Stamp Duty on Debt Assignment

Home | Knowledge Center | Thought Papers Stamp Duty on Debt Assignment

13th Feb, 2018

bbbbb Lorem ipsum dolor sit

Introduction

Assignment of debt is one of the most common forms of transactions in financial markets. It essentially entails transfer of a debt from a creditor (assignor) to a third-party (assignee). One of the biggest challenges faced in debt assignment transactions in India is the significant stamp duty implication on the deed of assignment. Considering the volume of assignment transactions undertaken generally by banks and financial institutions or by asset reconstruction companies (“ ARCs ”), the stamp duty levied becomes a significant cost in such transactions. The Constitution of India (“ Constitution ”) confers upon the Parliament and each State Legislature the power to levy taxes and other duties. The subjects on which the Parliament or a State Legislature or both can legislate are specified in the Seventh Schedule of the Constitution. The Seventh Schedule is divided into 3 (three) lists:

- Union List;

- State List; and

- Concurrent List.

The Parliament has the exclusive power to legislate on the subjects enumerated in the Union List. The State List enumerates the subjects on which each State Legislature can legislate and such laws operate within the territory of each State. The Parliament, as well as the State Legislatures, have the power to legislate over the subjects listed in the Concurrent List.

The entry pertaining to levy of stamp duty in the Union List is as follows: -

“91. Rates of stamp duty in respect of bills of exchange, cheques, promissory notes, bills of lading, letters of credit, policies of insurance, transfer of shares, debentures, proxies and receipts.”

The entry pertaining to levy of stamp duty in the State List is as follows: -

“63. Rates of stamp duty in respect of documents other than those specified in the provisions of List I with regard to rates of stamp duty.”

The entry pertaining to levy of stamp duty in the Concurrent List is as follows: -

“44. Stamp duties other than duties or fees collected by means of judicial stamps, but not including rates of stamp duty.” [emphasis supplied]

From the aforementioned entries, it is clear that the power to legislate on the rate of stamp duty chargeable on instruments of debt assignment (since it is not covered under Entry 91 of the Union List) is with the State Legislature. However, the power to determine whether stamp duty can be charged or not on a specific instrument is in the Concurrent List. In this regard, it may be noted that pursuant to the Enforcement of Security Interest and Recovery of Debt Laws and Miscellaneous Provisions (Amendment) Act, 2016 (“ Amendment Act ”), the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (“ SARFAESI ”) and the Indian Stamp Act were amended to provide for an exemption from stamp duty on a deed of assignment in favour of an ARC.

As mentioned above, the power to legislate on whether stamp duty is payable or not on an instrument is in the Concurrent List. Therefore, the Parliament has the power to legislate on the aforesaid subject.

Pursuant to the Amendment Act, section 5(1A) was inserted in SARFAESI which provides that any agreement or document for transfer or assignment of rights or interest in financial assets under section 5(1) of SARFAESI in favour of an ARC is not liable to payment of stamp duty.

In several States, notifications have been issued for remission and/ or reduction of stamp duties on debt assignment transactions. For instance, in Rajasthan, the stamp duty chargeable on any agreement or other document executed for transfer or assignment of rights or interests in financial assets of banks or financial institutions under section 5 of SARFAESI in favour of ARCs 1 has been remitted. Further, in Maharashtra, the stamp duty on instrument of securitization of loans or assignment of debt with underlying security has been reduced to 0.1% (zero point one percent) of the loan securitized or the debt assigned subject to a maximum of Rs. 1,00,000 (Rupees one lac) 2 .

Certain State Governments, such as those of Rajasthan and Tamil Nadu have reduced the stamp duty based on the nature of the financial asset being assigned. In Rajasthan, the stamp duty has been reduced for assignment of standard assets whilst in Tamil Nadu, the stamp duty has been reduced for assignment of non-performing assets and assignment in favour of ARCs.

This paper discusses a recent decision by the Allahabad High Court in the case of Kotak Mahindra Bank Limited v. State of UP & Ors. 3 (“ Kotak case ”), where it was held that an instrument of assignment is chargeable with stamp duty under Article 62(c) (Transfer) of Schedule 1B of the Indian Stamp Act, as applicable in Uttar Pradesh (“ UP Stamp Act ”), as opposed to Article 23 (Conveyance) of Schedule 1B of the UP Stamp Act.

The stamp duty payable in various States under Article 23 or the relevant provision for conveyance is on an ad valorem basis whereas the stamp payable under Article 62(c) or relevant provision for transfer of interest secured, inter alia, by bond or mortgage deed, is a nominal amount. For instance, in Uttar Pradesh, the stamp duty payable under Article 62(c) is Rs. 100 (Rupees one hundred).

Decision in the Kotak case

In the Kotak case, Kotak Mahindra Bank Limited (“ Kotak ”) had purchased and acquired certain loans from State Bank of India (“ Assignor ”) along with the underlying securities.

The question for consideration before the full bench of the Allahabad High Court was whether the deed executed by the applicant with the underlying securities would be chargeable with duty under Article 62(c) or Article 23 of Schedule 1B of the UP Stamp Act.

The court observed that in order to determine whether an instrument is sufficiently stamped, one must look at the instrument in its entirety to find out the true character and the dominant purpose of the instrument. In this case it was observed that the dominant purpose of the deed of assignment entered into between Kotak and the Assignor (“ Instrument ”), was to transfer/ assign the debts along with the underlying securities, thereby, entitling Kotak to demand, receive and recover the debts in its own name and right.

Article 11 of Schedule 1B of the UP Stamp Act provides that an instrument of assignment can be charged to stamp duty either as a conveyance, a transfer or a transfer of lease. The court observed that since the Instrument was not a transfer of lease, it would either be a conveyance or a transfer.

The court referred to the definition of conveyance in the UP Stamp Act, which reads as follows:

““ Conveyance ”. — “Conveyance” includes a conveyance on sale and every instrument by which property, whether movable or immovable, is transferred inter vivos and which is not otherwise specifically provided for [by Schedule I, Schedule IA or Schedule IB] [as the case may be];” [emphasis supplied]

The court held that the term conveyance denotes an instrument in writing by which some title or interest is transferred from one person to other and that the use of the words “on sale” and “is transferred” denote that the document itself should create or vest a complete title in the subject matter of the transfer, in the vendee. In this case since under the Instrument, the rights of the Assignor to recover the debts secured by the underlying securities had been transferred to Kotak, it was held that the requirement of conveyance or sale cannot be said to be satisfied.

The court further observed that debt is purely an intangible property which has to be claimed or enforced by action and not by taking physical possession thereof, in contrast to immovable and movable property. Where a transaction does not affect the transfer of any immovable or movable property, Article 23 of Schedule 1B cannot have any applicability.

The court’s view was that since debt along with underlying securities is an interest secured by bonds and/ or mortgages, transfer of such debt would be chargeable under Article 62(c).

The court further clarified that under the Instrument, merely the right under the contract to recover the debts had been transferred. Since the borrower(s) had never transferred the title in the immovable property given in security to the Assignor, the Assignor could merely transfer its rights i.e. mortgagee's rights in the property to recover the debts. It was further observed that the Assignor never had any title to the underlying securities and that it merely had the right to enforce the security interest upon default of the borrower(s) in repayment. The right transferred to Kotak was primarily the right to recover the debts, in accordance with law, by proceeding against the underlying security furnished by the bonds/ mortgage deed(s).

Therefore, the court held that the Instrument was chargeable with stamp duty under Article 62(c) of Schedule 1B of the UP Stamp Act.

Whilst coming to the conclusion that assignment of debt would not constitute a conveyance, the court referred to the definition of conveyance to state that debt is an intangible property which has to be claimed or enforced by action and not by taking physical possession thereof, in contrast to immovable and movable property.

In this regard, it may be noted that there are various judicial precedents 4 , where it has been held that an interest (including mortgage interest) in immovable property is itself immovable property.

However, even assuming assignment of debt with underlying securities over immovable property amounts to a conveyance, it

may be pertinent to refer to the definition of conveyance in the UP Stamp Act which specifically excludes a conveyance which is otherwise provided for by the Schedule to the UP Stamp Act.

Article 62(c) of the UP Stamp Act reads as follows:

“62. Transfer (whether with or without consideration) – … (c) of any interest secured by a bond, mortgagedeed or policy of insurance--”

In view of the above, transfer of any interest secured by a mortgage deed, which is covered under Article 62(c), would be excluded from the meaning of conveyance and would be chargeable to stamp duty under Article 62.

In this regard it may be pertinent to refer to the definitions of ‘bond’ and ‘mortgage deed’ under the UP Stamp Act, which is as follows:

“" Bond " includes

(a) any instrument whereby a person obliges himself to pay money to another, on condition that the obligation shall be void if a specified act is performed, or is not performed, as the case may be;

(b) any instrument attested by a witness and not payable to order or bearer, whereby a person obliges himself to pay money to another; and

(c) any instrument so attested, whereby a person obliges himself to deliver grain or other agricultural produce to another

“" Mortgage-deed ". — "mortgage-deed" includes every instrument whereby, for the purpose of securing money advanced, or to be advanced, by way of loan, or an existing or future debt, or the performance of an engagement, one person transfers, or creates, to, or in favour of another, a right over or in respect of specified property;”

In view of the above, where a debt secured by a bond or a mortgage deed is assigned under a deed of assignment, the stamp duty payable on such deed of assignment will be under Article 62(c) of the UP Stamp Act or corresponding provisions of the Stamp Act of other States.

However, in cases of unsecured loans or loans secured by an equitable mortgage (where there is no mortgage deed), the deed of assignment would attract ad valorem stamp duty chargeable on conveyance, since the same will not get covered under Article 62(c) or similar provisions in other states.

The market practice until now has been to stamp the deed of assignment of debt under the relevant article for Conveyance in the applicable Stamp Act. In fact, in States such as Maharashtra, the State Government has issued notifications for reduction of stamp duty on a deed of assignment under the article for Conveyance.

The judgment passed by the Allahabad High Court in the Kotak case may prove to be a welcome step in reducing the incidence of stamp duty on debt assignment transactions. However, it would need to be seen whether in other States a similar view is taken by stamp duty authorities.

This update has been prepared by Aastha (Partner), Debopam Dutta (Managing Associate) and Abhay Jain (Associate).

1 Notification No. F4(3)FD/Tax/2017-110 dated March 8, 2017 issued by Finance Department (Tax Division) Government Of Rajasthan.

2 Notification No.Mudrank-2002/875/C.R.173-M-1 dated May 6, 2002 issued by Revenue & Forests Department, Government of Maharashtra.

3 Reference Against MISC. Acts. No. 1 of 2016, order dated February 9, 2018.

4 Bank of Upper India Ltd. (in liquidation) v. Fanny Skinner and Ors., AIR 1929 All 161. See also Prahlad Dalsukhrai and Ors. v. Maganlal Muljibhai Tewar, AIR 1952 Bom 454 and Harihar Pandey v. Vindhayachal Rai and Ors., AIR 1949 Pat 170.

Our Offices

11, 1st Floor, Free Press House 215, Nariman Point Mumbai – 400021

+91 22 67362222

7A, 7th Floor, Tower C, Max House, Okhla Industrial Area, Phase 3, New Delhi – 110020

+91 11 6904 4200

68 Nandidurga Road Jayamahal Extension Bengaluru – 560046

+91 80 46462300

Binoy Bhavan 3rd Floor, 27B Camac Street Kolkata – 700016

+91 33 40650155/56

The rules of the Bar Council of India do not permit advocates to solicit work or advertise in any manner. This website has been created only for informational purposes and is not intended to constitute solicitation, invitation, advertisement or inducement of any sort whatsoever from us or any of our members to solicit any work in any manner. By clicking on 'Agree' below, you acknowledge and confirm the following:

a) there has been no solicitation, invitation, advertisement or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

b) you are desirous of obtaining further information about us on your own accord and for your use;

c) no information or material provided on this website is to be construed as a legal opinion and use of this website will not create any lawyer-client relationship;

d) while reasonable care has been taken in ensuring the accuracy of the contents of the website, Argus Partners shall not be responsible for the results of any actions taken on the basis of information provided in this website or for any error or omission in the website; and

e) in cases where the user has any legal issues, the user must seek independent legal advice.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Conventus Law

More results...

India – Recent Amendments To The Maharashtra Stamp Act.

February 25, 2021 by Conventus Law

26 February 2021

The Governor of Maharashtra on, February 9, 2021 , promulgated the Maharashtra Stamp (Amendment and Validation) Ordinance, 2021 with immediate effect. Two key amendments to the Maharashtra Stamp Act, 1958 have been introduced in relation to stamping of documents encompassing multiple transactions and stamp duty rates in case of mortgage by deposit of title deeds and mortgage deed. These amendments were earlier discussed by the Maharashtra Cabinet and approved on December 9, 2020 .

1. Stamping of Instruments Relating to Several Distinct Matters or Transactions

Section 5 of the Maharashtra Stamp Act, 1958 (‘ Principal Act ’) which deals with stamping of various instruments relating to several distinct matters has been amended retrospectively, with effect from August 11, 2015, to include within its ambit instruments relating to not only such distinct matters but also distinct transactions.

The Maharashtra Stamp (Amendment and Validation) Ordinance, 2021 (‘ Ordinance ’) is in line with the interpretation adopted by the Supreme Court judgment in the case of Chief Controlling Revenue Authority v Coastal Gujarat Power Ltd. and Ors. , (‘ Coastal Gujarat Power ’) wherein it was held that a single mortgage deed executed in favour of a security trustee, for the benefit of thirteen lenders, was to be construed as thirteen distinct transactions and was to be stamped accordingly for each transaction. In the case of Navi Mumbai SEZ v. State of Maharashtra (‘ Navi Mumbai SEZ ’) before the Bombay High Court, it was contended on similar facts that the phraseology in the Gujarat Stamp Act, 1958 and the Principal Act was different as the term ‘distinct transactions’ was not used in the Principal Act. Relying on past precedents, the High Court held that the phrase ‘distinct matters’ appearing in Section 5 of the Principal Act is equivalent to the phrase ‘distinct transactions’ and stamp duty should be levied in accordance with the principles set out in the Coastal Gujarat Power case.

The Ordinance has clarified the stance taken by the Courts that instruments which cover two or more distinct transactions, and cannot blend into one and be construed as part of a single transaction, will have to be stamped individually. Since the amendment to Section 5 of the Principal Act is retrospective, it must be ensured that such instruments, executed after August 11, 2015, are adequately stamped.

2. Changes in Stamp Duty Rates

The rates applicable to agreements relating to deposit of title deeds, pawn, pledge or hypothecation ( Article 6, Schedule I of the Principal Act ) and Mortgage Deed ( Article 40, Schedule I of the Principal Act ) have been amended and made uniform. The changes were brought in to remedy the increasing stamp duty evasions caused due to the differences between the stamp duty rates of these instruments. These changes are prospective in nature, unlike the retrospective amendment to Section 5.

Way Forward

After the Supreme Court’s decision in the case of Coastal Gujarat Power, it was inevitable that changes would be introduced to stamp acts across the country to bring them in line with the view taken by the Supreme Court. In any event, the general market practice being followed in financing transactions took this view into account and stamp duty was/is usually calculated on the basis of the number of lenders / banks involved in security documentation. What remains to be seen is whether the new amendment will further allow the Revenue Department to apply this view in other cases – for example, in addition to stamp duty being paid on the basis of multiple lenders, will additional stamp duty be payable on security documents if there are multiple borrowers or security providers, multiple facilities / debts being secured or multiple properties over which security is sought to be created. What is indeed now unquestionable is that the position taken by the Bombay High Court, in the case of Navi Mumbai SEZ, has also been given legislative effect and one may no longer seek to resist the application of the view of the Supreme Court set out in Coastal Gujarat Power to instruments stamped in Maharashtra merely due to the absence of the words ‘distinct transactions’ in the Principal Act.

Moreover, since this amendment to Section 5 of the Principal Act has been made retrospectively applicable, one may need to re-examine documents executed for transactions since August 11, 2015 to determine whether the decision of the Supreme Court in Coastal Gujarat Power has been followed. If not, one cannot rule out negative remarks being made during the audit process and documents may potentially require impounding/ adjudication in line with the provisions of the Principal Act as well.

For further information, please contact:

Zia Mody, Partner, AZB & Partners

Register for your monthly Asia legal updates from Conventus Law

Error: Contact form not found.

Poland – Polish Regulator Battles Misleading Labels In The Clothing Industry.

Sweden – Swedish Companies Are Implementing Age Restrictions On Advanced Skincare Products.

Cayman Islands Grand Court Orders Disclosure Despite PRC Data Security Law Concerns.

- eliot simpson - partner, appleby.

CONVENTUS LAW

CONVENTUS DOCS CONVENTUS PEOPLE

3/f, Chinachem Tower 34-37 Connaught Road Central, Central, Hong Kong

- Log in to your account

- Sign up as individual

- Sign up as builder/agent

- Login to add properties to your shortlist

Maharashtra Stamp Act: An Overview On Stamp Duty And Registration Charges

Prahalad singh, maharashtra stamp act introduction.

In India, the Indian Stamp Act, 1899 (ISA) is a central legislation, while states have their own local stamp act to administer with issues rising within that particular state. The Bombay Stamp Act, 1958 which came into force on 16 February 1969 (BSA), is a law for stamp duty within the state of Maharashtra. The Constitution of India permits both the Parliament and the State Legislature to make provisions and legislation for stamp duty within its limits. Accordingly, certain documents specified in the ISA are included. Under the BSA, an instrument is defined to include every document by which any right or obligation is, or is made, transferred, limited, extended, extinguished or recorded while a bill of exchange, checks, promissory notes, etc. is not included. These documents are excluded, as governed under the aforesaid ISA.

What is Maharashtra Stamp Act?

In Maharashtra, stamp papers could be purchased before 1 May 1994 in the names of advocates or by any other name. However, the stamp paper is to be purchased in the name of one of the parties thereafter. In addition, the validity of the stamp paper is restricted for a period of 6 months and if stamp paper is used thereafter, it is assumed that the document is executed on ordinary paper without a stamp.

If an instrument falls into Schedule I of the Bombay Stamp Act (BSA) with several duties rates, the instrument is chargeable with the highest of the prescribed fees. Apart from this, the BSA also prescribes a methodology for adjournment (proper assessment), the refund of duties, grievance procedures and defects, etc. The Collector is usually authorized or vested with the power to authorize. If a document is not stamped or appropriately stamped, it is likely to be affixed.

The Act was recently amended and amendments include revision of stamp duty on gift deeds, e-payment of stamp duty, amendment of penalty sections, and increase in stamp duty under certain instrument clauses.

What Is Stamp Duty?

Stamp duty is a type of tax, such as sales/income tax, etc. and its basic purpose is to raise revenue for the government. Thus, like any other tax, the stamp duty will have to be paid to the government in full and on time, with a delay with penalties. In general, stamp duty is levied on an instrument (and not on a transaction); stamp duty is payable on the property (whether immovable/movable or tangible/intangible) either on a fixed basis or on the basis of the consideration mentioned in the instrument as the case may be. In the case of immovable property, there is an additional theory of valuation of the property, which is also taken into account while deciding the stamp duty payable.

How Is Stamp Duty Calculated?

The stamp duty is calculated based on the ready reckoner rates and the property value mentioned in the buyer-seller agreement. In Maharashtra, stamp duty on the property varies by location. For example, stamp duty for a property located in the municipal limit of urban areas in Mumbai will be 5% of the market value, while a property located within the limits of any gram panchayat will attract stamp duty of 3% of the market value.

Stamp Duty And Registration Charges In Maharashtra

The stamp duty rates on property depend on several measures in the state of Maharashtra. This includes whether the property is located in urban or rural areas, the total cost of the transaction, etc. Recently, the Maharashtra government has reduced the stamp duty on properties for the next two years in areas falling under the Mumbai Metropolitan Region Development Authority. (MMRDA) and the municipal corporations of Pune, Pimpri-Chinchwad, and Nagpur.

This means that stamp duty on properties in Mumbai, Pune, and Nagpur, will be charged at 5% (4% stamp duty + 1% metro cess).

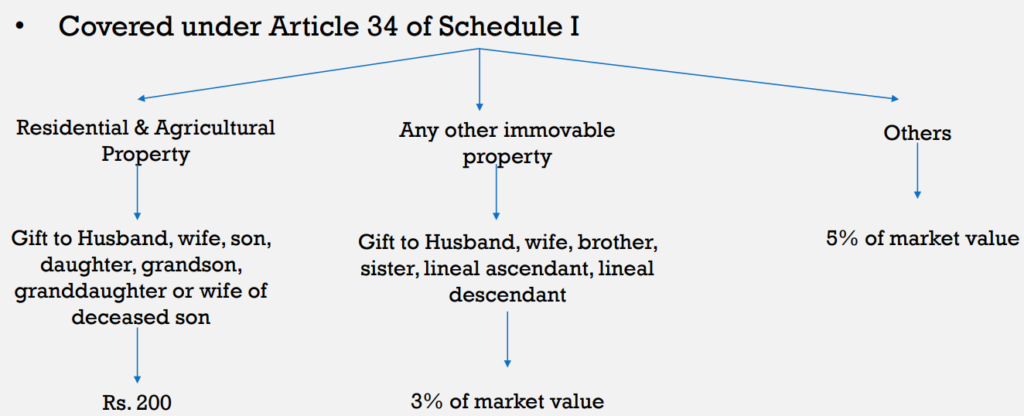

Moreover, according to Article 34 of the Maharashtra Stamp Act, which was revised in 2017, stamp duty on gift deeds is 3% of the property’s value. However, if the property in consideration is a residential or agricultural property and is gifted (without any payment) to family members, then, the stamp duty is Rs 200.

Factors that Determine Your Fee on Stamp Duty & Registration

Stamp duty and registration charges are imposed by the state governments on homebuyers. These apply to both freehold and leasehold land (agricultural and non-agricultural) as well as other types of properties such as homes, flats, or commercial properties. There are certain factors that determine how much stamp duty is in Mumbai and registration will be payable:

- Type of property

The fees on residential will be comparatively less than a commercial property.

- The type of location

Properties in rural areas, as well as semi-urban areas, have to pay significantly less than in posh areas.

- Market Value

The market value of the property and the area of the property are taken into account for the calculation of stamp duty charges.

How To Pay Stamp Duty & Registration Charges Online In Mumbai?

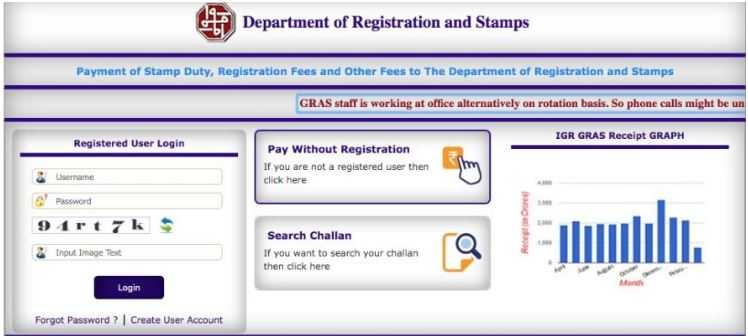

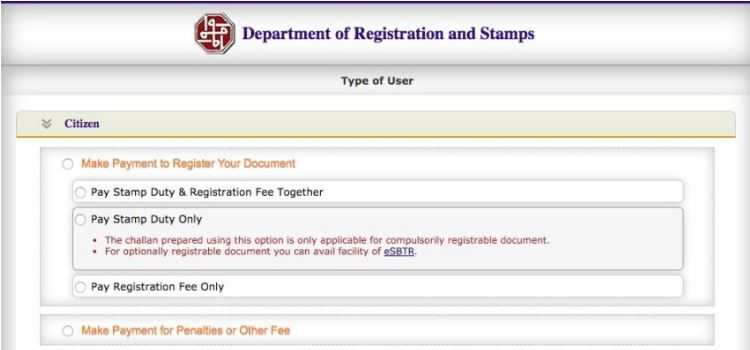

In Mumbai, you can go for payment of these charges through both online and offline mediums. The Government of Maharashtra has a dedicated portal ‘Government Receipt Accounting System’ (GRAS) in which you are required to enter all the necessary details about the property and its documents and make payments accordingly. Homebuyers must follow a few easy steps to pay the stamp duty and registration charges in Mumbai on the purchase of the property.

Step 1: Visit the Maharashtra Stamp Duty Online Payment Portal.

Step 2: If you are not registered with the portal, click ‘Pay without registration’. If you are a registered user, please fill in the login details.

Step 3: If you have selected the option ‘Without Pay Without Registration’, you will be directed to another page, where you will have to select ‘select citizen’ and select the type of transaction you want to do.

Step 4: Select ‘Pay to register your document’. Now, you can choose to pay stamp duty and registration fee together or only stamp duty or registration fee only.

Step 5: Fill in the required details such as District, Sub-Registrar office, Payment details, Party details, Property details, and Property value details.

Step 6: Select the payment option and once completed, generate the challan, which will have to be submitted at the time of execution of the deed.

If you are doubtful or stuck at any step or you want to recreate your invoice, you can leave a mail at [email protected]

Modes of Payment of Stamp Duty in Maharashtra

There are 4 modes of payment of Stamp Duty in Maharashtra:

- Non-judicial Stamp Papers – This is the traditional but cumbersome and time-consuming mode of stamping, and forces one to obtain physical stamp paper by engaging with licensed vendors. The instrument to be executed is printed on such stamp paper. This option is not practicable in cases where stamp duty of larger denominations is required to be paid.

- Franking a document – The process of franking a document requires submitting an application with an authorized bank or franking agency to pay stamp duty and stamp (using the vending machine) by the authorized bank or franking agency on the document denotes value. Franklin can only be done before the execution of the document and the maximum stamp duty cap is Rs. 5000 / document.

- e-SBTR/Electronic Secured Bank Treasury Receipt – E-SBTR is an online payment service for payment of stamp duty through an electronic payment gateway. For this one has to fill the filling ‘input form’ at the branch office with any bank providing e-SBTR facility and pay the required amount of stamp duty. The bank then records these details in the Government Virtual Treasury and creates an e-SBTR on the special government pre-printed secure stationery which serves as proof of payment of stamp duty. Since the e-SBTR is issued on a special government stamp, it is necessary to physically collect an e-SBTR from the respective branch of the bank upon the presentation of the confirmation of online payment for the print of input form and stamp duty.

- GRAS/Government Receipt Accounting System – Like e-SBTR GRAS, there is an online payment of stamp duty through an electronic payment system. However, under an e-SBTR mechanism, there is no need to physically go to the respective branch of the banks as recognition of e-challan generated online under GRAS as an accepted method of payment in sub-registrar offices and other offices of the department. Although a completely online process, GRAS has the limitation that it can only be used for compulsory registrable documents (under Section 17 of the Registration Act, 1908), including, inter alia, the right, title, and interest to or in immovable property. In financing transactions, therefore, this mode of payment will only be available for documents such as mortgages and cannot be used to pay stamp duty on other important but non-mandatory mandatory documents such as loan agreements, security and guarantee documents.

Recent Clarification on Stamp Duty in Maharashtra

Providing some relief to the Office of Inspector General of Registration and Controller General of Maharashtra through a circular dated 27th April 2020 and notified certain relaxations in relation to (a) Some exemptions have been notified in respect of filing of information (in the matter of financing, transactions required for the creation of mortgages on immovable property, through title deeds or deposits of similar mortgages):): and (b) Payment of stamp duty on non-compulsory registrable financing documents executed during the nationwide lockout period. The fee/exemption offered under the circular is summarized in the table below.

Stamp Duty News

- On 6 March 2020, the Maha Vikas Aghadi (MVA) government in its landmark decision announced a 1% stamp duty concession and other related charges applicable to the registration of documents in areas falling under the Mumbai Metropolitan Region Development Authority (MMRDA) and Municipal Corporations of Pune, Pimpri-Chinchwad, and Nagpur by 2022.

- On 31st March 2020, the Central Government has extended the applicability of stamp duty by 3 months. The provisions of the amended Indian Stamp Act, which were to come into force from 1 April 2020, will now come into force from 1 July 2020.

- On 11th May 2020, the Maharashtra government has lost Rs 3885 crore in stamp duty in 40 days of lockdown. The state government has earned only Rs 15 crore through stamp duty and registration in the last 40 days – a steep fall in comparison to the Rs 4000 crore it usually generates in such a period.

- On 28th May 2020, the Maharashtra Government has announced 1% concession of stamp duty.

Data Source: Google, Image source: https://gras.mahakosh.gov.in/

Related Articles

Stamp duty and registration fees are a crucial part of a property transaction in Madhya Pradesh and one of the highest in the country. Whenever a property is sold or purchased in the state, the buyer pays stamp duty and registration fee to the state government. Payment of stamp duty assures that a transaction is […]

Tellapur: The Perfect Destination for Real Estate Investment From a quiet village space to a bustling residential area, Tellapur is becoming a sought-after destination for real estate investments. Tellapur is emerging as a premium residential location in Hyderabad due to its central location near the Outer Ring Road (ORR) with easy accessibility to IT hubs […]

Mayfair Apartments is a plush urban resort nestled in lush greenery. A unique botanical escape where the components of nature – earth and sky are landscaped in a layered sight of scenic views and decorated gardens. At Greenmark Mayfair, all your wishes and desires are brought to life more flawlessly than you ever envisioned. Mayfair […]

Choosing a real estate property is always tricky as there are numerous factors involved in selecting your dream home. Be it an apartment or a villa, selecting your perfect abode depends on your interests and requirements. If you like to have a cozy little space and ample privacy, going for lavish villas in gated community […]

Latest Videos

Trending Article

A List of Top Luxury Villa Projects in Bangalore

Top 6 builders and developers in bangalore, 5 best places to live in kolkata that offers sound connectivity and amenities, luxe living: finding delhi’s posh localities and properties, latest properties, flats for sale in bangalore, flats for sale in delhi, flats for sale in mumbai, flats for sale in pune, flats for sale in chennai, flats for sale in kolkata, flats for sale in hyderabad, flats for rent in bangalore, flats for rent in delhi, flats for rent in mumbai, flats for rent in pune, flats for rent in chennai, flats for rent in kolkata, flats for rent in hyderabad, projects for sale in bangalore, projects for sale in delhi, projects for sale in mumbai, projects for sale in pune, projects for sale in chennai, projects for sale in kolkata, projects for sale in hyderabad.

- Browse Cities

- Properties for Sale in Bangalore

- Properties for Rent in Bangalore

- Browse Projects in Bangalore

- Browse Localities in Bangalore

- Agent Directory for Bangalore

- CommonFloor Groups

- Post Your Requirements

- Get Mobile App

- Call Us: 080-67364545

- All India Apartment Directory

Your details has been submitted successfully.

A Concise Guide to the Maharashtra Stamp Duty Act

Are you planning to buy property in Maharashtra? If your answer is yes, you need to be aware of a few taxation aspects that can make the process smooth and hassle-free. Buying property is not the same as renting one. Taking up a house for rent in Mumbai or any other place in Maharashtra does not require you to pay any tax. However, you need to do so when owning property. This is where the Maharashtra Stamp Act comes into the picture.

What Is the Maharashtra Stamp Duty Act?

When you buy property in Maharashtra, you need to get the transaction stamped or legalized by paying a certain amount of tax. You have to pay this tax to the state government, and it’s called the stamp duty.

The Maharashtra Stamp Act specifies the assets and resources on which you have to pay stamp duty to the state government. The Act also determines the amount that property owners are liable to pay as tax to the authorities.

How Is Stamp Duty Payable?

You can pay stamp duty using various means in Maharashtra, such as the ones mentioned below:

Stamp Paper

Stamp paper is a convenient way of paying stamp duty in Maharashtra. It is an often-foolscap piece of paper with a revenue stamp pre-printed on it.

As a property buyer, you have to purchase the non-judicial stamp paper from a government-authorized vendor. You need to type or write your property transaction details on the stamp paper.

Adhesive Stamps

Adhesive stamps are postage stamps that feature pressure-sensitive adhesive. You don’t need to moisten them to fix them on any paper. This is an alternative to stamp paper when paying the stamp duty.

eSBTR or Electronic Secure Bank and Treasury Receipt is a system through which you fill up an application and make payment via the authorized participating bank. The bank uploads the details to the Government Virtual Treasury database and issues you an eSBTR. This eSBTR serves as proof of payment for the stamp duty.

Franking is the process of stamping your property documents to indicate that you have paid the stamp duty and the documents are legal. A franking machine is used to do this.

Stamp Duty Rates in Maharashtra

The stamp duty rates in Maharashtra depend on several factors, such as:

- Type of Property : Stamp duty on a commercial property is more than that on a residential property

- Location of Property : Stamp duty of properties located in rural or semi-urban areas is less than those located in posh areas of large cities.

- Market Value : Stamp duty calculation takes into account the current market value of the property.

In March 2021, the Maharashtra state government declared a rebate of 1% in stamp duty if a property is transferred to only a woman’s name.

This decision will help women buy an affordable house in Pune , Mumbai, Nagpur, or any other place in Maharashtra in her name. However, joint property owners (male and female) will not get this rebate benefit.

The stamp duty rates for various places in Maharashtra are as follows:

- Mumbai : 5% for males and 4% for females (includes 1% metro cess for both cases)

- Pune** : 6% for males and 5% for females

- Thane** : 6% for males and 5% for females

- Navi Mumbai** : 6% for males and 5% for females

- Pimpri Chinchwad** : 6% for males and 5% for females

- Nagpur** : 6% for males and 5% for females

** includes stamp duty and local body tax for both cases

Stamp Duty on Indemnity Bond in Maharashtra

As per the Maharashtra Stamp Act, the stamp duty on indemnity bonds in Maharashtra is Rs.500. This stamp duty is payable online.

Agreement in Maharashtra

The stamp duty on Guarantee Agreement in Maharashtra is as follows:

- When the loan amount is less than ten lakhs rupees, the stamp duty is 0.1% of the amount specified in the deed, with a minimum of Rs.100.

- When the loan amount is more than ten lakhs rupees, the stamp duty is 0.2% of the amount specified in the deed.

Maharashtra Stamp Duty Impact on Property Registration

The Maharashtra state government had reduced the stamp duty on properties in April 2020. This rebate was provided for the next two years. It was applicable for areas under the Mumbai Metropolitan Region Development Authority (MMRDA) and municipal corporations of Nagpur, Pimpri-Chinchwad, and Pune.

However, the state government withdrew the rebate and restored the stamp duty to 5% from 1st April 2021. As a result, the state witnessed a dip of 50% in property registrations in April 2021.

Before the rebate was rolled back, Maharashtra witnessed a record-breaking 2.13 lakh property registrations across the state, except Mumbai, in March 2021. This figure fell to 90,500 registrations in April 2021. Mumbai also witnessed a boost in property registrations during the rebate period.

This is a clear indication of the huge impact of Maharashtra stamp duty on property registrations.

Recent Judgments on Maharashtra Stamp Duty

In a recent judgment, the Bombay High Court has stated that the Maharashtra state government must refund excess stamp duty within a month from the date on which it receives an application for the same.

If they fail to do so, the government will have to pay interest at 12% per annum. This came as a welcome decision for the property owners of Maharashtra.

The Maharashtra Stamp Duty Act has been witness to various amendments over time. It may seem overwhelming to deal with such legal intricacies when buying a property. However, this guide has simplified everything you need to know about stamp duty.

After all, such legal and tax obligations must not stop you from owning property!

Related Posts

Term Insurance for Family: Meaning, Benefits,…

The Benefits of Shared Rooms for…

Stamp Duty and Registration Charges in…

Exploring the Top Advantages and Disadvantages…

Hit enter to search or ESC to close

Search bar.

- Legal Queries

- Files

- Online Law Courses

- Lawyers Search

- Legal Dictionary

- The Indian Penal Code

- Juvenile Justice

- Negotiable Instruments

- Commercial Courts Act

- The 3 New Criminal Laws

- Matrimonial Laws

- Data Privacy

- Court Fees Act

- Commercial Law

- Criminal Law

- Procedural Law

- The Constitutional Expert

- Matrimonial

- Writs and PILs

- CrPC Certification Course

- Criminal Manual

- Execution U/O 21

- Transfer of Property

- Domestic Violence

- Muslim Laws

- Indian Constitution

- Arbitration

- Matrimonial-Criminal Law

- Indian Evidence Act

- Live Classes

- Writs and PIL

- Share on Facebook

- Share on Twitter

Share on LinkedIn

Share on Email

Gayatri P Man (Not Applicable) --> 24 August 2016

Stamp duty for assigning/licensing ipr

7 Replies

adv.bharat @ PUNE (Lawyer) --> 25 August 2016

What kind of assignement deed it is?

As per my knowledge ther is no such stamp duty for IPR.

For license agreemnt there is stamp duty & registration charges it is calculated as Total rent+ Deposit X 0.025.

If u like my solution then give THANKS on my profile.

Ms.Usha Kapoor (CEO) --> 02 September 2016

Dear Client,

As far as copy right is copncerned stamp duty is completely exempted according to Article 25 of Schedule 1 of Bombay stamp Act. Regarding Patents and Trade Marks the stamp duty payable depends on the amopunt of consideration exchnged bwetween th eseller and buyer of the sale/purchase of Patent/Trade Mark.Regarding Licence Agreements of IPRs you contacxt the concerned District Collector as to applicable rates of stamp duty for Licensing Agreements of IPR transactions.

As far as copy right is copncered stamp duty is completely exempted according to Article 25 of Schedule 1 of Bombay stamp Act. Regarding Patents and Trade Marks seller and buyer/Assignor/ Assignee of the sale/purchase of Patent/Trade Mark.Regarding Licence Agreements of IPRs you contacxt the concerned District Collector as to applicable rates of stamp duty for Licensing of IPR transactions.

As far as copy right is copncerned stamp duty is completely exempted according to Article 25 of Schedule 1 of Bombay stamp Act. Regarding Patents and Trade Marks the stamp duty payable depends on the amount of consideration exchnged bwetween the /Assignor/Assignee seller and buyer of the sale/purchase of Patent/Trade Mark.Regarding Licence Agreements of IPRs you contact the concerned District Collector as to applicable rates of stamp duty for Licensing Agreements of IPR transactions.

Ms.Usha Kapoor (CEO) --> 24 September 2016

Assignment of copyright

Assignment of copyright has to be in writing and signed by the assignor or by his duly authorised agent. Copyright consists of a bundle of different rights in the same work, which can be assigned either as a whole to one party or separately to different parties.

· The deed of assignment must specify the `rights assigned’, the duration and territorial extent of assignment, and the royalty payable, if any. When duration of assignment is not specified, it is presumed to be for five years and when territorial extent is not specified, it is presumed to extend within India. (Section 19, Copyright Act, 1957)

· An assignment of a Copyright is exempted from Stamp Duty. (Article 25 of Schedule I of the Bombay Stamp Act, 1958).

The above provisions apply both to registered and unregistered copyright. Apart from the above requirements, in case of registered copyright, the following additional steps also have to be taken.

Registered Copyright

Assignee has to make an application for registration of changes in the particulars of copyright entered in the Register of Copyrights in Form V under Rule 16 of Copyright Rules, 1958 to be delivered by hand or registered post. Attested copies of the deeds of assignments should be enclosed with the application.

Assignee has to make an application for registration of changes in the particulars of copyright entered in the Register of Copyrights in Form V under Rule 16 of Copyright Rules, 1958 to be delivered by hand or registered post. Attested copies of the deeds of assignments should be enclosed with the application..If you appreciate this answer please click the Thank you button on this forum./

Gayatri P Man (Not Applicable) --> 01 March 2017

@ adv.bharat @ PUNE and @ Ms.Usha Kapoor Thanks for your reply.

I am looking for the stamp duty on the licensing agreement for licensing patent-rights in Maharashtra.

Leave a reply

Your are not logged in . Please login to post replies Click here to Login / Register

Recent Topics

- Regarding disparity in salary

- Stop payment cheque bounce.

- how do I get a case papers of the year 1983 of the

- Mutual consent divorce - cause of action arose abr

- Financial fraud followed by arrest

- 2nd appeal dismissed

- Claiming compensation for alloted flat + Mental to

- Land conveyance

- Procedure for filing criminal complaint on statuto

- Multiple cheque bounce

Related Threads

Popular Discussion

- What happens if one respondent not recei

- Will validity on immovable property

- Adding disablity

- Regarding gratuity

- If teacher slap child but other teacher

- Update on my father's case

- Disowned case

- Want to study law

- Divorce on basis of desertion while chil

view more »

Browse by Category

- Business Law

- Constitutional Law

- Labour & Service Law

- Legal Documents

- Intellectual Property Rights

- Property Law

- Forum Portal

- Today's Topic

- Popular Threads

- Post New Topic

- Unreplied Threads

- Top Members

- Share Files

- LCI Online Learning

Member Strength 9,49,363 and growing..

Download LCI APP

Our Network Sites

- We are Hiring

- Terms of Service

- Privacy Policy

© 2024 LAWyersclubindia.com. Let us grow stronger by mutual exchange of knowledge.

Lawyersclubindia Search

Whatsapp groups, login at lawyersclubindia.

Alternatively, you can log in using:

Bringing you the Best Analytical Legal News

- Case Briefs

“Stamp Duty is only payable for additional area purchased under Re-development Agreement”: Bombay High Court

Bombay High Court quashed two of State Government’s circulars, limited the stamp duty only to additional area purchased during redevelopment, and laid several pointers which shall apply further beyond the facts of the present matter.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Skype (Opens in new window)

Bombay High Court: In a batch of petitions questioning the law regarding stamp duty levied on Permanent Alternate Accommodation Agreements (‘PAAA’) or Development Agreement (‘DA’) or a Redevelopment Agreement under the Maharashtra Stamp Act, 1958 , the Division Bench of G.S. Patel and Neela Gokhale, JJ. held that stamp duty must be paid only on the additional area purchased during redevelopment. The Court made it clear that the interpretation in the present matter shall not be confined to the facts of these cases.

The matter relates to DA and PAAA connected with development and redevelopment of housing societies. The law providesfor levying stamp duty on purchase of a property. Stamping of DA is not disputed in the present matter, while the issue resonates around the Stamp Authority’s demand to stamp individual PAAAs for members or existing occupants on a value reckoned at the cost of construction. The present petition challenges various circulars issued by the State Government charging stamp duty on PAAAs and related guidelines.

Dealing with the question of “Is there a meaningful distinction to be made between the society and its members in the context of a re-development by an outsider (a developer)?”, the Court rejected the submission of existence of a juristic entity in ‘society’ without its members with the explanation that “a co-operative society without members is a creature unknown to law.” Through denial of contention that individual society members have rights independent of the society in dealing with third parties in the case of Aditya Developers v. Nirmal Anand Co-Operative Housing Society Ltd. , 2016 SCC OnLine Bom 100 , the Court clarified that once a person voluntarily becomes a member of society, he/she loses his individuality and subsumes within the identity of society.

The Court commented that the developer is not selling homes to society members after re-development. The Bench also acknowledged that everyone among the societies, developers and individual society matters accept their liability to pay full stamp duty on the additional area purchased. The Court said that the only stamp duty a member must pay is for any additional area that she or he actually purchases for consideration.

The Court scrutinized the specific provisions of Maharashtra Stamp (Amendment) Act, 2021 under which Article 5 relates to every kind of agreement or a record of an agreement or memorandum of an agreement and Article 5 (g-a). The Court said that such an agreement is treated on par with a conveyance under Article 25 of the Maharashtra Stamp Act, 1958 . It further pointed towards Chapter II of the Act dealing with instruments that are liable to stamp and Sections 4, 5 and 6 pertaining to multiplicity.

The Bench referred to Prabha Laxman Ghate v. Sub-Registrar and Collector of Stamps , 2004 SCC OnLine Bom 74 challenging an amendment related to Article 5(g-a), DAs and societies, wherein the legislature’s intention to bring transactions otherwise not covered in the provisions within the ambit of the Stamps Act and subjected to duty was interpreted by the Court, which should not be limited to the facts of the case as opined by the Court in the present matter.

The Court examined the impugned circular dated 23-6-2015 which refers to Prabha Ghate (supra), but the exception to departure from or a variation of the DA is unsupported by the case mentioned as pointed by the Court. The circular dated 30-3-2017 referring to the circular dated 23-6-2015 communicates the requirement that DA between the developer, society and members should be treated as an incidental agreement under Section 4(1). The Court found no issue with this requirement, but the refusal to acknowledge PAAA for its essence and demand of a single document, tripartite or multi-tripartite in nature, which needs to be signed by everyone. The Court observed that if everybody signs the document, then Section 4(1) speaking of several instruments will have no application. The Court held that stamp authorities are legally not entitled to issue such a circular and it cannot be imposed under the Stamp Act. It further added that the circular cannot do something that the parent statute does not contemplate.

The Court held the circular dated 30-03-2017 unsustainable in law, which is liable to be quashed, and the circular dated 23-06-2015 excluding PAAAs from Section 4(1), being ultra vires of the Stamp Act, is also liable to be quashed.

The Court stipulated the following pointers through the present judgment and made it clear that these shall not be limited to the facts of the present matter:

A DA between a cooperative housing society and a developer for developing society’s property (land, building, apartments, flats, garages, godowns, galas) requires to be stamped.

The DA need not be signed by individual members of society as a mandate. Even if individual members do not sign the DA, it controls the re-development and society members’ rights.

A PAAA between developer and an individual society member does not require to be signed on behalf of the society.

Stamp cannot be levied twice. Once the DA is stamped, the PAAA cannot be separately assessed to stamp beyond the requirement of Rs. 100 under Section 4(1), if it specifically relates to rebuilt or reconstructed premises in lieu of the old premises used/occupied by the member. The same applies even if the PAAA includes an additional area available to the member, since it is not a purchase or a transfer but is in lieu of the member’s old premises. The stamp on DA includes reconstruction of every unit in the society building.

If PAAA is limited to rebuilt premises in the absence of actual purchase for consideration of any additional area, such PAAA is an incidental document under Section 4(1) of the Stamp Act.

PAAA between a developer and a society member must be additionally stamped if it provides for purchase for actual stated consideration and a purchase price of additional area beyond the area given to the member against the earlier premises.

Assessing stamp on PAAA on construction cost of the new premises in lieu of old premises cannot be sustained.

Reference to redevelopment and homes includes garages, galas, commercial and industrial use and every form of redevelopment of the society.

[ Adityaraj Builders v. State of Maharashtra, 2023 SCC OnLine Bom 540 , judgment dated 17-02-2023 ]

*Judgment authored by: Justice G.S. Patel.

Advocates who appeared in this case :

For Petitioners: Advocate Dharam Sharma, Advocate Ashraf Diamondwala, Advocate S. Murthy, Advocate Neha Shah;

For Respondents: AGP Jyoti Chavan, AGP Hemant Haryan, AGP Himanshu Takke, AGP Kedar Dighe, Advocate Sachin Chowdhari, Advocate Deepti, Advocate Abhishek Nikharge;

Amicus: Advocate Samit Shukla, Advocate Siddharth Shah, Advocate Anjali Shah and Advocate Anuj Sarla.

Section 125 CrPC: Can the second wife be entitled to maintenance from her husband?

Delhi HC granted bail to a man accused of raping woman he met on dating app on pretext of marriage

Do convicts have a fundamental right to procreate? Watch to know what Delhi High Court recently held

Book release of 8th edition of “Criminology, Penology and Victimology” revised by Sanjay Vashishtha

One comment.

What happens to A Agreement iof a member of registered chs in a redevelopment in which iAgreement is not registered or adjudicated at collectors of stamps and root registered at sub Registrars Office, or adequate stamp duty is not paid, during course of redevelopment?

I gather the developer takes set off of the earlier stamp duty paid and only pays vor the additional area as it is his liability to pay….???

Join the discussion

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Home » Blog » All-About Maharashtra Stamp Duty Amnesty Scheme – Benefits | Processes | Practical Insights

All-About Maharashtra Stamp Duty Amnesty Scheme – Benefits | Processes | Practical Insights

- Other Laws | Blog |

- Last Updated on 7 March, 2024

Recent Posts

News, Blog, FEMA & Banking

ADs to Forward Details of Option Transactions on a Weekly Basis by First Working Day of Following Week | RBI

Blog, News, Company Law

Portfolio Manager Now Requires New Client’s Separate Signature on Fee Annexure With Handwritten Confirmation | SEBI

Latest from taxmann.

By Adv. Shyamsundar Patil, IAS (Rtd) – Former MD | Mahananda, CA. Ramesh Prabhu – Chairman and CA. Shreyash Prabhu – Chairman | Maharashtra Societies Welfare Association (MahaSewa)

Table of Contents

- What is Stamp Duty?

- Why to pay Stamp Duty?

- When to pay Stamp Duty?

- Instruments on which stamp duty applicable

- Significance of year: 1958 – 1980 – 1985

- Stamp Duty on Gift deed

- Stamp Duty Amnesty Scheme 2023 – 2024

1. What is Stamp Duty?

- It is a tax payable to the STATE GOVERNMENT

- Payable under Section 3 of The Maharashtra Stamp Act, 1958

- Payable on Instruments given under Schedule-I of the Act

- Only on proper payment of stamp duty is an instrument admissible as evidence in Court

- Stamp duty to be paid in Full and On Time

- Delay of payment of stamp duty attracts Penalty

2. Why to pay Stamp Duty?

- It is to be paid as LAW exists

- To ensure Legal Validity of Document

- As per Sec 34 , Instrument not duly stamped is inadmissible as evidence

- If not paid, under sec 34 Penalty of 2% per month from date of signing till deficient stamp duty is paid

- Penalty up to 400% i.e. 4 times

If penalty is not paid, then?

- Confiscation

- Land Seizure

- Under Sec 59(1) of Maharashtra Stamp Act, 1958 Imprisonment for a term NOT LESS THAN 1 month which may extend to 6 months

3. When to pay Stamp Duty?

Stamp duty payable:

- Before execution of document

- On day of execution of document

- On next working day of execution of document

4. Instruments on which stamp duty is applicable

All Instruments provided in Schedule I of Maharashtra Stamp Act, 1958.

Total 63 different types of instruments are covered in the schedule

5. Significance of year: 1958 – 1980 – 1985

11th June, 1958:

- Bombay Stamp Act, 1958 came into effect which was later changed to Maharashtra Stamp Act, 1958 in the year 2015.

4th July, 1980:

- Market value concept was introduced.

- Stamp duty payable on market value or agreement value whichever is higher.

- Earlier stamp duty payable on agreement value only.

10th December, 1985:

- Stamp duty payable compulsory on Agreement for sale

- Before that only Rs. 5 required and stamp duty payment required during agreement for sale

Eg: Building constructed in 1983 having 100 members and conveyance of building to society done in 2023

80 members bought flat in 1983: In 1983 – Had to pay Rs.5 as stamp duty applicable. In 2023 – Have to pay stamp duty as applicable

20 members bought flat in 1987: In 1987 – Had to pay stamp duty rate applicable. In 2023 – Have to pay Rs.100 only for deemed conveyance.

6. Stamp Duty on Gift deed

NOTE: 1% metro cess charged additional applicable since 8-2-2019

7. Stamp Duty Amnesty Scheme 2023 – 2024

7.1 what is the meaning of amnesty.

- Forgiveness

Revenue and Forest department of Maharashtra has introduced Amnesty scheme to reduce stamp duty and penalties on specified instruments Previous scheme was launched in 2019

7.2 When was the scheme launched?

Stamp Duty Amnesty Scheme 2023 was introduced and declared by the Govt. of Maharashtra on 7th December, 2023 via Govt order: Mudrank-2023/C.R.No.342/M-1(Policy)

7.3 Time period for availing benefits

Scheme was launched in Two Phases for agreements between 1st January 1980 – 31st December 2020

- PHASE 1: From 1st December 2023 to 31st January 2024 – 29th February, 2024

- PHASE 2: From 1st February 2024 to 31st March 2024 – 1st March, 2024

Extended on 31st Jan, 2024 by Deputy Secretary – Shri Satyanarayan Bajaj

7.4 Instruments covered under this scheme

- Instrument related to Conveyance

- Agreement to sale

- Sale Certificate

- Agreement related to deposit of:

- Title deeds

- Hypothecation

For Residential/Non–Residential/Industrial use

- Agreement or Memorandum of agreement relating to transfer of immovable property for purpose of residential use

- Conveyance of allotment of residential/non-residential units from MHADA, CIDCO and SRA to slum dweller for purpose of rehabilitation under scheme

- Conveyance of allotment of residential/non-residential units or houses in registered Co-op Housing Societies or any apartment whose Deemed Conveyance is pending

- Any type of Development Agreement

- Agreement to sell

- Instrument of transaction of Assignment of developer rights

Related to redevelopment of any dilapidated old buildings or immovable property whose redevelopment is necessary

Any type of document related to:

- Amalgamation

- Arrangement

- Reconstruction of companies

Any type of instrument executed by:

- MHADA and its divisional board

- Municipal Corporation

- Municipal Council

- Nagar Panchayat

- Planning authorities like MIDC, SRA, etc.

First Allotment Letter or Share Certificate issued related to residential/non-residential units by Regd. Coop. Society on Government Land or by:

- Municipal Corporation, Council or Nagar Panchayat

- Approved planning authorities like MIDC, SRA, etc.

7.5 Benefits of the Scheme

If Instrument between 1st Jan 1980 – 31st Dec 2000 (Schedule – I) Phase I: From 1st December, 2023 to 29th February, 2024

If Instrument between 1st Jan 1980 – 31st Dec 2000 (Schedule – I) Phase II: From 1st March, 2024 to 31st March, 2024

If Instrument between 1st Jan 2001 – 31st Dec 2020 (Schedule – II) Phase I: From 1st December, 2023 to 29th February, 2024

If Instrument between 1st Jan 2001 – 31st Dec 2020 (Schedule – II) Phase II: From 1st March, 2024 to 31st March, 2024

7.6 General FAQs

Faq 1. what documents need to be submitted along with application for availing amnesty scheme.

- Original Instrument on which some amount of stamp duty paid or specified allotment letter issued by authorities or CHS on Government land

- Copy of Society Registration Certificate

- Copy of BMC Assessment bill

- Copy of IOD/CC/OC of building

- Copy of Property Card

- Copy of Share Certificate (front & back)

- Copy of Aadhar Card & Pan Card along with 2 recent passport size photographs

- Letter from society about details of flat/apartment

- Authority Letter

- Proof of having possession, like:

- Electricity bill

- Entry in Form A during society formation

- Telephone bill

- Election Card

- Bank Passbook

FAQ 2. My agreement is on a piece of paper (without stamp paper), can I avail the benefit?

- NOT ELIGIBLE for Amnesty Scheme

- Any amount of stamp paper should be present

FAQ 3. If stamp duty and penalty paid before the Scheme was announced, can I claim refund?

NO REFUND shall be granted

FAQ 4. How to apply for Scheme and within how many days to do the payment?

- Application to be made through Online mode through https://igrmaharashtra.gov.in website

- Within 7 days of receipt of demand notice from Registrar, payment has to be made

FAQ 5. How to tell if stamp paper is real or fake?

We have to submit application to proper authority to verify the stamp paper along with the Original Copy of the instrument requesting to verify the stamp. The appropriate authority issues a certificate as the case may be.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

R.K. Jain's Customs Tariff of India | Set of 2 Volumes

R.K. Jain's Customs Law Manual | 2023-24 | Set of 2 Volumes

R.K. Jain's GST Law Manual | 2023-24

R.K. Jain's GST Tariff of India | 2023-24

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

The stamp duty payable during assignation of debt by Asset Reconstruction Companies – By Adv. Haaris Moosa

In Phoenix Arc Private Limited, Mumbai Vs. M/S. Cherupushpam Films Pvt Limited, Ernakulam (2023) ibclaw.in 48 NCLT (hereafter Phoenix ARC) the question raised before the NCLT, Kochi Bench was whether stamp duty has to be paid on a deed assigning debt to an Asset Reconstruction Company (ARC). The NCLT Kochi Bench has held that the ARC is bound to pay the appropriate stamp duty as per the relevant state legislation, in this case the Kerala Stamp Act, 1959 (KSA, 1959

The stamp duty payable during assignation of debt by Asset Reconstruction Companies

Adv. Haaris Moosa

Stamping has been used by litigators as a deus ex machina for long. Insufficient stamping determines the fate of a case quite independent of its facts or merits. The interplay of the stamping legislations with the Insolvency and Bankruptcy Code, 2016 (IB Code, 2016), has not been adequately analysed by either courts or tribunals. Stamping in India is regulated by both Union and State legislations since it is covered by Entry 91 of the Union List and Entry 63 of the State List. The Union legislation is the Indian Stamp Act, 1899 (ISA, 1899) 1 and almost all the States have their own stamping statutes. The stamping legislations of old vintage have stood their ground even with the coming of avant garde legislations meant to streamline commercial transactions like the Arbitration and Conciliation Act, 1996, SARFAESI Act, 2002, Companies Act, 2013 and now the IB Code,2016.

In Phoenix ARC Private Limited, Mumbai Vs. M/S. Cherupushpam Films Pvt Limited, Ernakulam (2023) ibclaw.in 48 NCLT (hereafter Phoenix ARC ) the question raised before the NCLT, Kochi Bench was whether stamp duty has to be paid on a deed assigning debt to an Asset Reconstruction Company (ARC). The NCLT Kochi Bench has held that the ARC is bound to pay the appropriate stamp duty as per the relevant state legislation, in this case the Kerala Stamp Act, 1959 (KSA, 1959) 2 . The Hon’ble NCLT held that the applicability of KSA 1959 2 is not ruled out by the prescription under Section 8F of the Indian Stamp Act, 1899 (ISA, 1899) which exempts ARCs from paying any stamp duty on “ any agreement or other document for transfer or assignment of rights or interest in financial assets of banks or financial institution s” covered under section 5 of the SARFAESI Act, 2002.

KSA, 1959 in section 25, declares the assignment of a debt to be a conveyance, and the duty payable has been pegged at 8%. In the instant case, the Tribunal found that the assignment deed was to be stamped at 8% as per Section 25 of KSA, 1959 since the agreement was made in Kerala. Interestingly in the instant case, the stamp duty as per KSA, 1959 comes to Rs. 6,33,99,500/- while the assignment deed was found to be made on a non-judicial stamp paper of Rs. 500/-. Consequently, the Tribunal found the assignment deed to be unenforceable for insufficient stamping. Phoenix ARC breaks new ground in holding that the assignment of a debt to an Asset Reconstruction Company is liable to be stamped as per the concerned state stamping legislation.

In Essar Steel India Ltd. Committee of Creditors v. Satish Kumar Gupta [2019] ibclaw.in 07 SC (hereafter Essar Steel ) the supreme court confirmed the decision of the NCLAT, [2019] ibclaw.in 109 NCLAT in affirming the decision of the NCLT in rejecting an application that suffered from insufficient stamping. And held that “Further, the submission of the Appellants that they have now paid the requisite stamp duty, after the impugned NCLAT judgment, would not assist the case of the Appellants at this belated stage. These appeals are therefore dismissed.” 3 Quite to the contrary, in Praful Nanji Satra v. Vistra ITCL (India) Ltd. (2022) ibclaw.in 550 NCLAT , the NCLAT went on to reject an argument for dismissal of an application for insufficient stamping, holding that the only issue that the NCLT in IBC proceedings can look at is whether there has been a default, and nothing further. It was also held that insufficient stamping is a curable defect. The effect of insufficient stamping has attracted contradictory judgments from the NCLAT and the Supreme Court. However, Phoenix ARC follows the correct law laid down by the Supreme Court in Essar Steel .

It is to be noted that proceedings under Code are non-adversarial. Any applicant seeking to initiate corporate insolvency proceedings is required to produce documents that satisfy the Adjudicating Authority (the NCLT) proving the default committed by the corporate debtor. Such an applicant is also required to ensure that the financial contracts on which they rely are legally sound and are not truncated. While structuring true sale transactions for assignment of debt (standard assets or NPA), compliance under the applicable stamping legislations must be ensured to avoid legal complications.

Disclaimer: The Opinions expressed in this article are that of the author(s). The facts and opinions expressed here do not reflect the views of IBC Laws ( http://www.ibclaw.in ). The entire contents of this document have been prepared on the basis of the information existing at the time of the preparation. The author(s) and IBC Laws ( http://www.ibclaw.in ) do not take responsibility of the same. Postings on this blog are for informational purposes only. Nothing herein shall be deemed or construed to constitute legal or investment advice. Discussions on, or arising out of this, blog between contributors and other persons shall not create any attorney-client relationship.

Follow for daily updates:

- < https://legislative.gov.in/sites/default/files/A1899-2.pdf > [ ↩ ]

- < https://keralaregistration.gov.in/fileUploads/The%20Kerala%20Stamp%20Act.pdf > [ ↩ ][ ↩ ]

- [2019] ibclaw.in 07 SC , para 99 [ ↩ ]

Share your love:

Related posts, the insolvency and bankruptcy code (removal of difficulties) order, 2017.

S.O. 1683(E)(24.05.2017)—Whereas, the Insolvency and Bankruptcy…

Read Post »

United Bank of India Vs. Satyawati Tondon and others – Supreme Court

Username Password Remember Me …

Schedules-Insolvency and Bankruptcy Code, 2016

The Insolvency and Bankruptcy Code, 2016…

Indian Valuation Standards as issued by the ICAI effective for the valuation reports issued on or after 01.07.2018

The Institute of Chartered Accountants of…

CHANGES IN STAMP DUTY CHARGES IN MAHARASHTRA

REAL ESTATE UPDATE

16 th May, 2022

Issue No. 02/22-23

The stamp duty charges levied under the Maharashtra Stamp Act, 1958 (“ Act ”) have been amended and updated as follows:

- The stamp duty in Mumbai, Thane, Navi Mumbai, Pune, Nagpur and Nashik on transaction of Sale, Mortgage and Gift Deed will attract a 1% metro cess from April 1, 2022.

- The Maharashtra Legislative Assembly have passed a bill which inter alia extends the set-off period for payment of stamp duty on resale of immovable property from one year to three years. Earlier, if the resale of immovable property took place within one year of purchase, the stamp duty payable would only be on the difference of the property rates calculated in the purchase price and the resale price, and not on the entire consideration amount when the property is resold. Now, with the passage of this bill, this one-year set-off period has now been extended to three years.

- Stamp duty and Registration charges for a female will be with a concession of 1% over the prevailing stamp duty on property transactions, if the registration of sale deed, is done in the name of women.

- The existing ceiling of stamp duty payable on an agreement relating to deposit of title deeds, pawn, pledge or hypothecation where the amount secured exceeds Rs. 5 lakhs, stamp duty has been amended to 0.3 % of the amount secured subject to a maximum of Rs. 20 lakhs.

- Stamp duty on mortgage under article 40(b) of schedule I of the Act, when possession is not given or agreed to be given and if the amount secured is less than Rs. 5 lakhs then the stamp duty shall be 0.1% of the amount secured subject to a minimum of Rs. 100. If the amount secured is more than Rs. 5 lakhs then the stamp duty shall be 0.3% of the amount secured subject to a maximum of Rs 20 lakhs. Provided that in case of instrument executed by consortium of banks, the duty chargeable shall not exceed 50 Lakhs.

India: Major Relief: Members To Benefit From Stamp Duty Paid On Development Agreements

1. INTRODUCTION

The Inspector General of Registration and Controller of Stamps, State of Maharashtra, Pune (“ IGR, Maharashtra ”) has in its notification dated 26 th July 2023 (“ said Notification ”) issued explanatory directives in respect of levying stamp duty on permanent alternative accommodation agreements entered into between a developer and members of a co-operative housing societies (“ Society/Societies ”) for re-development of Society's property.

2. BACKGROUND

The IGR, Maharashtra had in its Circular dated 23 rd June 2015 1 and Circular dated 30th March 2017 2 issued guidelines in respect of stamp duty levied on the document executed by the developer in favour of a member of the Society while allotting flats/shares in a redeveloped building of a project (“ Earlier Circulars ”). The Earlier Circulars contemplated that the permanent alternative accommodation agreement shall be stamped as per Article 25 of the Maharashtra Stamp Act, 1958 (“ said Act ”) as applicable on a development agreement. The stamp duty required to be paid on the permanent alternative accommodation agreement was in addition to the stamp duty levied on the development agreement executed with the Society for redevelopment of Society's property which resulted in payment of double stamp duty.

The Earlier Circulars were challenged by Adityaraj Builders and Others before the Hon'ble Bombay High Court in Writ Petition No. 4575/2022 3 (said “Writ Petition”). As a major relief to the members of the Societies, the Hon'ble Bombay High Court passed an order dated 17th February 2023 in the said Writ Petition (“said Order”) whereby it was directed that once a development agreement is fully stamped, the permanent alternative accommodation agreement cannot be separately assessed to stamp beyond INR 100/- in lieu of Section 4 (1) of the said Act.

The IGR, Maharashtra vide the said Notification further reiterated and clarified the statutory position on payment of stamp duty on the permanent alternative accommodation agreements by issuing the following directives:

3. QUICK VIEW

3.1 In light of the said Notification, double stamp duty will not be required to be paid if a permanent alternative accommodation agreement is in respect of Existing Area and Additional Area only.

3.2 The permanent alternative accommodation agreements shall not be assessed for stamp beyond INR 100/- (Indian Rupees One Hundred Only) in lieu of Section 4 (1) of the said Act provided: (a) full stamp duty has been paid on the development agreement; and (b) the permanent alternative accommodation agreements is in respect of Existing Area and Additional Area. If the permanent alternative accommodation agreement includes the Purchased Area also, then stamp duty as per the said Act shall be applicable only in respect of the Purchased Area.

3.3 It comes as a major relief for developers as traditionally, it is seen that the developers had to pay the stamp duty on permanent alternative accommodation agreements for Existing Area and Additional Area. This will reduce the overall cost and expenses of the project.

3.4 This move will encourage the stakeholders to register the permanent alternative accommodation agreements upfront which otherwise used to be delayed to avoid paying stamp duty under Section 25 of the said Act. This will ultimately result in protection of rights of all the stakeholders.

1. Circular dated 23rd June 2015 bearing no. जा. क्रमाांक. कार्ाासन १५/बामुदत/मार्ादर्ाक सूचना/६२१