Home > Business > Business Startup

How to Get a Business Cooperative Started

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

A business cooperative is an enticing alternative to the standard capitalism model, offering a democratic management style, lower risk of debt, and other social and economic benefits. Cooperatives also give small-business owners more control over their organization and come with certain tax advantages.

In this article, we’ll define a cooperative business, offer examples of worker cooperatives, and discuss how to get a business cooperative started.

- What is a business cooperative?

Business cooperative examples

- Steps to starting a business cooperative

The takeaway

Business cooperative faq.

By signing up I agree to the Terms of Use and Privacy Policy .

What is a cooperative business?

A business cooperative (co-op), is an organization or enterprise owned by its members. While a traditional business serves the interests of investors, founders, or board members, a co-op services the interest of its customers or workers. Most co-ops are established to fulfill an economic need, such as providing products, services, or bargaining power that is otherwise unavailable to a certain group of people.

Business cooperatives come in many forms, such as housing co-ops, food co-ops, credit unions, and agricultural co-ops. However, many large corporations are also cooperatives, including Ace Hardware, REI, and Land O’Lakes dairy.

Here are some other well-known cooperatives in the US.

- Navy Federal Credit Union: The largest credit union in the US, serving military servicemen and government employees

- Alliant Credit Union: A credit union based in Chicago, Illinois, originally founded by employees of United Airlines

- Dairy Farmers of America: A marketing cooperative owned and operated by dairy farmers across the US

- Associated Wholesale Grocers: The nation’s largest food co-op, which supplies independent grocery stores across the country

- People’s Food Co-op: A Portland, Oregon-based food co-op with a focus on sustainability

- Berkeley Student Cooperative: A housing co-op for students of UC Berkeley

How to start a business cooperative

Since co-op founders usually organize cooperatives based on a specific need or problem, the first step in starting one is to identify that need. Once this is done, the group should take the following actions to officially establish the co-op:

1. Establish a steering committee.

A steering committee is a group of people that represents the members of the organization. This committee should create a timeline for coordinating the logistics of the co-op. They should also establish the co-op’s values and mission, as well as gauge the overall level of interest in the co-op.

2. Conduct a feasibility study.

Once the steering committee is established, the group should conduct a study to consider all possible challenges and obstacles the co-op might face. This study should look closely at opportunities for financing, operating costs, and other factors that influence the market.

3. Create articles of incorporation.

Every cooperative must have articles of incorporation and bylaws that govern the organization. These bylaws should be made by a legal counsel and can be changed and enhanced over time.

4. Draft a business plan.

Like a traditional business, a co-op should have a detailed business plan that guides the company as it grows. The plan should include a market analysis, a marketing plan, product research, and a description of the co-ops goals and objectives.

5. Get financing.

Most co-ops need cash flow for day-to-day operations. This cash often comes from member investments, but some co-ops use a business loan to finance their organization in the early stages.

6. Begin operations

At this point, the co-op can hire a manager and employees, secure a facility, and open its doors. It’s important for members to remain committed to and aligned with the goals of the organization to ensure long-term success.

A worker cooperative offers a number of benefits to small-business owners, including a democratic management style, less debt risk, and member dividends. To set up a business cooperative, a setting committee must conduct a feasibility study, establish articles of incorporation, create a business plan, and secure financing.

Would you like to learn more about starting a business cooperative? Check out Business.org for How to Start a Small Business: Must-Have Checklist to Spark Success .

Related reading

- 11 Best Collaboration Software for Small Business 2023

- Best Crowdfunding for Startups 2023: How to Fund Your Small Business

- Best Startup Business Line of Credit 2023

Some cooperatives are not designed to make a profit and instead operate at cost. If a cooperative does make a profit, the members who purchase goods or services generate that money. Those profits are typically returned to the members as a refund or put back into the organization.

Safety stock is a term used to describe the excess inventory business owners choose to keep in hand in the event of an increase in demand or supplier delay.

Here are the steps to starting a worker cooperative:

- Establish a steering committee.

- Conduct a feasibility study.

- Create articles of incorporation.

- Draft a business plan.

- Get financing.

- Begin operations.

A cooperative (co-op) is a type of business organization that exists to benefit its members rather than outside investors. The co-op is owned and run by the members, and any profits are divided among those members. Most cooperatives are organized to reduce costs, fulfill an unmet need, improve the quality of a product or service, or improve bargaining power.

What are some cooperative business examples?

There are many types of cooperative business organizations, including mutual insurance groups, credit unions, electrical power co-ops, housing co-ops, and retail co-ops, such as Ace Hardware or REI.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

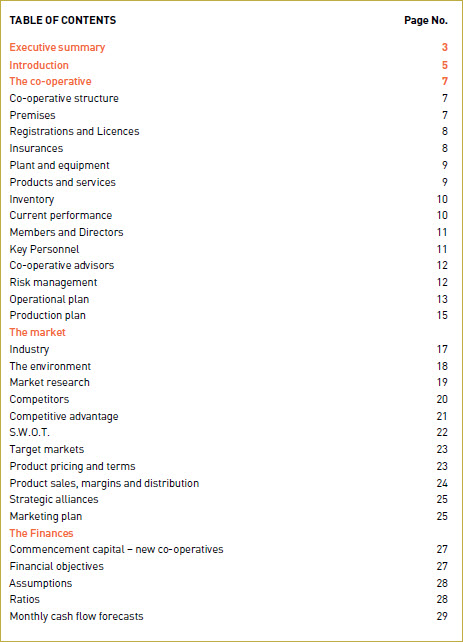

The co-operative model business plan

This appendix provides a model business plan outline. Make the plan your own. Your cooperative is unique in many ways so you don’t want the business plan to look just like everyone else’s; you want it to be an expression of your co-operative’s unique structure, products, plans, principles, values, environment and people.

The business plan itself does not need to have all the sections listed in the Table of Contents below, but you should put some effort into every section listed in it to have the co-operative well prepared before it is open for business.

Following the title page, the business plan should, at a minimum, have an executive summary, co-operative overview, market analysis, and plans for marketing, operations, production and finances.

Executive summary

Write the executive summary after you have finished the rest of the business plan. It’s an overview of the business plan, highlighting the main points and putting them into context. Consider organising the executive summary in the same order as the business plan.

The executive summary is placed at the start of the business plan to entice the reader to read the entire business plan, making it one of the most important sections.

It is not new information; it is a summary of information which is discussed in more depth throughout the business plan.

The executive summary should be able to stand on its own, and succinctly explain in one or two pages the distinctive characteristics of the co-operative and its products and why it will be successful.

It may include:

- the reason(s) the business plan has been written

- an overview of the co-operative and its market opportunities

- a description of the products or services

- a summary of its expected financial performance.

Complete it with conclusions and recommendations and a summary of how you’ve arrived at your conclusions.

Another way of looking at what the executive summary says is: What is the problem? What is the solution? What will be the outcomes?

Introduction

This section provides background information about the co-operative and could very briefly describe the co-operative type, when it was formed, who formed it and why, its location, mission, vision, values and principles, objectives and strategy to achieve them, industry, products and services, target market, development stage and achievements to date, summary of members and management, and capital raised to date.

The mission statement should say what you do, how you do it, and why you do it.

The vision statement should be somewhat loftier – describing what you want the co-operative to be in the long-term; it should be a “planned wish”.

The objectives state what the co-operative wants to achieve, usually within a certain timeframe, and are guided by the mission and vision. Objectives are business, social and financial objectives. They should be measurable, and there should be both short-term and long-term goals.

Values are statements about why the co-operative is in business, and who it serves. Values consider the social and environmental factors which the co-operative will be mindful of in achieving its objectives.

The introduction may also explain why the business plan is being written, and for whom. If it is written to support an application for finance include the name of the bank or other financier, the amount of funding sought, the term of the loan, the use of the loan, how it will be repaid, and the security the co-operative will provide.

Make it brief; one to two pages should do.

The co-operative

Co-operative structure

Outline the co-operative’s structure. Remember that many people do not understand the democratic and social principles of co-operatives, so briefly explain how it works, its rules, and how it will support your business and social objectives.

Describe the location, size and capacity of premises and any warehouse facilities. If the premises are leased state the cost of rent and length of the lease; if they have been purchased, state the value of the property. Explain how long the co-operative has been at the premises, if there is a strategic advantage in its location and, if any renovations or extensions are required, what they will cost.

Registrations and licences

List the registrations and licences that the co-operative has. If others are needed, explain what they are and when they will obtained.

Describe the insurance that the co-operative has and will be getting. It could include cover for premises, contents, workers’ compensation, liability, professional indemnity, business interruption, and motor vehicles.

Plant and equipment

Itemise the plant and equipment that the co-operative has and needs. If the business plan supports an application for funds, explain the importance of acquiring the equipment and provide details of quotes for their supply and installation. Consider listing the equipment in two tables: the first table showing the equipment already acquired and its cost and written down value; the second table listing equipment to be acquired, its value and when it is planned to be purchased or leased.

Products and services

In simple terms, describe the features of the products and services the co-operative currently provides, and those to be developed in the future. You may like to include photographs. Explain how they are different to others available in the marketplace, and why customers will buy products or services from your co-operative instead of from a competitor.

Describe the key components or raw materials used in making products, where they come from, and whether there are any restrictions on supply or agreements with suppliers. If there are likely to be price fluctuations, you might explain how they will be dealt with. You may wish to explain if there is a backup supplier available.

If it’s a new product under development, explain the progress made in research, product design and development, what tests are required and have been done, and any regulations applicable or licences or approvals that are needed. List any intellectual property protection sought to avoid duplication by competitors. Provide a timetable.

If there has been product testing in the marketplace, explain the results. Describe plans to upgrade the product or service or increase the range on offer. Describe quality assurance controls to be instigated.

If the co-operative provides a service, explain what it is, why it is needed, and how it is or will be delivered, monitored and improved.

If you have a product inventory, list the items in a table, or include an inventory list in the appendices.

You may wish to include here how you are going to minimise shrinkage of inventory due to theft, damage, loss or accounting errors.

Current performance

If the co-operative has already been trading, include a short summary of the co-operative’s turnover, gross profit and net profit for the current year and last year. More detailed information will be put into the financial section of the business plan. If the co-operative hasn’t begun trading yet, use the projected financial figures.

Members and directors

If the business plan is being written to assist you to ask for finance, use this section to show that the people who own and run the co-operative are competent and qualified. Give an overview of the number of members, active membership provisions, who the directors are, and the offices they hold.

Include a summary of their skills, qualifications, experience and industry knowledge. Consider including résumés in the appendices.

Key personnel

If you plan to engage employees or already have staff, list the positions, names (if already employed) and skills of employees, and whether their employment is full-time, part-time or casual. Résumés for managerial positions could be included in the appendices. If your cooperative is fairly large, draw an organisational chart which shows who reports to whom, and the positions they hold, and include it in the appendices.

Co-operative advisors

Include the business names and addresses of professional advisers who have helped to establish and grow the co-operative. These might be bankers, solicitors, financial advisors or planners, insurance agents, accountants, chambers of commerce, another co-operative or a co-operative peak body. This section shows that your co-operative is supported by a professional team.

Risk management

List the risks, in order of likelihood that they could occur, that the co-operative faces. State the impact the risk could have, how likely it is to occur, and what action you will take to prevent or minimise the risk to the co-operative. Key risks may include property damage, theft, electrical outages, pollution, legal liability, injury, loss of data, shifts in the economy, loss of customers, loss of suppliers, security, theft of copyright or inability to raise capital.

Operational plan

A new co-operative should explain how the co-operative will be run: the daily routines, people and functions that will make the co-operative run smoothly and successfully. Keep in mind the democratic nature of your co-operative and its social purpose; make it the focus of your actions. Directors and managers should use the operational plan to lead and inspire members and staff.

Break your operational plan down into actionable steps so it will easier to implement. Identify what each task is, who will do it, when it will be done by, and how you’ll know it has been done. Attention to detail will make the co-operative’s operations run more efficiently.

The operational plan might include ways in which you intend to devise and implement operating, accounting and management systems required for the first year of activities. Plan for staff selection and recruitment, duties and salary policies, performance monitoring, training, health and safety policies, technologies, record-keeping, banking, taxation, accounts payable and receivable, meeting legal obligations, finding suitable premises and office equipment, use of professionals, service to customers, orders and delivery management, promoting innovation, further research and development, meeting schedules, developing a co-operative culture, appropriate management style, working with members and directors, conflict resolution, compliance with regulations and inspections, and alliances with other co-operatives.

Existing co-operatives will need to consider many of the same issues, but have the advantage of having procedures already in place. They should develop an operational plan to improve the day-to-day operations of the co-operative, reduce overheads, plan for growth, alleviate risk and increase efficiency.

Production plan

The production plan will describe how the co-operative will manufacture, procure products or provide services, and provide the final product or service to customers.

It will describe:

- the complexity of the manufacturing

- the equipment and tools required

- the cost of raw materials and labour per unit

- the cost to produce a product or deliver a service

- the number of hours of production daily or weekly

- the number of units to be produced or the number of services to be delivered

- average selling price

- managing inventory levels

- forecast number of days stock is to be held

- cost control

- manufacturing staff requirements

- source and delivery partners and contract terms

- the time taken to produce the required stock levels

- environmental plans

- disposal of waste.

Quality assurance is crucial, whether the co-operative is providing a product or service. The co-operative relies on the loyalty of members and/or customers for repeat orders, so it needs to provide value for money and consistently high quality products or services. A strong quality assurance system will consider employee motivation and skills, standards and testing, feedback from customers, and minimising waste and product returns.

The market

This is an important section of the business plan, as it demonstrates that you have done your homework and it is likely that your product or service will be accepted by customers. There’s not much point in having a great product if you don’t have a market.

Much research is involved: you’ll need to understand who your customers will be, what will make them spend their money on your products or services, who your competitors are, what environmental factors could affect you, and how you are going to sell and promote your product or service. There are many places to go for information – try the Australian Bureau of Statistics, government departments, councils, Regional Development Australia, trade and professional associations, chambers of commerce and consumer organisations.

Find which ANZSIC code is used for your business. ANZSIC is used by the government to produce and analyse industry statistics. ANZSIC codes for all industries are found at www.abs.gov.au .

An industry sector contains a range of other businesses which supply similar services or products. Provide an overview of the industry sector the co-operative is in, such as the size, growth, key clients and markets, the largest providers, and demand and supply trends that affect the industry now, or may in the future. Describe any other relevant factors that drive the industry, such as innovation, regulations, seasons, financial and technical issues, distribution and supply and whether the industry is new or mature.

Provide a summary of where the co-operative is positioned within that industry, and its vulnerability to competition and trends.

The environment

Describe important trends and issues that could affect your co-operative’s operations and identify how you plan to deal with them.

Issues may include changes of government, international relations and trade, employment, environment and competition regulations, taxation legislation, new policies and laws, consumer protection, and industrial relations.

Issues may include interest rates, government spending, consumer confidence, unemployment, exchange rates, inflation, national and state economic growth, global economic outlook, materials availability, import substitution and skills shortages.

Issues may include demographics, education, standards of living, multiculturalism, housing availability, fashion, health awareness and income distribution.

Environmental

Issues may include environmental awareness, waste, pollution, energy, climate change and water.

Technological

Issues may include efficiencies, obsolescence, NBN, costs, savings, research, innovation and social networks.

Market research

It’s crucial to understand the marketplace and your customers, whether they are likely to buy the co-operative’s products or services, and possible ways to motivate them. There are two types of research you can do that will help with this: primary research, done by observing competitors, meeting with potential customers, or by survey; and secondary research, which is gathered from existing data.

What you will research will depend on what your products and services are, who your customers are, where your market is, and the level of competition in the marketplace.

Your market research might include:

- customer profiles and characteristics – age groups, gender, occupation, income, location, buying habits

- customer preferences, needs and expectations

- target markets

- the customer fit, and demand for products and services

- your fit, barriers to entry and influence on the market

- product specifications, acceptance and new opportunities

- product pricing and sales forecasts

- market size (units and value)

- market growth and trends

- market segmentation and definition

- competitor analysis

- advertising and promotional opportunities

- seasonal variations

- methods of distribution.

Describe the research you have done, and what it has revealed.

Competitors

Do not underestimate your competition. You need to understand and describe who your competitors are and the effects they will have on the co-operative’s business. Provide details of their market share, resources, products and target market, strategies, strengths and weaknesses.

Explain where the co-operative fits within the industry, what level of market share you expect, any barriers to entry and how you will address them.

Also describe how the competitors are likely to react at your co-operative’s entry into the market and the co-operative’s response strategy.

Competitive advantage

Describe what is different about your products or services compared to those of competitors. Explain why customers are likely to buy enough of your products or services to make the co-operative sustainable.

- Do you have a different target market?

- Is there an unmet need in the target market you can fulfil?

- Do you offer something different or new?

- Does your product or service have superior quality or features?

- Will the co-operative advantage work for you?

- If your product or service is unique, describe difficulties competitors will have in copying it, giving a lead time from product launch to when a competitor can duplicate your product.

List the co-operative’s internal strengths and weaknesses.

Then list the external factors that could affect the co-operative’s activities – the opportunities (e.g. market trends) and threats (e.g. competitors, economic uncertainty).

Describe how you can capitalise on the strengths and opportunities, and reduce the effect of weaknesses and threats.

Target markets

Describe the target markets for your product or service. Who are your customers? If you already know who they are, list the major clients if they agree to this information being made available to external parties. If you don’t have major clients, or there are potentially many of them, you should define the markets you will be selling to.

How have you identified your target markets? What are the characteristics of the target markets? Are your customers a certain age or gender, do they live in a particular location, have a certain type of job, ethnicity or income level? Are they members of the co-operative? What are their needs and preferences? How big is your target market? How often will they buy from you? Why and how will they buy your product or service? Are they end-users?

Consider if there are different segments to your target market. For example, would both students and professionals buy your products? Each segment may have different needs, and may be willing to pay different prices. If you understand the needs of each segment, you can adapt your marketing mix to provide what each segment wants.

Product pricing and terms

In determining the prices of your products or services, consider the costs to produce, or to deliver services, your customers’ sensitivity to the price and to price changes, and what the price reveals about the product’s value or quality. Will you offer quantity discounts, or discounts for repeat sales? Will co-operative members receive a discount or rebate?

Describe the expected payment terms for customers, e.g. direct customers pay cash while distributors and members pay within 30 days from invoice date.

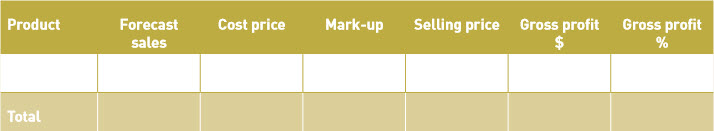

Product sales, margins and distribution

If your co-operative is new, estimate the number of products or services to be sold in the first year, and consider using a table to show your estimates. If the co-operative is already established, use both past and projected performance levels. You may wish to break the table down into weeks or months. The table can form the basis of sales volume records and pricing over time, and identify changes to help you to plan future sales targets and purchases of raw materials.

Describe how your products will be distributed – whether through direct sales, online marketing, direct mail, agents, wholesalers, representatives, retailers or consignments. Describe commissions or other fees involved.

Estimate the cost of other expenses such as shipping, warranties, contracts and liabilities.

Strategic alliances

List strategic partnerships the co-operative has, or plans to form, with other co-operatives or businesses.

These may be to work together in major ventures, or on market access, supplies or other resources. Provide information about the arrangements.

List key suppliers, and describe their history and reliability, location, what and how much they can supply, credit policy and delivery details, and the cost and availability of materials.

Marketing plan

Explain your marketing objectives – what you aim to achieve and what you will do to achieve them. Ensure they can be measured and evaluated. An example might be “to obtain 20% of market share by the end of the first year”, or “to ensure 50% of our target market recognise our brand, and 10% buy our products”. Then determine what marketing activities will help you achieve your aim.

Determine your marketing strategies and activities for each month of the first year to create awareness and sales. This is your marketing mix, and relates to product, place, price, promotion, people and process.

Product strategy : consider the products’ qualities, consistency, features, adaptability, packaging and design, how the customers will perceive the products’ features, and how you will market them.

Place strategy : consider distribution channels, location of retail outlets, the geographic area your products will be available in.

Price strategy : consider the selling price to various customers and markets, including discounts for quantity and early payment.

Promotion strategy : consider what advertising, selling, sales promotion, trade shows, website, media and public relations activities you will undertake to differentiate your product and make consumers aware of your product or service.

People strategy : consider who will sell the product and delivery it. People may include staff, strategic partners and agents.

Process strategy : this is the strategy where you plan, target, cost, develop, implement, document and review the systems to attain the other aspects of the marketing plan. You’ll plan to have the right product, in the right place, at the right price, in the right quantity, at the right time for the right customers.

The finances

Often the last part in the business plan, the finance section is important as it demonstrates the likely financial viability of the co-operative, and is vital information for anyone considering investing in the co-operative.

It shows what financial resources are needed to set up and operate the co-operative, forecasts of the co-operative’s performance based on expected sales levels, and it details the timing and the amount of investment needed from external sources.

Commencement capital – new co-operatives

List the amount of capital that has been raised and will be raised from members, and funding confirmed from other sources.

List the costs to start the co-operative (below) in a table, and show the month when the costs are expected to be paid.

- Set up the co-operative: these costs might include accounting and legal fees, registration of the co-operative and domain name, website, insurances and licences.

- Set up the premises: these costs might include a bond and advance rent, fit-out, electricity connection, telecommunications connections and stationery.

- Purchase plant and equipment: these costs might include machinery, tools, office furniture, vehicles, telecommunications, computers and software.

- Start of operations: these costs might include advertising, raw materials and supplies, wages, interest – and working capital to tide the co-operative over until it trades sustainably.

Subtract the set-up costs from the confirmed capital raised; the balance is the amount of borrowings you will require.

Financial objectives

List the co-operative’s financial objectives and how long you expect to take to achieve them. These may be profit targets, investment levels, returns to members and debt repayment.

Assumptions

Explain the key assumptions made in developing your financial forecasts:

- sales and purchases forecasts

- the time it will take to collect from debtors

- the time it will take to pay creditors

- interest rates

- time between manufacture and sale

- timing of member contributions

- timing of external capital injections

- increasing membership.

If the co-operative has already been trading, describe its financial history, including equity, debt and profit levels.

Include at least four key financial ratios:

- Debt equity ratio = total liabilities/members’ equity

- Return on investment = % of interest over total loans received, and % dividend over members’ capital injected

- Break-even point = the sales volume level where revenues and expenses are equal and provide no profit or loss. This will change each year with changes in costs, income, and interest levels.

- Working capital = current assets – current liabilities

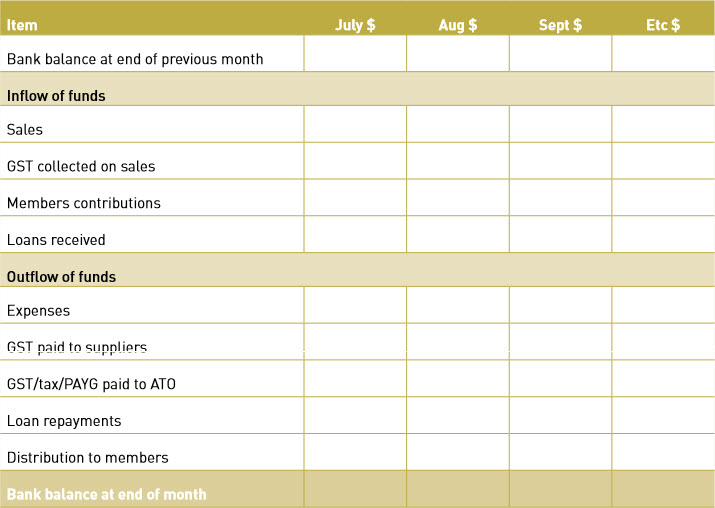

Monthly cash flow forecasts

The cash flow forecast demonstrates how and when cash comes into and goes out of the co-operative. Hopefully it also shows that income from sales will pay for bank loan repayments and other expenses. It will show you when you need an injection of cash to cover monthly bills, and when you need to conserve cash to pay for upcoming bills.

For the first year of trading, present monthly cash flow forecasts. After the first year, show yearly forecasts for at least two years.

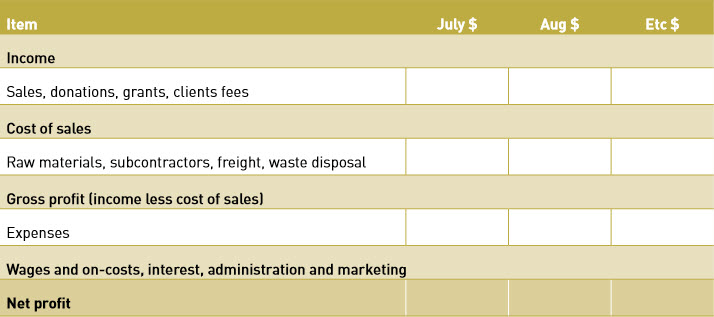

Monthly income and expenditure forecasts

Also called profit and loss forecasts, and forecasts of financial performance, income and expenditure forecasts show the co-operative’s projected income less expenditure, resulting in a profit (or loss) over a specific period of time. For the first year of trading, provide monthly or quarterly forecasts, and annually for the following two years.

Just a few quick tips for the financially challenged – income is usually from sales, and expenditure is usually the costs to run the co-operative and interest payments. Loans (liabilities), purchased equipment and inventory (assets), capital injections from members (equity) are all items for the balance sheet.

When you receive an invoice it is an expense, even if you haven’t paid it yet; so it is shown in the month the expense was incurred. Show all items as GST exclusive (i.e. without GST).

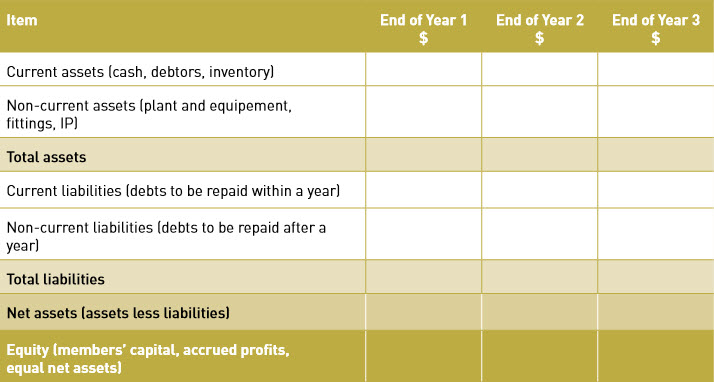

Balance sheet forecasts

The balance sheet, also known as the statement of financial position, shows the co-operative’s net worth at a particular point in time – usually the last day of the financial year. Assets are usually objects and cash the business owns, liabilities are usually debts owed, and equity is the capital contribution and accrued profits. Assets minus liabilities equals equity.

Provide balance sheet forecasts for three years.

Financial plan

Describe your plans for the co-operative’s financial viability. What is the total investment required for start-up? What are your short and medium-term investment plans? Where will funds come from? Have they been confirmed? How much comes from each source, and what conditions do funds come under (e.g. interest rates, repayment terms)? What security is offered?

When is the co-operative expected to make a profit? What level of sales is required to make a profit? When will members see a return? How much are profits expected to grow each year? How will costs be kept down? If non-distributing, will you retain surpluses, and where do you plan to donate excess surpluses?

Do you have an exit strategy?

A note on financial management

This note on financial management is not meant for inclusion in the business plan, but nevertheless is very important. (A summary of the financial management systems used could be included in the financial plan.)

Members (and investors) need to know how the co-operative is performing and need to receive regular accurate reports. Systems must correctly identify, measure and communicate financial information.

You need to understand and abide by accounting principles.

Complete, accurate, and up-to-date financial records must be kept. These may be handwritten, or on computer spreadsheets, but we recommend that unless the co-operative is very small, you should use financial software. Such software doesn’t replace an accountant, but usually knows what to debit and credit, and has a useful help function.

Develop strong systems for handling cash. Provide numbered and dated receipts for money received. Provide numbered and dated invoices (tax invoices if the co-operative is GST registered) for purchases and to others who owe you money.

Every month, reconcile your expenses paid and income received with the bank statement. Produce a balance sheet and profit and loss statement to help you keep an eye on finances and to allow you to plan and control the co-operative. Watch your creditor and debtor levels; ensure you collect money owing and pay expenses when due.

The strategic plan

A strategic plan is usually a long-term plan for the next three to five years. It explains the goals and objectives to be reached, and the path to achieve them. It’s a bit like a GPS for a very long journey, if you zoom out and ignore the minor roads.

Focus on a small number of key priorities. Too many priorities will mean you lose focus on the major objectives.

Make the priorities easy to translate into action plans, and have clear timelines to achieve outcomes.

Information that might distract from the business plan’s flow should be included as appendices. Provide a summary of the information within the business plan, and more detail in the appendices. It’s also a good place to include information that is not part of the business plan. Start a new page for each appendix.

Appendices might include the following:

- Disclosure statement.

- Co-operative rules.

- Past three years’ financial statements.

- Directors’ and key staff members’ résumés.

- Pictures of products, premises or location.

- Forecasts of purchases and payments to creditors.

- Forecasts of sales and debtor collections.

- Letters of support.

- Promotional materials.

STAY IN TOUCH

Subscribe to our email newsletter

SEARCH OUR SITE

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Subscribe Now!

Co-op 101: how to start a co-op.

Share this content with your representative

Are you wondering how to start a cooperative or if a co-op is right for your business? There are a lot of steps to starting a cooperative and factors to consider throughout the process. We’re here to help you get started. In this guide to starting a cooperative, we’ll provide an overview of how to organize a co-op and what you can expect. If you determine the co-op model is the right fit, you’ll be ready to commit to a rewarding and empowering business venture.

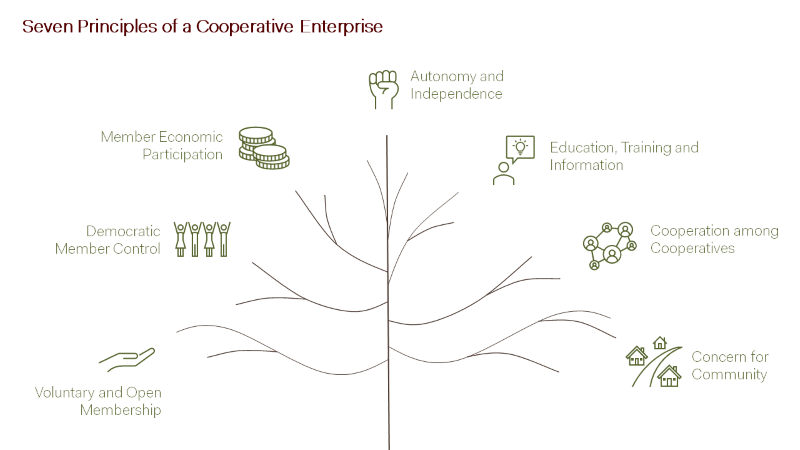

What Is a Cooperative?

A co-op, or cooperative , is a user-controlled, user-owned enterprise. It is a type of corporation . People voluntarily form a cooperative together to meet common needs and benefit from the products or services of the cooperative they create. For example, a grocery co-op is owned by the people who shop there.

Cooperatives are open to anyone who is willing to accept the terms of membership. They are fully controlled by their members, and members equally contribute to the capital. The profits of the co-op are distributed among the members or re-invested in the company.

Members have an equal say in the business of the cooperative. Unlike other types of corporations, where shareholders have more say if they own a higher percentage of the company, all co-op members follow the principle of “one member, one vote” which carries equal weight. Equality is one of the core values and founding principles of a co-op. A co-op will usually have a board of directors to run the co-op, set up policies and make sure the co-op stays on track. The members of the board are members of the cooperative and are usually elected by vote. The board of directors makes decisions based on the votes of regular members.

A cooperative can be created in any industry and can be any size. Cooperatives are commonly found in agriculture, grocery, healthcare, housing, financial services and utilities. One in three Americans is a member of a cooperative.

Should Your Business Be a Co-Op?

If you’re interested in starting a new business or changing the structure of your current business, there’s a lot to consider if you’re thinking about setting up a co-op. As with any business, you want to make sure the cooperative model suits your vision best before investing your time and money. Here are some reasons a cooperative might be right for you:

- Stability: According to the W.E. Upjohn Institute for Employment Research, employee-owned businesses are less likely to reduce employment during a recession . This helps companies like cooperatives make it through economic challenges. Employee-owners help increase profits as well. A Rutgers University study found that businesses that switch to employee ownership see profits increase as much as 14 percent .

- Democratic control: If you want your business to be run by its members rather than controlled by investors, a co-op might be right for you. With a co-op, no one has a greater say than the other person.

- Lower startup costs: A cooperative may be an appealing option for those who require lower startup costs. With a cooperative business, every member contributes to the capital and provides support.

- Benefits to the community: Co-ops are an excellent option for businesses that want to serve their community. For example, co-ops may obtain products or services that would usually be unavailable in the community or would otherwise be unaffordable. Co-ops also contribute to the economy of the local community. Overall, the focus of a cooperative is to benefit its members, instead of delivering profit to investors.

- Worker engagement: Employees are more likely to be engaged with a company they own and benefit from. They are also more likely to be committed to the quality of service and products they provide because they will want to see their company succeed.

- Tax advantages: Like other businesses, cooperatives face tax rules, but they can also reduce their tax burden in ways other corporations can’t. For example, a co-op can issue patronage dividends which can be deducted from the cooperative’s taxable income.

Despite the advantages, the cooperative model may not be the right fit for all businesses. Here are reasons why you may wish to reconsider starting a cooperative:

- Financing: Generally, cooperatives don’t attract large investors who want greater control of the company with more shares. It can also be tough for cooperatives to get loans from banks. However, that doesn’t mean financial assistance is unavailable for cooperatives. There are various funding opportunities to help co-ops get started, such as the Rural Cooperative Development Grant (RCDG) program which supplies funding for development through cooperative development organizations around the country. A cooperative may also attract funding if a funder wants to promote the development of the community.

- Longer decision-making process: Cooperatives require time to make decisions because all members are part of the decision-making process. If you anticipate the need to make decisions fast, a cooperative may not be the best option for your business.

- Reliance on members’ involvement: Co-ops depend on their members’ interest levels and involvement. If members lose interest in the co-op and stop investing energy in the business, it can be hard to continue to provide benefits for members.

- Profits are disbursed among members: A cooperative spreads its wealth among its members. Therefore, the founding members of a cooperative business do not benefit more than others only because they started the cooperative. This may make a co-op an unattractive option for some business owners.

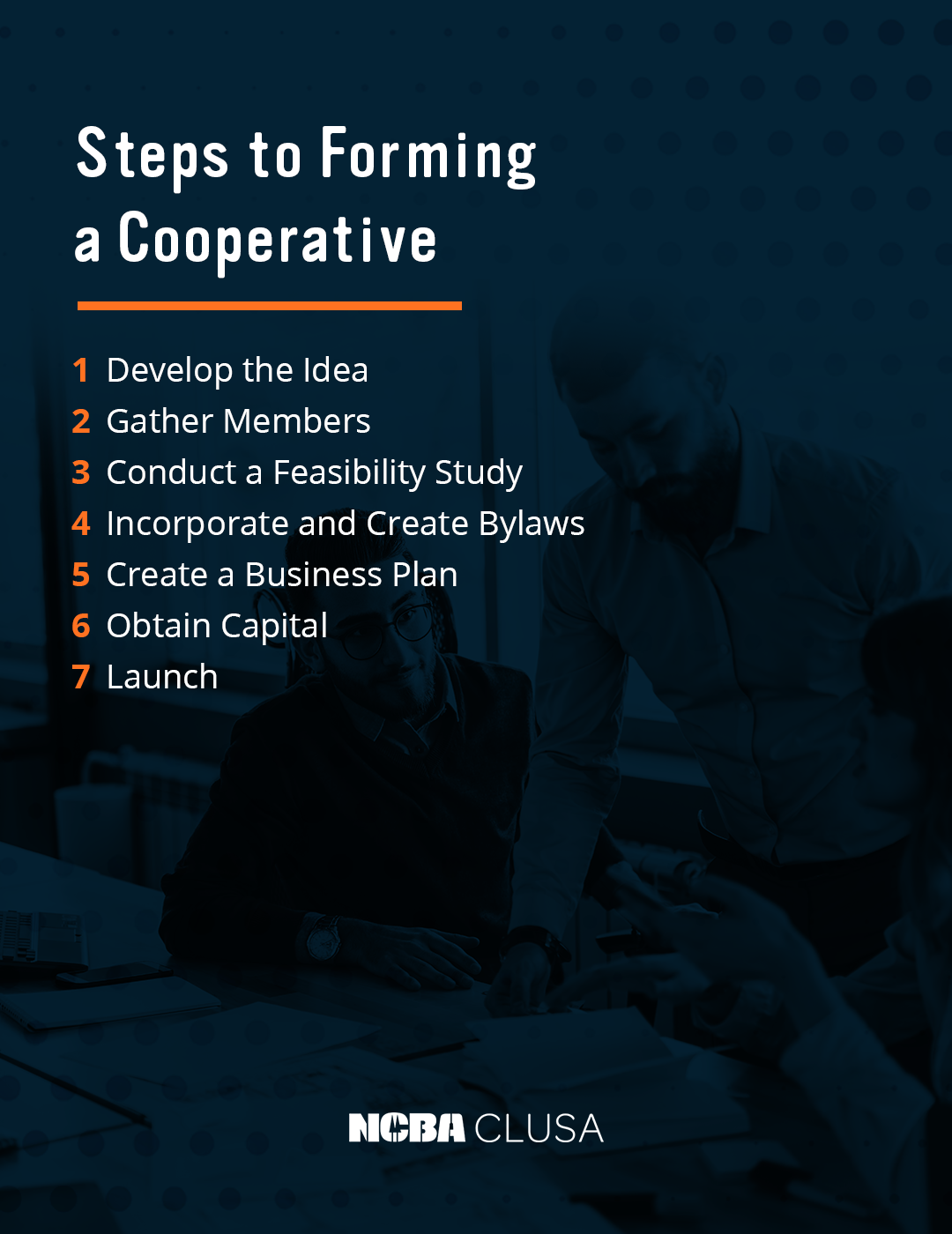

Steps to Forming a Cooperative

Like any business, starting a cooperative requires dedication and business know-how. If you are new to the business world, there are professionals out there to assist you throughout the process. Also, a cooperative is about its members, so you won’t be alone if you find people who want to join your mission and be part of your success.

Follow this step-by-step co-op startup guide to get an idea of what it takes to organize a co-op, and where to start.

1. Develop the Idea

A cooperative is a business that needs to make a profit to continue operating. You first need to know what you are going to sell or what services you plan to provide. Consider who will buy your product and if they will be willing to purchase your product or services at the prices you offer.

One way to develop a co-op idea is to identify something your community needs and how your business can fill that need. Are there certain products or services unavailable? Are some products of poor quality or overpriced? Research your community to determine if your idea will work. Plan to spend 3 to 6 months exploring your business idea.

2. Gather Members

You need to gather individuals who are genuinely interested in your business idea and who may want to become members of your cooperative. Hold a meeting with potential members and develop your mission and core values. Clearly define your business idea and describe how it’ll benefit the lives of the co-op members. Also during the meeting, choose the name of the co-op and its head office location.

3. Conduct a Feasibility Study

A feasibility study will help you determine if your idea is doable and will work well in your community. After you consider the results of the study, you can decide whether or not to continue with your co-op idea. If you decide to move forward, you can use the information from the study as the basis of your business plan. Here are components to include in your feasibility study:

- Preliminary analysis: First, consider if your product will serve the needs of your community. Also, ask if you can successfully compete with other businesses offering the same products or services. Lastly, identify any obstacles that may stand in your way of success. For example, can you acquire the capital needed for your business, or is it unaffordable? The preliminary analysis will illuminate the potential of your idea.

- Market survey: Conduct a market survey or hire an outside company to conduct the survey. Conducting a market survey is a crucial part of your feasibility study. You’ll review factors such as demographics and purchasing power in your community, and you’ll use the information to analyze competitors and potential customers.

You and other members might consider hiring a consultant to assist you with the feasibility analysis. It may be well worth the money to ensure you complete a thorough and accurate study because it can save you a lot of money and effort in the long run.

4. Incorporate and Create Bylaws

If you conclude that your idea is financially feasible, you can take the next steps with confidence. You’ll next want to elect a board of directors, incorporate your business and adopt bylaws.

You must incorporate your business if you want to be recognized as a corporation legally. A cooperative is a type of corporation. A corporation is simply the term used to describe a legal entity owned by a group of shareholders . There are many advantages to incorporating, such as:

- Protecting your assets against liabilities

- Allowing you to transfer ownership easily

- Receiving tax advantages

Not all cooperatives are incorporated. However, if you decide to incorporate, you’ll need to take the following steps:

- File articles of incorporation with your state: Articles of incorporation are documents your file with your state to legally record the formation of your cooperative. Articles of incorporation include information such as your co-op’s name and address, as well as the names and addresses of the board of directors. The exact document requirements vary by state.

- Write bylaws: Bylaws are the rules of your co-op. The board of directors establishes bylaws during the process of setting up a new company. Creating bylaws will be the step you take after your co-op is legally formed. You do not generally need to file bylaws with your state unless you are applying for non-profit status. Your bylaws should include information such as the name and address of the business, board member duties, and meeting and record-keeping procedures. Be sure to consult your state’s statutes to help you create bylaws. You might ask a lawyer to ensure your bylaws comply with the laws in your state.

5. Create a Business Plan

After you incorporate and create bylaws, it’s time to develop a detailed business plan. You can think of your business plan as a map that will show members and the board of directors which direction to take to reach common goals. Use the information you gathered from your feasibility study to help you write your business plan.

Overall, your business plan should include everything you and members need to know to run and grow the co-op. There is no right or wrong way to create a business plan as long as it meets your needs. Traditional business plans include the following:

- An executive summary which includes your mission statement and basic company information

- A description of the problems your co-op solves and the people it serves

- A market analysis describing trends in your industry, the outlook, what competitors are doing and how you’ll do it better

- Information about organization and management, such as who runs the co-op and how it’s structured

- A description of the products you sell or services you provide and how it benefits members

- How much funding you need and what you will use it for

6. Obtain Capital

The board of directors will be responsible for acquiring the capital needed to launch the co-op. You might raise money from members, local residents and lenders. You may also be eligible for government startup grants. Make sure you include how much financing you need and how you plan to obtain it in your business plan.

Once you have an adequate amount of capital, you’ll be ready to launch. Hire staff and teach them their duties and responsibilities as cooperative members. Open business doors and provide products and services to meet the needs of your members, and don’t forget to market your co-op. Lastly, remember to celebrate your journey and accomplishments.

Keys to Successful Cooperative Development

Various key elements will determine the success of your cooperative and its development. According to a cooperative development guide put together by the Cooperative Development Institute , the following elements are signs your co-op is off to a good start:

- Founding members are committed and motivated: Your co-op’s members will determine the success of the business. Without your members, the co-op can’t exist. The development of your co-op is more likely to be successful if the members are committed, motivated by your vision, involved in the process from the beginning and will benefit the most from the co-op.

- The project has strong leaders: Every project needs strong leadership to guide members and keep motivation high. If your project has leaders who are strongly interested in the success of the cooperative and are willing to contribute their skills, vision, and experience, you’ll be heading in the right direction.

- The vision is clear: You have to have a clear vision, so members know what’s expected of them, how to resolve issues, and most importantly, how to achieve goals.

- The business is well-planned: Planning is essential to the success of any business. Make sure you properly planned all the details of your cooperative and how it will operate. This should include market research.

- It’s financially feasible: You will need adequate capital to succeed. Founding members should be financially committed to the co-op. If you have the financial resources you need from the start, you’ll be able to grow.

Other tips for co-op success include:

- Stay focused

- Keep members up to date and involved

- Set realistic goals

- Use market research, rather than opinions, to guide decisions

- Identify and reduce risks

- Maintain open communication

- Invest in staff training and education

- Raise adequate funding

Join NCBA CLUSA Today

We hope we helped you learn the basics of starting a co-op. Starting any business is a complicated process that demands careful planning and consideration. It also requires the help of other individuals who are as dedicated to your mission as you are. At NCBA CLUSA, we are passionate about promoting the cooperative business model and Building an Inclusive Economy.

If you have more questions, we’re here to help. Browse our site to learn more about cooperatives and how we advocate for co-ops around the world or reach out to us so we can assist you. If you’re ready to join our mission to advance, promote and defend cooperative businesses, become a member today .

The Role of Energy Cooperatives in Advancing Clean Energy

Advantages of the Cooperative Business Model

Share this post.

We hope you enjoyed this article. If you did, we would love it if you would share it to your social networks!

Related Posts

Business Cooperatives

A business cooperative, also known as a "co-op," is an organization owned and operated by a group of individuals who come together to achieve common economic goals.

These goals may include purchasing supplies or services, marketing their products, or providing employment opportunities. Here is a breakdown of co-ops to decide if this is a good option for you and your business.

Benefits of Starting a Co-op

- Shared Ownership and Decision-Making: Co-ops are owned and governed by their members, which means that each member has an equal say in the decision-making process. This democratic structure ensures that all members have a voice in shaping the direction and policies of the co-op.

- Economic Benefits: Co-ops aim to provide economic benefits to their members, such as lower costs for inputs or access to markets that might be difficult to reach individually. By pooling resources and leveraging collective bargaining power, co-op members can often achieve economies of scale and negotiate better deals.

- Risk Sharing: In a co-op, the risks and rewards are shared among the members. This can help reduce individual financial risk and create a supportive network where members help each other overcome challenges.

- Long-Term Sustainability: Co-ops tend to have a long-term focus, prioritizing the needs and goals of the members and the community over short-term profits. This can lead to more sustainable business practices and a greater sense of social responsibility.

Steps to Start a Co-op

- Identify the Need: Determine if there is a demand for a co-op in your industry or community. Research and gather a group of interested individuals who share the same goals.

- Feasibility Study: Conduct a feasibility study to assess the viability of the co-op. This study should analyze the market, financial projections, legal requirements, and potential challenges.

- Develop a Business Plan: Create a detailed business plan outlining the co-op's goals, structure, operations, marketing strategies, and financial projections. This plan will serve as a roadmap for the co-op's development.

- Legal Structure: Choose a legal structure that suits your needs, such as a cooperative corporation, a limited liability company (LLC), or a cooperative association. Consult with an attorney specializing in cooperative law to ensure compliance with local regulations.

- Membership and Governance: Determine the membership criteria and admission process for the co-op. Establish governance procedures, including how decisions will be made, voting rights, and board member elections.

- Draft Cooperative Documents: Prepare the necessary legal documents, such as articles of incorporation, bylaws, membership agreements, and operating agreements. These documents outline the rights, responsibilities, and obligations of the co-op and its members.

- Funding and Financing: Identify potential financing sources for your co-op. This could include member investments, loans from financial institutions, grants, or crowdfunding. Prepare a financial plan that outlines the capital requirements and how the co-op intends to secure funding.

- Register and Comply with Regulations: Register your co-op with the appropriate government agencies and comply with legal and regulatory requirements. This may involve obtaining business licenses, tax identification numbers, and adhering to labor laws.

- Operationalize the Co-op: Once all legal and administrative requirements are fulfilled, begin operating the co-op according to the business plan and cooperative documents. Develop marketing strategies, recruit members, and start providing products or services.

Fiscal Responsibilities

Co-op members typically contribute financially through initial investments, purchasing shares, or paying membership fees. Members may also be required to contribute capital based on their usage or patronage of the co-op's services. Additionally, members may share in any profits or surpluses generated by the co-op, which can be allocated based on the cooperative's bylaws or predetermined formula.

Financing Sources for Co-ops

- Member Investments: Co-op members can provide initial capital through equity investments or by purchasing shares in the cooperative.

- Loans and Credit: Co-ops can obtain financing from traditional lenders, such as banks or credit unions, by presenting a solid business plan and demonstrating their creditworthiness.

- Grants and Funding Programs: Explore grants, subsidies, or funding programs specifically designed for co-ops. These may be available through government agencies, foundations, or other organizations supporting cooperative development.

- Crowdfunding: Raise capital through crowdfunding platforms that allow individuals to contribute money in exchange for rewards or equity in the co-op.

It's important to note that the specific steps, documents, and requirements may vary depending on your state and the type of co-op you intend to start. Consulting with legal, financial, and cooperative development professionals is highly recommended to ensure compliance with local laws and best practices for a co-op to be successful.

The information provided on www.onepercentforamerica.org is intended for general informational purposes only. It should not be considered as professional advice or a substitute for seeking professional guidance.

Apply for 1% Loan — Learn More

Checklist for Starting a Business

Types of Business Structures in the U.S.

Workers' Rights in the U.S.

Invest in all of us.

Your financial support will help make citizenship more affordable for millions of future Americans.

Invest Today

Steps to Startup

Starting a cooperative presents a unique opportunity for a group of people to meet a shared economic or social need. As democratically governed businesses, cooperatives can be a great way to structure a business that is guided by member values.

As with any new venture, starting a cooperative requires good ideas, expertise, time, energy, and money. It can take six months to two years, sometimes longer, for a new cooperative to go from an initial concept to launch.

The following are basic guidelines for getting started, but each new cooperative is unique. The manner in which the momentum, people, and money come together will vary. However, each of the steps described below is a logical point at which organizers can evaluate a cooperative’s progress and decide whether or not the effort should move forward.

Here are a few questions to ask yourself before getting started.

- What is the need that is not being met? What problem are you solving?

- Who are the members? What would motivate people to join the cooperative?

- Who are the competitors? Who else is already doing this?

- Who are your first customers?

- Who are strategic partners you can align yourselves with?

Made it through the basics? Good for you! Now it’s time to figure out if a new cooperative business is the right choice for you. You’ll find more details on how to get started in the steps below.

For even more info, please visit our Startup Resources Page .

Stage 1: Explore

This is an accordion element with a series of buttons that open and close related content panels.

Identify the problem and gauge interest

A core group of individuals explores an opportunity or common need for a particular product or service. They identify the benefits that a cooperative approach might offer and reach out to a broader group or community to gauge interest in the idea. This group organizes informational meetings for potential members to further define a common need. It also recruits others who have the skills and expertise required to lead the cooperative development process.

Form a steering committee

If there is enough initial interest in the cooperative idea, it is time to establish a steering committee. The steering committee should be made up of trustworthy individuals who have good business sense, will champion the project, and are capable of putting the interests of the group before their own. Many potential cooperative members will base their support of the cooperative on the credibility of the steering committee members. The steering committee:

- Gathers more information on the cooperative option and potential member support;

- Refines the business idea and its initial mission, purpose, and goals;

- Manages financial matters in a responsible and trustworthy manner;

- Leads decision-making during the cooperative development process.

Stage 2: Assess

Conduct a feasibility study.

The steering committee coordinates a feasibility study to assess the viability of the proposed cooperative venture. This study examines whether there is a market for the new cooperative’s products or services, and whether the co-op can generate enough revenue to cover the risks and costs of operating the business. It should be completed by someone who is knowledgeable about the particular business sector and does not have a vested interest in the study’s outcome. This study is a key step in the development of the cooperative. The group may need to pay for the study by conducting the first phase of a membership drive, or by applying for funding from federal, state, or non-profit agencies.

A feasibility study includes:

- Market analysis;

- Management, equipment, and facility needs;

- Revenue projections;

- Sources of financing;

- Potential membership.

Cooperative Development Grant . Wisconsin Economic Development Corp.

Cooperative Feasibility Study Guide . USDA Service Report 58, 2016.

Feasibility Study Outline . Iowa State University Extension, 2010.

Evaluate feasibility study results

The results of the feasibility study help the steering committee decide whether to continue the cooperative development process. This is a critical decision point during the development process.

Stage 3: Incorporate

File articles and adopt bylaws.

If the feasibility study indicates the concept is viable and the steering committee decides to move forward, the group may decide to legally incorporate as a cooperative. In Wisconsin, the group can choose to incorporate under Chapter 185 or Chapter 193 of the state statutes by filing Articles of Incorporation with the Wisconsin Department of Financial Institutions. The Articles provide the basic organizational information required by state statutes.

The steering committee often acts as the interim board of directors. It may draft the Articles and the initial set of bylaws, which describe how the cooperative is governed. Articles and bylaws should be reviewed by a lawyer familiar with cooperatives. Bylaws must be adopted or amended by the cooperative’s members at the first membership meeting.

Sample Articles of Incorporation . USDA Cooperative Information Report 7, How to Start a Cooperative, 2015.

Guidelines for Cooperative Bylaws. University of Wisconsin Center for Cooperatives, 2019.

For more, see our Legal & Taxation Resources page.

Open a bank account

Once the cooperative is established, the interim board of directors should open a bank account for cooperative financial transactions. In many cases, a group will incorporate earlier in the process so that the cooperative can receive funds and pay initial expenses.

Stage 4: Plan

Prepare a business plan.

A business plan is an in-depth analysis of and plan for the cooperative business. It is also an important communication tool for answering questions that potential members will have about the proposed cooperative. Banks and other funding sources will want to assess the business plan as part of their financing decisions. The business plan includes:

• Description of the goods or services offered; • Market analysis; • Marketing plan; • Operational plan; • Description of the management and ownership structures; • Sources and uses of start-up funds; • Projected financial data for the first five years of operations.

Elect a board of directors

A membership meeting is held within six months of incorporation to elect the first board of directors and to present and approve the bylaws. The board of directors begins coordinating the business plan implementation and works to secure start-up capital.

The Circle of Responsibilities for Co-op Boards . USDA Cooperative Information Report 61, 2014.

Benefiting from the Board: A Case Study . UW Center for Cooperatives, 2008.

For more resources see our Governance Resources page.

Stage 5: Capitalize

Begin membership drive.

The membership drive will indicate whether there is sufficient member support for the new cooperative. Materials for prospective members should clearly explain the cooperative’s mission, the financial requirements for membership, and the risks and benefits of membership. Some groups launch the membership drive earlier in the development process.

Cooperative Equity and Ownership: An Introduction . UW Center for Cooperatives, 2013.

Secure start-up capital

A cooperative may use both debt and equity to meet its initial capital needs. Cooperatives may also use member loans or preferred stock to raise start-up capital. Lending institutions will evaluate the risks associated with making a loan to the start-up cooperative business by analyzing the financial projections in the business plan and ensuring the co-op has capable staff lined up. Lenders will also look at the amount of member equity invested in the cooperative, since this indicates the level of risk and commitment that members are willing to assume. Members will typically be expected to supply 30-50% of the start-up equity capital. The cooperative will need to borrow the balance from a financial institution. Banks, credit unions, and loan funds that are specifically oriented to cooperatives and understand their unique structure can be important resources.

Stage 6: Launch

The board hires a general manager, who plays a key role in securing the operations site, developing vendor networks, and hiring additional staff. Some groups hire staff earlier to assist with the development process.

Address licensing, regulatory, and insurance requirements

There are often specific licensing or regulatory requirements that must be met before the business can begin operations. Legal, insurance, and risk management issues must also be addressed before launching.

Commit to ongoing training and education

Ongoing member education and board training are vital to establishing a sustainable foundation for successful cooperative operations. Education topics might include the cooperative model, cooperative finance and governance, industry trends, and working together effectively.

Other Startup Resources

You don’t have to do it alone! There are lots of great resources available, as well as co-op development centers all over the country that can help you get started.

Steps for Starting a Cooperative . USDA Powerpoint, 2016.

Cooperative Development Centers by State

How to Form a Farmer's Cooperative Business Plan

- Small Business

- Business Planning & Strategy

- Business Plans

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Set up a Co-op Store

How to write a farm business plan, how to become a cigar distributor.

- The Structure of a Cooperative Organization

- Grants for Beginning Female Farmers

Increased bargaining power and the opportunity to reach more markets makes a cooperative a lucrative idea for small farms. When it comes to preparing the business plan, co-op plans differ from those of other organizations in that the focus is about providing for the needs of the members rather than making a profit as a whole. The plan should include several key components that show your group has studied the market and is in agreement on the types of services the cooperative will provide.

Executive Summary

The executive summary appears at the beginning of your plan where it briefly explains the background and experience of each farmer involved in the co-op. Describe the legal nature of your cooperative and explain how decisions are made, such as requiring a vote by all of the members for major decisions. List the goals of the group in forming the organization, including reaching out to retail markets or accessing corporations that buy large quantities of farm goods.

Explain the services your cooperative plans to offer, such as providing training to help farmers better understand potential markets. Some co-ops provide immediate payment for delivery of products so the members can put the money right back into their farms. Or you may provide transportation to get products to market or high-quality storage spaces that members would not have access to otherwise. Since your co-op likely consists of farms that grow or raise similar types of products, explain how you need the selling power of the group as a whole to find better-paying markets that want larger quantities than individual farmers could produce.

Describe the branding your cooperative plans to use to develop a name and reputation in the marketplace. Explain the types of companies you plan to approach. For instance, a co-op made up of hay farmers may want to approach overseas markets that need large volumes of hay for their livestock. Explain how the co-op plans to differ from individual farms, such as by accessing wholesalers and restaurants that would be difficult to reach by single farmers. Provide details on the marketing, promotions and advertising activities needed to make your buyers aware of the products you provide as a cooperative.

Typically, the founding members lead a cooperative with legal, technical and financial consultants brought in when necessary. Explain who will monitor the business and marketing plan the cooperative creates to make sure all of the farmers are on target and participating in the manner originally planned.

The financial section explains how much cash each member will contribute to fund the cooperative. Outline the types of stock or certificates to be given to each farmer who becomes a member. Explain how the money invested will pay for facilities and marketing efforts as part of the co-op’s mission to provide services to the members that help them increase their profits.

- Oregon State University Small Farms: Siskiyou Sustainable Cooperative, A Model for Cooperative Farming and Marketing

- University of Kentucky: Grower Cooperatives

Nancy Wagner is a marketing strategist and speaker who started writing in 1998. She writes business plans for startups and established companies and teaches marketing and promotional tactics at local workshops. Wagner's business and marketing articles have appeared in "Home Business Journal," "Nation’s Business," "Emerging Business" and "The Mortgage Press," among others. She holds a B.S. from Eastern Illinois University.

Related Articles

Organizational structure of a co-op, wine marketing research grants, how to write a business plan for an animal shelter, grants for women-run businesses in agriculture, how to sell your product to concessions in arenas, cattle farm start-up grants, what is the difference between articles of organization & articles of association, how to obtain grant money to start a farm, what is the difference between wholesale & distribution, most popular.

- 1 Organizational Structure of a Co-Op

- 2 Wine Marketing Research Grants

- 3 How to Write a Business Plan for an Animal Shelter

- 4 Grants for Women-Run Businesses in Agriculture

Already know what you’re looking for?

How to start a co-operative: a step-by-step guide.

Starting a co-op? This article provides a step by step guide on how to start a co-operative. There’s a lot to do, and a lot to learn — but we have tons of supports, resources, and tools are available. This article provides a map to many of them.

A short note before we get started

Starting a business is exciting and rewarding, but it can also be frustrating.

At Co-operatives First, our job is to de-mystify the process of starting a co-operative business . That’s why we built this site. The Co-op Creator provides a variety of guides, tips, templates, and links. We’ve also developed an online course full of helpful videos to help you learn about this process — you can take that for free here .

For the DIYers out there, this is ideal. But sometimes folks need more hands-on support. If that’s you, our knowledgeable staff is a phone call or email away .

Okay, let’s get started.

Step 1: Decide if a co-op is the right choice for your business

What do you want to do.

Agree on the purpose of the business. Maybe your community doesn’t have enough daycare options. Maybe you’re a professional with your own firm who wants to share the cost of office space and administration. Perhaps you’re a producer who needs help packaging, marketing, and distributing your vegetables. Whatever the case, everyone needs to agree to and buy into the purpose of the co-op. A good place to start is by asking the question: what problem are you trying to solve and how does working as a group help solve that problem? This resource can help you focus ideas and engage potential members and markets in the process .

Who will do it?

A co-op is a business run by a group of people who share its benefits. You might already have a group that wants to work together. That’s great! You might also have an idea and need to get more people on board. To get the word out, you could organize a meeting to discuss how a co-op could work and see who wants to get involved.

Is a co-op the best fit?

If you’re thinking about starting a co-op, consider these two questions: What is the purpose of the business and who should benefit from it? If the answer is ‘provide a service for those who benefit from it,’ then a co-op is probably a good choice. The model works best when member interests are aligned and working as a group brings value beyond what can be achieved alone.

To learn more, here’s how co-ops compare to other business models . Or try our questionnaire .

Step 2: Get organized

Decided a co-op is the way to go? Time to organize your co-op’s structure, plan of action, and finances.

Create a steering committee

Co-ops need people to start and support them. So, if you haven’t already, find like-minded people to join you. But make sure these people have a personal interest in starting the co-op.

Also, keep in mind BC, Alberta, and Manitoba require three people to incorporate a co-op — in Saskatchewan you need six.

Develop an action plan

Sit down with your committee. Come up with a plan for starting your co-op. Decide what needs to get done, and who is going to do each task. Write it down and hold people accountable.

Do a PESTLE analysis

To assess the external factors that could impact your new business, try completing a PESTLE analysis . Also consider doing a business model canvas to better understand how the business will work.

Create a preliminary budget

How much money do you need to start the co-op? Where will it come from? Get a clear financial picture of your start-up before getting too far into it.

Create a governance structure

Who will make the decisions in your co-op? Figure out who’s in charge, and how the decision-making process will work in your business.

Step 3: Incorporate your co-op

Now you’re ready to incorporate your co-op, which means you’ll file documents with the government that legally create your business. You probably do this with your provincial government — but if your co-op will operate in more than one province, you can incorporate with the federal government.

We’ve created work plans that you can follow to incorporate your co-op in:

- Saskatchewan

- Canada (federal incorporation)

Incorporating your business will include the following tasks: