- Book a Speaker

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Reuse Permissions

Request permission to republish or redistribute SHRM content and materials.

12 Case Studies of Companies that Revised How They Compensate Employees

S HRM has partnered with ChiefExecutive.net to bring you relevant articles on key HR topics and strategies.

Higher compensation is part of the ransom for dealing with the pandemic for most American companies and industries. So salaries, wages, benefits and perks will cost them more—perhaps a lot more—in the year ahead.

The way CEOs and CHROs can make sure the Great Raise works to their companies' advantage is to be proactive, creative and equitable about it. Yet they also must weigh strategically the demands of the moment with their long-term compensation strategy.

"This is a time for real balance when it comes to how you deal with retention and attraction," said Paul Knopp, chair and CEO of KPMG US. "We all have to make sure we meet the market when it comes to base compensation, but the market has changed in a way that you also have to look at those benefits that are most attractive to employees for their careers."

While median full-time earnings of $1,001 per week in the third quarter of 2021 were nearly 9% higher than two years earlier, according to the Labor Department, expectations for 2022 remain frothy given the tight market for talent, the free-agent ethos encouraged by remote work, the geographic reshuffling of workers and decades-high inflation. U.S. wages will increase by 3.9 percent in 2022, according to the Conference Board, the highest rate since 2008.

The compensation surge is occurring at the high end, at a low end that's getting higher and everywhere in between. Goldman Sachs, for example, is offering paid leave for pregnancy loss and expanding the amount of time employees can take for bereavement leave while also boosting its retirement-fund matching contributions for U.S. employees to 6% of total compensation, or 8% for those making $125,000 a year or less.

Meanwhile, at Tyson Foods' chicken-processing plant in New Holland, Pa., the company has started offering a three-day workweek, plus pay for a fourth day that retains employees' status as full-time workers. Just for good measure, Tyson has created a $3,000 sign-on bonus for new hires.

"We're in a bidding war for talent that will go on for a long time," said Alan Beaulieu, president of ITR Economics.

For CEOs and CHROs, several new factors demand their attention along with the overall spike in compensation. They include:

- The end of retention. The "idea of a long-term commitment to one employer has been dead for a while, but it's really dead now," said Dave Roberson, CEO of the RoseRyan financial consulting firm. "You must have a stream of people. Assume you're going to be replacing people. So how do you keep the people you have, if you can, but also bring the next group in?"

- High-balling. A deal to recruit someone may not really be a deal these days. "You've made an offer and you think you've got a hire, and then they're asking for $5,000 or $10,000 more," said David Lewis, CEO of OperationsInc, an HR consulting firm. "Now you have to ask yourself what makes more sense strategically: say no and hold the line and lose the candidate and restart the process, not knowing how that will work out? Blow up your compensation structure? Or as a Band-Aid, give that person a sign-on bonus in hopes that the package will get them in the door?"

- Need for equalization. Recruiting with higher compensation also requires boosting pay and benefits for retention. "You need to be mindful of what you're paying others in the organization and understand the detrimental impact it will have when you bring someone in alongside a tenured employee," Lewis said. "Operate on the idea that everyone's salary is basically posted on the pantry door in your office."

- A focus on mental health. The pandemic, anti-contagion measures and the takeover of remote work has left many Americans isolated, confused, lonely—or at least disjointed. And they expect their employers to help them cope and adjust.

"Mental health is a real thing, regardless of how [a previous generation of leaders] feel and what we did," said Jeffrey Immelt, former CEO of General Electric. "Particularly post-Covid, it's something worth your time to try to understand."

Many Fortune 500 companies already offered mental-health benefits, but by now "mental health is just a place setter: You've got to have it in place to be competitive in the market today, across the board," said Richard Chaifetz, founder and CEO of ComPsych, a large provider of employee-assistance programs. "Companies understand the importance of keeping their people functioning at the highest level."

Codility, for example, has begun supplying all employees with 27 days of paid time off per year plus four mental-health days, which don't have to be approved. "We're offering these days in addition to personal-time-off days to recognize and bring to light the importance of mental health," said Natalia Panowicz, CEO of the platform that evaluates the skills of software engineers, with its U.S. hub in San Francisco.

CHRO360.com asked a dozen CEOs, CHROs and other top executives about their compensation strategies and practices for 2022. Here are some of their ideas:

Let Them Name Their Salary

Chris kovalik, ceo, rushdown revolt, a video-game maker in new york city.

We started as 12 part-timers, mostly people who were giving me their moonlight hours. That's not a lot different from now, except now we have 75 people. The magic of what we do is that we don't recruit anybody. We're just a magnet. We let people come to us.

When it comes to compensation, some say they wanted to volunteer, that they weren't expecting compensation. But we never, ever allow people to volunteer their time for us. So we say our company minimum wage is $15 an hour, and if you insist, we can pay you that per hour.

But generally people come to us with an expectation of compensation because they see that we're making money. When compensation came up, we'd say, "I don't know what your skill set is. I've never hired you before. How much do you think you're worth, and how much do you need?"

If every hour we're compensating them for the amount of money they want and need, if someone is part-time and only giving me 10 hours a week, I'd argue that they're giving me their best 10 hours. Because they're getting paid what they want and doing things that they want to be attached to and be part of.

There's no pattern to the compensation requests. If their number is too low, we'll say, "Are you sure? Are you just giving me a low-ball number I'll say yes to?" If it's high, I don't talk them down, but I ask them to justify it, and if the justification isn't adequate, what I say is, "How long do you think you'll need to prove that justification? Two to three weeks? Then let's pay you two-third to three-quarters of what you asked, and if you prove it, we'll go up to whatever you said."

Tailor Package for Youth Appeal

Ronald hall jr., ceo, bridgewater interiors, an auto-seat maker in detroit.

We enjoyed very low turnover pre-Covid, but during the last two years we have had to replace probably one-third of our workforce at our largest facility, about the same number from termination as voluntary. So we've had to work harder than ever to recruit.

Our most-tenured employees, who are the most highly trained, have had to pick up the slack, working record amounts of overtime and less-predictable production schedules.

In our upcoming negotiations with the United Auto Workers, we're trying to emphasize short-term bonuses rather than wage increases that get baked into our costs. But we have continued health insurance through the pandemic as well as our tuition-reimbursement program, and many employees have thanked me for that.

What I am hearing from new employees is that they're not as interested in benefits but rather in higher cash wages. We've long touted benefits like our generous 401(k) matching and better medical coverage versus our peers, but we're finding that doesn't resonate as readily now as it did a decade ago. So I've asked my team: Should we be looking at some kind of hybrid model of offering higher wages to people who want those and move those dollars from the benefits side to the wages side?

We've also looked at providing childcare in a partnering arrangement where there could be a center developed near our facilities, and we would arrange for some sort of company subsidy or guarantee some level of attendance. The challenge with that is the auto industry runs around the clock, and you'd need a daycare provider who'd be committed to opening around the clock and provide legal, regulated, benchmark-standard levels of care to all those children in the off hours.

Equalize as You Acquire

Diane dooley, chro, world insurance, a business and personal insurer in tinton falls, n.j..

We onboarded about 800 employees in 2021 through acquisitions of small agencies and organic growth, but there had been no compensation modeling. Now we're building out our compensation philosophy with commission plans, incentives and bonuses, centralizing components and ensuring we have the right framework.

When we do an acquisition, we might retain their compensation model for a year or two years then slowly migrate, but make sure employees aren't taking a cut in pay. We are also capitalizing commissions into base compensation—identifying what commissions would have been and what they will be, and recognizing roles that are moving away from a commission base.

Some agencies we acquire are smaller and may be below-market for total compensation. Now we're addressing those concerns. They need to be more front and center. We must do everything to retain our employee population. If they're woefully underpaid, or not at market, we risk losing people, and we don't want to do that.

Educating the owners of some of the agencies [we acquire] is a piece of this. As we partner with them, we are evaluating them and asking, "Did you give people an increase this year?" We're not telling them what to do but providing guidance about what to do.

We're also modifying and increasing our benefits, such as giving employees pet insurance. And making counteroffers is a critical piece today, usually for high-end employees. They work better than they used to because not a lot of people really want to make a move in this environment.

Innovate for the New World

Jason medley, chief people officer, codility, a provider of skill-evaluation software in london.

We really have to step back and be innovative and force ourselves to change. The companies that are going to win are going to be more progressive early and not fighting what's happening.

One thing we've done is change our outdated compensation models that give higher pay to employees living in tech hubs like San Francisco and New York and lower compensation for areas inside the coasts. Now, we've created a United States-wide salary band, so no matter where you live, the compensation is based on the role, not the location. You can go live and work wherever you want to.

We decided to approach compensation through a very human lens. People have seasonality in life, and maybe they are caregivers at different moments and want to live in different places. We want to be as flexible as possible, and this country band gives us that flexibility.

We are starting to see the same thing in Europe, where we have our headquarters in London and offices in Berlin and Warsaw, and employees all over, especially in Poland. People are wanting to live in the countryside of Spain but demanding a London salary. So we are transitioning to one European Union band and saying, "Here is your rate—live where you want to."

We are also seeing that with global warming, it's harder to get work done for people on the west coast of the U.S. and in Europe, because they didn't build homes with air conditioning. If you're sitting in a house at 90 degrees with no air conditioning, there's no way your performance is the same as someone with AC. Supplementing air conditioning isn't something we thought about before, but now we're very much having to look at those things.

Stay Ahead of Expectations

Traci tapani, ceo, wyoming machine, a sheet-metal fabricator in stacy, minn..

Our wages have gone up by about 20% for the typical worker. When I found people I could hire, I knew they were being brought in at an hourly rate that was too high for what I was paying my incumbent workers.

My strategy has been to be proactive about that and not wait for [existing] employees to say something about it or give them a reason to look for another job. We're proactively making wage adjustments to make sure our incumbent workers are in line.

Employees will leave for more money, so they're very appreciative of it. But in my shop, I also know that people like working here, and I know they don't want to leave. I don't want to give them a reason. If they can get an increase in pay that's substantial, I know that I can cut them off at the pass. Retaining my workforce is my No. 1 strategy. They're already here, and I'm going to do everything I can to keep them.

For that reason, we've also been more generous as time has gone on with paid time off, offering it sooner than we once would have, especially for new workers. We recognize that it's healthy for people to be away from work and also, in the pandemic, people need to be away from work. Knowing they have some paid time off makes it easier for them.

Leverage Benefits for DE&I

Mark newman, ceo, chemours, a chemical manufacturer in wilmington, del..

In general our company hasn't seen the Great Resignation. And in fact, we continue to believe our focus on being a great place to work is serving us well, along with appropriate benchmarking on compensation issues.

Chemours is a great place to work. We survey our employees every year, to improve our working environment from a compensation and benefits perspective. Also, from the [diversity, equity and inclusion] perspective, we're trying to make sure we tap into the full breadth of talent in our industry.

That means, for instance, we are helping people more with college loans. We are offering same-sex [marriage] benefits. We are providing more family leave for people who have kids. There is clearly an aspect of our benefits package that is evolving to be consistent with our strategy of making Chemours a great place to work.

Overall, we view compensation as something where we want to be either in the median or upper quartile. It's something we're very focused on from both a wage as well as benefit level. From Covid, there's been no fundamental change as it relates to us wanting to be in the median to top quartile.

We've had to make some local adjustments where the labor market is more super-charged. For example, we see a lot of that in the Gulf Coast region, especially with oil prices coming back, and petrochemicals and refining. But it's very much a regional factor. So if industries are moving to a certain region, like the South, you have to make sure you stay current with local benchmarks.

Offer Skin in the Game

Cesar herrera, ceo, yuvo health, a healthcare administrator in new york city.

We're a year-old company that provides tech-enabled administrative solutions for community health centers across the U.S. that are specifically focused on providing primary-care services for low-income individuals. We have a team of about 10 people right now, and we have a number of open roles and positions where we're likely going to be tripling the size of our team in 2022.

Google can compensate well above the market rate. We don't have that since we're an early-stage organization. What we do have as levers aren't up-front financial compensation but equity, support in your role and a relatively flat organization where you can have significant autonomy.

A lot of individuals are going to be driven by the mission; that's the case with the entire founding team. We've made sacrifices to create this organization. So you can come in at a meaningful position with a lot of decision-making.

But one of the biggest carrots we can give is, if you accept the lower pay and the risk that comes with an early-stage organization, you can have meaningful equity in the company. We have an options pool which is not to exceed 10% ownership of the organization, and as we grow and scale, we increase that options pool. For senior-level leaders, we do expect to be able to distribute up to 10% of the company to them.

Pay Extra for Continuity

Corey stowell, vice president of human resources, webasto americas, a maker of automotive sunroofs in auburn hills, mich..

We had to recruit for several hundred new openings at a brand-new facility right at the beginning of the pandemic. So we instituted an attendance bonus. For those who worked all their hours in a week, we paid an additional $3 an hour. We really had to keep it short-term, so we paid it weekly. If you wanted to pay it every month, you couldn't do it, because people needed that instant gratification.

Otherwise they could get it on unemployment. With our pay rate, they could earn more to stay at home and collect unemployment, a significant amount more than they could earn than working for us. So we also had to increase our wages, and we increased them by more than 20% in some classifications [in the summer of 2020].

We've filled all of our positions, but it's still a challenging market. We've had to increase all our wages, with the lowest for a position being $17 an hour, on up to $30 an hour.

We also have offered stay bonuses of $500 a month for three consecutive months, up to $1,500. And for hourly employees we've instituted a different attendance policy, where they can earn two hours of paid personal time for so many hours that they work consecutively with no attendance issues.

The key is the schedule—we can prepare and get someone to cover. That's easier to do than just managing whoever's going to come in today. In this environment, that really has changed with our workforce, and it's tough to rely on our current workforce.

Give Them the Keys

Elliott rodgers, chief people officer, project44, a freight-tracking software provider in chicago.

We have equipped and subsidized a van that we call Romeo, which employees can use to combine work with personal uses like family road trips. We cover the cost of the rental. It's a luxury van that comes equipped with a bed, a toilet and shower, Wi-Fi, device charging and a desktop workspace. And it's pet friendly.

We started it as a pilot project and reservations were full within 10 minutes of when we posted it internally. Then we extended it into 2022. By the end of 2021, more than 20 unique team members completed or nearly completed reservations. They've ventured out to places spanning Mount Rushmore and the Badlands; Rocky Mountain National Park; Salem, Mass.; and Pennsylvania. A pretty broad number of places.

It's something we're really proud of. It allows our team members the opportunity to work in a lot of different places while still being connected to us. And they've appreciated the opportunities to stay connected, but also be connected in other ways with nature and other places in the world. They can maintain their perspective while also continuing to contribute to their role in a productive way.

When you place a team member at the center of what they'd want in an experience like that, the value of it answers itself. It creates a comfort level where it provides the necessities for you to be able to continue to work, and you can work from anywhere. It's the best of both worlds. It's one thing to find that on your own but another to have that accessible to you via work, but done in a way that caters to you.

Help Them Come, Go—and Stay

Aamir paul, country president - u.s., schneider electric, a maker of electrical distribution and control products in andover, mass..

With our knowledge workforce, it's been about intentional flexibility. So, for instance, we launched a "returnship" program for women who'd left the workforce but might want to come back even at reduced hours. That means 20, 30, up to 40 hours a week, and we're finding some incredibly talented people who haven't been in the workforce.

This program is available to men as well. If there's a field engineer who's been in the electrical industry for 35 years and he's now retiring, but he's five years from getting his medical benefits, we say: Don't retire. Go on the program. Work 20 hours a week. Work from home. We'll reduce your pay proportionally, but we will couple you with three university hires, and they will call you on Microsoft Teams and show you what's happening on the job site, and you're going to walk them through it. Work just three days a week. We'll cover your benefits.

We've also expanded the parental leave policy, which already was one of the best in the industrial sector. And we created a way for people to buy more time off without having to leave their positions. They apply for more unpaid time off and we allow them to retain their position and seniority and allow them to work through whatever life event it is.

We landed on six weeks for the maximum. In the most intense industries—such as a fighter pilot or a surgeon—they've found that six weeks of being out of the rotation allows them to re-set. So that's what we did. Before, the limit was two weeks.

Give Sway to Local Management

Tom salmon, ceo, berry global, a maker of plastic packaging in evansville, ind..

We've got to be competitive in all the geographies we serve. We have 295 sites around the world and manage our employees in those sites geographically. Every geography will be a different labor environment. There are different criteria that employees are looking for. It's not just about wages but taking everything into consideration.

We let local management handle things with their insight about wages and competition. They're hearing directly from employees about what they like and don't like, what they want more of and less of. It's a site-by-site discussion.

For example, at some sites, it may be important for employees to be able to access the internet at lunch; at other sites, they may not value that as much. Some want a more advanced locker facility, with different shower facilities. That includes the southwestern United States, where the temperatures are warmer; but in New England, some might not want that.

In any event, if you treat these things locally, you're going to be able to affect that local population and address the need of that geography. If you blanket something across our entire plant population, you may provide something that's not desired or needed.

We depend on our local management to respond to the different demands in terms of compensation and benefits at their sites. The better the front-line leadership is, and the more satisfied their team is, the higher our retention rate and productivity and safety performance. So these leaders participate in profit-sharing plans for those respective sites, because they have a great influence on the success of a given facility.

Focus Benefits on Flexibility

Paul knopp, chair and ceo, kpmg us, a financial consulting firm in new york.

We announced a new package of enhancements to our benefits and compensation, tied to mental, physical, social and financial well-being. These increases are the biggest in the history of the company. You have to make sure your base compensation meets the market, but you also must have attractive benefits.

For example, we cut healthcare premiums by 10% for 2022 with no change in benefit levels, and we introduced healthcare advocacy services. We are replacing our current 401(k) match and pension programs with a single, automatic company-funded contribution within the plan that's equal to 6% to 8% of eligible pay.

As part of this, we're focusing on the crucial element of ensuring that employees know you're watching out for them. They also are looking for flexibility—you don't want to under-index on how important that is. So we also are providing up to three weeks additional caregiver leave, separate and apart from PTO. And all parents will receive 12 weeks of paid parental leave, in addition to disability leave for employees who give birth, allowing some up to 22 weeks of paid leave. We also have expanded our holiday calendar to now include Juneteenth.

Dale Buss is a long-time contributor to Chief Executive, Forbes, The Wall Street Journal and other business publications. He lives in Michigan.

This article is adapted from www.ChiefExecutive.net with permission from Chief Executive. C 2022. All rights reserved.

Related Content

Why AI+HI Is Essential to Compliance

HR must always include human intelligence and oversight of AI in decision-making in hiring and firing, a legal expert said at SHRM24. She added that HR can ensure compliance by meeting the strictest AI standards, which will be in Colorado’s upcoming AI law.

A 4-Day Workweek? AI-Fueled Efficiencies Could Make It Happen

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

Advertisement

Artificial Intelligence in the Workplace

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

HR Daily Newsletter

Stay up to date with the latest HR news, trends, and expert advice each business day.

Success title

Success caption

- News and Insights

Compensation Case Studies: Real-World Examples and Takeaways

- July 9, 2024

Why Compensation Case Studies are Crucial

When it comes to effective compensation strategies, understanding compensation case studies can be transformational for attracting, retaining, and engaging talent in your workforce. Real-world examples can offer practical solutions that are both innovative and proven to work.

What You’ll Learn: – Importance of competitive compensation in attracting top talent. – Strategies for retaining employees through effective benefits. – Ways to engage and motivate your workforce.

Companies like Apple and Amazon showcase how tailored wellness programs and performance-based compensation structures can drive both individual and organizational success.

I’m Chris Lyle, co-founder of CompFox, and I’ve spent years researching and implementing compensation strategies. My experience has shown that compensation case studies are vital for informed decision-making in HR and legal fields.

Next, we will dive deeper into what a compensation study entails and why it matters.

What is a Compensation Study?

A compensation study is a detailed review of how an organization pays its employees compared to the market and internal standards. It helps ensure that pay practices are fair, competitive, and aligned with the company’s goals.

Review Pay Practices

First, a compensation study looks at the organization’s current pay practices. This involves examining how salaries are set and adjusted, how bonuses and incentives are awarded, and what benefits are offered. The goal is to identify any inconsistencies or areas for improvement.

Salary Comparison

Next, the study compares salaries within the organization to those in the broader market. This is done through salary surveys and data analysis. Companies like Community Living Toronto have used salary comparisons to uncover and remedy internal equity issues.

Market Value

Understanding the market value of different roles is crucial. This involves looking at what other companies pay for similar positions. For example, The Talent Company prioritized external equity for high-demand roles by adjusting their pay bands and communicating changes clearly.

Equitable Salary Ranges

Equity in salary ranges ensures that employees are paid fairly for their work, regardless of gender, race, or other factors. Companies like Chemtrade have made organization-wide efforts to establish equitable salary structures, ensuring fairness across all levels.

Internal Pay Parity

Internal pay parity means that employees in similar roles with similar experience levels are paid equally. This is essential for maintaining employee morale and trust. For instance, Community Living Toronto addressed internal equity issues by reviewing and adjusting their pay practices.

Why It Matters

Conducting a compensation study helps organizations make informed decisions about pay. It ensures that they stay competitive in the job market, attract and retain top talent, and maintain a fair and motivated workforce.

In the next section, we’ll explore real-world compensation case studies from industry giants like Google and Netflix to understand how they have successfully implemented these strategies.

Real-World Compensation Case Studies

Google: innovating employee compensation and benefits.

Google is a pioneer in employee compensation and benefits. They don’t just offer competitive salaries; they create a complete ecosystem for their employees.

Equity and Transparency : Google openly shares financial information with employees. This transparency fosters a sense of ownership and connection between individual contributions and the company’s success.

Health and Wellness : Google provides on-site healthcare services, gourmet dining, and wellness programs. They focus on both physical and mental health, ensuring a healthy work environment.

Professional Growth : Google offers numerous opportunities for professional development. Employees have access to training programs, workshops, and seminars to enhance their skills.

Google’s holistic approach to compensation has set a new standard in the industry.

Netflix: Personalization in Compensation Packages

Netflix takes a personalized approach to employee compensation, setting them apart from traditional practices.

Tailored Packages : Netflix understands each employee’s unique needs and aspirations. They create customized compensation packages that resonate personally with each employee.

Flexible Work Schedules : Employees have the freedom to choose their work hours, promoting work-life balance.

Customizable Benefits : Netflix offers benefits that employees can tailor to their preferences, including health insurance options and retirement plans.

No Policy Vacation : Netflix has no set vacation policy, allowing employees to take time off as needed.

Career Paths : Netflix invests in the career growth of their employees, providing clear paths for advancement.

This personalized approach has contributed to Netflix’s low employee turnover rate of just 4%.

Microsoft: Equity and Long-Term Benefits

Microsoft emphasizes equity and long-term benefits in their compensation strategy.

Equity Ownership : Employees receive stock-based compensation, giving them a stake in the company’s success.

Long-Term Rewards : Microsoft offers long-term incentives like stock options and bonuses tied to company performance.

Retirement Plans : The company provides comprehensive retirement plans to ensure financial security for employees.

Microsoft’s focus on equity and long-term benefits helps retain top talent and align employee goals with company success.

Starbucks: Beyond Basic Benefits

Starbucks goes beyond basic benefits to support their employees.

Comprehensive Health Coverage : Starbucks offers extensive health insurance plans, including dental and vision coverage.

Educational Assistance : The company provides tuition assistance for employees pursuing higher education.

Stock Grants : Employees receive stock grants, allowing them to share in the company’s growth.

Part-Time Employee Benefits : Even part-time employees benefit from health coverage and stock grants.

Starbucks’ inclusive benefits package ensures all employees feel valued and supported.

IBM: Flexible Work Arrangements and Work-Life Balance

IBM champions flexible work arrangements to promote work-life balance.

Remote Work : IBM offers remote work options, allowing employees to work from anywhere.

Flexible Hours : Employees can choose their working hours to fit their personal schedules.

Autonomy : IBM trusts employees to manage their work independently, fostering a sense of responsibility.

Health and Wellness Initiatives : The company provides wellness programs and health resources to support employee well-being.

These flexible arrangements help IBM attract and retain a diverse and motivated workforce.

Apple: Wellness Programs for Employee Well-Being

Apple prioritizes employee well-being through comprehensive wellness programs.

Fitness Programs : Apple offers on-site fitness centers and exercise classes.

Mental Health Resources : Employees have access to mental health resources and counseling services.

Wellness Apps : The company provides wellness apps to help employees manage their health.

Balanced Lifestyle : Apple encourages a balanced lifestyle, promoting both work and personal well-being.

Apple’s wellness programs contribute to a healthy and productive work environment.

Amazon: Performance-Based Compensation Structures

Amazon uses performance-based compensation to drive employee success.

Performance Metrics : Compensation is tied to clear performance metrics, ensuring fairness and transparency.

Data-Driven Assessments : Amazon uses data to evaluate employee performance and determine rewards.

Career Growth : The company offers numerous opportunities for career advancement and development.

Development Opportunities : Amazon invests in employee development through training and mentorship programs .

Amazon’s performance-based approach motivates employees to achieve their best, driving company success.

How to Conduct a Compensation Analysis

Conducting a compensation analysis helps ensure your pay practices are fair and competitive. Here’s a step-by-step guide on how to do it:

1. Define Purpose

First, define the purpose of your compensation analysis. Ask yourself:

- Why are you conducting this study?

- What problems are you trying to solve?

- Are you looking to improve internal equity, stay competitive in the market, or both?

Clearly defining your goals will guide the entire process.

2. Job Evaluation

Next, perform a job evaluation . This involves:

- Identifying Job Roles : List all the roles in your organization.

- Assessing Job Value : Evaluate each role based on factors like responsibilities, required skills, and impact on the company.

This step helps you understand the relative value of each job, ensuring fair compensation across different roles.

3. Market Survey

Conduct a market survey to compare your salaries with those in the industry. This involves:

- Collecting Salary Data : Gather data from reliable sources like industry reports, salary surveys, and online databases.

- Benchmarking : Compare your pay rates with the market rates for similar roles.

A market survey helps you stay competitive by ensuring your salaries are aligned with industry standards.

4. Gather Internal Data

Collecting internal data is crucial. This includes:

- Current Salaries : Document the current pay for all employees.

- Employee Performance : Gather performance reviews and ratings.

- Job Tenure : Note how long employees have been in their roles.

This data helps you assess internal equity and identify any disparities.

5. Data Analysis

Finally, analyze the data you’ve gathered. Look for:

- Pay Gaps : Identify any discrepancies between what you pay and the market rates.

- Internal Equity Issues : Check for any pay disparities among employees in similar roles.

- Trends and Patterns : Look for trends that might affect your compensation strategy, such as high turnover in certain roles.

Use this analysis to make informed decisions about adjustments to your compensation structure.

By following these steps, you can ensure your compensation practices are fair, competitive, and aligned with your organizational goals .

Next, we’ll address frequently asked questions about compensation case studies.

Frequently Asked Questions about Compensation Case Studies

What is included in a compensation study.

A compensation study is a comprehensive review of an organization’s pay practices. It typically includes:

- Salary comparison : Evaluating current salaries against industry standards.

- Market value assessment : Determining the market rate for different roles.

- Equitable salary ranges : Ensuring pay ranges are fair and competitive.

- Internal pay parity : Identifying any pay disparities among employees in similar roles.

These elements help ensure that compensation is both competitive and fair, attracting and retaining top talent.

Which is an example of compensation?

Compensation can take many forms, including:

- Salary : Regular payment for employment.

- Wage : Hourly payment for work performed.

- Benefits : Non-monetary perks such as health insurance.

- Bonuses : Extra payments based on performance.

- Paid leave : Time off with pay, such as vacation or sick leave.

- Pension funds : Retirement savings plans.

- Stock options : Shares in the company offered as part of the compensation package.

These components together form a comprehensive compensation package.

Why do companies do compensation studies?

Companies conduct compensation studies for several reasons:

- Reliable benchmarks : To compare their pay practices with industry standards.

- Informed business decisions : To make data-driven decisions about salary adjustments and benefits.

- Manage talent market : To stay competitive in attracting and retaining employees.

- Attract and retain employees : To ensure their compensation packages are appealing and fair, reducing turnover and boosting employee satisfaction.

By understanding these elements, companies can create effective compensation strategies that support their overall business goals .

Next, we’ll explore real-world compensation case studies to see how leading companies have successfully implemented these strategies.

The importance of compensation strategies cannot be overstated. They are crucial for attracting talent, retaining employees, and engaging the workforce. Effective compensation strategies go beyond just salaries. They include benefits, bonuses, and other incentives that align with company goals.

Employee satisfaction is directly linked to well-thought-out compensation plans. When employees feel valued and fairly compensated, their motivation and productivity increase. This leads to higher retention rates and reduces the costs associated with turnover.

Organizational success is also tied to how well a company can manage its compensation strategies. Companies like Apple and Amazon show us that investing in employee well-being and performance-based incentives can drive both individual and collective achievements. These real-world examples highlight the power of aligning compensation with measurable contributions and employee growth.

At CompFox, we understand the complexities involved in managing compensation strategies. Our AI-powered legal research tools help California workers’ compensation attorneys streamline their research processes. By leveraging advanced AI, we provide precise and efficient solutions, saving time and reducing stress.

By embracing these insights and tools, your organization can create a supportive environment where employees thrive. This not only enhances employee satisfaction but also drives long-term organizational success.

For more information on how to implement effective compensation strategies and leverage AI-powered tools, visit our website .

By focusing on strategic and empathetic employee-centric programs, we can transform our workplaces into thriving environments. Let’s continue to learn from industry leaders and apply these lessons to achieve sustainable success.

SUBSCRIBE NOW

Join our community and never miss an update. Stay connected with cutting-edge insights and valuable resources.

Recent Article

A day in the life of a workers’ compensation case worker.

Explore the daily tasks, benefits, and challenges faced by a

Document Assembly Software for Law Firms: Everything You Need to Know

Discover the best document assembly software for law firms to

The Ultimate Guide to Understanding California Labor Code

Master the California Labor Code with our comprehensive guide. Learn

Privacy Policy | Cookie Policy | Terms and Conditions | Decisions | Sitemap

Performance Management Case Study

In collaboration with mckinsey & company.

Redefining Performance Management at DBS Bank

How lofty ambitions and innovative metrics sharpened customer focus, march 26, 2019, by: david kiron and barbara spindel, introduction.

In 2008, the year David Gledhill went to work for DBS Bank, few would have predicted that within a decade the Singapore-based bank would be racking up an impressive slate of honors. Nonetheless, DBS was the first recipient of Euromoney ’s Best Digital Bank Award in 2016; it received that distinction again in 2018 and, that same year, was also named Global Finance ’s Best Bank in the World.

Just a decade ago, however, DBS, beset by long lines at branches and ATMs, high turnover among relationship managers, and a plodding credit card application process, had the worst customer satisfaction scores of all the banks in Singapore. Chief data and transformation officer Paul Cobban, who came aboard in 2009, recalls that “it was almost embarrassing to tell people at dinner parties” that he worked for the bank “because DBS had such a bad reputation.”

Executives did not simply change their performance management systems to achieve these goals. They redefined the meaning and measurement of performance.

Soon after Cobban joined, a newly arranged management team, with the support of tech-savvy CEO Piyush Gupta, turned things around by thinking of DBS as more of a tech startup than a bank. Gledhill, DBS’s CIO, says, “Our future competition wasn’t going to come from just banks, but from a lot of cool technology companies that were going into finance.” DBS, in Gledhill’s words, committed to becoming “digital to the core,” and he and his team initiated a thoroughgoing culture change to support digital innovation.

Company Background

DBS Bank was established by Singapore’s government in 1968 as the Development Bank of Singapore Limited. (It became known as DBS in 2003.) Still headquartered in the island nation, the multinational financial services group, with a workforce of over 26,000, has expanded throughout China, Southeast Asia, and South Asia, and currently has 280 branches in 18 markets. With its focus in recent years on reimagining banking as a seamless and streamlined digital experience (it has made banking mobile-only, paperless, and branchless in some of its markets), DBS’s mission is embodied in the slogan “Live more, bank less.”

Gledhill finds that operating in Singapore has distinct advantages. He cites the country’s “advanced IT infrastructure and strong intellectual property regulatory frameworks,” which encourage and protect technological innovation, and he points out that 80 of the world’s top 100 tech companies have a presence on the island. He also mentions Singapore’s highly skilled and highly educated pool of talent. “Together with supportive government initiatives to further Singapore’s digital agenda,” Gledhill says, “we believe we are definitely in the right place to fulfill our digital ambitions.”

The Foundational Years: 2009 to 2014

When Gledhill, Cobban, and the rest of their team joined DBS, they immediately set about changing the culture of the company. In the wake of the 2008 financial crisis, DBS was determined to differentiate itself from Western banks by emphasizing that it provided, in Cobban’s words, “a special brand of Asian service.” The qualities of this service were embodied in the acronym RED: respectful, easy to deal with, and dependable. The hope was that living up to these qualities would improve the company’s customer satisfaction scores, which Cobban recalls were “rock-bottom.”

Under the umbrella of RED, they created cross-functional teams called PIEs (process improvement events). The goal was to come up with processes that could be implemented within one week and that would address the bank’s biggest service problems — say, the time it took to replace a lost credit card — often by improving speed and eliminating waste. Cobban recalls, “I said, ‘What can you actually change within a short time frame?’ And that was it from an incentive point of view. It made people realize if they put some effort in now, they can see major results. Even to this day, I’m not quite sure how this happened, but we unlocked the enthusiasm, the energy, of the bottom of the company.”

Removing operational barriers lifted the ambition of employees across the organization without the use of incentives.

Notably, the PIEs helped effect a culture shift in the organization by enabling rapid, visible improvements to a wide range of operational processes. Removing operational barriers lifted the ambition of employees across the organization without the use of incentives. “We create a mechanism that anybody can participate in,” Cobban says. “We make it a very low bar to participate, and we did not expect everyone to be successful.”

In addition to improving organizational processes, the new team ensured that the company’s focus was squarely on the customer. In 2009, in what Cobban calls “in hindsight a moment of genius,” the management team invented the measure of the customer hour, a unit of wait time for a customer (a customer waiting for a credit card for an hour equals one customer hour), and used the PIE concept to eliminate as many customer hours as possible. Cobban hoped to be able to take 10 million customer hours out of the bank and ended up taking out 250 million. The process, Cobban says, “was really focused on making the customer’s life better,” a goal that unlike, say, increasing the bank’s profits, gave DBS employees a shared sense of purpose. (Google, Cobban notes, has since adapted DBS’s customer hours concept.) The shift in focus entailed an accompanying shift in the meaning of performance, as the previous measures of success were no longer relevant.

The final innovation was to upgrade DBS’s technological capabilities. “We had to build resilience into our platforms and data centers,” Gledhill says. “Our securities and monitoring operations needed revamping. But more important was the need around insourcing. We built our own technology DNA around the company so that we could really start to look and act more like a technology company. We fixed our application stack and got rid of our legacy systems to build an environment on which we would really start to scale.” The company, which was 85% outsourced in 2009, was 90% self-managed by 2018.

Looking back on the new management team’s early successes, Cobban jokes that “we were so bad, it was easy to improve within that first year.” The team wasn’t yet aspiring to compete with tech companies, but it was laying the groundwork for doing so. Gledhill was still, at that point, “thinking about ‘world class’ as being world-class among banks.” He sees the team’s initial actions, which included experimenting with agile practices, as integral to DBS’s later successes, noting that “our foundational years from 2009 to 2014 were critical building blocks where we fixed the basics to be able to move fast.” The changes to DBS’s approach to performance during this period both responded to and helped drive the company’s digital transformation. Soon, however, the company articulated a new and ambitious goal that led to a major shift in its performance management.

Project GANDALF: 2014 to the Present

Around 2014, Gupta and Gledhill began to see DBS’s competition as tech companies — like Google, Amazon, Netflix, Alibaba, LinkedIn, and Facebook — rather than other banks. They set their sights on joining that pantheon as a world-class tech company. The initials of the tech giants together spell GANALF. The company goal was to add a D to the acronym, for DBS, to spell GANDALF, the wizard of J.R.R. Tolkien’s The Hobbit and The Lord of the Rings novels. “That aspiration, more than any single piece of technology or anything else,” Gledhill declares, “really galvanized people to a completely new level of performance and thinking.” The CIO adds that the company “made it fun as well.”

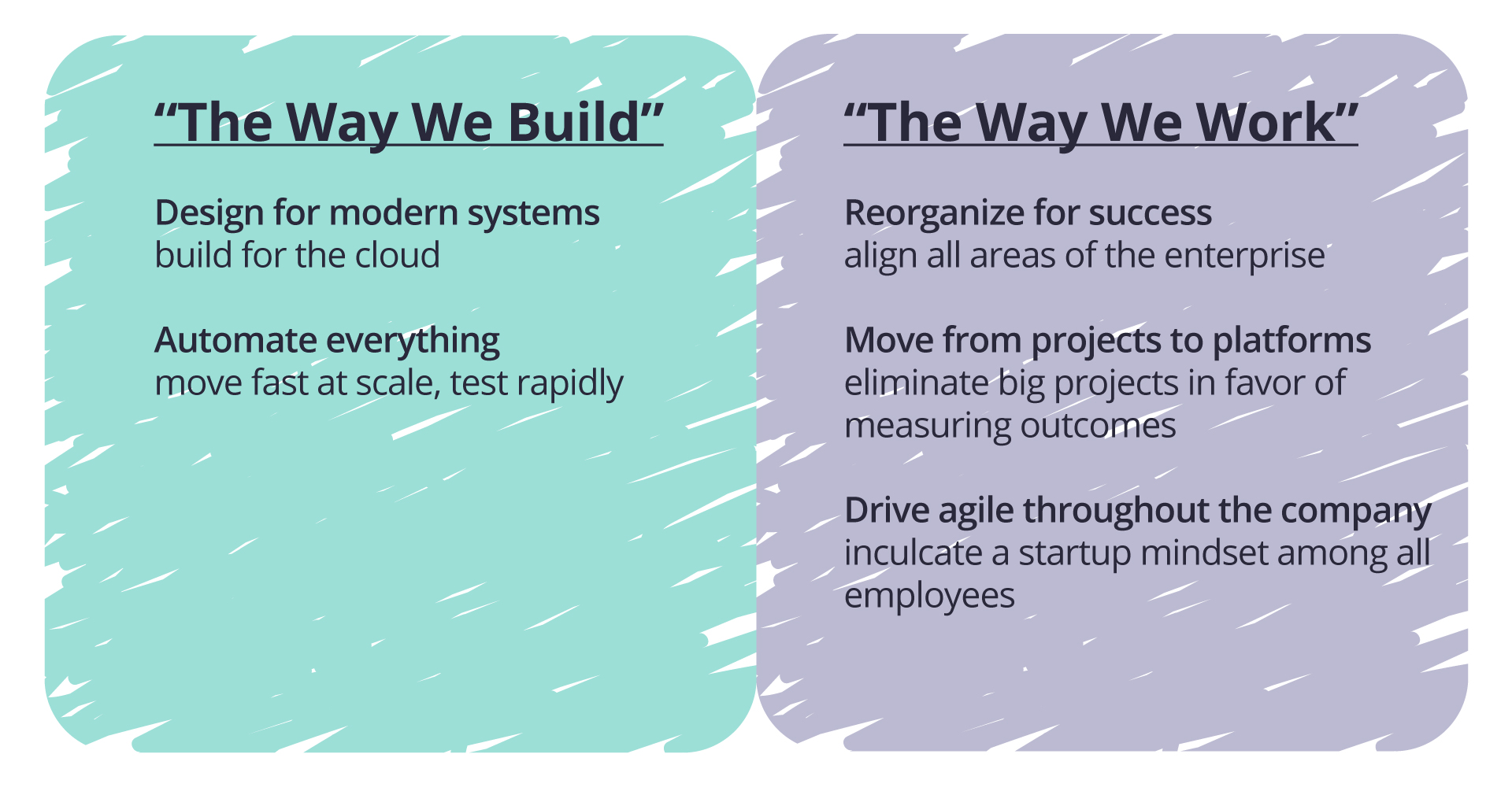

5 Focus Areas for DBS Bank’s Digital Transformation

The GANDALF goal led to a shift in the company’s approach to performance management, which DBS explicitly used to drive its transformation toward becoming a digital leader. The company quantified what it wanted to achieve and measured itself continually against its goals through its management scorecard and key performance indicators. The effort was enterprise-wide and aligned the business and technology sides. “It’s a partnership with HR in terms of reimagining the training and tools and the programs that we want to run,” Gledhill says. “It’s working with our marketing folks to figure out how we shape and sell our message. It’s working with the other business leaders to get them on board. So, it becomes a culture shift more than anything else, which has to affect all parts of the organization. Everybody has to shift the way they operate.”

To disrupt itself and join the digital elite, DBS took the following steps:

1. Gave new meaning to “performance.” Once the PIEs had resolved the customer satisfaction problems related to basic issues like length of wait time for customer center calls, they evolved into a set of programs focused more holistically on the customer. Cobban recalls, “We realized we now need to take friction out of the customer journey — it’s a lot faster than it used to be, but still there’s quite a lot of friction. This deep understanding of what customers really need is pivotal to what we built in.” DBS turned to human-centered design thinking to solve customer problems, running more than 500 “customer journey projects.” Employees are invited to create solutions and pitch them to senior staff. That might mean designing apps that don’t consume too much battery power because in a digital age, being “respectful,” part of the RED mandate, means being conscious of the importance of a customer’s battery life.

In 2017, in another move that greatly altered the company’s conception of performance, DBS developed a method for measuring the financial impact of digitization. Called the digital value capture (DVC), the data quickly and quantitatively demonstrated the importance of migrating customers to digital banking. “Through DVC, we noted that, compared to a traditional customer, a digital customer brings in twice the income, with 1.5, 2, and 3.6 times higher deposit, loan, and investment balances, respectively. A digital customer, on average, also costs 57% less to acquire and is more engaged, with 16 times more self-initiated transactions,” Gledhill notes. DVC data served multiple purposes: It created a new mandate for DBS employees, it was shared with investors, and it helped develop the enterprise’s business plan.

2. Used performance management to drive digital transformation. The company uses a balanced scorecard approach to measure performance, and digital transformation now comprises a significant part of the scorecard. As Gledhill explains, “Because we are really pushing this digital agenda, our scorecard has changed. We want to drive people to push digital adoption of the customers. And so 20% of our scorecard — so 20% of the bank’s performance, which ultimately defines how much we get paid — is focused on digital transformation.” The scorecard’s metrics are very precise. Gledhill continues, “We have very specific measures in there about the percent of customers we acquired digitally, about the shift from manual channel to electronic channel, execution for transactions, and how much we engage. So, acquire, transact, engage. Every business and every product within every business has targets about how it has to shift its customer base to those electronic channels. So, the scorecard is very tightly aligned to digital.”

“With most people, it was very liberating because it set an aspiration of something they’d completely, to that point, failed to imagine, and it was fun.” — David Gledhill

3. Changed the culture that supports performance management. In addition to providing a unifying sense of purpose to the organization, the GANDALF goal has focused DBS on its company culture. Through a process called Culture by Design, DBS has been extremely precise about codifying the culture it wants to establish: one that gives its 26,000-person workforce the feel of a startup. The acronym ABCDE details the characteristics of the culture: Agile (adapting more quickly), Be a learning organization (adopt new ways of approaching the business), Customer-obsessed (understanding customers’ pain points), Data-driven (using data holistically to transform internal processes), and Experiment and take risks (encouraging the 4D process: discover, define, develop, and deliver).

“Once we defined these key characteristics, we started reinforcing them by making aspects of these traits and behaviors a requirement for everyone,” Cobban explains. “We continue to reinforce these characteristics throughout the bank through multiple learning and collaboration programs. We focus on identifying ‘blockers’ to our cultural innovation and set about targeted countermeasures to address them.”

For instance, the company’s meetings, according to Cobban, were frequently ineffective. Problems included “people being late, unprepared, poor agenda, too many people in the meeting, too many meetings generally.” A program called Meeting MOJO was conceived to overcome this particular blocker. Under MOJO, every meeting now has a meeting owner (MO) who in turn appoints a joyful observer (JO). The MO, according to Cobban, ensures that the meeting has a clear agenda, that it starts and ends on time, and that there is “equal share of voice” throughout the discussion. At the end of the meeting, the JO provides feedback to the MO about whether the meeting was a success according to those criteria. “The results have been dramatic,” Cobban says. “More of our meetings start and finish on time, and they now have more structure and engage more attendees.”

“If you give people a sense of purpose and get out of the way, it’s far more powerful than trying to incentivize somebody with money.” — Paul Cobban

In addition, in 2017, DBS launched DigiFY, a mobile learning platform and online course intended to transform the company’s bankers into digital bankers. The program imparts skills in seven categories: agile; data-driven; digital business models; digital communications; digital technologies; journey thinking; and risk and controls. By the time employees achieve mastery in the three-part course, they are qualified to teach its precepts to their coworkers. Once the company decided it required digital bankers, it methodically set about defining, creating, supporting, measuring, and developing them.

As Cobban explains, all these changes took place within a traditional performance management system; what’s more, they were divorced from financial incentives. “We have not set out to change the culture of performance management directly through compensation. My experience is that it’s not effective in shaping a company,” he says. “Our performance approach is very conventional. We have an annual appraisal process. We have KPIs that we need to meet. If you give people a sense of purpose and get out of the way, it’s far more powerful than trying to incentivize somebody with money.”

Creating Buy-In at the Customer Center

Improvements to the customer center at DBS exemplify the shifts taking place within the organization at large. Beginning in 2014-2015, at the customer center as well as throughout the enterprise as a whole, performance management was used to drive the digital agenda. DBS’s head of customer center Geeta Sreeraman states that while the center, like most contact centers is “a highly KPI-driven environment;” the KPIs were very aligned to the bank strategy. “And our focus was, and continues to be,” she adds, “how do we participate in this whole digital transformation?” The answer was to use technology to engage the staff, improve efficiency, and enhance the customer experience.

A top priority was changing the mindset of the 500-plus customer care representatives. This was accomplished in part by enlisting the employees to collaborate in the creation of the unit’s KPIs. “We don’t want a top-down KPI that doesn’t account for their challenges,” Sreeraman says. The “culture of cocreation,” she observes, resulted in “a lot more buy-in.” Moreover, management regularly reviews and refines the unit’s metrics as the nature of engaging with customers changes. For instance, DBS customers increasingly use chat to handle simple banking issues. As customers turn to phone calls as a last resort to address more complex technical problems, KPIs related to the average time of a phone call are of lesser relevance. Metrics relating to first-contact resolution and customer satisfaction become more critical.

By the time customers do make phone calls, then, there is a strong possibility that they’re experiencing a problem that they were unable to solve using self-service online tools. DBS began using speech analytics not to punish poor performance but to understand both the challenges faced by call center staff and customer pain points. “A lot of our high-emotion calls were because of confusion,” Sreeraman says. If, for instance, the analytic tools revealed that callers were frustrated because they couldn’t access their bank statements, the company specifically trained employees to assist customers in accessing their statements online. (This solution had the added benefit of supporting DBS’s agenda to get its customers to go digital.) Similarly, if an urgent problem arises, the company can figure it out more quickly by registering an increase in negative emotions associated with calls.

Access to data enabled innovations at the customer care center. “We enhanced our internal data capabilities to make sure that we capture real-time data through dashboards,” Sreeraman says, adding that the data also facilitates any “real-time management that we need to do.” As part of having a transparent and open culture, an in-house mobile engagement app called Alive makes performance data available 24 hours a day. Managers can see which employees need additional support and which are in a position to stretch themselves. The app is also used to encourage employees to manage their own performance. They can “benchmark their performance with the rest of the cohort to assess if they are on track to meet their objectives,” Sreeraman says. Employees are encouraged to take responsibility: to self-assess, seek feedback from managers, and set SMART (specific, measurable, achievable, realistic, and time-bound) goals. This “self-driven” performance management, she says, is “where we are headed right now.”

As DBS’s recent accolades suggest, the bank has been successful in aligning its performance management system, its KPIs, and its culture with an ambitious digital transformation agenda. Of course, work remains to be done. Gledhill is interested in applying principles of performance management to the company’s teams; he also wants to deploy machine learning and advanced analytics tools to further optimize customer interactions. But as he measures DBS against the tech giants, reflecting on the audacious goal of putting the D in GANDALF, he is confident that the company will continue to make progress. “I would say we’re a long way away from some of the advanced tools and techniques these guys use, but here’s the point,” he reasons. “If this is always your North Star, you will always progressively move closer and closer to it. That’s how we look at it.”

David Gledhill

group chief information officer and head of group technology and operations

David Gledhill is group chief information officer as well as head of group technology and operations at DBS Bank. In 2017, he was the recipient of the MIT Sloan CIO Leadership Award, becoming the first CIO from an Asian company to have won. Prior to joining DBS in 2008, he worked for 20 years at JP Morgan.

Paul Cobban

chief data and transformation officer, technology and operations group

Paul Cobban is chief data and transformation officer, technology and operations, at DBS. He joined DBS in 2009 as managing director for business transformation, and was chief operating officer of technology and operations from 2013 to 2017.

Prior to joining DBS, Cobban held a variety of roles at Standard Chartered Bank, and he also worked at JP Morgan UK as an IT project manager and at IBM as a programmer and project manager.

Geeta Sreeraman

head of customer center, Singapore, technology and operations

Geeta Sreeraman is head of the customer center at DBS Bank, where she leads a team of 600 employees. Since joining DBS in 2011, she has held various senior positions, from managing relations with regulatory bodies to leading the development of the department. Under her leadership, her group has won many accolades, include Best Contact Centre at the Annual Contact Centre Association of Singapore Awards. She started her career as a relationship manager for Citibank India.

Banking On Technology-Enabled Performance Management

By Peter Cappelli

The DBS Bank example is a good illustration of how to pull off organizational change, especially a big one. The key is to use many different levers to get employees to behave differently. In this case, performance management is one of those.

It is useful to think of organizational change as similar to trying to get an individual employee to behave differently, but you have to do it at scale. There are all kinds of reasons we keep doing things the same way, but the most important is arguably that change is both unsettling and, in many cases, risky, especially if what we have been doing has been working pretty well for us.

It helps to have a powerful need for change. Some people refer to this as a burning platform — a pressure that is big enough that we cannot simply ignore it. DBS wasn’t failing; it just wasn’t very good. The pressure had to come from someplace else.

The success of DBS seems to have come from two initiatives. The first was empowerment. We’ve long known that employees can be engaged to work hard and creatively on projects for which they are responsible and that they own. The Singapore work culture is generally quite top-down, so the decision to empower teams to take on projects is more radical than it sounds. I suspect the employees responded to it with even more energy than they might elsewhere.

The second initiative relates to performance management, specifically the creation of measures of success. It is hard to engage people in anything if they do not know how they are doing, and it is especially difficult to improve if you cannot measure whether you are doing better: Imagine trying to improve your golf game if you went to the driving range and could never see where the ball went. The truly innovative initiative at DBS was to create a measure of performance — hours of customer time — that had face validity (we can see why it is good for business and for customers to bank faster), will stay in place over time, and is comparable across parts of the bank.

Paul Cobban says that the bank’s performance appraisal system is very conventional, but the management team did make changes in it that drove behavior in a different direction. That began with new organizational measures, a balanced scorecard, and new measures of individual behaviors that the team wanted employees to execute. We should not underestimate the importance of training on those behaviors because a big cause of resistance to change is employees who aren’t sure whether they will be able to hit the new goals, so they often do not try. Good training goes a long way toward taking that fear away.

Even with all these efforts, organizational changes typically fail. They are working at DBS in part because the leaders smartly let the new practices drive culture changes and aligned efforts to move employees in a new direction. DBS leaders provided a compelling vision of becoming a digital company, empowered employees to act on that vision, measured how they are doing, and gave them the skills to succeed. As with any successful change, it is a lot more work to make it happen than it sounds from a story. The key element here is leadership commitment: Put time and sustained resources into the effort and see it through to a conclusion.

Peter Cappelli is the George W. Taylor Professor of Management at The Wharton School and director of Wharton’s Center for Human Resources. He is also a research associate at the National Bureau of Economic Research in Cambridge, Massachusetts, served as senior advisor to the Kingdom of Bahrain for employment policy from 2003-2005, and since 2007 is a distinguished scholar of the Ministry of Manpower for Singapore.

About the Authors

David Kiron is the executive editor of MIT Sloan Management Review ’s Big Ideas Initiative, which brings ideas from the world of thinkers to the executives and managers who use them.

Barbara Spindel is a writer and editor specializing in culture, history, and politics. She holds a Ph.D. in American studies.

Contributors

Michael Fitzgerald, Carolyn Ann Geason, Allison Ryder, and Karina van Berkum

Acknowledgments

David Gledhill, CIO, DBS Bank

Paul Cobban, chief data and transformation officer, DBS Bank

Geeta Sreeraman, head of customer center, DBS Bank

More Like This

Add a comment cancel reply.

You must sign in to post a comment. First time here? Sign up for a free account : Comment on articles and get access to many more articles.

Reinventing Performance Management

How one company is rethinking peer feedback and the annual review, and trying to design a system to fuel improvement by Marcus Buckingham and Ashley Goodall

Summary .

At Deloitte we’re redesigning our performance management system. This may not surprise you. Like many other companies, we realize that our current process for evaluating the work of our people—and then training them, promoting them, and paying them accordingly—is increasingly out of step with our objectives.

Partner Center

- philippines

Case studies: FedEx and HSBC's revamped performance management approaches

- main#clickShareSocial">email

- main#clickShareSocial">telegram

- main#clickShareSocial">whatsapp

- main#clickShareSocial">wechat

- main#clickShareSocial">pinterest

- main#clickShareSocial">line

- main#clickShareSocial">snapchat

- main#clickShareSocial">reddit

Eric Tan, Managing Director, FedEx Singapore, and Vishesh Dimri, Lead - HR Consulting, HSBC, both place importance on trust, honesty, transparency, and ownership in their approaches, as we find out in these interviews.

Fedex singapore’s new management system drives trust & transparency.

Eric Tan, Managing Director, FedEx Singapore, shares insights into this performance review approach — from its inception, to what it entails, along with what employers could consider in the intended shift to such a model.

Delivery service provider FedEx Singapore (FedEx) is a keen advocate of a culture of continued engagement and transparency at its workplace, one where open communication and trust thrive amongst its over 1,000 employees.

This is done through a series of engagement initiatives such as its ‘Open Door Policy’ and ‘Survey Feedback Action’ (SFA), says Eric Tan, Managing Director, FedEx Singapore (pictured above, left) . “This allows our employees to understand the big picture and the part they play in the success of the organisation. FedEx lives up to our corporate philosophy of ‘people-service-profit’: By taking care of our people, they will provide outstanding service for our customers, which enables business growth, and we reinvest this revenue back into our people. All programmes and policies, at every organisational level, synchronise with this philosophy,” he affirms.

One way the company has been driving this is through a change in its performance management system — from a conventional performance appraisal system that utilised a comparative 10-point rating scale leveraging the bell curve methodology, to an enhanced performance review structure, which focuses on the work that employees accomplish (goals), and how it is accomplished (competencies).

Tan explains: “As a ‘people’ company, FedEx strives to continuously improve its performance management processes to drive individual, team, and organisational performance. To achieve this, we assume a holistic approach towards performance management and the employee experience. With a continuous improvement mindset, FedEx across Asia Pacific proactively anticipates process and technological enhancements so as to enable us to successfully transition into a new performance management process.

"These are all part of our concerted efforts to sustain a workplace culture where our people stand at the centre of our corporate philosophy."

What this enhanced performance review structure entails

According to Tan, this enhanced structure is designed to provide an in-depth understanding of what success looks like for the employee. It adopts an absolute rating scale to evaluate employee performance, based on the ratings of “Exceeded Expectations”, “Met Expectations”, and “Did Not Meet Expectations”.

Competencies refer to observable behaviours that an employee exhibits in their role when applying their knowledge, skills and abilities. To ensure these competencies are applicable to employees’ job roles, varying competency models for frontline employees, professionals and managers have been built for their individual application. To illustrate:

- Frontline employees are customer-centric and team-focused. Hence, the focus for them is to adapt to changes and communicate well to both internal and external customers.

- For professionals, having a business thinking mindset is imperative, so they need to build on their analytical skills and make timely decisions and recommendations.

- As for managers, it is critical for them to be equipped with the ability to lead, influence, inspire, and serve, as well as to cultivate exceptional team performance while ensuring their team members are valued and empowered in their day-to-day responsibilities.

No doubt, this change involved several key considerations, with the most impactful one being to instil a growth mindset that encourages employees to focus on future performance as opposed to reflecting on past performance.

It also came with its own set of challenges, with the main one being to manage this change as well as facilitate it. To address this, the HR team developed a collective approach to help prepare and support all employees through the transformation, ensuring a seamless process from start to end.

The employees responded “very well”, as a result. Tan notes: "We focused on employee engagement and concentrated our efforts on fostering genuine commitment between the manager and employee as we recognise the value in supporting our employees in their learning journeys as they develop and grow professionally. We believe this will, in turn, result in higher levels of productivity by our team members."

Overall, this new system goes hand-in-hand both with FedEx’s rewards framework, and career development framework. Tan highlights: “Building a performance-based work culture not only serves to boost employee morale, productivity, and performance, but also prepares the company for strategic workforce planning. It is especially pivotal for us as industry leaders to look at a blend of individual and organisational components to instil a growth culture for our people to be successful.

"Every employee is given the chance to pursue their dream in FedEx, and support is always readily available to help maximise their potential, through training and development platforms accessible to all."

Words of advice

Like Tan and his team, more leaders are shifting away from “quantitative” rating scales, to a more “qualitative” approach to appraisals. Yet, there are still leaders who prefer the former approach. And as Tan points out, there is no perfect structure to follow, as every approach comes with its unique pros and cons.

Thus, he says, it is more important to look at the direction the organisation is headed and adapt a model that works best for both the employees and the organisation at each stage. "The goal is to move all stakeholders, including employees, in a concerted manner toward our collective goal that serves people growth and business profitability."

At FedEx, this also means that apart from working closely with key stakeholders including but not limited to HR and senior management teams, the management is well supported in performance, development, and management skillsets through avid training programmes.

This encompasses effecting a mindset change by shifting from system-related work to providing resources and tools, to empower managers to conduct effective and meaningful performance & development conversations, build manager-employee relationships, and consistently engage their team members by leveraging coaching and feedback skillsets.

Reflecting on the company’s experience, Tan shares his words of encouragement for employers intending to improve their own performance management processes. "Performance is an ongoing journey, and we need to recognise the importance of continuously looking at improving the overarching employee experience by encouraging ongoing learning and communication rigorously and regularly. In any scenario – whether personal or professional – one should not stop learning, developing and upskilling to make the most of their talents and grow on the right trajectory, thereby bringing value to their teams and peers.

"Human performance is the function of many influences: accountability, feedback, motivation, skills and knowledge, rewards and recognition. These influences are interdependent and ultimately result in the desired performance."

HSBC drives manager-employee ownership of performance & development

Vishesh Dimri, Lead - HR Consulting, HSBC, shares how a focus on digital enablement, process effectiveness, and people manager capabilities helps drive open and honest conversations during feedback, foster stronger relationships, and more.

Banking and financial services firm HSBC focuses on three key pillars in driving the new way of work — digital enablement, process effectiveness, and people manager capabilities.

These pillars are what help ensure a holistic approach towards performance management and enablement for both its employees and managers, Vishesh Dimri, Lead - HR Consulting, HSBC (pictured above, right) shares.

First, as part of digital enablement, HSBC has in place an HR mobile application that allows an "easy and simple" adoption of everyday performance on a real-time basis, where employees and managers are able to capture achievements and share regular, two-way feedback via the use of technology. More than an app, it is "a demonstration of flexible and remote working, without compromising on outcomes or comfort", Dimri highlights.

With this app, employees are able to access an HR to-do list, their everyday performance & development plans, online learning resources (Learning On-the-Go), manage personal and employment information, as well as view real-time people manager dashboards, HSBC connections, and the organisation chart.

Additionally, managers are empowered to handle key approvals on-the-go, as well as manage the personal and job details for direct functional reports.

Next, process effectiveness involves the use of everyday performance principles including goal setting and regular check-ins to facilitate the achievement of career aspirations as well as maintain productivity.

"It fosters stronger relationships between managers and colleagues. Managers can support their team members in the right ways and, at the right times, towards a meaningful year-end assessment," Dimri explains.

Finally, the third pillar of people manager capability is enhanced through constant engagement, coaching, and providing content support such as training and briefings, support resources, and guides.

One of the key elements of HSBC's year-end assessment is the 'Fairness Review', which has in place the following governance processes to ensure it remains unbiased:

- seeking risk stewards’ inputs relating to non-financial performance,

- senior management reporting,

- audit checks, and

- evidence of all Fairness Review meeting discussions.

Dimri and his team also make it a point to support people managers in carrying out these reviews, through scenarios-based, bite-sized videos available via e-learning; briefing sessions; by refining the HSBC values to align with its behaviour rating scale to reflect the focus on Fairness Review, as well as via a continuous feedback tool.