- Events and webinars

The biggest AML blunders: 5 case studies and lessons learned

The last decade has been a whirlwind period for Anti-Money Laundering (AML) compliance – or, more accurately, non-compliance. The headlines have been dominated by record-breaking fines and high-profile investigations from regulators worldwide. Despite years of tightening regulations and increasingly sophisticated AML compliance tools, some of the most significant financial institutions and industry giants continue to stumble over the basics.

Here’s a closer look at some of the biggest AML failings of recent years and how these headline-making cases became a stark reminder of the critical importance of robust AML practices.

1. NatWest’s £264m fine for overlooking red flags (2021)

In December 2021, NatWest made headlines when it was fined £264.8 million after pleading guilty to serious breaches of AML regulations. This case involved a staggering £365 million in cash deposits over five years from a single customer, yet the bank failed to act on repeated red flags.

The customer in question, a small Bradford-based business, deposited large sums of cash across its accounts between 2011 and 2016 – amounts that were clearly disproportionate to the scale of the business. The cash deposits reached as much as £1.8 million on some days, which should have triggered immediate scrutiny. Yet, NatWest failed to investigate properly, and the suspicious activity continued unchecked.

Key takeaway: When a client’s transaction behaviour deviates significantly from what is expected – whether that’s in terms of volume, frequency, or origin – compliance teams must act swiftly.

AML programmes need to employ risk-based approaches, where resources are focused on clients and transactions that pose the highest risk. In NatWest’s case, the failure to ask key questions and scrutinise cash-heavy deposits led to the breach. Compliance teams should ensure that high-risk accounts are subject to ongoing monitoring and prompt investigations whenever red flags arise.

2. Danske Bank’s $2bn misstep (2022)

Despite being at the centre of Europe’s largest money laundering scandal a few years before, the biggest bank in Denmark, Danske Bank, once again found itself in hot water in 2022. The bank was hit with a staggering $2 billion fine after investigators uncovered a new series of compliance breaches involving high-risk customers in the Baltics. This stemmed from its Estonian branch, which processed $160 billion in suspicious transactions and facilitated access to the U.S. financial system for Danske Bank Estonia’s high-risk customers, who resided outside of Estonia – including in Russia. The U.S. and Danish authorities penalised Danske Bank after it admitted to defrauding U.S. banks and covering up its AML deficiencies.

This case is particularly damning given the bank’s history and raised serious questions about its ability to ever regain full regulatory trust.

Key takeaway: Global oversight of compliance practices in multinational institutions is non-negotiable. Danske Bank’s Danish headquarters should have maintained a firmer grip on activities in all their branches, particularly in regions known for higher financial risks.

Compliance frameworks should not only be consistent across nations but also adaptable to the specific risks of each jurisdiction. This means regular audits, constant communication between headquarters and regional offices, and the integration of global AML standards in line with local regulations. A centralised compliance programme, combined with localised risk assessments, can help prevent such catastrophic failures.

3. Binance’s $4.3bn fine for crypto AML and sanctions failings

The world’s largest cryptocurrency exchange, Binance , faced its most significant regulatory blow yet with a $4.3 billion fine for breaking AML laws and violating sanctions. U.S. authorities found that Binance had failed to implement sufficient Know Your Customer (KYC) and AML procedures, allowing billions in illicit funds to move through its platform.

The platform was found to have allowed over 100,000 illegal transactions, facilitating money laundering on a massive scale, linked to criminal activities including terrorism and human trafficking. The exchange’s lax approach to regulatory compliance put the entire crypto industry under greater scrutiny as a result and set a new benchmark for enforcement in the digital asset space.

Key takeaway: The rapidly changing cryptocurrency landscape presents unique challenges for AML teams, requiring unique compliance measures beyond traditional banking approaches. Compliance teams must understand the distinct nature of digital assets, including the pseudonymous and decentralised aspects of cryptocurrency transactions, which make traditional monitoring methods insufficient. This requires investing in specialised analytics tools that can identify, vet, and verify each individual or corporate customer before they are able to carry out transactions, and ensuring round-the-clock monitoring throughout their time on the exchange.

4. HSBC’s £1.2bn settlement for global AML failings (2012)

In 2012, HSBC was fined $1.9 billion for failing to prevent money laundering through its U.S. operations, which enabled Mexican drug cartels to launder billions through its branches. The bank’s monitoring systems were found to be inadequate, and its staff were poorly trained to identify and report suspicious activities.

According to the U.S. Senate’s investigation, HSBC’s business strategy emphasised expansion into high-risk regions without ensuring adequate AML controls were in place. The Mexican affiliate’s risky operations were well known, yet they were allowed to persist because of the revenue they generated.

The bank also facilitated transactions for sanctioned countries such as Iran, Sudan, and Myanmar, violating both international sanctions and AML regulations.

Key takeaway: This case is a reminder of the importance of getting the basics right. A robust KYC programme is fundamental to AML compliance. Financial institutions must conduct thorough due diligence on clients, especially in high-risk industries or regions. This includes verifying the source of funds, the nature of the business, and identifying beneficial ownership. Where clients present a higher risk, enhanced due diligence (EDD) should be conducted, with ongoing monitoring throughout the business relationship.

Effective AML compliance relies on robust monitoring systems capable of flagging any unusual activity among individual and corporate clients. High-risk regions should be subject to enhanced due diligence, with specialised teams tasked with monitoring these areas.

5. Deutsche Bank handed $186m fine for lax AML controls (2023)

In July 2023, Deutsche Bank was fined $186 million by the U.S. Federal Reserve for its failure to make sufficient progress in addressing deficiencies in its AML compliance programme. The fine follows a 2017 enforcement in which the bank was required to tighten its AML controls, but, six years later, the Federal Reserve determined that the bank still had not adequately resolved the issues. The case highlighted persistent gaps in Deutsche Bank’s ability to monitor suspicious activity, despite ongoing scrutiny by regulators.

Deutsche Bank’s core issue was its failure to fully remediate the weaknesses identified in 2017. Despite being under regulatory orders for years, the bank had not made sufficient progress in key areas like monitoring and addressing KYC gaps.

Key takeaway: When regulators identify issues, it’s not enough to show short-term improvements. Compliance teams need to implement a structured, long-term plan that includes frequent progress reviews, continuous testing, and audits. This helps ensure that any deficiencies are properly addressed and that the firm is adaptable to emerging AML risks. Having clear timelines for remediation and accountability for each stage is critical for success.

- Anti-Bribery

- Anti-Money Laundering

- Conflicts of Interest

- FCA Compliance

- Fraud & Fair Competition

- Modern Slavery

- Responsible Business

- SRA Compliance

- Tax Evasion

- Whistleblowing

- Emergency Response

- Environmental Sustainability

- Fire Safety

- Food Safety

- Hazardous Substances

- Health & Safety For Dutyholders

- Safeguarding

- Sitting, Posture & Lifting

- Specialist Environment

- Vehicle, Plant & Equipment Safety

- Workplace Safety

- Communication

- Customer Support / Customer Service

- Difficult & Sensitive Conversations

- Disciplinary & Grievance

- Healthy Living

- Maximising Performance

- Mental Health

- Personal Effectiveness

- Recruitment

- Artificial Intelligence

- Cyber Security

- Global Data Protection Best Practice

- Information Security

- US Data Privacy

- Bias Awareness

- Diversity Awareness

- Problematic Behaviour

- Promoting Respect & Inclusion

- Bullying & Harassment

- Supporting Working Carers

- UK Equality Legislation

- Financial Services

- Real Estate

- Manufacturing

- Construction

- In-Browser Editor

- Learning Paths

- Accessibility

- Bespoke Courses

- Learning in Multiple Formats

- Omnitrack Overview

- Tailored Dashboards

- Customisable Workflows

- API and Integration

- Build Your Own Workflows

- Hosting and Security

- Legal Compliance Suite

- SRA Consulting

- Work Place Safety

- Tailored Dashboard

- API and Integrations

- Build Your Own Workflow

- SRA Consultancy

Money Laundering Scandals: The Biggest Money Laundering Stories of 2021

What happened in AML compliance in 2021?

Fines running into the billions and jail terms totalling hundreds of years. AML enforcement has not taken a back seat during the pandemic, with fines, scandals, leaks and sweeping new regulations. The past year has been a blockbuster one for money laundering compliance. Here, we round up the biggest money laundering stories of 2021.

SEB Bank – fit for purpose?

The Swedish bank was fined $170m for AML failures back in 2020, relating to compliance deficiencies in its Baltic operations in the same scandal which ensnared Danske Bank. But this latest scandal doesn’t involve additional wrongdoing by SEB, but rather what their chief executive said about AML compliance programmes in general.

Johan Torgeby questioned if the regulations themselves were ‘fit for purpose,’ given SEB now employs thousands of people in compliance and asks its customers “a humongous amount of questions.” The CEO said that banks are only stopping about 1% of trillions of dollars of criminal cash entering the system, despite collectively spending over $20bn on compliance.

Torgeby praised cooperation between Swedish banks and the national police force however, calling their information sharing programme a much more effective method of stopping criminals than traditional regulatory compliance.

An AML revolution in the USA

Long taking its own course in money laundering compliance, the 2021 National Defense Authorization Act included sweeping reforms to AML laws in the United States which catch it up to the EU. Among the changes coming into force include requirements for additional beneficial ownership information. This is aimed at eliminating shell companies entirely, requiring companies who do business in the US to disclose detailed information about ultimate beneficial owners.

AML whistleblowers will receive increased protections, and rewards, while companies and individuals will face stiffer penalties for violations of AML rules or the Bank Secrecy Act. Suspicious activity reports and currency transaction reports will become easier to submit, and can be more easily shared with foreign governments and regulators.

Tackling the London Laundromat

Is London a haven for dirty money? The UK Parliament’s Intelligence and Security Committee seems to think so. The UK and its offshore dependencies such as Jersey or the Cayman Islands are being used as money laundering hubs, costing the UK economy over £100bn per year. Transparency International found nearly 1,000 UK shell companies involved in corruption and money laundering cases.

There’s been increasing calls for the UK government to act on its promise to introduce tougher AML rules, including more stringent beneficial ownership rules. In 2015, then prime minister David Cameron promised to introduce a register of beneficial owners of UK property, but this has still to be brought up in parliament. Secret property ownership in the UK came under significant scrutiny in 2021, with reports from the Pandora Papers showing that the Queen’s estate bought a £67m London property from the Azerbaijani dictator, and further properties sold to the monarch from an offshore company owned by President Aliyev’s 11-year-old son.

Opening Pandora’s filing cabinet

More than 11 million confidential secret documents were exposed in yet another leak of sensitive offshore company details, showing hidden wealth, tax avoidance and money laundering by the world’s rich and powerful. The extensive documents revealed a staggering amount of tax avoidance, particularly through shell companies registered offshore. While much of this is supposedly ‘legal,’ loopholes are being stretched and the public’s patience tested.

From a money laundering perspective, plenty of jurisdictions take the proceeds of tax evasion as a predicate offence for money laundering. So if rules were broken, illegal cash can be injected into the system. More so, the Pandora Papers showed the soft edge of international finance. If kings and dictators can set up offshore companies to secretly sell and buy millions in property to each other, what’s to stop kingpins and drug lords from doing the same thing? The key lesson in the fight against money laundering is that offshore jurisdictions and shady shell companies absolutely present a red flag.

Bin bags full of cash at NatWest

In the first criminal prosecution of a financial institution by the UK’s Financial Conduct Authority (FCA), Britain’s biggest bank NatWest was fined £264m for system-wide AML failures which allowed enabled black bin liners stuffed with cash to be deposited, literally bursting out of floor-to-ceiling branch safes.

The trial centred on a textbook case of money laundering by a supposed jeweller, Fowler Oldfield. Their predicted turnover was around £15m when the bank took them on as a client, but they ended up depositing over £365m over a five-year period, with the vast majority being in hard cash.

Many individual staff members did pick up on the activity, with one employee who’d been working for decades saying it was the most suspicious activity they’d seen in their career. Ultimately, the court found, the bank did not miss this. The criminality was spotted time and time again, but the systems and adequacy of the scrutiny failed.

Turkey grey-listed by FATF

The Financial Action Task Force (FATF), listed Turkey , alongside Mali and Jordan, on the watchdog’s grey list. This comes on the back of a “large number of serious issues” identified in the countries’ mutual evaluations in 2019. The three countries join a 22-state list subject to special monitoring, including Albania, Morocco, Syria and Yemen. However the FATF removed Botswana and Mauritius from the grey list, citing increased improvements.

Of particular concern to the FATF are Turkey’s banking and real estate sectors, as well as gold and precious stone dealers. Given Turkey’s proximity to Syria, Iraq and Lebanon, there are significant fears about terrorist financing crossing the relatively porous border and entering a large economy on the edge of Europe. The move could have significant implications for supply chains running through Turkey, who may need to undertake greatly enhanced due diligence for any businesses involved in the Turkish economy.

Enforcement steps up in Dubai

The United Arab Emirates moved a step forward in setting itself up as a financial centre of the Middle East. It launched a special court to combat money laundering and handed out over $12m in AML fines to banks in one month alone. The establishment of a specific court came in the same year as a new Executive Office to tackle AML, showing the country’s commitment to tackling financial crime.

Dubai is also investing heavily in the crypto space, while ensuring AML requirements for those businesses. The Emirates have been working closely with the FATF to ensure the nation’s legal, regulatory and operational standards meet international requirements. With political developments such as normalising relations with tech-hub Israel and reform of its strict Islamic social laws, Dubai could be set to join the international finance ranks of New York, London and Singapore within the very near future.

Crypto continues to make headlines

The ECB called for global regulation of crypto currencies to reduce the loopholes money launderers can exploit, and according to a variety of regulators, these are many. The UK’s FCA reported that a significant number of crypto asset providers had not met the standards required under British AML rules. Many did not get licences as a result. The EU also proposed new changes to require companies that transfer crypto assets to collect details on recipients and senders. Meanwhile, the US authorities announced the establishment of a new team to tackle complex investigations and prosecute criminal misuse of crypto.

Despite the regulatory pushback and noted environmental concerns of crypto mining, more and more asset providers are jumping into the space. 2021 saw new currencies launched and the rise of NFTs, digital artworks which can be sold for hundreds of thousands, presenting ever more challenges for AML compliance.

How are you managing your GDPR compliance requirements?

GDPR added a significant compliance burden on DPOs and data processors. Data breaches must be reported to the authorities within 72 hours, each new data processing activity needs to be documented and Data Protection Impact Assessments (DPIA) must be carried out for processing that is likely to result in a high risk to individuals. Penalties for breaching GDPR can reach into the tens of millions of Euros.

“In a world older and more complete than ours they move finished and complete, gifted with extensions of the senses we have lost or never attained, living by voices we shall never hear.”

VinciWorks CEO, VInciWorks

Spending time looking for your parcel around the neighbourhood is a thing of the past. That’s a promise.

20 Grosvenor Place

United Kingdom

Experience Exceptional.

- Privacy Notice

- Terms and Conditions

- Modern Slavery Statement

Learning that matters.

Software that works..

Experience Excellence.

© 2024 VinciWorks

The Danske Bank Money Laundering Scandal: A Case Study

79 Pages Posted: 10 Sep 2019

Elisabetta Bjerregaard

Copenhagen Business School

Tom Kirchmaier

London School of Economics - Centre for Economic Performance; Copenhagen Business School

Date Written: September 2, 2019

The case discusses the money laundering scandal at the Estonian branch of Danske Bank, the largest financial institution in Denmark. Danske Bank money laundering scandal is one of the largest money laundering scandal in European history. It began in 2007 following the acquisition from Danske Bank of Finnish Sampo Bank, which also had an Estonian branch. Between 2007 and 2015 over €200bn of suspicious transactions originating from Russia, former Soviet states and elsewhere flowed through its Estonian branch non-resident portfolio. Danske Bank stock price has been declining since March 2017 when the newspaper Berlingske first issued a series of articles on money laundering claims resulting in a significant destruction of shareholder value. Media reports widely misinterpreted the €200bn figure as representing entirely money laundering rather than a combination of legal and illicit transactions. In September 2018, Danske Bank admitted that its procedures for oversight failed completely in this case and that its money laundering controls in Estonia has been insufficient. As a result, the CEO and the Chairman of the Board of Directors stepped down and a number of employees both at the Estonian branch and at Group level were found not in compliance with legal obligations forming part of their employment with the bank and therefore dismissed. On February 2019 the Estonian Financial Supervisory Authority (FSA) intimated Danske Bank to cease its activities in Estonia. At the same time, independently of the notification from the Estonian FSA, Danske Bank decided to cease its activities in Latvia, Lithuania and Russia in line with its strategy of focusing on its Nordic core market. Danske Bank is currently under investigation from a range of authorities and it is expected that Danish, Estonian, European and US regulators will impose penalties. Moreover, twelve former employees in Estonia are under investigation by the Estonian State Prosecutor. Furthermore, in May 2019 the former CEO and other nine group senior managers were preliminarily charged in the case by the State Prosecutor for Serious Economic and International Crime (SØIK). Other European banks (Deutsche Bank, Swedbank, Raffeisen Bank) are being drawn into the case for allegedly helping transfer illicit funds from Danske Bank. It is unclear at this time how long the Danske Bank money laundering case will last or how many entities it will draw in.

Keywords: Money Laundering, AML, Danske Bank

JEL Classification: A23, G21, G28, F30, E44

Suggested Citation: Suggested Citation

Copenhagen Business School ( email )

Solbjerg Plads 3 Frederiksberg C, DK - 2000 Denmark

Tom Kirchmaier (Contact Author)

London school of economics - centre for economic performance ( email ).

Houghton Street London, WC2A 2AE United Kingdom +44 207 955 6854 (Phone)

HOME PAGE: http://sites.google.com/site/tomkirchmaier/home

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, finance education ejournal.

Subscribe to this fee journal for more curated articles on this topic

S&P Global Market Intelligence Research Paper Series

Subscribe to this free journal for more curated articles on this topic

Regulation of Financial Institutions eJournal

White collar crime ejournal.

- Anti-Financial Crime

- Anti-Money Laundering

- Fraud & Investigations

- Risk Management

- Certified Money Laundering Prevention Professional (CMLP)

- Certified Anti-Financial Crime Professional (CFCP)

- Certified Audit and Investigations Professional (CAIP)

- Certifications

- Online Courses

- Expert Webinars

- Learning Paths

- Completion Certificates

- Global Community

- Live Tutoring

- Resource Hub

- Interactive LMS

- Jobs by FCA

From Theory to Practice: AML Case Studies in Real Financial Institutions

Understanding AML Compliance Failures

To address the challenges and improve anti-money laundering (AML) efforts, it is essential to examine the reasons behind AML compliance failures. This section provides an overview of AML penalties in financial institutions, global enforcement actions on AML compliance, and common criticisms of AML programs.

Overview of AML Penalties in Financial Institutions

Between 2018 and 2021, financial institutions globally paid fines amounting to USD 8.14 billion to resolve AML compliance failures, primarily due to deficient anti-money laundering controls ( ACAGlobal ). These penalties highlight the significant consequences financial institutions face when they fail to effectively combat money laundering.

Global Enforcement Actions on AML Compliance

During the same period, institutions in the United States, Europe, and Asia experienced a substantial increase in enforcement actions related to AML compliance issues. Regulators both in the United States and other regions intensified their enforcement activities, demonstrating the global focus on combating money laundering.

Common Criticisms of AML Programs

AML programs of various financial institutions, including global banks, state banks, and regional banks, have faced criticism for their inability to detect and report suspicious transactions effectively. Regulatory scrutiny has revealed that some institutions failed to establish appropriate risk-based customer due diligence and enhanced due diligence programs, which are crucial components of AML compliance.

Additionally, there has been a growing recognition of the need for proactive monitoring, including transaction monitoring and sanctions screening systems, to effectively identify and report potential money laundering activities within financial institutions ( ACAGlobal ). This criticism emphasizes the importance of ongoing efforts to enhance AML programs and ensure their effectiveness in detecting and preventing money laundering activities.

By understanding the AML compliance failures, financial institutions can learn from past mistakes and implement measures to strengthen their AML programs. It is crucial for organizations to establish robust risk-based due diligence processes, implement effective monitoring systems, and continuously adapt to emerging threats. A comprehensive and proactive approach to AML compliance is vital in safeguarding financial systems and protecting against illicit financial activities.

Importance of AML Case Studies

In the field of anti-money laundering (AML), case studies play a crucial role in understanding the complexities and challenges faced by financial institutions in combating money laundering and financial crimes. These real-life examples provide valuable insights into the role of financial institutions, the significance of real-life scenarios, and the lessons learned from AML case studies.

Role of Financial Institutions in AML Efforts

Financial institutions, particularly banks, are at the forefront of the fight against money laundering and financial crime. They play a pivotal role in preventing illicit activities within the finance sector. A study conducted on AML case studies found that banks are crucial partners in safeguarding the integrity of the financial system and detecting and preventing illicit activities. Financial institutions are responsible for implementing robust compliance measures and effective anti-money laundering frameworks to ensure the identification and reporting of suspicious transactions.

Significance of Real-Life Examples

Real-life examples of money laundering and AML failures provide tangible illustrations of the challenges faced by financial institutions. These case studies demonstrate the consequences of inadequate compliance measures, loopholes in AML programs, and the potential impact on the institutions and the broader economy. By examining these real-life scenarios, professionals working in compliance, risk management, and anti-financial crime gain a deeper understanding of the complexities and risks associated with money laundering activities.

Lessons from AML Case Studies

AML case studies offer valuable lessons that can be applied to enhance AML programs and strengthen risk mitigation strategies. By analyzing the failures and successes of financial institutions in detecting and preventing money laundering, professionals can identify key factors that contribute to effective AML practices. These lessons encompass various aspects, including customer due diligence, transaction monitoring, reporting mechanisms, and the importance of collaboration with regulatory authorities.

It is important for professionals in the field to study and learn from AML case studies to continually adapt and improve their AML efforts. By understanding the challenges and successes of others, they can implement best practices and stay abreast of evolving trends and techniques in money laundering prevention.

By delving into the role of financial institutions, the significance of real-life examples, and the lessons learned from AML case studies, professionals can gain valuable insights to enhance their understanding and effectiveness in combating money laundering and financial crimes. AML case studies provide practical knowledge and serve as a foundation for continuous improvement in the fight against illicit activities within the financial sector.

AML Case Studies in Financial Institutions

Examining real-life examples of money laundering can provide valuable insights into the challenges faced by financial institutions and the consequences of non-compliance . The following case studies highlight significant AML (Anti-Money Laundering) failures in various financial institutions:

Wachovia Bank: Drug Cartel Money Laundering

Between 2004 and 2007, Wachovia Bank allowed drug cartels in Mexico to launder approximately $390 billion through its branches. Insufficient controls regarding the origin of funds enabled the bank to be used as a channel for cartels to launder U.S. dollars from drug sales in the United States.

Standard Chartered Bank: Sanctions Violations

Standard Chartered Bank faced penalties of $670 million in 2012 for breaking sanctions against Iran, as well as $265 billion for control failures that facilitated the evasion of U.S. regulations. The bank was also accused of violating U.S. sanctions on Burma, Libya, and Sudan. The violations highlighted significant weaknesses in the bank’s compliance systems ( Sanction Scanner ).

Danske Bank: Estonian Branch Scandal

Danske Bank’s Estonian branch became a conduit for thousands of suspicious customers, enabling illicit transactions totaling approximately $228 billion between 2007 and 2015. The bank faced substantial fines, and Danish authorities held several managers accountable for the money laundering scandal. This case emphasized the importance of robust AML controls and customer due diligence procedures ( Sanction Scanner ).

Nauru: Money Laundering Hub

In the 1990s, the small island nation of Nauru transformed itself into a tax haven, attracting Russian criminals who laundered an estimated $70 billion through shell banks. As a result, the U.S. Treasury designated Nauru as a money-laundering state in 2002, leading to severe sanctions comparable to those imposed on Iraq. This case shed light on the role of jurisdictions in facilitating money laundering activities.

Bank of Credit and Commerce International (BCCI): Fraud and Money Laundering

The Bank of Credit and Commerce International (BCCI) engaged in fraud and money laundering on a massive scale, with illicit activities totaling up to $23 billion. The bank employed falsified transactions and sophisticated schemes to circumvent regulatory oversight. In 1991, the Bank of England orchestrated the closure of BCCI due to these illicit activities, underscoring the need for effective regulatory supervision.

By studying these AML case studies in financial institutions, professionals working in compliance, risk management, and anti-money laundering can gain a deeper understanding of the consequences of inadequate AML measures. These examples emphasize the importance of robust AML programs, effective regulatory oversight, and continuous efforts to combat money laundering in the financial sector.

Impacts of Money Laundering on the Economy

Money laundering has far-reaching consequences on the economy, affecting various aspects of financial systems and economic growth. Understanding the economic implications of money laundering is crucial in combating this illicit activity and safeguarding the integrity of financial institutions.

Economic Consequences of Money Laundering

Money laundering damages financial sector institutions critical for economic growth. It promotes crime and corruption, which hinder economic progress and reduce efficiency in the real sector of the economy. The link between money laundering and terrorism can also complicate matters, as terrorists attempt to evade monitoring and prevent authorities from interfering with their planned attacks.

Moreover, money laundering has an impact on monetary policy. It increases luxury consumption and causes fluctuations in international capital flows, exchange rates, and instability in money demand. These factors can negatively affect effective economic management, especially in developing countries. False signals of money laundering activities can hinder the resolution of issues such as budget deficits and high inflation, further impacting economic stability.

Effects on Investment and Growth Rates

Money laundering has significant implications for investment and growth rates. It affects a country’s credibility and attractiveness to foreign investors due to price instability caused by black money. This situation leads to lower investment rates and a decline in long-term sustainable growth. Countries with high volumes of money laundering activities are considered risky for investors. Therefore, combating money laundering becomes essential for attracting international capital and fostering growth rates.

Income Distribution and Social Impact

Money laundering also has an impact on income distribution and social dynamics within a society. It causes income source losses, social degeneration, and income differentiation, leading to an increase in the propensity for crimes and tax evasion. This, in turn, increases the tax burden on those in the official sector and affects income distribution unfavorably. The social consequences of money laundering can result in a deterioration of trust within communities and hinder economic progress ( Sanction Scanner ).

Understanding the economic consequences of money laundering highlights the urgency for robust anti-money laundering efforts. By implementing effective measures, financial institutions and governments can mitigate the negative impacts on investment, growth rates, income distribution, and social dynamics within economies.

To tackle the challenges posed by money laundering, a collaborative approach is necessary. Financial institutions, regulators, and policymakers must work together to develop comprehensive AML solutions. Regulatory oversight plays a crucial role in ensuring compliance, while the use of technology and information sharing enhances the effectiveness of anti-money laundering measures. By addressing these challenges collectively, economies can safeguard their financial systems and promote sustainable economic growth.

AML Failures and Financial Institutions

In recent years, there have been several instances of AML compliance failures in financial institutions, leading to significant penalties, financial losses, and reputational damage. Understanding the consequences of non-compliance and learning from past failures is crucial for improving anti-money laundering efforts. This section explores the penalties for AML non-compliance, the financial losses and reputational damage faced by financial institutions, and the lessons learned from these failures.

Penalties for AML Non-Compliance

Financial institutions globally have faced substantial penalties for AML non-compliance. Between 2018 and 2021, these penalties amounted to USD 8.14 billion, highlighting the seriousness of deficient anti-money laundering controls ( ACAGlobal ). This figure emphasizes the need for robust AML programs and adherence to regulatory requirements. Institutions in the United States, Europe, and Asia experienced an increase in enforcement actions related to AML compliance issues during this period, with both US and non-US regulators intensifying their enforcement activities.

Financial institutions have faced penalties for various AML violations. For example, in 2012, HSBC agreed to pay $1.9 billion to settle allegations of money laundering violations. Standard Chartered also faced a $340 million fine in the same year for AML violations related to illegal transactions with Iran, Sudan, Libya, and Myanmar. These penalties highlight the financial consequences of non-compliance with AML regulations.

Financial Losses and Reputational Damage

AML failures can result in significant financial losses and reputational damage for financial institutions. The Danske Bank case in 2018 revealed that approximately €200 billion was laundered through its Estonian branch, leading to substantial financial implications ( Griffin ). Similar instances, such as the Panama Papers leak in 2016, which exposed the use of offshore accounts for money laundering and tax evasion, have eroded trust in the integrity of the financial system ( Griffin ). These incidents have often necessitated taxpayer subsidies for failing banks and restricted customer access to credit.

Reputational damage resulting from AML failures can have long-lasting effects. Financial institutions may face public scrutiny, loss of customer trust, and difficulties attracting new clients. Rebuilding reputation and trust can be a challenging and time-consuming process, making it imperative for institutions to prioritize effective AML compliance measures.

Lessons Learned from Past Failures

The failures observed in AML compliance programs highlight the importance of continuously improving anti-money laundering efforts. Financial institutions can learn valuable lessons from these past failures to strengthen their AML programs. Some key takeaways include:

Enhanced Customer Due Diligence : Institutions must establish robust risk-based customer due diligence and enhanced due diligence programs to effectively detect and report suspicious transactions. Thoroughly understanding customer profiles and conducting proper risk assessments are essential for mitigating money laundering risks.

Investing in Technology : Leveraging technology solutions, such as advanced analytics and artificial intelligence, can enhance transaction monitoring capabilities and improve the detection of suspicious activities. Embracing innovative technologies can aid in more efficient and accurate AML compliance.

Collaboration and Information Sharing : Financial institutions should collaborate with industry peers, regulatory bodies, and law enforcement agencies to share insights, best practices, and intelligence related to emerging AML risks. A collaborative approach leads to a more effective and comprehensive fight against money laundering.

By analyzing AML failures and implementing the lessons learned, financial institutions can bolster their AML programs, reduce the risk of non-compliance, and contribute to a more robust global anti-money laundering framework.

Addressing Money Laundering Challenges

To effectively combat money laundering, it is crucial for financial institutions to adopt a collaborative approach, enhance regulatory oversight, and leverage technology and information sharing. These measures play a significant role in strengthening anti-money laundering (AML) efforts and mitigating the risks associated with illicit financial activities.

Collaborative Approach for AML Solutions

The fight against money laundering cannot be tackled by any single institution or country alone. Collaborative efforts are essential to develop comprehensive AML solutions. As highlighted by the International Monetary Fund (IMF), combating money laundering requires countries to innovate together and share best practices ( IMF ). By fostering partnerships among financial institutions, regulatory bodies, law enforcement agencies, and international organizations, a collective approach can be established to detect, prevent, and deter money laundering activities effectively.

Through collaboration, stakeholders can share information, intelligence, and expertise, enabling a more holistic understanding of emerging money laundering techniques and trends. This collective knowledge can inform the development of robust AML policies, procedures, and technologies, strengthening the overall effectiveness of the financial system in combating money laundering.

The Role of Regulatory Oversight

Regulatory oversight plays a crucial role in ensuring the compliance of financial institutions with AML regulations and standards. Regulators are responsible for establishing and enforcing rules that guide financial institutions’ AML efforts. They monitor and assess the effectiveness of AML programs, conduct inspections, and impose penalties for non-compliance.

To address money laundering challenges effectively, regulators need to adopt a risk-based approach and focus on the bigger picture. This includes scrutinizing non-resident risks, cross-border laundering countermeasures, and the effectiveness of AML programs. Stronger international collaboration among regulators is also crucial to address these challenges collectively and ensure consistent AML standards across jurisdictions.

Importance of Technology and Information Sharing

In the digital age, technology plays a pivotal role in enhancing AML efforts. Financial institutions need to leverage advanced technologies, such as artificial intelligence, machine learning, and data analytics, to strengthen their ability to detect and prevent money laundering activities. These technologies can analyze vast amounts of data, identify patterns, and detect suspicious transactions more accurately and efficiently.

Information sharing is equally important in the fight against money laundering. Financial institutions should collaborate with regulatory bodies, law enforcement agencies, and other financial institutions to exchange information on emerging money laundering techniques, typologies, and red flags . Sharing information and intelligence in a timely and secure manner can help identify and disrupt money laundering networks more effectively.

By utilizing technology and promoting information sharing, financial institutions can enhance their AML capabilities, improve detection rates, and facilitate timely reporting of suspicious activities. These measures contribute to a stronger and more resilient financial system that can better withstand the challenges posed by money laundering.

Addressing money laundering challenges requires a multi-faceted approach that encompasses collaboration, regulatory oversight, and technological advancements. By working together, financial institutions, regulators, and other stakeholders can strengthen their AML defenses, protect the integrity of the financial system, and combat the illicit activities associated with money laundering.

For further insights into AML case studies and real-life examples, explore our articles on aml case studies , aml training case studies , and real-life examples of money laundering .

Red Flags And Atypical Customer Behavior: Anti-Money Laundering Awareness

From Masterpieces to Money Laundering: Unraveling the Art Markets Dark Secrets

Safeguard Your Business: Exploring the Potential of AML Compliance Software

Transaction Monitoring And Screening Of Anti Money Laundering And Counter Terrorist Financing

Revolutionize Compliance: Unveiling RegTechs Powerful Solutions

Relevant KYC Red Flags: Politically Exposed Persons, Shell Companies, High-Risk Jurisdictions, and Product Risk

Privacy overview.

The Value of FinCEN Data

Financial data, collected from financial institutions by the Financial Crimes Enforcement Network under the Bank Secrecy Act (BSA), has proven to be of considerable value in money laundering, terrorist financing and other financial crimes investigations by law enforcement. When combined with other data collected by law enforcement and the intelligence communities, FinCEN data assists investigators in connecting the dots in their investigations by allowing for a more complete identification of the respective subjects with information such as personal information; previously unknown addresses; businesses and personal associations; banking patterns; travel patterns; and communication methods.

FinCEN’s Law Enforcement Awards

Every year, FinCEN holds its Law Enforcement Awards ceremony, which recognizes successfully prosecuted cases. The goals of the program are to recognize those law enforcement agencies that made effective use of financial institution reporting to obtain a successful prosecution and to demonstrate to the financial industry the value of its reporting to law enforcement. The program also emphasizes that prompt and accurate reporting by the financial industry is vital to the successful partnership with law enforcement to fight financial crime. FinCEN receives case submissions from law enforcement for the program, and in all cases, the use of BSA reporting by the financial industry provided highly noteworthy added value to significant investigations. Case summaries for many of the submissions are described in the press releases below:

- FinCEN Holds Annual Ceremony to Recognize Law Enforcement Cases Supported by BSA Data (2023)

- Annual FinCEN Program Recognizes Law Enforcement Cases Supported by BSA Data (2022)

- FinCEN Recognizes the Significant Impact of Bank Secrecy Act Data on Law Enforcement Efforts (2021)

- FinCEN Recognizes Law Enforcement Cases Significantly Impacted by Bank Secrecy Act Filings (2020)

- FinCEN Holds Fifth Annual Awards Program to Recognize Importance of Bank Secrecy Act Reporting by Financial Institutions (2019)

- FinCEN Director’s Law Enforcement Awards Program Recognizes Significance of BSA Reporting by Financial Institutions (2018)

- FinCEN Awards Recognize Law Enforcement Success Stories Supported by Bank Secrecy Act Reporting (2017)

- FinCEN Awards Recognize Partnership Between Law Enforcement and Financial Institutions to Fight Financial Crime (2016)

- FinCEN Recognizes High-Impact Law Enforcement Cases Furthered through Financial Institution Reporting (2015)

Search Case Examples Prior to 2015 Using the Drop-Down Menu Below

- Share full article

Advertisement

Supported by

Inside the Bitcoin Laundering Case That Confounded the Internet

The arrests of Ilya Lichtenstein and Heather Morgan left the world of cryptocurrency incredulous: Could this goofy young couple have been Bitcoin’s Bonnie and Clyde?

By Ali Watkins and Benjamin Weiser

When anonymous hackers infiltrated the cryptocurrency exchange Bitfinex in 2016, it shook the nascent world of digital currency and prompted speculation about who might have stolen what was then $71 million in Bitcoin .

But unlike traditional financial transactions, Bitcoin trades are publicly visible — moving the coins risked revealing who was behind the heist. And so for six years, as the value of Bitcoin soared, the loot sat in plain sight online as tiny fractions of the giant sum occasionally disappeared in a blizzard of complex transactions.

It was as if a robber’s getaway car was permanently parked outside the bank, locked tight, money still inside.

And then, this month , the car sped off.

In the strange and sometimes shadowy world of cryptocurrency, it was as if the earth shook. In the years since the Bitfinex hacking, crypto had exploded into the mainstream, and the theft had become notorious: a bounty worth over $4 billion. At last, it seemed, the hackers had emerged from hiding.

But it was not the hackers who had moved the stolen Bitcoin — it was the government, which had seized it as part of an investigation into two New York City entrepreneurs: one a little-known Russian émigré and tech investor; the other, his wife, an American businesswoman and would-be social media influencer with an alter ego as a satirical rapper named Razzlekhan .

Charged with conspiring to launder billions of dollars in Bitcoin, the couple, Ilya Lichtenstein, 34, and Heather Morgan, 31, were accused of siphoning off chunks of the purloined currency and trying to hide it in a complex network of digital wallets and internet personas. If convicted of that and a second conspiracy count, they could face up to 25 years in prison.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in .

Want all of The Times? Subscribe .

- Reset your password

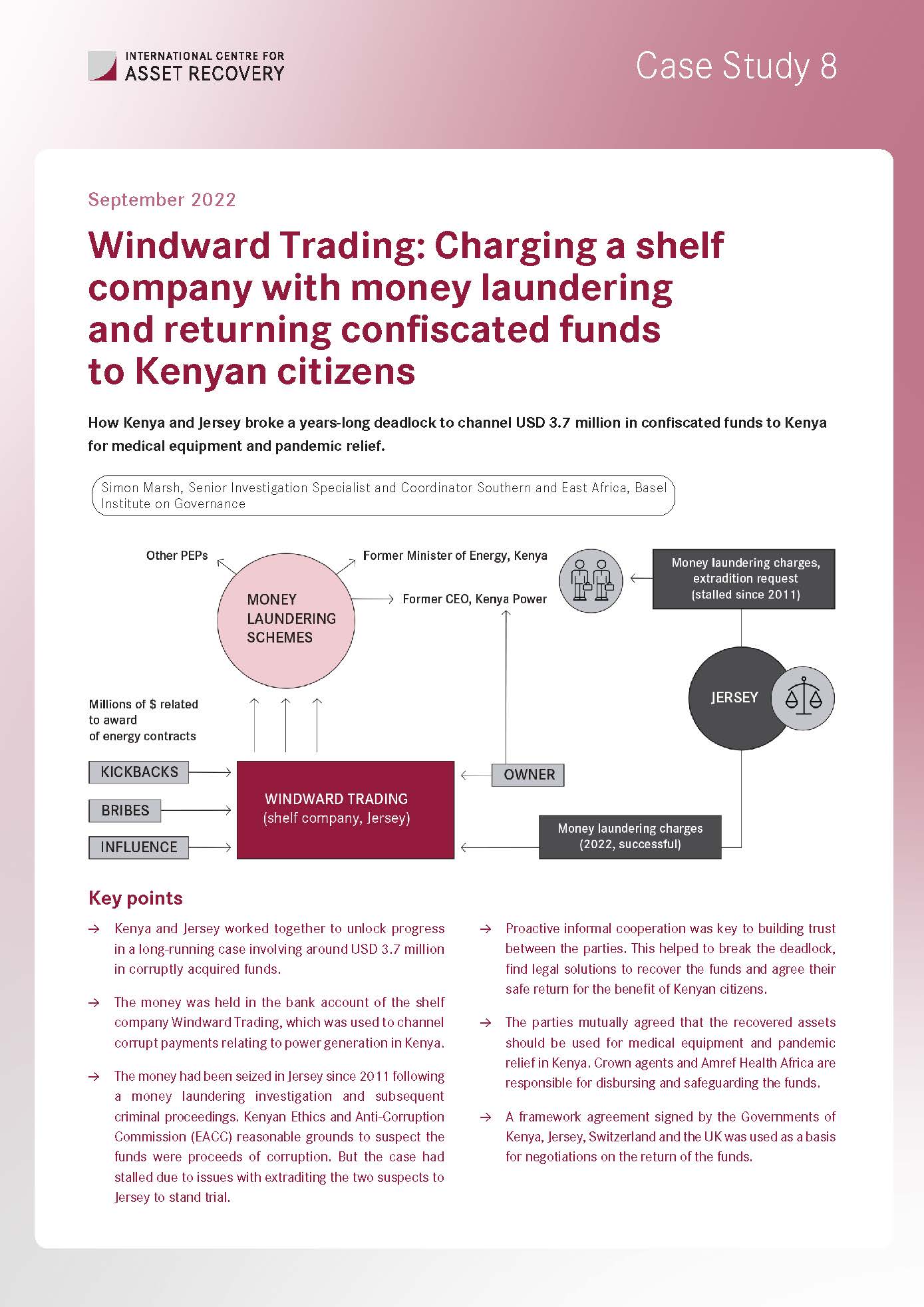

Case Study 8: Windward Trading: Charging a shelf company with money laundering and returning confiscated funds to Kenyan citizens

This case study describes how authorities in Kenya and Jersey worked together to unlock progress in a long-running case involving around USD 3.7 million in corruptly acquired funds.

The money was held in the bank account of the shelf company Windward Trading, which was used to channel corrupt payments relating to power generation in Kenya.

The money had been seized in Jersey since 2011 following a money laundering investigation and subsequent criminal proceedings. Kenyan Ethics and Anti-Corruption Commission (EACC) reasonable grounds to suspect the funds were proceeds of corruption. But the case had stalled due to issues with extraditing the two suspects to Jersey to stand trial.

Proactive informal cooperation was key to building trust between the parties. This helped to break the deadlock, find legal solutions to recover the funds and agree their safe return for the benefit of Kenyan citizens.

The parties mutually agreed that the recovered assets should be used for medical equipment and pandemic relief in Kenya. Crown agents and Amref Health Africa are responsible for disbursing and safeguarding the funds.

A framework agreement signed by the Governments of Kenya, Jersey, Switzerland and the UK was used as a basis for negotiations on the return of the funds.

Open-access licence and acknowledgements

This publication is part of the Basel Institute on Governance Case Study series, ISSN 2813-3900 . It is licensed for sharing under a Creative Commons BY-NC-ND 4.0 licence.

The Case Study series offers practitioners insights into interesting and precedent-setting cases involving corruption and asset recovery. Many such cases are drawn from partner countries of the Basel Institute's International Centre for Asset Recovery .

Suggested citation: Marsh, Simon. 2022. “Windward Trading: Charging a shelf company with money laundering and returning confiscated funds to Kenyan citizens." Case Study 8, Basel Institute on Governance. Available at: baselgovernance.org/case-studies.

Links and other languages

Simon Marsh

Engaging the private sector in Collective Action against corruption: A practical guide for anti-corruption agencies in Africa

Q&A: Monitoring corruption cases in Kenyan courts

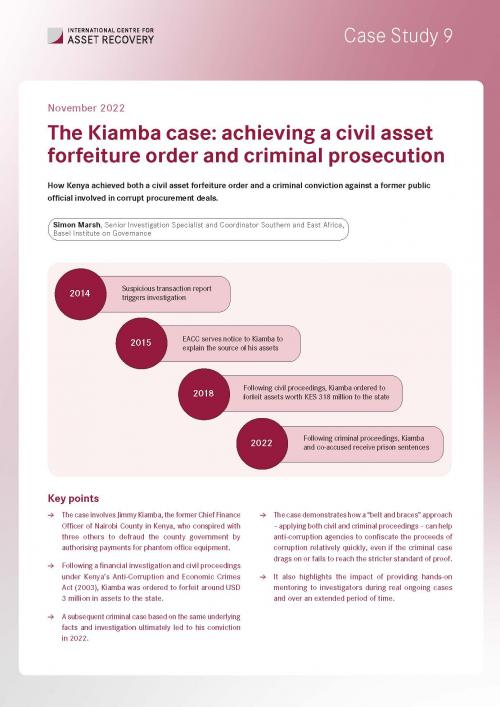

Case Study 9: The Kiamba case: achieving a civil asset forfeiture order and criminal prosecution

COMMENTS

Working from smallest to largest, these are the most famous money laundering cases from 2020 due to failure or significant room for improvement relating to compliance with applicable AML laws and regulations.

The last decade has been a whirlwind period for Anti-Money Laundering (AML) compliance – or, more accurately, non-compliance. The headlines have been dominated by record-breaking fines and high-profile investigations from regulators worldwide.

Fines, scandals, leaks and sweeping new AML regulations. What are the biggest money laundering cases from the past year? We round up the top money laundering stories here.

Danske Bank money laundering scandal is one of the largest money laundering scandal in European history. It began in 2007 following the acquisition from Danske Bank of Finnish Sampo Bank, which also had an Estonian branch.

In the field of anti-money laundering (AML), case studies play a crucial role in understanding the complexities and challenges faced by financial institutions in combating money laundering and financial crimes.

Financial data, collected from financial institutions by the Financial Crimes Enforcement Network under the Bank Secrecy Act (BSA), has proven to be of considerable value in money laundering, terrorist financing and other financial crimes investigations by law enforcement.

predicate offences associated with money laundering typologies. From among 117 case submissions, the subgroup selected 26 best cases and established the following seven targeted categories of predicate offences and associated money laundering typologies: 1. Bribery and Corruption 2. Cybercrime and Cryptocurrency 3. Drug Trafficking 4.

Danske Bank money launderin g scandal is one of the largest money laundering scandal in European history. It began in 2007 following the acquisition from Danske Bank of Finnish Sampo Bank,...

Charged with conspiring to launder billions of dollars in Bitcoin, the couple, Ilya Lichtenstein, 34, and Heather Morgan, 31, were accused of siphoning off chunks of the purloined...

This case study describes how authorities in Kenya and Jersey worked together to unlock progress in a long-running case involving around USD 3.7 million in corruptly acquired funds. The money was held in the bank account of the shelf company Windward Trading, which was used to channel corrupt payments relating to power generation in Kenya.