Real Estate Investing & Rental Management | How To

How to Write a Real Estate Investment Business Plan (+ Free Template)

Published September 22, 2023

Published Sep 22, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Jealie Dacanay

Download our Merchant Account Application Guide

Your Privacy is important to us.

This article is part of a larger series on Investing in Real Estate .

Get the templates and resources you need as a landlord

Download our Landlord Handbook e-book

- 1 Write Your Mission & Vision Statement

- 2 Conduct a SWOT Analysis

- 3 Choose a Real Estate Business Investing Model

- 4 Set Specific & Measurable Goals

- 5 Write a Company Summary

- 6 Determine Your Financial Plan

- 7 Perform a Rental Market Analysis

- 8 Create a Marketing Plan

- 9 Build a Team & Implement Systems

- 10 Have an Exit Strategy

- 11 Bottom Line

A real estate investment business plan is a guide with actionable steps for determining how you’ll operate your real estate investing business. It also indicates how you’ll measure your business’ success. The plan outlines your mission and vision statement, lets you conduct a strengths, weaknesses, opportunities, and threats (SWOT) analysis, and sets goals in place. It’s similar to a business plan for any business, but the objectives are geared toward how you will manage the business, grow your investment, and secure funding.

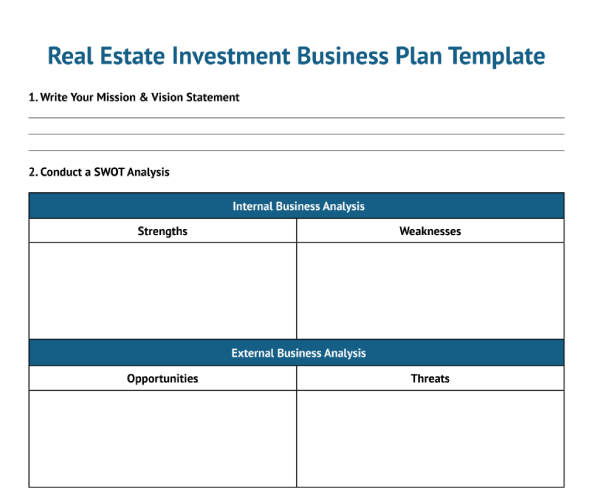

We’ve created a free real estate investment business plan template for you to download and use as a guide as you read through the article and learn how to write a business plan for real estate investment:

FILE TO DOWNLOAD OR INTEGRATE

Free Real Estate Investment Business Plan Template

Thank you for downloading!

1. write your mission & vision statement.

Every real estate investment business plan should begin with a concrete mission statement and vision. A mission statement declares actions and strategies the organization will use—serving as its North Star in achieving its business or investment objectives. A strong mission statement directs a real estate business, keeps teams accountable, inspires customers, and helps you measure success.

Before you compose your mission statement, you need to think about the following questions to do it effectively:

- What exactly is our business? The answer should encompass the essential functions of your real estate organization.

- How are we doing it? The response must explain your real estate goals and methods based on your core principles.

- Who are we doing it for? The response explains who your primary market is.

- What are our guiding principles? The “why” for your real estate company’s existence.

Mission statement example (Source: Oak Tree Capital )

The example above provides the mission statement of Oak Tree Capital. As a real estate investment business, it’s clear what its ultimate business objective is and how it will approach investing with integrity to maximize profit. Essentially, the investment company will drive monetary results—while maintaining its moral principles.

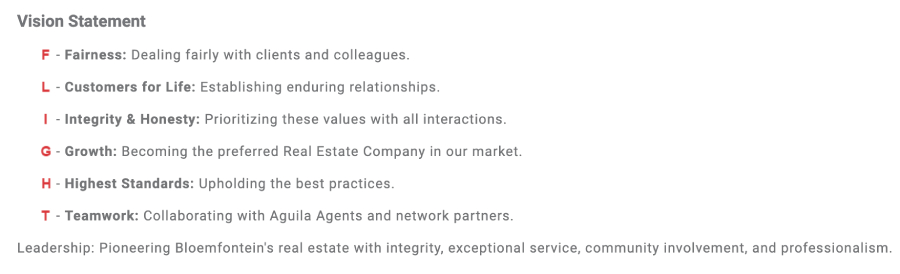

On the other hand, vision statements differ slightly from mission statements. They’re a bit more inspirational and provide some direction for future planning and execution of business investment strategies. Vision statements touch on a company’s desires and purpose beyond day-to-day operational activity. A vision statement outlines what the business desires to be once its mission statement is achieved.

For more mission statement examples, read our 16 Small Business Mission Statement Examples & Why They Inspire article and download our free mission statement template to get started.

If you want to write a vision statement that is truly aspirational and motivating, you should include your significant stakeholders as well as words that describe your products, services, values, initiatives, and goals. It would be best if you also answer the following questions:

- What is the primary goal of your organization?

- What are the key strengths of your business?

- What are the core values of your company?

- How do you aim to change the world as a business?

- What kind of global influence do you want your business to have?

- What needs and wants does your company have?

- How would the world be different if our organization achieved its goals?

In the example below from Aguila Real Estate, it hopes to be the preferred real estate company in its market.

Example of a vision statement (Source: Aguila Real Estate )

To make it easier, download our free template and follow our steps to create a vision statement for your small business. Take a look also at our 12 Inspiring Vision Statement Examples for Small Businesses in 2023 article to better understand how to create an impactful vision statement.

2. Conduct a SWOT Analysis

A SWOT analysis section of your real estate investing business plan template helps identify a business’ strengths, weaknesses, opportunities, and threats. This tool enables real estate investors to identify internal areas of improvement within their business through their strengths and weaknesses.

The opportunities and threats can assist with motivating a team to take actions that keep them ahead of an ever-changing real estate landscape. For a real estate business investor, the SWOT analysis is aimed at helping grow and protect investments over time.

Strengths & Weaknesses

Specifically for real estate investing, strengths and weaknesses correlate with the investment properties’ success and touch on items that will drive investment growth. The strengths can be the property’s location, condition, available amenities, and decreased vacancy. All of these items contribute to the success of a property.

On the contrary, the weaknesses include small unit sizes, excessive expenditures (finances to repair, upgrade, properties to acquire), low rents, and low cap rates. These weaknesses indicate less money is being collected and a lower overall return on investment (ROI). They are all factors that limit cash flow into the business and are internal factors that an investor can change.

See below for an example of strengths and weaknesses that could be included in a SWOT analysis:

Opportunities & Threats

Opportunities and threats are external factors that can affect an investment business. You don’t have control over these items, but you can maneuver your business to take advantage of the opportunities or mitigate any long-term effects of external threats. Opportunities relating to investment properties can be receiving certification with a city as a preferred development or having excess equity.

However, threats to an investment property do not need to be particularly connected to the property itself. They can be factors that affect your overall business. For example, interest rates may be high, which cuts your profits if you obtain a mortgage during that time frame.

An example of possible opportunities and threats for an investment business could be:

After creating your SWOT analysis, an investor can use these factors to develop business goals to support your strengths and opportunities while implementing change to combat the weaknesses and threats you anticipate. It also helps investors prioritize what items need to be addressed to succeed. These factors in a SWOT can change as the business grows, so don’t forget to revisit this portion and continuously reevaluate your SWOT.

3. Choose a Real Estate Business Investing Model

The core of real estate investing is to purchase and sell properties for a profit. How to make that profit is a factor in identifying your investment model. Different investing models are beneficial to an investor at different times.

For example, when interest rates are low, you may consider selling your property altogether. When interest rates are high and it is more difficult for people to obtain a mortgage, you may choose to rent out your properties instead. Sometimes, you must try a few models to see what works best for your business, given your area of expertise.

We’ve identified some investment business models to consider:

- Buy and hold: This strategy mainly involves renting out the property and earning regular rental income. This is also considered the BRRRR method : buy, rehab, rent, refinance, and repeat until you have increased your portfolio.

- Flipping properties : Flipping a property entails purchasing, adding value, and selling it higher than the investment costs. Many investors have a set profitability number they would like to hit but should consider market fluctuations on what they can realistically receive during the sale. Read our article on how to find houses to flip for more information.

- Owner-occupied: Investors can live in the property while renting out extra units to reduce their housing costs and have rental income coming in simultaneously. This model is best if you own multifamily units, especially duplexes, triplexes, or fourplexes . It’s also a great way to understand the complexities of being a landlord. You can transition your unit to another renter when you want to move.

- Turnkey: Buying a turnkey property is the best option for investors who wish to enter the real estate market without having to deal with renovations or tenant management. It’s a practical way for seasoned investors to diversify their portfolios with fewer time commitments.

Investors don’t have to stick to one model, and they can have a few of these investment models within their portfolio, depending on how much effort they would like to put into each property. Before choosing an investment model, consider which will help you meet your investing goals most efficiently.

Read our Investing in Real Estate: The 14-Tip Guide for Beginners article to learn how real estate investment works and other investing business models. Also, if you’re new to real estate investing and are looking for foundational knowledge to get started or seeking information about the best online courses for real estate investing, look at our The 13 Best Real Estate Investing Courses Online 2023 article.

4. Set Specific & Measurable Goals

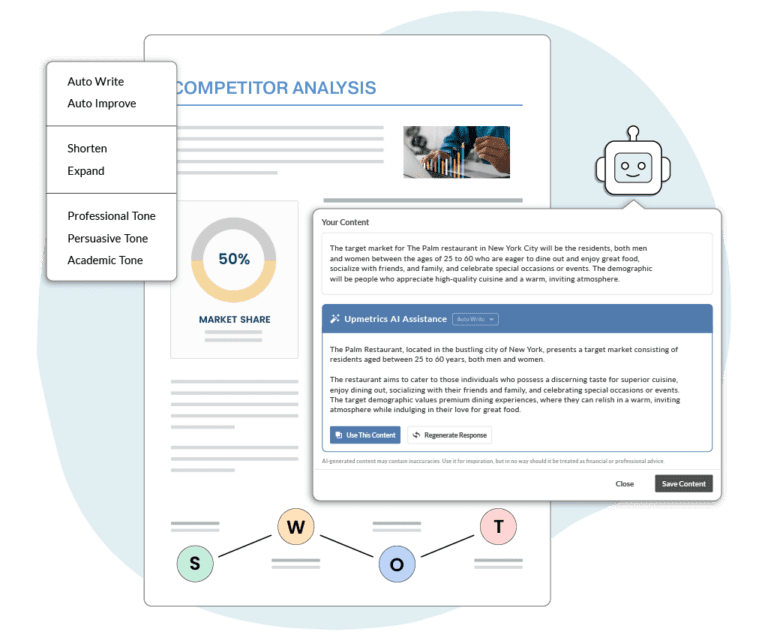

The next step to completing a real estate investment business plan for real estate investing is to set SMART goals. SMART is an acronym that stands for specific, measurable, achievable, relevant, and time-bound. Creating goals that contain all of the criteria of SMART goals results in extremely specific goals, provides focus, and sets an investor up for achieving the goals. The process of creating these goals takes some experience and continued practice.

An investor’s goals can consist of small short-term goals and more monumental long-term goals. Whether big or small, ideal goals will propel your business forward. For example, your end goal could be having a specific number of properties in your portfolio or setting a particular return on investment (ROI) you want to achieve annually.

Remember that your SMART goals don’t always have to be property-related just because you’re an investor. They can be goals that help you improve your networking or public speaking skills that can also add to a growing business.

Example of improving goals with SMART in mind:

Begin creating SMART goals with an initial goal. Then, take that initial goal and break it down into the different SMART components. SMART goals leave no room for error or confusion. The specific, measurable, and time-bound criteria identify the exact components for success.

However, the relevant and achievable parts of the goal require a little extra work to identify. The relevancy should align with your company’s mission, and extra research must be performed to ensure the goal is attainable.

Initial goal: Receive a 5% return on investment from the property

Smart goal:

- Specific: I want to achieve a 5% return on the 99 Park Place property.

- Measurable: The goal is to sell it for greater than or equal to $499,000.

- Achievable: The current market value for a two-bedroom in Chicago is selling for $500,000 and growing by 1% yearly.

- Relevant: I aim to meet my overall portfolio returns by 20% annually.

- Time-bound: I want to offload this property in the next three years.

5. Write a Company Summary

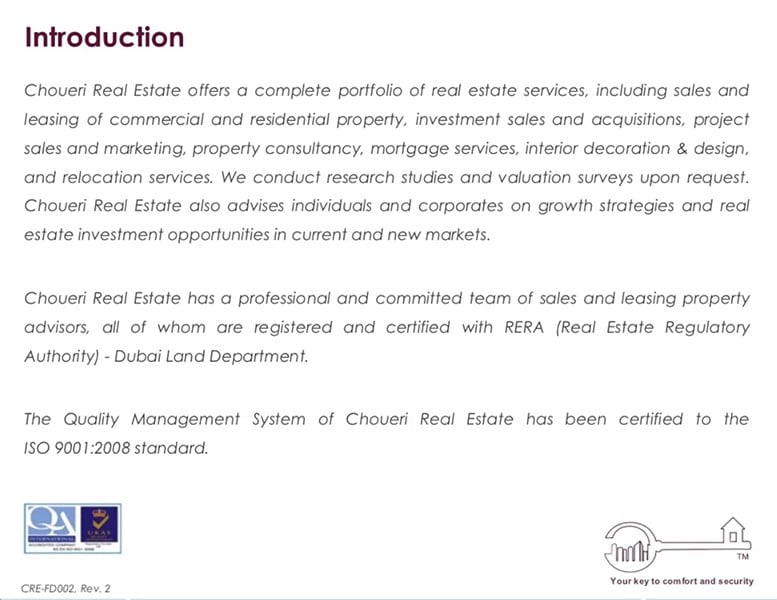

The company summary section of a business plan for investors is a high-level overview, giving insight into your business, its services, goals, and mission, and how you differentiate yourself from your competition. Other items that can be included in this overview are business legal structure, business location, and business goals. The company summary is beneficial if you want to involve outside investors or partners in your business.

Example company profile from Choueri Real Estate

A company summary is customizable to your target audience. If you’re using this section to recruit high-level executives to your team, center it around business operations and corporate culture. However, if you’re looking to target funding and develop investor relationships for a new project, then you should include investor-specific topics relating to profitability, investment strategy, and company business structure.

Partners and outside investors will want to consider your company’s specific legal business structure to know what types of liabilities are at hand. Legal business structure determines how taxes are charged and paid and what legal entity owns the assets. This information helps determine how the liabilities are separated from personal assets. For example, if a tenant wants to seek legal damages against the landlord and the property is owned by an LLC, personal assets like your personal home will not be at risk.

6. Determine Your Financial Plan

The most essential part of creating a real estate investing business is the financial aspect since much of the business involves purchasing, managing, and selling real estate. To buy real estate initially, you’ll have to determine where funding will come from. Funding can come from your personal assets, a line of credit, or external investors.

A few options are available to real estate investors when obtaining a loan to purchase properties. The lending options available to most real estate investors include the following:

- Mortgage: This is one of the most common means of obtaining financing. A financial institution will provide money based on a borrower’s credit score and ability to repay the loan.

- Federal Housing Authority (FHA) loans : This loan is secured by the FHA to assist with getting you a low down payment or lower closing costs, and sometimes easily obtain credit. There are some restrictions to qualify for this loan—but it could be suitable for newer investors who want to begin investing starting with their primary home.

- Home equity line of credit (HELOC) : If you currently have property, obtain a HELOC by using your current property to secure the line of credit and borrow against the equity in your property. As you repay the loan, your available balance on the line of credit gets replenished.

- Private lenders : These are lenders who are not financial institutions. These individual lenders typically have fewer restrictions than traditional lenders and will lend money to individuals who can grow their investments.

- Hard-money loans : This loan requires a hard asset to be leveraged for money. For example, you can put up the home you want to purchase as the asset for cash upfront, and the hard-money loan will be paid back once the home is sold or other funding is secured. This is great for short-term deals due to quick approval and little upfront money.

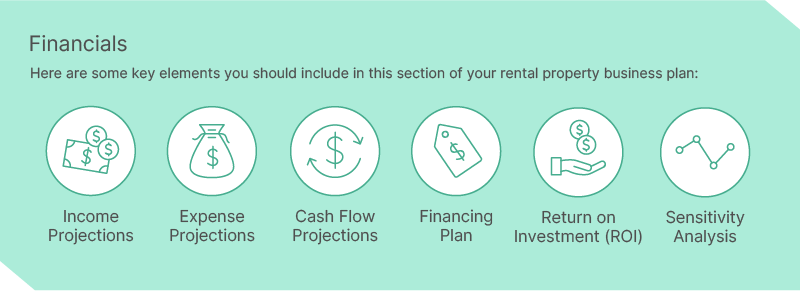

After funding is obtained to purchase property, financial projections help investors understand their financial standing. These projections can tell you potential income, profits, and when you may need additional funding in the future. Similar to lending options, these calculations are specific to your investing model. If you’re not planning to rent out the property, then calculations like gross rent multiplier are not applicable.

For more information on what is needed to obtain financing, read our articles Investment Property Financing & Requirements and 5 Best Crowdfunding Sites for Investors 2023 .

Additional Investment Calculations

In a rental property business plan, it’s important to use a rental property calculator to determine a property’s potential return on investment. The calculator considers various factors, such as purchase price, operating expenses, monthly income, or vacancy rates, to determine whether a property is a good investment.

Click on the tabs below for the other important calculations all investors should be aware of when purchasing and managing rental properties :

- Gross Operating Income

- Gross Rent Multiplier

- Vacancy Rate

The gross operating income (GOI) calculates the amount of rent and income received from a property minus any vacancy. It doesn’t take into account other expenses. It tells an investor how much income they’ll make after some assumed losses with vacancy.

GOI = Total rent + Other income – Vacancy losses

The capitalization (cap) rate calculates the return on investment (ROI) of a property. This equation is used to compare the return of one building to another. The higher the cap rate, the better since the purchase price is low.

Cap Rate = Net operating income / Purchase price

The gross rent multiplier (GRM) is a factor that helps determine a property’s potential profitability. It can be used to compare perspective buildings to determine which one is the better deal.

GRM = Property price / Gross annual income

The vacancy rate calculates the vacancy percentage of all your investment properties during a specific period. Percentage helps an investor determine how their property performs given current market conditions. If you have a high vacancy rate, you must determine the cause. Perhaps your asking rents are too high for the current housing market.

Vacancy Rate Formula = # of Vacant Units x 100 / Total # of Units

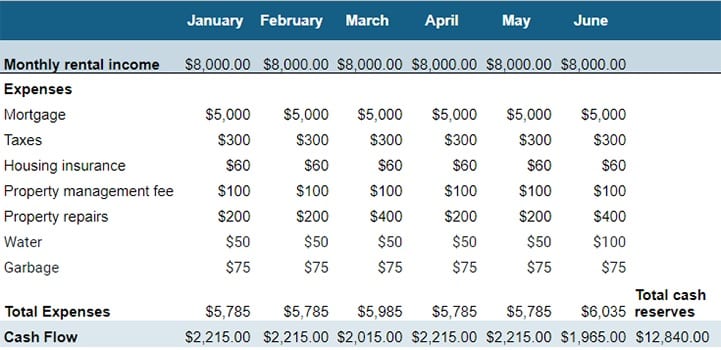

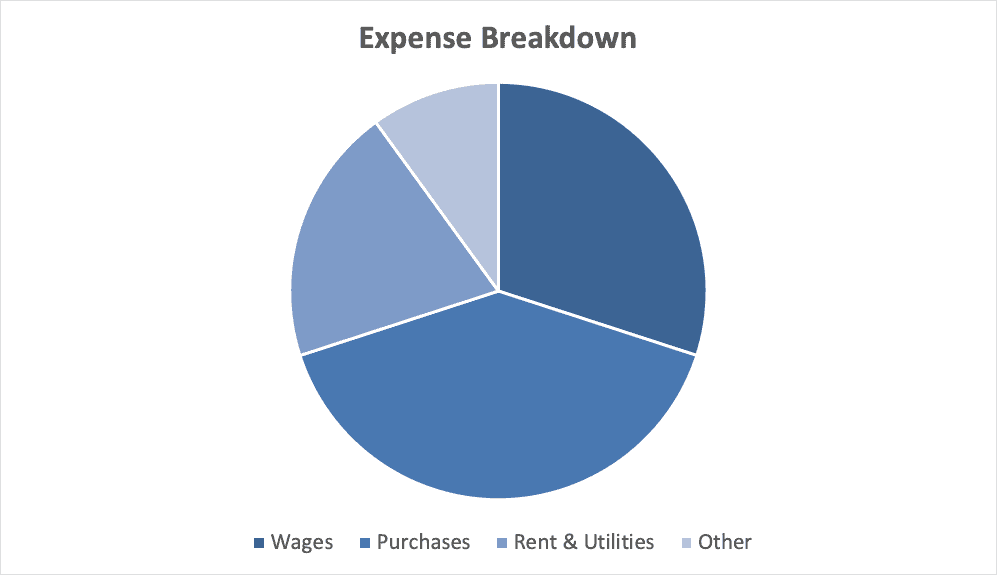

Cash flow is the movement of money in and out of your business, also known as net operating income. In an ideal scenario, investors will bring in more income than expenses, thus showing profit and a positive cash flow. Positive cash flow allows investors to decide how to use that profit. They can invest it in growing their portfolio or increasing their cash reserves for unexpected expenses.

Cash Flow = Gross rental income – Total expenses

Investors can use their current cash flow to forecast future cash flows, which will give you an idea of how much profit you will see over a specific period. Use past cash flow information to determine if there are any trends. For example, during the summer, your water expenses increase, or possibly every few months, you see an increase in property repairs. Consider these trends when estimating future cash flows and compare actual numbers to determine if your forecasting is accurate.

Use the template below to forecast future cash flow for six months and determine how much cash flow reserves you will have:

Cash Flow Template

💡 Quick tip:

In addition to the template, investing in property management software like TenantCloud will set you up for success. The free plan from TenantCloud will help you list apartments, collect rent payments, and screen applicants to maximize profits and minimize vacancies.

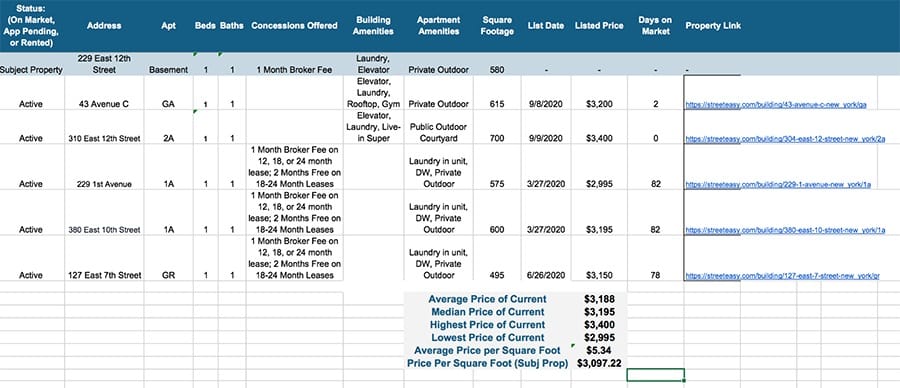

7. Perform a Rental Market Analysis

While determining what properties to purchase, investors should perform a rental market analysis (RMA) to gauge the investment potential of a rental property. The RMA consists of running comparables against current units on the market and collecting data that may affect your rental rate to understand if the rental property in question is a solid long-term investment. The analysis helps determine the average rental rate and future rent if you want to make any property upgrades.

Investors can use resources like Zillow to pull comparable property information and gather information on unit layout, building amenities, rental concessions offered, or listing prices. Once the information is gathered, the spreadsheet itemizes the average, median, highest, and lowest rent. When such information is available, it also provides an average price per square foot compared to the subject property. With this information, investors can decide whether the subject property is worth the investment.

Read our 10 Best States to Invest in Real Estate (& 5 Worst) in 2023 article to better understand which states yield a positive cash flow, build equity, and have long-term profitability.

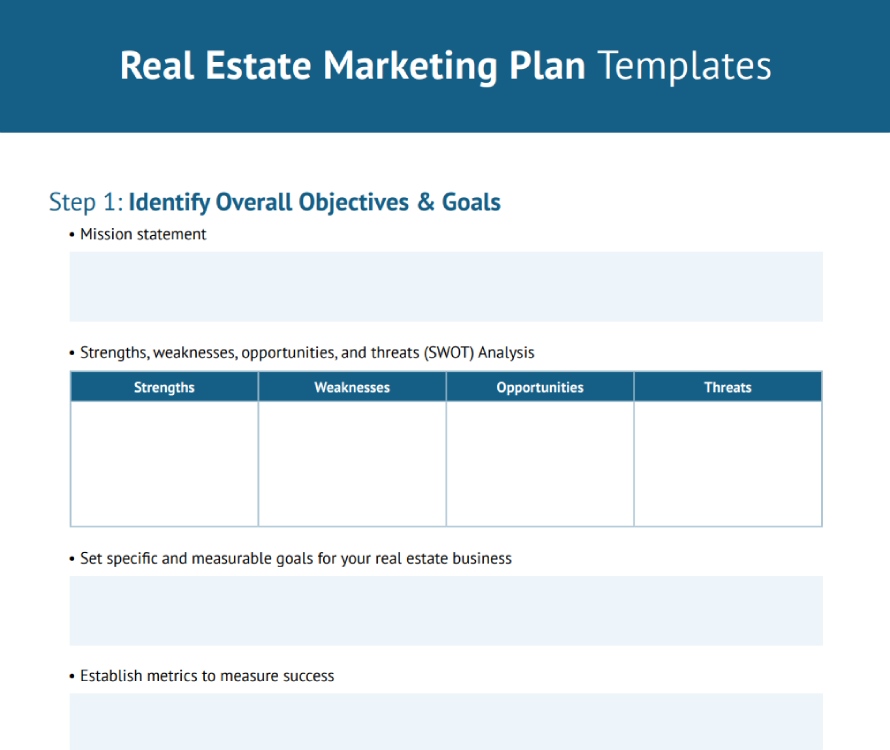

8. Create a Marketing Plan

Once you determine which property to invest in, investors should identify a marketing plan to list the vacant units. Some investors offload the marketing and advertising to real estate agents and brokerages, which will also collect a fee for renting out the property. Refer to some of the best real estate marketing materials to get started, or use our free real estate marketing plan template to lay out your objectives and tactics.

A real estate marketing plan should include your goals, budget, target market, competitors, feasible marketing strategies, and unique selling offers. In addition, it’s crucial to balance your strategy and split your potential marketing plans into categories, like print materials, online ads, email, and social media, so that you can be very specific with your goals and metrics.

Here are some of the real estate marketing mediums to include as you set your marketing goals:

- Real estate website and landing pages

- Email marketing

- SMS and text message marketing

- Real estate ads

- Social media marketing

- Print marketing materials

- Real estate signs

Download our marketing plan template by visiting our article Free Real Estate Marketing Plan Template & Strategy Guide .

9. Build a Team & Implement Systems

As a new investor, you may be unable to hire an entire team of employees to help perform research, run analysis, property management , and accounting duties. It is best to have a list of vendors you can rely on to assist you with purchasing, rehabilitating, and buying or selling your investment properties. Find vendors you trust so you can free yourself from having to micromanage them and know they have your best interest and the interest of your investments in mind.

Here are a few people you want to include on your team:

- Contractors

- Electricians

- Property managers

- Accountants

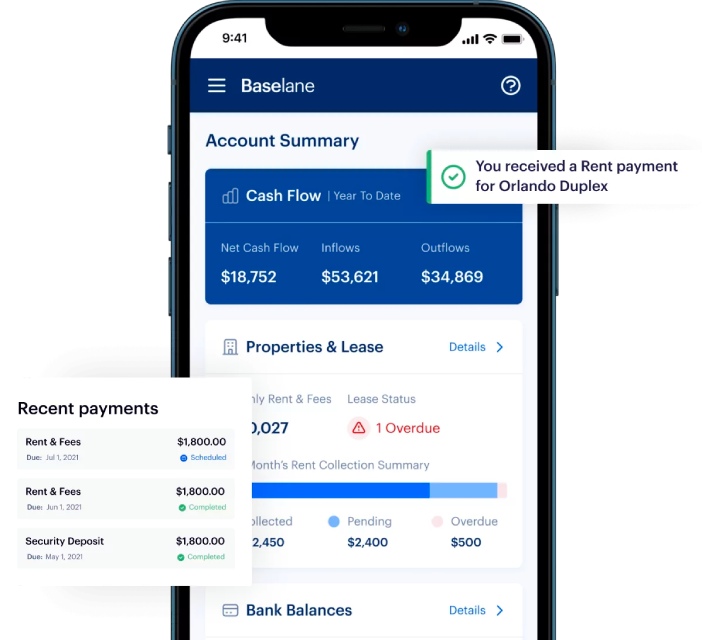

You should also utilize real estate investing apps and property intelligence software like Baselane that relieve you of manually performing daily duties to keep your investments profitable.

Automated rent collection feature (Source: Baselane )

Baselane is an all-in-one solution—from banking to rent collection, bookkeeping, reporting, and analytics. This software will help you efficiently manage your portfolio and eliminate the need for manual tasks. Learn more about how Baselane can make you a better property owner.

Visit Baselane

If you’re looking for more tools to help you get started, improve your portfolio management, and streamline your operations, read our 6 Best Real Estate Software for Investors 2023 article. We listed the six best software tools available for real estate investing based on affordability, customer reviews, features, and support to assist you in finding the best software that suits your needs.

10. Have an Exit Strategy

Since an investor’s money is tied up in the properties they own until they choose to sell, deciding when to sell or liquidate to get access to your money is part of an investor’s overall real estate exit strategy. The exit strategy for a real estate investment business is a plan for when an investor would like to remove themself from a deal or the business altogether. It helps weigh the different scenarios to minimize business risks and maximize the total return on investments.

A few exit strategy examples are:

The factors that an investor should consider when devising an exit strategy are minimizing financial loss, recouping as much of their original investment as possible, and avoiding any unseen fees that will cut into profits like tax consequences. An investor’s plan should always be to grow their original investment, but unforeseen circumstances may occur that will require you to plan on when to cut your losses as well.

Bottom Line

Before launching a successful real estate investment business, you must have an efficient business plan, aligning your strategies with your business objectives. Our real estate investment business plan template can help get you started. These plans act as a roadmap so you can focus on the steps required to grow your business. Business plans evolve, so continuously revisit and improve your strategies. There is no right or wrong way to write a real estate investor business plan as long as it is used to achieve your goals.

About the Author

Find Jealie On LinkedIn

Jealie Dacanay

Jealie is a staff writer expert focusing on real estate education, lead generation, marketing, and investing. She has always seen writing as an opportunity to apply her knowledge and express her ideas. Over the years and through her internship at a real estate developer in the Philippines, Camella, she developed and discovered essential skills for producing high-quality online content.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Your 10 Step Guide to Building a Real Estate Investing Business Plan

Real estate empires grow from a blueprint, not last-minute hunches. This guide outlines how to create a real estate investing business plan to help you navigate market dynamics, seek funding, and add to your team so that you can successfully grow your business.

Let’s be honest, the idea of drafting a formal real estate investing business plan probably doesn’t excite you. After all, you got into real estate investing to scout deals and transform properties, not write novels full of financial projections.

But experienced investors know a solid plan spells the difference between profitability and major headaches. It forces clarity on direction and feasibility before you sink hundreds of thousands into property purchases and rehabs.

Think of your business plan as a blueprint for success tailored to your unique investment goals and market conditions. Whether you currently own a few rentals or are launching a full-fledged development firm, a plan guides decisions, aligns partners, and demonstrates viability to secure financing.

So how do you build one effectively without needless complexity? What key strategy areas require your focus? Let’s explore components that set you up for growth while avoiding common first-timer pitfalls. With realistic planning as your foundation, your investing journey can start smooth and stay the course.

What is a real estate investing business plan?

At its core, a real estate investment business plan is simply a strategic guide outlining your intended real estate approach. It defines target markets, preferred project types based on expertise, capital sources, growth strategy, key operational procedures, and other investment specifics tailored to your situation.

View your plan as an evolving document rather than a rigid static rulebook collecting dust. It should provide goalposts and guardrails as markets shift over time and new opportunities appear. You'll be able to refer back to the plan to confirm that these new opportunities align with proven tactics that yield predictable returns.

Detailed upfront planning provides a sound foundation for confident direction. It protects stakeholders by identifying potential pitfalls and mitigation strategies before costly surprises trip up the stability of your real estate business.

So, it's worth it to take the time and develop a customized plan aligned to your niche, resources, and risk tolerance. While initially tedious, the practice of putting together your strategic real estate business plan ultimately provides clarity and confidence moving forward.

Importance of having a business plan

Now that we’ve defined what a business plan is, let’s explore why having one matters — especially if you want to grow a successful real estate investment company.

Have you considered what originally attracted you to investing in properties? Whether it was rehabbing flips, acquiring rentals, or simply a lucrative hobby, your motivations and ideal path can get lost in the daily distractions of life. That’s where an intentional business plan provides clarity and conviction moving forward.

Reasons every real estate investor should prioritize planning are:

- Goals and vision : You might be wanting to quit your day job and focus on real estate full time, or you might simply want to generate some extra income on the side. Either way, a business plan forces you to define what success looks like for you.

- Due diligence : Creating a plan forces you to research the real estate markets you want to invest in — analyzing sales, rents, permits, zoning, demographics, and growth projections. This helps you objectively identify high-potential neighborhoods and properties rather than relying on hearsay or intuition.

- Funding and financing : Lenders and potential investors will want to review your business plan to evaluate the viability and profitability of your real estate investment business before offering any financing . A complete plan builds credibility and confidence with stakeholders.

- Guide decision-making : It's easy to get distracted by the latest real estate seminar or shiny new construction techniques. But sticking to the parameters and strategies laid out in your plan prevents you from making hasty changes or going down rabbit holes.

- Identify potential risks : There are always things that can unexpectedly go wrong: what if interest rates spike and make your loans unaffordable, or your best tenants move out and unreliable folks move in? Brainstorming these scenarios in advance allows you to minimize risks and have contingency plans.

- Systemize operations : As you grow, how will you scale operations? A business plan helps you identify areas that will require attention as your business evolves, like creating maintenance checklists for rentals, standardizing lease agreements , or automating accounting procedures.

- Build the right team : Your business plan provides guidance on the team you'll need for your business. Know if you require a real estate agent to help you find deals or a property manager to handle tenant complaints at 2 AM.

- Track progress : Your plan helps you compare things like actual rehab costs, rental occupancy rates, cash flow, etc. to your initial projections and determine whether you're on track. You can then make adjustments as needed.

- Maintain strategy : As you scale your operations with new hires or partnerships, you'll want to maintain direction in alignment with your original business plan. For example, if you are considering new verticals like commercial real estate, does evaluation criteria match your proven risk metrics and return hurdles? A real estate business plan keeps everyone focused on the same goals as your business grows.

What to include in a real estate investment business plan

A good real estate investing business plan covers everything from business goals to financing strategy. Here are the ten key elements you should include:

1. Executive summary

The executive summary provides a high-level overview of your real estate investment business plan. It briefly describes your company mission, objectives, competitive advantages, growth strategies, team strengths, and financial outlook.

Think of it as the elevator pitch for your business plan, and write it last after you have completed the full plan. Limit it to 1-2 pages at most.

Make your executive summary compelling and motivate investors or lenders to learn more. Be sure to also summarize your past successes and experiences to build credibility.

2. Company description

The company description section provides background details on your real estate investment company. Keep this section brief, but use it to legitimize your business and team.

- Business model : Explain your core business model and investment strategies. Will you primarily flip properties, buy and hold rentals, conduct wholesale deals, or use another approach?

- Company history and achievements : Provide a brief timeline of your company's history, including its formation, past projects, key milestones, and achievements.

- Legal business structure : Identify your corporate structure, such as LLC , S-Corp , C-Corp, or sole proprietorship.

- Office location : Provide your company's office address, which lends you credibility. If you are initially working from home, consider establishing a local PO Box or virtual address.

- Founders and key team members : Introduce your founders and key team members. Highlight relevant real estate, finance, management expertise, and credentials.

- Past projects : Provide an overview of any successful prior real estate projects your company or founders have executed.

- Competitive advantages : Explain unique resources, systems, or other strengths that give your company an edge over competitors. These could be proprietary analytic models, contractor relationships, deal access, or specialized expertise.

- Technologies and tools : Discuss technologies, software programs, or tools your company uses to streamline processes and optimize operations.

3. Market analysis

The market analysis section validates whether your real estate investment strategy makes sense in a given area.

Conduct detailed research from multiple sources to create realistic real estate investment market projections and identify potentially profitable opportunities.

Outline why certain neighborhoods, property types, or price points pique your interest more than others.

Your market analysis should dig deep into factors like:

- Local sales and rental price trends : Analyze pricing history and current trends for both sales and rents. Look at different property types, sizes, and neighborhoods.

- Housing inventory and demand analysis : Research the balance of supply and demand and how that impacts prices. Is the market undersupplied or oversupplied?

- Market growth projections : Review forecasts from real estate analysts on expected market growth or decline in coming years. Incorporate these projections into your analysis.

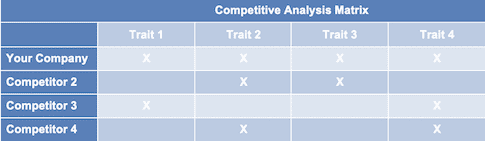

- Competitor analysis : Identify other real estate investors actively acquiring or managing properties in your target areas. Look at their business models and strategies.

- Target neighborhood and property analysis : Provide an in-depth analysis of your chosen neighborhoods and target property types. Outline positive attributes, risks, and opportunities.

- Demographic analysis : Analyze the demographics of potential tenants or homebuyers for your target properties. Factors like income, age, and family size impact demand.

- Local construction and renovation costs : Research materials and labor costs for accurate budgets and understand the permitting process and timelines.

- Regional economic outlook : Factor in projections for job growth, new employers, infrastructure projects, and how they may impact the real estate market.

4. SWOT analysis

SWOT stands for strengths, weaknesses, opportunities and threats. Conducting a SWOT analysis means stepping back from day-to-day business to assess your broader position and path from a strategic lens.

Internal strengths for your real estate investment business may include an experienced team skilled in major rehab projects, strong contractor relationships, or access to private lending capital. Weaknesses might be limited staff for handling tenant maintenance issues across a growing rental portfolio or only having a small number of referral partners for deal flow.

External opportunities can come from accelerating population growth and development in your target market, new zoning favorable to multifamily housing, or record-low mortgage interest rates. Threats could be rising material prices that hurt your flip margins, laws imposing restrictions on non-primary residence owners, or an oversupply of new luxury rentals, allowing tenants to be choosy.

The SWOT analysis highlights strengths to double down on and risks to mitigate in the real estate market.

5. Financial projections

The financial plan helps for both internal preparation and attracting investors. For real estate companies, the financial plan section should cover:

- Startup costs : Include the expected startup costs involved to start your investment project, such as getting licenses and permits or paying for legal fees.

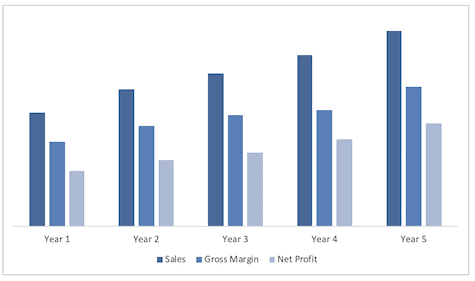

- Profit and loss forecasts : Create projected profit and loss statements that outline what you think your revenues and expenses will be over the next 3-5 years.

- Cash flow projections : Put together projected cash flow statements that show expected cash flow for each month.

- Return on investment projections : Project your company's expected ROI over time under the different investment scenarios.

- Funding requirements : Based on your forecasts, detail exactly how much capital you will need to start and operate your business until it is profitable. Specify whether you plan to use debt or equity financing.

6. Investment strategy

The investment strategy outlines your niche — will you focus on flipping, buying rentals, commercial properties, or a blend? Define any geographic targets like certain cities or zip codes backed by your research on growth potential.

Specify your criteria for ideal investment properties based on your goals. Decide which factors — age, size, layout, condition, or price point — matter most to you.

You can also use this section to explain how you plan to find deals, whether that's by scouting listed properties, attending foreclosure auctions, or networking to create off-market opportunities.

Clearly conveying your approach allows lenders and potential private investors to grasp your niche, planned pursuits, and process for finding deals. Having a strong strategy that summarizes how you locate, evaluate and capture deals matching your investing thesis can increase lender and private investor confidence in your ability to execute.

7. Marketing plan

Real estate marketing can’t just be an afterthought; it helps attract profitable deals, financing, and tenants to your business, making it a necessary component of your business plan to prioritize.

Components of your marketing plan can include:

- Networking: Actively networking at local real estate meetups puts you directly in front of promising off-market opportunities and partnerships with motivated sellers, lenders and contractors in your community.

- Social media: Consistently nurturing your social media presence can also pay off to help you find opportunities or potential investors.

- Direct marketing: Never underestimate old school direct marketing — sending postcards to addresses with outdated “We Buy Houses” signs or calling the For Sale by Owners numbers from public listings can help you reach motivated sellers.

- Listings management: Note that marketing does not end once you own property. To keep rental vacancies filled, leverage listing sites that can publish your units to a wide audience of prospective tenants.

8. Operations plan

Without systems, real estate investors struggle through renovations plagued by cost overruns, shoddy contractors who never call back, and frustrating tenants who always pay late . The operations component of your plan should consider aspects like:

- Renovations: Ever lined up a contractor who juggles too many clients and leaves your projects languishing? Create standardized processes for accurate scoping, vetting subs, enforcing deadlines contractually, and maintaining contingency funds.

- Business technologies: As your portfolio grows, tasks like tracking income, expenses , assets, and communicating with tenants can quickly overwhelm. Identify technologies early on that help centralize details to avoid getting swamped. Look into property management platforms that automate listings, tenant screening , digitized lease agreements, maintenance work order flows, and communications.

- Insurance: Tenants or contractors can sometimes damage assets. Discuss landlord insurance policies to protect you against lawsuits, natural disasters, and major property repairs as you scale up.

9. Team structure

If you plan to grow your team beyond just yourself or a few partners, your business plan should outline your organization's key roles and responsibilities. This helps you consider what positions you may need to fill as your company scales.

- Partners or co-founders: These are the main decision-makers and equity holders. Outline their background, skills, and the value they bring.

- Property manager: This person handles day-to-day management of properties, tenants and maintenance issues.

- Bookkeeper: You may need daily help managing bank accounts, invoices, taxes, and financial reporting.

- Contractors and project managers : You'll need trusted renovations, repairs, and landscaping contractors. Dedicated project managers help oversee large jobs.

- Leasing agents : As you grow and add more properties, leasing agents handle showings, applications, and signing new tenants.

- Real estate attorneys : Real estate investing requires proper legal filings and compliance. Attorneys can help you manage this risk.

10. Exit strategies

Every wise investor plans their exit strategy upfront before acquiring a property. Will you aim to flip the asset quickly or retain it as a rental long-term? What factors determine ideal timing and the right profit margin for you to walk away?

Build flexibility into your strategy, as markets move in unpredictable ways. Especially with flips, have contingency plans if your listing gets lowballs or no offers. Be willing to rent short-term, refinance and hold if possible, convert to condos, or just patiently wait until the market changes. Having reserves and backup options allows you to avoid a distress sale.

Also include plans for strategies after a property sale, like a 1031 exchange to defer capital gains taxes and reinvest in another property. You may want to use sale proceeds to reduce or clear outstanding debts, enhancing cash flow and financial standing.

Tips for your real estate business plan

Now that you know what to include, consider the following four tips to help your real estate investment business plan stand out.

1. Be detailed and specific

Resist the urge to gloss over details as you put together your plan. Drill down on the specifics for parameters like:

- Target purchase and rehab costs.

- Timelines for completing projects.

- Minimum profit margins.

- Maximum allowable vacancy rates .

- Minimum cash reserves.

2. Refine and update regularly

Markets change, so don't create your business plan and file it away. Review your plan regularly to see how market conditions and your actual results compare to projections.

Make adjustments as needed. Tweak your approach if your rehabs are going over budget or your properties aren't selling as quickly as expected.

Aim to update your full plan annually at a minimum. Even if your overall strategy remains consistent, refresh the details around market factors, financials, tactics, risks, and projections.

3. Seek expert feedback

Before implementing your new real estate investment business plan, seek feedback from advisors who can identify potential issues or weaknesses.

Ask experienced real estate investors in your area to review your plan and provide constructive input. It's also a good idea to share your plan and numbers with your CPA and legal counsel as well.

4. Keep it simple

While specificity is good, don't over complicate your business plan to the point where it becomes difficult to follow. You want to inform readers without confusing them.

The goal is for stakeholders, such as co-investors, lenders, and partners, to easily digest your plan and understand it after a quick skim. Make it easy for readers to grasp your reasons behind focusing on a given area or project type based on market conditions and opportunity.

A property investment business plan fit to your goals

After finally finishing your business plan, you’re probably eager to dive into tangible investments rather than tweaking spreadsheets. But in the real estate industry, even experienced investors periodically step back and update strategies.

Approach your business plan as a living document that evolves as the market shifts, as you create new partnerships, or when you need to make changes in strategy. Set reminders to revisit quarterly and confirm your activities of today still align with the vision from day one.

Solid planning is proven to improve outcomes in dynamic industries like real estate investing. Though preparation isn’t glamorous, it pays dividends. Thoughtfully constructing your playbook puts the odds of executing successfully in your favor.

With a solid blueprint backed by your research, you’re now ready to capture the best real estate investment opportunities.

Business plan real estate investor FAQs

How do i stay flexible and adapt my business plan to changes in the market.

To stay flexible, review your real estate investing business plan regularly and update it based on changes in market conditions, trends, and opportunities. If things change in the market, find ways to adapt your strategy. This can include your goals, target market, financing, and even your exit plans.

How do I know if my real estate investing business plan is effective?

You'll know your business plan is effective if you're meeting the key objectives and metrics you outlined. Let's say your plan called for you to purchase a certain number of properties and achieve a specific cash flow or rate of return. If you're falling short, you can use the plan to course-correct.

Are there any specific software or tools for creating a real estate investing business plan?

Azibo is a helpful software tool for creating real estate investing business plans. This comprehensive platform has templates and tools to build out key sections of your plan. Its robust accounting and financial capabilities help construct accurate statements and projections.

Incorporating Azibo's online rent collection allows you to model cash flows. By centralizing lease documents , accounting, and portfolio management, Azibo streamlines the process of putting together a strategically sound real estate business plan.

Important Note: This post is for informational and educational purposes only. It should not be taken as legal, accounting, or tax advice, nor should it be used as a substitute for such services. Always consult your own legal, accounting, or tax counsel before taking any action based on this information.

Nichole co-founded Gateway Private Equity Group, with a history of investments in single-family and multi-family properties, and now a specialization in hotel real estate investments. She is also the creator of NicsGuide.com, a blog dedicated to real estate investing.

Other related articles

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our newsletter.

Latest posts

Can i refuse to pay rent if there is mold in my apartment.

Mold can turn a rental home into an absolute nightmare if not handled correctly by both tenants and landlords. This guide covers giving notice of mold issues and landlord obligations for inspections and remediation. It also outlines tenant options like rent withholding or terminating leases, as well as relevant state and local mold laws all parties should follow.

Acceleration of Rent: 4 Commercial Lease Clauses

Rent acceleration clauses allow landlords to demand the full outstanding rent balance from tenants who breach the lease agreement. Discover the diverse phrasing and circumstances that can trigger these clauses and which ones carry harsher terms.

Michigan Squatters' Rights: What You Need to Know

Do squatters have the right to live on your property in Michigan? This article explains the laws surrounding squatters' rights and the steps that property owners need to take to remove them and keep their property secure.

- Making a property investment business plan

- Rental yield calculations

- Property investment strategies

- How to quit your job and invest in property

Setting investment goals

- Are property training courses worth the money?

- Do you need a property mentor?

- The process of buying an investment property

- How to evaluate a property investment

- Property assessment checklist

- The 4 types of property deal I look for (and why)

- How to find a property sourcer

- Deciding where to invest

- How to flip a house: the ultimate guide

- Rent-To-Rent: The ultimate guide

- Lease Options explained

- Lending against property

- Lessons from running a letting agency

- How to get started with limited funds

- Mortgages: The ultimate guide

- Mortgages for limited companies

- New mortgage rules: rental cover and portfolio landlords

- Interest-only vs repayment mortgages

- Bridging finance: the ultimate guide

- Property joint venture agreements – The ultimate guide

- Recycling your cash

- Self-manage or use a letting agent?

- Landlord insurance guide

- How to find tenants

- Writing a tenancy agreement

- What does self-managing a property involve?

- Rent guarantee insurance

- The 18-year property cycle

- Will London house prices crash?

- Avoiding Inheritance Tax

- Exit strategies

- Mortgage interest relief

- Buying through a company

How to create a rental property business plan (and why you need one)

Last updated: 21 October 2022

Take it from someone who’s spoken to a lot of investors over the last few years: almost everyone who achieves great success started out with a solid plan.

All businesses start out with a plan . Even if that plan is just “I think I can buy this widget for £1 and sell it for £1.50”, it’s still a statement of what the business will do and how it will make a profit.

But many – in fact, most – wannabe property investors start out without even the most basic of plans. Often, people have nothing more than vague thoughts like “ property prices go up, so it’s a good investment ” or “ most wealthy people seem to own property ”.

It might feel like sitting around planning is just delaying you from getting out to look at properties and start making money. But take it from someone who’s spoken to a lot of investors over the last few years: almost everyone who achieves great success started out with a solid plan.

(Or to put it another, more painful way: almost everyone who didn’t start with a plan ends up disappointed with where they end up – however much effort, money and time they put in.)

What does a rental property business plan look like?

It certainly doesn't need to be 100 spiral-bound pages of projections and fancy charts. In fact, the best plan would be so simple that it fits on the back of an index card – meaning that you can commit it to memory and use it to drive every decision you make.

In order to get to that simplicity though, you might need to do some seriously brain-straining thinking first.

It's not easy, but it is simple: your plan basically just needs to set out…

Where you are now

- Where you want to get to, and

- What actions you're going to take to bridge the gap

DOWNLOAD MY BUSINESS PLAN WORKSHEET

Get your plan down on paper by downloading my printable worksheet that takes you through the planning process

You'll receive a one-off email with your download link, and be subscribed to my Sunday email where I round up the main property news stories of the week. You can unsubscribe at any time, and your data will never, ever be passed to anyone else.

To give a cheesy analogy, you can't plan a route unless you know where you're starting from.

Working out your starting point is the easiest part, because it involves information that's either known or easily knowable to you.

You'll need to be clear about:

- The amount of money you've got to invest

- The amount of savings you can allocate to property investment in future years

- The time you can invest each week or month

- The skills and knowledge you can apply to your property business

Note that I said it was the easiest part, but still not easy – because it involves honesty about what you can commit, and self-knowledge to determine where your strengths lie.

Knowing how much money you've got to invest should be straightforward, but it's probably worthwhile speaking to a mortgage broker to check that you'll have borrowing options – because this will determine your total investment figure. A broker will also be able to tell you about your options around releasing equity from your own home, if that's something you want to consider.

I'd also strongly encourage you to consider what “emergency fund” you want to keep in cash, and deduct that from your total investable funds. I suggest having at least six months' expenses in the bank at all times: the last thing you want is to plough every last penny into investments, then lose your job the next day and be unable to pay your bills.

Where you want to get to

So now you know where you're starting from, where do you want to end up? In other words, what's your goal?

Yes, you want to be “rich”, or “secure”, or “build a future” – but what does that actually mean, in pounds and pence terms, for you?

And just as importantly, when do you want to have achieved that?

You might be surprised by how much thought is involved in answering these questions properly. It's easy to throw around terms like “enough to fund my lifestyle” and assume that it might involve an income of £10,000 per month, but it's another matter entirely to look honestly at your ideal lifestyle and determine what a genuinely meaningful figure is.

The same is true for “when” – and it's an often-ignored factor that actually cuts to the heart of the most basic of investment decisions.

For example, take a choice between two properties:

- Property 1 will give a return on your investment of 15% but will probably never increase in value

- Property 2 will give a return of 7% but has the potential to double in value over the next decade.

If your goal is to create a certain monthly income within three years, the Property 1 is likely to be a better choice. Growth is unlikely to happen to any great extent over that time, so you need to optimise for cash in the bank right now.

On the other hand, if you have a decade before you want to have achieved your goal, Property 2 is probably the better bet. It very much is a “bet” because you're taking something of a gamble on capital growth, but it's got a lot of time to happen – and when it does, your returns will dwarf the higher rental income you'd have made from the other property.

That's just one example of why making even simple decisions in your property business are impossible without having that most basic ingredient of your plan: where you ultimately want to end up, and when.

So, by this point in the plan you need to:

- Assess your finances to build up an honest picture of where you are now

- Put some serious thought into where you want to get to, and when

If you need help with this goal-setting process, I co-own Property Hub Invest which offers free strategy meetings . It's often easier to work this stuff out in conversation with someone who knows their stuff, rather than doing it all in your own head.

That's a great start, but for most people it'll produce an uncomfortable insight: the gap between where you are and where you want to be seems impossibly large! With the resources you've got now, how are you possibly going to reach your goal in a sensible period of time?

Well, that's where it's time to start thinking about the details of the third step: the strategy you'll use to pursue your goal.

A strategy to bridge the gap

The steps you take to get from Point A to Point Z are what's commonly referred to as your strategy – and strategy is a vital component of your business plan.

The way I like to think about strategy is the way you compensate for a lack of cash . It's an unusual way to look at it, but I find it useful – because it tells you (given your timeframe and your goal) how much heavy-lifting your strategy will need to do to keep you on track.

Think of it like this: if you had £10m in the bank and your goal was to make an income of £5,000 per month within a year, you wouldn't need any strategy at all . You could just use your £10m to buy any properties, anywhere – you wouldn't need to maximise the rent, manage them well or even keep them all occupied at all times! You'd be able to buy so much property that you really couldn't fail.

Sure, it'd be a pretty stupid thing to do – you should really have had a more ambitious goal – but you get the point.

Obviously, most of us aren't in that position – and that's why we need a strategy.

So, just what position are you in?

A rule of thumb

A handy way of looking at it is to take the amount of money you've got to invest in property, and assume that you can get a 5% annual return on that money (ROI) – which is a rough rule-of-thumb for a normal property bought with a 75% mortgage.

So, if you've got £100,000, you can generate a (pre-tax) profit of £5,000 per year – or £416 per month.

That's unlikely to be enough to hit most people's goals – but then there's the time factor. If you save up the rental income for 20 years, you'll be able to buy another batch of properties just like the first – so you'll now have income of £832 per month.

If you're happy with that, then you've already got your strategy: buy properties that will give you your desired ROI, then wait!

Portfolio-building strategies

But most people will want more than that: we've hardly been talking about life-changing sums, and 20 years is a long time to wait before you can buy again!

This is where more of an advanced strategy comes in, allowing you to get better results, faster.

This might include:

- Buying properties and adding value, so you can refinance at the higher value and buy your next property more quickly ( learn more about this strategy )

- Buying properties at a discount, allowing you again to refinance at the higher value and move on to the next one

- Turning properties into HMOs, so you can generate a higher ROI on them

- “Flipping” properties for a profit, so you can replenish your cash more quickly ( read my guide to flipping )

…or something else entirely.

I go into different strategies in enormous detail in my book, The Complete Guide To Property Investment .

Simply appreciating the need for one of these strategies from the start is a really big deal.

Most people don't: they'll rush in, use all their money to buy properties that generate (say) £500 profit per month, then…what? They'll be stuck – because they didn't go in with a plan for how they were going to get to their target number . They'll effectively be starting from scratch, having to scrape together the money to go again.

It's extremely common, and it doesn't surprise me – but it does frustrate me. If they'd started with just a bit of time making a plan, they wouldn't have made this mistake – because it would have become very obvious that they wouldn't reach their goal without applying some strategy.

Any of the strategies I listed (or a different one, or a combination of several of them), when applied effectively, can get you to where you need to be. But that's not to say that all of them will be equally good for you. Each of them has different risk factors, requires different time commitments, are suited to different skill sets, and so on.

That's why this is your business plan: copying someone else's homework isn't going to do you any good, because their skills, attributes and preferences will be different from yours.

For example, one person's plan might be to get their hands dirty by renovating properties for resale – completing two projects per year, and using the profits to buy an HMO. Within five years they'll have five HMOs, which will give them all the income they need.

Someone else might be hopeless at anything hands-on, but a master negotiator. Their plan could be to buy at enough of a discount that they can pull at least half of their funds back out again by refinancing – and keep doing that until in ten years' time they have 15 single-let properties giving them their target income figure.

(That's why when someone emails me asking if their strategy “sounds good”, I have to say that I don't know: usually it sounds like on paper like it would work for someone , but I have no idea if they're the right person to execute it.)

So, coming up with your strategy involves:

- Starting with an assessment of where you are now

- Deciding where you want to get to, and by when

- Seeing how far you'll fall short by just buying “normal” properties

- Thinking about your own skills, time and preferences to choose which strategy (or strategies) you'll use to fill in the gap

It might take a while, and that's OK – it's not an easy decision . To take the pressure off though, remember: your plan isn't set in stone. It's important to start with a clear vision and not get distracted by every new opportunity that comes your way, but every plan is just a starting point: you'll be seeing what works, reviewing and adjusting course along the way.

Once you've got a strategy down on paper, that's a huge step – and you should congratulate yourself, because it's a step that most people will never make (and will suffer for).

But of course, the act of writing the plan isn't going to magic it into existence: you need to get out there and execute on the plan.

Turning your property business plan into action

Having an appropriate goal and a solid strategy to get you there are essential, sure – but nothing is going to happen until you actually take the steps that are necessary to execute that strategy.

If you don't take the time to identify the steps and make a plan to carry them out, you'll end up in “pulling an all-nighter the day before your homework is due in” mode. And you don't want that: it's no good setting a five-year goal, feeling all virtuous for being such a strategic and big-picture thinker, then realising in four years and 364 days that you've not actually got any closer towards making it a reality!

So let's get those steps in place. And the good news is…it's really simple. (The best things usually are.)

Breaking it down

However big, ambitious and far in the future a goal seems to be, all goals are achieved in exactly the same way : by breaking them down into individual tasks, and working through those tasks one by one.

As you work through those tasks, it’s important to have sub-goals as “checkpoints” along the way.

Sub-goals are how you stay on track: by setting a deadline for each sub-goal, you can make sure that your progress is fast enough. They also keep you motivated, because it means you’ll always have a small “win” on the horizon: you won’t just be looking at the main goal (potentially) years off in the future. Think of them as mile markers at the side of a marathon course.

To put it another way:

Small task + Small task + Small task = Sub-goal Sub-goal + Sub-goal + Sub-goal = Overall goal

It's those small daily tasks that are the foundations of your achievement. And that's the beauty of a good plan: all you need to concentrate on is ticking off your tasks each day, and your overall goal is achieved automatically!

So, this final step in your plan is about breaking that big goal down into sub-goals, and those sub-goals down into bite-sized individual tasks. That's it!

As you break it down, there are a few things I find are useful to think about…

One-off tasks v recurring tasks

Your business will have two types of task:

- One-off tasks , like finding a mortgage broker

- Recurring tasks , like viewing properties and making offers

These two types of task will both appear in your weekly, monthly and quarterly to-do lists. A useful way of planning your time is to start by filling in your recurring tasks – like going through portals to find new potential acquisitions every day, and calling agents to follow up on offers once per week – then adding your recurring tasks on top.

By thinking about both types, you'll make sure you're not dropping the ball on the important day-by-day stuff, but you're also not ignoring the big-picture one-offs that are going to make a huge difference to your business in the long run.

The first, simplest step

Just like you break a goal down into sub-goals and sub-goals down into tasks, I favour breaking every one-off task down into the smallest possible unit .

For example, “find a mortgage broker” could be an important one-off task for you, but it's not something you can just sit down and do until it's done. Because it seems nebulous and you can never identify a block of time when you can do it from start to finish, you can end up never doing it at all.

Instead, you'll make yourself feel better by ticking off smaller tasks that seem easier – but are often less important.

The solution is to break every task down into as many sub-tasks as possible. So instead of “find a mortgage broker”, the tasks become :

- Email 3 contacts to ask for recommendations

- Post on The Property Hub forum to ask for recommendations

- Email everyone who is recommended to set up a quick call

- Draw up a shortlist of 2-3 people to have a longer conversation with

- Pick a winner

Doesn't that seem much easier already? You can imagine sitting down and bashing out the first task in five minutes right now, then you're underway!

Who will do each job?

Here's a potential lightbulb moment: you don't have to do everything in your business yourself.

Any business has different “functions”, or departments – like sales, manufacturing, and admin. A property business is no exception.

The basic functions of all property businesses are the same:

- Acquisition

- Refurbishment

- Refinancing/selling

The types of task that fall within each function will depend on your business plan. For example, if your aim is to find properties you can buy “below market value”, acquisition could be a major part of the business – involving direct-to-vendor marketing, networking with estate agents, and attending auctions.

On the other hand, if your model involves buying properties that you think will experience strong capital growth, there could be a lot more tasks in the “research” part of the business – and acquisition could be very straightforward once you’ve identified the opportunity itself.

Could you do every task within every function yourself? Maybe.

Could the business achieve better results if you bring in specialists to do what they do best? Definitely .

You could go big and employ an assistant to view properties and make offers for you, or just make sure you outsource functions like management and accountancy to the relevant professionals.

Whatever you do, once you start thinking about your property venture as a business with various departments, you'll start to break away from the idea that this is something you have to do all on your own – and that's a very powerful insight.

OK, this has been a long one – but we've covered a lot of ground.

To recap, those critical steps are:

- Assess where you are now

- Work out where you want to be, and by when

- Outline a strategy to get you there

- Fill in the detail, to get you from “big picture” to individual steps

It's a process that's worked for me, and I've seen it work for many investors I've encouraged to put it into action too.

Its power is in its simplicity: you take the time to intelligently decide exactly what you need to do, then you figure out a way to (to borrow a registered trademark) just do it . As long as you show up and work through your to-do list each day, the big, scary, long-term goal takes care of itself!

Of course, you'll need to assess your progress and adjust course along the way: nothing will pan out exactly as expected, and there's a lot that can change over a timespan of several years.

But by having your plan, what you won't do is get distracted by every new idea that comes your way – researching HMOs one day, and holiday lets the next – and end up getting nowhere.

(You'd be amazed by how many plan-less people that description fits to a tee.)

So now you know how to put a property business plan together. It's not a plan that will necessarily get you funding from the bank, but it's something more important than that: a plan you can use every day to make sure you stay on track to hit your goals.

The one thing that every successful investor does

- Property Management 101

- Property Law

- Join Our Network

How to Create a Real Estate Investment Business Plan for Residential Rental Properties (Free Template)

Ready to unlock the potential of real estate investment and build your financial future? Whether you’re an experienced investor or just starting out , crafting a well-thought-out business plan is critical if you're to succeed in the world of residential rental properties.

This article will guide you through the essential steps, considerations, and components of creating a real estate investment business plan. Plus, we've got a valuable free template to make your journey even more manageable.

Why You Need a Business Plan for Real Estate Investment

Crafting an effective real estate investment business plan is about more than paperwork; it's about turning your aspirations into achievements.

Creating a formalized business plan for your real estate investment venture is tantamount to success. It forces you—the investor—to organize your thoughts, feelings, goals, and ideas moving forward in the business in a single, powerful document.

Remember, this is a living document meant to be flexible as your business grows or changes tactics over the years. It keeps you on target, helps expand your business, and keeps your financial goals on track.

It’s also a helpful document for potential investors, creditors, and partners to peruse before pursuing a business venture with you.

And speaking of collaborators, finding sample real estate investment business plans or a template to download to get you started is a good idea. But before diving into that, let's look at a few general considerations that will shape your plan.

General Considerations for a Real Estate Investment Business Plan

Before you start actually writing your business plan, there are a few general considerations to keep in mind:

- The Why. When you start any new venture, it’s good to know you’ve got the strength to realize your goals, even when things get tricky. Defining why you’re embarking upon this real estate investment journey is necessary if you want to reach your destination. Why do you want to invest in real estate? To create financial independence? To serve the community? To provide for your family? Everyone’s “why” is unique to them. As such, your underlying motivation should be the starting point of creating a business plan. Everything follows from this origin.

- Financial Goals. Next, it’s wise to consider your financial goals. What are you hoping to accomplish financially? This is a business, and having defined financial goals will help keep your real estate investments trending in the right direction.

- Timeline. When do you want to achieve all this? Are you taking this business from now until retirement or looking to flip a few houses before the decade closes? Having a general timeline in mind when planning means you’ll be realistic about what goals you can accomplish.

- Real Estate Investment Strategy. There are countless ways to jumpstart your real estate investments. Doing a bit of research to discover which real estate investment strategies best suit your financial goals and desired timeline will ensure your business plan is realistic moving forward.

These considerations form the foundation of your real estate investment business plan. But how do you piece it together and create a comprehensive, winning document?

Spoiler alert: Property managers can be your secret weapon in crafting an airtight plan and guiding you through your investment journey.

But first, let's explore the essential components of your business plan and how a property manager can make the process smoother.

Essential Components of a Business Plan for Real Estate Investment

A well-thought-out business plan for real estate investment should help you secure the financing and partnerships needed to bring your dream to fruition.

To do this, it must include the following components:

- Executive Summary: a bird’s eye view. The first section of a business plan is like an abstract for a research paper. Here, you’ll introduce the plan and give an overview of what comes later in the document.

- Define your team. Who are you bringing on this journey? What are their qualifications? This section can attract new investors and partners by touting the team's accomplishments.

- Outline marketing strategy. A business plan won’t succeed without a marketing strategy to connect with potential clients, in this case, future tenants. Your real estate business plan must include understanding the need for top-quality marketing and a method to market your business successfully. Will you run social media ads? Rent local billboard space?

- Demonstrate initiative and a willingness to learn. Include a section to show that you know this industry, have researched the competition, and are aware of local real estate market trends and areas for growth. This will communicate to potential investors you’re willing to put in the elbow grease it takes to succeed long-term in this business.

- Describe the “What”. What services will you offer? What type of properties will you invest in? What are the next steps to your plan moving forward?

As you dive deeper into your real estate investment journey, remember that the strength of every property manager relationship reflects the property owner's dedication.

How to Create a Residential Real Estate Business Plan Quickly

If you're looking to create a residential real estate business plan quickly, here are a few must-have tips to get you started:

- Define: Mission. Vision. Values. A business is only as strong as its “big three” pillars: the mission, vision, and values. Begin your business plan by defining what the purpose of your business is (its mission), your plan to bring this mission to life (vision), and the values that will guide your actions when the going gets tough. Careful consideration of these will give you clarity when finding team members to build your business later on. You need people who click with what your business stands for.

- Identify short and long-term goals. A real estate business is only as successful as it prepares to be. Remember the adage: if you fail to plan, you plan to fail. Spending time identifying short (3-12 months out) and long (1-5 years in the future) term goals gives you and your team ways to mark the journey to success with well-defined milestones.

- Figure out the finances. How will you fund your business? There are many ways to find capital to bring your real estate business plan to life, but you may have to get creative. And you’ll need to stay organized and on task to bring your financial goals to fruition.

- Find the perfect property manager. The quickest way to accomplish this magnificent business plan you’re creating? Hire a property manager to help you skip the grunt work. But while finding the right manager for your business isn’t easy—you’ll need to research and interview several property managers before you get a feel for what’s best for you—the road will be much less bumpy with a solid business plan in hand.

How a Property Manager Can Help You Create a Real Estate Investment Business Plan

A property manager can help you create a real estate investment business plan in five important ways.

- Provide you with insights into the local real estate market.

- Help you identify and evaluate potential investment properties.

- Help you develop a marketing strategy to attract tenants.

- Help you manage your finances and keep track of your expenses.

- Provide you with guidance and support throughout the investment process.

When you enter property manager interviews armed with a robust business plan, you demonstrate your commitment and pave the way for a successful partnership.

Ultimately, creating the ideal business plan for real estate investment begins with you. Every property manager relationship is only as strong as the drive of the property owner.

Download APM’s free sample real estate investment business plan template to get started.

Get the latest property management trends delivered right to your inbox.

Find A Property Manager

- Single-Family Property Management

- Multifamily Property Management