Do Your Students Know How to Analyze a Case—Really?

Explore more.

- Case Teaching

- Student Engagement

J ust as actors, athletes, and musicians spend thousands of hours practicing their craft, business students benefit from practicing their critical-thinking and decision-making skills. Students, however, often have limited exposure to real-world problem-solving scenarios; they need more opportunities to practice tackling tough business problems and deciding on—and executing—the best solutions.

To ensure students have ample opportunity to develop these critical-thinking and decision-making skills, we believe business faculty should shift from teaching mostly principles and ideas to mostly applications and practices. And in doing so, they should emphasize the case method, which simulates real-world management challenges and opportunities for students.

To help educators facilitate this shift and help students get the most out of case-based learning, we have developed a framework for analyzing cases. We call it PACADI (Problem, Alternatives, Criteria, Analysis, Decision, Implementation); it can improve learning outcomes by helping students better solve and analyze business problems, make decisions, and develop and implement strategy. Here, we’ll explain why we developed this framework, how it works, and what makes it an effective learning tool.

The Case for Cases: Helping Students Think Critically

Business students must develop critical-thinking and analytical skills, which are essential to their ability to make good decisions in functional areas such as marketing, finance, operations, and information technology, as well as to understand the relationships among these functions. For example, the decisions a marketing manager must make include strategic planning (segments, products, and channels); execution (digital messaging, media, branding, budgets, and pricing); and operations (integrated communications and technologies), as well as how to implement decisions across functional areas.

Faculty can use many types of cases to help students develop these skills. These include the prototypical “paper cases”; live cases , which feature guest lecturers such as entrepreneurs or corporate leaders and on-site visits; and multimedia cases , which immerse students into real situations. Most cases feature an explicit or implicit decision that a protagonist—whether it is an individual, a group, or an organization—must make.

For students new to learning by the case method—and even for those with case experience—some common issues can emerge; these issues can sometimes be a barrier for educators looking to ensure the best possible outcomes in their case classrooms. Unsure of how to dig into case analysis on their own, students may turn to the internet or rely on former students for “answers” to assigned cases. Or, when assigned to provide answers to assignment questions in teams, students might take a divide-and-conquer approach but not take the time to regroup and provide answers that are consistent with one other.

To help address these issues, which we commonly experienced in our classes, we wanted to provide our students with a more structured approach for how they analyze cases—and to really think about making decisions from the protagonists’ point of view. We developed the PACADI framework to address this need.

PACADI: A Six-Step Decision-Making Approach

The PACADI framework is a six-step decision-making approach that can be used in lieu of traditional end-of-case questions. It offers a structured, integrated, and iterative process that requires students to analyze case information, apply business concepts to derive valuable insights, and develop recommendations based on these insights.

Prior to beginning a PACADI assessment, which we’ll outline here, students should first prepare a two-paragraph summary—a situation analysis—that highlights the key case facts. Then, we task students with providing a five-page PACADI case analysis (excluding appendices) based on the following six steps.

Step 1: Problem definition. What is the major challenge, problem, opportunity, or decision that has to be made? If there is more than one problem, choose the most important one. Often when solving the key problem, other issues will surface and be addressed. The problem statement may be framed as a question; for example, How can brand X improve market share among millennials in Canada? Usually the problem statement has to be re-written several times during the analysis of a case as students peel back the layers of symptoms or causation.

Step 2: Alternatives. Identify in detail the strategic alternatives to address the problem; three to five options generally work best. Alternatives should be mutually exclusive, realistic, creative, and feasible given the constraints of the situation. Doing nothing or delaying the decision to a later date are not considered acceptable alternatives.

Step 3: Criteria. What are the key decision criteria that will guide decision-making? In a marketing course, for example, these may include relevant marketing criteria such as segmentation, positioning, advertising and sales, distribution, and pricing. Financial criteria useful in evaluating the alternatives should be included—for example, income statement variables, customer lifetime value, payback, etc. Students must discuss their rationale for selecting the decision criteria and the weights and importance for each factor.

Step 4: Analysis. Provide an in-depth analysis of each alternative based on the criteria chosen in step three. Decision tables using criteria as columns and alternatives as rows can be helpful. The pros and cons of the various choices as well as the short- and long-term implications of each may be evaluated. Best, worst, and most likely scenarios can also be insightful.

Step 5: Decision. Students propose their solution to the problem. This decision is justified based on an in-depth analysis. Explain why the recommendation made is the best fit for the criteria.

Step 6: Implementation plan. Sound business decisions may fail due to poor execution. To enhance the likeliness of a successful project outcome, students describe the key steps (activities) to implement the recommendation, timetable, projected costs, expected competitive reaction, success metrics, and risks in the plan.

“Students note that using the PACADI framework yields ‘aha moments’—they learned something surprising in the case that led them to think differently about the problem and their proposed solution.”

PACADI’s Benefits: Meaningfully and Thoughtfully Applying Business Concepts

The PACADI framework covers all of the major elements of business decision-making, including implementation, which is often overlooked. By stepping through the whole framework, students apply relevant business concepts and solve management problems via a systematic, comprehensive approach; they’re far less likely to surface piecemeal responses.

As students explore each part of the framework, they may realize that they need to make changes to a previous step. For instance, when working on implementation, students may realize that the alternative they selected cannot be executed or will not be profitable, and thus need to rethink their decision. Or, they may discover that the criteria need to be revised since the list of decision factors they identified is incomplete (for example, the factors may explain key marketing concerns but fail to address relevant financial considerations) or is unrealistic (for example, they suggest a 25 percent increase in revenues without proposing an increased promotional budget).

In addition, the PACADI framework can be used alongside quantitative assignments, in-class exercises, and business and management simulations. The structured, multi-step decision framework encourages careful and sequential analysis to solve business problems. Incorporating PACADI as an overarching decision-making method across different projects will ultimately help students achieve desired learning outcomes. As a practical “beyond-the-classroom” tool, the PACADI framework is not a contrived course assignment; it reflects the decision-making approach that managers, executives, and entrepreneurs exercise daily. Case analysis introduces students to the real-world process of making business decisions quickly and correctly, often with limited information. This framework supplies an organized and disciplined process that students can readily defend in writing and in class discussions.

PACADI in Action: An Example

Here’s an example of how students used the PACADI framework for a recent case analysis on CVS, a large North American drugstore chain.

The CVS Prescription for Customer Value*

PACADI Stage

Summary Response

How should CVS Health evolve from the “drugstore of your neighborhood” to the “drugstore of your future”?

Alternatives

A1. Kaizen (continuous improvement)

A2. Product development

A3. Market development

A4. Personalization (micro-targeting)

Criteria (include weights)

C1. Customer value: service, quality, image, and price (40%)

C2. Customer obsession (20%)

C3. Growth through related businesses (20%)

C4. Customer retention and customer lifetime value (20%)

Each alternative was analyzed by each criterion using a Customer Value Assessment Tool

Alternative 4 (A4): Personalization was selected. This is operationalized via: segmentation—move toward segment-of-1 marketing; geodemographics and lifestyle emphasis; predictive data analysis; relationship marketing; people, principles, and supply chain management; and exceptional customer service.

Implementation

Partner with leading medical school

Curbside pick-up

Pet pharmacy

E-newsletter for customers and employees

Employee incentive program

CVS beauty days

Expand to Latin America and Caribbean

Healthier/happier corner

Holiday toy drives/community outreach

*Source: A. Weinstein, Y. Rodriguez, K. Sims, R. Vergara, “The CVS Prescription for Superior Customer Value—A Case Study,” Back to the Future: Revisiting the Foundations of Marketing from Society for Marketing Advances, West Palm Beach, FL (November 2, 2018).

Results of Using the PACADI Framework

When faculty members at our respective institutions at Nova Southeastern University (NSU) and the University of North Carolina Wilmington have used the PACADI framework, our classes have been more structured and engaging. Students vigorously debate each element of their decision and note that this framework yields an “aha moment”—they learned something surprising in the case that led them to think differently about the problem and their proposed solution.

These lively discussions enhance individual and collective learning. As one external metric of this improvement, we have observed a 2.5 percent increase in student case grade performance at NSU since this framework was introduced.

Tips to Get Started

The PACADI approach works well in in-person, online, and hybrid courses. This is particularly important as more universities have moved to remote learning options. Because students have varied educational and cultural backgrounds, work experience, and familiarity with case analysis, we recommend that faculty members have students work on their first case using this new framework in small teams (two or three students). Additional analyses should then be solo efforts.

To use PACADI effectively in your classroom, we suggest the following:

Advise your students that your course will stress critical thinking and decision-making skills, not just course concepts and theory.

Use a varied mix of case studies. As marketing professors, we often address consumer and business markets; goods, services, and digital commerce; domestic and global business; and small and large companies in a single MBA course.

As a starting point, provide a short explanation (about 20 to 30 minutes) of the PACADI framework with a focus on the conceptual elements. You can deliver this face to face or through videoconferencing.

Give students an opportunity to practice the case analysis methodology via an ungraded sample case study. Designate groups of five to seven students to discuss the case and the six steps in breakout sessions (in class or via Zoom).

Ensure case analyses are weighted heavily as a grading component. We suggest 30–50 percent of the overall course grade.

Once cases are graded, debrief with the class on what they did right and areas needing improvement (30- to 40-minute in-person or Zoom session).

Encourage faculty teams that teach common courses to build appropriate instructional materials, grading rubrics, videos, sample cases, and teaching notes.

When selecting case studies, we have found that the best ones for PACADI analyses are about 15 pages long and revolve around a focal management decision. This length provides adequate depth yet is not protracted. Some of our tested and favorite marketing cases include Brand W , Hubspot , Kraft Foods Canada , TRSB(A) , and Whiskey & Cheddar .

Art Weinstein , Ph.D., is a professor of marketing at Nova Southeastern University, Fort Lauderdale, Florida. He has published more than 80 scholarly articles and papers and eight books on customer-focused marketing strategy. His latest book is Superior Customer Value—Finding and Keeping Customers in the Now Economy . Dr. Weinstein has consulted for many leading technology and service companies.

Herbert V. Brotspies , D.B.A., is an adjunct professor of marketing at Nova Southeastern University. He has over 30 years’ experience as a vice president in marketing, strategic planning, and acquisitions for Fortune 50 consumer products companies working in the United States and internationally. His research interests include return on marketing investment, consumer behavior, business-to-business strategy, and strategic planning.

John T. Gironda , Ph.D., is an assistant professor of marketing at the University of North Carolina Wilmington. His research has been published in Industrial Marketing Management, Psychology & Marketing , and Journal of Marketing Management . He has also presented at major marketing conferences including the American Marketing Association, Academy of Marketing Science, and Society for Marketing Advances.

Related Articles

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Should a Company Reveal That it is Evaluating “Strategic Alternatives”?

Seeking “strategic alternatives” is industry jargon for considering a potential sale or merger. During this process, the company gauges interest from potential acquirers. From 1990 to 2018, there were more than 1,200 announcements made by public companies revealing that they were reviewing strategic alternatives (examples here and here ). Before deciding whether to disclose this information voluntarily, via a press release or SEC disclosure, executives or directors may ask: what are the costs and benefits of making the strategic alternatives process publicly known? Because an evaluation of strategic alternatives does not constitute a mandatory disclosure , the other option is to keep the process undisclosed until a deal, if any, materializes, and must then be announced.

In my paper , Economic Consequences of Announcing Strategic Alternatives , I analyze attributes of these corporate disclosures and their implications for the company’s operations, information environment, future mergers and acquisitions (M&A) sales process, and short-term and long-term share prices. This article explores the four key takeaways from this study.

Takeaway #1: Companies’ public announcements regarding strategic alternatives often contain common key phrases and details. These announcements generate 5.4% stock returns on average (measured over a 3-day window) and lead to subsequent offers and completed sales 41% and 32% of the time. However, certain key phrases signal deviations from these “average” occurrences.

82% of the announcements analyzed mention the retention of financial and/or legal advisors , and may specifically name the firms. Investors react to such announcements with stock returns that are 4.4% higher.

65% of the announcements analyzed specifically mention the sale of the company as an alternative under consideration. Announcements that contain this specific alternative generate returns that are 3.4% higher and are associated with a greater probability of being acquired.

63% of the announcements analyzed state that the company is seeking strategic alternatives to maximize or enhance shareholder value . Investors react to announcements containing such phrases with returns that are 2.5% higher.

Other common features of companies’ announcements include: a direct quote from an executive, director, or other company spokesperson explaining why the company is seeking strategic alternatives; mentioning that the directors have formed a special committee to oversee the strategic alternatives process; bundling the announcement with an earnings report and earnings guidance ; mentioning that an activist investor called for the company’s evaluation of strategic alternatives.

Takeaway #2: The benefits of publicly announcing the evaluation of strategic alternatives include heightened market attention from investors and a more robust M&A sales process, eventually leading to a greater probability of receiving an offer and consummating a transaction.

41% of strategic alternatives announcements are followed by an M&A offer within a year, representing an increased probability of about 34% over the baseline 7% probability of receiving an offer.

32% of strategic alternatives announcements are followed by a completed transaction within a year, representing an increased probability of about 27% over the baseline 5% probability of being sold.

The reason why strategic alternatives announcements lead to more successful M&A outcomes is because the news (public, in nature) reaches more market participants and potential suitors. The evidence in the study is consistent with this hypothesized reason: the announcement leads to increased downloads of the announcing company’s SEC filings, more M&A bids submitted for the company, a more diverse group of bidders (i.e., from different industries than the announcing company’s), and the timelier receipt of an offer. All these characteristics indicate a more robust M&A sales process, where all potential bidders are made aware of the company putting itself up for sale, so that the most ideal suitor and offer emerges in a timely fashion.

Takeaway #3: The costs of a public strategic alternatives process include increased disruption to the core business operations and seeding a negative public perception that alienates relationships with stakeholders such as customers and employees.

Financial performance—as measured by return on assets, operating income, and their seasonal changes—is abnormally lower in the first full fiscal quarter following the announcement of strategic alternatives. This occurs because managing a strategic alternatives process is a major distraction for executives and managers from running the business; since the public announcement generates greater attention and more inquiries, the distraction and disruption is greater as well.

In addition, the study finds that sales revenue, its seasonal change, employee headcount, and its annual change are abnormally lower following the announcement of strategic alternatives. This suggests that the company’s stakeholders see an announcement of strategic alternatives as a public admission of business problems. Companies seek strategic alternatives when the trajectory of the current stand-alone business strategy is troublesome—the company is essentially admitting that greater shareholder value could be achieved by selling the business than from continuing to run it. If a company makes its strategic alternatives evaluation publicly known, customers are likely to disengage with a company whose product offerings and customer service they perceive to be on the decline or about to cease altogether given a perceived future change in control. Similarly, employees feel that a potential change in control threatens their job security and employment conditions and thus are less focused and productive. In some cases, they may even leave the company.

Takeaway #4: Companies may conduct a cost-benefit analysis of making the public disclosure by looking at the impact of the announcement’s costs and benefits on long-term shareholder value.

For the sample as a whole, the negative effects of the announcement (e.g., worse business operations in takeaway #3 above) hinder one-year returns by about −19%. [1] However, if the company announces and is successful at getting acquired, the negative valuation consequence is offset by the valuation benefit from disclosure (e.g., increased probability of getting acquired and receiving a higher takeover premium from the ideal acquirer in takeaway #2 above). Thus, the acquired company nets about 9% higher shareholder returns from making the public announcement. However, most announcing companies are not eventually acquired. Therefore, the typical company is more likely to suffer the valuation consequences without being able to capture the benefit. Hence, the unconditional average long-run valuation effect from announcing is about −5%.

Effect of the announcement on shareholder value

Figure (a):

Effect of the announcement on shareholder value — partitioned by subsequent takeover status

Figure (b):

Effect of the public announcement on shareholder value . Stock returns are measured over trading days [-10, +252] relative to the announcement, and the market return has been subtracted from all lines. Figure (a) : The solid line depicts the mean stock returns of companies that announced they are seeking strategic alternatives. The dashed line represents the counterfactual returns estimated using peer firms with similar characteristics, but that did not announce. Figure (b) : The stock returns are separately presented for the subset of firms that are subsequently acquired, in green, or are not acquired, in orange. As in figure (a), the solid lines depict the mean returns of announcing companies, and the dashed lines represent the counterfactual returns estimated from non-announcing peer firms.

While the study presents quantitative estimates of the valuation consequences of disclosure for the sample as a whole, individual companies should conduct assessments of their unique costs and benefits from publicly disclosing their strategic alternatives process. Considerations of the announcement’s costs involve estimating the destruction of shareholder value from disrupting business operations and alienating stakeholders such as employees and customers. The resulting dysfunction may be less severe for a company that can shield the core business operations from the strategic alternatives evaluation process (e.g., segregating key employees’ duties) and can effectively manage communications with key stakeholders about the company’s continued dedication to its existing products and customer service (for customers) and corporate organization and culture (for employees). Considerations of the disclosure’s benefits involve an honest assessment of the increased probability of the transaction as a result of publicizing the strategic alternatives evaluation, and of the increased takeover premium that could be captured by shareholders from the ideal acquirer. A company that operates in a well-known industry with fewer players may be able to contact all potential buyers without a public announcement, and in this case, the benefit of disclosure may be limited.

As the four takeaways above described, this study documents various costs and benefits to a company of publicly announcing that it is seeking a potential sale or merger (“strategic alternatives”) and the impact of announcing on short-term and long-term shareholder value. A firm’s decision to announce causes costly disruptions to the business operations and stakeholder relationships which erode firm value. On the other hand, the announcement improves market attention to the company which may increase takeover-related gains to shareholders (if the company is subsequently acquired) and offset the costs.

The findings of this research are important because they provide 1) evidence of various channels between a disclosure choice and shareholder value; 2) separate, offsetting estimates of the disclosure’s costs and benefits affecting firm value; and 3) key considerations to investors and company decision makers who would face the consequences of this disclosure decision.

J enny Zha Giedt is an Assistant Professor at the George Washington University School of Business.

This post is adapted from her paper, “ Economic Consequences of Announcing Strategic Alternatives ” , available on SSRN .

[1] For simplicity, the percentages presented in this article are point estimates, whereas the study presents a range of magnitudes estimated from various model specifications.

3 thoughts on “ Should a Company Reveal That it is Evaluating “Strategic Alternatives”? ”

Hello Jenny!

It’s always a question to be – or not to be. Even when it comes to M&A, there’s no definitive answer about how a given company should play the game. It’s good to see that you’ve disclosed the advantages of disclosing the process of seeking strategic alternatives, as well as its downsides. In the end of the day, one should make the right decision, and being right does not always mean “easy”.

Thanks for your comment Marina. You’re absolutely correct in that the cost-benefit analysis of whether/how much to disclose is going to vary based on the individual company’s unique circumstances.

There are many considerations involved, and a few questions strategic leadership can ask themselves are: 1. Are there many potential acquirers from various industries that may emerge following a public announcement of my company’s search for strategic alternatives, or can I rely on my financial advisor to identify and contact substantially all of the potential suitors? 2. How confident am I in the company culture that employees will not be disrupted or tempted to jump ship if they are aware that the company is evaluating strategic alternatives? 3. Are customers likely to transfer to a competitor’s services if they hear that my company is seeking a merger, or are they unperturbed by a potential transaction?

Is a company CEO bound by silence during the SR process? What can he/she say while it is ongoing?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Examples of Strategic Alternatives

- Small Business

- Business Planning & Strategy

- Market Pricing Strategies

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Examples of Strategic Change

What could make a hostile takeover difficult, do two companies cease to exist in a merger.

- What Does Franchising Mean?

- What Will Happen to Common Stock Shares When a Company Comes Out of Chapter 11 Bankruptcy?

Strategic alternatives are strategies that a business develops to set the direction, for which human and material resources will be applied, for a greater chance of achieving selected goals, notes iEduNote. Generally, a company develops strategic alternatives when it's struggling and seeking a new direction to increase profits, or even simply to save itself from dissolution or bankruptcy.

A Floundering Company

The term strategic alternatives is somewhat of a code word for a company trying to put itself up for sale, says Mike Krantz of "USA Today," adding:

"Typically, when a company’s management or its investors think the firm needs to restructure itself in a radical way, it will announce that it’s looking for alternatives. That might involve selling the company to a competitor that can find efficiency or taking the company private by selling to private investors or the management."

Krantz says that companies generally take some time to fall to this point. He gives the example of retailer Aeropostale, which had stated it was looking for strategic alternatives in 2015. The company's stock plunged in 2016 when it appeared that the trendy teen-centered clothing store would fold if it didn't find investors to come to the rescue. The company did eventually declare bankruptcy, but investors came to the rescue with a "strategic alternative" plan of their own. Vicki M. Young, writing on WWD, explains:

"Just when it looked like it was game over for the teen retailer, ABG ... stepped in to lead a consortium to acquire Aéropostale for $243.3 million as a going concern. The consortium included mall landlords Simon Property Group and General Growth Properties. "

The chain soon reopened 500 stores in 2017, with the new owners saying they would roll out a grand marketing campaign, showcasing the brand’s positioning under new owner Authentic Brands Group. Nick Woodhouse, ABG’s president and chief marketing officer, explained his firm's new vision for the clothing chain:

“Aéropostale’s DNA is inherently free-spirited and appeals to a young audience who seek brands that deliver authenticity.”

Woodhouse explained that his company planned to revitalize the brand, so it again would embrace its "core youthful and aspirational energy." This is, of course, an extreme case of a "strategic alternative" – in which a company goes bankrupt and new owners take over – but the term does generally refer to friendly investors coming to the rescue of a flailing company, bringing with them fresh ideas, and usually plenty of cash.

Other Examples of Strategic Alternatives

There are actually six examples of strategic alternatives, says Dr. M. Thenmozhi, a professor in the Department of Management Studies at Indian Institute of Technology, Madras Chennai, a public engineering college in Southern India. Thenmozhi lists these examples of strategic alternatives:

- Concentration , such as vertical or horizontal growth

- Diversification , such as concentric or conglomerate

- Stability , which involves following a steady course and trying to maintain profits

- Divestiture/sale

- Liquidation

Aeropostale is an example of the last three strategic alternatives on this list. As "USA Today's" Krantz noted, the business hoped for a turnaround. That, of course, did not happen under the current management. They seemed headed for liquidation via the bankruptcy, but in the end, the clothing chain found itself the target of what was essentially a sale through bankruptcy court. The new owners did achieve a turnaround. As of June 1, 2018, the chain has more than 21,000 employees working at hundreds of stores worldwide. So, this was a strategic alternative that clearly worked, albeit with new leadership.

The first three examples of strategic alternatives on the above list are, to a lesser degree, examples of companies that are struggling, and seeking alternatives that will help them survive. Concentration, as a strategic alternative, means that the company is ready to throw off many of its diversified holdings, so that it can concentrate on its core business.

Diversification is just the opposite: it indicates that a company is suffering from falling sales and/or profits, and hopes to link up with other businesses to increase its bottom line. Stability, as a strategic alternative, is the least likely path for a company. By definition, if a company is doing well, if sales are booming or if customers are clamoring for its services, it would not need a strategic alternative.

So, if you see the term "strategic alternative" or you hear that a company is looking at "strategic alternatives," you know that the firm in question is almost certainly floundering: Its core business is not doing well, so it is looking for a way – any way – to climb out of a sinking hole; hence, the term strategic alternative. A company that's strong, is selling its products, and is well-connected to its customers, does not need a strategic alternative to survive and flourish.

- USA Today: Ask Matt: What are 'strategic alternatives?'

- SlideShare: Strategic Management and Strategic Alternatives

- iEduNote: Strategic Alternatives Types in Strategic Planning

- Aeropostale: Company Website

- National Programme on Technology Enhanced Learning (NPTEL): Types of Strategies

- WWD: Aéropostale Reopens 500-Plus Doors

Leon Teeboom has written for such newspapers as "The Los Angeles Times" and "The Orange County Register." He has also written for/and worked as an editor at "The Press-Enterprise" as well as two business publications and several online media companies.

Related Articles

Corporate life cycle strategy, why do businesses consolidate, what happens to a stock when a company is bought out, the disadvantages of expanding a business, the advantages of taking over companies, what is the meaning of strategic intent, what happens to stockholders when a business is merged, examples of a business plan exit strategy, what is the first step in the comprehensive strategic-management model, most popular.

- 1 Corporate Life Cycle Strategy

- 2 Why Do Businesses Consolidate?

- 3 What Happens to a Stock When a Company Is Bought Out?

- 4 The Disadvantages of Expanding a Business

What is Strategic Analysis? 8 Best Strategic Analysis Tools + Examples

A huge part of developing a strategic plan is a reliable, in-depth strategic analysis. An organization is separated into internal and external environments. Both components should be scrutinized to identify factors influencing organizations and guiding decision-making.

In this article, we'll cover:

What Is Strategic Analysis?

Types of strategic analysis, benefits of strategic analysis for strategy formulation, strategic analysis example - walmart, how to do a strategic analysis: key components, strategic analysis tools, how to choose the right strategic analysis tool, the next step: from analysis to action with cascade 🚀.

⚠️ Remember, insights aren't enough! Understanding your internal & external environment is vital, but true strategy comes from action. Cascade Strategy Execution Platform bridges the gap between analysis and execution. Talk to our strategy experts to turn your strategic analysis into a winning roadmap with clear goals and measurable results.

Strategic analysis is the process of researching and analyzing an organization along with the business environment in which it operates to formulate an effective strategy. This process of strategy analysis usually includes defining the internal and external environments, evaluating identified data, and utilizing strategic analysis tools.

By conducting strategic analysis, companies can gain valuable insights into what's working well and what areas need improvement. These valuable insights become key inputs for the strategic planning process , helping businesses make well-informed decisions to thrive and grow.

When it comes to strategic analysis, businesses employ different approaches to gain insights into their inner workings and the external factors influencing their operations.

Let's explore two key types of strategic analysis:

Internal strategic analysis

The focus of internal strategic analysis is on diving deep into the organization's core. It involves a careful examination of the company's strengths, weaknesses, resources, and competencies. By conducting a thorough assessment of these aspects, businesses can pinpoint areas of competitive advantage, identify potential bottlenecks, and uncover opportunities for improvement.

This introspective analysis acts as a mirror , reflecting the organization's current standing, and provides valuable insights to shape the path that will ultimately lead to achieving its mission statement.

External strategic analysis

On the other hand, external strategic analysis zooms out to consider the broader business environment. This entails conducting market analysis, trend research, and understanding customer behaviors, regulatory changes, technological advancements, and competitive forces. By understanding these external dynamics, organizations can anticipate potential threats and uncover opportunities that can significantly impact their strategic decision-making.

The external strategic analysis acts as a window , offering a view of the ever-changing business landscape.

The analysis phase sets “the stage” for your strategy formulation.

The strategic analysis informs the activities you undertake in strategic formulation and allows you to make informed decisions. This phase not only sets the stage for the development of effective business planning but also plays a crucial role in accurately framing the challenges to be addressed.

These are some benefits of strategic analysis for strategy formulation:

- Holistic View : Gain a comprehensive understanding of internal capabilities, the external landscape, and potential opportunities and threats.

- Accurate Challenge Framing : Identify and define core challenges accurately, shaping the strategy development process.

- Proactive Adaptation : Anticipate potential bottlenecks and areas for improvement, fostering proactive adaptability.

- Leveraging Strengths : Develop strategies that maximize organizational strengths for a competitive advantage.

At the very least, the right framing can improve your understanding of your competitors and, at its best, revolutionize an industry. For example, everybody thought that the early success of Walmart was due to Sam Walton breaking the conventional wisdom:

“A full-line discount store needs a population base of at least 100,000.”

But that’s not true.

Sam Walton didn’t break that rule, he redefined the idea of the “store,” replacing it with that of a “network of stores.” That led to reframing conventional wisdom, developing a coherent strategy, and revolutionizing an industry.

📚 Check out our #StrategyStudy: How Walmart Became The Retailer Of The People

%20(1).jpg)

Strategy is not a linear process.

Strategy is an iterative process where strategic planning and execution interact with each other constantly.

First, you plan your strategy, and then you implement it and constantly monitor it. Tracking the progress of your initiatives and KPIs (key performance indicators) allows you to identify what's working and what needs to change. This feedback loop guides you to reassess and readjust your strategic plan before proceeding to implementation again. This iterative approach ensures adaptability and enhances the strategy's effectiveness in achieving your goals.

Strategic planning includes the strategic analysis process.

The content of your strategic analysis varies, depending on the strategy level at which you're completing the strategic analysis.

For example, a team involved in undertaking a strategic analysis for a corporation with multiple businesses will focus on different things compared to a team within a department of an organization.

But no matter the team or organization's nature, whether it's a supply chain company aiming to enhance its operations or a marketing team at a retail company fine-tuning its marketing strategy, conducting a strategic analysis built on key components establishes a strong foundation for well-informed and effective decision-making.

The key components of strategic analysis are:

Define the strategy level for the analysis

- Complete an internal analysis

- Complete an external analysis

Unify perspectives & communicate insights

%20(1).jpg)

Strategy comes in different levels depending on where you are in an organization and your organization's size.

You may be creating a strategy to guide the direction of an entire organization with multiple businesses, or you may be creating a strategy for your marketing team. As such, the process will differ for each level as there are different objectives and needs.

The three strategy levels are:

- Corporate Strategy

- Business Strategy

- Functional Strategy

👉🏻If you're not sure which strategy level you're completing your strategy analysis for, read this article explaining each of the strategy levels .

Conduct an internal analysis

As we mentioned earlier, an internal analysis looks inwards at the organization and assesses the elements that make up the internal environment. Performing an internal analysis allows you to identify the strengths and weaknesses of your organization.

Let's take a look at the steps involved in completing an internal analysis:

1. Assessment of tools to use

First, you need to decide what tool or framework you will use to conduct the analysis.

You can use many tools to assist you during an internal analysis. We delve into that a bit later in the article, but to give you an idea, for now, Gap Analysis , Strategy Evaluation , McKinsey 7S Model , and VRIO are all great analysis techniques that can be used to gain a clear picture of your internal environment.

2. Research and collect information

Now it’s time to move into research . Once you've selected the tool (or tools) you will use, you will start researching and collecting data.

The framework you use should give you some structure around what information and data you should look at and how to draw conclusions.

3. Analyze information

The third step is to process the collected information. After the data research and collection stage, you'll need to start analyzing the data and information you've gathered.

How will the data and information you've gathered have an impact on your business or a potential impact on your business? Looking at different scenarios will help you pull out possible impacts.

4. Communicate key findings

The final step of an internal analysis is sharing your conclusions . What is the value of your analysis’ conclusions if nobody knows about them?

You should be communicating your findings to the rest of the team involved in the analysis and go even further. Share relevant information with the rest of your people to demonstrate that you trust them and offer context to your decisions.

Once the internal analysis is complete , the organization should have a clear idea of where they're excelling, where they're doing OK, and where current deficits and gaps lie.

The analysis provides your leadership team with valuable insights to capitalize on strengths and opportunities effectively. It also empowers them to devise strategies that address potential threats and counteract identified weaknesses.

Beginning strategy formulation after this analysis will ensure your strategic plan has been crafted to take advantage of strengths and opportunities and offset or improve weaknesses & threats. This way, the strategic management process remains focused on the identified priorities, enabling a well-informed and proactive approach to achieving your organizational goals.

You can then be confident that you're funneling your resources, time, and focus effectively and efficiently.

Conduct an external analysis

As we stated before, the other type of strategic analysis is the external analysis which looks at an organization's environment and how those environmental factors currently impact or could impact the organization.

A key difference between the external and the internal factors lies in the organization's level of control.

Internally, the organization wields complete control and can actively influence these factors. On the other hand, external components lie beyond the organization's direct control, and the focus is on scanning and reacting to the environment rather than influencing it.

External factors of the organization include the industry the organization competes in, the political and legal landscape the organization operates in, and the communities they operate in.

The steps for conducting an external analysis are much the same as an internal analysis:

- Assessment of tools to use

- Research and collect information

- Analyze information

- Communicate key findings

You'll want to use a tool such as SWOT analysis , PESTLE analysis , or Porter's Five Forces to help you add some structure to your analysis. We’ll dive into the tools in more detail further down this article!

Chances are, you didn't tackle the entire analysis alone. Different team members likely took responsibility for specific parts, such as the internal gap analysis or external environmental scan. Each member contributed valuable insights, forming a mosaic of information.

To ensure a comprehensive understanding, gather feedback from all team members involved. Collate all the data and share the complete picture with relevant stakeholders across your organization.

Much like strategy, this information is useless if not shared with everyone.

Remember : There is no such thing as overcommunication.

If you have to keep only one rule of communication, it’s that one. Acting on the insights and discoveries distilled from the analysis is what gives them value. Communicating those findings with your employees and all relevant (internal and external) stakeholders enables acting on them.

Setting up a central location where everyone can access the data should be your first step, but it shouldn't end there. Organize a meeting to go through all the key findings and ensure everyone is on the same page regarding the organization's environment.

There are a number of strategic analysis tools at your disposal. We'll show you 8 of the best strategic analysis tools out there.

.jpg)

The 8 best strategic analysis tools:

Gap analysis, vrio analysis, four corners analysis, value chain analysis.

- SWOT Analysis

Strategy Evaluation

Porter's five forces, pestel analysis.

Note: Analytical tools rely on historical data and prior situations to infer future assumptions. With this in mind, caution should always be used when making assumptions based on your strategic analysis findings.

The Gap Analysis is a great internal analysis tool that helps you identify the gaps in your organization, impeding your progress towards your objectives and vision.

The analysis gives you a process for comparing your organization's current state to its desired future state to draw out the current gaps, which you can then create a series of actions that will bridge the identified gap.

The gap analysis approach to strategic planning is one of the best ways to start thinking about your goals in a structured and meaningful way and focuses on improving a specific process.

👉 Grab your free Gap Analysis template to streamline the process!

The VRIO Analysis is an internal analysis tool for evaluating your resources.

It identifies organizational resources that may potentially create sustainable competitive advantages for the organization. This analysis framework gives you a process for categorizing the resources in your organization based on whether they hold certain traits: Valuable, Rare, Inimitable, and Organized.

The framework then encourages you to begin thinking about moving those resources to the “next step'' to ultimately develop those resources into competitive advantages.

👉 Grab your free VRIO strategy template that will help you to develop and execute a strategy based on your VRIO analysis.

The Four Corners Analysis framework is another internal analysis tool that focuses on your organization's core competencies.

However, what differentiates this tool from the others is its long-term focus. To clarify, most of the other tools evaluate the current state of an entity, but the Four Corners Analysis assesses the company’s future strategy, which is more precise because it makes the corporation one step ahead of its competitors.

By using the Four Corners, you will know your competitors’ motivation and their current strategies powered by their capabilities. This analysis will aid you in formulating the company’s trend or predictive course of action.

Similar to VRIO, the Value Chain Analysis is a great tool to identify and help establish a competitive advantage for your organization.

The Value Chain framework achieves this by examining the range of activities in the business to understand the value each brings to the final product or service.

The concept of this strategy tool is that each activity should directly or indirectly add value to the final product or service. If you are operating efficiently, you should be able to charge more than the total cost of adding that value.

A SWOT analysis is a simple yet ridiculously effective way of conducting a strategic analysis.

It covers both the internal and external perspectives of a business.

When using SWOT, one thing to keep in mind is the importance of using specific and verifiable statements. Otherwise, you won’t be able to use that information to inform strategic decisions.

👉 Grab your free SWOT Analysis template to streamline the process!

Generally, every company will have a previous strategy that needs to be taken into consideration during a strategic analysis.

Unless you're a brand new start-up, there will be some form of strategy in the company, whether explicit or implicit. This is where a strategy evaluation comes into play.

The previous strategy shouldn't be disregarded or abandoned, even if you feel like it wasn't the right direction or course of action. Analyzing why a certain direction or course of action was decided upon will inform your choice of direction.

A Strategic Evaluation looks into the strategy previously or currently implemented throughout the organization and identifies what went well, what didn't go so well, what should not have been there, and what could be improved upon.

👉To learn more about this analysis technique, read our detailed guide on how to conduct a comprehensive Strategy Evaluation .

Complementing an internal analysis should always be an analysis of the external environment, and Porter's Five Forces is a great tool to help you achieve this.

Porter's Five Forces framework performs an external scan and helps you get a picture of the current market your organization is playing in by answering questions such as:

- Why does my industry look the way it does today?

- What forces beyond competition shape my industry?

- How can I find a position among my competitors that ensures profitability?

- What strategies can I implement to make this position challenging for them to replicate?

With the answer to the above questions, you'll be able to start drafting a strategy to ensure your organization can find a profitable position in the industry.

👉 Grab your free Porter’s 5 Forces template to implement this framework!

We might sound repetitive, but external analysis tools are critical to your strategic analysis.

The environment your organization operates in will heavily impact your organization's success. PESTEL analysis is one of the best external analysis tools you can use due to its broad nature.

The name PESTEL is an acronym for the elements that make up the framework:

- Technological

- Environmental

Basically, the premise of the analysis is to scan each of the elements above to understand the current status and how they can potentially impact your industry and, thus, your organization.

PESTEL gives you extra focus on certain elements that may have a wide-ranging impact, and a birds-eye view of the macro-environmental factors.

There are as many ways to do strategy as there are organizations. So not every tool is appropriate for every organization.

These 8 tools are our top picks for giving you a helping hand through your strategic analysis. They're by no means the whole spectrum. There are many other frameworks and tools out there that could be useful and provide value to your process.

Choose the tools that fit best with your approach to doing strategy. Don’t limit yourself to one tool if it doesn’t make sense, don’t be afraid to combine them, mix and match! And, be faithful to each framework but always as long as it fits your organization’s needs.

Completing the strategic analysis phase is a crucial milestone, but it's only the beginning of a successful journey. Now comes the vital task of formulating a plan and ensuring its effective execution. This is where Cascade comes into play, offering a powerful solution to drive your strategy forward.

Cascade is your ultimate partner in strategy execution. With its user-friendly interface and robust features, it empowers you to translate the strategic insights distilled from your strategic analysis into actionable plans.

Some key features include:

- Planner : Seamlessly build out your objectives, initiatives, and key performance indicators (KPIs) while aligning them with the organization's goals. Break down the complexity from high-level initiative to executable outcomes.

- Alignment Map : Visualize how different organizational plans work together and how your corporate strategy breaks down into operational and functional plans.

%20(1).png)

- Metrics & Measures : Connect your business data directly to your core initiatives in Cascade for clear data-driven alignment.

.png)

- Integrations : Consolidate your business systems underneath a unified roof. Import context in real-time by leveraging Cascade’s native, third-party connector (Zapier/PA), and custom integrations.

- Dashboards & Reports : Stay informed about your strategy's performance at every stage with Cascade's real-time tracking and progress monitoring, and share it with your stakeholders, suppliers, and contractors.

Experience the power of Cascade today! Sign up today for a free forever plan or book a guided 1:1 tour with one of our Cascade in-house strategy execution experts.

Popular articles

Viva Goals Vs. Cascade: Goal Management Vs. Strategy Execution

What Is A Maturity Model? Overview, Examples + Free Assessment

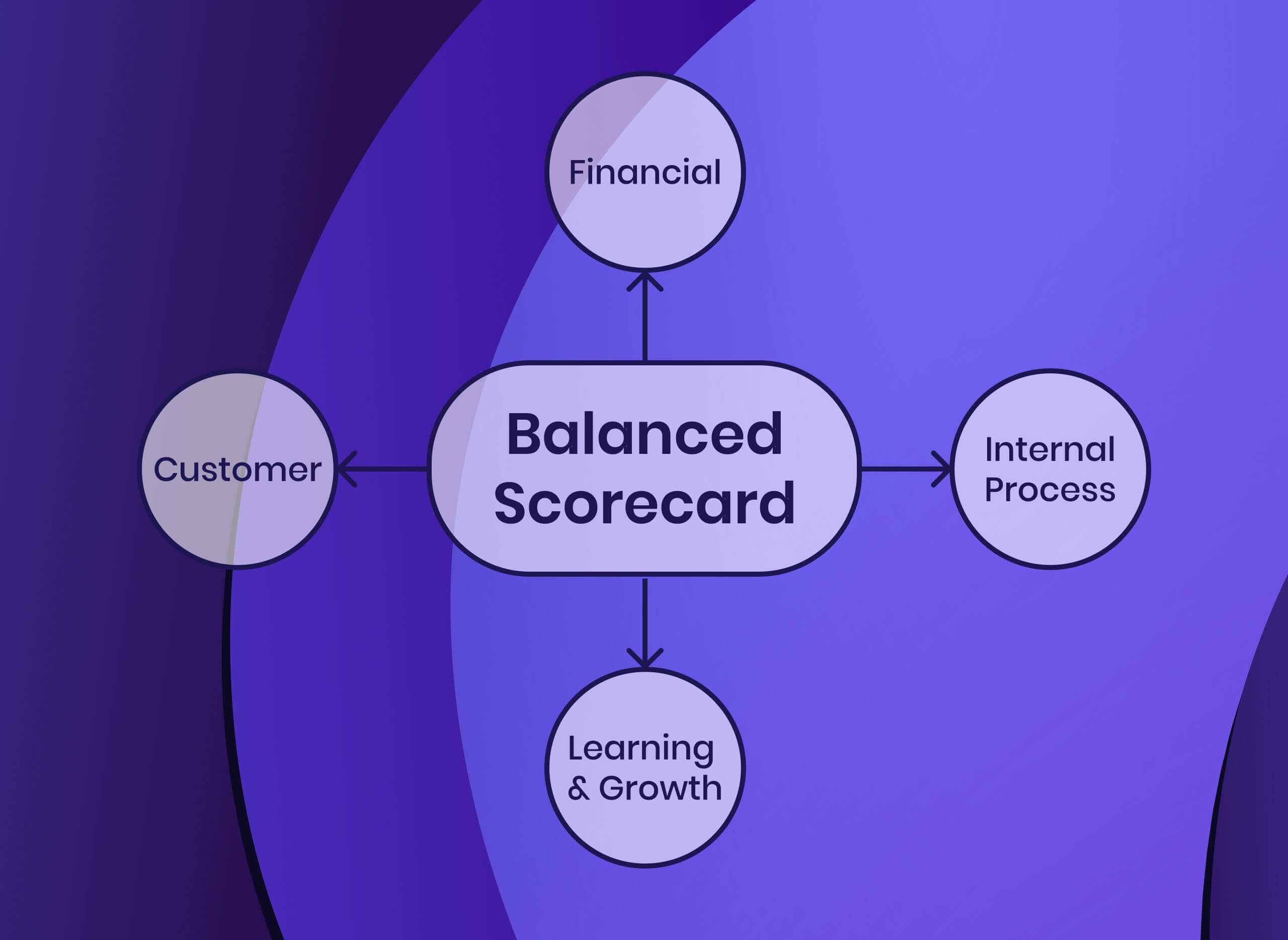

How To Implement The Balanced Scorecard Framework (With Examples)

The Best Management Reporting Software For Strategy Officers (2024 Guide)

Your toolkit for strategy success.

- Order Status

- Testimonials

- What Makes Us Different

STRATEGIC ALTERNATIVES Harvard Case Solution & Analysis

Home >> Harvard Case Study Analysis Solutions >> STRATEGIC ALTERNATIVES

STRATEGIC ALTERNATIVES:

Following are the strategic Alternatives that Tesla Motors should consider in order to improve the situation:

ALTERNATIVE # 1:

Strategic Alliances:

The company has made few strategic alliances with the renowned and dominating multi-national companies which has limited the overall growth of the company as well as it has also limited the overall ability of the company to tap into the various potential markets.

The top management of the company should make various strategies in order to make effective strategic alliances with the global multinational automobile companies such as BMW, Lexus, Mercedes, Audi, General Motors, Ford, etc.

This would help the company in tapping into new and potential markets and would further lead to increase in expansion of the operations, which would subsequently increase the overall customer base of the company as well as this would also enhance the overall revenue and profitability of the company.

Cost Controlling Procedures:

The top management of the company should implement various cost effective procedures and strategies within the operations of the company. This would decrease the overall operational costs of the company as it would help the top management of the company in identifying and eliminating the unnecessary and unidentified costs occurring in the operations of the company.

Thus, it would reduce the overall costs of the company and would subsequently allow the company to earn heavy profits. This would also enhance the overall competitiveness of the company as well as it would allow the top management of the company to offer low prices of their products.

Diversification:

The top management of the company should consider diversifying its product lines efficiently and effectively. The company only sell electric vehicles, which limits the scope of growth and expansion of the company at a widespread scale. The top management of the company should move towards producing hydrogen energy based cars or cars that could run on flexed fuel.

This would enhance the overall scope for the growth of the company as well as it would also enhance the overall scope for expansion of the company’s operations at a wide spread scale.

Global Expansion:

The top management of the company should focus towards global expansion of the operations of the company as there are still a large numbers of untapped potential markets. The top management of the company should focus of expanding its operation to Spain, Tokyo, and many other potential markets all across the world.

This would increase the overall customer base of the company as well as it would allow the company to earn economies of scale. This would readily enhance the overall revenues and profitability of the company at a large scale.

Thus, the top management of the company should make effective strategies in order to exploit the available opportunities present in many of the potential markets all across the world.

Extensive Marketing:

The company does not focus on marketing its products and services efficiently and effectively. This has a significant negative impact on the operations of the company as well as it considerably limits the overall growth of the company as well as revenues and profitability of the company.

Therefore, the top management of the company should make an effective marketing department, which would make effective marketing strategies in order to create brand awareness of the product among the people of the company efficiently and effectively.

The marketing department of the company should do marketing of the products of the company in such a way that it emphasizes on the benefits the people could get by using the products of the company. In addition to this, the marketing department should also make their marketing customer oriented rather than product oriented.

This would create brand awareness among the people and they would be readily attracted towards the product of the company. This would subsequently enhance the overall customer base of the company, which would enhance the overall revenue and profitability of the company. In addition to this, extensive and effective marketing of the product of the company would also enhance the overall competitiveness of the company and would allow the company to secure a leading position in the entire market.

Economic Products:

Tesla offers luxurious vehicles at high prices which limits its target market to a certain extent. It only targets the upper class customer s which limits the sales of the company to a considerable extent. The top management of the company should also manufacture low priced products so that the top management of the company could target all class of customers.

This would enhance the overall target market and subsequently the overall customer base of the company. However, the top management of the company should not discontinue or put less focus on its core product line as putting less focus on the core product line of the company would affect negatively in the interest of the company................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Harvard Case Study Analysis Solutions

- MicroFridge: The Concept

- Strategic Report: Domtar Corporation

- Value Stream Mapping Task

- Li & Fung (A): Beyond Filling in the Mosaic--1995-98

- Westlake lanes

- Cyberlab Assignment

- Curled Metal Inc.

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Evaluating strategic alternatives: an analytical model

1995, Computers & operations research

Related Papers

Journal of Multi‐Criteria Decision Analysis

Madjid Tavana

Slavko Ivkovic , Duska Pesic

The purpose of this paper is to introduce a matrix model based on fuzzy logic that could be utilized for matching the external environmental factors with the internal organizational factors in the process of extracting strategies. Since fuzzy triangular numbers used in this model, enables quantitative description of the imprecise environmental variables and realistic treatment of the uncertain factors that are matter of degree, proposed fuzzy matrix could be seen as an adaptive and more flexible quantitative tool that assist managers to better determine the priority of potential strategies in regards to relevant internal and external factors.

raquel duarte-davidson

Journal of the Operational Research Society

ALBERTO FRANCO

Journal of Management

Nandini Rajagopalan

This article develops an integrative framework of strategic decision processes based on a review of the past literature. The framework incorporates environmental, organizational, and decision-specific antecedents of process characteristics, and their process and economic outcomes. Key empirical studies are reviewed in the context of the framework and major patterns and contradictions are identified. Based on this review, useful implications for theory building, research methods and managerial practice are identified and several directions for future research are presented.

Patrick Humphreys

Noushi Rahman

The aim of this paper is to organise decision-making models and methods into one coherent matrix, using complexity (high to low) and time pressure (high to low) dimensions as relevant axes. Eight case vignettes are used to demonstrate the ®t of four decision-making models and four decision making methods within high-low complexity and high-low time pressure. The arguments and the vignettes suggest that a particular decision-making model or method becomes an appropriate tool for strategic decision-makers under varying complexity and time pressure. The appropriate model or method would change when the characteristics of the environment change. Decision-making models and methods can be systematically assessed with the proposed framework.

Dr. Anwar Hood Ahmed

Engineering management journal

Angela Fofan

Applied Computational Intelligence and Mathematical Methods

Sergio Forte

RELATED PAPERS

Anales De Hidrologia Medica

FRANCISCO ARMIJO CASTRO

International Journal of Circumpolar Health

Sacha Senécal

Proceedings of the 54th Annual Meeting of the Association for Computational Linguistics (Volume 1: Long Papers)

Eduard Hovy

Dr Punam Bedi

Marcus Vinicius Lamar

ranian Journal of Health Education and Health Promotion

Narges Rafiei

DANIEL FRANCISCO PALACIOS FERNANDEZ

MEDAN MAKNA: Jurnal Ilmu Kebahasaan dan Kesastraan

Lastry Monika

European Journal of Gastroenterology & Hepatology

Jessica Rey Tan

Jurnal Ekonomi Kuantitatif Terapan

Pediatric Rheumatology

Mirella Crapanzano

Journal of Renewable Materials

Assima Dauletbek

Lecture Notes of the Institute for Computer Sciences, Social Informatics and Telecommunications Engineering

Patrick Maillé

Juan Moreno

African Journal of Marine Science

Francis Marsac

Arteriosclerosis, Thrombosis, and Vascular Biology

Shenghan Lai

SEG Technical Program Expanded Abstracts 2007

Diabetes-metabolism Research and Reviews

Fernando Guerrero-romero

Routledge eBooks

Synnove Bendixsen

Advances in Natural Sciences: Nanoscience and Nanotechnology

Huy Hoang Trần

Al-Ma‘rifah

Kamal Yusuf

International Journal of Morphology

ENRIQUE OLAVE

hgtyfrf fggfhhfg

Routledge Resources Online - The Renaissance World

Benjamin Steiner

Social & Cultural Geography

Kath Browne

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Ask Matt: What are 'strategic alternatives?'

Q: What are ‘strategic alternatives?'

A: When companies are doing well, they don’t normally look for “strategic alternatives.” Long before companies look for strategic alternatives, investors should look elsewhere.

The term strategic alternatives is somewhat of a codeword for a company trying to put itself up for sale. Typically, when a company’s management or its investors think the the firm needs to restructure itself in a radical way, it will announce it’s looking for alternatives. That might involve selling the company to a competitor that can find efficiency or taking the company private by selling to private investors or the management. Companies don’t get to this point overnight, and investors should be out of a stock long before it happens. Consider the events at teen retailer Aeropostale (ARO) , which said this week it was looking for alternatives. The stock has dropped 84% over the past year and fell another nearly 50% Friday to roughly a quarter a share following disappointing quarterly results. Aeropostale is just another example of why investors shouldn’t hold onto a stock long enough for a company to pursue alternatives. There are much better alternatives for investors’ money.

USA TODAY markets reporter Matt Krantz answers a different reader question every weekday. To submit a question, e-mail Matt at [email protected] or on Twitter @mattkrantz.

Your company may already be a member. View our member list to find out, or create a new account .

Forgot Password?

Content Library

You can search our content library for case studies, research, industry insights, and more.

You can search our website for events, press releases, blog posts, and more.

AI Campaigns and Case Studies

By Joanna Fragopoulos March 29, 2024

A rtificial intelligence (AI), and its applications, is at the forefront of many discussions in many industries and fields, from marketing to tech to healthcare to education to law. How to implement and leverage these tools in a helpful way for users can be challenging for teams. However, when used well, AI can help save time analyzing data, personalize content and information, enhance creative ideas, and find ways to promote diversity, equality, inclusion, and belonging (DEIB). Below are case studies and campaigns that successfully utilized AI.

Leveraging Chatbots and ChatGPT

Zak Stambor, senior analyst of retail and e-commerce at Insider Intelligence, discussed AI at an ANA event , stating that it is "very clear that marketers will be spending more of their budgets on AI-infused productivity tools in the future." Stambor cited two companies utilizing chatbots to help consumers find what they need. For instance, Instacart started its Ask Instacart tool to help its users "create and refine shopping lists by allowing them to ask questions like, 'What is a healthy lunch option for my kids?' Ask Instacart then provides potential options based on users' past buying habits and provides recipes and a shopping list once users have selected the option they want to try," according to the ANA event recap . Further, Mint Mobile used ChatGPT to write an ad which it later released. The recap , however, stated that the company's CMO "emphasized that there were limitations with the technology and stressed the importance of understanding a brand's DNA before using generative AI. He recommended approaching ChatGPT in the same way successful marketers approach social media."

Smoothing the Request for Proposal (RFP) Process

Creating campaigns that are actually interesting and engage people, is, of course, every marketer's dream. ZS, a consulting and technology firm focused on transforming global healthcare, worked with Stein IAS to create its campaign " Data Connects Us ," which provided client services teams with content, case studies, reports, ZS's Future of Health survey, and data to help with the RFP process. The campaign leveraged AI to create "futuristic AI generated images — such as a futuristic hospital — and coupled it with copy communicating how ZS is positioned to help connect data with people and support real innovation. By leveraging emotionally engaging, distinct, and memorable creative, ZS was able to invite consumers to learn more about the company," as described in the ANA event recap .

Fostering DEIB

Google sought to promote DEIB practices as well as combat stereotypes and bias; the company was able to do this through the use of AI in the photography space. In 2018, the company established the Google Image Equity initiative, which enlisted experts on "achieving fairness, accuracy, and authenticity in camera and imaging tools," according to the ANA event recap . This result in Real Tone, which is a "collection of improvements focused on building camera and imaging products that worked equally for people of color" and became a consideration for people potentially buying a Google Pixel. As part of this process, the company collaborated with Harvard professor, Dr. Ellis Monk; together, they released a 10-shade skin tone scale that was more inclusive of diverse skin tones. This scale helps "train and evaluate AI models for fairness, resulting in products that work better for people of all skin tones."

Unearthing Creativity

Michelob ULTRA partnered with agency CB New York to create a virtual tennis match with John McEnroe, both in the past and present. McEnroe's past self was created using motion-capture technology and AI. Moreover, the brand also created a campaign called "Dreamcaster" with Cameron Black, who has been blind since birth, who longed to be a sports broadcaster "but felt he would never get the opportunity due to his disability," as explained in the ANA event recap . The recap went on to explain that Michelob worked with Black for an entire year to "create a spatial audio portal, complete with 62 surround sound speakers and more than 1,000 unique sounds, that 'placed' him at center court and told him what was occurring during a basketball game in real time. The portal featured a vest, designed with its own haptic language, to further assist Black in following the action by allowing him to feel the game's action. After 12 months of development and training, Black became the first-ever visually impaired person to broadcast an NBA game on live TV."

Deepening Personalization

To enhance personalization, Panera Bread created a loyalty program called "My Panera" in 2010. The program gives customers rewards based on visits; the rewards to be personalized which boosts the program's engagement. Recently, Panera worked with ZS Associates to utilize machine learning to create an automated "best next action" program to enable "true one-to-one interactions with My Panera members," as described in the ANA event recap , which went on to say that the company uses a "time-based criterion, combine[s] it with several other variables identified and sorted by AI, and serve[s] more than 100 different offers to the same audience. Panera can also leverage the technology to develop multiple email subjects or coupon headlines, make product recommendations based on past purchases, and even customize colors and copy within the communication to suit the sensibilities of the customer being targeted. Overall, there are more than 4,000 unique combinations of offer and product recommendations that a customer can receive."

The views and opinions expressed in Industry Insights are solely those of the contributor and do not necessarily reflect the official position of the ANA or imply endorsement from the ANA.

Joanna Fragopoulos is a director of editorial and content development at ANA.

IMAGES

VIDEO

COMMENTS

Strategic Analysis Case Study for Strategic Management for the Spring Semester of 2021 for the 2020-2021 academic year. analysis alternatives alternative the Skip to document University

Usually the problem statement has to be re-written several times during the analysis of a case as students peel back the layers of symptoms or causation. Step 2: Alternatives. Identify in detail the strategic alternatives to address the problem; three to five options generally work best.

This article explores the four key takeaways from this study. Takeaway #1: Companies' public announcements regarding strategic alternatives often contain common key phrases and details. These announcements generate 5.4% stock returns on average (measured over a 3-day window) and lead to subsequent offers and completed sales 41% and 32% of the ...

There are actually six examples of strategic alternatives, says Dr. M. Thenmozhi, a professor in the Department of Management Studies at Indian Institute of Technology, Madras Chennai, a public ...

3. Get valuable practice in identifying strategic issues that need to be addressed, evaluating strategic alternatives, and formulating workable plans of action. 4. Enhance your sense of business judgment, as opposed to uncritically accepting the authoritative crutch of the professor or "back-of-the-book" answers. 5.

Practical strategic alternatives analysis is based on the strategy that can effectively mitigate marketplace threats and opportunities as well as brand weaknesses and strengths. The four marketing ...

Strategic Planning Kit For Dummies. In strategic planning, making equitable trade-offs requires comparing apples to apples. Internal priorities are competing with other internal priorities, and external priorities are competing against other external priorities. The following example demonstrates how one company went about choosing their ...

2. Business-level. At the median level of strategy are business-level decisions. The business-level strategy focuses on market position to help the company gain a competitive advantage in its own industry or other industries. 3. Functional-level. At the lowest level are functional-level decisions.

As a case study, we apply this technique to developing potential strategies for the United States Air Force. Introduction. ... Our focus is generating strategy alternatives, equivalently strategy options, for the organization's long-term goals or direction. Numerous researchers have categorized approaches for strategy. Mintzberg (1987) proposes ...

Asian Health Services (AHS) has multiple directional strategies and strategic alternatives available for various organizational uses. According to the case, AHS's mission is to advocate for the medically unserved and ensure equality in providing and access to adequate healthcare services to everyone in the Asian community, including refugees and immigrants regardless of their culture ...

This study discussed strategic alternative and choice from the organizational perspective. ... The focus of the paper was a PBSO and hence a case study of a PBSO firm lead to the development of a ...

Adapted from the concept of projecting "Alternative Futures", we propose a systematic process for generating strategy options. Strategists, guided by the organization's founding principles and core values, determine the strategy drivers. They align these drivers to generate a 2 × 2 matrix which delineates four alternative strategies.

Step 2: Alternatives. Identify in detail the strategic alternatives to address the problem; three to five options generally work best. Alternatives should be mutually exclusive, realistic, creative, and feasible given the constraints of the situation. Doing nothing or delaying the decision to a later date are not considered acceptable alternatives.

A Guide to Case Analysis C-5 given; if so, the study questions and the case preparation exercises provided in the Case-TUTOR software will guide you. 5. Start your analysis of the issues with some number crunching. A big majority of strategy cases call for some kind of number crunching—calculating assorted fi-

PESTEL Analysis. We might sound repetitive, but external analysis tools are critical to your strategic analysis. The environment your organization operates in will heavily impact your organization's success. PESTEL analysis is one of the best external analysis tools you can use due to its broad nature.

STRATEGIC ALTERNATIVES Case Solution,STRATEGIC ALTERNATIVES Case Analysis, STRATEGIC ALTERNATIVES Case Study Solution, STRATEGIC ALTERNATIVES: Following are the strategic Alternatives that Tesla Motors should consider in order to improve the situation: ALTERNATIVE # 1: