- Search Search Please fill out this field.

What Is an Annual Report?

Understanding annual reports, special considerations, mutual fund annual reports, the bottom line.

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Annual Report Explained: How to Read and Write Them

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

An annual report is a document that public corporations must provide annually to shareholders that describes their operations and financial conditions. The front part of the report often contains an impressive combination of graphics, photos, and an accompanying narrative, all of which chronicle the company's activities over the past year and may also make forecasts about the future of the company. The back part of the report contains detailed financial and operational information.

Key Takeaways

- An annual report is a corporate document disseminated to shareholders that spells out the company's financial condition and operations over the previous year.

- It was not until legislation was enacted after the stock market crash of 1929 that the annual report became a regular component of corporate financial reporting.

- Registered mutual funds must also distribute a full annual report to their shareholders each year.

Investopedia / Jake Shi

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929 when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year. The report is typically issued to shareholders and other stakeholders who use it to evaluate the firm's financial performance and to make investment decisions.

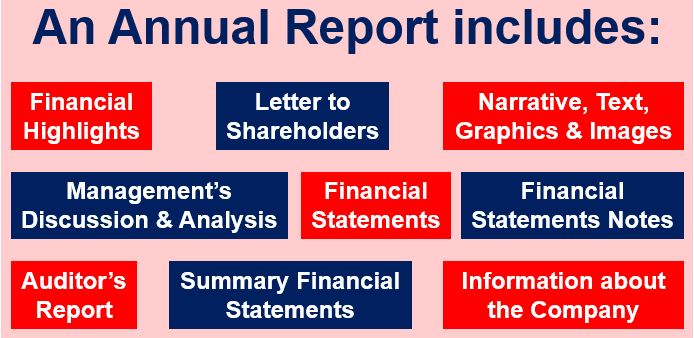

Typically, an annual report will contain the following sections:

- General corporate information

- Operating and financial highlights

- Letter to the shareholders from the CEO

- Narrative text, graphics, and photos

- Management's discussion and analysis (MD&A)

- Financial statements, including the balance sheet, income statement, and cash flow statement

- Notes to the financial statements

- Auditor's report

- Summary of financial data

- Accounting policies

Current and prospective investors, employees, creditors, analysts, and any other interested party will analyze a company using its annual report.

In the U.S., a more detailed version of the annual report is referred to as Form 10-K and is submitted to the U.S. Securities and Exchange Commission (SEC). Companies may submit their annual reports electronically through the SEC's EDGAR database . Reporting companies must send annual reports to their shareholders when they hold annual meetings to elect directors. Under the proxy rules, reporting companies are required to post their proxy materials, including their annual reports, on their company websites.

The annual report contains key information on a company's financial position that can be used to measure:

- A company's ability to pay its debts as they come due

- Whether a company made a profit or loss in its previous fiscal year

- A company's growth over a number of years

- How much of earnings are retained by a company to grow its operations

- The proportion of operational expenses to revenue generated

The annual report also determines whether the information conforms to the generally accepted accounting principles (GAAP). This confirmation will be highlighted as an " unqualified opinion " in the auditor's report section.

Fundamental analysts also attempt to understand a company's future direction by analyzing the details provided in its annual report.

In the case of mutual funds, the annual report is a required document that is made available to a fund's shareholders on a fiscal-year basis. It discloses certain aspects of a mutual fund's operations and financial condition. In contrast to corporate annual reports, mutual fund annual reports are best described as "plain vanilla" in terms of their presentation.

A mutual fund annual report, along with a fund's prospectus and statement of additional information, is a source of multi-year fund data and performance, which is made available to fund shareholders as well as to prospective fund investors. Unfortunately, most of the information is quantitative rather than qualitative, which addresses the mandatory accounting disclosures required of mutual funds.

All mutual funds that are registered with the SEC are required to send a full report to all shareholders every year. The report shows how well the fund fared over the fiscal year. Information that can be found in the annual report includes:

- Table, chart, or graph of holdings by category (e.g., type of security, industry sector, geographic region, credit quality, or maturity)

- Audited financial statements, including a complete or summary (top 50) list of holdings

- Condensed financial statements

- Table showing the fund’s returns for one-, five- and 10-year periods

- Management’s discussion of fund performance

- Management information about directors and officers, such as name, age, and tenure

- Remuneration or compensation paid to directors, officers, and others

How Do You Write an Annual Report?

An annual report has a few sections and steps that must convey a certain amount of information, much of which is legally required for public companies. Most public companies hire auditing companies to write their annual reports. An annual report begins with a letter to the shareholders, then a brief description of the business and industry. Following that, the report should include the audited financial statements: balance sheet, income statement, and statement of cash flows. The last part will typically be notes to the financial statements, explaining certain facts and figures.

Is an Annual Report the Same As a 10-K Filing?

In general, an annual report is similar to the 10-K filing in that both report on the company's performance for the year. Both are considered to be the last financial filing of the year and summarize how the company did for that period. Annual reports are much more visually friendly. They are designed well and contain images and graphics. The 10-K filing only reports numbers and other qualitative information without any design elements or additional flair.

What Is a 10-Q Filing?

A 10-Q filing is a form that is filed with the Securities and Exchange Commission (SEC) that reports the quarterly earnings of a company. Most public companies have to file a 10-Q with the SEC to report their financial position for the quarter.

Public companies must produce annual reports to show their current financial conditions and operations. Annual reports can be used to examine a company's financial position and, possibly, understand what direction it will move in the future. These reports function differently for mutual funds; in this case, they are made available each fiscal year and are typically simpler.

U.S. Securities and Exchange Commission. " Speech By SEC Commissioner: Remarks Before the Securities Traders Association ."

U.S. Securities and Exchange Commission. " Annual Report ."

U.S. Securities and Exchange Commission. " How to Read a 10-K/10-Q ."

U.S. Securities and Exchange Commission. " Final Rule: Shareholder Reports and Quarterly Portfolio Disclosure of Registered Management Investment Companies ."

U.S. Securities and Exchange Commission. " Mutual Funds - The Next 75 Years ."

:max_bytes(150000):strip_icc():format(webp)/10-K--f7185a10d5d342c68235646bd3ceefcd.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to write an annual report: 4 tips for getting started.

Connecting with shareholders, investors , and the public is key to growing your small business. Your annual report communicates the strength of your business, so your current shareholders can feel confident knowing how your business operates. It’s also a chance to build new relationships with investors and clients by showcasing your management, financial performance, company mission, and goals.

Learning to write strong annual reports is important for delivering required year-end documents, but it can also help you forge personal connections. Explore the essential components of the annual report, as well as strategies for adding a creative touch that sets your business apart.

Key Takeaways

- An annual report communicates your business affairs to stakeholders and the public

- It typically includes mission goals, financial position, structure, and strategies

- Depending on the size of your business, you may be legally required to provide an annual report

- A good annual report can also be used as a marketing tool

- Aim to create an annual report that’s clear, honest, and engaging

What this article covers:

What Is an Annual Report?

What to include in an annual report, how do you write a good annual report, why is an annual report important.

- Frequently Asked Questions

To write an annual report, the business operations and the financial position are listed, summarized, and recorded. The annual report is a financial document businesses provide to shareholders, potential investors, and analysts. It is the best source of information about the business performance and financial well-being of a business.

Publicly traded companies are required to file annual reports to the Securities and Exchange Commission. However, small businesses and non-profit organizations also prepare yearly reports to connect with customers and provide information about yearly operations, past performance, and future goals.

The annual report is an integral part of corporate reporting. Since the annual reports are based on specific legal requirements , the items included in the report vary.

Most annual reports provide a fundamental overview of the business over the past year. The sections typically included in an annual report are an opening letter from the chairman, a business profile, an analysis by management, and financial data.

Chairman’s Letter

Annual reports usually start with an introduction and a letter from the company’s chairman, primary owner, or CEO to the shareholders providing a snapshot of the significant developments in the past financial year, company initiatives, and a brief summary of the financials. Key elements included in this section are the challenges that the business faced, its successes, and insight into the growth of the company.

A table of contents follows the section.

Business Profile

This section includes the vision and mission statement of the company, details of directors, officers, and registered and corporate office, investor profile, the products or services that are the main source of revenue for the business, competitor profile, and risk factors of the business.

Management Discussion and Analysis

The section provides an overview of the business performance over the past three years and discusses profit margins, sales, and income

If the business has launched a new product or service or there are drastic shifts in sales and marketing efforts, this section should include them. The other topics of discussion include new hires, business acquisitions, and other information that the management thinks would benefit the stakeholders.

Financial Statements

The financial statements are the most important part of the annual report that allows current and future investors, shareholders, employees, and other business stakeholders to determine how well the company has performed in the past, its ability to pay off its debts , its cash flow, and its plans for growth. The statements that are included are:

- Balance sheet

- Cash flow statement

- Income statement

- Statement to shareholders

These statements show whether the company has made a profit or loss in the past year, how much earnings it has retained, and the proportion of revenues to operational expenses the previous year. Apart from the financial statements, information about the market price of shares of the company and the dividends paid have to be provided.

Looking for an easier way to organize your accounts? FreshBooks’ bookkeeping software lets you manage your own bookkeeping with easy filing methods and specialist support. Click here to get started.

Other elements included in the year-end report are:

- Notes to accounts with details about the accounting policies

- Comments by auditors on the financials of the company.

- Disclaimers about forecasted income and expenses

- Stories, infographics, and photographs

Annual reports are important elements of a brand’s transparency and accountability. However, rather than writing a ponderous document that only a few can understand, businesses are creating annual reports that speak to a broad group of people.

These reports communicate the values and goals of the company’s mission and brand. Producing a highly visual and narrative-driven interactive annual report can help businesses connect with shareholders, investors, and customers. Aim to include visual elements throughout the entire report to keep the document engaging.

Determine the Key Message

Annual reports are a perfect opportunity to highlight your accomplishments and the impact of these accomplishments. The investors and employees want to know what you did and why you did it. By connecting your business activities and your accomplishments to the final goals and mission statement, businesses can build trust and foster long-lasting connections.

Finalize Structure and Content

One of the most difficult parts of writing an annual report is deciding what to include and leave out. It’s important to map out the report’s content and structure.

Apart from the basic elements such as the introduction, chairman’s letter, business profile, and financial statement, the annual report should have a storyline that defines the report’s overall structure and shapes the content around a narrative thread. This makes identifying and cutting out information that does not actively move the story forward easier.

Use clear, precise, and unambiguous writing. Maintain a professional and unbiased position throughout the document. The content of the annual report should be transparent and honest. Don’t inflate accomplishments or disguise the losses that you faced.

Make writing your annual report easier by keeping clear and detailed records as you go. FreshBooks’ accounting templates help you organize your expenses, income, and receipts so you’ve got everything ready for the end of the year. Click here to start your free trial and learn how FreshBooks can help make accounting easy.

Use Compelling Design

A well-designed, engaging, professional report can be used as a marketing tool by a business. Ideally, readers should be able to scan through the document and get the relevant information they need. Here are some pointers for a good annual report design:

- Use headings and subheadings

- Devote space to photographs, infographics, and other compelling visual elements

- Keep the text short and simple

- Use a bold and complimentary color scheme and layout techniques that are in sync with your brand

- Emphasize key areas with colored text boxes, quotes, and captions

Plan in Advance

Creating an annual report is a long-term process that requires an organized system for recording and tracking data, media clipping, photographs, and a list of business achievements. While a number of companies create the annual reports in-house, others may hire a design firm to compile, proofread and finalize the document.

Ready to create a clear and compelling digital annual report? FreshBooks’ reports feature lets you explore report templates, performance tools, and accounting details so you can write your reports in-house. Try it free to begin your annual report today.

Both public and private companies use annual reports to provide important business and financial information to customers, investors, employees, and the media. Here are some reasons why writing annual reports is necessary for businesses:

- Provides an opportunity to highlight a company’s key achievements, expectations for the coming year, and overall goals and objectives

- Gives information on the company’s financial position

- Introduce you’re the key members of the business to stakeholders and the general public

- Tells shareholders and employees the company’s strategy for growth in the coming year

- Useful as a decision-making tool for managers

The annual reports keep your critical business information up to date. A failure by public companies to update the investors and the state might result in late fees or even the dissolution of your company.

Writing an annual report is essential for communicating your business position to shareholders, investors, and the public. Depending on the size of your company, you may also be legally required to produce annual reports for the Securities and Exchange Commission.

Your annual report should include four main components: the chairman’s letter, a profile of your business, an analysis of your management strategies, and your financial statements. Adding creative elements like graphic design and a narrative can also help your annual report double as a marketing tool. Learning to create a strong annual report is essential for guiding management decisions in your company and connecting to those who support and grow your business.

FAQs on How to Write an Annual Report

How do you write an annual report for a small business.

Writing the annual report for a small business follows a similar process as writing for a large company – you should include a chairman’s letter, business profile, management analysis, and financial statements. However, since you’re writing for a smaller business, you also have more flexibility to be creative. You can tailor your report to shareholders or make it a public-oriented document that you can use to market your small business.

Who Prepares the Annual Report?

Companies may have their own in-house writing and design team, or they may choose to hire an outside firm to prepare their report. Teams usually include accounting, writing, and graphic design professionals.

Which Things Should be Avoided while Writing a Report?

Avoid leaving your annual report to the last minute, trying to mask challenges your business has faced, or overloading the report with details and jargon. The aim is to be clear in your communication – be upfront about both your successes and losses, and write with accessible language that’s understandable to all your readers.

What are the 5 Basic Structures of a Report?

A good report can be structured in a simple 5-part setup to showcase your company’s performance. These sections are:

1. Introduction

3. Comments and disclaimers

4. Conclusion

5. References

You’ll start with a brief overview, then provide the body of information. Comments and disclaimers should explain any claims or facts, then summarize your information in the conclusion and cite any external references.

What are the 4 components of an annual report?

There are 4 key components to include when writing an annual report:

1. Chairman’s letter

2. Business profile

3. Management analysis

4. Financial statements

You can also include creative elements like stories, infographics, and photographs to make your report more visually engaging to your target audience.

Kristen Slavin, CPA

About the author

1000 more rows at the bottom Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Training and Development

- Beginner Guides

Learn to Communicate with Data

What is an annual report definitions, requirements and examples.

You want to impress shareholders, attract more investors, highlight your brand, engage your employees, or just file a report with the Securities and Exchange Commission (SEC). You need an annual report - but exactly what is an annual report?

But today, businesses and organizations create many different types of annual reports. Each type of annual report out there is designed with a very specific end goal in mind.

If that’s what you want to learn about - you’re in the right place.

To help you understand the world of annual reports, this post looks at everything you need to know about them - what they are, the different types, what goes into them, who reads them and how to create them. The post is broken down into the following sections. If you’d like to learn about something specific, click on a link to jump ahead.

- What is an annual report?

- What is included in an annual report?

- Who reads an annual report?

- What is the easiest way to create an annual report?

- How do you summarize an annual report?

- How do you create an attractive annual report?

If you want to check out our annual report templates to get a sense of what they look like and get design ideas, just visit our annual report templates page.

see all annual report templates

1. What is an annual report?

A traditional annual report is an in-depth, comprehensive overview of a business’s achievements and financial statements from the preceding year. It is produced on a yearly basis, and provided to shareholders, investors, stakeholders and others to inform them of the organization’s overall performance, financial status, and vision for the future.

Today, annual reports are often used as marketing tools for organizations to impress shareholders, investors, or donors; attract new ones; and to showcase their brand to employees, clients and others.

This example of an annual report design makes use of friendly, illustrated icons and bright colors to liven up very dry content. Not only is it more engaging to read, the organization’s branding jumps right off the page.

get this annual report template

Companies like Mailchimp regularly publish creative annual year-in-review reports , always outdoing their previous designs.

These types of annual reports are well-designed, fun, and engaging. They share information in a way that’s exciting and easy to understand, and serve as great branding assets. These types of annual reports can also be referred to as ‘year-in-review’ reports, highlighting major milestones for that year. This isn’t just something businesses do, either. Nonprofit organizations consistently promote their cause and the impact of their organizations. Annual reports, year-in-review reports, or impact reports that highlight the past year’s achievements are all staple nonprofit marketing tactics to gain donors and supporters.

Just take a look at this pages out of Novozymes annual report.

This is an annual report you can actually enjoy reading . The visuals are fun, engaging, informative and reflect the uniqueness of the Novozyme brand. The simple and attractive design is super helpful, since it helps us understand pretty complex information.

2. What is included in an annual report?

A typical annual report for a public company must have the following sections:

- A letter from the CEO

- Corporate financial data

- Operations and impact

- Market segment information

- Plans for new products

- Subsidiary activities

- Research and development activities

These are the barebones expectations for an annual report. Of course, depending on the size of your organization or type of organization, your annual report can range anywhere from 20 pages to 200.

Keep in mind, actual human beings read your annual report. It doesn’t just get filed away in a dusty government basement, never to be seen again. Making it easy to read and review is essential in helping people understand your annual report’s findings and how your business is performing.

So on top of those individual sections, it helps to include things like:

- A cover page

- A table of contents

- Mission and vision statement

- Charts, graphs and tables

- CSR initiatives

- An afterword

- A glossary

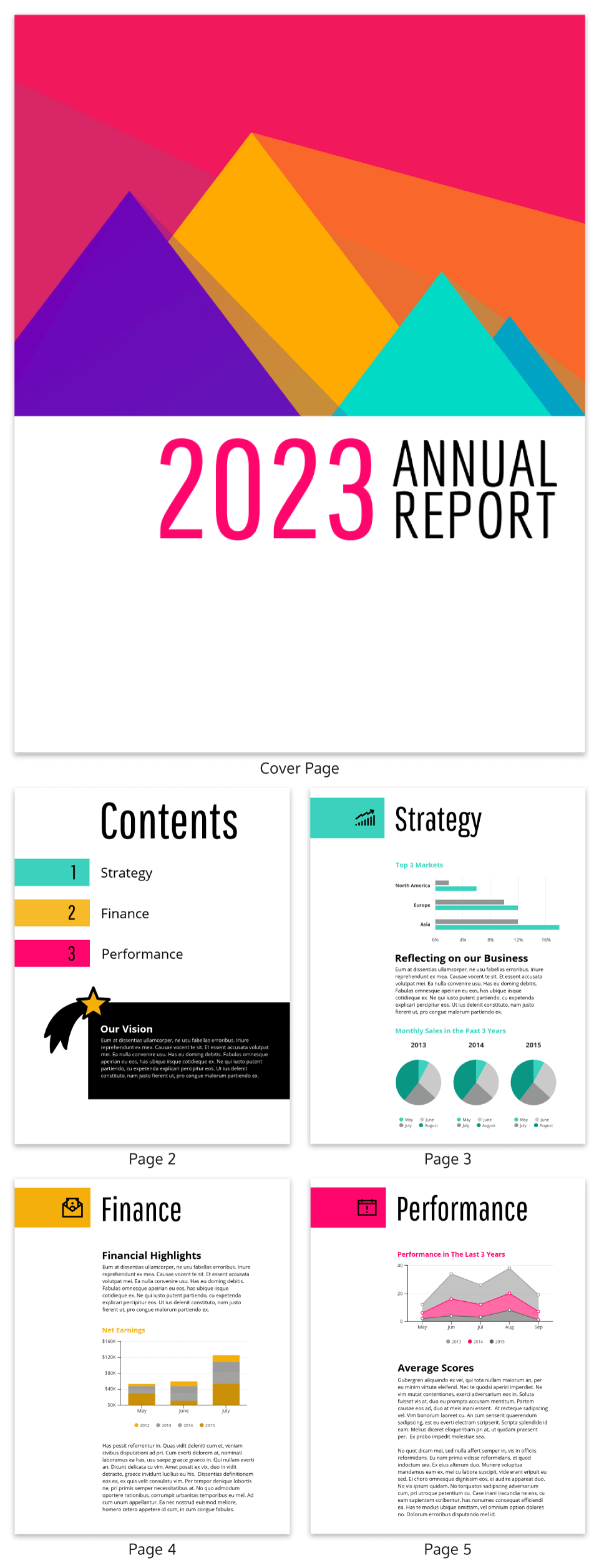

These are two examples of reader-friendly annual report designs.

Year end annual report template

This year end annual report template uses a color palette that pops, quality stock photos, and organized tables to visualize financial data and performance metrics. It includes a brief introduction and a table of contents.

Get this year end report template

Simple nonprofit annual report template

This nonprofit annual report reduces the use of text, and relies more on visuals, icons and charts to communicate data and figures.

Get this nonprofit annual report template

Ultimately, you decide how much information to include in your annual report, on top of what’s required. The best way to decide what to include, and how you present your annual report, is to consider the audience you’re creating an annual report for.

3. Who reads an annual report?

An annual report’s primary audience is your shareholders. These people have a legal right to know how your company is performing, how it is changing, what it has planned for the future and other facets of its operations.

But shareholders aren’t the only people with an interest in your company’s performance, its products, its projects, and plans for the future. More often, businesses use annual reports to present the organization’s brand as a whole. Your business’s vision for the future, its values and ideals, its social initiatives, its ambitions are all things that shareholders, as well as investors, employees, customers, donors (if you’re a nonprofit) business journalists and many others will take an interest in.

Annual reports for your staff

Annual reports are great ways for employees to learn more about your business and the brand. They can go through an annual report to see what other projects and initiatives the company has invested in. This is helpful for large businesses with hundreds or thousands of employees.

According to the most recent HR trends , employees care more than ever about employer branding and values. Take a look at the information highlighted in the sharply designed Roche Annual Report .

Among other things, this annual report highlights the value placed on the hard work of employees, teams and entire departments that have helped a business succeed.

In many instances, employees are shareholders within the company and they’re just as interested in how the company is performing. It’s another way to reinforce the value of their work, by showing how their team or department has helped the company to grow.

In the case of nonprofit organizations, annual reports help staff understand the impact of their hard work in the community.

Annual reports for your customers

Findings from Accenture Strategy’s global survey found that customers care deeply about the values and behaviors of major brands . Millennials and Gen-Zers in particular care most about brands driven by a purpose other than profit. According to the survey, nearly 40% of respondents stated they would stop purchasing from brands that appear socially irresponsible or ethically questionable.

You can see in this L’Oreal Annual Report , there are sections dedicated to their ethics and values.

Annual reports allow for a brand to present itself in the best light possible. Businesses can demonstrate the values that set them apart from competitors. They can talk about the types of suppliers and manufacturers they work with, how materials are sourced, the quality of their products, the well-being of their employees, their impact on the environment and more.

Nonprofit annual reports for donors

Nonprofit annual reports are testaments to all the money received and hard work that nonprofit organizations have done throughout the year. I’d argue they’re absolutely essential to a nonprofit.

Nonprofit annual reports demonstrate how the support from donors has helped to change people’s lives. After all, donors aren’t purchasing products the way customers do, what they’re “purchasing” is a social good that they want others to receive.

Annual reports highlight exactly how people’s lives are being transformed for the better. Check out the 2018 annual report from Girls Who Code .

Not only do they share the tremendous impact of the organization which donors want to know about - they do it in a visually creative, engaging way.

A nonprofit annual report highlights your organization’s successes, it provides some feel-good fulfillment to your staff who can look back at the fruits of their hard work, and donors know their money is being put to great use.

A nonprofit annual report also helps you make an appeal for more donations, bigger donations, grow your paid staff, and win over more volunteers for the coming year.

4. How do you summarize an annual report?

There are two simple ways to summarize an annual report. You can create an annual report infographic, or an annual report presentation. Both are great ways to share dense data and information in a way that’s manageable for your audience.

Annual report infographics

Let’s start with the annual report infographic. The advantage here is that you let the data tell the story. Rather than provide pages of analysis, visualize your data through charts, graphs, and icons. Take a look at this simple shareholder report infographic:

GET THIS ANNUAL REPORT INFOGRAPHIC TEMPLATE

The infographic focuses on a single data point. There may be layers of information that explain how that figure was determined, but this summary is practical and direct. For a more detailed report, create a long-form infographic report, by adding multiple sections that highlight individual data points.

You can use a layout like this annual report infographic:

get this infographic nonprofit report template

The use of text is minimal. The numbers and data tell the readers everything about the impact of the organization and how it has performed. This is an effective way to share relevant and valuable performance insights with shareholders, investors, or donors.

see all infographic templates

Annual report presentations

An alternate approach to summarizing an annual report is to create annual report presentation slides . You can share the slide deck on its own, or help it guide your presentation on key findings in your company’s complete annual report.

This simple annual report presentation deck dives right into the content. It’s a great example of how to break up data and make information easily digestible.

GET THIS ANNUAL REPORT PRESENTATION

Note how the large headings tell the audience exactly what each slide is focused on. Key findings are also highlighted on each slide, to complement the data the charts/graphs show.

If you expect a lengthier presentation slide, include an agenda or overview of your annual report presentation. This lets people know what you’ll be covering and how far along in your presentation you are.

The key to presenting is letting your audience know where they are in your presentation. Are you only halfway through or three quarters of the way done? Even with a summary, preparing your audience helps to keep them engaged, rather than distracted.

Our templates library has an attractive range of annual report presentation templates. Interested in designing your own? Check out our annual report presentation templates page.

SEE ALL BUSINESS PRESENTATION TEMPLATES

5. What is the easiest way to create an annual report?

As you’ve seen from the actual annual report examples I shared, and our annual report templates, annual reports are packed with a ton of content - text, visuals, charts, financial figures and more.

Hiring a design agency to design your annual report is one option. The cost for a professionally-designed annual report ranges anywhere from $5,000 to $12,000, and then depending on the types of visuals you need, even more.

Keep in mind, you’ll still need to pull all the content and data together yourself.

To save your organization time and money, without compromising on design, a professional annual report template is the way to go . You can visit Venngage’s annual report templates page today, browse hundreds of unique designs for a number of industries, and use preset layouts and design styles to format your content.

Customizing the templates is straightforward and doesn’t require any design experience. The Venngage editor is a drag-and-drop tool that’s simple to use. With it you can do a number of things like:

- Apply your branding through Venngage’s My Brand Kit , which includes your organization logo, brand colors and brand fonts

- Use chart and graph widgets to visualize financial data, trends, statistics and more

- Add beautiful icons that really elevate your annual report design

- Apply high-quality stock photos directly from Pixabay and Unsplash (or upload your own professional images).

6. How do you create an attractive annual report?

Why does the design of an annual report matter? Those who are interested in the information will take the time to read it, won’t they?

Sure, but they might not understand everything you’ve tried to communicate. Keep in mind, you’re sharing tons of data and ideas. If it’s boring and dry, investors might just take a nap instead.

I also mentioned that annual reports are a way to present your brand, and that employees and customers alike would be potential readers. How you present your organization influences their opinion of you, your values, what you’re all about and all the data you’ve packed in.

Captivating, engaging design provides your many different readers with an enjoyable experience, and helps them walk away with your annual report’s key takeaways. So below, I'll share a handful of annual report design best practices for you to keep in mind.

- Create a high-impact annual report cover page with large images

The cover of your annual report should grab, and hold, the attention of your readers. This can be hard to achieve without the help of a professional designer.

The workaround?

Use large, high quality images as the focal point of your cover page for a bold, eye-catching effect.

In this annual report example, bright blocks of color are combined with a full-page image to create a simple, yet striking design.

GET THIS TEMPLATE

Cover images should not be used purely for decoration. They should tell your customers, stakeholders, and employees something about the culture or values of your organization.

Use cover photos to set the tone for the report and to convey the company spirit that you’d like to project to your readers.

Does your company focus on positive customer experiences?

On company culture?

On high quality, professional products?

Take a look at how each of the companies below uses cover images to project their own, unique narrative focus. Nestle is focused on customer experiences, GE is focused on their employees, and Thermo Fischer Scientific is all about the product:

Source high quality images for a professional touch.

Using low quality or pixelated images can make the report look amateur and reflect poorly on your company or organization.

If you’re going to go with a full-page cover image, it’s worth investing in a professional photographer to take photos of real employees or customers, like L’Oreal has done for their annual report:

Otherwise, try to source high-resolution images from respected sites like Unsplash or Pixabay . You can access Unsplash and Pixabay's complete stock photo library in Venngage's editor as well.

- Choose the right charts for your annual report metrics

Annual reports are all about the numbers, meaning that a key ingredient of creating an effective annual report is choosing the right chart for each metric .

There are a few types metrics found in most annual reports, including:

- Financial highlights (revenue, earnings per share, growth, profit margin)

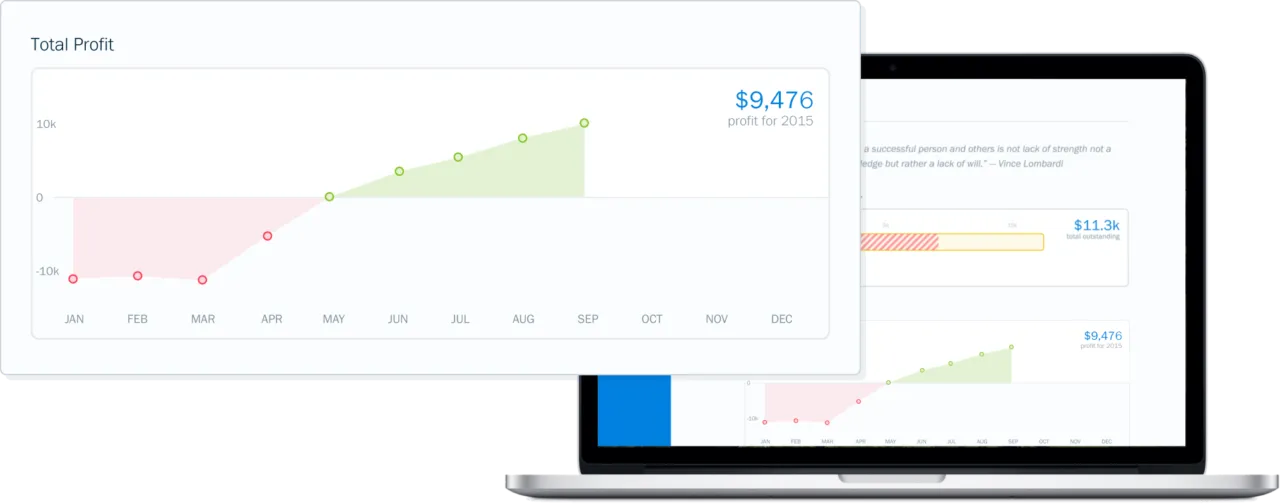

- Month by month financial trends

- Sales breakdown by market and by product

- Year over year financial performance

The type of data you are visualizing should determine what type of chart you use. Let’s review the best visualization types for each type of metric.

Use “big number” charts to summarize financial highlights.

The financial highlights section of an annual report should summarize the most important facts and figures of the year simply and concisely.

The easiest way to show this assortment of different metrics in a small space is to simply write out those numbers in big, bold text. We call this type of visualization a “big number” chart.

In a big number chart, the size of each number should vary based on its importance, as shown in Concho Resources’ 2017 annual report :

As you can see in the example below, big number charts communicate key metrics quickly, clearly, and with impact.

CREATE THIS REPORT TEMPLATE

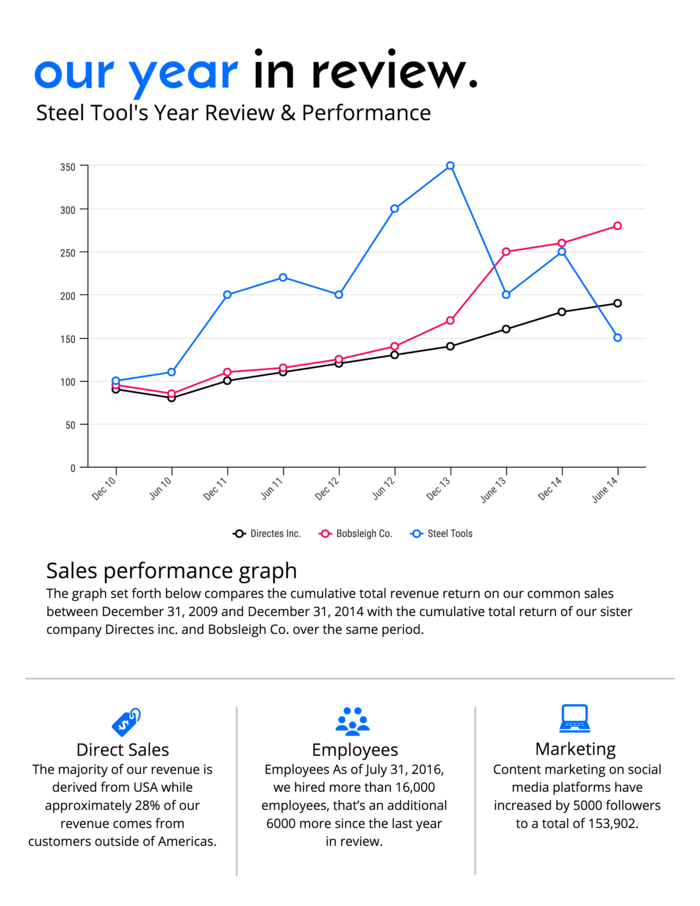

Use line charts to display monthly trends.

Line charts are the standard display for tracking changes over time, which is essential in an annual report. Investors and shareholders will want to see month by month trends for all sorts of financial metrics, including sales, profits, margins, and share earnings.

Line charts are perfect for comparing and contrasting sales trends across competitors, as seen in this annual report example:

As seen in Adidas’ 2016 annual report, line charts are particularly useful for tracking the growth of share prices over time (compared to market indices):

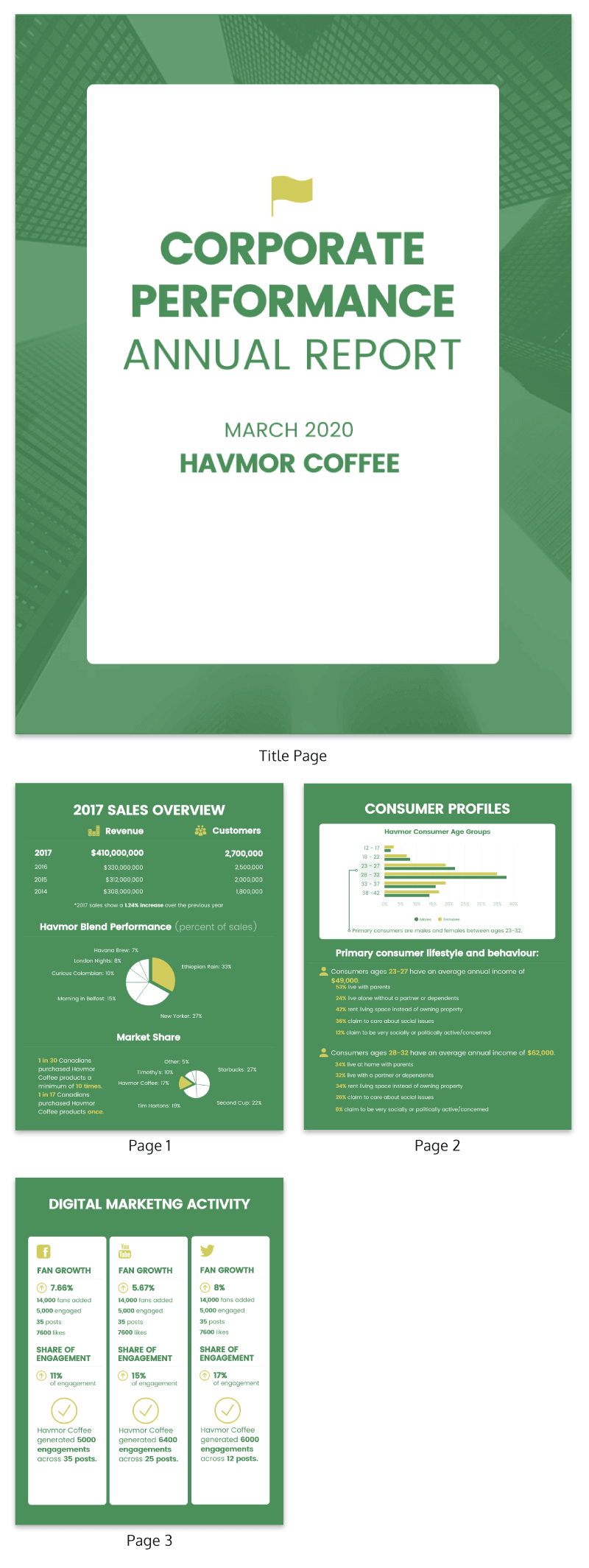

Use stacked bar or donut charts to show market composition.

Another core component of the finances section of an annual report is market segmentation, which shows the breakdown of annual sales into different categories.

You might break down your sales by geographic region, by product category, by customer profile...whatever helps your business identify opportunities for growth and improvement.

Traditionally, sales breakdowns are visualized with pie or donut charts, a standard method for showing part-to-whole relationships.

Pie charts, while intuitive to read, are notoriously poor data visualization tools. Most people struggle to distinguish between the size of similar pie segments at a glance.

A better choice would be a stacked bar chart, seen in the market segmentation report below.

Use grouped bar charts to compare year-over-year financial performance.

Year over year financial performance is of interest to many potential readers.

Investors, employees, and customers will all want to see how an organization’s current performance compares to that of previous years. It’s arguably the most important metric to be included in an annual report.

The most efficient method for visualizing year-over-year performance is with grouped bar charts, like these ones in GE’s 2017 annual report. The side-by-side bars emphasize the changes from one year to the next.

As seen above, it’s a good idea to use a highlight color to draw extra attention to the year of interest (2017, in this case).

- Use bold color accents to highlight key facts, quotes, and figures

Color should never be used simply for decoration in an annual report.

Although aesthetics should be a consideration, color should primarily be used to enhance communication--to clarify the information on the page.

As I just mentioned for the bar charts above, color can be used to highlight key information. It can be used to draw the reader’s attention to particularly important facts, figures, or data points in information-dense displays of text and data.

Check out how the yellow color is used to create visual contrast in this annual report example:

The contrast between the green background and the yellow highlight color draws attention to the most valuable bits of information: the data! The contrast creates points of visual focus, helping us make sense of the information on the page.

When creating your annual report, try to pick one highlight color and apply it to every key data point that you want your readers to pay attention to. The brighter, the better!

To learn more about using contrasting color schemes, check out this guide on how to use colors in infographics .

- Create a clear type hierarchy to make your annual report skimmable

Annual reports are typically quite information-heavy, with a great deal of technical information on each page.

To prevent your readers from getting lost (or worse: bored), it’s important to create a clear hierarchy of information on each page. This hierarchy will help your reader navigate through the report, allowing them to easily skim through to the most pertinent information.

You can create hierarchy by altering the size, weight, and placement of various elements. Headings should be larger than subheadings, key figures should be bolder than general body text, chart captions should be small and light, etc.

Check out how text hierarchy enhances the readability of the corporate performance annual report below. The titles and key numbers are styled in bold, black, large text, making them stand out from the rest of the page, while less pertinent text, like labels and captions, are smaller and more subtle:

When creating this visual hierarchy, it’s important to be mindful of the principles of typography. You don’t want the typography to distract from the content of the annual report.

Here are a few principles to keep in mind:

- Use a maximum of three different fonts to ensure the text is interesting but not chaotic.

- Use a stylized font for the header text and a minimal font for the body text.

- Use different font weights and styles to create contrast and draw the eye.

Want to learn more about typography for annual reports and infographics? Check out this guide on how to choose fonts .

- Create your annual report on a grid for a balanced page layout

I strongly suggest using a grid to format your annual report design.

Building off of an underlying grid framework will ensure consistency from page to page, while allowing you to experiment with different compositions (to keep your report interesting).

Using a grid can also help you create negative space, which is critical to great design. It gives the viewer time to process what they are seeing before moving on to the next section. Negative space is the core design component of most crisp, modern designs, like the one below:

- Focus on what’s important with a condensed one-pager annual report

Short, one page annual reports (also known as one-pagers) are gaining popularity as an alternative to extensive multi-page annual reports. These reports cover only the most important metrics, making it possible to grasp an organization’s performance at a glance.

One of the keys to a successful one page annual report is a simple color scheme. Pair neutral greys with a single bright highlight color for a sleek, cohesive look.

I hope this guide has answered the question, “what is an annual report”. To wrap up, here are all of the design best practices you should keep in mind when creating your next annual report.

Now you know everything there is to know about annual reports! If you still have burning question, comment and let us know. We'll share our expertise.

You can also check out more resources on report design examples, templates and tips below.

More report design guides:

55+ customizable annual report templates, examples & tips.

7 Business Report Templates You Need to Make Data-Backed Decisions

How To Write An Annual Report

Here is our guide to help you write your annual report, complete with industry-focused toc's. bonus section: deep-dive on the executive summary., introduction to annual reports.

- Establish a style guide: This is especially important when various people are working on writing and editing the report. A style guide prescribes language and tone of voice, but also serves consistency with rules for date formats, capitalization of words, hyphenation, acronyms, branding, and spelling.

- Determine the key messages upfront: Don’t use the writing process to “discover” the message(s) you want to convey in your annual report! In turn, the message or narrative thread should drive your writing.

- Finalize the structure: Before you start writing the annual report, all stakeholders need to sign off on the structure, otherwise you’ll end up producing content that will be cut from the final draft.

- Prepare a clear brief: Avoid confusion about the scope of the project, roles and responsibilities by writing a clear brief for your annual report.

- Plan in advance: Writing your annual report is a long-term process that requires organization and project management skills, especially when you hire external contractors to take care of tasks such as design or printing.

- Language: Use simple sentences, active verbs, and keep jargon to a minimum. Avoid clichés, keep sentences and paragraphs short, and check your imagery: flowery language and metaphors make things vague, but if you use them, check that they’re in line with your brand.

- Write in drafts: Your annual report doesn’t have to be perfect from the beginning. Rather than trying to get it right in one go, work in three iterations. Your first draft is a rough sketch where you obtain clarity of which section goes where and how long each section will be, more or less. In the second draft, the coherent narrative takes shape. In the third draft, you clean up the writing before your have someone else check it.

- Changes: Employ a professional proofreader or editor to work through necessary changes cost-effectively and efficiently. Consider legal counsel for a compliance or regulation check.

Best Practises For Annual Report Writing

Annual report executive summary, annual report templates, smb: small and midsize business.

- Letter or statement from the CEO

- Executive Summary

- Highlights of the past year

- Company information

- Optional: Stories, photos, and charts that construct a relatable narrative for investors.

- Optional: Instead of targeting investors, a small business can address and inspire employees in a special section.

- Financials:

- Balance sheet: Listing the company's current financial condition including tangible and intangible assets, long-term liabilities of the business, and equity, the balance sheet is a snapshot of how the company is doing.

- Income statement: Details on revenue and expenses to highlight profits and losses.

- Cash flow statement: Here the focus is on liquidity generated and spent in the past year

- Audit : If necessary or appropriate, include an auditor's report on the company's financial situation. Such an audit can be done internally or externally.

- Optional: Notes, appendix and clarification of financial statements.

- Optional: Accounting policies.

- Optional: A disclaimer about your forecast of expenses and revenue.

Nonprofit Organization / Non-Governmental Organization

- Welcome letter or personal introduction: This is your opportunity to showcase your mission. Your supporters probably don’t think as much about your mission as you do, so repeating your mission statement throughout the report is acceptable. Demonstrate throughout the report how your organization embodies, pursues, and fulfills that statement.

- Summary of highlights: Select major accomplishments you want to showcase and keep it engaging, but concise to not lose the attention of your readers. Limit the number of highlights and make sure to be inclusive: ask different people in all parts of the organization for their personal picks. Ensure that the accomplishments in the summary are in line with your message and mission statement. If possible, find a theme (such as growth, support, hope, responsibility etc.) to unite the highlights. Clarity is key, so spell out how the highlights relate to the organization’s mission.

- Financial information

- Three stories of accomplishment:

- The big picture

- A personal touch

- Example of past impact shaping the future

- Donor list: Depending on your organization, you can list donors, funders, volunteers, partners, sponsors, or association members.

- Mission statement / vision statement

- Summary of highlights

- Overview of the charity: Here you can give a brief summary of the history and talk about the charity, the people and the supporters.

- Governance: This will include legal information about the exact type of charity and the structure and management. You can include a report by the chairperson or CEO and state the objectives and activities as outlined in the chart.

- Financials: This section can include:

- Treasurer’s report

- Auditor’s statement or report

- Financial statements

- Other optional sections:

- Acknowledgements

- Call for contributions / action

- Future outlook

- State the mission clearly and relate back to it when you outline and highlight the activities and achievementsState clearly the organization’s mission and relate the activities back to the mission throughout the report.

- The information about the governance and structure of the charity should also reflect the mission.

- Disclose the charity’s risks, issues and challenges in the context of the mission.

- Avoid splintering your annual report into many mini-reports by your charity’s committees, if they exist. You can make these smaller reports available individually on the charity’s website.

- Welcome letter or personal introduction: Words by a founding member, church body or pastor to address the audience and set the tone for the annual report.

- Mission statement: What are the objectives and activities of the church?

- Overview: The identity of the church and its members as well as the values and the calling of the church, followed by details on the structure, governance, and management

- Stories of accomplishment and the church's work, for example:

- The community

- The mission and outreach

- Charity work with a personal touch

- Statement of Financial Activities

- Charity Balance Sheet

- Cash Flow Statement

- Notes to financial statements

- Audit by committee or independent auditor

- Callout: In this section, you can list donors, funders, volunteers, partners, sponsors, or church members as well as provide a call to action, for example to donate, take part in church work, or become a member.

What Is An Annual Report?

What is the purpose of an annual report.

Financials: Statements and audits of the financials as well as financial performance and goals of a company can comprise the bulk content of an annual report. Projected and achieved revenue figures are part of this section. A company might also report expansion, growth, revenue increase plans, as well as a return-on-investment analysis or effectiveness study. A nonprofit organization might account for its spending, report donations and also project financial goals. Achievements: A year-in-review goes beyond financial numbers and annual reports often feature a mission statement and highlight past achievements, which could include research, investment in personnel of infrastructure, employee benefits, personal success stories, customer or user testimonials, or product launches. This section seeks to portray the company as an innovator and industry leader which attracts participation. Promotion: An annual report is an opportunity for marketing and public relations, either in a special section, or throughout the entire report. The goal is to attract new shareholders, excite existing investors, and raise brand awareness with the general public. Compliance: Companies produce annual reports even when they don’t have to because they want to benefit from the marketing and PR opportunities. Publicly traded companies and entities that fit certain other criteria have to file annual reports with the SEC, the US Securities and Exchange Commission. To avoid producing two different reports, these companies commonly produce one general report that meets the compliance standards. Pro Tip If your annual report has to meet certain compliance standards (such as the SEC Form 10-K for publicly traded companies), make the best use of your resources and only produce one report for your entire audience which includes the necessary information.

What Are Annual Report Formats?

Printed Annual Reports: Traditionally, an annual report is a glossy and high-end print product distributed to shareholders, regulators, members of the press, and figures selected for marketing and PR reasons. The production and distribution of a high-quality print product is also a cost factor that has to be figured into the overall budget. Electronic Annual Reports: The advantage of a print production is that companies and organizations can simply re-use the document and make their annual report available in electronic format, for example as a PDF download on their website. This version can also be distributed through email and other digital means. Interactive Online Annual Reports: With this format, readers can browse and view an annual report just like a website. Graphs and charts can be animated or interactive, and there is the possibility of embedding videos and other multimedia material. You can precisely track reach and engagement with digital online annual reports and brand and design the it just like the website of your company or organization. Pro Tip An online, interactive annual report is a cost-effective opportunity to use your reporting to drive engagement and get the best results from making your report available to a broad audience.

What To Include

Chairperson’s statement or letter: The CEO, the primary owner or the chairperson usually addresses readers with an introduction in the form of a letter or personal statement. This might highlight the most significant developments as snapshots, include brief details of company initiatives, and give a brief summary of the financials–sort of like a teaser of what’s to come. This part commonly also focuses on the challenges, achievements, and growth. Business profile: In this section, you can profile your company or organization with a mission statement, and details on the corporate office, the board, the team or the employees. You can highlight your products or services which are the main revenue drivers, provide an analysis of the market, the competition, or the risk factors, and profile both the investors or donors you have and the ones you are looking for. Financials: Regulation and compliance will largely dictate what to include in this section, but unlike in other sections of your annual report, there is no room for storytelling, embellishing, or flowery language. Transparency, accuracy, and thorough reporting are key here. The absolute numbers speak about the company’s performance to investors, shareholders and stakeholders, regulators, employees, and the general public. Readers will get a complete picture of the profit and loss of the past year, the revenue and its division into earnings retained, investment, and operational expenses, and the company’s shares. A typical sequence in this section could be: income statement, balance sheet, equity statement, cash flow statement, and shareholder information with earnings per share. Consolidated statements can be followed with longer, in-detail explanations of the financials. Auditor’s Report: An audit of the financial situation and the spending can be split into the reporting of an audit committee and the reporting of an independent auditor or auditing body. Some companies include the former in their business profile, and the latter as part of the financial statements. Other sections: Depending on your company, other sections can be a director’s report, accounting policies, general policies, stories, image material, and details about other activities not related to the business, such as corporate social and environmental responsibility reports.

Annual Report Writing

Produce a brief.

- Format of your finished annual report and specifications for a printed product, if necessary, such as size and quantity.

- Expectations for internal and external contributors. This includes length of requested texts, design standards, style questions, and timelines.

- Specifications for deliverables that define the schedule, data, and format for contributors.

Background information or mission statement Concepts and deliverables Timing / deadlines Objectives of the annual report Key messages of the annual report Short description of the brand, personality, and audience Writing, style, and design specifications Pro Tip Write the brief for your annual report before you or anyone starts work on the actual report. Compose a clear annual report brief to avoid conflict, because conflict often stems from misunderstanding or miscommunication. Clarity helps everyone fulfill their roles during production.

How To Write The Executive Summary

Who is your audience? This will help you decide what critical information readers need. Make the story you tell in your annual report resonate with them. What is the objective of the summary? It serves the function of summarizing, but in addition, what do you need the audience to understand? What reaction should they have, what action should they take? What is the outcome? The executive summary should also list conclusions or recommendations based on the past year on which you are reporting. What changes are necessary, what actions will the business take in the future? What are the benefits of the achievements, which improvement will the company reap from implemented solutions? Don't make the reader guess or work to find out about the future course of the company or organization. How will you impress? Of course your executive summary should be able to stand out and give all the important details even for those who decide to skip the rest of the report. But ideally, it is able to draw the audience in and make them read on. Don't inflate numbers, invent facts or dress up the truth, of course, but carefully consider how you shape your message and organize your summary.

Format For The Executive Summary

Order of appearance: Apart from opening lines, you’ll have to decide if your summary follows the exact structure of your report as laid out in the table of contents, or if you organize it differently and establish a varying level of importance. In both cases, you can use subheadings to introduce sections and use bullet points as well as enough space to make the summary visually appealing and accessible to scanning. Length: When your summary reaches a length of two pages or beyond, it arguably stops being a summary and becomes an outright introduction. Be brief but comprehensive. Do a sketch where you describe each necessary section in just one word, then elaborate to three words, then a whole sentence. Sometimes a flow or coherence is better for the executive summary than giving a complete overview of the annual report. Tone of voice: The executive summary is formal and not casual and should match your target audience in tone of voice. Yet it’s neither the time nor place to get into technical jargon, lengthy definitions, and presentation of information that is only accessible with background information, expertise, or in-depth knowledge of the subject matter. Avoid acronyms and data that couldn’T stand for itself.

Any changes to the report require at least a check if not an update of the executive summary to ensure information remains relevant and consistent. Organize the summary either matching the table of contents or in the order of importance. Check for jargon, technical terms, filler words, and superfluous acronyms. Use active voice and direct language. Sparsely present precise and factual data from the report as highlights. Check to remove redundant information, repetitions, clichés, buzzwords, unnecessary phrases, and mixed messages. Use bullet points, subheadings and tables where appropriate to structure information. Format for readability and leave enough space. Check to include the most relevant information but remove anything not supported by the full report from the executive summary. Changes to headlines or sections of the report need to be reflected in the summary. Edit for brevity. Use test readers to verify that the summary stands alone to support your objectives.

Checklist For Your Annual Report Executive Summary

- Your Company Info

- Your Elevator Pitch

- The Problem You Are Solving

- Your Solution

- Your Target Audience

- Your Competitive Analysis

- Your Financials: Budget

- Your Financials: Revenue

- Your Financials: Funding

- Your Financials: Pricing

- Your Corporate Strategy

- Your Support Plan

- Your Leadership And Team

- Your Partners Or Donors

Executive Summary Template

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Quickly & Effectively Read an Annual Report

- 04 Jun 2020

Intelligent investing requires analyzing a vast amount of information about a company to determine its financial health. Armed with this information, an investor can better understand how much risk might be involved with backing a company based on how well it’s performed historically, in recent quarters, and toward its financial targets.

Exactly where this information comes from depends on the specific company that’s being invested in, but typically requires several financial statements, including a balance sheet, cash flow statement, and income statement.

In addition to these documents, most investors look forward to reviewing a company’s annual report—a collection of financial information and analysis that can prove invaluable in evaluating the health of a company.

If you’re not an investor, but an employee working within a corporation, the annual report can impart valuable information pertinent to your career. Understanding how your company is performing and the impact your actions have had on its business objectives can help you advocate for a promotion or other form of career advancement .

If you’re unfamiliar with what goes into an annual report, there’s some good news: You don’t need to be a financial expert to get value out of the document or understand the messaging in it.

Here’s an overview of the different information you’ll find in an annual report and how you can put it to use.

Access your free e-book today.

What Is an Annual Report?

An annual report is a publication that a public corporation is required by law to publish annually. It describes the company’s operations and financial conditions so that current and potential shareholders can make informed decisions about investing in it.

The annual report is often split into two sections, or halves.

The first section typically includes a narrative of the company’s performance over the previous year, as well as forward-looking statements: Letters to shareholders from the chief executive officer, chief financial officer, and other key figures, as well as graphics, photos, and charts.

The second section strips the narrative out of the picture and presents a variety of financial documents and statements.

Unlike other pieces of financial data—and because they include editorial and storytelling—annual reports are typically professionally designed and used as marketing collateral. Annual reports are sent to shareholders every year before an annual shareholder meeting and election of the board of directors, and often accessible to the public via the company’s website.

Annual Report vs. 10-K Report

Annual reports aren’t the only documents public companies are required to publish yearly. The US Securities and Exchange Commission (SEC) requires public firms also to produce a 10-K report , which informs investors of a business’s financial status before they buy or sell shares.

While there’s similar data in both an annual and 10-K report, the two documents are separate.

10-K reports are organized per SEC guidelines and include full descriptions of a company’s fiscal activity, corporate agreements, risks, opportunities, current operations, executive compensation, and market activity. You can also find detailed discussions of operations for the year, as well as a full analysis of the industry and marketplace.

Because of this, 10-K reports are longer and denser than annual reports, and have strict filing requirements—they must be filed with the SEC between 60 to 90 days after the end of a company’s fiscal year.

If you need to review a 10-K report, you can find it on the SEC website .

What Information Is Contained In An Annual Report?

An annual report typically consists of:

- Letters to shareholders: These documents provide a broad overview of the company’s activities and performance over the course of the year, as well as a reflection on its general business environment. An annual report usually includes a shareholder letter from the CEO or president, and may also contain letters from other key figures, such as the CFO.

- Management’s discussion and analysis (MD&A): This is a detailed analysis of the company’s performance, as conducted by its executives.

- Audited financial statements: These are financial documents that detail the company’s financial performance. Commonly included statements include balance sheets, cash flow statements, income statements, and equity statements.

- A summary of financial data: This refers to any notes or discussions that are pertinent to the financial statements listed above.

- Auditor’s report: This report describes whether the company has complied with generally accepted accounting principles (GAAP) in preparing its financial statements.

- Accounting policies: This is an overview of the policies the company’s leadership team relied upon in preparing the annual report and financial statements.

What to Look for in an Annual Report

While all the information found in an annual report can be useful to potential investors, the financial statements are particularly valuable, as they provide data that isn’t obscured by any sort of narrative or opinion. Three of the most important financial statements you should evaluate are the balance sheet, cash flow statement, and income statement.

The balance sheet shows a company’s assets, liabilities, and owners’ equity accounts as of a specific date, illustrating its financial position and health.

The income statement shows a company’s revenue and expense accounts for a set period, allowing you to gauge its financial performance. Using trial balances from any two points in time, a business can create an income statement that tells the financial story of the activities for that period.

Cash flow statements provide a detailed picture of what happened to a business’s cash during an accounting period. A cash flow statement shows the different areas in which a company used or received cash, and reconciles the beginning and ending cash balances. Cash flows are important for valuing a business and managing liquidity, and essential to understanding where actual cash is being generated and used. The statement of cash flows gives more detail about the sources of cash inflows and the uses of cash outflows.

These three documents can help you understand the financial health and status of a company, and they’re all included in the annual report. When you read the annual report—including the editorial information—you can gain a better understanding of the business as a whole.

An annual report can help you learn more details about what type of company you work for and how it operates, including:

- Whether it’s able to pay debts as they come due

- Its profits and/or losses year over year

- If and how it’s grown over time

- What it requires to maintain or expand its business

- Operational expenses compared to generated revenues

All of these insights can help you excel in your role, be privy to conversations surrounding the future of the company, and develop into an effective leader .

Critical Information for Investors and Employees Alike

Being able to analyze annual reports can help you gain a clearer picture of where a company sits within its industry and the broader economy, illuminating opportunities and threats.

The best part about learning to read and understand financial information is that you don’t need to be a certified accountant to do so. Start by analyzing financial documents over a set period. Then, when the annual and 10-K reports are published, you can review and understand what leadership is saying about the operational and financial health of your company.

If you’re an investor, knowing how to read an annual report can give you more information from which to base your decision on whether to invest in a company. If you’re an employee within an organization, learning how to read and apply the information contained in an annual report is an essential financial accounting skill that can help you understand your company’s goals and capabilities and, ultimately, further your career.

Do you want to take your career to the next level? Explore Financial Accounting and our other online finance and accounting courses , which can teach you the key financial topics you need to understand business performance and potential. Download our free course flowchart to determine which best aligns with your goals.

About the Author

What is an annual report?

Annual reports inform all interested parties about the financial success (or failure) of a public entity, private corporation, non-profit organization, or other business formation.

Ready to start your business? Plans start at $0 + filing fees.

by Jonathan Layton, J.D.

Jonathan Layton is a graduate of The College of William and Mary, where he majored in English literature. While...

Read more...

Updated on: February 1, 2024 · 4min read

What is the purpose of an annual report?

What is included in an annual report, who files the annual report, when should annual reports be filed, do small businesses or llcs need to file an annual report, what is the annual report requirement for large corporations.

An annual report is a document that contains comprehensive financial information about public companies, small and large corporations, non-profit organizations, partnerships, and other businesses. It includes their financial performance and activities over the prior fiscal year.

Some types of businesses must prepare and file an annual report by law with the Secretary of State where the company operates. Other companies prepare annual reports to keep shareholders, employees, and the community informed regarding the company's financial health.