This post may contain affiliate links. See our affiliate disclosure for more.

The Simple Guide to Establishing Your Freelance Bookkeeping Business

BIG NEWS! We just released The Freelance Files , a collection of professional done-for-you email scripts, contracts, invoices, and more for smarter freelancing. The first 50 customers, save 50% with this link .

10 Sites For Finding Freelance Bookkeeping Jobs

What is freelance bookkeeping, what are the duties of a freelance bookkeeper, how to start freelance bookkeeping, how to charge for freelance bookkeeping services, pros and cons to freelance bookkeeping, how to find freelance bookkeeping clients, important freelance bookkeeper statistics, a final note.

Do you love numbers? Did you find yourself right at home during your accounting class in college? If you like working with data, untangling transactions, and presenting clean reports to clients, the freelance bookkeeping world might be calling you.

Working as a freelance professional on the internet has become more than just popular, it has rapidly become the norm.

As we further entangle our lives with the digital space, more people are coming to realize that they can find professional careers from the comfort of their own home. According to a report released by Global Workplace Analytics, more than 5 million people worked from home in 2018!

During today’s discussion, you will learn everything there is to know about working in bookkeeping. From starting your business to landing your first client, we are going to introduce you to the wide world of freelance bookkeeping!

Working in the freelance world can be difficult. After all, you are in charge of everything from building your business to finding your clients. With so many hats in rotation, it can be hard to find the perfect job with your limited time.

The internet has made our lives easier in several ways. For freelancers, online job-hiring platforms have become a haven for connecting with clients.

Listed below, you will find ten of the best sites for finding freelance bookkeeping jobs.

One of the leading platforms for connecting bookkeepers with companies in need is Upwork. Established more than a decade ago in the heart of Silicon Valley, Upwork purports to have made more than $1 billion in 2020 for their freelance workers. Upwork operates on a bidding system.

This means that clients will post a casting call/job advertisement and freelancers will submit with their proposal. You can read a comprehensive comparison between Upwork and other platforms here .

Benefits : Easy sign-up process. Applicants can choose between remote, project-based, and contract jobs. The bidding system at Upwork is efficient, allowing freelancers to submit for a variety of jobs without any downtime.

2. FlexJobs

($14.95 — $49.95 Annually)

Flexjobs has been serving up freelance bookkeeping opportunities since 2007. Established by Sara Sutton Fell, Flexjobs offers remote, freelance, flex, and part-time job opportunities to its members.

A premium annual price keeps the pool of rival applicants down while a high level of customer satisfaction keeps bringing new businesses to the platform.

Benefits : Affordable membership plans reduce bidding wars while also improving the quality of the client. Flexjobs also focuses on remote and freelance job opportunities above conventional 9 to 5s.

Indeed has quickly turned into one of the largest hiring platforms on the internet. Used for far more than just online bookkeeping services, Indeed accrues more than 200 million visitors for jobs in countries all over the planet. Indeed offers free registration and an easy-to-implement resume uploading service.

Benefits : Indeed will have one of the largest collections of job postings for freelance bookkeeping professionals to sort through. Indeed also offers potential employees the ability to read reviews about their potential clients before signing a contract.

4. Freelancer.com

(Free + Paid Plans)

Freelancer.com alleges to be the largest freelancing and crowdsourcing hub on the internet. With 27 million employers in rotation as well as freelancers from 247 countries around the world, we aren’t going to argue their point.

Freelancer.com offers both free and premium plans depending on the freelancer in question. Fixed price projects will incur a 10% fee while services will require a 20% fee of the total price.

Benefits : While Freelancer.com does take a sizable chunk off the top of your profits, they offer a larger selection of potential jobs. Freelancer.com is likely the ideal starting spot for freelance bookkeepers looking to integrate their business into the market.

5. Glassdoor

Glassdoor is an innovative service that allows employees to review the companies that they work at. While information is the name of the game at Glassdoor, the prestigious company also offers an entire hiring sector to its members.

While not nearly as active as the other websites on this list, Glassdoor offers reputable jobs to those looking for them.

Benefits : Glassdoor’s employment section is filled with information as well as potential clients. Despite the lack of jobs on the board, bookkeepers will still be able to find steadier long-term work on occasion.

6. Fiverr

Fiverr exploded onto the scene as a budget platform for freelancers looking to make a quick buck. While Fiverr is brimming with every surface under the sun, a little digging will reveal a wealth of opportunity.

Freelance bookkeepers can sign up for an account, set their rates, and fill out their services page. Searching Fiverr for financial consulting services will reveal the depth of opportunities offered on the platform.

Benefits : Quick and easy registration. You can set your rates, build your brand, and market all in the same place. Fiverr also has protections installed to protect its user base.

(Free Application)

PARO is a freelance accountant platform that specializes in the area of finance. To get on the service, you will have to bypass a rigorous vetting process that weeds out nearly 98% of applicants. Should you make it through the application process, you will find yourself in good company.

Benefits : PARO is exceptionally rigorous when it comes to hiring staff, thus ensuring premium content is always available. PARO is also an ideal place to build your reputation while becoming comfortable within the industry.

8. PeoplePerHour

PeoplePerHour was established in 2007 as an outsourcing company with a brick-and-mortar location. Since transitioning to a digital interface, PeoplePerHour has reportedly gained more than 1.5 million users along with 1.1 million jobs from 89 different countries.

PeoplePerHour works a lot like Upwork as freelancers will incorporate a bidding system to apply for jobs.

Benefits : A booming marketplace means jobs are always available. PeoplePerHour also utilizes an escrow account to protect both freelancers and clients. Larger projects can be divided into multiple payments that will be paid out once a milestone is reached. PeoplePerHour is one of the better platforms for protecting employees.

9. LinkedIn ProFinder

(10 Free Bids Per Month + Paid Plans)

If you are an entrepreneur or freelancer, you owe it to yourself to create a LinkedIn ProFinder account. Not only is LinkedIn one of the major networking hubs for modern professionals, but its ProFinder tool is also fantastic for applying to jobs.

Clients will post job requests on a hiring board while freelancers will submit detailed proposals. You get 10 free bids every month with an optional monthly fee for unlimited bidding.

Benefits : The ‘free’ account is robust enough that new freelancers can rely on it without concern. LinkedIn’s built-in reputation allows for prestigious clients to utilize the platform. Proposing and tracking bids is easy and efficient.

10. Upward

Upward offers part-time, full-time, temp, and intern positions through its highly customizable job board. To get in on the action, users must only create an account before uploading their resume.

Established in 2009, Upward offers more than 10 million job listings from around the world. These listings are curated from newspapers, company pages, job sites, and Upward users.

Benefits: Upward is great for bookkeeping professionals looking for long-term jobs. Upward offers easy registration and profile integration to improve the chances of being selected during the application process.

According to the dictionary, a bookkeeper is simply a professional that records and tracks the financial affairs of a business. While that definition is limited in scope, it offers insight into what a professional freelance bookkeeper can expect to handle during their time at the office.

While tracking financial records makes up a significant portion of the typical workday, a bookkeeper must be ready and willing to wear many hats. Depending on certifications, industry experience, and professional expertise, a bookkeeper might be in charge of processing payroll, tax preparation, and even handling accounts payable.

As you dig deeper into the bookkeeping industry, you will consistently come across several terms. Let’s highlight a few of the most common terms that you will be expected to understand.

Account Reconciliation — The backbone of any bookkeeping service is reconciling accounts. Comparing transactions with details in your accounting software will give your client accurate information regarding their business.

Accounts Receivable — Accounts receivable are considered legal claims to a payment owed for goods/services rendered. In short, managing accounts receivable will entail going through invoices and payment details between client and customer.

Accounts Payable — The money owed by a company to its suppliers of goods and services. Common examples of accounts payable include short-term liabilities, legal services, supplies, and accounting services.

Balance Sheet — A balance sheet is a financial document that showcases a glimpse in time of the financial composition of your client. This balance sheet will include assets as well as liabilities and equity.

Assets — All the things that a company owns to run its business. Examples of assets include property, tools, furniture, cars, and even cash.

Liabilities — The debts that a business has incurred, including unpaid bills, bonds, and loans.

Accounting Period — Financial reports are tied to periods of time. Some companies opt for monthly reports while others prefer quarter and even annual reports.

General Ledger — The backbone of your bookkeeping business will rest on your general ledger. The general ledger is where a company’s financial accounts will be summarized.

When we talk about bookkeeping services, what immediately comes to mind? As a freelance bookkeeper, you will be wearing many hats throughout the typical workday. To accommodate the needs of your potential clients, you should expect to handle at least a handful of the following duties.

Monitor Financial Accounts — First and foremost, the primary job of a freelance bookkeeping professional is to monitor and record financial transactions for summation in a General Ledger.

One of the primary benefits of having a professional bookkeeping service is the ability to quickly look at a snapshot of your company’s financial situation. For that reason, bookkeepers must always be on top of things.

Handle Clerical Work — While we might associate bookkeeping with high-level accounting, that isn’t always the case. Bookkeeping is ideal for people who specialize in organizational skills as bookkeepers are routinely tasked with handling company clerical work.

Using industry-standard accounting software, bookkeepers will record cash, vouchers, checks and other financial transactions. This work requires a sharp eye and the ability to focus while routinely double-checking work.

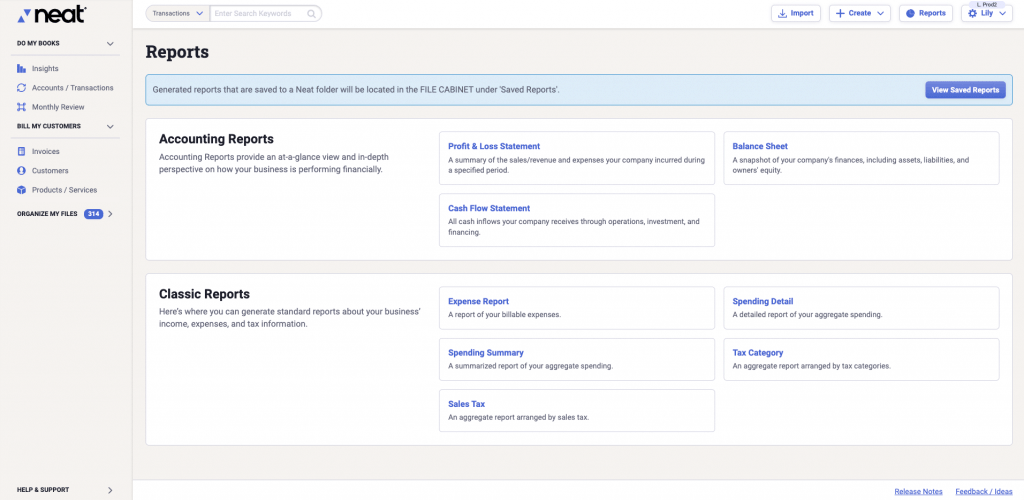

Produce Reports For Clients — Think of reports as the golden egg that a professional bookkeeper can lay. Producing accurate and timely reports, such as balance sheets or income statements , is integral to the long term success and vitality of a company.

Bookkeepers will work with the appropriate software to develop these forms as needed.

Organize Financial Records — Organization is the heart of bookkeeping. Depending on the size or style of business, this organization process can change dramatically. A family-owned antique store will not require the same financial organization as a rapidly growing law firm, for example.

Address Any Inconsistencies — With a sharp eye and the ability to recognize mistakes, bookkeepers must be able to quickly and accurately address any inconsistencies in their books.

By this point in time, you should know if the freelance bookkeeping world is for you. If you are ready to leap into the industry with both feet first, consider the following tips to start your bookkeeping career.

Decide What Services You Will Offer

A bookkeeping professional can offer a veritable treasure trove of services. Decide early on what kind of services you are going to offer. From accounts payable/receivable to payroll management and tax preparation, there are many services that you can offer your clients.

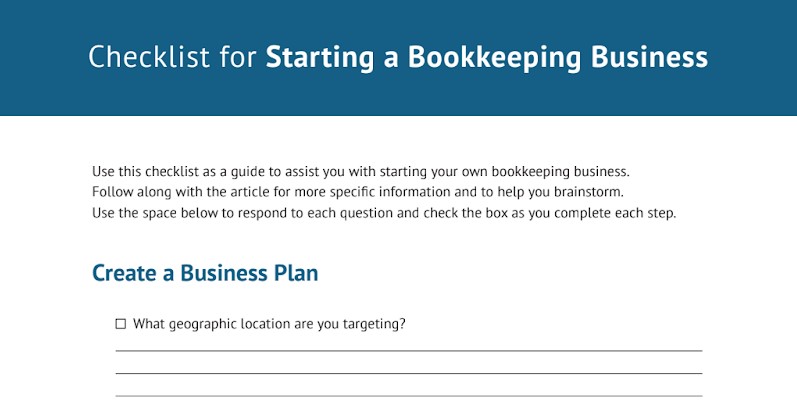

Create Your Business Plan

Every entrepreneur should craft a professional business plan. Detail start-up costs, services offered, and the daily responsibilities that you must attend to. For instructions on how to craft your business plan, consider the following information from Millo.

Consider Voluntary Certification

Certification is not required to work as a freelance bookkeeper. However, certifying your services will lend an air of professionalism and expertise to your name. To learn more about voluntary certification, consult with the NACPB .

Acquire Industry Standard Bookkeeping and Payroll Software

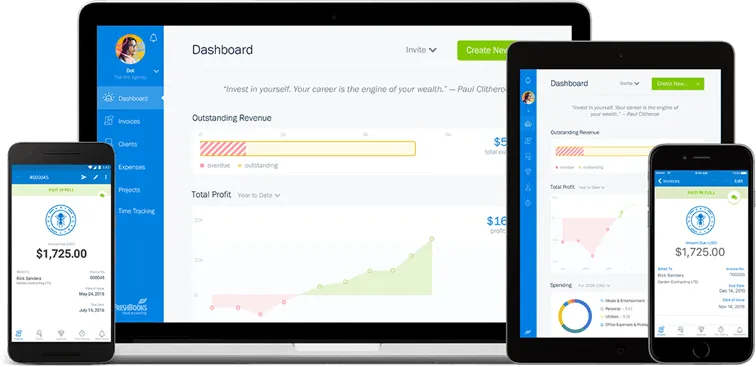

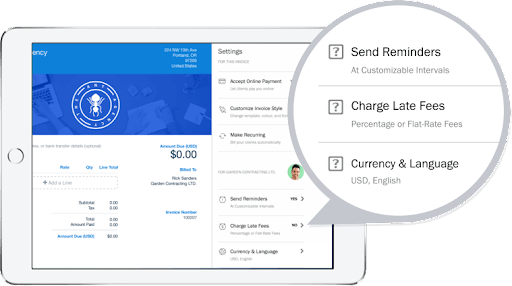

Unlike accountants, professional bookkeepers must tend to day-to-day matters for their clients. As a result, you need to be familiar with industry-standard software such as QuickBooks , TurboCASH, Freshbooks , and Odoo .

Perform Industry Research

There is a wealth of resources for industry research. The Bureau of Labor Statistics is a great place to get a birds-eye view of what your industry has to offer.

Establish Pay Model/Rates

After you have performed extensive industry research, you should be ready to establish a pricing model for your prospective clients. Depending on the client, be prepared to change your model.

Prepare Legally Binding Contract Templates

Every independent contractor should understand that the onus to protect themselves legally is on them. To make things easier, consider customizing your own legally binding contract template from ApproveMe.

Register With Top Freelance Job Platforms

Finding success as a freelance bookkeeper in today’s market requires you to stay on top of the game. Signing up for the top freelance job platforms will open you up to job opportunities. Be sure to polish up your resume for the best success at landing a job.

Millo has also produced an invaluable eBook revolving around the 25 Top Freelance Job Sites and it is worth checking out.

Incorporate Your Business

There is no limit to the benefits that will come from incorporating your business. Register with your Secretary of State as an LLC, corporation, or partnership. You will have to pay a fee, but you will receive tax benefits and legal protection in return.

Market Your Business

You can’t sell a service if nobody knows that you exist. While signing up for job platforms and emailing prospective clients can be a great start, you must do much more. Create a professional website and connect it to your job profiles.

If you’ve never used a bookkeeping service and have no idea how to charge your client, you’ve come to the right place. Bookkeeping service fees are going to be dependent on several different concepts including transaction volume, employee roster size, and industry.

With that being said, most freelance bookkeeping professionals will charge their clients via one of the following three pricing models.

- Hourly — While no longer the standard practice, hourly billing is still incredibly common in the freelance bookkeeping world. Hourly payment models revolve around a set rate, typically decided before a contract is taken. The average hourly rate for qualified general bookkeeping services will range from $19 to $50+ depending on the services required. Consider setting your price based on your experience to get the most accurate model.

- Flat Fee — Flat fee pricing has become more popular in recent years thanks to the flexibility that it offers to both parties. Flat fee pricing revolves around an advanced up-front monthly charge. This charge is based on a client’s specific needs. Larger and more voluminous clients will require a larger flat-fee for your services.

- Fixed Price Agreement — The best payment model for freelance bookkeepers is the fixed price agreement model. This payment model involves a bookkeeper analyzing a business as well as the challenges that the bookkeeper will face. A fixed price agreement will typically include an interview/meeting between client and bookkeeper to establish a perfect price.

We are living in a data-driven world. More than ever, establishing a business is about analyzing both the pros and cons of the effort. With so much information available, you should know what you are getting into before pursuing a career in freelance bookkeeping.

Pros of Freelance Bookkeeping

- Minimal Expenses — Startup costs for a bookkeeping company are almost nonexistent, at least compared to other freelancing endeavors. Outside of certification, training, and software costs, freelance bookkeepers need only pay for bidding-based job sites.

- Financial Freedom — Working from home opens doors to an entirely new level of freedom. With the ability to set your schedule and pick your clients, you can work as much or as little as your life requires.

- No Training Required — While you can voluntarily get certified to showcase your skills, there is no barrier of entry for the bookkeeping marketplace.

Cons of Freelance Bookkeeping

- Security Importance — As a professional bookkeeper, you will be working with sensitive data on behalf of your client. You are completely beholden and liable for whatever happens to that data. Investing in secured computing software is probably a great idea.

- Scheduling Inconsistencies — When you work as a freelancer, you are never guaranteed another job. As a result, you must endure the anxiety that comes with not knowing when you will land your next client. That being said, after establishing your business this should become much less of a concern.

- Tech Expertise Required — While bookkeeping predates the software that we use today, you still have to learn quite a bit about the tech field to stay up-to-date with your services. You must learn to work with new software to maintain industry standards.

Landing your first bookkeeping client can feel like a Herculean task. After all, there are many clients but there are even more professionals vying for work. If you need a little help to land your next bookkeeping client, consider implementing a few of the following tips.

Get Certified

If you are looking to become an expert in the bookkeeping field, you owe it to yourself to get certified. Become proficient with software like QuickBooks to become a certified QuickBooks ProAdvisor.

Hire a Marketing Professional

It has never been easier to get your name out into the world. However, marketing your services is a lot different from simply becoming well-known. Let a professional marketing team help you bring traffic to your business.

Join Job Sites

At the beginning of our discussion, we highlighted ten amazing platforms that can help you land your next big bookkeeping job. If you are looking to make this your career, consider signing up for as many of those job sites as possible. Keep an eye on new postings and make sure to be quick to apply.

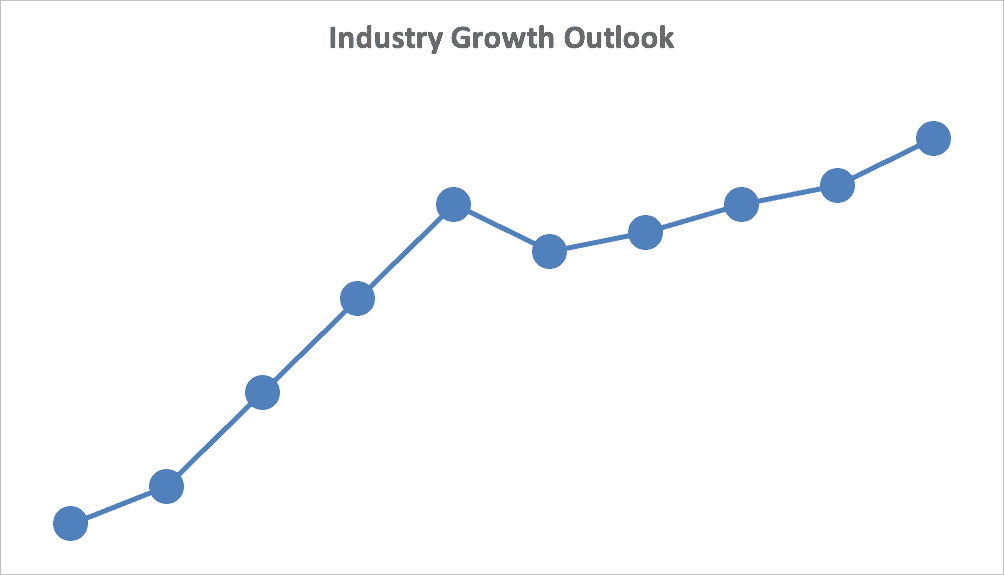

According to a study performed by Global Workplace Analytics, at least 4.3 million people in the United States worked from home at least part-time in 2018. This number is up by more than 140% since 2005, according to the same report by Global Workplace Analytics.

As the workforce continues to change and evolve, so will the freelance bookkeeping industry. With the industry currently growing, now is the perfect time to begin your freelance journey.

By this point in time, you should have a pretty clear understanding as to what a bookkeeper does. You should also be armed with the knowledge needed to begin building your own bookkeeping company.

With the business world in a constant state of evolution, you owe it to your business to keep an eye on industry trends and market research . If you are looking for more innovative ways to make the most out of your freelance efforts, consider checking out these six ways you can improve your company.

Use our guide to jumpstart your business before letting your skills and research lead you to success!

Keep the conversation going...

Over 10,000 of us are having daily conversations over in our free Facebook group and we'd love to see you there. Join us!

Freelancing Growth

Written by Randall Cropp

Contributor at millo.co.

Randall Cropp is a freelance writer, producer, and actor from the Greater Chicago area. A sports enthusiast and cat lover, Randall likes to spend every Sunday watching the Chicago Bears alongside his cat, Delilah.

Randall's Articles

At Millo, we strive to publish only the best, most trustworthy and reliable content for freelancers. You can learn more by reviewing our editorial policy .

- Search Search Please fill out this field.

- Small Business

- How to Start a Business

How to Start Your Own Bookkeeping Business: Essential Tips

Understanding the legal requirements

:max_bytes(150000):strip_icc():format(webp)/20171019_172018-5a12f5cdbeba3300373b7964-3d8c34a5e28d41cdb3c4e2df355329f4.jpg)

Starting a bookkeeping business is something you might be interested in if you naturally love numbers and want to break free of the traditional nine-to-five. It’s possible to offer bookkeeping services to clients in person or remotely, which may be ideal if you would prefer a work-at-home job.

Before starting a bookkeeping business, you’ll first need to know the basics of operating legally. It’s also helpful to understand how to market your services and manage the financial side of running a business.

Key Takeaways

- A degree in accounting is not required to start a bookkeeping business, though a certification in bookkeeping can be helpful to have.

- You’ll need to choose a business structure, and register your business with the proper state authorities if required by law where you live.

- If you plan to hire employees, you may need to obtain workers’ compensation insurance in compliance with state law.

- Developing a solid marketing plan can help you build your brand and attract clients to your business.

Understanding the Legal Requirements

The legal requirements for starting a bookkeeping business are similar to any other type of business. Some of the most important things you’ll need include:

- Selecting a business structure (i.e., sole proprietorship, limited liability company, etc.)

- Choosing a name for the business

- Registering your business with the proper state agencies

- Obtaining a federal Employer Identification Number (EIN) and state identification numbers, if necessary

- Applying for any necessary licenses or permits

- Opening a business bank account

- Getting business insurance , including liability coverage and/or home-based business insurance

The exact requirements for starting a small business will depend on the state in which you live. You may need to contact your secretary of state or department of revenue for more information on what paperwork you may need to complete to legally establish your bookkeeping business.

There may be additional steps required if you plan to hire employees for your business. For instance, you may need to obtain workers’ compensation insurance. The requirements for workers’ compensation vary by state. For instance, California requires workers’ compensation for all employers, regardless of the number of employees. In Alabama, on the other hand, businesses are not required to purchase workers’ compensation insurance if they have fewer than five employees.

Some states may impose steep penalties against businesses that fail to obtain workers’ compensation insurance.

Acquiring Bookkeeping Skills

Starting a bookkeeping business requires an understanding of accounting and bookkeeping practices. You may need to first complete a training program before you can launch.

For example, you might pursue any of the following:

- Bookkeeping certification

- Tax certification

- Accounting software certification

Unlike the requirements to become an accountant, the training required to become a bookkeeper is less strenuous. It’s possible to find and complete an online training program from home.

As you compare online bookkeeping courses , consider the range of topics covered, the course format, and the cost. Whether it makes sense to obtain just one bookkeeping certification or additional tax and accounting software certificates can depend on your niche and the types of services you plan to offer.

While a degree in accounting may be helpful for starting a bookkeeping business, it’s not an absolute requirement.

Creating a Business Plan for Your Bookkeeping Business

A business plan is a detailed overview of how you plan to launch and grow your business. There are several key elements that are typically included in a comprehensive business plan. Here’s what yours might look like as you draft a plan for your bookkeeping business.

- Executive summary : The executive summary should offer a brief overview of what your business is about, your mission, and how you’ll be successful. Your mission statement can also include information about your employees (if you plan to hire any) and your plans for growth.

- Company description : Your company description is an opportunity to provide additional details about your business, including who you plan to serve and what problems you’ll solve for your clients.

- Market analysis : Market analysis allows you to look at your competitors and identify their strengths and weaknesses. Completing this section can help you better understand what makes your bookkeeping business unique.

- Organization and management : This section should describe how your business is legally structured and who’s responsible for running it. If you’re operating as a one-person business, this part of your plan will likely be brief.

- Services : In the services section, you can expand on what types of services you plan to offer as a bookkeeper and who you expect your customers to be.

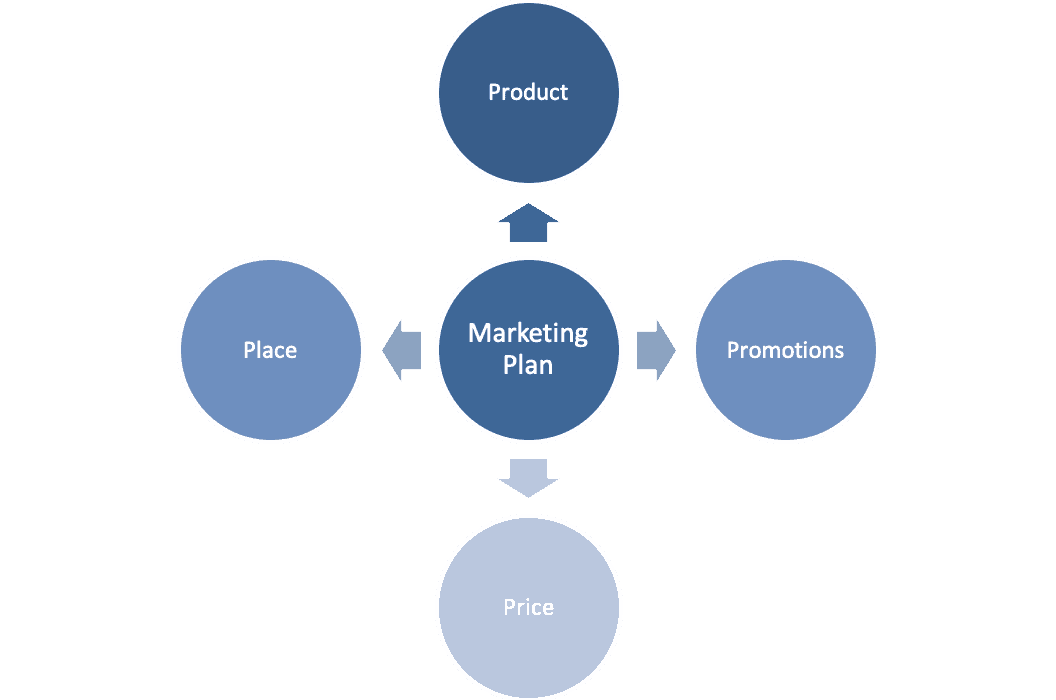

- Marketing : How you market your bookkeeping business can depend on your niche or target audience and what resources you have to invest in advertising. You’ll use this section to sketch out your marketing plans for attracting clients to your business.

- Financial projections : This section is where you’ll outline how much revenue and profit you expect to make from the business.

Having a business plan to start a bookkeeping business isn’t a requirement, but creating one can help you get some clarity on what your goals are and how you plan to proceed with growing the business. Even if you’re just planning to offer bookkeeping services remotely as a sole proprietor , it can still be helpful to flesh out the exact steps you’ll need to take to succeed.

A business plan may be required if you plan to apply for business financing from banks or investors.

Marketing Strategies for Your Bookkeeping Business

When you start any new business, you can’t expect customers or clients to magically find you. Instead, you’ll have to invest some time (and perhaps, money) in marketing your business.

If you’re specifically interested in working as a bookkeeper remotely, establishing a website and social media profiles may be a starting point for your marketing plan. Both can make it easier for potential clients to find you in online searches. You can also leverage social media to build your brand and increase your visibility.

Aside from a website and social media, there are some other options you might consider for marketing your services. They can include:

- Using LinkedIn to build out your professional network and establish credibility

- Joining a local meetup group of bookkeepers in your area

- Joining a professional business association in your area

- Participating in local small business events

- Seeking out opportunities to be a guest on podcasts in the finance niche

- Offering a seminar or workshop, either online or in person

When planning your marketing strategy , it’s important to think about the message you want to send to prospective clients. That message should be consistent across all of the channels you use to market your business, whether that includes YouTube, Facebook, TikTok, or another platform.

It’s also important to consider who your message is targeting. Your marketing content should speak to the needs and pain points of the types of customers you’re most interested in attracting to your business.

Managing Finances in Your Bookkeeping Business

Keeping track of cash flow is essential for running any business. As you prepare to start your bookkeeping business, it’s important to keep track of your expenses, which may include:

- Website hosting

- Accounting software

- Customer relationship management (CRM) software

- Cloud storage fees

- Home office supplies (if you’ll be working remotely)

- Registration fees

- Fees for certification or training

- Marketing costs

Once your business gets under way, you can make a monthly budget to track your cash inflows and outflows. You’ll also need to give some thought to how you plan to invoice your clients for your services. That includes choosing when to send invoices , how quickly you expect them to be paid, and which payment methods you'll accept.

Running a business also means paying taxes on your earnings. That includes income tax and estimated quarterly taxes . Generally, you’re required to make estimated quarterly tax payments to the Internal Revenue Service (IRS) if:

- You expect to owe at least $1,000 in tax for the year, after subtracting withholding and refundable credits.

- You expect your withholding and refundable credits to be the smaller of 90% of the tax shown on your current year’s return or 100% of the tax shown on your prior year’s return.

If your state imposes an income tax, you’ll also be responsible for making estimated tax payments to your state agency.

Opening a business bank account can make it easier to keep track of what funds go in and out. You can open a business bank account at a traditional bank, credit union, or online bank. You’ll need to provide your personal information, along with your business details, in order to open an account. Comparing fees, features, and accessibility can help you choose the best business bank account for your needs.

You might also consider applying for a business credit card to help cover expenses until you start making money. You can apply for a business credit card using your personal credit score and income ; business credit is not a requirement. If you’re considering a business credit card , you might want to look for one that offers a generous rewards program and/or charges no annual fee.

Acquiring Clients for Your Bookkeeping Business

Once you’ve covered all the legal aspects of starting your business, it’s time to start finding your first clients. There are a few ways you can go about doing this. These include:

- Looking for remote bookkeeping opportunities on freelance job boards

- Establishing profiles on sites like Fiverr or Upwork, which connect companies with freelance workers

- Reaching out to local businesses to ask if they need bookkeeping services

- Running ads on social media

- Joining local small business directories

- Offering a free consultation to local businesses

- Asking friends, family, or other business owners for referrals

Once you start getting your first clients, it’s important to focus on customer satisfaction. Clients who are happy with your services are more likely to stay loyal and continue to hire you. They also may be willing to refer you to people they know who might need a good bookkeeper.

Is Bookkeeping a Profitable Business?

Bookkeeping has the potential to be a profitable business if you’re able to maintain a solid roster of clients who are willing to pay competitive rates for your services. A typically remote bookkeeper’s salary is just over $55,000 a year, but it’s possible to make much more than that, depending on your clientele and the rates you charge.

Can You Start Your Own Bookkeeping Business?

It’s possible to start a bookkeeping business from scratch, even if you don’t have a professional or educational background in accounting or bookkeeping. Having a degree or certification in either area could be an advantage, but it’s possible to acquire the skills you need to become a bookkeeper online. Likewise, you don’t need to have experience running a business, but that could also prove helpful.

How Much Should I Charge My Bookkeeping Clients?

The amount you should charge your bookkeeping clients can depend on a number of factors, including how much experience you have, which certifications you hold, the types of services you offer, and the types of individuals or businesses you work with. Someone who’s new to the profession, for example, may start their rates at $20 an hour, while someone with several years of experience may charge $35 an hour or more. Researching average bookkeeper salaries for your area can give you an idea of what your competitors may charge.

The Bottom Line

Starting a bookkeeping business can be a great opportunity to take control of your career. Before diving in, however, it’s important to understand what’s involved to get your new business up and running. The more prepared you are before launching, the greater your chances of succeeding as an expert bookkeeper.

U.S. Small Business Administration. “ Launch Your Business .”

Insureon. “ State Laws for Workers’ Compensation .”

U.S. Small Business Administration. “ Write Your Business Plan .”

Internal Revenue Service. “ Estimated Tax .”

Glassdoor. “ Remote Bookkeeper Salaries .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-11255773532-a93b827339e146b28c0aa3084a98e115.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Limited time: Try B12 $1/mo for 3 months.

Build an AI website in 60 seconds

AI generates your personalized website instantly with built-in scheduling, payments, email marketing, and more.

Everything you need to know about starting a freelance bookkeeping business

Are you a bookkeeper looking to propel your career? Starting a freelance bookkeeping business can be a great way to do just that! Through freelance bookkeeping, you can increase your income, work flexible hours, and gain control over your career.

In the United States, a freelance bookkeeper earns around $48,691 a year, or approximately $23.41 per hour. This number has massive potential to increase the more you gain experience and expertise as a self-employed bookkeeper.

Read on to further explore the benefits of becoming a freelance bookkeeper and the steps to start your own bookkeeping business. We will also provide tips and resources that can help you succeed in the freelance bookkeeping world.

Introduction to a freelance bookkeeping business

Freelance bookkeeping is a great career option for those with experience in accounting, finance, and bookkeeping. With the right qualifications and knowledge, a freelance bookkeeper can offer a variety of services to clients and make a comfortable living.

Freelance bookkeepers are usually hired to perform tasks such as reconciling bank accounts, preparing financial statements, and providing advice on budgeting and cash flow management. They are often hired by small business owners who don’t have the resources or expertise to manage their books on their own. This can be a great way to earn a steady income while also helping others achieve financial success.

Becoming a freelance bookkeeper requires a strong understanding of basic bookkeeping and accounting principles, as well as experience working with software like QuickBooks. You must also be able to work independently, communicate well, and have customer service skills. Additionally, it is beneficial to have a degree or certification in accounting, finance, or bookkeeping.

When starting a freelance bookkeeping business, it is important to create a business plan, build a client base, and create a pricing structure for services. You must also ensure compliance with any applicable laws and regulations.

Benefits of freelance bookkeeping

Freelance bookkeeping offers an array of benefits that make it an attractive option for many entrepreneurs. Here are just some of them:

The potential to earn a good income

Freelance bookkeepers can set their own rates and hours, allowing them to determine how much they make each week. This flexibility also means that they can work around other commitments, such as family or part-time jobs. Additionally, many freelance bookkeepers find that they can use their skills in other areas, such as tax preparation, accounting, or even business coaching.

Allows you to work from anywhere

With the right equipment, such as a laptop, printer, and internet connection, a freelance bookkeeper can do their job from any location. This eliminates the need for commuting, allowing them to save on travel expenses and use their time more productively. Plus, with the right software, freelance bookkeepers can access their client’s data from any location, providing a faster and more efficient service.

Greater sense of autonomy and control

By setting their own rates and hours, freelance bookkeepers can be sure that they are earning a fair amount for the work that they are doing. Freelance bookkeepers can also work with various clients, allowing them to find the clients that best suit their needs and interests.

Gain more bookkeeping experience and knowledge

As freelance bookkeepers learn on the job, they gain a better understanding of the industry, which can be invaluable in their future endeavors. They can also pick up new skills and knowledge that can be beneficial to their professional development.

Qualifications needed for freelance bookkeeping jobs

To be successful in the freelance bookkeeping industry, you must have the necessary qualifications to be able to perform the services you are offering. This includes:

- Having a degree in accounting or finance, knowledge of bookkeeping and accounting software, and experience in the field of bookkeeping.

- A strong understanding of financial analysis and ability to interpret financial data.

- A thorough understanding of bookkeeping and accounting topics, such as payroll, taxes, corporate finance, and business analysis.

- Good communication skills since you’ll be working with clients to ensure that their financial records are kept up to date.

- Certifications to demonstrate your expertise and help you gain the trust of potential clients. For example, the American Institute of Professional Bookkeepers (AIPB) offers a certification program that verifies an individual’s knowledge and skills in the field of bookkeeping.

- Familiarity with the laws and regulations governing bookkeeping and financial management. This includes understanding the federal and state laws related to recordkeeping, taxes, and financial reporting. You also need to stay up to date on the latest regulations to provide the most accurate and up-to-date services to your clients.

Steps to starting a freelance bookkeeping business

It is important to plan and prepare for success to make sure that your business gets off to a great start. Here are some steps to help you get started.

Step 1: Register your business

First, you will need to decide on a business structure and register your business with the appropriate government agencies. You will need to decide whether you want to offer services as an independent contractor or as a sole proprietor. Then, you must obtain a business license, open a business bank account, and apply for an Employer Identification Number (EIN).

Step 2: Develop a business plan

Once you have the necessary paperwork in place, you should start developing a business plan. This plan should include items such as your target market, pricing, services you will offer, and marketing strategies. You should also make sure to create a brand and identity for your business by developing a logo and website .

Step 3: Get the best tools and software

Finally, you will need to decide on the bookkeeping tools and software you will use to manage your clients’ books. There are various programs and software available that can help you manage your client’s accounts in an efficient and organized way. You should also research the different rules and regulations related to bookkeeping in your state as well as any professional certifications that may be required.

With the right planning and preparation, you can make sure that your business is set up for success.

In 60 seconds, generate a professional, client-engaging website for free.

Tips for growing your freelance bookkeeping business

With the right guidance and strategies, you can build a successful freelance bookkeeping business that will be profitable for years to come. Here are some tips to help you get started and grow your freelance bookkeeping business.

First and foremost, it is essential to clearly understand the services you offer and the types of clients you want to target. Researching the market and your competitors is a great way to gain insight into what is in demand and which services people are looking for. With this knowledge, you can craft a service offering to set you apart from the competition.

Creating an effective marketing strategy is also key to the success of your business. You need to be able to reach the right people and inform them about the services you offer. Developing a website, using social media, and building relationships with potential clients can all help to spread the word about your business and attract more clients.

Finally, you should consider investing in the right tools and technology to help you stay organized and efficient. Automating some of your bookkeeping processes can save you time and help you provide better services to your clients. Investing in quality accounting software can also help streamline your bookkeeping operations and keep track of your business finances.

With the right strategies and tools in place, you can build a business that meets the needs of your clients and delivers exceptional results.

Resources for freelance bookkeepers

As a freelance bookkeeper, you need to have access to reliable resources to stay up to date on industry news, get expert advice, and find new clients. Here are some of the best resources:

Online community

Online communities provide a platform for members to connect, share advice, and access resources. Additionally, members can join industry-specific forums, read blogs, and find helpful tips on how to succeed as freelance bookkeepers.

Industry-specific magazines and newsletters

These publications bring the latest freelancer news and trends, as well as provide helpful advice for growing a freelance bookkeeping business. Staying up to date on this industry news and trends can help you maintain a competitive edge.

There are many books available that offer advice on topics such as setting up a business, building a client base, and managing business finances. Some books focus specifically on tax preparation and compliance, which are essential for any freelance bookkeeper.

Online courses and webinars

These provide in-depth knowledge on topics such as bookkeeping principles and software, as well as best practices for working with clients. Whether you’re just starting out or looking to take your business to the next level, these courses can be invaluable.

By taking advantage of these resources, freelance bookkeepers can gain the knowledge and skills necessary to succeed in this competitive field.

Start your freelance bookkeeping business with B12

Establishing your freelancing bookkeeping business online can be challenging, but with B12, we streamline the process and help you build a strong online presence. Get a credible website with client-facing tools like intake forms, contracts, payments, and scheduling built in. From creating the first draft of your website to launching it, our team of experts can assist you every step of the way. Sign up today!

Look professional online with tips from B12

Receive our email newsletter for advice on how to grow your business and engage clients.

Grow your business online in no time.

In 60 seconds, try B12 for free by generating a professional website that includes all the client-friendly tools you need to scale.

No credit card required

Related posts

Spend less time on your website and more time growing your business

Let B12 set up your professional online presence with everything you need to attract, win, and serve clients.

How To Become A Freelance Bookkeeper (Full Guide)

Table of Contents

Key Takeaway:

- Remote bookkeeping can be a rewarding option for individuals looking to work from home and earn a good income. To become a successful freelance bookkeeper, one needs to have a solid understanding of bookkeeping basics, including reconciling accounts, maintaining accurate financial records, and producing financial statements.

- Businesses hire remote bookkeepers to save on costs and to focus on core business operations. As a remote bookkeeper, you can work with clients from all over the world and offer a variety of bookkeeping services, including accounts payable and receivable, bank statement reconciliation, and financial reporting.

- To become a successful freelance bookkeeper, it’s important to network with other professionals in the industry and leverage online job boards to find potential clients. You should also create a solid business plan, which can include setting competitive pricing, defining your services, and outlining your marketing strategy.

Becoming a Freelance Bookkeeper: A Professional Guide

Aspiring to become a freelance bookkeeper is a wise decision. In today’s global market, companies require freelance bookkeepers to maintain their accounts and manage their finances efficiently. It is not only an opportunity to earn a good income, but it also enables you to work remotely and have flexible working hours.

To get started, the first step is to acquire relevant certification and skills. You can enrol in online courses or attend workshops to enhance your knowledge. Procuring a licence to work as a bookkeeper is necessary in some states, so make sure to check the licensing requirements in your area. Software proficiency in accounting tools is also a valuable asset for a freelance bookkeeper.

Apart from the technical skills, soft skills such as communication, planning, and time management are equally important. Building a strong network of potential clients is crucial to succeed in this field. Promoting your services through word-of-mouth or social media can help to gain new clients.

It is estimated that by 2029, the demand for freelance bookkeepers will increase by 11% . Therefore, joining the freelancing community can result in a stable career with growth opportunities.

Remote Bookkeeping Basics

As someone who’s interested in becoming a freelance bookkeeper, you’ll need to master the basics of remote bookkeeping. This section will explore those basics, starting with a look at some key facts about remote bookkeeping.

Understanding the common tasks you’ll be performing on a daily basis is also crucial, so we’ll cover that as well. Finally, we’ll talk about the essential skills you’ll need to thrive in this field, based on insights from experienced bookkeepers.

Essential Information Regarding Remote Bookkeeping

Remote bookkeeping involves managing the financials of a business from an off-site location. Key facts to keep in mind include the need to maintain accurate financial records for businesses, regular data entry, and tracking transactions. Remote bookkeepers must be comfortable working with cloud-based accounting software.

Furthermore, remote bookkeepers must ensure that each transaction is recorded accurately and that they reconcile accounts regularly. They should also have strong communication skills so that they can work closely with their clients to ensure their finances are managed appropriately.

A unique aspect of remote bookkeeping is the flexibility it provides . Bookkeeping jobs come as both part-time and full-time positions. With part-time work, you can build your client base slowly while still maintaining another job. Full-time options offer more stability but require a considerable client base.

Pro Tip: Get Certified or gain some professional skills in the field before starting your career as a remote bookkeeper.

Remote bookkeeping may not involve physical bookkeeping, but it sure does involve a lot of virtual counting.

Common tasks

As a remote bookkeeper, there are a set of tasks that you will be expected to accomplish during the course of your work. These routine needs can be called “regular functions” or “regular activities”.

- Updating and Managing Financial Records: A remote bookkeeper must keep up-to-date financial records for a small business that include payables, receivables, invoicing, expenditures, and receipts.

- Maintaining Filing Systems: Bookkeepers need to guarantee that all files are kept in order so that any information needed later can be located easily.

- Preparing Financial Reports: One of the most significant responsibilities is producing reports such as balance sheets, income statements, and tax filings.

- Cash Handling: The remote bookkeeper may also control cash inflows and outflows for their clients.

- Communication and Collaboration: As clients rely completely on their remote bookkeeper for financial details concerning the organization’s financial status, communication abilities are necessary when interacting with colleagues or stakeholders.

Remote bookkeeping requires more than fundamental accounting skills; it necessitates further comfort using up-to-date software technologies.

It’s essential to remember that every client has unique demands and procedures in terms of “regular activities.” Tailor your approach carefully.

According to Intuit Inc., more than 60% of small companies employ a third-party professional to manage their books, implying there is always work available. If you’re bad at math, being a remote bookkeeper might be a problem, but don’t worry, calculators exist for a reason.

Skills You Need

Having the right skills is crucial when it comes to remote bookkeeping. Here are some of the essential abilities you need to make a name for yourself as a skilled remote bookkeeper:

- Attention to detail: You must have great attention to detail, precise with numbers and details.

- Time Management Skills: Most remote bookkeeping jobs come with deadlines you’ll have to hit. Hence, you should possess excellent time-management skills.

- Organisational Skills: As a remote bookkeeper, organizing your tasks and responsibilities can be tedious and vital, which means being highly organized is a must-have skill.

- Excellent Communication Skills: Remote jobs require constant communication via email, phone calls or video chats; hence your communication skills need to be developed.

- Tech-Savvy: It’s important to have an understanding of modern accounting software in addition to basic computer applications such as spreadsheets and word processing programs.

If you’re hoping for success as a freelance bookkeeper, business planning is an underrated but significant skill that could set you apart from everyone else. By having robust strategies in place regarding customer acquisition, branding and managing finances, your business is likely headed in the right direction.

A study by GetApp revealed that nearly 90% of 500 US businesses surveyed outsource at least one accounting function . Because sometimes it’s easier to trust someone you’ve never met in person with your finances.

Why Businesses Hire Remote Bookkeepers

Businesses hire remote bookkeepers primarily to save costs on office space, equipment, and utilities. Remote bookkeeping allows companies to hire bookkeepers from anywhere, which expands the pool of talent and provides more expertise.

Additionally, remote bookkeepers offer timely and accurate financial statements, offering businesses better control of their finances. A critical benefit of hiring remote bookkeepers is the added flexibility, which allows businesses to scale up or down quickly.

Pro Tip: When hiring remote bookkeepers, ensure you use secure communication channels and software to protect your confidential financial information.

Bookkeeping vs. Accounting

Bookkeeping and accounting differ in their scope of work and responsibilities. Bookkeeping involves recording daily transactions, maintaining financial records, and producing financial reports.

On the other hand, accounting includes interpreting and analyzing financial data to provide financial advice and making strategic decisions.

Below is a comparison table between bookkeeping and accounting:

It’s important to note that while bookkeeping and accounting are distinct jobs, bookkeeping is a foundational skill required for accounting. Therefore, someone who aims to become an accountant should start with bookkeeping experience.

Pro Tip: Stay up-to-date with industry regulations and technical skills to excel in the field.

Types of Remote Bookkeeper Jobs

As someone looking to become a freelance bookkeeper, I found that remote bookkeeping jobs were the perfect solution for me. If you’re looking to become a freelance bookkeeper too, you’ll be happy to know that the world of remote bookkeeping offers a variety of job options.

In this upcoming section, I’ll dive into the different types of remote bookkeeping jobs available. From flexible part-time jobs to full-time positions with great benefits , there’s something for everyone in the bookkeeping world.

Part-time jobs

Remote Bookkeeping Part-Time Opportunities

Part-time bookkeeping jobs are an excellent alternative for people who are unable to work full time.

Part-time positions have recently increased because companies want more flexible arrangements for their teams. Remote bookkeeping is perfect for individuals who want to start a new career or earn additional income without committing to full-time hours.

Here are a few key points to consider regarding remote part-time bookkeeping jobs:

- The hours can be flexible, and employers may allow you to choose your schedule based on your availability.

- Most part-time jobs require preparation of basic financial statements, keeping track of monthly expenses, and managing accounts payable/receivable.

- Employers typically expect proficiency with accounting software such as QuickBooks and Xero , as well as spreadsheet applications like Excel .

- Training or certification could be necessary depending on the company’s requirements.

It is essential to remember that part-time bookkeeping does not usually include benefits such as health insurance or a 401(K) plan. However, some freelance or contractor opportunities may offer greater flexibility in scheduling and higher pay rates.

As demand for remote bookkeepers continues to grow, many businesses are struggling to locate qualified individuals with the appropriate expertise. According to recent studies, job openings in this field have risen significantly over the past decade. In addition, there is currently a scarcity of qualified candidates seeking roles due to the challenges of sourcing and cultivating talent.

I know of someone who started her small business from home while also helping close friends with their books. Her work grew in popularity, eventually leading her into project management opportunities alongside financial organization contracts that led to her business flourishing with various clients seeking assistance with their finances. The ability to become effective while working at home allowed her success in both personal gratification and financial stability within her career path as a part-time remote bookkeeper.

Looking for a remote bookkeeping job that won’t drive you insane? Check out these full-time opportunities that offer stability and a steady source of income.

Full-time jobs

Remote Bookkeeping offers a variety of employment options, including full-time jobs that offer stability and consistent work hours.

These positions provide long-term benefits and often offer opportunities for growth within the company. In addition to offering stability, full-time bookkeeping positions also offer a greater level of accountability for managing books and finances compared to part-time roles.

Full-time bookkeeping jobs typically require advanced skills such as managing financial statements, tracking expenses, generating balance sheets, reconciling bank accounts, and analyzing data reports.

Beyond these basic skills, there is also a need for excellent communication skills, industry knowledge and expertise in software tools such as Excel or QuickBooks. These jobs can be performed remotely and are well-suited for individuals who prefer a fixed schedule as opposed to the flexible hours of freelance or contract work.

Full-time remote bookkeeper jobs come with additional responsibilities such as creating budgets, forecasting cash flow projections and conducting financial analyses. One will also be required to communicate regularly with clients or superiors about financial updates and discrepancies. Perfect for individuals looking for reliability in their work environment.

An example of a successful hire is Sarah Jameson who found her first-ever full-time remote bookkeeping job on a networking site after completing an online course at community college in the US.

She was hired by an outsourced accounting given the nature of her relevant studies and skills experience – finding herself not only working remotely but earning significantly more money than she would have at a part-timer’s pay rate.

Get ready to network, learn, and plan your way to success with these essential resources for getting started in the remote bookkeeping world.

Resources For Getting Started

As someone who is starting out in the world of freelance bookkeeping, the first step is to gather information and resources for getting started. After researching, I found several valuable resources that I’ll be covering in this segment. The following sub-sections will be discussed in detail:

Finding online bookkeeping courses

Networking and job boards, creating a business plan.

By utilizing these resources, one can build a foundation for a successful freelance bookkeeping career. According to the American Institute of Professional Bookkeepers (AIPB) , the demand for bookkeepers is projected to grow by 10% from 2016 to 2026, which indicates that there are plenty of opportunities available for those interested in the field.

Acquiring Proficiency with Online Bookkeeping Courses

For finding online bookkeeping courses, search for reliable and comprehensive courses providing in-depth understanding of bookkeeping tools, software, and practices. Ensure that the course content is up-to-date with the latest trends.

Review the trainers’ credentials and feedback to ensure the quality of training. Networking with professionals in this field can help you find good courses that cater to your needs.

Remote learning platforms like Skillshare and Udemy offer a range of online bookkeeping courses at affordable prices.

Unique Detail:

Ensure that the online course’s curriculum is updated as per accounting standards and practices prevalent in your region.

True History:

Nowadays, many online bookkeeping platforms offer a range of user-friendly and interactive courses to meet the industry’s changing demands. In recent years, e-learning has emerged as an effective tool for individuals aspiring to learn about bookkeeping tools remotely.

Networking and job boards: Where awkward small talk and endless scrolling finally pay off for remote bookkeepers.

- Networking allows remote bookkeepers to connect with potential clients or employers through social media, industry events, and professional associations.

- Job boards provide a centralized platform to search for remote bookkeeping jobs. Popular job boards include Indeed, LinkedIn, and FlexJobs .

- Remote bookkeepers should also consider niche job boards that cater specifically to the accounting or finance industries .

Remote bookkeepers can benefit from utilizing both networking and job boards to increase their chances of finding work opportunities.

Pro Tip: When utilizing job boards, tailor your resume and cover letter to each specific job listing to maximize your chances of being hired.

Crafting a business plan is like creating a roadmap, except you’re driving blindfolded and guessing where the potholes are.

To Launch Your Own Bookkeeping Business: Semantic NLP variation of ‘Creating a business plan’

Putting together a comprehensive business plan is crucial before starting your bookkeeping business. It will help you determine the financial feasibility of running a bookkeeping service and create clear target goals. Outline your services, pricing, marketing strategy, and projected revenue in this document.

Ensure that your business plan includes essential details like market analysis and competitive research . Explore what target markets you’ll pursue in detail and explain how your services vary from competitors. Additionally, consider factors such as cash flow projections, legal structure options, and tax requirements .

Pro Tip: Create a dynamic business plan that serves not only as a roadmap but also an evolving document throughout the growth of your bookkeeping company.

When it comes to remote bookkeeping, let this FAQ be your crystal ball for all the answers you need.

Remote Bookkeeping FAQ

As a freelance bookkeeper, I’ve come across many questions regarding remote bookkeeping. In this segment, I would like to shed some light on the most common Remote Bookkeeping FAQs. I know that many aspiring bookkeepers have questions like What is the difference between a bookkeeper and an accountant? and How much can I earn as a freelance bookkeeper? Moreover, after deciding to start your own bookkeeping business, you may ask yourself What do I need to get started? and How do I market myself as a remote bookkeeper? So, let’s dive into the answers to all of these questions and help you get started on your freelance bookkeeping journey!

What is the difference between a bookkeeper and an accountant?

Bookkeeping and accounting are two distinct professions in the financial management of a business. The former involves basic tasks such as recording transactions, maintaining ledgers, and reconciling accounts while the latter is more complex and requires analyzing data to provide financial insights for decision-making.

Accountants tend to have advanced degrees or certifications and specialize in areas such as tax planning and audit preparations – work that goes beyond regular bookkeeping. Bookkeepers , on the other hand, focus on keeping precise financial records that build the foundation of accounting reports.

In addition to formal qualifications, an accountant typically has more experience than a bookkeeper and can offer strategic advice to businesses based on their financial data.

To ensure accuracy and compliance with regulations, it is vital to hiring either a bookkeeper or an accountant depending on your needs. This decision should be made after careful consideration of your business goals, budget, complexity of transactions, legal obligations, and risk management strategies .

You might not become a millionaire as a freelance bookkeeper, but hey, at least you’ll always have something to balance out your bank account.

How much can I earn as a freelance bookkeeper?

As a freelance bookkeeper, your earnings will be influenced by several factors. Your experience, location, and skills will determine your income. On average, freelance bookkeepers earn around $20-$50 per hour , depending on their level of expertise.

However, new freelancers may offer discounted prices to attract clients while building their portfolio. It’s crucial to maintain transparency with clients about your rates and offer competitive pricing options.

To increase your income as a freelance bookkeeper, consider offering additional services such as financial analysis or consulting. You can also target high-paying clients by specializing in a particular industry or niche.

Networking is another excellent way to boost your earning potential. Join online communities and job boards where potential clients are active or attend local business events to network with potential clients.

In summary, as a freelance bookkeeper, the amount you earn depends on various factors that vary from one freelancer to another. By gaining valuable experience, obtaining necessary skills and certifications and developing strategic marketing techniques you could earn an attractive income as a successful remote bookkeeper.

You just need a computer, accounting software, and a thick skin for dealing with clients’ excuses for not paying on time.

What do I need to start my own bookkeeping business?

Starting a bookkeeping business requires specific knowledge and skills. Here’s what you’ll need to know to begin your venture:

- First, register your business and obtain any necessary permits or licenses.

- Acquire reliable accounting software and equipment such as computers, printers, scanners, etc.

- Establish a professional website and create social media accounts for marketing purposes.

- Provide high-quality services that are reasonably priced by setting up competitive pricing while keeping in mind the local economy.

To build a successful bookkeeping business beyond start-up costs, invest time in networking with others who offer bookkeeping services. Inquire about other programs you could lead or join to meet professionals who share common interests and experience working remotely as a bookkeeper.

Many entrepreneurs dream of being their own boss, including people who become small business owners as bookkeepers with challenging responsibilities that come with managing countless clients’ finances every day. Jessie of Parker & Co Bookkeeping started out performing best accounting positions for companies similar to what she does for her clients today, but eventually made the switch to owning her own independent company where she could serve customers all by herself on her terms and work around her family schedule at home!

Promote yourself like you’re a bookkeeper on a mission to save the world, one financial statement at a time.

How do I market myself as a remote bookkeeper?

To market yourself as a remote bookkeeper, there are several key factors to consider. Here are six points you can use to market yourself more effectively:

- Develop a clear brand identity

- Create a professional website or online portfolio

- Network with other professionals in the accounting and bookkeeping industry

- Utilize social media platforms to showcase your work and attract potential clients

- Provide exceptional customer service and exceed client expectations

- Solicit feedback from clients and use it to continually improve your services

Furthermore, to stand out from the competition, consider specializing in a specific industry or type of bookkeeping task. For example, if you have experience in managing finances for small businesses, focus on marketing yourself as a small business bookkeeper.

Lastly, pro tip : Providing cost-effective pricing options and offering discounts for referrals can also help attract new clientele.

Aspiring bookkeepers can start their freelance career by embracing technology and specializing in a niche area. They can also consider joining a professional association to gain credibility and access to potential clients. It is important to stay updated on industry trends and to continually educate oneself. With dedication and a strong work ethic, one can establish a successful and fulfilling freelance bookkeeping business.

Some Facts About How to Become a Freelance Bookkeeper:

- ✅ No certification or license is required to become a freelance bookkeeper. (Source: Team Research)

- ✅ You don’t need an accounting, economics, or finance degree to become a bookkeeper. (Source: Team Research)

- ✅ Freelance marketplaces like Upwork have dozens of businesses actively searching for freelance bookkeepers. (Source: Team Research)

- ✅ With no experience, you can earn around $12 to $15 per hour to start, but after a few years, it’s very doable to make over $30 per hour. (Source: Team Research)

- ✅ Bookkeeping is a highly scalable job, and you can start as a solo bookkeeper and grow your client roster to start your bookkeeping agency. (Source: Team Research)

FAQs about How To Become A Freelance Bookkeeper

What is a freelance bookkeeper.

A freelance bookkeeper is a professional who provides virtual bookkeeping services to businesses on a contract basis. They work from home and use accounting software to handle financial record keeping for businesses. Freelance bookkeepers can work full-time, part-time or on a freelance basis.

What are the skills required to become a freelance bookkeeper?

Some of the essential skills required to become a freelance bookkeeper include proficiency in at least one bookkeeping program like QuickBooks, sharp basic math skills, problem-solving abilities, good communication and customer service skills, organizational skills, and business skills.

As a freelance bookkeeper, your earning potential will depend on your level of experience, expertise, and the rates you charge. With no experience, you can expect to earn around $12 to $15 per hour to start, but it’s very doable to make over $30 per hour in a few years’ time. Specialists can command over $60 an hour.

What is the difference between bookkeeping and accounting?

Bookkeeping and accounting are not interchangeable terms, although people often use them that way. A bookkeeper handles straightforward, day-to-day financial tasks, such as processing transactions and reconciling bank statements.

On the other hand, accounting roles require a bachelor’s degree at a minimum and certifications such as Certified Public Accountant or Certified Management Accountant are necessary to advance in the field. Accountants analyze and interpret the financial information that a bookkeeper provides to help the company make decisions.

What resources are available to help me get started as a freelance bookkeeper?

There are several resources available to help get started as a freelance bookkeeper. You can take online courses in bookkeeping, accounting, and business management, attend webinars or seminars, or read books on the subject.

Additionally, freelance marketplaces like Upwork have dozens of businesses actively searching for freelance bookkeepers. You can also find opportunities on job boards such as FlexJobs and networking sites like LinkedIn.

Why do companies hire remote bookkeepers?

Companies hire remote bookkeepers because it makes more sense to hire someone online on a part-time basis, rather than opting for a more traditional firm with higher overhead costs that get passed on in the form of higher rates.

Remote bookkeepers often make more money than they would by working for a traditional firm or agency, while still offering their services for a lower rate than clients would find elsewhere. Plus, not every business has the same needs, and online bookkeepers are more accustomed to customizing their services and approach based on an individual client’s needs.

Similar Posts

How To Become A Freelance Recruiter

How To Become A Freelance Social Media Manager (Best Guide)

How To Become A Freelance Technical Writer (Complete Guide)

How To Become A Freelance Editor (Full Blueprint)

How To Become A Freelance Writer Without A Degree

How To Become A Freelance Software Developer

Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their bookkeeping companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a bookkeeping business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Bookkeeping Business Plan?

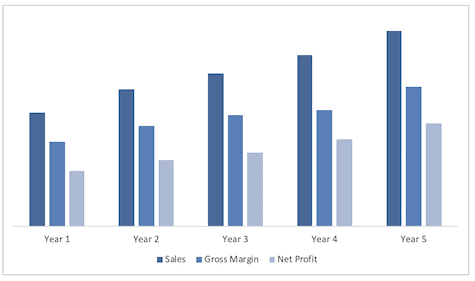

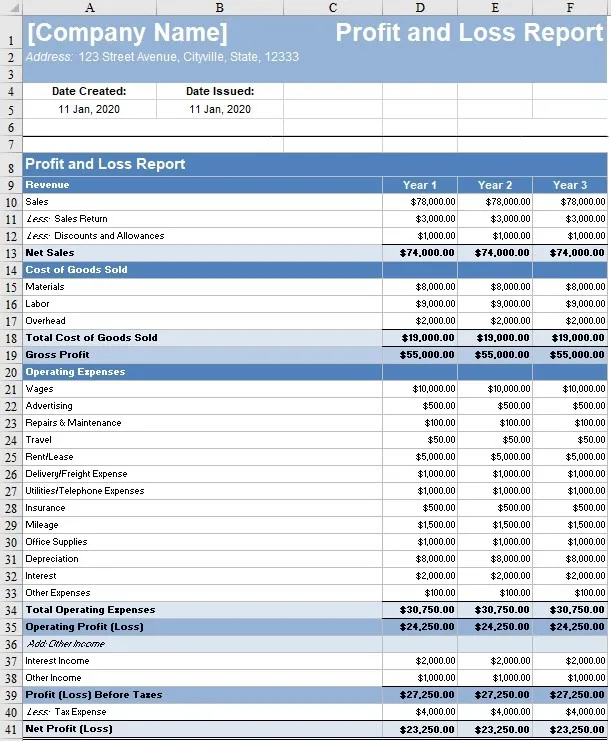

A business plan provides a snapshot of your business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Bookkeeping Business

If you’re looking to start your own bookkeeping business or grow an established business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bookkeeping business in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Bookkeeping Startups

With regards to funding, the main sources of funding for a bookkeeping business are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a bookkeeping company is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

How to write a business plan for a bookkeeping company.

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping companies.