Clinical Trials Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

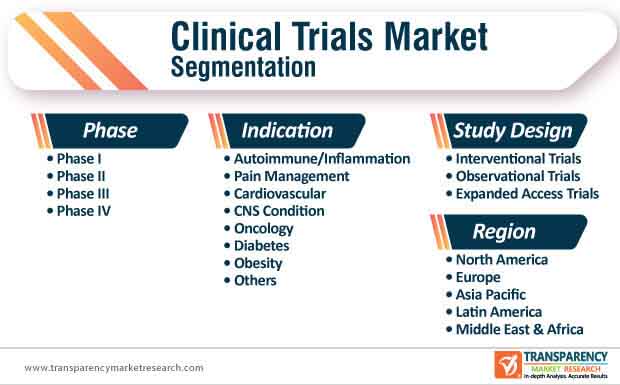

The Report Covers Global Clinical Trials Market Growth Analysis and is Segmented by Phase (Phase I, Phase II, Phase III, and Phase IV), Design (Treatment Studies and Observational Studies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America).

Clinical Trial Market Size

Need a report that reflects how COVID-19 has impacted this market and its growth?

Clinical Trial Market Analysis

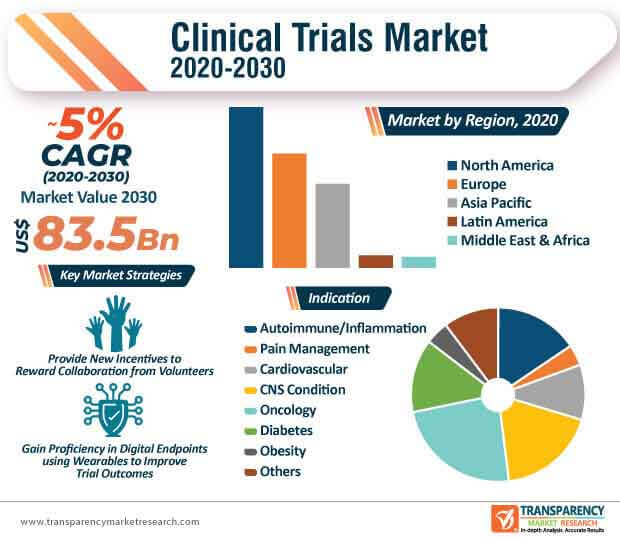

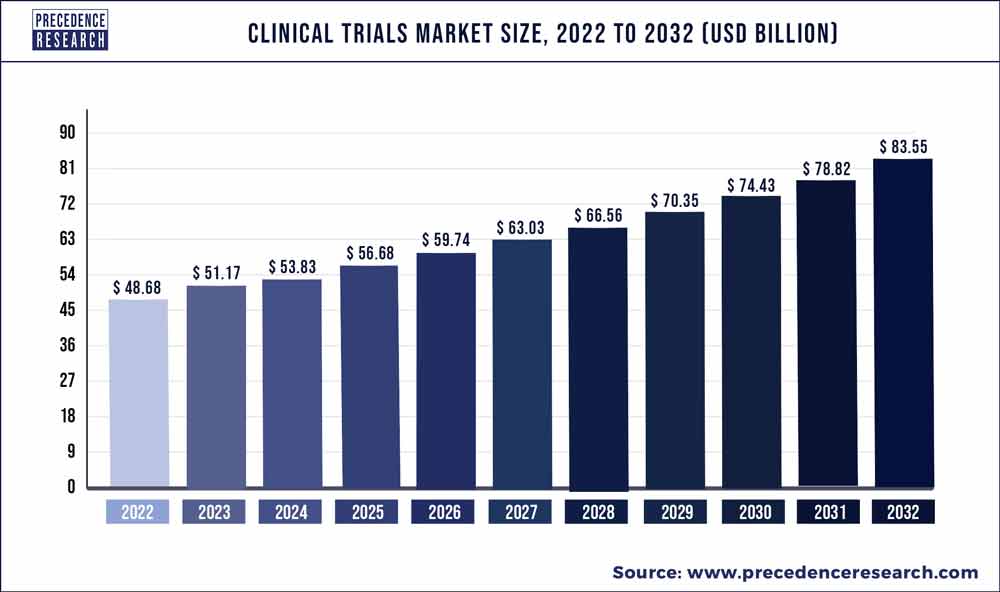

The Clinical Trials Market size is estimated at USD 50.66 billion in 2024, and is expected to reach USD 67.5 billion by 2029, growing at a CAGR of 5.91% during the forecast period (2024-2029).

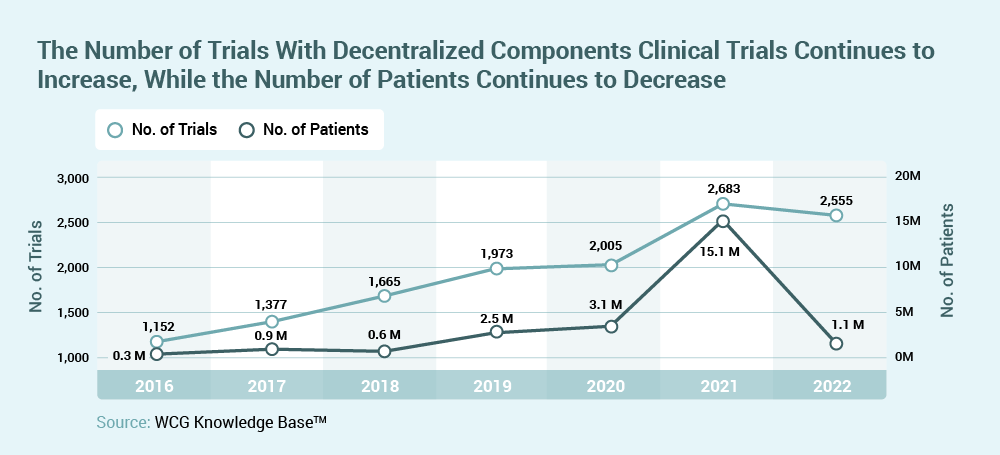

The COVID-19 pandemic tremendously impacted the market for clinical trials, as there has been a rising focus on developing new therapeutics or vaccines to treat the disease. Also, COVID-19 brought a shift in terms of the way clinical trials are performed. There has been an increased interest in virtual/decentralized trials in the clinical trial space, and those have been featured on conference agendas and in articles for a long time. Moreover, COVID-19 forced some of the trials to move to a virtual model to keep the trials on track during the pandemic. Additionally, as of November 8, 2022, a total of 8,397 studies have been registered for COVID-19 on the ClinicalTrials.gov website, among which 2,932 studies were registered for Europe alone, followed by 2,290 studies in North America. Thus, such an increase in the number of clinical trials registered to find an effective treatment for the disease is anticipated to drive market growth. Therefore, COVID-19 is predicted to have a significant impact on the market studied.

The major factors propelling the market's growth include the high demand for clinical trials in emerging markets, increased research and development (R&D) spending in the pharmaceutical industry, an increasing prevalence of diseases; and the focus on rare diseases and multiple orphan drugs in the pipeline. For instance, Novartis AG, one of the major players in the studied market, invested USD 9,540 million in the year 2021, which increased from USD 8,980 million in 2020. In addition, another market player, Pfizer Inc., invested USD 13,829 million in 2021 on R&D as compared to USD 9,393 in FY 2020. Thus, the increased research and development expenses by the major players in the market are expected to drive the growth of the market.

Factors such as growing burden of diseases need more advanced and effective medicines for treatment and thus contributes to the growth of the market. For instance, as per IDF Atlas 2021 edition, in 2021, there were 536.6 million people aged 20-79 years living with diabetes around the world and this number is expected to reach 783.7 million by 2045. Such high burden of diseases also propel the growth of the market.

Additionally, the initiatives taken by the government in different regions also conbtribute to the growth of the market. For instance, in January 2022, the European Commission (EC), the Heads of Medicines Agencies (HMA), and the European Medicines Agency (EMA) launched an initiative to transform how clinical trials are initiated, designed, and ran, referred to as Accelerating Clinical Trials in the EU (ACT EU). The aim of ACT EU is to further develop Europe as a focal point for clinical research, to further promote the development of high-quality, safe, and effective medicines, and to better integrate clinical research into the European health system. Such, initiatives by governments across the globe are contributing to market growth.

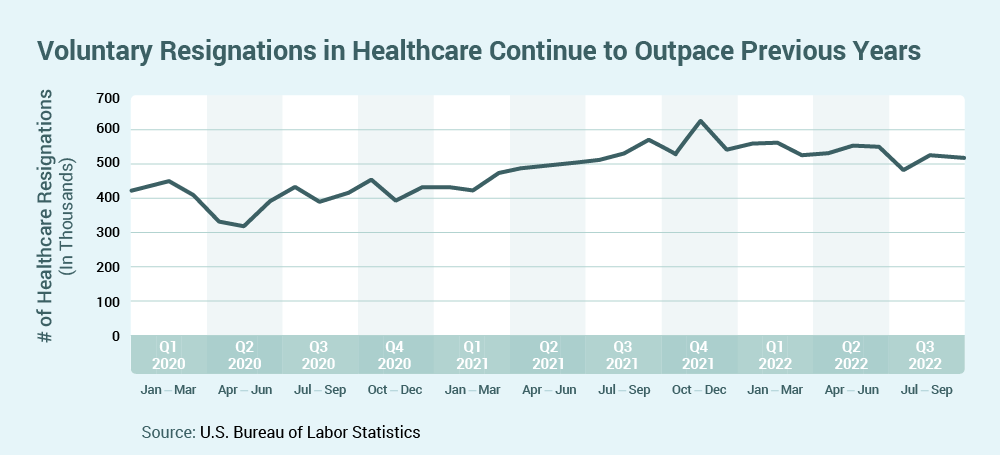

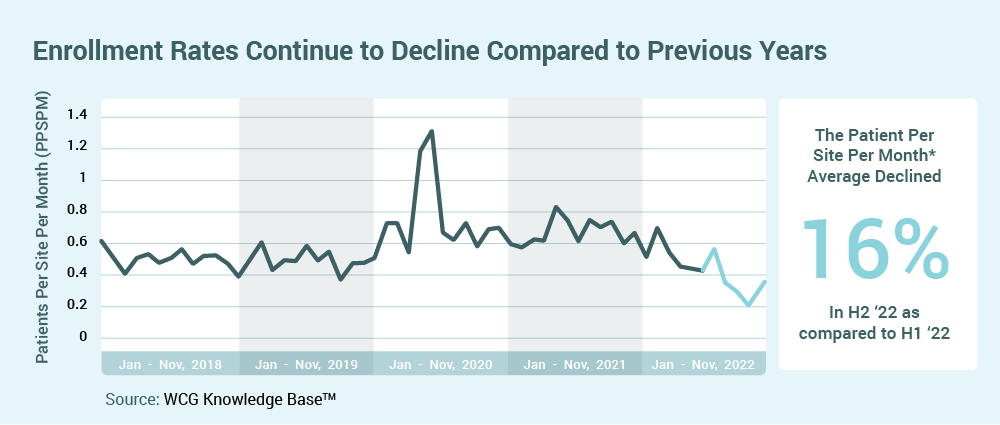

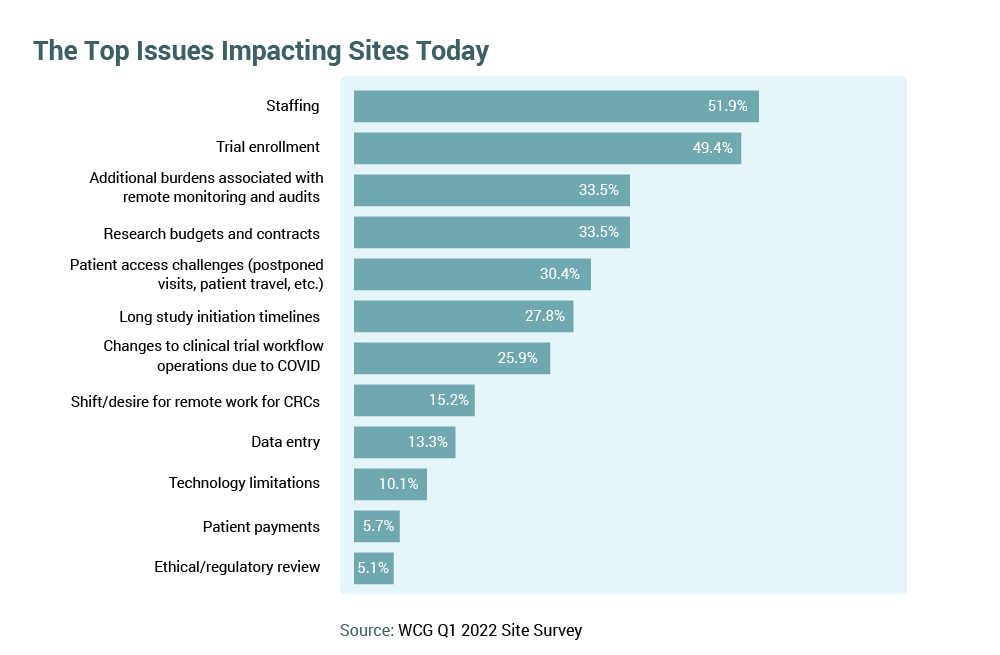

Therefore, owing to the factors mentioned above, the studied market is anticipated to grow over the forecast period. However, the lack of a skilled workforce in clinical research and stringent regulations for patient enrolment are factors that are expected to hinder the market growth during the analysis period.

Clinical Trial Market Trends

Phase iii by phase segment is expected to grow over the forecast period.

Phase III clinical trials evaluate the comparative effect of the new medication over the previous medications available or conducted to confirm and expand on safety and effectiveness results from Phase 1 and 2 trials. This usually involves up to 3,000 participants with the condition that the new medication is meant to treat and may last for many years. Also, the number of Phase III clinical trials remains comparatively higher than Phase II and Phase I trials, owing to their greater complexity and need for a larger patient pool. Factors such as increasing research activities, the growing burden of diseases, and many investigative drugs in Phase III are propelling the growth of the market segment.

The high number of clinical trials in Phase III is driving the growth of the market segment. For instance, according to the data from clinicaltrials.gov, as of November 8, 2022, 9,137 clinical trials were in Phase III for cancer, 5,069 for cardiology, and 5,217 for respiratory studies. Thus, such a high number of clinical trials registered under phase III of clinical trials is expected to contribute to the segment's growth.

Additionally, the Phase III trials conducted by market players are also contributing to the growth of the market segment. For instance, in May 2022, Lipidor AB reported that half of the patients have been enrolled in the Phase III study of AKP02 skin spray for mild to moderate psoriasis. Also, in August 2022, Wockhardt Ltd initiated a global Phase III clinical study of its new antibiotic candidate WCK 5222. It is entirely a new class of antibiotic known as "β-lactam ENHANCER', and is targeted for the treatment of hospitalized adults with complicated urinary tract infections, including acute pyelonephritis. Such a high number of studies in Phase III depicts the growth of the segment.

Thus, the factors mentioned above are expected to propel the segment's growth over the forecast period.

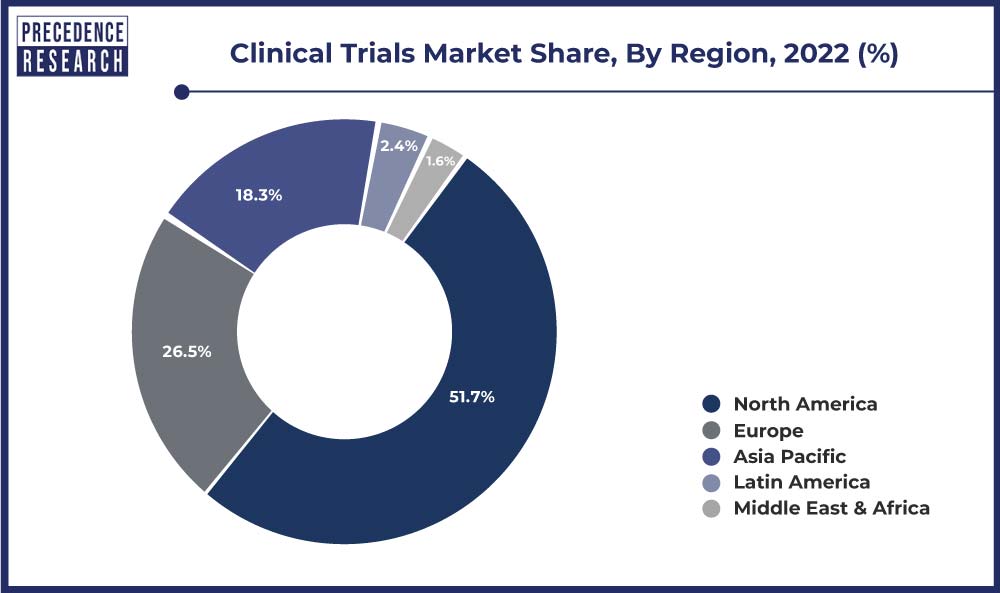

North America is Expected to Dominate the Market Over The Forecast Period

The North American region is expected to contribute significantly to the market growth during the study period owing to factors such as high R&D expenditure of the pharmaceutical industry, presence of well-established players, robust regulatory framework, and rising prevalence of diseases, coupled with the significant contribution of the United States.

The American Cancer Society estimated that in the United States, around 1,918,0303 new cases are estimated to register in 2022. Thus, the high burden of cancer is expected to boost the demand for the development of drugs and devices for disease diagnosis and treatment, thereby driving the market growth.

Additionally, the support from the government of the countries in the region is also contributing to the growth of the market. For instance, in June 2022, the Government of Canada launched the Clinical Trials Fund (CTF), supported by a Budget 2021 investment of USD 250 million over three years for the Canadian Institutes of Health Research (CIHR). With this funding, the government aims to improve health outcomes for Canadians while ensuring Canada is well-positioned to respond to future pandemics and other health priorities. The CTF will strengthen the clinical trials infrastructure in Canada and support the training of new clinical researchers.

Furthermore, the major market players in the region are active in the innovation of new drugs and devices, which is another factor predicted to contribute to the market growth in the region. For instance, in September 2021, Janssen started the Phase III trial for the investigational respiratory syncytial virus (RSV) vaccine among older adults. The study will evaluate the efficacy, safety and immunogenicity of Janssen's investigational adult vaccine against lower respiratory tract disease (LRTD) throughout North America and some other countries of different regions. Such trials are expected to propel the growth of the market in the region.

Such continuous developments are expected to fuel the clinical trials market in the North American region.

Clinical Trial Industry Overview

The clinical trials market is moderately competitive. Strategic partnerships between pharmaceutical companies and CROs are expected to impact the market's growth significantly. Also, the quick adoption of advanced technology for improved healthcare contributes to the growth of the market. Some of the key players are Clinipace, Eli Lilly and Company, Laboratory Corporation of America, ICON PLC, and Novo Nordisk AS.

Clinical Trial Market Leaders

Laboratory Corporation of America

Eli Lilly and Company

Novo Nordisk AS

*Disclaimer: Major Players sorted in no particular order

Clinical Trial Market News

- July 2022: An early-stage clinical trial investigating an investigational vaccine to stave off Nipah virus infection was started by the National Institute of Allergy and Infectious Diseases (NIAID), a division of the National Institutes of Health (NIH) of the United States.

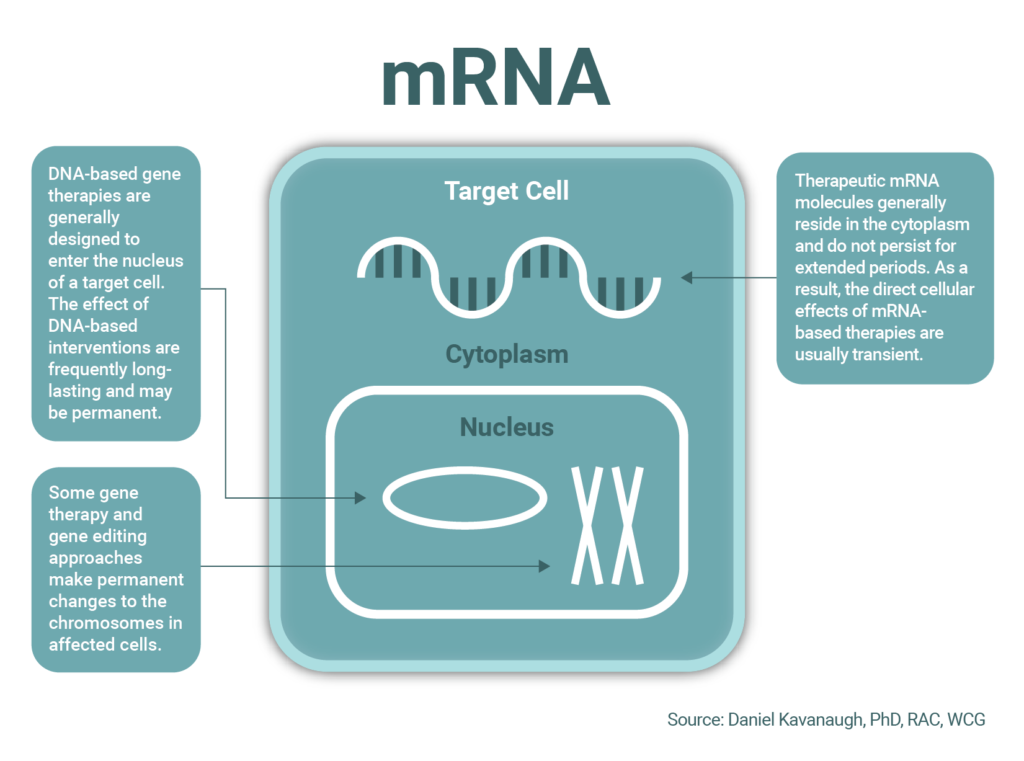

- May 2022: The International AIDS Vaccine Initiative (IAVI) and Moderna Inc. started a Phase I clinical trial of an mRNA vaccine antigen in Rwanda and South Africa.

Clinical Trial Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.2.1 Demand for Clinical Trials in the Emerging Markets

4.2.2 High R&D Expenditure of the Pharmaceutical Industry

4.2.3 Rising Prevalence of Diseases

4.3 Market Restraints

4.3.1 Lack of Skilled Workforce in Clinical Research

4.3.2 Stringent Regulations for Patient Enrollment

4.4 Porter's Five Forces Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size by Value - USD million)

5.1 By Phase

5.1.1 Phase I

5.1.2 Phase II

5.1.3 Phase III

5.1.4 Phase IV

5.2 By Design

5.2.1 Treatment Studies

5.2.1.1 Randomized Control Trial

5.2.1.2 Adaptive Clinical Trial

5.2.1.3 Non-randomized Control Trial

5.2.2 Observational Studies

5.2.2.1 Cohort Study

5.2.2.2 Case Control Study

5.2.2.3 Cross Sectional Study

5.2.2.4 Ecological Study

5.3 Geography

5.3.1 North America

5.3.1.1 United States

5.3.1.2 Canada

5.3.1.3 Mexico

5.3.2 Europe

5.3.2.1 Germany

5.3.2.2 United Kingdom

5.3.2.3 France

5.3.2.4 Italy

5.3.2.5 Spain

5.3.2.6 Rest of Europe

5.3.3 Asia-Pacific

5.3.3.1 China

5.3.3.2 Japan

5.3.3.3 India

5.3.3.4 Australia

5.3.3.5 South Korea

5.3.3.6 Rest of Asia-Pacific

5.3.4 Middle East and Africa

5.3.4.1 GCC

5.3.4.2 South Africa

5.3.4.3 Rest of Middle East and Africa

5.3.5 South America

5.3.5.1 Brazil

5.3.5.2 Argentina

5.3.5.3 Rest of South America

6. COMPETITIVE LANDSCAPE

6.1 Company Profiles

6.1.1 Clinipace

6.1.2 Laboratory Corporation of America

6.1.3 Eli Lilly and Company

6.1.4 ICON PLC

6.1.5 Novo Nordisk AS

6.1.6 PAREXEL International Corporation

6.1.7 Pfizer Inc.

6.1.8 Pharmaceutical Product Development LLC

6.1.9 IQVIA

6.1.10 F. Hoffmann-La Roche Ltd

6.1.11 Sanofi SA

6.1.12 Syneos Health

6.1.13 ClinDatrix Inc

6.1.14 Charles River Laboratory

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Clinical Trial Industry Segmentation

As per the scope of the report, clinical trials are experiments that are conducted under clinical research and follow a regulated protocol. These experiments are primarily performed to obtain data regarding the safety and efficacy of newly developed drugs. Clinical trial data is mandatory for drug approval and for it to be introduced in the market. This process is expensive and time-consuming and requires expertise at all stages. The Clinical Trials Market is Segmented by Phase (Phase I, Phase II, Phase III, and Phase IV), Design (Treatment Studies and Observational Studies), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market report also covers the estimated market sizes and trends for 17 different countries across major regions globally. The report offers values (in USD million) for the above segments.

Clinical Trial Market Research FAQs

How big is the clinical trials market.

The Clinical Trials Market size is expected to reach USD 50.66 billion in 2024 and grow at a CAGR of 5.91% to reach USD 67.50 billion by 2029.

What is the current Clinical Trials Market size?

In 2024, the Clinical Trials Market size is expected to reach USD 50.66 billion.

Who are the key players in Clinical Trials Market?

Clinipace, Laboratory Corporation of America, ICON PLC, Eli Lilly and Company and Novo Nordisk AS are the major companies operating in the Clinical Trials Market.

Which is the fastest growing region in Clinical Trials Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Clinical Trials Market?

In 2024, the Asia Pacific accounts for the largest market share in Clinical Trials Market.

What years does this Clinical Trials Market cover, and what was the market size in 2023?

In 2023, the Clinical Trials Market size was estimated at USD 47.83 billion. The report covers the Clinical Trials Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Clinical Trials Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Why is North America anticipated to witness a rapid growth rate in the Clinical Trials Market?

North America is anticipated to witness a rapid growth rate in the Clinical Trials Market due to a) High R&D expenditure of the pharmaceutical industry b) Presence of well-established players c) Robust regulatory framework d) Rising prevalence of diseases.

Which is the major segment in the Clinical Trials Market by phase?

The major segment in the Clinical Trials Market by phase is Phase III. This is mainly due to the high number of clinical trials conducted in this phase compared to others.

Our Best Selling Reports

- Sports Apparel Market

- EV Charging Station Market

- Automotive Suspension Systems Market

- Electric 3 Wheeler Market

- Pharmaceutical Plastic Packaging Market

- Security Paper Market

- Japan Used Car Market

- Lens Market

- Footwear Market

- Automotive Transmission Market

Clinical Research Industry Report

This comprehensive report offers a deep dive into the clinical trials industry, providing a detailed analysis of key market drivers and market segments. Mordor Intelligence offers customization based on your specific interests, including: 1. Service - Laboratory, Analytical Testing, Bioanalytical Testing 2. Therapeutic Area - Oncology, Neurology, CNS, Autoimmune/Inflammation 3. Application - MABs, CGT 4. End-User - Hospitals, Laboratories, and Clinics

Clinical Research Market Report Snapshots

- Clinical Research Market Size

- Clinical Research Market Share

- Clinical Research Market Trends

- Clinical Research Companies

Please enter a valid email id!

Please enter a valid message!

Clinical Trials Market Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Get this Data in a Free Sample of the Clinical Trials Market Report

Please enter your requirement

Thank you for choosing us for your research needs! A confirmation has been sent to your email. Rest assured, your report will be delivered to your inbox within the next 72 hours. A member of our dedicated Client Success Team will proactively reach out to guide and assist you. We appreciate your trust and are committed to delivering precise and valuable research insights.

Please be sure to check your spam folder too.

Sorry! Payment Failed. Please check with your bank for further details.

Add Citation APA MLA Chicago

➜ Embed Code X

Get Embed Code

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

- Health, Pharma & Medtech ›

Pharmaceutical Products & Market

Clinical trials – statistics & facts

How much do pharma companies spend on r&d, the complexities of clinical studies, drug developers seek approval, key insights.

Detailed statistics

Pharmaceuticals: cost of drug development in the U.S. since 1975

Total global pharmaceutical R&D spending 2014-2028

Number of drugs in the R&D pipeline worldwide 2001-2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Pharmaceuticals

Total number of registered clinical studies worldwide 2000-2024

CRO market size worldwide forecast 2028

Biotechnology

Top companies by COVID-19 treatment vaccines in development June 2022

Related topics

Recommended.

- Global pharmaceutical industry

- Pharmaceutical industry in the U.S.

- Top pharmaceutical drugs

- Coronavirus (COVID-19) vaccines and treatments

- Pharmaceutical research and development (R&D)

Recommended statistics

R&d overview.

- Premium Statistic Total global pharmaceutical R&D spending 2014-2028

- Premium Statistic Industry sectors - expenditure on research and development 2021

- Premium Statistic Top pharmaceutical R&D projects based on net present value August 2023

- Basic Statistic Research and development expenditure: U.S. pharmaceutical industry 1995-2022

- Premium Statistic Research and development in European pharmaceutical industry by country 2021

- Premium Statistic Total clinical research funding by National Institutes for Health 2013-2024

Total global pharmaceutical R&D spending 2014-2028

Total global spending on pharmaceutical research and development from 2014 to 2028 (in billion U.S. dollars)

Industry sectors - expenditure on research and development 2021

Percentage of spending on research and development of total revenue in 2021, by industrial sector

Top pharmaceutical R&D projects based on net present value August 2023

Selected top pharmaceutical R&D projects based on net present value (NPV) as of August 2023 (in billion U.S. dollars)

Research and development expenditure: U.S. pharmaceutical industry 1995-2022

Research and development expenditure of total U.S. pharmaceutical industry from 1995 to 2022 (in billion U.S. dollars)

Research and development in European pharmaceutical industry by country 2021

Pharmaceutical research and development spending in selected European countries in 2021 (in million euros)

Total clinical research funding by National Institutes for Health 2013-2024

Total clinical research funding by the National Institutes for Health (NIH) from FY 2013 to FY 2024 (in million U.S. dollars)

Top R&D companies

- Basic Statistic Global top pharmaceutical companies based on R&D spending 2026

- Basic Statistic Top 50 global pharmaceutical and biotech companies by R&D intensity in 2022

- Basic Statistic Top pharmaceutical companies in R&D spending growth 2022

- Premium Statistic Leading global contract research organizations based on revenue 2022

- Basic Statistic Roche: participation of patients in clinical trials 2009-2017

Global top pharmaceutical companies based on R&D spending 2026

Global top 10 pharmaceutical companies based on projected R&D spending in 2026 (in billion U.S. dollars)

Top 50 global pharmaceutical and biotech companies by R&D intensity in 2022

World's top 50 pharmaceutical and biotechnology companies based on R&D intensity in 2022

Top pharmaceutical companies in R&D spending growth 2022

World's top 50 pharmaceutical and biotechnology companies based on R&D spending growth in 2022

Leading global contract research organizations based on revenue 2022

Leading global contract research organizations (CROs) based on 2022 revenue (in million U.S. dollars)

Roche: participation of patients in clinical trials 2009-2017

Number of patients who took part in clinical trials for pharmaceutical company Roche from 2009 to 2017*

Clinical studies

- Basic Statistic Increase in clinical trials' complexity 2001-2015

- Premium Statistic Clinical trial success rates by therapeutic area 2020

- Basic Statistic Number of registered clinical studies by location worldwide 2024

- Basic Statistic Percent of registered clinical studies worldwide by location 2024

- Basic Statistic Share of recruiting clinical studies worldwide by location 2024

- Premium Statistic Total number of registered clinical studies worldwide 2000-2024

- Basic Statistic Total number of registered clinical studies with posted results worldwide 2008-2024

Increase in clinical trials' complexity 2001-2015

Increase in clinical trials' complexity between 2001-2005 and 2011-2015

Clinical trial success rates by therapeutic area 2020

Clinical trial success rates by therapeutic area as of 2020*

Number of registered clinical studies by location worldwide 2024

Number of registered clinical studies worldwide by location as of April 2024

Percent of registered clinical studies worldwide by location 2024

Percentage of registered clinical studies worldwide by location as of April 2024

Share of recruiting clinical studies worldwide by location 2024

Percentage of registered recruiting clinical studies worldwide by location as of April 2024

Total number of registered clinical studies worldwide since 2000 (as of April 2024)

Total number of registered clinical studies with posted results worldwide 2008-2024

Total number of registered clinical studies with posted results worldwide since 2008 (as of April 2024)

Participation

- Basic Statistic Top clinical trial participant countries worldwide 2015-19, by share

- Basic Statistic Clinical trial participants U.S. vs. rest of world by therapy area 2015-2019

- Basic Statistic Clinical trial participants gender share worldwide 2015-19, by geographic location

- Basic Statistic Clinical trial participants ethnicity share worldwide 2015-19, by geographic location

Top clinical trial participant countries worldwide 2015-19, by share

Top 20 clinical trial participant countries worldwide in 2015-2019, by share of participants

Clinical trial participants U.S. vs. rest of world by therapy area 2015-2019

Number of clinical trial participants in the U.S. and rest of the world in 2015-2019, by therapeutic area (in 1,000s)

Clinical trial participants gender share worldwide 2015-19, by geographic location

Gender share of clinical trial participants worldwide in 2015-2019, by geographic location

Clinical trial participants ethnicity share worldwide 2015-19, by geographic location

Ethnicity share of clinical trial participants worldwide in 2015-2019, by geographic location

Costs and market

- Basic Statistic Pharmaceuticals: cost of drug development in the U.S. since 1975

- Premium Statistic R&D expenditure of new therapeutic drugs 2009-2018

- Basic Statistic Estimated clinical trial cost per patient by therapeutic class 2015-2017

- Basic Statistic Estimated clinical trial cost per drug by therapeutic class 2015-2017

- Premium Statistic CRO market size worldwide forecast 2028

- Premium Statistic Global pharma CRO market size 2015-2024, by pre-clinical, clinical and discovery

- Premium Statistic Size of total U.S. clinical trial supplies market 2016-2025

Cost of developing a drug in the U.S. from the 1970s until today (in million U.S. dollars)*

R&D expenditure of new therapeutic drugs 2009-2018

Mean and median R&D expenditure on new drugs by therapeutic area between 2009 and 2018* (in million U.S. dollars)

Estimated clinical trial cost per patient by therapeutic class 2015-2017

Estimated clinical trial cost per patient by therapeutic area in 2015-2017* (in U.S. dollars)

Estimated clinical trial cost per drug by therapeutic class 2015-2017

Estimated clinical trial cost per drug by therapeutic area in 2015-2017* (in million U.S. dollars)

Global contract research organization (CRO) market in 2023 and 2028 (in billion U.S. dollars)

Global pharma CRO market size 2015-2024, by pre-clinical, clinical and discovery

Global pharmaceutical CRO market size from 2015 to 2024, by pre-clinical, clinical and discovery (in billion U.S. dollars)

Size of total U.S. clinical trial supplies market 2016-2025

Size of the total U.S. clinical trial supplies market from 2016 to 2025 (in million U.S. dollars)

Approvals, launches, setbacks

- Premium Statistic Pharmaceutical industry - number of new substances 1998-2022

- Premium Statistic Number of novel drugs approved annually by CDER 2008-2023

- Basic Statistic Key measurements of U.S. CDER drug approvals in 2023

- Basic Statistic FDA first premarket approvals for medtech products granted 2005-2022

- Premium Statistic Projection of top 2024 pharma and biotech launches by revenue 2028

- Basic Statistic Number of unsuccessful Alzheimer’s drugs in development in the U.S. 1998-2017

Pharmaceutical industry - number of new substances 1998-2022

Number of new chemical or biological entities developed between 1998 and 2022, by region of origin

Number of novel drugs approved annually by CDER 2008-2023

Total number of novel drugs approved by CDER from 2008 to 2023

Key measurements of U.S. CDER drug approvals in 2023

Percentage of drugs approved by the U.S. Center for Drug Evaluation and Research (CDER) in 2023 that met select key measurements

FDA first premarket approvals for medtech products granted 2005-2022

Number of first premarket approvals (PMA/HDE) granted by the FDA for medtech products from 2005 to 2022

Projection of top 2024 pharma and biotech launches by revenue 2028

Leading biotech and pharma product launches in 2024 and revenue forecasts for 2028 (in billion U.S. dollars)

Number of unsuccessful Alzheimer’s drugs in development in the U.S. 1998-2017

Number of unsuccessful Alzheimer’s drugs in development in the U.S. from 1998 to 2017

- Premium Statistic Top companies by COVID-19 treatment vaccines in development June 2022

- Basic Statistic Number of COVID-19 drugs in development worldwide by phase June 2022

- Basic Statistic Number of COVID-19 treatment vaccine trials worldwide by phase June 2022

- Basic Statistic Number of COVID-19 treatment vaccine trials worldwide by type June 2022

Leading companies by number of COVID-19 drugs and vaccines in development as of June 3, 2022

Number of COVID-19 drugs in development worldwide by phase June 2022

Number of coronavirus (COVID-19) drugs and vaccines in development worldwide as of June 3, 2022, by phase

Number of COVID-19 treatment vaccine trials worldwide by phase June 2022

Number of coronavirus (COVID-19) clinical trials for drugs and vaccines worldwide as of June 3, 2022, by phase

Number of COVID-19 treatment vaccine trials worldwide by type June 2022

Number of coronavirus (COVID-19) clinical trials for drugs and vaccines worldwide as of June 3, 2022, by type*

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

- Pharmaceutical trends in Europe

- Generics and biosimilars

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Healthcare IT

- Clinical Trials Market

"Designing Growth Strategies is in our DNA"

Clinical Trials Market Size, Share & Industry Analysis, By Phase (Phase I, Phase II, Phase III, and Phase IV), By Application (Oncology, CNS Disorder, Cardiology, Infectious Disease, Metabolic Disorder, Renal/Nephrology, and Others), and Regional Forecast, 2024-2032

Last Updated: April 30, 2024 | Format: PDF | Report ID: FBI106930

- Segmentation

- Methodology

- Infographics

- Request Sample PDF

KEY MARKET INSIGHTS

The global clinical trials market size was valued at USD 57.76 billion in 2023 and is projected to grow from USD 61.58 billion in 2024 to USD 106.78 billion by 2032, exhibiting a CAGR of 7.1% during the forecast period (2024-2032). Clinical trials are an important process in developing new therapeutics or medical devices. These studies are performed to analyze novel pharmaceuticals, medical devices, or any other therapeutics. These studies provide a scientific foundation for guiding and treating patients and evaluating novel medications and equipment. Increasing R&D by pharmaceutical and biotechnological companies globally has fueled the number of clinical trials being conducted globally.

Furthermore, increased companies' focus on the development of novel treatments for chronic diseases and rising demand for outsourcing R&D activities have also been fueling the market’s growth. For instance, in July 2021, the Beijing Illness Challenge Foundation (ICF) in China formed a strategic relationship with Parexel. This ground-breaking collaboration aimed to obtain direct feedback from individuals with rare diseases to improve their access to and participation in these studies.

The impact of COVID-19 pandemic resulted in the slow growth of the market during the pandemic. Many clinical studies were put on hold after the sudden outbreak of COVID-19 due to lockdown restrictions and the low presence of resources.

However, many pharmaceutical and biotechnological companies increased their focus on the development of drugs, test kits, and vaccines against the SARS-CoV-2 virus. These companies increased their focus on collaboration and partnership with CRO service providers for R&D and clinical studies.

- In January 2021, ICON plc, BioNTech, and Pfizer announced their partnership to develop an experimental COVID-19 vaccine program to provide clinical trial services.

However, the market experienced a significant recovery in 2021 compared to the prior year, due to the release of lockdown restrictions, mass vaccination, and increased demand for clinical trials to develop novel treatments.

Clinical Trials Market Trends

Pharmaceutical and Biotechnological Companies Increased their Investments in R&D

Many medical device, pharmaceutical, and biopharmaceutical companies continue to put significant resources into the development of technologies and new medications. The pharmaceutical sector, in particular, has been majorly making investments in R&D initiatives for the development of novel therapeutics. Pharmaceutical and biotechnology companies have increased their focus on expanding their R&D efficiencies by investing in R&D.

- For instance, according to the research article published by NCBI, in 2021, overall pharmaceutical expenditures in the U.S. increased by 7.7% as compared to 2020, for a total of USD 576.90 billion.

Moreover, over the past two decades, both R&D spending and the launch of new drugs have witnessed notable increases. This is due to the rapidly growing demand for innovative medicines to treat a wide range of diseases.

- For instance, as per the data published by the Congressional Budget Office in April 2021, the pharmaceutical industry’s research and development expenditure reached USD 83.00 billion in 2019, marking a tenfold increase compared to its yearly spending in the 1980s when adjusted for inflation.

Furthermore, these companies also initiated outsourcing of their R&D activities to CRO companies for time efficient and smooth conduction of these trials.

Request a Free sample to learn more about this report.

Clinical Trials Market Growth Factors

Increasing Prevalence of Chronic Diseases to Increase the Demand for the Development of Efficient Therapeutics

The burden of chronic diseases, such as diabetes, several types of cancers, neurological disorders, and arthritis, has been increasing at a significant pace globally. This is expected to fuel the demand for the development of more effective therapeutics.

- For instance, as per the data provided by the University of Washington (UW) education, in June 2023, the global population of individuals living with diabetes currently exceeds half a billion, and projections indicate it will surpass 1.30 billion within the next three decades. This growth is anticipated across all countries, marking a significant global increase.

- Similarly, according to the data published by Globocan in 2020, Europe accounted for 22.8% of all cancer cases and 19.6% of cancer deaths, representing 9.7% of the global population.

People worldwide are affected by chronic diseases. Compared to developing countries, emerging countries are more prone to chronic disease-related public health problems. According to the World Health Organization (WHO), in five out of six regions, chronic disease is the major reason for mortality. Infectious diseases, such as malaria, TB, HIV/AIDS, and other conditions, are still predominant in Sub-Saharan Africa and are expected to prevail in the coming years.

The global market is anticipated to grow significantly due to the high prevalence of chronic diseases during the forecast period.

Rising Number of Clinical Trials Globally has been Fueling the Market Growth

Registration of trials has been growing at a significant rate annually to meet the increasing demand to treat chronic diseases.

- For instance, as per the data published by WHO in 2022, the total number of these trials conducted in 2021 experienced an increase of 11.7% from the prior year.

These study trials conducted in the U.S. are comparatively fewer than in other countries worldwide. Due to its cost-effectiveness and easy process, many of the trials are conducted outside of the U.S. and the European Union. Clinical trial success rates are majorly dependent on the stage of the study and the treatments or items being developed.

In recent years, the number of registered trials has increased significantly.

- For instance, as per the International Clinical Trials Registry Platform (ICTRP), the annual number of these registered trials by high-income countries increased from 21,028 in 2010 to 29,538 in 2020.

In addition, clinical trials have addressed chronic diseases, emerging infectious diseases, and other global health problems through research and development of novel medicines. Clinical trial research has recognized several necessary interventions for various diseases. Therefore, increase in development of new drugs & medical devices is expected to drive the clinical trials market growth during the forecast period.

RESTRAINING FACTORS

Limited Availability of Skilled Workforce and High Costs of Study Trials Limit the Market Growth

Increasing globalization has been fueling the adoption of advanced technology. New opportunities are emerging in terms of occupation. Furthermore, rising industrialization and the requirement for new amenities have fueled the need for new skills. This factor has also enhanced competency in job opportunities.

Contract Research Organization (CRO) services face issues in drawing and maintaining vastly proficient experts as they require qualified as well as experienced scientists from the field of pharmaceutical, biotechnology, academic & research institutes, and medical device businesses. Companies must give high rewards and other such recognitions to compete efficiently, impacting other players’ capitals and operational outcomes, majorly small-scale analytical testing providers. This limited availability of experienced specialists could limit the adoption of advanced technologies and processes, limiting the market’s growth in the coming years.

Furthermore, adherence to regulatory requirements significantly impacts clinical trial costs. From research to the final drug approval, the drug development process is quite costly. According to the Tufts Center for the Study of Drug Development, on average, the complete drug development process costs USD 2.60 billion to develop a new medicine, including the cost of failures. Moreover, only 12.0% of new drug candidates that enter study trials get the U.S. FDA approval.

An additional important factor affecting the costs of a trial is the complexity of the study design and protocol. Apart from financial costs, there are several obstructions to conducting clinical trials, including difficulties in recruitment, lengthy time frames, retention of participants, insufficiencies in the clinical research workforce, and drug sponsor-imposed barriers.

These factors are expected to restrict the market growth during the forecast period.

Clinical Trials Market Segmentation Analysis

By phase analysis.

Increased Registration of Clinical Trials along with the Emergence of CRO Services has been Fueling the Segment’s Growth

Based on phase, the market is segregated into phase I, phase II, phase III, and phase IV.

Phase III segment generated the highest revenue in 2023. The market players’ increased initiative to outsource their R&D activities is responsible for the segment’s dominance in the market.

Furthermore, the phase II segment is expected to grow at the fastest CAGR over the forecast period. The segment's growth is attributed to the increasing prevalence of chronic diseases and increasing investment by pharmaceutical companies in the R&D of novel treatments.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Limited Presence for Effective Treatment of Cancer has been Fueling the Segment’s Growth

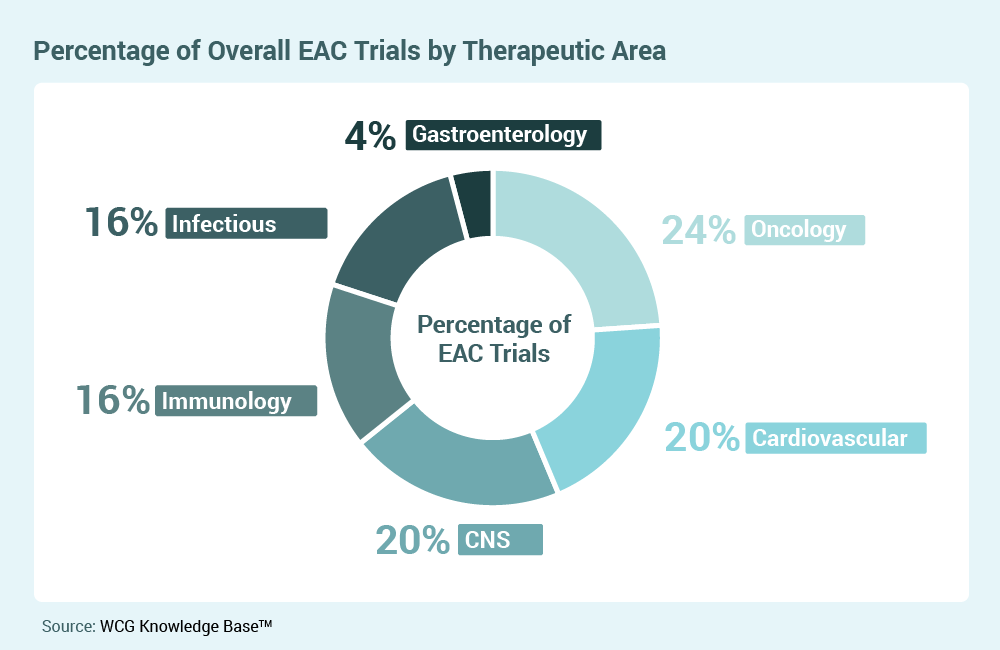

Based on application, the market is segmented into renal/nephrology, cardiology, metabolic disorder, infectious disease, CNS disorder, oncology, and others.

The oncology segment dominated the market by generating the highest revenue in 2023. The segment's growth is due to the growing demand for effective cancer treatment therapies and the rising number of drug approvals for cancer treatment.

- For instance, in 2020, Pralsetinib (Gavreto) received FDA approval. It is indicated for adult and pediatric patients aged 12 or older suffering from advanced or metastatic RET-mutant medullary thyroid cancer, which requires systemic therapy or RET fusion.

Furthermore, CNS disorder is expected to grow at a significant CAGR during the forecast period. The increase in the prevalence of CNS disorders is expected to accelerate the segment's growth. For instance, in 2019, neurological conditions accounted for 47.39 per 100,000 among the American population.

Moreover, the metabolic disorder segment is expected to grow substantially during the forecast period. This is due to the rise in prevalence of chronic diseases, such as diabetes, globally. For instance, according to a published article in 2020 by OECD-iLibrary, in Asia Pacific, around 227 million people are living with type 2 diabetes; half of them are undiagnosed, and thus could develop long-term complications. These factors are propelling CRO services for the metabolic disorder segment.

REGIONAL INSIGHTS

North America Clinical Trials Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Request a Free sample

North America accounted for a major clinical trials market share, generating a revenue of USD 27.65 billion in 2023. Pharmaceutical companies have increased their spending on R&D to improve their drug development. This has been fueling the market growth during the forecast period in the region.

- For instance, as per the Pharmaceutical Research and Manufacturers of America (PhRMA) trade group, in 2021, PhRMA's member companies' Research & Development (R&D) expenditure reached around USD 102.3 billion worldwide.

The market in Europe accounted for a substantial market share in 2021 and is expected to witness stagnant growth during the forecast period. The market growth in the region is attributed to increased R&D expenditure by leading pharmaceutical, biotechnology, and MedTech companies.

- For instance, in 2020, Roche Diagnostics spent around USD 11.30 billion on R&D.

Moreover, the market across the Asia Pacific region is expected to expand at the fastest CAGR during the forecast. The increasing prevalence of infectious and chronic diseases across Asia Pacific is expected to propel the demand for new drugs, thereby increasing the overall market in Asia Pacific.

- For instance, as per the data published in December 2023, around 35.0% of the Indian population is suffering from chronic illnesses, including diabetes and cardiac-related disorders.

List of Key Companies in Clinical Trials Market

Pharmaceutical Companies with a Strong Focus on the Expansion of Product Portfolios to Hold Key Market Share

IQVIA, Laboratory Corporation of America Holdings, and Pfizer, Inc. are among the prominent players in the market and captured a considerable global market share in 2023.

IQVIA and Laboratory Corporation of America Holdings accounted for significant market share in 2023. This is due to their strong emphasis on R&D to introduce solutions and to upskill their offerings.

- For instance, in November 2021, IQVIA announced its data aggregation strategy as a foundation to improve market insights. This helped the company to connect the right data and services to help patients. This increased the efficacy of the company’s services.

Similarly, Pfizer, Inc. held a considerable share of the market in 2023. This was due to the company’s strong brand presence with a strong pipeline of products. Moreover, the company strongly focuses on developing advanced and highly efficient therapeutics for chronic disease treatment.

Other significant players operating in the market, such as Icon PLC, Syneos Health, and Pharmaceutical Product Development, LLC (Thermo Fisher Scientific), emphasize various strategic developments such as service expansion, partnerships, and collaborations.

LIST OF KEY COMPANIES PROFILED:

- IQVIA Inc. (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- Thermo Fisher Scientific Inc . (U.S.)

- Parexel International Corporation (U.S.)

- Medpace Holdings, Inc. (U.S.)

- Icon plc (Ireland)

- Syneos Health (U.S.)

- WuXi AppTec (China)

- Charles River Laboratories (U.S.)

- Pfizer Inc . (U.S.)

- Lilly (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Thermo Fisher Scientific Inc. introduced CorEvidence, a cloud-based optimizing pharmacovigilance case processing and safety data management processes.

- December 2021 – Thermo Fisher Scientific Inc. announced the completion of the acquisition of Pharmaceutical Product Development, LLC. This acquisition expanded the key services and offerings provided by the company.

- December 2021 – Laboratory Corporation of America Holdings acquired Toxikon Corporation. This acquisition fueled the company’s strong non-clinical development portfolio.

- November 2021 – Icon plc announced the expansion of its Accellacare Site Network in reach and capabilities through new partnerships with six research sites across four countries.

- October 2021 - Parexel International Corporation and Kyoto University Hospital formed a strategic partnership to expand clinical research opportunities.

- July 2021 – Icon plc announced the acquisition of PRA Health Sciences, creating the world’s most advanced healthcare intelligence and clinical research organization.

REPORT COVERAGE

The research report provides a detailed competitive landscape. It includes the number of clinical trials and key industry developments such as partnerships, mergers, and acquisitions. Additionally, it focuses on key points such as new product launches in the market. Furthermore, the report covers regional analysis of different segments, company profiles of key players, and market trends. The report consists of quantitative and qualitative insights that contribute to the market growth.

To gain extensive insights into the market, Request for Customization

Report Scope & Segmentation

Frequently asked questions.

Fortune Business Insights says that the global market stood at USD 57.76 billion in 2023 and is projected to reach USD 106.78 billion by 2032.

The market is expected to exhibit a CAGR of 7.1% during the forecast period (2024-2032).

The phase III segment is set to lead the market by phase.

The key factors driving the market are increasing prevalence of chronic diseases and rising number of clinical trials.

IQVIA, Laboratory Corporation of America Holdings, and Pfizer, Inc. are the top players in the market.

Seeking Comprehensive Intelligence on Different Markets? Get in Touch with Our Experts

- STUDY PERIOD: 2019-2032

- BASE YEAR: 2023

- HISTORICAL DATA: 2019-2022

- NO OF PAGES: 151

Personalize this Research

- Granular Research on Specified Regions or Segments

- Companies Profiled based on User Requirement

- Broader Insights Pertaining to a Specific Segment or Region

- Breaking Down Competitive Landscape as per Your Requirement

- Other Specific Requirement on Customization

Healthcare Clients

Related Reports

- Contract Research Organization (CRO) Services Market

- Europe CRO Services Market

- ASEAN Contract Development and Manufacturing Organization (CDMO) Market

- Preclinical CRO Market

Client Testimonials

“We are quite happy with the methodology you outlined. We really appreciate the time your team has spent on this project, and the efforts of your team to answer our questions.”

“Thanks a million. The report looks great!”

“Thanks for the excellent report and the insights regarding the lactose market.”

“I liked the report; would it be possible to send me the PPT version as I want to use a few slides in an internal presentation that I am preparing.”

“This report is really well done and we really appreciate it! Again, I may have questions as we dig in deeper. Thanks again for some really good work.”

“Kudos to your team. Thank you very much for your support and agility to answer our questions.”

“We appreciate you and your team taking out time to share the report and data file with us, and we are grateful for the flexibility provided to modify the document as per request. This does help us in our business decision making. We would be pleased to work with you again, and hope to continue our business relationship long into the future.”

“I want to first congratulate you on the great work done on the Medical Platforms project. Thank you so much for all your efforts.”

“Thank you very much. I really appreciate the work your team has done. I feel very comfortable recommending your services to some of the other startups that I’m working with, and will likely establish a good long partnership with you.”

“We received the below report on the U.S. market from you. We were very satisfied with the report.”

“I just finished my first pass-through of the report. Great work! Thank you!”

“Thanks again for the great work on our last partnership. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U.S.”

“We feel positive about the results. Based on the presented results, we will do strategic review of this new information and might commission a detailed study on some of the modules included in the report after end of the year. Overall we are very satisfied and please pass on the praise to the team. Thank you for the co-operation!”

“Thank you very much for the very good report. I have another requirement on cutting tools, paper crafts and decorative items.”

“We are happy with the professionalism of your in-house research team as well as the quality of your research reports. Looking forward to work together on similar projects”

“We appreciate the teamwork and efficiency for such an exhaustive and comprehensive report. The data offered to us was exactly what we were looking for. Thank you!”

“I recommend Fortune Business Insights for their honesty and flexibility. Not only that they were very responsive and dealt with all my questions very quickly but they also responded honestly and flexibly to the detailed requests from us in preparing the research report. We value them as a research company worthy of building long-term relationships.”

“Well done Fortune Business Insights! The report covered all the points and was very detailed. Looking forward to work together in the future”

“It has been a delightful experience working with you guys. Thank you Fortune Business Insights for your efforts and prompt response”

“I had a great experience working with Fortune Business Insights. The report was very accurate and as per my requirements. Very satisfied with the overall report as it has helped me to build strategies for my business”

“This is regarding the recent report I bought from Fortune Business insights. Remarkable job and great efforts by your research team. I would also like to thank the back end team for offering a continuous support and stitching together a report that is so comprehensive and exhaustive”

“Please pass on our sincere thanks to the whole team at Fortune Business Insights. This is a very good piece of work and will be very helpful to us going forward. We know where we will be getting business intelligence from in the future.”

“Thank you for sending the market report and data. It looks quite comprehensive and the data is exactly what I was looking for. I appreciate the timeliness and responsiveness of you and your team.”

Get in Touch with Us

+1 424 253 0390 (US)

+44 2071 939123 (UK)

+91 744 740 1245 (APAC)

[email protected]

- Request Sample

Sharing this report over the email

The global clinical trials market size is projected to grow from $61.58 billion in 2024 to $106.78 billion by 2032, at a CAGR of 7.1% during the forecast period

Read More at:-

- Healthcare and Pharmaceuticals

- Healthcare Equipment and Services

Clinical Trials Market

Global Clinical Trials Market to Grow at a CAGR of 5.4% in the Forecast Period, Aided by the Increasing Focus on Therapeutic Drugs Generation

Global Clinical Trials Market Size, Share, Trends, Forecast: By Design: Treatment Studies, Observational Studies; By Phase; By Service Type: Site Identification, Patient Recruitment, Laboratory Services, Analytical Testing Services, Others; By Therapy Area; By Application; Regional Analysis; Patent Analysis; Supplier Landscape; 2024-2032

- Report Summary

- Table of Contents

- Pricing Detail

- Request Sample

Global Clinical Trials Market Outlook

The clinical trials market size attained a value of USD 49.22 billion in 2023. The market is anticipated to grow at a CAGR of 5.4% during the forecast period of 2024-2032 to attain a value of nearly USD 79.02 billion by 2032.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Increasing Demand for Oncology to Augment the Clinical Trials Industry Growth

Oncology clinical trials are more complex than other therapeutic disciplines since they require advanced treatments for specific malignancies. An oncology trial looks not only into the efficacy and safety of an antibiotic against infection, but also how it can improve the subject's quality of life. Because cancer research is growing at a quick rate, immunotherapy has shifted away from chemotherapy procedures and toward molecularly targeted medicines. The evolution of oncology clinical trials has seen rapid development in available clinical data, as well as a strong and rising pipeline of therapeutic candidates.

North America to Provide Significant Growth Opportunities to the Clinical Trial Industry

Geographically, North America accounts for a dominant share in the industry owing to large investment for outsourcing the big R&D companies. This is mainly due to the major demand for investments in drug development. Due to the rising COVID-19 cases, many big R&D firms have collaborated with government and non-government organisations to manufacture therapeutic drug injections. The United States is one of the largest global manufacturers of clinical trials as they are investing more in R&D development. Meanwhile, the Asia Pacific is expected to witness a robust growth in the forecast period due to the increasing focus of manufacturers to produce vaccines to decrease death risk due to the COVID-19 pandemic.

Clinical Trials: Market Segmentation

Clinical trials are research studies that are used to assess the effectiveness of a medicinal, surgical, or behavioural intervention. They are the primary method by which scientists determine whether a new treatment, such as a new medicine, diet, or medical instrument, is safe and effective in humans. A clinical trial is frequently performed to determine whether a new medication is more effective and has fewer negative side effects.

By design, the market is divided into:

- Randomised Control Trial

- Adaptive Clinical Trail

- Non- Randomised Control Trial

- Cohort Studies

- Case Control Study

- Cross Section Study

- Ecological Study

The regional markets for clinical trials include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Increasing Focus on Therapeutic Drugs Generation to Bolster the Growth of Clinical Trials Industry

The global clinical trial industry is being driven by the increasing demand for the production of therapeutic drugs across the globe. Due to the COVID-19 pandemic, significant changes in the clinical trials industry has shifted the central point of many research and commercial companies to give attention on the development of new therapeutic drugs and vaccines for COVID-19. The industry is also predicted to develop as a result of government initiatives in emerging nations to promote medication discovery and constant technical advances. Over the forecast period, it can be expected that Phase III will grow and become significant as it is one of the most important stages in determining whether or not a new intervention is effective and useful for clinical purposes.

Key Industry Players in the Global Clinical Trials Market

The report presents a detailed analysis of the following key players in the global clinical trials market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

- Parexel International Corporation

- Charles River laboratory

- Syneos Health

The comprehensive report looks into the macro and micro aspects of the industry. The EMR report gives an in-depth insight into the market by providing a SWOT analysis as well as an analysis of Porter’s Five Forces model.

Key Highlights of the Report

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface 1.1 Objectives of the Study 1.2 Key Assumptions 1.3 Report Coverage – Key Segmentation and Scope 1.4 Research Methodology 2 Executive Summary 3 Global Clinical Trial Market Overview 3.1 Global Clinical Trial Market Historical Value (2017-2023) 3.2 Global Clinical Trial Market Forecast Value (2024-2032) 4 Global Clinical Trial Market Landscape 4.1 Global Clinical Trial Developers Landscape 4.1.1 Analysis by Year of Establishment 4.1.2 Analysis by Company Size 4.1.3 Analysis by Region 4.2 Global Clinical Trial Product Landscape 4.2.1 Analysis by Service Type 4.2.2 Analysis by Design 4.2.3 Analysis by Therapy Area 5 Global Clinical Trial Market Dynamics 5.1 Market Drivers and Constraints 5.2 SWOT Analysis 5.3 Porter’s Five Forces Model 5.4 Key Demand Indicators 5.5 Key Price Indicators 5.6 Industry Events, Initiatives, and Trends 5.7 Value Chain Analysis 6 Global Clinical Trial Market Segmentation 6.1 Global Clinical Trial Market by Design 6.1.1 Market Overview 6.1.2 Treatment Studies 6.1.2.1 Randomised Control Trial 6.1.2.2 Adaptive Clinical Trail 6.1.2.3 Non- Randomised Control Trial 6.1.3 Observational Studies 6.1.3.1 Cohort Studies 6.1.3.2 Case Control Studies 6.1.3.3 Cross Section Study 6.1.3.4 Ecological Study 6.1.3.5 Others 6.2 Global Clinical Trial Market by Phase 6.2.1 Market Overview 6.2.2 Phase I 6.2.3 Phase II 6.2.4 Phase III 6.2.5 Phase IV 6.3 Global Clinical Trial Market by Service Type 6.3.1 Market Overview 6.3.2 Site Identification 6.3.3 Patient Recruitment 6.3.4 Laboratory Services 6.3.5 Analytical Testing Services 6.3.6 Bio-Analytical Testing Services 6.3.6.1 Cell Based Assay 6.3.6.2 Virology Testing 6.3.6.3 PK/PD Testing Services 6.3.6.4 Method Development, Optimization, Validation 6.3.6.5 Serology, Immunogenicity & Neutralizing Antibodies 6.3.6.6 Bio Marker Testing Service 6.3.6.7 Other Bioanalytical Testing Services 6.3.7 Clinical Trial Data Management Services 6.3.8 Clinical Trial Supply and Logistic Services 6.3.9 Medical Device Testing Services 6.3.10 Other Clinical Trial Services 6.4 Global Clinical Trial Market by Therapy Area 6.4.1 Market Overview 6.4.2 Oncology 6.4.3 Infectious Disease 6.4.4 Neurology 6.4.5 Immunology 6.4.6 Cardiology 6.4.7 Genetic Disease 6.4.8 Women’s Health 6.4.9 Other Therapy Areas 6.5 Global Clinical Trial Market by Application 6.5.1 Market Overview 6.5.2 Small Molecule 6.5.3 Vaccine 6.5.4 Cell & Gene Therapy 6.5.5 Other Applications 6.6 Global Clinical Trial Market by Region 6.6.1 Market Overview 6.6.2 North America 6.6.3 Europe 6.6.4 Asia Pacific 6.6.5 Latin America 6.6.6 Middle East and Africa 7 North America Clinical Trial Market 7.1 Market Share by Country 7.2 United States of America 7.3 Canada 8 Europe Clinical Trial Market 8.1 Market Share by Country 8.2 United Kingdom 8.3 Germany 8.4 France 8.5 Italy 8.6 Others 9 Asia Pacific Clinical Trial Market 9.1 Market Share by Country 9.2 China 9.3 Japan 9.4 India 9.5 ASEAN 9.6 Australia 9.7 Others 10 Latin America Clinical Trial Market 10.1 Market Share by Country 10.2 Brazil 10.3 Argentina 10.4 Mexico 10.5 Others 11 Middle East and Africa Clinical Trial Market 11.1 Market Share by Country 11.2 Saudi Arabia 11.3 United Arab Emirates 11.4 Nigeria 11.5 South Africa 11.6 Others 12 Patent Analysis 12.1 Analysis by Type of Patent 12.2 Analysis by Publication year 12.3 Analysis by Issuing Authority 12.4 Analysis by Patent Age 12.5 Analysis by CPC Analysis 12.6 Analysis by Patent Valuation 12.7 Analysis by Key Players 13 Grants Analysis 13.1 Analysis by year 13.2 Analysis by Amount Awarded 13.3 Analysis by Issuing Authority 13.4 Analysis by Grant Application 13.5 Analysis by Funding Institute 13.6 Analysis by NIH Departments 13.7 Analysis by Recipient Organization 14 Funding Analysis 14.1 Analysis by Funding Instances 14.2 Analysis by Type of Funding 14.3 Analysis by Funding Amount 14.4 Analysis by Leading Players 14.5 Analysis by Leading Investors 14.6 Analysis by Geography 15 Partnership and Collaborations Analysis 15.1 Analysis by Partnership Instances 15.2 Analysis by Type of Partnership 15.3 Analysis by Leading Players 15.4 Analysis by Geography 16 Regulatory Framework 16.1 Regulatory Overview 16.1.1 US FDA 16.1.2 EU EMA 16.1.3 INDIA CDSCO 16.1.4 JAPAN PMDA 16.1.5 Others 17 Supplier Landscape 17.1 IQVIA 17.1.1 Financial Analysis 17.1.2 Service Portfolio 17.1.3 Demographic Reach and Achievements 17.1.4 Mergers and Acquisitions 17.1.5 Certifications 17.2 PAREXEL International Corporation 17.2.1 Financial Analysis 17.2.2 Service Portfolio 17.2.3 Demographic Reach and Achievements 17.2.4 Mergers and Acquisitions 17.2.5 Certifications 17.3 Charles River Laboratory 17.3.1 Financial Analysis 17.3.2 Service Portfolio 17.3.3 Demographic Reach and Achievements 17.3.4 Mergers and Acquisitions 17.3.5 Certifications 17.4 ICON Plc 17.4.1 Financial Analysis 17.4.2 Service Portfolio 17.4.3 Demographic Reach and Achievements 17.4.4 Mergers and Acquisitions 17.4.5 Certifications 17.5 Syneos Health 17.5.1 Financial Analysis 17.5.2 Service Portfolio 17.5.3 Demographic Reach and Achievements 17.5.4 Mergers and Acquisitions 17.5.5 Certifications 17.6 Labcorp Drug Development (COVANCE) 17.6.1 Financial Analysis 17.6.2 Service Portfolio 17.6.3 Demographic Reach and Achievements 17.6.4 Mergers and Acquisitions 17.6.5 Certifications 17.7 Wuxi Apptec 17.7.1 Financial Analysis 17.7.2 Service Portfolio 17.7.3 Demographic Reach and Achievements 17.7.4 Mergers and Acquisitions 17.7.5 Certifications 17.8 Charles River Laboratories 17.8.1 Financial Analysis 17.8.2 Service Portfolio 17.8.3 Demographic Reach and Achievements 17.8.4 Mergers and Acquisitions 17.8.5 Certifications 17.9 PPD Inc 17.9.1 Financial Analysis 17.9.2 Service Portfolio 17.9.3 Demographic Reach and Achievements 17.9.4 Mergers and Acquisitions 17.9.5 Certifications 17.10 ICON Plc 17.10.1 Financial Analysis 17.10.2 Service Portfolio 17.10.3 Demographic Reach and Achievements 17.10.4 Mergers and Acquisitions 17.10.5 Certifications 17.11 Medpace Holdings Inc 17.11.1 Financial Analysis 17.11.2 Service Portfolio 17.11.3 Demographic Reach and Achievements 17.11.4 Mergers and Acquisitions 17.11.5 Certifications 17.12 Acm Global Laboratories 17.12.1 Financial Analysis 17.12.2 Service Portfolio 17.12.3 Demographic Reach and Achievements 17.12.4 Mergers and Acquisitions 17.12.5 Certifications 17.13 Advanced Clinical 17.13.1 Financial Analysis 17.13.2 Service Portfolio 17.13.3 Demographic Reach and Achievements 17.13.4 Mergers and Acquisitions 17.13.5 Certifications 17.14 SGS 17.14.1 Financial Analysis 17.14.2 Service Portfolio 17.14.3 Demographic Reach and Achievements 17.14.4 Mergers and Acquisitions 17.14.5 Certifications 17.15 PSI CRO AG 17.15.1 Financial Analysis 17.15.2 Service Portfolio 17.15.3 Demographic Reach and Achievements 17.15.4 Mergers and Acquisitions 17.15.5 Certifications 17.16 Bio Agile Therapeutics 17.16.1 Financial Analysis 17.16.2 Service Portfolio 17.16.3 Demographic Reach and Achievements 17.16.4 Mergers and Acquisitions 17.16.5 Certifications 18 Global Clinical Trial Market- Distribution Model (Additional Insight) 18.1 Overview 18.2 Potential Distributors 18.3 Key Parameters for Distribution Partner Assessment 19 Key Opinion Leaders (KOL) Insights (Additional Insight) 20 Company Competitiveness Analysis (Additional Insight) 20.1 Very Small Companies 20.2 Small Companies 20.3 Mid-Sized Companies 20.4 Large Companies 20.5 Very Large Companies 21 Payment Methods (Additional Insight) 21.1 Government Funded 21.2 Private Insurance 21.3 Out-of-Pocket

*Additional insights provided are customisable as per client requirements.

What was the clinical trial market size in 2023?

The global clinical trial Market was valued at USD 49.22 billion in 2023.

What is the forecast outlook for the clinical trial market?

The market is expected to grow at a CAGR of 5.4% from 2024 to 2032 to reach a value of USD 79.02 billion by 2032.

What are the major industry drivers?

The industry is primarily being driven by the growing rates of R&D projects for the development of therapeutic drugs, development in technologies, increasing focus of manufacturers to produce vaccines to decrease death risk due to the COVID-19 pandemic, and increasing cancer research.

What are the key industry trends of the global clinical trials market?

The key trends driving the market’s expansion are the increasing demand for the production of therapeutic drugs and increasing government initiatives.

What are the major regional markets of the global clinical trials market, according to the EMR report?

The major regions in the industry are North America, Latin America, Europe, Middle East and Africa, and the Asia Pacific with North America accounting for the largest share in the market.

What are the segments based on design in the market?

By design, the market is divided into treatment studies and observational studies. Treatment studies are further divided into randomised control trial, adaptive clinical trail and non- andomized control trial while observational studies are segmented into cohort studies, case control study, cross section study, and ecological study, among others.

Who are the key industry players, according to the report?

The major players in the industry are IQVIA, PAREXEL International Corporation, Charles River Laboratory, ICON Plc, and Syneos Health, among others.

Purchase Options 10% off

Methodology

Request Customisation

Report Sample

Request Brochure

Ask an Analyst

( USA & Canada ) +1-415-325-5166 [email protected]

( United Kingdom ) +44-702-402-5790 [email protected]

Mini Report

- Selected Sections, One User

- Printing Not Allowed

- Email Delivery in PDF

- Free Limited Customisation

- Post Sales Analyst Support

- 50% Discount on Next Update

Single User License

- All Sections, One User

- One Print Allowed

Five User License

- All Sections, Five Users

- Five Prints Allowed

Corporate License

- All Sections, Unlimited Users

- Unlimited Prints Allowed

- Email Delivery in PDF + Excel

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.

Stay informed with our free industry updates.

We use cookies, just to track visits to our website, we store no personal details. Privacy Policy X

Press Release

Industry Statistics

- Our Solution

- Food & Beverage

- Chemical & Materials

- Semiconductors and Electronics

- Materials & packaging

- Agriculture & Animal Feed

- Industrial Automation

- OIL, GAS & ENERGY

- Cloud Solutions

- Procurement Consulting

- Company Profile Analysis

- Primary Research

- DBMR Market Position Grid

- Bulk Report

- Industry Subscription

- Annual Update

- Quarterly Update

- Pharma Insights

- Market Insights

- Press Release

- Infographics

- White Paper

- Case Studies

- Business Case Studies

- COVID-19 Resources

- Our Company

- Company News Room

- Investor Relations

- US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975

- Database Cloud Login

Global Clinical Trials Market – Industry Trends and Forecast to 2030

- Medical Devices

- Upcoming Report

- No of Tables: 60

- No of Figures: 220

- Report Description

- Table of Content

- List of Table

- List of Figure

- Request for TOC

- Speak to Analyst

- Inquire Before Buying

- Free Sample Report

Market Size in USD Billion

CAGR : 5.15 %

Global Clinical Trials Market, By Phase (Phase I, Phase II, Phase III, Phase IV), Indication (Autoimmune/Inflammation, Pain Management, Oncology, CNS Condition, Diabetes, Obesity, Cardiovascular, Others), Design (Interventional, Treatment Studies, Observational Studies, Expanded Access), End User (Hospital, Laboratories, Clinics) – Industry Trends and Forecast to 2030.

Clinical Trials Market Analysis and Size

The growing demand for clinical trial in developing countries, growing geriatric population, globalization of clinical trials, technological evolution are the significant factors responsible for driving the growth of the clinical trials market. The leveraging online resources to increase patient recruitment rates in clinical trials is also projected to boost the market’s growth. In addition, the increasing occurrences of chronic diseases coupled with globalizing drug development activities also heighten the overall growth of the market.

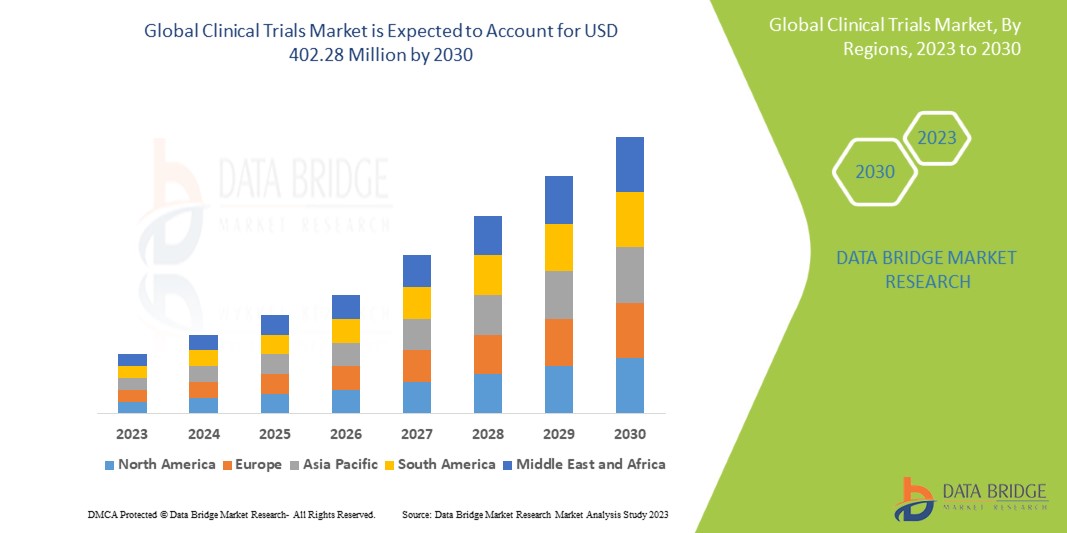

Data Bridge Market Research analyzes that the global clinical trials market which was USD 269.18 million in 2022, is likely to reach USD 402.28 million by 2030, and is expected to undergo a CAGR of 5.15% during the forecast period. “Laboratories" dominates the end segment of the clinical trials market due to increase in the number of research and development activities. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

Market Definition

Clinical trials are basically the research studies performed by researchers in people that are aimed to find out a new treatment, like a new drug or diet or medical device . It is also used to find out whether it is safe and effective in people.

Clinical Trials Market Dynamics

- Advancements in medical research

Increasing focus on developing novel therapies and treatments for various diseases drives the demand for clinical trials. Advances in genomics and personalized medicine also contribute to the growth.

- Rising prevalence of diseases

The growing incidence of chronic diseases like cancer, diabetes, and cardiovascular disorders necessitates extensive clinical trials for innovative drugs and therapies.

- Technological advancements

Integration of technologies like big data analytics, AI, and IoT in clinical trials streamlines processes, enhances data accuracy, and reduces costs, thereby driving market growth.

Opportunities

- Real-world evidence (RWE) studies

The integration of real-world data into clinical trials provides valuable insights into drug effectiveness and safety, opening avenues for more pragmatic and efficient trials

- Patient-centric trials

Emphasizing patient experience and convenience through methods like virtual trials and home healthcare services can enhance participation rates and data accuracy.

Restraints/Challenges

- Stringent regulatory procedures

Complex regulatory processes and the need for compliance with diverse guidelines in different countries pose challenges for sponsors, leading to delays and increased costs.

- Data security and privacy concerns

With the rise in digitalization, ensuring the security and privacy of patient data in clinical trials is a significant challenge. Adhering to data protection regulations adds complexity.

- Patient recruitment and retention

Identifying suitable participants and retaining them throughout the trial period is challenging. This affects the timeline and success of the trials.

This clinical trials market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the clinical trials market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Clinical Trials Market Scope

Clinical trails market is segmented on the basis of phase, indication, design, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries, and provide the users with valuable market overview and market insights to help them in making strategic decisions for identification of core market applications.

- Autoimmune/inflammation

- Pain management

- Cns condition

- Cardiovascular

- Interventional

- Treatment studies

- Observational studies

- Expanded access

- Laboratories

Clinical Trials Market Regional Analysis/Insights

Clinical trials market is analyzed and market size insights and trends are provided by country, phase, indication, design and end user as referenced above.

The countries covered in the clinical trials market report is U.S., Canada, Mexico, Germany, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Saudi Arabia, U.A.E, Egypt, Israel, rest of Middle East & Africa.

North America is expected to dominate the market due to increasing research and development and increasing adoption of new technologies in clinical research.

Asia-Pacific is expected to show fastest growth during the forecast period of 2023 to 2030 due to expected to show a rapid and lucrative growth rate in the forecast period owing to the increasing availability of large patient pool facilitating easy recruitment of candidates.

The country section of the report also provides individual market impacting factors and domestic regulation changes that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The clinical trials market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for clinical trials market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on clinical trials market. The data is available for historic period 2010-2020.

Competitive Landscape and Clinical Trials Market Share Analysis

The clinical trials market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to clinical trials market.

Some of the major players operating in the global clinical trials market are:

- Clinipace (U.S.)

- Laboratory Corporation of America Holdings (LabCorp) (U.S.)

- Eli Lilly and Company (U.S.)

- ICON Plc. (Ireland)

- Novo Nordisk A/S (Denmark)

- Parexel International Corporation (U.S.)

- Pfizer Inc. (U.S.)

- PPD, Inc. (U.S.)

- IQVIA (U.S.)

- Sanofi (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Alcami Corporation, Inc. (U.S.)

- Accell Clinical Research LLC (U.S.)

- Congenix LLP (U.S.)

- Labcorp Drug Development (U.S.)

- Ecron Acunova (India)

- Medpace (U.S.)

- LUMITOS AG (Germany)

- ICON plc (Ireland)

- SIRO Clapham Private Limited (India)

Please fill in the below form for detailed Table of Content

By clicking the "Submit" button, you are agreeing to the Data Bridge Market Research Privacy Policy and Terms and Conditions

Please fill in the below form for detailed List of Table

Please fill in the below form for detailed list of figure, please fill in the below form for infographics, research methodology:.