Do you have the world's best boss? Enter them to win two tickets to Sandals!

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Writing a Business Growth Plan

Table of Contents

When you run a business, it’s easy to get caught in the moment and focus only on the day in front of you. However, to be truly successful, you must look ahead and plan for growth. Many business owners create a business growth plan to map out the next one or two years and pinpoint how and when revenues will increase.

We’ll explain more about business growth plans and share strategies for writing a business growth plan that can set you on a path to success.

What is a business growth plan?

A business growth plan outlines where a company sees itself in the next one to two years. Business owners and leaders apply a growth mindset to create plans for expansion and increased revenues.

Business growth plans should be formatted quarterly. At the end of each quarter, the company can review the business goals it achieved and missed during that period. At this point, management can revise the business growth plan to reflect the current market standing.

What to include in a business growth plan

A business growth plan focuses specifically on expansion and how you’ll achieve it. Creating a useful plan takes time, but keeping your growth efforts on track can pay off substantially.

You should include the following elements in your growth plan:

- A description of expansion opportunities

- Financial goals broken down by quarter and year

- A marketing plan that details how you’ll achieve growth

- A financial plan to determine what capital is accessible during growth

- A breakdown of your company’s staffing needs and responsibilities

Your growth plan should also include an assessment of your operating systems and computer networks to determine if they can accommodate profitable growth .

How to write a business growth plan

To successfully write a business growth plan, you must do some forward-thinking and research. Here are some key steps to follow when writing your business growth plan.

1. Think ahead.

The future is always unpredictable. However, if you study your target market, your competition and your company’s past growth, you can plan for future expansion. The Small Business Administration (SBA) features a comprehensive guide to writing a business plan for growth.

2. Study other growth plans.

Before you start writing, review models from successful companies.

3. Discover opportunities for growth.

With some homework, you can determine if your expansion opportunities lie in creating new products , adding more services, targeting a new market, opening new business locations or going global, to name a few examples. Once you’ve identified your best options for growth, include them in your plan.

4. Evaluate your team.

Your plan should include an assessment of your employees and a look at staffing requirements to meet your growth objectives. By assessing your own skills and those of your employees, you can determine how much growth can be accomplished with your present team. You’ll also know when to ramp up the hiring process and what skill sets to look for in those new hires.

5. Find the capital.

Include detailed information on how you will fund expansion. Business.gov offers a guide on how to prepare funding requests and how to connect with SBA lenders.

6. Get the word out.

Growing your business requires a targeted marketing effort. Be sure to outline how you will effectively market your business to encourage growth and how your marketing efforts will evolve as you grow.

7. Ask for help.

Advice from other business owners who have enjoyed successful growth can be the ultimate tool in writing your growth plan.

8. Start writing.

Business plan software has streamlined the process of writing growth plans by providing templates you can fill in with information specific to your company and industry. Most software programs are geared toward general business plans; however, you can easily modify them to create a plan that focuses on growth.

If you don’t have business plan software, don’t worry. You can create a business growth plan using Microsoft Word, Google Docs or a similar tool. For each growth opportunity, create the following sections:

- What is the opportunity? Is your growth opportunity a new geographic expansion, a new product or a new customer segment? How do you know there’s an opportunity? Include your market research to demonstrate the idea’s viability.

- What factors make this opportunity valuable at this time? For example, your growth opportunity could utilize new technology, take advantage of a strategic partnership or capitalize on a consumer trend.

- What are the risk factors for this opportunity? Identify factors that may make this growth opportunity challenging to execute. For example, challenges may include the state of the overall economy, intense competition or supply chain distribution issues. What is your plan for dealing with these challenges?

- What is your marketing and sales plan? Identify the marketing efforts and sales processes that can help you seize this growth opportunity. Detail the marketing channel you’ll use ( social media marketing , print marketing), your message and promising sales ideas. For example, you could hire sales reps for a new geographic area or set up distribution deals with relevant brick-and-mortar or online retailers .

- What are the costs involved in this growth area? For example, if you add a new product, you may need to buy new manufacturing equipment and raw materials. While marketing costs are a given, remember to include incremental sales costs like commissions. Outline any economies of scale or places where your existing operations make the new growth area less expensive than a stand-alone initiative.

- How will your income, expenses and cash flow look? Project your income and expenses, and prepare a cash flow statement for the new growth area for the next three to five years. Include a break-even analysis, a sales forecast and all projected expenses to see how much the new initiative will add to the bottom line. Include how the new growth area will positively (or negatively) impact existing sales. For example, if you sell bathing suits and you decide to grow by adding cover-ups and sunglasses, you will likely sell more bathing suits.

A cash flow statement will indicate if you must secure additional financing, and a break-even analysis will let you know when the growth opportunity will stop being a drain on the company’s financial resources and start turning a profit.

After completing this exercise for each growth opportunity:

- Create a summary that accounts for all growth areas for the period.

- Include summarized financial statements to see the entire picture and its impact on the company.

- Evaluate the financing you’ll need to implement the plan, and include various options and rates.

Why are business growth plans important?

These are some of the many reasons why business growth plans are essential:

- Market share and penetration: If your market share remains constant in a world where costs consistently increase, you’ll inevitably start recording losses instead of profits. Business growth plans help you avoid this scenario.

- Recouping early losses: Most companies lose far more than they earn in their early years. To recoup these losses, you’ll need to grow your company to a point where it can make enough revenue to pay off your debts.

- Future risk minimization: Growth plans also matter for established businesses. These companies can always stand to make their sales more efficient and become more liquid. Liquidity can come in handy if you need money to cover unexpected problems.

- Appealing to investors: For most businesses, a business growth plan’s primary purpose is to find investors . Investors want to outline your company’s plans to build sales in the coming months.

- Concrete revenue plans: Growth plans are customizable to each business and don’t have to follow a set template. However, all business growth plans must focus heavily on revenue. The plan should answer a simple question: How does your company plan to make money each quarter?

Motivate your employees by sharing your growth plan. When employees see an opportunity for increased responsibility and compensation, they’re more likely to stay with your business.

What factors impact business growth?

Consider the following crucial factors that can impact business growth:

- Leadership: To achieve your goals, you must know the ins and outs of your business processes and how external forces impact them. Without this knowledge, you can’t direct and train your team to drive your revenue, and you will experience stagnation instead of growth.

- Management: As a small business owner, you’re innately involved in management – obtaining funding, resources, and physical and digital infrastructure. Ineffective management will impact your ability to perform these duties and could hamstring your growth.

- Customer loyalty: Acquiring new customers can be five times as expensive as retaining current ones, and a 5 percent boost in customer retention can increase profits by 25 percent to 95 percent. These statistics demonstrate that customer loyalty is fundamental to business growth.

What are the four major growth strategies?

There are countless growth strategies for businesses, but only four primary types. With these growth strategies, you can determine how to build on your brand.

- Market strategy: A market strategy refers to how you plan to penetrate your target audience . This strategy isn’t intended for entering a new market or creating new products and services to boost your market share; it’s about leveraging your current offerings. For instance, can you adjust your pricing? Should you launch a new marketing campaign?

- Development strategy: This strategy means looking into ways to break your products and services into a new market. If you can’t find the growth you want in the current market, a goal could be to expand to a new market.

- Product strategy: Also known as “product development,” this strategy focuses on what new products and services you can target to your current market. How can you grow your business without entering new markets? What are your customers asking for?

- Diversification strategy: Diversification means expanding both your products and target markets. This strategy is usually best for smaller companies that have the means to be versatile with the products or services they offer and what new markets they attempt to penetrate.

Max Freedman contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

Company Growth Strategy: 7 Key Steps for Business Growth & Expansion

Published: April 17, 2023

A concrete growth strategy is more than a marketing strategy, it's a crucial cog in your business machine. Without one, you're at the mercy of a fickle consumer base and market fluctuations.

So, how do you plan to grow?

If you're unsure about the steps needed to craft an effective growth strategy, we've got you covered.

Business Growth

Business growth is a stage where an organization experiences unprecedented and sustained increases in market reach and profit avenues. This can happen when a company increases revenue, produces more products or services, or expands its customer base.

For the majority of businesses, growth is the main objective. With that in mind, business decisions are often made based on what would contribute to the company’s continued growth and overall success. There are several methods that can facilitate growth which we'll explain more about below.

.png)

Free Strategic Planning Template

Access a business strategic planning template to grow your business.

- Sales and Revenue Growth

- Growth of Customer Base

- Expansion into New Regions

You're all set!

Click this link to access this resource at any time.

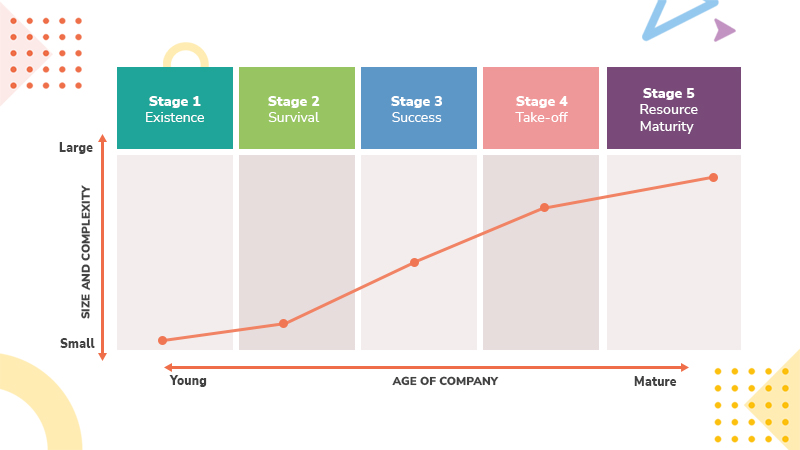

Types of Business Growth

As a business owner, you have several avenues for growth. Business growth can be broken down into the following categories:

With organic growth, a company expands through its own operations utilzing its own internal resources. This is in contrast to having to seek out external resources to facilitate growth.

An example of organic growth is making production more efficient so you can produce more within a shorter time frame, which leads to increased sales. A perk of utilizing organic growth is that it relies on self-sufficiency and avoids taking on debt. Additionally, the increased revenue created from organic growth can help fund more strategic growth methods later on. We’ll explain that below.

2. Strategic

Strategic growth involves developing initiatives that will help your business grow long term. An example of strategic growth could be coming up with a new product or developing a market strategy to target a new audience.

Unlike organic growth, these initiatives often require a significant amount of resources and funding. Businesses often take an organic approach first in hopes that their efforts will generate enough capital to invest in future strategic growth initiatives.

3. Internal

Internal growth strategy seeks to optimize internal business processes to increase revenue. Similar to organic growth, this strategy relies on companies using their own internal resources. Internal growth strategy is all about using existing resources in the most purposeful way possible.

An example of internal growth could be cutting wasteful spending and running a leaner operation by automating some of its functions instead of hiring more employees. Internal growth can be more challenging because it forces companies to look at how their processes can be improved and made more efficient rather than focusing on external factors like entering new markets to facilitate growth.

4. Mergers, Partnerships, Acquisitions

Although riskier than the other growth types, mergers, partnerships, and acquisitions can come with high rewards. There’s strength in numbers and a well-executed merger, partnership, or acquisition can help your business break into a new market, expand your customer base, or increase your products and services on offer.

Business Growth Strategy

A growth strategy is a plan that companies make to expand their business in a specific aspect, such as yearly revenue, number of customers, or number of products. Specific growth strategies can include adding new locations, investing in customer acquisition, or expanding a product line.

A company's industry and target market influence which growth strategies it will choose. Strategize, consider the available options, and build some into your business plan. Depending on the kind of company you're building, your growth strategy might include aspects like:

- Adding new locations

- Investing in customer acquisition

- Franchising opportunities

- Product line expansions

- Selling products online across multiple platforms

Your particular industry and target market will influence your decisions, but it's almost universally true that new customer acquisition will play a sizable role. That said, there are different types of overarching growth strategies you can adopt before making a specific choice, such as adding new locations. Let’s take a look.

Free Growth Strategy Template

Fill out this form to access your template, types of business growth strategies.

There are several general growth strategies that your organization can pursue. Some strategies may work in tandem. For instance, a customer growth and market growth strategy will usually go hand-in-hand.

Revenue Growth Strategy

A revenue growth strategy is an organization’s plan to increase revenue over a time period, such as year-over-year. Businesses pursuing a revenue growth strategy may monitor cash flow , leverage sales forecasting reports , analyze current market trends, diminish customer acquisition costs , and pursue strategic partnerships with other businesses to improve the bottom line.

Specific revenue growth tactics may include:

- Investing in sales training programs to boost close rates

- Leveraging technology to improve sales forecasting reports

- Using lower-cost marketing strategies to lower customer acquisition costs

- Continuing to train customer service reps

- Partnering with another company to promote your products and services

Customer Growth Strategy

A customer growth strategy is an organization’s plan to boost new customer acquisitions over a time period, such as month-over-month. Businesses pursuing a customer growth strategy may be more open to making large strategic investments, as long as the investments lead to greater customer acquisitions.

For this strategy, you may track customer churn rates , calculate customer lifetime value , and leverage pricing strategies to attract more customers. You might also spend more on marketing, sales, and CX , with new customer sign-ups as the north star metric.

Specific customer growth tactics may include:

- Investing in your marketing and sales organization’s headcount

- Increasing advertising and marketing spend

- Opening new locations in a promising market you’ve not yet reached

- Adding new product lines and services

- Adopting a discount or freemium pricing strategy

- Tracking metrics such as churn rates, customer lifetime value, and MRR

Marketing Growth Strategy

A marketing growth strategy — which is related, but not the same as, a market development strategy — is an organization’s plan to increase their total addressable market (TAM) and increase existing market share.

Businesses pursuing a marketing growth strategy will research different verticals, customer types, audiences, regions, and more to measure the viability of a market expansion.

Specific marketing growth tactics may include:

- Rebranding the business to appeal to a new audience

- Launching new products to appeal to buyers in a new market

- Opening new locations in other regions

- Adopting a different marketing strategy, e.g local marketing or event marketing , to appeal to new markets

- Becoming a franchisor so that individual business owners can buy franchises from you

Product Growth Strategy

A product growth strategy is an organization’s plan to increase product usage and sign-ups, or expand product lines. This type of growth strategy requires a significant investment into the organization’s product and engineering team (at SaaS organizations). In the retail industry, a product growth strategy may look like partnering with new manufacturers to expand your product catalog.

Specific tactics may include:

- Adding new features and benefits to existing products

- Adopting a freemium pricing strategy

- Adding new products to the existing product line

- Partnering with new manufacturers and providers

- Expanding into new markets and verticals to increase product adoption

Not sure what all of this can look like for your business? Here are some actionable tactics for achieving growth.

How to Grow a Company Successfully

- Use a growth strategy template.

- Choose your targeted area of growth.

- Conduct market and industry research.

- Set growth goals.

- Plan your course of action.

- Determine your growth tools and requirements.

- Execute your plan.

1. Use a growth strategy template [Free Tool] .

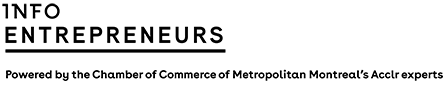

Image Source

Don’t hit the ground running without planning out and documenting the steps for your growth strategy. We recommend downloading this free Growth Strategy Template and working off the included section prompts to outline your intended process for growth in your organization.

2. Choose your targeted area of growth.

It’s great that you want to grow your business, but what exactly do you want to grow?

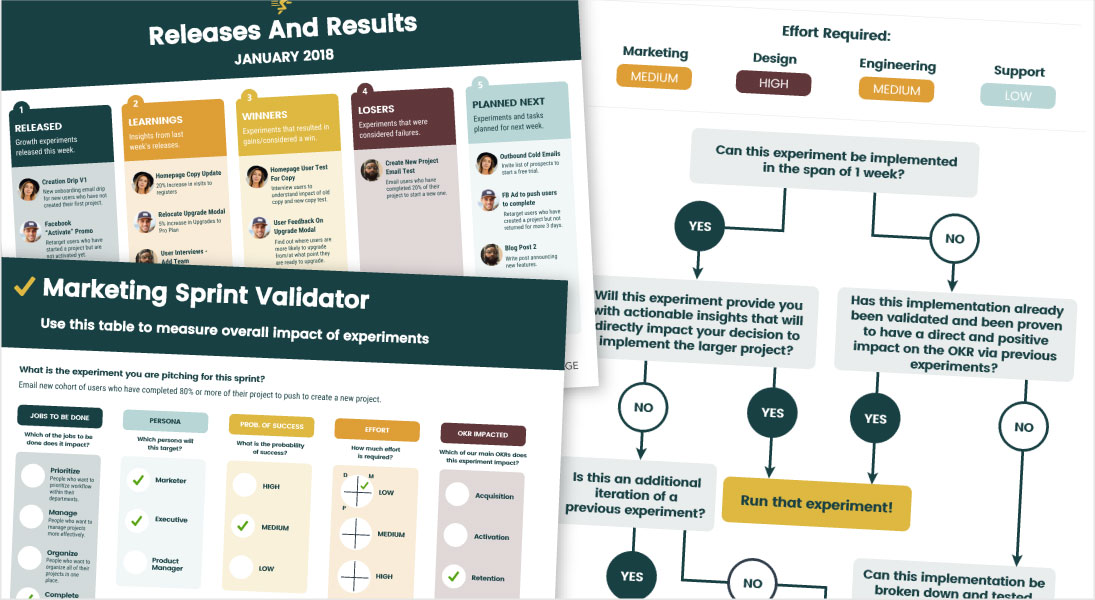

Your business growth plan should hone in on specific areas of growth. Common focuses of strategic growth initiatives might include:

- Growth in employee headcount

- Expansion of current office, retail, and/or warehouse space

- Addition of new locations or branches of your business

- Expansion into new regions, locations, cities, or countries

- Addition of new products and/or services

- Expanding purchase locations (i.e. selling in new stores or launching an online store)

- Growth in revenue and/or profit

- Growth of customer base and/or customer acquisition rate

It’s possible that your growth plan will encompass more than one of the initiatives outlined above, which makes sense — the best growth doesn't happen in a vacuum. For example, growing your unit sales will result in growth in revenue — and possibly additional locations and headcount to support the increased sales.

3. Conduct market and industry research.

After you’ve chosen what you want to grow, you’ll need to justify why you want to grow in this area (and if growth is even possible).

Researching the state of your industry is the best way to determine if your desired growth is both necessary and feasible. Examples could include running surveys and focus groups with existing and potential customers or digging into existing industry research.

The knowledge and facts you uncover in this step will shape the expectations and growth goals for this project to better determine a timeline, budget, and ultimate goal. This brings us to step four…

4. Set growth goals.

Once you’ve determined what you’re growing and why you’re growing, the next step is to determine how much you’ll be growing.

These goals should be based on your endgame aspirations of where you ideally want your organization to be, but they should also be achievable and realistic – which is why setting a goal based on industry research is so valuable.

Lastly, take the steps to quantify your goals in terms of metrics and timeline. Aiming to "grow sales by 30% quarter-over-quarter for the next three years" is much clearer than "increasing sales."

5. Plan your course of action.

Next, outline how you’ll achieve your growth goals with a detailed growth strategy. Again – we suggest writing out a detailed growth strategy plan to gain the understanding and buy-in of your team.

Download this Template

This action plan should contain a list of action items, deadlines, teams or persons responsible, and resources for attaining your growth goal.

6. Determine your growth tools and requirements.

The last step before acting on your plan is determining any requirements your team will need through the process. These are specific resources that will help you meet your growth goals faster and with more accuracy. Examples might include:

- Funding: Organizations may need a capital investment or an internal budget allocation to see this project through.

- Tools & Software: Consider what technological resources may be needed to expedite and/or gain insights from the growth process.

- Services: Growth may be better achieved with the help of consultants, designers, or planners in a specific field.

7. Execute your plan.

With all of your planning, resourcing, and goal-setting complete, you’re now ready to execute your company growth plan and deliver results for the business.

Throughout this time, make sure you’re holding your stakeholders accountable, keeping the line of communication open, and comparing initial results to your forecasted growth goals to see if your projected results are still achievable or if anything needs to be adjusted.

Your growth plan and the tactics you leverage will ultimately be specific to your business, but there are some universal strategies you can implement when getting started.

To expand a business and its revenue, companies can implement different strategies for growth. Examples of growth strategy include:

Growth Strategy Examples

- Viral Loops

- Milestone Referrals

- Word-of-Mouth

- The 'When They Zig, We Zag' Approach

- In-Person Outreach

- Market Penetration

- Market Development

- Product Development

- Growth Alliances

- Acquisitions

- Organic Growth

- Social Media

- Excellent Customer Service

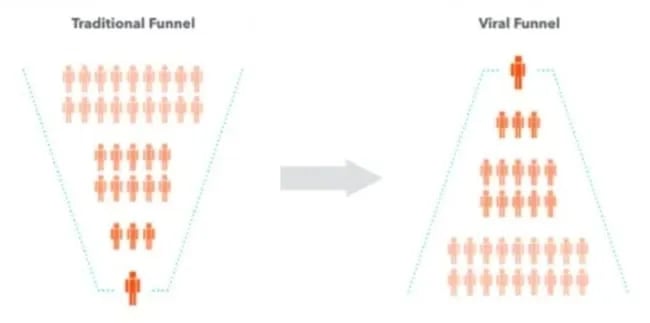

1. Viral Loops

Some growth strategies are tailored to be completely self-sustainable. They require an initial push, but ultimately, they rely primarily (if not solely) on users' enthusiasm to keep them going. One strategy that fits that bill is the viral loop.

The basic premise of a viral loop is straightforward:

- Someone tries your product.

- They're offered a valuable incentive to share it with others.

- They accept and share with their network.

- New users sign up, see the incentive for themselves, and share with their networks.

For instance, a cloud storage company trying to get off the ground might offer users an additional 500 MB for each referral.

Ideally, your incentive will be compelling enough for users to actively and enthusiastically encourage their friends and family to get on board. At its best, a viral loop is a self-perpetuating acquisition machine that operates 24/7/365.

That said, viral loops are not guaranteed to go viral, and they’ve become less effective as they’ve become more commonplace. But the potential is still there.

Part of the appeal is that the viral loop flips the traditional funnel upside-down:

Instead of needing as many leads as possible at the top, a viral loop funnel requires just one satisfied user to share with others. As long as every referral results in at least 1.1 new users, the system continues growing.

2. Milestone Referrals

The milestone referral model is similar to the viral loop in that it relies on incentives to kickstart and sustain it. But milestone referrals add a more intricate, progressive element to the process.

Companies that leverage viral loops generally offer a flat, consistent offer for individual referrals — businesses that use milestone referrals offer rewards for hitting specific benchmarks. In many cases, "milestones" are metrics like the number of referred friends.

For example, a business might include different or increasingly enticing incentives that come with one, five, and 10 referrals as opposed to a fixed incentive for each referral. A company will often leverage this strategy to encourage users to bring on a volume of friends and family that suits its specific business goals.

The strategy also adds an engaging element to the referral process. When done right, milestone referrals are simple to share with relatively straightforward objectives and enticing, tangible products as rewards.

3. Word-of-Mouth

Word-of-mouth is organic and effective. Recommendations from friends and family are some of the most powerful incentives for consumers to purchase or try a product or service.

The secret of word-of-mouth’s effectiveness lies in a deeply rooted psychological bias all people have — we subconsciously believe the majority knows better.

Social proof is central to most successful sales copywriting and broader content marketing efforts. That's why businesses draw so much attention to their online reputations.

They know in today's customer-driven world — one where communication methods change and information is available to all — a single negative blog post or tweet can compromise an entire marketing effort.

Pete Blackshaw , the father of digital word-of-mouth growth, says, "satisfied customers tell three friends; angry customers tell 3,000."

The key with word-of-mouth is to focus on a positive user experience. You need to grow a base of satisfied customers and sustain the wave of loyal feedback that comes with it.

With this method, you have to focus on delivering a spectacular user experience, and users will spread the word for you.

4. The "When They Zig, We Zag" Approach

Sometimes the best growth strategy a company can employ is standing out — offering a unique experience that sets it apart from other businesses in its space. When monotony defines an industry, the company that breaks it often finds an edge.

Say your company developed an app for transitioning playlists between music streaming apps. Assume you have a few competitors who all generate revenue through ads and paid subscriptions — both of which frustrate users.

In that case, you might be best off trying to shed some of the baggage that customers run into trouble with when using your competitors' programs. If your service is paid, you could consider offering a free trial of an ad-free experience — right off the bat.

The point here is that there's often a lot of value and opportunity in differentiating yourself. If you can "zig when they zag", you can capture consumers' attention and capitalize on their shifting interests.

5. In-Person Outreach

It might be a while before this particular approach can be employed again, but it's effective enough to warrant a mention. Sometimes, adding a human element to your growth strategy can help set things in motion for your business.

Prospects are often receptive to a personal approach — and there's nothing more personal than immediate, face-to-face interactions. Putting boots on the ground and personally interfacing with potential customers can be a great way to get your business the traction it needs to get going.

This could mean hosting or sponsoring events, attending conferences relevant to your space, hiring brand ambassadors, or any other way to directly and strategically reach out to your target demographic in person.

6. Market Penetration

Competition is a necessary part of business. Imagine that two companies in the same industry are targeting the same consumers. Typically, whatever customers Business A has, Business B does not. Market penetration is a strategy that builds off of this tug-of-war.

Market penetration increases the market share — the percentage of total sales in an industry generated by a company — of a product within a given industry. Coca-Cola, the most popular carbonated beverage in the United States, has a 42.8% market share. If competitors like Pepsi and Sprite were looking to increase market penetration, they would need to increase market share. This increase would imply that they are acquiring customers that were previously buying Coca-Cola or other carbonated beverage brands.

While lowering prices and advertising are two costly yet effective tactics to increase market share, they are part of a series of methods businesses can use for overall sales and customer retention.

7. Development

If a company feels as if they have plateaued and its current market no longer has room for growth, it might switch strategies from market penetration to market development. While market penetration focuses on a company and its current market, market development strategies lead businesses to tap into a new one.

Companies can decide to manufacture new products or find an innovative use for their project. Take Uber. Although few would say that the rideshare company has plateaued, six years after its launch in 2009, Uber launched UberEats, its online food ordering, and delivery platform. The company already had drivers set to take passengers to their destinations. Uber expanded their idea and has become one of the biggest names in the food delivery industry.

8. Product Development

For growth, many businesses need to introduce something new. Product development — the creation of a new product or the enhancement of an existing one — allows companies to attract new customers and retain existing ones.

Online fast-fashion retailers are an example of this. A company like ASOS built its brand off of clothing. To appeal to a bigger customer base, it has since added face and body products, a collection made up of ASOS products and other popular brands. If an interested customer prefers to shop for their clothes, makeup, and skincare products at once, the brand now serves as a big draw.

9. Growth Alliances

Growth alliances are strategic collaborations between companies. They further the growth goals of the involved parties. Take JCPenney and Sephora. For Sephora, it can’t hurt for the makeup retailer to have more stores across the country. JCPenney, however, needed to keep up with powerhouses like Macy’s and its fully-fledged makeup section.

In 2006, Sephora began opening stores inside JCPenney. As of 2022, Sephora Inside JCPenney is now in over 574 stores. Simultaneously, JCPenney now carries a selection of makeup to rival competitors.

10. Acquisitions

Companies can use an acquisition strategy to promote growth. By acquiring other businesses, companies expand their operations through creating new products or expanding into a new industry. One of the more obvious ideas for growth, this strategy offers significant benefits to companies. They allow for faster growth, access to more customers, lower business risk, and more.

Founded in 1837, Procter & Gamble is a consumer goods company known for its acquisitions. It initially started in soaps and candles but currently has 65 acquired companies that have allowed it to expand into different markets. The list includes Pampers, Tide, Bounty, Tampax, Old Spice, and more. Although its sales dipped between 2016-2019, Procter & Gamble’s net sales for 2021 were $76 billion, its best year within the last decade.

11. Organic Growth

As mentioned previously, organic growth is the most ideal business growth strategy. It could look like focusing on SEO, developing engaging content, or prioritizing advertisements. Instead of focusing on external growth, organic growth is a sustainable strategy that promotes long-term success.

12. Leverage Social Media

Having a strong social media presence can be invaluable to marketing and business growth. Be sure to establish brand pages on all social media platforms like Instagram, Facebook, Pinterest, TikTok, Twitter, etc. Social media can help you increase engagement with your target audience and make it easier for potential customers to find your brand. It’s also great for word-of-mouth promotion as existing customers will likely share your content with their network.

13. Provide Excellent Customer Service

It can be tempting to focus on acquiring new customers, but maintaining loyalty with your existing customers is just as important. Providing an excellent customer service experience ensures that you’ll continue to keep the customers you have, and there’s a good chance you’ll reap some referrals too.

The Key to Growing Your Business

Controlled, sustainable growth is the key to successful businesses. Industries are constantly changing, and it is the responsibility of companies to adapt to these changes.

Successful companies plan for growth. They work for it. They earn it. So what's your plan?

Editor's note: This post was originally published in March 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

9 Bad Sales Habits (& How to Break Them In 2024), According to Sales Leaders

![growth plan business plan 22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]](https://blog.hubspot.com/hubfs/Best-Sales-Strategies-1.png)

22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]

9 Key Social Selling Tips, According to Experts

![growth plan business plan 7 Social Selling Trends to Leverage This Year [New Data]](https://blog.hubspot.com/hubfs/social%20selling%20trends.png)

7 Social Selling Trends to Leverage This Year [New Data]

![growth plan business plan How Do Buyers Prefer to Interact With Sales Reps? [New Data]](https://blog.hubspot.com/hubfs/person%20phone%20or%20online%20sales%20FI.png)

How Do Buyers Prefer to Interact With Sales Reps? [New Data]

![growth plan business plan 7 Sales Tips You Need to Know For 2024 [Expert Insights]](https://blog.hubspot.com/hubfs/Sales%20Tips%202024%20FI.png)

7 Sales Tips You Need to Know For 2024 [Expert Insights]

What is Sales Planning? How to Create a Sales Plan

Sales Tech: What Is It + What Does Your Team Really Need?

![growth plan business plan 10 Key Sales Challenges for 2024 [+How You Can Overcome Them]](https://blog.hubspot.com/hubfs/sales%20challenges%20FI.png)

10 Key Sales Challenges for 2024 [+How You Can Overcome Them]

![growth plan business plan The Top Sales Trends of 2024 & How To Leverage Them [New Data + Expert Tips]](https://blog.hubspot.com/hubfs/sales-trends-2023.png)

The Top Sales Trends of 2024 & How To Leverage Them [New Data + Expert Tips]

Plan your business's growth strategy with this free template.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Growth Tactics

Creating an Effective Business Growth Plan

Last Updated on November 23, 2023 by Milton Campbell

As a business leader, you understand the importance of continually striving for growth and development in your enterprise. A carefully crafted growth plan can help you achieve your goals by outlining specific strategies and action plans to ensure that your company continues to thrive. In this article, we’ll explore the key components of an effective growth plan for your business and offer practical advice to help you create a roadmap to success.

What is a Growth Plan and Why Do You Need One?

A growth plan is a document that outlines the strategies and tactics that a business will use to achieve and sustain growth over a specified period. This plan should include a clear vision statement, measurable goals , and a detailed description of the strategies, action plans, and key performance indicators (KPIs) that will drive business growth. A growth plan can help you set goals and targets, identify potential challenges and opportunities, and ensure that all stakeholders are aligned with your vision. Furthermore, having a growth plan can help ensure the longevity of your business by providing a roadmap for success.

Factors Impacting Business Growth

Several factors can have a significant impact on the growth of a business. It is essential for business leaders and managers to identify and understand these factors in order to navigate the path to success. Let’s explore some key factors that influence business growth:

1. Economic Conditions

The overall health of the economy can greatly affect business growth. During periods of economic prosperity, with increased consumer spending and confidence, businesses tend to experience growth opportunities. Conversely, during economic downturns or recessions , consumer spending may decline, leading to challenges for businesses.

2. Market Demand and Competitiveness

The demand for a product or service has a direct impact on business growth. Assessing the market demand for your offerings, understanding consumer preferences, and identifying any gaps that your business can fill are crucial steps. Additionally, businesses need to evaluate the competitive landscape, including the presence of established competitors, barriers to entry, and emerging trends, in order to position themselves for growth.

3. Innovation and Technology

Keeping up with technological advancements and embracing innovation is essential for sustaining growth. Businesses that invest in research and development, adopt new technologies, and stay ahead of industry trends are often better positioned for growth. Innovation can lead to improved efficiency, enhanced product offerings, and increased customer satisfaction, all of which can drive business growth.

4. Financial Resources

Access to financial resources, such as capital for investment and working capital, is vital for business growth. Adequate funding allows businesses to expand operations, invest in marketing and advertising, develop new products or services, and hire additional staff. Businesses need to assess their financial capabilities and explore funding options to support their growth strategies.

5. Human Capital

The skills, knowledge, and expertise of the workforce are critical for driving business growth. Hiring and retaining talented employees who are aligned with the organization’s goals and values is essential. Businesses that invest in training and development programs, foster a positive work culture , and empower their employees are more likely to experience sustainable growth.

6. Regulatory Environment

The regulatory environment in which a business operates can impact growth opportunities. Compliance with industry-specific regulations, government policies, and legal requirements is crucial to avoid penalties and maintain credibility. Understanding and navigating the regulatory landscape allows businesses to identify potential obstacles and take necessary measures for growth.

7. Customer Satisfaction and Retention

Customer satisfaction and retention play a significant role in business growth. Satisfied customers are more likely to become repeat customers, refer others to the business, and contribute to its growth. Businesses need to focus on providing exceptional customer experiences, delivering quality products or services, and maintaining strong customer relationships to foster loyalty and drive growth.

These factors are just some of the many elements that influence business growth. By actively assessing and addressing these factors, businesses can create strategies and make informed decisions that contribute to their long-term success and expansion.

How to Develop a Growth Plan for Your Business

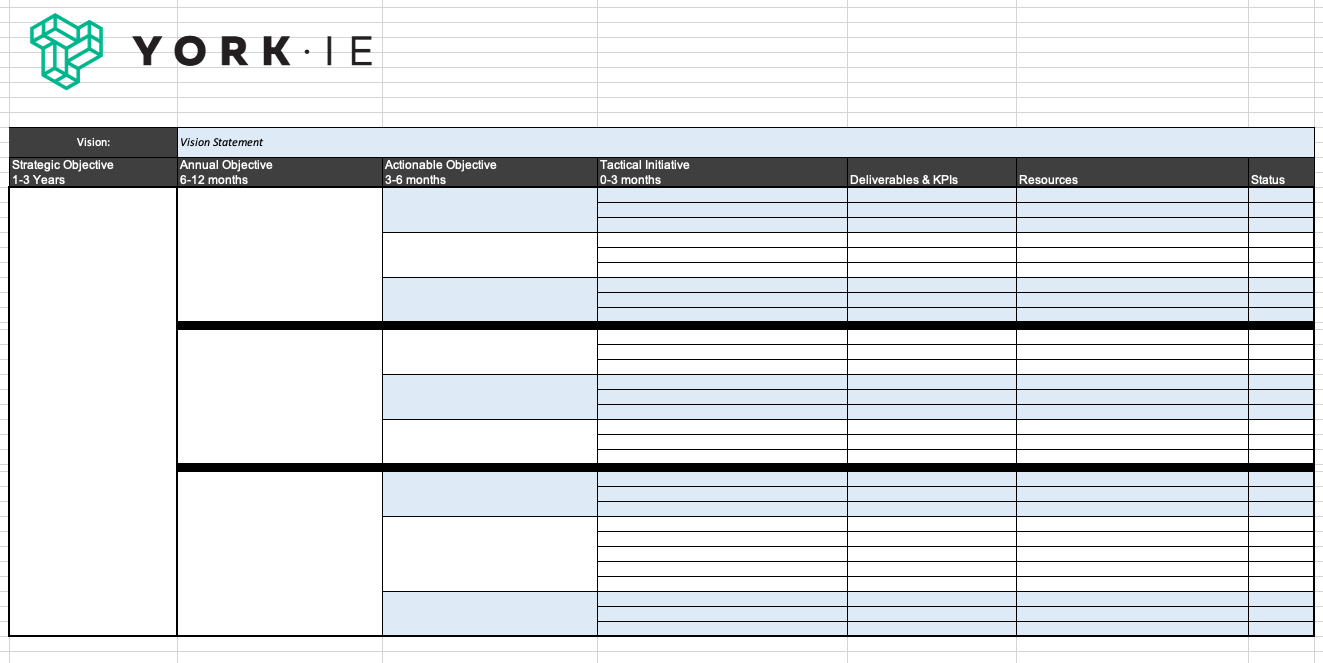

Developing a growth plan for your business is a crucial aspect of achieving long-term success. To create an effective growth plan, follow these steps:

Step 1: Define Your Growth Goals and Objectives

The first step in creating an effective growth plan is to define your goals and objectives. Think about where you want your business to be in three, five, or ten years and develop specific and measurable goals that will help you achieve your vision.

Step 2: Understand Your Business Needs

In order to create a growth plan that works for your business, you need to understand its needs. Consider the following questions:

- What are your business goals?

- Who is your target market?

- What products or services do you offer?

- What are your current strengths and weaknesses?

- What are the potential growth opportunities for your business?

Answering these questions will help you identify specific areas of your business that require additional attention and focus, and help you create a growth plan that addresses them.

Step 3: Develop a Strategy for Growth

Once you have defined your goals and identified the needs of your business, the next step is to develop a strategy for growth. Consider the following:

- What strategies and tactics will best help you achieve your growth goals?

- What internal resources or external partnerships will you need to execute your plan?

- What role will new products or services play in your growth strategy?

- Are there any particular areas of your business that you want to focus on developing?

- How will you measure success and ensure that your strategy is working?

Developing an effective growth strategy requires careful planning and consideration of various factors that can impact your business.

Step 4: Establish an Action Plan

With your growth goals defined, business needs understood, and a strategy created, the next step is to establish an action plan. This plan should outline specific initiatives that will help you achieve your growth targets, including timelines, milestones, resource commitments, and key performance indicators.

Step 5: Monitor and Adjust Your Plan

Developing a successful growth plan requires ongoing monitoring and adjustment to ensure that you remain on track and continue to grow. Regularly review your progress against your KPIs and take corrective action as needed to keep your business moving forward.

Tips for Creating an Effective Growth Plan

When it comes to business growth, creating an effective plan is crucial to achieving your goals and moving your organization forward. Here are some tips to help you create a growth plan that will work for your company:

Set Realistic Goals

It’s important to set goals that are achievable but also challenging. Make sure you consider your current business situation and resources, as well as your desired outcomes when setting your targets.

Understand Your Market

Your target market plays an essential role in your business growth. Ensure you have a deep understanding of your customer’s needs, their pain points, and the challenges they are facing.

Consider All Growth Strategies

Exploring diverse growth strategies can help you expand your business, reach new customers, and diversify your offerings. This could include everything from developing new products and services, expanding into new markets, or improving your operations and processes .

Focus on the Long-term

While short-term objectives are vital for any business, it’s equally critical to have long-term goals in mind. This ensures that you develop a roadmap to move toward your vision and don’t get sidetracked by short-term wins.

Foster an Organizational Culture of Growth

Building this culture starts from the top and should be reflected throughout your organization. Encourage staff to be innovative , take calculated risks, and capitalize on new opportunities and ideas to drive growth forward.

Identify Key Performance Indicators (KPIs)

To effectively measure your progress toward your growth goals, it is important to identify and track Key Performance Indicators (KPIs). These indicators can include metrics such as revenue growth, customer acquisition rate, customer satisfaction, market share, or any other relevant metrics specific to your business. Regularly monitoring these KPIs will help you assess if your growth plan is on track and enable you to make informed decisions and adjustments as needed.

Develop a Marketing and Sales Strategy

A strong marketing and sales strategy is crucial to drive business growth. Clearly define your target audience, develop compelling messaging, and identify the most effective channels to reach and engage your potential customers. Leverage digital marketing techniques, social media platforms, content marketing, SEO, and other tactics relevant to your industry to maximize your reach and generate quality leads. Align your marketing and sales efforts to ensure a seamless customer journey that leads to conversions.

Invest in Employee Development

Your employees play a significant role in driving business growth. Invest in their professional development and provide training opportunities to enhance their skill sets. Empower them to take ownership of their responsibilities and encourage a culture of continuous learning and improvement. By fostering a motivated and skilled workforce, you can boost productivity , innovation, and overall business performance.

Foster Strategic Partnerships

Strategic partnerships can be a valuable growth strategy for businesses. Look for complementary organizations or businesses with shared target audiences and explore opportunities for collaboration. By partnering with other businesses, you can tap into new markets, leverage each other’s strengths, share resources, and mutually benefit from the synergies created.

Continuously Monitor and Evaluate Your Plan

Creating a growth plan is not a one-time task; it requires ongoing monitoring and evaluation. Regularly review your progress, reassess your goals, and adjust your strategies as needed. Stay updated on market trends, customer preferences, and industry developments to ensure your growth plan remains relevant and effective. Be agile and adaptable in responding to changes and seeking new opportunities for growth.

Business Plan vs Growth Plan

Business plans and growth plans are essential tools for businesses, but they serve different purposes. While a business plan outlines the basics of a company, including its mission, product offerings, and financial projections, a growth plan focuses specifically on strategies to drive business growth. Let’s explore the differences between the two:

Business Plan

A business plan is a detailed blueprint of a company’s goals and objectives, outlining how it intends to achieve them. It typically includes the following components:

- Executive summary: A brief overview of the company’s mission, goals, and financial projections.

- Company description: A detailed description of the company’s mission, historical background, products or services offered, and target market.

- Market analysis: An overview of the industry, including trends, competition, and target audience.

- Organization and management: An overview of the company’s organizational structure , leadership team, and management style.

- Products and services: A detailed description of the company’s products or services, including pricing, distribution, and marketing strategies.

- Financial projections: Forecasted financial statements, including income statements, balance sheets, and cash flow statements.

A business plan serves as a roadmap for a company’s future, laying out how it plans to operate, grow and succeed.

Growth Plan

A growth plan is a strategic document designed to identify and prioritize strategies to drive business growth. Instead of focusing on the basics of the company like a business plan, a growth plan zooms into the company’s growth opportunities. It typically includes the following components:

- Review of business environment: An overview of the current business conditions and the challenges and opportunities that exist in the market.

- Mission and vision statement: A reaffirmation of the company’s goals and aspirations, and how these will translate into growth strategies.

- Goals and objectives: Specific, measurable objectives that align with the company’s mission and growth aspirations.

- SWOT analysis: An assessment of the company’s strengths, weaknesses, opportunities, and threats.

- Strategies and tactics: A detailed outline of the strategies and tactics that will be used to achieve the company’s goals and objectives.

- Performance metrics: Objective measures that will be used to track and evaluate the success of the growth plan.

A growth plan offers a framework for businesses to identify and prioritize growth opportunities, set realistic growth targets, and develop actionable strategies to achieve those targets.

In summary, while a business plan outlines the basics of a company, including its mission, goals, and financial projections, a growth plan focuses on strategies to drive growth. While both plans are essential for the success of a business, they play different roles in the development and execution of a company’s strategy.

Key Takeaways

Creating an effective growth plan for your business involves identifying your goals and objectives, assessing your business needs, developing a strategy, establishing an action plan, and monitoring and adjusting your plan as needed.

By following these steps and adopting a growth mindset, you can successfully achieve your business goals, help your organization thrive, and continue to grow for years to come. Remember to set realistic, measurable targets, focus on your customers’ needs, and stay open to new opportunities. With a well-constructed growth plan, you can continue to make your business successful and continue to grow.

Popular Posts

- How to Lead Through a Crisis! 10 Effective Tips

- Understanding Team Member Roles and Responsibilities in the Workplace

- 5-Minute Team Building Activities: Quick & Fun!

- Create an Action Plan For Non Performing Employees: 8 Tips

Don't Forget to Share

Growth Plan: What is it & How to Create One? (Steps Included)

“I want to increase sales this quarter. I want to expand my business this year. I want to hire new employees this month. I want to improve the quality of my product by the end of this year. I want to hit a new market target.”

If you run a business, you’ve probably said these things or something similar a thousand times. After all, every business has a list of goals they want to achieve by a particular time.

In a perfect world, we’d set goals, and we’d reach them without much effort. Unfortunately, in the real world, there are a lot of things we need to do after setting goals, like creating a growth plan.

A growth plan isn’t just about the goals and future of your business, but also the strategies you would implement to make sure that your vision comes to life.

Considering the fact that 50% of businesses fail during their first five years and 66% fail during their first ten, creating a solid growth plan is quintessential.

So, in this blog post, we’re going to tell you all about growth plans and how you can create one that works like a charm. So buckle up because you’re in for a ride.

Growth Plan: What Exactly is it? (Definition)

A growth plan is a strategic plan about how every aspect of your business will walk towards attaining the business goals. With a growth plan in hand, you’ll know exactly what to do, how, and when to do it.

Even though a growth plan sounds like the marketing tactics you’d implement to grow your business, it’s a lot more than that. It encompasses an overview of everything you’d be doing to grow your business.

Let’s understand the concept of a growth plan better with an example.

Suppose you’re running a gaming laptop business. Your goal is to increase your sales by 60% over the next five years. To achieve this goal, you might need to carry out a plethora of tasks like:

- Hiring new, more experienced sales reps.

- Upgrading the product after conducting market research.

- Finding investors who’d be willing to invest in the new version of the laptop.

- Hiring a social media marketer to handle your business’s social media accounts.

- Creating a TV advertisement that hits the right spot.

Now, you’d be writing all these things in your growth plan, along with other details like timeline, budget, name of the people responsible for carrying out a particular task, and more.

Want to know some other reasons why you need to create a growth plan? Let’s find out!

Read more: Growth Marketing: What is it & How to Carry it out for your Business?

3 Reasons Why You Should Create a Growth Plan

1. keeps you focused.

When you’re running a business, you usually try to flap your wings around in different places.

But, when some places don’t give you the results you expected, you get frustrated and realize that you wasted so much of your time and effort that you could’ve invested in other areas.

Well, a growth plan can help you avoid that frustration. With a growth plan, you’d know exactly what areas you should be focusing on and what areas you don’t need to pay attention to.

The result? You won’t be wasting any time and effort on places you won’t get any return from.

Read more: Business Development Plan: What Is It And How To Create A Perfect One?

2. Helps You When Things Go Sideways

We don’t want to scare you, but the landscape of the market is changing at a rapid pace.

That means things in your business can go haywire at any time. But, you really don’t need to worry about that if you have got a strong growth plan in place.

Like we said above, in a growth plan, you write all the strategies that’d lead you to growth. When things go wrong, you can just pick one of the strategies, modify them according to the current scenario, and you’re good to go!

3. Gives You a Direction

Your business isn’t a road trip. You can’t go rogue and see where the road takes you. You need a roadmap, a direction…and that’s exactly what a growth plan gives you.

A growth plan shows you the way towards achieving your goals. It tells you the route you need to take to reach your goals . Without it, you might end up taking the wrong turn and reach a dead end.

To put it simply, when you have a growth plan with you, you’ll know all about what you need to do to make your business successful.

Considering the importance of a growth plan, creating it is not something you can rush through. There are some steps that you need to follow, and we’re going to tell you all about them.

How to Create a Growth Plan In 5 Easy-Peasy Steps?

Set 1. set goals.

Every plan starts with setting business goals , and a growth plan is no different.

After all, you can’t just say “I want this” and expect something to happen automatically. You need to define what exactly you want to achieve, i.e., you need to set your goals.

Also, always make sure that your goals are not vague but realistic and measurable. For instance, “ Increasing sales ” isn’t a solid goal. “ Increasing sales by 20% over the next 6 months ” is the kind of goal you can measure.

Step 2. Conduct Market Research

You might think that once you’ve decided on your goals, you can just go ahead and start creating strategies. Unfortunately, it’s not that easy.

There’s another important step that you need to follow: carrying out market research. Creating strategies without considering the market is not going to help you achieve your goals.

Examine your target audience, the condition of the market, and your competitors. Evaluate what your audience is looking for, how saturated the market is, and what your competitors are doing.

Step 3. Evaluate Your KPIs

Once you’ve done the market research, it’s time to get back home, aka your business, and do some digging. You need to find out what’s working for your business and what’s not.

The best way to figure that out is by evaluating your KPIs. For those who don’t know, KPIs stand for Key Performance Indicators. They are the metrics that are “key” in determining your business’s success.

By assessing your KPIs, you’ll find out the key areas that are giving you the most fruitful results. You can then target these areas while you’re brainstorming strategies for growth. This brings us to the next step:

Read more: KPI Report: What it is & How to Create a Perfect One?

Step 4. Create Strategies

Okay, so now you know everything about the market and your company, so you’re all set to create strategies that you’d be implementing to achieve your goals.

From hiring new sales reps to upgrading your existing product – your strategies can be anything, as long as they help you achieve your goals.

We don’t need to say this, but make sure that your strategies align with your present and future budget. You don’t want to overspend right now and then be short of money when you execute a future strategy.

Step 5. Execute Your Plan

Brace yourselves because it’s time to get the ball rolling and execute the plan. Start implementing all the strategies according to the timeline you’ve set.

However, there’s something that you need to remember: Your plan isn’t a static piece of document. You need to keep modifying and updating it as you go.

Just follow the old saying, ‘ grow through what you go through .’ A strategy isn’t giving the results you expected? Change it. A strategy is working too well? Increase its timeline. A strategy isn’t in trend anymore? Slash it.

Yay! You’ve now learned how to create a solid growth plan.

Now, all that’s left for you to learn is how to create it the right way . See, your growth plan is a VERY essential document. You can’t just type all the strategies out and think that your growth plan is ready.

Your plan needs to have a proper structure and layout. It needs to be easy on the eyes and easy to comprehend. Most of all, it needs to be written after getting inputs from all the departments in your business.

It seems like a tough and long process, doesn’t it? It’s not, because Bit.ai is a platform where you can do all this and more. Want to know more about Bit.ai? Read on!

Read more: Growth Hacking: What is it & 21 Tools that can Help!

Bit.ai – The Perfect Tool for Creating Growth Plans & Other Business Documents

Yes, that’s the essence of Bit.ai – a document collaboration platform where you can create, organize, share and manage all company documents and other content.

You do not have to worry about formatting or designing your growth plan at all – just pick a template, and put all your strategies in it. Did you know that Bit gives you the option to choose from over 70 templates ?!

This nifty platform lets you and your team collaborate in real-time by co-editing, making inline comments, chatting via document chat, @mentions, and much more.

Want to make your growth plan more robust and comprehensive? Add rich media into it! Bit lets you add excel sheets, social content, cloud files, charts, surveys/polls, code, presentations, and much more to your documents.

One feature that makes Bit stand out is ‘smart workspaces’. On Bit, you can create infinite workspaces around projects and teams. This will help you in keeping all your documents related to your growth plan organized!

Bit.ai makes creating documents as easy as ABC, and there’s no reason why you shouldn’t give it a try.

Wrapping Up

There are some things in business you just can’t avoid, and creating a growth plan is one of them. If you don’t want your business to disappear into thin air, you need to create a proper growth plan.

A growth plan literally has the power to take your business to heights, but only if you create it properly and accurately. It’s not even a gigantic task, considering that you have Bit.ai with you.

So, what are you waiting for? Go ahead, start working on your growth plan and skyrocket the growth of your business. We’re totally rooting for you!

Got any questions or suggestions? Feel free to tweet us @bit_docs. We’d get back to you as soon as possible.

Further reads:

Financial Plan: What is it & How to Create an Impressive One?

13 Growth Marketing Strategies You Must Know About!

Mitigation Plan: What Is It & How To Create One?

12 Sales KPIs Your Sales Department Should Measure!

Go-To-Market Strategy Guide for Businesses!

Communication Plan: What is it & How to Create it? (Steps included)

How To Develop a Growth Mindset That Will Change Your Future?

12 Marketing Goals You Must Include In Your Plan!

Performance Report: What is it & How to Create it? (Steps Included)

Related posts

19+ best free stock photos websites you must explore, usability testing: definition, importance & how to do it, 7 types of reports your business certainly needs, corporate bylaws: definition, components, and format, how to write an outstanding personal statement (tips and benefits), customer journey vs buyer journey: the key differences.

About Bit.ai

Bit.ai is the essential next-gen workplace and document collaboration platform. that helps teams share knowledge by connecting any type of digital content. With this intuitive, cloud-based solution, anyone can work visually and collaborate in real-time while creating internal notes, team projects, knowledge bases, client-facing content, and more.

The smartest online Google Docs and Word alternative, Bit.ai is used in over 100 countries by professionals everywhere, from IT teams creating internal documentation and knowledge bases, to sales and marketing teams sharing client materials and client portals.

👉👉Click Here to Check out Bit.ai.

Recent Posts

Developer experience(dx): importance, metrics, and best practices, top 12 ai assistants of 2024 for maximized potential, maximizing digital agency success: 4 ways to leverage client portals, how to create wikis for employee onboarding & training, what is support documentation: key insights and types, how to create a smart company wiki | a guide by bit.ai.

Filter by Keywords

7 Growth Plan Templates to Build a Growth Strategy

Praburam Srinivasan

Growth Marketing Manager

October 20, 2023

Ever feel like you’re steering your ship without a compass? You want to grow your business, but the “how” aspect might be unclear. If you feeling lost at sea, a growth plan template could be the guiding star you’re looking for. ⭐

A growth plan template is a bit like a business-minded GPS, leading you through the winding roads of market trends, financial forecasts, and strategic planning . A good one will be your go-to guide for turning your big ideas and plans into a concrete roadmap to success. With a plan in place, you’ll reach your growth goals with ease.

In this guide, we’ll show you what makes a rock-solid growth plan template and how easily it works for business owners and entrepreneurs. We’ll also set you up with growth plan templates so your organization functions more fluidly and effectively. Let’s dive in!

What are the key components of a growth plan template?

1. clickup growth experiments whiteboard template, 2. clickup 30-60-90 day plan template, 3. clickup ansoff matrix whiteboard template, 4. clickup product development roadmap whiteboard template, 5. clickup development schedule template, 6. clickup process audit and improvement template, 7. clickup employee development plan template.

What Is a Growth Plan Template?

A growth plan template is a preformatted document that guides businesses in outlining objectives, strategies, and actions aimed at business growth. Think of it like a strategic plan or framework for focusing on different growth elements, such as market expansion, product development, and financial projections. And it applies just as much to startups as it does to established businesses. 🙌

It serves as a roadmap, giving cohesion and clarity to your growth initiatives. Whether scaling or diversifying, a growth plan template offers a structured way to find opportunities and roadblocks. And since it provides dedicated areas for keeping track of metrics and KPIs, measuring progress and adjusting strategies is user-friendly.

Growth plan templates provide a framework for outlining a business’s growth objectives and strategies for achieving them. Here are some critical components of a growth strategy template:

- Executive summary : An overview of the growth strategy and its goals

- Business overview : Details of your organization and its current operations

- Market analysis : Research on your target market (and the current market) will inform your growth strategy. Know your customer base, know your strategy

- Growth objectives : Clear, measurable goals tied to a timeline. This could be new customers, revenue growth, a social media strategy, or improving customer retention

- Strategies and tactics : The actions you’ll take to achieve your growth objectives

- Financial projections : Estimates of projected revenue and profit if growth objectives are achieved

- Key Performance Indicators (KPIs) : Metrics and other measurable data demonstrate the success of your growth strategy

- Resource allocation : A list of resources needed to reach your objectives, like a new marketing strategy, business model, or financial plan

- Risks and mitigation strategies : Assessing risks that could derail your plans and contingencies for avoiding those circumstances

- Implementation timeline : A schedule for when milestones will be reached and objectives completed

- Review and adjustment process : A system for reviewing and adjusting as necessary

7 Growth Plan Templates

If you haven’t turned to various strategic planning templates in your continuous effort to increase revenue, measure success, and identify new growth opportunities, then the time is now.

These pre-built assets are designed to help teams create and execute a unique business plan regardless of your industry or how many employees you’re working with. Bypass the hassle of spreadsheets and emails with a template that makes running experiments a breeze. 🌬

ClickUp makes it easy to find a business growth plan template customized to your needs. Get clarity on metrics and other KPIs vital to mapping out your organization and where you’d like it to be. A thoughtful and strategic business growth plan may be the missing piece you’re looking for. Here are seven growth plan templates to check out!

ClickUp’s Growth Experiments Whiteboard Template is a valuable resource for bringing your team together during brainstorming and growth planning sessions. With the ability to plan and act on your ideas from the same collaborative space, this template has every feature you need to follow through on an effective business growth plan.

You can customize every inch of this business growth plan template template—from the structure itself to the objects that bring it to life. Add sticky notes, Docs, media, or even live websites to your growth plan for additional context regarding your business operations. Then act on your ideas in an instant with the ability to convert any object on your board directly into an actionable task.

Plus, ClickUp Whiteboards are highly visual, meaning you can maintain a high-level view of the entire growth plan from the initial idea through implementation.

Each department’s growth plan should align with the strategic objective of the overall company. Suppose you’re aiming to revamp a marketing plan or reach a new target market. In this case, you may need to bring on team members with different skill sets or focus on team expansion.

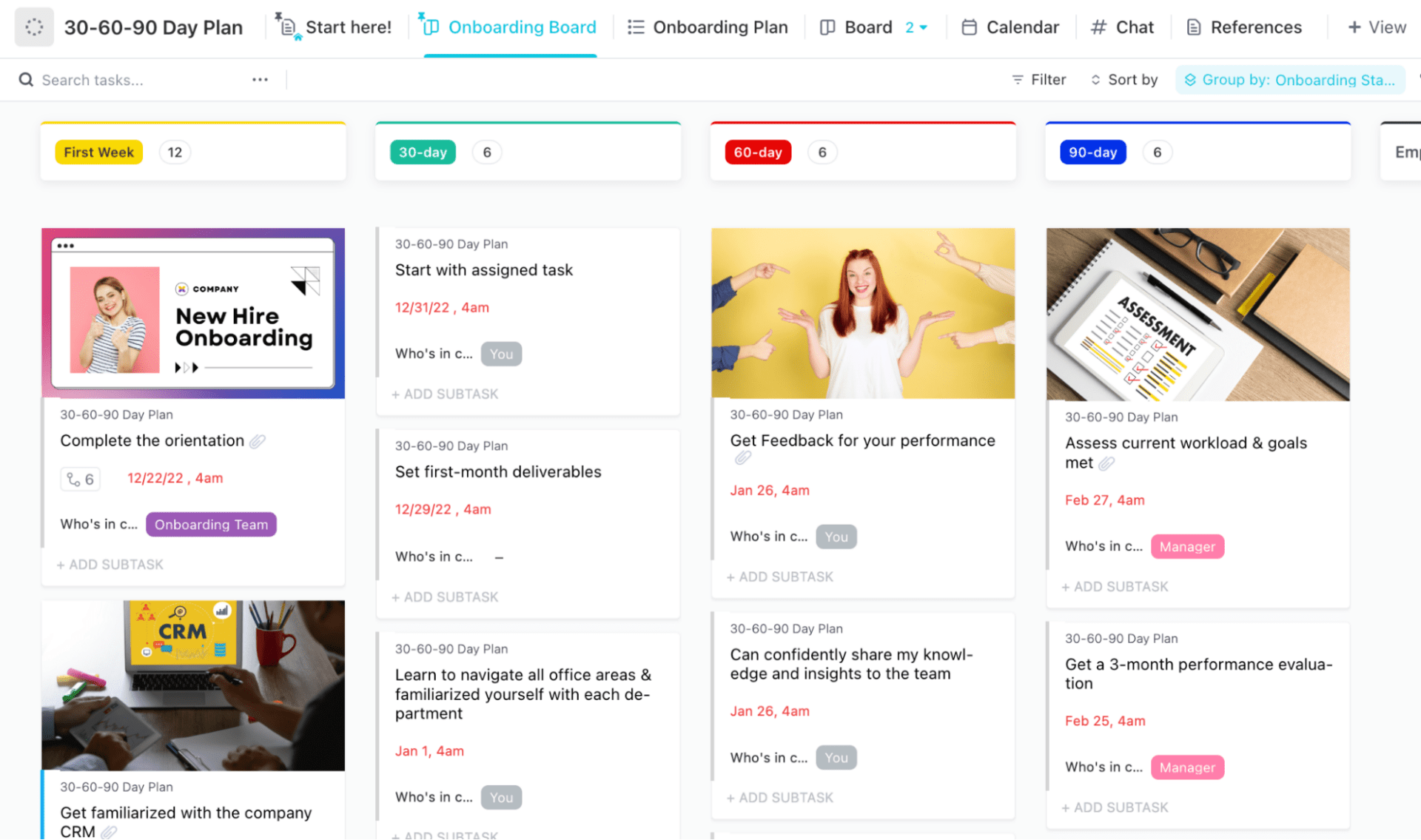

ClickUp’s 30-60-90 Day Plan Template provides an actionable framework for onboarding new employees. Quickly set goals, create milestones, and identify the steps needed to integrate smoothly into a new organization.

Custom features show you how progress is tracked at a glance, like a separate view for onboarding, which helps organize and keep track of all onboarding tasks. Or use Chat view to collaborate with stakeholders and discuss progress deftly. And with References view, store all necessary references for your plans.

When your organization aims for more growth and diversification, a 30-60-90 plan ensures a coordinated and transparent process where everyone is on the same page. At the same time, you’re enhancing how your team operates. Having the right tool in your corner is indispensable.

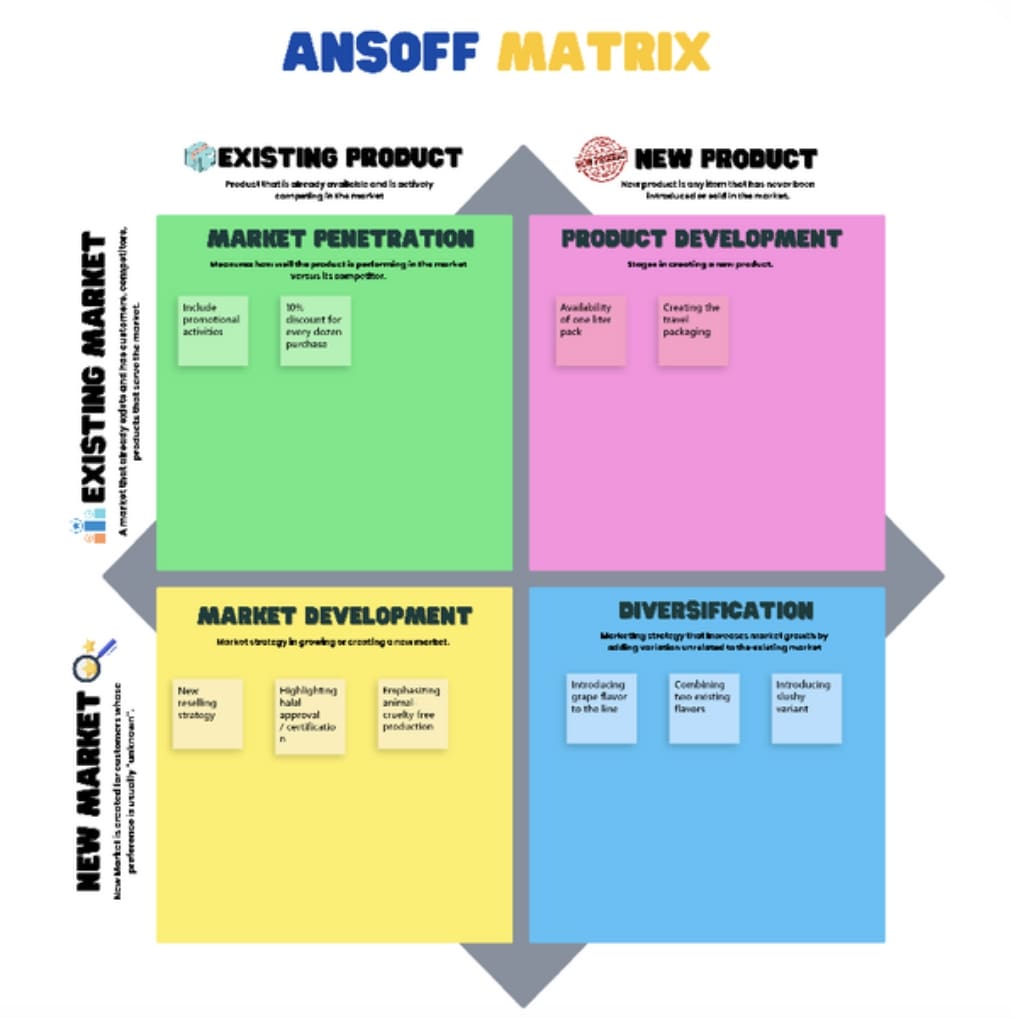

Understanding the risks and rewards associated with different business growth strategies is invaluable for sound decision-making. After all, what good is a growth strategy aimed at market penetration if it could potentially compromise your business?

Use ClickUp’s Ansoff Matrix Whiteboard Template to visualize available strategic options in a way that’s simple to understand and enhances collaboration with your team. This template makes it straightforward and intuitive to identify opportunities and risks, understand which strategies are the most appropriate for your business, and compare different plans against each other to find the best fit. 💡

And it easily adapts to your organization’s level. Launching a new product or planning explosive growth in new markets? Use this template for both.

Features like tagging, nested subtasks, multiple assignees, and priority labels make project management precise and extraordinarily efficient. Being able to brainstorm, organize ideas, and create content with team members ensures everyone is working in harmony. Status labels like Open and Complete add to the frictionless workflow.

If your organization is focusing on innovation, developing new products, or entering new markets, you’ll want to align those goals with your overall growth strategy. And all of that requires teamwork, planning, and clear direction.

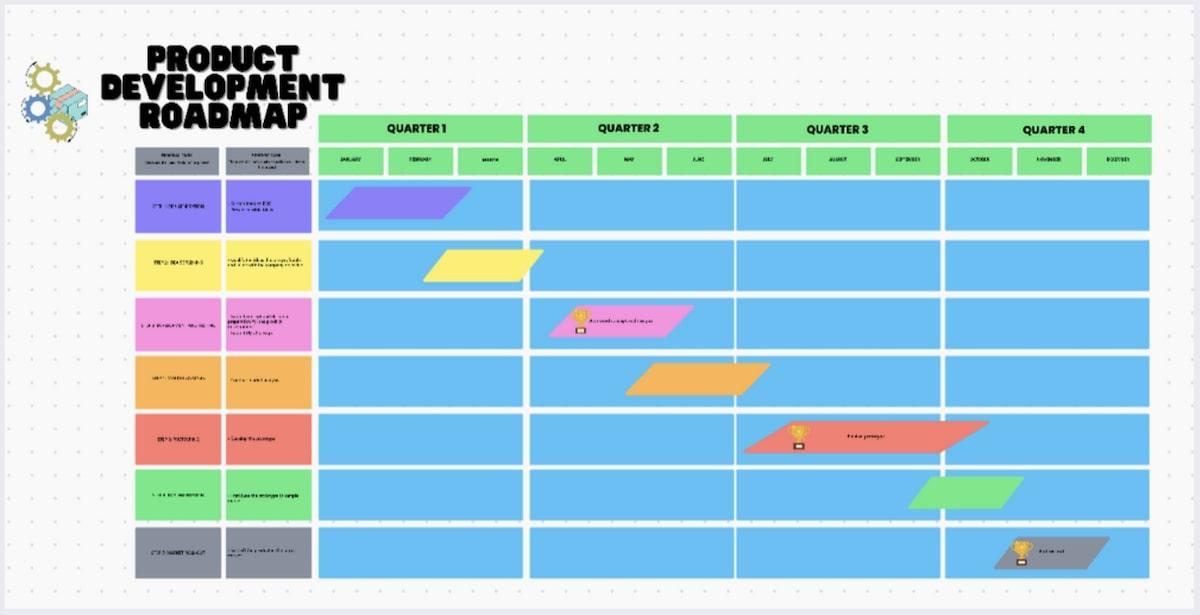

When you need a growth plan template that’s easily customizable, ClickUp’s Product Development Roadmap Whiteboard Template is a no-brainer. This template is designed for you to visualize, document, and track product development progress.

Features like custom fields let you manage tasks and visualize a path to product development that’s way more straightforward than a spreadsheet. Identify potential problems long before they become a fire you need to put out. Cross-team dependencies are easy to see, and engaging with stakeholders is seamless.

So whether you’re experimenting with pricing changes, improving existing products, or something in between, the key is having a comprehensive tool that keeps everyone in sync. And the right template can act as a centralized platform to empower team members in executing growth strategies effectively.

Unlike a product development roadmap, which offers a high-level view of a growth strategy and its direction, a development schedule digs deep into the nitty-gritty. See it as a more granular and tactical guide for you and your team.

Recognizing the need for meticulous planning, ClickUp’s Development Schedule Template ensures each step in your organization’s process is completed accurately and precisely. Stay on track, meet deadlines, adjust your schedule as needed, and allocate your resources and budget appropriately.

Update statuses for tasks with labels such as Done, In Progress, Needs Input, Stuck, and To Do to keep your team members informed and your projects on track. And use custom attributes like Stage, Attachment, Estimated Duration Days, Remarks, and Actual Duration Days to visualize progress at a glance.

A well-designed development schedule is much more than a sophisticated to-do list of tasks. It’s a dynamic and adaptable framework that helps you align strategic planning with tangible execution.

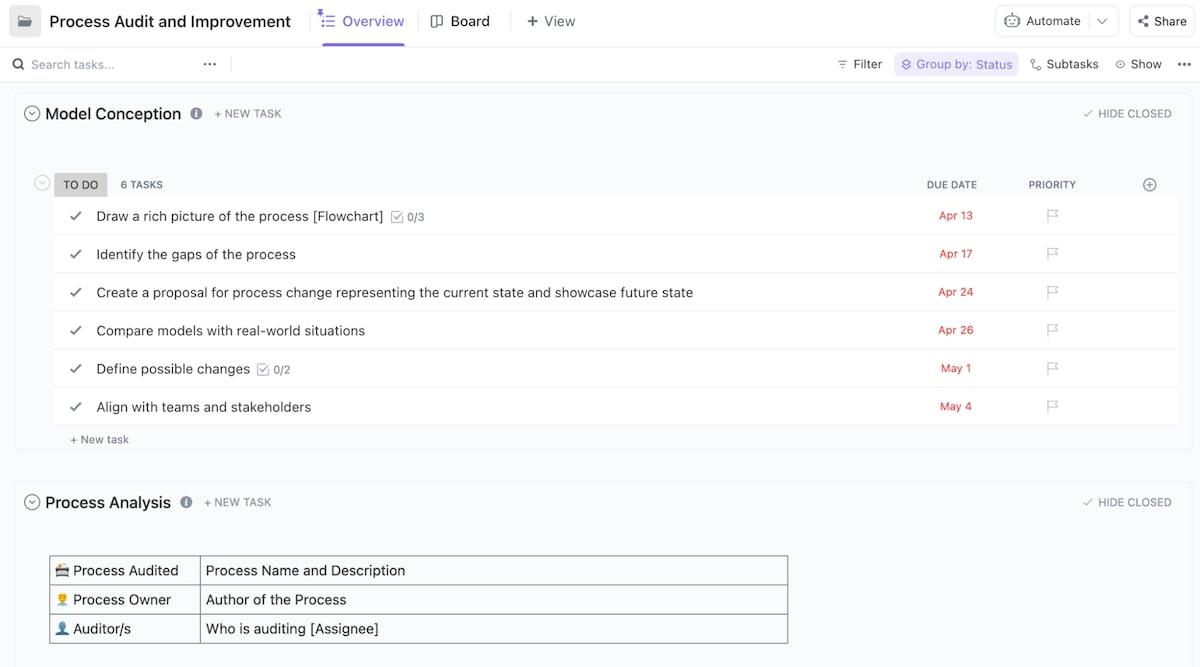

Most organizations probably have a few processes they would like to improve or streamline in their company. And since those processes influence the scalability of a business, initiatives for expansion into new markets, and product development, it pays to keep tabs on their effectiveness.

Use ClickUp’s Process Audit and Improvement Template to keep those tabs. The template allows you to execute quick process reviews or dive deep into how every aspect of your system functions. 🛠

Custom statuses like Not Started, In Progress, Complete, and To Do make keeping track of progress a breeze. Open two different views in different ClickUp configurations, such as the Overview and Getting Started Guide, so you and your team will have no problem jumping right into optimizing the processes that need it.

Categorize and arrange tasks to suit your needs—like audit planning, data analysis, and implementation—so you’ll clearly see the path from A to B. And combining this template with goal-tracking apps , teams and individuals will see progress on an even more detailed scale.

By conducting routine audits, you’ll optimize your processes for efficiency and productivity . Improve customer service and satisfaction by leaps and bounds. You’ll be able to create your own roadmap for taking corrective action where you need to and increase the quality of your decision-making.

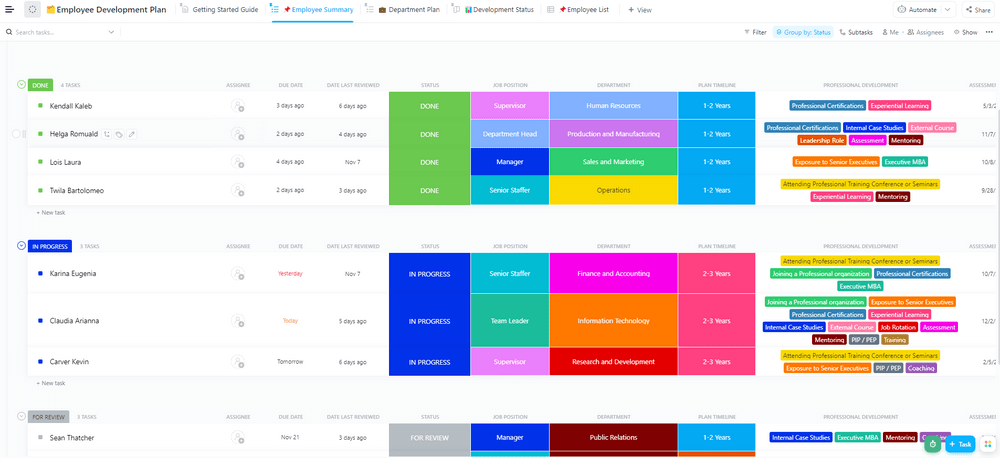

Employee development is an essential piece of any growth strategy. Your team members are one of your most valuable assets, and as your organization grows, your employees should grow with it.

An employee development plan shows you which departments or areas need new talent and which ones may need it in the future. These plans play a role in maintaining an engaged and motivated workforce, too. Even better, you’ll improve employee retention rates and create an environment that encourages your current team members to develop into future leaders in your organization. 🌻