Please upgrade your browser

E*TRADE uses features that may not be supported by your current browser and might not work as intended. For the best user experience, please use an updated browser .

Understanding assignment risk in Level 3 and 4 options strategies

E*TRADE from Morgan Stanley

With all options strategies that contain a short option position, an investor or trader needs to keep in mind the consequences of having that option assigned , either at expiration or early (i.e., prior to expiration). Remember that, in principle, with American-style options a short position can be assigned to you at any time. On this page, we’ll run through the results and possible responses for various scenarios where a trader may be left with a short position following an assignment.

Before we look at specifics, here’s an important note about risk related to out-of-the-money options: Normally, you would not receive an assignment on an option that expires out of the money. However, even if a short position appears to be out of the money, it might still be assigned to you if the stock were to move against you just prior to expiration or in extended aftermarket or weekend trading hours. The only way to eliminate this risk is to buy-to-close the short option.

- Short (naked) calls

Credit call spreads

Credit put spreads, debit call spreads, debit put spreads.

- When all legs are in-the-money or all are out-of-the-money at expiration

Another important note : In any case where you close out an options position, the standard contract fee (commission) will be charged unless the trade qualifies for the E*TRADE Dime Buyback Program . There is no contract fee or commission when an option is assigned to you.

Short (naked) call

If you experience an early assignment.

An early assignment is most likely to happen if the call option is deep in the money and the stock’s ex-dividend date is close to the option expiration date.

If your account does not hold the shares needed to cover the obligation, an early assignment would create a short stock position in your account. This may incur borrowing fees and make you responsible for any dividend payments.

Also note that if you hold a short call on a stock that has a dividend payment coming in the near future, you may be responsible for paying the dividend even if you close the position before it expires.

An early assignment generally happens when the put option is deep in the money and the underlying stock does not have an ex-dividend date between the current time and the expiration of the option.

Short call + long call

(The same principles apply to both two-leg and four-leg strategies)

This would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short and simultaneously sell the long leg of the spread.

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date, because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

Short put + long put

Early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

However, the long put still functions to cover the position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

Here's a call example

- Let’s say that you’re short a 100 call and long a 110 call on XYZ stock; both legs are in-the-money.

- You receive an assignment notification on your short 100 call, meaning you sell 100 shares of XYZ stock at 100. Now, you have $10,000 in short stock proceeds, your account is short 100 shares of stock, and you still hold the long 110 call.

- Exercise your long 110 call, which would cover the short stock position in your account.

- Or, buy 100 shares of XYZ stock (to cover your short stock position) and sell to close the long 110 call.

Here's a put example:

- Let’s say that you’re short a 105 put and long a 95 put on XYZ stock; the short leg is in-the-money.

- You receive an assignment notification on your short 105 put, meaning you buy 100 shares of XYZ stock at 105. Now, your account has been debited $10,500 for the stock purchase, you hold 100 shares of stock, and you still hold the long 95 put.

- The debit in your account may be subject to margin charges or even a Fed call, but your risk profile has not changed.

- You can sell to close 100 shares of stock and sell to close the long 95 put.

Long call + short call

Debit spreads have the same early assignment risk as credit spreads only if the short leg is in-the-money.

An early assignment would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short share position and simultaneously sell the remaining long leg of the spread.

Long put + short put

An early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

All spreads that have a short leg

(when all legs are in-the-money or all are out-of-the-money)

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

However, the long put still functions to cover the long stock position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

What to read next...

How to buy call options, how to buy put options, potentially protect a stock position against a market drop, looking to expand your financial knowledge.

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Options Exercise, Assignment, and More: A Beginner's Guide

So your trading account has gotten options approval, and you recently made that first trade—say, a long call in XYZ with a strike price of $105. Then expiration day approaches and, at the time, XYZ is trading at $105.30.

Wait. The stock's above the strike. Is that in the money 1 (ITM) or out of the money 2 (OTM)? Do I need to do something? Do I have enough money in my account? Help!

Don't be that trader. The time to learn the mechanics of options expiration is before you make your first trade.

Here's a guide to help you navigate options exercise 3 and assignment 4 —along with a few other basics.

In the money or out of the money?

The buyer ("owner") of an option has the right, but not the obligation, to exercise the option on or before expiration. A call option 5 gives the owner the right to buy the underlying security; a put option 6 gives the owner the right to sell the underlying security.

Conversely, when you sell an option, you may be assigned—at any time regardless of the ITM amount—if the option owner chooses to exercise. The option seller has no control over assignment and no certainty as to when it could happen. Once the assignment notice is delivered, it's too late to close the position and the option seller must fulfill the terms of the options contract:

- A long call exercise results in buying the underlying stock at the strike price.

- A short call assignment results in selling the underlying stock at the strike price.

- A long put exercise results in selling the underlying stock at the strike price.

- A short put assignment results in buying the underlying stock at the strike price.

An option will likely be exercised if it's in the option owner's best interest to do so, meaning it's optimal to take or to close a position in the underlying security at the strike price rather than at the current market price. After the market close on expiration day, ITM options may be automatically exercised, whereas OTM options are not and typically expire worthless (often referred to as being "abandoned"). The table below spells it out.

- If the underlying stock price is...

- ...higher than the strike price

- ...lower than the strike price

- If the underlying stock price is... A long call is... -->

- ...higher than the strike price ...ITM and typically exercised -->

- ...lower than the strike price ...OTM and typically abandoned -->

- If the underlying stock price is... A short call is... -->

- ...higher than the strike price ...ITM and typically assigned -->

- If the underlying stock price is... A long put is... -->

- ...higher than the strike price ...OTM and typically abandoned -->

- ...lower than the strike price ...ITM and typically exercised -->

- If the underlying stock price is... A short put is... -->

- ...lower than the strike price ...ITM and typically assigned -->

The guidelines in the table assume a position is held all the way through expiration. Of course, you typically don't need to do that. And in many cases, the usual strategy is to close out a position ahead of the expiration date. We'll revisit the close-or-hold decision in the next section and look at ways to do that. But assuming you do carry the options position until the end, there are a few things you need to consider:

- Know your specs . Each standard equity options contract controls 100 shares of the underlying stock. That's pretty straightforward. Non-standard options may have different deliverables. Non-standard options can represent a different number of shares, shares of more than one company stock, or underlying shares and cash. Other products—such as index options or options on futures—have different contract specs.

- Stock and options positions will match and close . Suppose you're long 300 shares of XYZ and short one ITM call that's assigned. Because the call is deliverable into 100 shares, you'll be left with 200 shares of XYZ if the option is assigned, plus the cash from selling 100 shares at the strike price.

- It's automatic, for the most part . If an option is ITM by as little as $0.01 at expiration, it will automatically be exercised for the buyer and assigned to a seller. However, there's something called a do not exercise (DNE) request that a long option holder can submit if they want to abandon an option. In such a case, it's possible that a short ITM position might not be assigned. For more, see the note below on pin risk 7 ?

- You'd better have enough cash . If an option on XYZ is exercised or assigned and you are "uncovered" (you don't have an existing long or short position in the underlying security), a long or short position in the underlying stock will replace the options. A long call or short put will result in a long position in XYZ; a short call or long put will result in a short position in XYZ. For long stock positions, you need to have enough cash to cover the purchase or else you'll be issued a margin 8 call, which you must meet by adding funds to your account. But that timeline may be short, and the broker, at its discretion, has the right to liquidate positions in your account to meet a margin call 9 . If exercise or assignment involves taking a short stock position, you need a margin account and sufficient funds in the account to cover the margin requirement.

- Short equity positions are risky business . An uncovered short call or long put, if assigned or exercised, will result in a short stock position. If you're short a stock, you have potentially unlimited risk because there's theoretically no limit to the potential price increase of the underlying stock. There's also no guarantee the brokerage firm can continue to maintain that short position for an unlimited time period. So, if you're a newbie, it's generally inadvisable to carry an options position into expiration if there's a chance you might end up with a short stock position.

A note on pin risk : It's not common, but occasionally a stock settles right on a strike price at expiration. So, if you were short the 105-strike calls and XYZ settled at exactly $105, there would be no automatic assignment, but depending on the actions taken by the option holder, you may or may not be assigned—and you may not be able to trade out of any unwanted positions until the next business day.

But it goes beyond the exact price issue. What if an option is ITM as of the market close, but news comes out after the close (but before the exercise decision deadline) that sends the stock price up or down through the strike price? Remember: The owner of the option could submit a DNE request.

The uncertainty and potential exposure when a stock price and the strike price are the same at expiration is called pin risk. The best way to avoid it is to close the position before expiration.

The decision tree: How to approach expiration

As expiration approaches, you have three choices. Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you.

1. Let the chips fall where they may. Some positions may not require as much maintenance. An options position that's deeply OTM will likely go away on its own, but occasionally an option that's been left for dead springs back to life. If it's a long option, the unexpected turn of events might feel like a windfall; if it's a short option that could've been closed out for a penny or two, you might be kicking yourself for not doing so.

Conversely, you might have a covered call (a short call against long stock), and the strike price was your exit target. For example, if you bought XYZ at $100 and sold the 110-strike call against it, and XYZ rallies to $113, you might be content selling the stock at the $110 strike price to monetize the $10 profit (plus the premium you took in when you sold the call but minus any transaction fees). In that case, you can let assignment happen. But remember, assignment is likely in this scenario, but it is not guaranteed.

2. Close it out . If you've met your objectives for a trade, then it might be time to close it out. Otherwise, you might be exposed to risks that aren't commensurate with any added return potential (like the short option that could've been closed out for next to nothing, then suddenly came back into play). Keep in mind, there is no guarantee that there will be an active market for an options contract, so it is possible to end up stuck and unable to close an options position.

The close-it-out category also includes ITM options that could result in an unwanted long or short stock position or the calling away of a stock you didn't want to part with. And remember to watch the dividend calendar. If you're short a call option near the ex-dividend date of a stock, the position might be a candidate for early exercise. If so, you may want to consider getting out of the option position well in advance—perhaps a week or more.

3. Roll it to something else . Rolling, which is essentially two trades executed as a spread, is the third choice. One leg closes out the existing option; the other leg initiates a new position. For example, suppose you're short a covered call on XYZ at the July 105 strike, the stock is at $103, and the call's about to expire. You could attempt to roll it to the August 105 strike. Or, if your strategy is to sell a call that's $5 OTM, you might roll to the August 108 call. Keep in mind that rolling strategies include multiple contract fees, which may impact any potential return.

The bottom line on options expiration

You don't enter an intersection and then check to see if it's clear. You don't jump out of an airplane and then test the rip cord. So do yourself a favor. Get comfortable with the mechanics of options expiration before making your first trade.

1 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the stock price is above the strike price. A put option is ITM if the stock price is below the strike price. For calls, it's any strike lower than the price of the underlying equity. For puts, it's any strike that's higher.

2 Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

3 An options contract gives the owner the right but not the obligation to buy (in the case of a call) or sell (in the case of a put) the underlying security at the strike price, on or before the option's expiration date. When the owner claims the right (i.e. takes a long or short position in the underlying security) that's known as exercising the option.

4 Assignment happens when someone who is short a call or put is forced to sell (in the case of the call) or buy (in the case of a put) the underlying stock. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise.

5 A call option gives the owner the right, but not the obligation, to buy shares of stock or other underlying asset at the options contract's strike price within a specific time period. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option.

6 Gives the owner the right, but not the obligation, to sell shares of stock or other underlying assets at the options contract's strike price within a specific time period. The put seller is obligated to purchase the underlying security at the strike price if the owner of the put exercises the option.

7 When the stock settles right at the strike price at expiration.

8 Margin is borrowed money that's used to buy stocks or other securities. In margin trading, a brokerage firm lends an account owner a portion of the purchase price (typically 30% to 50% of the total price). The loan in the margin account is collateralized by the stock, and if the value of the stock drops below a certain level, the owner will be asked to deposit marginable securities and/or cash into the account or to sell/close out security positions in the account.

9 A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when a customer exceeds their buying power. Margin calls may be met by depositing funds, selling stock, or depositing securities. Charles Schwab may forcibly liquidate all or part of your account without prior notice, regardless of your intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Today's Options Market Update

Weekly Trader's Outlook

Options Expiration: Definitions, a Checklist, & More

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Investing involves risks, including loss of principal. Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss.

Commissions, taxes, and transaction costs are not included in this discussion but can affect final outcomes and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Short selling is an advanced trading strategy involving potentially unlimited risks and must be done in a margin account. Margin trading increases your level of market risk. For more information, please refer to your account agreement and the Margin Risk Disclosure Statement.

Short Call - At a Glance

Alternative name.

- Uncovered Call

Pre-Requisite Strategy Knowledge

- Short Stock

Legs of Trade

- Sell 1 XYZ call

- Short 10 XYZ January 50 calls for $1.45, less fees and commissions

Rule to Remember

Max potential profit (gain).

- Net Premium Collected

Break-Even Point

- The breakeven point occurs when XYZ stock price is trading equal to the strike price plus the net premium collected.

Max Potential Risk (LOSS)

Ideal outcome.

- XYZ price rises significantly above the strike price plus net premium paid

Margin Requirement

Early assignment risk.

- Equity options in the United States can be exercised on any business day, and the holder of a short options position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment must be considered when entering positions involving short options. Early assignment of options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned.

- The short call strategy has early assignment risk.

- If the stock price is above the strike price of the short call, a decision must be made if early assignment is likely. If you believe assignment is likely and you do not want a short stock position, then appropriate action must be taken. Before assignment occurs, the risk of assignment can be eliminated by: (1) Purchasing the call option to close out your short call position.

- If early assignment of a short call does occur, stock is sold. If you do not own the stock that is to be delivered, then a short stock position is created. If you do not want a short stock position, you can close it out by buying stock in the marketplace. Important consideration : Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position.

- Also, if a short option is assigned it creates a short position which may result in hard to borrow securities lending fees.

- Powered by The Options Institute

Disclaimer: Cboe and Webull are separate and unaffiliated companies. This content is provided by Cboe and does not reflect the official policy or position of Webull. This content is for educational purposes only and is not investment advice or a recommendation or solicitation to buy or sell securities.

- Options Income Mastery

- Accelerator Program

Short Call Options Strategy (Awesome Guide w/ Examples)

Options trading 101 - the ultimate beginners guide to options.

Download The 12,000 Word Guide

Today we’re going to take a detailed look at the short call options strategy.

This is not a strategy that is recommended for beginners due to the unlimited loss potential, so don’t try this strategy until you have at least 12 months experience.

Let’s get started.

What Are Short Call Options?

Maximum loss, maximum gain, breakeven price, payoff diagram, risk of early assignment.

Short call options are also called naked calls due to the fact they are not covered by a position in the underlying stock.

Traders looking at this strategy would be mildly bearish, although it can be trading as an aggressive bearish position by bring the short strike closer to the stock price.

With a short call option, the trader is looking for the stock to stay flat or decline.

The trade can still profit in the case of the stock rising slightly, but that is not the preferred scenario as it could put the trade under pressure and see the trader sitting on unrealized losses and therefore faced with the difficult decision to cut losses or stay in a losing trade.

After placing a short call option trade, the trader has an obligation to sell the stock to the buyer of the option at the agreed price on or before the expiration date.

This would only occur if the call option was assigned by the buyer.

Assignment can occur at any time but is more likely when the stock price is above the strike price and there is little time value left in the call options.

If the stock price stays below the short strike for the duration of the trade, the call option will expire worthless and the option position will be removed from the seller’s account.

While this article is only focused on naked calls, selling a short call is common for investors who already own the stock and are looking to generate additional income. This strategy is known as a covered call .

The maximum loss on the trade is theoretically unlimited as the stock can continue moving higher with no limit.

For this reason, it is not a recommended strategy for beginners.

Some traders will set a stop loss at 1.5 to 2 times the premium received.

However, I’ve seen many cases where overbought stocks have rocketed higher following a positive news announcement.

Stop losses do little help in that situation as the stock blows right through the stop loss level.

The maximum gain for the strategy is limited to the premium received for selling the call option.

When calculating the percentage return, traders can take the premium received divided by the margin requirement.

This can be a little deceptive because the potential loss can be much higher than the margin requirement.

Also, if the stock moves higher, the margin requirements will increase as the position comes under pressure.

The breakeven price for a short call option strategy is the short call strike plus the premium received.

For example, if a stock is trading at $120 and the trader sells a $125 call option for a premium of $2.50, the breakeven price would be $127.50.

Keep in mind that is the breakeven price at expiry.

The trade could be in a loss position at much lower levels if the stock moves higher early in the trade.

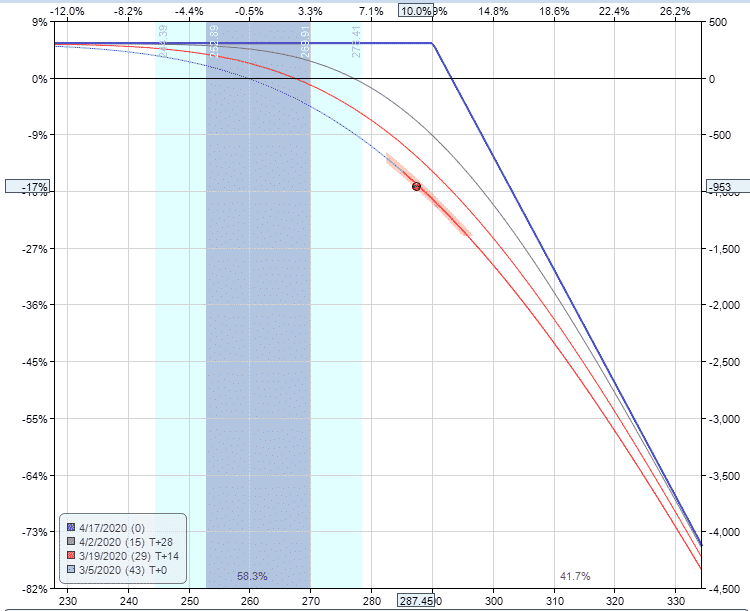

Short calls have a similar shaped payoff diagram to a long put.

Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium.

Above the breakeven price, losses accrue on a one to one basis with a move higher in the stock price.

The T+0 line in the payoff diagram below show that losses can occur at prices lower than the breakeven price on interim dates.

There is always a risk of early assignment when having a short option position in an individual stock or ETF.

You can mitigate this risk by trading Index options , but they are more expensive.

Usually early assignment only occurs on call options when there is an upcoming dividend payment and / or if there is very little time premium left.

Traders will exercise the call in order to take ownership of the stock before the ex-date and receive the dividend.

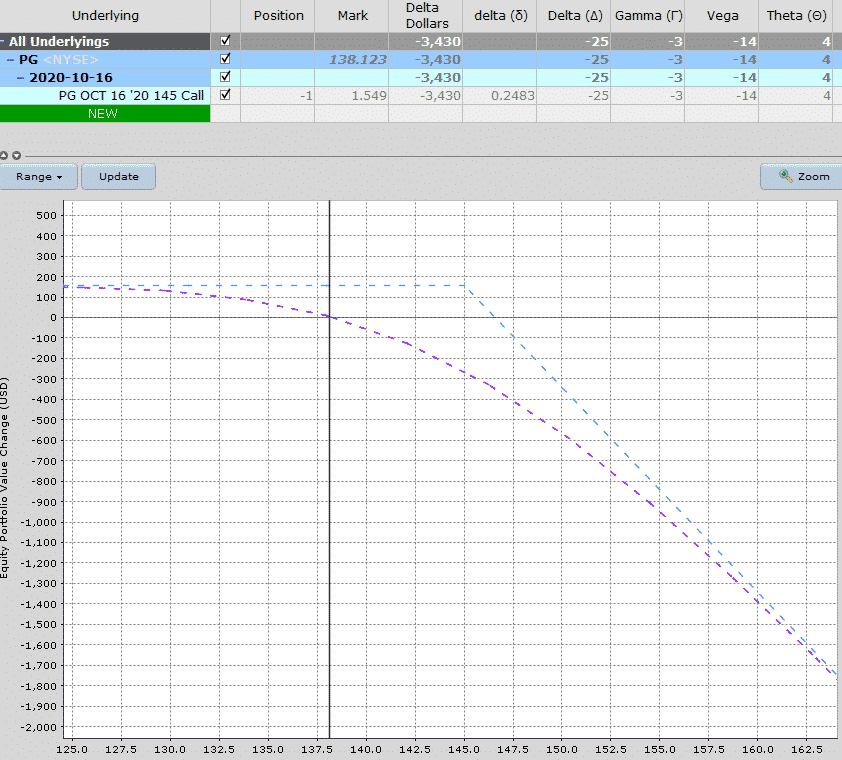

Short calls have negative delta, negative gamma, negative vega and positive theta.

As a negative delta trade, the ideal scenario for the trader is a drop in the stock price. Delta is going to be the main driver of the trade as far as the greeks are concerned.

The closer the trade is placed to the stock price, the higher the negative delta will be.

Aggressively bearish traders would place the short strike closer to the money which would provide a larger negative delta exposure and generate a higher option premium.

Less bearish traders might place the trade further away from the stock price giving them less delta exposure but also reducing the amount of premium received.

In the PG example above, the trade has a delta of -25 which is an equivalent exposure to being short 25 shares.

The delta will change as the trade progress due changes in the stock price and the other greeks.

Short calls are negative gamma which means the delta exposure will become more negative as the stock rises.

This has the effect of losses starting to “snowball” as the stock rises.

For this reason, it’s important to cut losses or hedge earlier rather than later.

The PG short call example has gamma of -3 meaning that for every $1 change in the underlying stock price, the delta will change by 3.

Vega is the greek that measures a position’s exposure to changes in implied volatility . If a position has negative vega overall, it will benefit from falling volatility.

Negative vega on a short call strategy means the position will benefit from a decrease in implied volatility after placing the trade.

If the stock stays flat and implied volatility drops, the trade will start to be in a profitable position.

The PG short call strategy has vega of -14 meaning that for every 1% change in implied volatility, the P&L on the position will change by +/- $14.

Short call options are a positive theta trade meaning that they will benefit from time passing.

This is also known as time decay .

The PG trade has theta of 4 meaning that the trade will make $4 per day from time decay with all else being equal.

It goes without saying that as a bearish trade, there is a risk that the price of the underlying will rise causing an unrealized loss, or a realized loss if we close the trade.

Some other risks associated with short call options:

ASSIGNMENT RISK

We talked about this already so won’t go into to much detail here and while this doesn’t happen often it can theoretically happen at any point during the trade. The risk is most acute when a stock trades ex-dividend.

If the stock is trading well below the sold call, the risk of assignment is very low. E.g. a trader would generally not exercise his right to buy PG at $145 when PG is trading at $138 purely to receive a $0.50 dividend.

The risk is highest if the stock is trading ex-dividend and the short call is in the money.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early.

However, this should not be the primary factor when determining which underlying instrument to trade.

Otherwise, think about closing your short call option before the ex-dividend date if it is in-the-money.

EXPIRATION RISK

Leading into expiration, if the stock is trading just above or just below the short call, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the spread and hope that the stock drops and stays below the short call, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

VOLATILITY RISK

As mentioned on the section on the greeks, this is a negative vega strategy meaning the position benefits from a fall in implied volatility .

If volatility rises after trade initiation, the position will likely suffer losses.

Let’s look at an example trade:

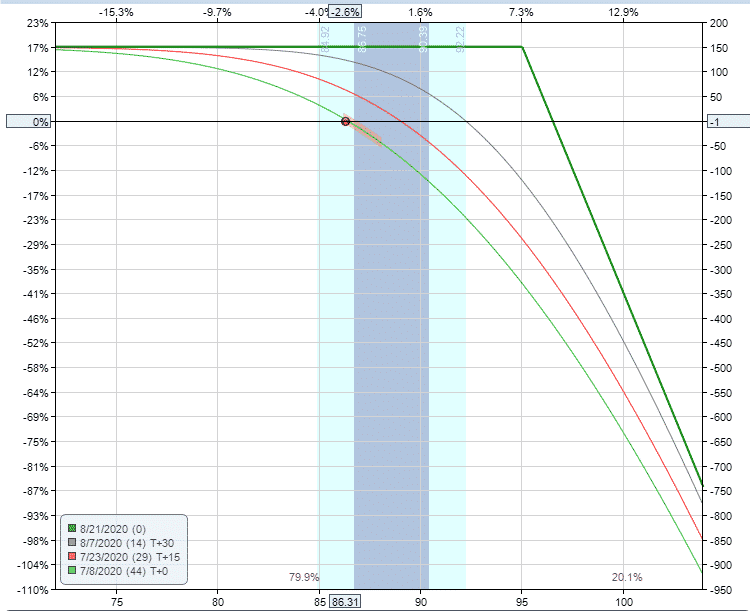

CVX SHORT CALL

Date: July 7, 2020

Current Price: $86.31

Trade Set Up:

Sell 1 CVX Aug 21st, 95 call @ $1.51

Premium: $151 Net credit

Capital (Margin) Requirement: $864

Return Potential: 17.48%

Annualized Return Potential: 141.78%

The trade was never under pressure and expired for a full profit.

Let’s also look at an example of a losing trade to illustrate what can go wrong.

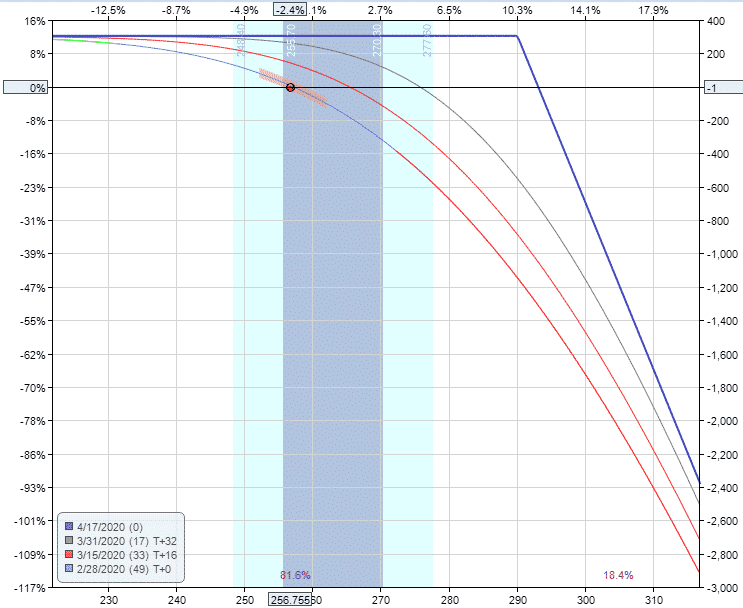

UNH SHORT CALL

Date: February 27, 2020

Current Price: $256.76

Sell 1 UNH Apr 17 th , 290 call @ $3.06

Premium: $306 Net credit

Capital Requirement: $2,568

Return Potential: 11.92%

Annualized Return Potential: 86.99%

This trade did not work at all and within a few days the trade was down $950. A good example of what can go wrong.

The margin requirement had also blown out to $5,495 which is an important consideration to keep in mind when trading short calls.

Short call options are a risky strategy due to the unlimited loss potential, so they are not recommended for beginners.

Traders employing this strategy are looking for the stock to decline, stay flat, or not rise by too much.

The profit is limited to the premium received.

Aggressively bearish traders might place the short call closer to the money in order to obtain a larger negative delta exposure and higher premium received.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice . The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Like it? Share it!

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Closed my Oct BB (a few moments ago) for 34% profit…that is the best of the 3 BBs I traded since Gav taught us the strategy…so, the next coffee or beer on me, Gav 🙂

FEATURED ARTICLES

Small Account Option Strategies

The Ultimate Guide To Implied Volatility

What Is A Calendar Spread?

3,500 word guide.

Everything You Need To Know About Butterfly Spreads

Iron Condors: The Complete Guide With Examples and Strategies

Help Center & Support

How can we help you today, short options assigned before expiration (early assignment).

Whenever you trade long (debit) or short (credit) equity options spread, the short leg can be assigned at any time. Why is this? Well, equity options, for the most part, are American-style. That's not because they trade on American exchanges, but rather, the method in which the owner of the option can choose to exercise their long option, which results in an assignment if you were short the option.

Behind every open options contract is a buyer (long holder) and seller (short holder). When the holder of a long option submits an exercise request with their broker, the request will go to the Options Clearing Corporation (OCC), and they will randomly select a broker with an account holding the short side of the corresponding options contract. The OCC refers to random options assignment process as the "Assignment Wheel." The "wheel" refers to the random account selection process after an exercise request. The short options holder will see the resulting position after the OCC randomly selects the broker and locates the account with the corresponding short position.

According to the Options Clearing Corporation, (long) options holders only exercise about 7%* of options. Particular market situations and periods could cause investors with short options to be part of that statistic and experience heightened assignment risk. As mentioned earlier, early assignment risk only applies to American-style options (equity options). All in all, it's essential to understand that assignment is random, and investors holding any short options contract will not know the intention of why a long holder exercises their long options position .

Divndend Risk

Investors short any options strategy with a short call contract on a dividend-paying stock is subject to dividend risk, which means the investor may owe the dividend if assigned short shares before the ex-dividend date. Dividend risk elevates when a short call is ITM, and the corresponding put is worth less than the upcoming dividend payment. You can find more information on Dividend Risk here , including one method of deeming high dividend risk. The only way to eliminate any dividend risk potential is by closing any short call options position before the ex-dividend date.

Hard-to-Borrow Securities (HTB Rates)

Investors with short calls may have heightened assignment risk when HTB fees are high because it could be more beneficial for the long call holder to exercise the option to receive long shares and lend them out due to the high HTB rate. In some respects, a high HTB fee can act like a "synthetic dividend." Also, since HTB fees are charged daily from settlement to settlement, short call(s) may have a higher assignment risk on Wednesdays or Thursdays to take advantage of any HTB fees charged over the weekend. You can learn more about hard-to-borrow fees in our article here .

Mininal extrinsic value near expiration or deep ITM Position

Little to no extrinsic value near expiration or being deep ITM Generally speaking, an option's extrinsic or time value tends to decay when it approaches expiration. As a result, investors holding an ITM long call or put could be more inclined to exercise it because the option no longer has any or much extrinsic value remaining. Since any extrinsic value is foregone when exercising a long options contract, investors may feel more inclined to exercise instead of closing the contract. Additionally, as an option goes deeper ITM it may have little to no extrinsic value. As a result, the contract may only trade at or near its intrinsic value, despite how many days to expiration remain on the contract.

First, long options do not get automatically exercised if you were assigned early because all exercise requests occur overnight. As a result, we (tastytrade) do not know that an account is assigned shares until the morning after the counterparty's exercise request. However, the only time a long option automatically exercises is if it expires ITM. Furthermore, automatically exercising long options after assignment can potentially cost you more money, and that's because of any residual extrinsic value that the long option may have . Please see the instructions below to see how you can close an option and assigned share position and still retain defined risk. No worries, this is a lot easier than you may think!

In most cases, a covered stock order may resolve the assignment

That said, if you are assigned early, then you can perform a covered stock by closing the assigned position and selling the corresponding long call or put. In other words, the theoretical max loss may reduce by performing a covered stock order due to any residual extrinsic value remaining in the long option. To learn about performing a covered stock order after being assigned early, please click here .

To learn what happens to options spread at expiration, please click here . To learn about reconciling your profit/loss after an assignment, please click here .

- Pattern Day Trading Rules (PDT)

- Pre-Market And After-Hours Orders (Extended Hours)

- Available Cryptocurrencies | Crypto | Cryptocurrency

- Trading Alerts

- Available Account Types at tastytrade

- Margin Interest

- Multiple Margin Accounts

- Closing with a Covered Stock Order | Assigned Early on an Options Spread

- How to Place a Crypto Order

- $0.00 Cost Basis on Short Equity Options

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

What Is Early Exercise? Benefits to Selling a Call Option Early

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

What Is Early Exercise?

Early exercise of an options contract is the process of buying or selling shares of stock under the terms of that option contract before its expiration date . For call options, the options holder can demand that the options seller sell shares of the underlying stock at the strike price. For put options it is the converse: the options holder may demand that the options seller buy shares of the underlying stock at the strike price.

Key Takeaways

- Early exercise is the process of buying or selling shares under the terms of an options contract before the expiration date of that option.

- Early exercise is only possible with American-style options.

- Early exercise makes sense when an option is close to its strike price and close to expiration.

- Employees of startups and companies can also choose to exercise their options early to avoid the alternative minimum tax (AMT).

Understanding Early Exercise

Early exercise is only possible with American-style option contracts, which the holder may exercise at any time up to expiration. With European-style option contracts, the holder may only exercise on the expiration date, making early exercise impossible.

Most traders do not use early exercise for options they hold. Traders will take profits by selling their options and closing the trade. Their goal is to realize a profit from the difference between the selling price and their original option purchase price.

For a long call or put , the owner closes a trade by selling, rather than exercising the option. This trade often results in more profit due to the amount of time value remaining in the long option lifespan. The more time there is before expiration, the greater the time value that remains in the option. Exercising that option results in an automatic loss of that time value.

Benefits of Early Exercise

There are certain circumstances under which early exercise may be advantageous for a trader:

- For example, a trader may choose to exercise a call option that is deeply in-the-money (ITM) and is relatively near expiration. Because the option is ITM, it will typically have negligible time value.

- Another reason for early exercise may be a pending ex-dividend date of the underlying stock. Since options holders are not entitled to either regular or special dividends paid by the underlying company, this will enable the investor to capture that dividend . It should more than offset the marginal time value lost due to an early exercise.

Early Exercise and Employee Options

There is another type of early exercise that pertains to company awarded stock options (ESO) given to employees. If the particular plan allows, employees may exercise their awarded stock options before they become fully vested employees. A person may choose this option to obtain a more favorable tax treatment.

However, the employee will have to foot the cost to buy the shares before taking full vested ownership. Also, any purchased shares must still follow the vesting schedule of the company's plan.

The money outlay of early exercise within a company plan is the same as waiting until after vesting, ignoring the time value of money . However, since the payment is shifted to the present, it may be possible to avoid short-term taxation and the alternative minimum tax (AMT) . Of course, it does introduce the risk that the company may not be around when the shares are fully vested.

Early Exercise Example

Suppose an employee is awarded 10,000 options to buy company ABC's stock at $10 per share. They vest after two years.

The employee exercises 5,000 of those options to purchase ABC's stock, which is valued at $15, after a year. Exercising those options will cost $7,000 based on a federal AMT rate of 28%. However, the employee can reduce the federal tax percentage by holding onto the exercised options for another year to meet requirements for long-term capital gains tax .

Financial Industry Regulatory Authority. " Options: Types ."

Financial Industry Regulatory Authority. " Trading Options: Understanding Assignment ."

Financial Industry Regulatory Authority. " Options: Risk ."

Titan. " How to Exercise Employee Stock Options ."

Internal Revenue Service. " Form 6251, Alternative Minimum Tax - Individuals ." Page 1.

Internal Revenue Service. " Topic No. 409, Capital Gains and Losses ."

:max_bytes(150000):strip_icc():format(webp)/StockOption_source-7a5ecb0c22a04d759e283596e7e64905.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Expiration, exercise, and assignment

Unlike stocks, options have set expiration , exercise , and assignment dates.

Each option contract has a set expiration date. This date significantly impacts the value of the option contract because it limits the time you can buy, sell, or exercise the option contract. Once an option contract expires, it will stop trading and either be exercised or expire worthless.

The following are a few important things to keep in mind as the expiration date of an option contract approaches:

- We’ll attempt to exercise any option you own that is $0.01 or more in-the-money, as long as your investment account has the required buying power, such as for a call option, or the necessary underlying shares to sell, such as for a put option. Keep in mind that managing your options positions, including taking proactive steps to mitigate risk, is ultimately your responsibility.

- If you don’t have enough buying power or underlying shares to exercise your option, we may attempt to sell the contract in the market for you within the last 30 minutes before the market closes on the options' expiration date.

- Robinhood’s risk checks are designed to close positions based on the position’s value, the implied risk, and your current account portfolio and value, among other things.

Moneyness of an option

In-the-money, at-the-money, and out-of-the-money refer to the position of the underlying security’s price relative to the strike price of the option. They’re also sometimes referred to as the moneyness of an option.

To learn more, check out Options trading from the pros .

If your option is in-the-money at the market’s close, Robinhood will attempt to exercise it for you at expiration unless:

- You don’t have sufficient buying power.

- The exercise would result in a short stock position.

- You’ve asked Robinhood to submit a Do Not Exercise (DNE) request on your behalf. Keep in mind, the cut-off time for submitting a DNE request is 5 PM ET.

Once your contract expires, it’ll move to your expired contracts in your account History .

After-hours price movements can change the in-the-money or out-the-money status of an options contract.

If for any reason we can't sell your contract, and you don’t have the necessary buying power or shares to exercise it, we may attempt to submit a DNE request to the Options Clearing Corporation (OCC), and your contract should expire worthless.

To determine if an option position is “at risk of being in-the-money,” Robinhood will calculate an estimated upper and lower bound for the underlying security’s close price on the expiration date. If your option’s strike price falls within these parameters, we may place an order to close your position.

If your option is in-the-money, Robinhood will typically exercise it for you at expiration automatically. However, you can also exercise your options contract early in the app:

- Navigate to the options position detail screen

- Select Exercise

You’ll then be guided through steps to exercise your contract.

Before expiration day, an early exercise request will be submitted immediately if it’s placed during regular market hours (9 AM-4 PM ET) and trading days. Contact us before 5 PM ET if you’d like to cancel an exercise request.

Early exercise requests submitted after 4 PM ET will be queued for the next trading day. You can cancel a pending exercise request until 11:59 PM ET.

On expiration day, you won’t be able to submit an early exercise request in the app or on the web after 4 PM ET. Contact us to request an exercise request after 4 PM ET. We’ll try to accommodate exercise requests until 5 PM ET on a best-effort basis.

How to confirm

After you exercise an option, you’ll get an in-app confirmation that your option was exercised and that the associated shares are pending. You’ll also get an email and an in-app notification before the next trading day confirming that your option was exercised or assigned (after we receive confirmation from the OCC).

How to submit a DNE

If your option is out-of-the-money, Robinhood will take no action and the contract will typically expire. If you’d like to submit a DNE request, you must contact us before 5 PM on the expiration date .

When you are assigned, you have the obligation to fulfill the terms of the contract. When you sell-to-open an options contract, you can be assigned at any point prior to expiration (regardless of the underlying share price).

Depending on the collateral held for a short contract, a few different things can occur. For more details, check out Navigating exercise & assignment .

Check out Advanced options strategies (Level 3) to learn more about calls, puts, and multi-leg options strategies.

Unassigned anticipated assignment

On rare occasions, the in-the-money short option of a spread won’t get assigned. This happens when the counterparty files a DNE request for their in-the-money option, or a post-market movement shifts the option from in-the-money to out-of-the-money (and the contract holder decides not to exercise). In this scenario, you’ll likely be long or short the stock the following trading day, potentially resulting in an account deficit or margin call.

All resulting short stock positions must be covered the following trading day.

The scenario listed above could result in a gain or loss that’s greater than theoretical max gain or loss on the position.

Early assignment

If you’re trading a multi-leg options strategy and are assigned a short position before expiration, keep the following in mind, such as any account deficits or margin calls .

Decreased buying power

Early assignment may result in decreased buying power. This is because the positions you hold are used to calculate your buying power, and at the time you’re assigned, you may not have the shares (for call spreads) or the buying power (for put spreads) needed to cover the deficit in your account. If you have an account deficit, you can’t open new positions until the deficit is resolved.

Account deficits

Early assignment may also result in an account deficit if it causes you to use more buying power than you have available. When you have an account deficit, there are a few potential actions that you can take, including exercising your long contract or buying/selling shares. If you have an account deficit and choose to exercise your long contract to increase your buying power, you will not be able to open new positions while your exercise is pending. But you should be able to open new positions once your exercise has been processed if exercising your long contract is sufficient to cover your account deficit.

Margin calls

Early assignment may also result in margin call if it causes your account value to fall below your margin maintenance requirement. When you have a margin call, there are a few potential actions that you can take: exercising your long contract, buying/selling shares by placing orders, or depositing enough funds to cover the margin call. If you have a margin call and choose to exercise your long contract to decrease your margin deficiency, your margin call may persist while your exercise is pending or, further, if the exercise was not sufficient enough to cover your margin deficit. If exercising your long contract is sufficient to cover your margin deficiency, any margin calls should be satisfied once your exercise is processed.

Early assignment and exercise

Keep in mind that we can’t process an early assignment before the end of the trading day and, so we can’t exercise the long leg until the next trading day (at the earliest). That’s because the Options Clearing Corporation (OCC) doesn’t notify us of your assignment until after the market closes (when they process assignments). While funds and shares that result from exercises are made available immediately during market hours, positions exercised after market hours are queued and credited to your account the next trading day.

Pending shares

If an option is exercised before expiration.

A few things can happen if your option is exercised early (also known as an early-exercise), depending on the time of day.

If the early exercise occurs during market hours (9 AM-4 PM ET), the associated shares will show in your account immediately, and will no longer show as a pending exercise in your account.

If the early exercise occurs after 4 PM ET, it’ll be queued for the next trading day, and the associated shares will remain pending until the exercise has cleared.

Some underlying assets (like exchange-traded products) are eligible for late-close options trading until 4:15 PM ET. Check out Options trading hours for details.

If a long option exercised or assigned at expiration

Once your contract has been exercised or assigned, we’ll hold the associated shares or cash collateral until we receive confirmation from the OCC that all aspects of the exercise or assignment have cleared. This process typically takes 1 business day. Once completed, the pending state of the exercise or assignment will be removed and your account will be updated accordingly.

Finding your trade details

- Select Account (person icon) → in the app, Menu (3 bars)

- Select History

- Select the option you’re looking for (e.g. XYZ $1,200 Call Oct. 21 Exercise)

Options dividend risk

Dividend risk is the risk that you’ll get assigned on a short call position (either as part of a covered call or spread) the trading day before the underlying security’s ex-dividend date. If this happens and you don’t own 100 shares of the stock, you’ll open the ex-date with a short stock position and actually be responsible for paying that dividend yourself. You can potentially avoid this by closing any position that includes a short call option at any time before the end of regular market hours on the trading day before the ex-date.

Robinhood may take action in your brokerage account to close any positions that have dividend risk the trading day before an ex-dividend date. Generally, we’ll only take action if the dividend that would be owed upon assignment represents a large portion of your total account value, which we’ll try to do on a best-effort basis.

Options dividend example

Let’s say, XYZ is going to pay a dividend as follows:

- Ex-date: October 1

- Record date: October 3

- Pay date: October 31

If you’re short, or you’ve sold an option call contract for XYZ that’s expiring on or after October 1, you’re at risk of an assignment.

For example, if you get assigned on September 30, you’d have a short position of 100 shares that were exercised by the counterparty (a person who bought and exercised the call option) when the market opens on October 1. If this occurs, you’ll have to deliver the underlying shares and pay the counterparty the dividend that is associated with these shares.

In this example, you’d owe a dividend of $100, which is $1 x 100 shares. We’d automatically deduct the dividend amount from your account, even if it causes you to have a negative balance.

You can avoid this dividend risk by closing your option before the market closes on any trading day before the ex-dividend date.

The day before the ex-dividend, we’ll try to prevent you from selling to open new short call options that are likely to be assigned that same night if the underlying symbol ex-dividend date occurs on the next trading day. This is only temporary, and you can open new short call positions on or after the ex-dividend date.

Disclosures

Any hypothetical examples are provided for illustrative purposes only. Actual results will vary.

Content is provided for educational purposes only, doesn't constitute tax or investment advice, and isn't a recommendation for any security or trading strategy. All investments involve risk, including the possible loss of capital. Past performance doesn't guarantee future results.

If multiple options positions or strategies are established in the same underlying symbol, Robinhood Financial may deem it necessary to pair or re-pair the separately established options positions or strategies together as part of its risk management process.

Robinhood Financial doesn't guarantee favorable investment outcomes. The past performance of a security or financial product doesn't guarantee future results or returns.

Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation.

For more information, review Robinhood Financial’s Margin Disclosure Statement , Margin Agreement and FINRA Investor Information . These disclosures have information on Robinhood Financial’s lending policies, interest charges, and the risks associated with margin accounts.

- Skip to main content

- Skip to primary sidebar

Additional menu

Options With Davis

Options Made Easy For Everyone

Covered Call Assignment – How To Avoid It & What To Do If Assigned

posted on May 5, 2023

Imagine you have a Covered Call right now and the underlying stock is now above your Covered Call strike price.

You’re panicking now because if you get assigned on the Covered Call, you will be Short 100 shares.

The worst part is that you don’t have the necessary capital to meet the margin requirement of Shorting the 100 shares.

And that would result in a margin call.

So what do you do?

And how do you avoid getting the risk of early assignment on your Covered Call?

What Happens When You’re Assigned On Your Covered Call?

Let’s assume you already own 100 shares of Amazon (Ticker: AMZN).

Then you sell a Covered Call at the strike price of 135.

If AMZN settles anywhere above $135 at the expiration date of the Covered Call, then your 100 shares will be called away at that price.

That means your 100 shares would be sold at $135.

When Are You In Danger Of Early Assignment?

So when is your Covered Call in danger of getting assigned early?

There’s always the possibility of early assignment when:

- Your Covered Call is In-The-Money (ITM). That means the current stock price is above your Covered Call strike price.

- And when your Covered Call is close to expiration.

- And when your extrinsic value is very little.

- And if the stock pays a dividend, you could get assigned early if the dividend paid is more than the extrinsic value.

In short, the main factor that determines whether you are in danger of getting assigned early is when the extrinsic value is very little.

That’s because when there’s little extrinsic value left in your Covered Call, there’s not much incentive left for the buyer to hold on to the Call Option.

So it’s very important to pay attention to how much extrinsic value is left in your Covered Call.

The good news is that getting assigned early is actually very rare.

To understand a little better why this is so, we need to get into the minds of the Call buyer (the person taking the opposite trade of your Covered Call).

Understanding The Mindset of Call Buyers

For this, let’s use the same example as we did earlier.

And let’s also assume that for selling the 135 strike price Covered Call you received a premium of $1.50.

Now let’s switch sides and imagine you’re now the Call buyer that just purchased the Call Option for $1.50.

Next, we want to come up with the different scenarios that might happen and see if you would exercise your Call Option early for each of them.

Scenario 1: Stock goes to $140.

In this scenario, the stock has gone up to $140 and your Call Option has now increased to $6.00:

- $5.00 in intrinsic value.

- $1.00 in extrinsic value.

By exercising your Call Option, you would be buying 100 shares of the underlying stock at $135.

And you will forfeit your extrinsic value of $1.00.

Knowing this, would you exercise your Call Option?

Let’s compare exercising versus selling off your Call Option.

If you exercise and you sell off your shares immediately after exercising, your profits would be:

[($140 – $135) x 100 shares] – $150 for purchasing the Call Option = $350

If you just sold off your Call Option, your profits would be:

($6.00 – $1.50) x 100 shares = $450

As you can see, you would have made more money if you had simply sold off your Call Option.

That’s because the extrinsic value boosted your profits.

But if you exercised your Call Option, you forfeited the extra $100 in profits.

Furthermore, exercising can come with extra fees from some brokers.

So in this scenario, it’s highly unlikely that the Call Buyer would exercise their Call Option, even if it’s ITM.

Scenario 2: Stock goes to $150.

Now what if the stock went higher to $150 instead?

In this scenario, your Call Option is now worth $15.25:

- $15.00 in intrinsic value.

- $0.25 in extrinsic value.

If you are the Call Buyer, would you exercise your Call Option now?

If you do, you’d be giving up $0.25 in extrinsic value.

That’s $25 in additional profits that you would miss out on by exercising.

I’m pretty sure it’s unlikely that you would exercise because I wouldn’t as well.

While $25 may not be much, it’s still money that we leave on the table by exercising.

So it makes no sense for us to exercise the Call Option and get into a Long stock when there’s still lots of time left before expiration.

If we really wanted to buy the stock, we still can wait till the last few days to expiration before deciding whether to exercise the Long Call or not.

So as you can see, extrinsic value plays a big part in the Call buyer’s decision whether to exercise the Call Option or not.

Scenario 3: Stock goes to $140 but goes ex-dividend tomorrow paying a dividend of $0.50.

This scenario is similar to scenario 1, but the difference is that the stock will be paying a dividend.

This is where a Short Call can have dividend risk.

That means that the Call buyer may want to exercise their Option to get into a Long stock position to get the dividends.

So in this scenario, your Call Option’s value is the same as scenario 1 which is $6.00:

However, the underlying stock will be paying a dividend of $0.50.

If you’re the Call buyer, would you exercise your Long Call?

Let’s compare exercising versus selling the Call Option.

If you exercise it, you will forfeit the $1.00 in extrinsic value, but gain the dividend of $0.50.

But if you sell the Call Option, you will forfeit the $0.50 dividend, but profit on the $1.00 in extrinsic value.

So in this scenario, you would gain more by simply selling the Call Option.

Hence, it’s for the Covered Call to get assigned in this scenario.

Scenario 4: Stock goes to $150 but goes ex-dividend tomorrow paying a dividend of $0.50.

This scenario is similar to scenario 2 but the stock goes ex-dividend tomorrow with a dividend payout of $0.50.

In this scenario, your Call Option’s value is $15.25:

But there’s a dividend payout of $0.50.

In this scenario, if you were the Call buyer, would you exercise your Long Call?

If we applied the same analysis as in scenario 3, then we would know that it makes sense to exercise the Call Option now because the dividend is greater than the extrinsic value.

That means by exercising the Call Option, you’d gain an additional $0.25 compared to if you hadn’t exercised your Long Call.

So in this scenario, there’s a high likelihood of getting assigned early.

How To Avoid Early Assignment

So how do you avoid the risk of early assignment?

By rolling your Covered Call .

When you roll, you’re adding duration to your Covered Call.

And by adding duration, you’re adding extrinsic value.

Remember, extrinsic value is simply time value.

The more days left to expiration, the more extrinsic value there is.

Additionally, when rolling, you have the choice to roll your Covered Call up as well.

That means you roll to a higher strike on top of rolling to a further expiration date.

This way you increase the chances of Covered Call working out.

But what if you’re already assigned?

If you’re already assigned and your shares have been called away, there are 3 things you can do:

- Buy your shares back immediately if you’re afraid the stock will continue rallying.

- Wait for a pullback before buying again.

- Sell a Cash Secured Put at the price you were called away.

- Find other trades.

At the end of the day, having your shares called away isn’t the end of the world.

You’ve already made a profit (assuming your Covered Call was above your entry price), and you can always find another trade.

And if you think the stock will keep going up in the long term, then just buy back the stock because you would still be in profit if you’re right on your long-term view.

Reader Interactions

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Sports Betting

- Sports Entertainment

- New York Yankees

- New York Mets

- Transactions

Recommended

Live updates, mets trade zack short to red sox after choosing to keep joey wendle.

- View Author Archive

- Get author RSS feed

Thanks for contacting us. We've received your submission.

Zack Short is officially a former Met.

The Mets traded the versatile infielder to the Red Sox on Wednesday for cash considerations. Short had been designated for assignment Friday, when J.D. Martinez was activated.

Short had won a job with the team out of camp as a sure-handed fielder and went 1-for-9 in 10 games.

When Martinez was ready to join the club, the Mets faced a roster crunch and essentially chose Joey Wendle — a similar player with more experience and a lefty hitter — over Short.

“He’s done it, been in this role a long time,” manager Carlos Mendoza said of Wendle after the Short DFA.

Without Short in the organization, the Mets recently signed veteran infielder Mike Brosseau and assigned him to Triple-A Syracuse, where the Mets also have veterans Jose Iglesias and Yolmer Sanchez as depth options with experience.

Share this article:

Log in using your username and password

- Search More Search for this keyword Advanced search

- Latest content

- Current issue

- For authors

- New editors

- BMJ Journals More You are viewing from: Google Indexer

You are here

- Online First

- We stand with the players: a call to action for the football community

- Article Text

- Article info

- Citation Tools

- Rapid Responses

- Article metrics

- http://orcid.org/0000-0003-4062-7601 Torstein Dalen-Lorentsen 1 , 2 ,

- http://orcid.org/0000-0002-0114-8539 John Bjørneboe 2 , 3 ,

- http://orcid.org/0000-0002-0475-637X Joar Harøy 2 ,

- http://orcid.org/0000-0003-4172-4518 Thor Einar Andersen 2

- 1 Department of Health Research , SINTEF Digital , Oslo , Norway

- 2 Oslo Sports Trauma Research Center, Department of Sports Medicine , Norwegian School of Sport Sciences , Oslo , Norway

- 3 Department of Physical Medicine and Rehabilitation , Oslo University Hospital , Oslo , Norway

- Correspondence to Dr Torstein Dalen-Lorentsen, Department of Health, SINTEF Digital, Oslo, Norway; torstein.dalen{at}sintef.no

https://doi.org/10.1136/bjsports-2023-108041

Statistics from Altmetric.com

Request permissions.

If you wish to reuse any or all of this article please use the link below which will take you to the Copyright Clearance Center’s RightsLink service. You will be able to get a quick price and instant permission to reuse the content in many different ways.

- Athletic Injuries

- Ethics, Medical

- Sporting injuries

Introduction

On 19 November 2023, Gavi the teenage phenomenon of FC Barcelona tore his anterior cruciate ligament and lateral meniscus while playing a European Qualifiers 2024 match for Spain. 1 At that point, the 19-year-old had played 81 matches since the beginning of last season in August 2023. In a commentary the next day, the sports daily Marca asked the question: ‘¿Quién lesionó a Gavi?’ or: ‘Who injured Gavi?’, a question implying a link between the injury and match load. 2 This commentary addresses the important question of whether the growing number of matches jeopardises the physical and mental health of top-level football players.

A consistent rise in match load

The UEFA Champions League is set to increase the number of matches by roughly 30% from next season, the FIFA Club World Cup is expanding, and so is the FIFA World Cup. In addition, during the 2022 World Cup in Qatar, the new interpretation of stoppage time led to a 60% increase in extra time compared with previous years, and an estimated 4%–5% increase in total match exposure. 5 Also, instead of friendly matches in most of the international breaks, European national teams now play Nations League matches with a larger incentive to win, and fewer opportunities to rotate and rest the best players. In addition, players face ever-increasing match demands. Players perform more high-intensity actions and cover greater distances at high speed, 6 which have been shown to increase muscle damage. 7 This additional strain on players requires more recovery time between matches. But instead, the recovery time is shortened.

More matches, more problems?

Match congestion has been the main emphasis where scientists have investigated match load and health problems. 8 However, with players involved in more than 70 games per season, it is evident that the entire season is congested! Last season, Vinicius Junior of Real Madrid and Brazil played 75% of his games with less than 5 days of recovery, that is, the classic definition of match congestion. The emphasis needs to shift from relative load, where we analyse changes in match load between congested periods in the season, to absolute load during a full season. We must ask: How many matches can a player tolerate without having to end the season? Miss several seasons? Or, be forced to retire due to injury? Unfortunately, we currently do not have the data to answer these questions.

The UEFA Elite Club Injury Study has reported overall injury incidence to have an average annual decrease of 3% since 2001. 9 However, when we visually interpret the reported trend, it appears that the tide is turning in the last 2 years of the study period. From the same dataset, we know that the incidence and severity of hamstring injuries have increased. 10 The trend is likely to continue—muscle injuries are the injury type most likely affected by increased match demands and match load. 10 Moreover, the most substantial increase in matches is yet to come.

When it comes to the number of matches, significant differences exist between leagues, teams and individual players. For players in lower ranked leagues, the increase in matches is likely less harmful. Additionally, even for lower ranked teams in the best leagues, this issue might not be as problematic. For instance, during the 2023/2024 season, Luton Town is playing 44 matches, while Manchester City is facing 59 matches.

However, the most substantial burden falls on the best players—those who participate in all competitions for both club and national teams. These elite players may have to endure more than 70 matches in consecutive seasons. Looking ahead to 2025, they could face over 85 matches per season. Notedly, for these top-elite-level players, there is currently no published injury epidemiology data.

Compound effect, increased risk or both?

To date, no causal link between training (and match) load and injury risk has been established. 11 This means that we do not have evidence for the exact influence of match load on injury risk (ie, incidence per 1000 hours of exposure). However, with an expanding match calendar (more exposure), the sheer compound effect is likely more important. Injury incidence per 1000 hours can remain stable, but 20% more matches will likely lead to a 20% increase in injuries at a group level. Bruno Fernandes of Manchester United and Portugal had almost 6000 minutes of match exposure during the 2022/2023 season—the most in Europe. Assuming a match injury incidence of 28 injuries per 1000 hours, 9 Fernandes could anticipate around three match-related injuries solely due to his exposure. Although a causal relationship between load and injury risk is not established, 11 it is likely they are related. And if that is the case, the candle is burning at both ends: at the one end—injury risk, and on the other—the compound effect of exposure. This could lead to a substantial increase in the total number of injuries.

Are the players being listened to?

There seems to be conflicting interest with governing bodies wanting to increase the number of matches and players wanting to maintain a reasonable match load to safeguard their own health. One of the players who has addressed this in the media, Raphael Varane, of Manchester United and former captain of France, said: “Despite our previous feedback, they have now recommended for next season: longer games, more intensity, and less emotions to be shown by players. We just want to be in good condition on the pitch to give 100 percent to our club and fans. Why are our opinions not being heard?” 12 The paradox for the players is that the only time they are ‘sidelined’ is when they are battling for their own health.

What can we as football community do?

More matches pose significant challenges. There is existing evidence and rationale supporting FIFPRO’s concerns about the physical and mental well-being of players. 13 Gavi’s recent injury signals the challenges of an escalating match calendar, echoing the appeal from players to reduce their match load. The main responsibility and ultimate decision lie with FIFA and UEFA, but clinicians and scientists have the responsibility to collect evidence and to communicate this to all stakeholders. Although the current evidence and rationale should be sufficient to advocate against the ever-expanding match calendar, we do not have data to advise exactly how much is too much . Therefore, to further advance our understanding, we must stop working in silos. 14 To address the complicated relationship between match load and injury risk, we must combine efforts and facilitate comprehensive, granular databases, incorporating valuable small data sets from the top-level clubs with national team players ( table 1 ).

- View inline

Key actions for each of the major stakeholders in the football community

The ever-expanding match calendar must stop until we understand scientifically what is safe. For the sustainable future development of top-level football, the stakeholders of the football community—and especially FIFA and UEFA—must prioritise players’ physical and mental health.

Ethics statements

Patient consent for publication.

Not applicable.

Ethics approval

- ↵ Injury update on Gavi . Available : https://www.fcbarcelona.com/en/football/first-team/news/3790503/injury-update-on-gavi [Accessed 4 Dec 2023 ].

- ↵ ¿Quién Lesionó a Gavi? Marca . Available : https://www.marca.com/radio/opinion/2023/11/20/655b099e268e3e000a8b45c3.html [Accessed 14 Dec 2023 ].

- Pinheiro VH ,

- Borque KA ,

- Laughlin MS , et al