- Browse All Articles

- Newsletter Sign-Up

SupplyChain →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Supply Chain Management Design & Simulation Online

Supply Chain Case Studies

SCM Globe comes with a library of case studies that explore COMMERCIAL , HUMANITARIAN , and MILITARY supply chains. When you purchase an account you have access to all the case studies and their simulations.

The case studies range from relatively simple beginning cases like Cincinnati Seasonings , to quite challenging advanced cases such as Zara Clothing Company , or Nepal Earthquake Disaster Response . Case studies are laboratories where you apply what you learn in lectures and readings to solve supply chain problems in highly realistic simulations. Each case has a " CASE STUDY CONCEPT " showing the supply chain principles and practices highlighted in that case.

SEE WHAT PEOPLE ARE SAYING ABOUT SCM GLOBE

Case studies presently available in the online library are shown below. You are welcome to use any or all of them. You can also create your own case studies, or we can create them for you. Cases are shown in the three categories. As you work with these cases you will gain an intuitive understanding of supply chain dynamics, and develop the analytical skills for designing and managing real supply chains.

People new to SCM Globe should start with the Cincinnati Seasonings case study . Work individually at first, not in groups. Each person needs their own account. Do the three challenges shown in the online introduction to Cincinnati Seasonings. That's how you'll learn to use the software, and how to use simulations to analyze and design supply chains. Then you will be ready to work in groups or work on more advanced cases. Click on the case studies below to see a description and introduction to each case.

Commercial Supply Chain Case Studies

Collaborative Supply Chains

S&J Trading Company – Angola

Java Furniture Company – Indonesia

Cincinnati Seasonings

Supply Chains of the Roman Empire

Ancient Silk Road – First Global Supply Chain

Zara Clothing Company Supply Chain

Fantastic Corporation – Global Supply Chain

Fantastic Corporation – Unexpected Disruptions

Humanitarian supply chain case studies.

Disaster Response Supply Chains: Flooding Scenario

Nepal Earthquake Disaster Response Supply Chain

Humanitarian Supply Chains: Syria Evacuation Scenario (CIV and MIL)

Military supply chain case studies.

Burma Campaign – 1944 Invasion of India

Battle of Smolensk – 1941 Invasion of Russia

Alexander the Great Needed Great Supply Chains

New case studies.

New cases are added based on projects we do with instructors, students, and supply chain professionals. Here are the new supply chain models in the library:

- Local and Sustainable Supply Chains – Blue Ocean Cooperative

- Aerospace Manufacturing Cluster – Rockford IL

- Hyderabadi Biryani – Paramount Restaurant

- Western Desert War – May 1941

- Russian Logistics for the Invasion of Ukraine

Interactive Supply Chain Case Studies

Every case study has a main theme or concept that it illustrates. You will be challenged to use knowledge acquired in lectures and readings as well as your own real-world experience to expand and re-design the supply chains in these case studies.

In the commercial supply chain cases you need to improve and expand the supply chains to support new stores and still keep operating costs and inventory as low as possible. In cases that deal with humanitarian or military missions you need to create supply chains to deliver the right supplies to the right locations when they are needed, and do so at a reasonable cost.

We are glad to provide a free evaluation account to instructors, students and supply chain professionals interested in exploring SCM Globe simulations — click here to request an account — Get Your Free Trial Demo

See SCM Globe pricing for Academic and Business versions of the software.

The best case to start with is Cincinnati Seasonings . After working through the three challenges presented in the online introduction to this case you will be ready to handle further challenges in this case or move on to more advanced cases. Get a quick introduction to working with case studies in “ Working with Case Studies “.

As problems are found in the simulations, you make decisions about how to fix them. Make changes to your supply chain model in the Edit screen. Then go to the Simulate screen and run a simulation to see the results of your changes. Depending on the changes you make, your supply chain simulation runs for additional days and other problems arise. As you address these problems you see about how supply chains work. Apply what you learn in readings and and lectures plus your work experience to solve the problems you encounter.

Keep improving your supply chain model until you get the simulation to run for 30+ days. Then download your simulation results and create a monthly Profit & Loss Report plus KPIs (as shown below). This provides an objective basis for evaluating the merits of different supply chain solutions.

Monthly Profit & Loss Reports identify areas for improvement. They help you improve your supply chain to keep it running for 30 days and also lower operating costs and inventory levels. You can work on lowering the carbon footprint of your supply chain too. These are the challenges you address in SCM Globe, and they are the same challenges people face when managing real supply chains. What works well in the simulations will also work well with actual supply chains. Skills you develop in working with the simulations are directly transferable to the real world.

NOTE: You can run simulations for longer than 30 – 60 days, but there is usually no reason to do so. This is because most companies do not run their supply chains unchanged for longer than 30 days at a time. They use a 30 day S&OP ( sales and operations planning ) cycle and these simulations correspond to that monthly S&OP cycle. These simulations focus on the tactical realities of operating a supply chain from one month to the next, and finding what works best.

Accessing the Online Library of Case Studies

As shown in the screenshots below, logon to your account and access the case study library from your Account Management screen. Click on the “View Library” button (arrow 1) in upper right corner of the Account Management screen. In the Library screen you see a list of available supply chain case studies; click “ Import ” to load a selected case study into your account; give the imported case a Name , and click “ My Account ” to go back to your Account Management screen.

You are welcome to import any or as many of the supply chain models in the library as you wish. Once you have a copy of a supply chain model in your own account you can make any changes you want to it.

In Account Management, you “ Create a New Supply Chain ” or work with an existing supply chain by clicking the “ Edit ” button (arrow 2) next to the existing supply chain you want to work on. You can also upload copies of supply chain models sent to you by other SCM Globe users (arrow 3) , and check your account expiration date (arrow 4) .

Use the Default Values or Enter New Data

When you load any of the case study supply chain models from the SCM Globe library, they come with default numbers already plugged in. You can either accept the defaults or do some research to find more current data. This data (like data and prices everywhere) changes all the time.

Look for data on products, facilities and vehicles that are used in your supply chain and see what their specifications and costs are. Costs can vary widely in different parts of the world. Go to websites of commercial real estate brokers in cities of interest and see what you can find out about rent costs:

- for cities in North America start with www.cityfeet.com

- and for cities in other parts of the world start with www.knightfrank.com

Metric System of Weights and Measures

In the case studies all weights, volumes, distances and speeds are expressed using the metric system. The metric system is used around the world in every country except three: Liberia; Myanmar; and the United States. So it is good for supply chain professionals to feel comfortable with the metric system.

Register on SCM Globe for Access to all Supply Chain Simulations

Click the blue "Register" button on the app login page, and buy an account with a credit card or PayPal (unless you already have one). Then scan the "Getting Started" section, and you are ready to start. Go to the SCM Globe library and click "Import" next to the supply chain models you want.

During the last decade, a cascading series of unpredictable events—including earthquakes, volcanic eruptions, catastrophic storms, disease outbreaks and armed conflicts—has exposed deep fragilities in global supply chains. These events served as initial alarm bells for much greater challenges to come.

Intricately woven supply chains were built on concepts such as just-in-time manufacturing and designed to reduce labor and operating costs. Over the years, companies relentlessly optimized their supply chains to serve markets with relatively predictable supply and demand patterns. However, recent and unprecedented events have shown how these choices have created inflexible supply chains that are brittle under stress.

Breaking a single link in a globalized supply chain can have a ripple effect, impacting customers thousands of miles away from the point of disruption. “Supply chain issues” has become a catchphrase for economic dislocation.

“In recent years, supply chain has gone from the background, something people did not think about, to a boardroom-level topic,” says Rob Cushman, Senior Partner, IBM Supply Chain Transformation. “It’s a concept that people have had very painful personal experiences with. And that’s why thinking about supply chain is pivoting from cost to being about resilience and agility, and ultimately driving growth.”

Cost savings

By deploying a cognitive supply chain, IBM reduced supply chain costs by USD 160 million and built in more resilience and agility

100% order fulfillment

Even during the peak of the covid-19 pandemic, IBM maintained a 100% order fulfillment rate of its products to clients

The worldwide reach, size and complexity of its supply chain organization represented a significant challenge as IBM began exploring transformation strategies for delivering a differentiated customer experience to promote customer loyalty and growth. IBM employs supply chain staff in 40 countries and makes hundreds of thousands of customer deliveries and service calls in over 170 nations. IBM also collaborates with hundreds of suppliers across its multi-tier global network to build highly configurable and customized products to customer specifications.

Previously, the IBM supply chain ran on legacy systems spread across different organizational silos, making information sharing slow and incomplete. Employees also performed much of their work on spreadsheets, which impeded collaboration and real-time data transparency.

However, at the same time the IBM supply chain was re-thinking business processes and transforming its technology platforms, IBM was making major strides in AI, cloud, data fabric, IoT, edge computing and other tools. “We saw the advances IBM was making in all these new technologies,” says Ron Castro, Vice President of IBM Supply Chain. “So, we asked, ‘Why not leverage our own technology to move our own supply chain forward?’”

“The principle behind why we embarked on this journey was to answer the question, ‘How can we best react to disruptions to manage resiliency and our client experience?’” says Castro. “We needed to identify disruptions quickly, analyze the data, get insights and decide on the best course of action.”

IBM supply chain management set out a bold vision to build its first cognitive supply chain. The aim was to have an agile supply chain that extensively uses data and AI to lower costs, exceed customer expectations, ruthlessly eliminate or automate non-value add work and exponentially improve the experience of supply chain colleagues.

IBM Consulting® was brought in at the beginning to help develop the processes required to drive the transformation. “We consider ourselves ‘Client Zero’ for IBM Consulting,” says Debbie Powell, IBM Digital Supply Chain Transformation Leader. “We have the technology to do what we need to do. It’s the culture and the processes where change was needed. We also realized that a lot of our knowledge was tribal and often depended on one person. We needed to digitize and democratize knowledge to support decision-making throughout the organization.”

IBM Consulting helped the IBM supply chain team use Design Thinking methods to plan its digital transformation and move from sequential to continuous planning. “We put a lot of effort into agility and a cultural shift to empower people and adjust workflows in a controlled way,” says Matthias Gräfe, Director of IBM Supply Chain Transformation. “We went from a top-down approach to identifying personas from the bottom up, the people that actually make the decisions.”

“Successful digital transformation required us to challenge traditional ways of working that were held sacred for decades and win the hearts and minds of supply chain colleagues for change to stick,” says Takshay Aggarwal, Partner, IBM Supply Chain Transformation.

At a high level, the IBM supply chain digital transformation revolves around building sense-and-respond capabilities. This was accomplished by democratizing data and automating and augmenting decisions achieved by combining cognitive control tower, cognitive advisor, demand-supply planning and risk-resilience solutions. “We view the cognitive control tower as the single source of truth where you have access to all the data and it helps advise the best course of action,” says Castro. “It also helps gather insights from the information quickly across the end-to-end supply chain.”

The cognitive control tower is powered by the IBM® Cognitive Supply Chain Advisor 360 Solution, which runs on IBM Hybrid Cloud and on Red Hat® OpenShift® (link resides outside of ibm.com) software. Cognitive Advisor 360 enables real-time, intelligent supply chain visibility and transparency. It also senses and responds to changes in demand as they happen and simplifies the automation of supplier management.

The system uses IBM Watson® technology to enable natural language queries and responses, which accelerates the speed of decision-making and offers more options to correct issues. “I can ask—in natural language—about part shortages, order impacts, risks to revenues and trade-offs,” says Cushman. “There’s a button that recommends actions to solve issues — that’s what Watson does. It’s augmented intelligence so we empower people with better information to make data-driven decisions very quickly.”

“With the cognitive supply chain, we have the benefit of bringing in all these data from legacy systems and internal and external sources, as well as unstructured data, to apply advanced analytics and different elements of AI,” says Castro. “And since the system responds to natural language, think about the power of being able to extract data and get insights and recommendations without having to be an expert in a legacy system or an ERP platform.”

The IBM cognitive supply chain technology architecture also includes IBM Edge Application Manager , IBM Maximo® Visual Inspection and IBM Track and Trace IoT —an integrated stack of solutions that connect data end-to-end across the supply chain. “Our procurement, planning, manufacturing and logistics data are connecting in close to real time,” says Cushman. “That’s how we can share inbound information from suppliers, manufacturing status updates with our external manufacturing partners and delivery information with our customers.”

“We’ve added demand sensing, so that the solution pulses the market for changes in demand, predicting the future. We’ve also embedded a cloud-based risk management tool called Resilinc into our procurement and inbound parts management process,” says Cushman. “It essentially uses AI to crawl the web and if there is a disruption, we can take action quickly to secure a second supply source.”

On a minute-by-minute basis, one of the biggest advantages of IBM’s cognitive supply chain is that it provides employees with immediate access to the information they need to read and mitigate disruptions. “There is unbelievable power that comes from taking lots of disparate data and putting it where people can see and understand it,” says Cushman.

“The real-time, single-view of the truth increases the velocity of decisions and leverages rapid response,” says Castro. “It helps us develop ‘what-if’ scenario analysis from a planning perspective all the way through to the execution team and suppliers.”

In fast-moving, real-world situations, quick, informed decisions provide a competitive advantage. “In the past, a major disruption—such as the closing of a major airport—would take days for us to understand the immediate impacts. With our current solution, we have ‘what-if’ capability that brings this analysis down to minutes,” says Powell. “In a supply constrained environment, whoever gets the information first wins.”

Since its cognitive supply chain became operational, IBM has saved USD 160 million related to reduced inventory costs, optimized shipping costs, better decision-making and time savings. “When mitigating a part shortage, it used to take four to six hours per part number,” says Powell. “We’ve brought that down to minutes and made further improvements to seconds.”

“Where’s my stuff?” is a common question in the supply chain industry. Finding an answer can entail hours of phone calls, emails and ERP queries across different geographies. “We’ve built a solution where you can log in and enter an order and you’ll have an answer in about 17 seconds,” says Cushman. “That was an enormous pivot and a powerful change in how we do business.”

By using its cognitive supply chain platform, the IBM supply chain team is also able to create new capabilities much faster. “Years ago, when we started this journey, we needed a long, looping roadmap with one or two years required for major capability upgrades,” says Castro. “With this digital enterprise, we now have teams that complete deployments in two or three weeks. We’ve moved to much more agile development.”

Despite dislocations caused by the COVID-19 pandemic, IBM fulfilled 100% of its orders by using its cognitive supply chain to quickly re-source and re-route parts as necessary. “During the last two years, the IBM supply chain did not fall behind. We met our commitments. Everyone else was screaming supply chain issues and we’re shipping products,” says Daniel Thomas, IBM Business Optimization Manager and Chief of Staff. “We delivered on our promises during the height of the disruptive era we live in.”

“Guaranteed supply is important, but many of our clients are also looking for predictability of supply,” says Castro. “The tools we have now help us address both issues. They enable us to manage the demand side to meet the right client expectations.”

“We have a responsibility to inspire younger supply chain leaders who will keep the IBM supply chain at the cutting edge and beyond for years to come,” says Aggarwal. “People entering the work force today have different experiences than previous generations. They are digital natives and expect a consumer-grade experience when managing their work. As we embarked on our journey, we actively engaged them in designing workflows and digital capabilities. There were trials and tribulations and we had multiple failures in design and rollout. Architecting the cognitive supply chain, and learning from failures and successes, made our young leaders champions of the cognitive supply chain and constant innovators of new capabilities.”

“IBM is the only global services company with its own multibillion-dollar supply chain, and we’ve transformed it into a data-driven architecture to drive our business. There’s a richness of experience that we bring to client conversations because we’ve done this work for ourselves,” says Cushman. “It’s all about how a supply chain delivers a differentiated customer experience to enable stickiness and growth.”

“The collaboration between IBM Systems and IBM Consulting teams to transform our own business and demonstrate the power of exponential technologies in supply chain has been one of our finest moments as a company,” says Cushman. “We look forward to sharing our real-world experience and learnings with our worldwide community of customers, partners and clients.”

IBM is an information technology company based in Armonk, New York. Founded in 1911, the company offers hardware, software and services in cloud computing, AI, commerce, data and analytics, IoT, mobile and cybersecurity, as well as business resiliency, strategy and design solutions. IBM has a global workforce of more than 280,000 employees serving clients in over 175 countries through IBM Consulting, IBM Software and IBM Infrastructure.

To learn more about the IBM solutions featured in this story, please contact your IBM representative or IBM Business Partner.

Build AI-enabled, sustainable supply chains that prepare your business for the future of work, create greater transparency and improve employee and customer experiences

IBM Sterling Supply Chain Insights with Watson provides visibility across the entire supply chain.

Sourcing minerals responsibly with blockchain technology

© Copyright IBM Corporation 2022. IBM Corporation, New Orchard Road, Armonk, NY 10504

Produced in the United States of America, July 2022.

IBM, the IBM logo, ibm.com, IBM Consulting, IBM Watson and Maximo are trademarks of International Business Machines Corp., registered in many jurisdictions worldwide. Other product and service names might be trademarks of IBM or other companies. A current list of IBM trademarks is available on the web at ibm.com/legal/copyright-trademark .

Red Hat®, JBoss®, OpenShift®, Fedora®, Hibernate®, Ansible®, CloudForms®, RHCA®, RHCE®, RHCSA®, Ceph®, and Gluster® are trademarks or registered trademarks of Red Hat, Inc. or its subsidiaries in the United States and other countries.

This document is current as of the initial date of publication and may be changed by IBM at any time. Not all offerings are available in every country in which IBM operates.

The performance data and client examples cited are presented for illustrative purposes only. Actual performance results may vary depending on specific configurations and operating conditions. THE INFORMATION IN THIS DOCUMENT IS PROVIDED “AS IS” WITHOUT ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING WITHOUT ANY WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND ANY WARRANTY OR CONDITION OF NON-INFRINGEMENT. IBM products are warranted according to the terms and conditions of the agreements under which they are provided.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Case Study: How Should We Diversify Our Supply Chain?

- Krishna G. Palepu

A Chinese appliance maker considers expanding production to Mexico.

In the wake of Covid-19’s disruptions, Kshore, a Chinese appliance maker, is thinking of realigning its supply chain. Like many other global manufacturers, it’s being pressured by its customers, which include Walmart and other large retailers, to reduce the time, expense, and environmental impact of shipping goods between countries.

On a trip to Monterrey, Mexico, Kshore’s CEO and COO tour factories that are closer to North American markets—and are impressed by their professionalism. But questions about transportation and staffing give the executives pause. Should Kshore start production in Mexico or consider other countries? Two experts weigh in.

On the sidewalk outside the airport in Mexico City, Yun Liu and Keith Smith, the CEO and COO of Kshore, a Chinese appliance maker with $150 million in annual revenues, waited for their town car. Their journey from Guangzhou, China, had been a long one.

- Krishna G. Palepu is the Ross Graham Walker Professor of Business Administration at Harvard Business School. His research focuses on globalization, emerging markets, and strategies for multinational and local companies in those markets. He cochairs the HBS executive program Leading Global Businesses.

Partner Center

- The approach allows each function to understand the assumptions relating to transformation that affect it and how its own assumptions affect others.

- Understanding dependencies enables each function to perform its own design, building, and execution in coordination with other teams.

- A case study of a leading global retailer highlights how the approach harmonizes disparate elements, fosters cross-functional alignment, and promotes an end-to-end transformation.

Subscribe to our Operations E-Alert.

Supply Chain Management

/ article, a unified approach to end-to-end supply chain transformation.

By Michael Hu , Kartik Goel , John Cheru , Ravi Srivastava , and Michael Ryba

Key Takeaways

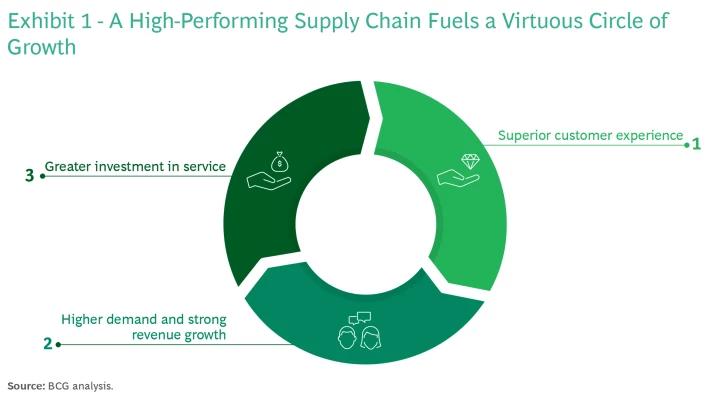

Supply chains play a leading role in enterprise growth . They are the engine of a virtuous cycle, driving customer satisfaction and, ultimately, higher revenue. But they are often vulnerable to the demand and supply uncertainties of the global landscape.

To increase resilience and improve performance, many companies have set out to transform their supply chains. Like builders constructing a complex house, however, they often must contend with the challenges of coordinating multiple teams, meeting ever-increasing demands for digitization, and adhering to accelerated timelines. As a result, their ambitious transformation initiatives fall short of expectations.

So how can companies ensure that every team involved in a supply chain transformation works in concert? We propose an innovative approach that allows companies to align their disparate supply chain elements with their broader business and commercial aspirations.

Supply Chains Are Essential but Fragile

By ensuring that the right products are available when and where they are needed, a high-performing supply chain enables exceptional customer experiences and fuels a virtuous cycle of growth. (See Exhibit 1.) The cycle starts with superior customer service, which drives demand and traffic. This, in turn, creates growth in revenue and margins. Ultimately, it provides the company with healthy coffers with which to further invest in capabilities such as talent, automation, and the data foundation that will improve customer service.

However, supply chains remain vulnerable to uncertainty and complexity arising from geopolitical volatility, macroeconomic challenges, climate change, technology disruptions, and changing consumer expectations. The pandemic-related supply chain shocks were not a temporary aberration but rather an especially acute illustration of supply chain fragility that will continue to threaten revenue growth.

In 2023, for example, despite an inflation rate exceeding 6%, retail sales continued to grow. The resulting strain on transportation and warehousing capacity drove higher costs—average freight costs in January 2023, for instance, were double those of four years earlier. Geopolitical factors, such as the war in Ukraine, have also intensified pressure on supply chains. Given this challenging environment, the need to strengthen supply chains has never been more pressing.

Transforming Supply Chains Is a Lot Like Building a House

Recognizing the urgency, many companies have launched end-to-end transformation initiatives to boost resilience and enhance their supply chain performance. But most of these efforts fail to meet expectations. In consumer sectors, less than 30% of large-scale supply chain transformations achieve their goals on time and within budget.

To grasp why supply chain transformations typically fall short, consider the building of a house. Homebuilders may start with a clear vision and a high-level blueprint. And they may employ the best architects, construction managers, masonry workers, plumbers, roofers, and electricians. But then the challenges begin. Although all the contractors may excel in their fields and follow the blueprint, they often lack the detailed information necessary to agree on key interfaces, dependencies, and design assumptions. Consequently, early prototypes may exhibit problems like rooms not connecting seamlessly with the roof or electrical wires laid in incorrect locations.

To improve coordination, homebuilders can hire a general contractor to orchestrate the various contractors. While this is a positive step, new problems arise: seamless integration is hampered by differing assumptions among the contractors, by the need to incorporate digital technologies for a “smart” house, and by the pressure to complete work within a reasonable timeframe.

Similar challenges occur when companies attempt to transform their supply chains. Many companies start with a piecemeal approach, addressing only specific aspects of the supply chain. Consider the example of an integrated business planning team establishing an AI-enabled multi-echelon revenue forecast for the end-to-end supply chain. Capturing the promised value from this initiative requires significant cross-functional coordination. The supply chain technology team must provide technological and data support, while the distribution and warehousing team must convert the new revenue forecast into daily labor, inventory, and trucking forecasts.

To remedy the shortcomings of a fragmented approach, the company may embark on an end-to-end transformation. It implements AI-enabled forecasting, for example, as one aspect of a broader transformation that also includes redefining the underlying processes and data foundations to ensure that an improved demand signal translates into better daily or weekly order fulfillment, replenishment, and inventory placement decisions across warehouses and store locations. While this holistic approach has the right level of ambition, it is challenging for three main reasons:

- Coordination. Defining new supply chain processes across various functions in a matrixed organization necessitates significant coordination, as well as collaboration with commercial teams.

- Digital Enablement. Companies need to understand how advanced digital technologies , such as AI and digital twins, can address the pain points in their supply chain. They must also ensure that the underlying data foundation and pipelines are set up to power the technologies.

- The Need for Speed. Transformations must be completed within one to two years, which demands a rapid and highly efficient mobilization to rework processes, capabilities, and data.

Ensuring That All Functions Pursue a Common Goal

To manage the complexity of an end-to-end supply chain transformation, companies need a blueprint that allows each function to understand the assumptions relating to the transformation that affect it and how its own assumptions affect others. The blueprint should also make dependencies, such as those between distribution and ordering, visible to all participants. This will enable each function to perform its own design, building, and execution in coordination with others.

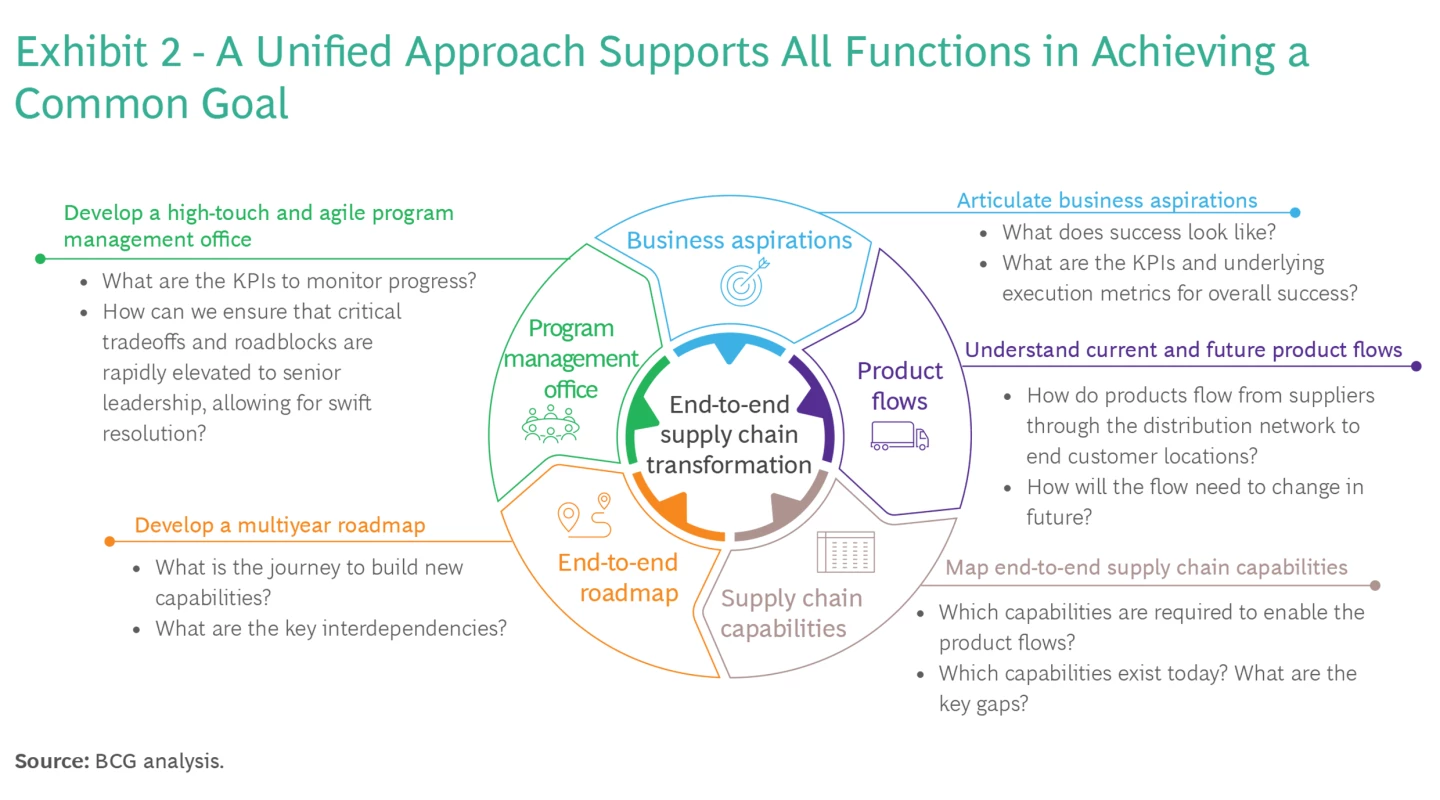

To facilitate the development of this blueprint, BCG has designed an approach composed of five interlocking steps. It ensures coordinated action by providing a strategic and execution roadmap across functions and teams. (See Exhibit 2.)

- Articulate and quantify business aspirations. To guide its efforts, the company must specify what it wants to achieve through the supply chain transformation. It can then determine the KPIs and the underlying execution metrics that contribute to meeting the overall success criteria.

- Understand current and future product flows. The company needs a baseline, granular understanding of how pallets, cases, and individual items flow from suppliers through distribution networks to end customer locations. It uses this information to assess how it must change the product flow to achieve its goals.

- Map end-to-end supply chain capabilities. Understanding product flows allows the company to determine which end-to-end supply chain capabilities it needs today and in the future. It can then pinpoint critical capability gaps and decide how to address them.

- Develop a multiyear capability-building roadmap . The company must determine how to build new capabilities that will enable current and future product flows. This requires identifying which capabilities are prerequisites for others and which ones are critical to completing the transformation.

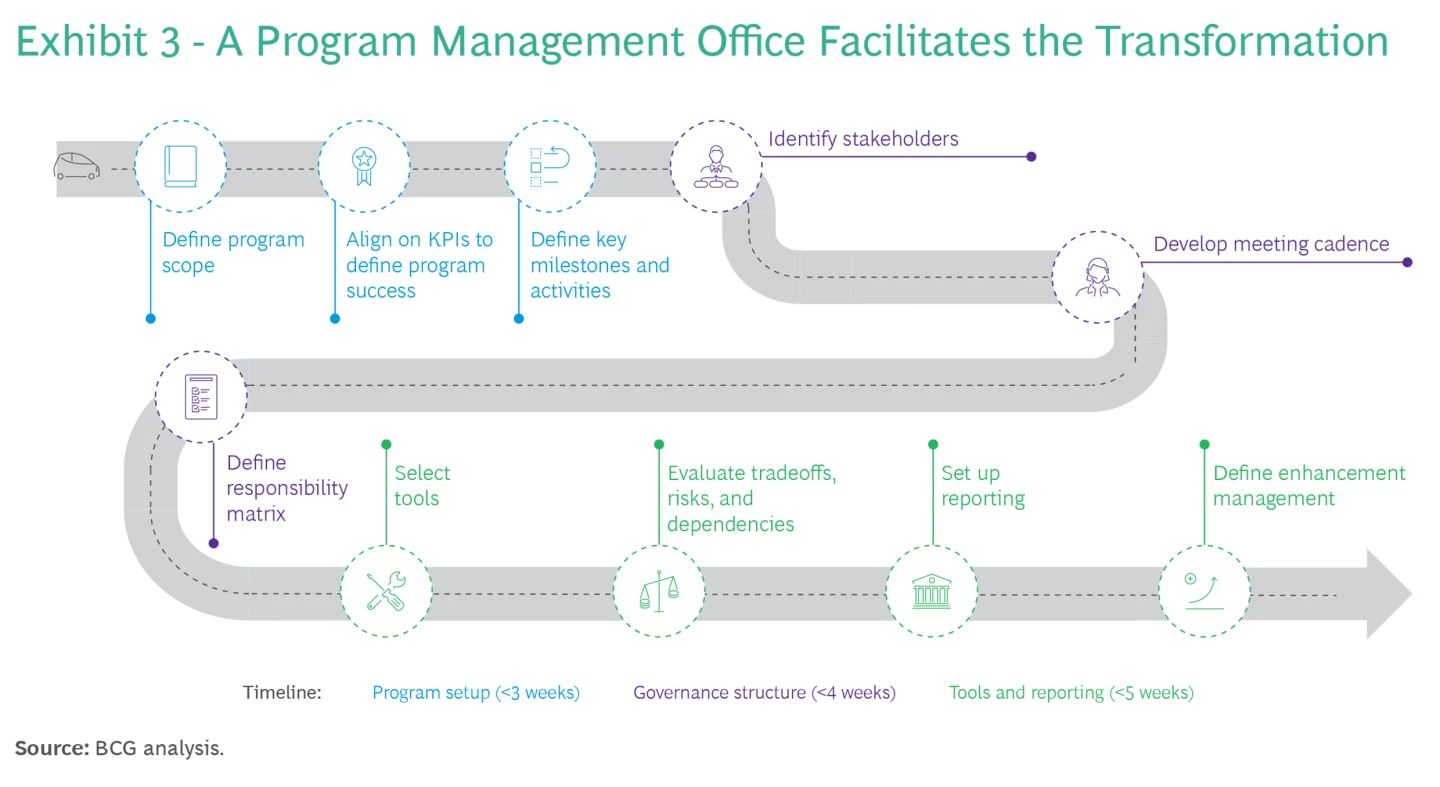

- Establish a high-touch and agile program management office. To support execution, the company needs to appoint a high-touch and agile PMO. (See Exhibit 3.) This body sets up the transformation program, defining KPIs and key milestones. It also creates the governance structure by assigning responsibilities across functions and developing the meeting cadence for evaluating critical tradeoffs and resolving issues. In addition, the PMO establishes tools and reporting formats, including the use of data analytics to enable more effective and agile decision making.

Case Study: Applying the Approach at a Leading Global Retailer

BCG applied this approach to support the end-to-end supply chain transformation of a global retailer. The company’s rapid growth had strained its supply chain and revealed key limitations, especially in cross-functional coordination and data enablement. Finding innovative solutions to these challenges was essential to realizing the company’s ambitious growth plans, including international expansion.

Deploying the Approach

The five-step approach described above provided key insights about the innovations and capabilities required to achieve the company’s goals.

Business Aspirations. We identified increasing revenue by 75% to 100% over the next decade as the primary business aspiration motivating the end-to-end supply chain transformation. We then developed an in-depth understanding of the supply chain implications, including numerical projections for case deliveries, stores in the network, and distribution centers required to service demand. We also identified supply chain innovations needed to achieve these goals, including the introduction of new nodes, such as market distribution centers that stock items closer to the stores and daily multiple deliveries from distribution centers to stores. Other necessary improvements were deploying different truck combinations at different times of day, having drivers manage drops during nonpeak hours, and using customized trucks to co-mingle selected products.

Product Flows. Mapping the end-to-end product flows for the current supply chain helped identify critical gaps. For example, the ordering process lacked essential functionalities for tracking order status, modifying orders, and rerouting orders when necessary. The product flow mapping also highlighted specific shortcomings in the current distribution network that limited its ability to support supply chain innovations.

We then mapped potential future product flows, considering delivery profile (number of drops, time of drop, and volume per drop), location of existing and new nodes (including the possibility of new nodes collocated with existing distribution centers), and type of transportation (including truck size and owned or leased fleets). This assessment helped narrow down the list of key future flows, which facilitated the development of the capability-building roadmap. For the shortlisted flows, we identified the activities needed at each node to realize the envisioned future supply chain.

Supply Chain Capabilities. We mapped each identified activity to an enabling supply chain capability. For example, the company needed an automated order forecasting engine to estimate the next day’s order based on starting inventory, the day’s sales, and heuristics-based forecasts of damaged orders. Such a system can significantly reduce the time that store owners spend placing orders each day.

Some of the key capabilities identified included the following:

- Revamped End-to-End Distribution Network. To support the identified innovations, we proposed investing in new distribution center capacity. This triggered the need to revamp the end-to-end distribution network. Although the new network entailed higher costs and complexity, it gave the retailer greater flexibility and control. The result was higher levels of service and support for product flows than the previous distribution network offered. To initiate implementation, we pinpointed portions of the distribution network that the company could prioritize in the short term and developed a full revamping plan for the long term.

- Digital-First Order Management Platform. The mapping of future product flows revealed that the company needed distributed order management capabilities. These include the ability to add or modify orders, track orders, reroute deliveries to contingent distribution centers in case of disruptions, and track end-to-end inventory. For instance, the company needed the ability to allocate a store owner’s order between the regional and market distribution center on a daily basis, depending on inventory levels at various nodes and delivery times. Recognizing the need for advanced capabilities, the company launched a digital-first order management platform and mobile app to facilitate intuitive and convenient ordering by its store owners.

- End-to-End Data Foundation. A cohesive end-to-end data foundation is a key enabler of a supply chain transformation. Considering future capabilities and product flow requirements, we identified several data gaps relating to, for example, KPIs (such as on-time in-full), end-to-end inventory across nodes, and recommendations for the daily order forecast. To address these gaps, we defined a strategy for capturing the right input data. Steps included requesting data from suppliers, placing GPS devices in trucks, and monitoring and reporting the temperature at distribution centers. We also determined the optimal flow of data to the company’s systems and tools to enable analytics, as well as the channels required to view and monitor output. Further, we supported the company in deploying these strategies, such as by developing and implementing a policy to send and receive key data from suppliers.

The data strategy and process design are mutually dependent. For example, the company needed end-to-end inventory data to support the daily order forecast. This insight led us to include an inventory module in the digital order management platform and to source the inventory data at stores directly from store owners at regular intervals.

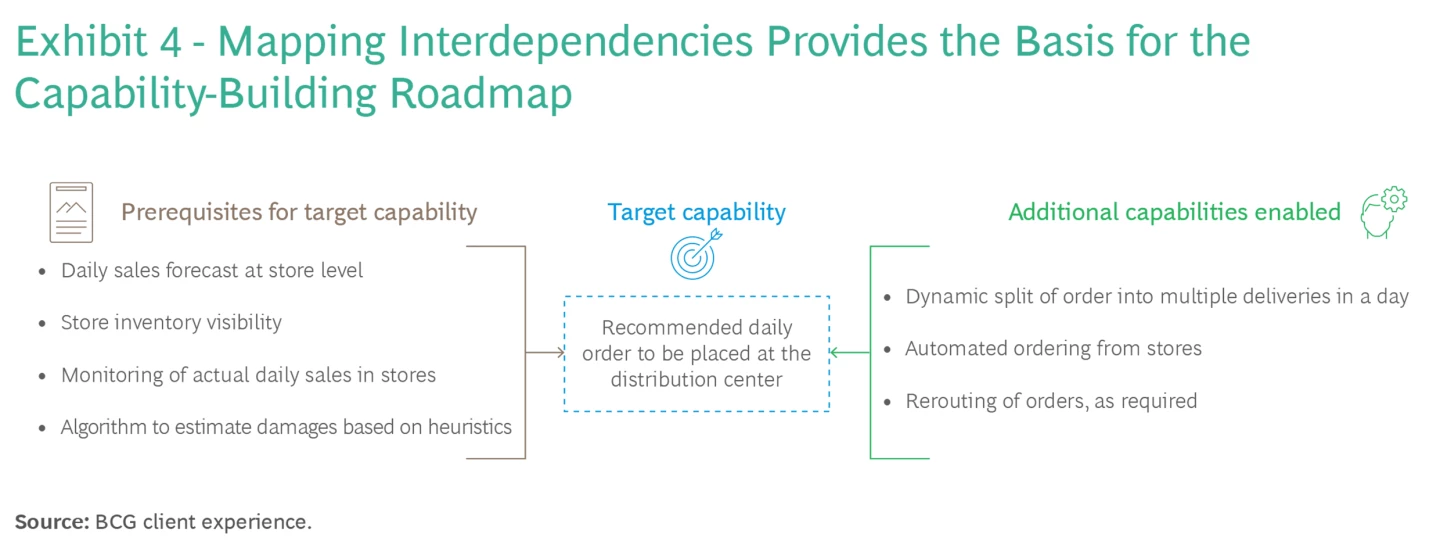

Capability-Building Roadmap. We developed the capability-building roadmap for the next three to five years, including the critical interdependencies across various capabilities.

Exhibit 4 illustrates interdependencies relating to the ability to recommend the daily order that store owners should place with the distribution center. The company had to establish four capabilities to enable the daily recommendations. These recommendations, in turn, enable additional capabilities.

Many capabilities necessary to achieve the company’s goal entailed a long chain of interdependencies. Mapping all the capabilities from end to end revealed considerable complexity, necessitating an integrated roadmap to guide the capability-building sequence.

Program Management Office. The PMO facilitated the transformation by addressing several challenges. These included inconsistent ways of working across different teams, the complexity of the resource structure and layers, and an absence of unified incentives. The PMO also significantly streamlined end-to-end execution by developing a weekly meeting cadence for monitoring the most critical KPIs (such as those relating to reducing costs, increasing capacity, and improving quality) using a third-party tracking tool.

Summing Up the Benefits

Since adopting our approach, the company has seen significant improvements in the coordination of design and implementation across functions:

- Alignment on Success Goals. Leaders and their teams understand the key overall goals and how they relate to their own project goals and objectives over three to five years.

- Clear Understanding of Broader Integration. Functional leaders understand how their initiatives fits into the broader initiative, ensuring clear coordination with both upstream and downstream processes and solutions.

- Efficiency and Accountability. The approach has helped to reduce duplicative work and clarified ownership and accountability, streamlining the overall process.

BCG’s innovative transformation approach offers an integrative blueprint for companies seeking to fortify and streamline their supply chain processes. The approach emphasizes the importance of coordination, digital enablement, and speed. Recent successes highlight its efficacy in harmonizing disparate elements, fostering cross-functional alignment, and driving end-to-end transformation. By adopting such a comprehensive strategy, companies can navigate the challenges of supply chain transformation more effectively, thereby setting the foundation for long-term enterprise growth.

Managing Director & Partner

Los Angeles

Managing Director & Senior Partner; Global Leader, Operations Practice

Partner and Director

ABOUT BOSTON CONSULTING GROUP

Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we work closely with clients to embrace a transformational approach aimed at benefiting all stakeholders—empowering organizations to grow, build sustainable competitive advantage, and drive positive societal impact.

Our diverse, global teams bring deep industry and functional expertise and a range of perspectives that question the status quo and spark change. BCG delivers solutions through leading-edge management consulting, technology and design, and corporate and digital ventures. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, fueled by the goal of helping our clients thrive and enabling them to make the world a better place.

© Boston Consulting Group 2024. All rights reserved.

For information or permission to reprint, please contact BCG at [email protected] . To find the latest BCG content and register to receive e-alerts on this topic or others, please visit bcg.com . Follow Boston Consulting Group on Facebook and X (formerly Twitter) .

- BECOME A CONTRIBUTOR

- WHITE PAPERS

- THE SUPPLY CHAIN DICTIONARY

What is Sales & Operations Planning?

The 4 supply chain metrics, static inventory an untapped source of working capital, s&op, a vision for the future. an interview with eric tinker, improving behaviours in support of world class s&op: coach for excellence.

- Planning & Forecasting Articles

How Can Data Improve Supplier Decisions

Information-based negotiations in the digital age, hurt, help or hero how to define and get more out of your most important suppliers, how to spot supplier risk during pickups & deliveries, how to spot supplier risk during on-site evaluations.

- Procurement & Sourcing Articles

The Long Tail of Inventory and Why It’s Important

No more excuses: transformative iot is staring you in the face, predictive analytics let manufacturers see more clearly into their supply chains, rise of the grocers, how 3d printing is set to shake up manufacturing supply chains.

- Manufacturing & Production Articles

6 Tips for Maximizing Efficiency and Productivity of Warehouse Operations

Robot trucks or autonomous vehicles will revolutionize the supply chain, data integration made sexy, how to avoid the most common warehouse safety hazards, out darn spot out, i say.

- Warhouse & Transport Articles

Returns – A Threat to the Bottom Line or an Opportunity to Cut Costs?

Supply chain sustainability takes root, why the 2030 sustainable development goals matter to packaging professionals, to build sustainable products, listen to your customers, getting packaging costs down to size.

- Reverse Logistics Articles

Transform Your Supply Chain For Omnichannel

The impact of maintenance operations on supply chain management, is your supply chain strategy inside-out or outside-in, how industry benchmarks can boost your asset recovery, supply chain visibility: we should be striving for more.

- Supply Chain Management articles

Accelerating the Shift to More Efficient Trucks

Insight – is it ok to lie, supply chain execution software convergence, 3d printing and the supply chains of the future, changing the production performance metric, supply chain management case study: the executive’s guide.

By Supplychainopz

Professionals in supply chain management use various methods to determine how to improve the performance of supply chain operations. Analysis of case study is certainly one of the most popular methods for people from business management background. In order to accelerate the learning, this article has gathered 20+ most sought-after supply chain case studies, analyzed/categorized them by industry and the findings are presented.

Boeing wants to encourage more flight frequency and direct route using a smaller capacity aircraft. Then they decide to outsource many things such as the design, testing and production of key components to key industrial partners and try to reduce number of components that go to assembly. The ultimate goal is to finish the final production process within 3 days. Airbus takes a bit different marketing approach. They want to utilize high capacity airplane to help airlines drive the operating cost down. They decide to selectively outsource the production of parts and keep the design and production of key components in-house.

Supply Chain of fashion industry involves a time based competition. Many customers have the unique product needs but a competition is very fierce because of the low barriers of entry. Many new players try to offer specialized products to customers all the time. This section features the supply chain case studies of H&M, Benetton, Zara and Adidas. – H&M aims to be the price leader in the fashion market.In order to materialize its vision, H&M tries to eliminate the middlemen in various stages of supply chain and consolidate the buying volumes. Product design is also the central part of its strategies. They don’t try to follow the high fashion designs but try to adopt the street trends which are easier to produce. At the end of the day, they can bring products to market within 2-3 weeks. – Benetton , in contrast, chooses to have a full control of its production but allow its licensees to operate the stores so they can focus on production and quality control. The reason is that they would like to create the worldwide brand awareness. For fast moving products, they use the production facilities in Europe. Asian suppliers will perform production for standardized products. – Zara is very famous for its time based strategy. In order to launch a new product within 15 days, Zara uses a small lot production. A new product will be tested in pilot stores. If product sales is good, a larger batch will be ordered. Otherwise, remaining products will be removed from the shelves and sold as mark-down in other stores. This creates the perception among consumers that Zara’s products are unique and you have to take it while stock lasts. Vertical integration contributes to the success of Zara, they own the majority of its production facilities and stores (this is the reason why Quick Response can be effectively implemented). Its automated distribution centers are strategically located between the center of populations so products are delivered to stores quickly. Zara also works with Air France, KLM Cargo and Emirates Air in order that they can coordinate directly with the airlines to make the outbound shipments to its stores and bring back some raw materials and semi-finished materials with return legs. The last supply chain case study in the fashion retailing industry is Adidas . In order to cope with changing customers’ demand, they decide to undertake Mass Customization strategy. The whole idea is to develop, market and deliver the product variety that most customers will find what they want. The first steps towards mass customization is to strategically offer the product choices. Too few variations will disappoint a customer but too many variations will simply postpone a buying decision. After that, Adidas asks the same key suppliers to produce custom components in order to achieve the economy of scale. In order to compensate a long waiting time, Adidas uses air freight or courier service. The reason why they can do this is that customized products are sold directly to customers so they have the higher profit margin to compensate the higher transportation cost. Supply chain strategy of the fashion retailing industry is summarized as below,

FMCG industry is typically the products sold to customers at a low cost and will be completely consumed within 1 year. The nature of this industry is the short product life cycle, low profit margin, high competition and demand fluctuation. This section will present the case studies of P&G, Unilever and Coca-Cola respectively. Forecasting and new product introduction has always been the issues for many FMCG companies, P&G is no exception. To cope with this, P&G conducts a merchandise testing at the pilot stores to determine the customer’s response to new product before the launch. The result is that the forecast accuracy is improved because a demand planner has an additional source data to make a better decision. Moreover, products can be shipped to stores in-time then lost sales is minimal. – Unilever also feels that the competition in FMCG industry has significantly increased. They have to launch the new products on regular basis but the forecasting of new product is difficult. So they create a better classification of new products (base, relaunch, repack, new) using a regression model to identify potential forecast errors for each type of new product. – Coca-Cola doesn’t really have many stock keep units when compared with other companies in the same industry. However, products go to over 2.4 million delivery points through over 430 distribution centers. Managing transportation at this scale is the absolute challenge. In order to streamline the delivery, Coca-Cola implemented a vehicle routing software. The reason is that is the software vendor has a very good relationship with Coca-Cola’s legacy ERP software vendor. Moreover, the vendor has a solid connection with the university who can help to develop the algorithm that fits in with the business’ needs. The result is that transportation planners at each distribution center can use the new tool to reduce travelling time/distance on daily basis.

Lean manufacturing concept has been implemented widely in the automotive industry so the case studies about lean manufacturing is very readily available. Due to the increasing competition in the automobile industry, car manufacturers have to launch a new model to the market more frequently. This section will show you how BMW manages a long term planning, how Ford applies lean concept to the new product development and how Hyundai manages the production planning and control. – BMW uses a 12-year planning horizon and divides it into an annual period. After that, they will make an annual sales forecast for the whole planning horizon. After the demand is obtained, they divide sales into 8 market and then select the appropriate production sites for each market, considering overall capacity constraints and total cost. As you may notice, this kind of a long range planning has to be done strategically. – Ford calls its product development system as “work streams” which include the body development, engine development, prototyping and launch process . The cross-functional team are the experts and their roles are to identify key processes, people, technology necessary for the development of new prototype. Each work stream team is responsible to develop timeline of each process. Detailed plan is usually presented on A3 sized paper. They clearly identifying current issues they are facing with supporting data, drawings and pictures. On weekly basis, they organize a big group meeting of all work stream team to discuss the coordination issues. – Hyundai deploys a centralized planning system covering both production and sales activities across the facilities and functional areas. They develop a 6-month master production plan and a weekly and a daily production schedule for each month in advance. During a short term planning (less than one month), they pay much attention to the coordination between purchasing, production and sales. Providing a long term planning data to its suppliers help to stabilize production of its part makers a lot.

Life cycle of technology products is getting shorter and shorter every day. Unlike FMCG, the launch of a new product in the hi-tech industry requires the investment in research and development quite extensively. Then, a poor planning will result in a massive loss. This section will cover JIT and outsourcing by Apple Inc, Supply Chain Risk Management by Cisco System, Technology Roadmap by Intel, Supply Chain Network Model by HP, Mass Customization by Dell and Quality Management by Sam Sung. Steve Jobs invited the Tim Cook to help to improve Apple’s Supply Chain in 1998. Jobs told Cook that he visited many manufacturing companies in Japan and he would like Cook to implement the JIT system for Apple. Jobs believed that Apple’ supply chain was too complex then both of them reduced the number of product availability and created 4 products segment, reduced on hand inventory and moved the assembling activities to Asia so they could focus on developing the breathtaking products that people wanted to buy. – Cisco Systems would like to be the brand of customer choice so they implement a very comprehensive supply chain risk management program by applying basic risk mitigation strategies, establishing appropriate metrics, monitoring potential supply chain disruptions on 24/7 basis and activate an incident management team when the level of disruption is significant. – Intel ‘s new product development is done by the process called Technology Roadmap. Basically, it’s the shared expectations among Intel, its customers and suppliers for the future product lineup. The first step to prepare the roadmap is to identify the expectations among semiconductor companies and suppliers. Then they identify key technological requirements needed to fulfill the expectations. The final step is to propose the plan to a final meeting to discuss about the feasibility of project. Some concerning parties such as downstream firms may try to alter some aspects of the roadmap. Technology Roadmap allows Intel to share its vision to its ecosystem and to utilize new technology from its suppliers. – HP ‘s case study is pretty unique. They face with a basic question, where to produce, localize and distribute products. Its simple supply chain network model is presented below,

From this example, only 3 possible locations result in 5 different way to design the supply chain. In reality, HP has more production facilities than the example above so there are so many scenarios to work with. How should HP decide which kind of a supply chain network configuration they should take to reduce cost and increase service to customer? The answer is that they use the multi-echelon inventory model to solve the problem. – Dell is one of the classic supply chain case studies of all time. Many industries try to imitate Dell’s success. The key ingredients of Dell’s supply chain are the partnership with suppliers, part modularity, vendor managed inventory program, demand management and mass customization. Also, you can find the simplified process map of Dell’s order-to-cash process as below,

– Sam Sung has proven to be the force to be reckoned with in the hi-tech industry. The secret behind its supply chain success is the use of Six Sigma approach. They studied how General Electric (GE), DuPont and Honeywell implemented six sigma. After that, they have created their own implementation methodology called DMAEV (define, measure, analyze, enable, verify). They use the global level KPI to ensure that each player in the same supply chain is measured the same way. Also, they utilize SCOR Model as the standard process. Any process changes will be reflected through an advance planning system (APS).

The last industry covered here is the general merchandise retailing industry. The critical success factor of this industry is to understand the drivers of consumer demand. Four case studies will be presented, namely, 7-11, Tesco, Walmart, Amazon and Zappos. – 7/11 is another popular case study in supply chain management. The integration of information technology between stores and its distribution centers play the important role. Since the size of 7/11 store is pretty small, it’s crucial that a store manager knows what kind of products should be displayed on shelves to maximize the revenue. This is achieved through the monitoring of sales data every morning. Sales data enables the company to create the right product mix and the new products on regular basis. 7/11 also uses something called combined delivery system aka cross docking. The products are categorized by the temperature (frozen, chilled, room temperature and warm foods). Each truck routes to multiple stores during off-peak time to avoid the traffic congestion and reduce the problems with loading/unloading at stores. – Tesco is one of the prominent retail stores in Europe. Since UK is relatively small when compared with the United States, centralized control of distribution operations and warehouse makes it easier to manage. They use the bigger trucks (with special compartments for multi-temperature products) and make a less frequent delivery to reduce transportation cost. Definitely, they use a computerized systems and electronic data interchange to connect the stores and the central processing system. – Wal-Mart ‘s “Every Day Low Prices” is the strategy mentioned in many textbooks. The idea is to try not to make the promotions that make the demand plunges and surges aka bullwhip effect. Wal-Mart has less than 100 distribution centers in total and each one serves a particular market. To make a decision about new DC location, Walmart uses 2 main factors, namely, the demand in the proposed DC area and the outbound logistics cost from DC to stores. Cost of inbound logistics is not taken into account. There are 3 types of the replenishment process in Wal-Mart supply chain network as below,

In contrary to general belief, Wal-mart doesn’t use cross-docking that often. About 20% of orders are direct-to-store (for example, dog food products). Another 80% of orders are handled by both warehouse and cross dock system. Wal-Mart has one of the largest private fleet in the United States. The delivery is made 50% by common carriers and 50% by private fleet. Private fleet is used to perform the backhauls (picks up cargoes from vendors to replenish DCs + sends returned products to vendors). Short-hauls (less than one working day drive) is also done by the a private fleet. For long-hauls, the common carriers will be used. There are 2 main information system deployed by Wal-Mart. “Retail Link” is the communication system developed in-house to store data, share data and help with the shipment routing assignments. Another system is called “Inforem” for the automation of a replenishment process. Inforem was originally developed by IBM and has been modified extensively by Wal-Mart. Inforem uses various factors such as POS data, current stock level and so on to suggest the order quantity many times a week. Level of collaboration between Wal-Mart and vendors is different from one vendor to the other. Some vendors can participate in VMI program but the level of information sharing is also different. VMI program at Wal-Mart is not 100% on consignment basis. – Amazon has a very grand business strategy to “ offer customers low prices, convenience, and a wide selection of merchandise “. Due to the lack of actual store front, the locations of warehouse facilities are strategically important to the company. Amazon makes a facility locations decision based on the distance to demand areas and tax implications. With 170 million items of physical products in the virtual stores, the back end of order processing and fulfillment is a bit complicated. Anyway, a simplified version of the order-to-cash process are illustrated as below,

Upon receipt of the orders, Amazon assign the orders to an appropriate DC with the lowest outbound logistics cost. In Amazon’s warehouse, there are 5 types of storage areas. Library Prime Storage is the area dedicated for book/magazine. Case Flow Prime Storage is for the products with a broken case and high demand. Pallet Prime Storage is for the products with a full case and high demand. Random Storage is for the smaller items with a moderate demand and Reserve Storage will be used for the low demand/irregular shaped products. Amazon uses an propitiatory warehouse management system to make the putaway decision and order picking decision. After the orders are picked and packed, Amazon ships the orders using common carriers so they can obtain the economy of scale. Orders will arrive at UPS facility near a delivery point and UPS will perform the last mile delivery to customers. Amazon is known to use Sales and Operations Planning (S&OP) to handle the sales forecast. Anyway, this must be S&OP process at product family/category level. To compete with other online retailers, Zappos pays much attention to the way they provide the services to customers. In stead of focusing on the call center productivity, Zappos encourages its staff to spend times over the phone with customers as long as they can so they can fully understand the customer’s requirements. They also upgrade the delivery from 3 days to 1 day delivery in order to exceed customer expectation.

All case study demonstrates that supply chain management is truly the strategic initiatives, not merely a cost cutting technique. Leading companies have a very strong customer focus because almost all of initiatives are something to fill the needs of customers. Relationship management is the unsung hero in supply chain management. It’s the prerequisite to the success of every supply chain. And at the end of the day, it comes down to the quality of supply chain people who analyze, improve and control supply chain operations. – See more at: http://www.supplychainopz.com/2014/04/supply-chain-management-case-study.html#sthash.MrnrGsyY.dpuf

Supply Chain Minded is a very active and fast growing online community in Supply Chain for Planning, Sourcing, Manufacturing, Delivery and Reverse Logistics professionals. The Supply Chain Minded community aims to inform and connect professionals active in Supply Chain, Purchasing, Manufacturing, Warehousing, Transport, Distribution; Reverse Logistics, Service Logistics, Lean & Six Sigma, 3PL.

© Copyright - Supply Chain Minded 2023

Brought to you by:

Walmart: Supply Chain Management

By: P. Fraser Johnson, Ken Mark

This case focuses on the supply chain strategy of Walmart. Set in 2019, it provides a detailed description of the company's supply chain network and capabilities. Data in the case allows students to…

- Length: 16 page(s)

- Publication Date: Jul 8, 2019

- Discipline: Operations Management

- Product #: W19317-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

This case focuses on the supply chain strategy of Walmart. Set in 2019, it provides a detailed description of the company's supply chain network and capabilities. Data in the case allows students to compare Walmart's source of competitiveness with those of other retailers-both online including Amazon.com and traditional brick-and-mortar retailers, such as Target-to develop insights into the management of a large, complex, global supply chain network. As competition between Walmart and its online and offline competitors heated up, a key challenge for the company's president and chief executive officer was deciding what changes made to Walmart's expanding supply chain would best support its strategic objectives. What supply chain capabilities would Walmart need as its business model continued to evolve?

Learning Objectives

This case can be used in an undergraduate or MBA course in supply chain management, operations management, business strategy, international business, logistics, purchasing, or marketing. It can provide an introduction to supply chain management using a company with which most students are familiar. In doing so, it allows students to learn how Walmart has built up its supply chain capabilities over the past five decades, and how the company leveraged these capabilities to become the world's largest retailer. Combining the Walmart case with the "Amazon.com: Supply Chain Management" case (W18451) in back-to-back classes provides a powerful illustration of the differences between two leading companies and demonstrates the importance of alignment of supply chain competencies with organizational strategy. After completion of this case, students will be able to: Assess Walmart's supply chain and identify its key competitive advantages. Quantify Walmart's ability to generate value from its supply chain. Identify potential opportunities and challenges for Walmart to improve its supply chain. Analyze the effects of the opportunities and challenges facing Walmart on its growth and evolution.

Jul 8, 2019 (Revised: Sep 9, 2019)

Discipline:

Operations Management

Geographies:

United States

Industries:

Retail trade

Ivey Publishing

W19317-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Get full access to The Supply Chain Management Casebook: Comprehensive Coverage and Best Practices in SCM and 60K+ other titles, with a free 10-day trial of O'Reilly.

There are also live events, courses curated by job role, and more.

The Supply Chain Management Casebook: Comprehensive Coverage and Best Practices in SCM

Read it now on the O’Reilly learning platform with a 10-day free trial.

O’Reilly members get unlimited access to books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.

Book description

30 up-to-date case studies illuminate every aspect of modern supply chain management

• Risk management, analytics, global supply chain issues, and much more

• Innovative processes, technologies, strategies, and tactics

• An indispensable resource for both students and practitioners

This casebook brings together 30 focused cases addressing virtually every aspect of supply chain management, from procurement to warehousing, strategy to risk management, IT to supplier selection and ethics. A global team of contributors presents key challenges in industries ranging from pharmaceuticals to fashion and previews issues ranging from the “limits of lean” to the potential of 3-D printing.

Cases vary in length and complexity, offering maximum flexibility to both instructors and readers; a convenient table provides fast access to specific topics. Qualitative cases are supported by relevant discussion questions and sample responses; quantitative cases are supported by completed numerical solutions, and, where applicable, associated spreadsheets.

Table of contents

- About This eBook

- Copyright Page

- Dedication Page

- Acknowledgments

- About the Author

- Objectives of the Book

- Organization of the Book

- Salvation Army: Origins and Purpose

- United States Southern Territory and Salvation Army–Dallas ARC

- Discussion Questions

- Products and Markets

- Vertically Integrated Supply Chain

- The Manufacturing Process

- Investment in Collaborative Planning, Forecasting, and Replenishment (CPFR)

- Stanford Blood Center: “Give Blood for Life”2

- A Snapshot of the SBC-SUMC Supply Chain in 2006

- Company Background

- Financial Risk Management Background

- The Automobile Industry in China

- Toyota China’s Production Planning and Demand Management

- The Company

- BESSI Leather Goods

- The Central Role of Planning

- The Challenge

- Appendix 7-1 Gantt Chart of the Fashion Product Collection Definition (from Grid Definition to Start of Production)

- Appendix 7-2 Fashion Product Collection Definitions

- Appendix 7-3 Demand Forecasting Process

- Case 9. Multi-Echelon Inventory Decisions at Jefferson Plumbing Supplies: To Store or Not to Store?

- Introduction

- The Indian Pharmaceutical Industry

- The Indian Pharmaceutical Supply Chain

- Upstream Supply Chain for High-Range Cements

- Appendix 13-1: Baseline Data and Three Solutions Offered by UPS

- Organization Background

- Organizational Structure and Facility Layout

- Operations Management

- Supply Chain Management

- Two Different Perspectives

- Overview of Fair Trade

- The Fair Trade Supply Chain

- Criticism of Fair Trade

- Starbuck’s Fair Trade Policy

- Company Overview

- The Rebranding Process

- Background for the Cooperative and the Industry

- Transaction Costs Approach

- COAPEL Supply Chain

- Process Reforms

- Organizational Operations

- Case 24-1: Helmets

- Case 24-2: Puffs

- Case 24-3: Sirop

- Case 24-4: Blower

- Jacket’s Decisions

- The Meeting

- Plant Visit

- Bangalore: City Statistics1

- Collection of Waste

- Role of Non-Governmental Organizations (NGOs)

- About the Company

- The Power Sector in India

- Cloud Computing

- Supply Chain Structure of CEL

- Appendix 27-1: CEL’s Balance of Plants Business in the Power Sector

- Appendix 27-2: Trends in Installed Generating Capacity of Electricity Nonutilities in India from 1970–71 to 2010–11

- Appendix 27-3: Business Process of CEL Sourcing

- Spare Parts Supply Chain Management at IGNYS Automotive

- Industry Background

- Introduction of the Case Companies

- Search for an International Partner

- Joint Business Development and Complementary Service Offering

- Joint Project Illustrations

- Mutual Benefits from International Logistics Partnership

- Classification of Risks

- General Supply Chain Resilience Model

- European Case Study

- Appendix 30-1

- Financial Times Press

Product information

- Title: The Supply Chain Management Casebook: Comprehensive Coverage and Best Practices in SCM

- Author(s): Chuck Munson

- Release date: June 2013

- Publisher(s): Pearson

- ISBN: 9780133367300

You might also like

Supply chain management best practices, 3rd edition.

by David Blanchard

SUPPLY CHAIN MANAGEMENT BEST PRACTICES Although the fundamentals of the supply chain industry remain constant, massive …

A Guide to Supply Chain Management: The Evolution of SCM Models, Strategies, and Practices

by Alexandre Oliveira, Anne Gimeno

Managing supply networks for innovation and competitive advantage: Concepts, models, roadmaps, and more Capture, organize, and …

Essentials of Supply Chain Management, Third Edition

by Michael Hugos

The latest thinking, strategies, developments, and technologies to stay current in supply chain management Presenting the …

The Supply Chain Game Changers: Applications and Best Practices that are Shaping the Future of Supply Chain Management

by Theodore H. Stank, J. Paul Dittmann, Michael Burnette, Chad Autry

BREAKTHROUGH BEST PRACTICES IN GLOBAL SUPPLY CHAIN MANAGEMENT FROM WORLD-CLASS PRACTITIONERS For all supply chain decision-makers, …

Don’t leave empty-handed

Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

It’s yours, free.

Check it out now on O’Reilly

Dive in for free with a 10-day trial of the O’Reilly learning platform—then explore all the other resources our members count on to build skills and solve problems every day.

- Software Categories

Get results fast. Talk to an expert now.

855-718-1369

Creating an omnichannel supply chain: a macy’s case study.

In February 2020, Macy’s announced their Polaris plan , a three-year strategy created to stabilize profits and create growth. This plan included closing 125 underperforming stores and consolidating offices. It also included a major overhaul of their supply chain model.

But, of course, Macy’s had to close their doors less than 6 weeks later due to COVID-19. As their online presence was the only presence available, their longstanding supply chain strategy, which was already starting to cause major issues within the company, needed immediate attention.

Macy’s CEO Jeff Gennette stated in September 2020, “Everything on the digital agenda has been accelerated. We’re optimizing inventory placement to meet customer demand wherever and however they shop in our store.”

What’s so bad about Macy’s supply chain model?

Customers expect a strong omnichannel experience — one that integrates both the online and offline world of the retailer, enabling a frictionless shopping experience.

For retailers, the goal is to take the retailer’s replenishment cycle from days to hours and reduce inventory at stores. This way, retailers expand their use of stores to fulfil online orders and hold less inventory altogether, allowing them to dedicate more room for digital fulfillment.

Omnichannel shopping is the baseline expectation for customers, as companies such as Gap, Target, and many others have upped their omnichannel game.

And Macy’s is, er, behind.

Macy’s way of viewing their supply chain in the past was traditional: Move products from point A to point B and optimize costs at each stop along the way. Each delivery channel has its own transportation plan and technology stack, siloing all distribution and fulfillment centers.

This supply chain method was acceptable 10 years ago, but to stay afloat in the in-store and online retail spaces, Macy’s needed to make a change. Silos created major cost issues, not to mention slow speed and service in today’s two-day-delivery age.

The company’s supply chain model operated two separate warehouse networks, one for stores and the other for direct customer (online) orders. This system made rebalancing inventory nearly impossible, among other issues.

Macy’s supply chain also lacked a central platform for locating inventory at the SKU level across the chain, and the cost of goods were high compared to competitors since each private brand sold at May’s was sourced independently.

Creating a better supply chain

In 2019 Macy’s hired Dennis Mullahy , the first ever Chief Supply Chain Officer, to transform the supply chain into one that supports an omnichannel strategy.

Since then, Macy’s has made leaps and bounds in optimizing their supply flow, with COVID expediting the process.

The company is transitioning to a centralized warehouse model, implementing a flow and fold design, meaning a light initial allocation to stores and flexible replenishments. Multipurpose warehouses hold inventory, which can both replenish stores and fulfill e-commerce orders.

By having a centralized inventory, the retailer is better able to strengthen its margins and fulfill orders quicker and in the ways customers want.

“Our new model will leverage all of our assets much more productively and improve customer satisfaction by increasing speed of delivery as well as generate efficiencies in our operations and inventory utilization.” Dennis Mullahy wrote.

In addition, Macy’s is getting on board with using data and analytics to not only get items to customers faster, but also improve inventory forecasting and allocation and package consolidation.

The company plans to increase drop-shipping to boost margins in e-commerce, where delivery costs have been the largest drain on profits. They’ll also renew their efforts into Macy’s Backstage operations in order to compete with other off-price companies such as Nordstrom Rack and TJMaxx.

Behind the curve

And while these improvements are giving Macy’s the help it needs, they should’ve seen the warning signs sooner. Retailers of equal size have been making moves to change their supply chain for years now, and Macy’s is just catching up.