Original text

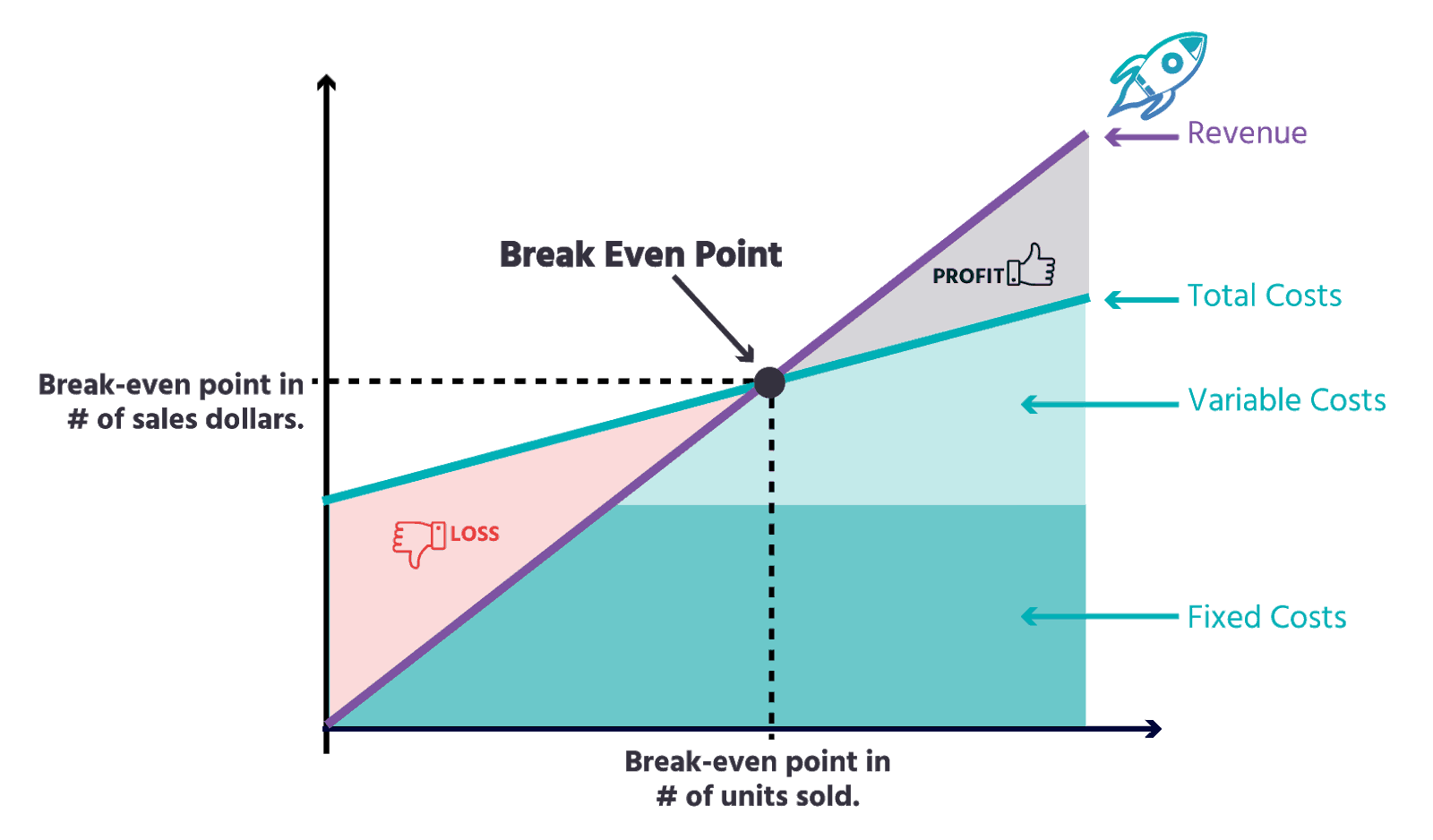

What is a break-even analysis? The break-even point is the point when your business’s total revenues equal its total expenses.

Your business is “breaking even”—not making a profit but not losing money, either.

After the break-even point, any additional sales will generate profits.

To use this break-even analysis template, gather information about your business’s fixed and variable costs, as well as your 12-month sales forecast .

When should you use a break-even analysis.

A break-even analysis is a critical part of the financial projections in the business plan for a new business. Financing sources will want to see when you expect to break even so they know when your business will become profitable.

But even if you’re not seeking outside financing, you should know when your business is going to break even. This will help you plan the amount of startup capital you’ll need and determine how long that capital will need to last.

In general, you should aim to break even in six to 18 months after launching your business. If your break-even analysis shows that it will take longer, you need to revisit your costs and pricing strategy so you can increase your margins and break even in a reasonable amount of time.

Existing businesses can benefit from a break-even analysis, too.

In this situation, a break-even analysis can help you calculate how different scenarios might play out financially. For instance, if you add another employee to the payroll, how many extra sales dollars will be needed to recoup that additional expense? If you borrow money, how much will be needed to cover the monthly principal and interest payments?

A break-even analysis can also be used as a motivational tool. For instance, you can calculate a monthly, weekly, or even daily break-even analysis to give your sales team a goal to aim for.

Do you need help completing your break-even analysis? Connect with a SCORE mentor online or in your community today.

Business Planning & Financial Statements Template Gallery Download SCORE’s templates to help you plan for a new business startup or grow your existing business.

Sales Forecast (12 months) The sales forecast is the key to the whole financial plan, so it is important to use realistic estimates. Download SCORE's Sales Forecast template.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

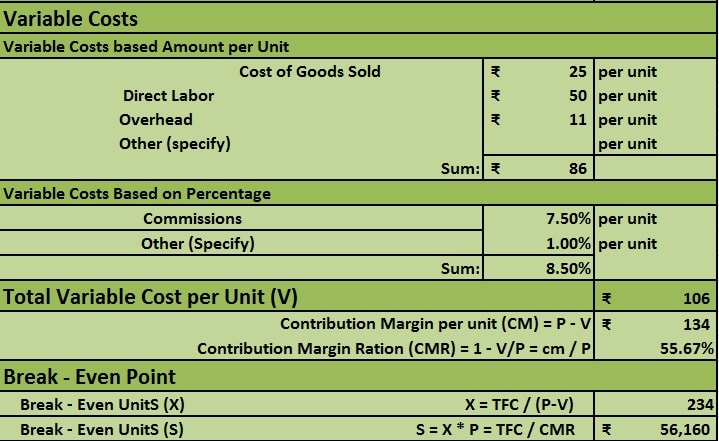

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

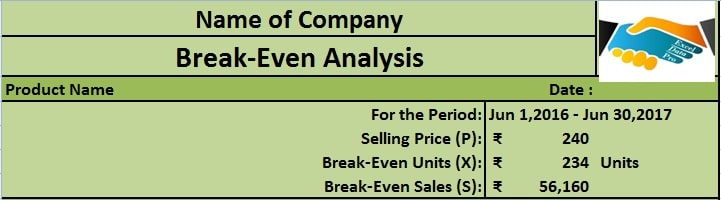

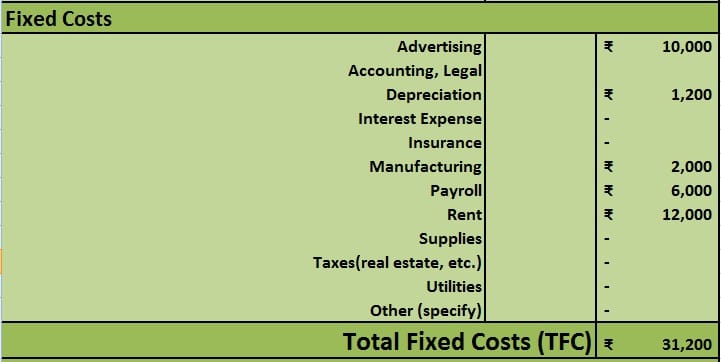

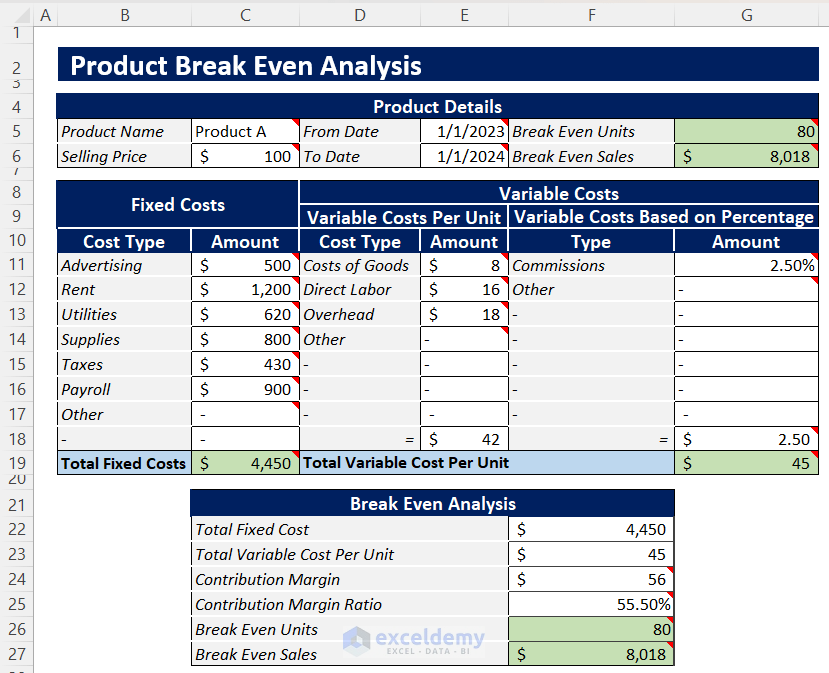

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- HR & Payroll

Break-Even Analysis Explained - Full Guide With Examples

Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point .

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

- Understand what break-even point is

- Know why it is important

- Learn how to calculate break-even point

- Know how to do break-even analysis

- Understand the limitations of break-even analysis

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

What is Break-Even Point?

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable .

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

Importance of Break-Even Analysis for Your Small Business

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price. Using and understanding the break-even point, you can measure

- how profitable is your present product line

- how far sales drop before you start to make a loss

- how many units you need to sell before you make a profit

- how decreasing or increasing price and volume of product will affect profits

- how much of an increase in price or volume of sales you will need to meet the rise in fixed cost

How to Calculate Break-Even Point

There are multiple ways to calculate your break-even point.

Calculate Break-even Point based on Units

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below. Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

Calculate Break-Even Point by Sales Dollar - Contribution Margin Method

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

- Fixed costs: Fixed costs are not affected by the number of items sold, such as rent paid for storefronts or production facilities, office furniture, computer units, and software. Fixed costs also include payment for services like design, marketing, public relations, and advertising.

- Contribution margin: Is calculated by subtracting the unit variable costs from its selling price. So if you’re selling a unit for $100 and the cost of materials is $30, then the contribution margin is $70. This $70 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit.

- Contribution margin ratio: is calculated by dividing your fixed costs from your contribution margin. It is expressed as a percentage. Using the contribution margin, you can determine what you need to do to break-even, like cutting fixed costs or raising your prices.

- Profit earned following your break-even: When your sales equal your fixed and variable costs, you have reached the break-even point. At this point, the company will report a net profit or loss of $0. The sales beyond this point contribute to your net profit.

Small Business Example for Calculating Break-even Point

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula , on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

What if we change the price?

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units. With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

What if we want to make an investment and increase the fixed costs?

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

What if we change the variable cost of producing a good?

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability .

What Are the Benefits of Doing a Break-even Analysis?

Smart Pricing : Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs : When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses : When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets : After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making : Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain : Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding : For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

When to Use Break-even Analysis

Starting a new business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Creating a new product

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

Adding a new sales channel

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Changing the business model

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

Limitations of Break-even Analysis

- The Break-even analysis focuses mostly on the supply-side (i.e., costs only) analysis. It doesn't tell us what sales are actually likely to be for the product at various prices.

- It assumes that fixed costs are constant. However, an increase in the scale of production is likely to lead to an increase in fixed costs.

- It assumes average variable costs are constant per unit of output, per the range of the number of sales

- It assumes that the number of goods produced is equal to the number of goods sold. It believes that there is no change in the number of goods held in inventory at the beginning of the period and the number of goods held in inventory at the end of the period

- In multi-product companies, the relative proportions of each product sold and produced are fixed or constant.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Key Takeaways

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

- You can identify how much, or how many, you have to sell to be profitable.

- Identify costs inside your business that should be alleviated or eliminated.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand .

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

Webinar Alert 🚨

Transforming numbers into storytelling - April 17th at 12 PM ET

- Integrations

- What is FP&A?

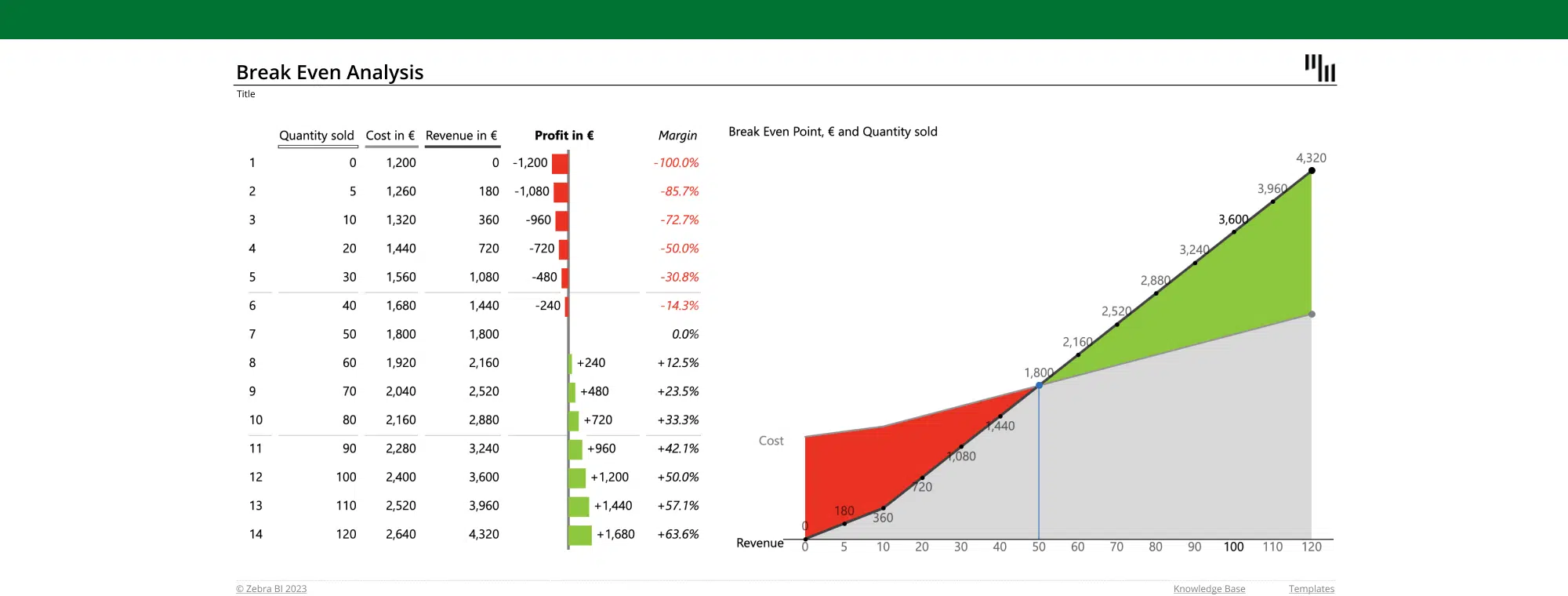

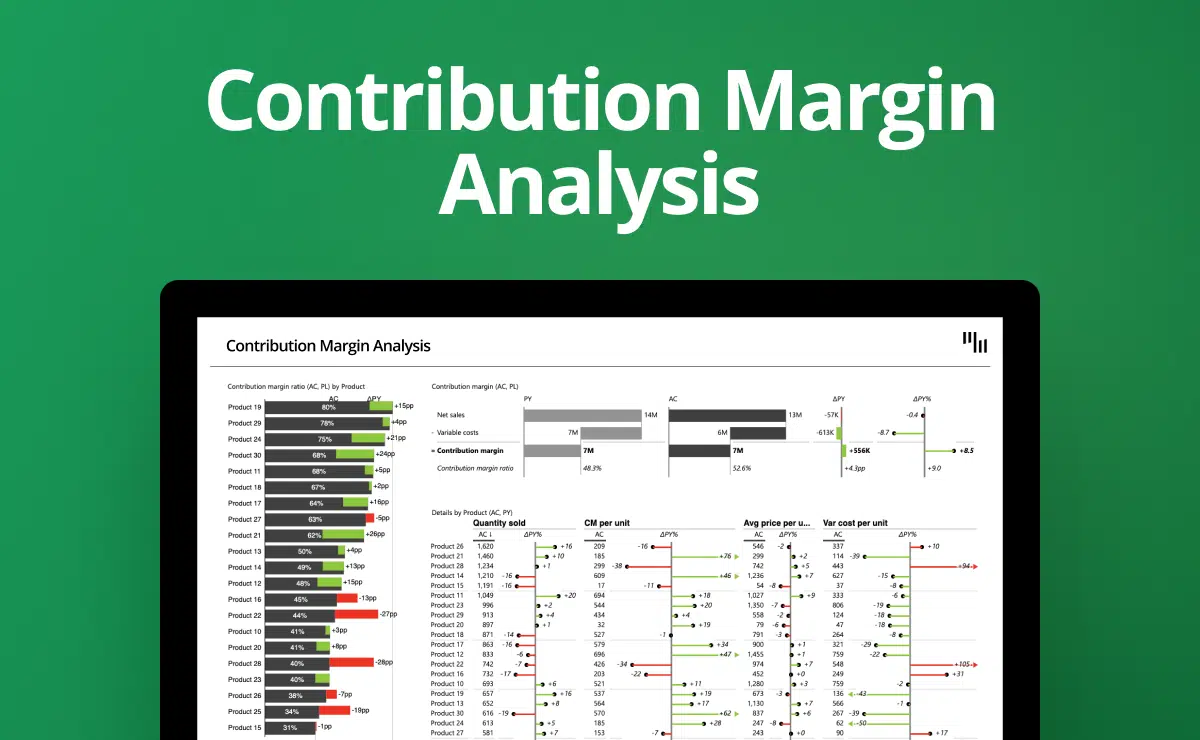

Business Break-Even Analysis Template Leveraging Sales and Financial Data

Before your business turns a profit, it reaches a point where the revenue coming in covers business expenses. With the right break-even analysis template, you can find that point with ease and increased accuracy.

Although break-even analytics aren’t always part of the monthly process, FP&A teams can use this template regularly to analyze new product release numbers, find the right pricing mix, and understand the impact of certain investments on business performance. Break-even analysis is a basic calculation in theory, but it is also one of the most informative pieces of supplemental information for FP&A teams and other business leaders.

Content created by: María Asín Portell, FP&A Ops Senior Associate at Abacum

Table of contents

FP&A Ops Senior Associate, Abacum

When you were creating a business plan at the very start of your venture, it’s likely that investors and banks regularly asked you to provide a break-even analysis. Identifying your break-even point is critical in the early days of business because it showcases the exact junction where your revenue from sales is equal to the costs associated with doing business – both fixed and variable costs.

For small businesses and mid-market companies alike, the break-even point provides a realistic target for when the organization can expect profitability. While many industries target a 6-month to 18-month break-even point, others may be a bit longer. In any new venture or startup, this break-even analysis template turns a frequent, time-consuming analytical task into something that can be done in minutes.

Be careful not to fall into the trap of thinking that a break-even analysis template only works for small businesses that are just starting out; this metric is constantly updated and reevaluated by mid-market and large businesses, too. When rolling out a new product, the sales team needs to understand the break-even point to determine sales targets. If HR wants to hire new employees, FP&A teams need to understand where the point of profitability sits and how to maintain that even with added expenses.

If finance leaders don’t have a deep understanding of the break-even constraints they need to manage, then your business could dip below the line of profitability, lose investor funding, and even be forced to close down shop.

Don’t worry, getting a handle on break-even analytics is insanely simple with our break-even analysis template; let us show you how to make the most out of the custom template within Abacum . Abacum’s custom break-even analysis template seamlessly integrates with your business systems, including, ERPs, HRIS, BI tools, CRMs, spreadsheets, data lakes, and other data sources. Through this integration, your FP&A team can construct an accurate template that works every time.

What is Break-Even Analysis?

Break-even analysis looks at total revenue, total variable costs, and total fixed costs to determine the sales volume required to cover costs entirely. It does not delve into profitability, but rather, highlights exactly when an organization can expect to switch from negative to positive returns.

With advanced financial modeling, break-even analytical capabilities are more advanced than they have been in the past. The end result is the number of units needed to reach an equilibrium between the inflow of revenue and the outflow of costs. Now, companies can get out of clunky Excel templates and move to automated, detailed break-even analysis templates that provide a better look into all the variables that lead to the end result.

FP&A Tip:

Break-even analysis is sometimes considered a simple business calculation, but in reality, if an organization wants it to be accurate, it requires detailed tracking, reporting, and financial modeling. Something that seems as small as testing a new marketing campaign can lead to changes in both revenue and costs, completely changing the result of the equation.

What is the Formula for Break-Even Analysis?

There are multiple ways to think about your break-even point; sometimes teams are trying to solve for the number of units that they need to sell in order to break even, others analyze the product price needed to break even, and even further, you might be attempting to understand how long it takes to break even.

The starting formula for break-even analytics is as follows:

Break-Even Point = Fixed Costs / (Price – Variable Costs)

- Fixed costs do not change regardless of the number of units sold. Things like rent, payroll, and business insurance would fall under fixed costs.

- Variable costs will fluctuate based on production and sales numbers. How much your organization spends on shipping, manufacturing, and packaging would fall under variable costs.

- Price minus variable costs is known as the contribution margin per unit.

With Abacum, no matter what you’re trying to figure out in relation to your break-even point, our system allows you to test different scenarios, understand the marketing funnel associated with product sales, and even adjust cost levers or expected incoming revenue based on certain business decisions such as a strategic campaign or major sale.

What the Break-Even Point Tells You

At all stages of doing business, monitoring your contribution margin, fixed costs, variable costs, and break-even point will provide valuable insights and information. There are many scenarios when detailed analytics around these metrics come in handy, such as:

- When planning for a new product release, the sales team, marketing team, and FP&A team must collaborate to determine the right selling price and cost-volume-profit ratio. If multiple products are being released at the same time, the break-even point analysis can offer insight into the optimal pricing strategies for all products.

- In the startup world, break-even analytics are imperative when connecting with investors or pitching your business in any capacity. Prior to starting business operations, this analysis can shed light on projected performance, letting partners know whether or not your business plan is sound.

- If a new marketing campaign is being created, the break-even point highlights the payback period for the campaign. If executive leaders aren’t ready to take on the costs of something with a lengthy payback period, they may request that their teams redraft the campaign plans.

Relevant in many settings, break-even analysis can be done in simple Excel sheets or in more detailed, complex systems that have advanced capabilities. Today, to get an accurate look into your break-even point, we recommend moving away from, or at least supplementing manual Excel macros with next-generation software like Abacum.

With Abacum, you don’t have to get rid of your existing Excel worksheets or Google Sheets calculations; instead, our software effortlessly links with all your existing systems, pulls data from multiple sources, and creates a consolidated, final view with actionable insights, detailed visuals, and scenario testing features.

Sales Funnel Revenue Outcomes

End-to-end, a good break-even analysis encompasses many business functions and considers a number of factors. Starting with your sales funnel, your business can get an idea of how much revenue will come in based on a number of different metrics. With Abacum, we seamlessly track and display many important metrics, so you know you’re getting the information you need every time.

Depending on your business, some of these line items may include:

- Beginning of Period ARR

- New ARR from Sales

- Contraction ARR

- Pipeline Opportunities Weighted by Stage

Of course, with each of these items, businesses can click into the transaction-level detail behind them, revealing the supporting data. Abacum pulls the information from your ERPs, CRMs, and other systems, ensuring all summary views are cohesive and accurate.

Having a strong understanding of your sales funnel leads directly to better revenue predictions, improved spending management, and the best business results. Getting a read on your break-even point starts with sales and marketing, even if the formula doesn’t showcase them directly.

Fixed & Variable Costs

If a business owner needs to adjust their break-even point, one of the most effective ways to do so is by reducing costs associated with the curation of the goods or services their business offers to its customers. Considering total fixed costs and total variable costs can shed light on areas of opportunity to cut spending, but this process also illustrates which costs should be increased due to their impact on sales, and therefore, revenue.

Fixed costs can be a bit more difficult to adjust because they include things like the office space lease and business insurance. Although these costs are critical to doing business, the cost-per-unit actually goes down when production shoots up.

Total variable costs, on the other hand, fluctuate with production levels. If you make more units, you’re going to spend more on direct labor, raw materials, and shipping. Finding bulk discounts with suppliers, hiring the right people at the right price, and optimizing certain processes are all ways to reduce variable costs.

Abacum & Excel

As FP&A professionals ourselves, the team at Abacum knows just how integral apps like Microsoft Excel and Google Sheets are in business today. For decades, these tools have paved the way when it comes to financial analytics, with VBA code, macros, and other advanced features changing our finance teams operated many years ago.

We don’t expect these tools to go away or leave finance ecosystems entirely, but in today’s reality, they should funnel into software tools, like Abacum, with more processing power and better analytical capabilities. Abacum can easily connect with your existing business systems, including more traditional business platforms like Excel.

With tools that are more manual, like Excel and Google Sheets, updating a file with multiple calculations can take a devastating amount of time away from value-add activities. Something that seems as simple as downloading raw data, inputting it into the file, and refreshing the file for a new month can end up taking hours depending on the size of the data set and the complexity of the file. Adopting a tool that does that all automatically pays dividends by saving your employees time when they need it most.

Bringing it Together with Abacum

Abacum’s offerings when it comes to overall revenue management, sales funnel management, cost adjustments, and break-even analytics is unparalleled by other products on the market. We built a holistic, comprehensive tool that allows users to slice and dice data from nearly-endless sources until their business picture is complete.

We’re committed to helping you usher in a new era of financial analytics; everything from marketing campaign tracking to break-even analysis to sales reporting can be done in Abacum. When cross-functional collaboration is as easy as it is with our platform, every strategic business plan on the table becomes easier to reach and exceed.

Break-Even Analysis FAQ

How do i prepare the break-even analysis template.

When using Abacum, preparing a break-even analysis template goes from being a clunky, manual process to a streamlined, often automated undertaking. All you need to do is make adjustments to system mappings, ensure all the necessary financial data is being processed in the template, and, voila, your break-even analysis template will populate automatically.

How to calculate my break-even point?

The formula for an organization’s break-even point is: Break-Even Point = Fixed Costs / (Price – Variable Costs). Use this to factor in all the funds that are coming in from the sale of your goods or services, along with the costs incurred in production and business operations, and you’ll be able to understand your break-even point.

Why is break-even analysis important?

Break-even analysis highlights the exact point that your business expects to cover all costs with revenue. In theory, any sales made beyond the break-even point indicate positive revenue numbers and a healthy business.

This metric is utilized throughout the life of a business; new product releases, startup funding rounds, and so much more lean on break-even analysis to paint a complete financial picture.

How to write a break-even analysis in a business plan?

If you’re in the business planning stage, it can be challenging to figure out the numbers behind sales funnels and operating costs, but it can be done. Use industry estimates to get an approximate picture that is as accurate as possible.

In your business plan, directly call out all the inputs you are using for each component of this analysis to show the legitimacy of your calculation.

Does Excel have a break-even analysis template?

Although Excel doesn’t have a built-in break-even analysis template, it is possible to build your own within the tool. Or, if you prefer, some websites offer free downloads of existing templates that can be utilized within Excel. To skip the hassle altogether, using a SaaS solution such as Abacum can bypass time-consuming template building and allow your FP&A team to get straight to analytics, business partnering, and advancing your organization’s financial goals.

Discover Abacum

Abacum makes break-even analysis easy with templates, know how

Related Templates

Fp&a approved: profit and loss (p&l) statement template.

Learn more ->

This FP&A Approved Cash Flow Statement Template Helps Protect Your Company’s Cash

This financial projections template is upleveling fp&a outcomes, eager to transform your strategic finance team.

Break Even Analysis

A startup business will utilize a Break Even Analysis to calculate whether or not it would be financially viable to produce and sell a new product or pursue a new venture. This analysis is a common tool used in a solid business plan . The formulas for the break even point are relatively simple, but it can be difficult coming up with the projected sales , selecting the right sale price , and calculating the fixed and variable costs . While these tasks are still the responsibility of the business owner, our Break Even Calculator can help you run and report the analysis.

In addition to the spreadsheet, this page explains the formulas used in a break-even analysis. If you are more worried about your budget than your time, you can use the formulas and explanation below the template to create your own spreadsheet from scratch.

Break Even Analysis Calculator

60-day money-back guarantee.

License : Private Use (not for distribution or resale)

"No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

Description

The Break Even Point is usually either the number of units you have to sell or the dollar amount of sales required to cover your costs. It may also be defined as (1) the point at which an investment will start generating a positive return or (2) the point at which total costs = total revenue. A break-even analysis can also be used to calculate the Payback Period , or the amount of time required to break even.

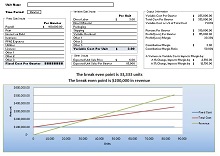

Our Break-Even Analysis Calculator is a simple spreadsheet that contains 3 separate worksheets to solve for either (1) Break-Even Units, (2) Break-Even Price, or (3) Payback Period. All of these scenarios are just different ways of manipulating the basic breakeven equation, explained in detail below.

In addition to the Break-Even Point, the worksheets also solve for the number of units or the price to reach a target Net Income Before Taxes (NIBT).

Bonus : Break-Even Analysis for Multiple Products

Calculate the break-even units (X) and break-even sales (S) for multiple products by defining a Sales Mix and assuming it to be constant over time. (See the screenshot on the left).

This version of the break even calculator is included as a separate download when you purchase the above spreadsheet.

Solving Break-Even Analysis Problems

The formula used to calculate a breakeven point (BEP) is based on the linear Cost-Volume-Profit (CVP) Model [1] which is a practical tool for simplified calculations and short-term projections. See reference [1] for more information about this model, and especially the discussion about the assumptions. All the different types of break-even analyses are based on the following basic equation:

Break-Even Equation

The variables and definitions used in the break-even equation are listed below.

- P = Selling Price per unit

- V = Variable Cost per unit.

- X = Number of Units Produced and Sold

- TR = Total Revenue = P * X

- TC = Total Costs = TFC + TVC

- TFC = Total Fixed Costs

- TVC = Total Variable Costs = V * X

- P-V = Contribution Margin per unit (CM)

- CMR = Contribution Margin Ratio = (P - V) / P

Payback Period

The Payback Period is the time it will take to break even on your investment . In break-even analyses in which are are solving for the break-even price or number of sales, the payback period is defined ahead of time. Depending on rate of change in your market, this may be a few months or a few years. Or, if you are just starting a business, your bank may want to see evidence that you will start making a profit after 18 months, or some other period.

Sales Price

One of the assumptions of the linear CVP model is that the Sales Price per unit (P) remains constant. So, the total revenue (TR) is just the price (P) multiplied by number of units sold (X). However, prices typically decrease with increasing demand, so be aware that the linear CVP model is a simplification.

Variable Costs

Variable costs include the production, direct labor, materials, and other expenses which depend on the number of units produced and sold. On financial statements , like an income statement , Cost of Goods Sold (COGS) is a variable cost. Some variable costs may be percentage-based (like commissions) while others may be dollar-based (like material costs).

Example : If you are selling software online, the payment processing service might charge $1 plus 7.5% of the sale price. If the sale price was $14.00, then the Variable Cost per unit (V) would be 1+(0.075*P) = $2.05. In the break-even calculator, you can split the cost between the percentage-based and dollar-based categories.

Direct Labor : Let's say that every 100 sales requires 8 hours of technical support over the life of the products. If the labor cost (including payroll taxes) is $20/hr, then the Variable Cost per unit (V) would be V = (8*$20)/100 = $1.60 per unit.

The linear CVP model assumes that the Variable Cost per Unit (V) is constant over the specified Period. You should be aware that this is a simplification. For example, when labor is involved in production, productivity can have a significant effect (see ref [1]).

Fixed Costs

Fixed costs are those which are assumed to be constant during the specified payback period and which do not depend on the number of units produced. Advertising, insurance, real estate taxes, rent, accounting fees, and supplies would all be examples of fixed costs. Fixed costs also include salaries and payroll taxes for non-direct labor such as administrative assistants and managers, or in other words, the payroll not included as variable costs.

In reality, increasing production may also increase the expenses that are listed as "fixed costs" because they increase as the business grows and hires new employees. After you run the break-even analysis, and especially if you use the CVP model to calculate sales required to reach a target profit, you should revisit your cost analysis to ensure that the costs match the level of production and sales required to reach your goals.

Break Even Chart

The spreadsheet includes a break-even chart like the one shown below, which shows the Break-Even Point (BEP) as the intersection between the Total Revenue and Total Cost when plotted with the number of units on the x-axis. The Profit (or Loss) is also shown on the chart as Total Revenue - Total Cost.

Formula to Calculate the Break-Even Point

You can find the basic breakeven point formula all over the place, and the formula that is most often given is for calculating the "Break Even Units", or the number of units that you'll have to sell to cover costs. Actually, there are many ways to define the break even point. You may want to solve for the total dollar sales to break even, what price you'll have to charge to break even. You may also want to calculate how long it will take you to break even, which is officially called the payback period .

Break-Even Units

The following formula is for calculating the number of units (X) you will have to sell over the specified period of time.

If you want to solve for the number of units required to reach a targeted Net Income Before Taxes (NIBT), then substitute (TFC+NIBT) for TFC in the above equation.

Break-Even Sales

The break-even sales amount (S) is just the total revenue (TR) at the break-even point , which can be calculated as S = X × P. The following formula, derived from TR = X × P is another way to calculate the break-even sales amount.

The value (1 - V / P) is known as the Contribution Margin Ratio (CMR), which is basically just the percentage of revenue earned for each unit sale after subtracting out the variable costs:

Break-Even Price

To solve for the price, you can use the Goal Seek tool in Excel to set X to a certain value by changing the price.

The formula for solving for the break-even price requires you to break down the variable costs into dollar-based and percentage-based costs:

- V = Vd + (Vp × P) = Variable Costs per unit

- Vd = Total Dollar-Based costs per unit

- Vp × P = Total Percentage-Based costs per unit

The following formula is used to solve for the sale price (P) required to break-even if you produce and sell X units during the specified payback period.

If you want to solve for the price required to reach a targeted net income before taxes (NIBT), then substitute (TFC + NIBT) for TFC in the above equation.

For very simple sales scenarios, the CPV model can be used to solve for the Payback Period, or the number of months required to break even. Like the other formulas, we start with TR = TC. Both the revenue and the costs may depend on time so we have to define a few new terms.

To calculate the payback period, the number of units sold (X) is specified as a number of units per month. The fixed costs are broken down further into Start-up Costs (SC) and Recurring Fixed Costs (RC). Start-Up Costs are the costs required to develop the product, or create the very first product. Recurring Fixed Costs are those which are paid monthly or annually but which are not directly tied to the number of units sold, like web-hosting fees, monthly advertising expenses, insurance premiums, etc.

- t = Payback Period in months

- TFC = SC + (RC × t)

- TVC = V × x × t

- SC = Total Start-up Costs

- RC = Recurring Costs per month

- x = Number of units sold per month = X / t

Example: The selling price for an iPhone application is P=$1.99 and I expect to sell x=450 units per month. The development cost of the application is SC=$7,500 and my recurring monthly fees for advertising and web hosting come to RC=$65.00/month. I am charged a commission of Vp=30% to sell the app from iTunes. Result: The break-even spreadsheet calculates the payback period to be 13.35 months, which I'd round up to 14 months (because fractional recurring costs don't make sense in this case).

Important: This calculation should only be used as a rough estimate. It does not take into account the time value of money, risk, interest, financing, opportunity costs, etc. The financial formulas NPV and IRR are usually better for calculating the return on an investment.

References and Resources

- [1] Management Accounting: Concepts, Techniques & Controversial Issues by James R. Martin, Chapter 11.

- Break-Even Period for Paying Points on a Mortgage at decisionaide.com - An interesting calculator I wish I had seen a while ago.

- Cost-Volume-Profit Analysis at wikipedia.com - Some nomenclature.

- How to Do a Breakeven Analysis at about.com

Reference this Page

Follow us on ..., related templates.

Financial Statements

Finance articles.

Download our FREE BREAK EVEN ANALYSIS TEMPLATES

For small businesses and freelancers.

Our free break even analysis templates help you to determine your break even point

DOWNLOAD YOUR FREE BREAK EVEN ANALYSIS TEMPLATE HERE:

Break Even Analysis 1

- File format: .xls

- After entering various fixed and variable costs to produce your product you will need to enter the sales price. The template then calculates the break even point.

- DOWNLOAD NOW

Break Even Analysis 2

- File format: .xlsx

- This template is more advanced and asks you to enter a number of business-related expenses and the sales price of your products. It then calculates the break even point and produces a graph too.

Break Even Analysis 3

- This Excel sheet is very simple and straight-forward. Simply enter three numbers and get a break even analysis graph as result.

How to use a break-even analysis for your small business

A break-even analysis (or break-even point) is a calculation that determines how much of a good or service needs to be sold in order to cover the total fixed costs. It examines the margin of safety for a business based on the revenues earned from the normal business activities. The break-even analysis determines the level of sales that the business must have, but it is a document intended only for internal usage. Therefore, it is not recommended to be provided to investors, regulators, and other financial institutions. In a break-even analysis, the business owner will look at the fixed costs of the good or service relative to the profit that each additional good or unit of service will earn. If your business has lower fixed costs, you will have a lower break-even point of sale. For example, if your fixed costs come to $5, then you will break even if your product sells for at least that amount. However, the break-even analysis does not take into account the variable costs that are incurred for every good or unit of service sold. Therefore, while a $5 sales price in the example above will allow your product or service to break-even, your variable costs will still need to be taken into account. When we talk about the break-even analysis, we�re also dealing with the contribution margin. This margin is the difference between the price that the product is being sold for and the variable costs. Therefore, if the total fixed costs for the product are $5 per product and the total variable costs are $12, and the product is sold for $30, the contribution margin will be $18 and the net profit will be $13. You can calculate your break-even point analysis in one of two ways: units or dollars/sales. For break-even analysis in units, you would simply divide your fixed costs by the sales per unit minus the variable cost per unit. It would look like this: Break-even analysis in units = fixed costs / (sales price per unit � variable cost per unit) For break-even analysis in dollars or sales amount, you will simply multiply the sales price per unit by the break-even analysis in units. It would look like this: Break-even analysis in $ = sales price per unit x break-even analysis in units With these calculations, you�ll be able to know when exactly your company will turn a profit. After all, having great revenues is great, but without the additional knowledge of what your costs are, you may be making lower profits than you think. Therefore, the break-even analysis will tell you that point when your business is becoming profitable.

CHECK OUT OUR OTHER FREE TEMPLATES HERE:

Log in to your account.

Your email:

Forgot password?

New to InvoiceBerry? Sign up now

New to InvoiceBerry?

Sign up and start sending invoices now!

Don't worry, we won't post anything without your permission.

Choose password:

Already have an account? Log in

Forgot password

Please enter your email address and we'll send you a new password for your account

Back to login

10 Break Even Analysis Templates For Small Business

Started a business and need to analyze at what point your business will be able to earn all the money it has invested?

Break-even analysis templates can help you in understanding how to perform a break-even analysis which can assist you in doing the same for your venture.

In this article, we’ve researched and collected the best Break Even Analysis Templates to help you streamline your Break-Even Analysis process.

Here they are:

1. Simple Break Even Analysis Template

This simple break even analysis template is an Excel template which takes into account your fixed costs and variable costs to determine the total amount of sales required to break even ( source )

See a preview of this template:

2. Blank Break Even Analysis Template

This is a blank break even analysis template which you can make use of to forecast the amount of sales that will be required to be done by your company to break even. ( source )

3. Finance Director Break Even Analysis Template

This break-even analysis template can help determine the pricing of the goods to be retailed to break even by considering various costs like employee salaries, marketing expenses, etc. ( source )

4. Pricing and Break-even Analysis Example Template

This break-even analysis template can help you graphically represent how breaking even for your company will be affected by altering the pricing of the goods and services you provide. ( source )

5. Break Even Analysis Chart Template

This break-even analysis chart template is a ready-to-use template in Excel. It is very simple and straightforward. Simply enter three numbers and get a break-even analysis graph as result. ( source )

6. Boulder Break Even Analysis Template

The Boulder break-even template is more advanced and asks you to enter various business-related expenses and the sales price of your products. It then calculates the break-even point. ( source )

7. Breakeven Analysis Data Template

This accessible breakeven analysis template helps you calculate how much you need to sell before you begin to make a profit. It is easy to customize. ( source )

8. Harvard Business School Break-Even Analysis

This Harvard Business School Break-even analysis helps you determine the total sales amount. It is easy to customize. ( source )

9. Monthly Breakeven Analysis Template

This monthly break-even analysis can record monthly sales and pricing of goods. It can easily be downloaded and saves time in calculating the amount. ( source )

10. Breakeven Sales Value Calculation Template

This Breakeven Sales Value Calculation Template can be used to calculate the cost and sales of goods. The calculations of break-even analysis are essential to investors for their primary concern is to make a profit. ( source )

- 4,818 founder case studies

- Access to our founder directory

- Live events, courses and recordings

- 8,628 business ideas

- $1M in software savings

I'm Pat Walls and I created Starter Story - a website dedicated to helping people start businesses. We interview entrepreneurs from around the world about how they started and grew their businesses.

Join our free newsletter to get unlimited access to all startup data. We just need your email:

Check your email

If there's a Starter Story account associated with that email you'll get an email with a link to automatically log in. The link will expire in 15 minutes.

Your existing password still works, should you want to log in with it later.

With Starter Story, you can see exactly how online businesses get to millions in revenue.

Dive into our database of 4,418 case studies & join our community of thousands of successful founders.

Join our free newsletter to get access now. We just need your email:

Break-Even Analysis Template for Excel

Comprehensive Break-Even Analysis for Optimal Profitability

Adapt the template to your unique business needs, enhance financial planning and forecasting, identify areas for improvement and growth, download our break-even analysis template today, invest in your business's financial success, features used, more professionally-designed templates to use.

Privacy Policy

Legal documentation

Try it in your Excel. For free.

" * " indicates required fields

What Is Break-Even Analysis and How to Calculate It for Your Business?

You may have an idea that spurs you to open a business or launch a new product on little more than a hope and a dream. Or, you might just be thinking about expanding a product offering or hiring additional personnel. It’s wise, however, to limit your risk before jumping in. A break-even analysis will reveal the point at which your endeavor will become profitable—so you can know where you’re headed before you invest your money and time.

A break-even analysis will provide fodder for considerations such as price and cost adjustments. It can tell you whether you may need to borrow money to keep your business afloat until you’re pocketing profits, or whether the endeavor is worth pursuing at all.

What Is Break-Even Analysis?

A break-even analysis is a financial calculation that weighs the costs of a new business, service or product against the unit sell price to determine the point at which you will break even. In other words, it reveals the point at which you will have sold enough units to cover all of your costs. At that point, you will have neither lost money nor made a profit.

Key Takeaways

- A break-even analysis reveals when your investment is returned dollar for dollar, no more and no less, so that you have neither gained nor lost money on the venture.

- A break-even analysis is a financial calculation used to determine a company’s break-even point (BEP). In general, lower fixed costs lead to a lower break-even point.

- A business will want to use a break-even analysis anytime it considers adding costs—remember that a break-even analysis does not consider market demand.

- There are two basic ways to lower your break-even point: lower costs and raise prices.

How Break-Even Analysis Works

A break-even analysis is a financial calculation used to determine a company’s break-even point (BEP). It is an internal management tool, not a computation, that is normally shared with outsiders such as investors or regulators. However, financial institutions may ask for it as part of your financial projections on a bank loan application.

The formula takes into account both fixed and variable costs relative to unit price and profit. Fixed costs are those that remain the same no matter how much product or service is sold. Examples of fixed costs include facility rent or mortgage, equipment costs, salaries, interest paid on capital, property taxes and insurance premiums.

Variable costs rise and fall according to changes in sales. Examples of variable costs include direct hourly labor payroll costs, sales commissions and costs for raw material, utilities and shipping. Variable costs are the sum of the labor and material costs it takes to produce one unit of your product.

Total variable cost is calculated by multiplying the cost to produce one unit by the number of units you produced. For example, if it costs $10 to produce one unit and you made 30 of them, then the total variable cost would be 10 x 30 = $300.

What is Contribution Margin?

The contribution margin is the difference (more than zero) between the product’s selling price and its total variable cost. For example, if a suitcase sells at $125 and its variable cost is $15, then the contribution margin is $110. This margin contributes to offsetting fixed costs.

Unit Contribution Margin = Sales Price – Variable Costs

The average variable cost is calculated as your total variable cost divided by the number of units produced.

In general, lower fixed costs lead to a lower break-even point—but only if variable costs are not higher than sales revenue.

Why Does Your Business Need to Perform Break-Even Analysis?

A break-even analysis has broad uses on its own merit. But it’s also a critical element of financial projections for startups and new or expanded product lines. Use it to determine how much seed money or startup capital you’ll need, and whether you’ll need a bank loan.

More mature businesses use break-even analyses to evaluate their risks in a variety of activities such as moving innovative ideas to production, adding or deleting products from the product mix and other scenarios. One example is in budgeting the addition of a new employee. A break-even analysis will reveal how many additional sales it will take to break even on expenses associated with the new hire.

What Is a Standard Break-Even Time Period?

An acceptable break-even window is six to 18 months. If your calculation determines a break-even point will take longer to reach, you likely need to change your plan to reduce costs, increase pricing or both. A break-even point more than 18 months in the future is a strong risk signal.

When to Use a Break-Even Analysis

Basically, a business will want to use a break-even analysis anytime it considers adding costs. These additional costs could come from starting a business, a merger or acquisition, adding or deleting products from the product mix, or adding locations or employees.

In other words, you should use a break-even analysis to determine the risk and value of any business investment, especially when one of these three events occurs:

1. Expanding a business

Break-even points (BEP) will help business owners/CFOs get a reality check on how long it will take an investment to become profitable. For example, calculating or modeling the minimum sales required to cover the costs of a new location or entering a new market.

2. Lowering pricing

Sometime businesses need to lower their pricing strategy to beat competitors in a specific market segment or product. So, when lowering pricing, businesses need to figure out how many more units they need to sell to offset or makeup a price decrease.

3. Narrowing down business scenarios

When making changes to the business, there are various scenarios and what-ifs on the table that complicate decisions about which scenario to go with. BEP will help business leaders reduce decision-making to a series of yes or no questions.

How Do You Calculate the Break-Even Point?

ERP and accounting software with managerial accounting features will typically calculate your BEP for you, but you may want to understand what goes into that equation.

Break-even analysis formula

Break-even quantity = Fixed costs / (Sales price per unit – Variable cost per unit)

You can also use our break-even analysis template.

Use Our Break-Even Analysis Template

Find your break-even point by using this break-even analysis template, customizable to your business.

Get the template

Break-even analysis example

Beth has dreams of opening a gourmet cupcake store. She does a break-even analysis to determine how many cupcakes she’ll have to sell to break even on her investment. She’s done the math, so she knows her fixed costs for one year are $10,000 and her variable cost per unit is $.50. She’s done a competitor study and some other calculations and determined her unit price to be $6.00.

$10,000 / ($6 – $0.50) = 1,819 cupcakes that Beth must sell in one year to break even

The Limitations of a Break-Even Analysis

The most important thing to remember is that break-even analysis does not consider market demand. Knowing that you need to sell 500 units to break even does not tell you if or when you can sell those 500 units. Don’t let your passion for the business idea or new product cause you to lose sight of that basic truth.

On the flip side, you’ll need to decide how much effort and time you’re willing to expend to reach the break-even point. For example, are you willing to invest a substantial percentage of your sales team’s time and effort over several months to reach the break-even point? Or, is producing and selling something else a better and more profitable use of time and effort?

If you find demand for the product is soft, consider changing your pricing strategy to move product faster. However, discounted pricing can actually raise your break-even point. If you’re not careful, you’ll move product faster at the lower price but will incur more variable costs to produce more units in order to reach your break-even point.

Plan & Forecast More Accurately

How to Lower Your Break-Even Point

There are two basic ways to lower your break-even point: lower costs and raise prices. But neither should be done in a vacuum. Weigh your options carefully in pricing methods and consumer psychology to make sure you don’t sell more product but lose money in the bargain.

Further, consider all elements of costs, such as the associated quality and delivery, before slashing them to prevent damage to your brand. Outsourcing products or service can also reduce costs when demand or volume increase.

Financial Management

Cash Flow Analysis: Basics, Benefits and How to Do It

Cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period. Cash on hand determines a company’s runway—the more cash on hand and the lower…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Break Even Analysis Template

Identify fixed costs, identify variable costs per unit, calculate total variable costs, identify sales price per unit, calculate total sales, perform basic break-even analysis, prepare initial break-even analysis report, approval: financial analyst for initial break-even analysis.

- Prepare initial break-even analysis report Will be submitted

Incorporate feedback from Financial Analyst

Perform refined break-even analysis, prepare final break-even analysis report, review key assumptions and sensitivities, approval: manager for key assumptions and sensitivities.

- Review key assumptions and sensitivities Will be submitted

Incorporate feedback from Manager

Perform final break-even analysis with considered sensitivities, prepare final break-even analysis presentation, approval: senior manager for final break-even analysis presentation.

- Prepare final break-even analysis presentation Will be submitted

Address final queries from Senior Manager

Finalize break-even analysis template, take control of your workflows today., more templates like this.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Download Break-Even Analysis Excel Template