Get 14 Days Free

- Morningstar Analyst Research

- Performance

- Risk and Rating

- Fees and Expenses

- Target Market

- Sustainability

- Methodology

- Company Website

- Our Signature Methodologies

Connect With Us

- Global Contacts

- Advertising Opportunities

Terms of Use Privacy Policy Modern Slavery Statement Cookie Settings Disclosures

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. It is projection/opinion and not a statement of fact. Morningstar assigns star ratings based on an analyst’s estimate of a stock's fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Analyst Rating

- Technical Events

- Smart Money

- Top Holdings

- Credit Cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal Loans

- Student Loans

- Car Insurance

- Options 101

- Good Buy or Goodbye

- Options Pit

- Yahoo Finance Invest

- EV Deep Dive

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- CA Privacy Notice

Yahoo Finance

Thesis global multi asset acc (gb00b3sbv573.l).

- Previous Close 199.00

- YTD Return 7.79%

- Expense Ratio 2.39%

- Category GBP Aggressive Allocation

- Last Cap Gain 0.00

- Morningstar Rating ★ ★ ★ ★ ★

- Morningstar Risk Rating Average

- Sustainability Rating --

- Net Assets 30.24M

- Beta (5Y Monthly) 0.87

- Yield 0.30%

- 5y Average Return --

- Holdings Turnover --

- Last Dividend 0.00

- Inception Date Jun 21, 2010

Thesis Global Multi Asset Acc Overview Thesis Unit Trust Management Limited / GBP Aggressive Allocation

The investment objective of the Company is to achieve long-term capital appreciation from a globally diversified portfolio

Thesis Unit Trust Management Limited

Fund Family

GBP Aggressive Allocation

Fund Category

Inception date, performance overview: gb00b3sbv573.l.

Trailing returns as of 3/31/2019. Category is GBP Aggressive Allocation.

1-Year Return

3-year return, 5-year return, holdings: gb00b3sbv573.l, top 10 holdings (41.91% of total assets), sector weightings, related mutual fund news.

3 Top-Performing Mutual Funds to Consider for Your Retirement Portfolio

Are these 3 Top-Ranked Mutual Funds In Your Retirement Portfolio?

3 Top-Ranked Mutual Funds for Your Retirement

3 Great Mutual Fund Picks for Your Retirement

Should You Add These 3 Top-Performing Mutual Funds to Your Portfolio?

Make the Most of Your Retirement with These Top-Ranked Mutual Funds

3 Solid Tech Funds to Buy as Interest Rate Hike Fears Wane

3 Funds to Add to Your Portfolio on Rebounding Semiconductor Sales

- Get 7 Days Free

Multi-Asset Income Funds: Is the Extra Income Worth the Extra Risk?

A deep dive into this group.

/s3.amazonaws.com/arc-authors/morningstar/984ff87e-463c-4fca-8c15-ebbf7f9593b2.jpg)

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

While all the major asset classes have collectively taken a beating this year, multi-asset income, or MAI, funds have held up comparatively well. In the first five months of 2022, the three most crucial markets for U.S. investors—domestic stocks, international stocks, and U.S. bonds—have tumbled nearly in lockstep. Specifically, through May 31, the Morningstar US Market Index dove 14.1%, the Morningstar Global ex-US Index fell 10.3%, and the Morningstar US Core Bond Index dropped 9.0%. Meanwhile, the 68 mutual funds we identify as multi-asset income slid an average of just 7.4%. In other words, they have recently been more buoyant than the broad markets—despite devoting an average of 45% of assets to equities.

Those results might make you think these funds are solid capital-preservation tools. But portfolios that offer sustainable, repeatable downside protection generally do so because their design includes some combination of cash, short-term fixed-income, and holdings with low intercorrelation. Multi-asset income funds, on the other hand, exist specifically to distribute attractive levels of income, so most of them eschew low-yielding bonds and hold different assets based on income potential more than for diversifying characteristics. In other words, the multi-asset income fund group may occasionally do well in a downturn, but that’s by chance—not by plan.

While these funds have done well in this downturn, they don’t always play strong defense: Just two years ago in the pandemic panic, most of them plummeted. Their heavy emphasis on income has meant that, inside most of these multi-asset packages, two subasset classes usually take up a lot of space. And these two subasset classes, high-yield bonds and large-value stocks, can move together in a downturn—sometimes for better and sometimes for worse.

The Origins of Multi-Asset Income

It’s obvious why investors would want an investment to produce income and almost as clear why they’d want it to come from more than one asset class. Most people invest primarily to secure comfortable retirements—specifically to generate dependable, stable, long-lasting levels of income, ideally without quickly or sharply cutting into principal. And most investors would rather not put all their eggs in one basket, as the proverb goes. Traditionally, mixing stocks and bonds has seemed prudent. But over the past four-plus decades, using a straightforward mix for income in retirement has become far more challenging as bond yields and aggregate stock dividend yields have steadily, significantly declined.

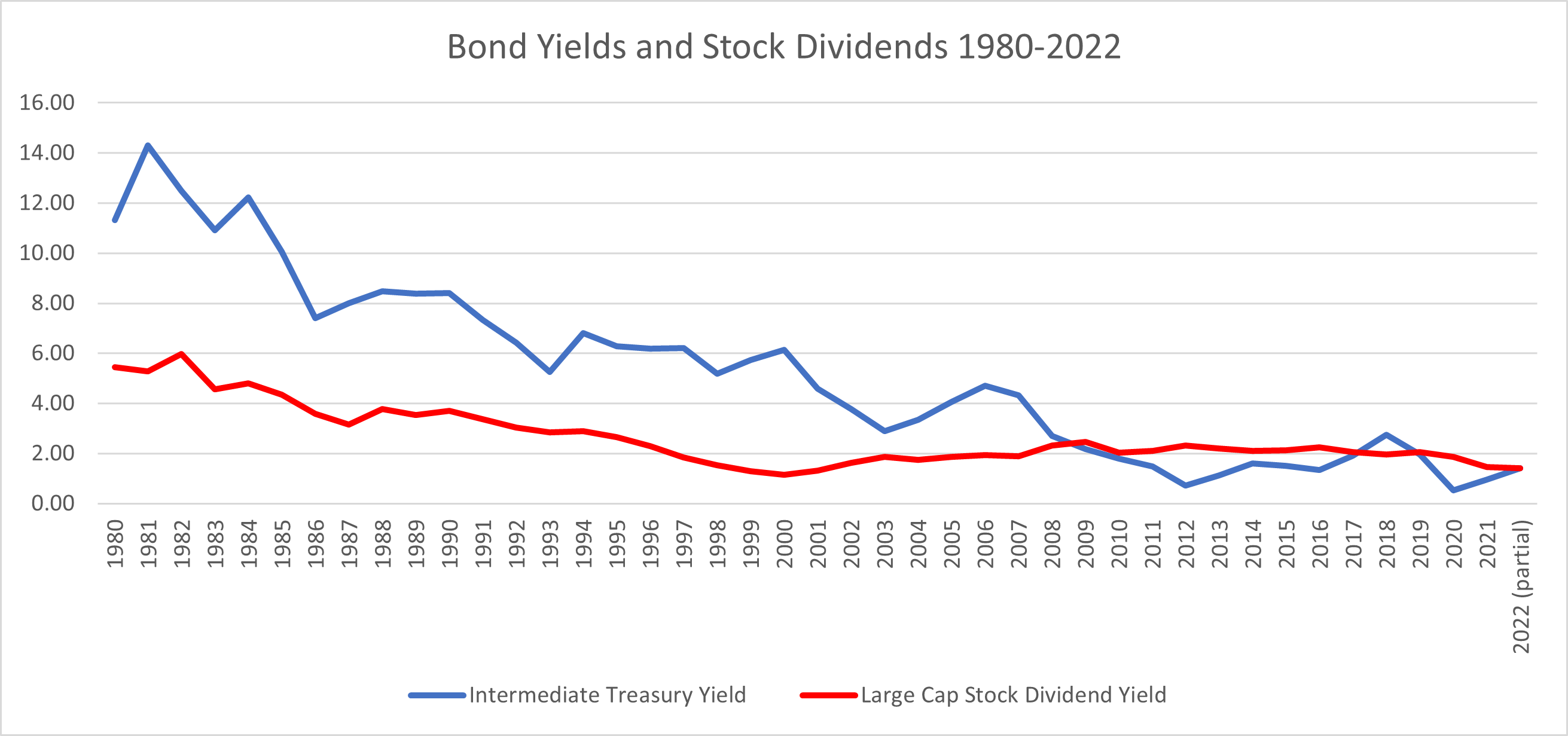

Four decades ago, in 1980, intermediate-term Treasuries yielded 11.3% and large-cap stocks yielded 5.5%. By April 30, 2022, both intermediate government-bond yields and stock dividends had cratered to 1.4%. An even mix of bonds and stocks produced a roughly 8.4% portfolio yield in 1980; at the end of April 2022, the same blend only generated a 1.4% yield.

- source: Morningstar Direct; IA SBBI Indexes. The IA SBBI US IT Government Yld Index tracks Intermediate Treasury Yields The IA SBBI US Large Stock IR Index tracks the monthly income return of the S&P 500.

For retirees looking to replace paychecks with income, a once-simple determination has become a baffling challenge. Many investors hope that multi-asset income funds are part of the solution.

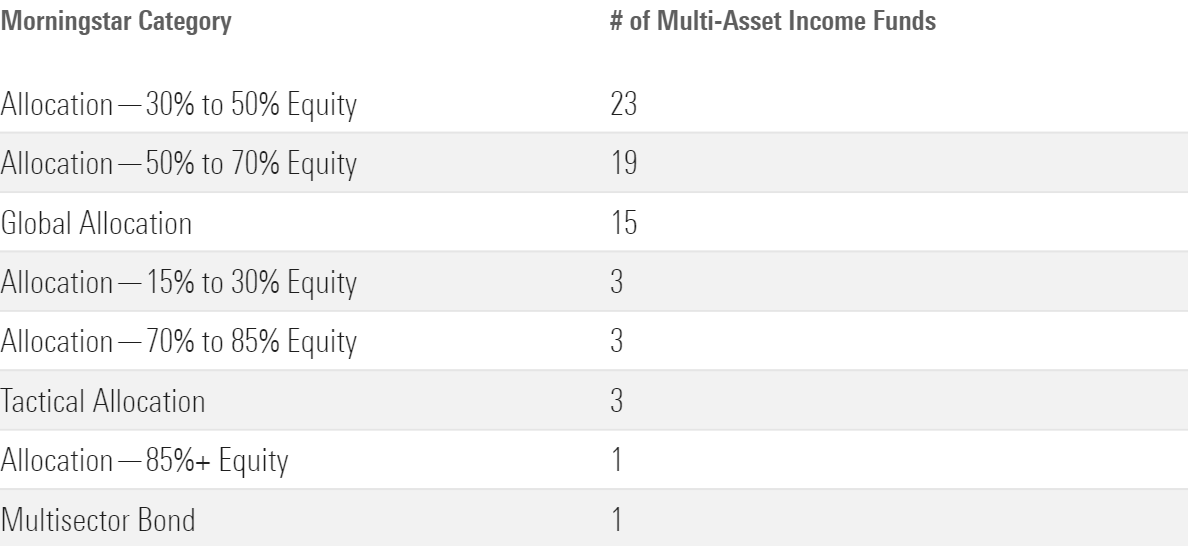

The core idea behind multi-asset income funds is straightforward: a portfolio that aims to provide income from a variety of assets. To be clear, Morningstar doesn’t group multi-asset income funds into one Morningstar Category because the funds collect income from a wide array of asset-allocation schemes, and holdings exposures drive our category system. We do have a separate multi-asset income institutional category that tracks 68 funds with two key things in common: All actively focus on income, and they have more than one asset class in their portfolio. All but one (Delaware Wealth Builder DDIAX) have “income” in their name: 13 contain the phrase “multi-asset income” and another 14 use “income builder.” The 68 funds spread across eight conventional Morningstar Categories, mainly congregating in three:

- source: Morningstar Analysts

These funds have consistently provided yields well above their own category peers that don’t intentionally focus on income. As the saying goes, however, you can’t get blood from a turnip. In an investment world where yields (especially in fixed-income) remain below their historical averages—even after the sharp rise in bond yields in 2022—few assets provide the kind of truly attractive yields that were once commonplace. Moreover, those investments producing higher income generally carry some type of added risk.

So, while most portfolios that mix multiple asset classes aim to offset the characteristics of one asset with counterbalancing traits from another, multi-asset income funds tend to lean heavily on subasset classes whose behavior has some key similarities. Specifically, the large-value equities these funds overweight tend in some ways to be a rather bondlike group of stocks given their attractive dividend yields and sedate profile (relative to other stocks). And in the fixed-income sleeves of multi-asset income funds, there’s heavy emphasis on high-yield bonds, whose sensitivity to companies’ creditworthiness makes them more volatile than other types of bonds (although they’re generally only about half as volatile as equities). Plus, high-yield bonds often slide when stocks do—just when higher-quality bonds tend to serve as ballast. Overall, multi-asset income funds have succeeded in generating plump yields, but that’s because they have heavy concentration risks in areas such as high-yield bonds and large-value equities, meaning the multi-asset income funds can fall much more than one would expect when risk becomes reality.

A Popular Potential Solution

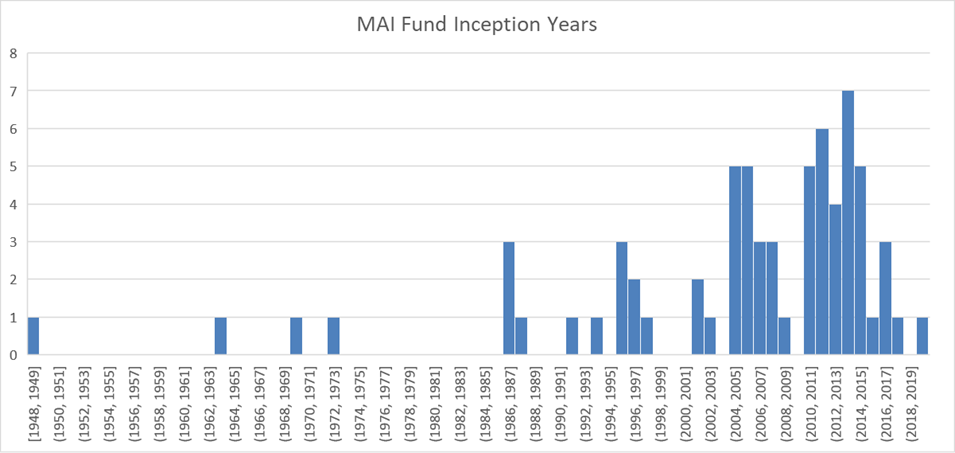

While they’ve proliferated since the global financial crisis from 2007-09, multi-asset income funds aren’t an exclusively recent phenomenon. About half of those existing today were launched in the last decade, a quarter in the previous decade, and the remainder before 2000. (Not all of them—especially the older ones—have always been multi-asset income funds. For instance, Goldman Sachs Income Builder GKIRX was originally Goldman Sachs Balanced and changed name and strategy in 2012.)

- source: Morningstar Direct

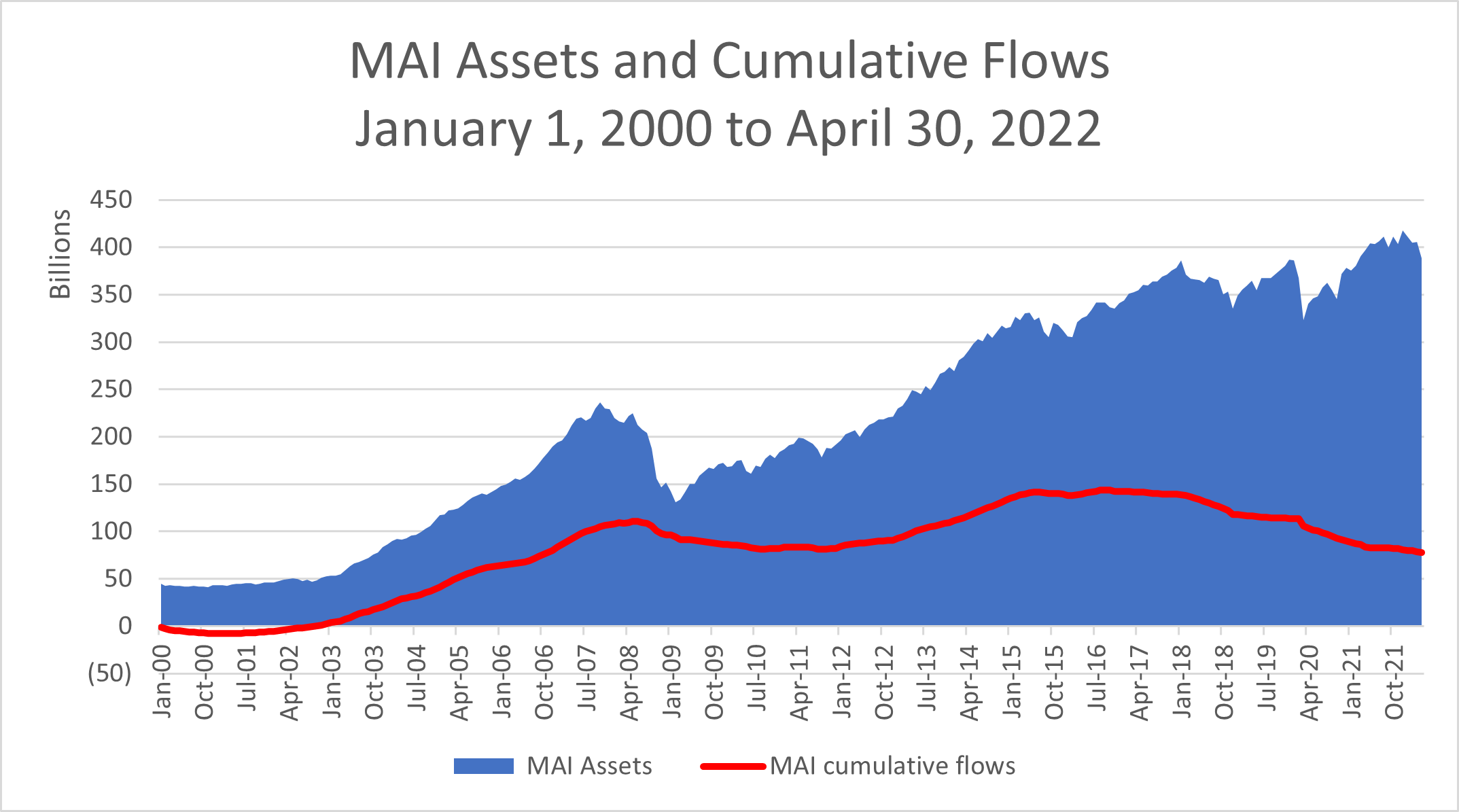

Over the past two-plus decades, multi-asset income funds have quietly accumulated a large asset base. At the turn of the century, they held $48 billion but as of April 30, 2022, held roughly 8 times that amount at $388 billion. That asset base is a bit smaller than that of the diversified emerging-markets category and a bit more than the collective assets of the funds in the small-blend category. (It’s worth noting that about 40% of the assets in multi-asset income offerings are invested in two American Funds—American Funds Capital Income Builder CAIBX and American Funds Income Fund of America AMECX.) Most of this asset growth has been asset appreciation, though: Inflows have only totaled $78 billion over those two-plus decades.

A Few Fundamental Risks

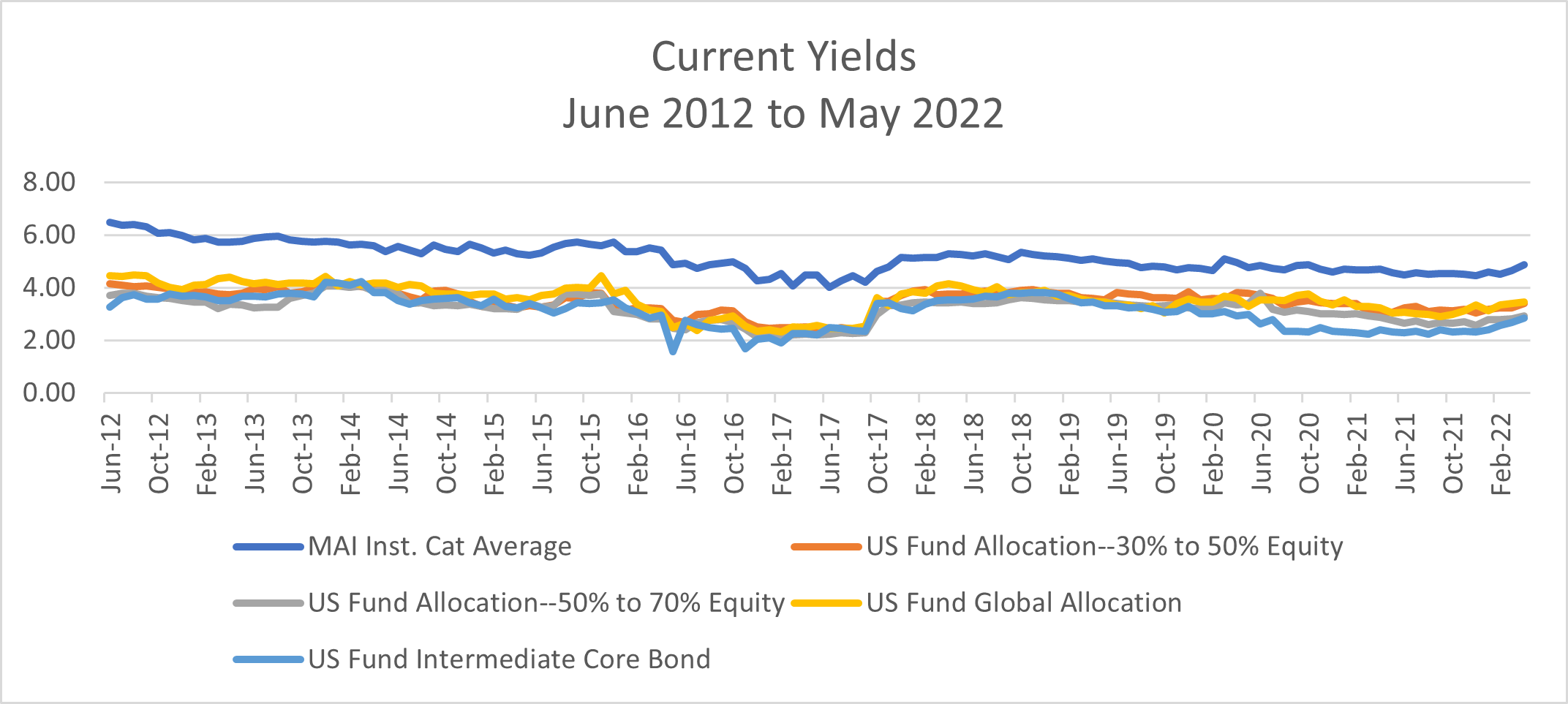

Compared with some broadly comparable Morningstar Categories, including those that call them home, multi-asset income funds as a group have certainly provided lofty income. While their average yields declined to 4.9% from 6.5% over the past decade, they’ve consistently boasted much higher yields than those of the allocation categories and especially the intermediate core bond Morningstar Category that covers the same ground as the broad-market Morningstar Core Bond Index or the Bloomberg U.S. Aggregate Index.

Indeed, versus the intermediate core bond category, which carries considerable interest-rate risk but only modest credit risk, the multi-asset income institutional category has had a roughly 200-basis-point yield advantage over time. Put another way, the average yield among multi-asset income funds is currently about 72% higher than that of the average core bond fund. That yield premium is a dependable signal of one type of elevated risk or another.

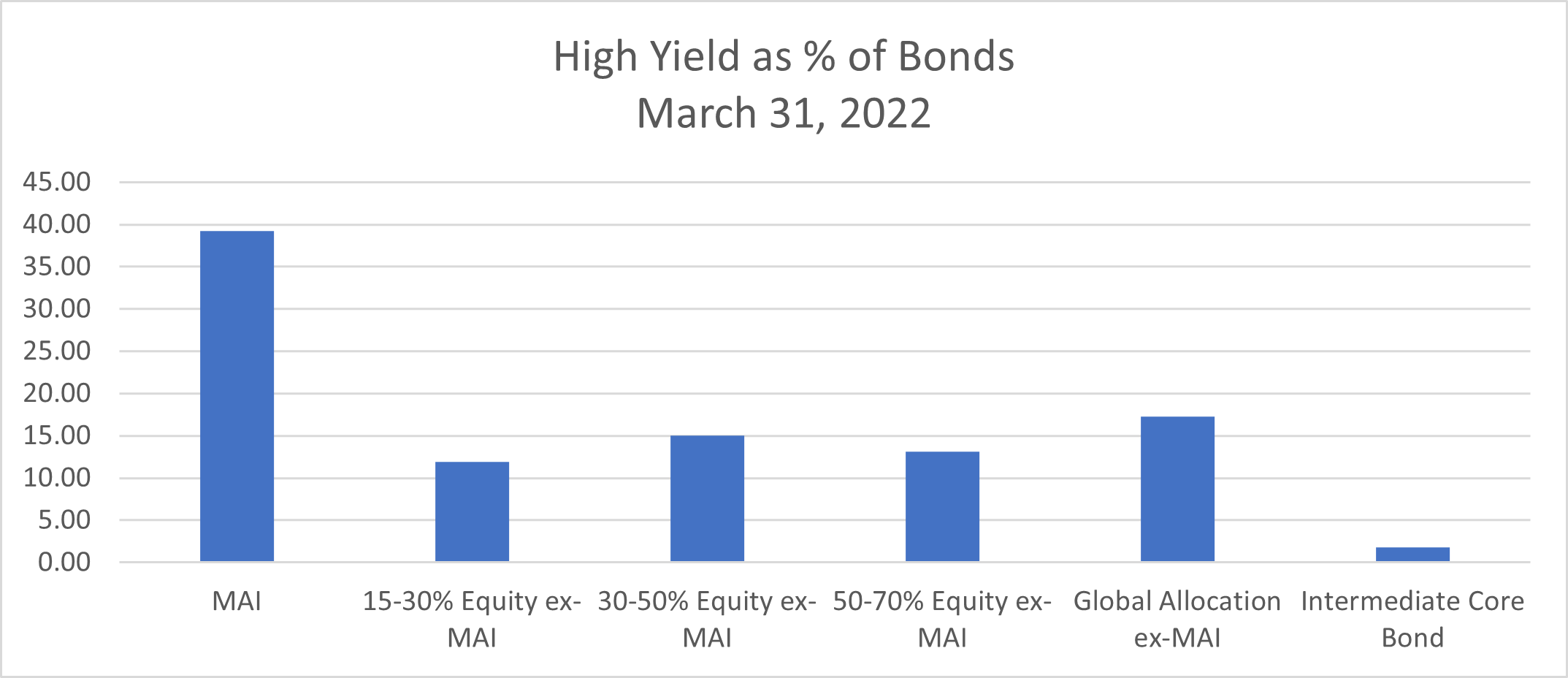

While these funds are far from uniform, the most common hunting grounds for their income, as above, are in high-yield bonds and large-value stocks. Across the 68 funds in the institutional category, on average, 39% of fixed-income assets went to high-yield bonds as of March 31, 2022. For comparison, in the intermediate core bond category, the average was 2%; for funds outside the multi-asset income group in the allocation—30% to 50% equity Morningstar Category, the average was 15% of assets in high-yield bonds.

Turning to large value, as of March 31, 2022, multi-asset income funds invested, on average, 28% of equity assets in large-value stocks. For comparison’s sake, within the allocation—30% to 50% equity and global allocation categories (aside from multi-asset income funds) the typical fund devoted an average of 18% and 20% of equity assets to large-value stocks.

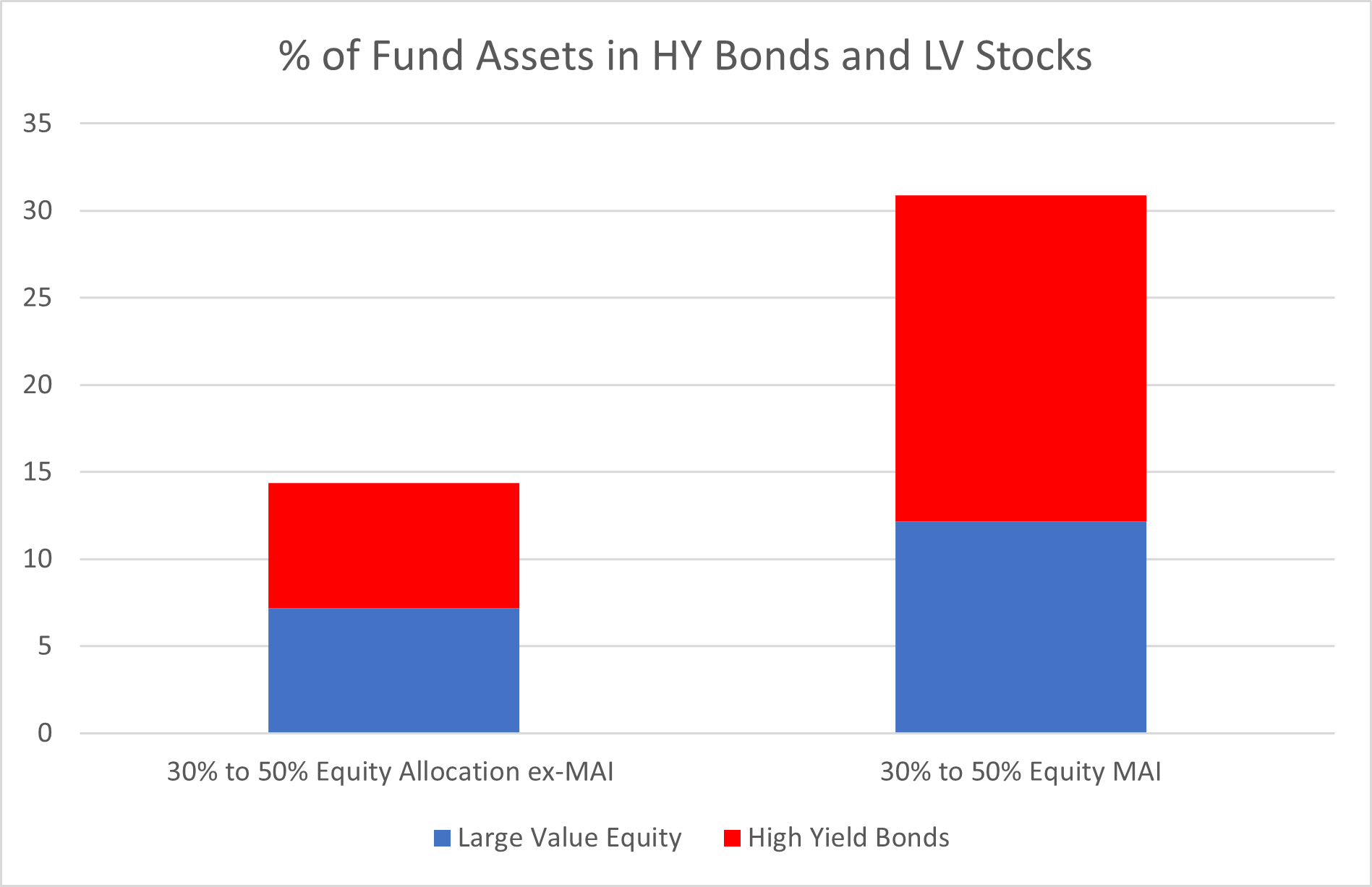

To get a sense of what these concentrations mean in combination, here’s a quick look at the allocation—30% to 50% equity category as of March 31, 2022. Excluding the subgroup of multi-asset income offerings, funds in that category averaged 14% of fund assets combined in high-yield bonds and large-value stocks. By contrast, multi-asset income funds in the category carried 31% of their assets in high-yield bonds and large-value equities. Note that these are averages; some funds lean extra hard on these areas: Transamerica Multi-Asset Income TASHX recently devoted 60% of assets to high-yield bonds and large-value stocks. Such a level of concentration in two asset classes that share risk factors, such as credit sensitivity, makes them precarious.

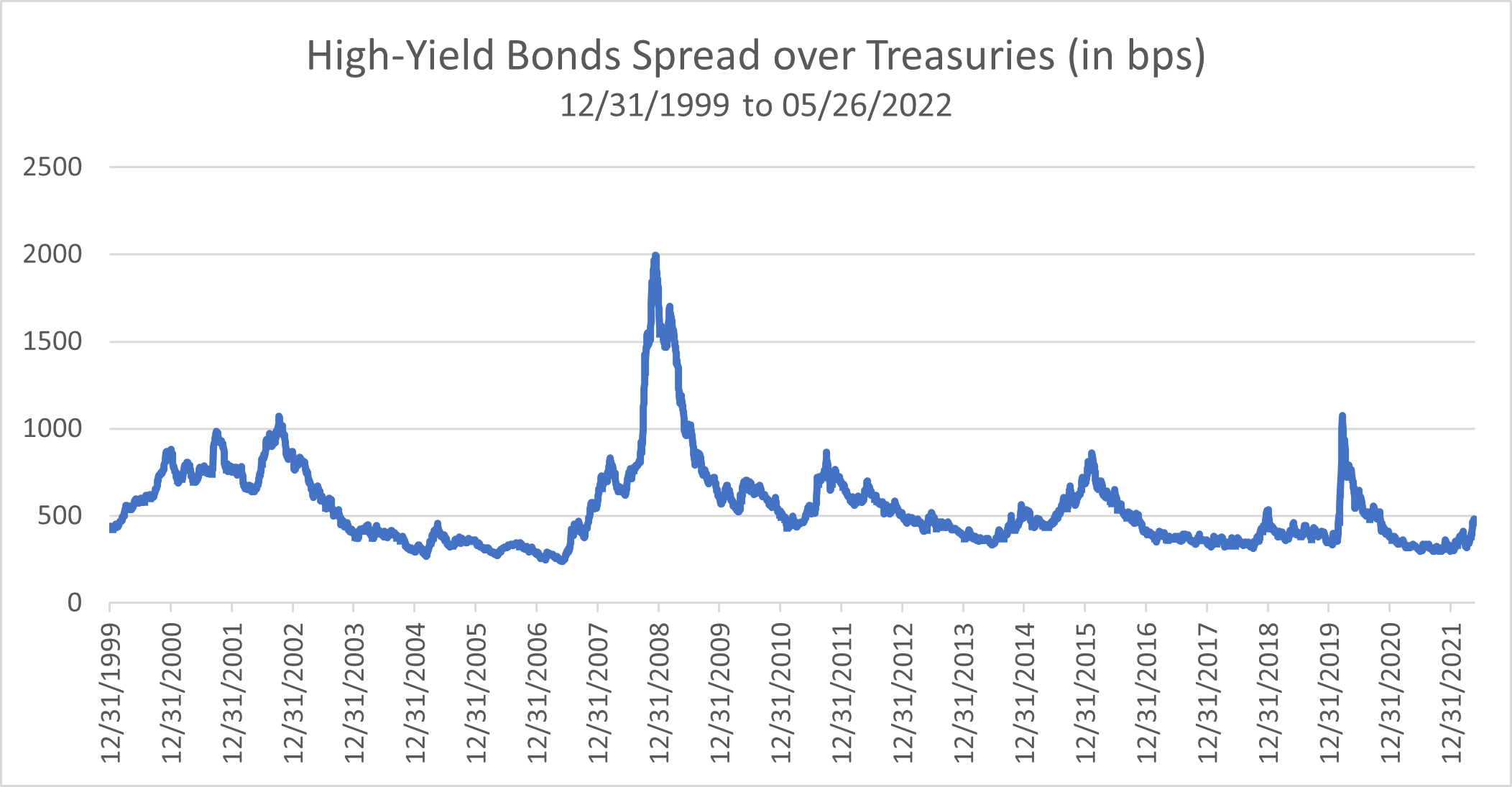

In addition to this concentration risk, there is also high-yield bonds’ credit risk. As interest rates have risen in 2022, credit spreads have widened. That said, they’ve only recently reached the normal range—not a generous one. Since Dec. 31, 1999, high-yield investors have received an average premium of 5.4% percentage points over 10-year Treasuries, with the median level at 4.6%. The average spread was just 3.3% on March 31, 2022, before it rose swiftly to 4.6% as of May 26, 2022.

- source: Morningstar US High-Yield Bond OAS Index

This fairly standard level of compensation comes when many believe the Federal Reserve’s overnight lending rate hikes may cause a recession. Receiving only average yields on debt from companies with risky financial footing in a precarious environment doesn’t argue strongly for a comfortable margin of safety. If the economic risks become reality, considerable drawdowns in high-yield bonds remain possible.

Return-Based Risk Measurements Miss the Mark

The fundamental risks that we see in multi-asset income funds, moreover, can hide in plain view for extended periods. That is, when looking at metrics based on trailing returns, funds can look sedate until a crisis. On this front, multi-asset income funds faced a comeuppance in early 2020 during the pandemic panic from Feb. 19 through March 3.

The classical volatility measure is historical standard deviation, which didn’t signal an impending problem heading into the 2020 crisis. From 2012 up through early 2020, it would have been fair to call multi-asset income funds sedate based on it. Over this nine-year period, they had an average three-year standard deviation of 6.6%, roughly two thirds that of the S&P 500 index’s 10.5% mark. At the end of 2019, multi-asset income funds’ average three-year standard deviation was just below that level, at 6.4%. As the pandemic panic took hold, however, their average standard deviation jumped to 10.3% in just three months, a 60% increase.

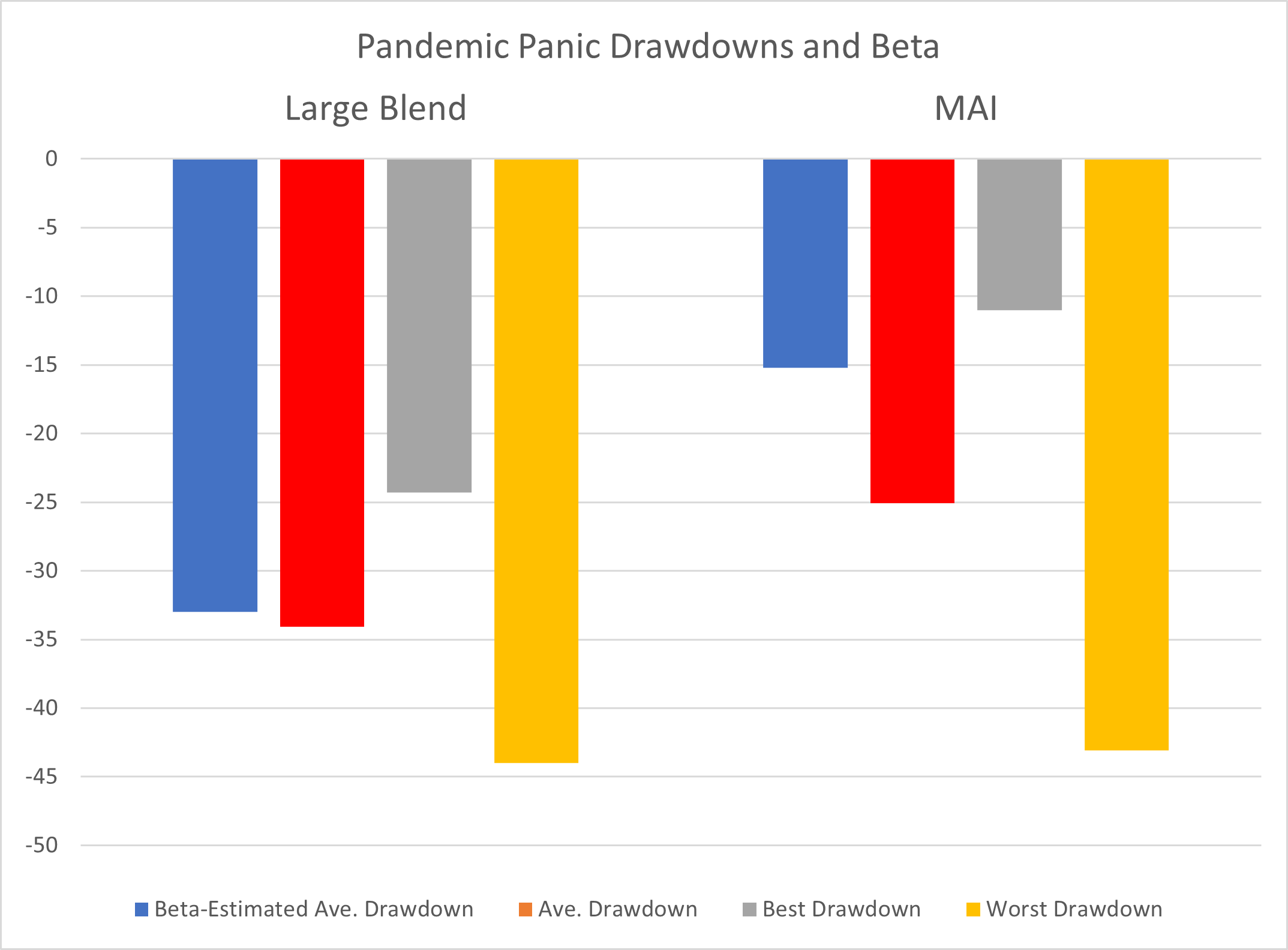

Another metric that would have projected a relatively low-risk image was beta, which approximates market sensitivity. Ideally, this metric should indicate how much an asset will fall (or rise) compared with a broad market benchmark—typically the S&P 500 index. It can be helpful in making rough estimates. For instance, in late 2019, the nearly 300-fund large-blend category had an average beta of 0.99 to the S&P 500. So, when that index fell 33.5% from Feb. 19 through March 23, 2020, you would have expected the average large-blend fund to drop about the same amount. The actual figure was 34.1%, for a single percentage point of additional damage.

On the other hand, the admittedly heterogenous multi-asset income group had an average beta of 0.45 to the S&P 500 at the end of 2019. Using that number, you’d estimate a typical pandemic-panic loss of 15.2%. The actual losses, however, were an average of 25.1%, or roughly 1,000 basis points more than a beta measurement would have suggested. Of course, that’s just the average loss: Individual fund showings ranged from a best return of negative 11.0% to a worst return of negative 43.1%.

The calculation behind beta rests on past returns, and as the warning goes: Past performance does not necessarily predict future results.

To understand why multi-asset income funds slid so badly, you’d need to go back to fundamentals risks: multi-asset income funds’ concentration in their favored subasset classes. First, there’s large value. While that corner of the market didn’t implode, it did underperform: The large-value Morningstar Category fell 37% in the pandemic panic. Second, high-yield bonds crashed when compared with other fixed-income assets. The average high-yield bond fund plummeted 20.0% in the pandemic panic—or 1,700 basis points worse than the typical intermediate core bond fund. When investors anticipated the ravages of recession and default, highly compressed credit spreads gapped widely, driving a selloff that coincided with and echoed the stock market’s plunge.

A sharp capital loss can easily create a difficult situation for income investors. After all, total returns are composed of capital returns and income. But those investors who are spending the income—and there’s no good reason to own a strongly income-focused fund if you’re not spending the income—are not reinvesting to build their asset bases back up. That can be fine in a mild pullback but creates more difficulty in a crisis. Because of the pandemic panic, 26 out of 68 mulit-asset income funds (nearly 40% of the total group) had negative returns in 2020—and didn’t fully recover from the sharp losses early in the year. Problematically, 21 out of those 26 also had lower income levels in 2020 than in 2019. And these funds’ income levels dropped a lot, averaging 22% less income from 2019 to 2020. Keep in mind, those income returns were not mere paper losses: Owners of those funds living on the income either had to reduce spending, find funds elsewhere, or sell down something in their overall portfolios to make up the difference. (While investors may seek the high income levels that multi-asset income funds provide, it’s not a good idea to use them as one-fund holdings in retirement.) Those who sold down their MAI funds, of course, were lowering their income levels going forward because they were, in effect, locking in losses in their asset bases.

As noted, every downturn is different, and multi-asset income funds won’t always deliver bad surprises when the stock market falls. As above, in 2022 through May 31, 2022, the Morningstar US Market Index has fallen 14.1%. The multi-asset income funds had an average three-year beta of 0.59 to this broad index as of year-end, so an investor might have expected a loss of 8.5%. The actual average for the funds has been a decline of 7.4%—nearly a percentage point better than one might have anticipated.

The rising interest rates that are largely driving the current downdraft in both equity and bond markets may also help create a new era for multi-asset income funds. First, with higher absolute yields now more widely available, the funds themselves may diversify more and tamp down risks. Second, now that core bond holdings have improved yields, investors may find the income streams of more conservative vehicles more attractive.

Multi-Asset Income Funds That Stand Out in the Crowd

In the meantime, while it’s clear that many multi-asset income funds now carry significant risks hiding in plain view, worthy mutual funds in the group do exist. Indeed, several carry high Morningstar Analyst Ratings, and they’ve often fared better than the pack.

The only Gold-rated fund in the multi-asset income group is Vanguard Wellesley Income VWINX, which resides in the allocation—30% to 50% equity category. It should be no surprise that its profile is more conservative than those of its multi-asset income peers. The fund stands apart by emphasizing dividend growth over dividend level and, strikingly, by swearing off high-yield bonds. Its yield was recently a conservative and maintainable 2.9%; given its relative caution, the Vanguard fund fell just 17.2% in the pandemic panic—outperforming the average multi-asset income fund in the allocation—30% to 50% equity category by 700 basis points.

American Funds has three Silver-rated funds in its lineup that demonstrate how multi-asset income funds can manage risk effectively in different ways. American Funds Income Fund of America AMECX is one of the few multi-asset income residents of the allocation—70% to 85% equity category. It mixes a 71% stake in dividend-paying equities (with a combined target of 2.5% yield) with high-yield bonds that consume 5% to 10% of total assets. Given an equity weight that’s fairly high-octane in the multi-asset income group, the fund fell a comparatively light 25.7% in the pandemic panic—in line with the typical multi-asset income fund overall. American Funds Capital Income Builder CAIBX is a similar global allocation fund that tilts more toward foreign stocks. Recently, it devoted 79% of assets to equities, including 34% from abroad. It doesn’t lean hard on high yield, however, with just 6% of its bond assets in that sector. Much like its sibling, it slid 25.0% in the pandemic panic, about the same as average multi-asset income funds with much higher equity weightings. Finally, American Funds Conservative Growth & Income RINFX has demonstrated that even with high exposures to the favored MAI areas, a fund can perform well in choppy markets. Its 39% combined weight in large value and high yield is even higher than the 31% figure typical of multi-asset income funds in the allocation—30% to 50% equity category. Yet, given the portfolio managers’ security-selection skill, the fund outperformed those multi-asset income allocation—30% to 50% equity peers by 300 basis points in the 2020 pandemic panic.

Finally, showing that a multi-asset income fund can do well despite a truly heavy stake in high-yield bonds, there is Silver-rated BlackRock Multi-Asset Income BIICX. The fund loaded up on high-yield fare to the tune of 54% of bond assets recently. So, the managers do hold a larger slug of riskier bonds but focus tightly on keeping the fund’s volatility below that of a 50% equity and 50% bond benchmark. Using that framework, the fund lost just 19.5% in the pandemic panic, nearly 500 basis points better than the typical allocation—30% to 50% equity multi-asset income offering’s loss despite the large high-yield stake.

More in Funds

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

4 Big Fund Downgrades

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

How to Choose an Index Fund

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

The Oldest Balanced Fund Is Still a Top Choice

About the author, todd trubey.

Todd Trubey is a senior manager research analyst for Morningstar Research Services LLC, a wholly owned subsidiary of Morningstar, Inc. He covers multi-asset and alternative fund strategies.

Before rejoining Morningstar in 2021, Trubey served as vice president of marketing and analytics for Advisory Research and as vice president of portfolio strategies for Ariel Investments. In his previous stint with Morningstar, he worked in training and education and was a senior fund analyst.

Trubey holds a bachelor's degree in English from Sewanee: The University of the South and master's and doctorate degrees in English from Northwestern University.

Why Vanguard Dividend Growth Is a Great Portfolio Anchor

How to find a great dividend fund, what makes a great dividend fund, morningstar’s best books to give and get for 2023, 3 attractive equity-income funds, morningstar’s 2022 recommended reading list, target-date retirement funds in 4 charts, you probably own too much domestic equity, these 2 bond funds gain gold status in march, sponsor center.

Log in or register

Please choose the professional site you want to access.

My Fidelity

Access exclusive insights and fund information from the Fidelity investment team, and manage email communications.

Account Management

Manage your firm’s Fidelity investment accounts with access to client reports, tax vouchers, and contract notes.

Fidelity Adviser Solutions

Manage your clients’ accounts with access to platform services, product wrappers, assets, and funds from a broad range of providers.

Fidelity View

Access account information and reports online. To register, contact your Client Service Manager.

Fidelity Funds - Global Multi Asset Income Fund A-ACC-USD

Understanding our share classes.

Most Fidelity funds offer more than one share class to investors. Each share class invests in the same underlying portfolio of securities and has the same objectives. However, different share classes may have different features to accommodate specific investor needs.

Our share class guide provides an overview of the key factors you should consider when deciding which share class is most suitable. We hope you find this useful.

Read the guide

Further information is also available in the prospectus and the key information document for each fund, which is available on this website. We recommend that you read this information before taking any investment decision.

Risk indicator

- Historical data may not be a reliable indication for the future.

- The risk category shown is not guaranteed and may change over time.

- The lowest category does not mean a "risk free" investment.

- The risk and reward profile is classified by the level of historical fluctuation of the Net Asset Values of the share class, and within this classification, categories 1-2 indicate a low level of historical fluctuations, 3-5 a medium level and 6-7 a high level.

- The value of your investment may fall as well as rise and you may get back less than you originally invested.

- The fund may invest in instruments denominated in currencies other than the fund base currency. Changes in currency exchange rates can therefore affect the value of your investment.

Price (USD)

Past performance does not predict future returns. The value of investments and the income from them can go down as well as up and investors may not get back the amount invested. Data shown does not take into account any Initial Charge that may apply. Fluctuations in currency exchange rates may affect the value of an investment. Please note that the shares are denominated in their respective share class currency and that the currency conversion provides an indicative price only.

Performance for 12 month periods

Performance & risk.

- Sustainability related disclosures

Corporate actions

Performance.

Important information about how data is calculated and presented

Source of fund performance and volatility and risk measures is Fidelity. Performance is excluding initial charge. Basis: nav-nav with income reinvested, in USD, net of fees. If you took an initial charge of 5.25% from an investment, this is the equivalent of reducing a growth rate of 6% per annum over 5 years to 4.9%. This is the highest initial charge applicable, if the initial charge you pay is less than 5.25%, the impact on the overall performance will be less. Market indices are sourced from RIMES and other data is sourced from third-party providers such as Morningstar.

The fund portfolio holdings may differ from the index composition. The market index is for comparative purposes only.

Example calculation for US$1,000 1

Note to the sample calculation: An initial charge of e.g. 5.25% will reduce the individual investment performance on the first day through the payment of this initial charge. The amount available for investment will decrease by 4.99% (calculation: 100% - [(100% / 105.25%) * 100]). This means that with an investment sum of 1,000.-, fund shares with an initial value of 950.12 will be purchased. Additional account management fees may apply.

Top Positions (% TNA)

Introduction.

This factsheet contains information about the composition of the fund at a particular point in time. It aims to help you understand how the fund manager is positioned to achieve the fund’s objectives. The Top Allocations table shows the manager’s choice of investment disciplines, funds or other holdings. It includes cash held as a strategic investment. Investment disciplines includes the use of “pools”. For internal management purposes, Fidelity forms “pools” to co-manage assets from different funds. (These pools are not directly available to customers and do not constitute separate entities.) The Top Positions table shows the largest individual investments. For equities, all investments, including derivatives, linked to a particular issuing company have been combined to form a total percentage holding for each company. Where a company is listed in two separate countries, each listing may be classified as a separate issuing company. Fixed income investments are listed by individual issue (and not by issuer) to reflect the characteristics of the individual bonds. All derivatives are included on an exposure basis. Cash investments are not shown in the table.

Understanding share classes

Most Fidelity funds offer more than one share class to investors. Our share class guide provides an overview of the key factors you should consider when deciding which share class is most suitable. We hope you find this useful.

Exclusive for My Fidelity users

- Value-added information for professional investors

- Stay updated with latest fund related news

The fund aims to generate stable, natural income over a market cycle with low levels of volatiliy and is managed with a focus on mitigating capital losses. The fund follows a team approach with portfolio managers drawing upon the expertise of the broader multi asset team and Fidelity’s research capabilities. The fund is unconstrained and is managed actively with a flexible investment approach to navigate different market environments and deliver consistently on the objectives. It seeks to capture attractive income opportunities from a diversified range of traditional and alternative asset classes while managing risk and mitigating capital losses in volatile markets.

Important Information

The value of your investment may fall as well as rise and you may get back less than you originally invested. The use of financial derivative instruments may result in increased gains or losses within the fund. There is a risk that the issuers of bonds may not be able to repay the money they have borrowed or make interest payments. When interest rates rise, bonds may fall in value. Rising interest rates may cause the value of your investment to fall. The Investment Manager’s focus on securities of issuers which maintain favourable ESG characteristics or that are sustainable investments may affect the fund’s investment performance favourably or unfavourably in comparison to similar funds without such focus. When referring to sustainability – related aspects of the promoted fund, the decision to invest should take into account all characteristics or objectives of the promoted fund as detailed in the Prospectus. Information on sustainability-related aspects is provided pursuant to SFDR at https://www.fidelity.lu/sfdr-entity-disclosures .

Fund performance (USD)

Cumulative performance, quarterly performance, annual performance, performance for calendar years, volatility & risk (3 years), notes on portfolio data, morningstar style box™, top allocations (% tna), charges and expenses, objectives & investment policy.

Objective: The fund aims to achieve moderate capital growth over the medium to long term and provide income. Investment Policy: The fund invests in a range of asset classes Including debt securities, equities, real estate, infrastructure, from anywhere in the world, including emerging markets. The fund invests at least 50% of its assets in securities of issuers with favourable environmental, social and governance (ESG) characteristics. The fund may invest in the following assets according to the percentages indicated: investment grade bonds: up to 100% below investment grade bonds: up to 60% emerging market bonds: up to 50% equities: up to 50% government bonds: up to 50% China A and B shares and listed onshore bonds (directly and/or indirectly): less than 20% (in aggregate) eligible REITs and infrastructure securities: less than 30% (in each asset class) hybrids and contingent convertible (CoCo) bonds: less than 30%, with less than 20% in contingent convertible (CoCo) bonds money market instruments: up to 25% SPACs: less than 5%. The fund may also Invest in other subordinated financial debt and preference shares The fund’s exposure to distressed securities is limited to 10% of its assets. Investment Process: In actively managing the fund, the Investment Manager will allocate investments across asset classes and geographic areas based on their potential to generate income and capital growth or reduce overall risk. The fund’s income is mainly generated by dividend payments of equities and coupon payments of bonds. The Investment Manager also considers ESG characteristics when assessing investment risks and opportunities. In determining favourable ESG characteristics , the Investment Manager takes into account ESG ratings provided by Fidelity or external agencies. Through the investment management process, the Investment Manager aims to ensure that investee companies follow good governance practices. The fund adheres to the Fidelity Sustainable Investing Framework standards. For more information, see “Sustainable Investing and ESG Integration” and the Sustainability Annex. Derivatives and Techniques: The fund may use derivatives for hedging, efficient portfolio management and investment purposes. Benchmark: None.

Corporate documents

The fund promotes environmental or social characteristics, but does not have as its objective a sustainable investment. The fund promotes environmental and social characteristics by investing in securities of issuers with favourable ESG characteristics. Favourable ESG characteristics are determined by reference to ESG ratings. ESG ratings consider environmental characteristics including carbon intensity, carbon emissions, energy efficiency, water and waste management and biodiversity, as well as social characteristics including product safety, supply chain, health and safety and human rights. The fund partially intends to make sustainable investments. No reference benchmark has been designated for the purpose of attaining the environmental and social characteristics promoted. The fund will invest: (i) a minimum of 50% of its assets in issuers with favourable ESG characteristics; (ii) a minimum of 2% in sustainable investments of which a minimum of 0% have an environmental objective (which is aligned with the EU Taxonomy), a minimum of 1% have an environmental objective (which is not aligned with the EU Taxonomy) and a minimum of 1% have a social objective. In respect of its direct investments in corporate issuers, the fund is subject to: (a) a firm-wide exclusions list, which includes cluster munitions and anti-personnel landmines, and (b) norms-based screening of issuers which the investment manager considers have failed to conduct their business in accordance with international norms, including as set out in the UNGC. The above exclusions and screens (the “Exclusions”) may be updated from time to time. Attainment of the environmental or social characteristics promoted throughout the fund’s lifecycle is monitored on a daily basis, using Fidelity’s internal compliance monitoring system and the sustainability indicators are monitored by Fidelity’s sustainable investing team on a quarterly basis. Data is obtained from a combination of internal and external sources. Limitations in data availability or methodological challenges may constrain Fidelity’s ability to generate insights into an individual issuer’s contribution towards promotion of environmental or social characteristics. However, these challenges may be mitigated by issuer engagement and Fidelity do not expect these constraints to have a material impact on the fund’s ability to achieve the environmental or social characteristics promoted. Due diligence on underlying assets is carried out by reference to ESG ratings and engagement.

The fund promotes environmental or social characteristics, but does not have as its objective a sustainable investment.

What are the objectives of the sustainable investments that the financial product partially intends to make and how does the sustainable investment contribute to such objectives?

The fund determines a sustainable investment as follows: (a) issuers that undertake economic activities that contribute to one or more of the environmental objectives set out in the EU Taxonomy and qualify as environmentally sustainable in accordance with EU Taxonomy; or (b) issuers whereby the majority of their business activities (more than 50% of revenue) contribute to environmental or social objectives aligned with one or more of the United Nations Sustainable Development Goals (“SDGs”); or (c) issuers which have set a decarbonisation target consistent with a 1.5 degree warming scenario or lower (verified by the Science Based Target Initiative or a Fidelity Proprietary Climate Rating) which would be considered to contribute to environmental objectives; provided they do no significant harm, meet minimum safeguards and good governance criteria.

How do the sustainable investments that the financial product partially intends to make, not cause significant harm to any environmental or social sustainable investment objective?

Sustainable investments are screened for involvement in activities that cause significant harm and controversies, assessed through a check that the issuer meets minimum safeguards and standards that relate to principal adverse impacts (PAIs) as well as performance on PAI metrics. This includes: • Norms-based screens - the screening out of securities identified under Fidelity’s existing norms-based screening (as set out below); • Activity-based screens - the screening out of issuers based on their participation in activities with significant negative impacts on society or the environment, including issuers that are considered to have a ‘Very Severe’ controversy using controversy screens, covering 1) environmental issues, 2) human rights and communities, 3) labour rights and supply chain, 4) customers, 5) governance; and • PAI indicators - quantitative data (where available) on PAI indicators is used to evaluate whether an issuer is involved in activities that cause significant harm to any environmental or social objective.

How does this financial product take into account principal adverse impacts on sustainability factors?

For sustainable investments, as set out above, Fidelity undertakes a quantitative evaluation that identifies entities with challenging performance on PAI indicators. Issuers with a low score will be ineligible to be ‘sustainable investments’ unless Fidelity’s fundamental research determines that the issuer is not breaching “do no significant harm” requirements or is on the path to mitigate the adverse impacts through effective management or transition.

Are the sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights?

Norms-based screens are applied: Issuers identified as failing to behave in a way which meets their fundamental responsibilities in the areas of human rights, labour, environmental and anti-corruption as aligned with international norms including those set out by the OECD Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights, the UN Global Compact (UNGC) and the International Labour Organisation (ILO) Conventions, are not considered sustainable investments.

What are the environmental or social characteristics promoted by this financial product?

The fund promotes environmental and social characteristics by investing in securities of issuers with favourable ESG characteristics. Favourable ESG characteristics are determined by reference to ESG ratings. ESG ratings consider environmental characteristics including carbon intensity, carbon emissions, energy efficiency, water and waste management and biodiversity, as well as social characteristics including product safety, supply chain, health and safety and human rights. The fund partially intends to make sustainable investments. No reference benchmark has been designated for the purpose of attaining the environmental and social characteristics promoted.

What investment strategy does this financial product follow and how is the strategy implemented in the investment process on a continuous basis?

A minimum of 50% of the fund’s assets will be invested in securities with favourable ESG characteristics. Favourable ESG characteristics are determined by reference to ESG ratings provided by external agencies and Fidelity ESG ratings. Fidelity’s Multi Asset Research team aim to understand an individual manager’s approach to ESG by evaluating how far ESG considerations are integrated within the investment process and philosophy, the analyst’s financial analysis and the composition of the portfolio. They consider how ESG factors are integrated into the investment policy of the strategy, and, where proprietary ratings are used, how ESG research and output is evidenced in individual security weights and any applicable engagement and exclusion policies. The team consults a range of data sources, including Fidelity Sustainability Ratings as well as third-party data, in order to assess the ESG metrics of the relevant strategies. In respect of its direct investments in corporate issuers, the fund is subject to: 1. a firm-wide exclusions list, which includes cluster munitions and anti-personnel landmines, and 2. a norms-based screening of issuers which the Investment Manager considers have failed to conduct their business in accordance with international norms (as set out above). The above exclusions and screens (the “Exclusions”) may be updated from time to time. Please refer to the website for further information Sustainable investing framework (fidelityinternational.com). The Investment Manager also has discretion to implement enhanced, stricter sustainable requirements and exclusions from time to time.

What are the binding elements of the investment strategy used to select the investments to attain each of the environmental or social characteristics promoted by this financial product?

The fund will invest: (i) a minimum of 50% of its assets in issuers with favourable ESG characteristics, (ii) a minimum of 2% in sustainable investments of which a minimum of 0% have an environmental objective (which is aligned with the EU Taxonomy), a minimum of 1% have an environmental objective (which is not aligned with the EU Taxonomy) and a minimum of 1% have a social objective. In addition, the fund will systematically apply the Exclusions as described above.

What is the policy to assess good governance practices of the investee companies?

The governance practices of issuers are assessed using fundamental research, including Fidelity ESG Ratings, data regarding controversies and UN Global Compact violations. Key points that are analysed include track record of capital allocation, financial transparency, related party transactions, board independence and size, executive pay, auditors and internal oversight, minority shareholder rights, among other indicators.

Does this financial product consider principal adverse impacts on sustainability factors?

Consideration of the principal adverse impacts on sustainability factors of investment decisions (referred to as principal adverse impacts) is incorporated through a variety of tools, including: (i) Due Diligence - analysis of whether impacts on sustainability factors are material and negative. (ii) ESG rating - Fidelity references ESG ratings which incorporate consideration of material principal adverse impacts such as carbon emissions, employee safety and bribery and corruption, water management and, for sovereign issued securities, ratings used incorporate consideration of material principal adverse impacts such as carbon emissions, social violations and freedom of expression. (iii) Exclusions - When investing directly in corporate issuers, the fund applies the Exclusions (as defined below) to help mitigate the principal adverse impacts through excluding harmful sectors and prohibiting investment in issuers that breach international standards, such as the UNGC. (iv) Engagement - Fidelity uses engagement as a tool to better understand principal adverse impacts and, in some circumstances, advocate for mitigating the principal adverse impacts. Fidelity participates in relevant individual and collaborative engagements that target a number of principal adverse impacts (i.e. Climate Action 100+, Investors Against Slavery and Trafficking APAC). (v) Voting - Fidelity’s voting policy includes explicit minimum standards for board gender diversity and engagement with climate change for corporate issuers. Fidelity may also vote to help mitigate principal adverse impacts. (vi) Quarterly reviews - monitoring of principal adverse impacts through the fund’s quarterly review process. Fidelity takes into account specific indicators for each sustainability factor when considering whether investments have a principal adverse impact. These indicators are subject to data availability and may evolve with improving data quality and availability. Information on principal adverse impacts will be available in the annual report of the fund.

What is the planned asset allocation for this financial product?

(#1 Aligned with E/S characteristics) The fund will invest: 1. a minimum of 50% of its assets in securities of issuers with favourable ESG characteristics; 2. a minimum of 2% of its assets in sustainable investments (#1A sustainable) of which a minimum of of 0% have an environmental objective (which is aligned with the EU Taxonomy), a minimum of 1% have an environmental objective (which is not aligned with the EU Taxonomy) and a minimum of 1% have a social objective. (#1B Other E/S characteristics) Includes securities of issuers with favourable ESG characteristics but are not sustainable investments.

#1 Aligned with E/S characteristics includes the investments of the financial product used to attain the environmental or social characteristics promoted by the financial product.

#2 Other includes the remaining investments of the financial product which are neither aligned with the environmental or social characteristics, nor are qualified as sustainable investments.

The category #1 Aligned with E/S characteristics covers:

- The sub-category #1A Sustainable covers sustainable investments with environmental or social objectives.

- The sub-category #1B Other E/S characteristics covers investments aligned with the environmental or social characteristics that do not qualify as sustainable investments.

How does the use of derivatives attain the environmental or social characteristics promoted by the financial product?

Where the security underlying a derivative has favourable ESG characteristics in accordance with Fidelity's Sustainable Investing Framework, the derivative may be included in determining the proportion of the fund dedicated to promotion of environmental or social characteristics.

What is the minimum share of investments with an environmental objective aligned with the EU Taxonomy? (including what methodology is used for the calculation of the alignment with the EU Taxonomy and why; and what the minimum share of transitional and enabling activities)

The fund invests a minimum of 0% in sustainable investments with an environmental objective aligned with the EU Taxonomy. The compliance of the investments of the fund with the EU Taxonomy will not be subject to an assurance by auditors or a review by third parties. The EU Taxonomy alignment of the underlying investments of the fund is measured by turnover.

Does the financial product invest in fossil gas and/or nuclear energy-related activities that comply with the EU Taxonomy¹?

¹fossil gas and/or nuclear related activities will only comply with the eu taxonomy where they contribute to limiting climate change (“climate change mitigation”) and do not significantly harm any eu taxonomy objectives - see explanatory note in the left hand margin. the full criteria for fossil gas and nuclear energy economic activities that comply with the eu taxonomy are laid down in commission delegated regulation (eu) 2022/1214..

The two graphs below show in dark blue the minimum percentage of investments that are aligned with the EU Taxonomy. As there is no appropriate methodology to determine the Taxonomy-alignment of sovereign bonds*, the first graph shows the Taxonomy alignment in relation to all the investments of the financial product including sovereign bonds, while the second graph shows the Taxonomy alignment only in relation to the investments of the financial product other than sovereign bonds.

* For the purpose of these graphs, ‘sovereign bonds’ consist of all sovereign exposures

The fund invests a minimum of 0% in transitional activities and a minimum of 0% in enabling activities.

What is the minimum share of sustainable investments with an environmental objective that are not aligned with the EU Taxonomy?

The fund invests a minimum of 1% in sustainable investments with an environmental objective that is not aligned with the EU Taxonomy. Investments could be aligned with the EU Taxonomy but the Investment Manager is not currently in a position to specify the exact proportion of the fund’s underlying investments which take into account the EU criteria for environmentally sustainable economic activities. However, the position will be kept under review as the underlying rules are finalised and the availability of reliable data increases over time.

What is the minimum share of socially sustainable investments?

The fund invests a minimum of 1% in sustainable investments with a social objective.

What investments are included under “#2 Other”, what is their purpose and are there any minimum environmental or social safeguards?

The remaining investments of the fund which are not aligned with the favourable ESG characteristics, will be invested in accordance with the financial investment objective of the fund, or cash and cash equivalents for liquidity purposes and derivatives which may be used for investment and efficient portfolio management. As minimum environmental and social safeguard, all direct investments in corporate issuers will adhere to the Exclusions.

What sustainability indicators are used to measure the attainment of the environmental or social characteristics promoted by this financial product?

The fund uses the following sustainability indicators in order to measure the attainment of the environmental or social characteristics that it promotes: i) the percentage of the fund invested in securities of issuers with favourable ESG characteristics in accordance with Fidelity’s Sustainable Investing Framework; ii) in respect of its direct investments in corporate issuers, the percentage of the fund invested in securities of issuers with exposure to the Exclusions (defined below); iii) the percentage of the fund invested in sustainable investments; iv) the percentage of the fund invested in sustainable investments with an environmental objective in economic activities (that do not qualify as environmentally sustainable under the EU Taxonomy); and v) the percentage of the fund invested in sustainable investments with a social objective.

How are the environmental or social characteristics and the sustainability indicators monitored throughout the lifecycle of the financial product and the related internal/external control mechanism?

The portfolio compliance team monitors attainment of the environmental or social characteristics promoted throughout the fund’s lifecycle on a daily basis, using Fidelity’s internal compliance monitoring system. The sustainability indicators are monitored by Fidelity’s sustainable investing team on a quarterly basis. The fund’s periodic disclosures report on the extent to which the fund has attained the environmental or social characteristics promoted and the sustainability indicators during the period.

What is the methodology to measure the attainment of the environmental or social characteristics promoted by the financial product using the sustainability indicators?

The attainment of sustainability indicators is measured by Fidelity’s sustainable investing team on a quarterly basis, using data obtained from daily monitoring of the environmental or social characteristics promoted by the fund.

What are the data sources used to attain each of the environmental or social characteristics including the measures taken to ensure data quality, how data is processed and the proportion of data that is estimated?

Data Sources Data is obtained from a combination of internal and external sources. External sources include: MSCI and Factset that provide data on principal adverse impacts, controversy data and ESG ratings data; Institutional Shareholder Services (ISS) that provide carbon data, climate data and data on UN Global Compact violators; Moody’s that provide EU Taxonomy data. Internal sources include Fidelity Sustainability Ratings, which complement the third-party sourced ESG ratings and controversy data for exclusions and qualitative assessments. Measures taken to ensure data quality When a data provider is initially onboarded by Fidelity, an assessment of data quality and an evaluation of data samples is made. Fidelity assesses the quality of MSCI ESG ratings data on an ongoing daily basis, using broad statistics to check data points for accuracy and completeness. Fidelity also performs certain manual checks from time to time on externally sourced data. How data is processed Data is processed in accordance with applicable local laws on processing of data and in accordance with Fidelity’s policies on data processing. Proportion of data that is estimated Fidelity does not generally estimate data, although may do so in certain circumstances. External data providers may estimate data.

What are the limitations to the methodologies and data sources? (Including how such limitations do not affect the attainment of the environmental or social characteristics and the actions taken to address such limitations)

Limitations in data availability or methodological challenges may constrain Fidelity’s ability to generate insights into an individual issuer’s contribution towards promotion of environmental or social characteristics. The data used is in part provided by external data providers, which may apply different models and may contain inaccurate or incomplete data. In case of insufficient data, these data providers may rely on estimates and approximations using internal methodologies that may be subjective. These methodologies may also vary for each data provider. As the fund relies in part on this data when making investment decisions, it might have a negative impact on the performance of the fund. However, these challenges may be mitigated by issuer engagement and Fidelity do not expect these constraints to have a material impact on the fund’s ability to achieve the environmental or social characteristics. In addition, Fidelity continue to seek alternative data providers and aim to introduce additional proprietary tools to help bridge data gaps and to provide alternative insight into an issuers performance on sustainability issues and will continue to evolve Fidelity’s ESG ratings to reflect evolving best practice.

What is the due diligence carried out on the underlying assets and what are the internal and external controls in place?

Due diligence on underlying assets is carried out by reference to ESG ratings and engagement. (i) ESG ratings which incorporate analysis of the environmental and social characteristics of an issuer and consideration of material principal adverse impacts such as carbon emissions, employee safety and bribery and corruption, water management and, for sovereign issued securities, ratings used incorporate consideration of material principal adverse impacts such as carbon emissions, social violations and freedom of expression. Fidelity ESG ratings for each issuer are reviewed on an annual basis. (ii) Engagement - Fidelity uses engagement as a tool to better understand issuers and, in some circumstances, advocate for change. Fidelity participates in relevant individual and collaborative engagements that target a number of principal adverse impacts (i.e. Climate Action 100+, Investors Against Slavery and Trafficking APAC). The Sustainable Investing frameworks and activities are overseen by the Fidelity Sustainable Investing Operating Committee (the ‘SIOC’). The SIOC is responsible for setting the policies and objectives of Fidelity as they relate to sustainable investing and oversee the implementation and delivery of these policies and objectives. This committee is comprised of Fidelity senior executives from across Fidelity’s business units, including the Global Head of Stewardship and Sustainable Investing. In addition, the SIOC is responsible for the conduct, oversight and execution of Fidelity’s ownership rights in investee issuers, including engagement and proxy voting activities. The Fidelity Sustainable Investing frameworks and Fidelity ESG Ratings have been reviewed and validated by Fidelity internal risk and internal audit teams.

Is engagement part of the environmental or social investment strategy?

If so, what are the engagement policies (including any management procedures applicable to sustainability-related controversies in investee companies).

Engagement and voting form part of the fund’s consideration of principal adverse impacts on sustainability factors but are not part of the investment strategy. The Investment Manager’s Sustainable Investing Principles and Voting Policy sets out how it may integrate shareholder engagement in investment strategies. Engagements can be undertaken to gain a deeper understanding of an issuer’s sustainability and impact on environmental and social factors practices to better inform investment decisions and to use influence to improve the sustainability practices of issuers. The Investment Manager seeks to maintain an ongoing dialogue with management of issuers. Formal meetings are typically held with most issuers at least twice a year. In addition to these regular dialogues, there are a variety of other opportunities for ESG-focussed engagements including those in response to a controversy or adverse event, or if flagged for engagement during the Fidelity Sustainability Rating assessment process, a thematic engagement on a particular sustainable investing issue, in response to an issuer’s request for engagement on a specific governance or corporate event, or through involvement with a third-party engagement forum. Once the Investment Manager has identified an engagement opportunity, a constructive dialogue starts with issuers to explain the Investment Manager’s beliefs and expectations, and to encourage shifts in long term behaviour. The Investment Manager documents engagements with issuers in a centralised application platform, which is available to the entire investment team. Engagements can have various timeframes depending on the materiality and urgency of the topic in discussion. A lack of impact of the engagement can lead to a worsened Fidelity Sustainability Rating or lead to considerations around voting and divestment.

Has a reference benchmark been designated for the purpose of attaining these characteristics promoted by the financial product?

Date of initial publication: 01/01/2023 | Version 3 | Date of latest update: 07/02/2024

The periodic disclosure of the fund, as required under SFDR, is available as an appendix to the annual report here . This takes effect from the first publishing date in 2023.

We recommend that you obtain detailed information before taking any investment decision. Investments should be made on the basis of the current prospectus and key information document, which are available along with the current annual and semi-annual reports free of charge from our distributors and from our Service Centre in the United Kingdom.

Similar Funds

- FF - Global Multi Asset Defensive Fund A-ACC-USD

- FF - Global Multi Asset Dynamic Fund A-ACC-EUR

- FF - Global Multi Asset Dynamic Fund A-ACC-EUR (EUR/USD hedged)

- FF - Global Multi Asset Dynamic Fund A-ACC-USD

- FF - Global Multi Asset Dynamic Fund A-EUR

- FF - Global Multi Asset Dynamic Fund A-EUR (EUR/USD hedged)

- FF - Global Multi Asset Dynamic Fund A-USD

- FF - Global Multi Asset Dynamic Fund Y-ACC-EUR

- FF - Global Multi Asset Growth & Income Fund I-ACC-USD

- FF - Global Multi Asset Growth & Income Fund Y-ACC-USD

- FF - Global Multi Asset Growth & Income Fund Y-MCDIST(G)-USD

- FF - Global Multi Asset Income Fund A-ACC-EUR (hedged)

- FF - Global Multi Asset Income Fund A-ACC-USD (hedged)

- FF - Global Multi Asset Income Fund A-MCDIST(G)-USD

- FF - Global Multi Asset Income Fund A-MINC(G)-USD

- FF - Global Multi Asset Income Fund A-QINC(G)-EUR (hedged)

- FF - Global Multi Asset Income Fund I-ACC-EUR (hedged)

- FF - Global Multi Asset Income Fund I-ACC-USD

- FF - Global Multi Asset Income Fund I-EUR (EUR/USD hedged)

- FF - Global Multi Asset Income Fund Y-ACC-EUR (hedged)

- FF - Global Multi Asset Income Fund Y-ACC-USD

- FF - Global Multi Asset Income Fund Y-MINC(G)-GBP (GBP/USD hedged)

- FF - Global Multi Asset Income Fund Y-MINC(G)-USD

- FF - Global Multi Asset Income Fund Y-QINC(G)-EUR (hedged)

- FID FIF - Fidelity MoneyBuilder Balanced Fund A-INC-GBP

- FID FIF - Fidelity MoneyBuilder Balanced Fund W-ACC-GBP

- FID FIF - Fidelity MoneyBuilder Balanced Fund W-INC-GBP

- FID FIFIV - Fidelity Allocator World Fund W-ACC-GBP

- FID FIFIV - Fidelity Multi Asset Allocator Adventurous Fund W-ACC-GBP

- FID FIFIV - Fidelity Multi Asset Open Adventurous Fund A-ACC-GBP

- Mutual Funds

- SmartRetirement Funds

- 529 Portfolios

- Alternatives

- Separately Managed Accounts

- Money Market Funds

- Commingled Funds

- Featured Funds

Asset Class Capabilities

- Fixed Income

- Multi-Asset Solutions

- Global Liquidity

Investment Approach

- ETF Investing

- Model Portfolios

- Sustainable Investing

- Commingled Pension Trust Funds

Education Savings

- 529 Plan Solutions

- College Planning Essentials

Defined Contribution

- Target Date Strategies

- Startup and Micro 401(k) Plan Solutions

- Small to Mid-market 401(k) Plan Solutions

Market Insights

- Market Insights Overview

- Guide to the Markets

- Quarterly Economic & Market Update

- Guide to Alternatives

- Market Updates

- On the Minds of Investors

- Principles for Successful Long-Term Investing

- Weekly Market Recap

- 7 Essentials of ESG

Portfolio Insights

- Portfolio Insights Overview

- Asset Class Views

- Long-Term Capital Market Assumptions

- Multi-Asset Solutions Strategy Report

- Strategic Investment Advisory Group

Retirement Insights

- Retirement Insights Overview

- Guide to Retirement

- Principles for a Successful Retirement

Portfolio Construction

- Portfolio Construction Tools Overview

- Portfolio Analysis

- Investment Comparison

- Bond Ladder Illustrator

- Retirement Plan Tools & Resources Overview

- Target Date Compass®

- Core Menu Evaluator℠

- Price Smart℠

- Account Service Forms

- News & Fund Announcements

- Insights App

- Market Response Center

- Artificial Intelligence

- Diversity, Equity, & Inclusion

- How we invest

- Media Resources

- Our Leadership Team

- LinkedIn Twitter Facebook

Build stronger multi-asset portfolios

Since the launch of our first multi-asset fund in 1970, we have worked tirelessly to address our clients’ needs by creating portfolios that access the opportunities and overcome the challenges in an increasingly complex and interconnected world.

Our approach

We integrate the industry's foremost team of asset allocation specialists with the breadth and depth of J.P. Morgan's global investment platform - 500 investment strategies across asset classes, geographies and investment styles.

Specialist expertise, demonstrated results

Research Driven

Actively share in the expertise of our globally-integrated network of dedicated multi-asset investment specialists.

Actionable Insights

Be empowered to take better investment decisions by accessing our exclusive asset allocation and portfolio construction tools.

Outcome Oriented

Harness the power of our multi-asset investment strategies through a deep offering of portfolio solutions built around client needs.

Demonstrated Results

Capitalize on the track record of one of the world’s top multi-asset managers, backed by a 45-year history of leadership and innovation across market cycles.

Featured multi-asset solutions funds

Global allocation fund.

Designed to maximize long-term total return, pursuing opportunities worldwide.

Income Builder Fund

Designed to pursue attractive yield opportunities worldwide to increase income and total return potential.

SmartRetirement® Target Date Funds

Target date funds designed for real life. Built on real-life participant behaviors, the Funds are an all-in-one target date fund solution for any point of a participant’s retirement journey.

Model Portfolios by J.P. Morgan Let us build models while you build client relationships

Visit our Models Resource Center Explore our Models

Explore Other Asset Classes:

- Equity Funds

- Fixed Income Funds

- Alternatives Funds

TARGET DATE FUNDS: The JPMorgan SmartRetirement Blend Funds are target date funds with the target date being the approximate date when investors plan to retire. Generally, the asset allocation of each Fund will change on an annual basis with the asset allocation becoming more conservative as the Fund nears the target retirement date. The principal value of the Fund(s) is not guaranteed at any time, including at the target date.

*TDFs may suffer investment losses, including near and following retirement. There is no guarantee that a TDF will provide adequate retirement income.

There may be additional fees or expenses associated with investing in a Fund of Funds strategy. International investing has a greater degree of risk and increased volatility due to political and economic instability of some overseas markets. Changes in currency exchange rates and different accounting and taxation policies outside the U.S. can affect returns. Real estate funds may be subject to a higher degree of market risk because of concentration in a specific industry, sector or geographical sector. Real estate funds may be subject to risks including, but not limited to, declines in the value of real estate, risks related to general and economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrower. Securities rated below investment grade are considered "high-yield," "non-investment grade," "below investment-grade," or "junk bonds." They generally are rated in the fifth or lower rating categories of Standard & Poor's and Moody's Investors Service. Although they can provide higher yields than higher rated securities, they can carry greater risk. Investments in derivatives may be riskier than other types of investments. They may be more sensitive to changes in economic or market conditions than other types of investments. Derivatives may create leverage, which could lead to greater volatility and losses that significantly exceed the original investment.

- No services available for your region.

Terms and C o nditions for the Retail Informational Website for Hong Kong Special Administrative Region of the People's Republic of China ("Hong Kong")

This Website including without limitation the information, functions and documents herein (the “ Contents ”), are intended exclusively for investors residing in Hong Kong (“ Hong Kong Investors ”). It is your responsibility to be aware of, to obtain all relevant regulatory approvals, licences, verifications and/or registrations under, and to observe all applicable laws and regulations of any relevant jurisdiction in connection with your entrance to this website. This Website and its Contents are made available on a confidential basis, for informational purposes only (the “ Purpose ”) and for the exclusive use of Hong Kong Investors. You undertake to keep this Website and its Contents as confidential and not to circulate the link to this Website or otherwise disclose any Contents to any third party. This Website is owned by Goldman Sachs Asset Management (Hong Kong) Limited, which is licensed by the Securities and Futures Commission (“ SFC ”) in the Hong Kong Special Administrative Region of the People's Republic of China (" Hong Kong ") pursuant to the Securities and Futures Ordinance (“ SFO ”) (Cap 571) (CE no: BFK567). This Website is administered by various companies within the Goldman Sachs Group, which shall collectively hereinafter be referred to as the "Firm".

You must read these Terms and Conditions for your own protection and benefit. When you have read the Terms and Conditions and provided you are entitled to view this Website according to these Terms and Conditions and any applicable laws and regulations, please click on the button below to acknowledge that you have read, understood and accept the Terms and Conditions and to proceed to the main part of the Website. If you are not a Hong Kong Investor or its authorised representative or if you are not in compliance with any of the provisions contained in the Terms and Conditions, you must not access this Website. You hereby represent that you understand and acknowledge that failure to comply with these Terms and Conditions may result in irreparable injury to the Firm for which monetary damages alone may not be an adequate remedy. You hereby agree that in the event of non-compliance with these Terms and Conditions you will indemnify and hold the Firm harmless against any liabilities (including all costs of investigation and defence) and other damages arising from any breach by you or by any of your delegates of these Terms and Conditions and the Firm may be entitled to specific performance and injunctive or other equitable relief as a remedy in addition to and not in lieu of any appropriate relief in the way of monetary damages.

The Contents are not intended to be accessed or used by any person or entity in any country or jurisdiction where this access or use is illegal or where the Firm will be under a legal obligation to register shares of any collective investment scheme or any offering of such shares. It is your responsibility to observe all applicable laws and regulations of any relevant jurisdiction.

CONTENTS NOT TO BE CONSTRUED AS A SOLICITATION, A RECOMMENDATION OR ADVICE

The funds referred to in this Website are authorized by the SFC for sale to the public in Hong Kong (the “ Funds ”). The SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits or performances of the scheme. It does not mean that the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. The material contained in this Website has not been reviewed by the SFC or any regulatory authority in Hong Kong.

Investment involves risk and may lose value. If you are considering making an investment, you are advised to obtain your own independent professional advice and to carefully consider all relevant risk factors. The price of units or shares and the income from them in relation to any investment may go down as well as up and any past performance is not indicative of future performance. The Firm does not guarantee the performance of the Funds.

An investment in the Funds often involves investing in international markets. In addition to the normal risks associated with investing, international investments involve the risk of losing all or part of any capital from unfavourable fluctuations in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. An investment in emerging markets also involves heightened other risks such as increased volatility and the possibility of lower trading volume.

Important information about the Funds is contained in the prospectus for the Funds which is available upon request from the Firm. BEFORE ACQUIRING THE SHARES OF ANY FUNDS BY PURCHASE OR EXCHANGE, IT IS YOUR RESPONSIBILITY TO READ THE FUNDS’ PROSPECTUS OR OFFERING MATERIALS, INCLUDING THE RISK FACTORS.

The Contents do not constitute an invitation to invest or a public offer of securities in the U.S., Hong Kong or elsewhere. The Contents are provided exclusively for the Purpose, at the Hong Kong Investor's request and they have not been prepared as an offer to trade any particular security referred in the Contents.