5 Tax Preparer Cover Letter Examples

Tax Preparers meticulously navigate complex tax codes, ensuring accuracy and maximizing client benefits. Similarly, your cover letter is a strategic navigation through your professional journey, highlighting your precision, expertise, and value to potential employers. In this guide, we'll delve into top-notch Tax Preparer cover letter examples, helping you craft a narrative that showcases your skills and leaves a lasting impression.

Cover Letter Examples

Cover letter guidelines, tax preparer cover letter example, tax analyst cover letter example, senior tax analyst cover letter example, tax intern cover letter example, tax manager cover letter example, how to format a tax preparer cover letter, cover letter header, what to focus on with your cover letter header:, cover letter header examples for tax preparer, cover letter greeting, get your cover letter greeting right:, cover letter greeting examples for tax preparer, cover letter introduction, what to focus on with your cover letter intro:, cover letter intro examples for tax preparer, cover letter body, what to focus on with your cover letter body:, cover letter body examples for tax preparer, cover letter closing, what to focus on with your cover letter closing:, cover letter closing paragraph examples for tax preparer, pair your cover letter with a foundational resume, cover letter writing tips for tax preparers, highlight relevant skills and experience, showcase your attention to detail, explain your problem-solving skills, express your commitment to ethical practices, personalize your cover letter, cover letter mistakes to avoid as a tax preparer, failing to highlight relevant skills, not tailoring the cover letter to the job, overlooking proofreading, being too long-winded, not showing enthusiasm, cover letter faqs for tax preparers.

The best way to start a Tax Preparer cover letter is by addressing the hiring manager directly, if their name is known. Then, introduce yourself and clearly state the position you're applying for. Immediately highlight your relevant qualifications or achievements that make you a strong candidate for the job. For instance, you could mention your experience in tax preparation, your attention to detail, or your ability to handle confidential information. This will grab the reader's attention and show them you are a serious and qualified candidate.

Tax Preparers should end a cover letter by summarizing their interest in the position and their qualifications. They should also express their eagerness to contribute to the company. A strong closing might be, "With my extensive experience in tax preparation and my commitment to accuracy and compliance, I am confident that I can contribute significantly to your team. I look forward to the possibility of discussing my qualifications further." It's also important to thank the reader for their time and consideration. Lastly, they should include a professional closing, such as "Sincerely" or "Best regards," followed by their name. This ending reiterates their interest, highlights their qualifications, and shows respect for the reader's time.

A Tax Preparer's cover letter should ideally be about one page long. This length is sufficient to concisely present your qualifications, experience, and interest in the position without overwhelming the reader with too much information. It's important to remember that hiring managers often have many applications to review, so keeping your cover letter concise and to the point will increase the chances of it being read in its entirety. As a Tax Preparer, your cover letter should focus on your attention to detail, understanding of tax laws, and experience with various tax preparation software.

Writing a cover letter with no experience as a Tax Preparer can seem challenging, but it's important to remember that everyone starts somewhere. Here are some steps to guide you: 1. Start with a Professional Greeting: Address the hiring manager by their name if it's available. If not, use a professional greeting like "Dear Hiring Manager." 2. Opening Paragraph: Start by introducing yourself and stating the position you're applying for. Mention where you found the job posting. This is also a good place to capture their attention with a brief statement about why you're interested in the role and the company. 3. Highlight Relevant Skills and Education: Even if you don't have direct experience, you can still showcase relevant skills and education. If you've taken any tax-related courses or have a degree in a related field like accounting or finance, be sure to mention it. Highlight any skills that are relevant to the job description, such as attention to detail, organization, and proficiency with numbers. 4. Discuss Transferable Skills: If you have experience in other jobs or areas, discuss how those skills can transfer to a Tax Preparer role. For example, if you've worked in customer service, you can talk about your communication skills and ability to handle sensitive information. 5. Show Enthusiasm for the Industry: Express your interest in the tax industry and your willingness to learn and grow in the role. This can help make up for a lack of experience. 6. Closing Paragraph: Reiterate your interest in the role and thank the hiring manager for considering your application. Mention that you're looking forward to the opportunity to further discuss your qualifications. 7. Professional Sign-off: Sign off the letter professionally with "Sincerely" or "Best regards," followed by your full name. Remember to keep your cover letter concise and to the point. Use a professional tone and language throughout. Proofread your letter thoroughly to avoid any spelling or grammatical errors. This will show the hiring manager that you are serious about the role and have taken the time to apply properly.

Related Cover Letters for Tax Preparers

Accountant cover letter.

Tax Accountant Cover Letter

Tax Consultant Cover Letter

Tax Associate Cover Letter

Financial Analyst Cover Letter

Bookkeeper Cover Letter

Tax Preparer Cover Letter

Tax Analyst Cover Letter

Senior tax analyst cover letter, tax intern cover letter, tax manager cover letter, related resumes for tax preparers, tax preparer resume example.

Try our AI-Powered Resume Builder

Tax Preparer Cover Letter Example + Tips

4.5/5 stars with 500 reviews

The two things that are supposed to be inescapable in life are death and taxes. To make money off the latter, consider becoming a tax preparer. The income is significant and steady, but you have to stay up to date with the constant changes in tax law.

1 Main Street New Cityland, CA 91010 Cell: (555) 322-7337 E-Mail: [email protected]

Dear Hiring Manager,

I’m writing in response to your ad seeking an Tax Preparer at Ford Bookkeeping. As a highly competent Tax Preparer, I would bring an organized, detail-oriented, and self-motivated attitude to this role. In my current position, I maintain an exceedingly functional office environment while working with individuals and small businesses to prepare Federal and State income tax returns. I have a knack for problem solving and work well independently and with little oversight. I respond to requests from colleagues and clients in a timely manner and am adept at prioritizing multiple ongoing projects. Additionally, I have excellent experience in:

Finding optimal deduction opportunities for every client. Networking to improve small business customer base. Increasing referrals through proficiently managing client satisfaction. Upselling bookkeeping services to business tax clients to maximize revenue generation.

I am a self-starter and excel at financial analysis, tax return preparation, and bank reconcilliations. I am also deeply familiar with QuickBooks and Microsoft Office Suite software and adapt quickly to new programs. As a part of the team at Ford Bookkeeping, I hope to provide clients with first-rate support and help your business grow with a strong referral base. My resume and references are attached. I would welcome the opportunity for an interview and look forward to hearing from you soon.

Sincerely, Emma Jones

Average Rating

Job description & responsibilities.

A tax preparer is someone who fills out the forms and files the tax returns for individuals and businesses. This can mean filing tax returns at the federal, state or local level. The tax preparer is responsible for filling out the forms in a transparent and honest way that reflects what is necessary and permissible under current tax law. Since basic math is inevitably a part of the tax filing process, any math related background you have should be featured prominently in your tax preparer cover letter. Tax preparers are also responsible for correcting any errors that are later discovered in the forms they file.

Qualifications

Unless you are an attorney or a certified public accountant, one normally does not encounter the details of tax law in everyday life. That means you must have specific training in the tax code, which is widely available from tax preparation firms, college and online courses or even the Internal Revenue Service itself. The challenge is not the basics of tax law, but in keeping up to date with the laws. The tax code is constantly changing, plus the numbers are often altered to account for inflation. Some states have laws requiring how often tax preparers must formally update their training.

Salary Range

According to the Bureau of Labor statistics, the average tax preparer who works full time makes an average of 36,000 dollars per year. However, there are opportunities for much higher paydays if you do taxes for businesses as opposed to individuals. Businesses will pay as much as $200 per hour to someone who can identify all the tax breaks and other money saving angles available to them. Tax preparers must be constantly updating their knowledge by keeping abreast of changes in the tax laws at the federal, state and local level. For those that do, it should be easy to find steady employment at good pay.

Related Skills

- Undercover Investigations

- Area Recovery

- Crash recoveries

- Financial and tax regulations

- Property tax challenges

- Newsletter writing

- Email blasts and newsletters

- Recovery and rehabilitation

- Tax preparation expertise

- Maximizing coverage

More Resume Examples for the Next Step in Your Finance Manager Career

- Branch Manager Trainee Resume

- Chamber Of Commerce Director Resume

- Financial Controller Resume

- Credit Manager Resume

- Equity Research Analyst Resume

- Financial Executive Resume

- Financial Analyst Resume

- KYC Analyst Resume

- Personal Banker Resume

- Project Analyst Resume

- Strategic Planning Analyst Resume

- Tax Consultant Resume

- Tax Preparer Resume

- Venture Capital Analyst Resume

More Cover letter Examples for the Next Step in Your Finance Manager Career

- Financial Advisor Cover Letter

- Financial Analyst Cover Letter

- Personal Banker Cover Letter

More Cv Examples for the Next Step in Your Finance Manager Career

- Financial Advisor CV

- Bank Branch Manager CV

- Board Director CV

- Consultant CV

- Credit Manager CV

- Credit Risk Analyst CV

- Equity Research Analyst CV

- Estimation Engineer CV

- Forex Trader CV

- Fund Manager CV

- Investment Banker CV

- Project Assistant CV

- Tax Consultant CV

- Tax Manager CV

- Treasury Accountant CV

- Treasury Manager CV

Advertisement

You control your data

We and our partners use cookies to provide you with our services and, depending on your settings, gather analytics and marketing data. Find more information on our Cookie Policy . Tap "Settings” to set preferences. To accept all cookies, click “Accept”.

Cookie settings

Click on the types of cookies below to learn more about them and customize your experience on our Site. You may freely give, refuse or withdraw your consent. Keep in mind that disabling cookies may affect your experience on the Site. For more information, please visit our Cookies Policy and Privacy Policy .

Choose type of cookies to accept

These cookies allow us to analyze our performance to offer you a better experience of creating resumes and cover letters. Analytics related cookies used on our Site are not used by Us for the purpose of identifying who you are or to send you targeted advertising. For example, we may use cookies/tracking technologies for analytics related purposes to determine the number of visitors to our Site, identify how visitors move around the Site and, in particular, which pages they visit. This allows us to improve our Site and our services.

These cookies give you access to a customized experience of our products. Personalization cookies are also used to deliver content, including ads, relevant to your interests on our Site and third-party sites based on how you interact with our advertisements or content as well as track the content you access (including video viewing). We may also collect password information from you when you log in, as well as computer and/or connection information. During some visits, we may use software tools to measure and collect session information, including page response times, download errors, time spent on certain pages and page interaction information.

These cookies are placed by third-party companies to deliver targeted content based on relevant topics that are of interest to you. And allow you to better interact with social media platforms such as Facebook.

These cookies are essential for the Site's performance and for you to be able to use its features. For example, essential cookies include: cookies dropped to provide the service, maintain your account, provide builder access, payment pages, create IDs for your documents and store your consents.

To see a detailed list of cookies, click here .

This site uses cookies to ensure you get the best experience on our website. To learn more visit our Privacy Policy

- Resume Examples

- Tax Preparer Resume Sample & Writing Guide [20+ Tips]

Tax Preparer Resume Sample & Writing Guide [20+ Tips]

Our customers have been hired by:

You’re one of the few mortals who aren’t scared of taxes. In fact, you’re actually passionate about helping people and companies submit their tax reports. But being passionate isn’t always enough. To get a tax preparer job, you must sit down and do another universally dreaded thing: write a resume.

Don’t despair, though. We’ve put together a guide to help you write your tax preparer resume quickly and painlessly.

This guide will show you:

- A tax preparer resume example better than 9 out of 10 other resumes.

- How to write a tax preparer resume that will land you more interviews.

- Tips and examples of how to put skills and achievements on a tax preparer resume.

- How to describe your experience on a resume for a tax preparer to get any job you want.

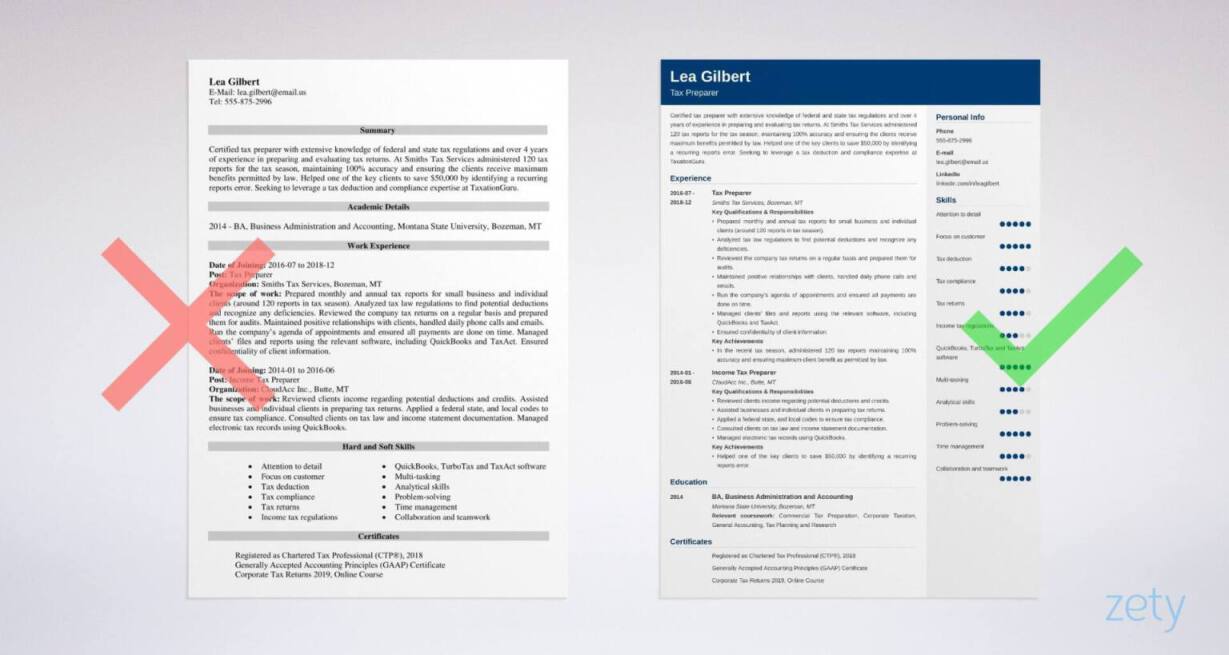

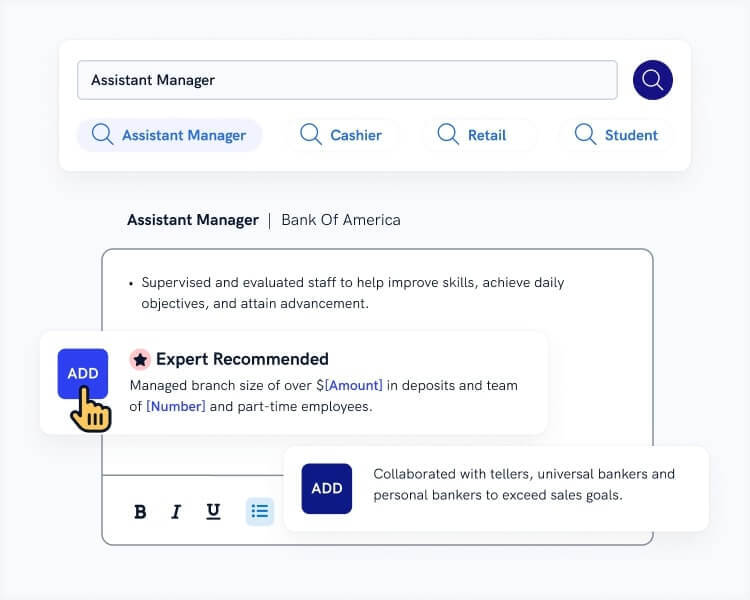

Want to save time and have your resume ready in 5 minutes? Try our resume builder. It’s fast and easy to use. Plus, you’ll get ready-made content to add with one click. See 20+ resume templates and create your resume here .

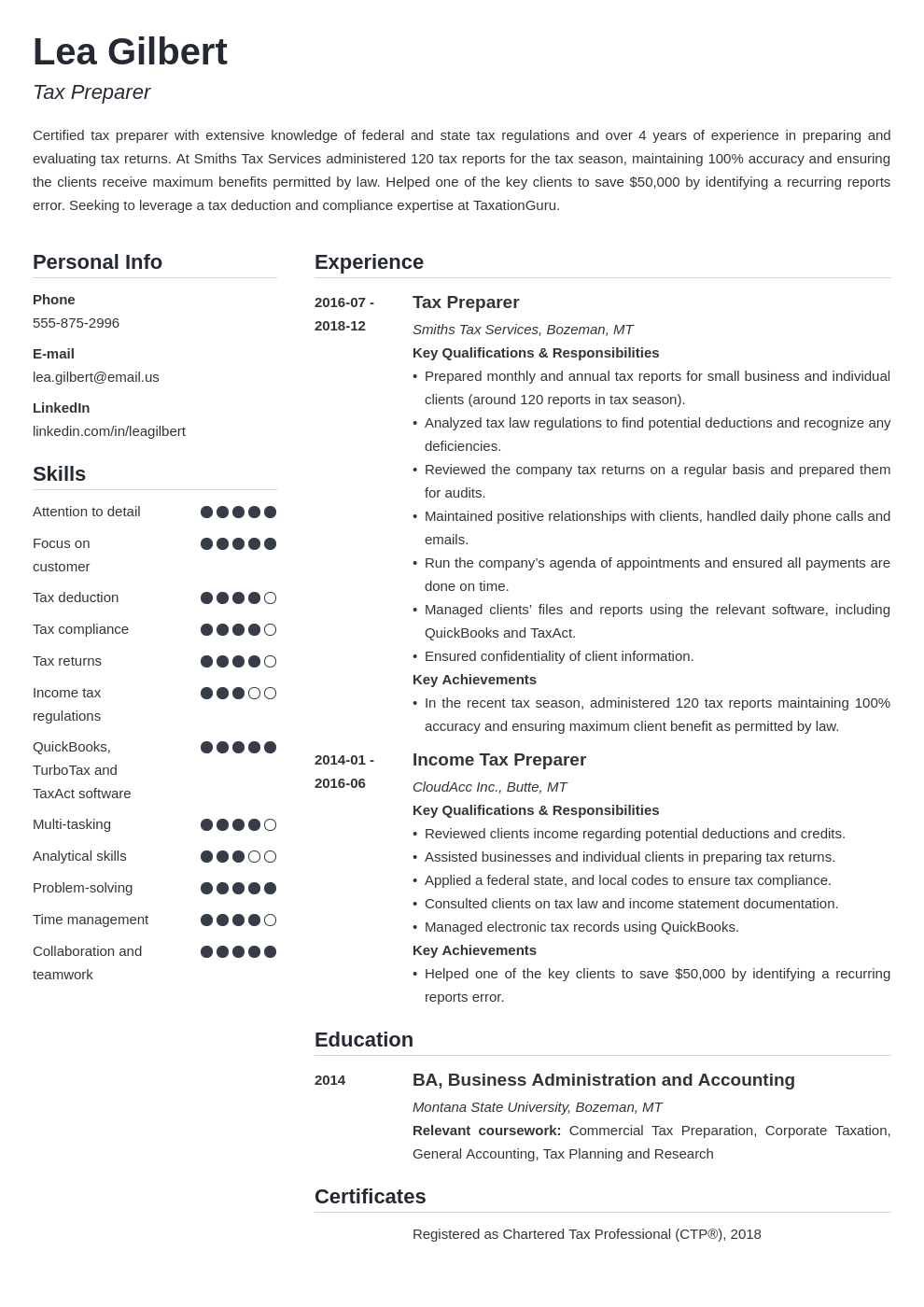

Sample resume made with our builder— See more resume samples here .

Tax Preparer Resume Sample

Lea Gilbert

Tax Preparer

555-875-2996

linkedin.com/in/leagilbert

Summary of Qualifications

Certified tax preparer with extensive knowledge of federal and state tax regulations and over 4 years of experience in preparing and evaluating tax returns. At Smiths Tax Services administered 120 tax reports for the tax season, maintaining 100% accuracy and ensuring the clients receive maximum benefits permitted by law. Helped one of the key clients to save $50,000 by identifying a recurring reports error. Seeking to leverage a tax deduction and compliance expertise at TaxationGuru.

Work Experience

Smiths Tax Services, Bozeman, MT

July 2016–December 2018

Key Qualifications & Responsibilities

- Prepared monthly and annual tax reports for small business and individual clients (around 120 reports in tax season).

- Analyzed tax law regulations to find potential deductions and recognize any deficiencies.

- Reviewed the company tax returns on a regular basis and prepared them for audits.

- Maintained positive relationships with clients, handled daily phone calls and emails.

- Run the company’s agenda of appointments and ensured all payments are done on time.

- Managed clients’ files and reports using the relevant software, including QuickBooks and TaxAct.

- Ensured confidentiality of client information.

Key Achievements

- In the recent tax season, administered 120 tax reports maintaining 100% accuracy and ensuring maximum client benefit as permitted by law.

Income Tax Preparer

CloudAcc Inc., Butte, MT

Jan 2014–June 2016

- Reviewed clients income regarding potential deductions and credits.

- Assisted businesses and individual clients in preparing tax returns.

- Applied a federal state, and local codes to ensure tax compliance.

- Consulted clients on tax law and income statement documentation.

- Managed electronic tax records using QuickBooks.

- Helped one of the key clients to save $50,000 by identifying a recurring reports error.

BA, Business Administration and Accounting

Montana State University, Bozeman, MT

Completed : 2014

Relevant coursework : Commercial Tax Preparation, Corporate Taxation, General Accounting, Tax Planning and Research

- Attention to detail

- Focus on customer

- Tax deduction

- Tax compliance

- Tax returns

- Income tax regulations

- QuickBooks, TurboTax and TaxAct software

- Multi-tasking

- Analytical skills

- Problem-solving

- Time management

- Collaboration and teamwork

Certifications

- Registered as Chartered Tax Professional (CTP®), 2018

- Generally Accepted Accounting Principles (GAAP) Certificate

- Corporate Tax Returns 2019, Online Course

Looking for more inspiration on how to write finance resumes? Look at our dedicated guides:

- Accounts Receivable Resume

- Accounts Payable Resume

- Accounting Resume

- Accounting Clerk Resume

- Accounting Intern Resume

- Collector Resume

- Tax Accountant Resume

- Tax Intern Resume

- Loan Processor Resume

- Professional Resume Samples

Here’s how to write a professional tax preparer resume that will help you get this job!

1. Choose the Best Format for Your Tax Preparer Resume

What does your tax season T-shirt say?

Act. Count. Think.

Following simple rules helps with complex matters—

This is also true about writing a resume.

If you want to make your tax preparer resume clear as black and white use these simple resume formatting rules:

- Start with a professional header that includes your resume contact information .

- Create clear resume sections that are easy to follow.

- Use a chronological resume layout which puts your recent achievements up front.

- Pick good resume fonts . Classics always work best.

- Don’t overload your resume with too much information. Leave enough white space instead.

- If you’re not sure which one is better— PDF or Word resume , go for the PDF. Unless the employer asks for a different file format.

2. Write a Tax Preparer Resume Objective or Summary

Hiring managers are busy just as you are when taxes are due.

That’s why your resume usually gets only about a 6-second look-see.

No chance to get an extension.

Act quickly and grab the recruiter’s attention right off the bat with a great professional profile .

It can be either a resume summary or resume objective:

Use a career summary if you have plenty of tax accounting experience. It’s your space to declare all the career wins and gains.

If you’ve just got your PTIN but have done little about it, use a career objective . It presents your skills and shows your motivation to do things right.

Pro Tip : Numbers don’t lie and you know it best. Add some $ or % to your tax preparer resume to show your achievements are quantifiable.

3. Create the Perfect Tax Preparer Job Description for a Resume

Your resume work experience section is the core of the spreadsheet.

Gather all records as it pays off!

But don’t just list every single thing you’ve done for a company or a client. List only the relevant duties and stay professional.

Here’s a checklist for a tax preparer job description:

- Tailor your resume to a job offer.

- Start with your latest or current job.

- List your job titles , company names, locations, and dates of work.

- Create a list of 6-7 experience bullet points for each position.

- Avoid “responsible for”. Instead, use a resume action verbs , such as prepared, resolved, monitored, utilized, ensured, etc.

Pro Tip: Looking for an entry-level tax prep position but don’t know how to get your feet wet? Find a freelance job online or do some volunteering first. These are both great for your tax preparer resume description.

4. Make Your Tax Preparer Resume Education Section Great

People trust you with the details of their financial life.

It's time to make the hiring manager trust you, too.

Even if some tax prep duties can be learned on the job, your resume education section is of great value to the hiring company.

Besides your IRS registration, add your educational history to your tax preparer resume. Here’s how:

- Candidates with rich professional experience can only list their degree, school name and location, and graduation year.

- Those who are less experienced should consider listing their GPA (if higher than 3.5), academic accomplishments and relevant coursework.

Pro Tip: Looking for opportunities to grow in the taxation sector or want to renew your tax professional credentials? Follow the activity of the organizations, such as The Accreditation Council for Accountancy and Taxation® and The National Association of Tax Professionals .

5. Highlight Your Tax Preparer Skills

A deduction ace is your office nickname and you’ve always had an eye for detail.

Time to itemize your skills.

Look at the list below and pick out the key tax preparer skills:

Tax Preparer Skills on a Resume

- Attention to Detail

- Knowledge of Current Tax Law

- Focus on Customer

- Computer Skills

- Familiarity with GAAP

- Tax Deduction

- Payroll Taxes

- Account Analysis

- Tax Compliance

- Tax Returns

- Income Tax Regulations

- Foreign Tax Regulations

- Strong Work Ethic

- Mathematical Skills

- Tax Software (ProSeries, TurboTax, TaxAct)

- Multi-Tasking

- Analytical Skills

- Critical Thinking

- Decision Making

- Problem-Solving

- Time Management

- Collaboration skills

Pro Tip: What’s the best way to select relevant skills for your resume? Create a master list of all your job skills ( soft skills, hard skills , and technical skills ). Then reread the job offer and pick only these skills that are sought-after.

When making a resume in our builder, drag & drop bullet points, skills, and auto-fill the boring stuff. Spell check? Check . Start building a professional resume template here for free .

When you’re done, our easy resume builder will score your resume and our resume checker will tell you exactly how to make it better.

6. Add Other Sections to Your Tax Preparer Resume

All the above sections—these are more than necessary.

But is there any other chance to impress the hiring manager?

Consider adding the following sections to your tax preparer resume:

- Language skills

- Achievements and awards

- Professional certification

- Volunteer experience

- Hobbies and interests

- Professional associations

Pro Tip: Tax preparers who got state licensure may call themselves CPAs. Be careful when listing your CPA credentials on a resume or a LinkedIn profile and check if your licence is still valid. The license status requirements may vary from state to state.

7. Attach a Tax Preparer Resume Cover Letter

Do you need a cover letter for your tax preparer resume?

You do. More than 50% of hiring managers still expect to get one.

Follow the tips below to write your tax preparer cover letter and win that interview:

- Format a cover letter correctly. Use clear headings and paragraphs.

- Set the right tone with a catchy cover letter opening sentence .

- Say what you can offer to the employer.

- Make a call to action when ending a cover letter .

Pro Tip : Should you follow up on your job application ? Positive. A follow-up email will boost your chances of getting this dream tax prep job.

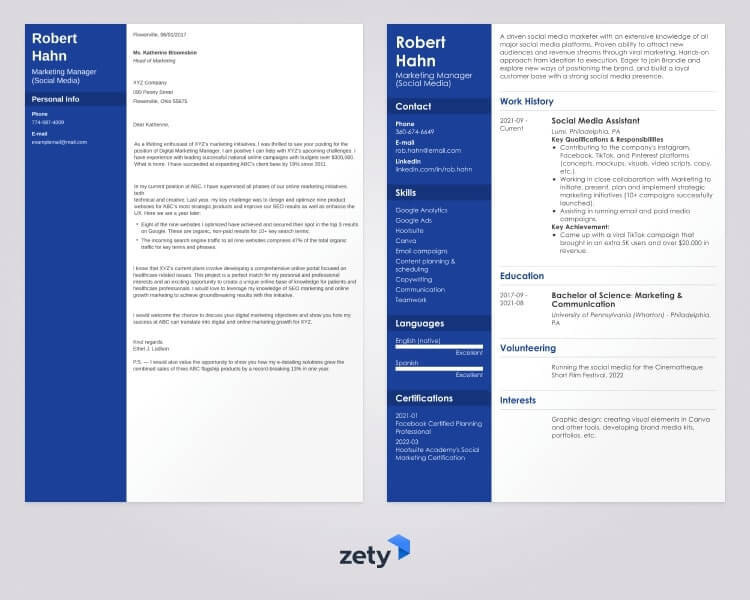

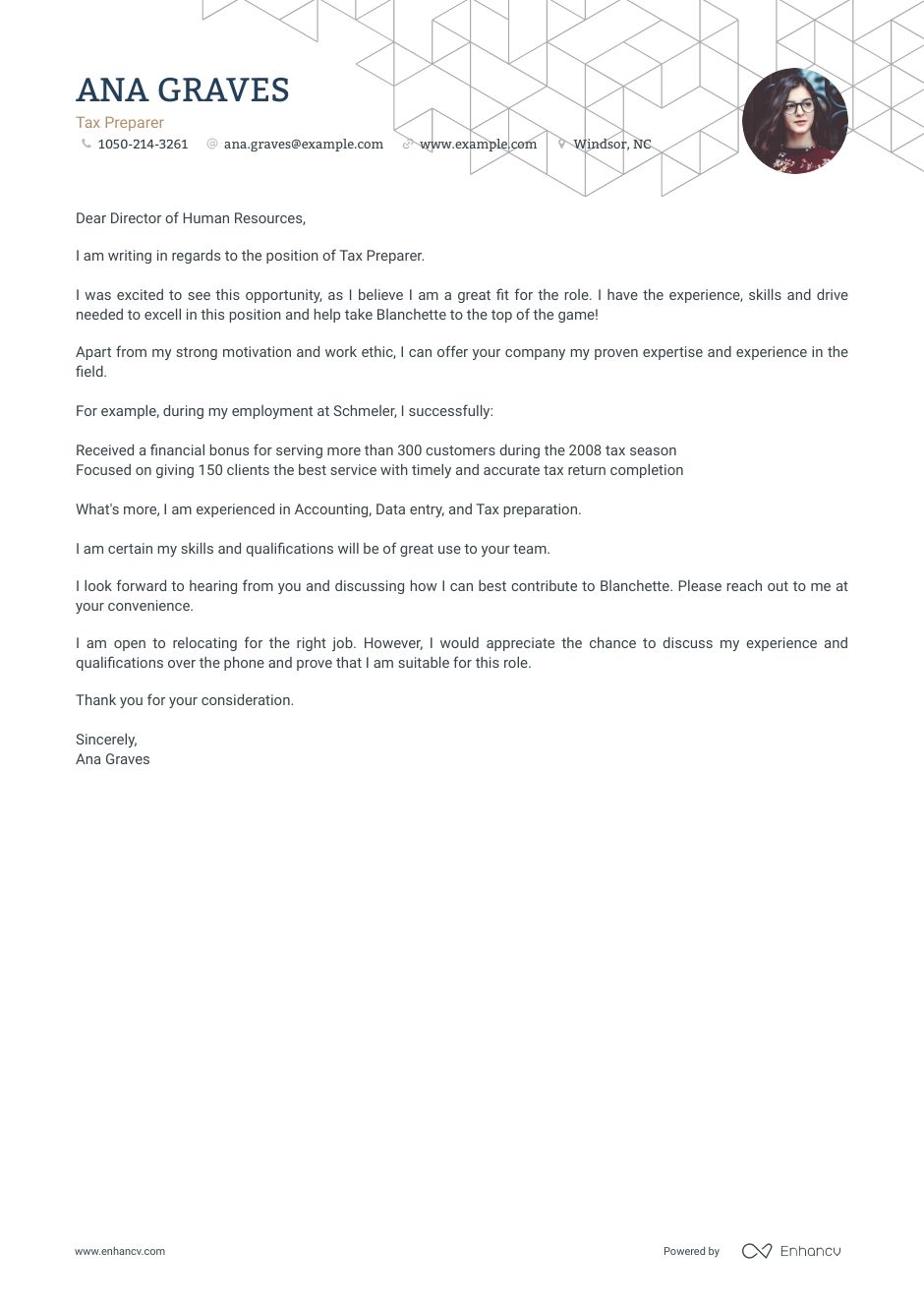

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here. Here's what it may look like:

See more cover letter templates and start writing.

That’s it!

You just saw a job-winning tax preparer resume sample and you’re ready to write your own one.

Are you writing an income tax preparer resume or you deal with international taxes? What do you think about our tax preparer resume example? Let us know in the comments.

We've got some more resume guides you might find interesting:

- Insurance Sales Agent Resume

- Bank Teller Resume

- Bookkeeper Resume

- Budget Analyst Resume

- Business Resume

- Business Analyst Resume

- Consultant Resume

- Financial Analyst Resume

- Data Analyst Resume

- Data Entry Resume

- Payroll Resume

- Personal Banker Resume

- Staff Accountant Resume

- Private Equity Resume

About Zety’s Editorial Process

This article has been reviewed by our editorial team to make sure it follows Zety's editorial guidelines . We’re committed to sharing our expertise and giving you trustworthy career advice tailored to your needs. High-quality content is what brings over 40 million readers to our site every year. But we don't stop there. Our team conducts original research to understand the job market better, and we pride ourselves on being quoted by top universities and prime media outlets from around the world.

- https://www.irs.gov/tax-professionals/ptin-requirements-for-tax-return-preparers

- https://www2.deloitte.com/us/en/pages/about-deloitte/articles/citizenship-deloitte-volunteer-impact-research.html

- https://www.acatcredentials.org/home

Don't miss out on exclusive stories that will supercharge your career!

Get a weekly dose of inspiration delivered to your inbox

Similar articles

Letter of Interest Sample + How to Write It in 2024

Your dream workplace never advertises job openings? Send them a letter of interest that will help them notice you and make you a VIP candidate for the next open position.

What Should I Major In? How to Choose a Major in 9 Steps

What should I major in? This question causes anxiety in the heart of every student, but with the help of this complete tutorial, you'll soon learn how to choose a major you’ll love Tips and advice from experts will get you on your way to choosing a major for university and college courses right away.

![cover letter for tax preparer When and How to List References on a Resume [+Examples]](https://cdn-images.zety.com/pages/resume_references_4.jpg?fit=crop&h=250&dpr=2)

When and How to List References on a Resume [+Examples]

Wondering how to add references to a resume? And should a resume include references at all? Read on, and you’ll find all there is to know about references on a resume.

How do you help a hiring manager visualize your contributions as a tax preparer? How do you demonstrate that of all the candidates, you are the most qualified and enthusiastic? The one opportunity you are allotted to answer these questions is in the writing and submission of your cover letter. By catering your material specifically to the job and industry to which you are applying, you can highlight your understanding of the responsibilities you will be undertaking. Use this professional tax preparer cover letter sample to get you started and guide you through the process of articulating your content.

Professional Tax Preparer Cover Letter Sample

Tax preparer cover letter must-haves.

When writing your cover letter, keep in mind the importance of incorporating language you find in the job description. For example, if the employer is requesting someone who is organized and detail-oriented, talk about how you embody those skills and utilize them to achieve results. This kind of approach to formatting will demonstrate that you paid attention to the description, are understanding of the job you will be performing, and possess the desired skills. The professional tax preparer cover letter sample above demonstrates how to do this and is also a good example of the length your material should be. By keeping your correspondence focused and industry-specific, you can keep your reader engaged and create a lasting impression.

Best Action Verbs for a Tax Preparer Cover Letter

As you can see in this professional tax preparer cover letter sample, you can make your content more effective by including action verbs like consolidated, informed, executed, managed, oversaw, prioritized, calculated, and computed.

Cover Letter Text

Dear Mrs. Traci Gillings,

I was pleased to be informed of an opening for a tax preparer at Gunner Filings. My educational background in financial planning combined with my experience in tax preparation have enabled me to gain each of the skills you outlined in your job posting. In the description you provided, you requested a candidate with considerable experience working in finances. I have spent fifteen years working as either an accountant or tax preparer and am well-versed in the practices involved in dealing with sensitive financials. You also asked for someone who is organized and confidential. My organizational skills surpass those of most people, and I ensure that each client is kept informed throughout the filing process. I hold myself to the highest standard when dealing with personal financials and only discuss classified information with approved parties. I can guarantee that I will follow all outlined protocols to ensure the reputation of Gunner Filings is upheld and highlighted. Because I am punctual and reliable, you can always count on me to show up on time and stay until all of my responsibilities are completed. I am excited to talk with you further about how my skills and abilities can contribute to the objectives of your organization. Thank you for your time.

Advertisement

Professional Tax Preparer Cover Letter Example for 2024

Read for inspiration or use it as a base to improve your own Tax Preparer cover letter. Just replace personal information, company application data and achievements with your own.

Professional Tax Preparer Cover Letter Tips to Help You Stand Out

You probably know that cover letters complement resumes and that recruiters just love asking for them. But why are cover letters important?

Well, because they are your chance of telling a story.

And let’s face it – listing different skills and achievements on your resume is essential. But connecting the dots in your cover letter and explaining what’s helped you gain expertise will make you stand out.

Read our proven Tax Preparer cover letter tips and examples below.

Let’s begin by discussing the difference between a cover letter and a resume. The resume is the place where you should list all your hard skills, achievements, and talents.

The cover letter, on the other hand, is your chance to share more about yourself and show who you are.

But what’s the way to grab the reader’s attention? How can you make the hiring manager want to meet you and learn more about you?

Stand out with a strong introduction and an appropriate salutation

Addressing your cover letter to a specific person works in your favor for two reasons: it shows your attention to detail, and it proves that you’ve taken the time to research who the person might be.

However, sometimes this might be much more difficult than expected. On such occasions, we advise you to focus on salutations that go beyond the impersonal “To Whom It May Concern”.

Here’s a brief list of suitable phrases:

- Dear Mr. James,

- Dear Human Resources Manager,

- To the [team you're applying for] Department,

- Dear [company name] Recruiter

We’ve all heard it – introductions are a big deal.

A good cover letter introduction can help you land an interview, while a bad introduction can ruin all your chances of getting your dream job as Tax Preparer.

So what are the things that can make your cover letter stand out? Honesty, excitement, and motivation.

Show your motivation and excitement to join the company in an honest way. And if you think that’d suit the company – share your vision with the recruiter. Tell them how you think being part of the team can help both parties grow.

Emphasize your tax preparer soft skills and mention your hard skills

So what skills do you need to include? Well, unfortunately, there’s no one answer to this. It all depends on the job description and the skills you’ve currently got.

According to experts, what recruiters look for in cover letters is how you can link your soft skills to particular achievements and goals. So, try to figure out what has helped you on the way to success.

However, don’t forget about hard skills. Even if they’re not the focus of your happy story, you need to include at least the ones that were mentioned as part of the requirements section of the job posting. This will help you pass applicant tracking systems (ATS) that screen applicant documents for certain keywords and phrases.

Show how passionate you are to join the company

Proving that you are familiar with the company, its problems, and its goals is without a doubt one of the best ways to stand out.

If you want to show your passion for the company, mention how your skills and previous achievements can help the team grow.

It’s also worth mentioning how your experience can help resolve some of the most common industry issues.

Go for a strong ending

Using the right words to end your Tax Preparer cover letter is essential for two reasons.

First, it supports the great first impression you’ve already made. Second, it’s a way to express your gratitude for the recruiter’s time and consideration.

The closing line you choose depends on your preferences and the company culture. If you want to be on the safe side, stick to more traditional phrases, such as “Looking forward to hearing from you” and “Thank you for your consideration”.

Cover letter examples by industry

- Accounts Receivable

- Financial Advisor

- Loan Processor

- Loan Officer

- Personal Banker

- Financial Analyst

- Investment Banking Analyst

- Senior Financial Analyst

- Director Of Finance

- Financial Consultant

- Budget Analyst

- Accounting Analyst

- Accounting Assistant

- Pricing Analyst

- Accounts Clerk

- Vp Of Finance

- Director Of Accounting

- Fund Accountant

- Finance Director

- Leasing Consultant

Cover letters helped people get noticed

Updated for today’s recruitment standards

Worried your cover letter design is past the expiration date? We’ll help you craft a new one that leaves an impression and beats luck.

Daniel Pietersen

Senior customer support engineer.

" Enhancv gave me a sense of relief and a feeling of confidence when passing it along to a potential employer. "

Daniel Pietersen on using Enhancv

Check out more winning cover letter examples for inspiration

Learn from people who have succeeded in their job hunt.

- Preschool Teacher Cover Letter

- Ppc Specialist Cover Letter

- Digital Director Cover Letter

- Ui Developer Cover Letter

- Lab Technician Cover Letter

- Marketing Coordinator Cover Letter

- Business Development Cover Letter

- Process Engineer Cover Letter

- Change Management Cover Letter

- Cto Cover Letter

- Clinical Research Coordinator Cover Letter

- Full Stack Developer Cover Letter

Land a job interview by pairing your Tax Preparer cover letter with a great resume

Matching your cover letter with an equally good resume will without a doubt put you in front of other applicants.

Check out our Tax Preparer resume writing tips or talk to an expert for some valuable tips and guidance.

Resume Without Work Experience: 6+ Sections to Demonstrate Impact

Do employers look at a resume or cover letter first, should i use a resume template and why, how to write a great resume for a job in 2024, should i hand in my resume in person, driver's licence on resume.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Examples

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

Tax Preparer Cover Letter

15 tax preparer cover letter templates.

How to Write the Tax Preparer Cover Letter

I am excited to be applying for the position of tax preparer. Please accept this letter and the attached resume as my interest in this position.

Previously, I was responsible for support in the Insurance Premium Tax compliance functions including estimates, quarterly and annual tax return filings.

Please consider my qualifications and experience:

- Exceptional Interpersonal Skills, Organized, Detail-Oriented

- Proficient in Computer Internet Usage

- A professional demeanor and dependable

- Successful completion of introductory income tax classes

- Full Service Tax Preparer

- Work daily in Ultra-Tax Software

- Review and answer key tax questions and provide courteous and professional feedback

- Work daily with a variety of complicated tax scenarios

Thank you for your time and consideration.

Phoenix Murphy

- Microsoft Word (.docx) .DOCX

- PDF Document (.pdf) .PDF

- Image File (.png) .PNG

Responsibilities for Tax Preparer Cover Letter

Tax preparer responsible for support to different areas involved in tax matters such as accounting, legal, FP&A, treasury, HR and commercial teams.Provide support to different areas involved in tax matters such as accounting, treasury, accounts payable, legal, HR teams.

Tax Preparer Examples

Example of tax preparer cover letter.

Previously, I was responsible for guidance to Tax Interns and Associates in the scanning and preparation of tax returns; make recommendations on return preparation regarding accuracy, efficiency and tax saving opportunities.

My experience is an excellent fit for the list of requirements in this job:

- Prior history of working in Ultra-Tax software preferred

- Role requires someone who is process oriented and highly organized

- UltraTax software experience strongly preferred

- Bilingual (English & Cantonese / Russian)

- Tax preparation requires extensive contact with the general public

- Able to restore backups and obtain reports necessary for income tax preparation

- Able to research internal revenue code in order to properly prepare income tax returns

- Knowledge of Personal Income Taxes Tax Law

Royal McDermott

In response to your job posting for tax preparer, I am including this letter and my resume for your review.

Previously, I was responsible for income tax accounting guidance and training to various stakeholders on the tax team.

- Work independently and as apart of a team

- Develop a well-organized system to account for financial transactions by establishing a chart of accounts

- Assisting with 1040 returns

- Prior tax preparation experience

- Proficient in MS systems

- Have been to tax school

- Active PTIN highly preferred

- Tax - Individual

Thank you for taking your time to review my application.

I submit this application to express my sincere interest in the tax preparer position.

Previously, I was responsible for monthly tax-effect accounting calculations for reporting (Tax Integrator), assist in the preparation of annual income tax returns and reconcile tax related accounts.

I reviewed the requirements of the job opening and I believe my candidacy is an excellent fit for this position. Some of the key requirements that I have extensive experience with include:

- Excellent computer skills especially in QuickBooks and Excel

- Enrolled Agent certification and/or C.P.A

- Experience with Thomson Reuters’ Tax Accounting software programs – UltraTax CS, Planner CS, and FixedAssets CS– is desirable

- Proficient in understanding tax planning and strategy

- Have an achievement-oriented attitude

- Become an integral part of the team and make an impact

- Detail oriented, efficient, and positive attitude

- Experience with UltraTax preferred

Haven Ruecker

In the previous role, I was responsible for designated outside expatriate service provider with tax information for preparation of personal income tax return in home and host country of assignees.

Please consider my experience and qualifications for this position:

- Successful completion of Tax Knowledge Assessment or equivalent

- QuickBooks knowledge is desirable

- Proficiency with Microsoft office suite (Excel, Word and OneNote)

- Individual Tax

- Intuit Lacerte

- Individual tax return preparation preferred

- Knowledge of basic accounting concepts involved in tax return preparation preferred

- UltraTax and Quickbooks experience preferred

Dallas Kemmer

Previously, I was responsible for information used in the tax return preparation, and reconciling such information to the corresponding tax accounts on the general ledger system.

- ProSeries Tax 1040 software

- QuickBooks knowledge is desirable, proficiency with Microsoft office suite (Excel, Word and OneNote)

- Willingness to work Saturdays and evenings

- Knowledge of Itemization, self-employment income and expenses allowed by the IRS

- Ultra Tax knowledge

- Skilled in QuickBooks

- Previous accounting or tax prep experience

- Previous tax preparation experience preferred

Thank you in advance for taking the time to read my cover letter and to review my resume.

Story Hodkiewicz

Related Cover Letters

Create a Resume in Minutes with Professional Resume Templates

Create a Cover Letter and Resume in Minutes with Professional Templates

Create a resume and cover letter in minutes cover letter copied to your clipboard.

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Tax Services Cover Letter Samples & Examples That Worked in 2024

If you're looking to land a role as a tax service professional, having a top-notch tax services cover letter is crucial. Your cover letter is where you show your commitment to the job and professional expertise. Our handy tips, real-life examples, and easy-to-use templates are here to help you build a cover letter that really sells your strengths.

Keep reading to learn all about:

- Creating a tax services cover letter header & headline

- Crafting a personalized greeting on your tax services cover letter

- Writing a memorable tax services cover letter introduction

- Showcasing your value & accomplishments as a tax services professional

- Ending your tax services cover letter with a strong closing statement

- Accessing the best job search resources for tax services professionals

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

1. Create a well-formatted tax services cover letter header & headline

The first step to writing an effective cover letter is to create a well-formatted header and headline.

A cover letter header includes all the necessary identifying information about the applicant and company, while a cover letter headline serves as a title that hooks the attention of the employer.

Below, we have provided more in-depth explanations and examples of each of these cover letter elements:

Formatting the header

Within your cover letter header, you should aim to have between 3 to 4 lines of text that include:

- The name of the company and department you are applying to

- Your name and professional title

- Your professional contact information (phone number, email address, etc.)

Here is an example of a well-formatted header on a tax services cover letter

To: TurboTax, Hiring Department From: John Smith , Tax Services Professional (123) 456-7890 | [email protected] | linkedin.com/in/john-smith

Writing the headline

To create a strong cover letter headline, you should always use a keyword related to the position, an eye-catching number or trigger word, a powerful adjective or verb, and a promise.

Here is an example of a well-written headline from a tax services cover letter

How My 3-Step Approach to Maximizing Tax Returns Can Benefit Both Your Company & Clients

Trigger Word/Number : 3-Step Approach Keyword: Tax Returns Adjective/Verb: Maximizing, Benefit Promise: Both Your Company & Clients – this promise shows employers that you will not only describe your professional skills but that you will also relate them directly to the needs of their company and clients.

Let your cover letter write itself — with AI!

2. craft a personalized greeting on your tax services cover letter.

Whenever possible, it is essential to include a personalized greeting within your cover letter.

Unlike generalized greetings – such as “To Whom It May Concern” – a personalized greeting will address a specific person or department by name. In doing so, this shows an employer you have conducted thorough research on their company and have great attention to detail.

If you are unable to uncover the exact person or department that will review your application, try out one of these alternatives:

To the [Company Name] Team

To the [Company Name] Hiring Manager

3. Write a memorable tax services cover letter introduction

Following your personalized greeting is the introduction of your cover letter, which should include:

- A brief overview of your professional history and goals

- A statement on why you are enthusiastic about applying to this company

- A mutual acquaintance (when possible)

Here is an example to help demonstrate how to write a tax services cover letter introduction

To the [Company Name] Hiring Manager,

I am a Tax Services professional with 4+ years of experience preparing taxes for high-level corporate clients. Your business partner, Jack Doe, has employed me as his personal Tax Advisor for the past 2 years and recommended I apply for this position.

Find out your resume score!

4. Showcase your value & accomplishments as a tax services professional

After your cover letter introduction is squared away, your next step is to write the body paragraphs of your letter. Ideally, your cover letter should contain between 2 to 4 body paragraphs that offer detailed answers to the following questions.

- What excites you about working at this company?

- What do you hope to learn from working at this company?

- What accomplishments or qualifications make you stand out as an applicant?

- What key skills do you possess that are relevant to the position?

While offering answers to each of these questions is important, focusing on accomplishments is particularly crucial. This is because your relevant accomplishments help to show employers the real-life value you can bring to their company.

Here is an example of how to describe an accomplishment in a tax services cover letter

As a Tax Services professional at [Former Employer], I optimized the company’s record filing system to reduce tax preparation time by 30% annually. Additionally, I identified 10 additional write-offs and deductions the company could claim, increasing their annual tax return by 15%.

5. End your tax services cover letter with a strong closing statement

To conclude your cover letter, you need a strong closing statement that offers actionable details, including:

- An enthusiastic sentence saying you are looking forward to hearing from them

- An additional sentence stating you will follow up, including how you will contact them or how they can contact you

- A formal sign-off

Here is an example of an effective closing statement from a tax services cover letter

As your new Tax Services professional, I will dedicate my time to optimizing your tax preparation activities and maximizing your returns. I am eager to further discuss this opportunity with you directly and am available to schedule a meeting every weekday from 10 a.m. to 4 p.m. The best way to reach me is at (123) 456-7890.

Warm Regards,

[Applicant Name]

6. Valuable job search resources for tax services professionals

Navigating the job market as a tax services professional might feel a bit daunting. But don't worry, we've gathered the best resources to take some of that weight off your shoulders:

- Professional job boards: Many job platforms such as Indeed , LinkedIn , and Glassdoor display posts for tax services roles. For industry-specific job sites, check out TaxTalent or AccountingJobsToday .

- Networking platforms: LinkedIn takes the crown here. Not only can you find job postings, but you can also connect with other tax professionals, join related groups, and stay updated on industry news.

- Professional organizations: Join groups like The National Association of Tax Professionals (NATP) or the Taxation section of the American Bar Association . They can provide you with professional development resources, networking opportunities, and job listings.

- Career services: If you're still studying or have recently graduated, your university's career service office can be a great asset. They often have job placement help, resume assistance, and other useful resources.

- Recruitment agencies: Several firms like Robert Half and Randstad specialize in roles for finance and tax professionals.

Remember, the more resources you utilize, the better your chances of finding the perfect role. Time to put those job-hunting skills into action!

Follow this cover letter outline for maximum success.

Tax Services Cover Letter FAQ

Your cover letter should include your personal contact information, the date, and the company's contact information. Start with a professional greeting, a compelling opening line, and an introduction. Then detail your relevant experience, important skills, and why you're interested in the role. Finally, include a strong closing statement and your signature.

Customise each cover letter by incorporating the job description's keywords and focusing on your skills that best suit the job requirements. Make sure to research the company and mention how your expertise can benefit their specific needs.

A cover letter should be concise and impactful, usually no more than a page long. Aim for three to four brief paragraphs.

A cover letter is an excellent opportunity to stand out and showcase your personal brand, illustrating your skills and experience in a way that your resume cannot. It allows you to explain why you're enthusiastic about the role and how you can contribute to the company.

While it might be tempting to save time, it's crucial to tailor each cover letter to the specific job application. Alignment with the job description and company values can demonstrate your attention to detail and interest in the role.

Nikoleta Kuhejda

A journalist by trade, a writer by fate. Nikoleta went from writing for media outlets to exploring the world of content creation with Kickresume and helping people get closer to the job of their dreams. Her insights and career guides have been published by The Female Lead , College Recruiter , and ISIC, among others. When she’s not writing or (enthusiastically) pestering people with questions, you can find her traveling or sipping on a cup of coffee.

All accounting / finance cover letter examples

- Finance Analyst

- Insurance Agent

- Investment Advisor

All tax services cover letter examples

Related tax services resume examples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Tax Professional Cover Letter Examples

A great tax professional cover letter can help you stand out from the competition when applying for a job. Be sure to tailor your letter to the specific requirements listed in the job description, and highlight your most relevant or exceptional qualifications. The following tax professional cover letter example can give you some ideas on how to write your own letter.

Cover Letter Example (Text)

Joleen Nering

(462) 119-9364

Dear Caitlin Nusser,

I am writing to express my interest in the Tax Professional position at H&R Block, as advertised. With a solid foundation in tax preparation and advisory services from my five years at PricewaterhouseCoopers LLP, I am excited about the opportunity to bring my expertise to your team and contribute to your company's success.

During my tenure at PwC, I honed my skills in a range of tax-related areas, including compliance, consulting, and planning for both individual and corporate clients. My ability to analyze complex tax regulations and translate them into understandable, actionable strategies has been key to assisting clients in navigating the ever-evolving tax landscape. I have also developed a strong proficiency in various tax software, which I believe will allow for a smooth transition to the systems utilized at H&R Block.

I am particularly drawn to H&R Block because of its reputation for providing exceptional client service and its commitment to staying at the forefront of the tax industry. I am eager to contribute to this environment with my proactive approach and my dedication to continuous learning and professional development. I am confident that my background, combined with my passion for tax work, will enable me to add value to your team and your clients.

Thank you for considering my application. I am looking forward to the opportunity to discuss how my experience and skills align with the needs of H&R Block. I am enthusiastic about the prospect of joining your esteemed company and am available at your convenience for an interview.

Warm regards,

Related Cover Letter Examples

- Professional Services Consultant

- Taxi Driver

- Tax Accountant

- Tax Advisor

- Tax Analyst

- Tax Assistant

Sample cover letter for Full Time position at H&R block

Tax preparor, got the job yes.

H&R Block

xxxxxxx, WA

I am writing to submit my candidacy for a current opening for tax professionals and office managers with H&R Block. I’m currently enrolled in a tax preparation course with the company and would like to continue to develop my tax preparation skills, while also using my degree in finance and accounting. I believe your opportunity creates the best option for this growth. As a competent tax preparer, I would bring an organized, detail-oriented and self-motivated attitude to this role.

In previous positions, I maintained an exceedingly functional office environment while working with individuals and small businesses to maintain their financial reports, filing their taxes, managing accounts and providing professional customer service. I have recognized for my problem solving skills and work well independently and with little oversight . I respond to requests from colleague and clients in a timely and accurate manner.

I have extensive experience networking with the community and potential clients to improve grow the customer base and increase referrals through proficiently managing client satisfaction. I am familiar with QuickBooks, Microsoft Word, Microsoft Excel and adapt quickly to new programs.

I have attached my resume for your review along with my application and look forward to hearing from you soon.

Tax Professional Cover Letter Examples (Template & 20+ Tips)

Create a standout tax professional cover letter with our online platform. browse professional templates for all levels and specialties. land your dream role today.

Are you a tax professional searching for a new job? Your cover letter is the first impression you can make on potential employers. Writing a great cover letter is essential to landing an interview. Our Tax Professional Cover Letter Guide will provide you with all the tips you need to create a successful cover letter.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder .

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Credit Specialist Cover Letter Sample

- Finance Consultant Cover Letter Sample

- Billing Supervisor Cover Letter Sample

- Junior Financial Analyst Cover Letter Sample

- Loan Closer Cover Letter Sample

- Trading Analyst Cover Letter Sample

- Financial Business Analyst Cover Letter Sample

- Actuary Cover Letter Sample

- Audit Director Cover Letter Sample

- Banking Analyst Cover Letter Sample

- Statistical Analyst Cover Letter Sample

- Account Administrator Cover Letter Sample

- Loan Officer Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Finance Associate Cover Letter Sample

- Accounting Specialist Cover Letter Sample

- Account Clerk Cover Letter Sample

- Finance Officer Cover Letter Sample

- Banking Consultant Cover Letter Sample

- Real Estate Salesperson Cover Letter Sample

Tax Professional Cover Letter Sample

Dear Hiring Manager,

I am writing to apply for the position of Tax Professional that your company recently posted. I am confident that my qualifications and experience make me an ideal candidate for this role.

I have a Bachelor of Science degree in Accounting and over ten years of experience in the field of taxation. During this time, I have gained a comprehensive understanding of tax laws and regulations, along with a wide range of experience in tax preparation, filing, and compliance. Additionally, I have worked extensively with clients to advise them on strategies to minimize their overall tax liabilities.

In my current position as Tax Professional at XYZ Consulting, I have been responsible for preparing complex returns for both individuals and businesses. I have a great deal of experience with multi-state and international tax filings, and I am proficient with all of the leading tax software programs. I have also managed teams of up to six tax professionals, ensuring that all deadlines were met and that all returns were accurate.

I am confident that I can bring this same level of dedication and expertise to your organization. I am organized and detail-oriented, and I am comfortable working independently or as part of a team. I am also an excellent communicator, which enables me to effectively explain complex tax concepts to clients in a clear and concise manner.

I am excited about the opportunity to join your team and am confident that I can help your company meet its tax-related goals. I have enclosed my resume and would welcome the opportunity to discuss my qualifications in further detail. Thank you for your time and consideration.

Sincerely, John Doe

Why Do you Need a Tax Professional Cover Letter?

- A Tax Professional cover letter is an important part of the job application process for any tax professional position.

- It gives potential employers an opportunity to learn more about you and your qualifications beyond what is included in your resume.

- A cover letter also provides you with an opportunity to explain why you are the best candidate for the job and how your skills and experience match the job requirements.

- A Tax Professional cover letter is a great way to demonstrate your knowledge and understanding of the tax code, as well as your ability to communicate complex information in a concise and organized manner.

- It also demonstrates your enthusiasm for the job and your commitment to helping the organization meet their tax-related goals.

- Finally, it gives potential employers the chance to get to know you better, which can be a deciding factor in whether or not you are offered the position.

A Few Important Rules To Keep In Mind

- Keep the letter short and to the point. Your cover letter should be no longer than one page.

- Start with a strong introduction. Introduce yourself and state why you are interested in the position.

- Outline your relevant experience. Highlight your background in taxation and detail any relevant experience you have in the industry.

- Highlight your unique qualifications. Demonstrate how your qualifications make you the ideal candidate for the job.

- Provide examples of your work. Demonstrate previous successes, such as filing taxes for clients or successfully resolving tax issues.

- Close your letter with a strong call to action. Request an interview and provide contact information.

- Proofread your letter for mistakes. Be sure to double-check all details for accuracy.

What's The Best Structure For Tax Professional Cover Letters?

After creating an impressive Tax Professional resume , the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Tax Professional cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Tax Professional Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

Dear [Hiring Manager],

I am writing to apply for the Tax Professional position at [Company Name]. With my degree in Accounting and my experience in tax preparation, I am confident that I am the perfect candidate for this role.

During the past [number] years in the tax preparation industry, I have acquired technical knowledge and skills in the areas of state and federal tax regulations. I have a comprehensive understanding of complex tax codes, and I am well-versed in using industry-specific software such as [software name]. In addition, I also have a strong ability to interpret and analyze financial data and other tax documents.

In my current role as a Tax Professional at [Company Name], I have been responsible for preparing, filing, and reviewing federal and state tax returns for a wide variety of clients. I have experience in providing tax advice to clients, and I am proficient in researching tax-related matters. I have also been responsible for ensuring accuracy and quality in all of the work I produce.

I am confident that I can bring the same level of expertise and commitment to your organization. I am excited to learn more about this position and how I can help your team reach its goals.

I look forward to hearing from you soon. Please do not hesitate to contact me if you have any questions.

Sincerely, [Your Name]

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Tax Professional Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Not customizing the cover letter to the job you are applying for.

- Using too much technical jargon.

- Failing to edit and proofread the cover letter.

- Not addressing the hiring manager or recruiter by name.

- Making typos or grammatical errors.

- Using a generic salutation such as "To Whom It May Concern."

- Including too much personal information.

- Not providing specific examples of your accomplishments.

- Not making a clear connection between your skills and the job requirements.

- Exaggerating or lying about your qualifications.

- Focusing too much on yourself instead of the hiring company.

- Not keeping the cover letter concise and to the point.

Key Takeaways For a Tax Professional Cover Letter

- Demonstrate a strong knowledge of taxation regulations and laws.

- Highlight any certifications or special training related to tax preparation.

- Showcase excellent communication and organizational skills.

- Mention any experience in client management.

- Display a commitment to continuing education and professional development.

- Detail any experience in tax planning and analysis.

- Display an ability to handle high-volume workloads.

- Include any specialized software experience.

- Highlight any experience in areas such as financial planning, estate planning, and accounting.

IMAGES

VIDEO

COMMENTS

Tax Preparers meticulously navigate complex tax codes, ensuring accuracy and maximizing client benefits. Similarly, your cover letter is a strategic navigation through your professional journey, highlighting your precision, expertise, and value to potential employers. In this guide, we'll delve into top-notch Tax Preparer cover letter examples, helping you craft a narrative that showcases your ...

2. Compose a greeting. The next step in setting up a cover letter is to add the greeting which includes the recipient's name and contact information. First, add the current date on a separate line. Below, write the recipient's full name, their company name and company address each on their own lines.

Free Tax Preparer cover letter example. When I learned of Lumina Financial's need for a Tax Preparer, I felt compelled to submit the enclosed resume. As an experienced and analytical tax accountant with an extensive background performing accounting and tax preparation functions while driving operational efficiency, I am well positioned to ...

1 Main Street. New Cityland, CA 91010. Cell: (555) 322-7337. E-Mail: [email protected]. Dear Hiring Manager, I'm writing in response to your ad seeking an Tax Preparer at Ford Bookkeeping. As a highly competent Tax Preparer, I would bring an organized, detail-oriented, and self-motivated attitude to this role.

Cover Letter Body. Dear [Tax Preparer Hiring Manager], I am writing to apply for the position of Tax Preparer at [company name]. I am confident that my experience and qualifications make me an ideal candidate for the job. I have a Bachelor's Degree in Accounting and have over five years of experience as a Tax Preparer.

More than 50% of hiring managers still expect to get one. Follow the tips below to write your tax preparer cover letter and win that interview: Format a cover letter correctly. Use clear headings and paragraphs. Set the right tone with a catchy cover letter opening sentence. Say what you can offer to the employer.