(216) 292-5660

216.930.1983

Learn About Notice of Assignment for Invoice Factoring

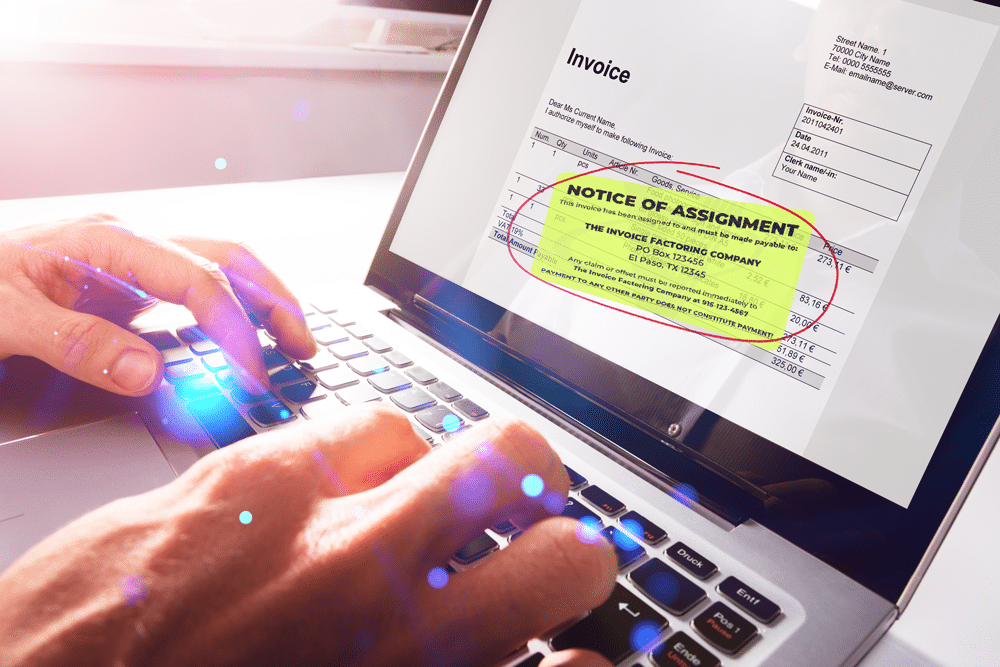

In a factoring relationship, you agree to assign your selected receivables to the factoring company. By advancing your cash against your invoices, the factor has purchased the right to collect amounts due from your customers. The Notice of Assignment is a critical part of your factoring paperwork as it reflects the change in invoice ownership.

What is a Notice of Assignment?

The Notice of Assignment is a simple letter the factoring company sends to your customers whose invoices you are factoring. In writing, the notice informs your customers that the accounts receivable is assigned, and future payments should be made payable to the factoring company. The notice will also include a remittance address so your customer can change their payment information.

The Notice of Assignment legally explains to your customers that any payments they make to you instead of the factor will not satisfy their obligation. The factoring company may hold your customers liable for misdirected amounts. This may occur if your customers choose to ignore the notice or fail to update payment information.

Many factors will require your customers to sign and return a copy of the notice to acknowledge receipt. This is not always required, though. Instead, the Notice of Assignment may include language that considers your customer’s continued use of your services to constitute an agreement to the notice. In addition, the factor may only revoke a Notice of Assignment if they send a signed and notarized release notification to your customers. They will do so if you choose not to factor that account any longer or you end your factoring relationship. In either case, the account must have no outstanding balance.

What Programs Don’t Use a Notice of Assignment?

Financing programs that do not use a notice of assignment include non-notification factoring and sales ledger financing.

Non-notification factoring is similar to regular factoring, but with a few key differences. Instead of sending a conventional Notice of Assignment to customers, the factoring company informs them of a new payment address using the company’s regular letterhead. This allows the customer to still send payments to the new address without being aware that it belongs to the factor. To qualify for non-notification factoring, companies typically need to have monthly revenues of at least $300,000, a track record of over a year, reliable financial reports, and no serious financial difficulties.

Sales ledger financing operates like a line of credit based on outstanding receivables. Companies can access up to 90% of their outstanding receivables at any given time without the need to submit a factoring schedule of accounts for each transaction. Although the finance company still handles payments, the customer does not receive a Notice of Assignment. Instead, they receive a letter indicating a change in the payment address. Sales ledger financing offers greater flexibility compared to non-notification factoring, with daily rates allowing for better cost control. The qualification requirements for sales ledger financing usually include monthly revenues of at least $300,000, a track record of 1-2 years, reliable financial reports, good receivables management systems, and no serious financial difficulties.

Get Started Now

Secure the funds you need today. Complete the form or call.

Why do Factoring Companies Notify Your Customers?

The Notice of Assignment is a vital form of protection for a factoring company. It protects the factor in case the business owner (the factor’s client) receives the payment instead of the factoring company.

In a best-case scenario, the notice serves to inform every party in a factoring transaction of their rights and responsibilities. It also gives your customer the appropriate address to make account payments, allowing your factoring relationship to continue smoothly.

In a worst-case scenario, a factor can recover unpaid amounts from your customer should they continuously pay over notice or not pay at all. A Notice of Assignment is evidence in any legal proceeding — from a demand letter for payment to a full-fledged lawsuit — that asserts the factor’s standing and rights to payment.

What Will Your Customers Think?

Customers may have concerns or questions when they receive a letter regarding the use of invoice factoring. It’s understandable that they may be unsure or unfamiliar with this financing tool. As a business owner, it’s important to address these concerns and communicate with your customers effectively.

First and foremost, it’s essential to acknowledge that invoice factoring is a common practice utilized by many small and midsize companies to finance their operations and facilitate growth. Chances are, your customers are already aware of this financing method and how it works.

When discussing invoice factoring with your customers, emphasize the benefits it provides to them. By using factoring, you can offer them extended payment terms, such as 30- to 60-day terms, while still ensuring excellent service. This enables your customers to utilize their available cash resources more effectively. Without factoring, providing extended payment terms might be challenging, especially for businesses experiencing growth.

It’s crucial to assure your customers that little is changing in terms of the services and support your company provides. Reassure them that they will still have the same level of communication and engagement with you and your employees as before. Highlight that despite factoring being implemented, your commitment to their satisfaction remains unchanged.

Address the misconception that factoring indicates financial trouble within your company. Remind your customers that factoring is a versatile tool used to achieve various goals and objectives, just like other forms of financing such as loans or lines of credit. Factoring simply serves to smooth out your cash flow and support your business’s overall financial stability and growth.

Overall, open communication with your customers is key. Provide them with transparency and reassurance, explaining the benefits of factoring and emphasizing that it is a common and established financing practice. By effectively addressing their concerns, you can foster trust and maintain strong relationships with your valued customers.

Why a Notice of Assignment Matters To You

You will receive a copy of the Notice of Assignment that the factor sends to your customers. While the notice is to inform your customers, it also has an important implication for you as well.

As your factoring agreement explains, payments your company receives from your customers over notice are payable to the factoring company. Even in the smoothest transition, you may receive payments sent before receipt of the notice or released before your customers’ updated their payment system. There will likely be a provision explaining the procedure for sending misdirected payments to the factor in these cases. Misdirected payments are usually sent by overnight check or via bank transfer.

However, you may be responsible for additional penalties and fees if your customers continue to pay over notice, and you deposit those payments into your account. In addition, you may end up owing more, depending on fee structure, due to the extra time it takes for the factor to receive payment. Some factors include a misdirected payment fee in the factoring agreement that you will have to pay if you fail to return misdirected payments to the factor. Therefore, fees may be higher if you are responsible for the misdirection.

As with any legal document, be sure to be fully aware of the language used within the Notice of Assignment. Be mindful of your customers’ responsiveness to the notice. Take action immediately if you realize that any of your customers are not sending their payments on time. This transparency solidifies your factoring relationship, builds trust with your factor, and protects your interests.

What if the Payment is for an Invoice I Didn’t Factor?

When you assign your customers’ receivables to your factoring company, you agree to direct all payments to the factor, even for invoices that you did not factor. This eliminates complications for all parties and ensures that the factoring company receives every payment they should. Without an all-inclusive assignment, your customers would receive a notification every single time you factor an invoice. They would have to retain two addresses on file, increasing the likelihood of misdirected payments.

Your factoring company will have a straightforward procedure in place to address non-factored payments. This may include applying those payments to open invoices and sending you the difference or the total amount in a regularly scheduled reserve release. Stay prepared by asking your factor about their policies surrounding non-factored payments.

Factor Finders can help you find the right factoring company for your invoice factoring needs. Contact us to learn more about our factoring services for every industry and to get started today.

Don’t want to talk on the phone?

Get a free quote by filling out our online form .

Connect With Us

(216) 865-4922

Newsletter Sign-Up

Need fresh ideas on how to grow your small business? We've got you covered!

Quick Links

© 2024 Factor Finders, LLC All Rights Reserved.

Privacy Overview

Secure the funds you need today.

Factoring , Newsletters

THE NOTICE OF ASSIGNMENT: A REFRESHER COURSE

Allen J. Heffner Nov 20, 2023

The Notice of Assignment is probably the single most important document for a Factor. Understanding what needs to be included in the Notice of Assignment, how to send it, and who to send it to can mean the difference between getting paid and not. Despite the fact that every Factor is (or should be) familiar with legal requirements relating to Notices of Assignment, we still find that many of our factoring clients who end up in litigation make basic mistakes relating to their Notices of Assignment. The article focuses on what information needs to be included in the Notice, who the Notice should be sent to, and how the Notice should be delivered.

What needs to be included in the Notice of Assignment?

To be effective, there is certain information that must be included in the Notice of Assignment. The Uniform Commercial Code (“UCC”) requires that the notice must:

- Notify the Account Debtor that the amount due or to become due has been assigned;

- Notify the Account Debtor that payment is to be made to the Factor;

- Reasonably identify the rights assigned; and

- Be signed by the Factor or its client.

The Notice of Assignment should also include a remittance address so the Account Debtor is informed how and in what manner the Factor should be paid.

Additionally, while not explicitly required under the current version of the UCC, Factors should include language in their Notice of Assignment that: (i) the Client has assigned all of its present and future accounts receivable to Factor; (ii) the Factor holds a first priority security interest in all of the client’s accounts receivable; and (iii) all payments owing to the client must be paid to the Factor.

Who should the Notice of Assignment be sent to?

Notices of Assignment should not be sent directly to individuals with an Account Debtor. Sending the Notice to a specific individual may lead to issues relating to the authority of that individual to receive documents on behalf of the Account Debtor. Moreover, Factors that direct Notices of Assignment directly to individuals open themselves up to arguments that the Notices of Assignment was not properly delivered. For instance, our clients that have sent Notices of Assignment to individuals have ended up in situations where the individual to whom the Notice of Assignment was addressed no longer worked with the Account Debtor or the individual was located at a different office and the Notice of Assignment was not sent to the proper location. To be safe and to avoid unnecessary issues, Factors should send the Notice of Assignment to the Account Debtor’s accounts payable department.

Additionally, some states have specialized definitions for what constitutes “notice” on behalf of a company. If there is any question as to where a Notice of Assignment should be sent, Factors should check with their attorney to determine where these should be sent.

How should the Notice of Assignment be delivered?

The crucial issue for the enforceability of a Notice of Assignment is proof of receipt by the Account Debtor, not proof of delivery. Therefore, it is good business practice to send the Notice of Assignment either certified mail or other method that provides for proof of delivery.

Many of our clients have asked about whether it is proper to deliver the Notice of Assignment via e-mail asking the Account Debtor to confirm receipt or with “read receipts” turned on. Some Factors prefer this method because it is more cost efficient.

While sending Notices of Assignment via e-mail is enforceable, we would not recommend it as a general business practice. Sending the Notice in this manner requires delivering the Notice to a specific individual, which we have discussed above can be problematic. Sometimes officers and directors of companies have assistants or other personnel manage their e-mail accounts, raising the possibility that the individual to whom the Notice was sent, never saw the e-mail, even though the e-mail was “read.”

Last, there is no requirement that the Notice be signed by the Account Debtor and returned to the Factor. Often, we see our client’s Notice include a “confirmation of receipt” line for the Account Debtor to sign and return. Sometimes, the Factor will have proof of delivery to the Account Debtor but the Notice was not signed and returned by the Account Debtor. This adds unnecessary ambiguity as to whether the Notice was actually received by the Account Debtor. Therefore, we instruct our clients not to include such requests for proof of receipt.

Who should send the Notice of Assignment?

Some of our clients that have had bad experiences with Account Debtors after delivering a Notice of Assignment have chosen to have their Client be the one to deliver the Notice of Assignment. There is no legal requirement as to whether the Factor or the Client is the correct party to deliver the Notice of Assignment. However, we recommend the Factor be the one to deliver the Notice of Assignment. This way, the Factor is in complete control of the contents of the Notice of Assignment, how it is delivered, and receives confirmation of its delivery. We have been in situations in which the Factor allowed the Client to deliver the Notice of Assignment, but the Client did not deliver the Notice of Assignment in accordance with the law, leading to avoidable litigation.

Should a Factor respond to an Account Debtors questions regarding a Notice of Assignment?

Absolutely, yes. If requested by an Account Debtor, pursuant to the UCC, a Factor must furnish reasonable proof of the assignment for the Notice of Assignment to be valid. Too often we see situations in which requests are made or questions are posed by Account Debtors that the Factor ignores, thinking that because the Account Debtor received the Notice of Assignment, nothing else needs to be done. The Factor should respond to the Account Debtor and provide reasonable proof of the assignment. These communications can also provide invaluable insight as to the relationship between the client and the Account Debtor, how and when payments will be made, and can provide the Account Debtor a sense of trust with the Factor.

A Notice of Assignment is crucial for Factors because it provides legal protection, establishes priority of interest, prevents confusion, facilitates legal recourse, and enables effective communication with Account Debtors. Without this notice, Factors may encounter difficulties in asserting their rights and collecting payments from Account Debtors, potentially jeopardizing the financial transaction.

Bruce Loren and Allen Heffner of the Loren & Kean Law Firm are based in Palm Beach Gardens and Fort Lauderdale. For over 25 years, Mr. Loren has focused his practice on construction law and factoring law. Mr. Loren has achieved the title of “Certified in Construction Law” by the Florida Bar. The Firm represents factoring companies in a wide range of industries, including construction, regarding all aspects of litigation and dispute resolution. Mr. Loren and Mr. Heffner can be reached at [email protected] or [email protected] or 561-615-5701

Bruce E. Loren · Michael I. Kean · Allen J. Heffner · Kyle W. Ohlenschlaeger · Frank Sardinha, III · Lucia E. DeFilippo

Newsletters & Media

Testimonials

Press Releases Privacy Policy Terms of Use

© 2022 All Rights Reserved

1.915-859-8900 Get a Free Quote

Factoring Notice of Assignment (NOA): Everything You Need to Know

A factoring notice of assignment (NOA) is usually required when you factor your invoices. Rest assured, NOAs are quite common in business and aren’t a cause for concern. However, it helps to understand what they are and how they work so that you can explain them to your customers as needed.

Assignment of Debt Explained

Companies transfer debt, along with all associated rights and obligations, to third parties all the time. One example of this occurs with collection companies. In these cases, the business, also referred to as the creditor, sells its uncollectable balances or assigns specific debts to the collection company. The collection company is then authorized to collect those specific balances on behalf of the creditor.

Assignment of debt may also come into play when businesses outsource their receivables and leverage certain types of funding, among other situations.

What Does Notice of Assignment Mean?

The customer, also referred to as the debtor, must be informed when a creditor assigns their debt to a third party. The document used in this process is referred to as a notice of assignment of debt.

What is a Notice of Assignment in Factoring?

When you leverage invoice factoring , you’re selling an unpaid B2B invoice to a factoring company at a discount. In exchange, you receive up to 98 percent of the invoice’s value right away and get the remaining sum minus a small factoring fee when your client pays. This means you’re not waiting 30, 60, or more days for payment. This cash flow acceleration helps businesses bridge cash flow gaps caused by slow-paying customers, seasonality, rapid growth, and more. Plus, the cash can be used for anything the business needs. This unique process means businesses can receive immediate funding without creating debt like other funding sources.

A notice of assignment is required in factoring because you’re assigning debt to a third party – the factoring company – and the customers involved need to know.

The Role of Notice of Assignment for Cash Flow

Invoice factoring stands out as a solution for businesses seeking to improve their cash flow. When a company decides to use invoice factoring, it enters into a factoring relationship, where accounts receivable and financial rights are handled differently than usual. This process involves the NOA, a pivotal document in factoring transactions. Essentially, NOA is a simple letter informing customers that the payment terms have changed and future payments should be made payable to the factoring company.

This notification ensures that there are no misdirected payments, which is a critical aspect when managing accounts payable and securing immediate cash. By using factoring, businesses can access working capital, which reduces the strain of slow-paying customers. It’s important for factoring clients to understand how factoring companies notify your customers and the implications of this process. The factoring contract typically outlines these details, ensuring that every party in a factoring transaction is aware of their responsibilities, especially regarding remittance addresses and payment information.

Factoring services offer an alternative to traditional lines of credit, providing businesses with high advances at low rates. This method is beneficial for companies that demand longer payment terms from their clients. By transferring the right to collect payments to the factoring company, the business can focus on its core operations while the finance company handles the receivables. Understanding the benefits of factoring and effectively communicating them to your customers may improve the factoring process and maintain healthy customer relationships, even when introducing new financial arrangements like invoice factoring.

The Importance of a Notice of Assignment in Factoring

Notice of Assignment in invoice factoring keeps your customers in the loop so they know who is collecting and why. It also lets them know where to send their payments. This streamlines the process and helps ensure there’s no confusion about where payments need to go.

Elements of a Factoring NOA Document

Each factoring company words its NOA a bit differently, but NOAs usually include:

- A statement that indicates the factoring company is now managing the invoice or invoices.

- A notice that payments should be made to the factoring company.

- Details on how payments can be made, including addresses, bank details, or payment portal information.

- What will occur if payments are sent to the business instead of the third party.

- A signature from someone at your business to show your customer that the NOA is authentic and a signature space for your customer to sign indicating that they’ve read and understand the document.

How Do Factoring Companies Notify Your Customers

A factoring notice of assignment is usually sent to customers by U.S. mail, though sometimes factoring companies use other delivery services or even digitize the NOA.

What Will Your Clients Think of You Factoring Your Invoices?

Sometimes, businesses that are new to invoice factoring have concerns about how customers will react to factoring or receiving an NOA. However, it’s usually not a cause for concern.

Although your factoring company isn’t an outsourcing company, it behaves quite similarly when collecting invoices. Nearly 40 percent of small businesses outsource at least one business process, Clutch reports. That means a significant portion of your customers already have some experience engaging with third parties. Furthermore, invoice factoring is growing in leaps and bounds and is expected to grow by eight percent in the coming years, per Grandview Research . Many of your customers already have experience with factoring or will very soon. Because most businesses have some exposure to factoring or will in the near future, it’s generally seen as an ordinary business practice – nothing more, nothing less.

However, even if factoring is entirely new to your customers, how they respond to your decision is often determined by how you present it. For instance, it accelerates payments without putting pressure on your customers to pay faster. It has benefits for them, too, and can help improve the relationship. This alone can actually help some businesses win bids or attract new customers. Explaining it to them this way can help soothe any concerns if customers come to you with questions.

How to Ensure Your Customer Relationships Are Protected

Most factoring companies will take good care of their customers because they are a reflection of you. Your repeat business helps ensure they’ll have repeat business. However, reviewing a factoring company’s testimonials and success stories is always a good idea to understand better how they operate before you sign up.

It’s also essential to work with a company like Viva that doesn’t send mass notifications to all its customers. We only notify those who are debtors on the invoices you’d like to factor to eliminate any confusion.

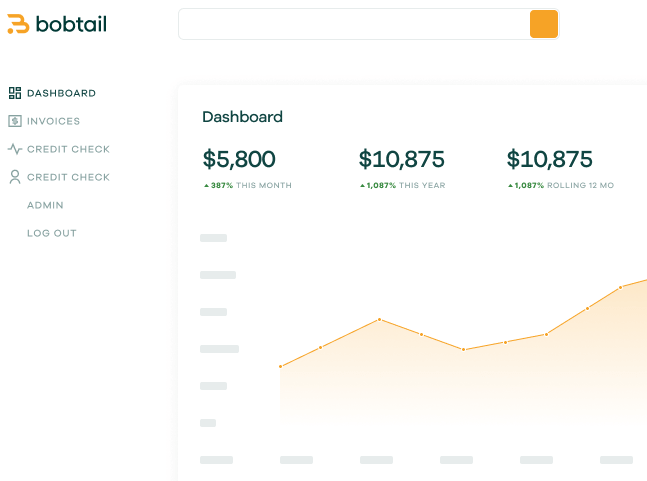

Lastly, it’s better to work with a company that provides you with 24/7 access to your account so you can see what’s paid and outstanding at a glance and can make decisions about orders using real-time data.

Request a Complimentary Invoice Factoring Quote

At Viva Capital, we always provide white glove care to the businesses we serve and their customers.As part of our service, we handle the Notice of Assignment with professionalism. Our collection experts make it easy for your customers to manage their bills and are happy to answer their questions. You’ll also have access to your personal Customer Account Portal so you can make informed decisions on the fly and always know what’s outstanding. To learn more or get started, request a complimentary invoice factoring quote .

- Recent Posts

- 10 Credit Crunch Business Strategies to Boost Your Resilience - March 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring - February 9, 2024

- Factoring Notice of Assignment (NOA): Everything You Need to Know - January 4, 2024

About Armando Armendariz

The Cost of Invoice Factoring: Is it Worth It?

Why Relying on Business Credit Cards is Dangerous

Comments are closed.

Request FREE Funding Estimate

Discover how we've helped businesses just like yours.

How Medlock Contractors has forged better relationships with their subcontractors with the help of Viva Capital Funding.

How R. Ramirez Express saves $5,000 per year in fuel costs with Viva Capital Funding.

How BelCon Logistics grew 1,000% in just 3.5 years with Viva Capital Funding.

How Top of the Line Healthcare Staffing boosted revenue 1,000% with Viva Capital Funding.

How Sun City Pallets boosted revenue 400% with Viva Capital Funding.

How DMI Industries Supplies grew and continued its global expansion plans with Viva Capital Funding.

How Cold Way Transportation boosted revenue 47% with Viva Capital Funding.

Industries we serve

- Transportation

- Manufacturing

- Service providers

- Construction

- Other Industries

Latest articles and insights

- Agile Business Transformation: Navigating Market Shifts for Long-Term Success April 8, 2024

- 10 Credit Crunch Business Strategies to Boost Your Resilience March 21, 2024

- What to Include in an Invoice to Get Paid Fast March 7, 2024

- Insurance for Business: Which Policies to Consider and Why February 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring February 9, 2024

Get A Free Consultation 866.834.7338

- Equipment Financing

- Ultimate Invoice Factoring Guide

- Recommended Load Boards

- Partner with Integrity

- Get Started

- Application to Become a New Client

- Why Integrity Factoring

- Employment Opportunities

What is a Notice of Assignment?

- What is a Notice of…

A factoring contract can contain many parts, but few are as important as the Notice of Assignment.

What are the parts of a notice of assignment.

A notice of assignment contains a few standard parts. First, it informs your customers that you are factoring your invoices and that your factoring company has been assigned as the payee for your accounts receivables. Next, a notice of assignment provides your customer with an updated remittance address for all current and future payments to be sent to. Third, it contains explicit instructions that all payments should be made to the factoring company’s remittance address only, and that no other payments should be made to any other address without explicit permission from the factoring company. It also contains verbiage that states that payments made in conflict to this notice of assignment will not be considered to have discharged a customer’s obligation for payment to the factoring company. Lastly, the factoring client signs the notice of assignment to prove it is valid.

Why do my customers need to know that I’m factoring?

The right to receive payments for amounts owed is one of the main protections a factoring company has in the factoring process. It is an essential part of almost every factoring program. In order to assure that payments are directed appropriately, a factoring company must contact a customer to verify that the notice of assignment has been accepted and the remittance address has been updated.

Why does my factoring company receive payments for invoices that weren’t factored?

A notice of assignment gives your factoring company the right to collect for ALL payments owed to you by your customer. Some factoring companies require that you factor every invoice for your customers, making this a non-issue. However, if you are working with a factoring company that allows you to pick and choose which invoices to factor for a customer, your factoring company will also receive payments for those unfactored invoices.

This happens for two reasons. First, allowing multiple remittance addresses for a payee exponentially increases the chance of a misdirected payment being made. Second, asking the customer to shoulder the additional workload of keeping track of which payments should be made to which remittance address would make invoice factoring unattractive for many customers, and thus limit the number of companies willing to work with a business that was factoring. All factoring companies have policies to efficiently deal with unfactored payments when they arrive.

What happens if I receive a payment that should have been sent to my factoring company?

Most factoring companies understand that accidents happen, and mistakes will be made. If an error in payment occurs in good faith, factoring companies have processes in place to deal with the issue. Firstly, it is important that a factoring client does not deposit the payment into their account, but rather they should immediately notify their factoring company of the errant payment and send it immediately to their factoring company. If a factoring client fails to do so, or attempts to hide the payment from their factoring company, then that client will be responsible for a misdirected payment, which often carries heavy penalties in the factoring contract.

Notice of Assignment

This notice of assignment letter can be used by a party to a commercial contract to provide notice to the other party of its assignment of its rights or performance under the contract to a third party. This template includes practical guidance, drafting notes, and alternate and optional clauses. Counsel should review the underlying agreement. This template presumes that consent is not required for assignment and that the entire agreement is being assigned. The underlying agreement should also provide confirmation of the proper individual or department to whom the notice is sent. For a full listing of related assignment content, see Assignment in Commercial Transactions Resource Kit. For a full listing of related contract clauses, see General Commercial Contract Clause Resource Kit. For more information regarding the assignability of commercial contracts, see Commercial Contracts Assignment. If consent to an assignment is required, see Request for Consent to Assignment.

What is a Notice of Assignment and How Does it Protect the Construction Business?

by CapitalPlus | Nov 8, 2023 | Blog

The Notice of Assignment, or NOA, is commonly used in business, including the construction industry. Let’s learn about the definition and how it protects us, construction businesses.

A Notice of Assignment is used when rights or obligations under a contract are transferred from one party to another. For example, if a company assigns its rights to payment under a construction contract to a third party like a factoring company , a Notice of Assignment would be sent to the party owing the payment to inform them of the new payee. The NOA helps to ensure that a construction company’s actions are transparent and that it has taken the necessary steps to inform and coordinate with all parties who may be impacted by its activities.

How does the “Notice of Assignment” protect construction trades?

Being a formal document, the Notice of Assignment states that a contract or obligation has been transferred from one party (the assignor) to another (the assignee). Here’s how it protects a construction company:

- Clarity of Responsibility : An NOA clearly delineates the transfer of rights or obligations under a contract, such as the right to receive payment or the duty to perform work, ensuring that all parties know who is now responsible.

- Proof of Notification : In the event of any disputes arising regarding the assignment, the NOA serves as legal proof that all parties were properly informed. This can be crucial in the event there is litigation or arbitration.

- Protection of Payment Rights : For a construction company that has sold or assigned its right to receive payment for work performed, the NOA informs the client or project owner of the Factoring company to which payments should be made, thus protecting the company’s financial interests.

- Avoidance of Duplication : The NOA prevents the original client from making payments to the assignor when the right to receive payment has been assigned to another entity, thus avoiding duplicate payments or financial confusion.

- Legal Requirement : In some jurisdictions, a NOA is a legal requirement to enforce the assignment against third parties. Without it, the assignee may not be able to legally claim their rights under the contract.

- Maintaining Business Relationships : By formally notifying clients of the assignment, the NOA provides the construction company transparency and trust in its business relationships, which is essential for ongoing and future business.

In summary, the Notice of Assignment ensures that all parties are informed about where contractual rights and obligations lie after an assignment has taken place.

If you have questions about NOAs or any other aspect of the invoice factoring process , feel free to reach out. We are glad to help.

Notice of Assignment | Practical Law

Notice of Assignment

Practical law canada standard document 3-599-7067 (approx. 8 pages).

13 February 2023

Notice of Assignment in Factoring in the U.S

When a business uses invoice factoring, they transfer ownership of its accounts receivable to a factoring company, which then has the responsibility to collect payment for those invoices.

Therefore, a document is issued to alert its customers of this. This is known as a notice of assignment.

Meaning of Notice of Assignment

A notice of assignment is a document that notifies clients that a factoring company has acquired ownership of their accounts receivable, or invoices, from the original business.

The notice's objective is to alert customers to the ownership change and specify who should receive payments.

Importance of Notice of Assignment

A notice of assignment is vital because it officially notifies customers that the ownership of an invoice has changed hands and that they should now direct payments to the factoring company.

The notice helps ensure that payments are sent to the appropriate parties , avoiding misunderstandings and potential conflicts and preventing uncertainty.

In the event of a disagreement, having a detailed and official notice of assignment can safeguard the legal interests of both the company and the factoring company.

Impact of Notice of Assignment on Businesses

The possible impacts faced by businesses by using a factoring company and sending their customers a notice of assignment are:

1. Enhanced customer relationships: By providing clear and official notification to customers of the change in ownership of invoices, a business can help maintain and strengthen its relationship with them.

2. Improved cash flow: By transferring ownership of invoices to a factoring company, a business can receive payment more quickly and improve its overall cash flow.

3. Increased operational efficiency: By using a factoring company to manage the collections process, a business can free up internal resources and focus on its core operations, leading to increased efficiency.

4. Reduced risk: By transferring the responsibility of collecting payment to a factoring company, a business can reduce its exposure to the risk of non-payment and bad debt.

However, before deciding to utilize factoring , it's crucial to consider any potential drawbacks, such as losing control over the collection process and the expense of the factoring service.

Factors Covered in a Notice of Assignment The main sections covered are:

- The company's accounts receivable have been transferred to a third-party financial institution, and payment should now be made to them

- The customer should now send payments to a new address, typically a secure payment processing location

- The customer will be responsible if they make a payment to the wrong address

Information in a Notice of Assignment

In a factoring notice of assignment, the following details are covered to notify the business’ customer about the transfer of ownership of accounts receivable:

- Particulars of the accounts receivable being assigned , including the amount and invoice numbers

- Details of the factor and the client/debtor

- Specifics of the assignment of the accounts receivable, including the effective date and any conditions of the assignment

- Instructions for the customer on how to direct future payments to the factor

- Any other relevant terms and conditions of the factoring agreement

What Happens When an Obligor Doesn’t Receive Notice of Agreement

A business that sells its accounts receivables (invoices) to a third-party factor must send a notice of agreement to its customers.

The purpose of the notice is to inform the customer that the factor has taken ownership of the invoice, and the payments should be made directly to the factor instead of the business.

If the customer does not receive the notice, they may continue to make the payments to the business, leading to confusion, delayed payments to the factor and potential disputes.

In some cases, the customer may have the right to demand a return of the payment made to the factor or stop payment if the notice of assignment was not correctly given.

How to Receive Notice of Agreement

A factoring notice of agreement is typically provided by the factoring company or third-party factor that has purchased the accounts receivable (invoices) from the business.

The notice is usually generated by the factor and given to the business to send to its customers.

The business may also be responsible for ensuring that the notice of assignment is delivered correctly to its customers.

Some factoring companies provide templates or sample notices that the business can use.

Requirements for a Notice of Assignment

To obtain a notice of assignment (NOA) from a factoring company, the following requirements are necessary:

- Monthly revenue of at least $300,000

- A stable financial track record of 1-2 years

- Accurate and trustworthy financial reports

- Effective management of accounts receivable

- No significant financial difficulties

1. Who Sends a Factoring Notice of Assignment? A factoring notice of assignment is typically sent by the business that has sold its accounts receivables or invoices to a third-party factor or factoring company.

The factor usually provides the notice of assignment, and the business may have to sign a factoring agreement with the factor to obtain the notice.

The notice informs the business’ customers that the factor has taken over the ownership of the invoices, and the payments should be made directly to the factoring company instead of the business.

2. How Much Does a Notice of Assignment Cost? The cost for issuing a notice of assignment in factor can differ based on various elements, such as the amount assigned, the state where the assignment is taking place and the particular provisions of the assignment agreement.

This cost may include legal fees, filing paperwork fees and other administrative expenses. It's crucial to examine the assignment agreement thoroughly to determine the precise cost and be aware of any additional fees that may be incurred.

3. How Long Does a Notice of Assignment Take? The duration of issuing a notice of assignment in factoring can differ based on particular circumstances. Usually, the process can take anywhere between a few days to weeks.

The length of the time may be influenced by factors such as the state in which the assignment is getting issued, the complexity of the assignment agreement and the accessibility of relevant parties.

Moreover, the time needed for the notice of assignment may be affected by any legal challenges or hindrances.

4. Does Notice of Assessment Mean You Owe Money? In the United States, a notice of assessment usually implies that you owe money to the government.

However, it is contingent on particular circumstances. The Internal Revenue Service (IRS) sends out the notice of assessment to inform taxpayers of any modification to their tax obligations.

If the notice displays an increase in the amount owed, it implies that the taxpayer has an outstanding balance with the IRS and should pay it promptly to prevent further interest and penalties.

On the other hand, if it shows a decrease in the amount owed, it showcases that the taxpayer has paid more taxes than required and may be eligible for a refund.

It is, therefore, always advisable to thoroughly examine the notice and to get help from a professional.

5. Is Notice of Agreement a Proof of Debt? A notice of agreement alone is not considered proof of a debt. The document merely outlines the terms and conditions agreed upon by the parties involved.

It is not enough evidence to confirm the presence of debt but rather serves as a record of the agreement between the parties.

To establish proof of debt, other financial documents such as receipts, invoices or other documentation may be necessary.

The specific requirements for proving a debt depend upon the type of debt and the laws of the jurisdiction where it is being established.

6. What is a Letter of Release? A letter of release from a factoring company is a declaration that a debt has been satisfied and is no longer the company's responsibility.

In factoring, a business sells its accounts receivable to a factoring company for a fee to receive cash quickly.

Upon receiving the payment on the accounts receivable by the business’ customer, the factoring company issues a letter of release, confirming that the debt has been fully paid off and the company is no longer obligated to it.

The letter serves as proof that the debt has been fully resolved. It can be used to clear the debt from the business's financial records.

The specifics of the letter of release, including the terms and conditions, will depend on the particular factoring agreement and the laws in the jurisdiction where it is formed and drafted.

Siddhi Parekh

Finance manager at drip capital.

Table of Content

- Information in a NOA

- What Happens When an Obligor Doesn’t Receive NOA

- How to Receive NOA

- Requirements for NOA

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

- Invoice Factoring

- Accounts Receivable Financing

- DIP Financing

- Working Capital Loans

- Asset Based Lending

- Bridge Loans

- Purchase Order Financing

- Inventory Financing

- M&A Financing

- Manufacturing

- Distribution

- Consumer Packaged Goods

- Service Companies

- Oil & Gas

- Transportation

- Application

- Case Studies

- DOWNLOADABLE RESOURCES

- Financial Calculators

- Financial Glossary

- Request A Quote

What is a Notice of Assignment?

In This Article

When you enter a factoring contract, you agree to sell your invoices, or accounts receivable, to a factoring company or third party that gives you a cash advance. This third party will then become your company’s collection department on these invoices. To notify your clients of this change of invoice ownership, the financial provider will send them a Notice of Assignment (NOA).

If you’re considering factoring your accounts receivable, you may be wondering what an NOA contains and what effects it may have on your customers and business. In this guide, we’ll cover the components of an NOA, how your factoring company sends them, and their role in the factoring process.

What is a NOA in Factoring?

A notice of assignment is a simple letter from a third party to your customers. It legally explains that a change of invoice ownership has occurred, informing your clients that a third party (bank, factoring company, financing company) will now manage and collect accounts receivable. The NOA will provide a remittance address so customers can update their payment information. The purpose of this communication is to notify your customers of a change in the collection process.

What Is a Notice of Assignment?

Understand how implementing a Notice of Assignment with Porter Capital’s factoring services can fast-track your receivables!

Discover Our Factoring Services

How Do Factoring Companies Notify Your Customers?

Factoring is more common than ever and clients range from NYC modeling agencies and namesake branded product line manufacturers, to small startup companies selling gourmet food items. No company is too large or too small to factor their invoices and many work with big box stores that demand longer payment terms to have products on their shelves. These 90 to 120 day payment terms can make factoring a necessity for smooth cash flow.

Your customers will receive the NOA as a letter in the mail to sign and return. Your business will also receive a copy of this letter. Ensure you fully understand the language used in the NOA and your responsibilities in the transition process. Sometimes business owners worry about their customers’ reactions to receiving an NOA. Invoice factoring is becoming an increasingly popular and acceptable means for financing businesses across many industries, so your customers may already be accustomed to the process. You can alert your clients about a coming NOA, proactively resolving any questions or concerns that may arise.

Why Is a NOA in Factoring Important?

When you enter a factoring contract, you agree to sell the intangible financial rights to your invoices and receive cash up front for those invoices. Because the rights are intangible, factoring companies need legal language that outlines ownership of the AR. Once the NOA is completed, a business receives the cash advance while the factor waits for invoice payments. The NOA is a critical part of the financial relationship and protects the financing provider in the event of misdirected payments. An NOA ensures all parties are aware of their responsibilities throughout the factoring process so everyone can enjoy the benefits.

Components of a NOA Document

The NOA document will contain a few vital pieces of information, including:

- Notification that accounts receivable have been assigned and is payable to a third party

- An updated payment address.

- An explanation of customer liability in the event of a misdirected payment.

Each component of the NOA ensures the factoring relationship runs smoothly by giving customers the information they need to make correct payments. It may also outline steps for your company to take if you receive a misdirected payment.

Contact Porter Capital for a Factoring Quote

When you need to improve your cash flow, consider invoice factoring with Porter Capital. With over 30 years in the business, we can offer you and your customers the reliable and trustworthy services you expect and deserve. We will help you find the best solutions for your specific business demands, enabling you to enjoy greater stability and flexibility.

Work with a trusted factoring company to expand your business, get ahead of the competition and increase customer satisfaction. Contact us online today to receive a quote for our factoring services.

Share This Article

Related posts.

2023 Deals of the Year – ABFJournal

What Is Staffing Factoring and Who Benefits From It?

How to Find Clients for Your Staffing Agency

Fuel savings are here! Learn more on our blog .

Learn how to set up your business for success this year on our blog .

+1 (410) 204 2084

What Is A Notice Of Assignment In The Trucking Industry?

To understand a notice of assignment, trucking company owners first have to be familiar with factoring—and to understand factoring, we’ll have to discuss the nuances of cash flow in the shipping industry.

Basically, the challenge for fleet owners (and owner-operators) is that their customers take forever to pay their invoices. You deliver a load and issue the invoice. The shipper may take 30 or 45 or 60 days—or more—to pay that invoice. Meanwhile, you’ve got fuel costs, payroll, insurance payments, and the thousand other financial obligations that keep your trucks on the road. You need that invoice paid now .

Factoring is the industry’s solution for quick payments to carriers. A factoring company steps in and pays your invoice today. Then that company collects from your customer, the shipper or broker who hired you to haul a given load. For their service, the factoring company keeps a low percentage of the total invoice value. (With Bobtail, the factoring fee ranges from 1.99% to 2.99%, depending on the volume of invoices you factor.)

Note that factoring is not a loan; the factoring company buys your invoices, so there’s no compounding interest or credit impact. Factoring beats loans as a cash-flow solution, hands down.

Struggling with slow payments from shippers and brokers? Keep cash flowing the simple way with Bobtail factoring.

With these preliminaries out of the way, we’re ready to answer the question that brought you here: What exactly is a notice of assignment in trucking?

Defining The Notice Of Assignment In Trucking

Factoring requires shippers and brokers to make changes in their billing systems. You’re no longer the collector on a factored invoice; the factoring company is. Accounts payable departments are busy places, and it’s easy for a shipper’s finance team to get confused when you do the work but another company collects the payment (after that company pays you, of course).

A notice of assignment clears up the billing relationship in a factoring agreement. A notice of assignment is a contractual document, supplied to both the carrier and the customer, that tells the customer to pay the factoring company, not the carrier.

The notice of assignment is an essential piece of paperwork, one of the documents you’ll have to keep on file as you establish a factoring relationship. You’ll have to sign the notice of assignment, and so will your customer. In short, this is a contractual agreement that carries legal consequences, and clarifies who exactly the shipper should pay for a delivered load.

Why is a notice of assignment important?

Consider the case of a trucking company that shifts to factoring after months or years of collecting directly from a shipper. That carrier’s payment details are already set up in the shipper’s accounting systems. Due to accidents or willful fraud, it’d be easy for the carrier to collect on an invoice twice—once from the factoring company and again from the customer.

In that scenario, the factoring company loses money, or at least becomes embroiled in a flurry of paperwork and legal challenges. So the notice of assignment is designed to protect the factoring company. But this document provides benefits for you, the carrier, and your customers, too.

How A Notice Of Assignment Benefits Shippers And Carriers

Who needs more paperwork? While it may seem like just another legal document, notices of assignment are actually helpful for all three parties involved in a factoring payment deal: the factoring company, sure, but also the carrier and the customer.

For shippers , the notice of assignment is a strong incentive to update payment details in their accounting systems. It delineates the nature of the financial agreement. It provides visibility and clarity that avoids conflict down the line. Most importantly, factoring companies require shippers to sign a notice of assignment—and factoring benefits customers, too. It keeps them from having to renegotiate payment terms, and gives them the full 30 or 60 days to pay, which allows them to optimize their own cash utilization.

Carriers also benefit from the clarity that comes with a notice of assignment. This document allows you to rest assured that the customer won’t accidentally pay you for a factored invoice, so you don’t have to spend all day trying to get the money into the right hands—or face collection threats of your own.

The binding agreement contained within a notice of assignment protects you from legal problems. It’s simply smart business to make sure everyone knows exactly who should get paid, and for what. Notices of assignment accomplish this goal—and, with Bobtail, the paperwork is simpler than you might think.

Simplifying Notices Of Assignment

Traditional factoring companies aren’t the most efficient financial operators in the world. They make you sign restrictive contracts. They might even tell you who you can work with, and who you can’t. They stack hidden fees on everything from set-up to ACH transfers to terminating the deal. And they make you fill out reams of paperwork before depositing a cent.

Bobtail is different every step of the way. We started this company to eliminate the inefficiencies in the factoring process, and that includes personalized assistance with handling notices of assignment.

When you sign up with Bobtail—a quick, online process involving a single application form—you’ll get a personal account manager who’s always ready to answer questions and solve problems. They’ll issue your notice of assignment and make sure your customers understand the document and why it’s necessary.

All you have to do is carry on carrying loads.

When you decide to factor an invoice, the process is even simpler. Just deliver the load, upload the invoice, attach a rate confirmation and a bill of lading, and get paid. It’s all done through Bobtail’s online system, so you can handle financing from the rig. We also provide a user-friendly digital dashboard that makes it easy to track every invoice at every step of the financing process. There’s simply no easier way to factor an invoice.

At Bobtail, we believe that you know what’s best for your business. That’s why we don’t make you sign a long-term contract; this is no-contract factoring. You pick which accounts to factor and which to collect from directly, and we don’t have volume requirements or exclusive financing deals.

We also don’t charge hidden fees. You just pay a flat factoring fee so there’s no confusion on exactly how much cash will hit your bank account—or when. Invoices are filled the same day you submit them, or the next day if the invoice arrives after 11 a.m. Eastern time.

Don’t be intimidated by a notice of assignment in trucking—or any other documents related to your factoring service. With Bobtail, our devoted customer service team makes sure everything runs smoothly, and we’re there to help every step of the way. Or, as one Trustpilot review puts it:

“They always answer the phone! The staff is very helpful and cordial. The three things I love are: Payments are on time, the website is easy to use, and great customer service!”

(Read more customer reviews on Trustpilot.)

Ready to improve cash flow without the headaches? Sign up to learn more today.

If you have questions about account set-up, notices of assignment, or anything else related to factoring, contact the Bobtail sales team at (410) 204-2084, or email us at [email protected].

Caroline Asiala is the Digital Marketing Manager at Bobtail. With a background rooted in advocating for migrant rights, Caroline leverages her expertise in content creation to support small trucking businesses, many of which are immigrant-owned and operated, with the information they need to make their businesses thrive.

Download our mobile app

Assignments: why you need to serve a notice of assignment

It's the day of completion; security is taken, assignments are completed and funds move. Everyone breathes a sigh of relief. At this point, no-one wants to create unnecessary paperwork - not even the lawyers! Notices of assignment are, in some circumstances, optional. However, in other transactions they could be crucial to a lender's enforcement strategy. In the article below, we have given you the facts you need to consider when deciding whether or not you need to serve notice of assignment.

What issues are there with serving notice of assignment?

Assignments are useful tools for adding flexibility to banking transactions. They enable the transfer of one party's rights under a contract to a new party (for example, the right to receive an income stream or a debt) and allow security to be taken over intangible assets which might be unsuitable targets for a fixed charge. A lender's security net will often include assignments over contracts (such as insurance or material contracts), intellectual property rights, investments or receivables.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

The main difference between legal and equitable assignments (other than the formalities required to create them) is that with a legal assignment, the assignee can usually bring an action against the contract counterparty in its own name following assignment. However, with an equitable assignment, the assignee will usually be required to join in proceedings with the assignor (unless the assignee has been granted specific powers to circumvent that). That may be problematic if the assignor is no longer available or interested in participating.

Why should we serve a notice of assignment?

The legal status of the assignment may affect the credit scoring that can be given to a particular class of assets. It may also affect a lender's ability to effect part of its exit strategy if that strategy requires the lender to be able to deal directly with the contract counterparty.

The case of General Nutrition Investment Company (GNIC) v Holland and Barrett International Ltd and another (H&B) provides an example of an equitable assignee being unable to deal directly with a contract counterparty as a result of a failure to provide a notice of assignment.

The case concerned the assignment of a trade mark licence to GNIC . The other party to the licence agreement was H&B. H&B had not received notice of the assignment. GNIC tried to terminate the licence agreement for breach by serving a notice of termination. H&B disputed the termination. By this point in time the original licensor had been dissolved and so was unable to assist.

At a hearing of preliminary issues, the High Court held that the notices of termination served by GNIC , as an equitable assignee, were invalid, because no notice of the assignment had been given to the licensee. Although only a High Court decision, this follows a Court of Appeal decision in the Warner Bros Records Inc v Rollgreen Ltd case, which was decided in the context of the attempt to exercise an option.

In both cases, an equitable assignee attempted to exercise a contractual right that would change the contractual relationship between the parties (i.e. by terminating the contractual relationship or exercising an option to extend the term of a licence). The judge in GNIC felt that "in each case, the counterparty (the recipient of the relevant notice) is entitled to see that the potential change in his contractual position is brought about by a person who is entitled, and whom he can see to be entitled, to bring about that change".

In a security context, this could hamper the ability of a lender to maximise the value of the secured assets but yet is a constraint that, in most transactions, could be easily avoided.

Why not serve notice?

Sometimes it's just not necessary or desirable. For example:

- If security is being taken over a large number of low value receivables or contracts, the time and cost involved in giving notice may be disproportionate to the additional value gained by obtaining a legal rather than an equitable assignment.

- If enforcement action were required, the equitable assignee typically has the option to join in the assignor to any proceedings (if it could not be waived by the court) and provision could be made in the assignment deed for the assignor to assist in such situations. Powers of attorney are also typically granted so that a lender can bring an action in the assignor's name.

- Enforcement is often not considered to be a significant issue given that the vast majority of assignees will never need to bring claims against the contract counterparty.

Care should however, be taken in all circumstances where the underlying contract contains a ban on assignment, as the contract counterparty would not have to recognise an assignment that is made in contravention of that ban. Furthermore, that contravention in itself may trigger termination and/or other rights in the assigned contract, that could affect the value of any underlying security.

What about acknowledgements of notices?

A simple acknowledgement of service of notice is simply evidence of the notice having been received. However, these documents often contain commitments or assurances by the contract counterparty which increase their value to the assignee.

Best practice for serving notice of assignment

Each transaction is different and the weighting given to each element of the security package will depend upon the nature of the debt and the borrower's business. The service of a notice of assignment may be a necessity or an optional extra. In each case, the question of whether to serve notice is best considered with your advisers at the start of a transaction to allow time for the lender's priorities to be highlighted to the borrowers and captured within the documents.

For further advice on serving notice of assignment please contact Kirsty Barnes or Catherine Phillips from our Banking & Finance team.

- [email protected]

- T: +44 (0)370 733 0605

- Download vCard for Catherine Phillips

Related Insights & Resources

Gowling WLG updates

Sign up to receive our updates on the latest legal trends and developments that matter most to you.

- Personal Pension

- Auto-enrolment

- State Pension

- Retirement Income

- Responsible Money

- Vantage Point

- ESG Investing

- Fixed Income

- Investment Trusts

- Multi-asset

- Model Portfolios

- Talking Point

- Residential

- Life Insurance

- Critical Illness

- Income Protection

- Business Protection

- Financial Conduct Authority

- Financial Ombudsman Service

- Inheritance Tax

- Capital Gains Tax

- Tax Efficient Investments

- National Insurance

- FT Wealth Management

- Trade Bodies

- Paraplanning

- Consumer duty

- Mergers and Acquisitions

- Diversity and Inclusion

- Simoney Kyriakou

- Jeff Prestridge

- Stephanie Hawthorne

- Darren Cooke

- Ask the Expert

- Alternatives

FCA issues warning notice against Neil Woodford

The Financial Conduct Authority has said Neil Woodford had a “defective and unreasonably narrow” understanding of his responsibilities for managing his fund, which was suspended in 2019.

The regulator has set out its proposed action against Woodford and Woodford Investment Management .

In a statement, the FCA has also criticised Link Fund Solutions, the administrator of Woodford Equity Income, for failing to act with “due skill, care and diligence” in carrying out its role.

Link Group, LFS's parent company, has already agreed to make a voluntary contribution to the redress as it considers it has no legal responsibility for the obligations of LFS.

The redress payment is made up of LFS's assets plus part of the proceeds from the sale of LFS (without the Woodford liability) to Dublin-based Waystone Group.

Today (April 11) the FCA issued its final notice to Link, in which it said the company failed to manage the liquidity of the fund from July 31, 2018 until it was suspended just under a year later.

It also said it failed to manage how easily assets in the fund could be turned into cash - so investors could access their money at short notice.

The regulator also revealed it has issued a warning notice statement to Neil Woodford and Woodford Investment Management.

It confirmed there were no other parties under investigation in relation to the fund.

The notice read: “The FCA considers that during the relevant period (July 31, 2018 to June 3, 2019) Mr Woodford held a defective and unreasonably narrow understanding of his responsibilities for managing [Woodford Equity Income's] liquidity risks.”

It added he failed to ensure the fund had an appropriate liquidity profile.

The warning notices given to Woodford and his firm are not the FCA's final decisions and the regulator said any final decision would be made public.

The Link final notice confirms the failings which led to the FCA's investigation and subsequent agreement to pay compensation to those affected.

Those invested in the fund when it was suspended started to receive a share of the up to £230mm redress scheme , which was approved by the High Court in February.

Therese Chambers, joint executive director of enforcement and market oversight at the FCA, said: “Link Fund Solutions' job was to properly manage the Woodford Equity Income fund and to protect investors' interests. Their failings led to losses for those trapped in the fund when it was suspended.

"It is right that they compensate investors for the losses that resulted from their failings, and we're pleased that the scheme has started making payments ."

A Link spokesperson said: “As we have previously stated, LFSL entered into a conditional settlement agreement with the FCA and Link Group expressly on the basis that there is no admission of liability.

"If the scheme had not been approved, LFSL would have challenged the FCA's findings and defended itself against any claims made against it by scheme investors.

“We are pleased the scheme has become effective and the initial payment has now been made to scheme investors. We have always believed the scheme was the best option to provide investors with a substantial level of redress.”

tara.o'[email protected]

What's your view?

Have your say in the comments section below or email us: [email protected]

More on Woodford Investment Management

Related Topics

- International edition

- Australia edition

- Europe edition

Neil Woodford’s understanding of risk ‘defective’, FCA says

Watchdog issues warning notice to former star stockpicker over collapse of his fund in 2019

The former star stockpicker Neil Woodford has been hit with a warning notice by the Financial Conduct Authority over the spectacular collapse of his fund five years ago, with the watchdog accusing him of having “defective understanding” of liquidity risks faced by the fund.

In the warning issued on Thursday, the FCA said it intended to take action against Woodford and Woodford Investment Management (WIM) in respect of their conduct in the management of the Woodford Equity Income Fund (WEIF) before its suspension in 2019.

The FCA said Woodford held “a defective and unreasonably narrow understanding of his responsibilities for managing the WEIF’s liquidity risks”, while also claiming that he had failed to ensure the company had appropriate liquidity when making investment decisions.

Lawyers representing Woodford and the firm rejected the findings, which they called “unprecedented and fundamentally misconceived”.

Woodford was forced to collapse the £3.7bn fund in June 2019 , with almost 300,000 investors affected. The fund was launched by Woodford in 2014 after a successful career working as a fund manager at Invesco.

However, after his initial success earned him the moniker of “Britain’s Warren Buffett”, a number of unsuccessful investments resulted in many investors withdrawing cash , prompting a liquidity crisis.

In the notice, the FCA said the investment decisions made by Woodford and WIM materially increased the risk of and resulted in the WEIF’s liquidity profile “becoming unreasonable and inappropriate”.

It added: “They also materially increased the risk that the WEIF would need to be suspended and thereby place those investors who did not redeem prior to the point of suspension at a disadvantage.”

In a separate final notice to Link Fund Solutions (LFS), the company in charge of the fund’s liquidity, the FCA said it “failed to act with due skill, care and diligence in its management”. It also stated that it failed to manage the liquidity of the fund and ensure that concerns about the liquidity position were acted upon.

In September 2022, the FCA said it could fine Link £50m because of its role in the collapse of the fund. However, the watchdog revealed in the final notice that it would not be pursuing the fine as this would reduce the amount out of pocket investors could receive back.

In February, the high court gave the green light for a £230m redress scheme, with those who invested in the fund when it was suspended to receive a share.

The warning notice marks the FCA’s intention to take action but Woodford will be able to make representations to its regulatory decisions committee before it decides what action to take. Woodford’s lawyers have said he will challenge the FCA decision.

after newsletter promotion

A statement issued on behalf of WilmerHale and BCLP, legal counsel to Woodford and WIM, said: “The FCA alleges that WIM and Mr Woodford failed to act with due skill, care and diligence during the 11 months from 31 July 2018 to 3 June 2019, when Link decided to suspend the fund.

“It is striking that the FCA’s only criticisms of Neil Woodford relate to his involvement in matters relating to the fund’s liquidity framework, which was, in fact, Link’s responsibility and supervised by the depositary (the depositary is responsible for the safekeeping of the fund’s assets and for overseeing the fund’s authorised corporate director) and the FCA.”

A spokesperson from LFS said: “As we have previously stated, LFSL [Link Fund Solutions Limited] entered into a conditional settlement agreement with the FCA and Link Group expressly on the basis that there is no admission of liability. If the scheme had not been approved, LFSL would have challenged the FCA’s findings and defended itself against any claims made against it by scheme investors.

“We are pleased the scheme has become effective and the initial payment has now been made to scheme investors. We have always believed the scheme was the best option to provide investors with a substantial level of redress.”

- Neil Woodford

- Financial Conduct Authority

- Financial sector

- Investment funds

- Investments

- Hargreaves Lansdown

Woodford fund compensation for investors likely to total 77p in the pound

Hargreaves Lansdown hit by lawsuit on behalf of Woodford fund investors

Neil woodford investors sue administrators of collapsed fund.

MPs urge FCA to hand over Woodford inquiry to independent judge or QC

Neil Woodford needs permission to set up new firm, says FCA

Investment manager Neil Woodford to set up new firm

Mark Barnett, a Neil Woodford protege, sacked from investment trust

Neil Woodford fund investors to share second £142m payout

Most viewed.

Woodford Had ‘Defective’ Understanding of Risk, FCA Says

- Stock picker Neil Woodford hit with FCA warning notice

- Lawyers for Woodford say he intends to challenge the findings

Once-famed fund manager Neil Woodford was hit with a warning notice by the UK’s financial regulator, which said he had a “defective and unreasonably narrow understanding” of liquidity risks in the lead-up to the collapse of his fund.

The Financial Conduct Authority said it planned to take enforcement action against the stock picker and his defunct firm Woodford Investment Management , according to a statement Thursday. A warning notice is issued before the FCA comes to a final decision.

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, digital standard + weekend, digital premium + weekend.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend newspaper delivered Saturday plus standard digital access

- FT Weekend Print edition

- FT Weekend Digital edition

- FT Weekend newspaper delivered Saturday plus complete digital access

- Everything in Preimum Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Turn Your Curiosity Into Discovery

Latest facts.

Follistatin344 Peptide Considerations

Approach for Using 5 Tips To Help You Write Your Dissertation

40 facts about elektrostal.

Written by Lanette Mayes

Modified & Updated: 02 Mar 2024

Reviewed by Jessica Corbett

Elektrostal is a vibrant city located in the Moscow Oblast region of Russia. With a rich history, stunning architecture, and a thriving community, Elektrostal is a city that has much to offer. Whether you are a history buff, nature enthusiast, or simply curious about different cultures, Elektrostal is sure to captivate you.

This article will provide you with 40 fascinating facts about Elektrostal, giving you a better understanding of why this city is worth exploring. From its origins as an industrial hub to its modern-day charm, we will delve into the various aspects that make Elektrostal a unique and must-visit destination.

So, join us as we uncover the hidden treasures of Elektrostal and discover what makes this city a true gem in the heart of Russia.

Key Takeaways:

- Elektrostal, known as the “Motor City of Russia,” is a vibrant and growing city with a rich industrial history, offering diverse cultural experiences and a strong commitment to environmental sustainability.

- With its convenient location near Moscow, Elektrostal provides a picturesque landscape, vibrant nightlife, and a range of recreational activities, making it an ideal destination for residents and visitors alike.

Known as the “Motor City of Russia.”

Elektrostal, a city located in the Moscow Oblast region of Russia, earned the nickname “Motor City” due to its significant involvement in the automotive industry.

Home to the Elektrostal Metallurgical Plant.

Elektrostal is renowned for its metallurgical plant, which has been producing high-quality steel and alloys since its establishment in 1916.

Boasts a rich industrial heritage.

Elektrostal has a long history of industrial development, contributing to the growth and progress of the region.

Founded in 1916.

The city of Elektrostal was founded in 1916 as a result of the construction of the Elektrostal Metallurgical Plant.

Located approximately 50 kilometers east of Moscow.

Elektrostal is situated in close proximity to the Russian capital, making it easily accessible for both residents and visitors.

Known for its vibrant cultural scene.

Elektrostal is home to several cultural institutions, including museums, theaters, and art galleries that showcase the city’s rich artistic heritage.

A popular destination for nature lovers.

Surrounded by picturesque landscapes and forests, Elektrostal offers ample opportunities for outdoor activities such as hiking, camping, and birdwatching.

Hosts the annual Elektrostal City Day celebrations.

Every year, Elektrostal organizes festive events and activities to celebrate its founding, bringing together residents and visitors in a spirit of unity and joy.

Has a population of approximately 160,000 people.