Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., standard business plan financials: projected profit and loss.

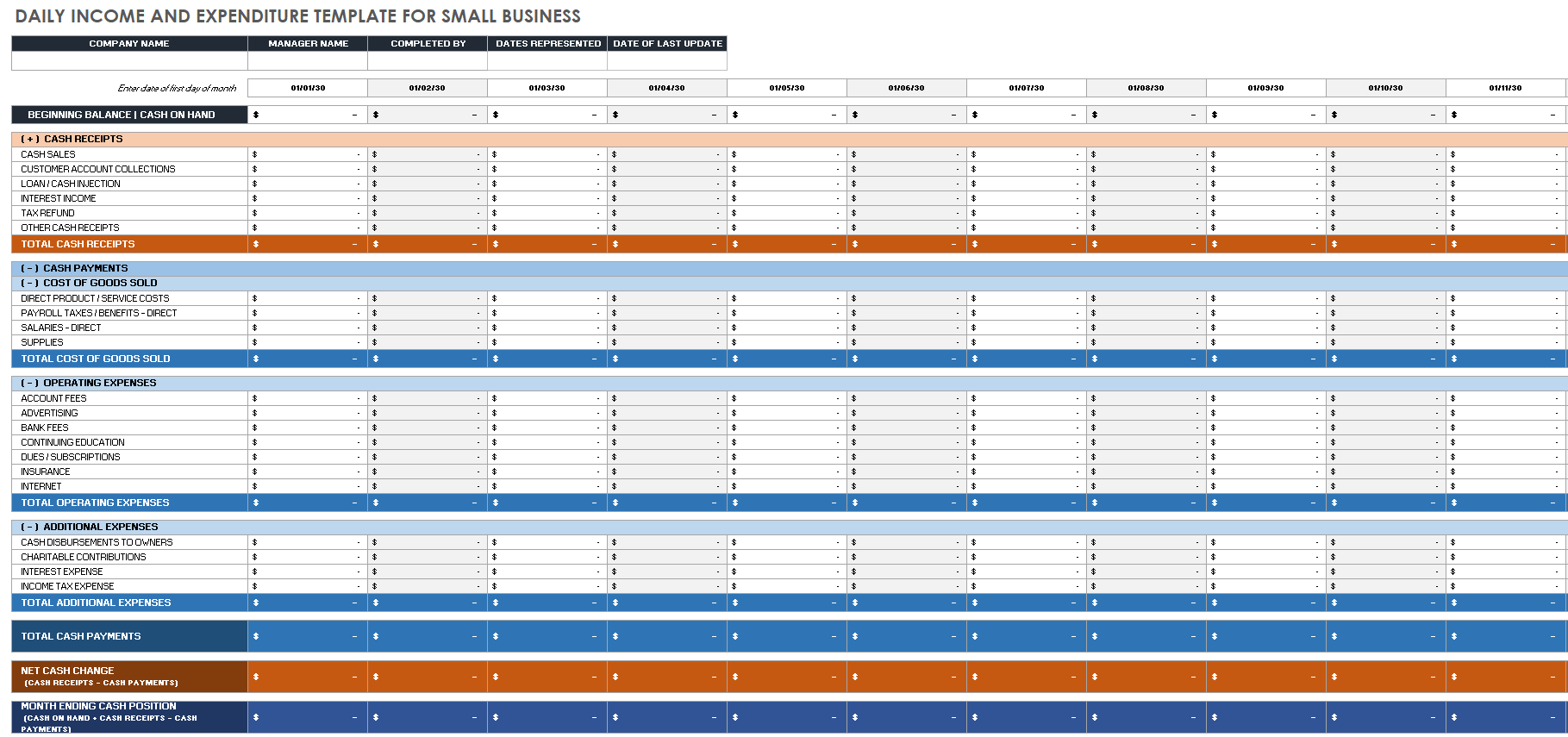

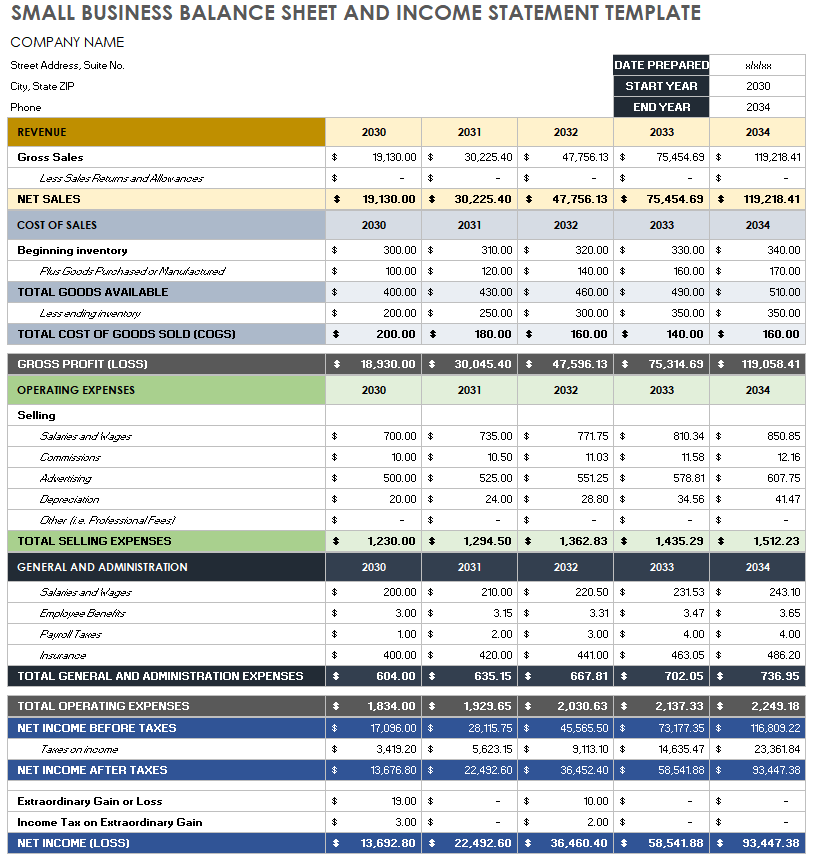

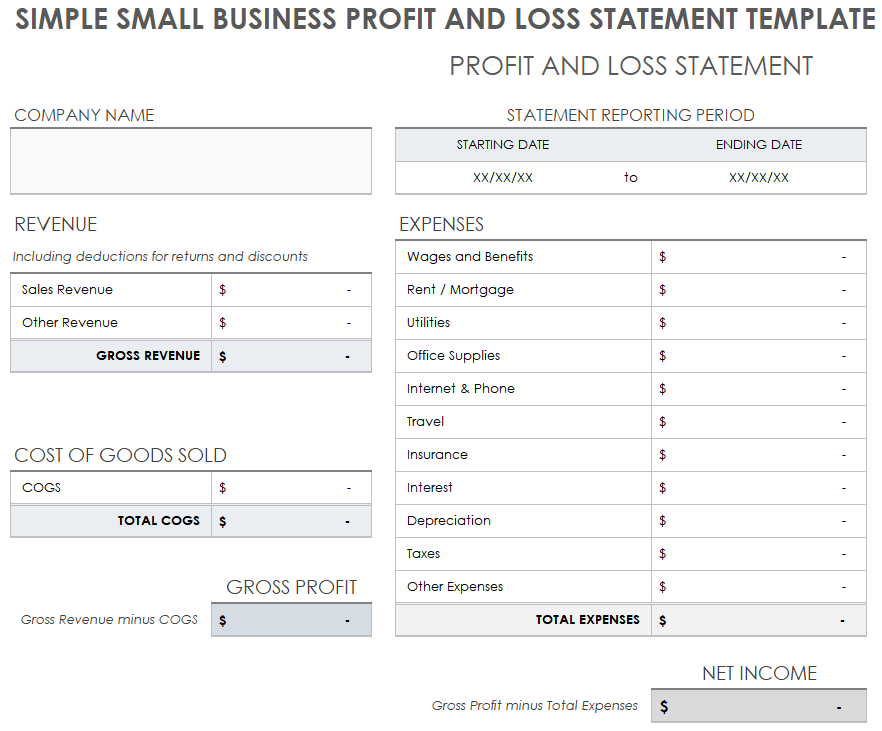

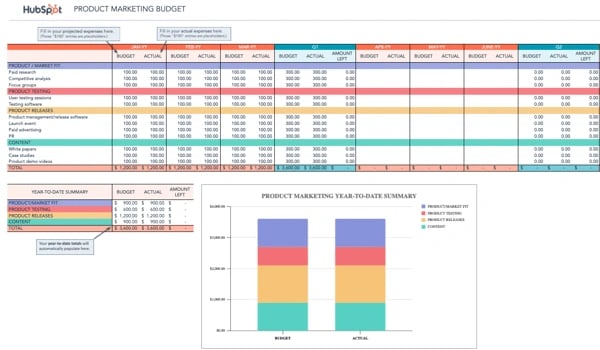

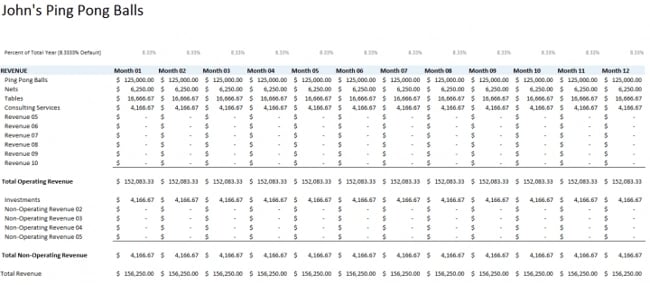

Continuing with my series here on standard business plan financials, all taken from my Lean Business Planning site, the Profit and Loss, also called Income Statement, is probably the most standard of all financial statements. And the projected profit and loss, or projected income (or pro-forma profit and loss or pro-forma income) is also the most standard of the financial projections in a business plan.

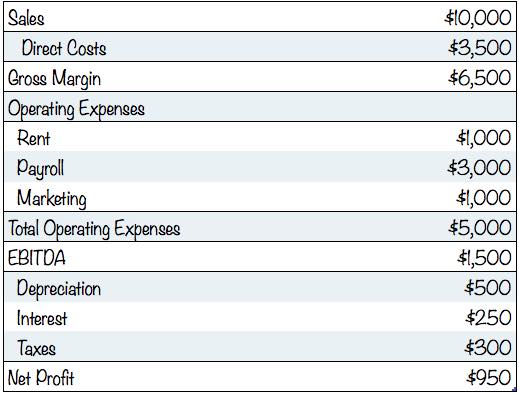

- It starts with Sales, which is why business people who like buzzwords will sometimes refer to sales as “the top line.”

- It then shows Direct Costs (or COGS, or Unit Costs).

- Then Gross Margin, Sales less Direct Costs.

- Then operating expenses.

- Gross margin less operating expenses is gross profit, also called EBITDA for “earnings before interest, taxes, depreciation and amortization.” I use EBITDA instead of the more traditional EBIT (earnings before interest and taxes). I explained that choice and depreciation and amortization as well in Financial Projection Tips and Traps , in the previous section.

- Then it shows depreciation, interest expenses, and then taxes…

- Then, at the very bottom, Net Profit; this is why so many people refer to net profit as “the bottom line,” which has also come to mean the conclusion, or main point, in a discussion.

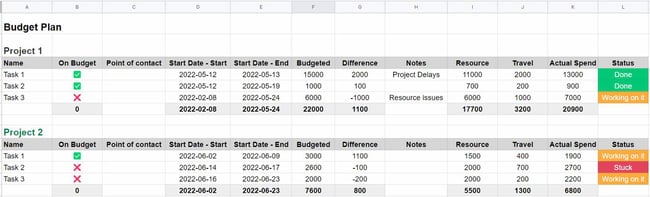

The following illustration shows a simple Projected Profit and Loss for the bicycle store I’ve been using as an example. This example doesn’t divide operating expenses into categories. The format and math start with sales at the top. You’ll find that same basic layout in everything from small business accounting statements to the financial disclosures of large enterprises whose stock is traded on public markets. Companies vary widely on how much detail they include. And projections are always different from statements, because of Planning not accounting . But still this is standard.

A lean business plan will normally include sales, costs of sales, and expenses. To take it from there to a more formal projected Profit and Loss is a matter of collecting forecasts from the lean plan. The sales and costs of sales go at the top, then operating expenses. Calculating net profit is simple math.

Keep your assumptions simple. Remember our principle about planning and accounting. Don’t try to calculate interest based on a complex series of debt instruments; just average your interest over the projected debt. Don’t try to do graduated tax rates; use an average tax percentage for a profitable company.

Notice that the Profit and Loss involves only four of the Six Key Financial Terms . While a Profit and Loss Statement or Projected Profit and Loss affects the Balance Sheet because earnings are part of capital, it includes only sales, costs, expenses, and profit.

Hi, In case of bank financing for machineries and working capital, how can it be broken down in to the expense stream? ( capital + interest)

When you spend on assets is not deductible from income, and is therefore not an expense. What you spent to repay the principle of a loan is not deductible, and therefore not an expense. The interest on a loan is deductible, and is an expense.

Excuse me, may I know if the project profit & loss should plan for the first year only or for year 1-3 in business plan of a new company?

Kattie Wan, I recommend for normal cases the projected profit and loss monthly for the first 12 months, and two years annually after that. There are always special cases, though; every business is different.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- Write Your Business Plan | Part 1 Overview Video

- The Basics of Writing a Business Plan

- How to Use Your Business Plan Most Effectively

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 3 Key Things You Need to Know About Financing Your Business

- 12 Ways to Set Realistic Business Goals and Objectives

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- Write Your Business Plan | Part 2 Overview Video

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- Write Your Business Plan | Part 3 Overview Video

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

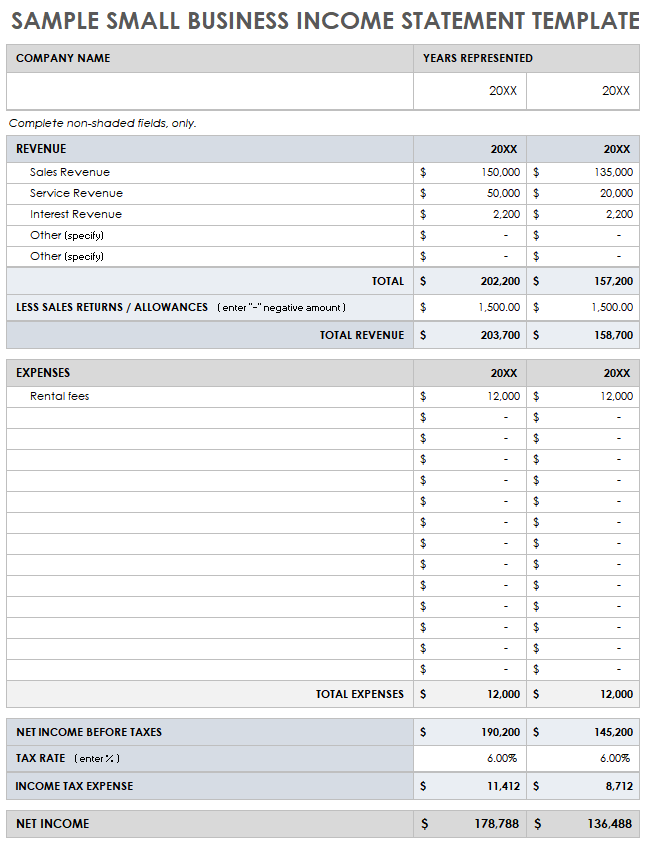

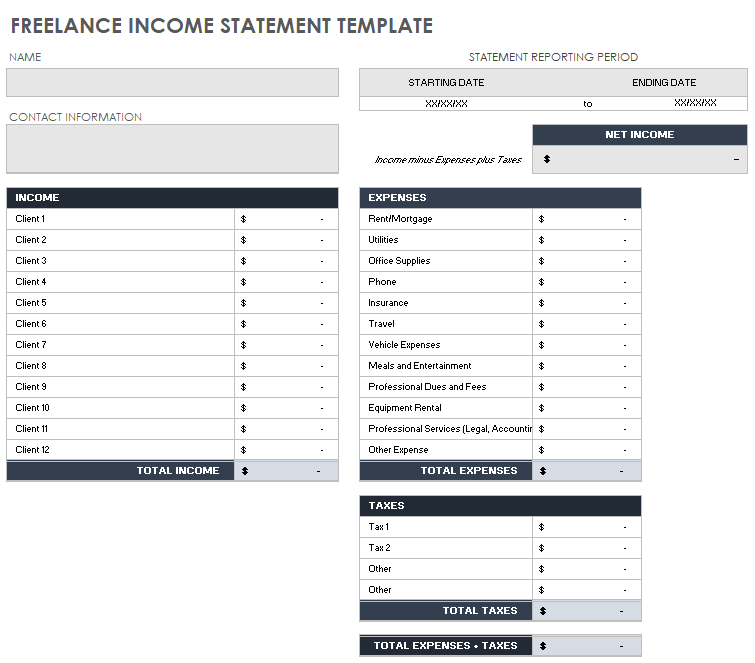

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

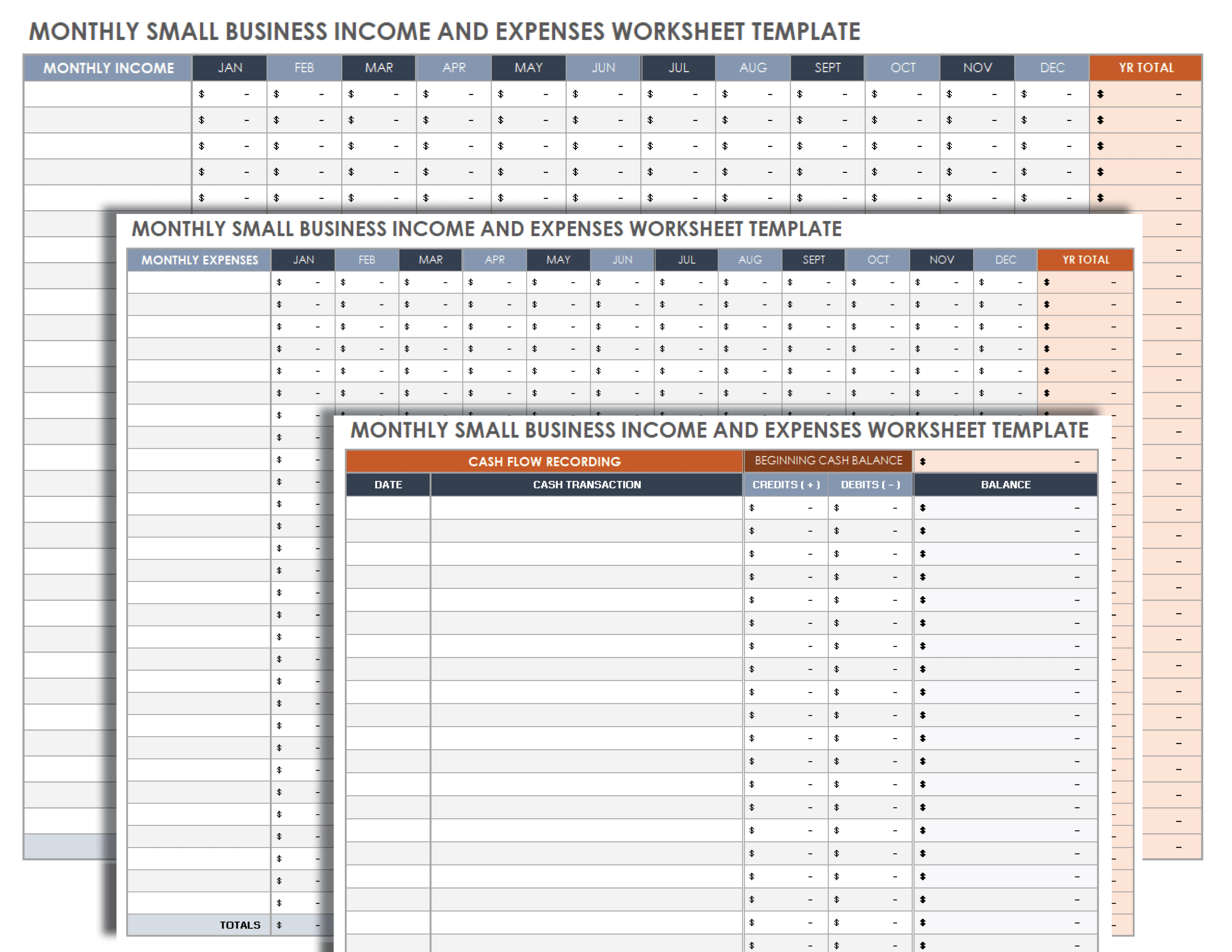

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

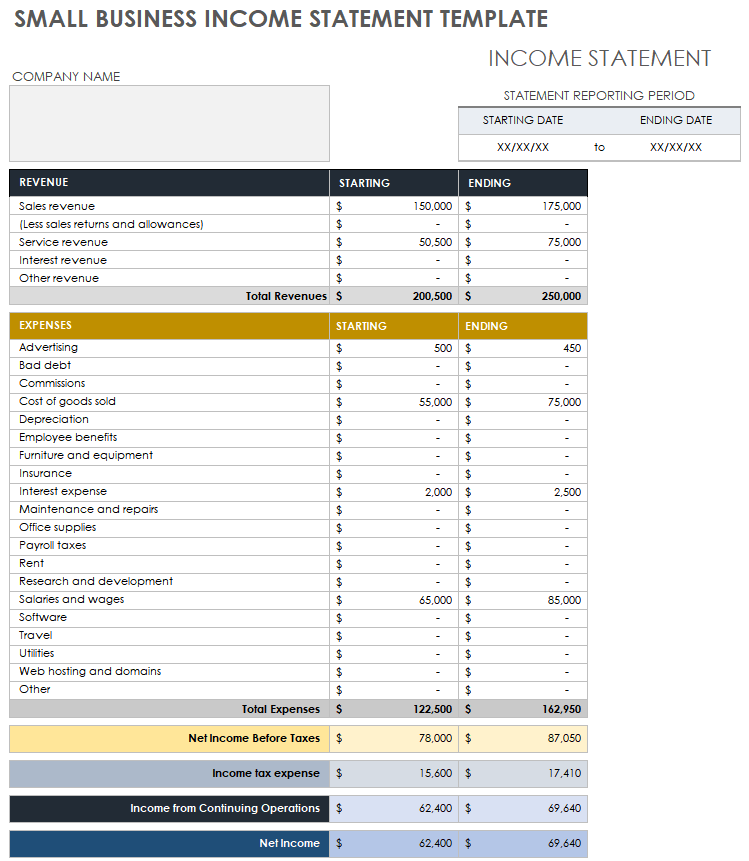

How to Write an Income Statement for Your Business Plan Your income statement shows investors if you are making money. Here's everything you'll need to create one.

By Eric Butow Edited by Dan Bova Oct 27, 2023

Key Takeaways

- An income statement is your business's bottom line: your total revenue from sales minus all of your costs.

Opinions expressed by Entrepreneur contributors are their own.

This is part 2 / 11 of Write Your Business Plan: Section 5: Organizing Operations and Finances series.

Financial data is always at the back of the business plan, but that doesn't mean it's any less important than up-front material such as the description of the business concept and the management team. Astute investors look carefully at the charts, tables, formulas, and spreadsheets in the financial section because they know that this information is like the pulse, respiration rate, and blood pressure in a human being. It shows the condition of the patient. In fact, you'll find many potential investors taking a quick peek at the numbers before reading the plan.

Related: How to Make Realistic Financial Forecasts

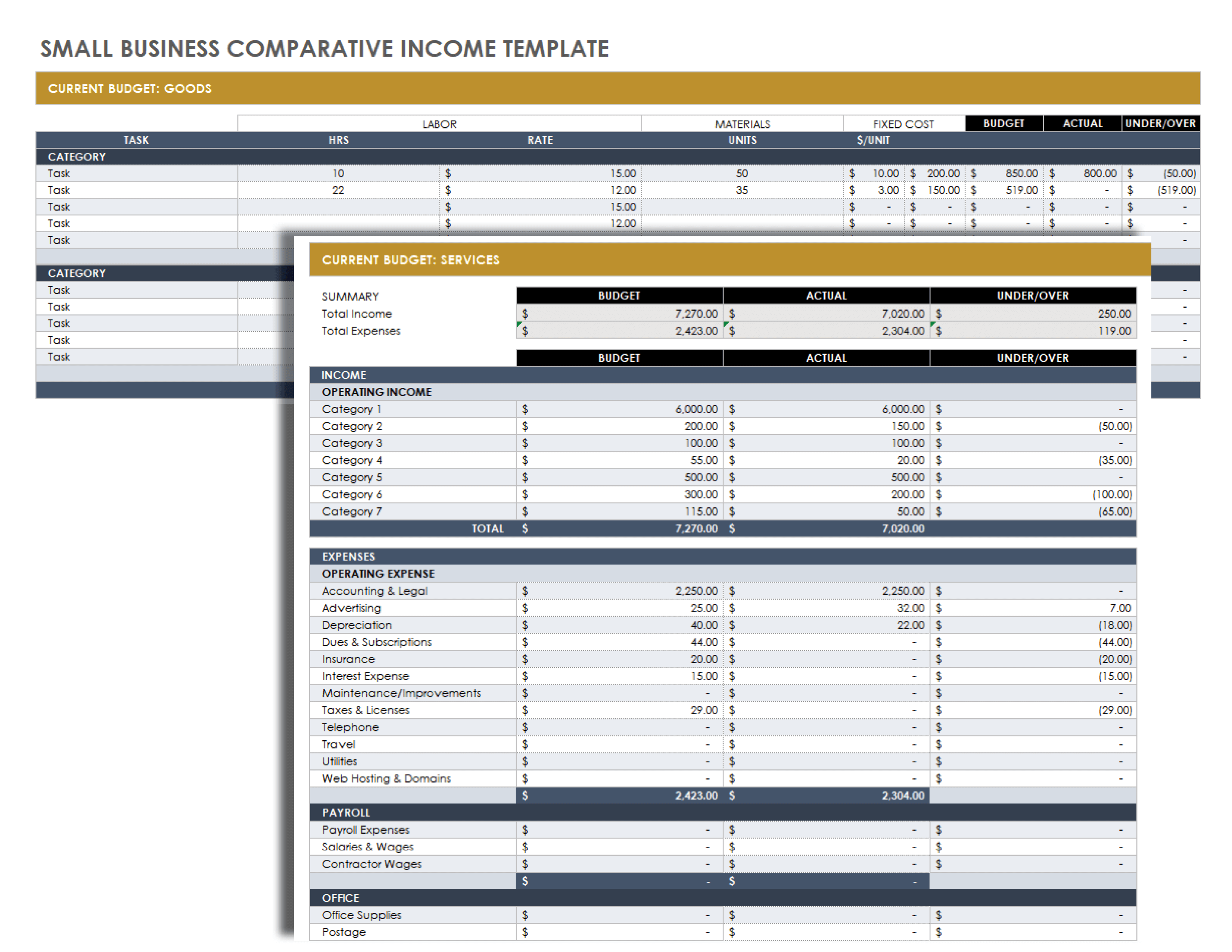

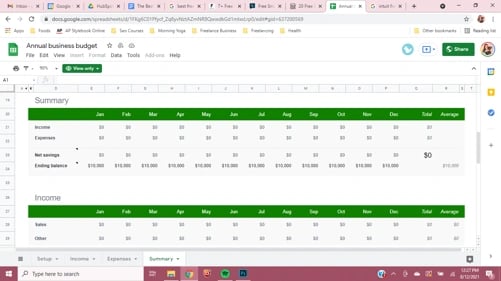

Financial statements come in threes: income statement, balance sheet, and cash flow statement. Taken together they provide an accurate picture of a company's current value, plus its ability to pay its bills today and earn a profit going forward. This information is very important to business plan readers.

Why You Need an Income Statement

In his article, How to Do a Monthly Income Statement Analysis That Fuels Growth , Noah Parsons writes: "In short, you use your income statement to fuel a greater analysis of the financial standing of your business. It helps you identify any top-level issues or opportunities that you can then dive into with forecast scenarios and by looking at elements of your other financial documentation.

Related: How to Make a Balance Sheet

You want to leverage your income statement to understand if you're performing better, worse or as expected. This is done by comparing it to your sales and expense forecasts through a review process known as plan vs actuals comparison. You then update projections to match actual performance to better showcase how your business will net out moving forward."

What Is In an Income Statement

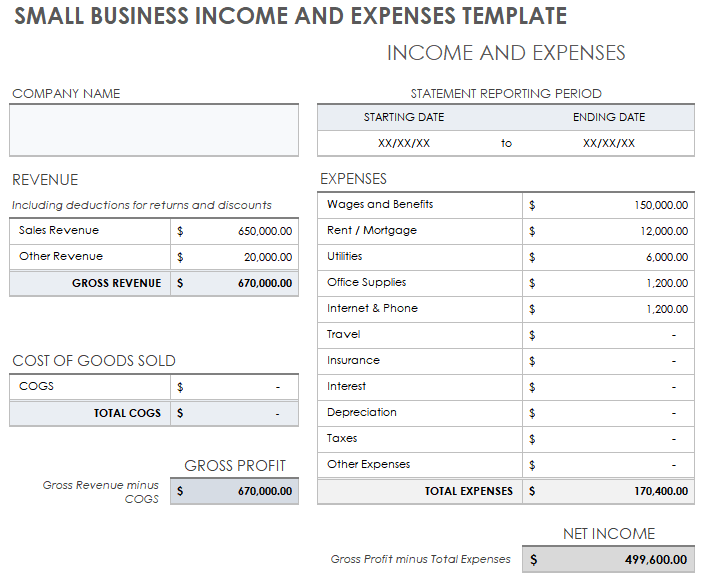

An income statement shows whether you are making any money. It adds up all your revenue from sales and other sources, subtracts all your costs, and comes up with the net income figure, also known as the bottom line.

Related: How to Make a Cash Flow Statement

Income statements are called various names—profit and loss statement (P&L) and earnings statement are two common alternatives. They can get pretty complicated in their attempt to capture sources of income, such as interest, and expenses, such as depreciation. But the basic idea is pretty simple: If you subtract costs from income, what you have left is profit.

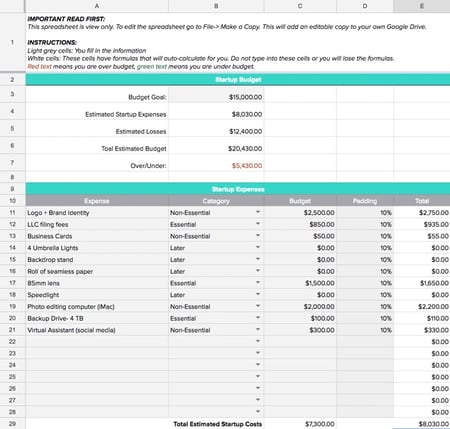

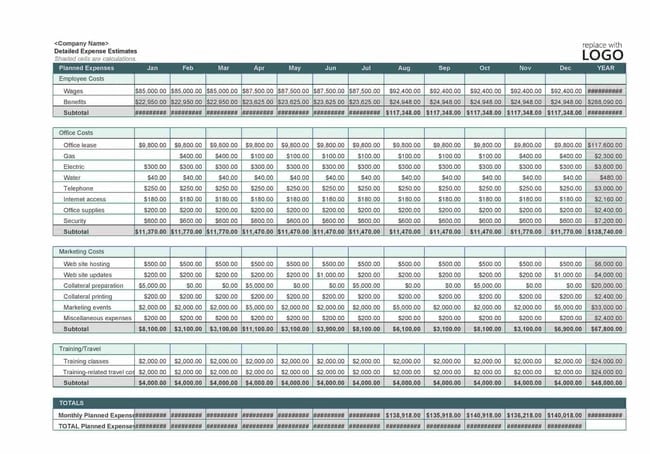

To figure out your income statement, you need to gather a bunch of numbers, most of which are easily obtainable. They include your gross revenue, which is made up of sales and any income from interest or sales of assets; your sales, general, and administrative (SG&A) expenses; what you paid out in interest and dividends, if anything; and your corporate tax rate. If you have those, you're ready to go.

Related: Tips and Strategies for Using the Balance Sheet as Your Franchise Scorecard

Sales and Revenue

Revenue is all the income you receive from selling your products or services as well as from other sources such as interest income and sales of assets.

Gross Sales

Your sales figure is the income you receive from selling your product or service. Gross sales equals total sales minus returns. It doesn't include interest or income from sales of assets.

Interest and Dividends

Most businesses have a little reserve fund they keep in an interest-bearing bank or money market account. Income from this fund, as well as from any other interest-paying or dividend-paying securities they own, shows up on the income statement just below the sales figure.

Related: How to Measure Franchise Success With Your Income Statement

Other Income

If you finally decide that the branch office out on County Line Road isn't ever going to turn a decent profit, and you sell the land, building, and fixtures, the income from that sale will show up on your income statement as "other income." Other income may include sales of unused or obsolete equipment or any income-generating activity that's not part of your main line of business.

Costs come in all varieties—that's no secret. You'll record variable costs, such as the cost of goods sold, as well as fixed costs—rent, insurance, maintenance, and so forth. You'll also record costs that are a little trickier, the prime example being depreciation.

Related: How to Use Financial Ratios to Understand the Health of Your Business

Cost of Goods Sold

Cost of goods sold, or COGS, includes expenses associated directly with generating the product or service you're selling. If you buy smartphone components and assemble them, your COGS will include the price of the chips, screen, and other parts, as well as the wages of those doing the assembly. You'll also include supervisor salaries and utilities for your factory. If you're a solo professional service provider, on the other hand, your COGS may amount to little more than whatever salary you pay yourself and whatever technology you may use for your business.

Related: My Company Hears Hundreds of Pitches Every Year — Here's What Investors Are Actually Looking For.

Sales, General, and Administrative Costs

You have some expenses that aren't closely tied to sales volume, including salaries for office personnel, salespeople compensation, rent, insurance, and the like. These are split out from the sales-sensitive COGS figure and included on a separate line.

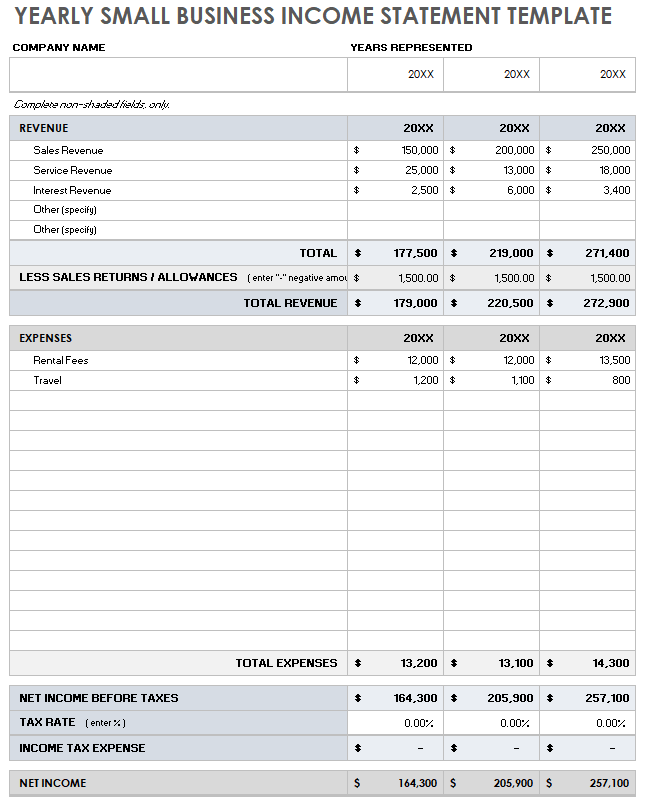

Depreciation

Depreciation is one of the most baffling pieces of accounting wizardwork. It's a paper loss, a way of subtracting over time the cost of a piece of equipment or a building that lasts many years even though it may get paid for immediately.

Related: 10 Mistakes to Avoid When Pitching Investors (Infographic)

Depreciation isn't an expense that involves cash coming out of your pocket. Yet it's a real expense in an accounting sense, and most income statements will have an entry for depreciation coming off the top of pretax earnings. It refers to an ongoing decrease in asset value.

If you have capital items that you are depreciating, such as an office in your home or a large piece of machinery, your accountant will be able to set up a schedule for depreciation. Each year, you'll take a portion of the purchase price of that item off your earnings statement. Although it hurts profits, depreciation can reduce future taxes.

Paying the interest on loans is another expense that gets a line all to itself and comes out of earnings just before taxes are subtracted. This line doesn't include payments against the principal. Because these payments result in a reduction of liabilities—which we'll talk about in a few pages in connection with your balance sheet—they're not regarded as expenses on the income statement.

Related: How to Craft a Business Plan That Will Turn Investors' Heads

The best thing about taxes is that they're figured last, on the profits that are left after every other thing has been taken out. Tax rates vary widely according to where your company is located, how and whether state and local taxes are figured, and your special tax situation. Use previous years as a guidepost for future returns. If you are just opening your business, work carefully with your accountant to set up a system whereby you can pay the necessary taxes at regular intervals.

Buzzword: EBIT

EBIT stands for earnings before interest and taxes. It is an indicator of a company's profitability, calculated as revenue minus expenses, excluding tax and interest.

Related: Don't Make This Huge Mistake on Your Financial Model

Important Plan Note

Don't confuse sales with receipts. Your sales figure represents sales booked during the period, not necessarily money received. If your customers buy now and pay later, there may be a significant difference between sales and cash receipts.

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

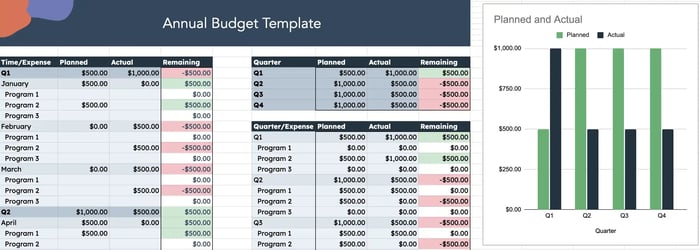

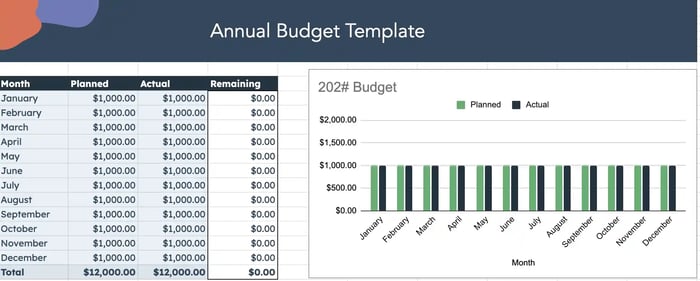

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

.png?format=auto)

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

1 Min. Read

How to Calculate Return on Investment (ROI)

5 Min. Read

How To Write a Business Plan for a Life Coaching Business + Free Example

7 Min. Read

How to Write a Bakery Business Plan + Sample

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Small Business Trends

How to create a business plan: examples & free template.

This is the ultimate guide to creating a comprehensive and effective plan to start a business . In today’s dynamic business landscape, having a well-crafted business plan is an important first step to securing funding, attracting partners, and navigating the challenges of entrepreneurship.

This guide has been designed to help you create a winning plan that stands out in the ever-evolving marketplace. U sing real-world examples and a free downloadable template, it will walk you through each step of the process.

Whether you’re a seasoned entrepreneur or launching your very first startup, the guide will give you the insights, tools, and confidence you need to create a solid foundation for your business.

Table of Contents

How to Write a Business Plan

Embarking on the journey of creating a successful business requires a solid foundation, and a well-crafted business plan is the cornerstone. Here is the process of writing a comprehensive business plan and the main parts of a winning business plan . From setting objectives to conducting market research, this guide will have everything you need.

Executive Summary

The Executive Summary serves as the gateway to your business plan, offering a snapshot of your venture’s core aspects. This section should captivate and inform, succinctly summarizing the essence of your plan.

It’s crucial to include a clear mission statement, a brief description of your primary products or services, an overview of your target market, and key financial projections or achievements.

Think of it as an elevator pitch in written form: it should be compelling enough to engage potential investors or stakeholders and provide them with a clear understanding of what your business is about, its goals, and why it’s a promising investment.

Example: EcoTech is a technology company specializing in eco-friendly and sustainable products designed to reduce energy consumption and minimize waste. Our mission is to create innovative solutions that contribute to a cleaner, greener environment.

Our target market includes environmentally conscious consumers and businesses seeking to reduce their carbon footprint. We project a 200% increase in revenue within the first three years of operation.

Overview and Business Objectives

In the Overview and Business Objectives section, outline your business’s core goals and the strategic approaches you plan to use to achieve them. This section should set forth clear, specific objectives that are attainable and time-bound, providing a roadmap for your business’s growth and success.

It’s important to detail how these objectives align with your company’s overall mission and vision. Discuss the milestones you aim to achieve and the timeframe you’ve set for these accomplishments.

This part of the plan demonstrates to investors and stakeholders your vision for growth and the practical steps you’ll take to get there.

Example: EcoTech’s primary objective is to become a market leader in sustainable technology products within the next five years. Our key objectives include:

- Introducing three new products within the first two years of operation.

- Achieving annual revenue growth of 30%.

- Expanding our customer base to over 10,000 clients by the end of the third year.

Company Description

The Company Description section is your opportunity to delve into the details of your business. Provide a comprehensive overview that includes your company’s history, its mission statement, and its vision for the future.

Highlight your unique selling proposition (USP) – what makes your business stand out in the market. Explain the problems your company solves and how it benefits your customers.

Include information about the company’s founders, their expertise, and why they are suited to lead the business to success. This section should paint a vivid picture of your business, its values, and its place in the industry.

Example: EcoTech is committed to developing cutting-edge sustainable technology products that benefit both the environment and our customers. Our unique combination of innovative solutions and eco-friendly design sets us apart from the competition. We envision a future where technology and sustainability go hand in hand, leading to a greener planet.

Define Your Target Market

Defining Your Target Market is critical for tailoring your business strategy effectively. This section should describe your ideal customer base in detail, including demographic information (such as age, gender, income level, and location) and psychographic data (like interests, values, and lifestyle).

Elucidate on the specific needs or pain points of your target audience and how your product or service addresses these. This information will help you know your target market and develop targeted marketing strategies.

Example: Our target market comprises environmentally conscious consumers and businesses looking for innovative solutions to reduce their carbon footprint. Our ideal customers are those who prioritize sustainability and are willing to invest in eco-friendly products.

Market Analysis

The Market Analysis section requires thorough research and a keen understanding of the industry. It involves examining the current trends within your industry, understanding the needs and preferences of your customers, and analyzing the strengths and weaknesses of your competitors.

This analysis will enable you to spot market opportunities and anticipate potential challenges. Include data and statistics to back up your claims, and use graphs or charts to illustrate market trends.

This section should demonstrate that you have a deep understanding of the market in which you operate and that your business is well-positioned to capitalize on its opportunities.

Example: The market for eco-friendly technology products has experienced significant growth in recent years, with an estimated annual growth rate of 10%. As consumers become increasingly aware of environmental issues, the demand for sustainable solutions continues to rise.

Our research indicates a gap in the market for high-quality, innovative eco-friendly technology products that cater to both individual and business clients.

SWOT Analysis

A SWOT analysis in your business plan offers a comprehensive examination of your company’s internal and external factors. By assessing Strengths, you showcase what your business does best and where your capabilities lie.

Weaknesses involve an honest introspection of areas where your business may be lacking or could improve. Opportunities can be external factors that your business could capitalize on, such as market gaps or emerging trends.

Threats include external challenges your business may face, like competition or market changes. This analysis is crucial for strategic planning, as it helps in recognizing and leveraging your strengths, addressing weaknesses, seizing opportunities, and preparing for potential threats.

Including a SWOT analysis demonstrates to stakeholders that you have a balanced and realistic understanding of your business in its operational context.

- Innovative and eco-friendly product offerings.

- Strong commitment to sustainability and environmental responsibility.

- Skilled and experienced team with expertise in technology and sustainability.

Weaknesses:

- Limited brand recognition compared to established competitors.

- Reliance on third-party manufacturers for product development.

Opportunities:

- Growing consumer interest in sustainable products.

- Partnerships with environmentally-focused organizations and influencers.

- Expansion into international markets.

- Intense competition from established technology companies.

- Regulatory changes could impact the sustainable technology market.

Competitive Analysis

In this section, you’ll analyze your competitors in-depth, examining their products, services, market positioning, and pricing strategies. Understanding your competition allows you to identify gaps in the market and tailor your offerings to outperform them.

By conducting a thorough competitive analysis, you can gain insights into your competitors’ strengths and weaknesses, enabling you to develop strategies to differentiate your business and gain a competitive advantage in the marketplace.

Example: Key competitors include:

GreenTech: A well-known brand offering eco-friendly technology products, but with a narrower focus on energy-saving devices.

EarthSolutions: A direct competitor specializing in sustainable technology, but with a limited product range and higher prices.

By offering a diverse product portfolio, competitive pricing, and continuous innovation, we believe we can capture a significant share of the growing sustainable technology market.

Organization and Management Team

Provide an overview of your company’s organizational structure, including key roles and responsibilities. Introduce your management team, highlighting their expertise and experience to demonstrate that your team is capable of executing the business plan successfully.

Showcasing your team’s background, skills, and accomplishments instills confidence in investors and other stakeholders, proving that your business has the leadership and talent necessary to achieve its objectives and manage growth effectively.

Example: EcoTech’s organizational structure comprises the following key roles: CEO, CTO, CFO, Sales Director, Marketing Director, and R&D Manager. Our management team has extensive experience in technology, sustainability, and business development, ensuring that we are well-equipped to execute our business plan successfully.

Products and Services Offered

Describe the products or services your business offers, focusing on their unique features and benefits. Explain how your offerings solve customer pain points and why they will choose your products or services over the competition.

This section should emphasize the value you provide to customers, demonstrating that your business has a deep understanding of customer needs and is well-positioned to deliver innovative solutions that address those needs and set your company apart from competitors.

Example: EcoTech offers a range of eco-friendly technology products, including energy-efficient lighting solutions, solar chargers, and smart home devices that optimize energy usage. Our products are designed to help customers reduce energy consumption, minimize waste, and contribute to a cleaner environment.

Marketing and Sales Strategy

In this section, articulate your comprehensive strategy for reaching your target market and driving sales. Detail the specific marketing channels you plan to use, such as social media, email marketing, SEO, or traditional advertising.

Describe the nature of your advertising campaigns and promotional activities, explaining how they will capture the attention of your target audience and convey the value of your products or services. Outline your sales strategy, including your sales process, team structure, and sales targets.

Discuss how these marketing and sales efforts will work together to attract and retain customers, generate leads, and ultimately contribute to achieving your business’s revenue goals.

This section is critical to convey to investors and stakeholders that you have a well-thought-out approach to market your business effectively and drive sales growth.

Example: Our marketing strategy includes digital advertising, content marketing, social media promotion, and influencer partnerships. We will also attend trade shows and conferences to showcase our products and connect with potential clients. Our sales strategy involves both direct sales and partnerships with retail stores, as well as online sales through our website and e-commerce platforms.

Logistics and Operations Plan

The Logistics and Operations Plan is a critical component that outlines the inner workings of your business. It encompasses the management of your supply chain, detailing how you acquire raw materials and manage vendor relationships.

Inventory control is another crucial aspect, where you explain strategies for inventory management to ensure efficiency and reduce wastage. The section should also describe your production processes, emphasizing scalability and adaptability to meet changing market demands.

Quality control measures are essential to maintain product standards and customer satisfaction. This plan assures investors and stakeholders of your operational competency and readiness to meet business demands.

Highlighting your commitment to operational efficiency and customer satisfaction underlines your business’s capability to maintain smooth, effective operations even as it scales.

Example: EcoTech partners with reliable third-party manufacturers to produce our eco-friendly technology products. Our operations involve maintaining strong relationships with suppliers, ensuring quality control, and managing inventory.

We also prioritize efficient distribution through various channels, including online platforms and retail partners, to deliver products to our customers in a timely manner.

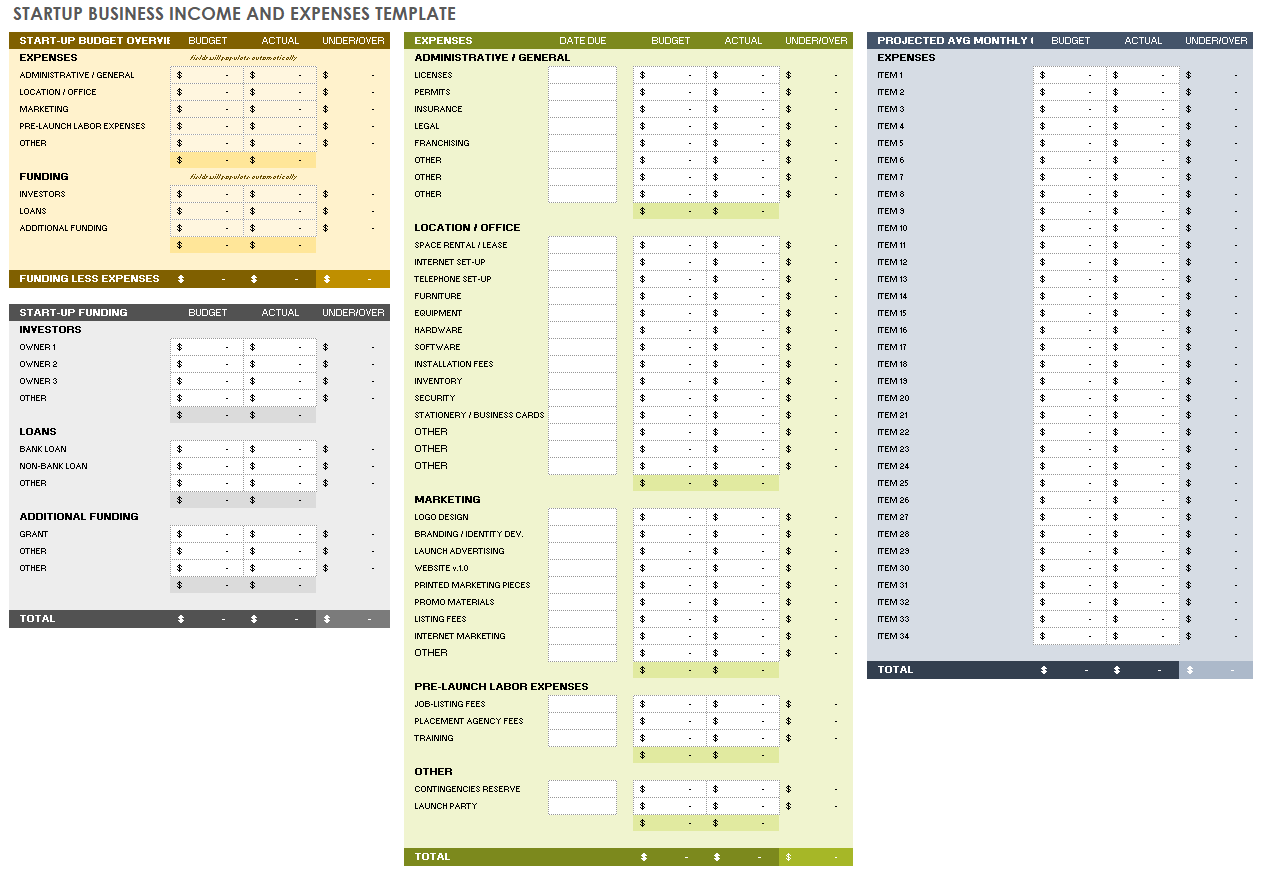

Financial Projections Plan

In the Financial Projections Plan, lay out a clear and realistic financial future for your business. This should include detailed projections for revenue, costs, and profitability over the next three to five years.

Ground these projections in solid assumptions based on your market analysis, industry benchmarks, and realistic growth scenarios. Break down revenue streams and include an analysis of the cost of goods sold, operating expenses, and potential investments.

This section should also discuss your break-even analysis, cash flow projections, and any assumptions about external funding requirements.

By presenting a thorough and data-backed financial forecast, you instill confidence in potential investors and lenders, showcasing your business’s potential for profitability and financial stability.

This forward-looking financial plan is crucial for demonstrating that you have a firm grasp of the financial nuances of your business and are prepared to manage its financial health effectively.

Example: Over the next three years, we expect to see significant growth in revenue, driven by new product launches and market expansion. Our financial projections include:

- Year 1: $1.5 million in revenue, with a net profit of $200,000.

- Year 2: $3 million in revenue, with a net profit of $500,000.

- Year 3: $4.5 million in revenue, with a net profit of $1 million.

These projections are based on realistic market analysis, growth rates, and product pricing.

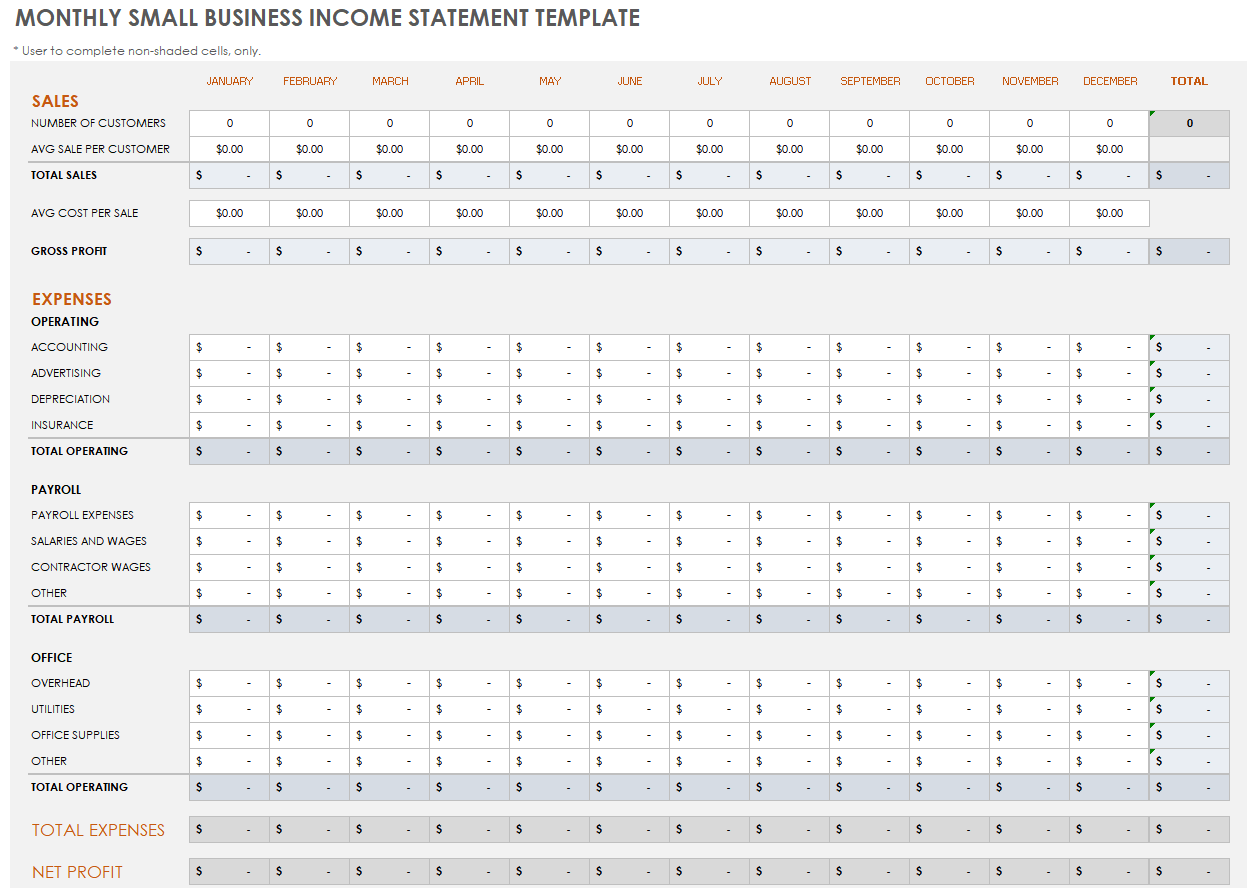

Income Statement

The income statement , also known as the profit and loss statement, provides a summary of your company’s revenues and expenses over a specified period. It helps you track your business’s financial performance and identify trends, ensuring you stay on track to achieve your financial goals.

Regularly reviewing and analyzing your income statement allows you to monitor the health of your business, evaluate the effectiveness of your strategies, and make data-driven decisions to optimize profitability and growth.

Example: The income statement for EcoTech’s first year of operation is as follows:

- Revenue: $1,500,000

- Cost of Goods Sold: $800,000

- Gross Profit: $700,000

- Operating Expenses: $450,000

- Net Income: $250,000

This statement highlights our company’s profitability and overall financial health during the first year of operation.

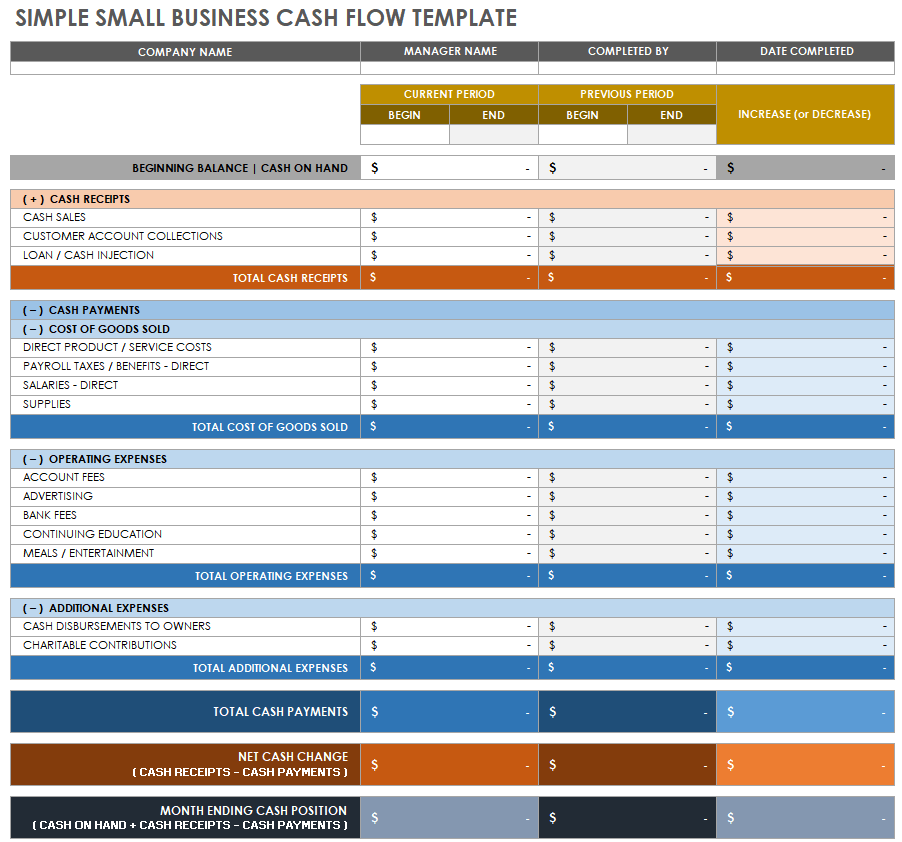

Cash Flow Statement

A cash flow statement is a crucial part of a financial business plan that shows the inflows and outflows of cash within your business. It helps you monitor your company’s liquidity, ensuring you have enough cash on hand to cover operating expenses, pay debts, and invest in growth opportunities.

By including a cash flow statement in your business plan, you demonstrate your ability to manage your company’s finances effectively.

Example: The cash flow statement for EcoTech’s first year of operation is as follows:

Operating Activities:

- Depreciation: $10,000

- Changes in Working Capital: -$50,000

- Net Cash from Operating Activities: $210,000

Investing Activities:

- Capital Expenditures: -$100,000

- Net Cash from Investing Activities: -$100,000

Financing Activities:

- Proceeds from Loans: $150,000

- Loan Repayments: -$50,000

- Net Cash from Financing Activities: $100,000

- Net Increase in Cash: $210,000

This statement demonstrates EcoTech’s ability to generate positive cash flow from operations, maintain sufficient liquidity, and invest in growth opportunities.

Tips on Writing a Business Plan

1. Be clear and concise: Keep your language simple and straightforward. Avoid jargon and overly technical terms. A clear and concise business plan is easier for investors and stakeholders to understand and demonstrates your ability to communicate effectively.

2. Conduct thorough research: Before writing your business plan, gather as much information as possible about your industry, competitors, and target market. Use reliable sources and industry reports to inform your analysis and make data-driven decisions.

3. Set realistic goals: Your business plan should outline achievable objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). Setting realistic goals demonstrates your understanding of the market and increases the likelihood of success.

4. Focus on your unique selling proposition (USP): Clearly articulate what sets your business apart from the competition. Emphasize your USP throughout your business plan to showcase your company’s value and potential for success.

5. Be flexible and adaptable: A business plan is a living document that should evolve as your business grows and changes. Be prepared to update and revise your plan as you gather new information and learn from your experiences.

6. Use visuals to enhance understanding: Include charts, graphs, and other visuals to help convey complex data and ideas. Visuals can make your business plan more engaging and easier to digest, especially for those who prefer visual learning.

7. Seek feedback from trusted sources: Share your business plan with mentors, industry experts, or colleagues and ask for their feedback. Their insights can help you identify areas for improvement and strengthen your plan before presenting it to potential investors or partners.

FREE Business Plan Template

To help you get started on your business plan, we have created a template that includes all the essential components discussed in the “How to Write a Business Plan” section. This easy-to-use template will guide you through each step of the process, ensuring you don’t miss any critical details.

The template is divided into the following sections:

- Mission statement

- Business Overview

- Key products or services

- Target market

- Financial highlights

- Company goals

- Strategies to achieve goals

- Measurable, time-bound objectives

- Company History

- Mission and vision

- Unique selling proposition

- Demographics

- Psychographics

- Pain points

- Industry trends

- Customer needs

- Competitor strengths and weaknesses

- Opportunities

- Competitor products and services

- Market positioning

- Pricing strategies

- Organizational structure

- Key roles and responsibilities

- Management team backgrounds

- Product or service features

- Competitive advantages

- Marketing channels

- Advertising campaigns

- Promotional activities

- Sales strategies

- Supply chain management

- Inventory control

- Production processes

- Quality control measures

- Projected revenue

- Assumptions

- Cash inflows

- Cash outflows

- Net cash flow

What is a Business Plan?

A business plan is a strategic document that outlines an organization’s goals, objectives, and the steps required to achieve them. It serves as a roadmap as you start a business , guiding the company’s direction and growth while identifying potential obstacles and opportunities.

Typically, a business plan covers areas such as market analysis, financial projections, marketing strategies, and organizational structure. It not only helps in securing funding from investors and lenders but also provides clarity and focus to the management team.

A well-crafted business plan is a very important part of your business startup checklist because it fosters informed decision-making and long-term success.

Why You Should Write a Business Plan

Understanding the importance of a business plan in today’s competitive environment is crucial for entrepreneurs and business owners. Here are five compelling reasons to write a business plan:

- Attract Investors and Secure Funding : A well-written business plan demonstrates your venture’s potential and profitability, making it easier to attract investors and secure the necessary funding for growth and development. It provides a detailed overview of your business model, target market, financial projections, and growth strategies, instilling confidence in potential investors and lenders that your company is a worthy investment.

- Clarify Business Objectives and Strategies : Crafting a business plan forces you to think critically about your goals and the strategies you’ll employ to achieve them, providing a clear roadmap for success. This process helps you refine your vision and prioritize the most critical objectives, ensuring that your efforts are focused on achieving the desired results.

- Identify Potential Risks and Opportunities : Analyzing the market, competition, and industry trends within your business plan helps identify potential risks and uncover untapped opportunities for growth and expansion. This insight enables you to develop proactive strategies to mitigate risks and capitalize on opportunities, positioning your business for long-term success.

- Improve Decision-Making : A business plan serves as a reference point so you can make informed decisions that align with your company’s overall objectives and long-term vision. By consistently referring to your plan and adjusting it as needed, you can ensure that your business remains on track and adapts to changes in the market, industry, or internal operations.

- Foster Team Alignment and Communication : A shared business plan helps ensure that all team members are on the same page, promoting clear communication, collaboration, and a unified approach to achieving the company’s goals. By involving your team in the planning process and regularly reviewing the plan together, you can foster a sense of ownership, commitment, and accountability that drives success.

What are the Different Types of Business Plans?

In today’s fast-paced business world, having a well-structured roadmap is more important than ever. A traditional business plan provides a comprehensive overview of your company’s goals and strategies, helping you make informed decisions and achieve long-term success. There are various types of business plans, each designed to suit different needs and purposes. Let’s explore the main types:

- Startup Business Plan: Tailored for new ventures, a startup business plan outlines the company’s mission, objectives, target market, competition, marketing strategies, and financial projections. It helps entrepreneurs clarify their vision, secure funding from investors, and create a roadmap for their business’s future. Additionally, this plan identifies potential challenges and opportunities, which are crucial for making informed decisions and adapting to changing market conditions.

- Internal Business Plan: This type of plan is intended for internal use, focusing on strategies, milestones, deadlines, and resource allocation. It serves as a management tool for guiding the company’s growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. The internal business plan also helps identify areas of improvement, fosters collaboration among team members, and provides a reference point for measuring performance.

- Strategic Business Plan: A strategic business plan outlines long-term goals and the steps to achieve them, providing a clear roadmap for the company’s direction. It typically includes a SWOT analysis, market research, and competitive analysis. This plan allows businesses to align their resources with their objectives, anticipate changes in the market, and develop contingency plans. By focusing on the big picture, a strategic business plan fosters long-term success and stability.

- Feasibility Business Plan: This plan is designed to assess the viability of a business idea, examining factors such as market demand, competition, and financial projections. It is often used to decide whether or not to pursue a particular venture. By conducting a thorough feasibility analysis, entrepreneurs can avoid investing time and resources into an unviable business concept. This plan also helps refine the business idea, identify potential obstacles, and determine the necessary resources for success.

- Growth Business Plan: Also known as an expansion plan, a growth business plan focuses on strategies for scaling up an existing business. It includes market analysis, new product or service offerings, and financial projections to support expansion plans. This type of plan is essential for businesses looking to enter new markets, increase their customer base, or launch new products or services. By outlining clear growth strategies, the plan helps ensure that expansion efforts are well-coordinated and sustainable.

- Operational Business Plan: This type of plan outlines the company’s day-to-day operations, detailing the processes, procedures, and organizational structure. It is an essential tool for managing resources, streamlining workflows, and ensuring smooth operations. The operational business plan also helps identify inefficiencies, implement best practices, and establish a strong foundation for future growth. By providing a clear understanding of daily operations, this plan enables businesses to optimize their resources and enhance productivity.

- Lean Business Plan: A lean business plan is a simplified, agile version of a traditional plan, focusing on key elements such as value proposition, customer segments, revenue streams, and cost structure. It is perfect for startups looking for a flexible, adaptable planning approach. The lean business plan allows for rapid iteration and continuous improvement, enabling businesses to pivot and adapt to changing market conditions. This streamlined approach is particularly beneficial for businesses in fast-paced or uncertain industries.

- One-Page Business Plan: As the name suggests, a one-page business plan is a concise summary of your company’s key objectives, strategies, and milestones. It serves as a quick reference guide and is ideal for pitching to potential investors or partners. This plan helps keep teams focused on essential goals and priorities, fosters clear communication, and provides a snapshot of the company’s progress. While not as comprehensive as other plans, a one-page business plan is an effective tool for maintaining clarity and direction.

- Nonprofit Business Plan: Specifically designed for nonprofit organizations, this plan outlines the mission, goals, target audience, fundraising strategies, and budget allocation. It helps secure grants and donations while ensuring the organization stays on track with its objectives. The nonprofit business plan also helps attract volunteers, board members, and community support. By demonstrating the organization’s impact and plans for the future, this plan is essential for maintaining transparency, accountability, and long-term sustainability within the nonprofit sector.

- Franchise Business Plan: For entrepreneurs seeking to open a franchise, this type of plan focuses on the franchisor’s requirements, as well as the franchisee’s goals, strategies, and financial projections. It is crucial for securing a franchise agreement and ensuring the business’s success within the franchise system. This plan outlines the franchisee’s commitment to brand standards, marketing efforts, and operational procedures, while also addressing local market conditions and opportunities. By creating a solid franchise business plan, entrepreneurs can demonstrate their ability to effectively manage and grow their franchise, increasing the likelihood of a successful partnership with the franchisor.

Using Business Plan Software

Creating a comprehensive business plan can be intimidating, but business plan software can streamline the process and help you produce a professional document. These tools offer a number of benefits, including guided step-by-step instructions, financial projections, and industry-specific templates. Here are the top 5 business plan software options available to help you craft a great business plan.

1. LivePlan

LivePlan is a popular choice for its user-friendly interface and comprehensive features. It offers over 500 sample plans, financial forecasting tools, and the ability to track your progress against key performance indicators. With LivePlan, you can create visually appealing, professional business plans that will impress investors and stakeholders.

2. Upmetrics

Upmetrics provides a simple and intuitive platform for creating a well-structured business plan. It features customizable templates, financial forecasting tools, and collaboration capabilities, allowing you to work with team members and advisors. Upmetrics also offers a library of resources to guide you through the business planning process.

Bizplan is designed to simplify the business planning process with a drag-and-drop builder and modular sections. It offers financial forecasting tools, progress tracking, and a visually appealing interface. With Bizplan, you can create a business plan that is both easy to understand and visually engaging.

Enloop is a robust business plan software that automatically generates a tailored plan based on your inputs. It provides industry-specific templates, financial forecasting, and a unique performance score that updates as you make changes to your plan. Enloop also offers a free version, making it accessible for businesses on a budget.

5. Tarkenton GoSmallBiz