Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Featured Topics

View the Entrepreneurship Working Group page.

Econometrics

Microeconomics, macroeconomics, international economics, financial economics, public economics, health, education, and welfare, labor economics, industrial organization, development and growth, environmental and resource economics, regional and urban economics, more from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

50 Best Finance Dissertation Topics For Research Students 2024

Link Copied

Share on Facebook

Share on Twitter

Share on LinkedIn

Finance Dissertation Made Easier!

Embarking on your dissertation adventure? Look no further! Choosing the right finance dissertation topics is like laying the foundation for your research journey in Finance, and we're here to light up your path. In this blog, we're diving deep into why dissertation topics in finance matter so much. We've got some golden writing tips to share with you! We're also unveiling the secret recipe for structuring a stellar finance dissertation and exploring intriguing topics across various finance sub-fields. Whether you're captivated by cryptocurrency, risk management strategies, or exploring the wonders of Internet banking, microfinance, retail and commercial banking - our buffet of Finance dissertation topics will surely set your research spirit on fire!

What is a Finance Dissertation?

Finance dissertations are academic papers that delve into specific finance topics chosen by students, covering areas such as stock markets, banking, risk management, and healthcare finance. These dissertations require extensive research to create a compelling report and contribute to the student's confidence and satisfaction in the field of Finance. Now, let's understand why these dissertations are so important and why choosing the right Finance dissertation topics is crucial!

Why Are Finance Dissertation Topics Important?

Choosing the dissertation topics for Finance students is essential as it will influence the course of your research. It determines the direction and scope of your study. You must make sure that the Finance dissertation topics you choose are relevant to your field of interest, or you may end up finding it more challenging to write. Here are a few reasons why finance thesis topics are important:

1. Relevance

Opting for relevant finance thesis topics ensures that your research contributes to the existing body of knowledge and addresses contemporary issues in the field of Finance. Choosing a dissertation topic in Finance that is relevant to the industry can make a meaningful impact and advance understanding in your chosen area.

2. Personal Interest

Selecting Finance dissertation topics that align with your interests and career goals is vital. When genuinely passionate about your research area, you are more likely to stay motivated during the dissertation process. Your interest will drive you to explore the subject thoroughly and produce high-quality work.

3. Future Opportunities

Well-chosen Finance dissertation topics can open doors to various future opportunities. It can enhance your employability by showcasing your expertise in a specific finance area. It may lead to potential research collaborations and invitations to conferences in your field of interest.

4. Academic Supervision

Your choice of topics for dissertation in Finance also influences the availability of academic supervisors with expertise in your chosen area. Selecting a well-defined research area increases the likelihood of finding a supervisor to guide you effectively throughout the dissertation. Their knowledge and guidance will greatly contribute to the success of your research.

Writing Tips for Finance Dissertation

A lot of planning, formatting, and structuring goes into writing a dissertation. It starts with deciding on topics for a dissertation in Finance and conducting tons of research, deciding on methods, and so on. However, you can navigate the process more effectively with proper planning and organisation. Below are some tips to assist you along the way, and here is a blog on the 10 tips on writing a dissertation that can give you more information, should you need it!

1. Select a Manageable Topic

Choosing Finance research topics within the given timeframe and resources is important. Select a research area that interests you and aligns with your career goals. It will help you stay inspired throughout the dissertation process.

2. Conduct a Thorough Literature Review

A comprehensive literature review forms the backbone of your research. After choosing the Finance dissertation topics, dive deep into academic papers, books, and industry reports, gaining a solid understanding of your chosen area to identify research gaps and establish the significance of your study.

3. Define Clear Research Objectives

Clearly define your dissertation's research questions and objectives. It will provide a clear direction for your research and guide your data collection, analysis, and overall structure. Ensure your objectives are specific, measurable, achievable, relevant, and time-bound (SMART).

4. Collect and Analyse Data

Depending on your research methodology and your Finance dissertation topics, collect and analyze relevant data to support your findings. It may involve conducting surveys, interviews, experiments, and analyzing existing datasets. Choose appropriate statistical techniques and qualitative methods to derive meaningful insights from your data.

5. Structure and Organization

Pay attention to the structure and organization of your dissertation. Follow a logical progression of chapters and sections, ensuring that each chapter contributes to the overall coherence of your study. Use headings, subheadings, and clear signposts to guide the reader through your work.

6. Proofread and Edit

Once you have completed the writing process, take the time to proofread and edit your dissertation carefully. Check for clarity, coherence, and proper grammar. Ensure that your arguments are well-supported, and eliminate any inconsistencies or repetitions. Pay attention to formatting, citation styles, and consistency in referencing throughout your dissertation.

Don't let student accommodation hassles derail your finance research.

Register with amber today!

Finance Dissertation Topics

Now that you know what a finance dissertation is and why they are important, it's time to have a look at some of the best Finance dissertation topics. For your convenience, we have segregated these topics into categories, including cryptocurrency, risk management, internet banking, and so many more. So, let's dive right in and explore the best Finance dissertation topics:

Dissertation topics in Finance related to Cryptocurrency

1. The Impact of Regulatory Frameworks on the Volatility and Liquidity of Cryptocurrencies.

2. Exploring the Factors Influencing Cryptocurrency Adoption: A Comparative Study.

3. Assessing the Efficiency and Market Integration of Cryptocurrency Exchanges.

4. An Analysis of the Relationship between Cryptocurrency Prices and Macroeconomic Factors.

5. The Role of Initial Coin Offerings (ICOs) in Financing Startups: Opportunities and Challenges.

Dissertation topics in Finance related to Risk Management

1. The Effectiveness of Different Risk Management Strategies in Mitigating Financial Risks in Banking Institutions.

2. The Role of Derivatives in Hedging Financial Risks: A Comparative Study.

3. Analyzing the Impact of Risk Management Practices on Firm Performance: A Case Study of a Specific Industry.

4. The Use of Stress Testing in Evaluating Systemic Risk: Lessons from the Global Financial Crisis.

5. Assessing the Relationship between Corporate Governance and Risk Management in Financial Institutions.

Dissertation topics in Finance related to Internet Banking

1. Customer Adoption of Internet Banking: An Empirical Study on Factors Influencing Usage.

Enhancing Security in Internet Banking: Exploring Biometric Authentication Technologies.

2. The Impact of Mobile Banking Applications on Customer Engagement and Satisfaction.

3. Evaluating the Efficiency and Effectiveness of Internet Banking Services in Emerging Markets.

4. The Role of Social Media in Shaping Customer Perception and Adoption of Internet Banking.

Dissertation topics in Finance related to Microfinance

1. The Impact of Microfinance on Poverty Alleviation: A Comparative Study of Different Models.

2. Exploring the Role of Microfinance in Empowering Women Entrepreneurs.

3. Assessing the Financial Sustainability of Microfinance Institutions in Developing Countries.

4. The Effectiveness of Microfinance in Promoting Rural Development: Evidence from a Specific Region.

5. Analyzing the Relationship between Microfinance and Entrepreneurial Success: A Longitudinal Study.

Dissertation topics in Finance related to Retail and Commercial Banking

1. The Impact of Digital Transformation on Retail and Commercial Banking: A Case Study of a Specific Bank.

2. Customer Satisfaction and Loyalty in Retail Banking: An Analysis of Service Quality Dimensions.

3. Analyzing the Relationship between Bank Branch Expansion and Financial Performance.

4. The Role of Fintech Startups in Disrupting Retail and Commercial Banking: Opportunities and Challenges.

5. Assessing the Impact of Mergers and Acquisitions on the Performance of Retail and Commercial Banks.

Dissertation topics in Finance related to Alternative Investment

1. The Performance and Risk Characteristics of Hedge Funds: A Comparative Analysis.

2. Exploring the Role of Private Equity in Financing and Growing Small and Medium-Sized Enterprises.

3. Analyzing the Relationship between Real Estate Investments and Portfolio Diversification.

4. The Potential of Impact Investing: Evaluating the Social and Financial Returns.

5. Assessing the Risk-Return Tradeoff in Cryptocurrency Investments: A Comparative Study.

Dissertation topics in Finance related to International Affairs

1. The Impact of Exchange Rate Volatility on International Trade: A Case Study of a Specific Industry.

2. Analyzing the Effectiveness of Capital Controls in Managing Financial Crises: Comparative Study of Different Countries.

3. The Role of International Financial Institutions in Promoting Economic Development in Developing Countries.

4. Evaluating the Implications of Trade Wars on Global Financial Markets.

5. Assessing the Role of Central Banks in Managing Financial Stability in a Globalized Economy.

Dissertation topics in Finance related to Sustainable Finance

1. The impact of sustainable investing on financial performance.

2. The role of green bonds in financing climate change mitigation and adaptation.

3. The development of carbon markets.

4. The use of environmental, social, and governance (ESG) factors in investment decision-making.

5. The challenges and opportunities of sustainable Finance in emerging markets.

Dissertation topics in Finance related to Investment Banking

1. The valuation of distressed assets.

2. The pricing of derivatives.

3. The risk management of financial institutions.

4. The regulation of investment banks.

5. The impact of technology on the investment banking industry.

Dissertation topics in Finance related to Actuarial Science

1. The development of new actuarial models for pricing insurance products.

2. The use of big data in actuarial analysis.

3. The impact of climate change on insurance risk.

4. The design of pension plans that are sustainable in the long term.

5. The use of actuarial science to manage risk in other industries, such as healthcare and Finance.

Tips To Find Good Finance Dissertation Topics

Embarking on a financial dissertation journey requires careful consideration of various factors. Your choice of topic in finance research topics is pivotal, as it sets the stage for the entire research process. Finding a good financial dissertation topic is essential to blend your interests with the current trends in the financial landscape. We suggest the following tips that can help you pick the perfect dissertation topic:

1. Identify your interests and strengths

2. Check for current relevance

3. Feedback from your superiors

4. Finalise the research methods

5. Gather the data

6. Work on the outline of your dissertation

7. Make a draft and proofread it

In this blog, we have discussed the importance of finance thesis topics and provided valuable writing tips and tips for finding the right topic, too. We have also presented a list of topics within various subfields of Finance. With this, we hope you have great ideas for finance dissertations. Good luck with your finance research journey!

Frequently Asked Questions

How do i research for my dissertation project topics in finance, what is the best topic for dissertation topics for mba finance, what is the hardest finance topic, how do i choose the right topic for my dissertation in finance, where can i find a dissertation topic in finance.

Your ideal student home & a flight ticket awaits

Follow us on :

Related Posts

How To Get Into Oxford University 2024-25

.jpg)

A Comprehensive Guide to UK Intakes: Spring, Winter, and Fall

.webp)

UK Grading System Guide 2024: Everything You Need To Know!

Planning to Study Abroad ?

Your ideal student accommodation is a few steps away! Please fill in your details below so we can find you a new home!

We have got your response

.jpg)

amber © 2024. All rights reserved.

4.8/5 on Trustpilot

Rated as "Excellent" • 4800+ Reviews by students

Rated as "Excellent" • 4700+ Reviews by Students

amber © 2023. All rights reserved.

- Browse All Articles

- Newsletter Sign-Up

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

- Research & Ideas

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

- Cold Call Podcast

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 14 Mar 2023

What Does the Failure of Silicon Valley Bank Say About the State of Finance?

Silicon Valley Bank wasn't ready for the Fed's interest rate hikes, but that's only part of the story. Victoria Ivashina and Erik Stafford probe the complex factors that led to the second-biggest bank failure ever.

- 13 Mar 2023

What Would It Take to Unlock Microfinance's Full Potential?

Microfinance has been seen as a vehicle for economic mobility in developing countries, but the results have been mixed. Research by Natalia Rigol and Ben Roth probes how different lending approaches might serve entrepreneurs better.

- 16 Feb 2023

ESG Activists Met the Moment at ExxonMobil, But Did They Succeed?

Engine No. 1, a small hedge fund on a mission to confront climate change, managed to do the impossible: Get dissident members on ExxonMobil's board. But lasting social impact has proved more elusive. Case studies by Mark Kramer, Shawn Cole, and Vikram Gandhi look at the complexities of shareholder activism.

- 07 Feb 2023

Supervisor of Sandwiches? More Companies Inflate Titles to Avoid Extra Pay

What does an assistant manager of bingo actually manage? Increasingly, companies are falsely classifying hourly workers as managers to avoid paying an estimated $4 billion a year in overtime, says research by Lauren Cohen.

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Search IDEAS All Articles Papers Chapters Books Software In: Whole record Abstract Keywords Title Author Sort by: new options Relevance Oldest Most recent Most cited Title alphabet Recently added Recent & relevant Relevant & cited Recent & cited From: Any Year 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1985 1980 1975 1970 1960 1950 1940 1930 1900 1800 1700 To: Any Year 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1985 1980 1975 1970 1960 1950 1940 1930 1900 1800 1700 More advanced search New: sort by citation count and by recently added --> What is IDEAS? IDEAS is the largest bibliographic database dedicated to Economics and available freely on the Internet. Based on RePEc , it indexes over 4,600,000 items of research, including over 4,200,000 that can be downloaded in full text. RePEc is a large volunteer effort to enhance the free dissemination of research in Economics which includes bibliographic metadata from over 2,000 participating archives , including all the major publishers and research outlets. IDEAS is just one of several services that use RePEc data. For some statistics about the holdings on this site, see here . Authors are invited to register with RePEc to create an online profile. Then, anyone finding some of their research here can find your latest contact details and a listing of their other research. They will also receive a monthly mailing about the popularity of their works, their ranking and newly found citations. How do I find on IDEAS what I am looking for?

More services and features.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Corrections.

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews.

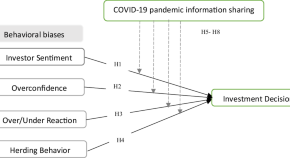

Viral decisions: unmasking the impact of COVID-19 info and behavioral quirks on investment choices

- Wasim ul Rehman

- Omur Saltik

- Suleyman Degirmen

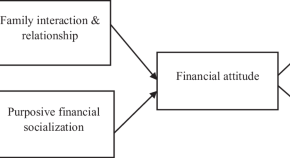

Parents’ financial socialization or socioeconomic characteristics: which has more influence on Gen-Z’s financial wellbeing?

- Khalid Abdul Ghafoor

- Muhammad Akhtar

Cyclical dynamics and co-movement of business, credit, and investment cycles: empirical evidence from India

- Ridhima Garg

The effects of heterogeneous CSR on corporate stock performance: evidence from COVID-19 pandemic in China

COVID-19, the Russia–Ukraine war and the connectedness between the U.S. and Chinese agricultural futures markets

- Yongmin Zhang

- Yingxue Zhao

The complex relationship between credit and liquidity risks: a linear and non-linear analysis for the banking sector

- Jihen Bouslimi

- Abdelaziz Hakimi

- Kais Tissaoui

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

- © 2017

Current Issues in Economics and Finance

- Bandi Kamaiah 0 ,

- C.S. Shylajan 1 ,

- S. Venkata Seshaiah 2 ,

- M. Aruna 3 ,

- Subhadip Mukherjee 4

Department of Economics, University of Hyderabad, Hyderabad, India

You can also search for this editor in PubMed Google Scholar

IBS Hyderabad, Hyderabad, India

Department of economics, ibs hyderabad, hyderabad, india.

Showcases several empirical techniques that enhance the quality of research and its applicability for policy analysis

Covers a wide range of contemporary macroeconomic issues presented in diversified themes

Contains contributions from researchers and academicians from various premier institutes

6055 Accesses

13 Citations

3 Altmetric

- Table of contents

About this book

Editors and affiliations, about the editors, bibliographic information.

- Publish with us

Buying options

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

This is a preview of subscription content, log in via an institution to check for access.

Table of contents (13 chapters)

Front matter, fiscal policy, monetary policy and financial integration, impact of debt on short-run and long-run growth: empirical evidence from india.

- Nikita Pahwa

Fiscal Deficit and Economic Growth Relationship in India: A Time Series Econometric Analysis

- M. R. Anantha Ramu, K. Gayithri

Relationship Between Monetary Policy and Industrial Production in India

- Amrendra Pandey, Jagadish Shettigar

Co-movement Among Asian Forex Markets: Evidence from Wavelet Methods

- Anoop S. Kumar, Bandi Kamaiah

International Trade and Economic Growth

Nexus between international trade and economic growth.

- Laila Memdani

Causality Between Exports and GDP: An Empirical Evidence from BIMSTEC Region

- Gurpreet Kaur, Vishal Sarin, Jasdeep Kaur Dhami

Productivity and Firm Performance

Intellectual capital and financial performance: evidences from indian business process outsourcing industry.

- Mohd Anas Raushan, Ahmed Musa Khan

CSR as Investment: An Analysis of Ownership Structure and Firm Performance

- Vasiq Nuvaid, Sucheta Sardar, Sujoy Chakravarty

Productivity Performance of Indian Banks with FDI Contents

- Jayashree Patil-Dake

Is the Acquirer More Efficient Than Target? An Empirical Study from Selected Bank Consolidation in India

- M. Kollapuri

Agriculture and Food Security

Foreign exchange rate and agricultural performances: a time series exercise for india.

- Madhabendra Sinha, Partha Pratim Sengupta

Assessing Nutritional Intake from a Field Study in Odisha

- Bhabani Prasad Mahapatra, Bhagabata Patro

Dynamics of Food Grains Production in Telangana

- S. Indrakant

This book discusses wide topics related to current issues in economic growth and development, international trade, macroeconomic and financial stability, inflation, monetary policy, banking, productivity, agriculture and food security. It is a collection of seventeen research papers selected based on their quality in terms of contemporary topic, newness in the methodology, and themes. All selected papers have followed an empirical approach to address research issues, and are segregated in five parts. Part one covers papers related to fiscal and price stability, monetary policy and economic growth. The second part contains works related to financial integration, capital market volatility and macroeconomic stability. Third part deals with issues related to international trade and economic growth. Part four covers topics related to productivity and firm performance. The final part discusses issues related to agriculture and food security. The book would be of interest to researchers, academicians as a ready reference on current issues in economics and finance.

- Macroeconomic Instability

- Inflation and Monetary Policy

- Wavelet Method

- Financial Integration

- Economic Growth

- Productivity

- Exchange Rate

- International Trade

- Food Policy

- development finance

Bandi Kamaiah

C.S. Shylajan, S. Venkata Seshaiah

M. Aruna, Subhadip Mukherjee

Dr. Bandi Kamaiah is currently Professor and Dean of School of Economics at University of Hyderabad, India, and President of The Indian Econometric Society (TIES). He has held multiple administrative positions as SAP and ASHIS Coordinator, Head of the Department of Economics at University of Hyderabad. He also served as the Head of RBI Endowment Unit, ISEC, Bangalore. With 140 research papers in international journals of repute, his areas of research interest are monetary and financial economics, applied time series analysis, macroeconomics and international finance.

Dr. C.S. Shylajan is Professor and Dean Academics at IBS Hyderabad, India. Prior to this, he was a Post Doctoral Fellow at Indian Institute of Management (IIM) Calcutta. He was also a Visiting Research Fellow at ICTP, Italy as part of a Research Program sponsored by UNESCO and Beijer Institute, Sweden. His areas of research interest are international economics, macroeconomics, environmental economics, etc. He was the Consulting Editor of IUP Journal of Public Finance during 2006-2012. He is currently Associate Editor of International Journal of Ecology and Development .

Dr. S.Venkata Seshaiah is Professor and Director at ICFAI Business School, Hyderabad, India. He was a Consulting Editor for ICFAI Journal of Applied Economics and he has also edited several books in the area of economic development. He is also a scientific adviser for many national and international journals. His areas of interest are financial economics, capital markets, business strategy, and behavioral economics.

Dr. M. Aruna is Associate Professor with the Department of Economics at IBS Hyderabad. She obtained her PhD from Osmania University and has received short term fellowship from ICSSR, New Delhi. Her research has been published in journals like Economic and Finance Review , Theoretical Economic Letters , Energy Revi ew Studies, Indian Journal of Economics and Business Economics , Business Economics and Finance Review , and Journal of Educational Planning and Administration .

Dr. Subhadip Mukherjee is an Assistant Professor in the Department of Economics, ICFAI Business School Hyderabad. He completed the Fellow Programme in Management (FPM) in Economics from IIM Bangalore. His research has been published in journals such as Economic Modelling and also Edited Volume by Springer etc. His areas of research interest include international trade, applied econometrics especially with respect to micro level analysis of firms and industries, and development economics.

Book Title : Current Issues in Economics and Finance

Editors : Bandi Kamaiah, C.S. Shylajan, S. Venkata Seshaiah, M. Aruna, Subhadip Mukherjee

DOI : https://doi.org/10.1007/978-981-10-5810-3

Publisher : Springer Singapore

eBook Packages : Economics and Finance , Economics and Finance (R0)

Copyright Information : Springer Nature Singapore Pte Ltd. 2017

Hardcover ISBN : 978-981-10-5809-7 Published: 22 January 2018

Softcover ISBN : 978-981-13-5497-7 Published: 12 December 2018

eBook ISBN : 978-981-10-5810-3 Published: 12 January 2018

Edition Number : 1

Number of Pages : XII, 223

Number of Illustrations : 13 illustrations in colour

Topics : Macroeconomics/Monetary Economics//Financial Economics , Economic Growth , Development Finance

Policies and ethics

- Find a journal

- Track your research

10 Popular Posts on Economic Topics in 2021

What did people most want to know about the economy in 2021?

Inflation and COVID-19’s effects on the economy were top of mind, judging by the popularity of posts on those topics in our On the Economy blog, which offers frequent commentary, analysis and data from our economists and other St. Louis Fed experts. But examinations of longer-run trends, such as employment growth over 20 years, also attracted attention.

For readers of our Open Vault blog, which explains everyday economics and the Fed, the nuts and bolts of topical subjects like central bank digital currency and Fed “tapering” struck a chord, as did a post about the economic concept of externalities, explained with canine and pandemic examples.

Here’s a look at a few of the posts that were among the favorites published from January through Nov. 30.

Inflation Trends

How covid-19 may be affecting inflation.

The changing of U.S. consumer spending patterns during the pandemic may have affected the measurement of inflation, according to an On the Economy post published in February. The Bureau of Labor Statistics gathers information about prices in the U.S., weights the prices and aggregates them for the consumer price index, or CPI. Inflation is measured as the CPI’s rate of growth over a certain period.

But what happens if a certain category of goods or services becomes a bigger, or smaller, part of consumer spending? Based on spending habits in prior years, the official weights might not be the “true” weights in 2020, when social distancing led to more eating at home and less spending in restaurants.

What Are Risks for Future Inflation?

As U.S. inflation surged in 2021, an October On the Economy post identified some upside and downside risks for future inflation. A follow-up post examined whether higher inflation could “be attributed to a small group of goods and services or whether it is a more generalized event.” Looking at the overall price change over the period of the pandemic, “the role of outliers is greatly diminished, revealing that higher inflation is perhaps a broader phenomenon,” the post said.

Economic and Monetary Policy Explainers

Externalities: it’s what pandemics, pollution and puppies have in common.

Externalities are costs and benefits that impact or spill over to someone other than the producer or the consumer of a good or a service. As a June Open Vault post explained, that applies to everything from pandemics to puppies. In a pandemic, a lack of social distancing by one person creates an externality that is negative: a higher risk of infection for everyone. Puppies that only bark at strangers, meanwhile, could provide a positive externality for neighbors as a warning system.

A June Open Vault blog post highlighted the Economic Lowdown series video “Externalities.” What makes pollution a negative externality is explained in this clip.

Here’s What the Fed Means by Tapering

As anticipation built this fall for a Federal Open Market Committee decision to “taper,” so did curiosity about what tapering is. An Open Vault post answered that question: The Fed can turn to large-scale asset purchases when economic conditions warrant, and tapering means reducing the pace of those purchases. The post, published a week after the Nov. 3 announcement of the FOMC’s decision to start tapering, also explained how tapering works.

What Is the Federal Open Market Committee?

Readers curious about what tapering is could have learned earlier in the year about the committee that makes that and other monetary policy decisions. As a February Open Vault post explained, the FOMC is the main monetary policymaking body of the Federal Reserve and is comprised of leaders from around the Federal Reserve System.

People and Places

Older workers accounted for all net employment growth in past 20 years.

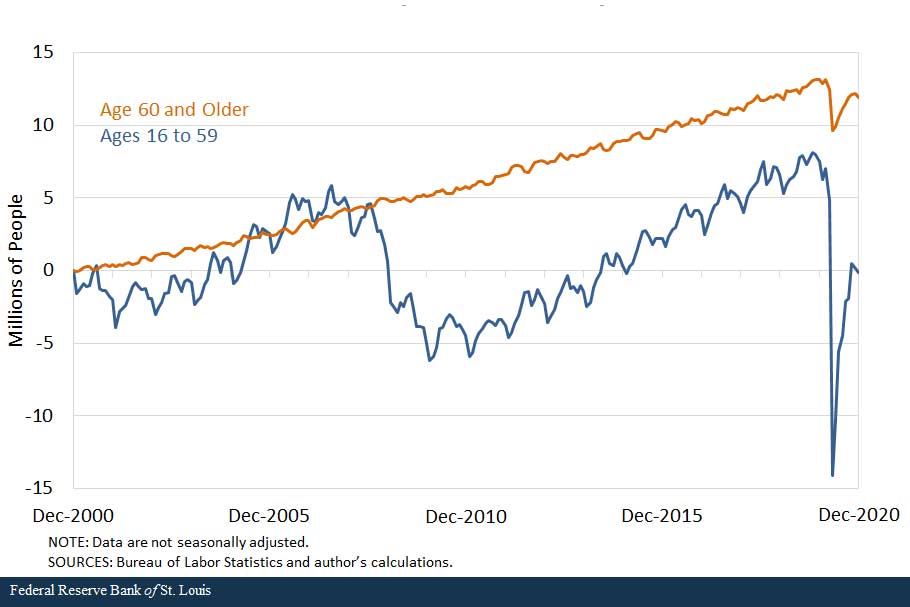

Before there was the “Great Resignation,” there was an employment increase: A February On the Economy post said that a rise in employment of people age 60 and older was responsible for U.S. employment growth of 11.8 million from December 2000 to December 2020. (See chart.) Among those workers, the increase in employment is attributed to the group’s population growth and increased employment-to-population ratio.

Cumulative Net Change in the Number of Employed People since December 2000

House Prices Surpass Housing-Bubble Peak on One Key Measure of Value

The steady increase of a house price-to-rent ratio “would imply increasing overvaluation” of houses, a May On the Economy post said. That was the case in early 2021 (using data available through March), when an index measuring the ratio of house prices to rent in the U.S. had risen rapidly over the course of a year and reached its highest level since at least 1975.

Sign up now for the free symposium, which has the theme, “Leading the Way in Challenging Times.” The event will run 6 to 8 p.m. CT on Feb. 23-24. Participants will hear insights from leading economists.

Inspiring Young Women to Pursue Economics

A January Open Vault post previewed a February 2021 event that is “designed to inspire young women and underrepresented minorities who may be interested in econ—and to encourage those pursuing a degree to persist.” The next Women in Economics Symposium is set for Feb. 23-24, 2022.

Money and Finance

Wealth gaps between white, black and hispanic families in 2019.

Across education, family structure and generations, gaps persist between the wealth of white families and that of Black and Hispanic families, the authors of a January On the Economy post found.

For instance, they wrote: “More education was associated with more wealth for all the racial and ethnic groups considered. However, wide gaps remain at every education level, with Black and Hispanic families having less median family wealth than white families with the same education.”

And Black and Hispanic families are less likely than white families to have financial and other assets like homes and businesses, and when they do, those assets were more likely to have lower values.

Navigating the ABCs of CBDCs—Central Bank Digital Currencies

“You’ve likely heard of Bitcoin, Ethereum, or even Dogecoin, but you may not have heard of ‘Fedcoin,’ an informal name some have used for the idea of a digital currency tied to a central bank, namely the Federal Reserve,” a June Open Vault post said. The post highlighted short videos in which a St. Louis Fed economist answered questions on central bank digital currencies, including about possible effects on privacy and bank lending.

Heather Hennerich is a senior editor with the St. Louis Fed External Engagement and Corporate Communications Division.

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Media questions

All other blog-related questions

Finance Research Topics to Sail Your Academic Research Successfully

Are you thinking of starting working on your research paper but still weighing which topic to select? Finance includes a whole series of stellar finance research topics. This list of these enticing finance research topics is here to relieve half of your pressure. Our expert writers cautiously draft these topic suggestions. Every topic on these lists is picked up by performing extensive deep research. These topic ideas will help you create an impressive research paper that will guarantee the highest academic grades.

If you’re doubtful about your topic selection, our experts have covered it too. They are here to provide you with their expert guidance or help with research paper writing . But before we begin delving into the topic selection guide, it’s essential to know what precisely a finance research paper is.

Table of Contents

What Are Finance Research Papers?

Research is conducted to retrieve the outcome of a research topic. It follows analyzing the concerning results and framing the conclusion by making future recommendations. Students tend to explore, identify, interpret and evaluate their finance research topics’ primary and secondary sources. A finance research paper provides an excellent opportunity for students to extend their critical and analytical thinking on the conscripted topic.

Suggestions for Selecting Appropriate Research Topics in Finance

Whether it is financing research topics, or economics research topics the process of identifying the ideal research topic stays the same with every subject. So are you looking for some expert guidance in selecting the perfect topic? Look nowhere because these six essential tips are here to help you discover the classic research topics in finance.

- Significance: the golden rule to dazzle finance research papers is to choose the most crucial topic in your field. Perhaps it’s a trending topic that needs further examination or an ongoing topic that reflects significant grounds for processes. However you can also include a historical finance research topic, but you must reflect on its association with the current world. It’s always vital to choose a topic that shows some significance in the present finance sphere. Thus the only extremity, in this case, is the significance of your finance research topic.

- Enigma: Now, another golden rule for selecting financial research topics is to handpick a topic that incorporates an equal amount of thrill, captivation, understatement, and equivocalness. Formulate the topic appropriately so that your supervisor should feel enigmatic by reading the whole paper.

- Avoid complex terminology: Your finance topic for research papers must showcase your clear and comprehensive ideas. Try dodging complicated terminology. How you frame and construct your whole research topic matters the most.

- Answer the unanswered questions : You can also comprehend finance questions that have not been answered before in your field. Provide additional research to identify suitable answers to those questions

- Reading scholarly articles: Professional writing experts from Edumagnate.com suggest that previous reading articles can help you immensely with your research process. These articles and journals would give you an idea of various hidden finance research topics. You can narrow down those suggestions to frame a specific topic for your research.

Finance Research Topic Ideas

The most cardinal step of identifying the researchable topics in finance is to look for topics that have never been researched. Missing out on the ideal topic can lead to various difficulties for your research paper on finance topics. We hope you must have selected your finance research topic. If not, no worries because we offer you this winning list of finance research topics that are your savior. So, have fun researching your ideal finance research topic.

Captivating Finance Research Topics

Look at these recurring finance research topics that various scholars have used in their research. Here are our top most exciting finance topics in no particular order.

- Acquisition and merger: A detailed study on the setbacks and benefits

- Detailed research on climate finance

- The revised index on the financial condition of the enterprises

- Accessing the ideological US economies and income tax policies

- Personal finance: A report on the interdisciplinary profession

- The topics of American economics and finance research

- A diagnostic framework for Investment management

- A conceptual review of Possible solutions to the capital asset pricing model

- The essence of money in the theory of finance

- A model for the future of e-commerce and the influence of manipulating commodity

- Activating commodities resilience: the history of the emergence of country funds

- Trusting in the future: financial management methods

- Finance: an introduction to the quantitative method

- An introduction to the dynamic copula methods in finance

- Corporate organizations: revitalizing enterprises for the competitive world

- An overview of the financial markets and developments

Enchanting Corporate Finance Research Topics

Another sure-fire option is selecting corporate finance research topics. So if you think there’s nothing to add in this domain, you might want to reconsider your decision. Let’s read out these most exciting corporate finance research topics:

- Quantitative risk analysis on operational and integrated risks

- The syndications of private equity and the potential risks

- Liquidity risk management: The liquidity route to a lower cost of capital

- The risks adjustments by the equity investors

- A bibliometric study on the dividend policy

- How is liquidity effective for balancing financial risks for organizations?

- SWIFT system: The pluses and minuses and how it operates

- A concise analysis of mutual funds and investments

- Ethical concerns associated with corporate finance management

- A comprehensive study on the fundamental of corporate risk management

- The relationship of risk management with investment management

- Microeconomics of technology adaption: how is microeconomics enhancing revenue

- The mathematical and computational methods of financial management

- How to access the vulnerable risk structures of corporate debts

- Asymmetric information on the monetary policy and the risk-bearing channels

- Corporate restructuring: financial solutions strategies in times of crises

A List of Personal Finance Topics to Write About

Personal finance is a vulnerable area that studies the management of finances, including savings and investing of money. Every individual wishes to enhance their financial stability. Research on this area tends to impact an individual’s living standards directly.

- Evaluation of saving strategies: alternate budgetary sources

- A customers perspective on the challenges, benefits, and security issues of mobile banking

- The great USA recession: how the USA recession has changed consumer behavior

- The analysis of personal financial literacy among American citizens

- The logic of budgeting: The best ways to save while on a budget

- Power budgeting techniques for American households

- A detailed analysis of the ideal ways to properly manage your taxes

- Practices, challenges, and security issues of mobile banking in America

- Convenient or affordable healthcare: a basic entitlement for every citizen

- Cost-effectiveness and detailed analysis of credit score

- The effects of a tax on fabricating financial decisions

- Saving money when you’re on a tight budget: perspective, perception, and a plan

- A descriptive study of the relationship between employee motivation and work productivity

- Consumer household finance: characteristics of personal finance as an incentive for the household to bear risks

- A comprehensive study of the financial benefits of working from home

- Measuring customer segments for personal finance services

- The influence of tax in making financial decisions for households

- The impact of inflation and interest rates on personal finances

Business Finance Topics for Research Paper

Every decision involved in business management comes with some financial implications. Therefore, business people must understand the fundamentals of finance. To elaborate your understanding of business finance, you must write on finance research topics about management, financial analysis, valuation, etc. Here are some brilliant finance research ideas for you:

- Risk and crises management in the global financial business

- Strategies of effective Financial management for SMEs

- Interest and inflation risk: industrial behavior in the context of inflation

- Business modernization: applications of business finance

- Business essentials: financial accounting of business enterprises

- Accessing and managing the business intelligence in SMEs

- Empowering self-help organizations by providing effective financial aid

- Increasing strategic accountability of corporate bodies

- Financial and ethical considerations for business finance

International Finance Research Topics

Since the international market is growing effectively worldwide, why shouldn’t we study some exciting international finance research topics for your research?

- Fundamentals of international studies on the dividend policy models

- Impact of global economic crises on organizations

- The market of corporate control on an international scale

- The roles and values of the circular economy for the prevention of global finance crises

- The aftermath of global financial crises

- Financial problems: how can banks lower the impacts

- The world experience of stock exchange: why are bank offices crucial?

- The role of the banking sector in decreasing financial crises

- China’s growth strategy: evidence and proofs from micro-level data

- Recent trends and crises in the foreign exchange market

- A handbook on the risk management analysis for hedge funds

Healthcare Research Topics in Finance

Finance management is highly crucial for an effective healthcare system. Are you interested in understanding this field in detail? If yes, then these are a few most relevant finance research topics on healthcare:

- The global campaign against the high prices of healthcare facilities in the US

- Re-conceptualizing strategies for achieving healthcare necessities for homeless citizens

- The dilemma of unequal access to cancer patients across the world

- The global campaign to eliminate inequalities in access to healthcare

- A review of UK’s health research funding: which healthcare department requires more funding?

- Why is there a need for free and privatized healthcare systems in different nations

- Enhancing healthcare financing in the US: essentials of the US healthcare systems

- How can different nations enhance their healthcare sectors without affecting the economy?

- A review of UK health research funding: why is finance research a priority for healthcare sectors

- What is the impact of free healthcare systems on the economy of a country

- Inequalities in access to healthcare systems by income in developed nations

- Impact of government funding on healthcare systems

- The origin of healthcare finances

- Worldwide free health: how can we achieve it?

- What is the impact of government on healthcare amenities?

- A comprehensive data on the healthcare history of the USA

- Lesson from developing countries on improving healthcare facilities

Read Also – Business Research Topics to Upgrade Project Submission

Finance Research Topics for Thoughtful Minds

We hope you have found your ideal finance research topic by now, but for those still confused about the topics, we have brought some additional interesting finance research topics for you.

- An overview of how financial systems affect the economic development of a nation

- The frontiers and evolvement of finance in the development of money relations

- The appendix to the anatomy of control of funds in different nations

- The integration of financial markets and securities

- Enhancing transparency and accountability in corporate enterprises

- Sustainability concerning green governance for industries that pollute the ecosystem

- Significance and regulations of risk management programs

- The public finance structure and the quality of life

- The dynamics of share price formation: How do interest rates impacts share price?

- The leasing puzzle: economics of leasing

- The uniqueness of bank loans: bank insolvency and the issue of non-performing loan

Complementary Finance Research Topics

If you are still confused about your research topic, the doors of a professional finance assignment help service are always open for your assistance. It is a list of some complimentary finance research topics for you, which comprises various aspects of financial studies. So here you go!

- The impact of finance on the evolving market relations

- Role and features of financial systems in developing nations

- Theory of public finance structure in the federal system

- The future and the economic aspects of finance

- Cyber security attributes affecting online banking and online transactions

- Plus and minuses of mobile banking in developed or developing nations

- A comparative study on behavioral finance and traditional finance

- Analytical issues and discretely disclosure in external finance

- Internal financing versus external financing

- Understanding the financial crises of 2007-2009