daily operational needs and short-term obligations. It represents the liquid assets and short-term liabilities of a business. Essentially, working capital is the capital that "works" within the company to ensure ongoing operations, including inventory management, payment of suppliers, and meeting financial obligations.

How to calculate Working Capital?

To calculate working capital, you need to take into account the current assets and current liabilities of a company. Current assets include cash, accounts receivable, inventory, and other assets that can be converted into cash within a year. Current liabilities, on the other hand, encompass short-term debts, accounts payable, and other obligations due within a year. The formula for calculating working capital is as follows:

Working Capital = Current Assets - Current Liabilities

For instance, if a company has $500,000 in current assets and $300,000 in current liabilities, the working capital would be:

Working Capital = $500,000 - $300,000 = $200,000

Is it good to have a high or low Working Capital?

Whether it's favorable to have high or low working capital isn't necessarily a straightforward "high good, low bad" type of situation. Here are a few factors to consider:

Having high working capital might mean the company has plenty of liquid assets to cover its short-term liabilities. It's generally seen as a positive sign, as the business is likely to be able to pay off its debts, invest in its operations, and weather any short-term financial downturns.

However, if a company has very high working capital, it might indicate that they aren't using their assets efficiently. They may have too much inventory, or they may not be investing enough in long-term growth opportunities. Too much cash on hand, for instance, might be better spent on research and development, acquisitions, or other investments that could drive future growth.

Some companies operate effectively with negative working capital. This typically happens when a company can collect cash from customers quickly but has negotiated long payment terms with suppliers. This approach requires careful management, but in industries like retail or technology, it is often a sign of efficiency. For instance, if a company can negotiate longer payment terms with suppliers, it can decrease its current liabilities, leading to a decrease in working capital and improved cash flow. This means the company can use its cash for a longer period before paying off its debts.

Therefore, the favorability of high or low working capital depends on the specific circumstances of the company, the industry it operates in, and its business model. It's always best to interpret working capital in the context of a broader financial analysis.

In conclusion, working capital is a critical financial metric that reflects a company's operational efficiency and short-term financial health. The favorability of high or low working capital can greatly depend on the company's specific circumstances, industry norms, and business model. While a high working capital typically signals an ability to meet short-term obligations and invest in operations, excessive working capital might imply inefficiency in asset utilization. Similarly, although low working capital may indicate potential financial distress, certain businesses can efficiently operate with negative working capital which in many cases can be seen as a sign of strength. It is imperative to understand that working capital should always be assessed in conjunction with other financial indicators for a comprehensive understanding of a company's overall financial position.

The Capital Markets in One Search Engine

Search through millions of slides and transcripts from events such as earnings calls, capital market days, and investor conferences for any keyword.

- Start free trial

Peter McKendry

Chief executive officer, the co-group limited.

After giving opportunities to numerous accounting services providers, we found Whiz consulting. The experience of working with Whiz was overwhelming. The timely and accurate deliverable of the team is commendable. Highly recommended.

Trusted by thousands of leading brands

Get 30 Mins Free Personalized Consultancy Just drop in your details here and we'll get back to you!

By using our offerings and services, you are agreeing to the Terms of Services and understand that your use and access will be subject to the terms and conditions and Privacy Notice .

Estimating Working Capital Requirements: What Every Business Needs To Know?

In any business, cash is king. Having a positive working capital ensures that a company has the resources it needs to meet its short-term obligations and take advantage of opportunities that may arise. Contrary to this, a company with a negative working capital may face difficulty meeting obligations like outstanding accounts payable and the risk of defaulting on loans or missing out on opportunities. Therefore, it is important to understand and accurately forecast the working capital required to keep operations running smoothly. However, this can be difficult if you do not know all the basics. In this blog, you will learn how to estimate your working capital requirements using different methods and ensure that you have the funds available for business operations. But first, let us learn the importance of working capital and why is working capital estimation necessary.

What is Working Capital?

Working capital is the amount of money a company needs for day-to-day operating expenses, such as raw materials, employee salaries, and rent. It tells you how well a company can pay its short-term obligations. It is the difference between a company’s current assets and current liabilities. If a company does not have enough working capital, it will be unable to pay financial obligations like accounts payable and may have to declare bankruptcy. Thus, ensuring positive working capital in your business is important. However, you can only ensure a positive working capital if you are aware of its elements or components. Here, we have highlighted certain important components of working capital to ensure a positive working capital and improve your financial literacy as a business owner .

Components of Working Capital

As mentioned above, every business must clearly understand its working capital requirements. This can be a complex task, as there are many factors to consider. However, you can better understand what is required by breaking it down into parts.

The first component of working capital is current assets. These are the assets that will be used to pay for the day-to-day operations of the business. They include cash, inventory, accounts receivable, and other short-term assets. Then the second component is the current liabilities. These are the debts and obligations that need to be paid in the short-term. They include things like accounts payable, taxes payable, and wages payable. The third and final component is called the cash conversion cycle. It refers to the time it takes for a business to convert its raw materials into finished products and then sell those products to customers.

By understanding these 3 components of working capital, you can get a better handle on how much cash balance your business needs to maintain smooth operations. So, now that you have gained a decent understanding of working capital and its components, let us delve deeper to explore its importance and why working capital estimation is needed.

Importance of Working Capital

- To ensure timely payment of bills and salaries: One of the most important uses of working capital is to ensure that all bills and salaries are paid on time. This is particularly important in businesses with tight cash flow or irregular income streams. If you are unaware of your working capital requirement, you will probably not have sufficient funds to pay off your short-term obligation. As a business owner, you can ensure timely payment of bills and salaries by investing in outsourced services as well.

- To maintain inventory levels: Another key use of working capital is to finance inventory levels. This is especially important for businesses that operate on just-in-time delivery models where any interruption in supply can lead to significant losses. Hiring outsourced accounting services from experienced service providers can help manage inventory levels more accurately.

- To take advantage of early payment discounts: Many suppliers offer early payment discounts, which can lead to significant savings for businesses. However, these discounts can only be taken advantage of if enough funds are available to make the payments on time. Positive working capital will enable you to take advantage of such discounts.

- To support expansion plans: If a business wants to expand, it will need access to additional funds to finance the growth. Working capital can provide this funding through internal accruals or external financing sources such as loans or equity injections. However, business expansion becomes possible only when you give complete attention to the core activities.

Purposes of Estimation

So far, we learnt that as a business owner, it is crucial to clearly understand your working capital needs to make well-informed financial decisions. Estimating your working capital requirements is a vital step in this process. There are several different purposes for which you may need to estimate your working capital requirements. You may need to estimate your working capital in order to:

- Develop a business plan: A key component of any business plan is a detailed financial analysis. This analysis will include an estimation of your working capital needs.

- Secure financing: If you are seeking financing from investors or lenders, they will likely require an estimation of your working capital needs as part of their due diligence process.

- Monitor cash flow: It is important to monitor your business’s cash flow closely. A part of this process includes estimating your future working capital needs so that you can make adjustments to your operations accordingly.

- Make strategic decisions: Whether you are starting your business from scratch or running an established one, you will need to make several strategic business decisions. Estimating your future working capital needs help in making different strategic decisions.

Not just the points mentioned above, you might encounter a lot of other reasons to estimate working capital. So, let us learn some methods for ensuring an effective working capital estimation.

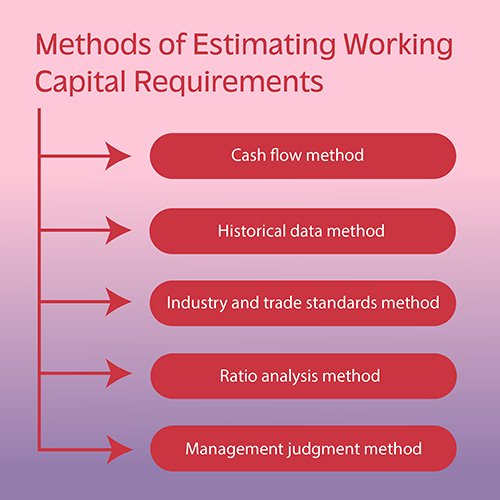

Different Methods of Estimating Working Capital Requirements

There are a number of different methods that can be used to estimate working capital requirements. Let us highlight some of the important ones.

- Cash flow method- The cash flow method is a popular option for estimating working capital requirements. With this method, you forecast your company’s future cash flow and use that information to estimate the amount of working capital you will need. The cash flow method simply projects future cash inflows and outflows to determine how much working capital will be required. This can be done using financial statements, such as income statements and balance sheets. This will give you a good idea of how much working capital you will need in the future.

- Historical data method- As the name suggests, the historical data method uses information from the company’s past to estimate future working capital requirements. This approach is based on the premise that a company’s future working capital needs will be similar to its past needs. To calculate working capital using this method, you first need to determine your company’s average cash conversion cycle (CCC) over time. The CCC is the number of days it takes for a company to convert raw materials into cash. Once you have determined the CCC, you can estimate your company’s future working capital needs by multiplying the CCC by your projected sales.

- Industry and trade standards method- This approach can be used to get a general idea of the minimum amount of working capital required for a specific industry or trade. To use this method, you will need to find industry-specific data on the average level of inventory, accounts receivable, and accounts payable. This information can be found in surveys or reports from trade associations or other similar organisations. Once you have gathered this data, you can estimate your company’s working capital requirements by applying these averages to sales volume. While this approach does not provide a precise estimate, it can help get a general idea of the minimum amount of working capital that may be required for your business.

- Ratio analysis method- With the ratio analysis method, businesses look at their financial statements and calculate some key financial ratios. The ratios used in the ratio analysis method are the current ratio, quick ratio, and inventory turnover. Even if you own a small business, such financial ratios help to give a snapshot of how well the business is doing and how much working capital is needed.

- Management judgment method- This method relies on the knowledge and experience of management to come up with an estimate. To use this method, management first needs to consider the company’s past working capital needs. They will then look at any changes that have happened within the company or industry which could impact future working capital requirements. After considering all this, management will come up with an estimate for the company’s future working capital needs. This method is often used because it is quick and easy and does not require sophisticated financial analysis. However, this method can be less accurate than other methods because it is based on subjective judgement rather than hard data.

Bottom line

So far, we have learnt that working capital describes the funds available to a business to grow, expand, and meet short-term obligations. It is important to maintain a healthy working capital balance to avoid defaulting on accounts payable and other debts. Thus, estimating working capital requirements is an important part of managing a business effectively and profitably. By understanding the various methods available to estimate the necessary funds, you can ensure access to the right amount of funds at all times and make sure your business finances remain healthy. Moreover, keeping on top of estimated costs can help you avoid overpaying for services or materials when too much cash has been set aside. Thus, be sure to use the best method when estimating how much working capital you need to ensure the successful operation of your company.

All Categories

- E-commerce Accounting

- Accounts Reconciliation

- Accounting & Bookkeeping