Cemex, one of the world’s largest cement producers, created a blue ocean of high profitability and growth in the cement industry that historically competed solely on price and functionality. It did so by shifting the orientation of its industry from functional to emotional.

In Mexico, cement sold in retail bags to the average do-it-yourselfer represents more than 85 percent of the total cement market. As it stood, however, the market was unattractive. There were far more noncustomers than customers. Even though most poor families owned their own land and cement was sold as a relatively inexpensive functional input material, the Mexican people lived in chronic overcrowding. Few families built additions, and those that did took on average four to seven years to build a single additional room. Why? Most of families’ extra money was spent on village festivals, quinceañeras (girls’ fifteen-year birthday parties), baptisms, and weddings.

As a result, most of Mexico’s poor had insufficient and inconsistent savings to purchase building materials, even though having a cement house was the stuff of dreams in Mexico.

Cemex’s answer to this dilemma came with its launch of the Patrimonio Hoy program, which shifted the orientation of cement from a functional product to the gift of dreams. When people bought cement they were on the path to building rooms of love, where laughter and happiness could be shared —what better gift could there be? At the foundation of Patrimonio Hoy was the traditional Mexican system of tandas , a community savings scheme. In a tanda , a group of individuals contributed a small sum each week for ten weeks. In the first week, lots are drawn to see who “wins” the pot in each of the ten weeks. All participants win the 1,000 pesos one time only, but when they do, they receive enough to make a large purchase.

In traditional tandas the “winning” family would spend the windfall on an important festival or religious event such as a baptism or marriage. In the Patrimonio Hoy , the winner is directed toward building room additions with cement. Think of it as a wedding registry, except that instead of giving silverware, for example, Cemex positioned cement as a loving gift.

At its debut, the Patrimonio Hoy building materials club that Cemex set up consisted of a group of roughly seventy people contributing on average 120 pesos each week for seventy weeks. The winner however, did not receive the total sum in pesos but rather received the equivalent building materials to complete an entire new room. Cemex complemented the winnings with the delivery of the cement to the winner’s home, construction classes on how to effectively build rooms, and a technical adviser who maintained a relationship with the participants during their project. The result: Patrimonio Hoy participants build their homes or additions three times faster at a lower cost than the norm in Mexico.

Whereas Cemex’s competitors sold bags of cement, Cemex was selling a dream, with a business model involving innovative financing and construction know-how. Cemex went a step further, throwing small festivities for the town when a room was finished thereby reinforcing the happiness it brought to people and the tanda tradition.

Since the company launched this new emotional orientation of Cemex coupled with its funding and technical services, demand for cement has soared. For more than 15 years, Cemex has been contributing to solving the housing shortage in underserved areas through its Patriomonio Hoy program. It has won multiple awards, including the UN Programme’s 2006 World Business Award in support of the UN Millennium Development Goals and the 2009 UN Habitat Award for Best Practices in Affordable Housing Solutions.

Overall, Cemex created a blue ocean of emotional cement that achieved differentiation at a low cost. It did so by challenging the functional–emotional orientation of its industry, as path five of blue ocean strategy’s six paths framework suggests.

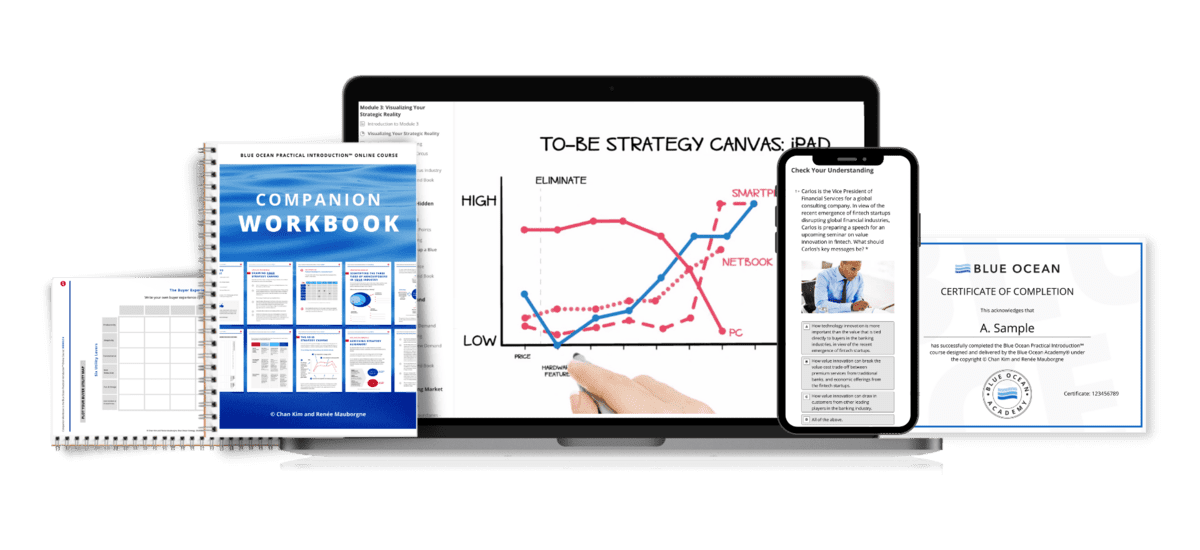

THE BLUE OCEAN ONLINE COURSE UPDATED

Learn the essentials of blue ocean strategy and shift created by #1 Management Thinkers in the World.

For anyone tired of competing head-to-head and wanting to seize new growth.

Average user rating

The blue ocean strategy practitioner program.

Transform your strategic perspective, master blue ocean tools and frameworks, & learn to unlock new growth opportunities

Get started with new market creation with our live, interactive, expert-led program.

ENROLL TODAY

CEMEX Essay

In May 2000, CEMEX was preparing to expand through acquisitions in Asia, Africa and the Middle East. What kind of global giant do you think Lorenzo Zambrano wanted the firm to become? Using module theory and evidence from the CEMEX case study, critically evaluate his chances of success.

Lorenzo Zambrano’s bid to dominate the global market in cement manufacturing, distribution and overall profitability is the main driving force in expanding overseas through Foreign Direct Investment. As he notes, CEMEX is looking forward to control at least 25 percent of the global market or better still maintain the global leadership in cement production and marketing (Bartlett, Ghoshal & Beamish, 2008).

In fact, the main pushing force behind this desire can be attributed to cut-throat competition that has prevailed in the international manufacturing and marketing of cement. Market rivals such as Hoderbank and Lafarge are indeed the main challenge to CEMEX as the latter seeks to lead while others follow.

In order to beat this growing competition both for domestic and foreign markets, CEMEX is shrewd in its management programs in the expansion process. The chances for success are very tricky and unless the company develops a blended approach in its expansion bid, the future may as well be bleak. Nonetheless, good management of its affairs as already demonstrated in its past records is likely to maneuver CEMEX to market leadership.

For instance, it has changed quite a number of its managerial aspects as it seeks to expand its operations in overseas markets. Earlier on, the management of CEMEX noted that the earnings of the company had reduced significantly due to geographical diversification. Hence, between the periods of 1994 to 1997, the cash flow in terms of standard deviation had reduced to a mean of about 7 percent down from 9.5 percent in the domestic market.

In addition, CEMEX has also gone through the ever volatile and fluctuating currency exchange rates in host countries as was the case with Spain. Through its highly capable management, CEMEX folded the possession of its assets that did not belong to Mexico and thereafter financed all the newly acquired business. Such kind of response during economic peril is indeed necessary to sustain the operations of a firm engaging in foreign investment.

Moreover, CEMEX still has higher chances of succeeding in its foreign operations owing to the fact the overseas locations definitely provide a healthy ground for marketing its products. According to market seeking theory in Foreign Direct Investment, a foreign market may be more appealing to a firm than the domestic one.

In particular, these may be company products that are either not available at the target market or a superior substitutes to the existing products. Besides, the foreign market can also attract consumers from the adjacent countries, thereby widening the marketing portfolio further (Bartlett, Ghoshal & Beamish, 2008). For this reason, CEMEX has a chance of attracting not just the marketing opportunities from the host country but also from the adjacent locations.

Nonetheless, this form of Foreign Direct Investment is underpinned by one main challenge in the sense that the marketing points being targeted in the foreign country may not be compatible with the location where FDI is to be undertaken (Ghemawat, 2005). In any case, both direct and indirect can be used to carry out FDI.

In the first scenario, the host country is used as the ground for exploiting the available market. This characteristic way of exploiting the host country be seeking other adjacent marketing opportunities can also be classified as export-platform Foreign Direct Investment.

When seeking foreign markets through acquisitions, CEMEX will have to put in mind two important considerations. Firstly, the prevailing economic and political factor that may affect the process of exporting goods and services from the host country especially in the case of indirect marketing is important. Secondly, the level of appropriateness in the production process is also paramount.

CEMEX will also have the chance of firmly establishing its operations in the host countries when its cement products are of the desired high quality and competes favourably with the existing products. In any case, the firm will be able to enhance better methods of production. This can be explained from the fact the prevalence of competition among various firms producing similar products will be heightened. Hence, each firm will endeavour to produce the best in a bid to capture and maintain market leadership.

Nonetheless, fierce competition can also jeopardize a favourable marketing environment for CEMEX when local competitors crowd up for a single market. This will especially be inevitable if a larger share of the market is dominated by the foreign affiliates. Fortunate enough, CEMEX does not operate alongside its foreign affiliates in the same country and therefore, this will provide a better opportunity for the firm to compete fairly.

Empirical based research has conclusively established that the desire to seek resources is one of the driving motives why a firm would engage itself in Foreign Direct Investment (Ghemawat, 2005). A company may be prompted to secure its investment abroad since the domestic ground is either too costly or lacks the relevant factors of production. It is vital to note that skilled and unskilled labour or advances in technology may markedly escalate the cost of production at the domestic level therefore leading to low returns.

On the other hand, advances in technology or managerial capabilities may not be accounted for when seeking to invest abroad since such resources can be accessed readily at home though at a higher cost. Hence, assets that are non market in nature are of utmost importance since it is impossible to transfer them through transactions. For instance, CEMEX may not be in a position to import high skilled and affordable labour to the domestic market owing to economic and political barriers at hand.

Although, the firm is seeking for ways and means of becoming a global leader in cement manufacturing and marketing, this initiative may be hampered by both local and international barriers to trade as well as government policies and cultural values in some regions. This is evident in the case of Egypt when CEMEX has to schedule its operations alongside prayer breaks due to the Islam religious practices.

As CEO of CEMEX, Lorenzo Zambrano ‘plans for volatility’ (p.241). Identify and assess the main environmental risks confronting him in the late 1990s, explaining which module theories and frameworks you have found most useful to support this analysis. After CEMEX has fully established itself as a market leader in Mexico, the company has decided to invest in overseas economies. However, this decision to expand its operations does not come without risks and challenges to the business environment.

Firstly, Lorenzo Zambrano opted to invest in the southern United States. Nonetheless, the US economy is not performing well since it is experiencing a serious downturn. In particular, the construction industry is not doing well either. This becomes a major environmental challenge for the Chief Executive Officer of CEMEX. To make matters worse, the US manufactures joined hands to protest against dumping of cheap goods from Mexico and consequently, they file a petition in court to stop the same.

As the US producers demand protection from their government, CEMEX is faced with a hurdle of going through local trade barriers. The countervailing duty of 58 percent imposed by United States International Trade Commission is meant to prohibit any import trade that may jeopardize local producers. Although the duty has been reduced to about 31 percent, the overseas environment is not conducive at all for CEMEX.

In light of international trade and foreign direct investment, trade and tariff barriers can indeed cause a major headache for firms investing in a foreign country (Ghemawat & Hout, 2008). At a macro level like in the case of CEMEX, there are helpful tools that can be used to understand the environmental risks associated with expansion abroad.

For instance, the PESTEL can assist in the process of identifying differences that exist along national boundaries. These differences may range from imposed trade barriers and tarrifs to customs or prevailing economic conditions. Hence, CEMEX under the leadership of Zambrano should have applied this theoretical approach before investing in United States.

Other components that can be analyzed using this tool include the political and socio-cultural differences of the host country, the legal aspects affecting international trade as well as the general environmental factors. According to CAGE framework by Ghemawat (2005), the geographic, cultural, administrative as well as economic factors prevailing in the targeted host country are worth considering before finally settling for an expansion plan in the desired foreign country.

Through empirical research and analysis, the most suitable country can be chosen for investment. For instance, a macro business trend like CEMEX that is continually expanding can make use of both CAGE and PESTEL tools to assess the link between the already existing locations and new geographical points where a form is wishing to diversify its operations (Ghemawat, 2005).

In addition, the industry and market forces such as demand, supply, recession or general economic downturn can be identified and evaluated using the Porter’s Diamond model.

Other expansion ventures in foreign locations have also been marred with challenges. For instance, the after operating for a short while, CEMEX found out that the Egyptian was not one of the best due to its fragmented nature. The company managed to secure a market share of only 17 percent below its target mark of at least 25 percent. Managing the regulatory context of the Egyptian market was also cumbersome.

Although CEMEX might have recorded impressive growth in some of its foreign acquisitions, the isolated cases of failure, for instance where the firm had to relocate or stop its operations altogether can be avoided by limiting the avenues through acquisitions fail (Ghemawat, 2005).

For instance, well documented research has concluded that acquisitions have a very high rate of failure. In some cases, the expected growth in returns may not be realized at all. In order to avoid the possible failures in acquisitions, CEMEX should always endeavor to conduct sufficient research both for the host country and the prevailing conditions that may hider or promote overseas expansion.

Secondly, the CEMEX management should establish in advance whether there is cultural compatibility between the host country and the cement manufacturing traditions. Lack of this form of compatibility like in the case of the Egypt acquisition may lead to definite failure. In addition, communication plays a very important part in transacting business.

This is indeed one of the pitfalls CEMEX had to go through while investing abroad. Although the firm uses English as the language of communication, there were some instances when there was communication breakdown since the spoken language in host country is not English.

Towards the end of 1997 and before the close of that decade, CEMEX acquired two Filipino cement manufacturing companies namely APO and Rizal. However, the country went through the earliest phases of macroeconomic pressures that swept East Asia towards the close of 1990s.

In spite of these inevitable shortcomings in global acquisitions by CEMEX, the firm can still take advantage of the existing marketing opportunities by practicing competitive advantage. This basically means the ability to meet the needs and concerns of consumers by delivering competitive services compared to competitors.

The building industry which is also the sole buyer of cement and its products will be mainly interested in both performance or service delivery as well as the price of the commodity. As mentioned earlier, CEMEX attempted to avail cheap cement from Mexico to United States in a bid to gain competitive advantage. However, this move was counteracted by the local producers in US who argued that the domestic industry was being economically injured by cheap cement from Mexico.

Nonetheless, CEMEX can counter such a move by making sure that its competitive advantage edge is based on effective and efficient management of the available resources so that the cost of overheads is reduced (Ghemawat & Hout, 2008). In addition, the CEMEX management should establish an effective response mechanism for all queries emanating from buyers.

Critically assess the view that CEMEX had a distinctive capability in the management of information on the late 1990s. What were the main issues and options facing the firm in May 2000, as it tried to sustain and develop its resources for the future?

From a personal perspective, Zambrano embraced and emphasized the use of Information Technology at CEMEX. Although Mexico had a weak Information and Communication Technology infrastructure in the 1980s when Zambrano was taking over as the Chief Executive Officer of the firm, the latter did not only insisted on the importance of ICT, he also directed huge spending and investment on ICT infrastructure to an extent that it overshadowed the country’s poorly established telecom facility (Bartlett, Ghoshal & Beamish, 2008).

Although Zambrano acknowledged the fact the use of ICT in boosting the production and marketing of cement would be more pronounced as Mexico opens up, he did not relent on this exercise arguing that it was important to invest heavily in ICT. To begin with, the firm set up a satellite communication disk that would be used to connect the various affiliate firms within Mexico with lots of ease.

Before the start of 1990s, the firm had already established its own private network through which all data and voice calls in and out of company would be channeled. This system was also used to link operation in Spain acquisitions. In a bid to complete the ICT needs of the company, Cemtec was established which eased down the process of installing hardware as well as software development. By 1999, CEMEX was already spending about one percent of its net sales on the development of ICT.

In fact, the market rivals for CEMEX company were reportedly unable to match up the standards of ICT investment by the company although there were making every effort to boost their ICT standards. This is the reason why CEMEX was considered to have a distinctive prowess in the management of its ICT services towards the end of 1990s.

The use of ICT by the company transformed operations in a number of ways. For instance, the speed of delivery at the site which stood at 20 minutes only was phenomenon of CEMEX and it earned the company a reputation that could not be matched by any of its close competitors. In fact, CEMEX was branded the architect of ‘digital business design’.

During the same period, the suppliers and distributors of CEMEX products were also linked through the international network, commonly known as the internet.

As a result of ICT development, Zambrano and his management team could access information easily and readily and make relevant decisions expeditiously. For example, it was possible to get access of sales data on a daily basis based on the geographical location as well as the product line.

Moreover, CEMEX employees were also taken through capacity building and training programs on ICT so that they could be able to understand, interpret and manage data effectively. This was also in line with the company’s desire to overhaul the old communication system and adopt a new one(Bartlett, Ghoshal & Beamish, 2008).

In order to train its employee effectively, a private TV channel making use of the CEMEX satellite dish was set up. Besides, the company developed a Master of Business Administration (MBA) program that could be learnt on a virtual environment. The course content was made possible through the collaboration of the firm and Monterrey Tech.

In May 2000, the company had already accumulated a sum of 1.175 billion dollars aimed at investing in foreign acquisitions. The most important factor under consideration was choice of the most profitable location where foreign investment could be entrusted.

Although China was considered to be a fertile ground for investment due to its large population, the key limiting factor was that most of China’s cement production is carried out in small scale holdings (about 75 percent) (Bartlett, Ghoshal & Beamish, 2008). Hence, the absence of adequate commercial production of cement would prove to be economically unsustainable for CEMEX. Worse still, the company also realized that only the emerging markets in African and Asia could support the six major market rivals.

Therefore, the firm opted to go ahead with its global acquisitions in the upcoming markets. However, the expansion process was to be done with due care based on past experiences so as to minimize the chances of failure. There were various stages that were to be followed to the letter before global acquisitions could be carried out especially in distant markets.

Firstly, CEMEX reiterated the relevance of opportunity identification before embarking on investment business. The company had to devise screening tools that could exhaustively identify the available opportunities even as it explored far locations.

One single most important consideration before investing in a foreign country was its population size. As expected, it was supposed to be large in order to increase the marketing base. In addition, the host country was expected to be characterized with low current consumption scale (Bartlett, Ghoshal & Beamish, 2008).

The second factor to be considered by CEMEX was due diligence. This process is aimed at carrying out a critical examination of the company to be acquired in the host country. Usually, a team or groups of people familiar with the process are assigned a company to examine.

Last but not least, CEMEX had to reorient its management strategies as it expanded on a global scale. The management style has to be adjusted accordingly in order to be compatible with the needs and requirements of the host country.

Bartlett, C.A., Ghoshal, S. & Beamish, P.W. (2008). Transnational Management: Text, Cases, and Readings in Cross-Border Management . Fifth edition. New York and London: McGraw-Hill/Irwin

Ghemawat, P. & Hout, T. (2008). Tomorrow’s Global Giants Not the Usual Suspects, Harvard Business Review , 86(11): 80-88.

Ghemawat, P. (2005). Regional Strategies for Global Leadership, Harvard Business Review , 83(12), 98-108.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2020, July 3). CEMEX. https://ivypanda.com/essays/case-study-of-cemex/

"CEMEX." IvyPanda , 3 July 2020, ivypanda.com/essays/case-study-of-cemex/.

IvyPanda . (2020) 'CEMEX'. 3 July.

IvyPanda . 2020. "CEMEX." July 3, 2020. https://ivypanda.com/essays/case-study-of-cemex/.

1. IvyPanda . "CEMEX." July 3, 2020. https://ivypanda.com/essays/case-study-of-cemex/.

Bibliography

IvyPanda . "CEMEX." July 3, 2020. https://ivypanda.com/essays/case-study-of-cemex/.

- Cemex Firm's Innovation and Entrepreneurship

- Corporate Social Responsibility in CEMEX

- Blockbuster and CEMEX Company

- Cemex Company: International Business Management

- CEMEX’s Acquisition Strategy

- Analysis of the Globalization of Cemex

- CEMEX’s Foreign Direct Investment

- Mergers, Acquisitions, and Cultural Dilemmas

- Cement Industry in Kuwait and SWOT Analysis for Kuwait Cement Industry

- Different Types of Cement

- Palm, Inc.: Mobile Phone Industry Analysis

- The Rise and Fall of Canadian Tire's Web Site

- Toyota Motors the Largest Carmaker in the World: A Testament to the Impact of Globalisation

- UK Airline Industry: Regulation Costs

- Fashion and Leather Goods Group

To read this content please select one of the options below:

Please note you do not have access to teaching notes, cemex: information technology, an enabler for building the future.

Publication date: 25 January 2017

Teaching notes

The case examines the role of IT in CEMEX, a giant Mexican building materials manufacturer in an industry categorized by low margins and high costs. In the early 1990s, CEMEX made significant investments in its IT systems, resulting in a data-based management operation that put it at the forefront of the industry. As the company grew through acquisitions, it integrated IT through “The CEMEX Way,” a set of standardized processes, organizations, and systems implemented on a common IT platform.

In 2007, when CEMEX acquired Rinker, a major Australian concrete company, aligning Rinker with CEMEX IT systems was critical to quickly streamline operations and realize efficiencies. The CIO of CEMEX had developed a new integration process called Processes & IT (P&IT) that he was considering using for the Rinker integration. However, P&IT required additional resources, including significant upfront fixed costs and investment in new personnel teams at a time when the company was already struggling with the integration of another acquisition. CEMEX could either align Rinker to The CEMEX Way or use the opportunity to invest significantly more in evolving to the new P&IT approach that focused on business process management.

- Business Process Improvement

- Competitive Strategy

- Control Systems

- Decision Making

- Global Strategy

- Knowledge Management

- Information Technology

- International Business

- Mergers and Acquisitions

- Risk Management

Walker, R. (2017), "CEMEX: Information Technology, an Enabler for Building the Future", . https://doi.org/10.1108/case.kellogg.2021.000051

Kellogg School of Management

Copyright © 2017, The Kellogg School of Management at Northwestern University

You do not currently have access to these teaching notes. Teaching notes are available for teaching faculty at subscribing institutions. Teaching notes accompany case studies with suggested learning objectives, classroom methods and potential assignment questions. They support dynamic classroom discussion to help develop student's analytical skills.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

CEMEX: A Cement Company Which Crafted a Strategy to Serve the Impoverished in a Profitable Way

Urban poverty is as daunting an issue as rural poverty, which Professor C K Prahalad distinctly highlighted in his book, the fortune at the bottom of the pyramid, decades ago. Our subjective dominant logic, shaped by our own ideologies, experiences, interactions, and source of knowledge, has partially restricted our idea of poverty to the rural world.

As Prof. Prahalad says, the very assumption that the rural population is primarily poor and the urban population is relatively rich is a fallacy. In the developing world, more than one-third of the urban population lives in shanty towns and slums.

According to a recent World Bank report , fifty-five percent of the world’s population, which is approximately 4.2 billion inhabitants, live in cities, and by 2050 nearly seven out of ten individuals in the world would live in cities.

With more than eighty percent of global GDP generated in cities, urbanization can contribute to sustainable growth if managed well by increasing productivity, allowing innovation and new ideas to emerge (source: Worldbank.org).

However, the potential of growth and prosperity may remain a distant dream with impending challenges of poverty. More than one billion urban poor live in informal settlements contributing more to inefficiencies and chaos. The ability to build and finance a quality home has been beyond the means of most of the World’s impoverished.

The Genesis of private participation in deprived markets

Before the early 21st Century, the perceived role of private enterprises in addressing poverty and inadequacies in deprived markets was largely nonfigurative. The millennium development goals were originally developed without recognition of the role that the private sector could play.

The social contract of the private sector was later formulated and incorporated by the then Secretary-General of the United Nations, Mr. Kofi Annan. The Blue Ribbon Commission was organized by the United Nations Development Program on the private sector and poverty, which did most of the pioneering work.

The report of the Blue Ribbon Commission, which was issued in 2004, provided a significant impetus to active private participation in dealing with poverty-related issues, of which affordable and sustainable housing was one.

Building Houses Aren’t Similar to Selling Chips, Shampoos and Mobile Recharges

Over the past fifty years or so, most of the major multinational companies have discovered and realized the colossal potential of deprived markets. To serve them profitably, innovative and contextual business models have been developed.

Companies such as Unilever, P&G, Nestle, and ITC have been focusing and generating significant revenue and profit from this market. These companies not only had to work diligently on their marketing mix elements, i.e., product, price, place, and promotion but on their entire business model as well.

Though profitably serving the deprived markets is a great challenge, the magnitude of this challenge increases multi-fold when the offer is a ‘home.’

CEMEX Strategy- Helping Poor Build Their Homes

We would all agree on the fact that any form of innovation is fundamentally meant to address a state of deprivation. Most, or rather, all innovative ideas were conceived to circumvent challenges when they are confronted with.

One such colossal challenge is helping people with extremely limited economic resources to build their homes, and mind it!! This help is not in the form of charity but the form of a profitable business.

One of the most basic and primary ingredients required to build a house is ‘Cement’. And ironically, the people who need it the most, have never been the target customers for cement companies.

My experience of internship with one of the largest cement companies in India twenty years back had provided me an opportunity to understand the business of cement in a closer way.

The trade sales of cement usually occur through channel partners, who cater to the mass retail market. In contrast, the non-trade sales are contributed by large institutional projects, which buy directly from the company, in most cases. The conventional network of distributors is a sort of a linchpin to tap the retail demand for cement. After charging their share of commission, retail discounts are provided on volume. So, it is obvious for impoverished with very little money to not get considered a customer ever, for something like cement.

However, an economic crisis during 1994 and 95 in Mexico , made a cement company, CEMEX, think differently to circumvent the crisis, which later became the core part of its business strategy. CEMEX is a Mexican multinational building materials company, founded in 1906 and has a revenue of around $20 bn.

The Mexican economic crisis led to a significant drop in domestic sales of cement. Part of this stemmed from legal barriers that broke down, paving the way for international competition. An analysis of hemorrhaging revenues by the company CEMEX led to a discovery of customer segments ignored for long by cement companies wilfully.

A deeper investigation of cement sales during the crisis by the CEMEX analysts revealed that though cement sales plummeted as much as fifty percent in the formal market, sales in the less quintessential low-income segment that consisted of people who mostly build their own houses without employing professional masons, registered a fall only by ten to fifteen percent. The leadership team of CEMEX understood that the over-dependency on the formal segment actually made it vulnerable and decided to reevaluate its strategy.

The most primary and obvious reason for cement companies to focus on the formal segment is the average revenue per customer. Though fewer big-ticket customers could generate most of the company’s revenues, the situation is just the opposite for low-income customers. At that time, it was estimated that sixty percent of the Mexican population earned less than $5 a day. The segment was relatively virgin and could become an engine for growth in the future.

The potential of this colossal low income relatively unserved market was also accompanied by its own set of challenges. Headed by Francisco Garza Zambrano and a consulting team from Business Design Associates, CEMEX performed in-depth market research, which provided key insights into serving this segment profitably.

Three key areas of improvement were identified;

- the first was to make credit accessible for the poor before selling cement;

- the second was to improve brand perception of CEMEX among these customers through building trust;

- and the third was to change or improve distribution methods and construction practices so that they deliver more efficiency and cost-effectiveness to low-income customers.

Inducing and sustaining behavioral change at the Bottom of the Pyramid

It is a known fact that the low-income segments lack financial discipline and hence, not considered to be creditworthy. Saving money is not standard practice for most low-income families, and Mexicans are no exception.

The best form of savings that a low-income Mexican family does take the form of tandas – a local neighborhood, family, and network of friends who pool money if and when they have to create an informal mini-corpus. Once a week, one of the members bids for the pool by deep discounting or lottery. However, this tanda system was not nearly as effective for housing. The Mexican men mostly ended up spending such amount on anything but constructive or meaningful activities.

CEMEX realized that women are the key drivers of savings in families, and particularly in Mexico, they are highly entrepreneurial. As a bold cultural innovation, CEMEX modified the existing tanda system and renamed it Patrimonio Hoy, in 1998.

The system not only created a trust-based platform to save money but also provided access to credit based on their savings and payment discipline. Patrimonio Hoy consisted of socios or partners , who get together to form a group, restricted to a maximum of three members. Each of these three members registered groups had to make a commitment of contributing 120 pesos per member per week for 70 weeks. The company charged 15 pesos per member per week as a membership fee and in return, provided benefits that were unprecedented.

The raw materials including cement were provided at a frozen price anytime during these 70 weeks. Technical consultation pertaining to the right quantity and quality of raw materials required to build a house or a single room was provided free of cost, which optimized the utilization of raw materials and minimized wastage. The personal visits of architects to customer locations created a great deal of trust in the low-income society.

In tandem with this system, it was also necessary for CEMEX to modify its distribution network. The conventional distribution system in which the distributors primarily cared about prices and discounts and the industry was driven by a price war, seemed to be a misfit. The new system demanded distributors to have excellent delivery capabilities, the high storage capacity of raw materials and inventory, and a good understanding and appreciation for this new low-income segment. It was also necessary to take a cut in commission to serve this segment, which would be compensated by volume of business.

After successfully rolling out Patrimonio Hoy in Mexico, CEMEX launched another initiative called Construmex , a platform for remittances, which would help many Mexican Diasporas residing in the United States to send money directly to CEMEX distributors and reserve construction materials for building their houses in Mexico. The system turned out to be way more efficient than other money transfer agencies.

Today, CEMEX is the fifth largest cement company globally, producing 87.09 million tonnes of cement a year, with an estimated cement production capacity of 93 million tonnes across its 56 cement production plants. It is present across America, Africa, Europe, Middle East, and Asia. It is a company focused on creating sustainable value by providing industry-leading products and solutions to satisfy customers’ construction needs across the world.

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

Dr. Mrinmoy Bhattacharjee has nearly two decades of experience spanning across industry and academia. Currently, he is working as an Associate Professor in the area of Marketing with Alliance School of Business under Alliance University, Bangalore.

Related Posts

Style Theory business model: revolutionizing the clothes rental industry

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

How does DoorDash make money | Business Model

Innovation focused business strategy of Godrej

How does Robinhood make money | Business Model

How does Venmo work & make money | Business Model

How does Etsy make money | Business Model & Marketing Strategy

How does Twitch make money | Business Model

How does Klarna make money | Business Model

How does Khan Academy make money | Business Model

How does Quora make money | Business Model

Ola’s business model- Everything You Need to Know

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Brought to you by:

CEMEX: Information Technology, an Enabler for Building the Future

By: Russell Walker, Israel Feuerberg, Lorena Sanchez Garcia, Santiago Trevino Villasenor

The case examines the role of IT in CEMEX, a giant Mexican building materials manufacturer in an industry categorized by low margins and high costs. In the early 1990s, CEMEX made significant…

- Length: 9 page(s)

- Publication Date: Jan 25, 2017

- Discipline: Operations Management

- Product #: KEL992-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The case examines the role of IT in CEMEX, a giant Mexican building materials manufacturer in an industry categorized by low margins and high costs. In the early 1990s, CEMEX made significant investments in its IT systems, resulting in a data-based management operation that put it at the forefront of the industry. As the company grew through acquisitions, it integrated IT through "The CEMEX Way," a set of standardized processes, organizations, and systems implemented on a common IT platform. In 2007, when CEMEX acquired Rinker, a major Australian concrete company, aligning Rinker with CEMEX IT systems was critical to quickly streamline operations and realize efficiencies. The CIO of CEMEX had developed a new integration process called Processes & IT (P&IT) that he was considering using for the Rinker integration. However, P&IT required additional resources, including significant upfront fixed costs and investment in new personnel teams at a time when the company was already struggling with the integration of another acquisition. CEMEX could either align Rinker to The CEMEX Way or use the opportunity to invest significantly more in evolving to the new P&IT approach that focused on business process management.

Learning Objectives

After reading and analyzing the case, students will be able to: recognize the importance of process methods and goals in ensuring harmony between processes and technology platforms, speeding up solution deployments, and enabling continuous improvement and innovation; understand the impact of IT processes in integrating a large acquisition; and recommend an appropriate model for integrating an acquisition.

Jan 25, 2017

Discipline:

Operations Management

Geographies:

Industries:

Construction and engineering

Kellogg School of Management

KEL992-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Analyze case study of CEMEX

Related Papers

José G. Vargas-Hernández

This article, through a qualitative and quantitative analysis, focuses on strategies that CEMEX has carried out to determine how they influence their dominance index or market power. The qualitative analysis is based on mergers and acquisitions; meanwhile, quantitative analysis is performed by means of calculations Herfindahl Hirschman Index and the Index of Dominance. Currently Cementos Mexicanos is the industry leader in building’s materials with global presence as it produces markets and distributes cement in approximately 50 countries, maintaining business relationships with approximately 108 nations. Its main strategies are based on the expansion and acquisition of companies in the cement industry.and distributes cement in approximately 50 countries, maintaining business relationships with approximately 108 nations. Its main strategies are based on the expansion and acquisition of companies in the cement industry.

This article, through a qualitative and quantitative analysis, focuses on strategies that CEMEX has carried out to determine how they influence their dominance index or market power. The qualitative analysis is based on mergers and acquisitions; meanwhile, quantitative analysis is performed by means of calculations Herfindahl Hirschman Index and the Index of Dominance. Currently Cementos Mexicanos is the industry leader in building's materials with global presence as it produces markets and distributes cement in approximately 50 countries, maintaining business relationships with approximately 108 nations. Its main strategies are based on the expansion and acquisition of companies in the cement industry..

José G. Vargas-hernández , José G. Vargas-Hernández

The opening of the Mexican economy and globalization bring new opportunities for Mexican companies to expand their markets and get their products around the world. The internationalization process requires a sound strategy for the consolidation in foreign markets. The aim of this study is to analyze the different internationalization strategies followed by three Mexican companies with a global presence: Grupo Modelo, Grupo Bimbo and Cemex. We conclude that the differences in their strategies arise from the characteristics of each of these companies.

José G. Vargas-Hernández , José G. Vargas-hernández

Charmaine Nuguid

Environmental Quality Management

Calvin Chang

Donald Lessard

Abstract: Since Vernon's seminal work (Vernon 1966; Vernon 1971), international firm expansion has been predominantly portrayed as a phenomenon led by firms located in economically and technologically developed countries in search for new markets, natural resources, knowledge leverage, and/or risk diversification.

The term multinational has meant the expansion of American firms around the globe. During the 1970s and 1980s “Third World multinationals” were identified and characterized by a number of authors. However, their foundations have changed over time under the competitive advantage strategy of the global economy era. Profound economic changes in emerging economies during the 1990s resulted in a more competitive environment that forced large firms to develop new strategies, build new capabilities and move into more global competitive markets. Newer emerging multinationals enterprises (MNEs) from emerging economies are in the process of transforming the global foreign direct investment (FDI).

The Canadian journal of infectious diseases = Journal canadien des maladies infectieuses

Islamuna: Jurnal Studi Islam

achmad fauzi

Moral decadence that befalls most students in Indonesia is very alarming. The moral values which are expected belong to themselves increasingly decline. It is proven by the brawl among students, pregnant out of wedlock, drug abuse, and the persecution on the teachers significantly increase. By using analytical-descriptive method, this study concerns to the character education in KH. M. Hasyim Asy‘ari’s perspective taken from his book entitled Âdâb al-‘Âlim wa al-Muta‘allim which is focused on the students ethics in studying, including ethics in learning, student’s ethics to the teacher, and student’s ethics in dealing with the lesson. The result of this study shows that character education in KH. M. Hasyim Asy‘ari’s perspective has a harmony even precedes a number of values within character education materials of the Research and Development Agency, Curriculum Center of the Ministry of National Education, Indonesia. Thus, it can be developed within character education discourse that...

RELATED PAPERS

Microelectronics Reliability

guy HOLLINGER

Nazri Kamsah

Revista Uruguaya De Ciencia Politica

NICOLAS BENTANCUR

International Journal of Molecular Sciences

Andrea Fratter

Nature Reviews Methods Primers

Bhupesh K Prusty

Merete Tangstad

Yves Jacquot

Archives of Osteoporosis

Academic Medicine

Ezgi Tiryaki

Journal of Clinical & Experimental Cardiology

Hastangka Hastangka

Surface Science

Carsten Benndorf

Journal of Statistical Science and Application

claudia marin

Rafliandra Cahyono

Journal of Geophysical Research: Earth Surface

Daniel Calvete Manrique

Annals of the Academy of Medicine, Singapore

Mark Richards

Archaeological and Anthropological Sciences

M.ª Lourdes Montes Ramírez

Cristian Vendittozzi

Applied Sciences

jose Montiel

Kalpataru: Jurnal Sejarah dan Pembelajaran Sejarah

Karmila Karmila

Studia Ecologiae et Bioethiace

Studia Ecologiae et Bioethicae (ISSN: 1733-1218) , Maduka Enyimba

Ngamjahao Kipgen, Doungul Letkhojam Haokip (eds), Against the Empire: Polity, Economy and Culture during the Anglo-Kuki War, 1917-1919, London: Taylor and Francis, 2020

S. Thangboi Zou

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

MBA Knowledge Base

Business • Management • Technology

Home » Management Case Studies » Case Study of Cemex: Incorporating IT into Business

Case Study of Cemex: Incorporating IT into Business

Founded in 1906, Cemex is one of Mexico’s few truly multinational companies, with market-leading operations in Mexico, Spain, Venezuela, Costa Rica, Philippines, Panama, Dominican Republic, Egypt, Colombia, and a significant presence in the Caribbean, Indonesia, and the southwest United States. It is the largest cement company in America and one of the three largest cement companies in the world, with revenues of $4.8 billion and close to 65 million metric tons of production. Cemex and its subsidiaries engage in the production, distribution, marketing, and sale of cement, ready-mix concrete, and related materials. Its strategy includes focusing on cement and concrete products, diversifying globally to cushion against volatility in local markets, developing efficient production and distribution processes, using IT to help increase flexibility, improve customer satisfaction, and reduce bureaucracy and excess staffing, and providing training and education for employees. Its state-of-the-art Tepeaca facility supplies one fifth of the Mexican market and may be the lowest cost cement producer in the world, with operating costs of $25 per ton, roughly $10 lower than the industry average, and emissions far lower than legal requirements. In 1992 Cemex purchased Spain’s two largest cement companies, reviewed, their operations thoroughly, invested in facilities, and reduced the workforce dramatically, such as by consolidating 19 offices into one.

Although it was a laggard IT user through the 1980s, Cemex is now widely recognised as a company that uses IT extensively and views IT as an integral part of its long-term strategy . Lorenzo Zambrano, a Stanford MBA whose family owned a third of the stock, became its CEO at age 41 in 1985. In 1987, he hired an information system director and gave him the mandate of developing Cemex’s then primitive IT capabilities. Within a year, dispersed operations were being linked via satellite. In one case, a cement plant in a town with only 20 telephones used a satellite dish to transmit voice and data, thus bypassing Mexico’s chaotic phone system. By 1998, managers could use the satellite-based communications network to monitor operations and market conditions all over the world and to communicate using voice, video, Lotus Notes, and other technologies.

Application areas that demonstrate the importance of IT include management information and control of operations. Cemex managers can immediately link to any of the 18 plants in Mexico and immediately access the status of each cement kiln, recent production data, and even the deployment of trucks dispatched by different cement and concrete distribution centers. Financial statements are available two days after the end of the fiscal month, an endeavor that used to take a whole month. Eliminating these lengthy delays in evaluating production, costs, and sales volume helps in running a lean, low-cost operation by making it possible for management to take action quickly instead of waiting almost two months to just receive the data in some cases.

Use of IT in controlling operations occurs at many points. Cemex’s ready-mix delivery trucks are equipped with dashboard computers that allow tracking using global positioning satellite technology. A central dispatcher in a region constantly reroutes the trucks as customers cancel, delay, or speed up orders. In 1995, because of traffic gridlock, capricious weather, and labor disruptions at the construction site, Cemex could promise delivery no more precisely than within three hours of the scheduled delivery time. Such conditions often forced customers to cancel, reschedule, or change half of their orders. Today, at its largest operations in Mexico and Venezuela, Cemex is committed to delivering ready-mix shipments within 20 minutes of the scheduled time. The reason for this dramatic improvement in customer service is its dynamic synchronization of operations, which has increased the productivity of the company’s trucks by 35%. The result is significant savings in fuel, maintenance, and payroll costs, and a considerable increase in customer goodwill.

A Cemex news release in September 2000 announced the launch of CxNetworks, a new subsidiary that will build a network of e-businesses, as an integral element of its overall e-enabling strategy. CxNetworks will leverage Cemex’s assets onto the Internet and extend the reach of the company into marketplaces that complement its core business. CxNetworks will initially focus on three business areas: the development of online construction marketplaces, the creation of an Internet-based marketplace for the purchase of indirect goods and services, and the expansion of Cemtec- Cemex’s information technology and Internet consulting services company into new markets. CxNetworks is in the process of developing and will soon launch a series of online construction market places with a variety of local partners in South America, Europe, the United States, and Mexico. These businesses will offer an array of construction products, including cement, as well as online services and information to small and large contractors, builders, and other construction industry participants.

Questions For Discussion:

- How did Cemex fundamentally change the way it conducted its business?

- What role do information systems play in Cemex’s strategy and business model?

- How much do information systems help Cemex deal with its problems and compete in the industry?

Related Posts:

- Case Study of KFC: Establishment of a Successful Global Business Model

- Case Study: The International Growth of Zara

- Case Study: Nestle's Growth Strategy

- Case Study: Disney's Cultural Lessons From Tokyo and Paris

- Case Study: America Online (AOL) Merger with Time Warner (TWX)

- Case Study: Wal-Mart's Distribution and Logistics System

- Case Study: Failure of Vodafone in Japan

- Case Study: Southwest Airlines Competitive Advantages

- Case Study of Zara: A Better Fashion Business Model

- Case Study: MasterCard's Business Model

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Share Podcast

The Key to Preserving a Long-Term Competitive Advantage

Learn how to repackage your company’s existing knowledge to pioneer new products and services.

- Apple Podcasts

- Google Podcasts

For more than a century, the pharmaceutical company Roche has been headquartered in Basel, Switzerland. It’s one of more than a dozen pharmaceutical companies that have long been based there.

Howard Yu , Lego Professor of Management and Innovation at IMD Business School in Switzerland, discusses how this industrial cluster is a unique example of enduring competitive advantage. He explains how these companies offer a counter-narrative to the pessimistic view that you can’t stay ahead of the competition for long.

In this episode, you’ll learn how these historic companies began as makers of chemical dyes and later evolved into microbiology. You’ll also learn how to repackage your company’s existing knowledge to pioneer new products and services. And you’ll learn why persistence and experimentation over the long term are prerequisites for innovation.

Key episode topics include: strategy, innovation, competitive strategy, pharmaceutical industry, competitive strategy.

HBR On Strategy curates the best case studies and conversations with the world’s top business and management experts, to help you unlock new ways of doing business. New episodes every week.

- Listen to the full HBR IdeaCast episode: How Some Companies Beat the Competition… For Centuries (2018)

- Find more episodes of HBR IdeaCast

- Discover 100 years of Harvard Business Review articles, case studies, podcasts, and more at HBR.org .

HANNAH BATES: Welcome to HBR On Strategy , case studies and conversations with the world’s top business and management experts, hand-selected to help you unlock new ways of doing business.

For more than a century, the pharmaceutical company Roche has been headquartered in Basel, Switzerland. It’s just one of more than A dozen pharma companies who have long been based in the historic city, which sits at the crossroads of Switzerland, Germany, and France. Innovation expert Howard Yu says that this industrial cluster is a unique example of enduring competitive advantage.

Yu is the Lego Professor of Management and Innovation at IMD Business School in Switzerland. He explains that the story of these enduring companies offers a counter-narrative to the pessimistic view that you can’t stay ahead of the competition for long. In this episode, you’ll learn how these historic companies began not as pharmaceutical companies, but as makers of chemical dyes. Their transition from organic chemistry to microbiology was an enormous change that ensured the longevity of their businesses.

You’ll also learn how to rethink and repackage your company’s existing knowledge in order to pioneer new products and services – and you’ll learn why persistence and experimentation over the long term are pre-requisites for innovation.

This episode originally aired on HBR IdeaCast in July 2018. Here it is.

CURT NICKISCH: Welcome to the HBR IdeaCast from Harvard Business Review. I’m Curt Nickisch. Float down the Rhine River through the City of Basel in Switzerland and the murky water will carry you past the red sandstone cathedral up on the hill, along old stone embankments and under a medieval bridge. You’ll also pass the gleaming Roche Tower jetting diagonally into the sky like an optimistic sales forecast. And outside the old city, you’ll drift past the shiny new sculptured glass offices of Novartis. These global pharmaceutical companies here have rich corporate campuses.

HOWARD YU: At Novartis for example, the campus looks almost like a modern museum in many ways. There are stone gardens. There are major art installations all across the campus and the buildings were designed by a famous architect.

CURT NICKISCH: Speaking there is Howard Yu. He’s a management and innovation professor at IMD Business School in Switzerland. And what really impresses him is that these enterprises have been on the shore of the Rhine River for the better part of two centuries. After all, Yu grew up in Hong Kong where he saw industries rise and fall in short order. He says this enduring industrial cluster in Basel is unique.

HOWARD YU: And it’s just interesting element around how a city, a cluster industry can enjoy so much bountiful prosperity that really tricked me to go explore this particular city.

CURT NICKISCH: How these companies have stayed on top for so long is the subject of his new book. It’s called Leap: How Businesses Thrive in a World Where Everything Can Be Copied. I spoke to Yu recently on a day when my seasonal allergies were pretty bad, maybe something that those drug companies in Basel could help with. Howard, thanks so much for talking with the HBR IdeaCast.

HOWARD YU: My pleasure.

CURT NICKISCH: You have this title, Leap for your book, but when you talk about the pharmaceutical companies in Basel, there’re companies that have been in one place for a long time. They look like they’ve just stayed the same and endured. So, how do you explain that these pharmaceutical companies in Basel have lept ahead?

HOWARD YU: Yeah. The pharmaceutical cluster in Basel, Switzerland is sort of an anomaly because, in the field of competitive strategy, I think we are so well trained and thinking is so entrenched that you want to build up a defense for competitive possession. That you want to build a structural barrier to protect your businesses against competition over a long period of time. That seems to be the dominant thinking among executives and manager. That is a mirage. Because no value proposition can stay unique forever. Any blue ocean may turn red over time. If we were to look at different industries for a moment from automotive to textile, for example, to heavy machinery, personal computers, all the way to the mobile phone, inevitably what we see is expertise and capital and know how to migrate from one country to another. This anomaly in Basel kind of jumped out at me. And they’ve been settling in the same location for almost close to 200 years.

CURT NICKISCH: So, what is the conventional thinking, at least in Switzerland or elsewhere about how these drug companies have endured there?

HOWARD YU: Yeah. The usual response I get is, an executive would say, well, drug discovery is very high-tech. Or, drugs are subject to FDA approval, which is hard to get and as patent right. And yet, personal computers once upon a time, also have a lot of IP. Automotive has a lot of IP. And even the textile industry, 200 hundred years ago is the high-tech of the day. And yet they couldn’t stay away unscathed by global competition. What’s really interesting about Basel is how do these drug companies continue to reinvent itself? So, I decided to spend some time to just to understand from a historical development, a historical perspective what have these pharmaceutical companies have been doing throughout its long history of time, 200 years or so, to stay competitive, to fend off other low-cost competition differently than other industry we’ve seen.

CURT NICKISCH: What did you find?

HOWARD YU: Yeah, so it turns out at first they were actually old chemical dye maker for the textile industry. Now, some of these chemists, somehow they discovered there are medicinal benefits of the chemical dye. So, the first blockbuster in the world in the 19th Century is actually is antipyretic. It’s a fever-reducing drug. So, in many ways, organic chemistry is the hotbed for innovation. Now, we all remember back in high school, Alexander Fleming who discovered antibiotics, penicillin. So, after the Second World War, all the pharmaceutical companies essentially begins to study intensively around microbiology. They sent in a few workers to go down mineshafts. They sent a balloon to collect air samples. They called employees to ask them to look at the back of the fridge to look at an interesting mold.

CURT NICKISCH: Really?

HOWARD YU: Yes, in search of the next pay dirt. So, essentially the innovation discipline gradually moved away from organic chemistry to microbiology. Now of course, now these states, if we ask anybody what is the hotbed for innovation for medicine, its genomics. So, if you’re looking at pharmaceutical co-industry, what’s really interesting is for these pioneers to discover new drugs, essentially they need to leap from one knowledge discipline to the next, starting from organic chemistry to microbiology’s and then today, it’s genomics. And I believe it is because the recurring, or the continuous leap from one discipline to another that allows the pioneering company, such as the one in Basel that is able to stay on top of the competition. And it’s essentially leaping to a new discipline that opens up new paths for growth, so that the latecomer, the copycats always have a hard time in catching them up.

CURT NICKISCH: Got it. They essentially have to be pioneers and then become pioneers again and then become pioneers again.

HOWARD YU: That’s right.

CURT NICKISCH: You said this is different from other industries.

HOWARD YU: Yep. That is a sort of stark contrast and that really draw my interest to understand what causes some company to stay pioneering and prosper long period of time, versus others kind of being swept away.

CURT NICKISCH: Yeah. You also went to Harvard Business School where your dissertation advisor was Clayton Christensen and so, you studied disruptive innovation as well. The name of your book is Leap: How to Thrive in a World Where Everything Can Be Copied. But I think a lot of people think of disruption or companies going out of business, not having their stuff copied, but having other people basically, rather than copy them it’s more like they pull the rug out from under them. Is this a world where everything can be copied or something a little different?

HOWARD YU: That’s a great question. What we see in my research is disruption oftentimes is a real threat, but that’s not the only threat. In fact, even when an industry seemingly stays constant, nothing changes, the pioneering company, if it doesn’t leap to a new knowledge discipline, sooner or later its financial resources or its market positioning will get threatened. The latecomer will catch up. Let me give you an analogy here. Competition, industry competition is always like mountaineering. Meaning, every company tries to reach the mountain peak. Now, if the knowledge discipline stays stagnate from automotive to textile, to piano making, sooner or later the latecomer will reach the same height. However, if the knowledge discipline evolves from organic chemistry to biology’s to genomics such as the one we explore in pharmaceuticals, then the mountains almost feeling like there’s a constant mudslide that pushes everyone downwards. In those situation,s it turns out it’s the most experienced one, the most early one that has mastered the old knowledge that withstands a better chance to stay on top of this game. And which is why if you’re looking at industry such as solar panel manufacturing, mobile phone making, and wind turbine, and heavy machinery, the latecomer i.e., the Asian competitor, they all have pretty much a meaningful or even formidable position in the global market versus drug discovery. The Western company paradoxically still leads the pack in leading drug discovery itself. And I think it’s because this leap of knowledge discipline that pushed out the latecomers so much that they had a hard time in catching up.

CURT NICKISCH: For now.

HOWARD YU: For now.

CURT NICKISCH: Yeah. That’s so interesting. I like how you reference the mastery of the old because it sounds like it’s not just about focusing on the new or leaping to someplace new. Can you help explain why that mastery is so important?

HOWARD YU: If we go back to the study of microbes or microbiology, in fact at that time the scientists and the engineers, they were pouring different dyes and acid onto bacteria, to understand the mechanism and the reaction. In fact, the discovery of chromosome is because some of these chemists actually pouring dye, to dye the nuclear of the cell, then they see the structure of a chromosome. As cell divided, was the roll. So, it’s this idea that what you know in the past is the pre-knowledge for you to understand the future. And I think there is a lot of fear about disjoint or discontinuous disruption that causes people to completely disregard about the past. Now, sometimes this continuous change does hit an industry in a very big way. But complete disregarding the past, and forget about everything that you have as a unique asset and never reimagine how to repackage this unique asset for future use, that’s a big pity.

CURT NICKISCH: So, what’s an example of a company outside of Switzerland that you think has done this well, sort of in modern times where they’ve been able to use their pre-knowledge of where they’ve been to make leaps into new places and stay experts and stay ahead of the followers?

HOWARD YU: I deliberately tried to find international examples, seemingly impossible examples during my research and one company that I came across is from Japan. Its name is Recruit Holdings and it used to be a classified post publisher. So, they make a print magazine, like the Yellow Pages. And I thought this company should have died a long time ago because of their obsolete business model. Interestingly enough, Recruit Holdings was able to reinvent itself, leaping into new knowledge discipline and today is an international service provider for small, medium-size companies across Japan that today if you’re looking at a PE ratio, price per earnings ratio, or revenue or sales per spot price, they were at the same range as Google and Facebook.

CURT NICKISCH: How specifically did they do that?

HOWARD YU: Yeah, so when Recruit begins to notice the emergence of the internet, one thing that they’ve done is to do small-scale experiments. They moved one of the magazines online and provide all those contents for free. Now, they don’t turn profitable overnight. In fact, they suffered some corporate loss over the course of three years and it’s only the fourth year then they see their online magazine to begin to rake in revenue.

CURT NICKISCH: Right. This sounds, I mean this sounds like a classic job of managing disruption of your industry.

HOWARD YU: Absolutely right. Because in many ways they don’t know what they don’t know and you have to go into the field and do it by yourself, rather than outsource to a management consultant, in order to gain that early experience. Because this is, we’re talking about the early 2000s. No one had worked out the internet rules. It was at the time that even academic research about platform strategies, still very little. But what they have learned over time, a lot of the customers are putting ads on their magazine, a small time proprietor, mom and pop store, beauty salon, small-time restaurants. They don’t just want sales, but in fact, there are a host of administrative tasks that were distracting. For example, if you are a beauty salon, the last thing you want is to have double book your customers who are trying to get a haircut at the same slot. But yet, at the same time all the small time proprietors, they continue to do a lot of these booking systems on paper. Very labor intensive, using, taking up a lot of time that distracts them from serving the customer better. And so, Recruit Holdings begins to experiment beyond just selling advertising space online. They provide an internet-based solution such as a booking system for customers, such as table reservations at restaurants. The interesting thing for Recruit is they never just stopped from one single service, but the moved into a vertical stack. Meaning every time they encountered and discovered ping pong of their customer, they think about a new solution and provide that solution to wrap it around job to be done so well that their customer finds it very hard to resist. Now, eventually, they begin to change their business model from simply selling advertisement space online, too much more akin to a subscription base for services and so on. And so today, what they have been doing is to really thinking about how can we harness our database through artificial intelligence? So, again a new knowledge frontier.

CURT NICKISCH: So, that’s a pretty remarkable digital transformation. To go from being a classified company on printed pages to a company that’s working in new forms of artificial intelligence to stay ahead as a tech company. How did they do that? How did they know to make the transformation as they did and not go the route that most companies did?

HOWARD YU: Yeah, that’s a very important question because in many ways when companies leap the investment it represents or the payoff of these investment represents is very, very hard to translate into a financial or conventional financial analysis. And I think this is actually the root cause of why we see so few companies are successfully able to leap into the new knowledge frontier. If I take a broad view of Recruit Holdings as I go through the whole corporate archives, two things jumped out. One is the company has a buyer’s for experimentation. And in many ways that is the only way to reduce the dark space of ignorance because we can debate all day long whether this is our strategic intent, whether this should be going forward or not, but unless the company really tries things out on the ground, they don’t know what they’re doing, they know. And so, one is the idea of empowering middle manager to experiment with different initiatives around a new knowledge discipline, that’s absolutely paramount. However, that’s not sufficient because time and time again, I have observed companies who are quite happy to do small-scale experimentation, but no one finally makes the call of pulling the trigger and move from an emerging strategy into a deliberate strategy. This is really important because from R&D to product development, into scale and commercialization, it requires major double down of the investment amount. Yet again, what we see from Recruit to other companies who are able to leap forward is that at some point the senior management team will essentially review all the early evidence and at some point, they will pull the trigger despite the short-term payoff doesn’t look very favorable.

CURT NICKISCH: How rare is this organizational skill and insight and commitment?

HOWARD YU: You know, I thought it was pretty rare at first, but it’s actually more common as my research continued to unfold. I saw that type of CEO behavior also from companies such as Proctor & Gamble, Apple is another example, Amazon is another example, even NGOs, and others. The CEO, once he understands the new knowledge discipline, actually could reconfigure how the company brings drugs to the market, he essentially tells his direct reports, quote, money doesn’t matter. Let’s go ahead. Now it does require the senior leader to say something like of that kind of nature. Money doesn’t matter. Full steam ahead. And so it’s this idea of a combination of experimentation of the middle manager who is close to the market, close to the ground and gets the learning. But at the same time, at some point, you do require a senior executive to move from an experimentation mode into a deliberate mod and to make that resource allocation accordingly. That would result in a leap of an organization. I admit it’s rare, but rare not in the sense that it’s not a learnable skill. But it requires executives and senior managers to really change the way they spend their time and delegate as much as possible of their main business to people who can pick up that responsibility, but also use more time in understanding the new business, the new knowledge discipline which requires personal learning. And I think it’s this disjoint between the two, as a result, we see less occurrence than we hoped to have observed.

CURT NICKISCH: How do you know if you work at one of these companies?