Brought to you by:

Performing Industry Research to Inform Investment Decisions

By: Nabil N. El-Hage, Ann Cullen

Conducting thorough research about an industry is often an important component of investment analysis. Written specifically for HBS MBA students, provides guidance on how to perform industry research…

- Length: 24 page(s)

- Publication Date: Oct 6, 2006

- Discipline: Finance

- Product #: 207069-PDF-ENG

What's included:

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Conducting thorough research about an industry is often an important component of investment analysis. Written specifically for HBS MBA students, provides guidance on how to perform industry research to inform investment decisions. Provides detailed information about the recommended resources available for this type of research, focusing primarily on what is available from Harvard Business School's Baker Library. Focusing on how companies operate in the context of their industry, commences with an overview of why industry research is relevant, then offers detailed guidelines on how to approach and what to consider when investigating an industry as part of the analysis necessary to make a decision about investing in a company.

Learning Objectives

To provide a guide to students on how to approach industry research as part of analyzing the types of investments discussed in the "Active Investing in Illiquid Assets" course.

Oct 6, 2006 (Revised: Aug 14, 2008)

Discipline:

Harvard Business School

207069-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Rigorous primary research

A Rational Multi-Asset Portfolio Rebalancing Decision-Making Framework

Resilient Liquidity: The Robust Reaction of Equity Volume and Spreads to Market Volatility

Vanguard economic and market outlook for 2024: A return to sound money

Filter by topic

Sort by date

Financial wellness & planning

May 26, 2022

For many families, planning for college costs is a top financial priority. A Byzantine landscape of consumer choices, loans, tuition discounting, and public and private aid, however, makes it difficult to answer key questions like "How much will this cost us?” This is especially so for young families, for whom future spending needs are necessarily vague. Vanguard researchers explore how understanding the dynamics of financial aid and net pricing can help parents set a realistic savings target early on and shape a savings plan that evolves with them.

Portfolio considerations

May 20, 2022

A number of factors have fueled the growth of index investing around the world. “The case for low-cost index-fund investing,” a newly revised research paper from Vanguard’s Investment Strategy Group, explores these factors. The paper discusses why the authors expect that index investing will continue to be effective over the long term.

April 14, 2022

The past few decades were a good time for spending from a retirement portfolio. What about the next 30 years? The apparent shifts in capital market conditions seen since the start of 2022 led us to examine sustainable withdrawal rates. Looking at historical return environments our authors developed three scenarios, with rates from 2.8% to 3.3%.

April 13, 2022

Vanguard believes private corporate pension plans should consider a liability-driven investing (LDI) program in the fixed income portion of their portfolio. Based on our analysis, a customized mix of U.S. investment-grade credit bonds and Treasuries aligns well with that liability. Such a mix has historically helped plan sponsors mitigate risk.

March 29, 2022

Personalized indexing (PI) is a flexible portfolio management solution that can track a personalized index and harvest capital losses for tax-saving purposes. This paper presents a portfolio construction plan using PI, touching on how to optimally implement tax-loss harvesting and allocate to PI in the presence of other assets.

August 10, 2022

Investors typically decide whether to convert to a Roth IRA from a traditional IRA by comparing their current and expected future marginal tax rates. The traditional wisdom has been that higher future tax rates make conversion more desirable and lower ones make it less so. Vanguard researchers describe a break-even tax rate (BETR) that yields a more accurate view of what future tax rate would make an investor indifferent to a conversion.

March 15, 2022

New Vanguard research indicates that investors are frequently using non-total market index funds to build portfolios with active exposures, according to “How investors use passive for active,” a paper authored by Vanguard’s Jan-Carl Plagge, Haifeng Wang, and Jim Rowley. The paper was published in The Journal of Beta Investment Strategies .

Behavioral research

February 23, 2022

Investors prefer some aspects of human advice over digital but perceive value in all advice services. Technology can help human advisors scale their businesses while strengthening their uniquely human value proposition.

February 02, 2022

Vanguard shares our current views on best practices for U.S. private-sector pension plan asset allocation. We highlight the value of identifying three targets—the return-seeking asset allocation, interest rate hedge ratio, and credit spread hedge ratio—that can be the foundation for a robust, customized portfolio construction process.

December 15, 2021

Retirees often eschew investing for total returns, relying instead on dividends and interest from high-income-producing assets to support spending from ad hoc portfolios. We introduce a method for building high-income portfolios that maximize the investor’s utility of wealth based on total returns while accounting for yield preferences.

Economics & markets

December 13, 2021

Our annual forecast explains why we expect the global economy to slow, leaving full-year 2022 growth, in our base case, of 4.8%. It also explains why our 10-year market outlook is guarded, as reflected in the low-single-digit range of expected returns for a globally diversified, 60% stock/40% bond portfolio.

November 19, 2021

Tax-loss harvesting (TLH) has been promoted as a “free lunch” for increasing investment returns. Vanguard researchers explore the potential for TLH and demonstrate how to customize a TLH strategy for optimal benefits. A case study is also featured that illustrates how the benefits of TLH can vary considerably from investor to investor.

November 15, 2021

Historically low yields on most global fixed income investments are likely to result in low returns over the next decade, leading some investors to question the allocation to bonds in multi-asset portfolios. In this paper, Vanguard researchers demonstrate the value of bonds as “shock absorbers” for portfolios when equity markets are under stress.

October 29, 2021

This paper examines the effect of automatic escalation on defined contribution plan contribution rates and provides insights into plan designs that maximize participants’ chance of savings at rates necessary for a secure retirement. The motivations of participants to override automatic deferral rates and annual increases are also explored.

October 11, 2021

This study explores how factoring in health care cost uncertainty can benefit retirement planning by enabling the development of more customized plans. Vanguard researchers employ a stochastic health care model to offer more realistic insights into how longevity and health care-related risks affect the viability of spending plans in retirement.

September 08, 2021

Growth in pension liabilities, along with new disclosure requirements and market-based accounting standards, have led defined benefit pension plan sponsors to consider corporate finances as they manage their plans. This paper discusses how pension plan risk can affect corporate finances and the strategies sponsors can use to mitigate that risk.

October 08, 2021

Parents and students face distinct challenges when financing higher education expenses. This research paper discusses financial aid options, tax credits, and 529 savings plans and other savings vehicles, as well as the need to plan strategically and understand how college spending decisions affect one's broader financial situation.

September 28, 2021

With interest rates and inflation expected to rise, the negative stock/bond correlation that supports the diversification properties of a balanced portfolio could also be at risk. In this paper, researchers find that negative correlation will continue and the diversification benefits of a 60% stock/40% bond portfolio will persist.

Vanguard’s Megatrends series examines fundamental shifts in the global economic landscape that are likely to affect the financial services industry and broader society. In this edition, Vanguard researchers explore China’s future as an economic powerhouse and its broad implications for global growth, geopolitics, and financial markets.

September 23, 2021

Vanguard’s Megatrends series examines fundamental shifts in the global economic landscape that are likely to affect the financial services industry and broader society. In this paper, Vanguard economists examine global trade growth and conclude that growth will likely slow, as it has since the global financial crisis, but not decline.

September 13, 2021

Vanguard researchers classify the economic and market environment into five states: recession, recovery, expansion, slowdown, and high inflation. This paper discusses the characteristics, valuations, and return expectations of each and concludes that investors willing to take on active risk should adopt a dynamic, state-dependent approach.

Amid a backdrop of highly accommodative monetary and fiscal policies, how likely are persistently higher rates of inflation in the United States for 2022 and beyond? In this paper, Vanguard researchers present the findings of Vanguard’s state-of-the-art forecasting model to project core inflation over the next two years.

August 30, 2021

Employing machine-learning, Vanguard researchers found that government bonds have historically acted as a counterbalance in an equity/bond portfolio during low-rate periods. Although in some months both equities and bonds fall, the analysis suggests that this can be thought of as market noise and distinctly different from typical outcomes.

Most target-date fund series offer a single post-retirement asset allocation designed to help retirees replace a reasonable portion of pre-retirement income. In this paper, Vanguard researchers offer a framework demonstrating that adding a second asset allocation could support additional goals for those with the resources and desire to pursue them.

A Vanguard survey shows that most investors underestimate the risk of mild cognitive impairment. In addition, while most respondents had some plans to mitigate the effects of cognitive decline, they were less likely to focus on the transfer of control of their finances, the timing of which can have significant implications for financial well-being.

August 05, 2021

This paper examines developments in the fixed income markets before and during the liquidity event precipitated by the coronavirus pandemic and the accompanying economic shock to the global financial markets. Vanguard calls for fixed income market participants and policymakers to make recommendations to improve market resiliency in the future.

July 23, 2021

This research looks at the withdrawal patterns, rates, and frequencies of more than two million Vanguard retail households at or near retirement age. It finds that only 52% took at least one withdrawal during the three-year study period.

Asset classes

Vanguard researchers examine the range of frequencies, durations, and magnitudes of underperformance experienced by active fixed income funds. The findings: Nearly all outperforming active fixed income funds experience periods of underperformance, although significant drawdowns over long periods are less likely than they are for active equity funds.

July 14, 2021

This paper explores the relationship of the number of fixed income holdings in a fund to systemic risk and alpha.

July 06, 2021

Vanguard researchers analyze the results of a survey of Vanguard investors' expectations for U.S. stock returns throughout the COVID market crisis. The results indicate that expectations follow market activity in close lockstep, shifting in tandem with recent performance rather than rising and falling in a more rational or contrary manner.

June 25, 2021

The Financial Independence, Retire Early (F.I.R.E.) movement relies on the 4% rule to determine withdrawals over 40 to 50 years in retirement. But that rule was designed for a 30-year horizon. This paper illustrates how F.I.R.E. investors can improve their chances of financing an early retirement by employing Vanguard’s investing principles.

June 11, 2021

This paper presents a framework, developed by Vanguard and Mercer, to forecast health care costs for U.S. retirees. Vanguard researchers outline key health care cost factors and personal considerations and frame expenses as an annual cost rather than a lifetime lump sum, enabling retirees to plan accordingly during their retirement years.

June 07, 2021

This supplement to How America Saves delves deeper into defined contribution plan landscape, combining comprehensive data on plan design and participant behavior with practical advice and insights from Vanguard's leading retirement plan experts to offer recommendations to improve plan efficacy and employee participation.

"How America Saves" is the industry's definitive report on American's retirement savings habits. The 2021 edition details how automatic plan features and target-date funds helped millions of defined contribution plans participants adhere to their financial goals, even amid severe market volatility resulting from the coronavirus pandemic.

June 02, 2021

While the global economy recovers from the pandemic, central bank policy rates are expected to lift off starting in 2023 as quantitative easing unwinds. But how will that affect bond yields? Vanguard's model suggests that long-term government bond yields will increase only modestly as ultra-accommodative monetary policy normalizes.

June 01, 2021

Critical to constructing a portfolio for a specific goal is selecting a combination of assets that offers the best chance of meeting that objective. This paper reviews the decisions investors face when constructing a globally diversified portfolio and discusses the importance of broad asset allocation and diversification within sub-asset classes.

May 28, 2021

Although one-third of participants in Vanguard defined contribution plans had access to a self-directed brokerage option in 2020, only 1 percent of those participants chose to use it. On average, brokerage participants invest half of their account balance in the brokerage option.

April 20, 2021

Investors can diversify their portfolios through equity allocations to markets outside their home market. This research paper explores the potential benefits, and the factors to assess in determining portfolio allocations.

April 19, 2021

The past ten years have been tremendous for growth stocks, but we do not expect that trend to continue. This research presents the results of our fair value model for the ratio of value to growth stocks. These results suggest that value will outperform growth over the next ten years by as much as the equity risk premium.

April 12, 2021

Researchers and policymakers have suggested that annuities can help retirees manage the risk of outliving their assets. Vanguard research finds, however, that most retirees are reluctant to annuitize and decide against exchanging liquid wealth for guaranteed income in order to retain future financial flexibility.

March 31, 2021

Retirement planning is a complex process based on an individual's unique circumstances and objectives. In this paper, Vanguard offers a retirement planning framework to help investors prioritize goals, understand risks, assess available financial resources, and develop a sound plan to achieve financial security.

May 24, 2019

In this paper, Vanguard researchers examine investing behavior in 1.8 million 529 plan accounts holding $53 billion in assets. The findings: Accounts using automatic investment methods exhibit the most consistent savings behavior, and those using age-based allocations have substantially less portfolio risk than self-directed ones.

October 11, 2018

Technology advances have spawned fear that they eliminate jobs. New Vanguard research finds more room for optimism.

February 19, 2019

ETFs can be useful tools for investors building their portfolios. A Vanguard commentary explores their role in portfolio construction and in providing market liquidity and market information.

June 23, 2022

A new Megatrends paper explores equilibrium interest rates, the forces that shape them, and where they may be headed.

June 16, 2022

Our experts provide insights into who has retired during the pandemic and whether these retirees might need to return to the workforce.

June 28, 2022

Recent Vanguard research indicates that gender diversity on a fund’s investment team may offer performance benefits. The findings underscore the benefit of evaluating the diversity of an investment management team with the same rigor we do portfolio diversification, recognizing the meaningful impact that both can have on fund performance.

July 06, 2022

Even the most groundbreaking technological innovations can experience a lag between discovery and the implementation of a commercial application. That lag—along with current social, economic, and technological conditions—can have vast implications on the broader economy.

July 13, 2022

We summarize in two pages the conditions of five major economic blocs and provide 10-year return forecasts for major asset classes.

July 27, 2022

A Vanguard white paper looks at ways to tailor portfolios to address specific investor goals and preferences.

March 29, 2019

This paper presents a methodology for estimating the trading volume on U.S. exchanges attributable to index funds, index ETFs, and other indexing strategies. Vanguard researchers estimate that index funds and index ETFs currently account for approximately 1% of overall trading volume on U.S. exchanges, well below the more widely quoted 5% to 7%.

August 04, 2022

Using four hypothetical case studies, a new Vanguard research paper, The Value of Personalized Advice , provides insights into how to think about and measure the value of financial advice for individual clients.

September 14, 2022

Regulation, fee, and technology trends in the advice industry may get all the attention, but it’s still soft skills and relationships that will distinguish advisors from others. Learn more from the latest in the Vanguard Advisor’s Alpha series.

September 15, 2022

A new Vanguard research paper sheds light on how investors’ health state can affect their asset allocation and consumption in retirement.

November 09, 2022

Vanguard Financial Advice Model (VFAM) is a new approach to financial planning, assessing combinations of strategies and their relative value for an investor.

November 08, 2022

A new Vanguard research paper outlines an approach to determining life insurance needs that could save thousands of dollars while minimizing the chances that coverage falls short of those needs.

October 31, 2022

A recently updated research paper makes the investment case for Vanguard target-date funds and offers insights into the role these strategies can play in the portfolios of different types of investors.

October 27, 2022

As direct indexing accelerates in popularity among investors, one of its measurable benefits is the ability to implement a systematic tax-loss harvesting (TLH) strategy. Vanguard researchers examine the value of different modes of TLH for direct indexing investors to determine which is the most effective. The paper was published in The Journal of Beta Investment Strategies .

October 24, 2022

Our research shows that an annual rebalancing is optimal for investors who don’t participate in tax-loss harvesting or where maintaining tight tracking to the multiasset benchmark portfolio is not a concern.

October 06, 2022

Understanding your health care priorities and available coverage types can help you choose a Medicare coverage option, according to Vanguard researchers.

September 22, 2022

Americans donated $471 billion to charitable organizations in 2020. Vanguard research explores the three key elements of a successful giving plan: When to give, what to give, and how to give.

June 06, 2019

Our Megatrends series examines fundamental shifts in the global economy likely to affect the financial services industry and society. In this edition, Vanguard explores the economic implications of an unprecedented shift in the age of global populations toward a smaller young-age cohort and a larger old-age cohort.

January 31, 2018

In this article published in The Journal of Portfolio Management in 2018, Vanguard researchers describe an enhancement to a standard approach of forecasting U.S. stock market returns. Starting with the cyclically adjusted price-to-earnings (CAPE) ratio, they incorporate bond yields, inflation, and volatility into the calculations. The authors find that results from this “fair-value” CAPE forecasting model, while not perfect, are about 40%–50% more accurate than conventional methods for 10-year-ahead stock market forecasts since 1960.

August 14, 2023

Key components for efficient tax savings: threshold planning, capital gains, income exclusions, and deductions.

July 27, 2023

Our updated research examines saving and investing behavior in 1.9 million 529 plan education savings accounts.

July 05, 2023

Updates are provided on our 2023 outlook for growth, inflation, and central bank policies, plus 10-year asset class return forecasts.

June 15, 2023

In its 22nd edition, How America Saves provides an in-depth examination of the retirement plan data of nearly 5 million defined contribution plan participants.

May 16, 2023

Learn how our target enrollment glidepath can help maximize risk-adjusted value for investors saving for college.

May 12, 2023

Our research explores practical ways to build savings for an emergency while balancing long-term financial goals.

April 28, 2023

Selectively adding a credit tilt to the bond portion of a portfolio can enhance long-term expected returns.

April 04, 2023

This paper highlights some of the generational differences we have observed in our recordkeeping data over a 15-year period as a result of automatic solutions. We answer the question: How have generational patterns of saving and investing changed in DC plans?

March 28, 2023

Our research offers a framework to help maximize wealth by taking advantage of your investment options alongside repaying debt.

March 01, 2023

This paper compares the performance of cost averaging with lump-sum investing as strategies for investing cash.

February 27, 2023

Relocating to a cheaper housing market can help retirees bolster retirement readiness, Vanguard research finds.

February 15, 2023

Our research considers ways to measure inflation based on the specific circumstances of an individual and how to build portfolios that seek to minimize the risks of rising costs.

February 01, 2023

A small commodities position may improve an investor’s outcome while adding resilience to a portfolio.

January 31, 2023

Best way to hedge a portfolio against inflation? Research suggests a method but not without its own risks.

January 23, 2023

Pension plan sponsors considering a risk transfer should look beyond immediate benefits and consider the impact on the management of the remainder of the plan, according to Vanguard experts.

January 09, 2023

The prospect of saving for long-term financial planning goals can be overwhelming at times given its enormity and uncertainty. Vanguard’s guide to financial wellness offers a blueprint for achieving financial flexibility to meet both short- and long-term goals.

December 13, 2022

Studies of ESG investment strategies have tried to identify an ESG-related factor to explain performance, but Vanguard research reveals that the performance of many ESG investment strategies is largely driven by well-known traditional sources of risk. We found quite a bit of variability in the exposure to and influence of the factors explored.

December 12, 2022

Our base case for 2023 includes a global recession brought about by policymakers’ efforts to control inflation. Unemployment is likely to rise and consumer demand weaken, but central banks may still miss their targets of 2% inflation in 2023.

November 30, 2022

Sustainable withdrawal rates can vary considerably, depending on the levels of desired bequests, portfolio depletion risk, and asset allocation, highlighting the need for customization rather than relying on a single rule of thumb. Learn more about the feasible ranges.

November 21, 2022

There’s no place like home, even when it comes to stock investing. Recent Vanguard research discusses investor local bias, what that disposition means for a portfolio, and how a few small tweaks can alleviate a portfolio’s concentration risk.

November 16, 2022

Time-varying asset allocation can help build diversified, tax-efficient portfolios, Vanguard researchers say.

October 23, 2020

What is the value of tax-loss harvesting? Examining more than 80,000 investors, Vanguard analysts demonstrate that outcomes of equity-based tax-loss harvesting vary significantly across investor characteristics and market environments. The expected results range from no benefit or even negative returns to gains of more than 1% annually.

August 08, 2022

A new Vanguard research paper, Revisiting the conventional wisdom regarding asset location , takes a second look at best practices for asset location and whether they are appropriate for investors.

March 19, 2024

Vanguard researchers present a framework to help investors choose the most efficient rebalancing method in terms of risk, return, and costs.

January 05, 2024

Our research into years of daily stock-level data suggests that U.S. equities are resilient to periods of volatility and that liquidity remains available under all market conditions.

December 12, 2023

A return to sound money, with interest rates above inflation, is the best financial market development in 20 years.

November 17, 2023

In this paper, Vanguard espouses four simple and enduring principles to help investors achieve long-term success. Goals: Create clear, appropriate investment goals. Balance: Keep a balanced and diversified mix of investments. Costs: Minimize costs. Discipline: Maintain perspective and long-term discipline.

November 15, 2023

Our research looks at the role factors can play in shaping a portfolio’s performance and risk profile.

November 01, 2023

Vanguard research considers investors who may benefit from target portfolios using valuation-aware, time-varying return forecasts.

October 20, 2023

We consider the “loss harvest profile” of direct indexing over time, focusing on volatility and cash contributions.

October 13, 2023

Vanguard research shows how to optimize after-tax returns through placement of equity subclasses across accounts.

October 03, 2023

A Vanguard analysis assesses retirement readiness for a nationally representative sample of American workers.

September 15, 2023

The benefits of HSAs aren’t limited to just covering medical expenses, according to updated Vanguard research.

September 06, 2023

Negative convexity has rejoined duration and credit as central considerations in active muni investing.

Vanguard is the trusted name in investing. Since our founding in 1975, we’ve put investors first.

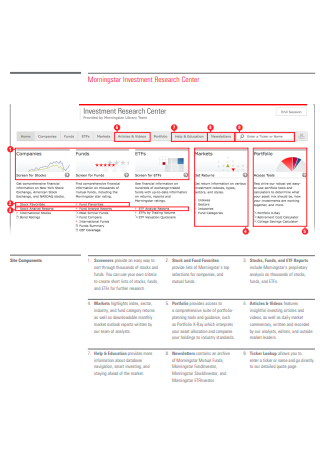

Morningstar Investment Research

Morningstar’s independent research is only biased in favor of investors. Dig into expert analysis from 100+ global researchers on securities, funds, markets, and portfolios. With transparent insights, investors can make more confident investment decisions.

Trending Investment Research

2024 target-date strategy landscape, 2024 diversification landscape, u.s. renewable energy pulse, q1 2024 oil and gas industry pulse, small-cap equities and funds, q1 2024 u.s. economic outlook, motors and markets 2024, u.s. e&ps landscape, 2023 model portfolio landscape, software landscape report, q1 2024 markets observer, global equity fund flows, mutual fund manager stock hit rates, 2024 utilities outlook, what motivates clients to stay with their financial advisors, q1 2024 stock market outlook, dividend funds landscape report, q4 2023 digital & analog semiconductors pulse, oil & gas industry pulse: q4 2023, 2023 retirement withdrawal strategies report, luxury goods landscape report, u.s active/passive barometer, cybersecurity landscape report, a global guide to strategic-beta exchange-traded products, compare robo-advisor performance & assess the best options, a simple framework for structured products, fund managers switching firms - should investors tag along, can asset managers take direct indexing to the masses, why money is important to investors, large growth stocks: hurdles and risks for fund managers, intended and unintended crypto exposures, beware of overconfidence in “outlook season”, 2022 health savings account landscape, morningstar's cryptocurrency landscape, morningstar’s global automotive observer:, 2022 u.s. interest rate & inflation forecast, morningstar's guide to tax managed investing, thematic fund handbook, sustainable investing, global sustainable fund flows report, us annual sustainable funds landscape, sfdr article 8 and article 9 funds, investing in times of climate change, esg proxy-voting insights: blackrock, vanguard, state street, us sustainable fund flows, esg landscape on commercial air travel, proxy-voting insights: voting on politics, morningstar sustainability atlas, esg landscape on biopharma, esg commitment level landscape, 2022 carbon credits landscape, esg landscape on oil and gas, proxy-voting insights: 2022 in review, water, water everywhere. how are asset managers responding, esg landscape on consumer packaged goods, net zero asset managers initiative, cop15: a turning point for investor approaches to biodiversity, esg landscape on telecommunication services, the hidden esg risks of feel-good companies, how to talk to investors about sustainable investing, esg landscape on autos, investment strategies, liquid alternatives observer, momentum inflection factor, morningstar’s primer on defined outcome etfs, global thematic funds landscape, morningstar prospects, the reasons behind fund closures, financial well-being, 2024 target-date funds and cits landscape, q1 2024 u.s. asset manager pulse, morningstar's annual 529 college-savings plan landscape, us asset manager landscape report, mind the gap: a report on investor returns in the u.s., morningstar's robo-advisor landscape, morningstar's u.s. fund fee study, global investor experience: fees and expenses report.

- Browse All Articles

- Newsletter Sign-Up

InvestmentBanking →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

See the signals.

Benchmark review: equity rally continues in 2024 as bonds take a breather, public publication content.

The S&P 500 is off to its best start since 2019 and 14th-best since 1926. Growth and related sectors outperformed, but Value and small-caps rebounded late. Bonds were the only major asset class to decline in Q1.

Complete the form and a member of our team will send you a copy of this publication.

While you wait, explore additional NDR research and solutions.

Institutional Investors

Custom Research

Wealth Managers

Stock Selection

ETF Selection

HubSpot Form for Publications

News alerts.

Please note that you are using an unsupported browser. While the site will continue to function, you might experience sub-optimal behavior until you upgrade. Please update your browser to a later version for a better experience.

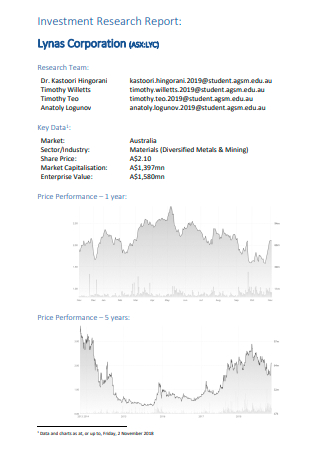

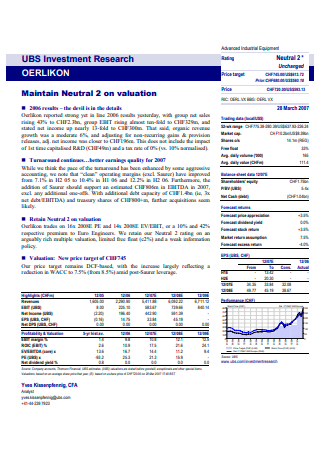

13+ SAMPLE Investment Research Report in PDF

Investment Research Report

13+ sample investment research report, what is an investment research report, different types of investment research report, basic elements of an investment research report, how to write an investment research report, what are some examples of investment research reports, what to study before having a stock investment, how to make a stock report, what are the best investments for beginners.

Investment Research Report Template

Investment Research Earnings Report

Sample Investment Research Report

Investment Research Report Example

Printable Investment Research Report

Investment Research Report in PDF

Investment Research Report Format

Simple Investment Research Report

Formal Investment Research Report

Investment Research Report Providers

Investment Research Center Report

Investment Research and Strategy Report

Investment Research Marketplace Report

Long Term Investment Research Report

1. formal investment research report, 2. investment research earnings report, 3. investment research center report, 4. investment research marketplace report, step 1: identify the specific goals in the investment research , step 2: make an outline of the investment research process , step 3: demonstrate the possible challenges and analysis, step 4: proofread and revise the research report, step 5: prepare the final science research report, share this post on your network, file formats, word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates, you may also like these articles, 12+ sample construction daily report in ms word | pdf.

Introducing our comprehensive sample Construction Daily Report the cornerstone of effective project management in the construction industry. With this easy-to-use report, you'll gain valuable insights into daily activities report,…

25+ SAMPLE Food Safety Reports in PDF | MS Word

Proper food handling ensures that the food we intake is clean and safe. If not, then we expose ourselves to illnesses and food poisoning. Which is why a thorough…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

3 things America can do to solve its retirement crisis, according to BlackRock chief Larry Fink

- America has a retirement crisis on its hands.

- But there are things the US can do to help people better prepare for post-work life, Larry Fink said.

- The BlackRock chief outlined three things to help alleviate financial burden on retirees.

America has a real retirement crisis on its hands — and there are three things it can do to help solve it, according to BlackRock chief Larry Fink.

In his annual letter to investors, the CEO of the world's biggest asset manager pointed to an unfolding crisis for current and future retirees. Over half of Americans over the age of 65 are living off less than $30,000 a year , according to 2022 Census data . Meanwhile, 45% of middle-income households risk not keeping up with their pre-retirement living standards once they turn 65, according to data from the Center for Retirement Research .

That's complicated by the fact that Social Security may not be able to provide the same support for younger workers when they reach retirement age, Fink said. According to the Congressional Budget Office, the Old-Age and Survivors Insurance Trust Fund , one fund within the Social Security program, is expected to be depleted within the next 10 years.

"As a society, we focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those years," Fink said. "Today in America, the retirement message that the government and companies tell their workers is effectively: 'You're on your own.'"

That needs to be changed, he said, detailing three ways the US could better prepare people for retirement age.

1. Make investing automatic for workers

Americans have fallen behind on their retirement savings, largely because many can't afford to set aside cash for the future, while a large portion of workers — around 57 million, according to the AARP — don't have access to a retirement plan at work .

46% of Americans aged 55-65 don't have any cash invested in a personal retirement account , according to 2022 Census data.

Related stories

More intuitive investment options, like target date funds and mandates for employers to contribute to a retirement plan for their employees, may be able to help, Fink suggested.

He pointed to the Superannuation Guarantee, an automatic employer contribution program based in Australia. That prevented the nation from heading into a retirement crisis in the 90s, with Australia now home to one of the largest retirement systems in the world.

"As a nation, we should do everything we can to make retirement investment more automatic for workers," he said.

2. Help retirees spend their savings

Most retirees are uncomfortable dipping into their pile of savings. The average retiree still had 80% of their pre-retirement cash even nearly 20 years after exiting the workforce, according to a 2018 BlackRock survey .

That trend has led BlackRock to develop its LifePath Paycheck, a program that will automatically dole out paychecks to retirees from their retirement accounts.

"The retirement paradox has a simple explanation: Even people who know how to save for retirement still don't know how to spend for it," Fink said.

3. Give young people a reason to want to invest

Fear is one of the main obstacles preventing young people from investing in their retirement, Fink said. Just 40% of 12th graders say it's " hard to have hope for the world ," according to a University of Michigan public sentiment survey.

That compares to public sentiment in the mid-90s and early 2000s, when 60% of 12th graders said they were optimistic about earning a degree, obtaining a good job, and obtaining more wealth than their parents, a separate analysis found.

"I've been worker in finance for almost 50 years. I've seen a lot of numbers. But no single data point has ever concerned me more than this one," Fink said. "If future generations don't feel hopeful about this country and their future in it, then the US doesn't only lose the force that makes people want to invest. America will lose what makes it America."

Better solutions to prepare young people for retirement is one such way to boost hope, he added.

"Perhaps the best way to start building hope is by telling young people, 'You may not feel very hopeful about your future. But we do. And we're going to help you invest in it,'" Fink said.

Retirement is increasingly seen as a luxury, especially among millennials and Gen Z. 23% of Gen Zers say they don't expect to ever retire , according to a 2022 McKinsey & Company survey, the most pessimistic outlook of any age group.

Watch: Nearly 50,000 tech workers have been laid off — but there's a hack to avoid layoffs

- Main content

IMAGES

VIDEO

COMMENTS

PDF | On Jun 3, 2020, Nikiforos T. Laopodis published Understanding Investments: Theories and Strategies | Find, read and cite all the research you need on ResearchGate

Introduction. In this Handbook, we present both original research studies and reprints of articles addressing applied investment research, focus-ing on fundamental and calendar anomalies, and new investment methodologies and markets that have developed over the past 30 years.

The bulk of research in modern economics has been built on the notion that human beings are rational agents who attempt to maximize wealth while minimizing risk. These agents carefully assess the risk and return of all possible investment options to arrive at an investment portfolio that suits their level of risk aversion. Models based on these

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Determinants of Investment Behavior Volume Author/Editor: Robert Ferber, edLWRU Volume Publisher: 1%(5 Volume ISBN: -87014-309-3

ISBN: 978-981-122-264-1 (ebook) USD 34.95. Also available at Amazon and Kobo. Description. Chapters. Reviews. Authors. Supplementary. This book introduces the readers to the rapidly growing literature and latest results on financial, fundamental and seasonal anomalies, stock selection modeling and portfolio management. Fifty years ago, finance ...

Conducting thorough research about an industry is often an important component of investment analysis. Written specifically for HBS MBA students, provides guidance on how to perform industry research to inform investment decisions. Provides detailed information about the recommended resources available for this type of research, focusing primarily on what is available from Harvard Business ...

2. Literature review. The role of investment behaviour holds critical importance in determining the performance of financial markets. Three factors were considered in investment behaviour: risk perception, satisfaction, and rate of profitability (Nguyen et al., Citation 2020).The moderating variable that was taken in this research is the uncertainty of Covid-19 and how it impacts the financial ...

was a key to investment excellence, now seen by them as more important than traditional asset allocation. There was only modest concern over returns. In contrast, returns were the number one issue deterring investment into real estate. What would cause additional allocation to private assets? Private assets: the shift continues 61% 57% 56% ...

This exploratory study aims at filling the identified research gap by proposing linear regression models of the financial investment behaviour of Mainland Chinese and Hong Kong investors. Based on the results of regression analyses, (i) there exist significant differences in financial investment behaviour between Mainland Chinese and Hong Kong ...

Open PDF. Portfolio considerations. May 20, 2022 The case for low-cost index fund investing. A number of factors have fueled the growth of index investing around the world. "The case for low-cost index-fund investing," a newly revised research paper from Vanguard's Investment Strategy Group, explores these factors. The paper discusses why ...

Morningstar's independent research is only biased in favor of investors. Dig into expert analysis from 100+ global researchers on securities, funds, markets, and portfolios. With transparent ...

Goldman Sachs Global Investment Research produces and distributes research products for clients of Goldman Sachs on a global basis. Analysts based in Goldman Sachs offices around the world produce research on industries and companies, and research on macroeconomics, currencies, commodities, and portfolio strategy.

by Steven J. Davis, John Haltiwanger, Kyle Handley, Ben Lipsius, Josh Lerner, and Javier Miranda. Private equity buyouts are a major financial enterprise that critics see as dominated by rent-seeking activities with little in the way of societal benefits. This study of 6,000 US buyouts between 1980 and 2013 finds that the real side effects of ...

RW-4704-982215856.pdf | RW-4704-982215856.pdf | RW-4704-982215856.pdf | 1. Four Major Themes for the Global Economy 3 2. Back to the Future — Lessons from the Past for What Lies Ahead 8 ... Source: Goldman Sachs Global Investment Research, IMF Exhibit 2: Global Population Growth Has Halved Since the 1960s/70s and The Projected Peak Population ...

of investment decision making, but rather selects those methods that can be readily applied by non-experts. In addition to presenting methods for decision making, this guide also discusses some risk factors that firms might face when adopting a technology, process, or other investment. For instance, employee resistance to organizational change

Chapter 1: Introducing Investment Banking9. The services offered by investment banks typically fall into one of a few buckets. One of the best ways to understand investment banks is to exam- ine all the functions that some of the biggest investment banks perform. For example, Morgan Stanley, one of the world ' s largest investment banks, has ...

Since 1980, NDR has been providing the world's leading investment management firms with objective, historical research. With a range of products and services utilizing a 360 degree methodology, we deliver award-winning solutions to the world's leading investment management companies.

Based on a 2021 report published by the Federal Reserve, the year 2020 posted the lowest 10-year treasury securities yield from 1970 to 2020 with 0.89%. This is a drop from the 2018 and 2019 figures, which were 2.91% and 2.14%, respectively. The highest within this span was in 1980 with an 11.43% yield.

Exhibit 1: Total Investment Sales, by Property Sector Source: Knight Frank Research (based on data available as at 31 March 2024) Private investment sales are:- a. Investment transactions that comprise an entire building or property with a total worth of S$10.0 million and above; OR b. Bulk sales within a development amounting to S$10.0 million ...

Fear is one of the main obstacles preventing young people from investing in their retirement, Fink said. Just 40% of 12th graders say it's " hard to have hope for the world ," according to a ...