- Product overview

- All features

- Latest feature release

- App integrations

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- asana-intelligence icon Asana AI

- workflow icon Workflows and automation

- portfolio icon Resource management

- Capacity planning

- Time tracking

- my-task icon Admin and security

- Admin console

- Permissions

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Project intake

- Resource planning

- Product launches

- View all uses arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Project planning |

- How to create a competitive analysis (w ...

How to create a competitive analysis (with examples)

Competitive analysis involves identifying your direct and indirect competitors using research to reveal their strengths and weaknesses in relation to your own. In this guide, we’ll outline how to do a competitive analysis and explain how you can use this marketing strategy to improve your business.

Whether you’re running a business or playing in a football game, understanding your competition is crucial for success. While you may not be scoring touchdowns in the office, your goal is to score business deals with clients or win customers with your products. The method of preparation for athletes and business owners is similar—once you understand your strengths and weaknesses versus your competitors’, you can level up.

3 ways to transform your enterprise project management

Watch a live demo and Q&A session to help you streamline goal-setting, accelerate annual planning, and automate how teams intake strategic work.

What is a competitive analysis?

Competitive analysis involves identifying your direct and indirect competitors using research to reveal their strengths and weaknesses in relation to your own.

![direct and indirect competitors in business plan [inline illustration] What is a competitive analysis (infographic)](https://assets.asana.biz/transform/c1a37dfd-53a8-44c4-b57b-10fc6a332ba1/inline-project-planning-competitive-analysis-example-1-2x?io=transform:fill,width:2560&format=webp)

Direct competitors market the same product to the same audience as you, while indirect competitors market the same product to a different audience. After identifying your competitors, you can use the information you gather to see where you stand in the market landscape.

What to include in a competitive analysis

The purpose of this type of analysis is to get a competitive advantage in the market and improve your business strategy. Without a competitive analysis, it’s difficult to know what others are doing to win clients or customers in your target market. A competitive analysis report may include:

A description of your company’s target market

Details about your product or service versus the competitors’

Current and projected market share, sales, and revenues

Pricing comparison

Marketing and social media strategy analysis

Differences in customer ratings

You’ll compare each detail of your product or service versus the competition to assess strategy efficacy. By comparing success metrics across companies, you can make data-driven decisions.

How to do a competitive analysis

Follow these five steps to create your competitive analysis report and get a broad view of where you fit in the market. This process can help you analyze a handful of competitors at one time and better approach your target customers.

1. Create a competitor overview

In step one, select between five and 10 competitors to compare against your company. The competitors you choose should have similar product or service offerings and a similar business model to you. You should also choose a mix of both direct and indirect competitors so you can see how new markets might affect your company. Choosing both startup and seasoned competitors will further diversify your analysis.

Tip: To find competitors in your industry, use Google or Amazon to search for your product or service. The top results that emerge are likely your competitors. If you’re a startup or you serve a niche market, you may need to dive deeper into the rankings to find your direct competitors.

2. Conduct market research

Once you know the competitors you want to analyze, you’ll begin in-depth market research. This will be a mixture of primary and secondary research. Primary research comes directly from customers or the product itself, while secondary research is information that’s already compiled. Then, keep track of the data you collect in a user research template .

Primary market research may include:

Purchasing competitors’ products or services

Interviewing customers

Conducting online surveys of customers

Holding in-person focus groups

Secondary market research may include:

Examining competitors’ websites

Assessing the current economic situation

Identifying technological developments

Reading company records

Tip: Search engine analysis tools like Ahrefs and SEMrush can help you examine competitors’ websites and obtain crucial SEO information such as the keywords they’re targeting, the number of backlinks they have, and the overall health of their website.

3. Compare product features

The next step in your analysis involves a comparison of your product to your competitors’ products. This comparison should break down the products feature by feature. While every product has its own unique features, most products will likely include:

Service offered

Age of audience served

Number of features

Style and design

Ease of use

Type and number of warranties

Customer support offered

Product quality

Tip: If your features table gets too long, abbreviate this step by listing the features you believe are of most importance to your analysis. Important features may include cost, product benefits, and ease of use.

4. Compare product marketing

The next step in your analysis will look similar to the one before, except you’ll compare the marketing efforts of your competitors instead of the product features. Unlike the product features matrix you created, you’ll need to go deeper to unveil each company’s marketing plan .

Areas you’ll want to analyze include:

Social media

Website copy

Press releases

Product copy

As you analyze the above, ask questions to dig deeper into each company’s marketing strategies. The questions you should ask will vary by industry, but may include:

What story are they trying to tell?

What value do they bring to their customers?

What’s their company mission?

What’s their brand voice?

Tip: You can identify your competitors’ target demographic in this step by referencing their customer base, either from their website or from testimonials. This information can help you build customer personas. When you can picture who your competitor actively targets, you can better understand their marketing tactics.

5. Use a SWOT analysis

Competitive intelligence will make up a significant part of your competitor analysis framework, but once you’ve gathered your information, you can turn the focus back to your company. A SWOT analysis helps you identify your company’s strengths and weaknesses. It also helps turn weaknesses into opportunities and assess threats you face based on your competition.

During a SWOT analysis, ask yourself:

What do we do well?

What could we improve?

Are there market gaps in our services?

What new market trends are on the horizon?

Tip: Your research from the previous steps in the competitive analysis will help you answer these questions and fill in your SWOT analysis. You can visually present your findings in a SWOT matrix, which is a four-box chart divided by category.

6. Identify your place in the market landscape

The last step in your competitive analysis is to understand where you stand in the market landscape. To do this, you’ll create a graph with an X and Y axis. The two axes should represent the most important factors for being competitive in your market.

For example, the X-axis may represent customer satisfaction, while the Y-axis may represent presence in the market. You’ll then plot each competitor on the graph according to their (x,y) coordinates. You’ll also plot your company on this chart, which will give you an idea of where you stand in relation to your competitors.

This graph is included for informational purposes and does not represent Asana’s market landscape or any specific industry’s market landscape.

![direct and indirect competitors in business plan [inline illustration] Identify your place in the market landscape (infographic)](https://assets.asana.biz/transform/fb2a8437-bb5e-4f0c-b5d0-91d67116bebe/inline-project-planning-competitive-analysis-example-2-2x?io=transform:fill,width:2560&format=webp)

Tip: In this example, you’ll see three companies that have a greater market presence and greater customer satisfaction than yours, while two companies have a similar market presence but higher customer satisfaction. This data should jumpstart the problem-solving process because you now know which competitors are the biggest threats and you can see where you fall short.

Competitive analysis example

Imagine you work at a marketing startup that provides SEO for dentists, which is a niche industry and only has a few competitors. You decide to conduct a market analysis for your business. To do so, you would:

Step 1: Use Google to compile a list of your competitors.

Steps 2, 3, and 4: Use your competitors’ websites, as well as SEO analysis tools like Ahrefs, to deep-dive into the service offerings and marketing strategies of each company.

Step 5: Focusing back on your own company, you conduct a SWOT analysis to assess your own strategic goals and get a visual of your strengths and weaknesses.

Step 6: Finally, you create a graph of the market landscape and conclude that there are two companies beating your company in customer satisfaction and market presence.

After compiling this information into a table like the one below, you consider a unique strategy. To beat out your competitors, you can use localization. Instead of marketing to dentists nationwide like your competitors are doing, you decide to focus your marketing strategy on one region, state, or city. Once you’ve become the known SEO company for dentists in that city, you’ll branch out.

![direct and indirect competitors in business plan [inline illustration] Competitive analysis framework (example)](https://assets.asana.biz/transform/56c32354-f525-4610-9250-f878ea0b9f26/inline-project-planning-competitive-analysis-example-3-2x?io=transform:fill,width:2560&format=webp)

You won’t know what conclusions you can draw from your competitive analysis until you do the work and see the results. Whether you decide on a new pricing strategy, a way to level up your marketing, or a revamp of your product, understanding your competition can provide significant insight.

Drawbacks of competitive analysis

There are some drawbacks to competitive analysis you should consider before moving forward with your report. While these drawbacks are minor, understanding them can make you an even better manager or business owner.

Don’t forget to take action

You don’t just want to gather the information from your competitive analysis—you also want to take action on that information. The data itself will only show you where you fit into the market landscape. The key to competitive analysis is using it to problem solve and improve your company’s strategic plan .

Be wary of confirmation bias

Confirmation bias means interpreting information based on the beliefs you already hold. This is bad because it can cause you to hold on to false beliefs. To avoid bias, you should rely on all the data available to back up your decisions. In the example above, the business owner may believe they’re the best in the SEO dental market at social media. Because of this belief, when they do market research for social media, they may only collect enough information to confirm their own bias—even if their competitors are statistically better at social media. However, if they were to rely on all the data available, they could eliminate this bias.

Update your analysis regularly

A competitive analysis report represents a snapshot of the market landscape as it currently stands. This report can help you gain enough information to make changes to your company, but you shouldn’t refer to the document again unless you update the information regularly. Market trends are always changing, and although it’s tedious to update your report, doing so will ensure you get accurate insight into your competitors at all times.

Boost your marketing strategy with competitive analysis

Learning your competitors’ strengths and weaknesses will make you a better marketer. If you don’t know the competition you’re up against, you can’t beat them. Using competitive analysis can boost your marketing strategy and allow you to capture your target audience faster.

Competitive analysis must lead to action, which means following up on your findings with clear business goals and a strong business plan. Once you do your competitive analysis, you can use the templates below to put your plan into action.

Related resources

7 steps to crafting a winning event proposal (with template)

How Asana drives impactful product launches in 3 steps

How to streamline compliance management software with Asana

New site openings: How to reduce costs and delays

Direct vs. Indirect Competition: How to Increase Your Market Share

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

In business, you must understand your competitors.

Because your competitors are after the same audience you are.

This means understanding:

- Who your competitors are

- What they are doing to grow their market share

- What strategies you should leverage to increase your market share

There are two types of competitors : direct competitors and indirect competitors.

Understanding them both is crucial because different competitors compete in different ways.

In this post, we’ll take a deep dive into direct vs. indirect competition.

We’ll get into how to identify direct and indirect competition, how to analyze its impact on your business, and how to create winning strategies that help you quickly increase your market share.

What is direct and indirect competition?

Direct competition refers to competitors that offer your target market the same products or services that you offer.

Indirect competition, on the other hand, refers to competitors that offer different solutions that could replace your business to satisfy your customers’ wants and needs.

Now that you understand direct and indirect competition at a high level let’s explore them further.

Understanding direct competitors

Direct competitors are businesses that offer similar products to yours and serve the same target audience as you do.

Some well-known examples of direct competitors are…

- FedEx and UPS directly compete in the package delivery and courier industry

- Nike and Adidas are direct rivals in the athletic footwear and apparel market

- Boeing and Airbus are major competitors in the commercial aircraft industry

Consumers tend to stay loyal to a brand, but under certain circumstances, they might switch to a competitor brand.

This means your direct competitors pose a direct threat to your business. They’d be more than happy to steal your clients away from you while you’re not watching.

Now, before I get into ways to find direct competitors or some strategies to beat them, let’s talk about indirect competitors.

Understanding indirect competitors

Your indirect competitors also pose a real threat to your business because indirect competitors serve your market by solving the same customer needs that you do.

They serve those customer needs differently to your business, however. This usually means offering different products or services than you do.

For instance…

Although someone is looking for a hotel, they might be happy to stay in a vacation rental.

Although someone is looking for a broom, they might be happy to use a vacuum cleaner.

Although someone is looking for fruit juices, they might be happy to drink sports drinks.

I’m sure you get the picture.

Now, before we move on, you must understand that there is more to indirect competitors than just the products they provide. There are more ways than one to serve your target market .

Many sales funnels start by simply answering a question your prospect might have. When you do that, you are able to build a relationship with your audience.

That relationship should eventually influence their buying decision when they are looking to spend money on a product or service.

Your indirect competitors are lurking at every funnel stage, ready to steal the show and start a conversation with your audience. This means even your SEO and social media competitors are indirect competitors.

Even if they don’t offer products or services.

For example, a child psychologist might win clients by posting blog content about behavioral issues. But prospects might never see that content because bloggers or news sites might own the traffic share for that topic.

Now that it seems there are competitors lurking around every corner let’s have a look at how you can find your direct and indirect competitors. Once you’ve found them, I’ll show you some ways to deal with them.

Spy on your competitors

Build better marketing strategies with competitor analysis tools.

How to find direct competitors

It’s time to try to figure out who your competitors are. And, since business tends to be complex, I recommend using more than one method.

In this section, I’ll show you a few ways to find and evaluate your competitors.

We’ll get into a few data-driven strategies as well as some old-fashioned ways to understand your competitors.

I’ll be focusing on website traffic data. But you should also apply this thinking to how you position your products.

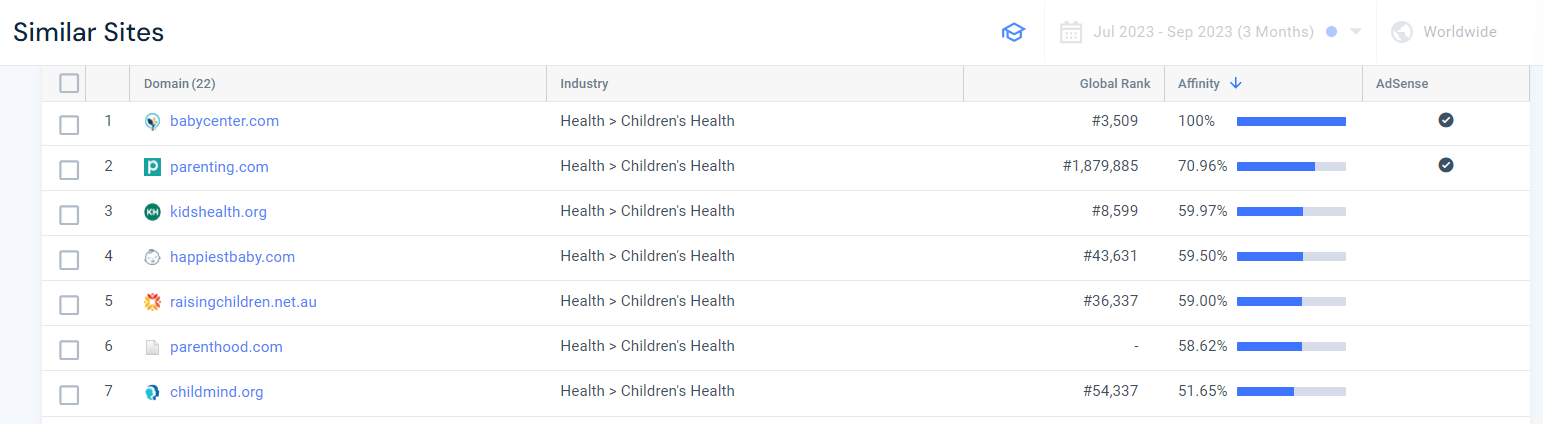

The Similarweb Similar Sites Report

My favorite way to find competitors is to use the Similar Sites report.

There are two reasons I love this report. Firstly, it gives you a big-picture look at your competitive market by comparing your site to similar sites using multiple data points, including:

This means you are not relying on a single metric to find your competitors.

Secondly, I love it because once you have a list of similar sites, you can filter by industry to find direct competitors or see all sites that are competing, even if they are in different industries.

So, for instance, let’s take a look at the sites that are similar to parents.com .

Now, although these sites have a similar audience, looking at the Industry column, you’ll see that many of them are in the general health industry.

Parents.com is specifically in the Children’s Health niche, but thebump.com and whattoexpect.com are related to pregnancy and not parenting.

It’s easy to understand why these sites serve a similar audience. As we saw in the initial analysis, parents.com is heavily invested in SEO, focusing on informational content that targets parents.

It’s likely that thebump.com and whattoexpect.com are also competing for top-of-the-funnel organic traffic, and their top-of-the-funnel informational content is highly likely to overlap. But are they selling similar products? Are they making money the same way?

If not, you can assume that they are indirect competitors (which I’ll cover later in this post.)

You can easily filter out other niches by only showing sites in the Children’s Health niche .

Nice. We now have a list of sites directly competing in the Children’s Health niche.

Okay, you’ve seen some Similarweb data. Now, let’s see what we can learn from Google.

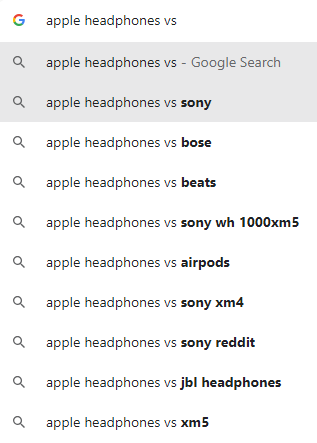

Looking at Google’s Autosuggest

To round out your understanding of your competitors, Google is your friend. Because when you sell products on your site, your customers are likely to do a little research before buying.

At some point, they are likely to compare what you sell to your competitors’ products. Common searches might be: [your product] vs. [a competitor’s product].

Now, this approach will work well if your brand is recognizable and your product is competitive.

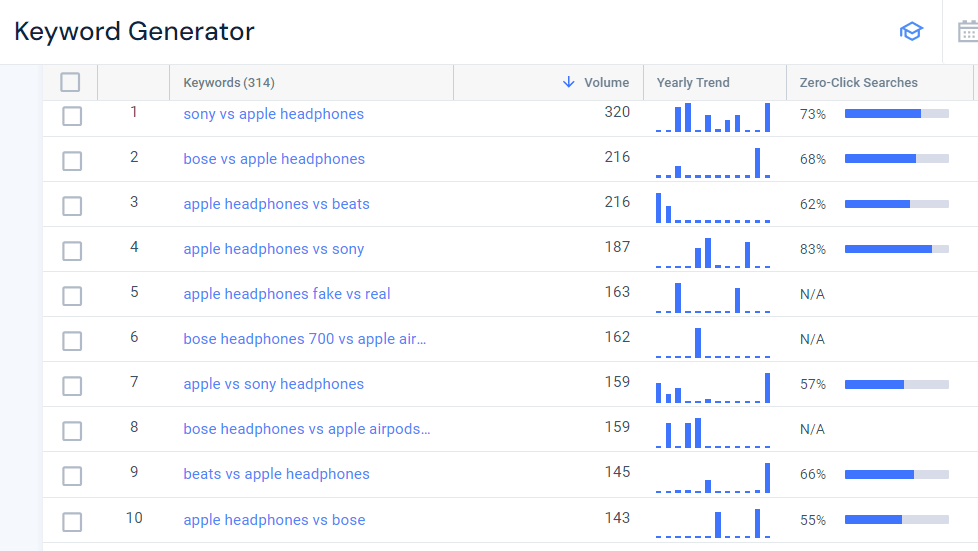

For instance, I decided to see which headphones compete directly with Apple headphones. As you can see, Google shows an extensive list.

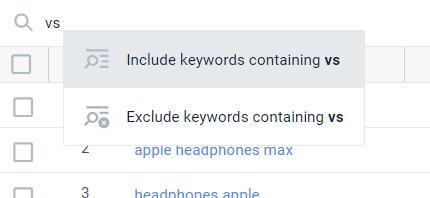

What’s more, you can expand this list with your keyword research tool .

For instance, I’ve searched for the seed keyword ‘apple headphones’ in the Similarweb Keyword Generator . Then, using the search filter, I only include keywords that include ‘vs.’

As you can see below, the tool brings a nice list of searches made by actual users looking to compare similar products.

It’s important to understand the context here.

Although these keywords might be worth targeting in an SEO campaign, we are focusing on something more significant.

These keywords are surfacing brands that are directly competing on a product level.

Now that you understand how to find direct competitors let’s expand your competitor list to indirect competitors.

How to find your indirect competitors

In this section, I’ll show you how to find indirect competitors. It’s important to remember that your indirect competitors are serving your audience at different stages of the sales funnel , even if they are not offering the same products as your business.

Finding indirect competitors in different niches

As I mentioned above, you can use the Similarweb Similar Sites report to find sites that are similar to yours in terms of content, audience, keywords, and referrals.

We’ve also seen that to find direct competitors, you can filter out sites in different industries. To find indirect competitors, just do the opposite.

For instance, since parents.com is in the Children’s Health niche, to find indirect competitors, set the filter only to show sites from the women’s health niche that share a similar audience to parents.com.

As I mentioned in the direct competitors section, these sites are focused on women’s health and not specifically parenting.

Another way to find indirect competitors is to look for sites that target similar keywords.

Organic Competitors report

The Similarweb Organic Competitors report simply finds your top organic search competitors by analyzing the degree to which their keywords and rankings overlap with yours.

So, for instance, I’ve dropped nerdwallet.com into the Website Analysis tool . Looking at the Organic Competitors report, we can see a nice list of sites competing for organic traffic.

This tool brings you a list of competitors that are less focused than the Similar Sites report. The reason is the tool only looks at one metric.

Keyword overlap.

The result is you see sites that are only competing on your keywords but are not necessarily competing on a product level. Use this data to expand your list of indirect competitors.

You’ve now spent some useful time looking at the data — but don’t neglect your richest source of business intel.

Customer feedback

Some of your best insights will come from your current customers.

Think about it.

These are people who’ve gone through your sales funnels and have come out the other side.

Because they use your products and services, they most likely share the same pain points your future prospects have.

So, if you want to understand your competitors, ask your existing customers things like:

- What made them decide to use your services?

- Are there any product alternatives?

- How do the alternatives compare to your product?

There are many ways to do this, including:

Whatever they say, take notes. Their answers are likely to be pure gold.

Okay, so you’ve found out who your competitors are.

What do you do now?

How to deal with your competitors

Now that you understand your competitive market , it’s time to figure out how to increase your market share. You have limited resources, so the question here is what you should focus on strategically to move your business forward with the resources you have.

Since dealing with your competitors requires strategic planning, you must first understand your competitive market.

This requires careful analysis as your chosen strategy should solve a specific weakness your business might have.

What’s more, there are different areas of your business that you can work on at any given time, including:

Once you’ve figured out what you need to improve, you can then move on to actually creating a strategy that will help your business grow. For instance, you might see that your competitors get way more traffic or social media engagement than your business.

This analysis will help you see where your business is lacking and can improve.

Rather than give you exact steps to follow, I’ll demonstrate how I’d go through the process of strategic analysis . After the analysis, I’ll also show you some best practices and things to think about.

For these examples, I’ll focus on traffic and engagement metrics, but in reality, you could follow a similar process when looking at how you are presenting your product in the market or how you are converting prospects into paying customers.

Website Performance: Analyzing your competitors

At this stage, you are looking for a weakness that you can leverage in your marketing strategy . Let’s compare your site to your top competitors and see what comes up.

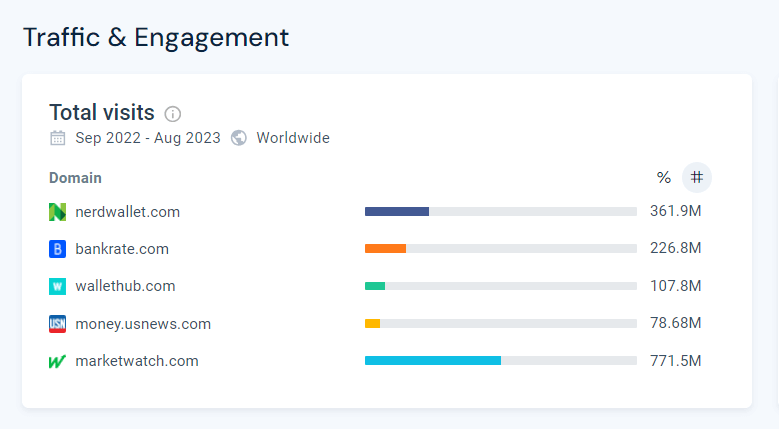

I’ve dropped nerdwallet.com into the Similarweb Website Analysis. I’ve also added the site’s four top competitors, making sure that the competitors are all in the same industry.

By doing this, I can now compare all of the top metrics to see where there are obvious opportunities.

The first thing that jumps out to me is when we look at the Traffic & Engagement report. As you can see below, marketwatch.com is getting substantially more Traffic & Engagement than all of the other sites analyzed.

This tells me there are traffic opportunities to be won.

Let’s use the Marketing Channels Overview to dig into where marketwatch.com is getting all of that traffic from. Having this clear will help you decide if you want to go after a similar traffic source.

As you can see above, marketwatch.com is getting a substantial amount of direct traffic. Another metric that stands out is referral traffic.

This suggests two things about marketwatch.com’s traffic lead.

- The fact that they get so much direct traffic suggests they have a strong brand. I’m assuming that because direct traffic refers to visitors entering the URL, using a bookmark, or clicking a saved link. Could there be another reason?

- The fact that they get so much referral traffic shows me that they are successful at creating relationships with other sites. I know this because referral traffic refers to traffic coming to a site through affiliates, links, content partners, and traffic from direct media buying or news coverage.

Now, before I give a strategic analysis, let’s look at one more report. The more data we see, the better we’ll understand their strategy.

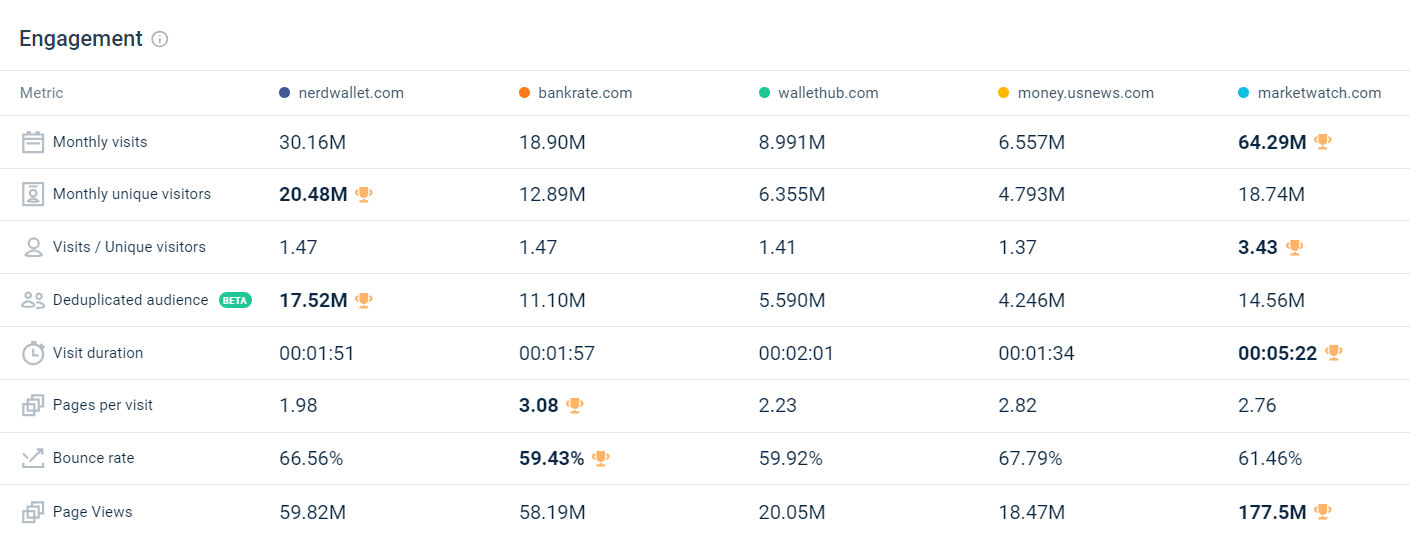

The Engagement report will give us a bigger insight into marketwatch.com’s traffic and why they are winning against nerdwallet.com.

As you can see above, although marketwatch.com is getting more than double the Monthly Visits that nerdwallet.com is, nerdwallet.com has more Monthly Unique Visitors than marketwatch.com.

How on earth does that make sense?

Looking at the Visits/Unique Visitors, you’ll see that:

- An average user on nerdwallet.com visited the site 1.47 times over the last year

- An average user on marketwatch.com visited the site 3.43 times over the last year

In other words, the secret to marketwatch.com’s massive traffic numbers is not because of its strong brand. It’s because’s website is more ‘sticky.’ Viewers want to come back to the site.

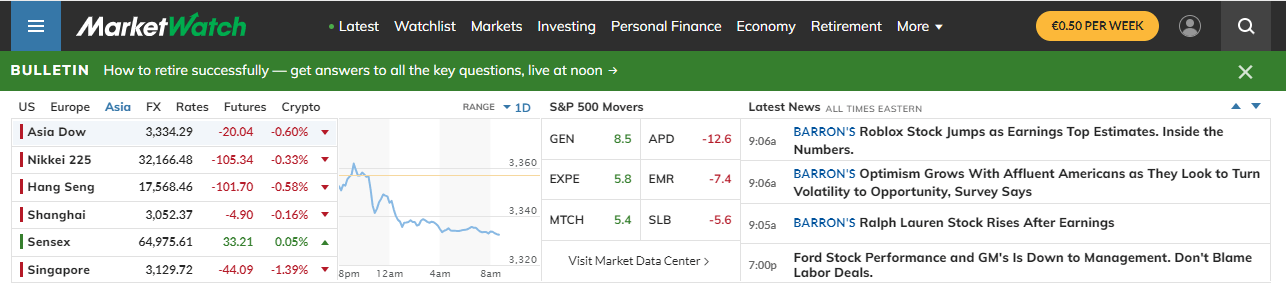

Now, before we understand the insight, let’s first take a look at the marketwatch.com home page.

Marketwatch.com is sharing share-price data right on the home page. This might explain why the site is getting so much referral traffic.

Also, if you check the backlinks , even though nerdwallet.com has substantially more backlinks , marketwatch.com has links from news sites like drudgereport.com and wsj.com.

And here is the insight…

Marketwatch.com gets substantial traffic by presenting itself as a financial news site. The result is visitors come back regularly to check the news. What’s more, it gets its referral traffic by supplying data to news sites.

Nerdwallet.com could, in theory, play the same game and present itself as a news site. This could result in more returning traffic. What’s more, presenting timely financial data (like Marketwatch.com does) could result in substantial news-site traffic.

Now, is it worth it for nerdwallet.com to take that insight and go with it? I’ll leave it to their team.

Another example.

Finding organic competitors

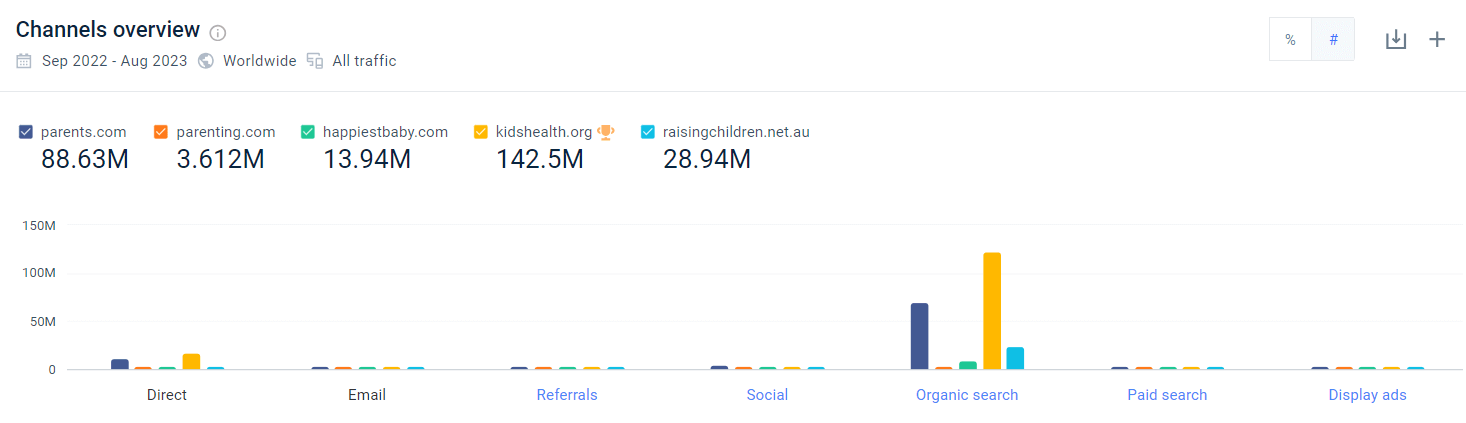

Back to parents.com, when we look at the big-picture metrics comparing the site to its direct competitors, the story is clear.

As you can see above, kidshealth.org is getting substantially more traffic than the other competitors.

And, jumping to the Channels Overview and looking at traffic, we see that the vast majority of that is Organic Traffic.

Should parents.com try to go after that same traffic?

If they decide to do that, the next step would be competitive SEO analysis .

There’s no space to cover that fully in this post — but here is one approach to help you get started and give you a flavor of what’s possible.

Drop all of the site’s competitors into the Similarweb Keyword Gap tool and hit the Opportunities filter.

This will bring you a comprehensive list of keywords your competitors are ranking on that your site is not. You could then filter those keywords to find the best short, middle, and long-term opportunities.

Now you’ve found a strategic insight, what do you do next?

A strategic approach to dealing with competitors:

You’ve discovered the strengths and weaknesses of the industry leaders. It’s now time to create a strategic plan.

To help you do that, here are some strategies you can use in dealing with competitors. You might need a mix of strategies, and what you choose should be based on your analysis.

I’ll break down these strategies based on direct and indirect competition.

Direct competition

In general, when dealing with direct competitors, your biggest challenge is finding a way to stand out in your market. Here are a few ways to do that:

- Product Differentiation : Focus on making your product or service stand out through unique features, quality, or niching down.

- Targeted Marketing: Tailor your marketing efforts to highlight what makes your offerings better than the competition’s.

- Competitive Pricing: Offer competitive prices or bundle services to provide added value.

- Customer Experience: Provide exceptional customer service and support to build loyalty.

Indirect competition

- Market Expansion: Identify new customer segments or markets that your indirect competitors haven’t yet reached.

- Diversification: Expand your product or service offerings to cater to additional needs of your existing customers.

- Collaboration: Consider partnerships or collaborations that complement your offerings with those of your indirect competitors.

- Educate Customers: Educate your target audience about the unique advantages of your product over alternatives.

- Innovation: Invest in research and development to create new solutions that outperform indirect competitors.

Looking at direct and indirect competition from 30,000 feet

If you’ve made it this far, you now understand what direct and indirect competitors are and how you find them. You should also now know how to find what strategies they are using to own their corner of the market.

This process is powerful and will help you create a winning strategy that will help your business stand out and win market share.

The key point to understand is there are two strategic approaches you can take when dealing with both indirect and direct competitors.

- Do it better

- Do something no one else is doing

Doing it better means literally rolling up your sleeves and trying to capture market share away from your competitors.

To do this, your goal is to show that your business is better than your competitors. This can be achieved with:

- Better branding

- Greater ad spend

There are many options.

The other option is to do something that no one else is doing. A great example of this is how marketwatch.com gets its traffic from news sites while all of its competitors are only focusing on organic traffic.

Both of these are valid strategic options. The question is which approach will bring you the most sustainable value over the long run.

What are examples of famous direct competitors?

Here are some direct competitors in various industries:

1. Ecommerce:

- Amazon vs. Alibaba

- Walmart vs. Target

2. Automobiles:

- Toyota vs. Honda

- Ford vs. General Motors

3. Airlines:

- Delta Air Lines vs. American Airlines

- Emirates vs. Qatar Airways

4. Streaming Services:

- Netflix vs. Hulu

- Amazon Prime Video vs. Disney+

What are examples of some famous companies and their indirect competitors?

1. Apple (iPhone):

- Direct Competitors: Samsung, Google Pixel

- Indirect Competitors: Canon (cameras), Nintendo (portable gaming devices)

2. Coca-Cola:

- Direct Competitors: PepsiCo, Dr. Pepper Snapple Group

- Indirect Competitors: Starbucks (beverages), bottled water brands

3. Amazon (ecommerce):

- Direct Competitors: Walmart, eBay

- Indirect Competitors: Netflix (streaming services), Shopify (e-commerce platform)

4. Nike (athletic footwear and apparel):

- Direct Competitors: Adidas, Puma

- Indirect Competitors: Lululemon (athleisure), Under Armour (sportswear)

by Darrell Mordecai

Darrell creates SEO content for Similarweb, drawing on his deep understanding of SEO and Google patents.

Related Posts

Competitive Benchmarking: Crack the Code to Your Competitors’ Success

Mastering Travel Competitor Analysis: A Step-by-Step Guide

What is Competitive Intelligence: Importance, Types & More

Find Competitors of Your Company Using Smart Strategies

Finding Your Competitors’ Target Audience for a Unique Edge

Understanding Competitive Intensity: How Tough Is Your Market?

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!