What is a Competitive Analysis — and How Do You Conduct One?

Published: April 24, 2024

Every time I work with a new brand, my first order of business is to conduct a competitive analysis.

A competitive analysis report helps me understand the brand’s position in the market, map competitors’ strengths/weaknesses, and discover growth opportunities.

![researching competitors Download Now: 10 Competitive Analysis Templates [Free Templates]](https://no-cache.hubspot.com/cta/default/53/b3ec18aa-f4b2-45e9-851f-6d359263e671.png)

In this article, I’ll break down the exact steps I follow to conduct competitor analysis and identify ways to one-up top brands in the market.

We’ll cover:

What is competitive analysis?

What is competitive market research, competitive analysis in marketing.

- How To Conduct Competitive Analysis in 5 Steps

How to Do a Competitive Analysis (the Extended Cut)

Competitive product analysis, competitive analysis example, competitive analysis templates.

- Competitive Analysis FAQs

Competitive analysis is the process of comparing your competitors against your brand to understand their core differentiators, strengths, and weaknesses. It’s an in-depth breakdown of each competitor’s market position, sales & marketing tactics, growth strategy, and other business-critical aspects to see what they’re doing right and find opportunities for your business.

Competitive analysis gives you a clearer picture of the market landscape to make informed decisions for your growth.

That said, you have to remember that competitive analysis is an opportunity to learn from others. It isn’t:

- Copying successful competitors to the T.

- Trying to undercut others’ pricing.

- A one-and-done exercise.

Let’s look at how this exercise can help your business before breaking down my 5-step competitive analysis framework.

4 Reasons to Perform Competitive Analysis

If you’re on the fence about investing time and effort in analyzing your competitors, know that it gives you a complete picture of the market and where you stand in it.

Here are four main reasons why I perform a competitive analysis exercise whenever working with a brand for the first time:

- Identify your differentiators. Think of competitor analysis as a chance to reflect on your own business and discover what sets you apart from the crowd. And if you’re only starting out, it helps you brainstorm the best opportunities to differentiate your business.

- Find competitors’ strengths. What are your competitors doing right to drive their growth? Analyzing the ins and outs of an industry leader will tell you what they did well to reach the top position in the market.

- Set benchmarks for success. A competitor analysis gives you a realistic idea of mapping your progress with success metrics. While every business has its own path to success, you can always look at a competitor’s trajectory to assess whether you’re on the right track.

- Get closer to your target audience. A good competitor analysis framework zooms in on your audience. It gives you a pulse of your customers by evaluating what they like, dislike, prefer, and complain about when reviewing competing brands.

The bottom line: Whether you’re starting a new business or revamping an existing one, a competitive analysis eliminates guesswork and gives you concrete information to build your business strategy.

.webp)

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

You're all set!

Click this link to access this resource at any time.

Competitive market research is a vital exercise that goes beyond merely comparing products or services. It involves an in-depth analysis of the market metrics that distinguish your offerings from those of your competitors.

A thorough market research doesn't just highlight these differences but leverages them, laying a solid foundation for a sales and marketing strategy that truly differentiates your business in a bustling market.

In the next section, we’ll explore the nuts and bolts of conducting a detailed competitive analysis tailored to your brand.

10 Competitive Analysis Templates

Fill out the form to access the templates., essential aspects to cover in competitive analysis research .

Before we walk through our step-by-step process for conducting competitor analysis, let’s look at the main aspects to include for every competitor:

- Overview. A summary of the company — where it’s located, target market, and target audience.

- Primary offering. A breakdown of what they sell and how they compare against your brand.

- Pricing strategy. A comparison of their pricing for different products with your pricing.

- Positioning. An analysis of their core messaging to see how they position themselves. Customer feedback: A curation of what customers have to say about the brand.

Now, it’s time to learn how to conduct a competitive analysis with an example to contextualize each step.

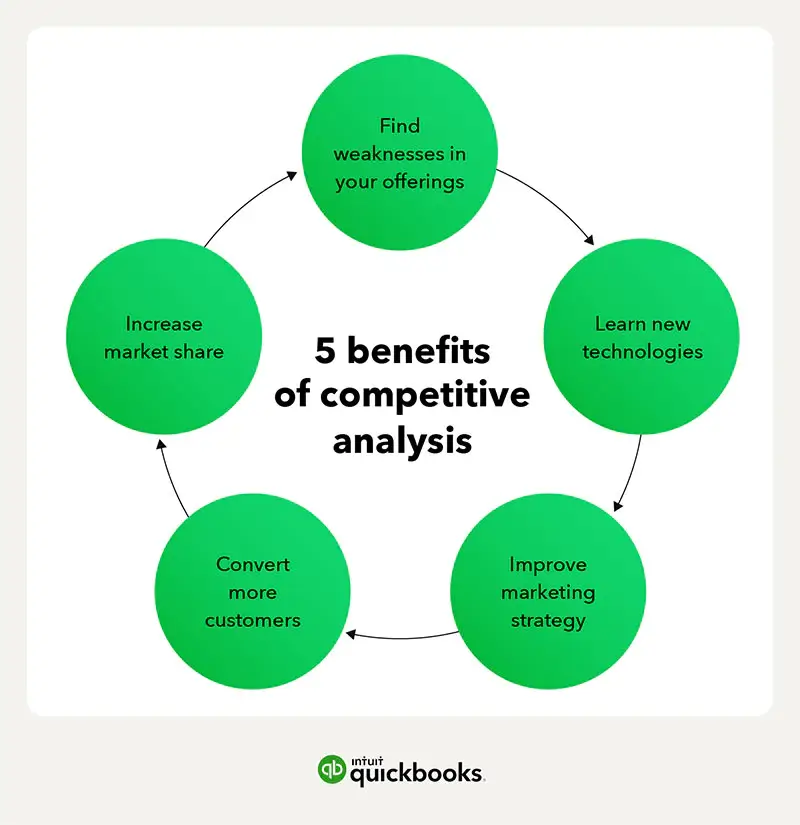

Every brand can benefit from regular competitor analysis. By performing a competitor analysis, you'll be able to:

- Identify gaps in the market.

- Develop new products and services.

- Uncover market trends.

- Market and sell more effectively.

As you can see, learning any of these four components will lead your brand down the path of achievement.

Next, let's dive into some steps you can take to conduct a comprehensive competitive analysis.

How to Conduct Competitive Analysis in 5 Quick Steps

As a content marketer, I’ve performed a competitive analysis for several brands to improve their messaging, plan their marketing strategy, and explore new channels. Here are the five steps I follow to analyze competitors.

1. Identify and categorize all competitors.

The first step is a simple yet strategic one. You have to identify all possible competitors in your industry, even the lesser-known ones. The goal here is to be aware of all the players in the market instead of arbitrarily choosing to ignore a few.

As you find more and more competitors, categorize them into these buckets:

- Direct competitors. These brands offer the same product/service as you to the same target audience. People will often compare you to these brands when making a buying decision. For example, Arcade and Storylane are direct competitors in the demo automation category.

- Indirect competitors. These businesses solve the same problem but with a different solution. They present opportunities for you to expand your offering. For example, Scribe and Whatfix solve the problem of documentation + internal training, but in different ways.

- Legacy competitors. These are established companies operating in your industry for several years. They have a solid reputation in the market and are a trusted name among customers. For example, Ahrefs is a legacy competitor in the SEO industry.

- Emerging competitors. These are new players in the market with an innovative business model and unique value propositions that pose a threat to existing brands. For example, ChatGPT came in as a disruptor in the conversational AI space and outperformed several brands.

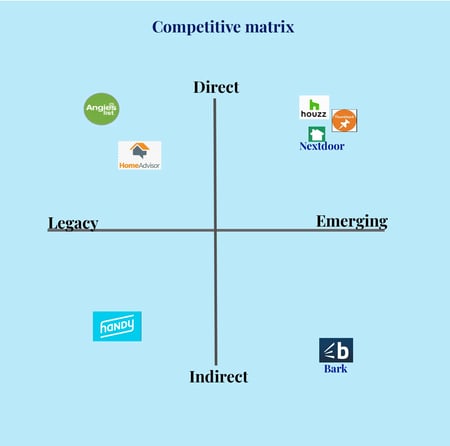

Here’s a competitive matrix classifying brands in the community and housing space:

Testing It Out

To help you understand each step clearly, we’ll use the example of Trello and create a competitor analysis report using these steps.

Here’s a table of the main competitors for Trello:

able of the main competitors for Trello:

2. Determine each competitor’s market position.

Once you know all your competitors, start analyzing their position in the market. This step will help you understand where you currently stand in terms of market share and customer satisfaction. It’ll also reveal the big guns in your industry — the leading competitors to prioritize in your analysis report.

Plus, visualizing the market landscape will tell you what’s missing in the current state. You can find gaps and opportunities for your brand to thrive even in a saturated market.

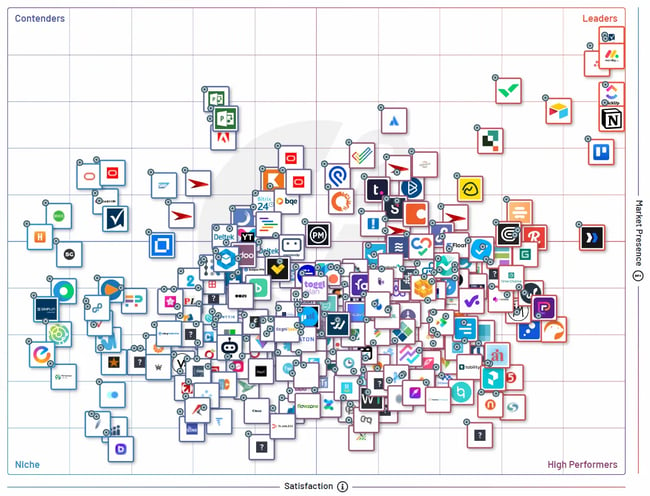

To map competitors’ market positions, create a graph with two factors: market presence (Y-axis) and customer satisfaction (X-axis). Then, place competitors in each of these quadrants:

- Niche. These are brands with a low market share but rank high on customer satisfaction. They’re likely targeting a specific segment of the audience and doing it well.

- Contenders. These brands rank low on customer satisfaction but have a good market presence. They might be new entrants with a strong sales and marketing strategy.

- Leaders. These brands own a big market share and have highly satisfied customers. They’re the dominant players with a solid reputation among your audience.

- High performers. These are another category of new entrants scoring high on customer satisfaction but with a low market share. They’re a good alternative for people not looking to buy from big brands.

This visualization will tell you exactly how crowded the market is. But it’ll also highlight ways to gain momentum and compete with existing brands.

Here’s a market landscape grid by G2 documenting all of Trello’s competitors in the project management space. For a leading brand like Trello, the goal would be to look at top brands in two quadrants: “Leaders” and “High Performers.”

Image Source

3. Extensively benchmark key competitors.

Step 2 will narrow down your focus from dozens of competitors to the few most important ones to target. Now, it’s time to examine each competitor thoroughly and prepare a benchmarking report.

Remember that this exercise isn’t meant to find shortcomings in every competitor. You have to objectively determine both the good and bad aspects of each brand.

Here are the core factors to consider when benchmarking competitors:

- Quality. Assess the quality of products/services for each competitor. You can compare product features to see what’s giving them an edge over you. You can also evaluate customer reviews to understand what users have to say about the quality of their offering.

- Price. Document the price points for every competitor to understand their pricing tactics. You can also interview their customers to find the value for money from users’ perspectives.

- Customer service. Check how they deliver support — through chat, phone, email, knowledge base, and more. You can also find customer ratings on different third-party platforms.

- Brand reputation. You should also compare each competitor’s reputation in the market to understand how people perceive the brand. Look out for anything critical people say about specific competitors.

- Financial health. If possible, look for performance indicators to assess a brand's financial progress. You can find data on metrics like revenue growth and profit margins.

This benchmarking exercise will involve a combination of primary and secondary research. Invest enough time in this step to ensure that your competitive analysis is completely airtight.

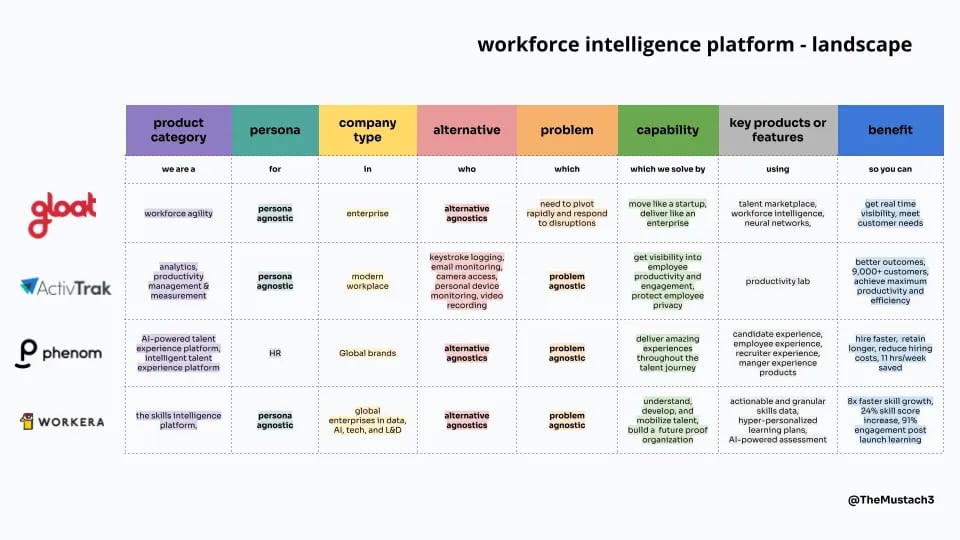

Check out this example of a competitor benchmarking report for workforce intelligence tools:

Here’s how I benchmarked Asana based on these criteria using the information I could find:

4. Deep dive into their marketing strategy.

While the first few steps will tell you what you can improve in your core product or service, you also need to find how competitors market their products.

You need to deep-dive into their marketing strategies to learn how they approach buyers. I analyze every marketing channel, then note my observations on how they speak to their audience and highlight their brand personality.

Here are a few key marketing channels to explore:

- Website. Analyze the website structure and copy to understand their positioning and brand voice.

- Email. Subscribe to emails to learn their cadence, copywriting style, content covered, and other aspects.

- Paid ads. Use tools like Ahrefs and Semrush to find if any competitor is running paid ads on search engines.

- Thought leadership. Follow a brand’s thought leadership efforts with content assets like podcasts, webinars, courses, and more.

- Digital PR. Explore whether a brand is investing in digital PR to build buzz around its business and analyze its strategy.

- Social media. See how actively brands use different social channels and what kind of content is working best for them.

- Partnerships. Analyze high-value partnerships to see if brands work closely with any companies and mutually benefit each other.

You can create a detailed document capturing every detail of a competitor’s marketing strategy. This will give you the right direction to plan your marketing efforts.

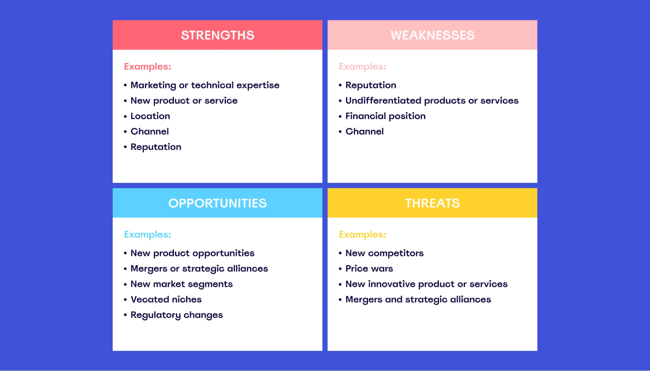

5. Perform a SWOT analysis.

The final step in a competitive analysis exercise is creating a SWOT analysis matrix for each company. This means you‘ll take note of your competitor’s strengths, weaknesses, opportunities, and threats. Think of it as the final step to consolidate all your research and answer these questions:

- What is your competitor doing well?

- Where do they have an advantage over your brand?

- What is the weakest area for your competitor?

- Where does your brand have the advantage over your competitor?

- In what areas would you consider this competitor a threat?

- Are there opportunities in the market that your competitor has identified?

You can use tools like Miro to visualize this data. Once you visually present this data, you’ll get a clearer idea of where you can outgrow each competitor.

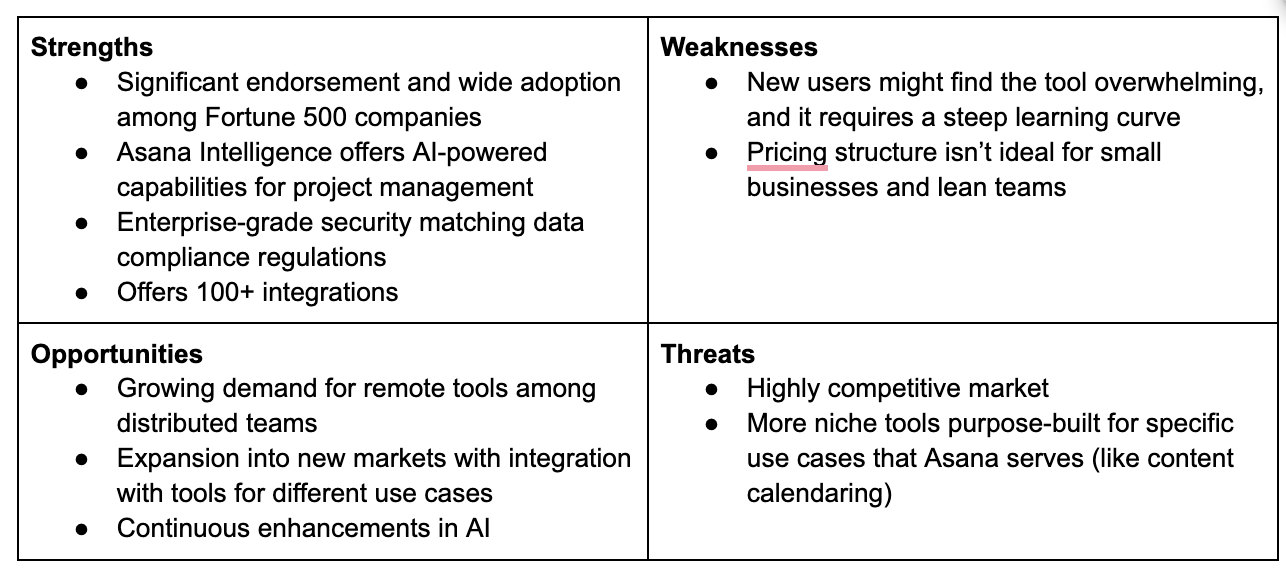

Here’s a SWOT analysis matrix I created for Asana as a competitor of Trello:

- Determine who your competitors are.

- Determine what products your competitors offer.

- Research your competitors' sales tactics and results.

- Take a look at your competitors' pricing, as well as any perks they offer.

- Ensure you're meeting competitive shipping costs.

- Analyze how your competitors market their products.

- Take note of your competition's content strategy.

- Learn what technology stack your competitors use.

- Analyze the level of engagement on your competitors' content.

- Observe how they promote marketing content.

- Look at their social media presence, strategies, and go-to platforms.

- Perform a SWOT Analysis to learn their strengths, weaknesses, opportunities, and threats.

To run a complete and effective competitive analysis, use these ten templates, which range in purpose from sales to marketing to product strategy.

Featured Resource: 10 Competitive Analysis Templates

1. Assess your current product pricing.

The first step in any product analysis is to assess current pricing.

Nintendo offers three models of its Switch console: The smaller lite version is priced at $199, the standard version is $299, and the new OLED version is $349.

Sony, meanwhile, offers two versions of its PlayStation 5 console: The standard edition costs $499, and the digital version, which doesn’t include a disc drive, is $399.

2. Compare key features.

Next is a comparison of key features. In the case of our console example, this means comparing features like processing power, memory, and hard drive space.

3. Pinpoint differentiators.

With basic features compared, it’s time to dive deeper with differentiators. While a glance at the chart above seems to indicate that the PS5 is outperforming its competition, this data only tells part of the story.

Here’s why: The big selling point of the standard and OLED Switch models is that they can be played as either handheld consoles or docked with a base station connected to a TV. What’s more, this “switching” happens seamlessly, allowing players to play whenever, wherever.

The Playstation offering, meanwhile, has leaned into market-exclusive games that are only available on its system to help differentiate them from their competitors.

4. Identify market gaps.

The last step in a competitive product analysis is looking for gaps in the market that could help your company get ahead.

When it comes to the console market, one potential opportunity gaining traction is the delivery of games via cloud-based services rather than physical hardware.

Companies like Nvidia and Google have already made inroads in this space, and if they can overcome issues with bandwidth and latency, it could change the market at scale.

How do you stack up against the competition? Where are you similar, and what sets you apart? This is the goal of competitive analysis.

By understanding where your brand and competitors overlap and diverge, you’re better positioned to make strategic decisions that can help grow your brand.

Of course, it’s one thing to understand the benefits of competitive analysis, and it’s another to actually carry out an analysis that yields actionable results. Don’t worry — we’ve got you covered with a quick example.

Sony vs. Nintendo: Not all fun and games.

Let’s take a look at popular gaming system companies Sony and Nintendo.

Sony’s newest offering — the Playstation 5 — recently hit the market but has been plagued by supply shortages.

Nintendo’s Switch console, meanwhile, has been around for several years but remains a consistent seller, especially among teens and children.

This scenario is familiar for many companies on both sides of the coin; some have introduced new products designed to compete with established market leaders, while others are looking to ensure that reliable sales don’t fall.

Using some of the steps listed above, here’s a quick competitive analysis example.

In our example, it’s Sony vs Nintendo, but it’s also worth considering Microsoft’s Xbox, which occupies the same general market vertical.

This is critical for effective analysis; even if you’re focused on specific competitors and how they compare, it’s worth considering other similar market offerings.

PlayStation offers two PS5 versions, digital and standard, at different price points, while Nintendo offers three versions of its console.

Both companies also sell peripherals — for example, Sony sells virtual reality (VR) add-ons, while Nintendo sells gaming peripherals such as steering wheels, tennis rackets, and differing controller configurations.

When it comes to sales tactics and marketing, Sony and Nintendo have very different approaches.

In part thanks to the recent semiconductor shortage, Sony has driven up demand via scarcity — very low volumes of PS5 consoles remain available. Nintendo, meanwhile, has adopted a broader approach by targeting families as its primary customer base.

This effort is bolstered by the Switch Lite product line, which is smaller and less expensive, making it a popular choice for children.

The numbers tell the tale : Through September 2021, Nintendo sold 14.3 million consoles, while Sony sold 7.8 million.

Sony has the higher price point: Their standard PS5 sells for $499, while Nintendo’s most expensive offering comes in at $349. Both offer robust digital marketplaces and the ability to easily download new games or services.

Here, the key differentiators are flexibility and fidelity. The Switch is flexible — users can dock it with their television and play it like a standard console or pick it up and take it anywhere as a handheld gaming system.

The PS5, meanwhile, has superior graphics hardware and processing power for gamers who want the highest-fidelity experience.

5. Analyze how your competitors market their products.

If you compare the marketing efforts of Nintendo and Sony, the difference is immediately apparent: Sony’s ads feature realistic in-game footage and speak to the exclusive nature of their game titles.

The company has managed to secure deals with several high-profile game developers for exclusive access to new and existing IPs.

Nintendo, meanwhile, uses brightly lit ads showing happy families playing together or children using their smaller Switches while traveling.

6. Analyze the level of engagement on your competitor's content.

Engagement helps drive sales and encourage repeat purchases.

While there are several ways to measure engagement, social media is one of the most straightforward: In general, more followers equates to more engagement and greater market impact.

When it comes to our example, Sony enjoys a significant lead over Nintendo: While the official Playstation Facebook page has 38 million followers, Nintendo has just 5 million.

Competitive analysis is complex, especially when you’re assessing multiple companies and products simultaneously.

To help streamline the process, we’ve created 10 free templates that make it possible to see how you stack up against the competition — and what you can do to increase market share.

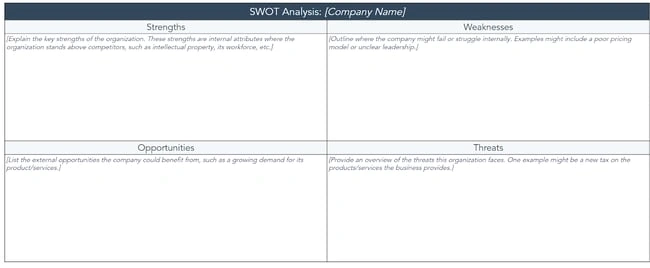

Let’s break down our SWOT analysis template. Here’s what it looks like:

Don't forget to share this post!

Related articles.

25 Tools & Resources for Conducting Market Research

Market Research: A How-To Guide and Template

![researching competitors SWOT Analysis: How To Do One [With Template & Examples]](https://blog.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM SAM SOM: What Do They Mean & How Do You Calculate Them?

![researching competitors How to Run a Competitor Analysis [Free Guide]](https://blog.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![researching competitors 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://blog.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![researching competitors 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://blog.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

10 free templates to help you understand and beat the competition.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, sizing up the competition: how to conduct competitive research.

Competitive research can reveal trends in the marketplace and gaps in your own business plan.

Competitive research is a crucial part of any good marketing plan. This term may elicit some negative images but competitive research has nothing to do with spying. It has everything to do with paying attention to your competition and what they are doing.

Many people will lose out on business to competitors they have never even heard of simply because they’ve never taken the time to do competitive research. Understanding what your competition is doing will help you position yourself, and your product or service, within the market.

What is competitive research?

Competitive research involves identifying your competitors, evaluating their strengths and weaknesses and evaluating the strengths and weaknesses of their products and services. By looking at your biggest competitors, you can see how your own products and services stack up and what kind of threat they pose to your business. It also helps you identify industry trends you may have been missing.

Four benefits to doing competitive research are:

- Understanding your market . Competitive research can reveal trends in the marketplace that might have otherwise been missed. The ability to identify and predict trends is a huge asset for any business, helping to improve value proposition for customers. This is an important component of competitive research that you should constantly be doing.

- Improving your marketing . Your customers care about how your product or service is going to make their lives better. If they are leaving to go to one of your competitors, it’s probably because that company does a better job of explaining the benefits to the customer base, or does in fact provide a better product or service. Competitive research helps you understand why customers choose to buy from you or your competitors and how your competition is marketing their products. Over time, this can help you improve your own marketing programs.

- Identifying market gaps . When you do competitive research, you’re analyzing the strengths and weaknesses of your competitors. You’ll often find that, by looking at the data, there is a segment of the population that is being underserved. This could put your business in a unique position to reach those customers.

- Planning for the future . The most important byproduct of competitive research is that it will help you create a strategic plan for your business. This includes things like improving your product or service, using more strategic pricing strategies, and improving the promotion of your products.

Good competitive research could put your business in a unique position to reach customers who are being underserved.

6 steps to competitive research

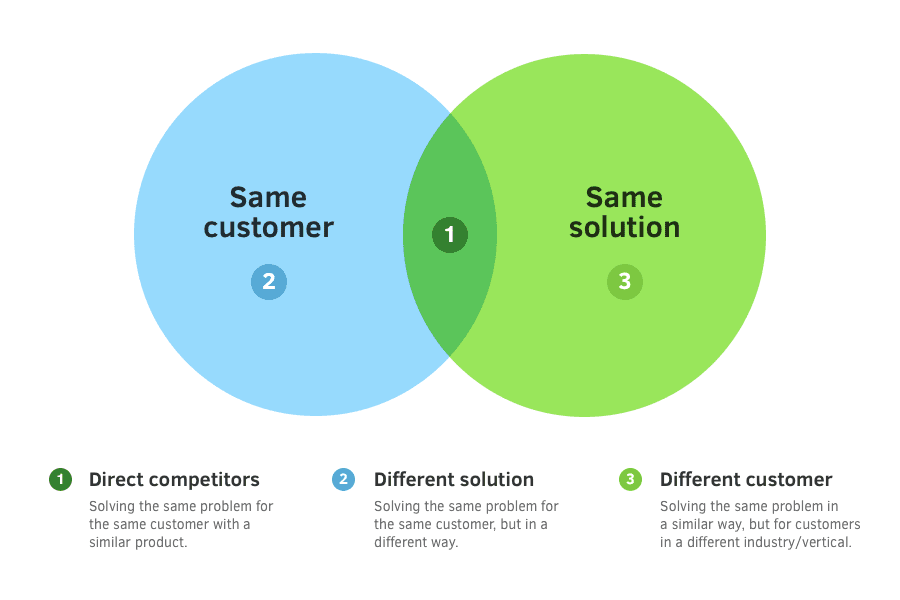

It may sound obvious, but the first step is to simply identify who your top competitors are . There are two different types of competitors to identify: direct and indirect.

Direct competitors are targeting the same customer base you’re targeting. They are solving the same problem that you are trying to solve and sell a similar product or service.

Indirect competitors may sell something similar to your product or service but target a different audience, or they may target your same customer base but have a slightly different product or service.

It’s important to understand this segment of your market for two reasons: (1) it could provide you with growth opportunities for your own business, and (2) it could also highlight a threat to your business of which you would otherwise be unaware.

Here are six steps to getting started on competitive research:

Identify main competitors.

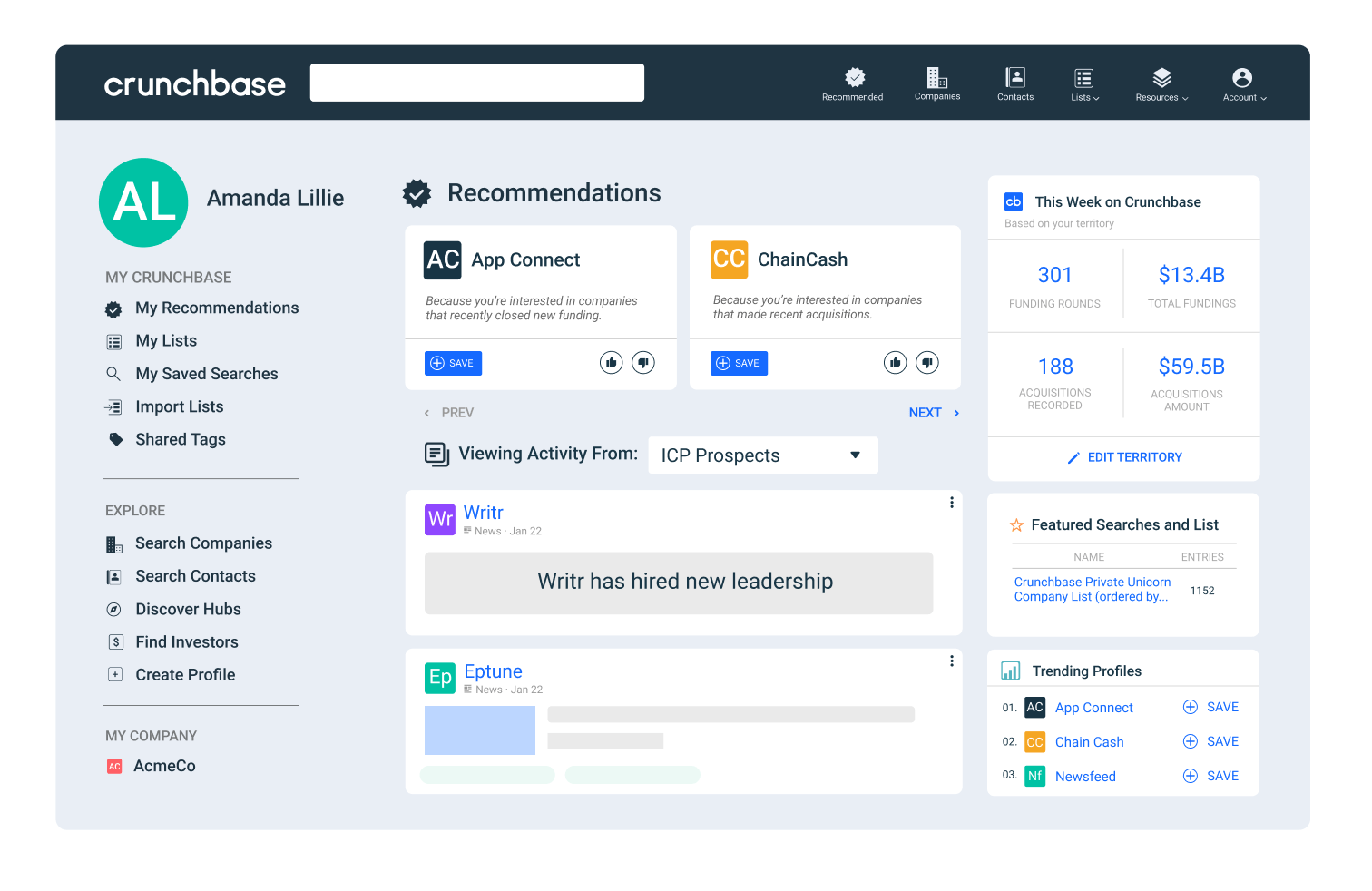

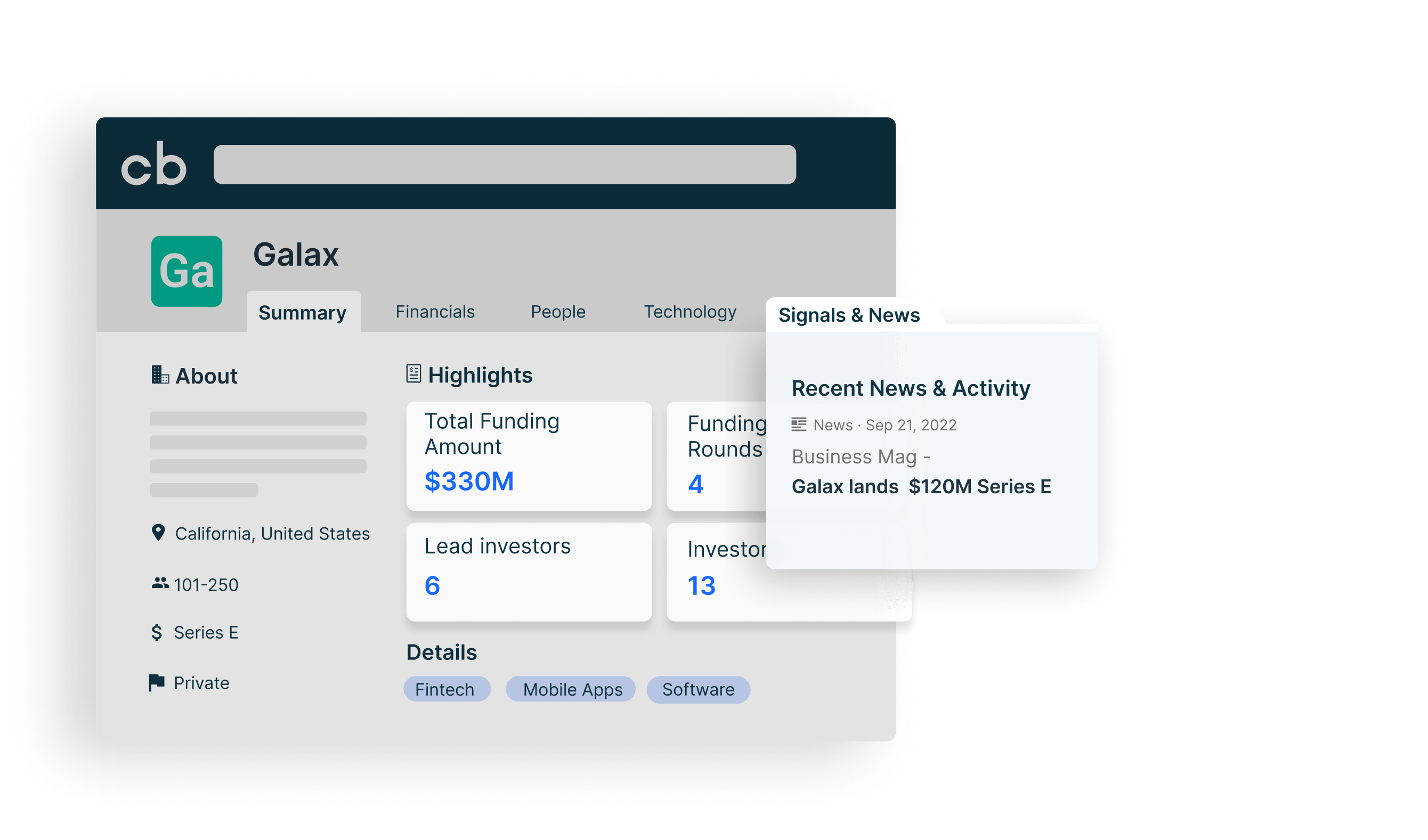

The most obvious way to do this is simply by searching your product or service category on the web and seeing what comes up. You can also check websites like Crunchbase or Product Hunt . You may find competitors that you might not have noticed before.

The goal is to cast a wide net and get an idea of who your main competitors are. Another good way to identify direct and indirect competitors is to ask your potential customers what services they are already using.

Analyze competitors' online presence

Once you’ve identified your main competitors, you want to look at their website, the type of content they are publishing, and their social media presence. Then, look for any blogs, white papers, and social media content being provided about their products and how to use them. Ask yourself these questions:

- What is the user experience like on their website?

- Is it easy to navigate?

- Do you clearly understand the products or services they offer?

- Is their website mobile-optimized?

- How often do they blog and most importantly, is the quality of their content good?

- What topics do they blog about most frequently?

- What social platforms are they actively using to talk about their products and services?

- Is this content engaging their target audience?

The answers to these questions show you opportunities where you can outperform your competitors. You will want to pay close attention to anything they are doing well that you aren’t doing. This will help give you a better understanding of where you should be focusing your attention and resources.

Gather information

The best way to gather information about your competitors is by acting like one of their customers. Sign up for their email list so you can get an idea of how they communicate.

Also, follow their blog and social media accounts and watch how they interact with their customers online. What kind of experience do customers have with your competitors?

You should consider shopping from them so you can see what their product looks like and what the experience is like from a customer perspective.

Track your findings

Make sure you track your competitors' findings on a spreadsheet; it will help with ongoing monitoring. This isn’t a complicated process, you just need to keep track of what they are doing over time so that you can see how they change everything from pricing to marketing and promotional activities.

You’ll start by dividing your competitors into direct and indirect customer columns. You’ll then track the following information:

- Company name

- Social media sites

- Unique features

- Pros and cons

- Screenshots and additional links

Check online reviews

Try to find as many reviews of your competitors as possible. Read their social media reviews, comments on their blogs, and case studies on their website. If they offer and present Google reviews, read them as well. It’s a good idea to understand not only the good things that your competitors may be doing, but the bad things as well. Include mentions with the Better Business Bureau about them in your research.

How customer-focused are they? This could be an opportunity for you to stand out. And, if they sell a product similar to yours, this will be a good way to find out if a lot of people are interested in it.

Any negative feedback will help you identify areas where you can improve your own product or service.

Identify areas for improvement

Now that you’ve taken note of some of the biggest differences between you and your competitors, it’s time to think about how you can use this information to improve your own business results.

Your competitive research should reveal at least one area your business can stand to improve in. This will help you learn how to engage better with your customers and online followers.

Keep in mind that competitive research is never a "one-and-done" event. Ongoing monitoring, such as observing how competitors evolve, is necessary to ensure that you are staying competitive in the marketplace.

Tools for competitive research

Software and technology now make it easier than ever to conduct competitive research. However, there are hundreds of competitive research tools on the market and narrowing down the right software can feel overwhelming.

This is why we’ve done the legwork and narrowed it down for you. Here are four tools you should consider using to conduct your competitive research:

SEMrush : This is one of the best competitive research tools on the market. It contains over 30 tools that can track things like SEO, PPC, keyword research, competitive research, and more. SEMrush will help you discover new competitors, find their best-used keywords, and analyze their ad copy. They have flexible pricing plans depending on your business needs.

SpyFu : This search analytics tool reveals the keywords websites buy on Google. So, once you’ve identified your biggest competitors, you can track every keyword they’ve bought. Plus, you can track every keyword they are ranking for and find the content and backlinks that helped them rank in the first place.

BuzzSumo : BuzzSumo lets you see how your content is matching up to your competitors’ content. You can see which content is shared more frequently on social media compared to others, and you can even schedule alerts on your competitors’ content which will make it easier to continue tracking them.

Owletter : Owletter tracks and analyzes emails sent from a website. This allows you to track your competitors’ email marketing and see what is and isn’t working for them. To get started, you’ll need to sign up to join your competitors’ email list. Then, every time you receive an email, Owletter will take a screenshot, analyze it, and alert you to any useful information.

Competitive research can seem daunting at first but it’s an essential part of running a successful business. When you incorporate the right tools into your research, you may find that it’s not as difficult as you imagined.

On some level, understanding your competitors is just as important as understanding your customers. Your competitors have valuable lessons to teach you and it’s important to regularly monitor their online activity. Doing so will strengthen your business and improve your own value for your customers.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Competitor Research: What it is + How to conduct one

Having the feeling that your company is falling behind the competition is frustrating, right? Competitor research is one efficient strategy for staying one step ahead of the game. You can learn about your competitors’ strengths and weaknesses, gain valuable insights into their strategies, and ultimately improve your own business through competitive analysis.

In this post, I’ll discuss competitor research in detail and give you actionable tips on how to conduct it effectively. So brace yourself to overcome the competition.

What is Competitor Research?

Competitor research is the process of identifying your competitors, finding out what their strengths and weaknesses are, and evaluating their products or services. It helps you understand the market and find ways to differentiate your business.

You may learn a lot about the target market and the competition by analyzing the products and services of your big competitors. It also assists in identifying previously unnoticed industry trends in the business world.

LEARN ABOUT: Market Evaluation

Why is Competitor Research Important?

Competitor research is an important aspect of business strategy because it allows companies to learn about their competitors’ strengths and weaknesses. Businesses can identify opportunities for improvement and areas where they can gain a competitive advantage by conducting a competitive analysis of their product or service, pricing, and marketing strategies.

Businesses may adapt their strategy to better serve their potential customers and position themselves to succeed in their industries by keeping up to date with what their competitors are doing. Following are some reasons for the importance of competitor analysis:

- To Understand the Market: Competitive market research helps to find market trends, consumer preferences, and other important elements that have an impact on their industry by researching their competitors.

- To Identify Opportunities: Businesses can identify market gaps where they can gain a competitive advantage by researching their competitors. For instance, they might identify market opportunities or brand-new customer groups to focus on.

- To Develop Better Strategies: By conducting a comprehensive competitive analysis, you can better understand why customers choose to buy from you vs. your competitors. Businesses may identify what works and what doesn’t by analyzing what their major competitors are doing and then modifying their marketing strategy accordingly.

LEARN ABOUT: market research trends

Is competitor research qualitative or quantitative?

Competitor research can use both qualitative and quantitative methods based on the particular research objective and the data that needs to be collected.

- Qualitative research collects non-numerical data and is frequently employed to better understand customer behavior, attitudes, and opinions. Conducting customer interviews, evaluating interactions on social media, and reviewing online reviews are examples of qualitative research methods.

- Quantitative research contains the collection of numerical data and is frequently used to measure market trends and the behavior of customers. Quantitative research approaches include conducting surveys or questionnaires, evaluating sales data, or making use of web analytics tools to measure website traffic

The appropriate strategy will depend on the goals of the research, the resources available, and the exact information you want to learn from the research.

Both qualitative and quantitative research approaches have their advantages and disadvantages. In many cases, a mix of qualitative and quantitative research methods can offer a complete picture of the competitive market.

LEARN ABOUT: Qualitative Interview

What should be included in competitor research?

A comprehensive competitor analysis or research should include some key elements to provide a complete picture of the market environment. Here are a few important things to consider:

Identify competitors

Analyzing the online presence of competitors.

- Website Design and Layout: It covers your competitor’s website’s layout, design, user-friendliness, and mobile responsiveness.

- Content Quality: It involves the accuracy, relevancy, and audience-usefulness of the content on your competitor’s website.

- Search Engine Optimization (SEO): It analyzes the on-page and off-page SEO tactics used by your competitors, including how they make use of keywords, meta descriptions, headings, URL structures, domain authority, and link-building strategies.

- Traffic Analysis: Find out how much organic and sponsored traffic your competitor’s website gets, including their use of calls-to-action, landing pages, and forms.

- Social Media Integration: Check out how your competitors use social networking symbols and widgets on their websites.

- Lead Generation: Check your competitor’s website for pop-ups, lead magnets, and other lead collection methods.

Competitive analysis of Products or Services

- Identify the gaps: Product or service that your competitors provide but you do not.

- Differentiators: Product or service that you provide but not by your competitors.

Pricing research

Marketing audit.

- Sponsored Ad Campaigns

- Social media advertisements

- Newsletters

SWOT analysis

Gathering information and tracking your findings.

- Business name

- Social media

- Special features

- Pros and cons

- additional details

Improvements and conclusions

Competitive research is a continuous process. For you to remain competitive in the market, ongoing monitoring is required, such as watching how competitors change. Creating a competitor analysis template will make future market research easier for you.

LEARN ABOUT: Market research industry

Dumpster Diving vs. Value Driving: Which would you pick?

Instead of spending all of our time and money figuring out what the competition is doing — shouldn’t we just give our customers what they want?

Yeah. It was getting ridiculous. That little sentence almost got me fired. But, I had honestly had enough.

I was the 1-woman competitive intelligence department for a large pharmaceutical packaging company who had suddenly had a reality check moment when they saw bits and pieces of their multi-million dollar business start vanishing before their eyes.

Suddenly, I realized that other companies were providing the same products, and they went from one extreme to the other.

Over the next year or so, I did phone interviews, customer interviews, and even some dumpster diving, all for competitor analysis and with the intent of trying to figure out what was going on.

This was all in the days before the internet, so there was a lot of hands-on, feet-on-the-ground, kind of competitor analysis that I did. And my conclusion-customer satisfaction was a way better investment of time and money. But that doesn’t mean that you should ignore the competition and not do competitor analysis; no way.

How to begin the competitor research process

Figure out what do you want to know and why.

When I first started doing competitive intelligence, it was a knee-jerk reaction to seeing sales and profits dwindle.

- Where did the money go?

- Why aren’t they ordering the same number of parts as last year?

- Who took my business?

And ultimately, the most important questions underlying all of these were “WHY were our customers leaving us?” and “What are we going to do about it?”

This was a good place to start our competitive analysis and competitive intelligence journey. The first step is knowing that you have competitors (duh! EVERYONE has competitors) and then understanding exactly what was important to our customers that we weren’t fulfilling on and our competitors were.

What’s your competitive dilemma?

- Do you see a competitor getting more of your ideal customer than you are?

- Do you see customers spending more on your type of product or service with someone else?

- Do you see customers “doing it themselves” when you can do it better?

Get as specific as you can about exactly what you want to know and why.

What decisions are you going to make, and what information do you need to make them?

This is a sister question to the first and will often come only after you understand exactly what’s going on in your competitive landscape. But it’s a critical piece of information to have in your competitor’s research because it will drive your time, money, and resources for a good amount of time.

So, the clearer you are on what decisions you’re going to make and what information you need to make them, the faster the process will go and the more effective you’re going to be.

What is it about this “competitive situation” that have you stumped?

- Are you trying to launch a new product and not sure if customers would switch from a competitor to you?

- Are you considering getting into a new market and wondering how to position yourself against an entrenched competitor?

- How many customers would you need to be successful?

Imagine that competition was NOT an issue; what would you need to know to be successful? This will help you identify and focus on very specific questions that will move your story and strategy forward and keep you from getting mired in “nice to know” information.

Decide on who your actual competition is in your competitor research

You probably believe that your greatest competitor is the person who lives next door, lives across the country, or offers the same service as you do. Is that right? Your competitors are any other possibilities that your customer may have to get the result that you promise. That is how I would define it. Keep reading to find out.

Types of Competition

As you can see, there are three categories of competition:

Direct competitors

Indirect competitors, secondary competitors.

Take a moment to list some of your direct and indirect competitors, as well as secondary competitors, now. This will really help you get some context around your competitor research.

Here are some Cool Tools That Will Help You Track Your Competition . Meanwhile, you can use some of our product survey templates and find out where your competitive advantage lies.

What tools can I use to do competitor analysis?

Competitive analysis is now more accessible than ever because of developments in software and technology. With so many options available, choosing the best tool for conducting market research might be difficult.

Because of this, I’ve done the research and narrowed it down for you. Let’s take a look:

- Google Alerts: Set up a Google Alert to be notified whenever your competitor’s name, product, or brand name, or maybe even their management team, is mentioned.

- Social Media Tracking: Use HootSuite to keep an eye on your competitors. I like this platform because it’s free, and you can make separate tabs for whatever you’re doing. So, make a tab that searches for the most important hashtags in your industry. Then, make another tab that searches for your competitors’ names and brand names.

- Email Promotions: If your competitors use email marketing, SIGN UP to get their emails. Sure, they can take you off the list, but you’ll still get information in your inbox.

- BuzzSumo: I started using BuzzSumo to come up with ideas for blog posts, but I’ve since learned that it’s also a great tool for figuring out how your competitors are doing. Just look up the name or brand of a competitor and see how many social shares they have.

- HubSpot’s Marketing Grader: This was originally made as a way to get people to sign up for your email list and show you how to make your website better. But why not use it to rate the website of your competitor instead? It’s a simple way to see where they can’t reach customers (oh, and you can use it for your own site for the same thing).

- Market research, Academic research, capturing qualitative and quantitative insights, and social media sentiment analysis .

- Analyze pricing research data to determine market factors, including competition intelligence, purchase behavior, and pricing sensitivity.

- A/B testing across questions, segments, and ideas.

Competitor Analysis FAQ

Is competitor analysis the same as swot analysis, why do we do competitor analysis, what are the types of competitor analysis, what are the objectives of competitor research.

LEARN ABOUT: Test Market Demand

Final Words

Competitor research can be difficult initially, but it’s crucial to successful business management. It might not be as difficult as you thought when using the appropriate research tools.

QuestionPro is a set of research tools that let researchers make surveys, polls, online focus groups, and even mobile surveys. The platform has an easy-to-use interface and advanced customization options that let researchers make their surveys fit their specific research needs while collecting accurate data.

QuestionPro also has powerful tools for analyzing data, such as data visualization and real-time reporting , which make it easy for researchers to understand and present their findings. The automation features of the platform also make it easy for researchers to collect and look at data.

FREE TRIAL LEARN MORE

MORE LIKE THIS

Taking Action in CX – Tuesday CX Thoughts

Apr 30, 2024

QuestionPro CX Product Updates – Quarter 1, 2024

Apr 29, 2024

NPS Survey Platform: Types, Tips, 11 Best Platforms & Tools

Apr 26, 2024

User Journey vs User Flow: Differences and Similarities

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

The Beginner's Guide to Competitor Research

How much time do you spend researching your competitors? Does your business have a research strategy in place? Do you know your strengths and weaknesses compared to your business rivals’? Unfortunately, for many businesses both big and small, competitor research is rarely given the attention it deserves, and that’s often detrimental to your company’s long-term growth. While there’s never been a better time to start and grow your business, there’s also never been more competition. With so many products, services, and pieces of content vying for our attention, it’s more important than ever to give you and your business the best chance to succeed — and that starts with knowing everything you can about your competition. Maybe your media company has been growing year after year and, all of a sudden, your growth stalls. Maybe you’ve recently discovered your most loyal customers are suddenly jumping ship. Or maybe you’ve just launched your ecommerce store and are looking for ways to get traction and increase exposure. Regardless of the stage your business is currently in or the challenges you face, competitor research can help you grow your brand, improve customer retention, and deliver the best product and service possible. In this post, you’ll learn the importance of competitor research, how to get started, the common mistakes to avoid, and how to use Quantcast to help you stay up to date.

The Benefits of Competitive Research

By now, it goes without saying — to stay relevant in your industry, you must constantly innovate. And innovation costs both time and resources. It also requires staying on top of the most effective industry trends, strategies, and tactics; ensuring your products improve; and meeting customer requests for new features. It can be overwhelming at best. But when competitor research is done properly, it’s a great resource that helps you understand and implement what’s working so you can focus on what you do best. With a well-executed competitor research plan, you can:

- Highlight your competition’s weak points so you can successfully position yourself as a better alternative

- Stay up to date with the latest macro trends in your industry so you can plan an effective long-term business strategy

- Learn the best practices for SEO, marketing, and social media

- Use your research to formulate, execute, and test new ideas, products, and services

- Determine common pain points of the customers and readers in your industry

- Help better define your target markets and opportunities for growth

Step 1 – The SWOT Analysis

The first step in competitive research is the strengths, weaknesses, opportunities, and threats (SWOT) analysis. Running a SWOT analysis gives you a foundation to base your competitor research on, helps you stay focused on the most essential parts of your business, and gives you a holistic view of where your company currently stands. You can run a SWOT analysis internally or externally. It’s incredibly useful for researching your competitors, and though you should perform SWOT analyses both internally and externally for maximum results, this blog focuses on the benefits of using it to analyze your specific business. To get a running start on your competitor analysis, set aside a few hours to answer the SWOT analysis questions below. Be as accurate and honest as possible so you can use this information to develop a realistic approach to your future strategy. You may also want to include other decision makers as well to get the most accurate possible view of your company.

SWOT Analysis

Internal – things you can control.

- What does your company do better than your competitors? For example, do you have better customer service, higher-quality products, services that get better results?

- What unique assets does your company have? Include things like your IP, technology, company culture, team, and overall reputation.

- What are some positive attributes your customers and clients would use to describe your company? Would they use words like trustworthy and reliable? Are they happy with your service?

Weaknesses:

- Where is your company lacking? Is it in financial capital, culture, teams, or efficiency?

- What do your competitors perform better at? Do they have more locations, faster turnaround times, or a big marketing budget?

- Which assets does your company lack that your competitors have? Do they have bigger networks, perhaps, or more reputable investors?

- Where do your customers and clients say you could improve? Are you constantly out of stock or slow to respond to mistakes within your business?

External – Things That Are Out of Your Control

Opportunities:

- How is your business uniquely positioned to succeed? Do you have a strong technology infrastructure or a strong team to scale and grow?

- What trends can you take advantage of today and in the future?

- Where can you capitalize on errors your competition has made?

- Do you have opportunities to improve your systems and processes based on future projections?

- Are the demographics of your customers and clients rapidly changing?

- Are there any current events affecting your ability to do business?

- Is the global market affecting your ability to sell and deliver value?

- Are there new laws or legislation impacting your business model?

Running your SWOT analysis helps put you and your company on the right track as you start researching your competition and shows you where your company stands. This will deepen the insights you gain as you continue to research. Of course, you can start your competitive research without doing a SWOT analysis, but we don’t recommend it. Its benefits increase as you research — and you can replicate it for some of your biggest competition, compare it to your SWOT analysis, then strategize.

Step 2 – List Your Competitors

Make a list of all your competitors. Include every competitor you can think of, and then do some online research, include others in your brainstorming, and see if you can discover any up-and-coming competitors or companies you haven’t heard of. Here are a few tips for creating your competitor list:

- Take your time and be thorough. The more time you invest in this process up front, the better your results and learnings will be.

- Don’t stop after the first three or four competitors spring to mind. Remember to include up-and-coming or lesser-known companies.

- When searching online for additional competitors, use the keywords, products, and services related to your industry and niche.

- Once your list includes five to 10 companies, you’re ready for more in-depth research.

Step 3 – Deepen Your Research

One of the biggest roadblocks holding businesses back from doing competitive research is a lack of direction. What metrics should you look for? Where should you spend your time and effort? Here’s where you should focus as you research your competition.

Take a hard look at your competitors’ SEO efforts to understand where they stand in the marketplace and to give your company a baseline for improvement. Look for the answers to these questions as you research:

- When you search on industry-specific terms, do your competitors rank on the front page of the search results?

- What can you learn from your competitors who have a strong SEO presence?

- Is their content marketing helping them increase their market share?

- Is their content typically in long form or shorter blog posts?

- How do they format their content?

- Do they publish a lot of guest posts?

These SEO tools can also help:

- Moz SEO tools

Content marketing is one of the most effective ways to drive sales, increase engagement, and develop brand awareness. Understanding your competitors’ content marketing strategy will give you insight on where you can improve or tweak your company’s current strategy. (If you don’t have a content marketing strategy, you definitely should.) Look for answers to these questions as you peruse your competitors’ content:

- What are your competitor’s most popular posts about?

- What do the least popular posts cover?

- What is the company’s content distribution strategy?

- Are readers engaged with the content? For example, are there reader comments posted at the ends of articles or posts? If so, which topics elicited the most commentary?

Here are some tools to get you started:

- Google Trends

Website traffic

When you understand your competitors’ web traffic, you’ll have a better overall view of their businesses health. While high web traffic doesn’t automatically mean a thriving business, it’s a good indicator of positive momentum. Look for answers to these questions in your research:

- If a competitor’s traffic numbers made a big jump, what educated guesses can you make about what might have caused the increase?

- Have their traffic numbers increased recently?

- Do they have a high number of email subscribers?

- Is their website professionally designed?

- Do the pages on their website load quickly?

- Do they consistently push content on their website and blog?

- Do they have a lot of high-quality back links?

These tools can also help:

- Google Analytics

Demographic data

Knowing your competitors’ demographics can show you how to boost your marketing efforts and grow your business. They can also help you better understand your competitors’ overall marketing plan, especially their content marketing strategy. Your research should answer the overall question, “Who consumes your competitors’ content, products, and services?” More specifically, you should discover:

- Is the audience primarily male or female? Of what age?

- What are their customers’ occupations and education levels?

- What are their interests and shopping habits?

- What are their political views?

- Where do they live?

- Is there an opportunity for you to take some of their market share by changing your marketing strategy?

Asking these questions will give you valuable insight into their overall brand strategy. These tools can also help:

- Quantcast Measure

- Website Informer

Step 4: Keep researching

Competitor research isn’t a one-time venture. To keep innovating and growing, you have to keep up the research. Here’s how.

Read your competitors’ content

It should be a company-wide habit to consume your competitor’s content on a regular basis. Not only will this keep you up to date with the latest in what’s working and what’s not, but it also gives you the opportunity to respond with high-quality content of your own based on the latest popular marketing trends. Check out their social media channels One of the best ways to keep track of your competitor’s social media content is to use a social media tool, such as Hootsuite . You’ll see your competitors’ latest posts so you can always have an eye on what they’re sharing. Sign up for competitors’ mailing lists If you are looking for free insight on what your competition is doing, sign up for their product mailing list or newsletter. This alone could provide numerous ways to improve your product or service.

Common competitor research mistakes

Make sure you don’t fall into these common pitfalls.

Copying your competitors

Stealing your competitor’s intellectual property and beyond is a surefire way to hurt your brand and potentially get you into legal trouble. While it might be tempting to just tweak some of your competitor’s most popular content or service and call it your own, it will quickly crack the foundation of trust your business has worked so hard to build. Instead, keep your brand unique. Let your competitors’ work inspire you to branch out, reach farther, and create something new.

Lack of commitment

Competitor research is a long-term strategy. You can’t just Google a few business rivals and call it a day, then expect lasting value. If possible, get buy-in on your competitor research project from your entire company or at least the key decision makers. Having the resources you need to effectively research your competitors will help you make the most out of your efforts. Think of competitor research as a never-ending process, and stay up to date with what your competitors are doing on a regular basis.

Tracking the wrong metrics

If you track the wrong metrics, you’ll lose time, and you could also put your company on the wrong path, costing significant capital in the long run. Tracking the wrong metrics and drawing the wrong conclusions about the data you discover go hand in hand, so stay focused on what’s truly important. To avoid researching irrelevant data and metrics, reference your findings from the SWOT analysis and refer to your KPIs regularly. Don’t get bogged down with details that aren’t relevant to your business goals. If one of your competitors is targeting a demographic you have no intention of marketing to, don’t spend time understanding that data set.

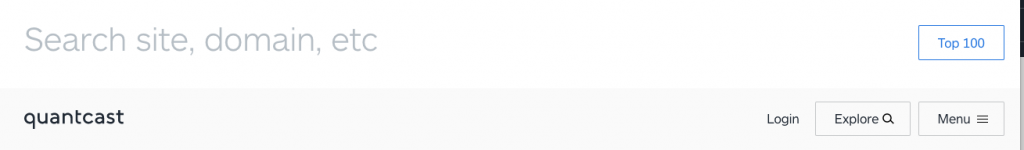

How to use Quantcast for competitive research

If all of this sounds overwhelming, consider letting Quantcast handle the legwork. While there are many tools you can choose for competitor research, Quantcast gives you all you need to understand your business rivals in simple formats. The work is done — all you have to do is put it to use. With Quantcast’s search feature, you can quickly get a glimpse at the important metrics for most of your biggest competitors and then adjust your overall business strategy accordingly.

[Quantcast search feature]

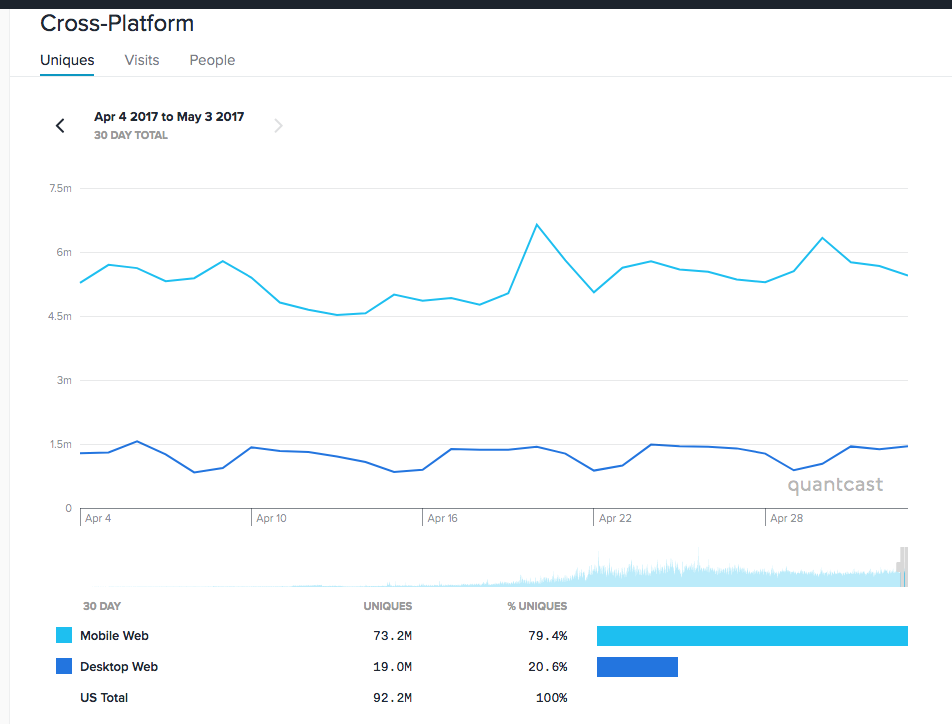

We provide analytics and metrics in easy-to-understand visual charts that show you exactly where you stand compared to your competition. For example, after researching your competitor on Quantcast Measure, you might discover interesting things about the devices its audience uses to view content. Using that knowledge, you can improve your mobile and desktop sites.

[Simple graphs from Quantcast Measure showing website metrics]

Weathering the competitive business landscape is a constant difficulty without the proper knowledge and tools. Let competitor research help you stay relevant in the eyes of your customers, readers, and partners. Now more than ever, it’s important to stay on the top of the latest industry trends. Learn more about how Quantcast Measure can lighten your workload. Legal Disclaimer: This article is for informational purposes only and is not legal advice nor a substitute for legal counsel. Please consult your legal advisor before doing competitor research and anytime you have questions with respect to intellectual property rights.

Request Demo Let's Grow Together

Whether you’re a brand, agency, or publisher, learn how Quantcast can help you reach new customers, drive incremental growth, and deliver business outcomes.

Send us an email

How to gain a competitive advantage by analyzing marketing initiatives by competitors

Written by by Jasmine Williams

Published on November 30, 2023

Reading time 7 minutes

It doesn’t matter how niche a product or service you offer. There are probably other companies that do the same thing. Competition is a normal part of business–and it’s what drives innovation.

Digging into your competitor’s approach through a marketing competitor analysis is critical to putting together or updating your brand’s marketing strategy. It is the key to your business’s future success because when you look more closely into your competitors’ marketing, you learn from their successes and mistakes. And this informs your marketing game plan.

In this article, you’ll see why a marketing competitive analysis is important and get expert tips on conducting one.

What is competitor analysis in marketing?

Marketing competitor analysis is the process of researching and analyzing your competitors’ marketing strategies and tactics to identify their strengths and weaknesses.

Look at the four Ps of marketing —product, price, place and promotion—these are four essential factors in marketing a product or service. Analyzing this gives you a competitive edge. Once you know more about your competitors’ methods, you can avoid their pitfalls and take advantage of missed opportunities to optimize your marketing.

But who exactly are your competitors? A competitor is any business that could pull market share away from your organization now or in the future.

There are two main types of competitors: direct and indirect. Direct competitors actively compete with you for the same customers, such as a similar business in your local area. Indirect competitors are those in the same category as you but sell different products or services and target a different market.

For example, if you run a B2B CRM software company that sells to small and medium-sized businesses, a CRM for enterprise clients would be your indirect competitor.

For a marketing competitor analysis, you should focus on your direct competitors.

How to analyze marketing competitors

To analyze your competitor’s marketing strategy, you need to gather as much competitive intelligence as possible about their marketing, from web and social media to field marketing. Fortunately, there are competitive intelligence tools to make this process much easier. You’ll also need to establish criteria for evaluating the effectiveness of their efforts.

What are the steps for a marketing competitor analysis?

While you were likely already familiar with the concept of a marketing competitor analysis, you might not know exactly how to put one together from scratch. Plus, with so much data available, you might find it tough to know where to start or where to focus.

Here’s a step by step process to get you started.

1. Determine your competitors

To find your direct competitors, turn to search engines, social media and customer insights to learn who’s competing against you. Search for keywords related to your product or service and see what other businesses rank for them.

For example, a Google search for “makeup brands” highlights a few of the world’s leading makeup companies.

Also follow social media hashtags related to your product or service. For example, if you run a home office furniture company, you might follow hashtags like #ergonomicchair or #homeoffice.

You could also survey and ask your customers what other brands they considered when making a similar purchase.

2. Research their content strategy

Once you have a shortlist of competitors, look at their online content. Consider these five key factors when evaluating your competitor’s content strategy:

- Content type: Do they have a blog? Are they running paid social ads or posting organic social content? Publishing whitepapers/ebooks? Creating engaging videos? Podcasts? Take stock of the different kinds of content they’re producing.

Use tools like Meta’s Ad Library to see your competitors’ ads. Continuing with the furniture brand example, we can see that one brand, Autonomous, is currently promoting its bulk order promotion and an ErgoChair deal.

Knowing what types of discounts and products your competitors heavily promote is extremely helpful for your sales, marketing or product development strategies.

- Total amount of content: If they have a blog, see how many posts have they published. Checking out how much content they’ve developed in total could help you set expectations or benchmarks for your content.

- Publishing frequency: Are they publishing new content weekly, monthly or less often? Posting more frequently than your competitors could help you engage your audience better.

- Quality: Is their content accurate, well-researched and polished? If not, this is a clear area where your brand can pull ahead.

- Calls-to-action (CTAs): What’s their sales pitch? What unique selling propositions (USPs) do they include in the content? Use their approach as a guide—or try something entirely different to differentiate your brand. For example, scheduling software Calendly has a section on its homepage highlighting a few USPs, like its granular availability tools and easily shareable and embeddable scheduling link.

When it comes to competitor analysis, these USPs serve as a benchmark and inspiration for product development as they highlight features users expect from a scheduling tool. This will enable you to optimize your offer to compete.

3. Monitor their social media reach

According to The Sprout Social Index ™ 2023 , 68% of consumers follow brands on social to stay informed about new products or services. Look closely at your biggest competitors’ social presence and see how you compare and where to improve.

When conducting a social media competitive analysis , consider the following factors:

- Audience size: Your competitors’ follower count may indicate your biggest competition.

- Engagement: How many likes and comments does your competitor’s content get. If they’re getting a lot of attention, try to understand why.

- Hashtags: What hashtags are your competitors using? How many people are tagging your competitors in posts? These factors help you better understand your competitors’ overall discoverability and level of brand awareness.

- Top posts: Track competitor posts performing the best. Make a note of any patterns or themes and use this information to improve your content.

FYI: Sprout Social’s Listening and Competitive Analysis features make tracking these data points a breeze.

4. Keep an eye on their online presence

Conduct keyword research to see what keywords your competitors use and rank highly for, and find new opportunities for your content. News mentions tell you about how your competitors are doing in the media and provide data for sentiment analysis (i.e., how the public feels about their brand).

Sprout’s Competitive Analysis Listening tool offers a side-by-side competitor comparison of metrics like average positive sentiment. Sprout’s Listening insights also show you trends, topics and posts in your industry, all filterable by sentiment.

Online reviews also give you insight into brand sentiment. Google Alerts will keep you in the loop about your competitors’ new content, news mentions and website changes. And ofcourse, our Spike Alerts help you monitor and respond to significant increases in mentions or keywords related to your brand or industry.

5. Evaluate their website for affiliations and events

Looking into the events your competitors attend or sponsor offers insight into their target audience, brand values and personality. Sponsoring an important cause also helps a brand foster a more positive reputation, so researching competitor events and affiliations will tell you more about what your target audience cares about, which you can use to your benefit in your marketing strategy.

For example, consulting firm Accenture sponsoring AfroTech, an annual conference for Black tech professionals, highlights their commitment to inclusion and diversity.

6. Consider working with a market research firm

If all this research and analysis sounds daunting, outsource the work to a market research firm. They will gather and analyze competitor data about your competitors’ strengths, weaknesses, opportunities and threats (SWOT). Plus, since they’re not a part of your company, they often gather more neutral, unbiased findings.

7. Summarize findings and determine next steps

You’ve collected all this data, but what does it all mean? Once you’ve completed your research, break down your marketing competitor analysis into actionable takeaways that your key stakeholders can easily understand. Summarize the key findings and most interesting points, and use charts, graphs and other visual aids to make the data more digestible. Form your next steps based on the insights you gather.

Benefits of a marketing competitor analysis

Even if your competitors don’t change, your general market will. From evolving consumer behavior to new technological developments, your business must be aware of, and ready to, adapt to these shifts.

Plus, with the right tools for competitor analysis , you can quickly collect, refine and incorporate this data into your marketing strategy. For example, adding Sprout’s marketing toolkit makes competitive analysis less daunting and more automated.

Here are a few more ways regular competitor analysis marketing helps you stay agile and ahead of the curve.

Optimize product placement

Look at how your competitors position their products compared to yours. Analyze their messaging, branding and packaging to see how your products or services compare and what you can do better. Also, look at the channels they use to distribute their products, such as retail stores, online marketplaces or direct-to-consumer sales. If there are any channels they don’t use effectively, this could be an opportunity for your brand to shine.

Determine product outlook

Monitoring your competitors’ product releases and updates may uncover areas where they are falling behind. Fill in these gaps to better position your brand. Analyzing your competitors’ marketing strategies helps you anticipate upcoming product launches or promotions that could impact your sales.

Establish benchmarks

Comparing your competitors’ marketing metrics, such as website traffic, social media engagement and conversion rates, allows you to set competitive benchmarks for improvement. Competitor analysis also often reveals industry best practices to incorporate into your marketing strategy.

Gain a competitive edge with marketing competitor analysis

A marketing competitor analysis is valuable for any business that wants to stay competitive and grow its market share. Keep an eye on your competitors to identify new growth opportunities, benchmark your performance and adapt to changes in the market.

Try Sprout free for 30 days and use our competitive analysis reports to get a leg up on your competition.

- Competitive Strategies

- Review Sites

Everything you need to know to conduct a competitive analysis (plus template)

- Marketing Disciplines

Competitive insights: 6 essential market factors and how you can collect them

- Leveling Up

How to build a competitive analysis report with examples and tools

- Customer Experience

Business intelligence reporting: making sense of your organization’s data

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

.png)

11 Strong Tips on How to Research Competitors [+Template]

Competitor research is crucial to the success of any product or service as no business operates in a vacuum. But the usual tactics of market research may not be sufficient to reveal critical competitive intelligence. Competitor research needs a specialized set of processes that use data to uncover actionable intelligence.

This doesn’t mean that the process must be complicated or tedious. Using proven methods and frameworks, businesses of any size can objectively research their competitors without having to set aside significant resources or time. This will help them to better price and position their products and services and even develop solutions that are in sync with the expected market forces.

Based on a comprehensive analysis of successful firms, here are 11 tips that you can use to uncover crucial competitive intelligence. You will also find a competitor research template at the end of this article.

1. Build a Tiered Competitor List

The first step in gaining competitive intelligence would be to make a tiered list of your three or four top competitors. These are the businesses you would need to track in-depth. Some could be direct rivals and some might have a different core competency but with products or services that would compete with yours.

You should also research emerging competitors as most of these challenger brands would have disruptive technologies or processes. According to research, there’s a 77 percent chance that your greatest competitor might still be unknown to you.